Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.98 CAD

7.12 B CAD

63.63 B CAD

885.45 M

About CANADIAN IMPERIAL BANK OF COMMERCE

Sector

Industry

CEO

Victor Dodig

Website

Headquarters

Toronto

Founded

1961

FIGI

BBG00JQBVN19

Canadian Imperial Bank of Commerce is a financial institution, which engages in the provision of banking and wealth management services. It operates through the following segments: Canadian Personal and Business Banking, Canadian Commercial Banking and Wealth Management, U.S. Commercial Banking and Wealth Management, Capital Markets and Direct Financial Services, and Corporate and Other. The Canadian Personal and Business Banking segment provides financial advice, services, and solutions. The Canadian Commercial Banking and Wealth Management segment caters to middle-market companies, entrepreneurs, high-net-worth individuals, families, and asset management services to institutional investors. The U.S. Commercial Banking and Wealth Management segment includes provision of solution and services across the U.S., focusing on middle-market and mid-corporate companies, entrepreneurs, high-net-worth individuals, families, and operating personal and small business banking services in four U.S. markets. Capital Markets and Direct Financial Services segment consists of integrated global markets products and services, investment and corporate banking, and research. The Corporate and Other segment refers to the functional groups such as technology, infrastructure, innovation, risk management, people, culture and brand, finance and enterprise strategy, and other support groups. The company was founded on June 1, 1961 and is headquartered in Toronto, Canada.

Related stocks

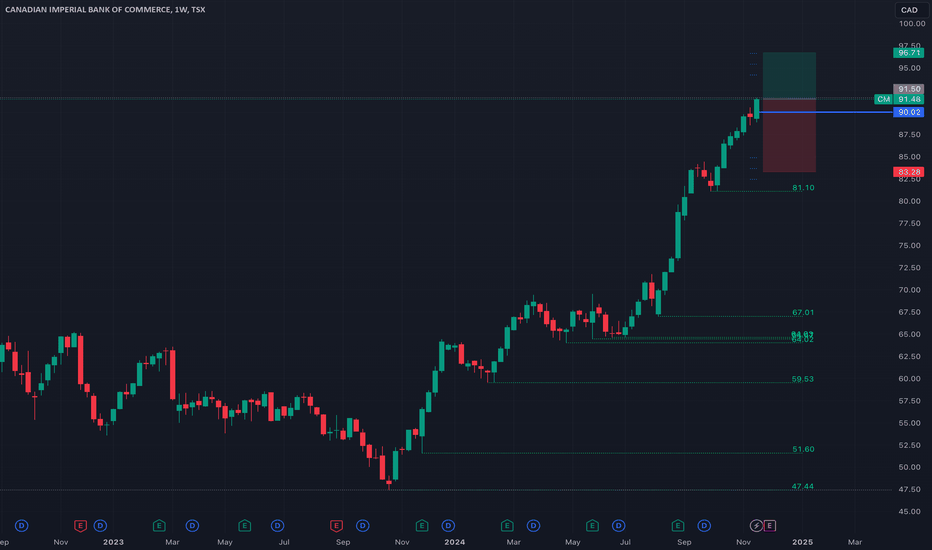

A signal so bullish it might make you $CMKey Stats

P/E Ratio: 12.86 (below the sector average of 11.8)

Dividend Yield: 3.89%, with consistent payout history

Next Earnings Date: Feb 27, 2025

Recent Upgrade: Barclays raised target to $98 (Nov 30, 2024)

Revenue Growth: 7% YoY

Top 3 Technical Reasons for Bullish Bias

Brea

Chartvzn Analysis: Canadian Imperial Bank of Commerce (CM)b]Key Stats

Market Cap: CAD 55.6B

P/E Ratio: 12.89 (Moderately undervalued compared to industry averages)

Dividend Yield: 5.91% (Solid for income investors)

Revenue Growth: 2.58% YoY (Recent FY revenue: CAD 21.31B)

