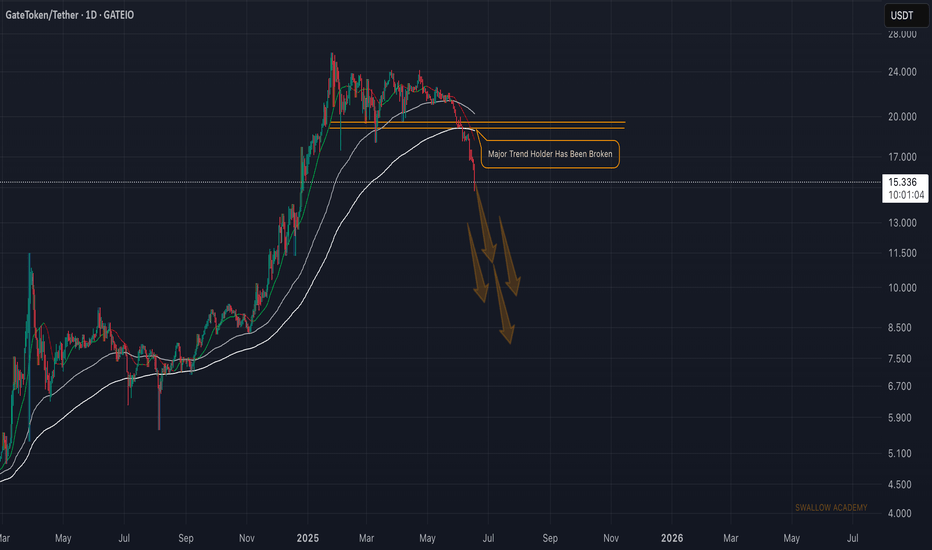

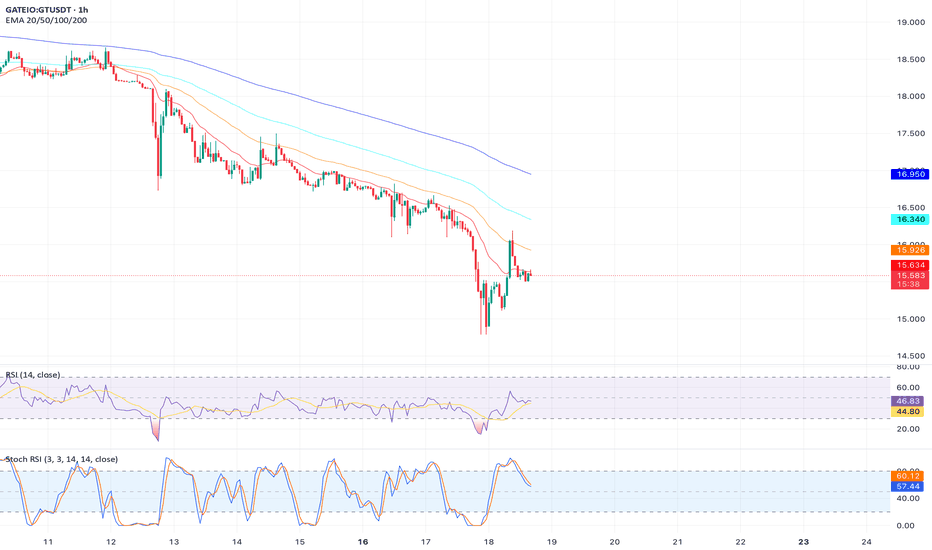

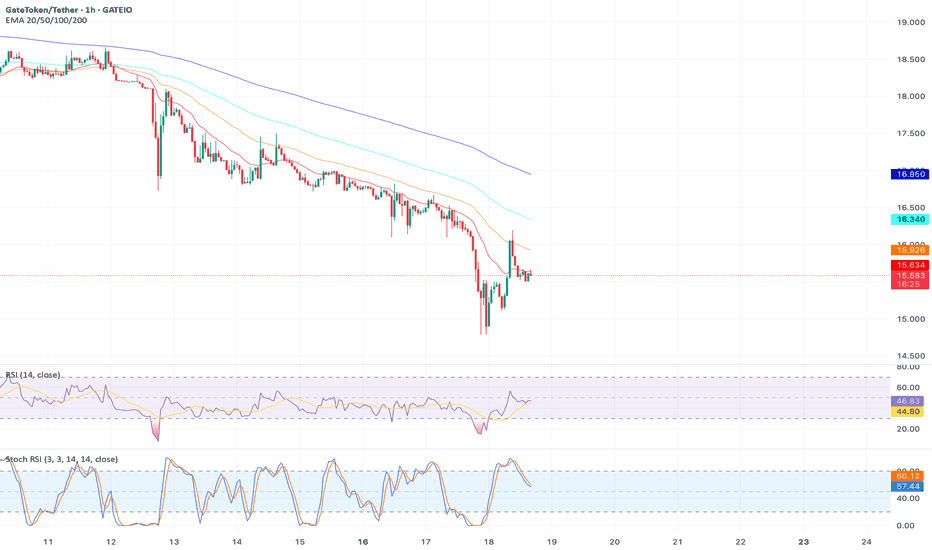

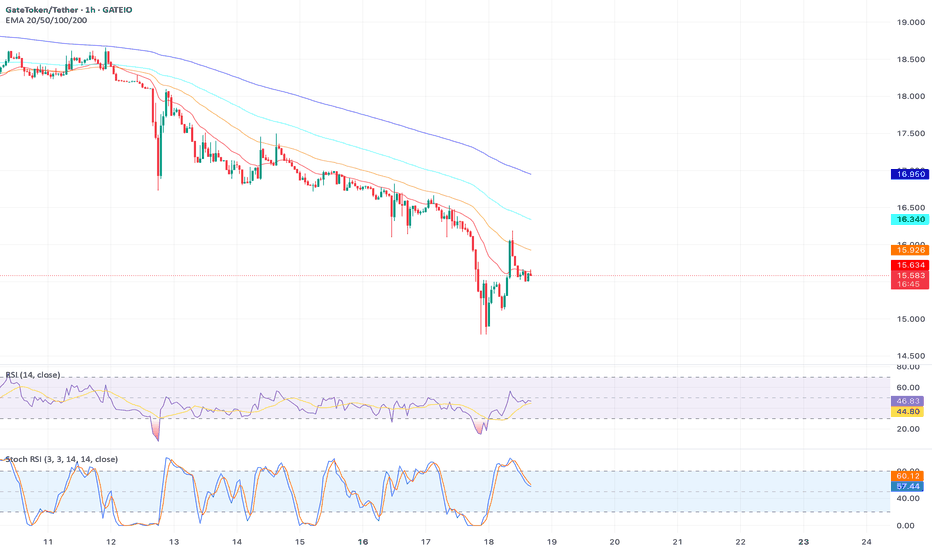

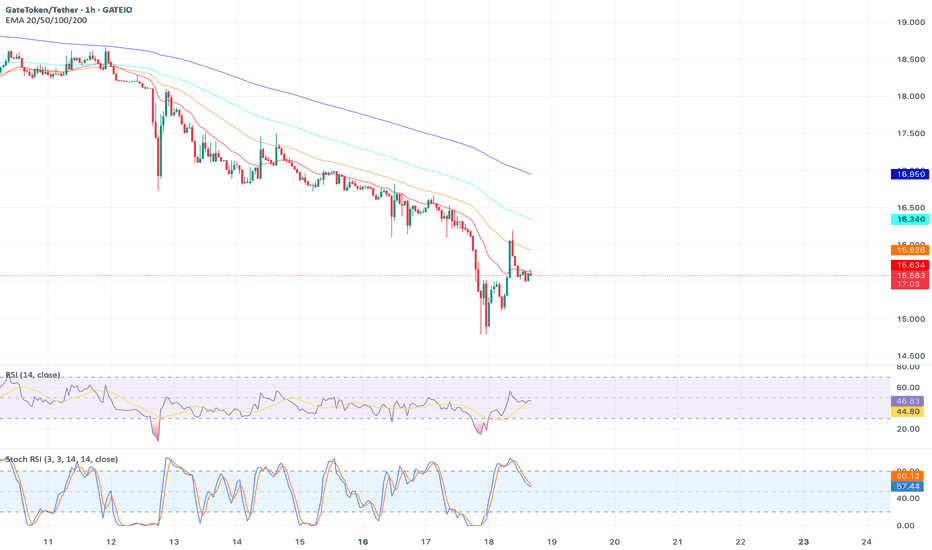

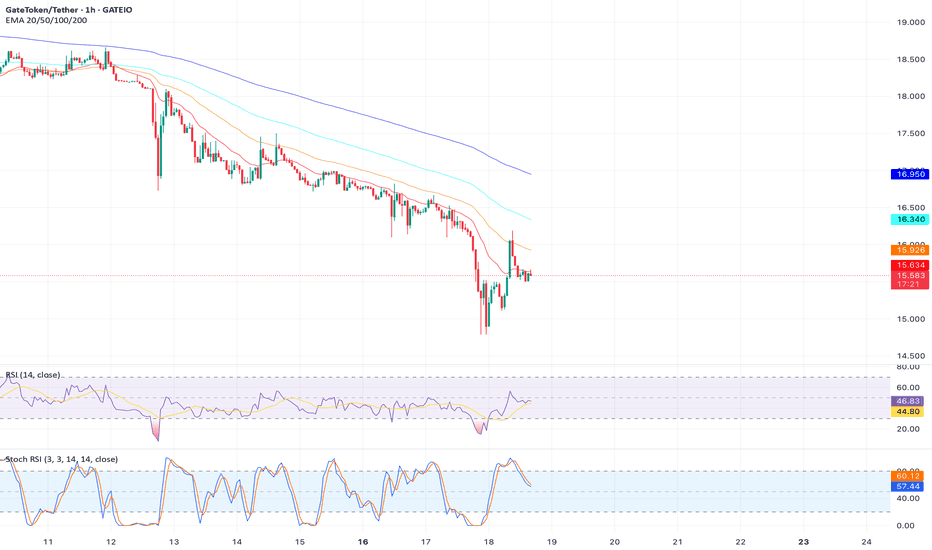

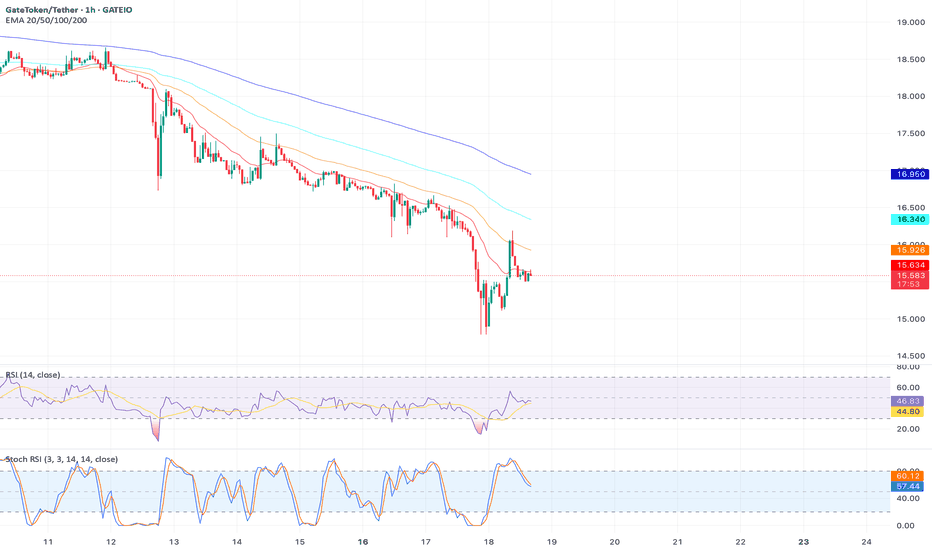

