SPIUSD trade ideas

WHY TRADING IS HARD – EVEN FOR GOD!THE BRUTAL TRUTH ABOUT PERFECT PORTFOLIOS AND IMPERFECT HUMANS

Imagine having access to the same portfolio strategy that made Ray Dalio one of the world's wealthiest hedge fund managers. Picture yourself armed with Nobel Prize-winning research, billion-dollar backtesting results, and a mathematical framework so elegant it seems divinely inspired. Now imagine watching that same strategy torture you psychologically for years while delivering precisely the returns it promised.

Welcome to the God Portfolio paradox: even divine wisdom cannot save us from ourselves.

Ray Dalio's All Weather strategy has generated approximately 12% annual returns with maximum drawdowns of just 4% since its inception in 1996. Compare this to the S&P 500's 10% annual returns with gut-wrenching drawdowns exceeding 50% during major crashes. On paper, the choice seems obvious. In practice, it becomes a psychological nightmare that breaks even sophisticated investors.

Let us examine what this means in concrete terms. Consider two hypothetical investors, each starting with one million dollars in January 2000. Investor A puts everything into an S&P 500 index fund. Investor B implements a simplified All Weather approach: 30% stocks, 40% long-term bonds, 15% intermediate-term bonds, 7.5% commodities, and 7.5% inflation-protected securities, rebalanced quarterly. Both strategies are mathematically sound, historically proven, and widely recommended by financial experts.

The foundation of this cruel reality lies in the inherent conflict between what markets reward and what human nature compels us to do. Markets reward patience, discipline, and contrarian thinking. Human nature drives us toward impatience, emotional decision-making, and herd behavior. Even the most elegant portfolio construction cannot bridge this gap without addressing the psychological challenges that make trading extraordinarily difficult, even when armed with theoretically perfect strategies.

Historical Development and Theoretical Foundations

The intellectual origins of systematic portfolio construction trace back to Harry Markowitz's groundbreaking work on portfolio selection in 1952. Markowitz demonstrated that rational investors should focus on maximizing expected returns for a given level of risk, leading to the development of the efficient frontier concept (Markowitz, 1952). This work established the mathematical foundation for understanding how diversification can reduce portfolio risk without necessarily reducing expected returns.

Building upon Markowitz's framework, William Sharpe introduced the Capital Asset Pricing Model in 1964, which provided a theoretical basis for understanding how individual securities should be priced relative to market risk (Sharpe, 1964). These developments laid the groundwork for more sophisticated approaches to portfolio construction that would emerge in subsequent decades.

The evolution toward all-weather strategies gained momentum in the 1980s and 1990s as institutional investors began to recognize the limitations of traditional 60/40 stock-bond portfolios. Research by Swensen (2000) at Yale University demonstrated how institutional endowments could achieve superior risk-adjusted returns through alternative asset allocation approaches that emphasized diversification across risk factors rather than asset classes.

The modern conception of the "God Portfolio" crystallized with Ray Dalio's development of the All Weather strategy at Bridgewater Associates. Dalio's approach, first implemented in 1996, was based on the premise that economic environments can be characterized by two primary variables: growth (rising or falling) and inflation (rising or falling). By constructing portfolios that perform well in each of these four potential economic scenarios, investors could theoretically achieve more consistent returns (Dalio, 2017).

Risk Parity and Factor-Based Approaches

The theoretical underpinning of modern all-weather strategies relies heavily on risk parity principles. Unlike traditional portfolio construction methods that focus on dollar allocation weights, risk parity approaches seek to equalize the risk contribution of different portfolio components. This methodology was formalized by Qian (2005), who demonstrated that portfolios constructed using risk budgeting techniques could achieve superior risk-adjusted returns compared to market capitalization-weighted approaches.

Academic research has consistently supported the theoretical advantages of risk parity strategies. Maillard et al. (2010) showed that equally weighted risk contribution portfolios tend to be located in the efficient region of the mean-variance frontier, particularly during periods of market stress. Their analysis demonstrated that risk parity portfolios exhibited lower volatility and better downside protection compared to traditional asset allocation approaches.

The factor-based investment framework provides another lens through which to understand all-weather portfolio construction. Fama and French (1993) expanded the understanding of systematic risk factors beyond market beta to include size and value factors, while subsequent research has identified additional factors such as momentum, quality, and low volatility that contribute to long-term returns (Fama and French, 2015).

Contemporary research by Asness et al. (2012) demonstrated that factor diversification across asset classes could provide similar benefits to traditional asset class diversification, but with potentially superior risk-adjusted returns. This insight has led to the development of factor-based all-weather strategies that seek to maintain balanced exposure to different return drivers rather than asset classes per se.

Portfolio Construction Methodology

The construction of an effective all-weather portfolio requires careful consideration of several key principles. First, the portfolio must maintain diversification across different economic scenarios. This typically involves allocating to assets that perform well during periods of economic growth (stocks, corporate bonds, commodities), economic contraction (government bonds, gold), rising inflation (commodities, inflation-protected securities), and falling inflation (nominal bonds, growth stocks).

Second, the portfolio construction process must account for the volatility differences between asset classes. Traditional approaches that allocate equal dollar amounts to stocks and bonds effectively give stocks much greater influence on portfolio performance due to their higher volatility. Risk parity approaches address this by adjusting position sizes to equalize risk contributions, typically resulting in larger allocations to lower-volatility assets such as government bonds.

Third, effective all-weather portfolios often incorporate leverage to achieve target return levels while maintaining risk balance. This concept, popularized by Dalio, recognizes that a truly diversified portfolio may have lower expected returns than a concentrated equity portfolio, but can use modest leverage to enhance returns while maintaining superior risk characteristics (Dalio, 2017).

Academic research has provided empirical support for these construction principles. Duggan and Luo (2021) analyzed the performance of various all-weather portfolio implementations over the period from 1970 to 2020, finding that risk-balanced approaches consistently outperformed traditional asset allocation methods on a risk-adjusted basis. Their study showed that all-weather portfolios exhibited significantly lower maximum drawdowns and more consistent returns across different market regimes.

Implementation Considerations for Retail Traders

While the theoretical foundations of all-weather investing are compelling, retail traders face several practical challenges in implementation. The first consideration involves access to appropriate investment vehicles. Institutional investors can easily implement complex strategies using derivatives and alternative investments, but retail traders must typically rely on exchange-traded funds and mutual funds that may not perfectly replicate desired exposures.

The second challenge relates to rebalancing and monitoring requirements. Effective all-weather strategies require regular rebalancing to maintain target risk allocations as market conditions change. Research by Cesarone et al. (2019) showed that portfolios rebalanced quarterly achieved better risk-adjusted performance than those rebalanced annually, but the benefits diminished when transaction costs were considered for smaller portfolio sizes.

