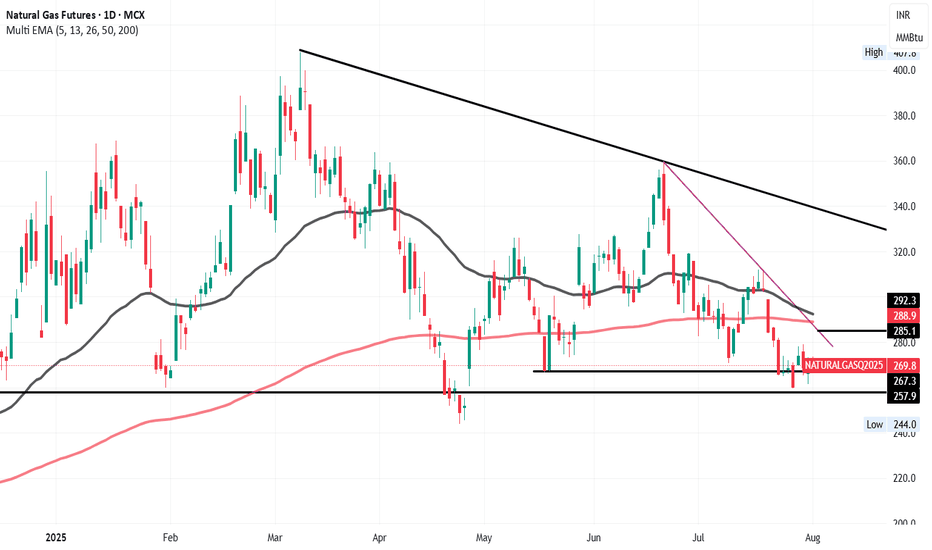

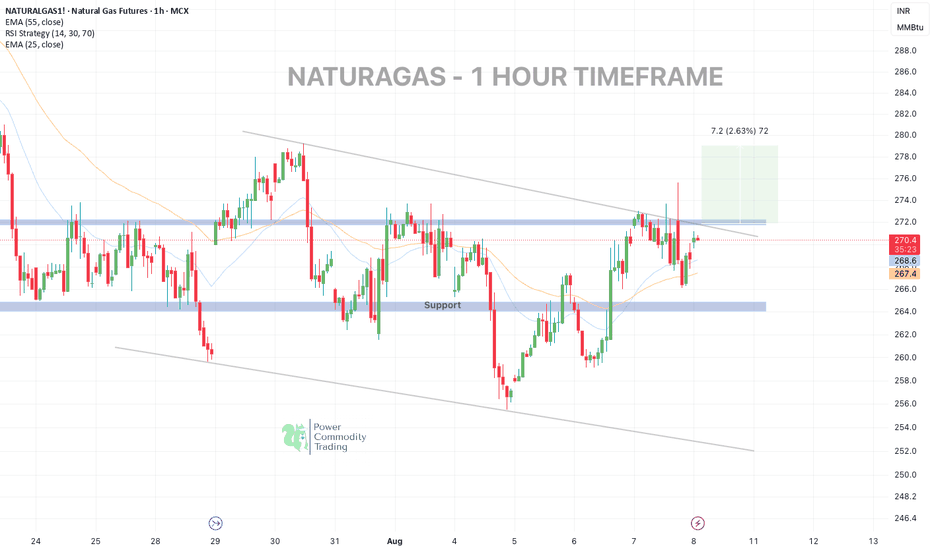

Natural Gas – Bullish Rebound Expected Towards 285–288Natural Gas is currently showing signs of a short-term bounce after testing key support around the 267–258 zone. My view remains bullish in the short term with potential upside toward 285–288, which aligns with the downward purple trendline and both the 50 EMA (around 292.3) and 200 EMA (around 288.

