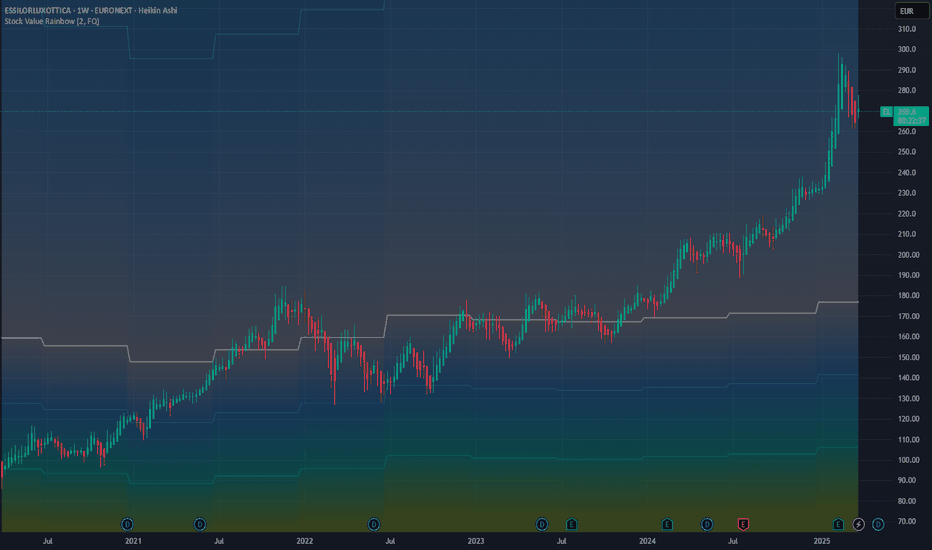

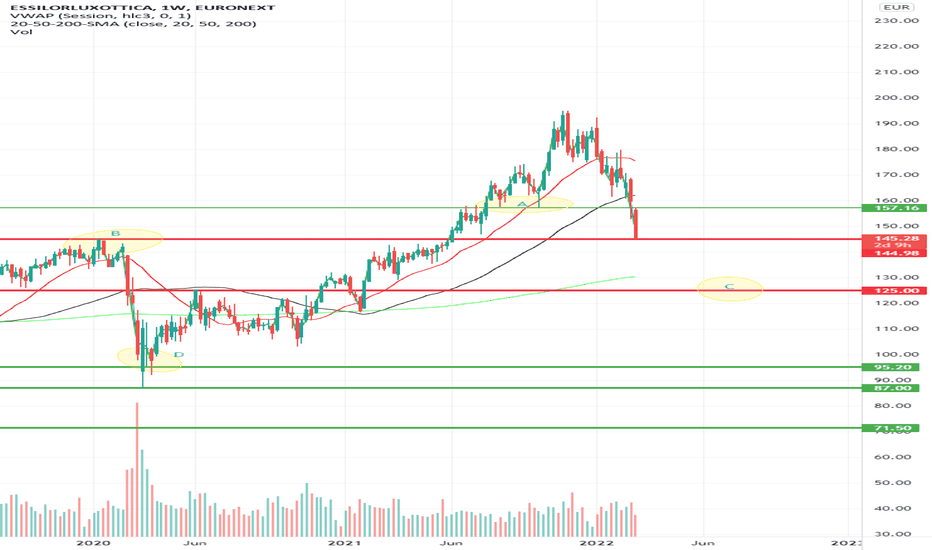

EL: Over Priced Stock, Stuck GrowthEssilor growth has been stuck for the past 10 years. However the stock continue to grow up at unreasonable level. Although the company focus on innovation of smart glasses with Meta, doesn't seems to produce real income growth in the next 5 years. Trade wars and tariffs can significantly impact a co