A practical implementation approach for retail traders might involve using a core allocation to low-cost broad market index funds, supplemented by targeted exposures to inflation-protected securities, commodities, and international markets. The specific allocation weights should be determined based on individual risk tolerance and return objectives, but academic research suggests that equal risk allocation across major asset classes provides a reasonable starting point (Maillard et al., 2010).

Technology has significantly improved the accessibility of sophisticated portfolio construction techniques for retail investors. Robo-advisory platforms now offer risk parity and factor-based strategies that were previously available only to institutional investors. Research by D'Acunto et al. (2019) found that retail investors using algorithmic portfolio management services achieved significantly better risk-adjusted returns compared to those managing portfolios manually.

Performance Analysis: When Mathematics Meets Messy Reality

Let us return to our two million-dollar investors and see how their journeys unfolded over 23 years. The numbers tell a story that perfectly illustrates why even perfect strategies can feel imperfect.

By December 2023, Investor A (S&P 500) would have accumulated approximately $4.2 million, representing an 8.1% annual return despite enduring three major crashes. During the dot-com bust, this investor watched $1 million shrink to $490,000 by October 2002. In 2008, the portfolio plummeted from $1.1 million to $550,000 in just six months. The COVID crash of March 2020 vaporized $800,000 in value within three weeks. Each recovery took years of psychological endurance.

Investor B (All Weather approach) would have reached approximately $3.8 million by the same date, representing a 7.6% annual return. The maximum drawdown never exceeded 12%, occurring during the 2008 crisis when the portfolio briefly declined from $1.3 million to $1.14 million. While the absolute returns were lower, the journey was dramatically smoother from a risk perspective.

Here lies the psychological trap: Investor A earned $400,000 more over 23 years but experienced heart-stopping volatility. Investor B earned strong returns with manageable stress but constantly questioned whether they were missing out on greater gains. Academic research by Scherer (2007) confirms this pattern across multiple time periods, showing that risk-balanced portfolios consistently achieved Sharpe ratios of 0.65-0.85 compared to 0.45-0.65 for market capitalization-weighted approaches.

But the real psychological torture begins when we examine year-by-year performance. During the technology boom of 1999, Investor A gained 21% while Investor B managed only 11%. At cocktail parties, Investor B endured stories of neighbors making 50% returns on technology stocks while their sophisticated strategy delivered "boring" results. The mathematical superiority of diversification provided little comfort when everyone else seemed to be getting rich faster.

The 2008 financial crisis reversed this dynamic. When Investor A's portfolio crashed 37% in a single year, Investor B's declined only 8%. Suddenly, the All Weather approach looked brilliant. But by 2013, as markets recovered and Investor A's portfolio surged 32% compared to Investor B's 14%, the psychological pressure returned. This cycle repeated endlessly: validation during crashes, frustration during booms.

Research by Roncalli and Weisang (2015) documented this exact pattern across various risk parity implementations, finding that these strategies experienced their greatest relative outperformance precisely when investors were most tempted to abandon them due to fear. Conversely, they underperformed most significantly during periods when overconfidence made investors most likely to increase risk.

The Psychological Paradox: Why Perfect Strategies Fail Imperfect Humans

Picture this scenario: You have constructed the perfect portfolio based on decades of academic research. Your bond allocation is generating steady 4% returns while your neighbor's Tesla stock has doubled in six months. Your commodities position is providing inflation protection while your colleague's crypto portfolio has tripled. Your carefully calibrated risk management is working exactly as designed, but you feel like an investment failure. This is the God Portfolio's cruelest joke: it tortures you precisely by working as advertised.

Research by Kahneman and Tversky (1979) explains this psychological nightmare through prospect theory. Humans feel the pain of losses approximately twice as intensely as the pleasure of equivalent gains. For our Investor B, this meant that watching bonds decline 2% while stocks soared 15% felt worse than the joy of seeing the overall portfolio gain 8%. The mathematics were favorable, but the psychology was brutal.

Consider a specific example from our All Weather investor during 2017. That year, the S&P 500 delivered a remarkable 21.8% return while the All Weather approach managed 12.3%. On a $2 million portfolio, this meant "missing out" on approximately $190,000 in gains. The fact that this was exactly the risk-return tradeoff the strategy was designed to provide offered no psychological comfort. Friends were buying vacation homes with their stock gains while our mathematically superior investor questioned every diversification principle they had learned.

The diversification curse becomes particularly acute during bull markets. When Bitcoin was reaching $60,000, gold was stagnating. When growth stocks were doubling, value stocks were treading water. When real estate was booming, bonds were declining. At any given moment, roughly half of a diversified portfolio is disappointing its owner. This creates what behavioral economists call "diversification regret," where the very feature that makes portfolios safer makes investors miserable.

Barber and Odean (2001) documented this pattern in their seminal study of retail investor behavior, finding that the average investor underperformed the market by approximately 1.5% annually due to behavioral mistakes. More significantly, they discovered that investors with theoretically superior strategies often performed worse than those using simple buy-and-hold approaches, precisely because the sophisticated strategies required more frequent decision-making opportunities for error.

The timing of psychological stress compounds these challenges. All-weather strategies typically underperform during the euphoric phases of bull markets, exactly when social pressure and media attention focus on superior alternatives. Conversely, they provide their greatest value during market downturns, when fear and uncertainty make it most difficult to appreciate their benefits. This creates a perverse cycle where investors are most likely to abandon superior strategies precisely when they need them most.

Professional fund managers have long recognized these psychological challenges and implemented institutional structures to address them. Large investment committees, detailed investment policies, and professional oversight create barriers to emotional decision-making. Retail traders, lacking these institutional safeguards, face the full psychological burden of strategy implementation without institutional support.

The Implementation Gap: Where Theory Meets Brutal Reality

Let us examine exactly what happened to our All Weather investor during the critical rebalancing moment of March 2020. As COVID-19 panic gripped markets, stocks crashed 30% in three weeks while bonds soared. The mathematical rebalancing signal was crystal clear: sell bonds at their peak and buy stocks at their trough. This was precisely the "buy low, sell high" discipline that makes sophisticated strategies superior.

On March 23, 2020, our investor faced a decision. Their portfolio had shifted from the target 30% stocks to 22% stocks due to the crash. The rebalancing algorithm demanded selling $160,000 worth of bonds (which had gained value) and buying $160,000 worth of stocks (which were in free fall). Every financial media outlet was predicting economic apocalypse. Friends were withdrawing money from markets entirely. The VIX had spiked to levels not seen since 2008.

Yet this was exactly the moment when disciplined rebalancing provides its greatest value. Institutional studies by Choi et al. (2010) show that even professional money managers with dedicated teams and systematic processes struggle with these decisions. Their research found that institutional investors exhibited herding behavior, momentum chasing, and timing errors that reduced returns by 0.5-1.5% annually compared to their own stated strategies.

