Related commodities

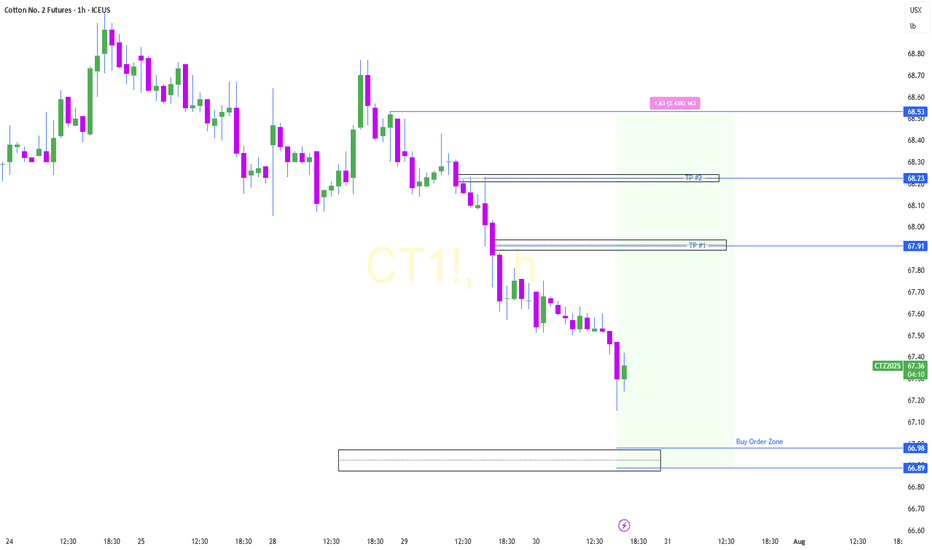

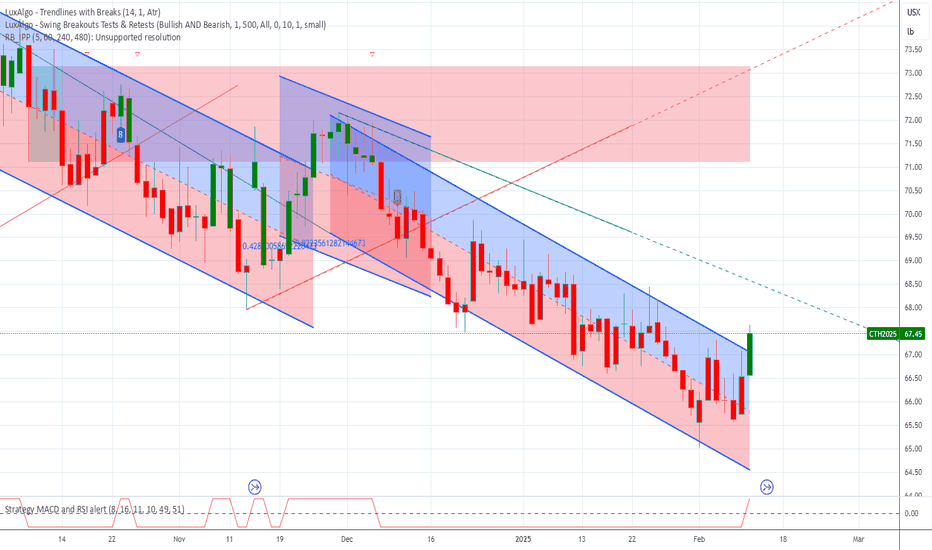

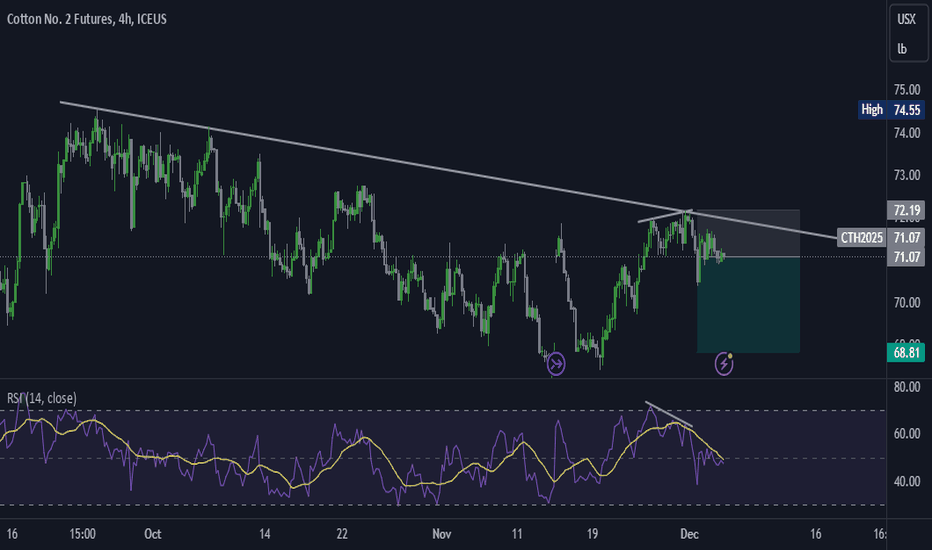

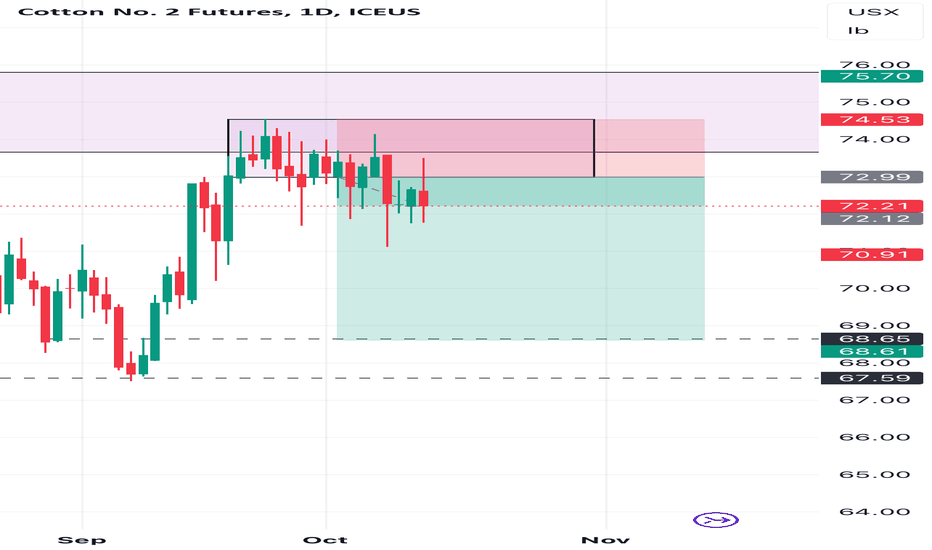

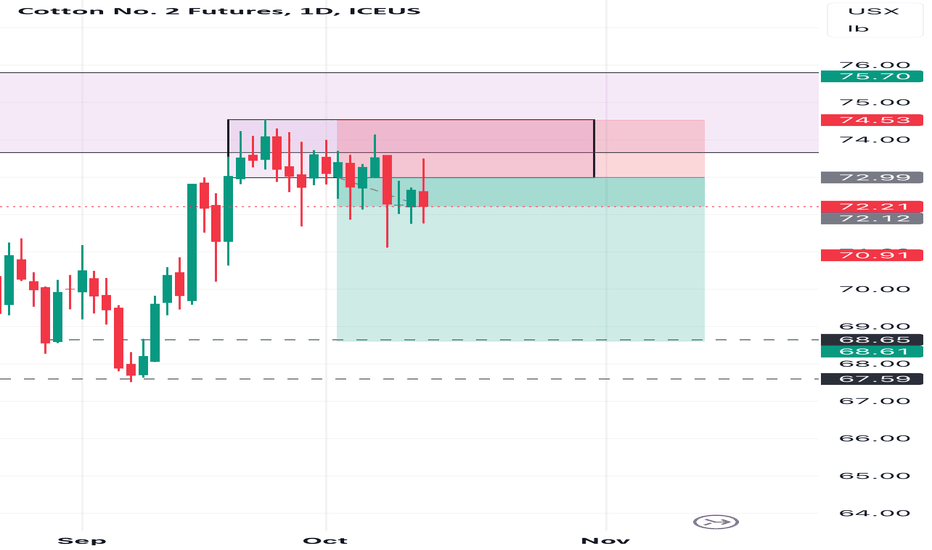

Clear Diversions = Time to enter### **Cotton No. 2 Futures (CT1!) - Bullish Divergence & Trade Setup**

(**Not Financial Advice**)

#### **📌 Key Observations:**

- **Bullish Divergence**: RSI is making higher lows while price is making lower lows → Indication of **potential reversal**.