GateToken (GT): Major Trend Holder 200EMA Has Been BrokenGatecoin seems to be doomed, where we have had a market structure break (MSB), which then led to a break of the 200EMA.

Now if we do not see any foundation to form here (in form of support), then we are doomed, and price can dip as low as $9.20

Swallow Academy

Related pairs

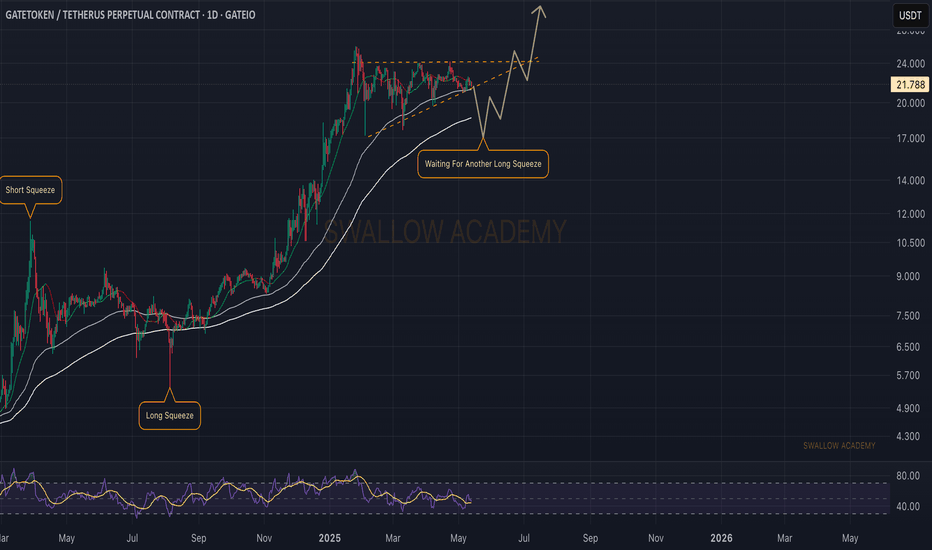

Gatetoken (GT): 200 EMA Is Strong Trend Holder | Long Squeeze?Gatetoken caught our attention with that strong 200EMA trend that price has been gliding on for some time now. As price has stumbled upon some sort of resistance area, we are seeing a nice bullish pattern forming here, but before a proper breakout, we might see another long squeeze, so watch out!

