COTTONCNDY Futures

COTTONCNDY1! trade ideas

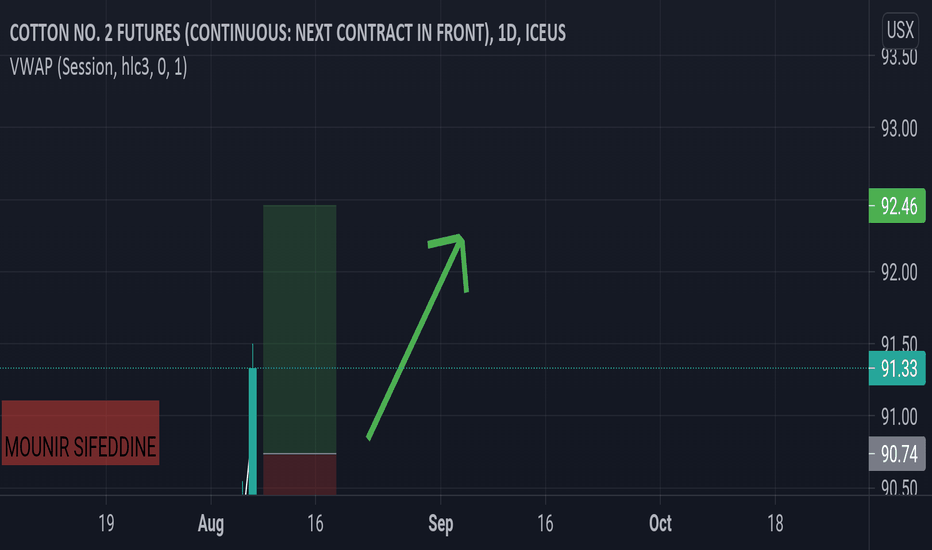

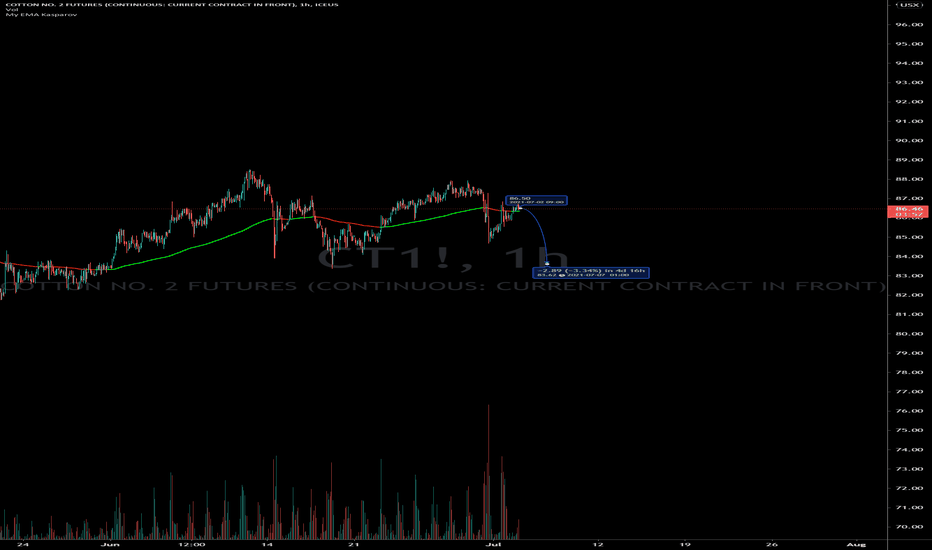

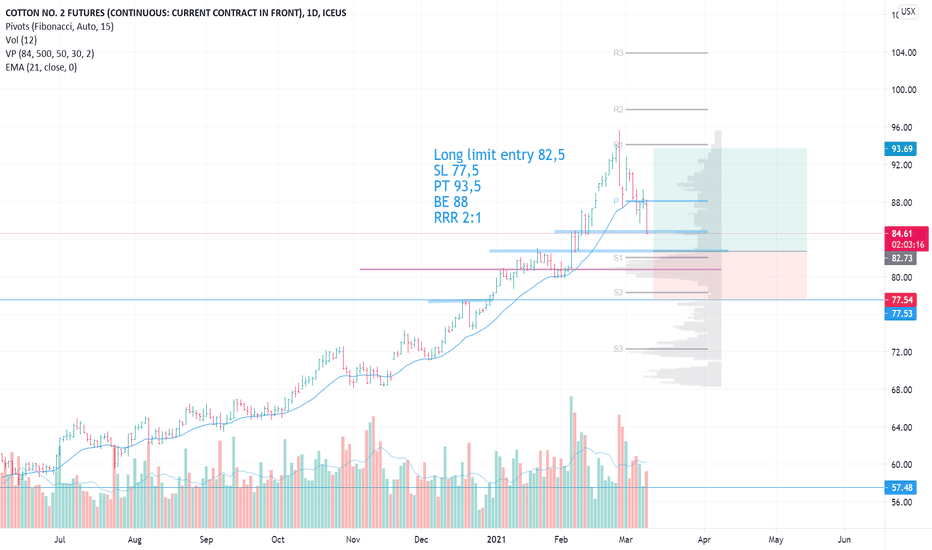

Good profit since my last idea from level 92$Yesterday I posted an idea about cotton(short lower 92) and it goes down 3,5% .Reason for short have 3 main things :

1.Key level 92$ from D1 timeframe.

2.Instrument closed close to our level.

3.Clean area below our level.

