Key facts today

Deere anticipates $600 million in tariff headwinds for FY25 and an additional $300 million in early FY26, while planning a 2%–4% pricing increase in FY26 to mitigate rising costs.

Oppenheimer has increased its price target for Deere & Co. to $566.00 per share, up from $560.00.

1.04 CAD

9.66 B CAD

70.23 B CAD

About Deere & Company

Sector

CEO

John C. May

Website

Headquarters

Moline

Founded

1837

FIGI

BBG01LGQ0MP1

Deere & Co. engages in the manufacture and distribution of equipment used in agriculture, construction, forestry, and turf care. It operates through the following segments: Agriculture and Turf, Construction and Forestry, and Financial Services. The Agriculture and Turf segment focuses on the distribution and manufacture of a full line of agriculture and turf equipment and related service parts. The Construction and Forestry segment offers machines and service parts used in construction, earthmoving, road building, material handling and timber harvesting. The Financial Services segment finances sales and leases by John Deere dealers of new and used agriculture and turf equipment and construction and forestry equipment. The company was founded by John Deere in 1837 and is headquartered in Moline, IL.

Related stocks

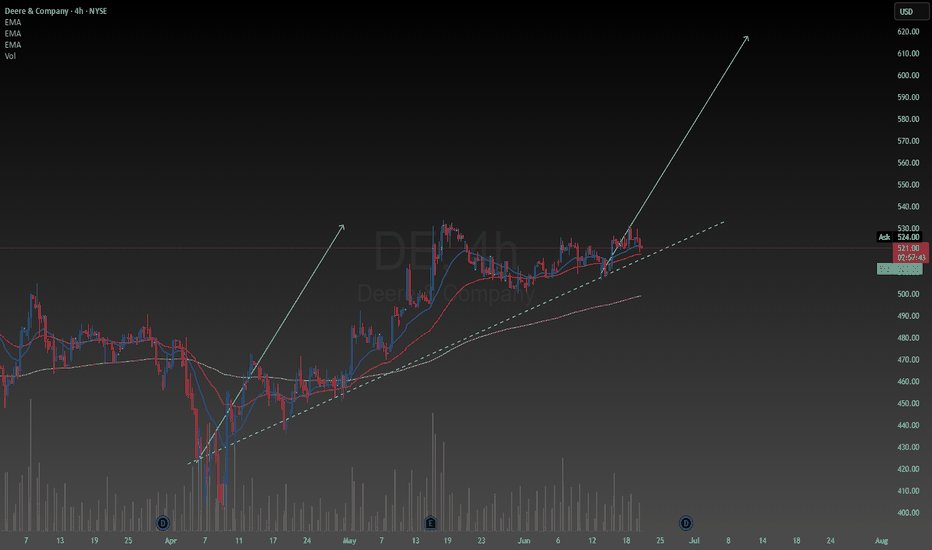

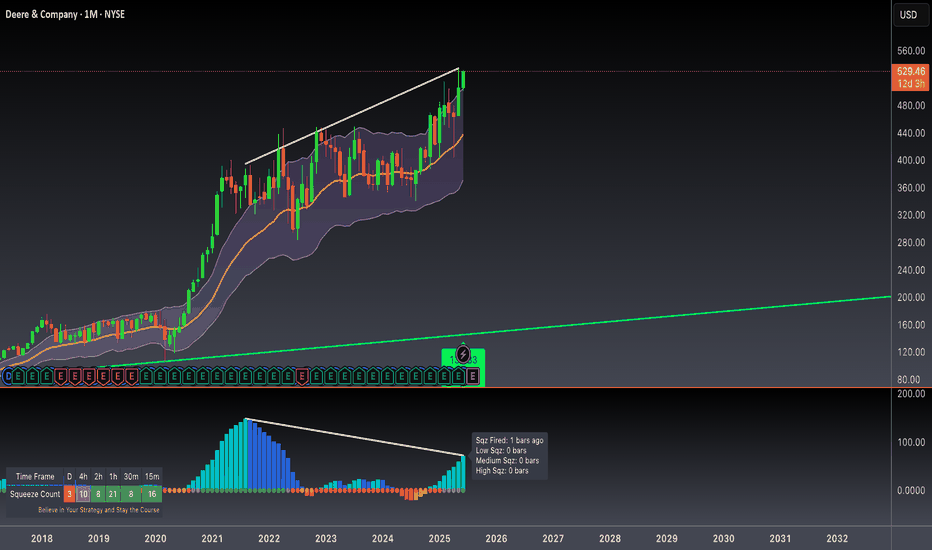

John Deere position trade setupI have been wanting an excuse to add this to my portfolio for a while now. Primarily because Bill Gates has it in his portfolio. I like to try and copy the most successful investors like Warren Buffett, Cathy Wood, Bill Gates, etc... I paid the market price today for a position with a cost average o