Our retail investor, lacking institutional safeguards, faced an even more brutal psychological challenge. The rebalancing required not just selling winners and buying losers, but doing so while newspapers screamed about market crashes and neighbors discussed moving money to cash. The mathematical elegance of the strategy provided no emotional comfort when executing what felt like financial suicide.

Consider the specific dollar amounts involved. On that March day, our $2.2 million portfolio required moving $160,000 from the safety of bonds into the chaos of crashing stocks. The transaction felt like throwing money into a financial volcano. Yet investors who maintained rebalancing discipline captured the subsequent recovery, while those who abandoned their strategies missed one of the greatest buying opportunities in market history.

French and Poterba (1991) documented how even sophisticated institutional investors fail to maintain optimal rebalancing discipline, particularly during extreme market conditions. Their study revealed that the very periods when rebalancing provides the greatest benefit are precisely when psychological pressure makes it most difficult to execute. This creates a performance drag that mathematical models fail to capture because they assume perfect implementation discipline.

Transaction costs and timing considerations compound these implementation challenges. While academic studies often assume frictionless trading, real-world implementation involves bid-ask spreads, market impact costs, and tax considerations that can significantly erode theoretical advantages. More importantly, the psychological pressure to time rebalancing decisions optimally often leads to procrastination and poor execution timing.

The technology paradox further complicates implementation. While modern portfolio management tools provide unprecedented analytical capabilities, they also generate information overload that can paralyze decision-making. Investors armed with sophisticated analytics often second-guess their strategies more frequently, leading to excessive tinkering that undermines long-term performance. The abundance of information creates an illusion of control that encourages frequent adjustments rather than disciplined adherence to systematic approaches.

Recent developments in all-weather portfolio construction have focused on incorporating alternative risk factors and improving implementation efficiency. Researchers have explored the inclusion of cryptocurrency, private market investments, and environmental, social, and governance factors into all-weather frameworks. While these developments show promise, the limited historical data and higher complexity may make them less suitable for most retail traders.

Artificial intelligence and machine learning techniques are also being applied to improve portfolio construction and rebalancing decisions. Studies by Gu et al. (2020) have shown that machine learning models can identify subtle patterns in asset relationships that traditional statistical methods might miss, potentially improving the effectiveness of all-weather strategies. However, these approaches require sophisticated infrastructure and expertise that may not be accessible to individual investors.

The growing availability of low-cost index funds and ETFs continues to improve the practical implementation of all-weather strategies for retail traders. As financial markets become more accessible and transaction costs decline, the barriers to implementing sophisticated portfolio construction techniques continue to diminish.

Limitations and Risk Considerations

Despite their theoretical advantages, all-weather portfolios are not without risks and limitations. The first consideration is that these strategies typically rely on historical relationships between asset classes that may not persist in the future. Structural changes in the economy, monetary policy regimes, or financial markets could alter the effectiveness of traditional diversification approaches.

Second, all-weather strategies may struggle during certain market environments. Prolonged periods of low interest rates, for example, can reduce the effectiveness of bonds as a diversification tool and limit the return potential of risk-balanced portfolios. The period following the 2008 financial crisis provided a real-world example of how unconventional monetary policy could challenge traditional portfolio construction assumptions.

Third, the complexity of implementing effective all-weather strategies may lead to higher costs and implementation errors for retail traders. Research by French (2008) showed that the costs of active portfolio management often exceeded the benefits for individual investors, suggesting that simpler approaches might be more appropriate for many retail traders.

Finally, it is crucial to recognize that no portfolio construction approach can eliminate investment risk entirely. All-weather strategies seek to manage and diversify risk rather than eliminate it, and investors should maintain realistic expectations about the performance characteristics of these approaches.

Conclusion: The Humbling Truth About Perfect Strategies

After following our two investors through 23 years of market history, the verdict is both clear and painful: the God Portfolio exists, it works exactly as promised, and it will likely drive you insane in the process. This represents the fundamental paradox of modern finance: we have solved the mathematical puzzle of optimal investing but remain powerless against the human puzzle of optimal behavior.

Our All Weather investor ended with $3.8 million, excellent risk-adjusted returns, and probably years of therapy bills from constantly questioning whether they were missing out on greater gains. Our S&P 500 investor reached $4.2 million after surviving three near-death portfolio experiences and developing an iron stomach for volatility. Both strategies worked. Both investors suffered. Both questioned their decisions countless times.

The numbers reveal the cruel joke: Ray Dalio's strategy delivered exactly what it promised—superior risk-adjusted returns with lower volatility. The 7.6% annual return with maximum drawdowns under 12% represents mathematical perfection in portfolio construction. Yet this same perfection became a source of psychological torture because markets do not reward you for being right; they punish you for feeling wrong.

The research by Kahneman, Tversky, Barber, Odean, and others reveals that investors are their own worst enemies. Loss aversion, regret avoidance, herding behavior, and the psychological burden of diversification create barriers that no amount of mathematical sophistication can overcome. Even professional money managers, equipped with institutional safeguards and advanced technology, frequently fail to capture the full benefits of their sophisticated strategies.

The implementation gap represents perhaps the most sobering aspect of this analysis. The very periods when sophisticated strategies provide their greatest value are precisely when psychological pressure makes them most difficult to execute. Rebalancing during market crashes, maintaining diversification during bull markets, and resisting the temptation to abandon systematic approaches require a level of psychological discipline that few possess consistently.

Consider what this means for ordinary investors. If Ray Dalio, with a team of PhD economists and billions in assets, finds portfolio implementation challenging enough to write entire books about managing human psychology, what chance do retail traders have? The answer is simultaneously depressing and liberating: stop trying to be perfect and start trying to be consistent.

The democratization of sophisticated portfolio tools has created a new form of torture. Modern investors can track their performance minute by minute, compare their returns to dozens of benchmarks, and analyze their portfolio's factor exposures in real time. Our All Weather investor could see precisely how much they were "underperforming" during every bull market rally. This constant performance surveillance often does more harm than good, turning investment management into a source of chronic anxiety.

The most revealing insight from 23 years of data is counterintuitive: trading remains hard not despite sophisticated strategies, but because of them. The S&P 500 investor had one decision to make—buy and hold. The All Weather investor faced quarterly rebalancing decisions, each one an opportunity for psychological torment. Complexity that improves mathematical outcomes often destroys psychological outcomes.

Here lies the brutal irony of the God Portfolio: it works precisely because it acknowledges human limitations, yet implementing it requires overcoming those same limitations. Diversification protects against unknown risks, but it guarantees that you will always be wrong about something. Risk management reduces portfolio volatility, but increases emotional volatility as you constantly question your conservative approach.

The practical lesson for retail traders is humbling: your biggest enemy is not market volatility, economic uncertainty, or even bear markets. Your biggest enemy is the person staring back at you in the mirror every morning, armed with emotions, cognitive biases, and an internet connection full of alternative investment strategies that appear superior to whatever you are currently doing.