With risk 20 cents it gave us 3 dollars profit.

Personally, I did not go into this tool becouse my login model was not there.

The main task is to determine the direction of movement,and we did it :)

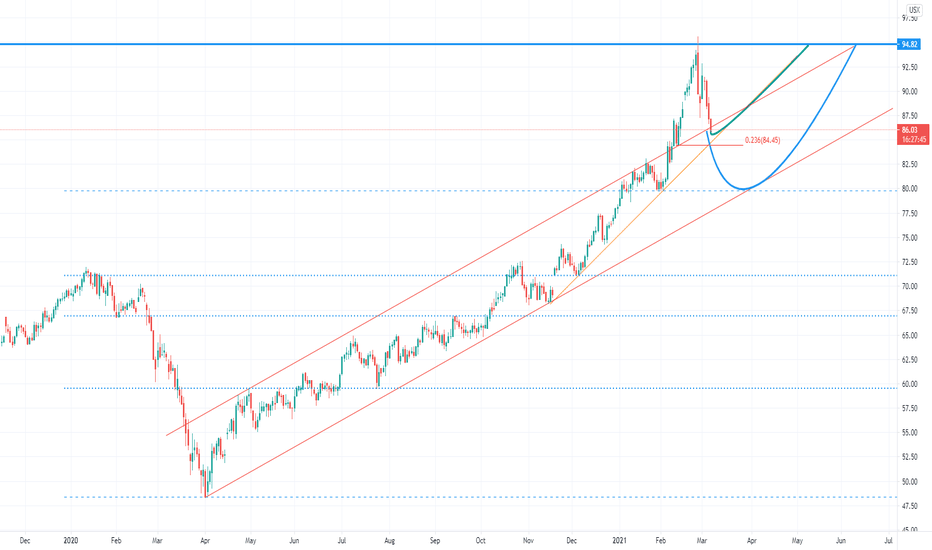

Cotton.Short lower level 92$Global trend long, local trend short.We have key level 92$.Price cinfirm this level few times so we know-there are some bulls and lower this level they have stop losses.When price will broke this level I expect thet bulls will close their long possision and bears will open short possision so we should get some impuls down.With entrens be attention with next things :

1.Open possision only with low volatility.

2.Stopp loss not more then 20 cents.

Keep in mind that Cotton have some support level on 91$ so cover part of your possision few cent before this level :)

