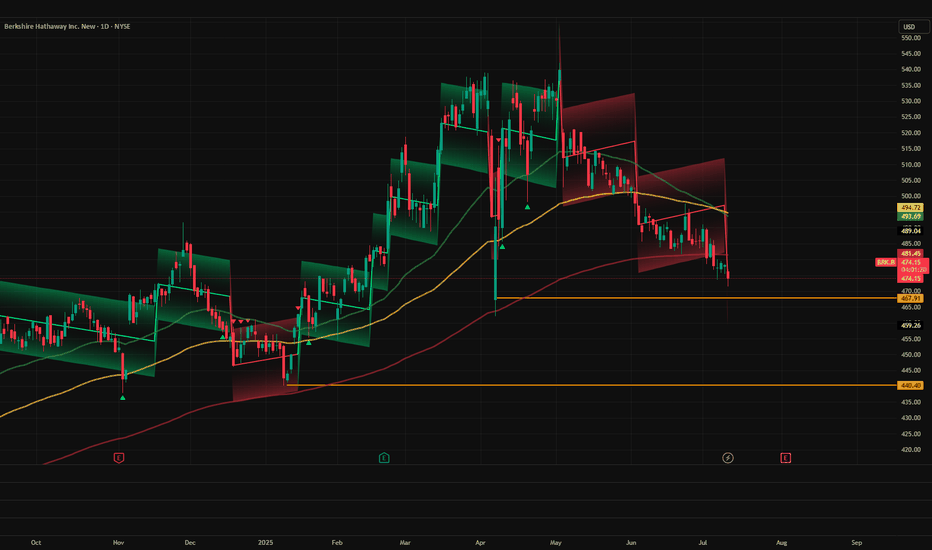

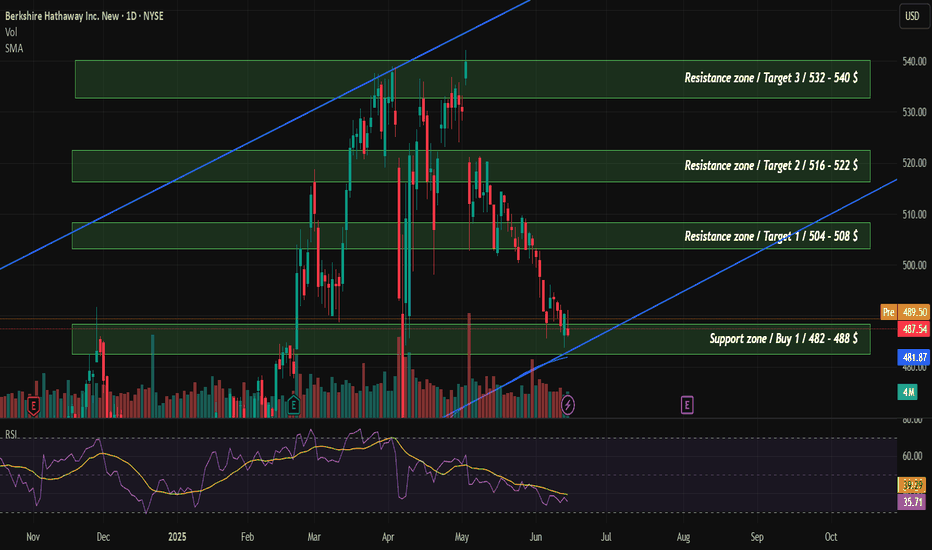

What's the deal with BRK.B?! Where is the short term bottom?I'm pretty new to this, so I'm looking to see if anyone has any thoughts about BRK.B. The best looking support is the April low, but it seems like it could fall below to the Jan 2025 low with the way it is steadily dropping. That would suck! I'm averaged at $491 and prefer not to see it go that low,

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

37.53 USD

89.00 B USD

371.43 B USD

1.34 B

About Berkshire Hathaway Inc.