- **Support & Resistance Levels**:

- **Su

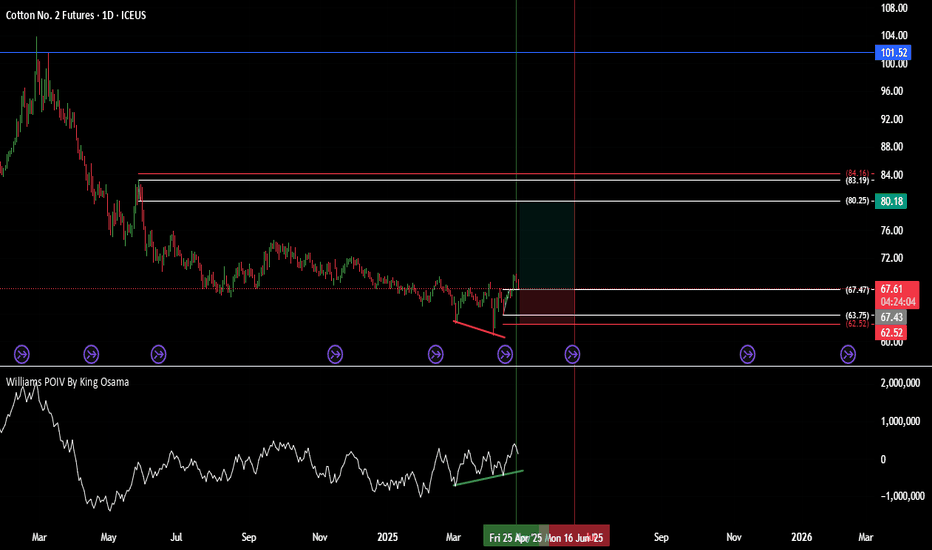

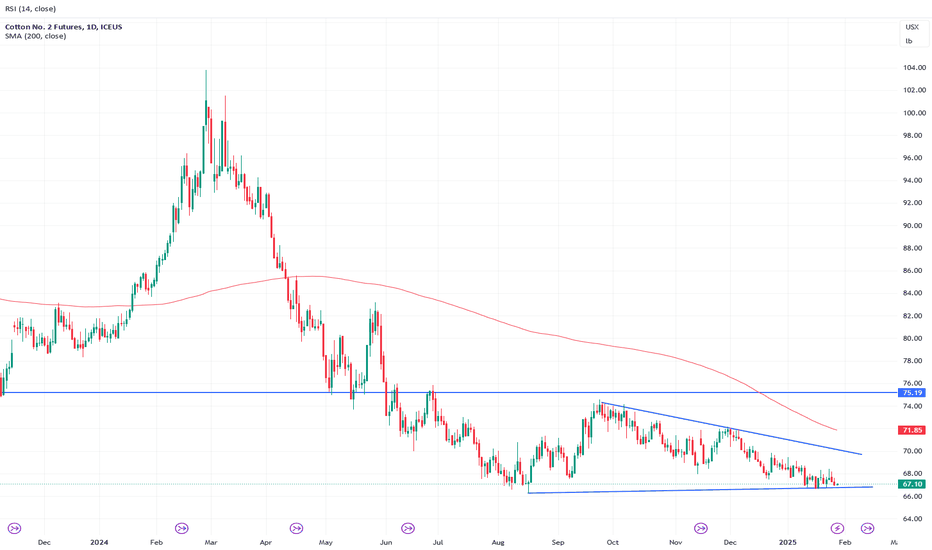

Cotton Futures: Decoding the Matrix of Market ForcesCotton, a seemingly unassuming commodity, is quietly aligning for a significant bullish move. But remember—this is not a prompt for reckless action. The entry is reserved for those who wait for the Daily timeframe to confirm the trend change.

