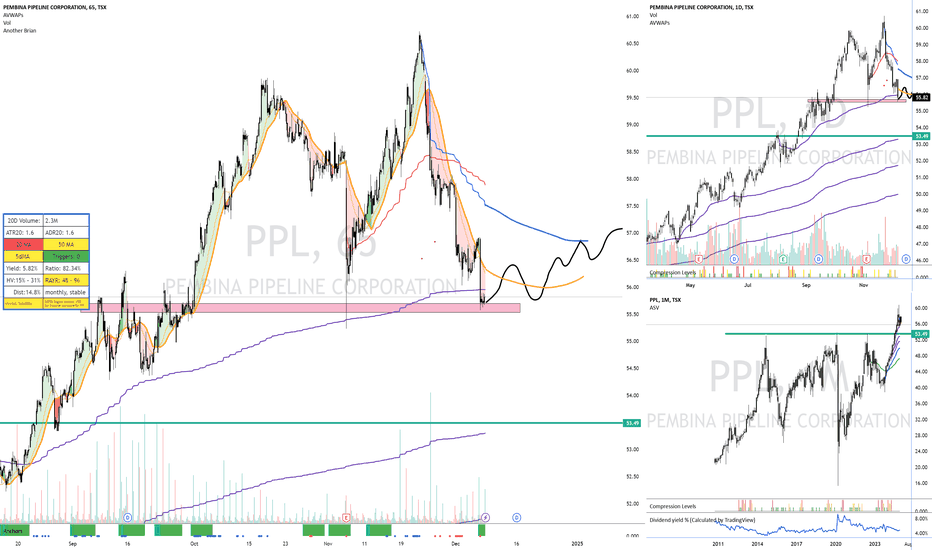

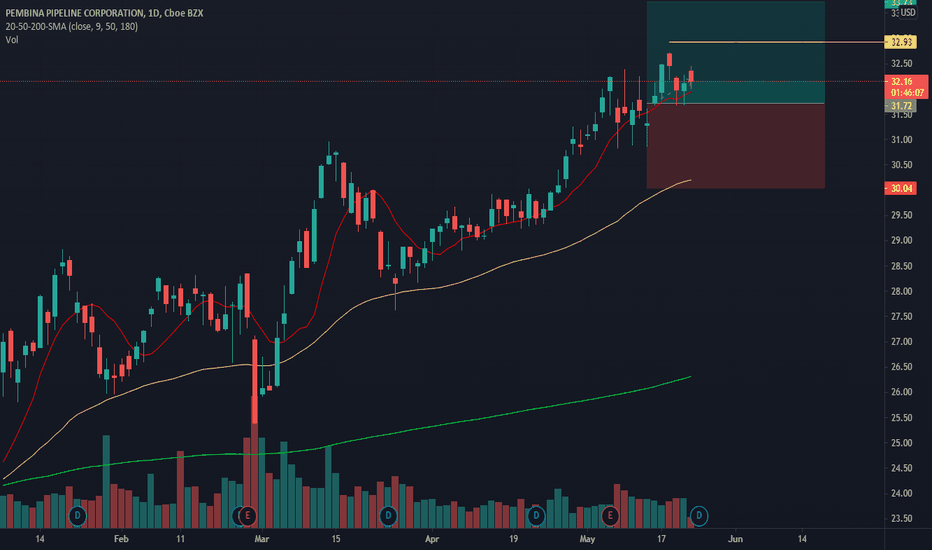

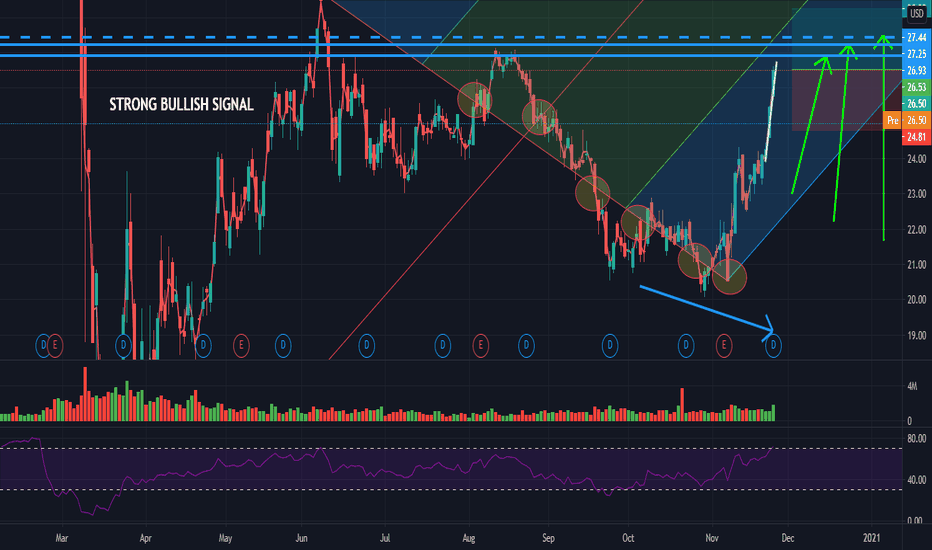

Get ready for the upsideThe stock appears to be in a pullback phase. I anticipate it will find support around the previous monthly highs, keeping prices contained between that level and the anchored VWAP (Volume-Weighted Average Price) from the recent swing high. Once the price advances back up toward this anchored VWAP an

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.07 CAD

1.86 B CAD

7.31 B CAD

580.50 M

About PEMBINA PIPELINE CORPORATION

Sector

Industry

CEO

J. Scott Burrows

Website

Headquarters

Calgary

Founded

1954

FIGI

BBG008FDNYF1

Pembina Pipeline Corp. engages in the provision of transportation and midstream services. It operates through the following segments: Pipelines, Facilities, Marketing and New Ventures, and Corporate. The Pipelines segment includes conventional, oil sands and transmission pipeline systems, crude oil storage and terminalling business and related infrastructure. The Facilities segment consists of processing and fractionation facilities and related infrastructure that delivers the firm's customers with natural gas and NGL services. The Marketing and New Ventures segment undertakes value-added commodity marketing activities, including buying and selling products and optimizing storage opportunities. The company was founded on September 29, 1954 and is headquartered in Calgary, Canada.

