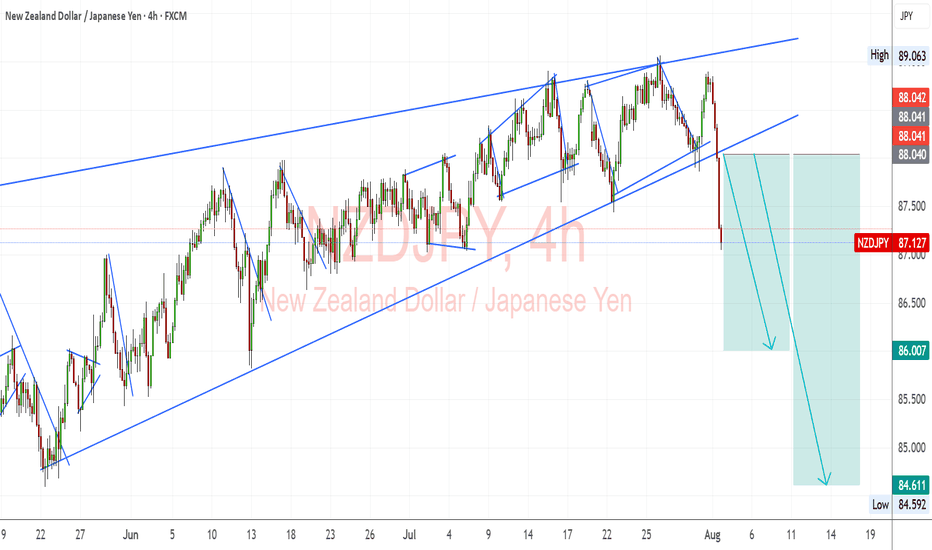

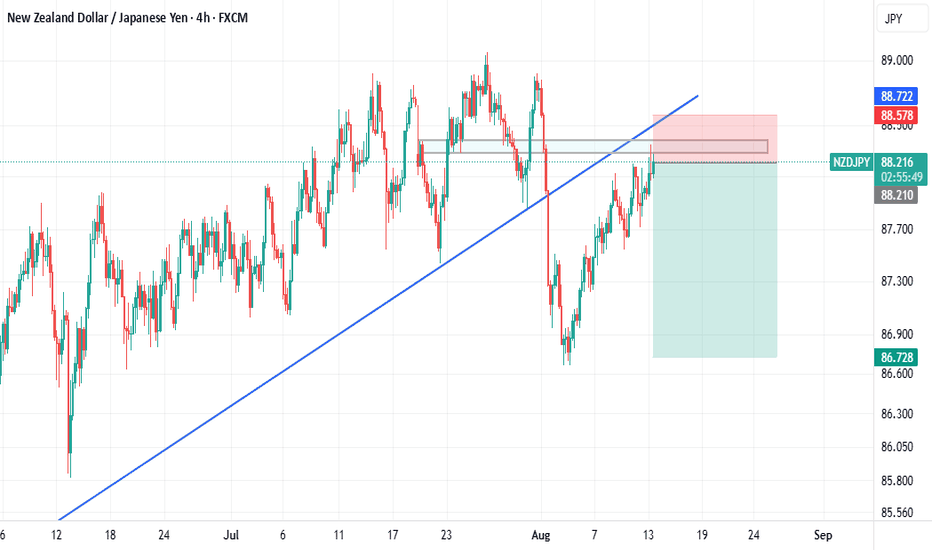

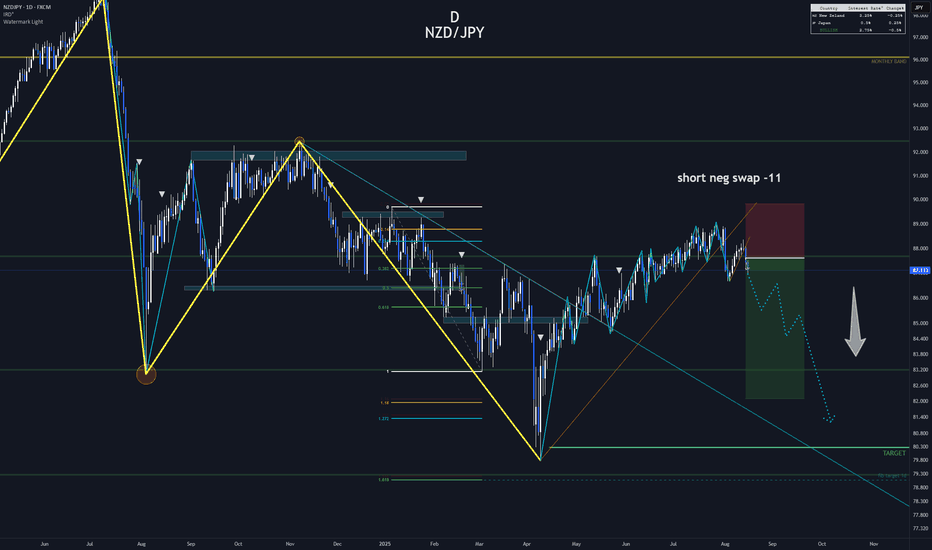

NZD/JPY: Bearish Breakdown from Ascending ChannelNZD/JPY has decisively broken below its ascending channel, signaling a shift from bullish structure to bearish momentum. This move aligns with fundamental headwinds for NZD and the potential for