Sector

Industry

CEO

Warren Edward Buffett

Website

Headquarters

Omaha

Founded

1839

FIGI

BBG000DWG505

Berkshire Hathaway, Inc engages in the provision of property and casualty insurance and reinsurance, utilities and energy, freight rail transportation, finance, manufacturing, and retailing services. It operates through following segments: GEICO, Berkshire Hathaway Reinsurance Group, Berkshire Hathaway Primary Group, Burlington Northern Santa Fe, LLC (BNSF), Berkshire Hathaway Energy, McLane Company, Manufacturing, and Service and Retailing. The GEICO segment involves in underwriting private passenger automobile insurance mainly by direct response methods. The Berkshire Hathaway Reinsurance Group segment consists of underwriting excess-of-loss and quota-share and facultative reinsurance worldwide. The Berkshire Hathaway Primary Group segment comprises of underwriting multiple lines of property and casualty insurance policies for primarily commercial accounts. The BNSF segment operates railroad systems in North America. The Berkshire Hathaway Energy segments deals with regulated electric and gas utility, including power generation and distribution activities, and real estate brokerage activities. The McLane Company segment offers wholesale distribution of groceries and non-food items. The Manufacturing segment includes industrial and end-user products, building products, and apparel. The Service and Retailing segment provides fractional aircraft ownership programs, aviation pilot training, electronic components distribution, and various retailing businesses, including automobile dealerships, and trailer and furniture leasing. The company was founded by Oliver Chace in 1839 and is headquartered in Omaha, NE.

Related stocks

Berkshire Hathaway: Time to consider exitsHello,

Despite recent market volatility, Berkshire Hathaway (BRK.A, BRK.B) has demonstrated resilience, with its stock rising approximately 16% year-to-date in 2025, significantly outperforming the S&P 500’s 2% decline. This performance has fueled speculation about Warren Buffett’s strategy, partic