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.90 CHF

2.22 B CHF

24.92 B CHF

307.10 M

About ESSILORLUXOTTICA

Sector

Industry

CEO

Francesco Milleri

Website

Headquarters

Charenton-le-Pont

Founded

1971

ISIN

FR0000121667

FIGI

BBG007FJN7W0

EssilorLuxottica SA engages in the design, manufacture, and distribution of ophthalmic lenses, frames and sunglasses. It operates through the following segments: Professional Solutions and Direct to Consumer. The Professional Solutions segment represent the wholesale business of the Group, i.e. the supply of the Group's products and services to all the professionals of the eyecare industry (distributors, opticians, independents, third-party e-commerce platforms. The Direct to Consumer segment represents the retail business of the Group, i.e. the supply of the Group products and services directly to the end consumer either through the network of physical stores operated by the Group (brick and mortar) or the online channel (e-commerce). The company was founded by Leonardo Del Vecchio on October 01, 2018 and is headquartered in Charenton-le-Pont, France.

Related stocks

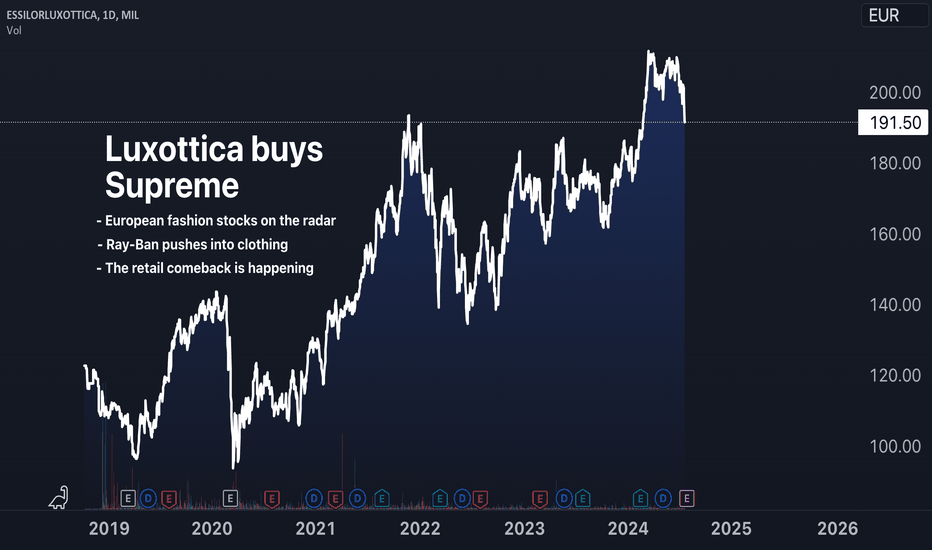

Supreme is now European: The World's Fashion Capital ExpandsA certain acquisition caught my attention this week. The company sunglass company Ray-Ban (owned by EssilorLuxottica) has just acquired Supreme for $1.5 billion in their first push into clothing. For those of you who know the street wear brand Supreme, this should come as a rather interesting acquis

