Related commodities

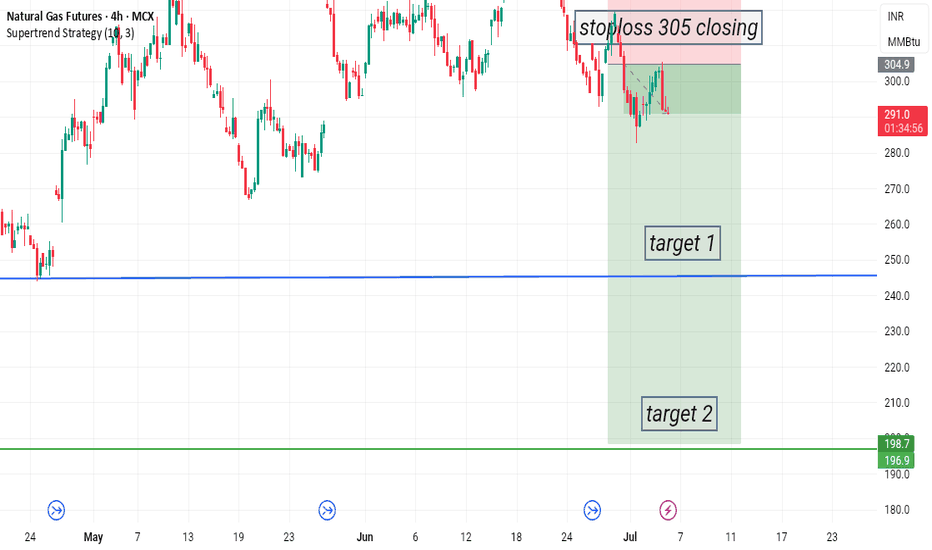

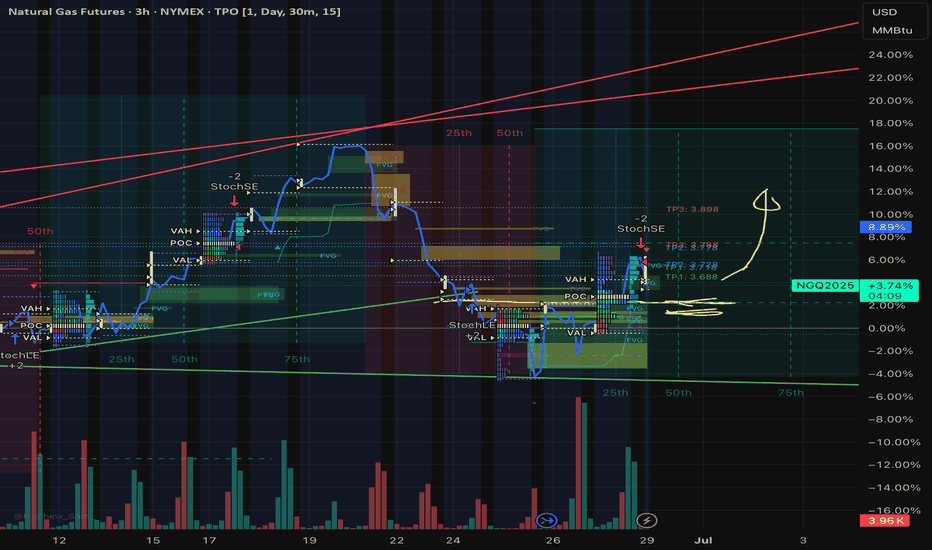

NATURALGAS1! Short time Breadkdown Alert !!This is the 4 hour chart of Natural Gas Futures.

NATURALGAS1 has given a short-term channel breakdown; the previous support may now possibly act as resistance at 300 level.

The breakdown target is the lower boundary of the broader channel, which may now act as support near at 240 level.