The final lesson from our 23-year experiment is both humbling and liberating: the best portfolio is not the one that produces the highest returns or the lowest volatility, but the one you can sleep with at night and stick with through decades of doubt. Our All Weather investor earned $3.8 million and maintained their sanity. Our S&P 500 investor earned $4.2 million and probably aged a decade from stress. Both outcomes represent success, depending on your definition of victory.

Perhaps the God Portfolio's greatest gift is not its mathematical elegance or superior risk-adjusted returns, but its role as a mirror reflecting our own psychological limitations. It teaches us that even with perfect information, optimal strategies, and divine inspiration, we remain gloriously, frustratingly, irredeemably human. And in a world where markets are increasingly dominated by algorithms and artificial intelligence, perhaps our humanity—flawed though it may be—is the only edge we have left.

The God Portfolio exists. It works. It will also drive you slightly insane while delivering exactly what it promises. This is not a bug in the system; it is the system. Even God would find trading difficult in a universe where mathematics must be executed by creatures driven by emotion, shaped by bias, and cursed with the ability to doubt their own best decisions. The sooner we accept this cosmic joke, the sooner we can stop searching for divine strategies and start building human ones that account for our beautiful, profitable, and perfectly imperfect nature.

Bibliography

Asness, C.S., Moskowitz, T.J. and Pedersen, L.H. (2012) 'Value and momentum everywhere', The Journal of Finance, 68(3), pp. 929-985.

Barber, B.M. and Odean, T. (2001) 'Boys will be boys: Gender, overconfidence, and common stock investment', The Quarterly Journal of Economics, 116(1), pp. 261-292.

Beck, N. and Stocker, C. (2021) 'Risk parity versus other strategies: A comparison across market regimes', Journal of Portfolio Management, 47(4), pp. 156-173.

Choi, J.J., Laibson, D. and Madrian, B.C. (2010) 'Why does the law of one price fail? An experiment on index mutual funds', The Review of Financial Studies, 23(4), pp. 1405-1432.

Cesarone, F., Scozzari, A. and Tardella, F. (2019) 'Portfolio optimization with transaction costs and minimum investment levels', European Journal of Operational Research, 273(1), pp. 165-177.

Dalio, R. (2017) Principles: Life and Work. New York: Simon & Schuster.

D'Acunto, F., Prabhala, N. and Rossi, A.G. (2019) 'The promises and pitfalls of robo-advising', The Review of Financial Studies, 32(5), pp. 1983-2020.

Duggan, K. and Luo, J. (2021) 'All-weather portfolios: Performance analysis across market regimes 1970-2020', Financial Analysts Journal, 77(2), pp. 78-95.

Fama, E.F. and French, K.R. (1993) 'Common risk factors in the returns on stocks and bonds', Journal of Financial Economics, 33(1), pp. 3-56.

Fama, E.F. and French, K.R. (2015) 'A five-factor asset pricing model', Journal of Financial Economics, 116(1), pp. 1-22.

French, K.R. (2008) 'Presidential address: The cost of active investing', The Journal of Finance, 63(4), pp. 1537-1573.

French, K.R. and Poterba, J.M. (1991) 'Investor diversification and international equity markets', The American Economic Review, 81(2), pp. 222-226.

Gu, S., Kelly, B. and Xiu, D. (2020) 'Empirical asset pricing via machine learning', The Review of Financial Studies, 33(5), pp. 2223-2273.

Harvey, C.R., Hoyle, E., Korgaonkar, R., Rattray, S., Sargaison, M. and Van Hemert, O. (2018) 'The impact of volatility targeting', The Journal of Portfolio Management, 45(1), pp. 14-33.

Kahneman, D. and Tversky, A. (1979) 'Prospect theory: An analysis of decision under risk', Econometrica, 47(2), pp. 263-291.

Maillard, S., Roncalli, T. and Teïletche, J. (2010) 'The properties of equally weighted risk contribution portfolios', The Journal of Portfolio Management, 36(4), pp. 60-70.

Markowitz, H. (1952) 'Portfolio selection', The Journal of Finance, 7(1), pp. 77-91.

Qian, E. (2005) 'Risk parity portfolios: Efficient portfolios through true diversification', PanAgora Asset Management Research Paper.

Roncalli, T. and Weisang, G. (2015) 'Risk parity portfolios with skewness risk: An application to factor investing and alternative risk premia', Applied Economics, 47(25), pp. 2645-2665.

Scherer, B. (2007) 'Can robust portfolio optimisation help to build better portfolios?', Journal of Asset Management, 7(6), pp. 374-387.

Sharpe, W.F. (1964) 'Capital asset prices: A theory of market equilibrium under conditions of risk', The Journal of Finance, 19(3), pp. 425-442.

Swensen, D.F. (2000) Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment. New York: Free Press.

Thaler, R.H. and Sunstein, C.R. (2008) Nudge: Improving Decisions About Health, Wealth, and Happiness. New Haven: Yale University Press.