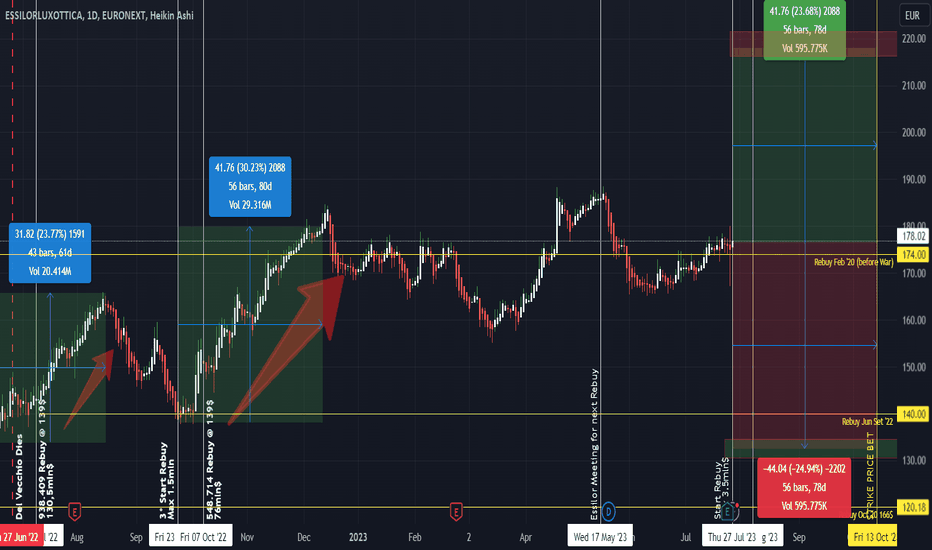

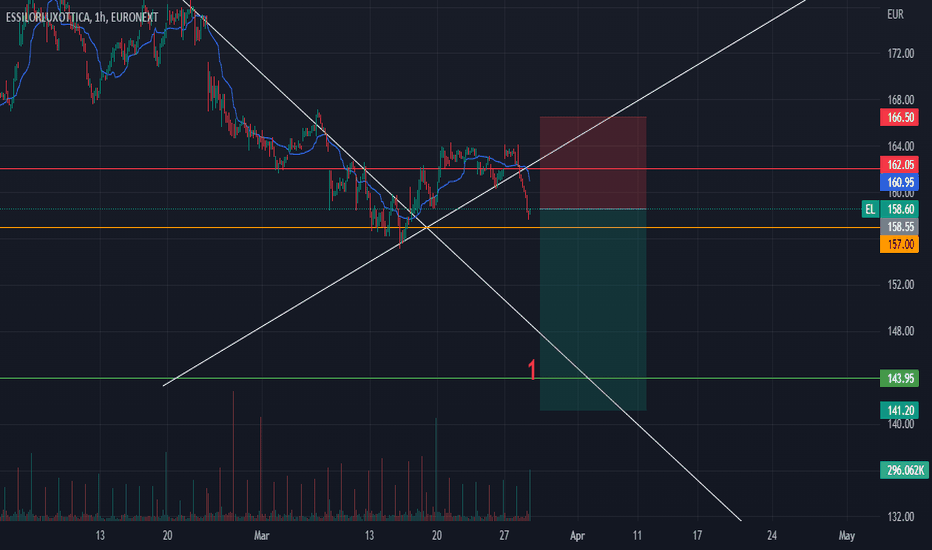

Insider Trading Alert? Essilor's BuyBack Unleashed!Essilor Luxottica is a non-crypto company with all the facets of token modus operandi. I call it "the unstoppable" due to the heavy "slow" manipulation it is subjected to. "Slow" because it's a European asset, so it moves with less volume.

Introduction: Given the delicate period and general uncer

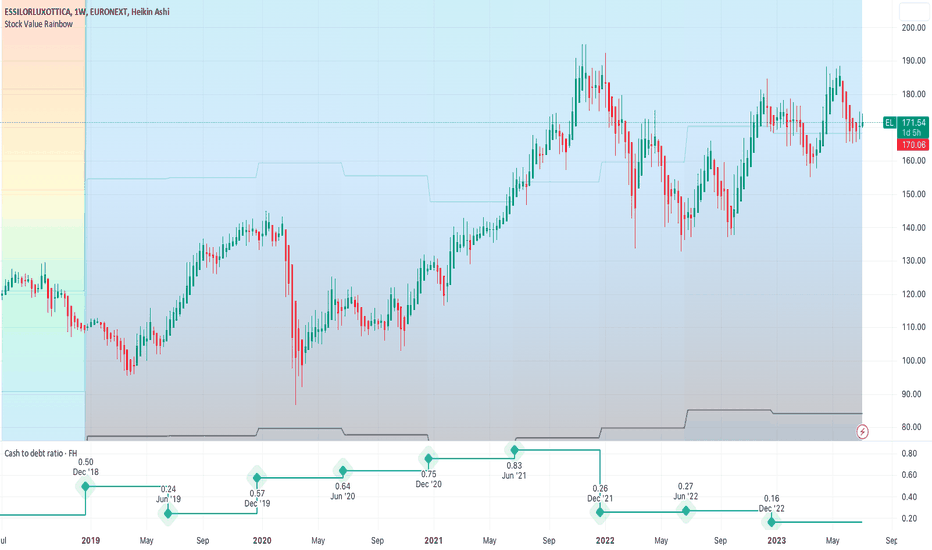

Essilor Luxottica is CashtrappedEssilor Luxottica is a multinational corporation that designs, produces and markets ophthalmic lenses, optical equipment, prescription glasses and sunglasses. The company dominate nearly a thirds of global eyewear industry under it's wings.