S

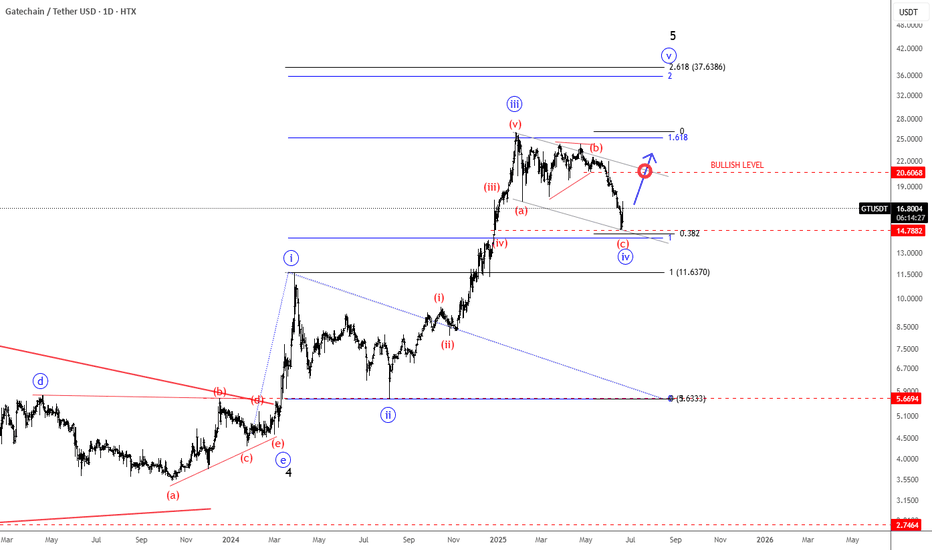

GateChain Slows Down Within An Impulsive Bullish TrendGateChain with ticker GTUSD came slightly lower, but we still see it trading in a higher degree wave »iv« correction that can resume the bullish trend for wave »v«. It can be actually finishing final subwave (c) of a three-wave (a)(b)(c) corrective decline, so keep an eye on strong support here at

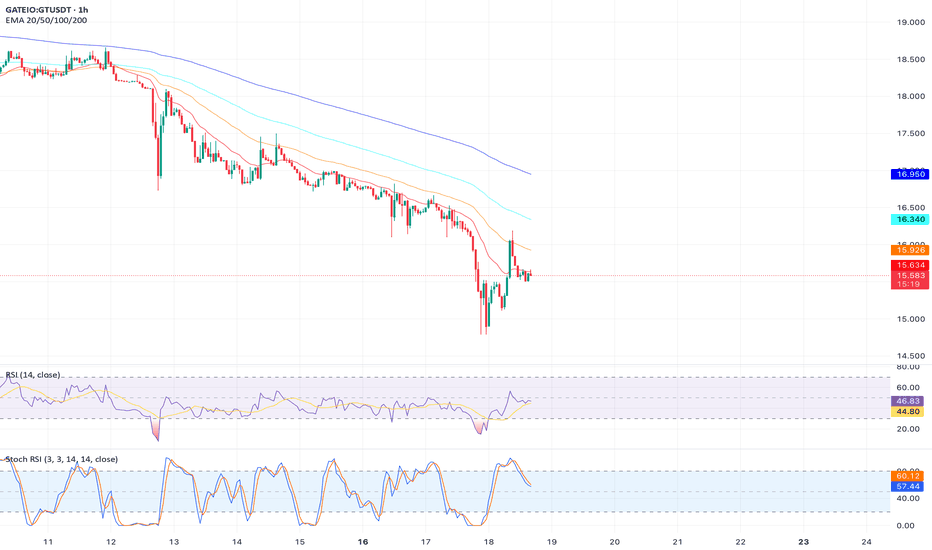

$GT’s Inverted Adam & Eve Pattern Targets $13.50Analysis: On the weekly chart, NASDAQ:GT is forming an inverted Adam & Eve pattern, a bearish reversal signal. The price is below the 20-week SMA ($15.90), and trading volume is decreasing on rebounds, indicating reduced buyer interest. A break below $15.30 could trigger a sharp decline.