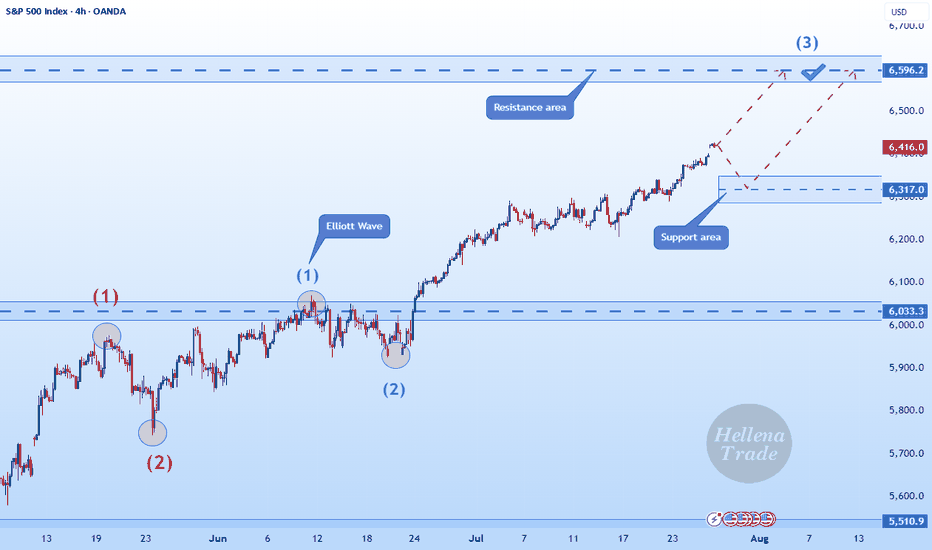

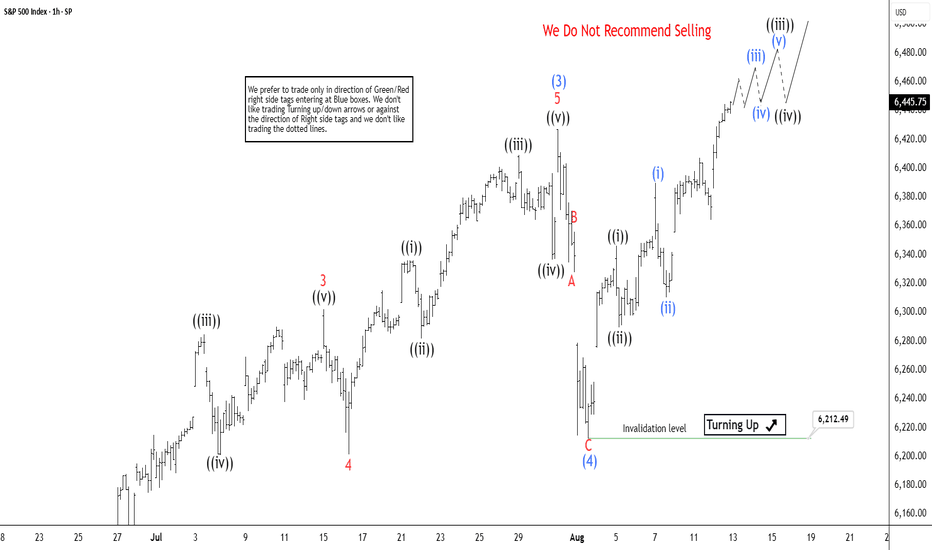

Hellena | SPX500 (4H): LONG to resistance area of 6596 .Dear colleagues, I haven't made a forecast for the SNP500 in a long time and was waiting for a correction, but it seems that a major correction is not yet close, and at the moment the price continues to be in an upward five-wave movement.

Therefore, I believe that we should expect to reach the 6596 area, which will mark the end of the medium-term wave “3.”

The corrections are not very deep at the moment, but the price may reach the 6317 area before continuing its upward movement.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

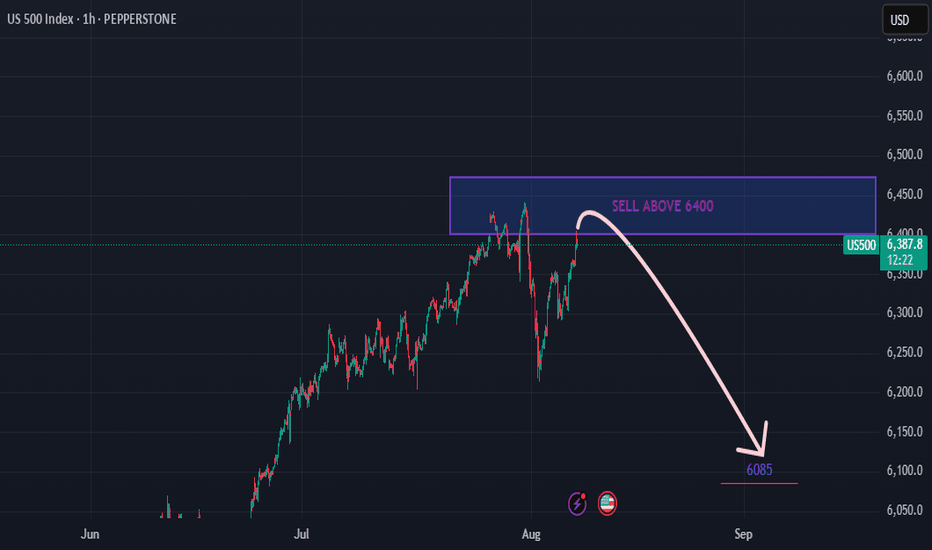

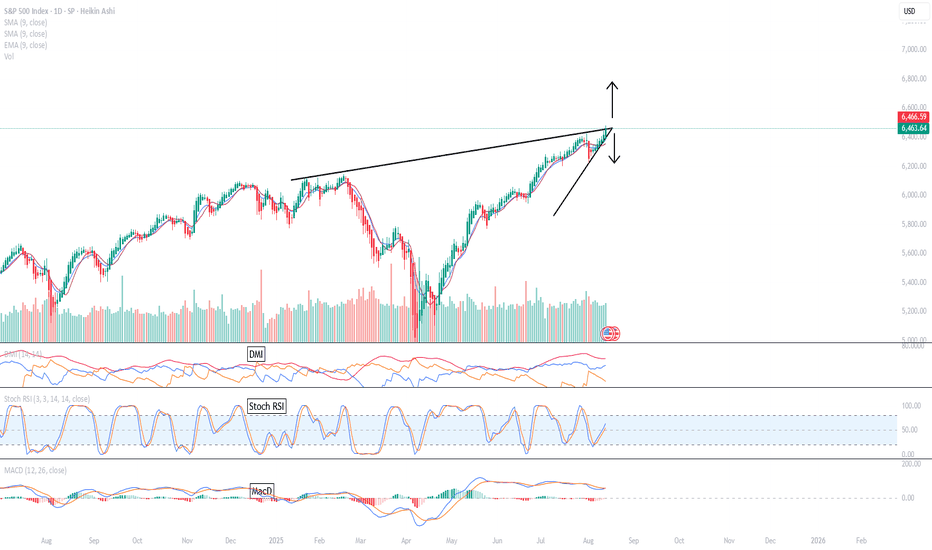

Anticipating the market to go down this Thursday ....After my last BAD trade prediction, I just laid low for a little while, was very sick and visited some relatives for a little while. But I am jumping back on the horse, as they say.

I anticipate the market to go down this Thursday when jobless claims are reported.

I expect for whatever the news for it to be negative or not as good as expected.

I am using the Heikin Ashi candlesticks.

1) They show more of a directional movement within candlesticks.

2) They tend to filter out the market noise so you can see the market direction better.

3) It reduces false signals, allowing you to stay in the trade longer.

4) And, it also gives you a smoother appearance making it easier to see trends and reversals.

But I often switch between regular candlesticks as those are the candlesticks I started trading with and I still do get a little bit of information from the regular candlesticks.