Related stocks

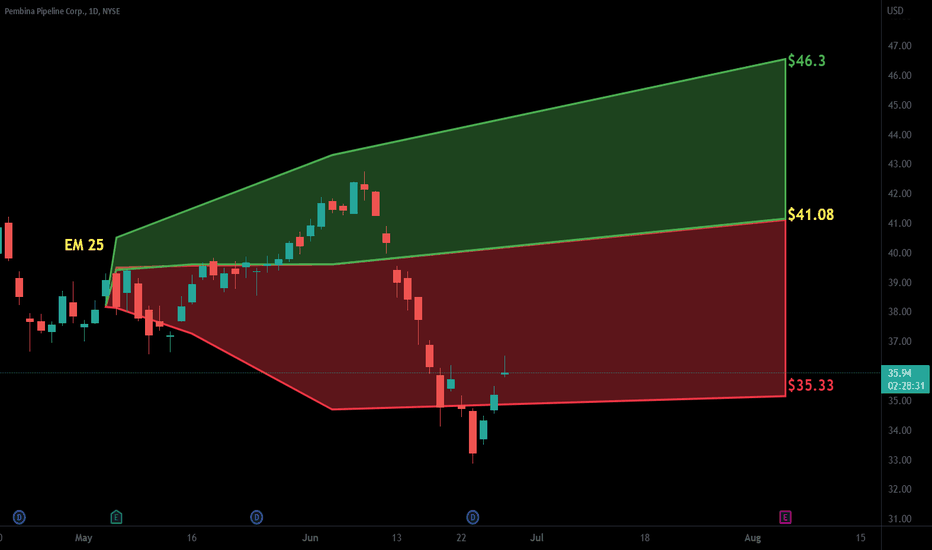

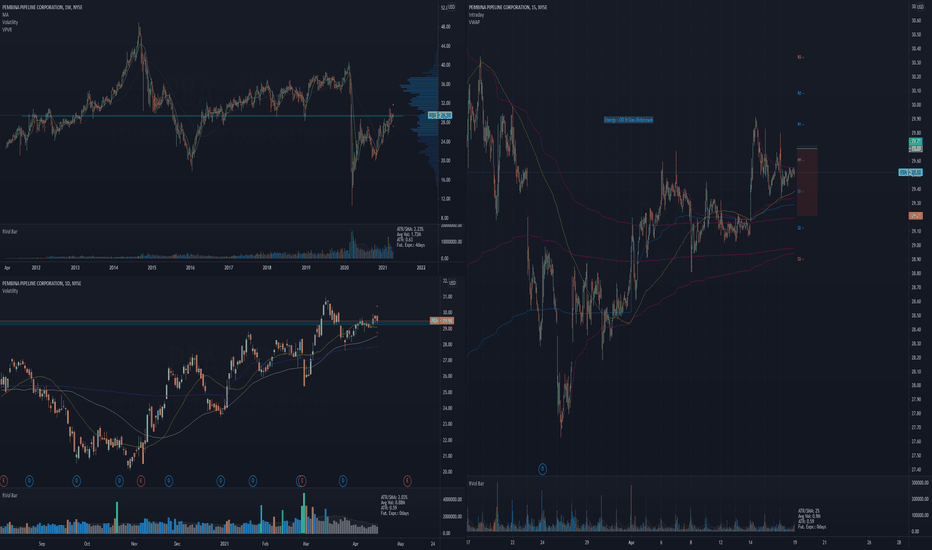

PBA long term hold with oil As previously published on the XLE idea, energy is not done yet and oil has higher price to go.

PBA is one of our favorites here at Flightschool.

It is possible to wait for a better entry but either way we like this as a good long term hold with a monthly dividend while you wait.