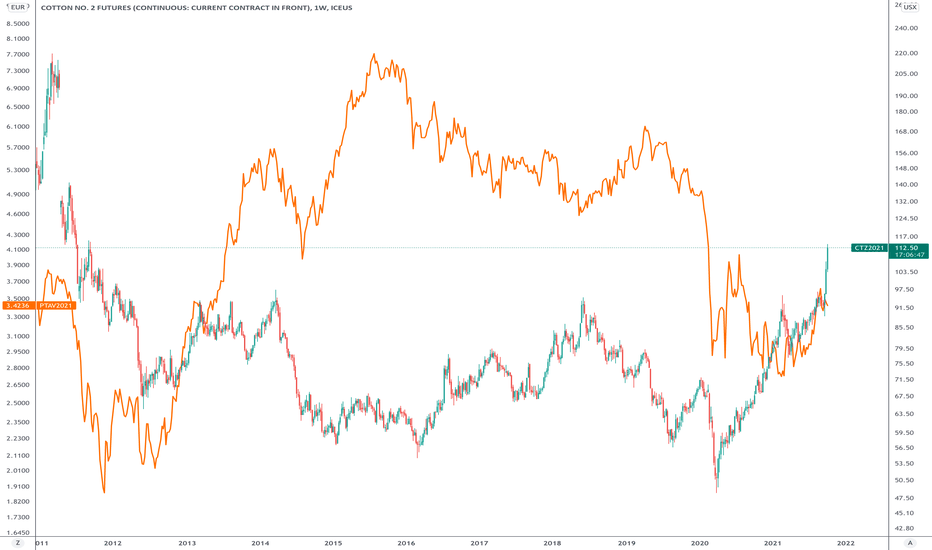

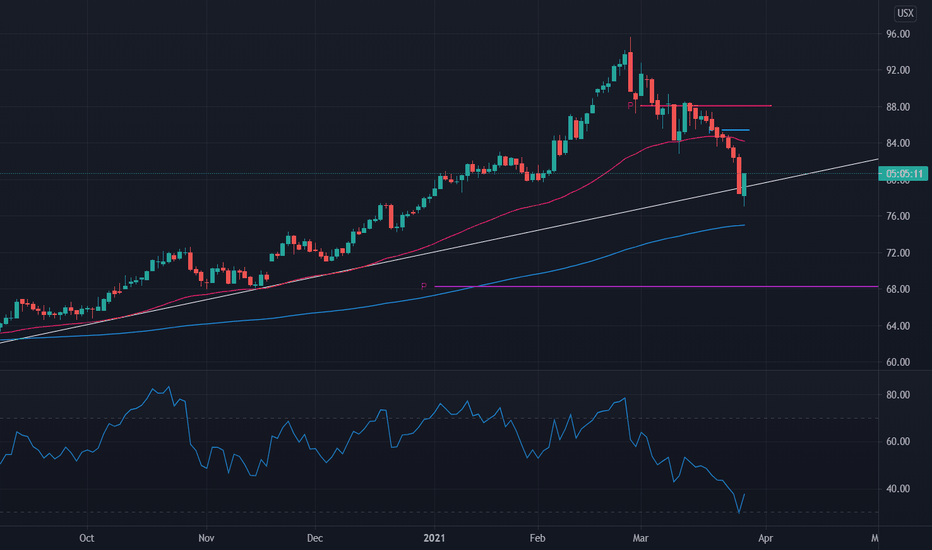

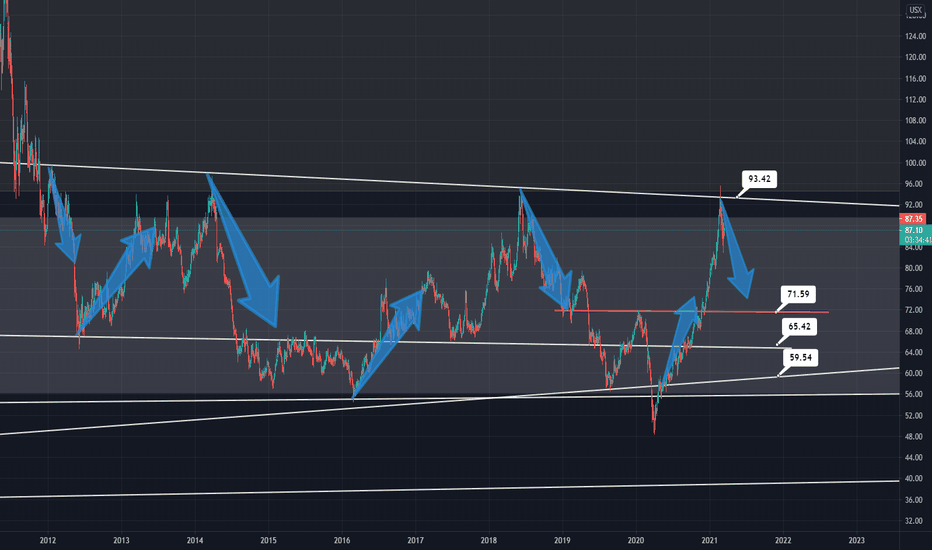

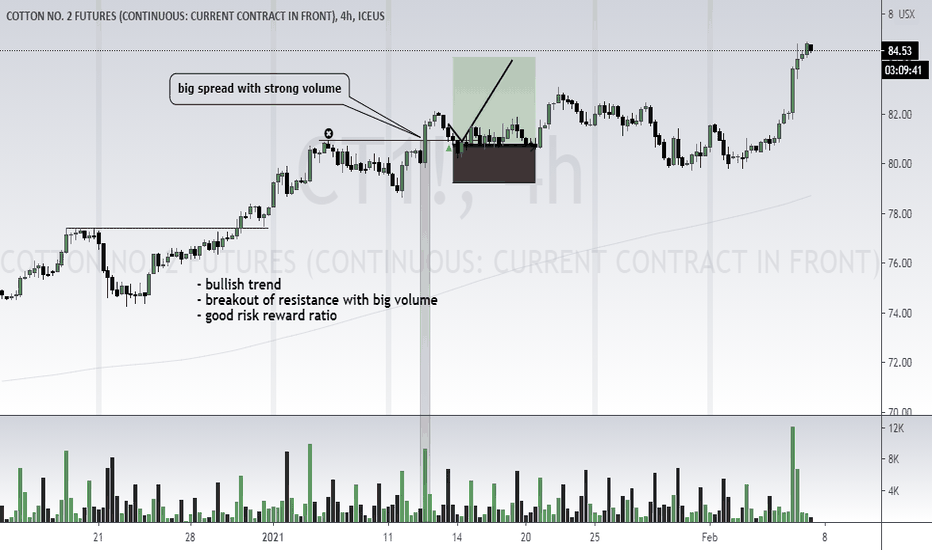

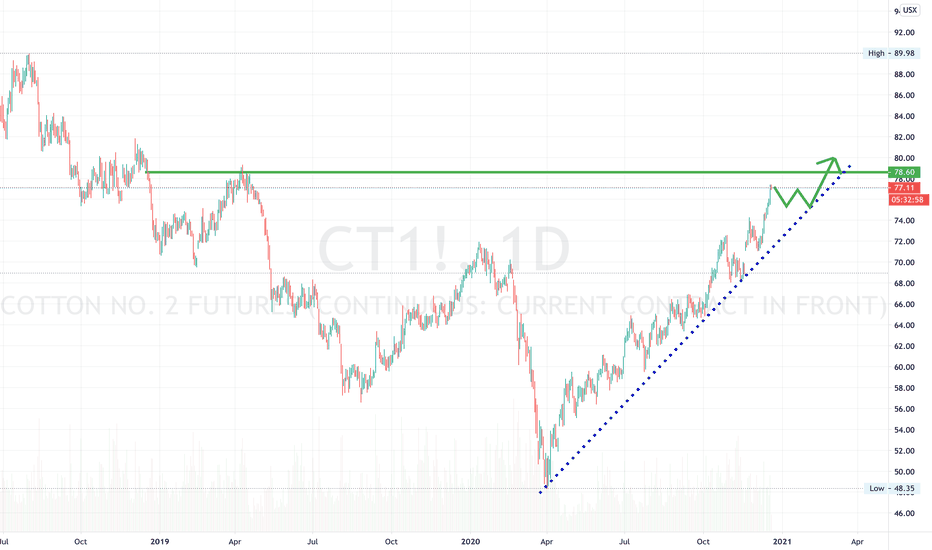

COTTON - 12% LOWER SINCE OUR LAST POSTOn our main Futures trade, Cotton has indeed gone in our direction by a massive 12%.