The Codes of the Cotton Conspiracy

Code #1: The Commerc

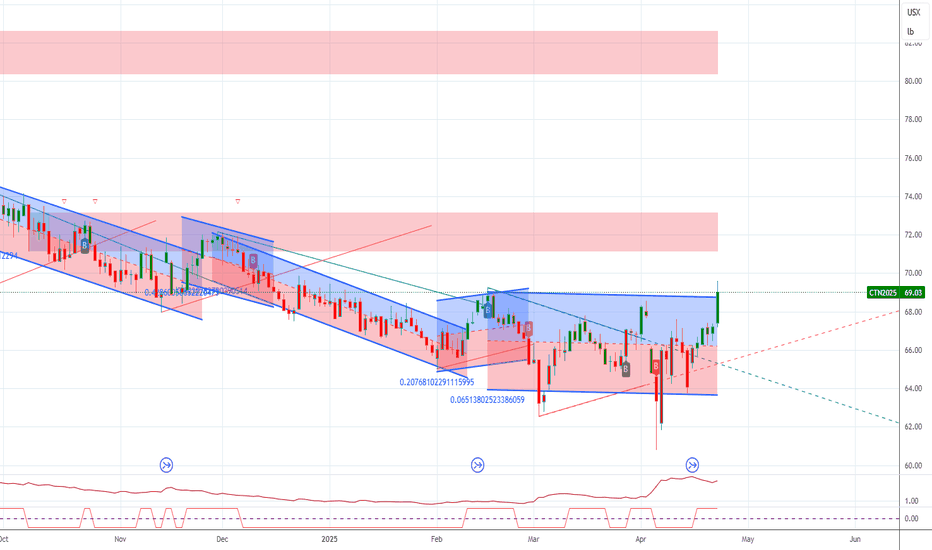

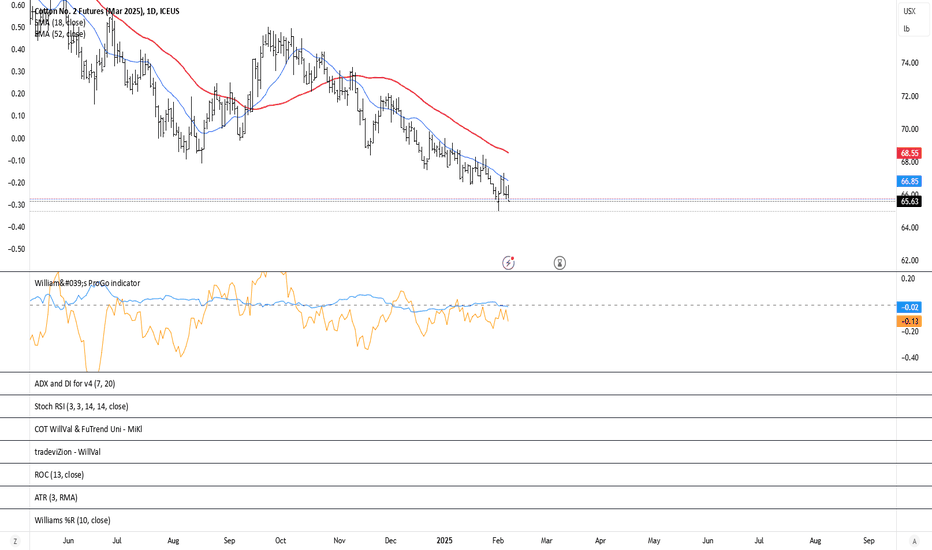

Cotton: Navigating the DeclineCOTTON, in a long-term decline since last February is currently stuck within a narrowing range, with a minimum break above 70 cents per pound needed to change the negative outlook.

However, it is worth noting managed money accounts have held a net short position for a record-breaking 39 weeks. In

See all ideas

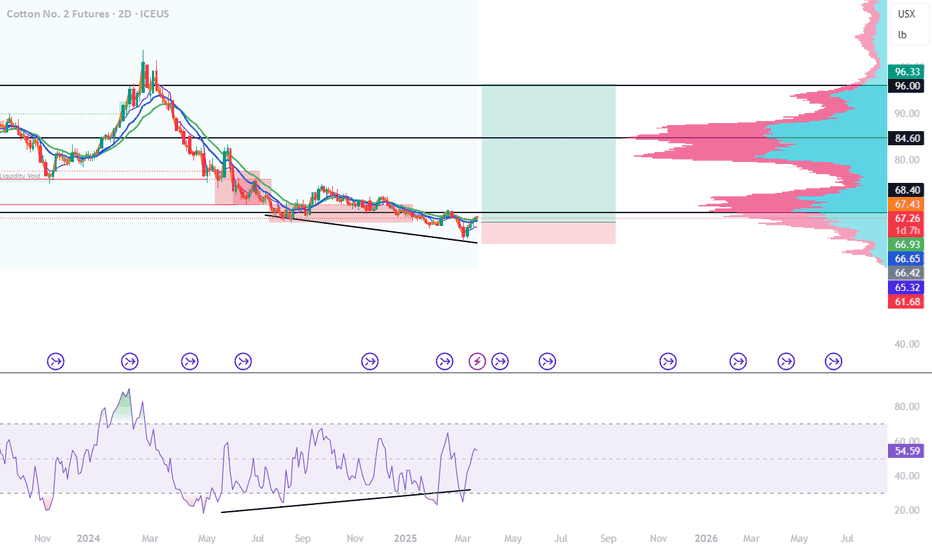

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.