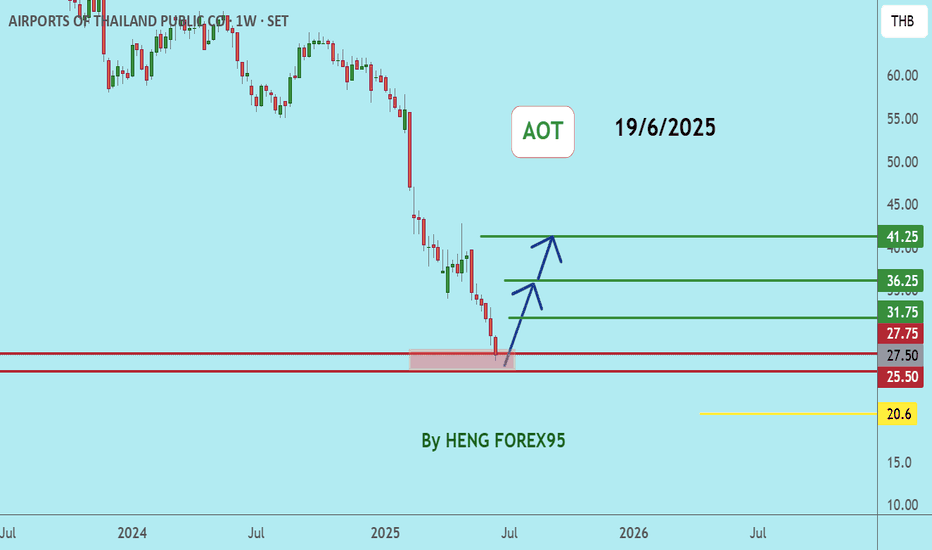

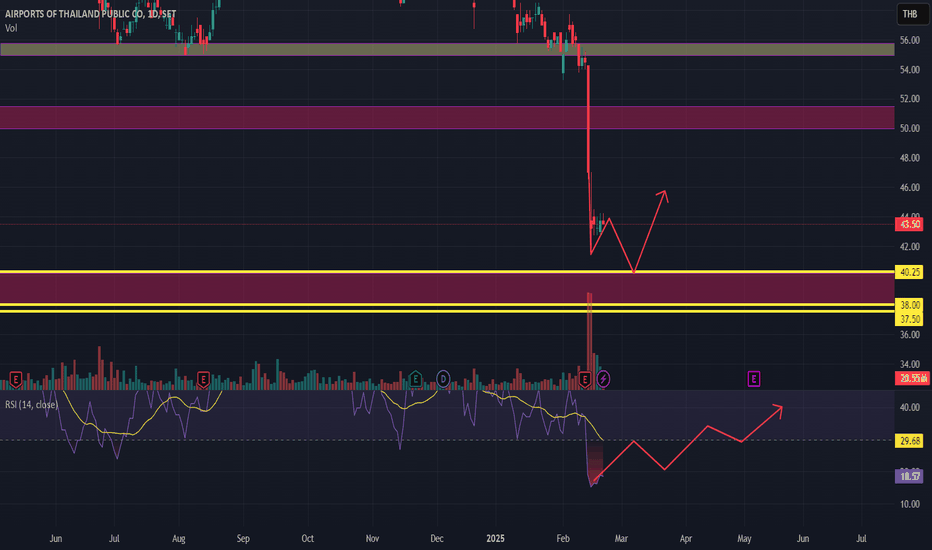

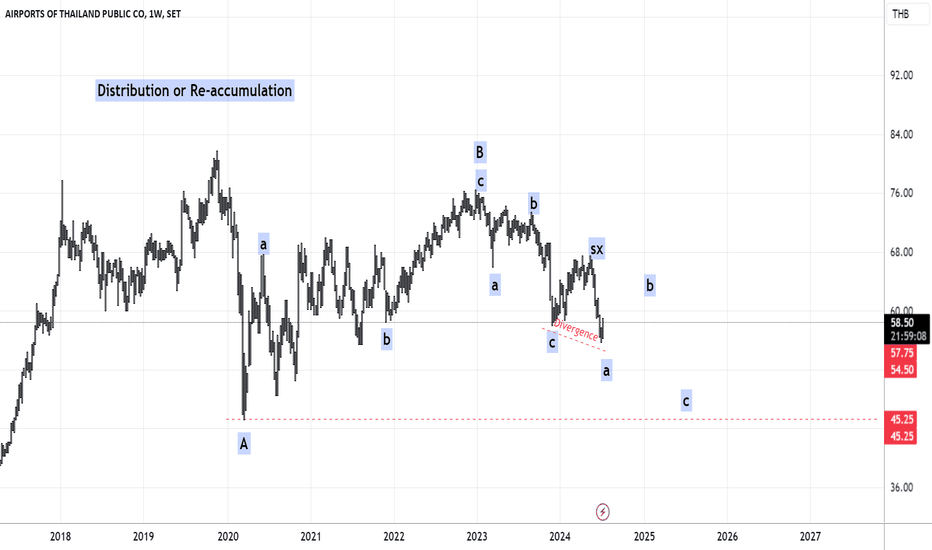

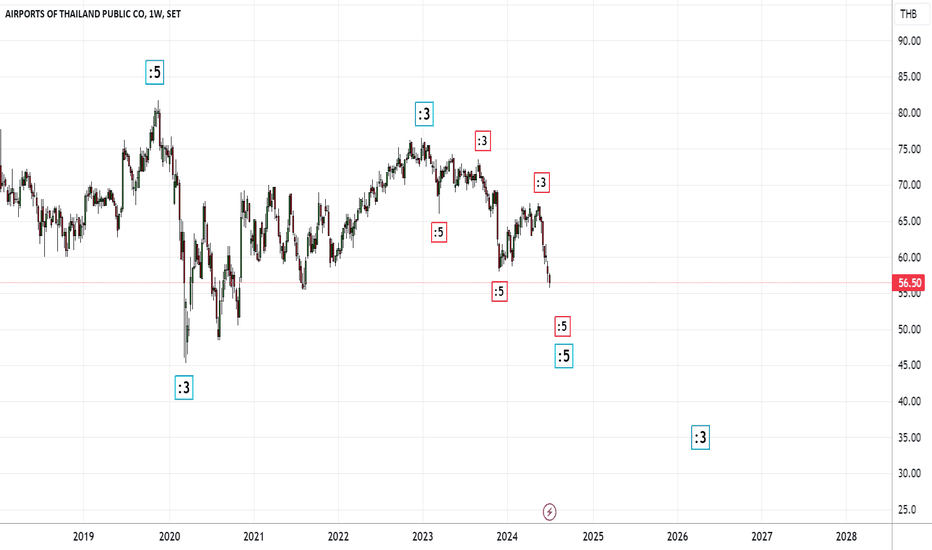

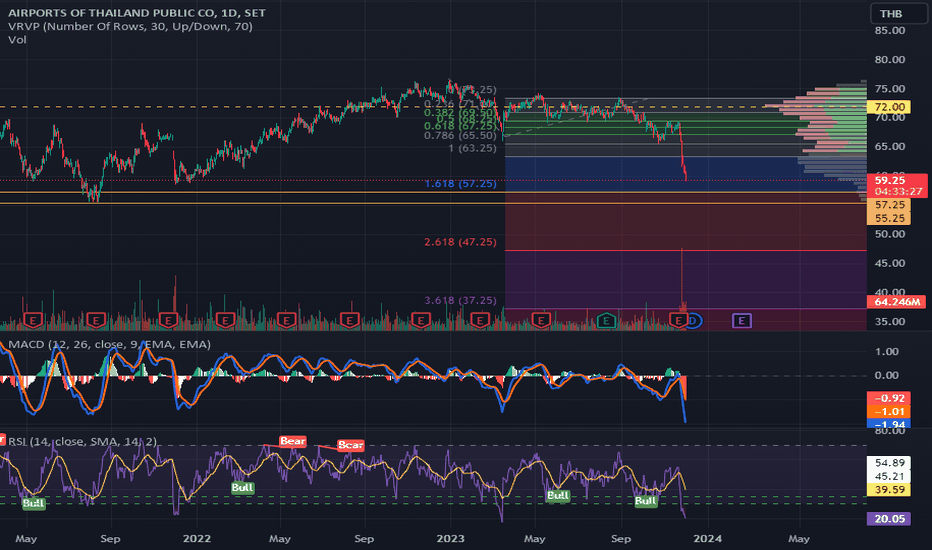

AOTAOT price is now near the support zone of 27-25. If the price cannot break through the 25 baht level, it is expected that the price will rebound. Consider buying in the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suita