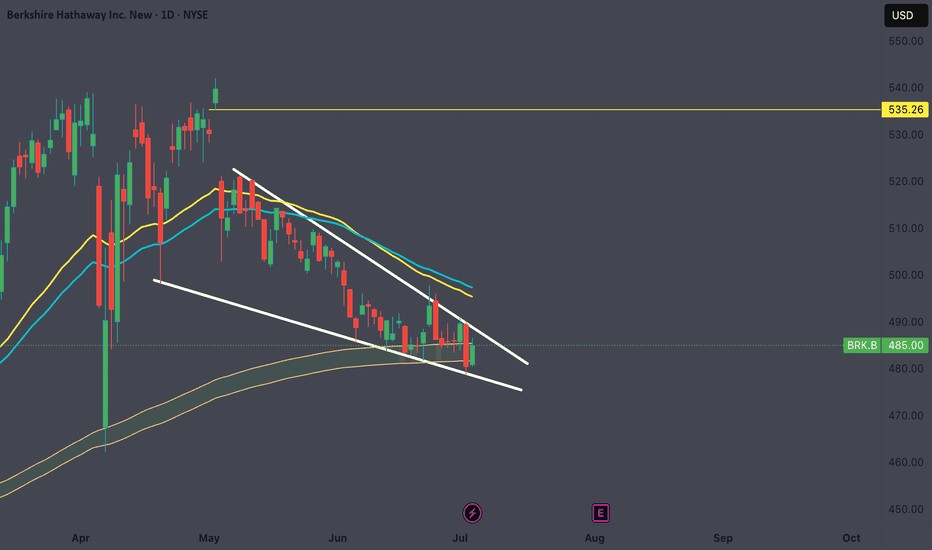

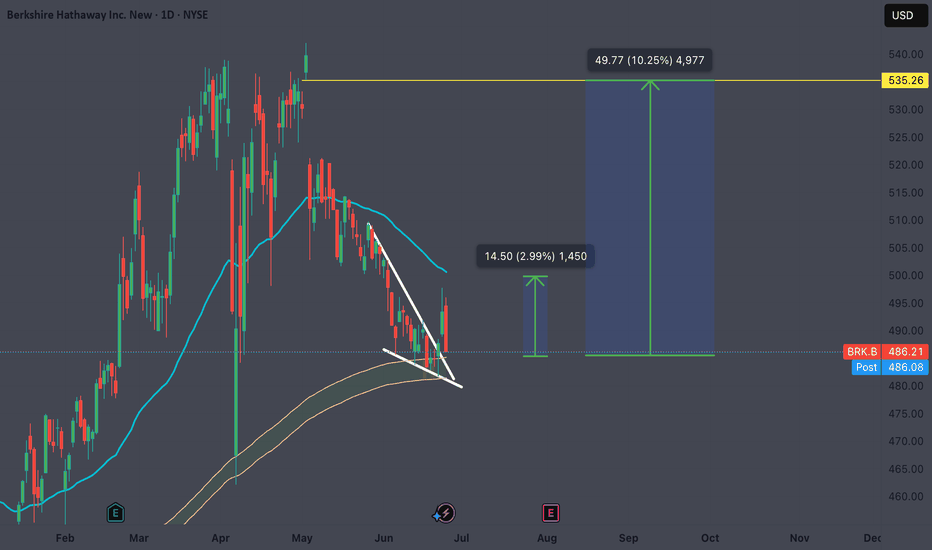

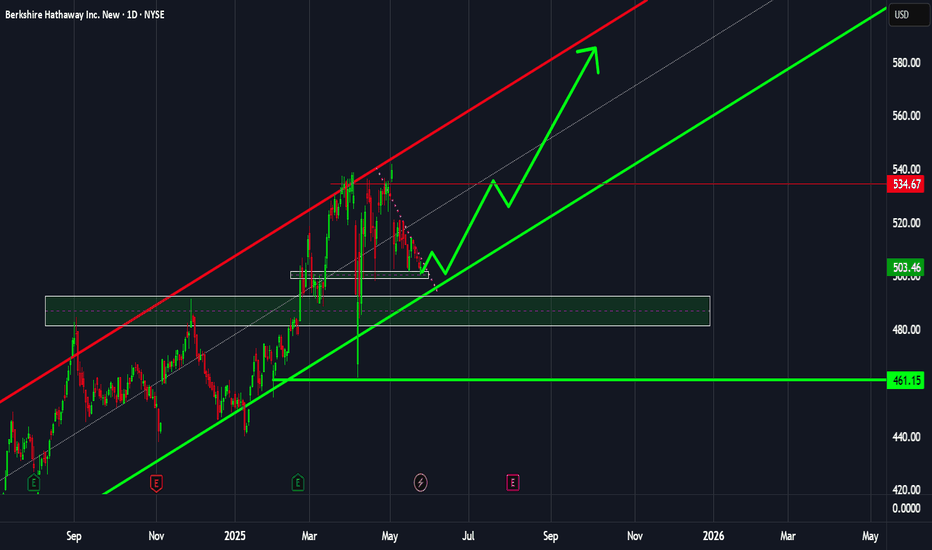

Berkshire Bounce ImminentNYSE:BRK.B Ready To Bounce!

- Breakout and now retesting descending wedge

- Overnight gap up from June 23rd to 24th was filled today

- Retesting top band of 200ema cloud

Targets:

- 3% to 50ma

- 10% to gap fill at $535

If you take anything away from this post, remember this:

Do NOT fade Uncl

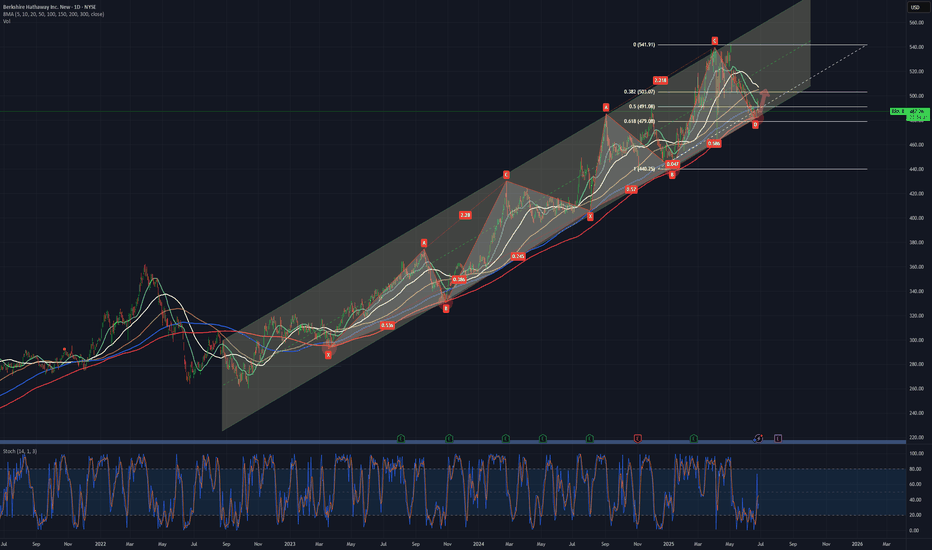

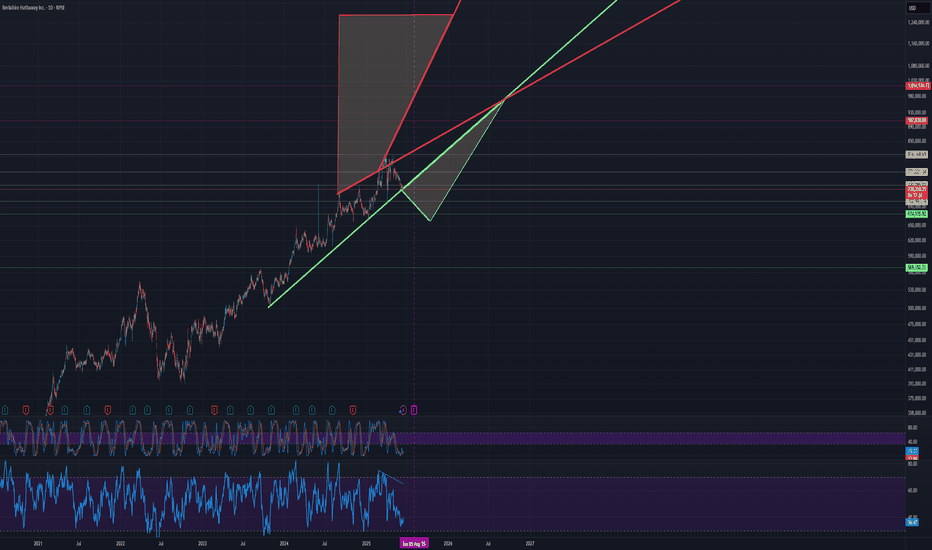

BRK.B Long The stock has been trading within a defined channel for nearly five years, suggesting it may be approaching a pivotal bottom. If this turns out to be the case, we could have the opportunity to acquire additional shares of this outstanding company at more attractive prices. It's crucial to stay vigil

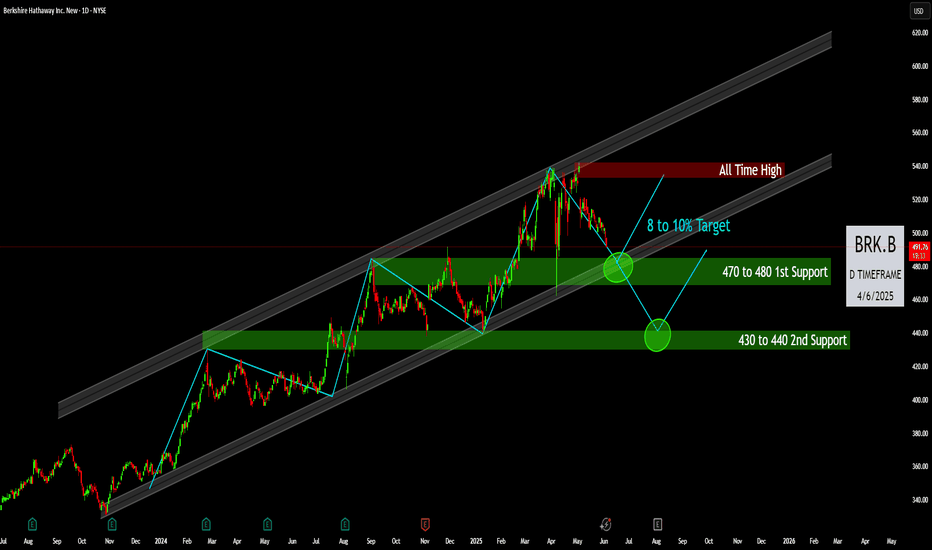

BRK.B: Channel-Bound & Targeting New HighsThis chart for Berkshire Hathaway Class B (BRK.B) presents a clear and actionable technical setup, operating within a well-defined long-term bullish channel.

