Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.13 USD

27.29 M USD

507.00 M USD

386.39 M

About Marqeta, Inc.

Sector

CEO

Michael Milotich

Website

Headquarters

Oakland

Founded

2010

FIGI

BBG0112Z87D8

Marqeta, Inc. engages in the creation of digital payment technology. The firm develops a modern card issuing platform, providing infrastructure and tools for building configurable payment cards. It provides its customers issuer processor services and also acts as a card program manager. The company was founded by Jason M. Gardner in 2010 and is headquartered in Oakland, CA.

Related stocks

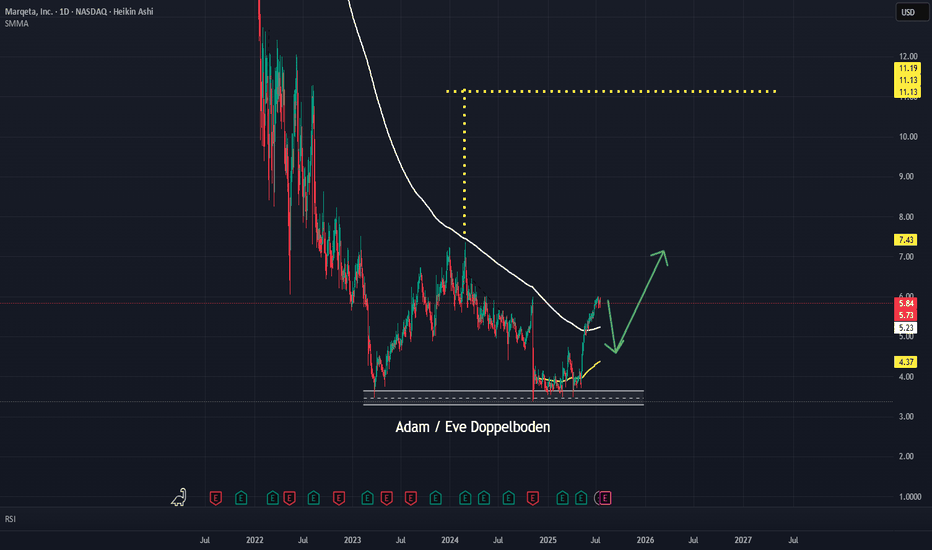

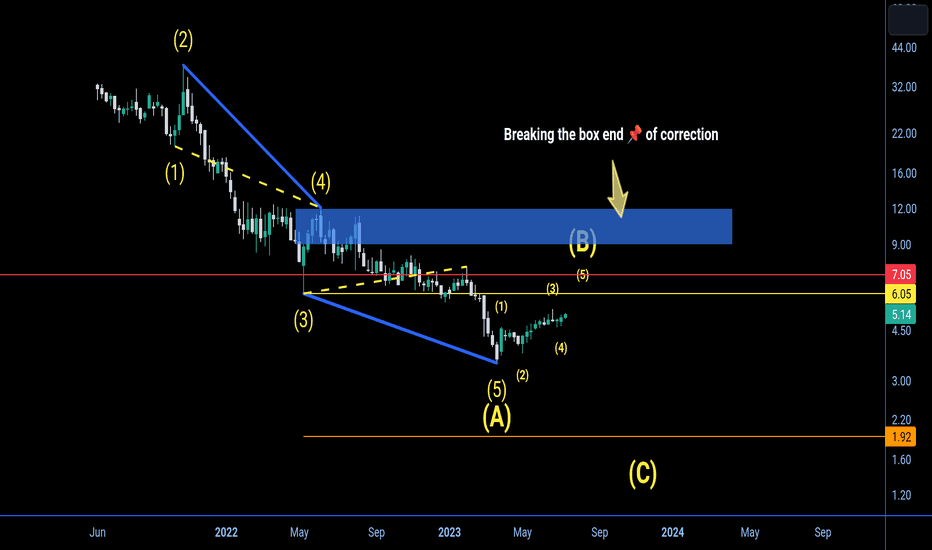

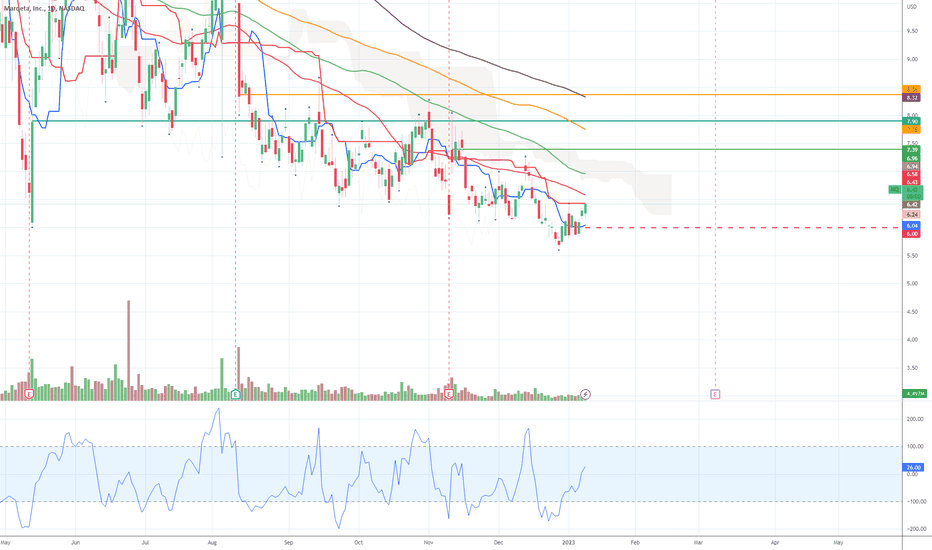

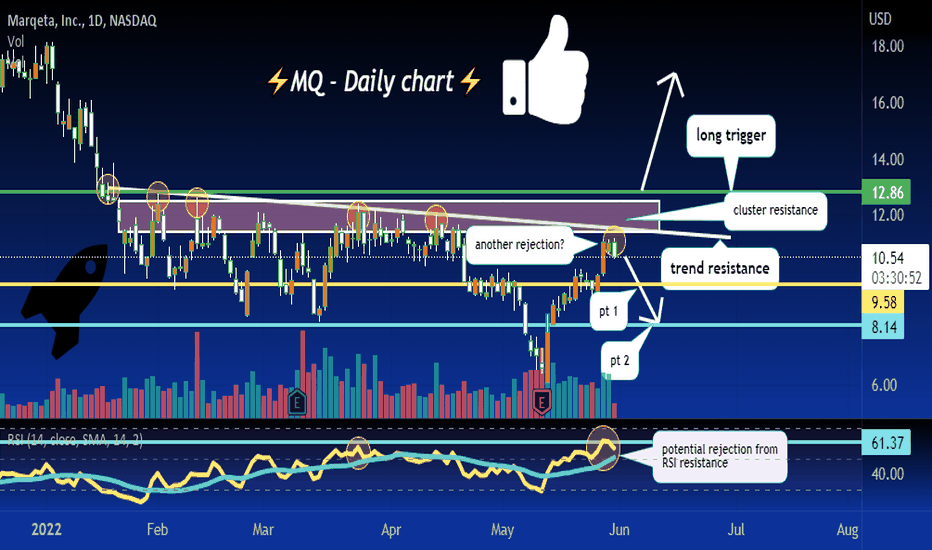

$MQ looks good"Marqeta is a modern card issuing platform that provides the infrastructure and tools for businesses to create, manage, and control payment card programs, including debit, prepaid, and credit cards. They offer an open API platform that allows companies to build customized payment solutions, manage t