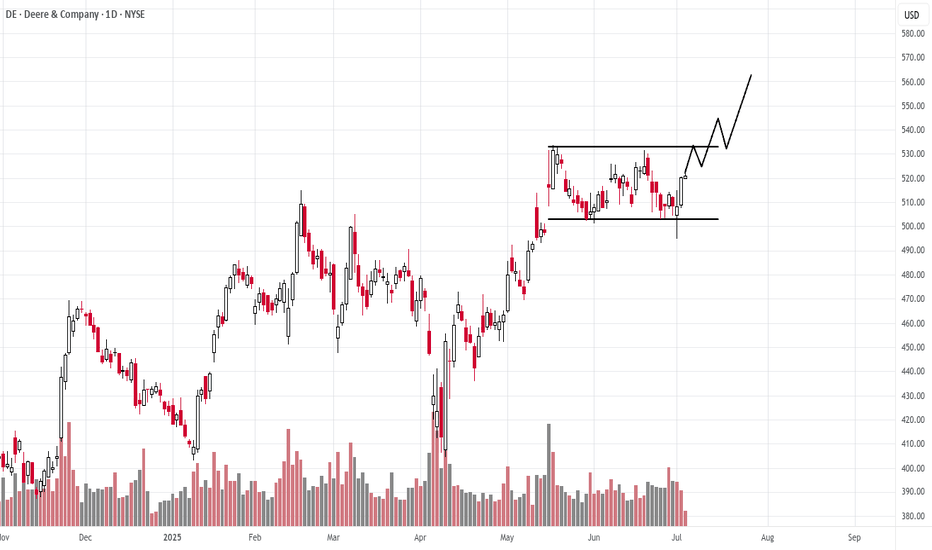

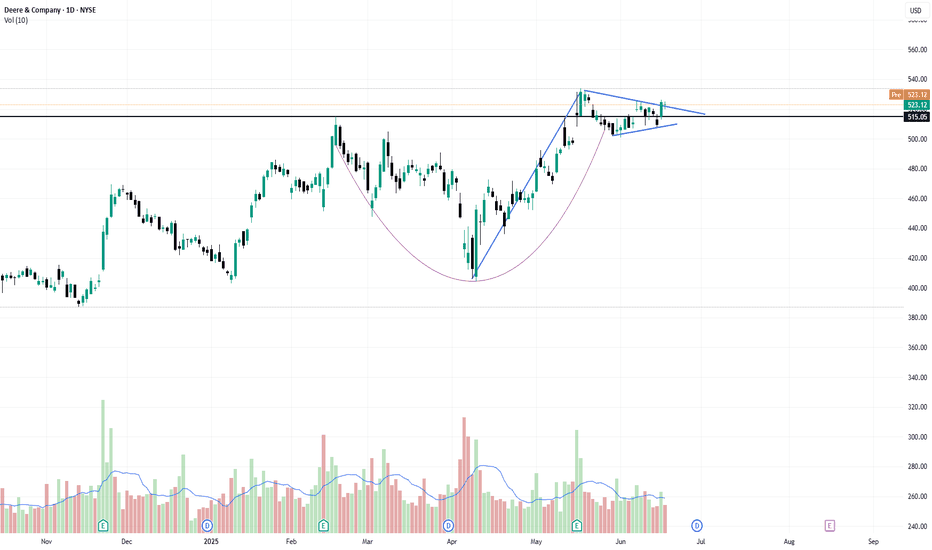

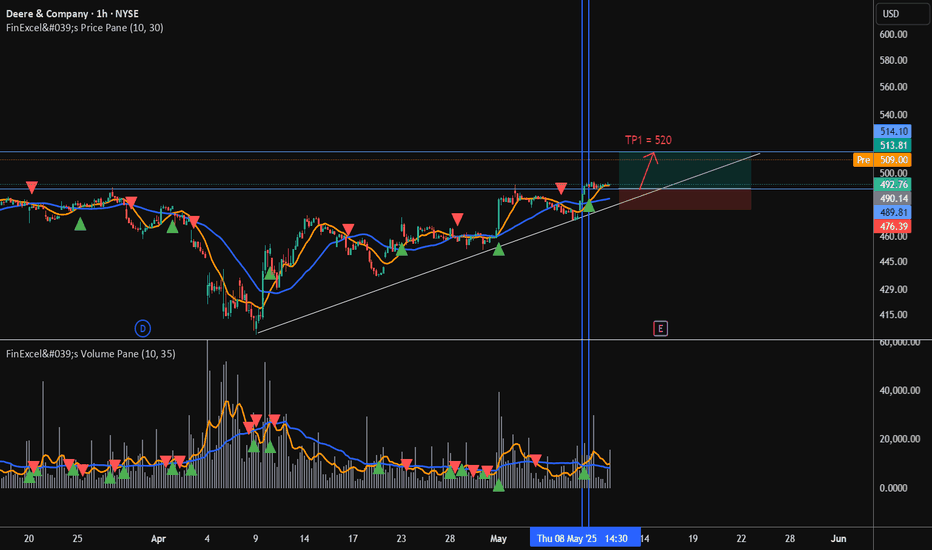

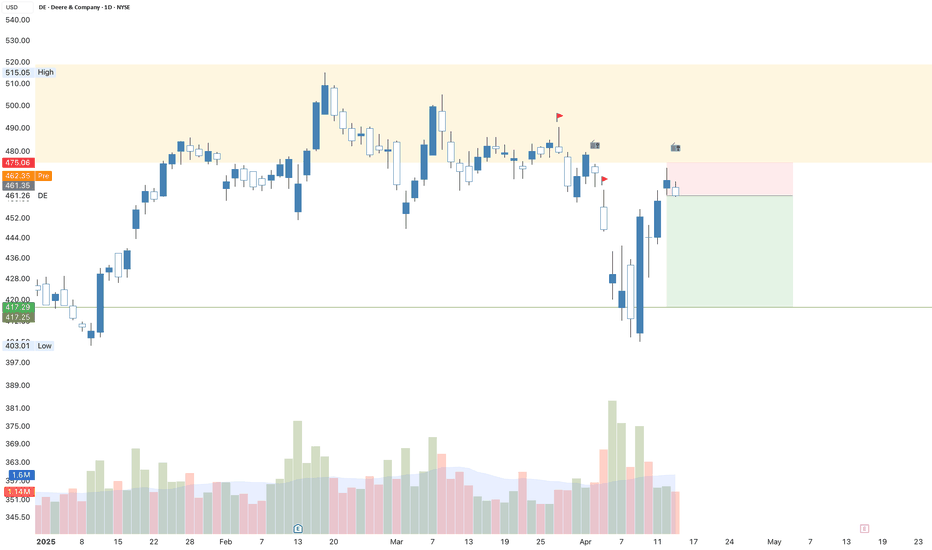

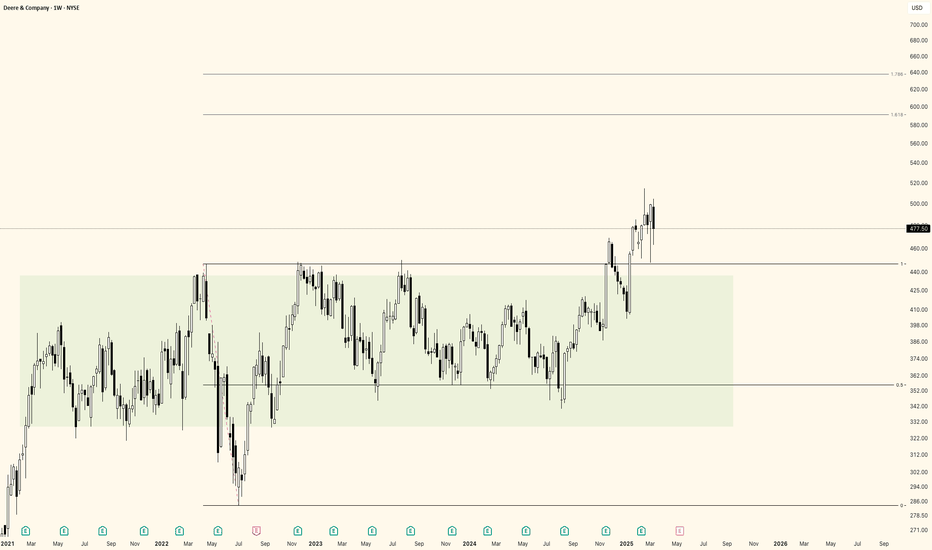

the wedge pattern breakout near ATHStock is outperforming the index and trading near its all-time high and forming a small wedge pattern, indicating consolidation before a potential breakout. A sustained move above $507.50 could trigger bullish momentum. Targeting $553 in the near term. Risk-reward remains favorable with strong price

Farming and construction equipment on Rise, DE has chanceDE might get chance in the recent reported boom of farming and construction equipment makers rise in the US.

DE is already on 2.2% rise as per Reuters.