Related commodities

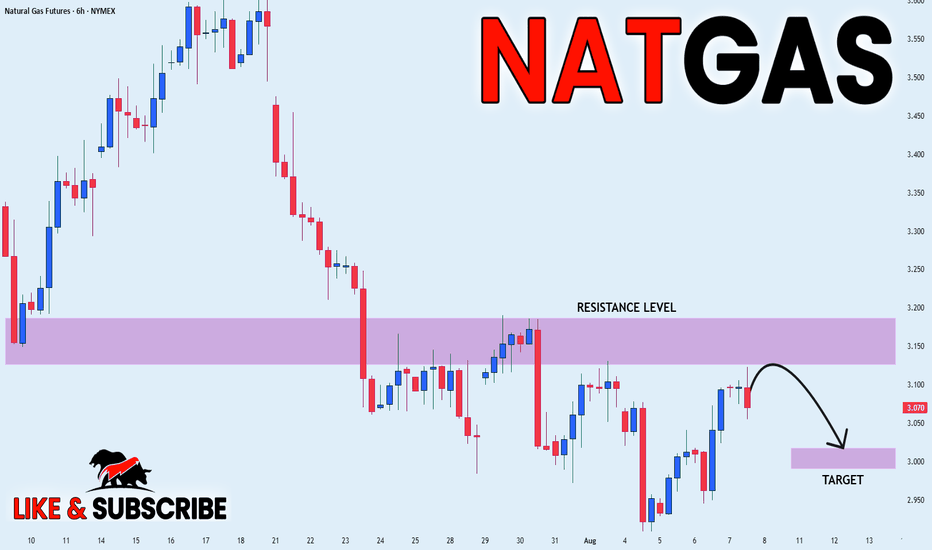

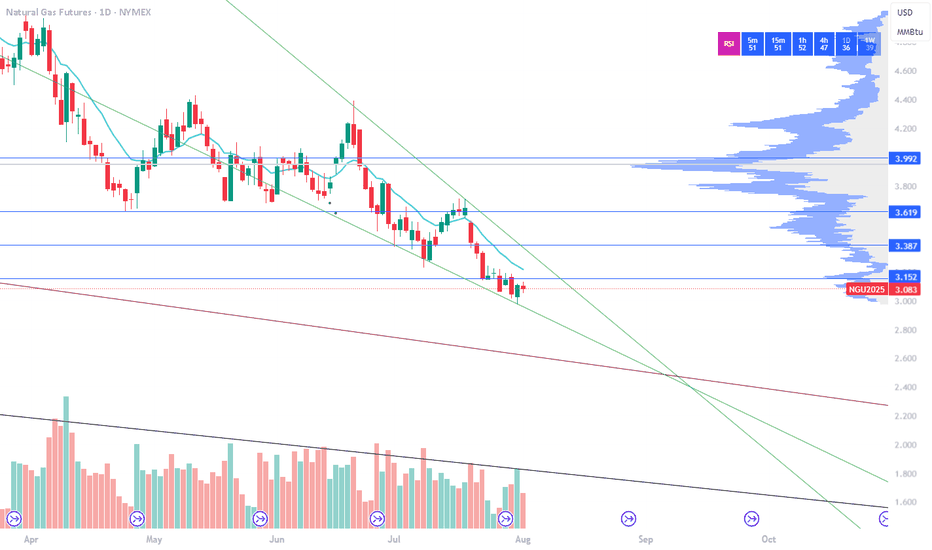

NATGAS WILL FALL|SHORT|

✅NATGAS made a retest of the

Strong horizontal resistance level of 3.150$

And as you can see the price is already

Making a local pullback from

The level which sends a clear

Bearish signal to us therefore

We will be expecting a

Further bearish correction

SHORT🔥

✅Like and subscribe to never miss

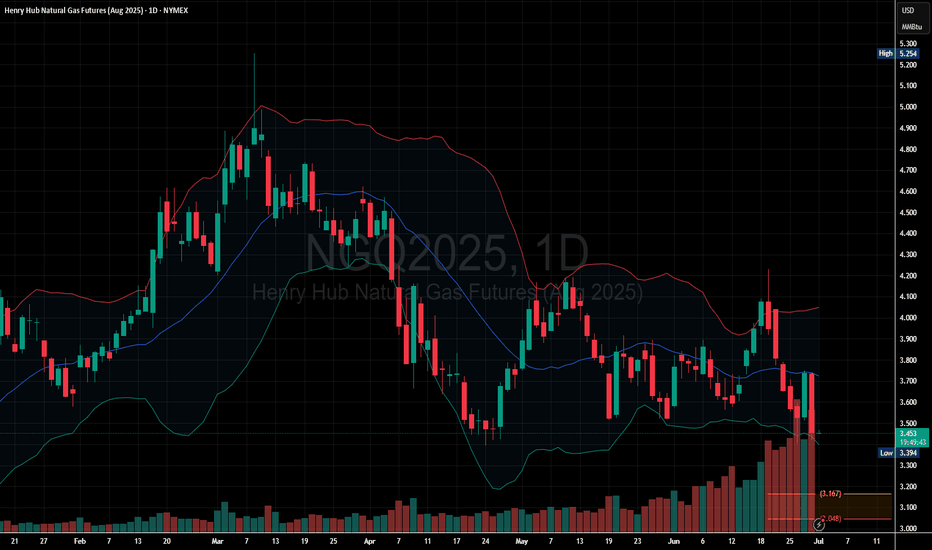

Natural Gas Slips Below Support – More Downside Ahead ?

Recent candles are large-bodied bearish candles, indicating strong selling pressure.

Bollinger Basis is sloping downward, showing short-term bearish momentum.

Price is currently below both the 20-day and 50-day moving averages, reinforcing the bearish outlook.