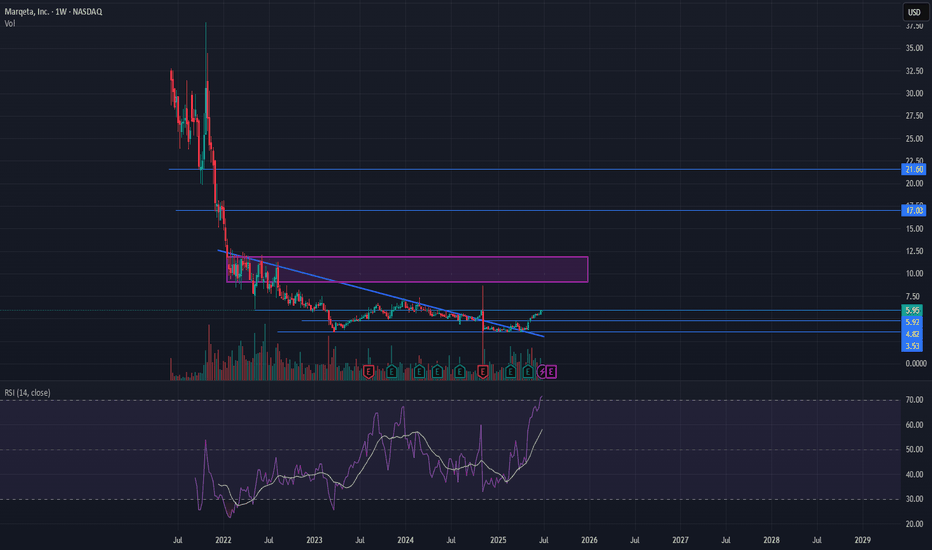

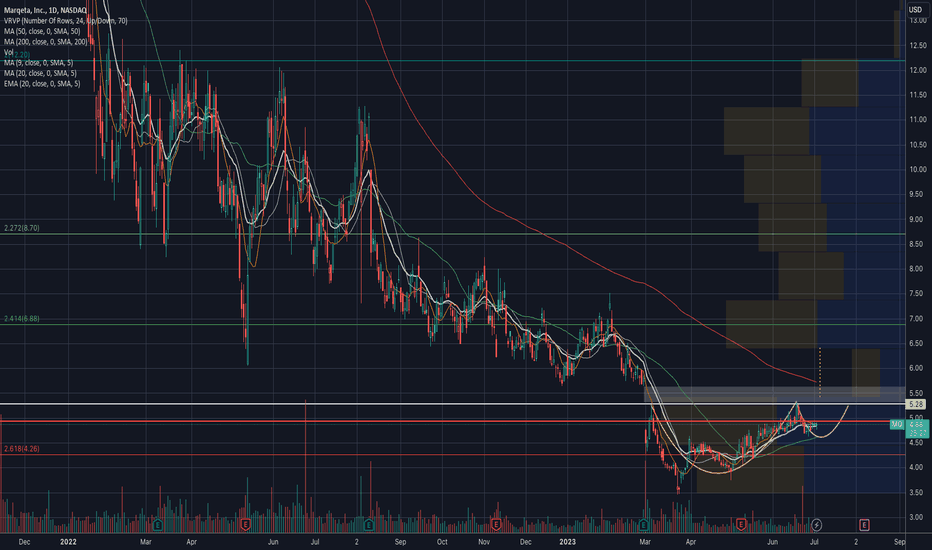

MQ usstock going to rise 400-800% I am not a financial advisor 📌 before taking my analysis pls #DYOR

I am always available 😊 in private chatting box & check profile 😊 to get connected 😉