Machinery are really affected by the volatility in the Tariff war, some time increasing and some time decreasing. Every business wants a secure s

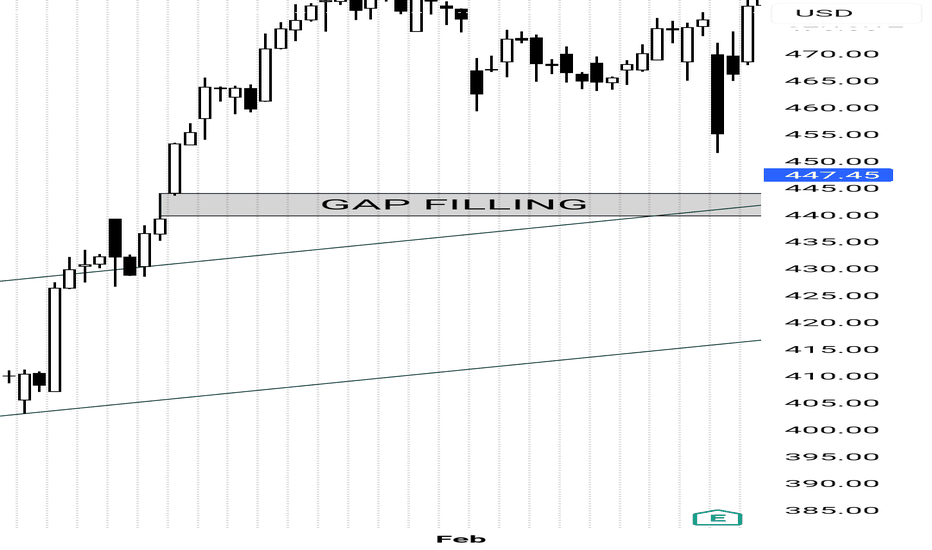

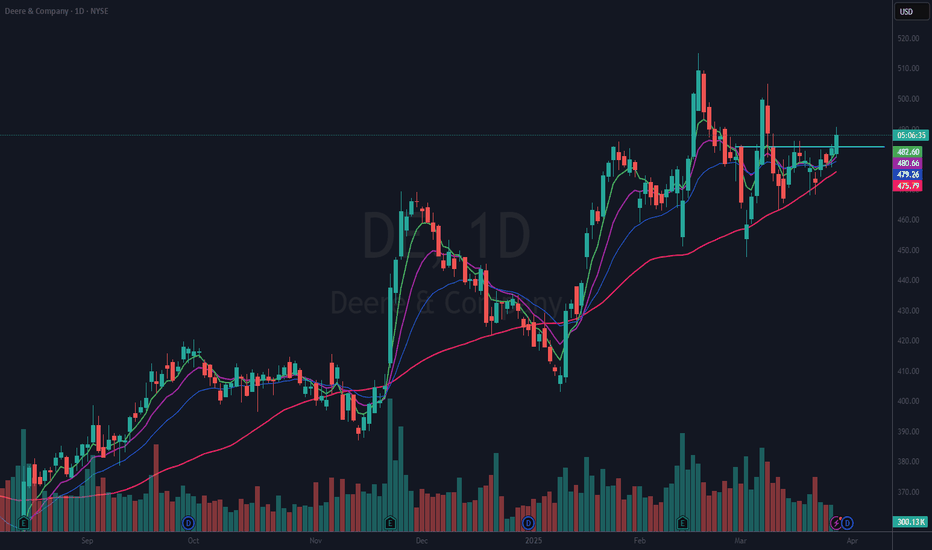

$DE Breaking Out of Flat Base?I went long NYSE:DE on Mar 5th after it bounced right back over the 50 DMA (red). It had been choppy, so I waited to add to the position until today. Why today? If you look you can see the pattern of the candles kept getting tighter and consolidating around the shorter term EMAs. I had drawn in wh

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

J

HJCHD

John Deere Credit Compania Financiera SA 7.0% 17-JAN-2028Yield to maturity

7.49%

Maturity date

Jan 17, 2028

J

HJCJC

John Deere Credit Compania Financiera SA 8.5% 25-JUL-2027Yield to maturity

7.39%

Maturity date

Jul 25, 2027

J

HJCGD

John Deere Credit Compania Financiera SA 6.5% 21-OCT-2028Yield to maturity

6.14%

Maturity date

Oct 21, 2028

J

DE5472035

John Deere Capital Corporation 4.05% 08-SEP-2025Yield to maturity

4.86%

Maturity date

Sep 8, 2025

J

DE6020490

John Deere Capital Corporation FRN 06-MAR-2028Yield to maturity

4.78%

Maturity date

Mar 6, 2028

J

DE5827563

John Deere Capital Corporation 5.05% 12-JUN-2034Yield to maturity

4.74%

Maturity date

Jun 12, 2034

See all DEER bonds

Curated watchlists where DEER is featured.