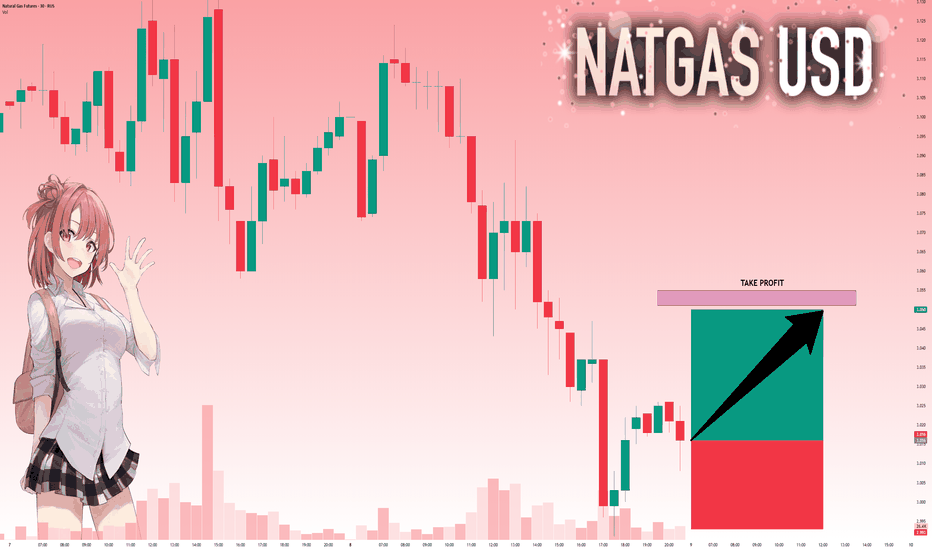

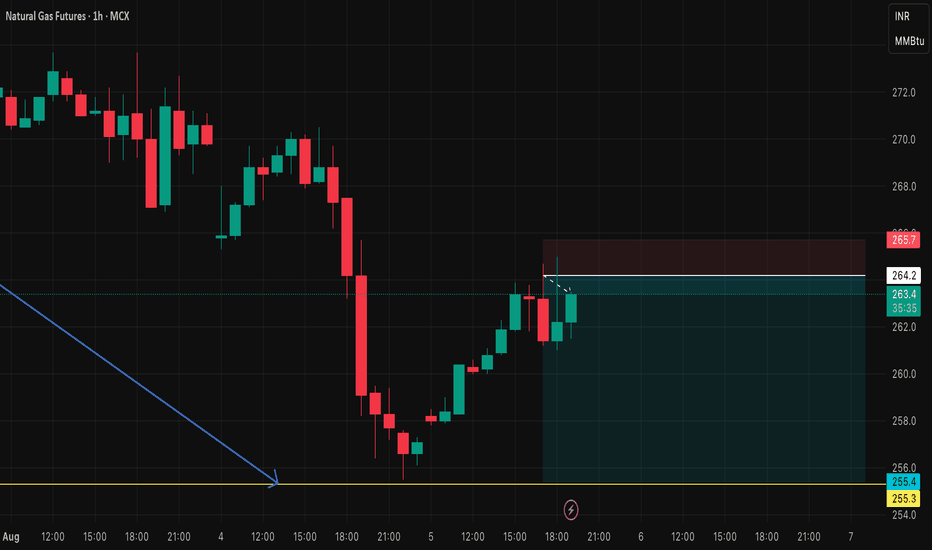

NG1!: Strong Bullish Sentiment! Long!

My dear friends,

Today we will analyse NG1!together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3.016 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the n

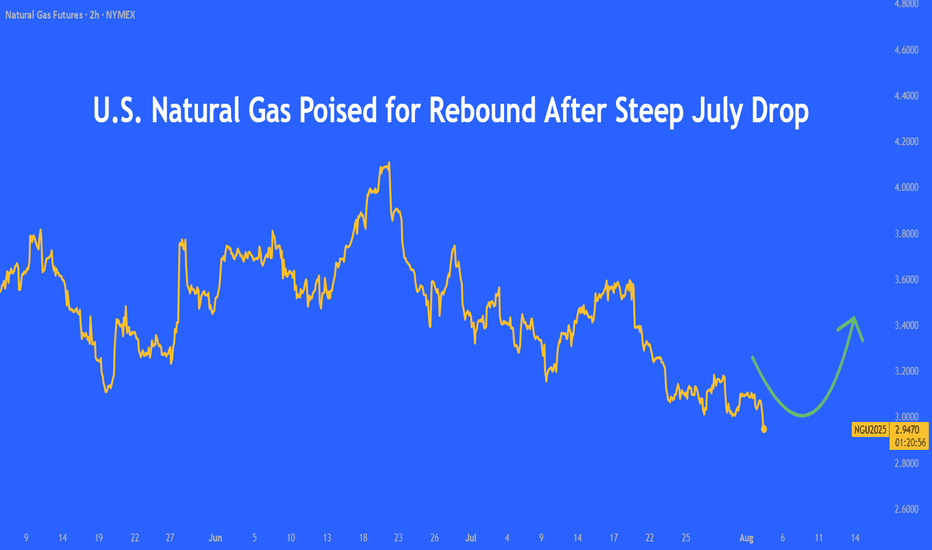

U.S. Natural Gas Poised for Rebound After Steep July DropU.S. natural gas prices sank in July due to mild weather, strong supply, and LNG export disruptions. The EIA cut its price outlook but expects a recovery by winter.

While technicals hint at a short-term rebound, oversupply and weak summer demand keep pressure on prices. A sustained recovery depends

NATURALGAS TRENDLINE BREAKOUT OR FAKEOUT?Timeframe: 1H Breakout Watch 🚀

Technical Overview:

Natural Gas is testing key horizontal resistance around 272 after multiple rejections. Price is holding above 25 EMA and 55 EMA, showing short-term bullish momentum.

Key Levels to Watch:

• Resistance: 272 – 274

• Breakout Target: 278 – 280 (if s

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of French PEG Natural Gas Futures is 23.375 EUR / MWH — it has risen 0.09% in the past 24 hours. Watch French PEG Natural Gas Futures price in more detail on the chart.

Track more important stats on the French PEG Natural Gas Futures chart.

The nearest expiration date for French PEG Natural Gas Futures is Jul 30, 2031.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell French PEG Natural Gas Futures before Jul 30, 2031.