Let's get into the stock

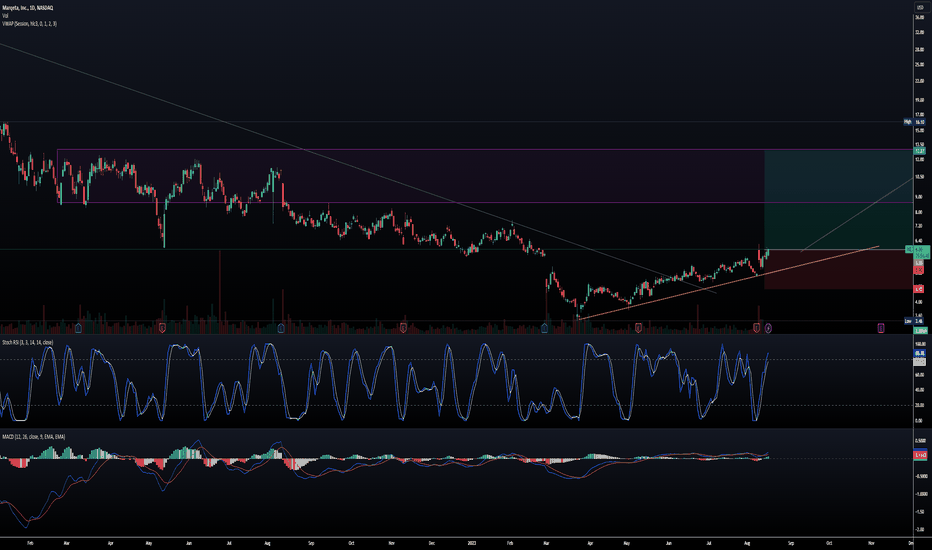

From beginning of chart 📉📈 it's getting downtrend it's impossible to confirm upward trend 📉

Present 💝 there will trap

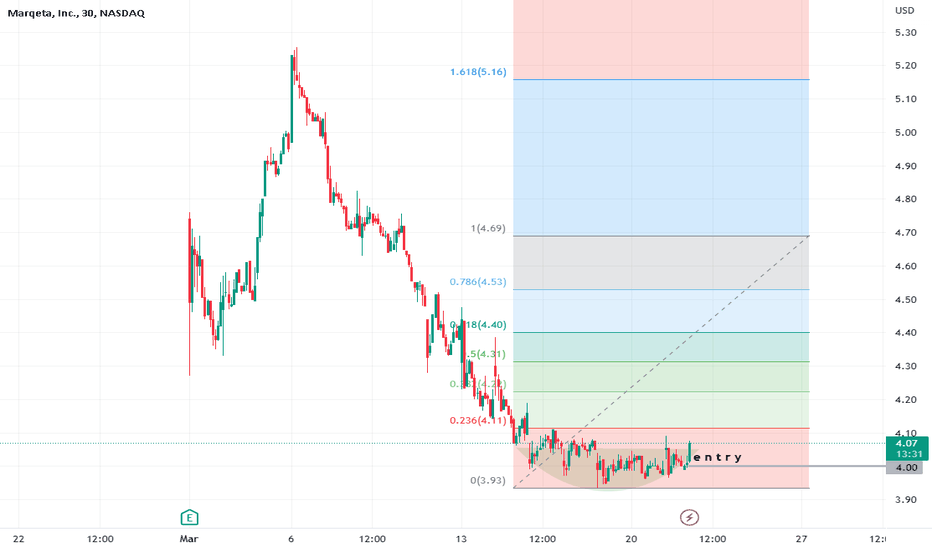

$MQ reversal play 👁🗨️*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

This after

$MQ - looking like a reversalNASDAQ:MQ Looks to be forming a reversal ☕️. $4.92 to $5 is a tough point of control resistance area hence the stock has been trading in narrow range. Took a starter position. Targets - $5.70, $6.50, $8.70. Downside risk - $4.26. I would probably add more if we see $4.26 and below. 💥🚀💰

