Crude Oil – Retesting Resistance | Possible Pullback Trade Setu

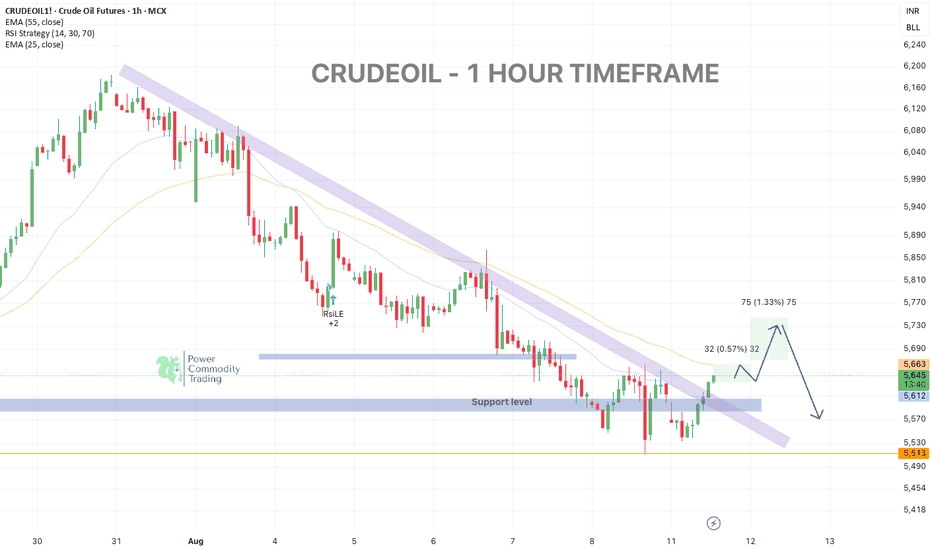

Crude Oil (1H timeframe)

broken out from its short-term downtrend channel and is now retesting key resistance near 5740.

Price is holding above the 5610 support, but upside is likely capped unless bulls sustain momentum.

🔹 Key Levels:

• Resistance: 5740 – 5770

• Support: 5610 → 5513

📊 Techni

Contract highlights

Related commodities

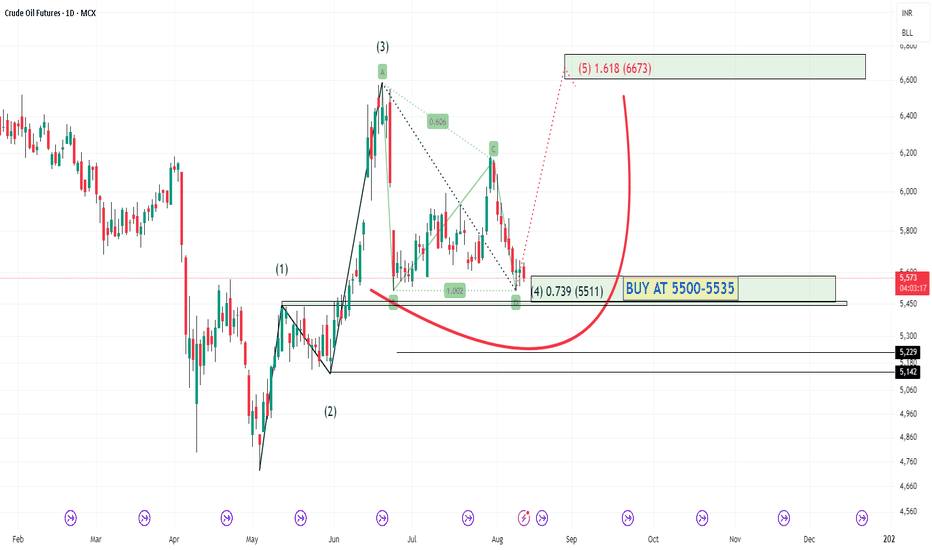

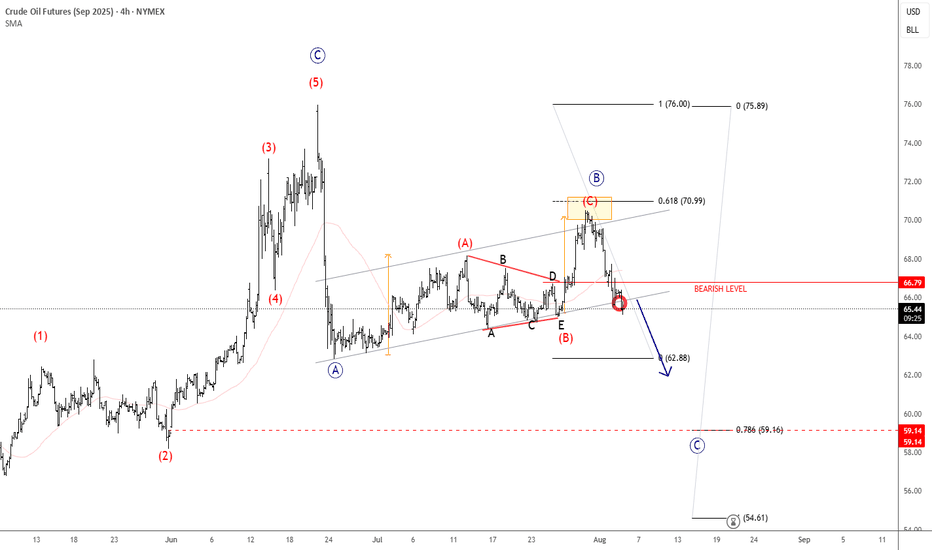

Oil Market Insights: Demand Zones and Future FundamentalsYesterday, CL1! oil tested and rebounded from my weekly demand zone without triggering my entry, resulting in a missed opportunity for several points. This suggests to me that there is buying interest at this level, regardless of the fact that non-commercial traders are short. I am now looking for a

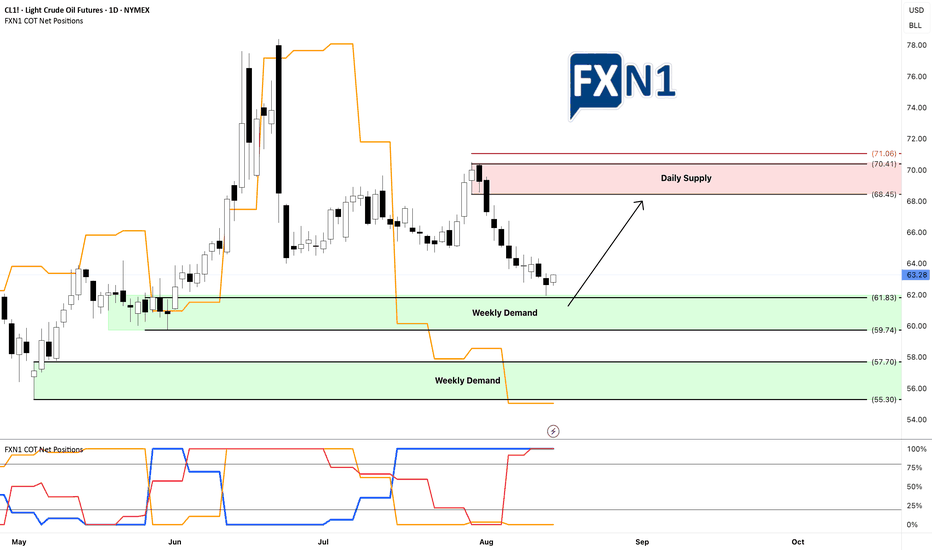

Oil Trap Activated – Limit Orders Set for the Big Score💥🛢️Crude Oil Vault Breach Plan – DCA Heist Begins!🧨💰

🚨Asset: CL1!