Next Earnings Date: December 7, 2024

Technical Reasons for Upside

Bullish Ham

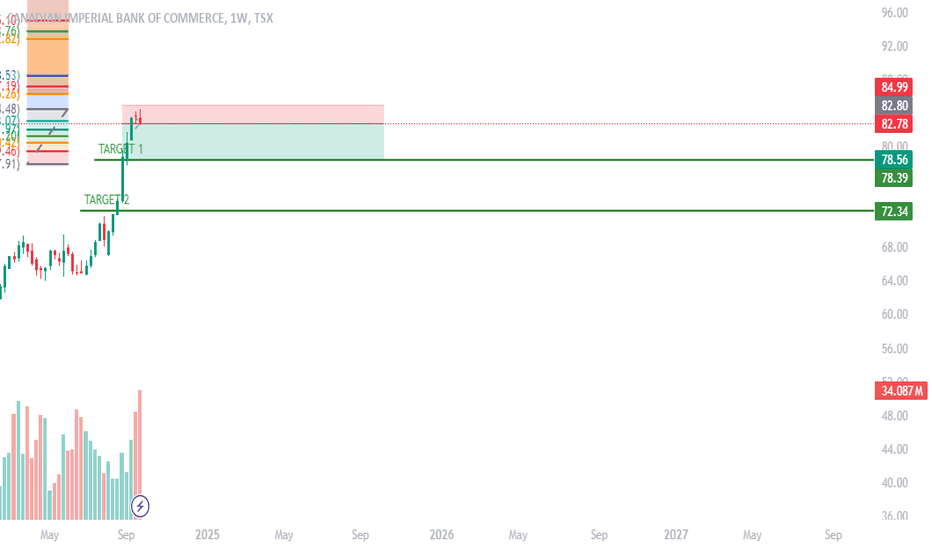

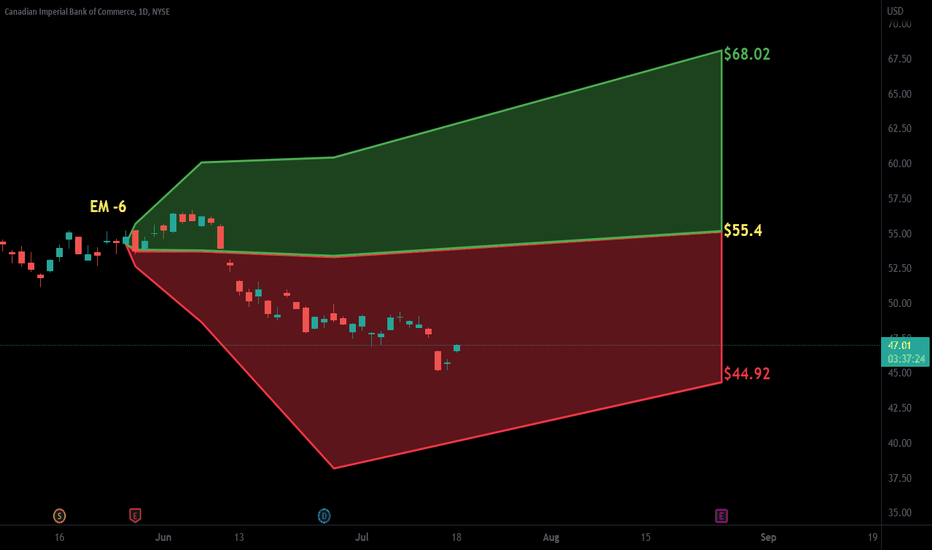

High Probability Short Trade on CM with 1:5 Risk to Reward RatioHuge liquidity available above ATH 84. Price may sweep the liquidity above and reverse down and fill the fair value gaps. Strict stop loss should be executed if the 30 minute candle closes above 86. Target 1 - 78.5. Target 2- 73.

