BMW: Stability, Innovation, and Opportunity in a Changing WorldIn times of market turbulence, great opportunities often lie hidden beneath temporary setbacks. Recent tariff-related ripples may have rattled BMW’s price, but for those looking to invest for the long haul, this dip is a golden opportunity to buy into one of the world’s most reliable automakers.

Key facts today

BMW Group Middle East's customer support services grew 7% in early 2025, with 76% of customers with vehicles under 10 years old using the authorized service network.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

10.52 EUR

7.29 B EUR

142.38 B EUR

277.54 M

About BAY.MOTOREN WERKE AG ST

Sector

Industry

CEO

Oliver Zipse

Website

Headquarters

Munich

Founded

1916

ISIN

DE0005190003

FIGI

BBG008P7FBB6

Bayerische Motoren Werke AG engages in the manufacture and sale of automobiles and motorcycles. It operates through the following segments: Automotive, Motorcycles, Financial Services, and Other Entities. The Automotive segment develops, manufactures, assembles, and sells cars and off-road vehicles, under the following brands: BMW, MINI, and Rolls-Royce, as well as spare parts and accessories. The Motorcycles segment focuses on the premium segment. The Financial Services segment offers credit financing, leasing, and other services to retail customers. The Other Entities segment includes holding and group financing activities. The company was founded on March 6, 1916 and is headquartered in Munich, Germany.

Related stocks

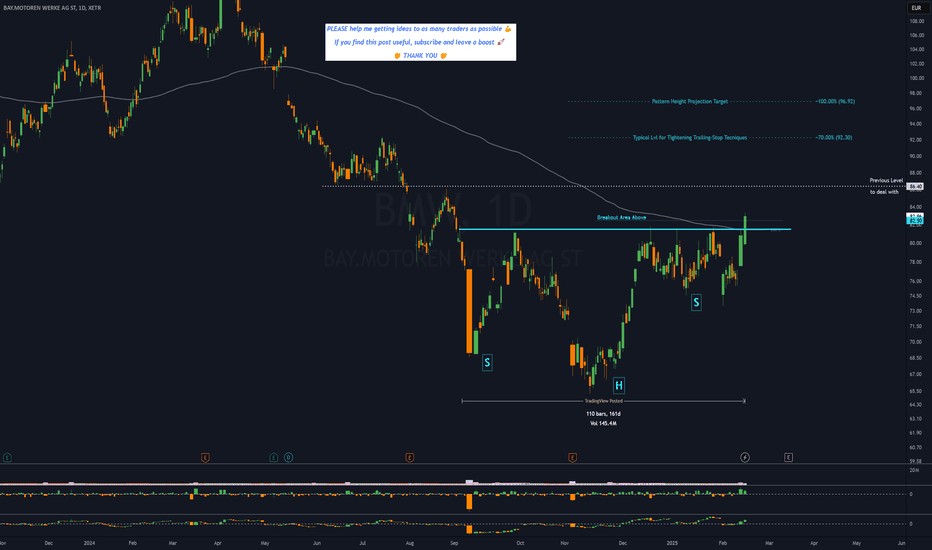

BMW - 5 months HEAD & SHOULDERS══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

-

BMW - a possible end for this horrifying trend?I was a huge fan of the stock long time age because it was for me an extremely underrated stock which was very cheap compared to the earnings and I liked the fact that BMW could constantly increase their earnings each quarter a lot. I sold long time ago because it had to make a retracement for a new

