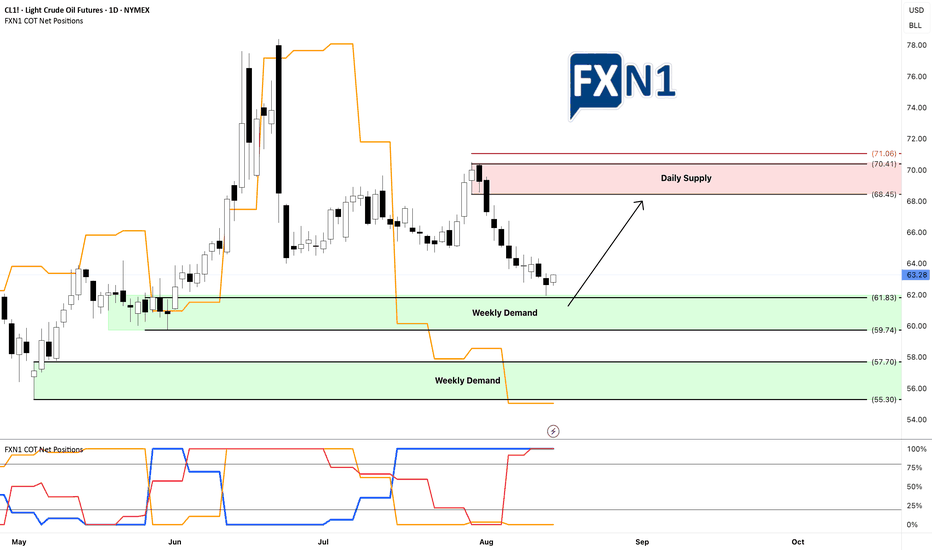

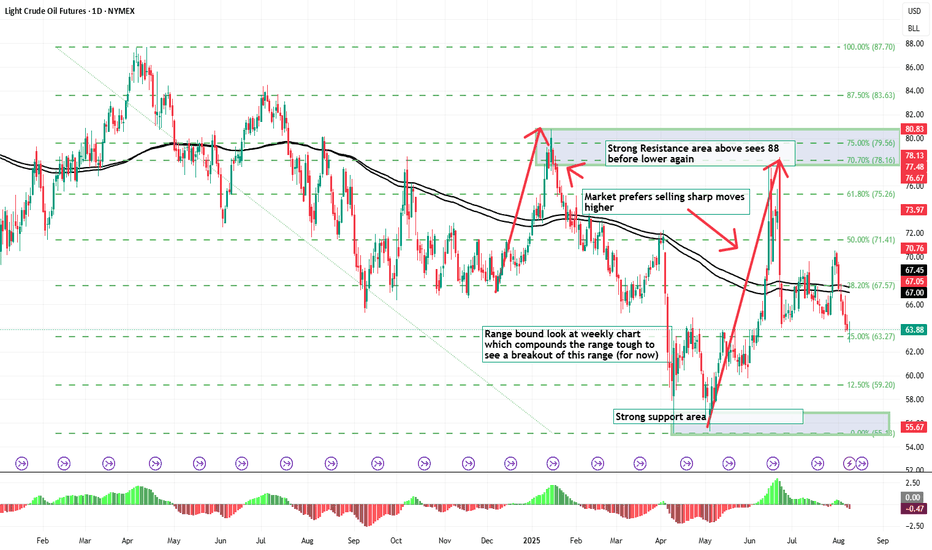

Oil Market Insights: Demand Zones and Future FundamentalsYesterday, CL1! oil tested and rebounded from my weekly demand zone without triggering my entry, resulting in a missed opportunity for several points. This suggests to me that there is buying interest at this level, regardless of the fact that non-commercial traders are short. I am now looking for a