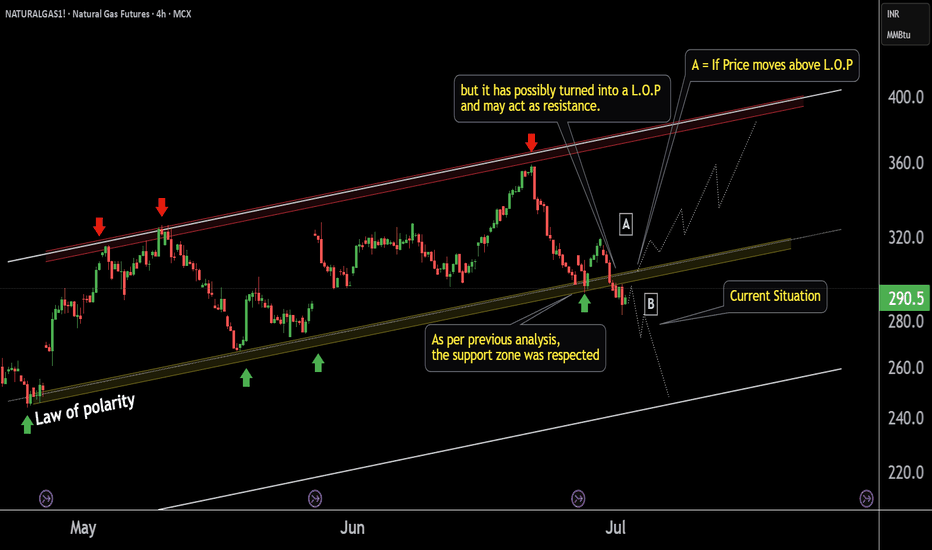

If lop is

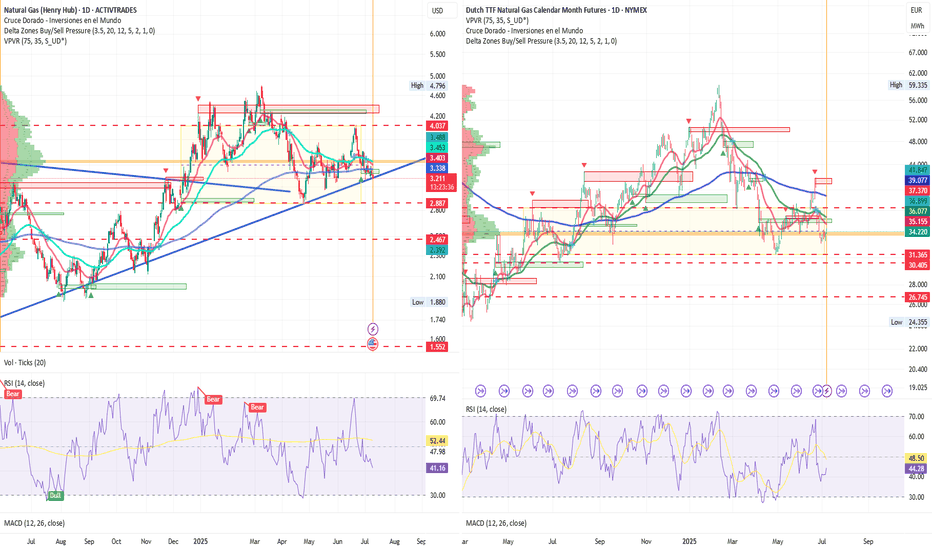

Europe Shudders over Winter Gas FearsEurope Shudders over Winter Gas Fears: Germany Puts Market on Edge

By Ion Jauregui – Analyst at ActivTrades

Europe is once again sounding the alarm over a potential energy crunch this coming winter. The continent’s gas reserves—particularly Germany’s—are significantly below normal levels for this

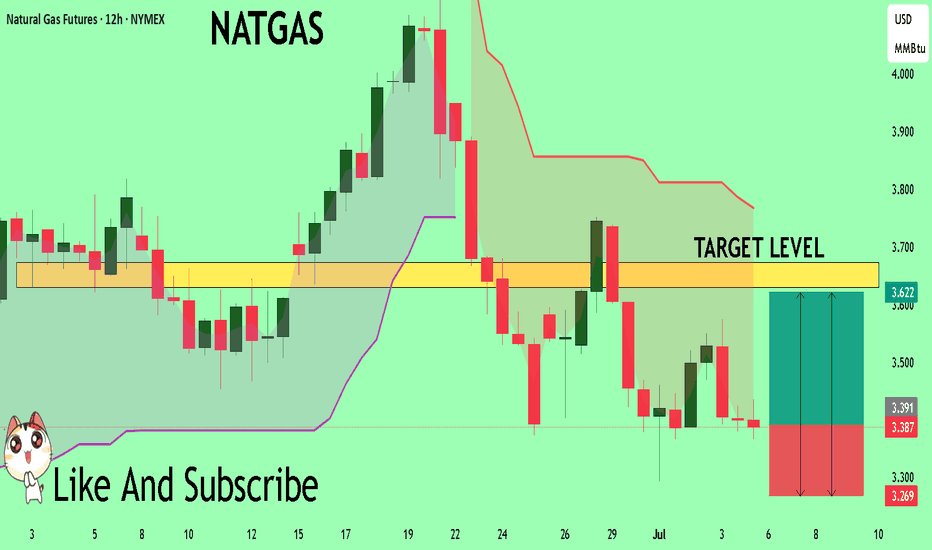

NG1!: Move Up Expected! Long!