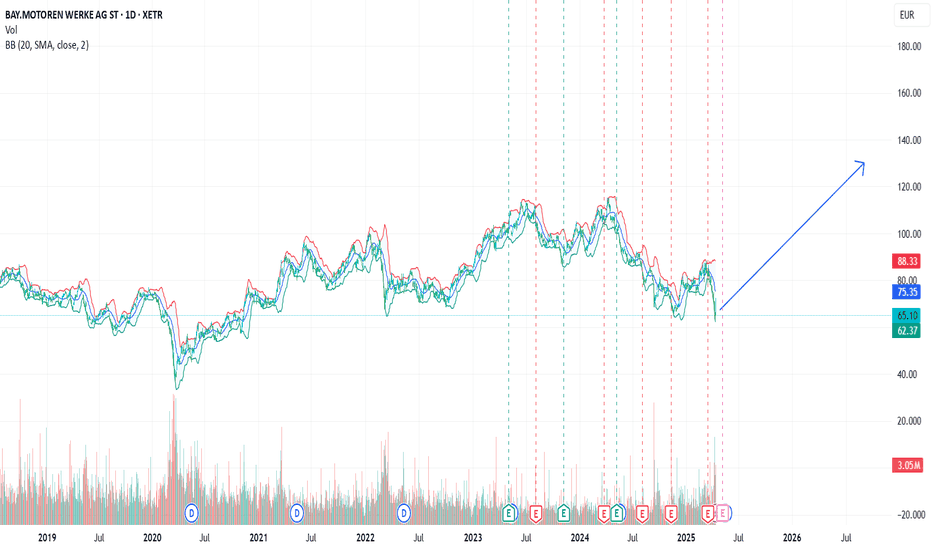

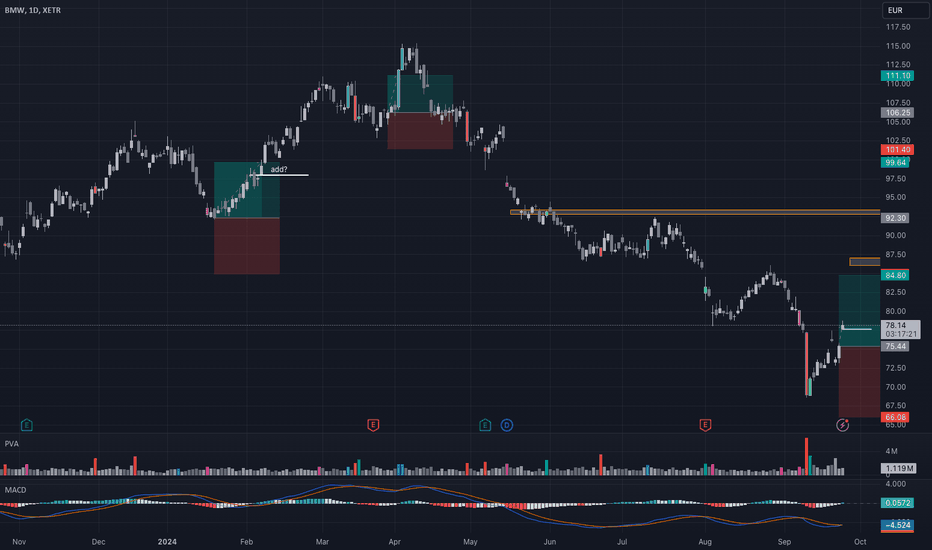

BUYS ON BMW ABOVE 82 EUR💡 Today we analyze BMW

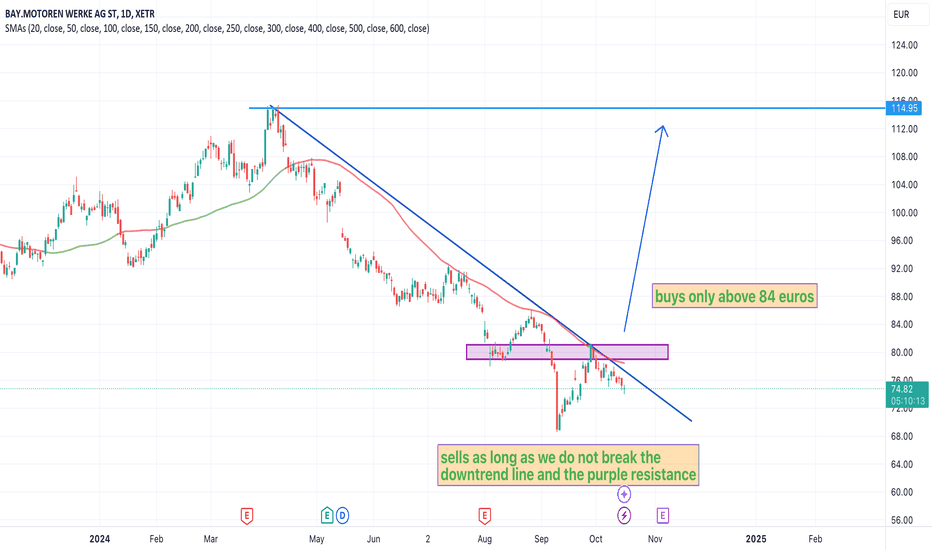

BMW is a solid company that has shown resilience. Currently, the price is around 74 euros, and a good entry point would be after breaking the downward trendline and key resistance, about 82 euros. It’s important to wait for confirmation of a daily close.