Dominant Bullish Channel: BRK.B is clearly trading within a well-established, upward-sloping channel. This channel dictates the long-term

I have almost good fundamental views about Berkshire HathawayHello Traders and Investors,

According to my fundamental analysis considering EPS revisions and forecasts and also by taking the analysis TP and recommendations. I give a good score to BRK-B.

By considering the technical matters I think BRK.B, while is not a really good option for short-term, coul

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

N

ENRN5056545

Northern Natural Gas Co. 4.1% 15-SEP-2042Yield to maturity

7.56%

Maturity date

Sep 15, 2042

N

ENRN5163032

Northern Natural Gas Co. 3.4% 16-OCT-2051Yield to maturity

7.34%

Maturity date

Oct 16, 2051

B

BRK5147453

Berkshire Hathaway Energy Company 2.85% 15-MAY-2051Yield to maturity

7.29%

Maturity date

May 15, 2051

E

D4914006

Eastern Energy Gas Holdings, LLC 3.9% 15-NOV-2049Yield to maturity

7.14%

Maturity date

Nov 15, 2049

See all BRK.B bonds

Curated watchlists where BRK.B is featured.

Frequently Asked Questions

The current price of BRK.B is 475.86 USD — it has decreased by −0.50% in the past 24 hours. Watch Berkshire Hathaway Inc. New stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Berkshire Hathaway Inc. New stocks are traded under the ticker BRK.B.

BRK.B stock has fallen by −1.05% compared to the previous week, the month change is a −3.09% fall, over the last year Berkshire Hathaway Inc. New has showed a 14.94% increase.

We've gathered analysts' opinions on Berkshire Hathaway Inc. New future price: according to them, BRK.B price has a max estimate of 591.00 USD and a min estimate of 485.00 USD. Watch BRK.B chart and read a more detailed Berkshire Hathaway Inc. New stock forecast: see what analysts think of Berkshire Hathaway Inc. New and suggest that you do with its stocks.

BRK.B reached its all-time high on May 2, 2025 with the price of 542.07 USD, and its all-time low was 19.80 USD and was reached on May 31, 1996. View more price dynamics on BRK.B chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BRK.B stock is 1.46% volatile and has beta coefficient of 0.50. Track Berkshire Hathaway Inc. New stock price on the chart and check out the list of the most volatile stocks — is Berkshire Hathaway Inc. New there?

Today Berkshire Hathaway Inc. New has the market capitalization of 1.03 T, it has decreased by −0.66% over the last week.

Yes, you can track Berkshire Hathaway Inc. New financials in yearly and quarterly reports right on TradingView.

Berkshire Hathaway Inc. New is going to release the next earnings report on Aug 4, 2025. Keep track of upcoming events with our Earnings Calendar.

BRK.B earnings for the last quarter are 4.47 USD per share, whereas the estimation was 4.72 USD resulting in a −5.40% surprise. The estimated earnings for the next quarter are 4.99 USD per share. See more details about Berkshire Hathaway Inc. New earnings.

Berkshire Hathaway Inc. New revenue for the last quarter amounts to 89.72 B USD, despite the estimated figure of 90.83 B USD. In the next quarter, revenue is expected to reach 92.26 B USD.

BRK.B net income for the last quarter is 4.60 B USD, while the quarter before that showed 19.69 B USD of net income which accounts for −76.63% change. Track more Berkshire Hathaway Inc. New financial stats to get the full picture.

No, BRK.B doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 14, 2025, the company has 392.4 K employees. See our rating of the largest employees — is Berkshire Hathaway Inc. New on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Berkshire Hathaway Inc. New EBITDA is 69.72 B USD, and current EBITDA margin is 19.46%. See more stats in Berkshire Hathaway Inc. New financial statements.

Like other stocks, BRK.B shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Berkshire Hathaway Inc. New stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Berkshire Hathaway Inc. New technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Berkshire Hathaway Inc. New stock shows the buy signal. See more of Berkshire Hathaway Inc. New technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.