We told you guys, some might consider it a 'boring' trade, more excitement in trading cryptos and indices or forex but as we stated before 'Cotton is Soft and Predictable', an asset worth your attention.

Cotton stands for seasonality and this makes trading CT1 a rather predictable exercise.

Take a look at the chart and tell me if you like it.

Also look at my previous idea and how well it worked! Be inspired, don't look only for adventures but also for ''easier' trades.

Take a look at our previous ideas and how nicely we managed to ride this price on the way up (perfectly) and on our way down (perfectly again).

one love,

the FXPROFESSOR

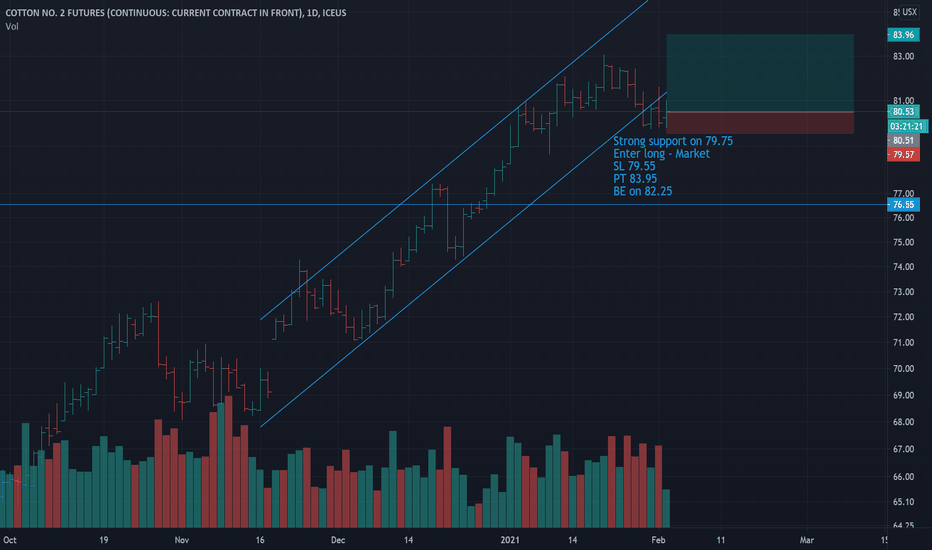

COTTON - Soft and PredictableHi guys,

today I want to introduce you all to an asset worth your attention.

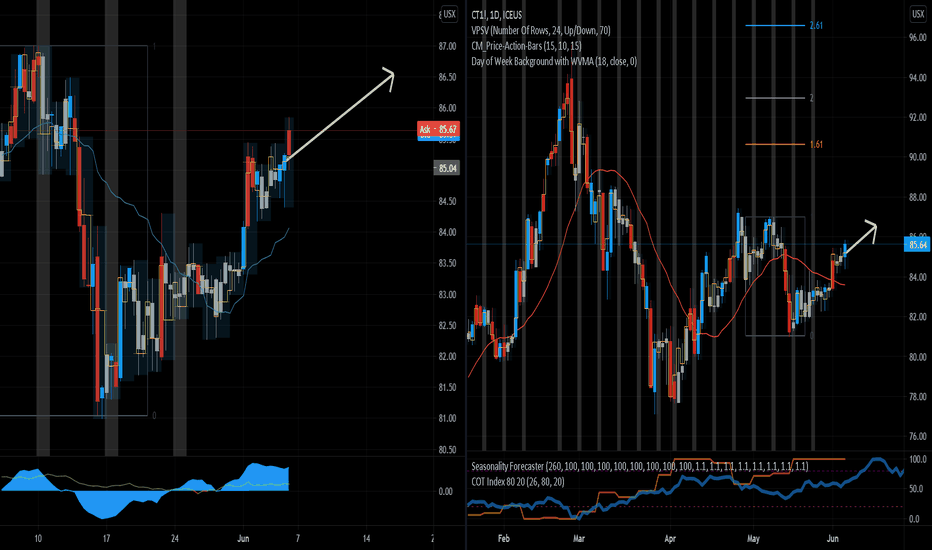

Cotton stands for seasonality and this makes trading CT1 a rather predictable exercise.

Take a look at the chart and tell me if you like it.

Also look at my previous idea and how well it worked! Be inspired, don't look only for adventures but also for ''easier' trades.