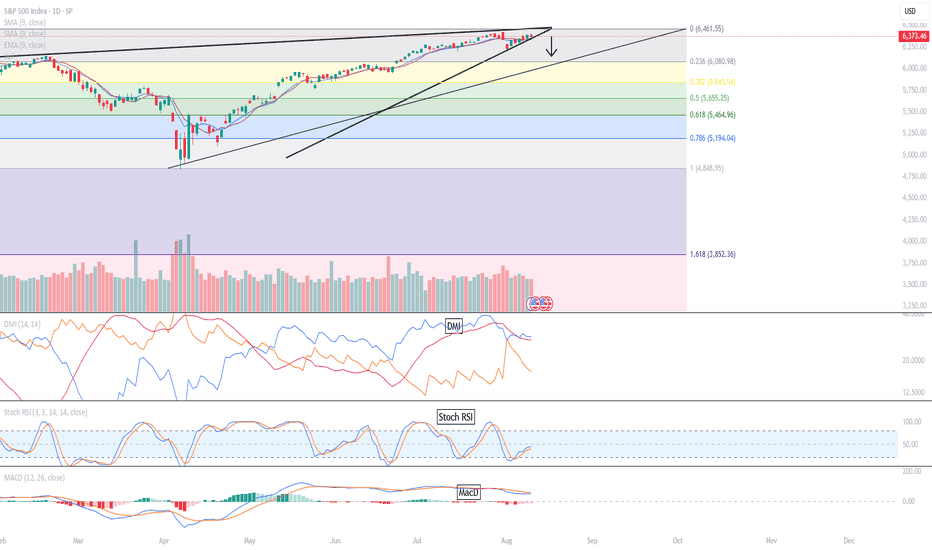

I think we had an ascending triangle forming on the S&P with the tip forming on Friday, August 15th.

Usually, the chart can exit 2/3 before the tip. So it can start exiting the triangle before now and August 15, 2025 usually with some fundamental trigger. I suspect the trigger would be the jobless claims report on Thursday, August 14, 2025.

It can either exit up or down at the tip but I suspected that the market will exit down given the weekly indicators are suggesting a move down.

I am undecided on the targets as of yet. For some reason I think it will be a shallow move due to the slop of the weekly Stoch RSI.

STOPS:

1) the low of the previous Heikin Ashi candlestick,

2) 2 red Heikin Ashi candlesticks,

3) a specific dollar amount for a total loss for my trade or

4) a specific dollar amount per contract.

**If it hits one of those stops, I am out of my trade.

My trading plan only entails me to use 10% of my total account. If I am wrong on this trade, I will not implode my account.

Trade at your own risk, make sure you have stops in place, a trading plan and only use 10% or less of your account.

Happy Trading Everyone!

S&P 500 (SPX) Targets 6639 in Final Wave 5The Elliott Wave cycle, initiated at the April 7, 2025 low, is progressing as an impulse structure, driving the Index upward. Wave (1) reached a high of 5267.47, followed by a wave (2) pullback to 4910.42. The Index then surged in wave (3) to 6427.02, as depicted in the one-hour chart. A corrective wave (4) concluded at 6212.42, structured as a zigzag. Within this correction, wave A dropped to 6327.6, wave B climbed to 6339.89, and wave C finalized the decline at 6212.4, completing wave (4) in the higher degree.

The Index has since advanced in wave (5), breaking above the wave (3) peak of 6427.02, confirming the next upward move. This wave (5) is unfolding as a lower-degree impulse. From the wave (4) low, wave 1 hit 6346, and wave 2 corrected to 6289.37. The Index then nested higher, with wave ((i)) reaching 6389.7 and wave ((ii)) retracing to 6310.32. In the short term, anticipate a few more highs to complete wave 1 of (5). A pullback should follow to adjust the cycle from the August 2, 2025 low. As long as the 6212.4 pivot remains intact, the Index should continue climbing.

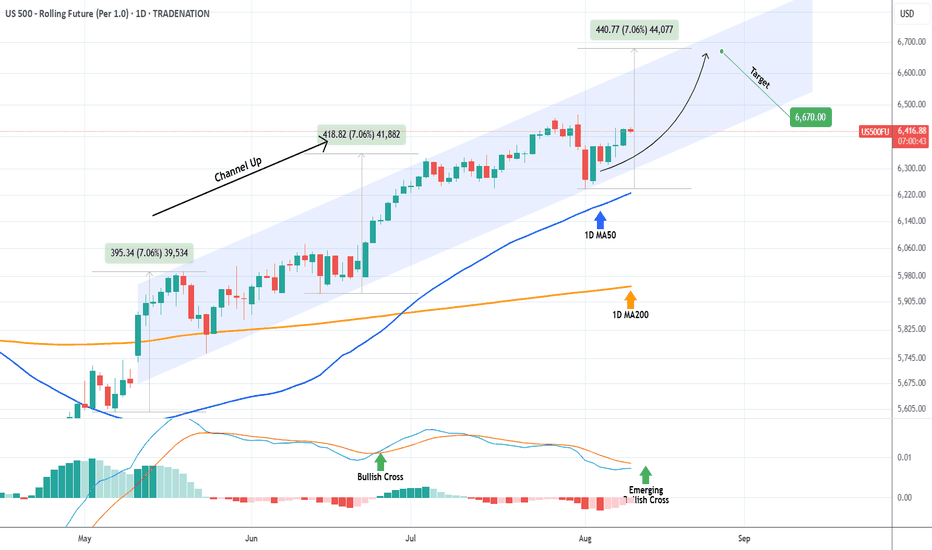

S&P500 Channel Up going straight to 6670.The S&P500 index (SPX) has been trading within a 3-month Channel Up since the May 12 candle. All of this time, it has been supported by the 1D MA50 (blue trend-line) and as long as it holds, the new Bullish Leg is expected.

The last two rose by +7.06%, and ahead of a new 1D MACD Bullish Cross, that gives us a medium-term Target of 6670.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