JPY strength amid intervention risks and global risk-off sentiment.

Technical Analysis (4H Chart)

Patter

Related currencies

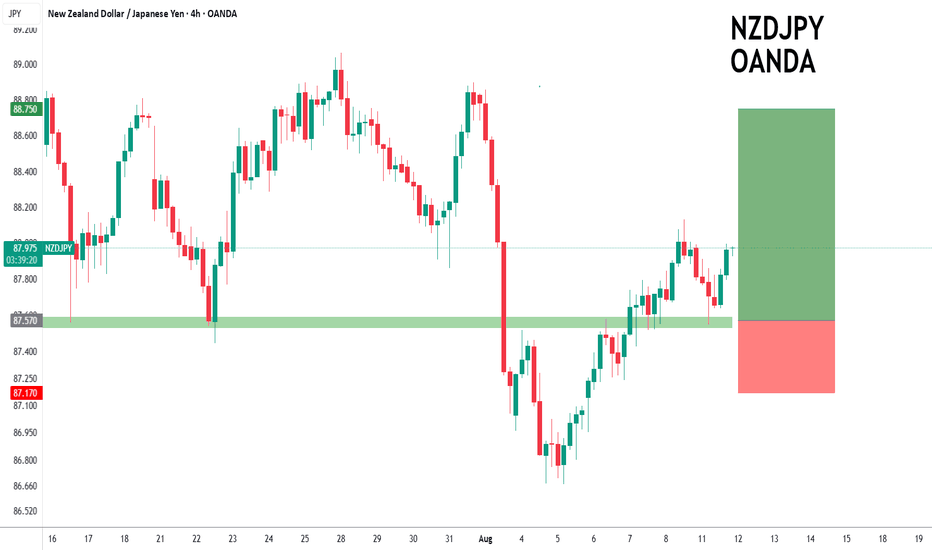

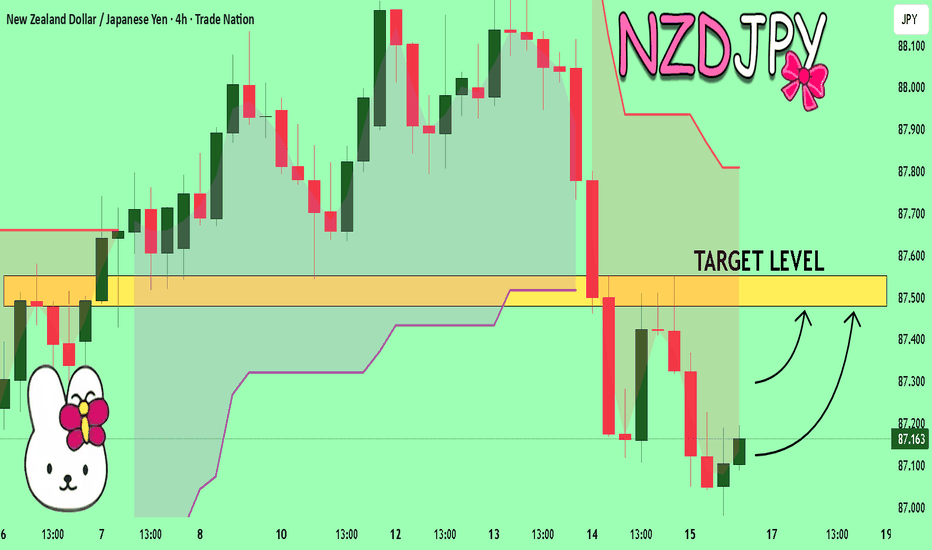

NZDJPY to find buyers at previous support?NZDJPY - 24h expiry

Previous support located at 87.60.

87.44 has been pivotal.

Dip buying offers good risk/reward.