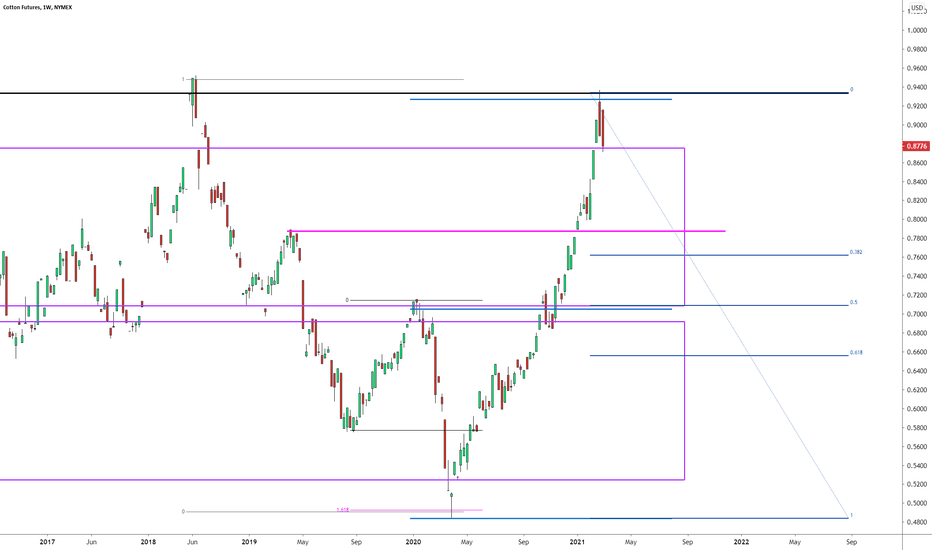

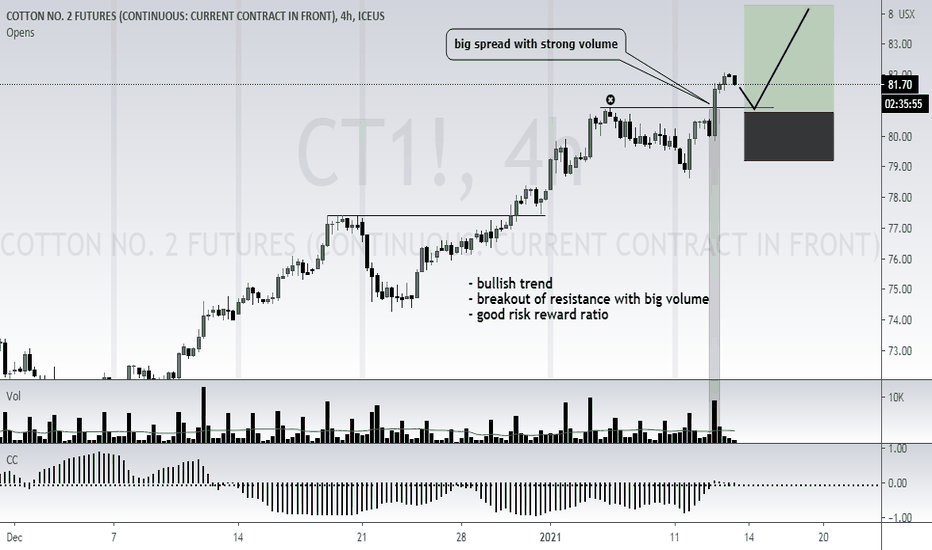

#COTTON TARGET DONE!!-Thank you for reading this idea! Hope it's been useful to you.

-Remember this analysis is not 100% accurate.Use it with your own risk.

-Comment below and let me know what you think of this analysis and what is yours? I welcome all comments, feedback, ideas and sharing of knowledge

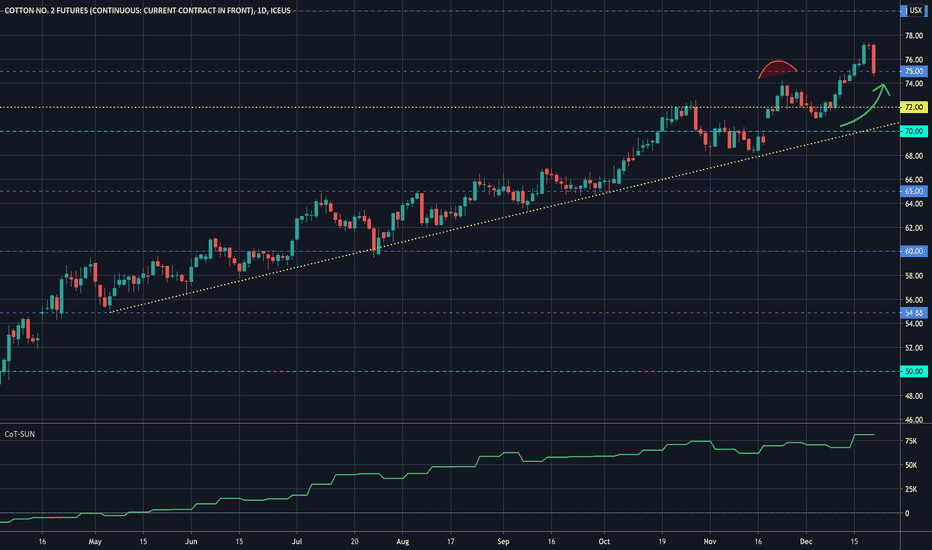

Weekly cotton market review 12/21/2020.Support us by consulting our free magazines with color stock charts and weather maps on our commodity-market-review.com website.

TECHNICAL ANALYSIS OF COTTON

Last week, ICE U.S. cotton futures closed higher at $77.16 cents per pound. Cotton prices ended up sharply last week returning to pre-pandemic levels and 2019 highs.

ICE U.S. cotton stocks were down to 78031 bales. Total cash transactions were 782746 bales this week compared to 630082 bales the previous week, an increase of 152664 bales this week compared to 98938 bales the previous week and 109251 bales at the same time last year. Demand has been good, with China, Korea and Vietnam showing interest.

Harvesting is complete in most areas, but continues further north in Oklahoma and Kansas.

According to the latest USDA report, the 2020/21 global cotton production forecast has been revised down to 113903K bales from 116112K previously. The decrease is due to the U.S. and Indian production. World cotton consumption estimates have been revised upwards to 115625K bales from 114050K previously. The 2020/21 market will therefore be in deficit, with a drop in stocks to 97520K instead of the 101435K initially forecast. The stocks according to the forecasts will therefore be down but historically high.