1. Operational stre

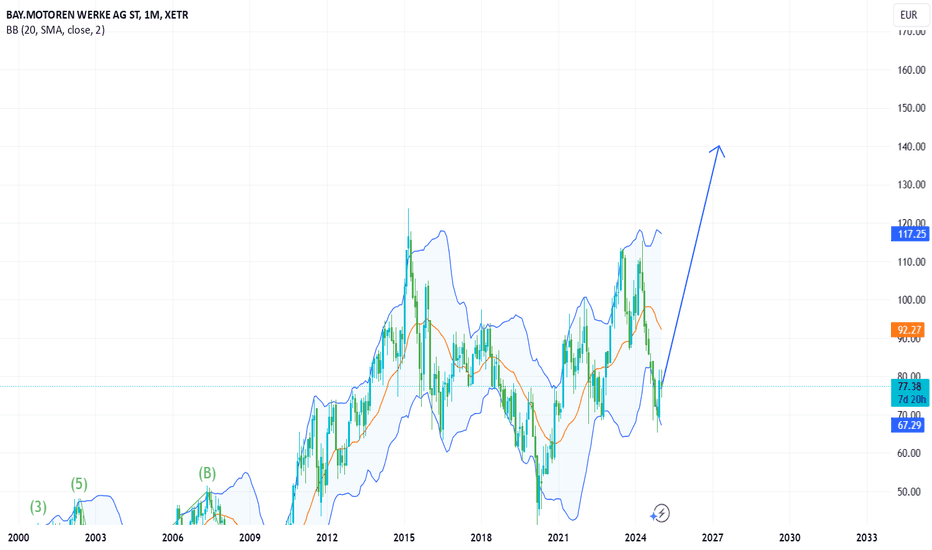

BMW (BMW): Navigating Through Uncertainty in the Auto MarketThe German automotive industry is currently facing significant challenges, from rising production costs and the transition to electric vehicles to increased competition from China. Despite these hurdles, we believe that most of the negative factors are already priced into the market.

From a technic

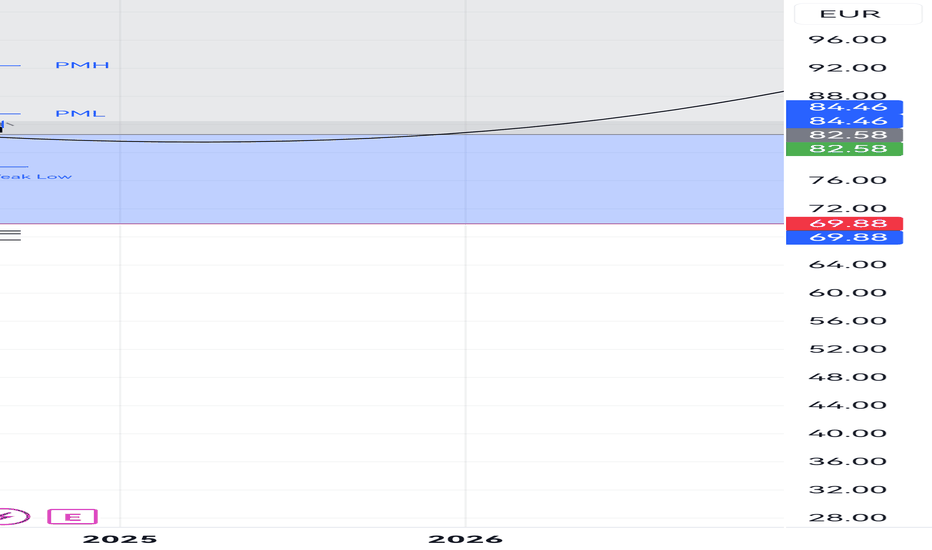

Bayerische Motoren Werke AG (BMW) | Chart & Forecast SummaryKey Indicators on Trade Set Up in General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Active Sessions on Relevant Range & Elemented Probabilities;

* Asian(Ranging) - London(Upwards) - NYC(Downwards)

* Weekend Crypto Session

# Trend | Time Frame Conductive | Weekly Time Frame

- General

Volkswagen, Stellantis, BMW, Mercedes (automobile)Volkswagen, Stellantis, BMW, Mercedes (automobile): The automotive industry is undergoing a transition to electric vehicles. These companies hold strong positions, but they need to successfully navigate this transformation against competitors like Tesla and Polestar (lol).