Contract highlights

Related commodities

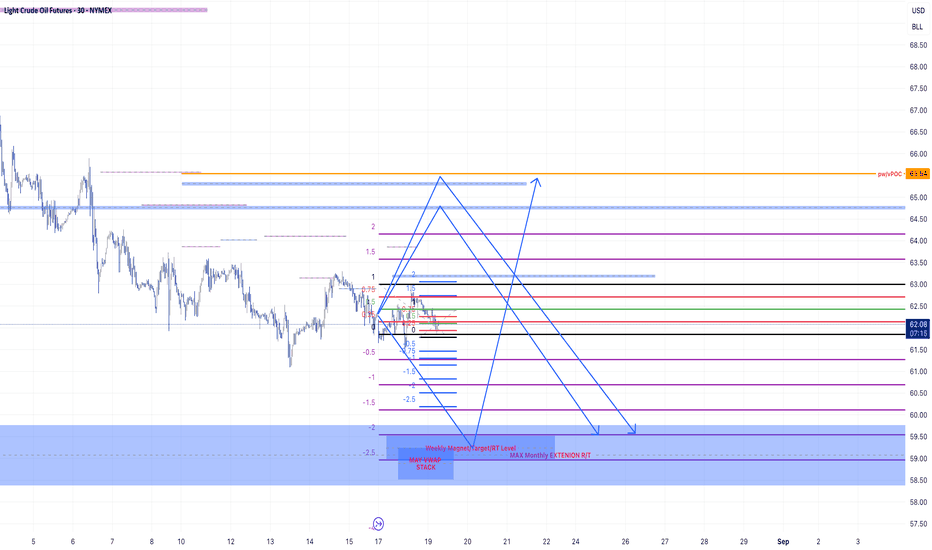

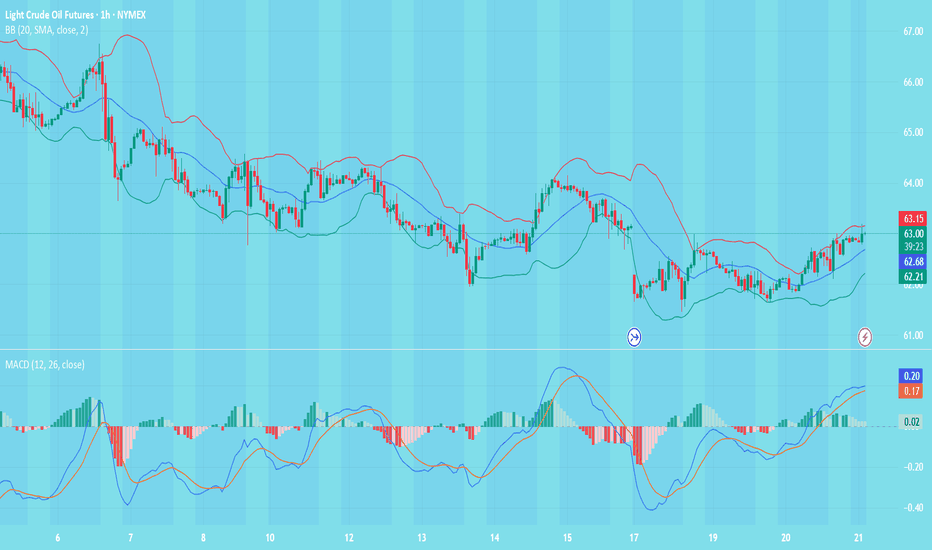

This is part two of a monthly reviewThis is the 21st of August.. It's important to go back and look at a previous video since I'm trying to make decisions as to the direction of the market and this will give you a chance to see whether or not price action and patterns can find you good trade location which includes small stops and rea