📈Bias: BULLISH RAID MODE ON

🎯Target: $74.50

🛡️Stop Loss: $67.50

🔑Entry: ANY LEVEL – Thief stacking limit orders like layers of gold bars 💼⚖️ (DCA Mode Activated)

🕵️♂️Thief Trader is not chasing, we're ambushing 🧠 — scaling in smart

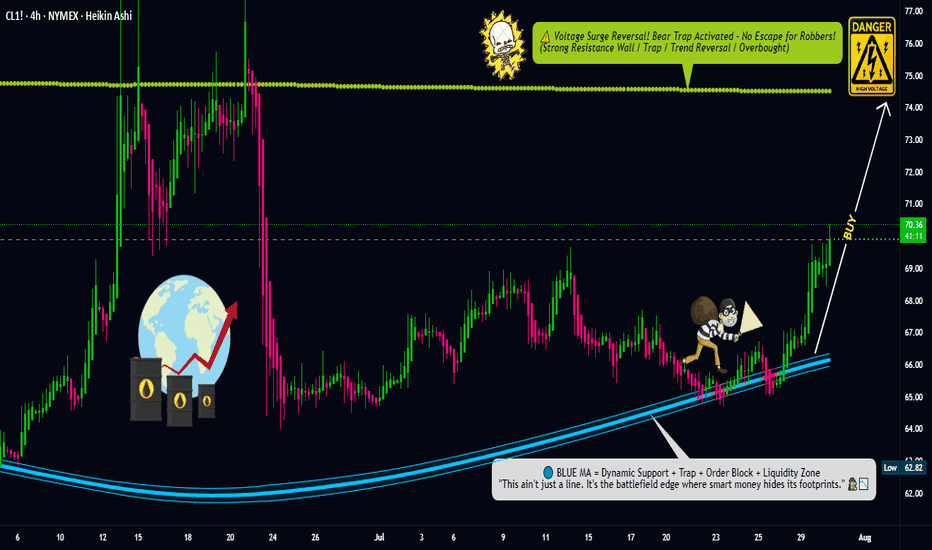

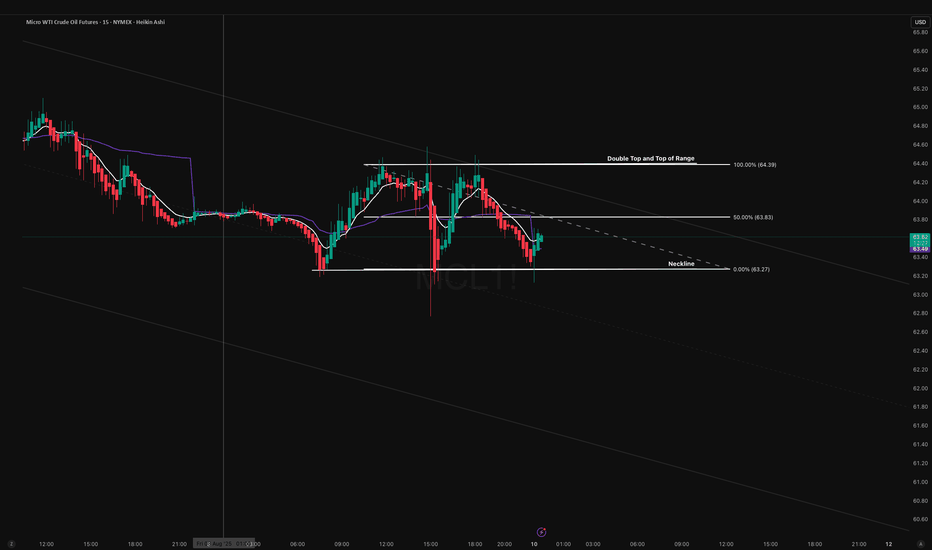

MCL About to Take the Express Elevator DownOn the 15-min chart, MCL has completed a clean double top at 64.50, with neckline support broken at 63.00. This pattern is forming within a broader descending channel, adding higher-timeframe confluence for further downside.