Key Level

$GT’s Break Below 200-EMA Signals $14.00 TargetAnalysis: NASDAQ:GT has broken below the 200-day EMA ($15.50) on the daily chart, a significant bearish signal. The price is forming a bearish flag pattern, with the RSI at 42 trending downward. Recent posts on X highlight NASDAQ:GT ’s weak market structure, supporting a bearish bias.

Key Levels

$GT’s Bearish Channel Targets $13.80 SupportAnalysis: NASDAQ:GT is trading within a descending channel on the daily chart, with the price rejecting the upper trendline at $16.00. The RSI is at 40, nearing oversold but with room for further downside. Volume is higher on bearish candles, indicating seller dominance.

Key Levels:

Support: $14.5

$GT’s Lower Highs Confirm Bearish Trend to $14.2Analysis: On the 4-hour chart, NASDAQ:GT is forming lower highs, signaling a bearish trend. The price is below the 50-period SMA ($15.75), and the ADX is rising, indicating strengthening bearish momentum. Support at $15.30 was breached, setting up a move toward the next key level.

Key Levels:

Supp

$GT’s Failure at $16.00 Resistance Targets $13.5Analysis: NASDAQ:GT failed to break the $16.00 resistance on the daily chart, forming a bearish shooting star candle. The price is below the 50-day SMA ($15.80), and the MACD is showing a bearish crossover. Declining volume indicates fading bullish conviction, aligning with broader altcoin weaknes

$GT’s Overbought RSI Signals Pullback to $14.5Analysis: The 1-hour chart shows NASDAQ:GT trading near the upper Bollinger Band ($16.20) with an RSI of 78, indicating overbought conditions. A bearish divergence is forming, as the RSI declines while price tests resistance at $15.80. Low volume on recent highs suggests fading momentum.

Key Level

$GT Forms Bearish Head and Shoulders, Eyes $14.00Analysis: On the 4-hour chart, NASDAQ:GT is forming a head and shoulders pattern with a neckline at $15.50. The price is trading below the 20-day SMA ($15.70), and the Stochastic Oscillator is in overbought territory, signaling a potential reversal. A breakdown below $15.50 could accelerate sellin

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where GTUSDT is featured.

Up-and-coming crypto: New kids on the block

30 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of Gatechain / Tether USD (GT) is 17.5525 USDT — it has risen 0.91% in the past 24 hours. Try placing this info into the context by checking out what coins are also gaining and losing at the moment and seeing GT price chart.

Gatechain / Tether USD price has risen by 5.53% over the last week, its month performance shows a 14.27% increase, and as for the last year, Gatechain / Tether USD has increased by 144.75%. See more dynamics on GT price chart.

Keep track of coins' changes with our Crypto Coins Heatmap.

Keep track of coins' changes with our Crypto Coins Heatmap.

Gatechain / Tether USD (GT) reached its highest price on Jan 25, 2025 — it amounted to 25.9730 USDT. Find more insights on the GT price chart.

See the list of crypto gainers and choose what best fits your strategy.

See the list of crypto gainers and choose what best fits your strategy.

Gatechain / Tether USD (GT) reached the lowest price of 0.2425 USDT on Mar 13, 2020. View more Gatechain / Tether USD dynamics on the price chart.

See the list of crypto losers to find unexpected opportunities.

See the list of crypto losers to find unexpected opportunities.

The safest choice when buying GT is to go to a well-known crypto exchange. Some of the popular names are Binance, Coinbase, Kraken. But you'll have to find a reliable broker and create an account first. You can trade GT right from TradingView charts — just choose a broker and connect to your account.

Crypto markets are famous for their volatility, so one should study all the available stats before adding crypto assets to their portfolio. Very often it's technical analysis that comes in handy. We prepared technical ratings for Gatechain / Tether USD (GT): today its technical analysis shows the buy signal, and according to the 1 week rating GT shows the buy signal. And you'd better dig deeper and study 1 month rating too — it's buy. Find inspiration in Gatechain / Tether USD trading ideas and keep track of what's moving crypto markets with our crypto news feed.

Gatechain / Tether USD (GT) is just as reliable as any other crypto asset — this corner of the world market is highly volatile. Today, for instance, Gatechain / Tether USD is estimated as 5.21% volatile. The only thing it means is that you must prepare and examine all available information before making a decision. And if you're not sure about Gatechain / Tether USD, you can find more inspiration in our curated watchlists.

You can discuss Gatechain / Tether USD (GT) with other users in our public chats, Minds or in the comments to Ideas.