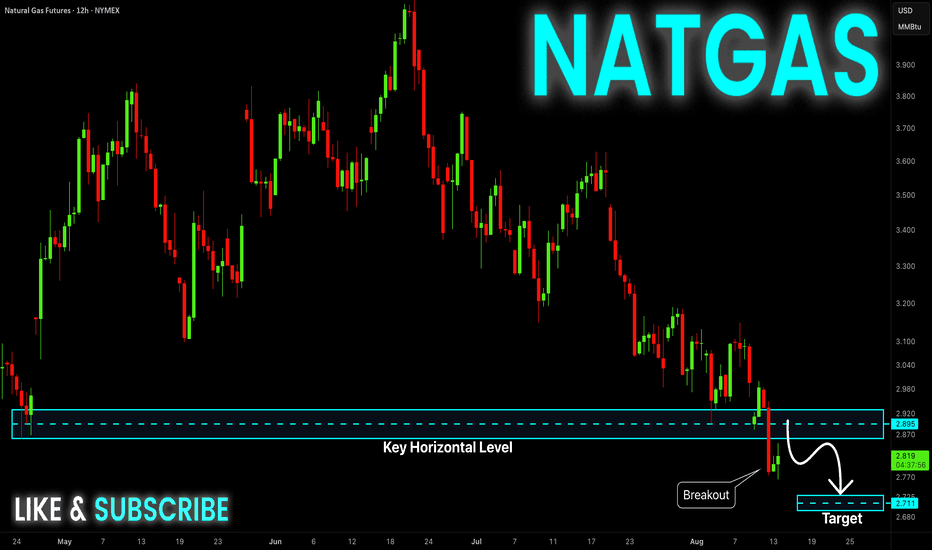

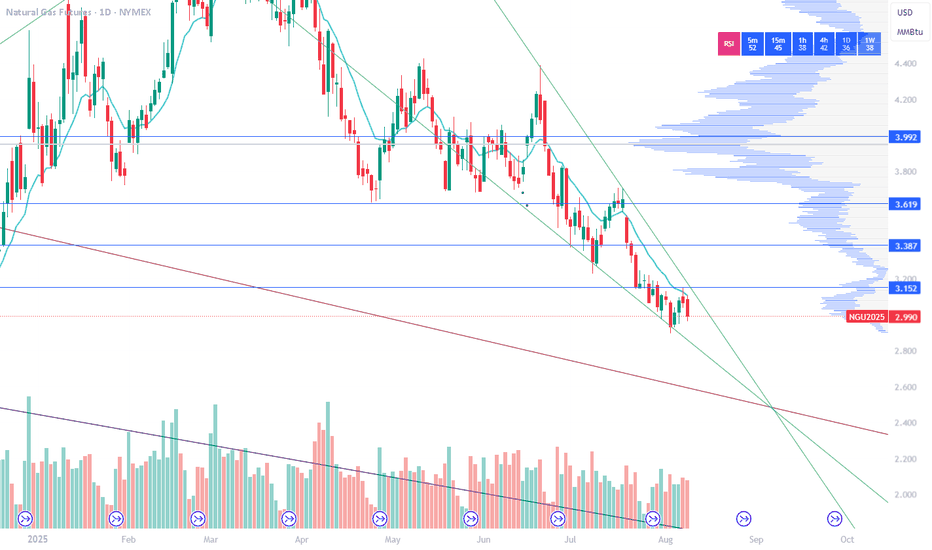

NATGAS Swing Short! Sell!

Hello,Traders!

NATGAS made a bearish

Breakout of the key horizontal

Level of 2.895$ while trading

In a downtrend so we are

Bearish biased and we will

Be expecting a further

Bearish continuation

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure:

Contract highlights

Related commodities

NG1!: Strong Bullish Sentiment! Long!

My dear friends,

Today we will analyse NG1!together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3.016 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the n