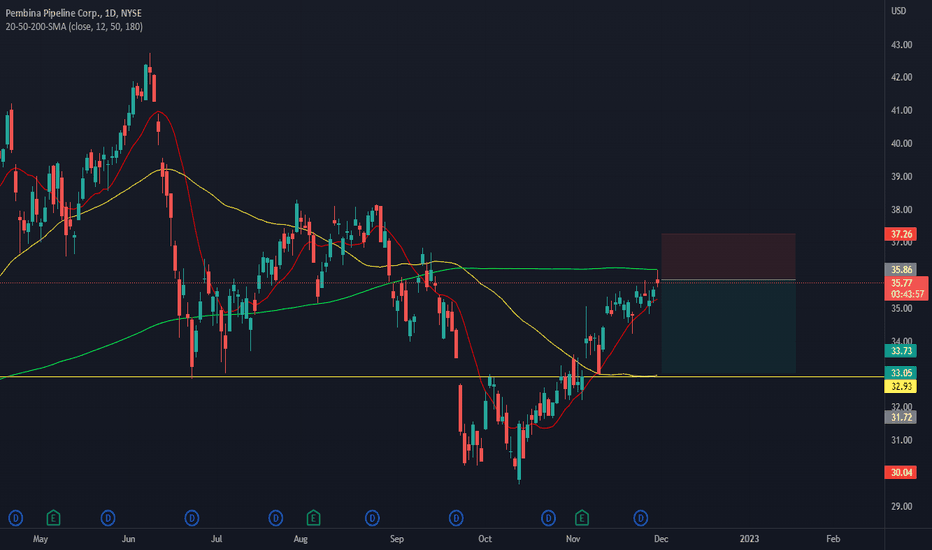

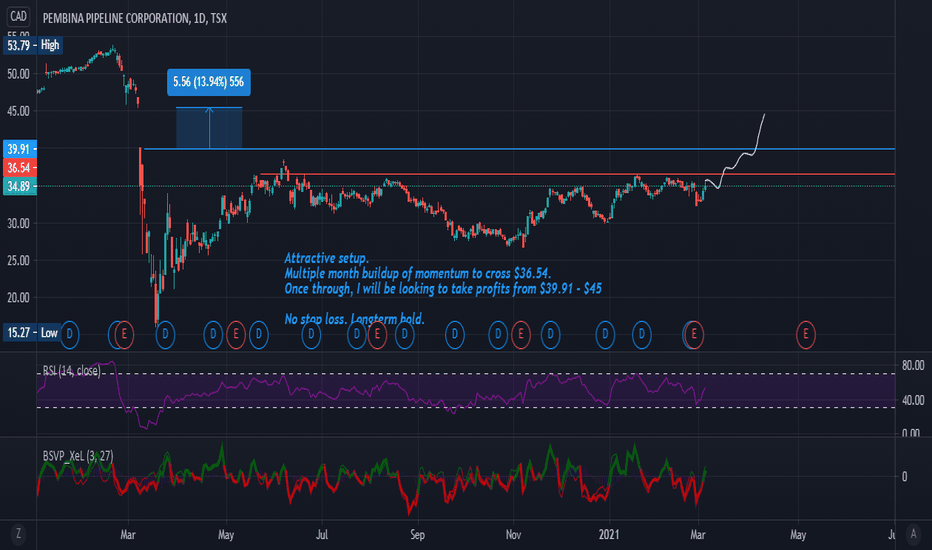

PBA - the rest of the resistanceNYSE:PBA

Energy has not been the best performing sector recently. However, the Oil & Gas Midstream still looks decent. PBA is one of the stocks from that industry that has a nice-looking chart.