1.25 THB

19.18 B THB

67.12 B THB

14.29 B

About AIRPORTS OF THAILAND PUBLIC CO

Sector

Industry

Website

Headquarters

Bangkok

Founded

1903

ISIN

TH0765010Z16

FIGI

BBG000BT8MG9

Airports of Thailand Public Co. Ltd. engages in the operation of airports. It operates through the following segments: Airport, Hotel, Ground Aviation, and Security. The company was founded on December 17, 1903 and is headquartered in Bangkok, Thailand.

Related stocks

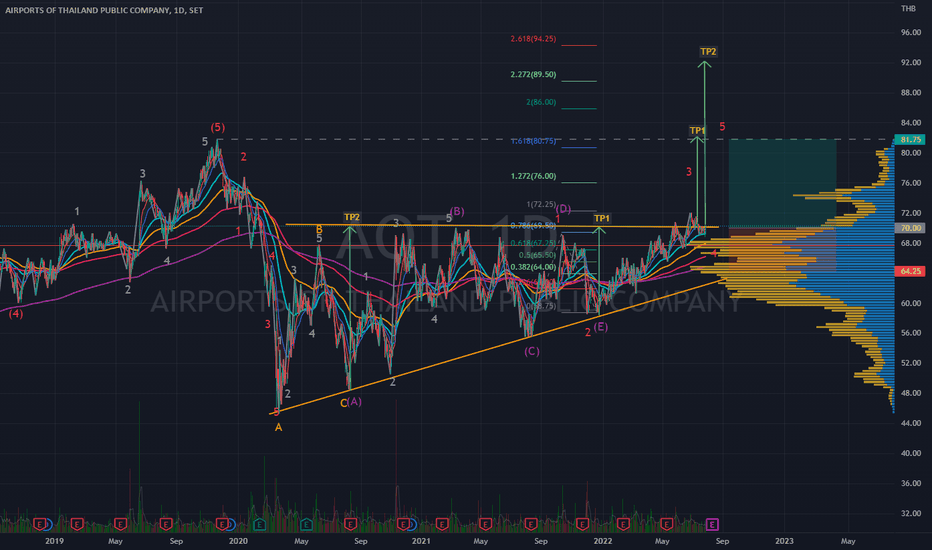

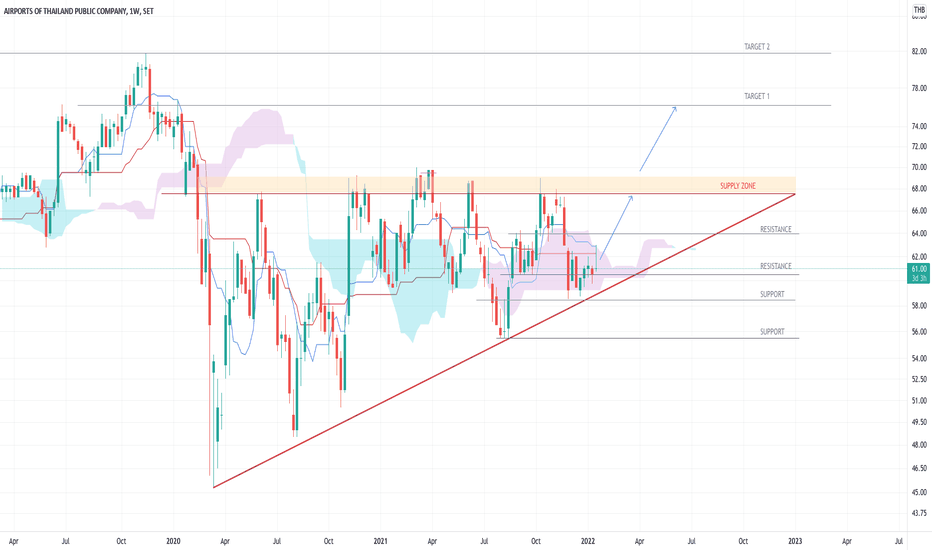

AOT | Wave Projection | Rising triangle ABCDE Uptrend TargetPrice action and chart pattern trading setup

