Related commodities

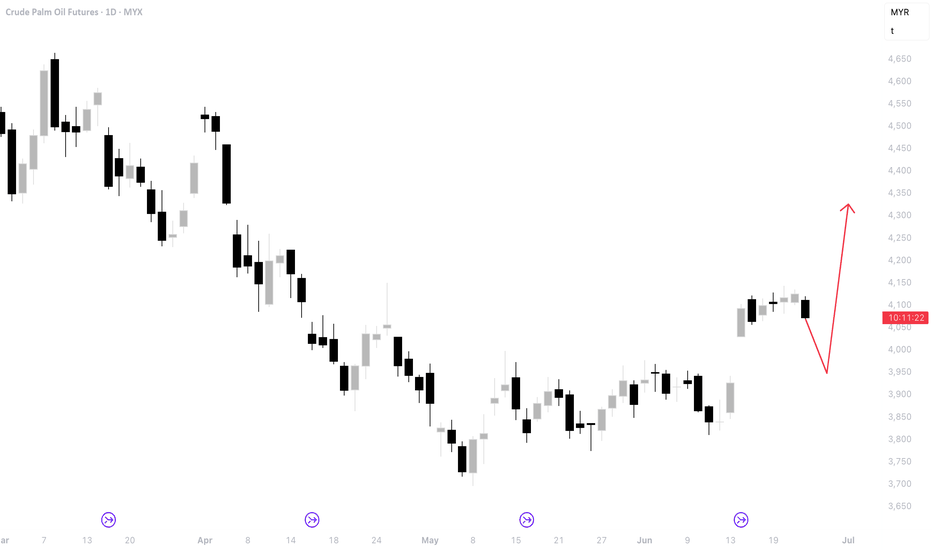

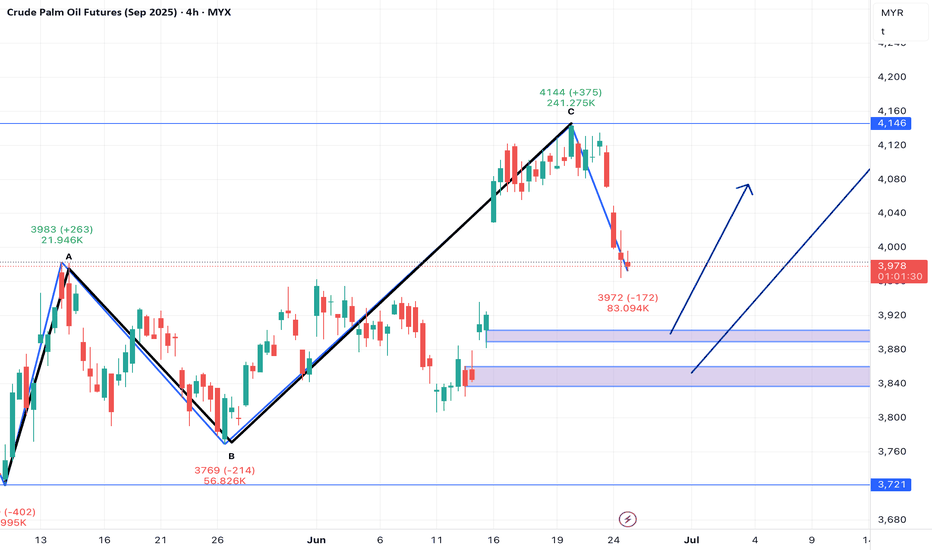

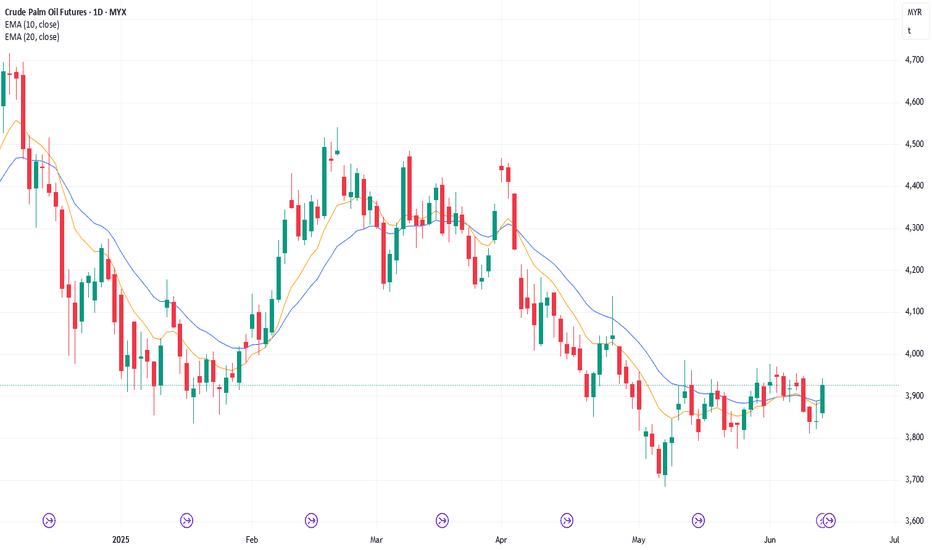

24/6/25 Profit Taking, Bears Need FT Selling

Monday’s candlestick (Jun 23) was an inside bull bar closing near its high.

In our last report, we said traders would see if the bulls could create a strong breakout above the 4150 with sustained follow-through buying, or if the market would stall around the 4150 area followed by more profit-ta

23/6/25 Can Bulls Get a BO or Stall Around 4150?