The overnight dip has been bought into and there is scope for further bullish pressure going into this morning.

Prices have reacted from 86.67.

We look to Buy at 87.57 (stop at

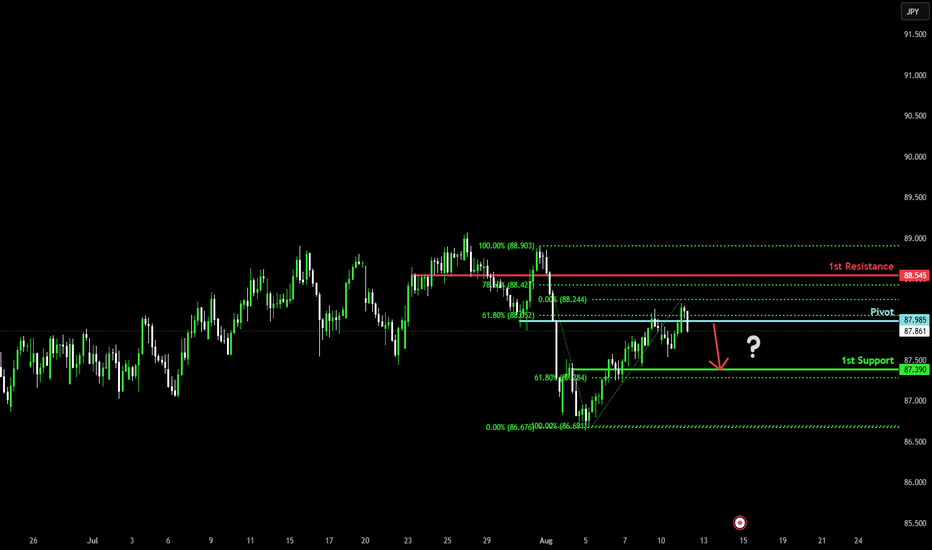

Potential bearish drop?NZD/JPY is reacting off the pivot and could drop to the 1st support, which is slightly above the 61.8% Fibonacci retracement.

Pivot: 87.98

1st Support: 87.39

1st Resistance: 88.54

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with mon

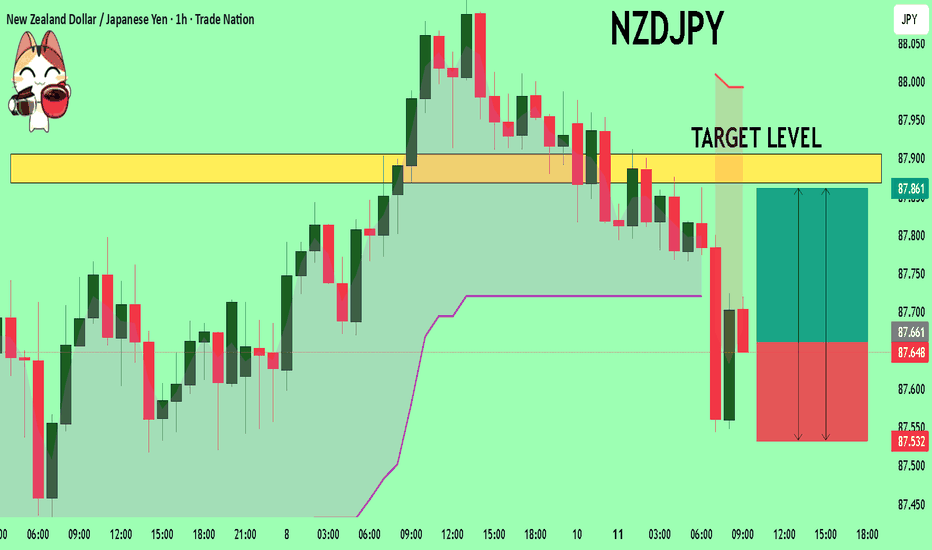

NZDJPY Will Explode! BUY!

My dear subscribers,

This is my opinion on the NZDJPY next move:

The instrument tests an important psychological level 87.665

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Ta

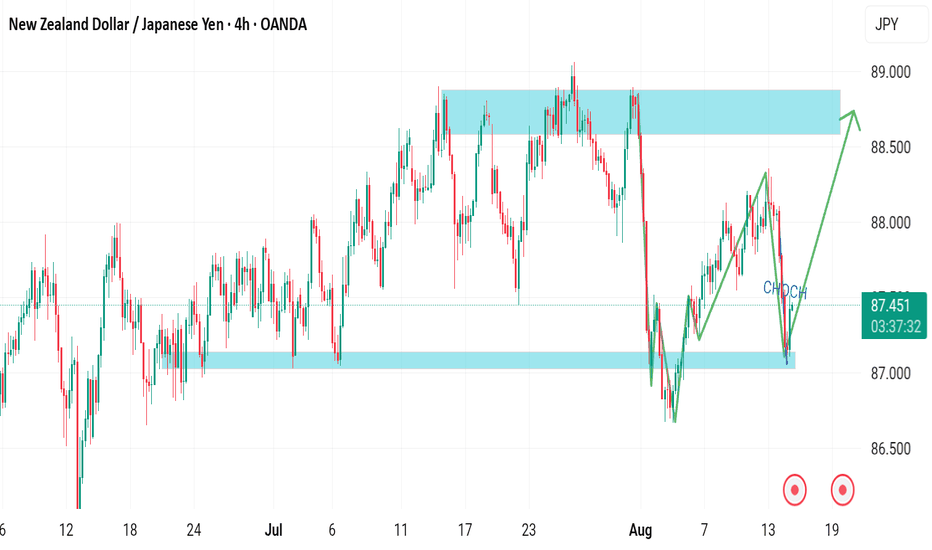

NZDJPY Sellers In Panic! BUY!

My dear friends,

NZDJPY looks like it will make a good move, and here are the details:

The market is trading on 87.169 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the ma

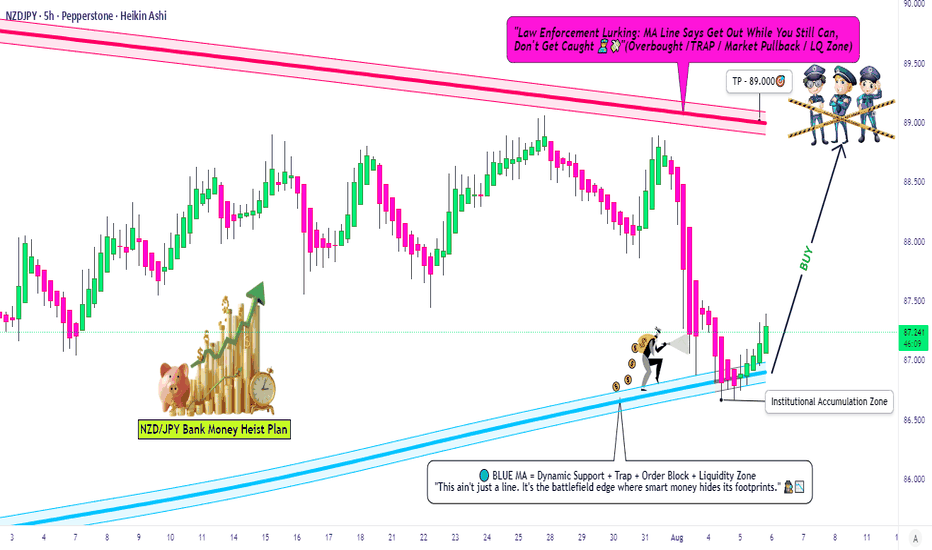

Is NZD/JPY the Next Bullish Vault Breach? Target: 89.000💰 NZD/JPY – Thief's Layered Strike Plan | Bullish FX Heist 🚀💹

🌍 What’s up, Market Bandits?!

Welcome to the Thief Trader Vault — where trades aren't guessed… they're executed with stealth 🕵️♂️💼. Today's blueprint? We're cracking into the NZD/JPY vault with a layered limit order raid – the perfect se

NZDJPY SHORTThe to short on NZDJPY daily chart. we have down Market wave and just recently we change short term trend that indicates the start of new extension leg down.

We can trade 3 patterns here.

Original fibonacci

Markte wave

or short term trend

Trade on the chart is the trade on Original fibonacci.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of NZDJPY is 87.531 JPY — it has decreased by −0.31% in the past 24 hours. See more of NZDJPY rate dynamics on the detailed chart.

The value of the NZDJPY pair is quoted as 1 NZD per x JPY. For example, if the pair is trading at 1.50, it means it takes 1.5 JPY to buy 1 NZD.

The term volatility describes the risk related to the changes in an asset's value. NZDJPY has the volatility rating of 0.36%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The NZDJPY showed a −0.39% fall over the past week, the month change is a −0.84% fall, and over the last year it has decreased by −2.04%. Track live rate changes on the NZDJPY chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

NZDJPY is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade NZDJPY right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with NZDJPY technical analysis. The technical rating for the pair is sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the NZDJPY shows the neutral signal, and 1 month rating is neutral. See more of NZDJPY technicals for a more comprehensive analysis.