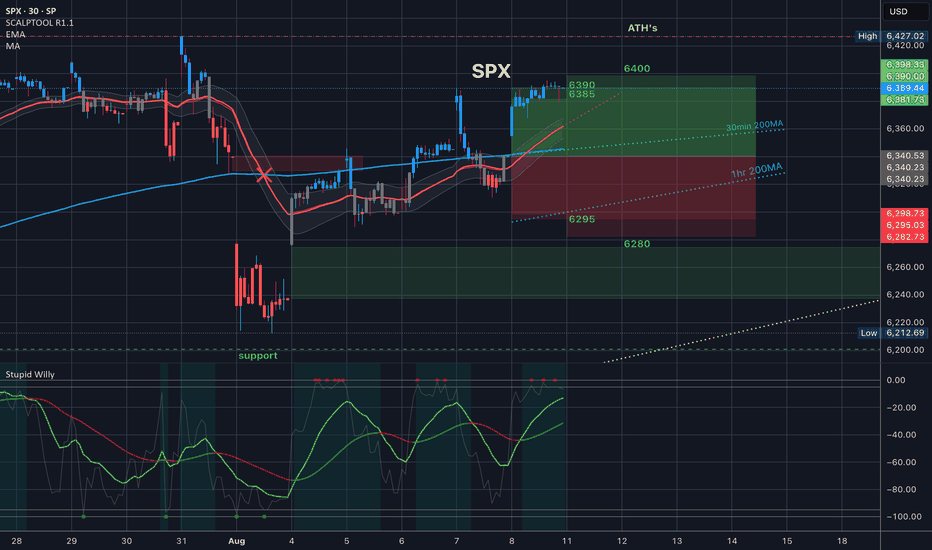

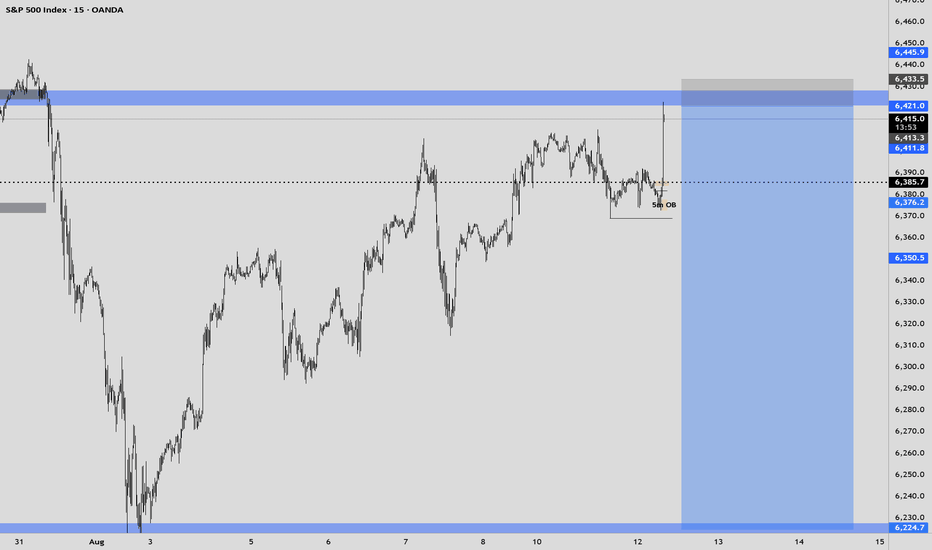

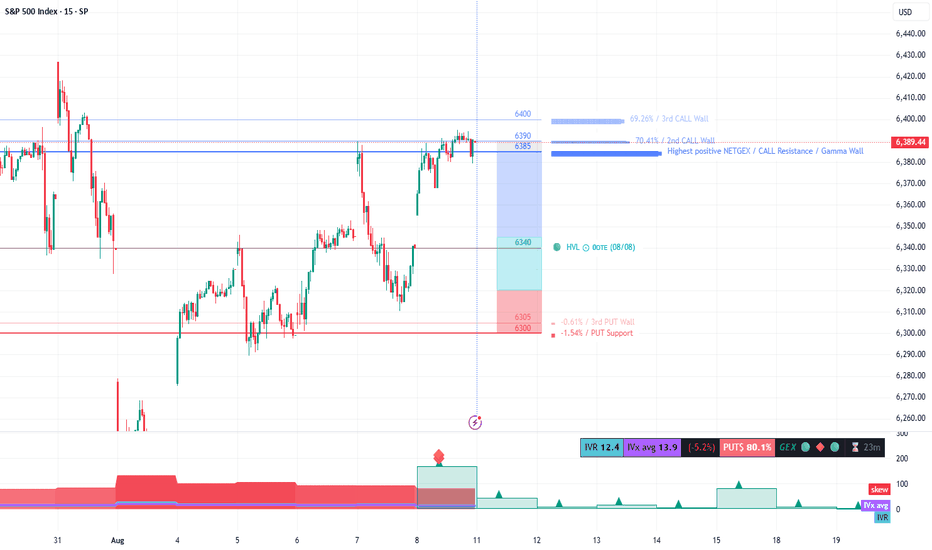

$SPX All Time High’s in view // Last Friday review

Ok, this is a review of last Friday’s price action from the setup provided in the member video. We opened with a gap up and a rally to the top of the implied move. We actually took it to the top of the 30 day average volatility, which rounded out was 6390

So 6390/6400 bear call spreads paid.

ATH’s not to far away here.

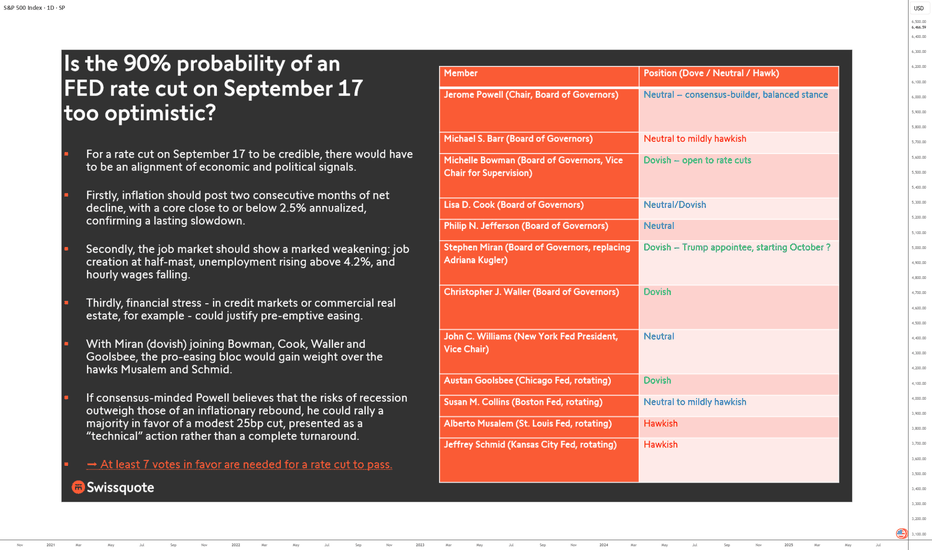

FED rate cut on 09/17 - A TRICK?Since the publication of the latest report on the US labor market (the NFP report), the probability of the Federal Reserve (FED) resuming the cut in the federal funds rate has changed significantly. The FED rate has been stable since the end of 2024, and the implied probability (see CME FED Watch tool below) of a 0.25% rate cut on Wednesday September 17 exceeds 90%.

Is this a trap? Is the market too optimistic?

1) US economy, macro-check: is a rate cut on Wednesday September 17 credible in terms of growth, employment and inflation?

Is a rate cut in September fundamentally credible? The US macro-economic situation is complex, with disinflation on hold against a backdrop of tariffs, but a labor market that is beginning to show signs of weakness. Jerome Powell always defended the monetary status quo until he had confirmation that the underlying PCE inflation rate had moved towards 2%. Tariffs don't seem to be causing a second wave of inflation, but they are putting disinflation on pause, while degrading the labor market with the number of unemployed at its highest level since the year 2021. This is probably why a rate cut could take place on Wednesday September 17.

2) Is a rate cut on Wednesday September 17 credible from the point of view of the balance of power between the 12 voting members of the FOMC?

Let's keep in mind that a rate cut is possible if and only if 7 FOMC members (out of 12) vote in favor of a rate cut. Jerome Powell has no veto power, and he has a single vote like the others. The arrival of Stephen Miran will add another vote for the rate-cutting camp, but the neutral FOMC members will still have to be convinced. The current balance of power among the FOMC's 12 voting members does not yet guarantee a rate cut on September 17.