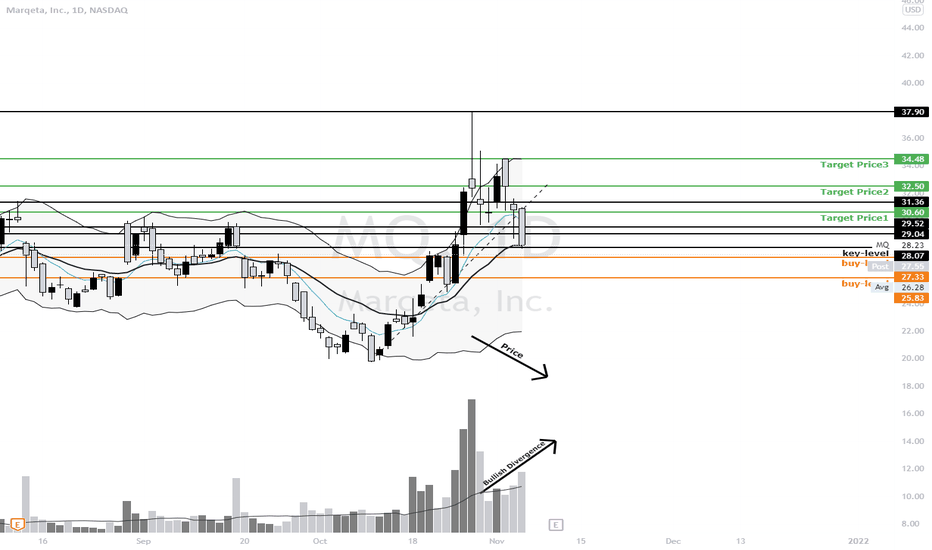

Long | MQNASDAQ:MQ

Put it on your watch list, and enjoy this perfect opportunity.

Possible Scenario: LONG

Evidence: Price Action, Bullish Divergence, Dark pool activity, Options flow.

Entry point: current price, it can drop more but not important.

TP1: 30.5$

TP2: 32.5

TP3: 34.5

I expect it hit ATH very soo

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where MQ is featured.

Frequently Asked Questions

The current price of MQ is 6.83 USD — it has increased by 20.25% in the past 24 hours. Watch Marqeta, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Marqeta, Inc. stocks are traded under the ticker MQ.

MQ stock has risen by 20.25% compared to the previous week, the month change is a 14.60% rise, over the last year Marqeta, Inc. has showed a 39.39% increase.

We've gathered analysts' opinions on Marqeta, Inc. future price: according to them, MQ price has a max estimate of 8.00 USD and a min estimate of 5.00 USD. Watch MQ chart and read a more detailed Marqeta, Inc. stock forecast: see what analysts think of Marqeta, Inc. and suggest that you do with its stocks.

MQ stock is 18.24% volatile and has beta coefficient of 0.30. Track Marqeta, Inc. stock price on the chart and check out the list of the most volatile stocks — is Marqeta, Inc. there?

Today Marqeta, Inc. has the market capitalization of 2.66 B, it has decreased by −1.67% over the last week.

Yes, you can track Marqeta, Inc. financials in yearly and quarterly reports right on TradingView.

Marqeta, Inc. is going to release the next earnings report on Nov 5, 2025. Keep track of upcoming events with our Earnings Calendar.

Marqeta, Inc. revenue for the last quarter amounts to 150.39 M USD, despite the estimated figure of 140.36 M USD. In the next quarter, revenue is expected to reach 148.09 M USD.

MQ net income for the last quarter is −647.00 K USD, while the quarter before that showed −8.26 M USD of net income which accounts for 92.17% change. Track more Marqeta, Inc. financial stats to get the full picture.

No, MQ doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 8, 2025, the company has 854 employees. See our rating of the largest employees — is Marqeta, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Marqeta, Inc. EBITDA is −53.94 M USD, and current EBITDA margin is −21.70%. See more stats in Marqeta, Inc. financial statements.

Like other stocks, MQ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Marqeta, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Marqeta, Inc. technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Marqeta, Inc. stock shows the buy signal. See more of Marqeta, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.