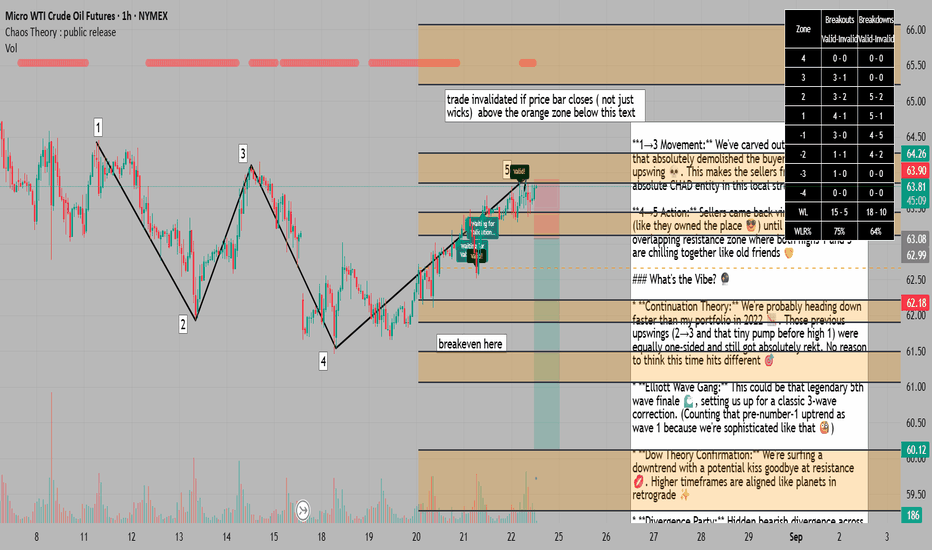

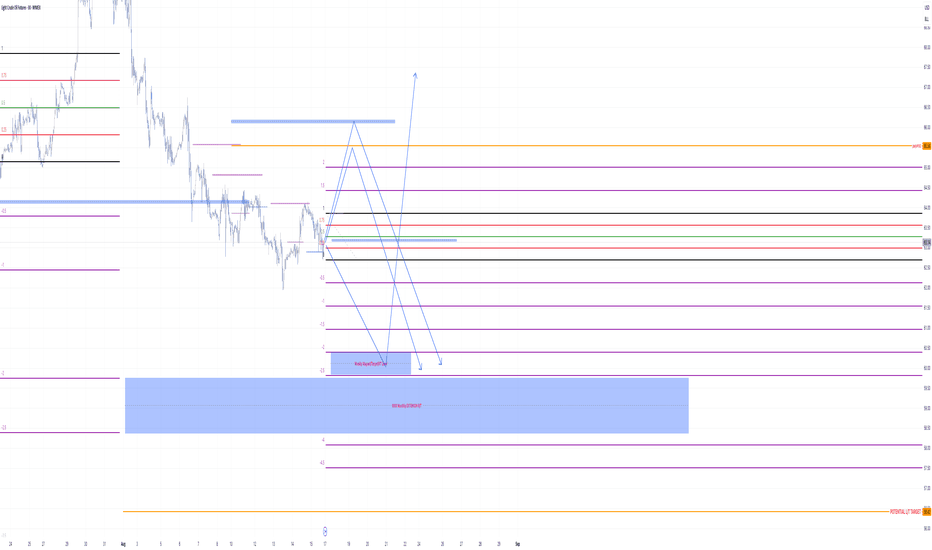

A return to solid sellers in a downtrend paves the way for =SELL

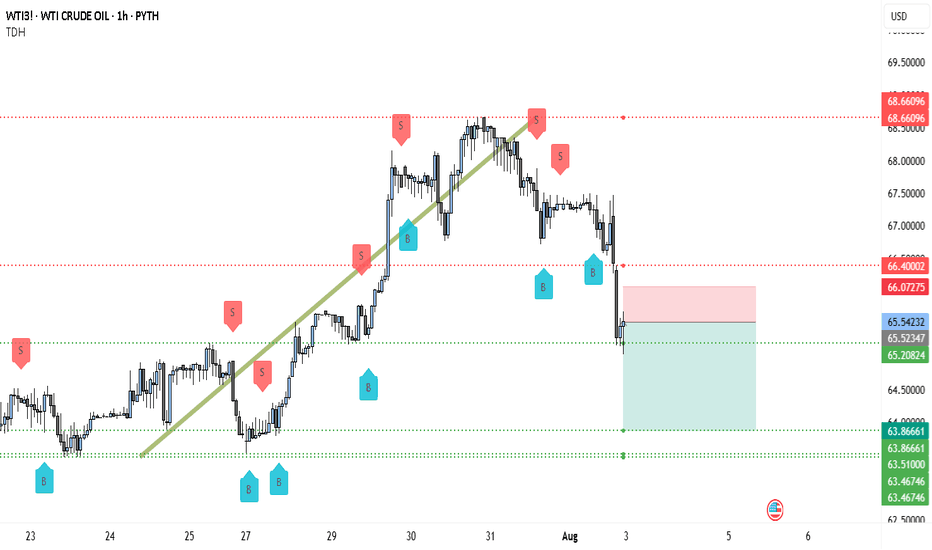

**1→3 Movement:** We've carved out a spicy lower low that absolutely demolished the buyers from that 2→3 upswing 💀. This makes the sellers from numero uno the absolute CHAD entity in this local structure 💪

**4→5 Action:** Sellers came back virtually unchecked (like they owned the place 😎) until th

Crude Oil Warning $66.40 Flip Signals $63.86 TargetWTI rolled over after failing near $68.66096 (top red dashed