On the international level, the Republican leader of the senate Mitch McConnell announced Sunday evening that a 900 billion agreement would have been reached. The Fed said its purchases of securities would continue at the current pace of $120 billion per month until substantial additional progress has been made. The brexit saga continues, with the European Parliament's Sunday night deadline for a deal passed, but negotiations will continue. No one seems to want to take responsibility for a possible failure. After Pfizer, the FDA also approved Moderna's vaccine. As far as the pandemic is concerned, the vaccination campaign has started in the United States. The new strain of coronavirus detected in Great Britain worries, it would be 70% more contagious. The global death toll is rising, we have just passed 76 million cases worldwide, with more than 1.692 million deaths. The United States is still the most affected country, with 317,000 deaths and more than 17 million cases.

The Dollar fell last week, with the DXY closing lower at 89.924, hitting a 2 1/2 year low. The long-term trend is still bearish.

WEATHER IN THE UNITED STATES

The hurricane season in the North Atlantic is officially over, and the U.S. cotton harvest is also coming to an end. Rainfall in October was above normal, but lower than normal in November. Last week's rainfall was normal.

ICE US CERTIFIED COTTON STOCKS

ICE cotton stocks at the height of the harvest season were down to 78031 bales from 86544 last week. Stocks are above the five-year average for the same period.

THE DOLLAR

The DXY index representing the Dollar against a basket of foreign currencies closed last week down to 89.924, hitting a 2 1/2 year low. The long-term trend is still bearish. The possibilities of reaching an agreement on a contingency plan to support the U.S. economy, as well as the possibility of an economic recovery, are expected to continue.

Disappointing economic results weighed on the currency last week. Indeed, U.S. Retail Sales down to -0.9% and Unemployment Claims up to 885K disappointed.

A low dollar is generally favorable for dollar-denominated commodity markets.

COMMITMENTS OF TRADERS

The weekly COT (Commitments of Traders) report of the Commodity Futures Trading Commission (CFTC) shows all the positions opened by all market participants. The COT report is published on Friday, and reflects the open positions on Tuesday of the same week. It shows the position of commercial traders (producers, commodity buyers, ...) but also non-commercial (speculators).

The net positions of speculators on the futures markets are particularly interesting to observe.

The speculative net position on the cotton futures markets is up this week to 81.341 K instead of 67.96 K.

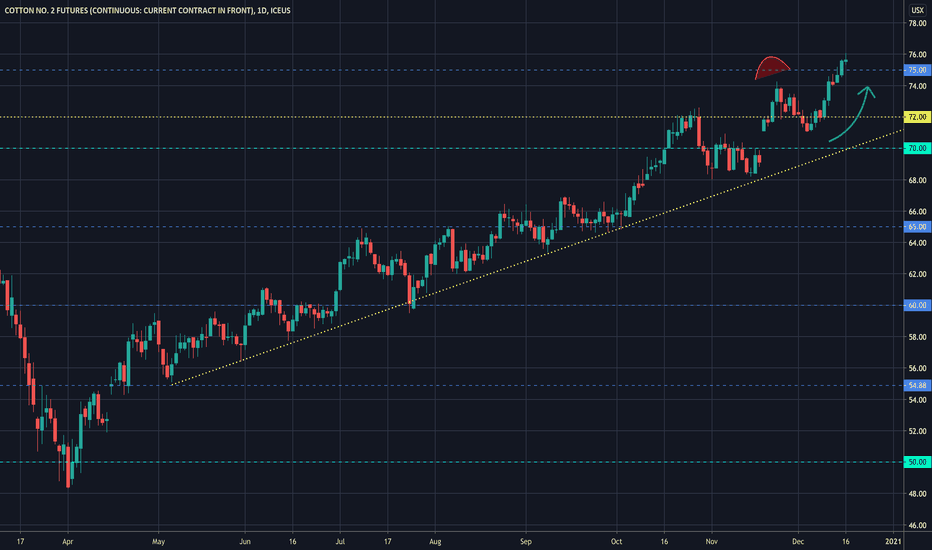

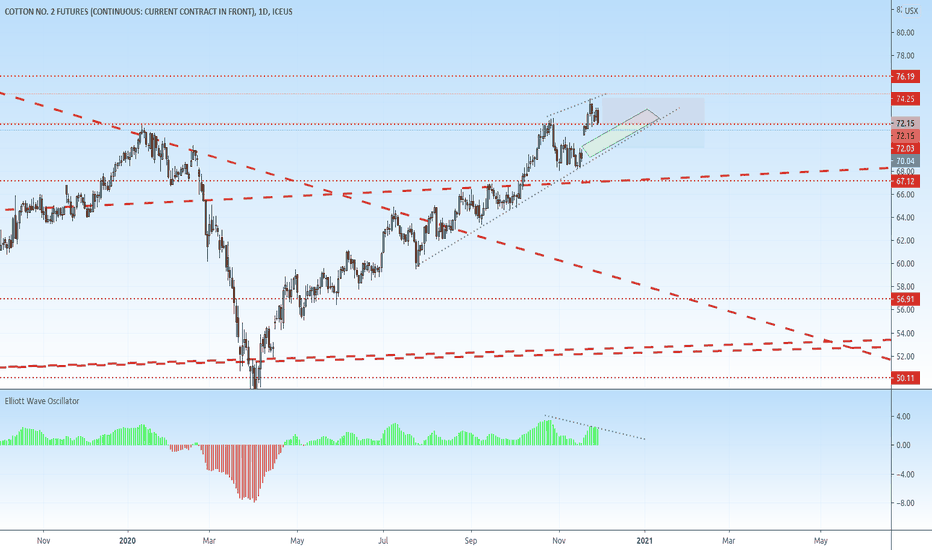

Weekly cotton market review 12/14/2020.Support us by consulting our free magazines with color stock charts and weather maps on our commodity-market-review.com website.