Bearish Scenario (Primary Bias – 70% Probability)

- Entry Zone: 63.80–64

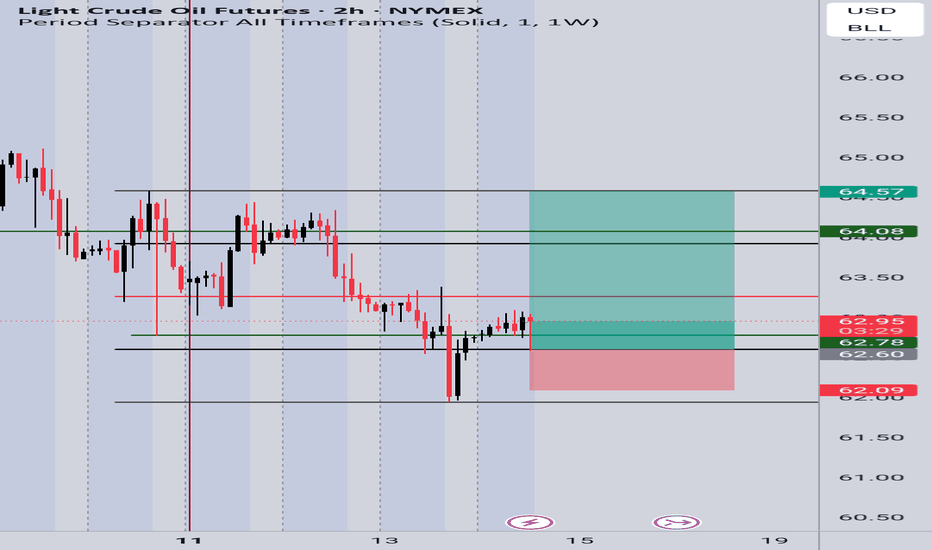

CL1! Long Setup – Recovery BounceBias: Bullish

Reasoning:

Demand zone respected – Price reacted strongly from the 62.00 – 62.20 support zone, forming a bullish rejection wick.

Liquidity sweep – The recent dip below support grabbed liquidity before reversing upward, signaling possible continuation.