I would even suggest buying a DEC 20 CM 80PUT @ maximum of 1.4

P

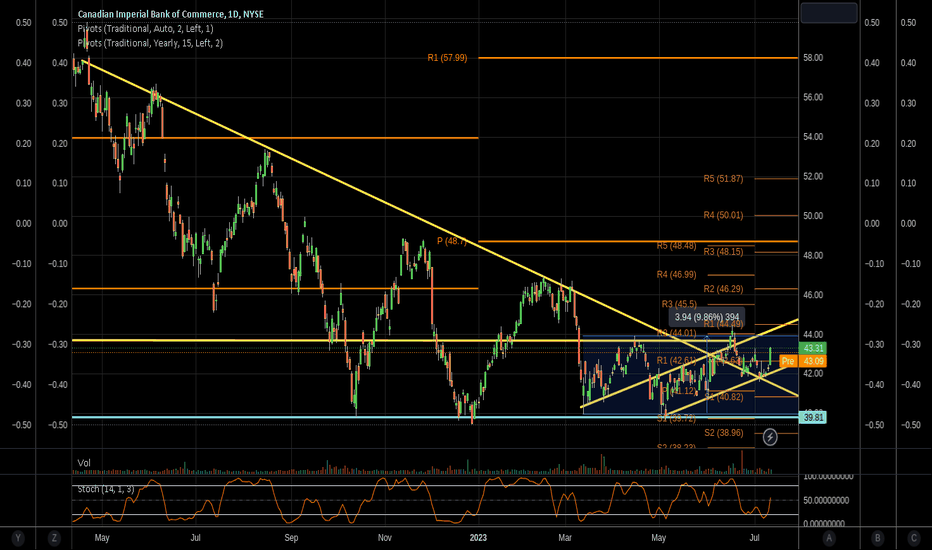

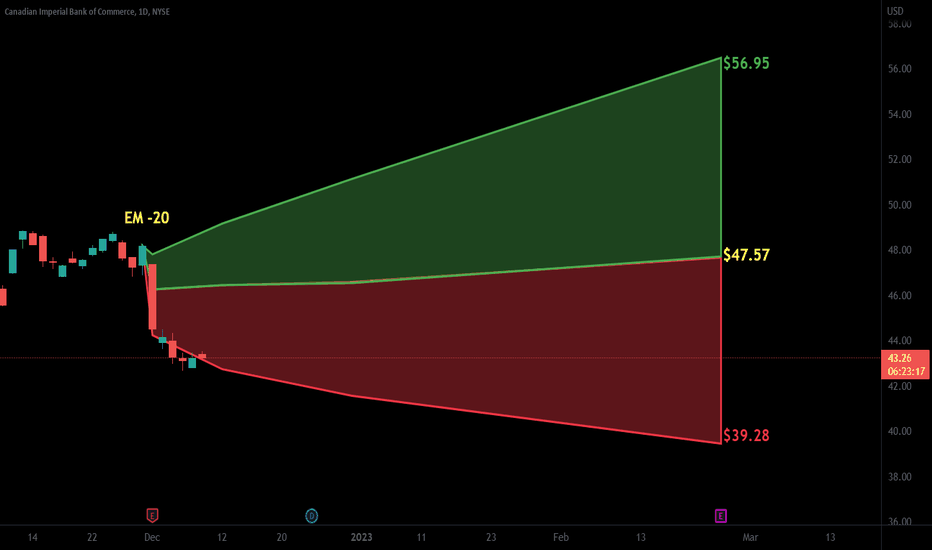

LT Support Area / 200-500 Channel DailyA bunch of support here and stochastics look good on all timeframes presently. A move above 43.50 puts it into a 200-500 moving channel. Next resistance is the 44 figure. 47.50 first target and then 49.40-51.50. Stop would be daily close below 41.70 so RR is reasonable. Volume is currently ligh