My dear friends,

Today we will analyse NG1! together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3.403 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the ne

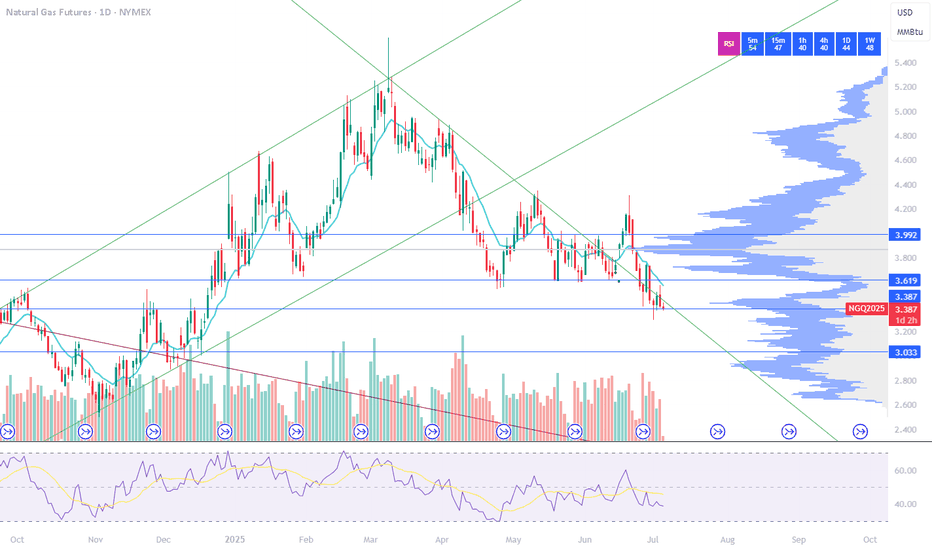

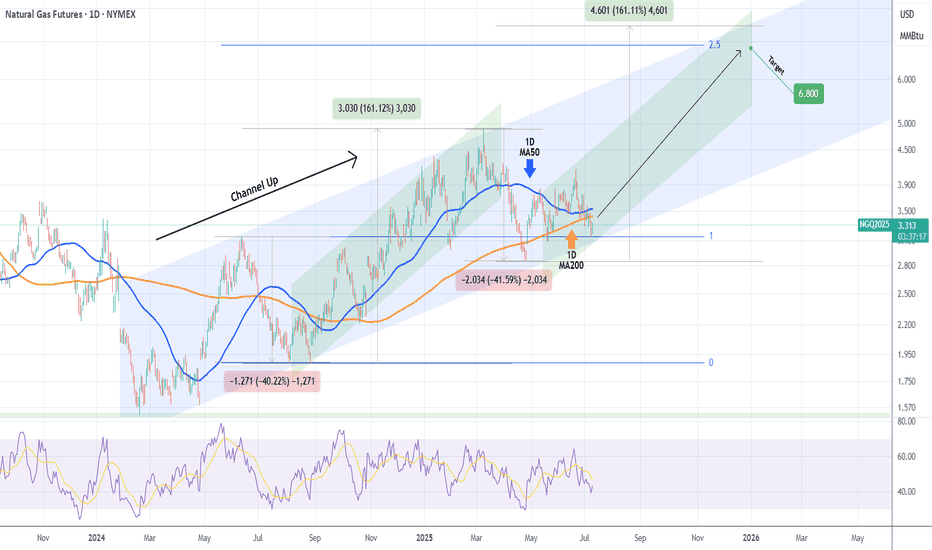

NATURAL GAS Best buy opportunity of the Channel Up.Natural Gas (NG1!) touched yesterday the bottom (Higher Lows trend-line) of the 1.5-year Channel Up, marginally below the 1D MA200 (orange trend-line) and is reacting so far today with a bullish tone.