Higher timeframe confluence – O

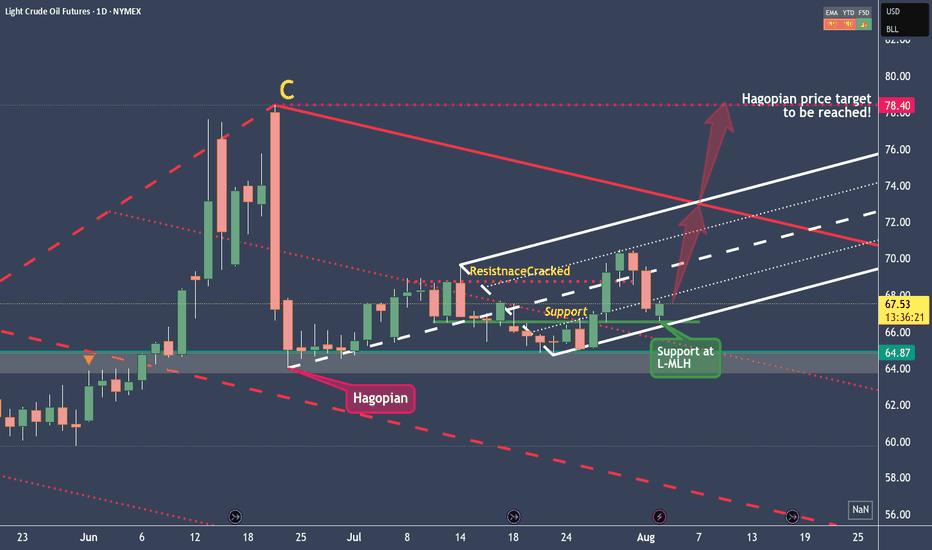

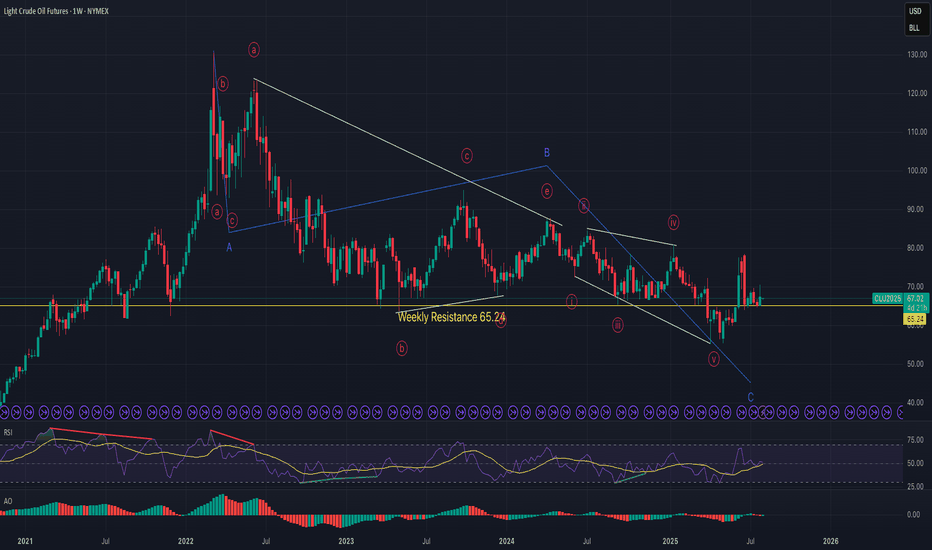

Crude Oil setting up for a Long Trade to $78.40In the long term, Crude Oil is in a short position.

We can see this from the red pendulum fork, which projects the price movement downward.

However, in the short- to medium-term, we're long, as clearly illustrated by the white fork. Supporting the case for higher prices is the Hagopian signal that

Wave 2 Completed for CLI am back after taking some time off. I'm renewing my interest in Elliot Wave counts but am looking only to use for validation of past price action and possible movement going forward but will not rely on the counts as a primary means for set ups along with fib extensions. I'll be focusing more on

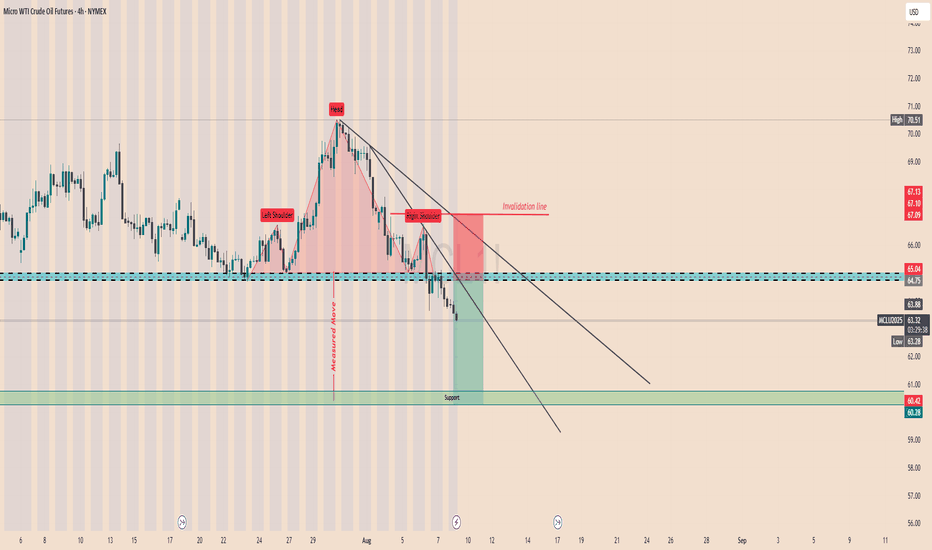

Crude Oil Resumes Its WeaknessCrude oil rised and then fell sharply from above 78 dollars back in June, after tensions in the Middle East. The drop unfolded as an impulse into wave A, so even if this is just a counter-trend move down from 78, it still appears incomplete. After we recently spotted a corrective rally in wave B tha

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Crude Oil Futures (Jul 2015) is Jun 22, 2015.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Crude Oil Futures (Jul 2015) before Jun 22, 2015.