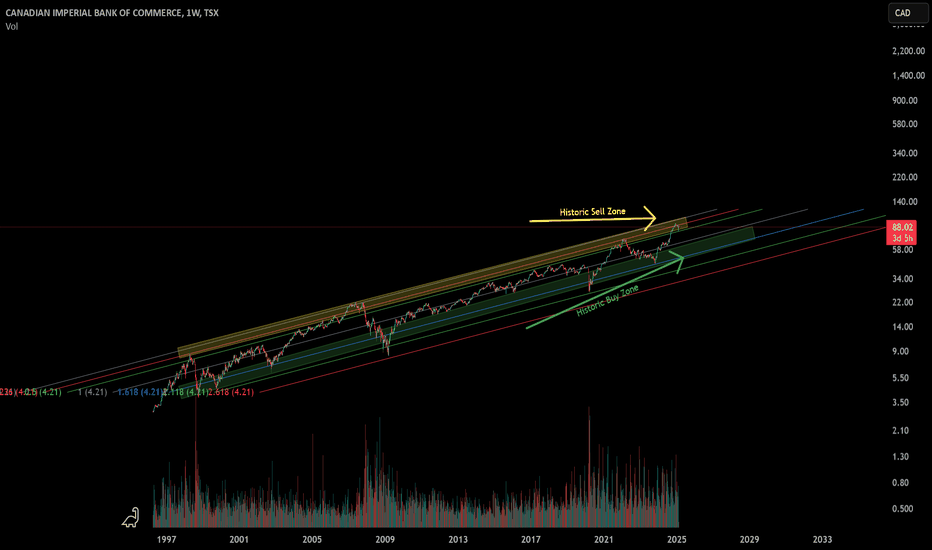

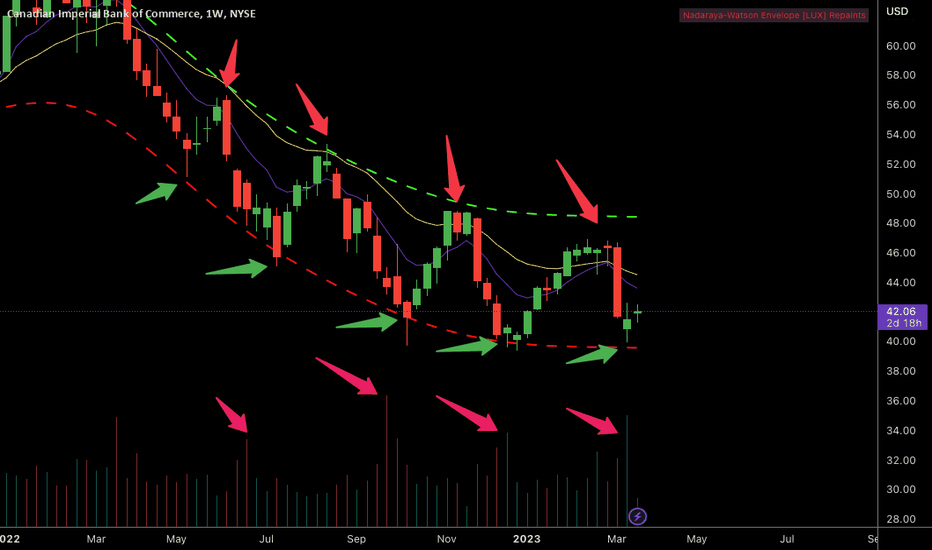

Pattern of the Year?I actually really like this chart. It literally has a simple pattern, buy the bottom envelope (green arrows) and sell the top envelope (red arrows). The biggest thing that sticks out to me is the volume (pink arrows). Before every bounce to the upside, there is always a HUGE volume spike. Will we se

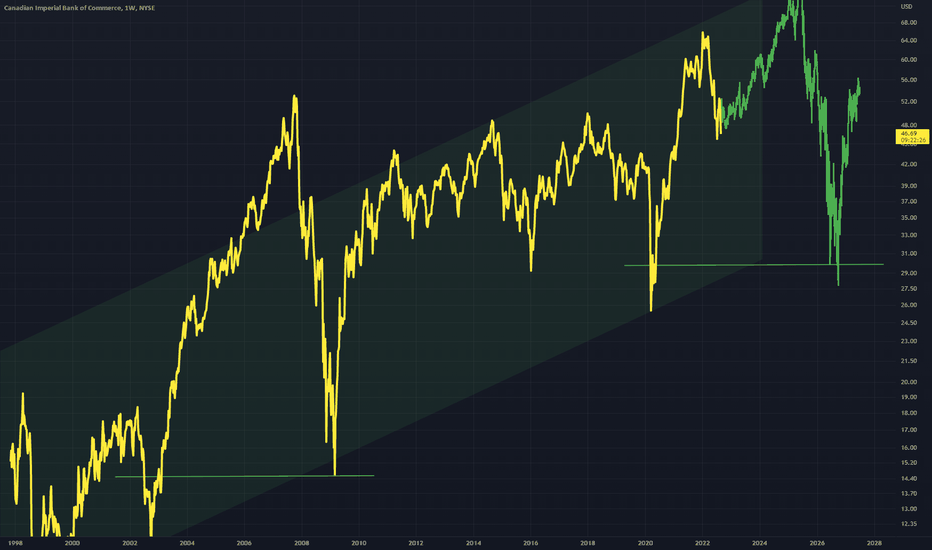

CM - Double BottomsA large Up channel

Price right now is looking to push to the limit and hit the top of the up channel

Once this is hit price may be rejected and pushed back down to the bottom or out of the up channel

This will also be observed as a double bottom pattern , comparable to one seen earlier in prices evo

Canadian Imperial Bank Canada Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutua

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

CM5214185

Canadian Imperial Bank of Commerce 0.0% 27-JUN-2025Yield to maturity

11.26%

Maturity date

Jun 27, 2025

XS2727408283

CIBC 30Yield to maturity

9.09%

Maturity date

May 30, 2030

CM5504107

Canadian Imperial Bank of Commerce 6.0% 18-NOV-2026Yield to maturity

7.85%

Maturity date

Nov 18, 2026

CM5584832

Canadian Imperial Bank of Commerce 5.0% 12-MAY-2027Yield to maturity

7.02%

Maturity date

May 12, 2027

CM5927353

Canadian Imperial Bank of Commerce 6.95% 28-JAN-2085Yield to maturity

6.96%

Maturity date

Jan 28, 2085

XS2703700638

CIBC 6.62% 38Yield to maturity

6.62%

Maturity date

Oct 13, 2038

CM5107595

Canadian Imperial Bank of Commerce 1.5% 29-JAN-2036Yield to maturity

6.45%

Maturity date

Jan 29, 2036

CM5512020

Canadian Imperial Bank of Commerce 5.45% 09-DEC-2025Yield to maturity

6.35%

Maturity date

Dec 9, 2025

XS2659300185

CIBC 6.33% 33Yield to maturity

6.33%

Maturity date

Jul 28, 2033

CM5350828

Canadian Imperial Bank of Commerce 2.25% 31-JAN-2029Yield to maturity

6.27%

Maturity date

Jan 31, 2029

CM5744503

Canadian Imperial Bank of Commerce 5.1714% 31-JAN-2027Yield to maturity

6.24%

Maturity date

Jan 31, 2027

See all CM.PR.S bonds

Frequently Asked Questions

The current price of CM.PR.S is 25.50 CAD — it has increased by 0.20% in the past 24 hours. Watch CM V4.5 PERP 47 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NEO exchange CM V4.5 PERP 47 stocks are traded under the ticker CM.PR.S.

CM.PR.S stock has fallen by −0.43% compared to the previous week, the month change is a 0.79% rise, over the last year CM V4.5 PERP 47 has showed a 8.10% increase.

CM.PR.S reached its all-time high on Jun 5, 2025 with the price of 25.58 CAD, and its all-time low was 11.24 CAD and was reached on Mar 18, 2020. View more price dynamics on CM.PR.S chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

CM.PR.S stock is 0.43% volatile and has beta coefficient of 0.61. Track CM V4.5 PERP 47 stock price on the chart and check out the list of the most volatile stocks — is CM V4.5 PERP 47 there?

Today CM V4.5 PERP 47 has the market capitalization of 88.46 B, it has increased by 2.12% over the last week.

Yes, you can track CM V4.5 PERP 47 financials in yearly and quarterly reports right on TradingView.

CM V4.5 PERP 47 is going to release the next earnings report on Aug 28, 2025. Keep track of upcoming events with our Earnings Calendar.

CM.PR.S earnings for the last quarter are 2.05 CAD per share, whereas the estimation was 1.88 CAD resulting in a 8.90% surprise. The estimated earnings for the next quarter are 1.97 CAD per share. See more details about CM V4.5 PERP 47 earnings.

CM V4.5 PERP 47 revenue for the last quarter amounts to 7.02 B CAD, despite the estimated figure of 6.95 B CAD. In the next quarter, revenue is expected to reach 7.03 B CAD.

CM.PR.S net income for the last quarter is 2.00 B CAD, while the quarter before that showed 2.16 B CAD of net income which accounts for −7.63% change. Track more CM V4.5 PERP 47 financial stats to get the full picture.

Yes, CM.PR.S dividends are paid quarterly. The last dividend per share was 0.37 CAD. As of today, Dividend Yield (TTM)% is 3.95%. Tracking CM V4.5 PERP 47 dividends might help you take more informed decisions.

CM V4.5 PERP 47 dividend yield was 4.13% in 2024, and payout ratio reached 49.35%. The year before the numbers were 7.03% and 66.54% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 24, 2025, the company has 48.52 K employees. See our rating of the largest employees — is CM V4.5 PERP 47 on this list?

Like other stocks, CM.PR.S shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CM V4.5 PERP 47 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So CM V4.5 PERP 47 technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating CM V4.5 PERP 47 stock shows the buy signal. See more of CM V4.5 PERP 47 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.