If this evolves in a full-scale rebound, then technically it will be the pattern's new Bullish Leg

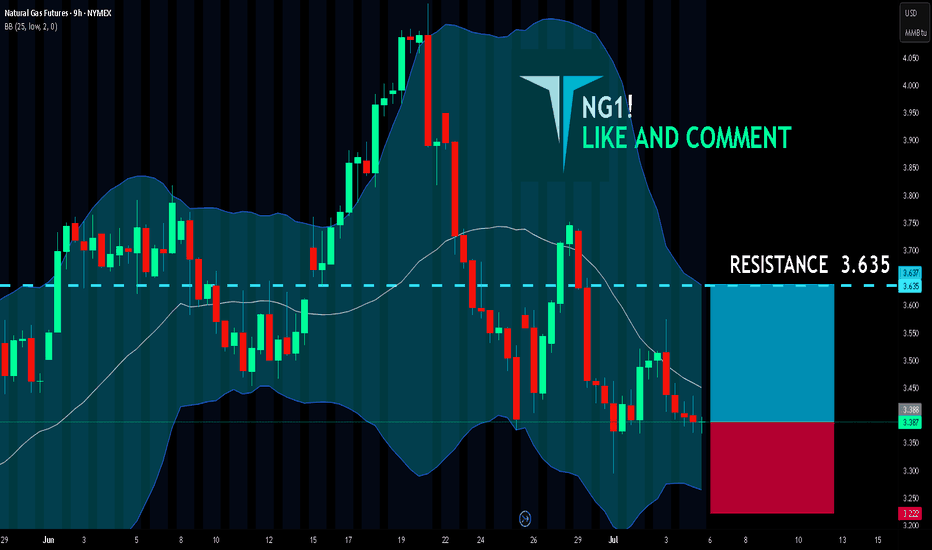

NG1! SENDS CLEAR BULLISH SIGNALS|LONG

NG1! SIGNAL

Trade Direction: long

Entry Level: 3.387

Target Level: 3.635

Stop Loss: 3.222

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LI

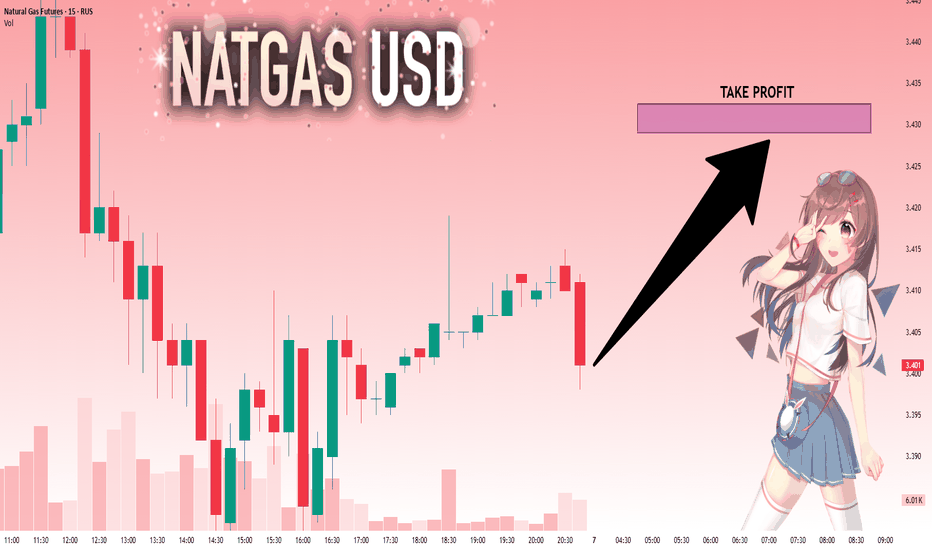

NATGAS My Opinion! BUY!

My dear followers,

This is my opinion on the NATGASnext move:

The asset is approaching an important pivot point 3.387

Bias - Bullish

Safe Stop Loss - 3.269

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish tren

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of LNG Japan/Korea Marker (Platts) Futures (Nov 2025) is 12.860 USD — it has risen 0.55% in the past 24 hours. Watch LNG Japan/Korea Marker (Platts) Futures (Nov 2025) price in more detail on the chart.

Track more important stats on the LNG Japan/Korea Marker (Platts) Futures (Nov 2025) chart.

The nearest expiration date for LNG Japan/Korea Marker (Platts) Futures (Nov 2025) is Oct 17, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell LNG Japan/Korea Marker (Platts) Futures (Nov 2025) before Oct 17, 2025.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for LNG Japan/Korea Marker (Platts) Futures (Nov 2025). Today its technical rating is neutral, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of LNG Japan/Korea Marker (Platts) Futures (Nov 2025) technicals for a more comprehensive analysis.