line). The breakdown through $66.40002 turned that level into resistance 🚧. After a sharp selloff, price is now hovering around the $65.54 area (thin entry line labeled 65.54232), just beneath the minor pivot band at 65.54 / 65.52 / 65.21

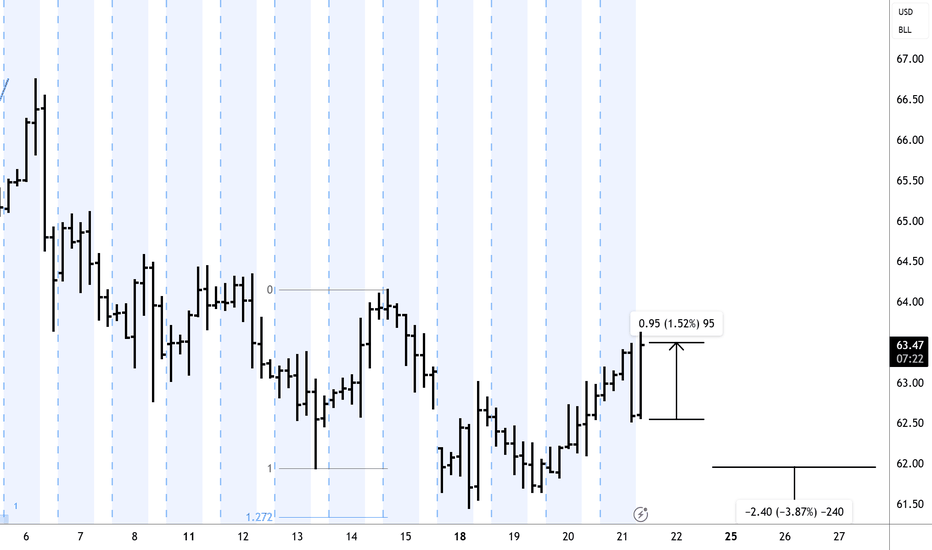

WTI(20250821)Today's AnalysisMarket Update:

This week, central bankers from around the world gathered in Jackson Hole, Wyoming, for the annual global central bank meeting. They planned not only to exchange research and enjoy the beautiful mountain scenery, but also to defend Federal Reserve Chairman Jerome Powell. Powell has c