> Rising triangle ABCDE pattern @ breakout neckline position

> TP1 estimated @ height of E wave +17% upside 1.618 extension of CDE wave

> Stoploss @ triangle support -8% downside

> RRR: 2:1

Always trade with affordable risk and respect your stop

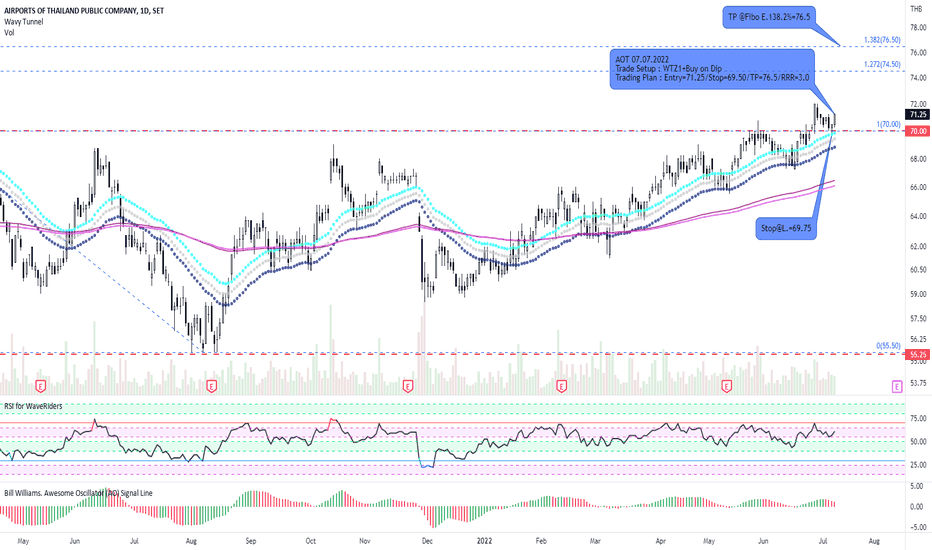

AOT and WTZ1+Buy on DipAOT has been consolidating in the trading range for several months due to effects of Covid pandemic to the airport operation. However, after the situation becomes better, some investors expect company's revenues will return. Expectation reflects to its technical signal on WTZ1. After its price bro