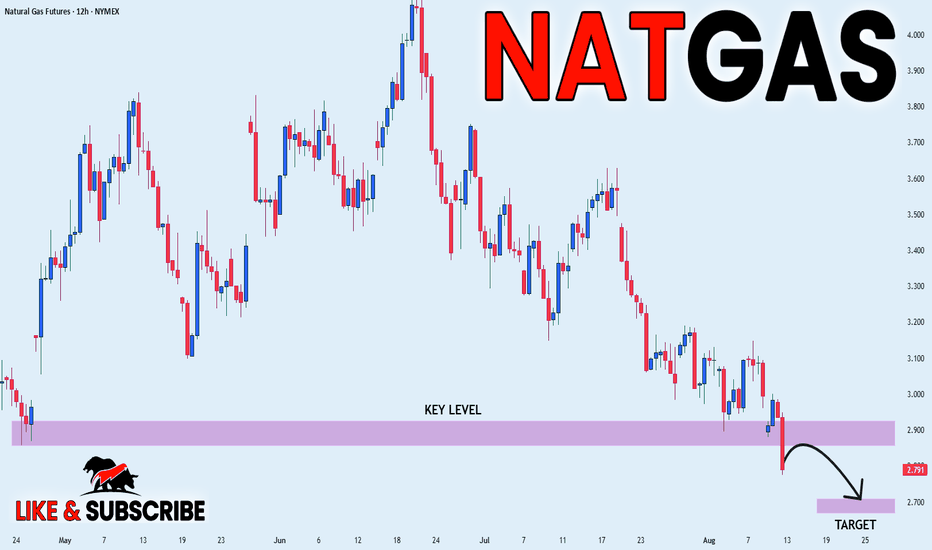

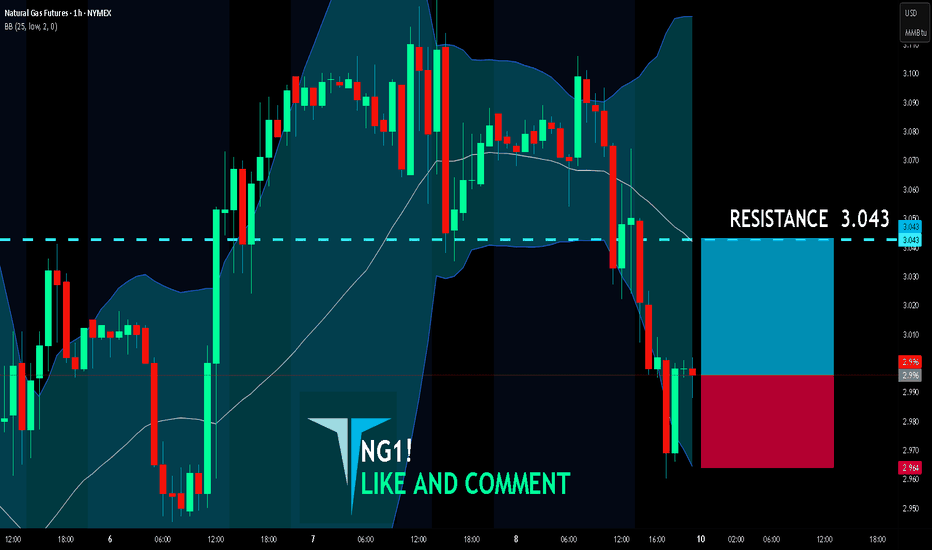

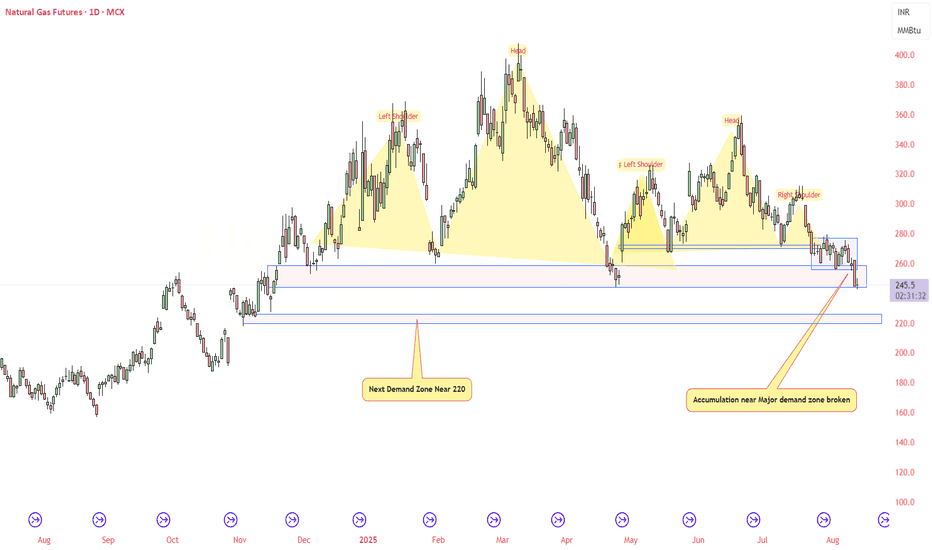

Natural Gas Slips Below Support – More Downside Ahead ?

Recent candles are large-bodied bearish candles, indicating strong selling pressure.

Bollinger Basis is sloping downward, showing short-term bearish momentum.

Price is currently below both the 20-day and 50-day moving averages, reinforcing the bearish outlook.