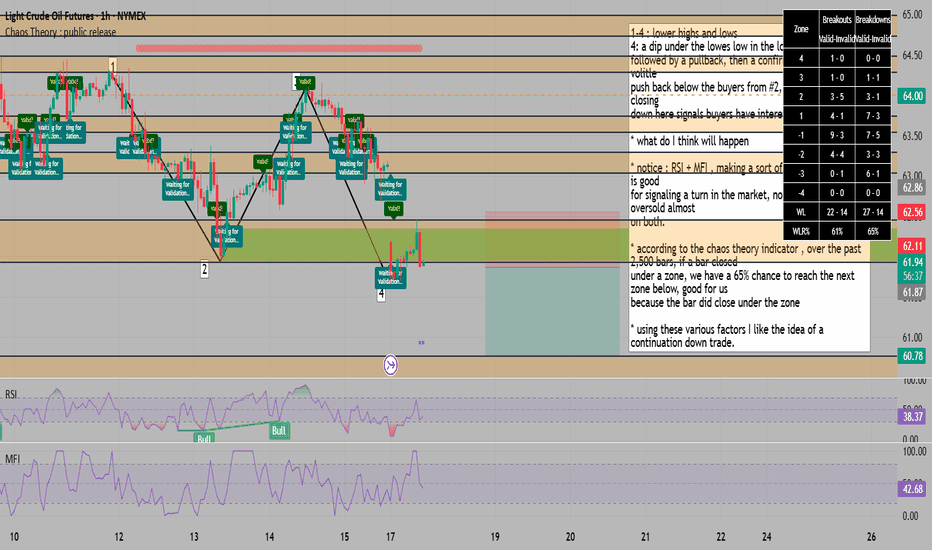

downtrend continuation confirmed on the hourly for the next leg1-4 : lower highs and lows

4: a dip under the lowes low in the local structure ,

followed by a pullback, then a confirmation STRONG volitle

push back below the buyers from #2, for me the candle closing

down here signals buyers have interest

* what do I think will happen

* notice : RSI + MFI , m

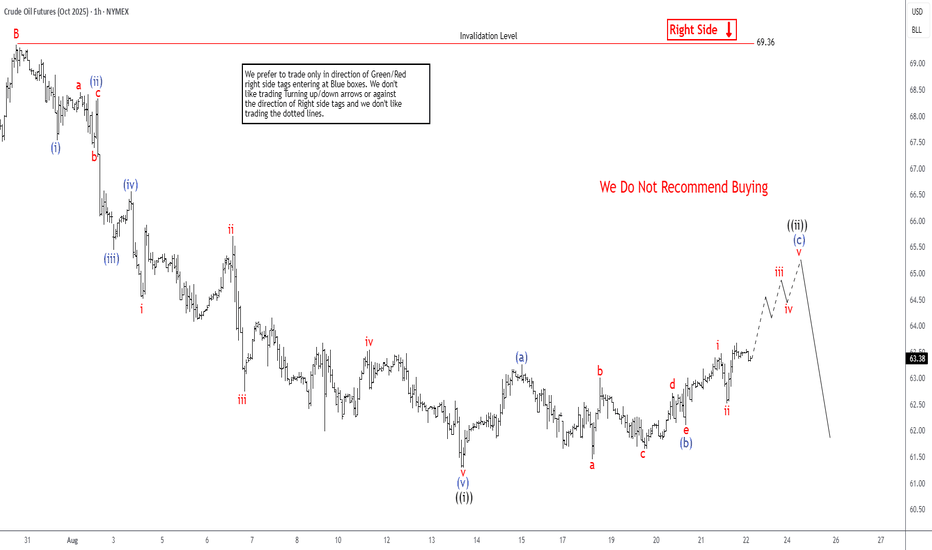

Oil (CL) Anticipating a Decline from $64.7 LevelCrude oil (CL) exhibits a bearish trend following its June 23, 2025, peak, signaling further declines. The ongoing descent forms a zigzag Elliott Wave pattern. From the June high, wave A dropped to $64, while wave B rebounded to $70.58, as depicted in the accompanying one-hour chart. Wave C, now unf

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Crude Oil Futures (Jul 2020) is Jun 22, 2020.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Crude Oil Futures (Jul 2020) before Jun 22, 2020.