Friday’s candlestick (Jun 20) was an outside bull doji closing slightly above the middle of its range.

In our last report, we said traders would see if the bulls could create a strong breakout above the 4150 with sustained follow-through buying, or if the market would stall around the 4150 area

20/6/25 Buying Above 4150 or Profit Taking?

Thursday’s candlestick (Jun 19) was a small doji bar.

In our last report, we said traders would see if the bulls could create a strong breakout above the Jun 17 high with sustained follow-through buying, or if the market would stall around the Jun 17 high area instead.

The market traded slight

19/6/25 - Bulls Need Strong Breakout Above Jun 17 High

Wednesday’s candlestick (Jun 18) was an inside bull bar closing in its upper half.

In our last report, we said traders would see if the bulls could create follow-through buying over the next several days, or if the bears would get a follow-through bear bar instead.

The market traded slightly h

18/6/25 Bulls Need FT Buying, Bears Want FT Bear Bar

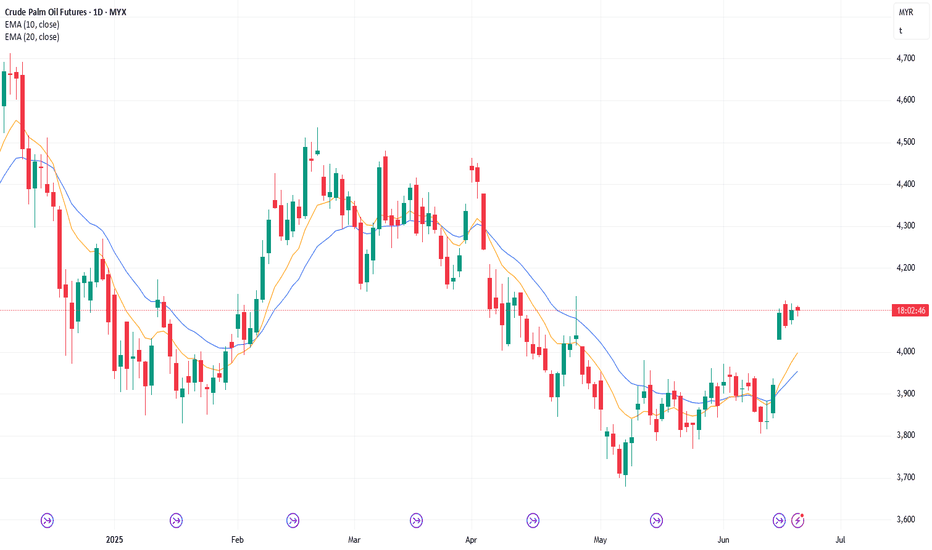

Tuesday’s candlestick (Jun 17) opened higher but closed as a bear bar near its low.

In our last report, we said traders would see if the bulls could create follow-through buying over the next several days, or if the market traded down and lacked follow-through buying instead. If this is the cas

17/6/25 Bulls Need FT Buying to Confirm the Breakout

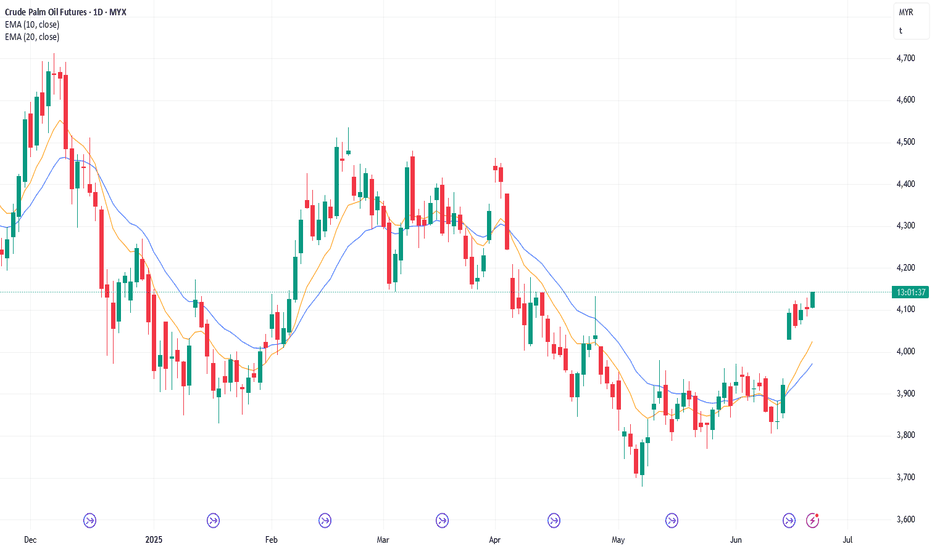

Monday’s candlestick (Jun 16) was a bull bar closing near its high and breaking out above the trading range.

In our last report, we said the market would likely open higher. Traders would see if the bulls could close the day as a bull bar above the 4000 level, or if the market opens higher, but

16/6/25 Bulls Need Strong Follow-through Buying on Monday

Friday’s candlestick (Jun 13) was a bull bar closing near its high and above the 20-day EMA.

In our last report, we said traders would see if the bears could create another follow-through bear bar, or if the market stalls again and form a bull bar trading above the 20-day EMA in the next few da

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Crude Palm Oil Futures is May 15, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Crude Palm Oil Futures before May 15, 2025.