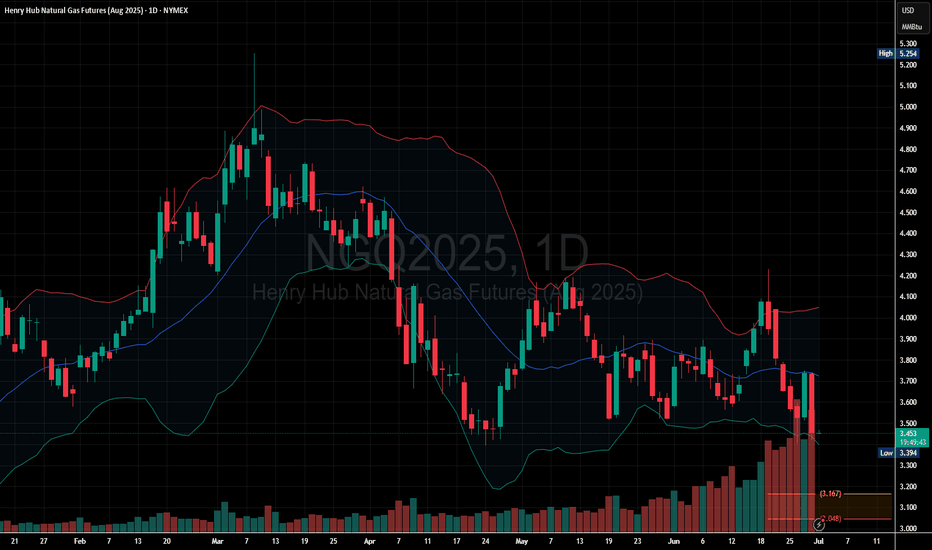

NATGAS The Target Is UP! BUY!

My dear friends,

Please, find my technical outlook for NATGAS below:

The price is coiling around a solid key level - 2.996

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal

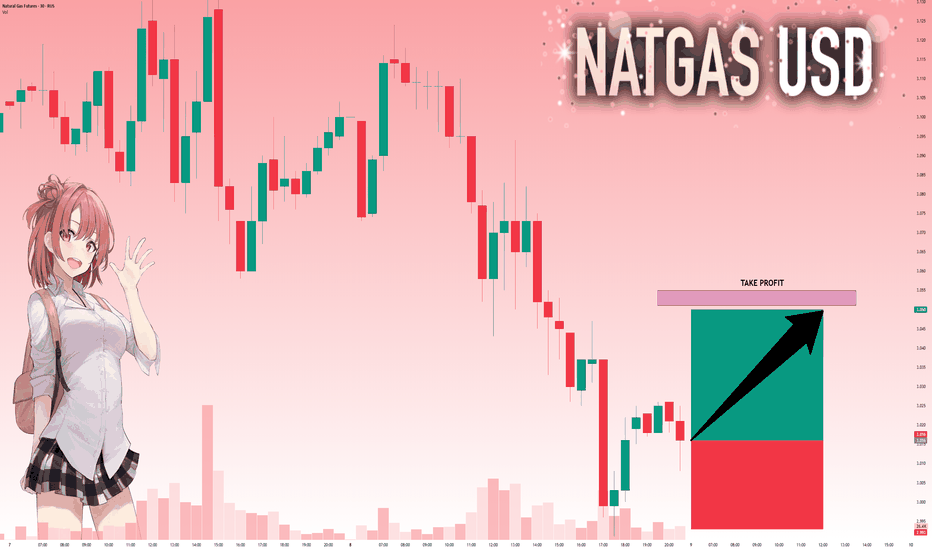

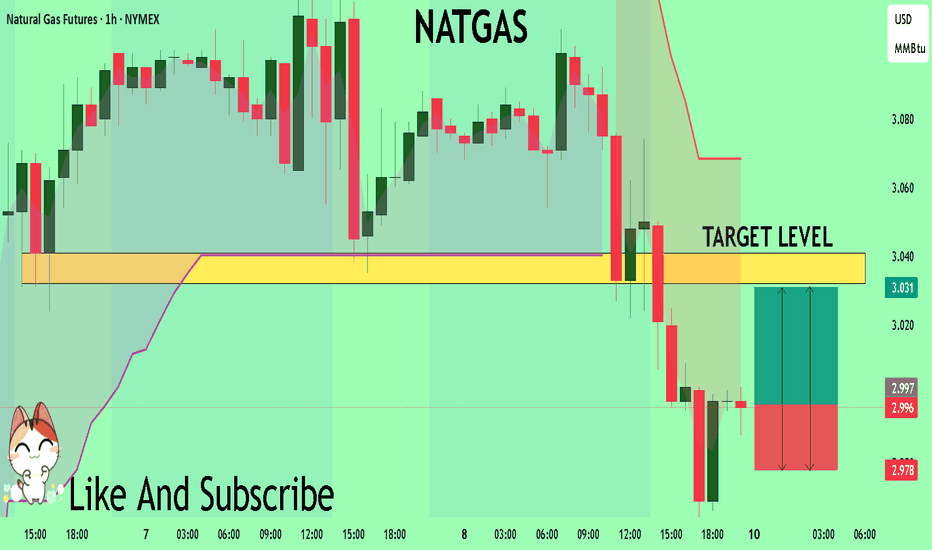

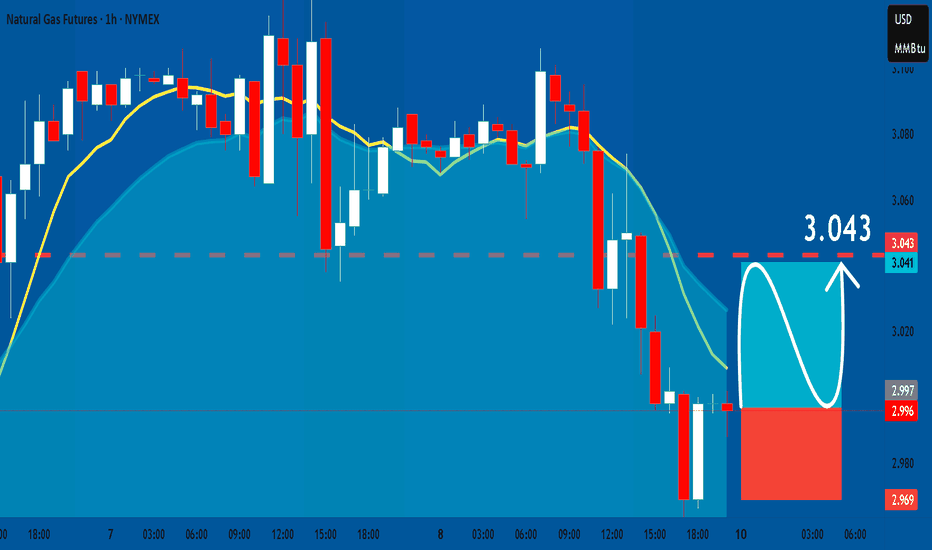

NG1! BUYERS WILL DOMINATE THE MARKET|LONG

NG1! SIGNAL

Trade Direction: long

Entry Level: 2.996

Target Level: 3.043

Stop Loss: 2.964

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LI

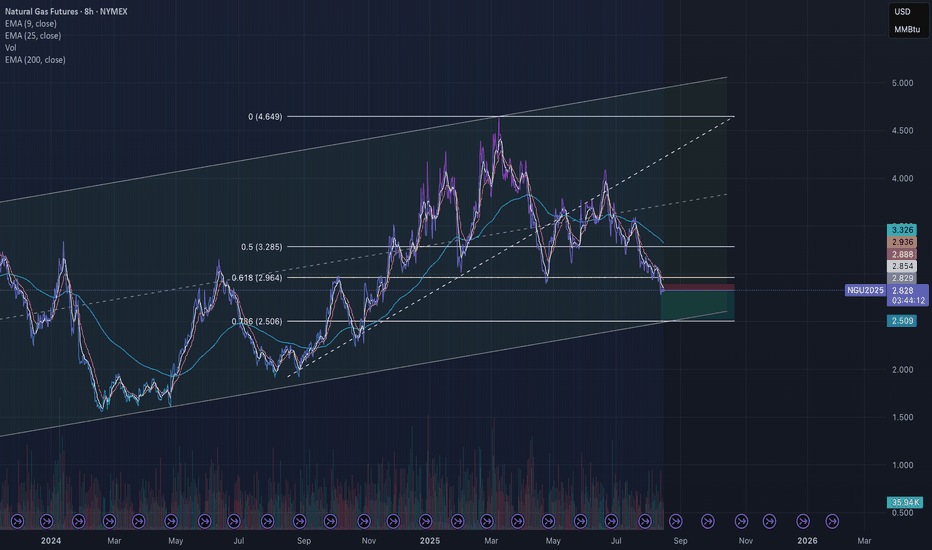

NATGAS: Bullish Continuation & Long Signal

NATGAS

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy NATGAS

Entry - 2.996

Stop - 2.969

Take - 3.043

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a month

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Henry Hub Natural Gas Futures (Oct 2018) is Sep 26, 2018.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Henry Hub Natural Gas Futures (Oct 2018) before Sep 26, 2018.