Trading at 43.1% below es

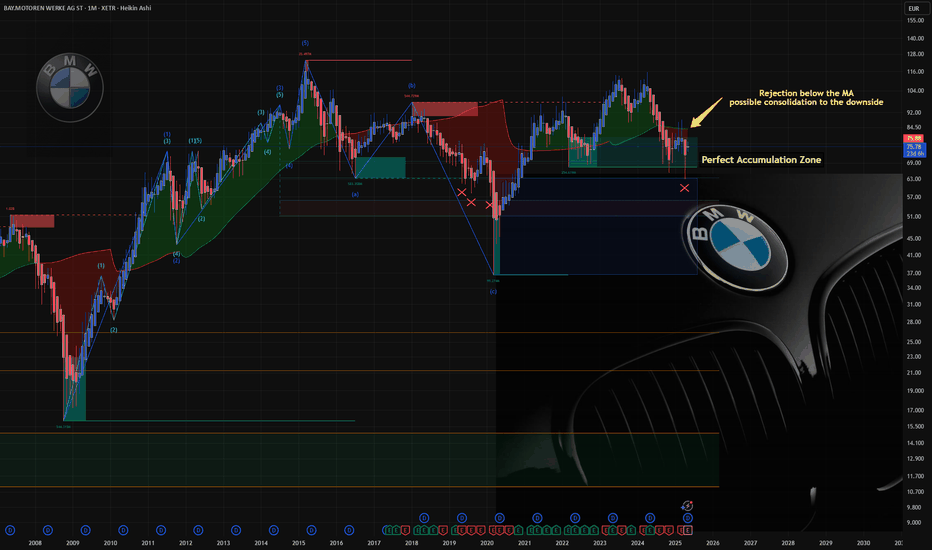

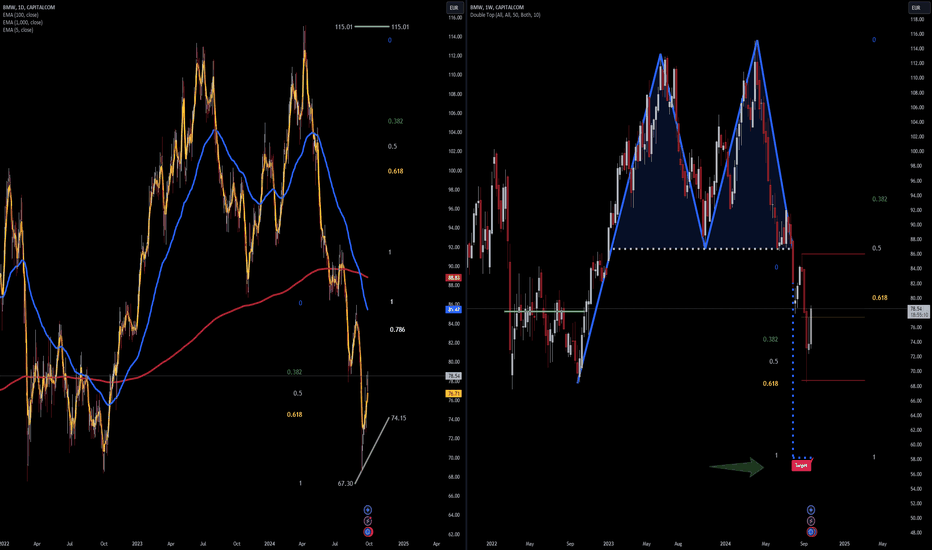

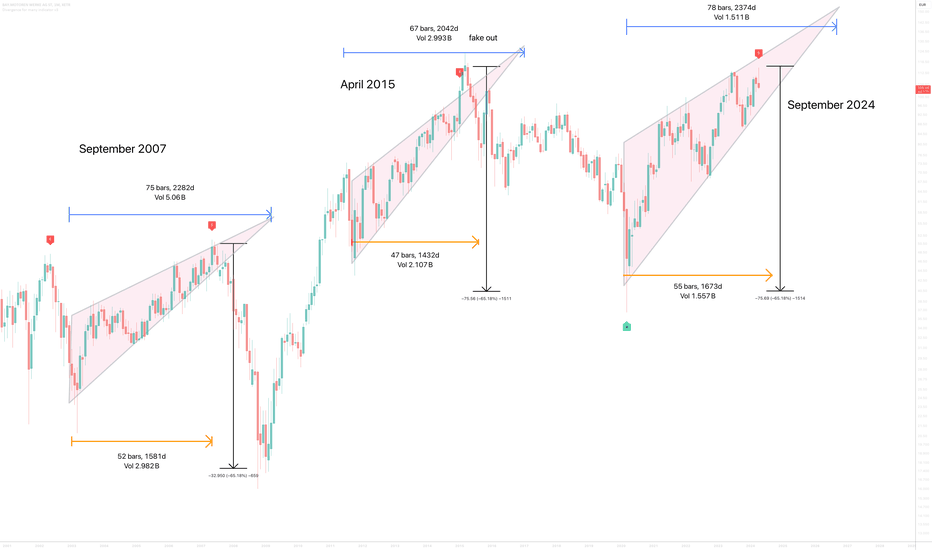

IS BMW about to correct 60% in September?On the above monthly chart price action has grown 200% since May 2020. A number of reasons now exist to consider a cautious outlook. They include:

1) Bearish divergence. 5 oscillators now print negative divergence with price action as measured over an annual period. This measurement is equivalent t

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

USU09513JN0

BMW US CAP 23/25 REGSYield to maturity

7.53%

Maturity date

Aug 11, 2025

BAMX5780495

BMW US Capital LLC 5.15% 02-APR-2034Yield to maturity

5.46%

Maturity date

Apr 2, 2034

XS263077687

BMW INT. INV 23/26 MTNYield to maturity

5.41%

Maturity date

Jun 6, 2026

BAMX6032389

BMW US Capital LLC 5.4% 21-MAR-2035Yield to maturity

5.35%

Maturity date

Mar 21, 2035

BAMX6032395

BMW US Capital LLC FRN 21-MAR-2028Yield to maturity

5.32%

Maturity date

Mar 21, 2028

USU09513JP5

BMW US CAP 23/25 FLR REGSYield to maturity

5.31%

Maturity date

Aug 11, 2025

USU09513JG5

BMW US CAP 21/31 REGSYield to maturity

5.30%

Maturity date

Aug 12, 2031

BAMX5868639

BMW US Capital LLC FRN 13-AUG-2027Yield to maturity

5.27%

Maturity date

Aug 13, 2027

BAMX5780487

BMW US Capital LLC 5.05% 02-APR-2026Yield to maturity

5.26%

Maturity date

Apr 2, 2026

BAMX6032399

BMW US Capital LLC FRN 19-MAR-2027Yield to maturity

5.25%

Maturity date

Mar 19, 2027

BAMX5780493

BMW US Capital LLC 4.9% 02-APR-2029Yield to maturity

5.17%

Maturity date

Apr 2, 2029

See all BMW.EUR bonds

Curated watchlists where BMW.EUR is featured.

Frequently Asked Questions

The current price of BMW.EUR is 61.58 EUR — it has decreased by 0.00% in the past 24 hours. Watch BMW I stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SIX exchange BMW I stocks are traded under the ticker BMW.EUR.

BMW.EUR stock has fallen by 0.00% compared to the previous week, the month change is a 0.00% fall, over the last year BMW I has showed a 0.00% decrease.

We've gathered analysts' opinions on BMW I future price: according to them, BMW.EUR price has a max estimate of 98.00 EUR and a min estimate of 63.00 EUR. Watch BMW.EUR chart and read a more detailed BMW I stock forecast: see what analysts think of BMW I and suggest that you do with its stocks.

BMW.EUR reached its all-time high on Jun 15, 2015 with the price of 100.80 EUR, and its all-time low was 61.58 EUR and was reached on Jun 3, 2019. View more price dynamics on BMW.EUR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BMW.EUR stock is 0.00% volatile and has beta coefficient of 1.38. Track BMW I stock price on the chart and check out the list of the most volatile stocks — is BMW I there?

Today BMW I has the market capitalization of 46.85 B, it has decreased by −2.80% over the last week.

Yes, you can track BMW I financials in yearly and quarterly reports right on TradingView.

BMW I is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

BMW.EUR earnings for the last quarter are 3.38 EUR per share, whereas the estimation was 3.22 EUR resulting in a 4.86% surprise. The estimated earnings for the next quarter are 2.73 EUR per share. See more details about BMW I earnings.

BMW I revenue for the last quarter amounts to 33.76 B EUR, despite the estimated figure of 35.27 B EUR. In the next quarter, revenue is expected to reach 36.07 B EUR.

BMW.EUR net income for the last quarter is 2.10 B EUR, while the quarter before that showed 1.50 B EUR of net income which accounts for 40.08% change. Track more BMW I financial stats to get the full picture.

Yes, BMW.EUR dividends are paid annually. The last dividend per share was 4.30 EUR. As of today, Dividend Yield (TTM)% is 5.49%. Tracking BMW I dividends might help you take more informed decisions.

BMW I dividend yield was 5.44% in 2024, and payout ratio reached 37.02%. The year before the numbers were 5.95% and 33.95% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 4, 2025, the company has 159.1 K employees. See our rating of the largest employees — is BMW I on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BMW I EBITDA is 19.27 B EUR, and current EBITDA margin is 14.21%. See more stats in BMW I financial statements.

Like other stocks, BMW.EUR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BMW I stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BMW I technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BMW I stock shows the strong sell signal. See more of BMW I technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.