TECHNICAL ANALYSIS OF COTTON

Last week, ICE U.S. cotton futures closed higher at $74.08 cents per pound.

ICE U.S. cotton stocks were down to 86544 bales. Total cash transactions totaled 6,30082 bales this week compared to 5,31144 bales the previous week, an increase of 9,8938 bales this week compared to 5,0282 bales the previous week and 1,4261 bales at the same time last year. Demand has been good, with China, Pakistan and Vietnam showing interest.

Harvesting is complete in most areas, but continues further north, in Oklahoma and Kansas, with an advance of about 80%.

According to the latest USDA report, the 2020/21 global cotton production forecast has been revised down to 113903K bales from 116112K previously. The decrease is due to US and Indian production. World cotton consumption estimates have been revised upwards to 115625K bales from 114050K previously. The 2020/21 market will therefore be in deficit, with a drop in stocks to 97520K instead of the 101435K initially forecast. The stocks according to the forecasts will therefore be down but historically high.

On the international level, the ECB has increased its asset buyback program by 500 billion, the US support plan has been delayed again and again, and a brexit no-deal is increasingly likely. The FDA in turn is approving the use of Pfizer's vaccine, and vaccination begins this week in the US. In terms of the pandemic update, we have just surpassed 72 million cases worldwide, with more than 1.607 million deaths. The U.S. is still the most affected country, and will approach and surpass the 300,000 mark in deaths and more than 16 million cases.

The Dollar consolidated last week as the DXY closed higher at 90.976, with the long-term trend still bearish.

WEATHER IN THE UNITED STATES

The hurricane season in the North Atlantic is officially over, and the U.S. cotton harvest is also coming to an end. Rainfall in October was above normal, but lower than normal in November. Last week, many areas experienced their first significant frost of the season. Wet and cold weather, with slightly above normal rainfall in the delta was reported last week.

ICE US CERTIFIED COTTON STOCKS

ICE cotton stocks at the height of the harvest season were down to 86544 bales for 101220 last week. Stocks are above the five-year average for the same period.

THE DOLLAR

The DXY index representing the Dollar against a basket of foreign currencies closed last week up at 90.976, although the long-term trend is still bearish. The DXY consolidated last week. The ECB increased its asset repurchase program by $500 billion, and, the U.S. support plan is still lagging behind, still failing to agree on emergency aid of just over $900 billion. The dollar has also strengthened against the pound sterling, on an increasingly likely no-deal, as the disagreements seem so deep.

A low dollar is generally favorable to dollar-denominated commodity markets.

COMMITMENTS OF TRADERS

The weekly COT (Commitments of Traders) report of the Commodity Futures Trading Commission (CFTC) shows all the positions opened by all market participants. The COT report is published on Friday, and reflects the open positions on Tuesday of the same week. It shows the position of commercial traders (producers, commodity buyers, ...) but also non-commercial (speculators).

The net positions of speculators on the futures markets are particularly interesting to observe.

The speculative net position on the cotton futures markets is down this week to 67.96 K instead of 70.799 K.