The company has shown a strong growth of revenue over the

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

FR1346367

ESSILORLUXO. 19/31 MTNYield to maturity

3.20%

Maturity date

Nov 27, 2031

FR1400RX8

ESSILORLUXO. 24/32 MTNYield to maturity

3.14%

Maturity date

Mar 5, 2032

FR14010BK

ESSILORLUXO. 25/30 MTNYield to maturity

2.87%

Maturity date

Jan 10, 2030

FR1400RYN

ESSILORLUXO. 24/29 MTNYield to maturity

2.74%

Maturity date

Mar 5, 2029

FR1351607

ESSILORLUXO. 20/28 MTNYield to maturity

2.45%

Maturity date

Jun 5, 2028

ESLD

ESSILORLUXO. 19/27 MTNYield to maturity

2.38%

Maturity date

Nov 27, 2027

FR1351606

ESSILORLUXO. 20/26 MTNYield to maturity

2.34%

Maturity date

Jan 5, 2026

See all EI bonds

Frequently Asked Questions

The current price of EI is 117.00 CHF — it hasn't changed in the past 24 hours. Watch EXXILORLUXOTTICA stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SIX exchange EXXILORLUXOTTICA stocks are traded under the ticker EI.

We've gathered analysts' opinions on EXXILORLUXOTTICA future price: according to them, EI price has a max estimate of 280.86 CHF and a min estimate of 215.33 CHF. Watch EI chart and read a more detailed EXXILORLUXOTTICA stock forecast: see what analysts think of EXXILORLUXOTTICA and suggest that you do with its stocks.

EI stock is 0.00% volatile and has beta coefficient of 0.95. Track EXXILORLUXOTTICA stock price on the chart and check out the list of the most volatile stocks — is EXXILORLUXOTTICA there?

Today EXXILORLUXOTTICA has the market capitalization of 101.42 B, it has increased by 2.74% over the last week.

Yes, you can track EXXILORLUXOTTICA financials in yearly and quarterly reports right on TradingView.

EXXILORLUXOTTICA is going to release the next earnings report on Jul 28, 2025. Keep track of upcoming events with our Earnings Calendar.

EI earnings for the last half-year are 2.80 CHF per share, whereas the estimation was 2.65 CHF, resulting in a 5.67% surprise. The estimated earnings for the next half-year are 3.76 CHF per share. See more details about EXXILORLUXOTTICA earnings.

EXXILORLUXOTTICA revenue for the last half-year amounts to 12.43 B CHF, despite the estimated figure of 12.36 B CHF. In the next half-year revenue is expected to reach 12.99 B CHF.

EI net income for the last half-year is 933.60 M CHF, while the previous report showed 1.32 B CHF of net income which accounts for −29.03% change. Track more EXXILORLUXOTTICA financial stats to get the full picture.

Yes, EI dividends are paid annually. The last dividend per share was 3.69 CHF. As of today, Dividend Yield (TTM)% is 1.69%. Tracking EXXILORLUXOTTICA dividends might help you take more informed decisions.

EXXILORLUXOTTICA dividend yield was 1.68% in 2024, and payout ratio reached 76.01%. The year before the numbers were 2.18% and 77.32% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 28, 2025, the company has 196.75 K employees. See our rating of the largest employees — is EXXILORLUXOTTICA on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. EXXILORLUXOTTICA EBITDA is 6.18 B CHF, and current EBITDA margin is 24.79%. See more stats in EXXILORLUXOTTICA financial statements.

Like other stocks, EI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade EXXILORLUXOTTICA stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So EXXILORLUXOTTICA technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating EXXILORLUXOTTICA stock shows the sell signal. See more of EXXILORLUXOTTICA technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.