Trade characteristics:

it's right on the long-term resistance that was broken and the price now cluste

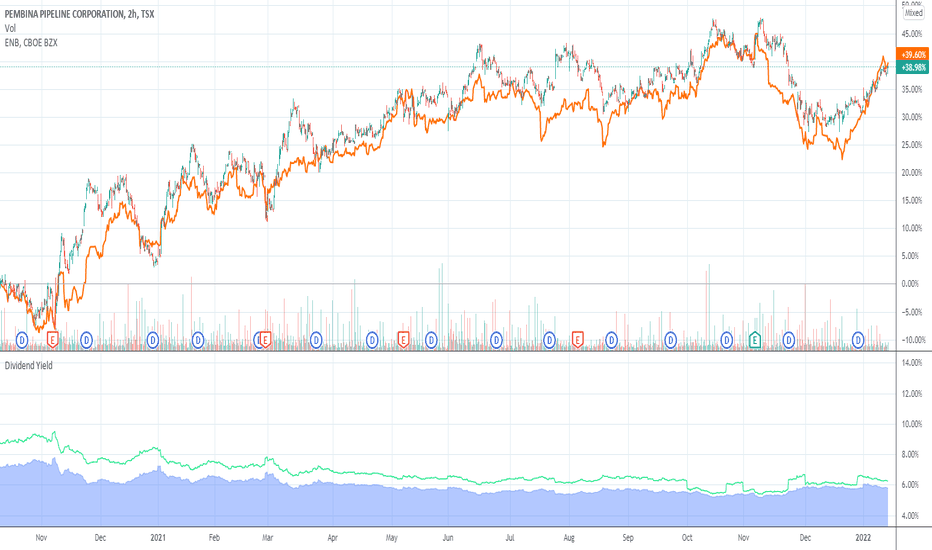

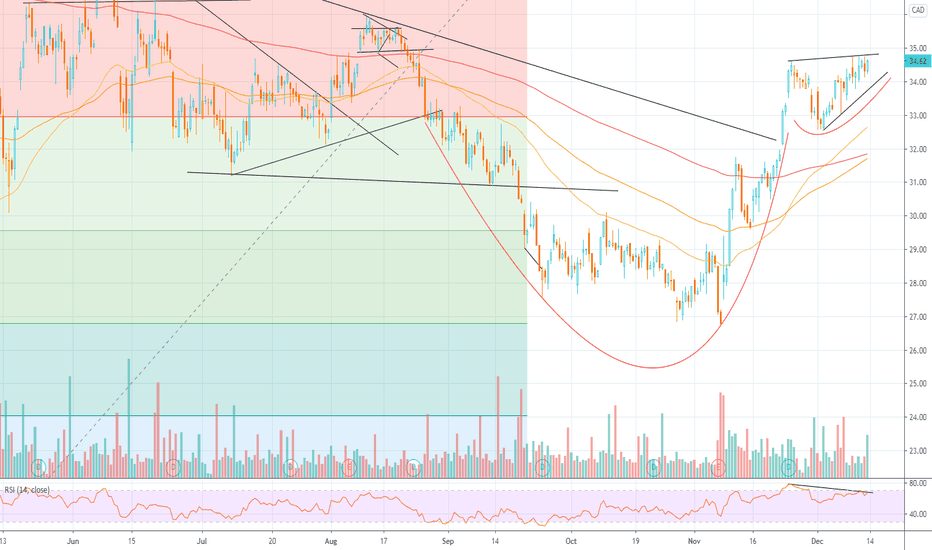

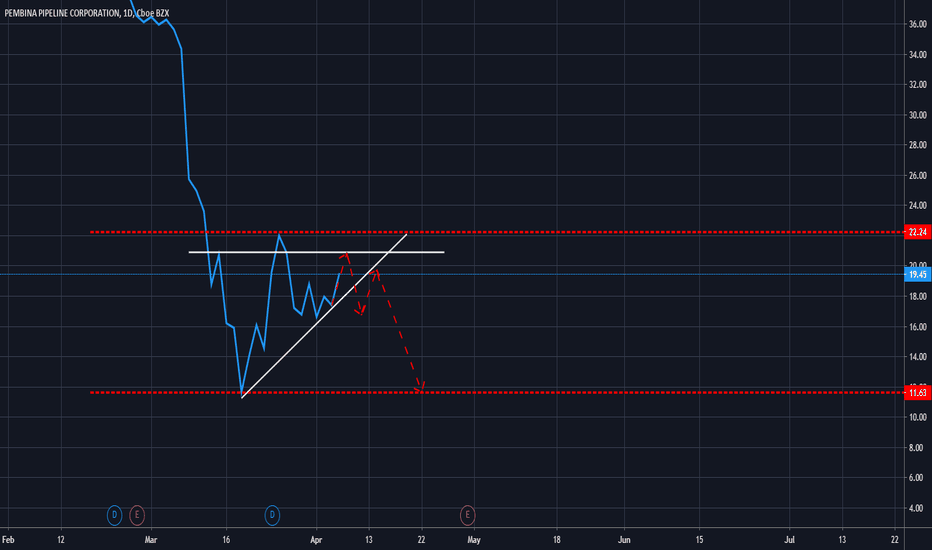

PPL Cup and Handle - of use for aggressive traders perhapsMidstream linked Analysis KEY, PPL, to a lesser degree ENB

Tracking some minor bearish divergence on the 4hr RSI, this is a supplemental analysis with regards to a study for KEY > trying to see if there is an overall pattern for the industry as a whole. I am not interested in looking for a sell on

PEMBINA PIPELINE CORPORATION Title DailyHello traders, PEMBINA PIPELINE CORPORATION is in an uptrend with a trace made by sellers and with an explosion in the volume of purchase issued. In the TIMEFRAME M1 we notice a marubozu in panic on a high volume of sales it goes on its low point to turn around. Great potential to breakout the price

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where PPL.PR.I is featured.

Midstream oil: The middlemen of the energy sector

35 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of PPL.PR.I is 24.96 CAD — it has decreased by −0.16% in the past 24 hours. Watch PPLCN V4.302 PERP 9 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NEO exchange PPLCN V4.302 PERP 9 stocks are traded under the ticker PPL.PR.I.

PPL.PR.I stock has fallen by −0.16% compared to the previous week, the month change is a 1.05% rise, over the last year PPLCN V4.302 PERP 9 has showed a 11.93% increase.

PPL.PR.I reached its all-time high on Jul 15, 2021 with the price of 26.40 CAD, and its all-time low was 9.40 CAD and was reached on Mar 18, 2020. View more price dynamics on PPL.PR.I chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PPL.PR.I stock is 0.16% volatile and has beta coefficient of 0.31. Track PPLCN V4.302 PERP 9 stock price on the chart and check out the list of the most volatile stocks — is PPLCN V4.302 PERP 9 there?