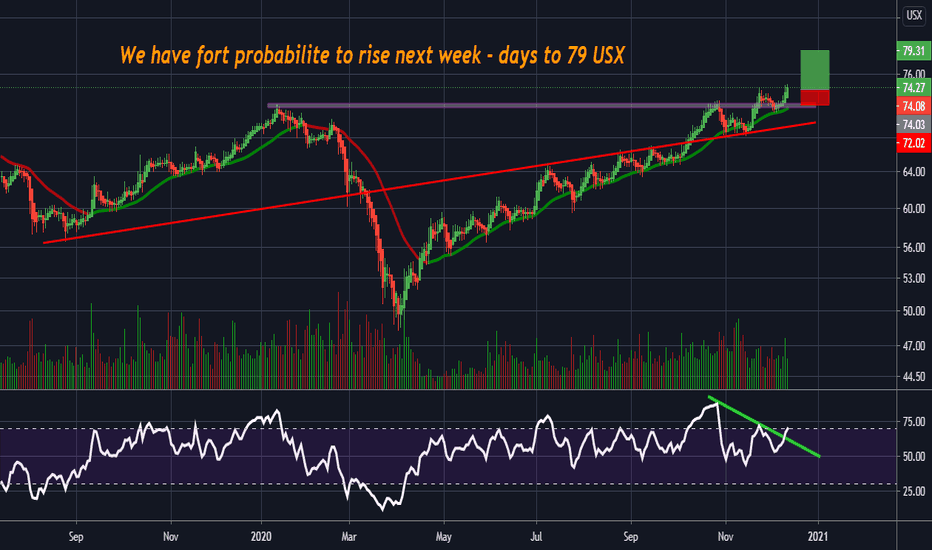

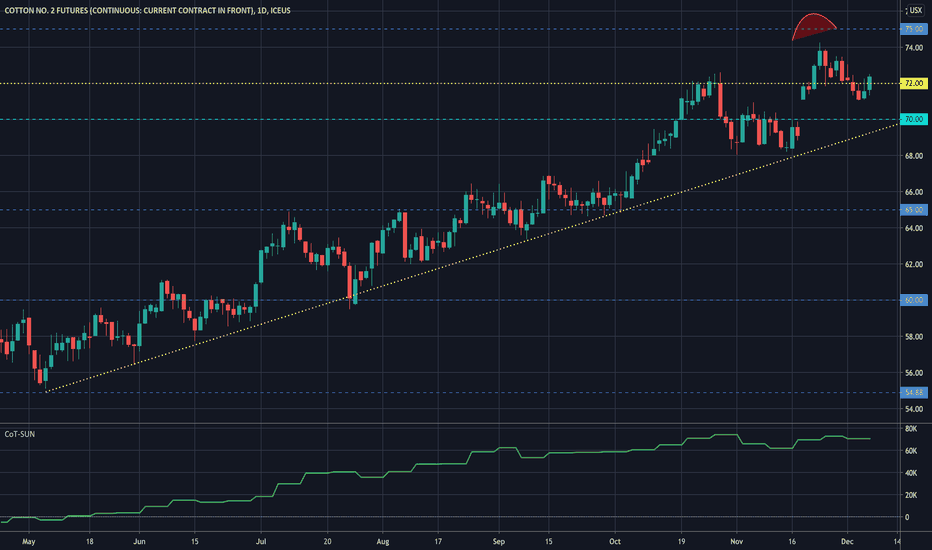

Weekly cotton market review 12/07/2020.Support us by consulting our free daily magazines with color stock charts and weather maps on our commodity-market-review.com website.

TECHNICAL ANALYSIS OF COTTON

Last week, ICE U.S. cotton futures closed lower at $71.57 cents per pound.

ICE U.S. cotton stocks were down to 101220 bales. Total cash transactions were 531144 bales this week compared to 479062 bales last week, an increase of 52082 bales this week compared to 83328 bales last week and 53680 bales at the same time last year. Demand has been good, with China, Pakistan and Vietnam showing interest.

-In the Southeast, a cold bottom passed through the region over the weekend, and many areas experienced their first major frost. Alabama, Florida, Georgia experienced up to 7 centimeters of rain, interrupting work, then resuming where the soils were sufficiently firm. Harvest was 80% complete in Alabama and Georgia, 74% in North Carolina, 77% in South Carolina, and 62% in Virginia, where harvest was late due to wet conditions.

-In the Delta, a cold front resulted in lower temperatures and low precipitation in the region during the week. Up to 5 cm of precipitation was reported during this period, with light snow in the northern regions. Field activities were for the most part completed. A few growers reported disappointing yield results and/or grade reductions, which they attributed to wet weather throughout the harvest season, resulting in boll rot in some of the areas. Harvest was 100% complete in Arkansas, 95% in Missouri and Tennessee, 100% in Louisiana and 98% in Mississippi.

-In Texas, intermittent rains were reported in parts of southern Texas. Ginning is continuing in the coastal zone.

Internationally, last week was marked by the sharp fall of the dollar. The DXY, after breaking through the 92 resistance, is heading towards the 90's, and the Euro was close to $1.22 after disappointing U.S. empoi figures. Hopes for a vaccine, the FED reaffirming that the priority remains to support the economy, and the joint Democratic and Republican proposal for a $908 billion emergency plan are driving equity markets. Curiously, commodities as a whole did not benefit from the dollar's decline.

Discussions between the British and the Europeans continue as the December 31 deadline approaches in the hope of reaching a post-brexit trade agreement. Regarding the pandemic update, we have just passed the 67 million cases worldwide, with more than 1.537 million deaths. The United States continues to be the most affected country with more than 282,000 deaths and more than 14.7 million cases. Italy passes the 60,000 death mark, and the United States is facing a spectacular rebound of the epidemic with more than 230,000 cases Saturday, in 24 hours. The United Kingdom, the first country to license Pfizer vaccine, begins vaccination Tuesday.

WEATHER IN THE UNITED STATES

The hurricane season in the North Atlantic is officially over, and the U.S. cotton harvest is also coming to an end. Rainfall in October was above normal, but lower than normal in November. Last week, many areas experienced their first significant frost of the season. Slightly above normal rainfall was reported last week in parts of the southeast, south delta and southeast Texas.

ICE US CERTIFIED COTTON STOCKS

ICE cotton stocks at the height of the harvest season were down to 101220 bales for 115929 last week. Stocks are above the five-year average for the same period.

THE DOLLAR

The DXY index representing the Dollar against a range of foreign currencies closed last week down to 90.701, and the trend is still bearish. The DXY after breaking the 92 resistance, plunged last week and is on its way to the 90. The Euro rose as high as 1.2175 on Friday after very disappointing U.S. employment figures. As a backdrop, Powell said the priority remains to support the economy, and Democrats and Republicans are working together on a $908 billion emergency support proposal as a first step. For later, once the Joe biden administration is in place, work for a more substantial plan. Forex traders are anticipating an increase in the money supply.

A low dollar is generally good for dollar-denominated commodity markets.

COMMITMENTS OF TRADERS

The weekly COT (Commitments of Traders) report of the Commodity Futures Trading Commission (CFTC) shows all the positions opened by all market participants. The COT report is published on Friday, and reflects the open positions on Tuesday of the same week. It shows the position of commercial traders (producers, commodity buyers, ...) but also non-commercial (speculators).

The net positions of speculators on the futures markets are particularly interesting to observe.

The speculative net position on the cotton futures markets is down this week to 70.799 K instead of 73.111 K.