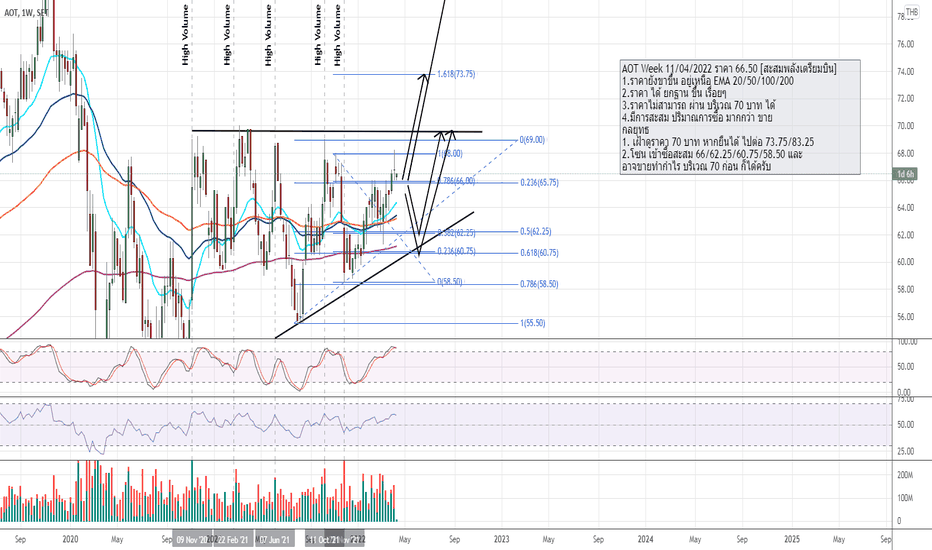

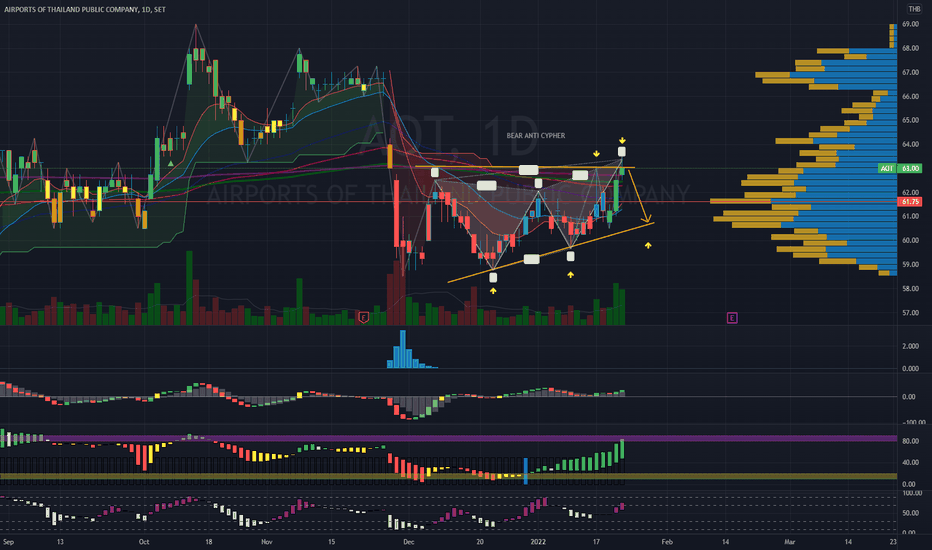

AOT Week 11/04/2022 Price 66.50 [Collect the power to Fly]AOT Week 11/04/2022 Price 66.50

1. The price is still rising above the EMA 20/50/100/200.

2. The price has raised the base continually.

3. The price cannot pass through the area of 70 baht.

4. There is a cumulative amount of purchases greater than sales.

strategy

1. Watch the price of 70 baht. I

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of AOT.F is 30.25 THB — it has decreased by −3.20% in the past 24 hours. Watch AIRPORTS OF THAILAND PUBLIC CO FOREIGN stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SET exchange AIRPORTS OF THAILAND PUBLIC CO FOREIGN stocks are traded under the ticker AOT.F.

AOT.F stock hasn't changed in a week, the month change is a −7.63% fall, over the last year AIRPORTS OF THAILAND PUBLIC CO FOREIGN has showed a −46.93% decrease.

AOT.F reached its all-time high on Jul 13, 2023 with the price of 102.00 THB, and its all-time low was 0.002 THB and was reached on Jan 8, 2009. View more price dynamics on AOT.F chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AOT.F stock is 5.93% volatile and has beta coefficient of 0.96. Track AIRPORTS OF THAILAND PUBLIC CO FOREIGN stock price on the chart and check out the list of the most volatile stocks — is AIRPORTS OF THAILAND PUBLIC CO FOREIGN there?

Today AIRPORTS OF THAILAND PUBLIC CO FOREIGN has the market capitalization of 432.14 B, it has increased by 3.67% over the last week.

Yes, you can track AIRPORTS OF THAILAND PUBLIC CO FOREIGN financials in yearly and quarterly reports right on TradingView.

AOT.F net income for the last quarter is 5.05 B THB, while the quarter before that showed 5.34 B THB of net income which accounts for −5.45% change. Track more AIRPORTS OF THAILAND PUBLIC CO FOREIGN financial stats to get the full picture.

Yes, AOT.F dividends are paid annually. The last dividend per share was 0.79 THB. As of today, Dividend Yield (TTM)% is 2.61%. Tracking AIRPORTS OF THAILAND PUBLIC CO FOREIGN dividends might help you take more informed decisions.

AIRPORTS OF THAILAND PUBLIC CO FOREIGN dividend yield was 1.25% in 2024, and payout ratio reached 58.83%. The year before the numbers were 0.50% and 58.50% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AIRPORTS OF THAILAND PUBLIC CO FOREIGN EBITDA is 42.37 B THB, and current EBITDA margin is 62.24%. See more stats in AIRPORTS OF THAILAND PUBLIC CO FOREIGN financial statements.

Like other stocks, AOT.F shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AIRPORTS OF THAILAND PUBLIC CO FOREIGN stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AIRPORTS OF THAILAND PUBLIC CO FOREIGN technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AIRPORTS OF THAILAND PUBLIC CO FOREIGN stock shows the sell signal. See more of AIRPORTS OF THAILAND PUBLIC CO FOREIGN technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.