Today PPLCN V4.302 PERP 9 has the market capitalization of 29.46 B, it has decreased by −2.45% over the last week.

Yes, you can track PPLCN V4.302 PERP 9 financials in yearly and quarterly reports right on TradingView.

PPLCN V4.302 PERP 9 is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

PPL.PR.I earnings for the last quarter are 0.80 CAD per share, whereas the estimation was 0.80 CAD resulting in a −0.11% surprise. The estimated earnings for the next quarter are 0.70 CAD per share. See more details about PPLCN V4.302 PERP 9 earnings.

PPLCN V4.302 PERP 9 revenue for the last quarter amounts to 2.28 B CAD, despite the estimated figure of 2.37 B CAD. In the next quarter, revenue is expected to reach 2.19 B CAD.

PPL.PR.I net income for the last quarter is 502.00 M CAD, while the quarter before that showed 572.00 M CAD of net income which accounts for −12.24% change. Track more PPLCN V4.302 PERP 9 financial stats to get the full picture.

Yes, PPL.PR.I dividends are paid quarterly. The last dividend per share was 0.27 CAD. As of today, Dividend Yield (TTM)% is 5.44%. Tracking PPLCN V4.302 PERP 9 dividends might help you take more informed decisions.

PPLCN V4.302 PERP 9 dividend yield was 5.15% in 2024, and payout ratio reached 91.14%. The year before the numbers were 5.82% and 88.61% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 25, 2025, the company has 3 K employees. See our rating of the largest employees — is PPLCN V4.302 PERP 9 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PPLCN V4.302 PERP 9 EBITDA is 3.62 B CAD, and current EBITDA margin is 45.60%. See more stats in PPLCN V4.302 PERP 9 financial statements.

Like other stocks, PPL.PR.I shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PPLCN V4.302 PERP 9 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PPLCN V4.302 PERP 9 technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PPLCN V4.302 PERP 9 stock shows the strong buy signal. See more of PPLCN V4.302 PERP 9 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.