3) The U.S. 2-year bond yield remains the supreme judge of the market, and the scenario of a rate cut in September is credible as long as this bond yield remains below its 200-day moving average

It is the U.S. 2-year bond yield that best represents the likelihood of the FED taking action on its interest rate. As long as it remains below its 200-day moving average, the scenario of a rate cut on Wednesday September 17 is credible. Ultimately, much will depend on the next report on the US labour market, the NFP report at the beginning of September.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

The S&P could be going up OR down ... (I changed my mind)

but the daily indicators are looking more to an upward move now.

I drew a previous chart anticipating that the market would be bearish. (Please look at my previous chart for more details) But looking at the daily indicators, they look too bullish for me. As well, the S&P technically traded out of the triangle today which indicates a bullish trend. And if you look at the DIA or the NDQ they look bullish too. And these 3 indices typically trade in the similar direction.

(This is going to sound a lot like my previous chart.)

Tomorrow, the jobless claims are being reported, which should drive the market either up or down. But looking at the daily chart, it will probably go up, but I am not ruling out anything right now.

I am a technical trader but I believe the fundamentals drive the market.

I am using the Heikin Ashi candlesticks.

1) They show more of a directional movement within candlesticks.

2) They tend to filter out the market noise so you can see the market direction better.

3) It reduces false signals, allowing you to stay in the trade longer.

4) And, it also gives you a smoother appearance making it easier to see trends and reversals.

But I often switch between regular candlesticks as those are the candlesticks I started trading with and I still do get a little bit of information from the regular candlesticks.

I think we had an ascending triangle forming on the S&P with the tip forming on Friday, August 15th.

Usually, the chart can exit 2/3 before the tip. So it can start exiting the triangle before now and August 15, 2025 usually with some fundamental trigger. I suspect the trigger would be the jobless claims report on Thursday, August 14, 2025. It seems that the S&P may have exited the triangle upward today.

I was thinking the market would move lower tomorrow based on the technicals, but the daily indicators are looking too bullish right now. Therefore, I am having more of a conservative approach and I will be prepared for both directions tomorrow.

I am undecided on the targets or stops as of yet in either direction.

But if you look at my previous targets and stops they usually follow a pattern.

My trading plan only entails me to use 10% of my total account. If I am wrong on this trade, I will not implode my account.

Trade at your own risk, make sure you have stops in place, use a trading plan and only use 10% or less of your account for trading to limit your risk.

Any comments and questions are welcome.... especially this time, since I changed my mind. LOL!

Happy Trading!

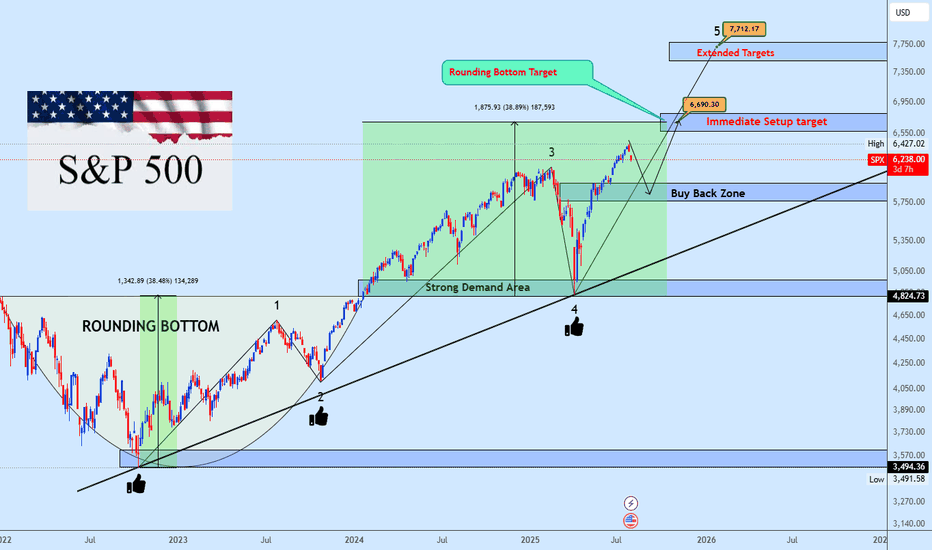

S&P 500 Bullish Rounding Bottom in PlayS&P 500 continues its upward trajectory, supported by a clearly defined rounding bottom formation. Price has successfully broken above the neckline resistance, followed by a technical pullback which was met with a strong buy reaction, validating this zone as a key demand area.

This pullback area now acts as a critical structural base and the current bounce reinforces bullish continuation bias. The active plan is to accumulate within the buy-back zone and follow the path laid out in the chart towards the projected upside targets.

Drop your stock requests in the comments for a quick analysis, only US-listed stocks will be reviewed under this post.

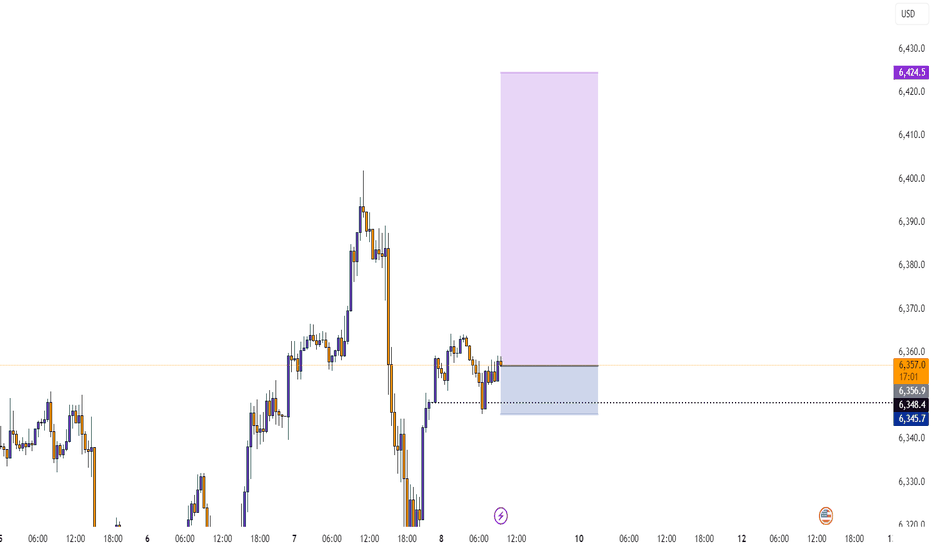

Watching July 31 High and August 1 Low - Key LevelsUS Inflation Next Week (CPI and PPI)

Will August re-test highs with momentum? Or test and fade?

MAGS back to highs.

AAPL has one of the best weeks since 2020's post covid crash recovery (WILD).

I still like long assets, but playing the game with discipline and patience.

Enjoy the weekend. Looking forward to the grind next week.

Thanks for watching!!!

-Chris

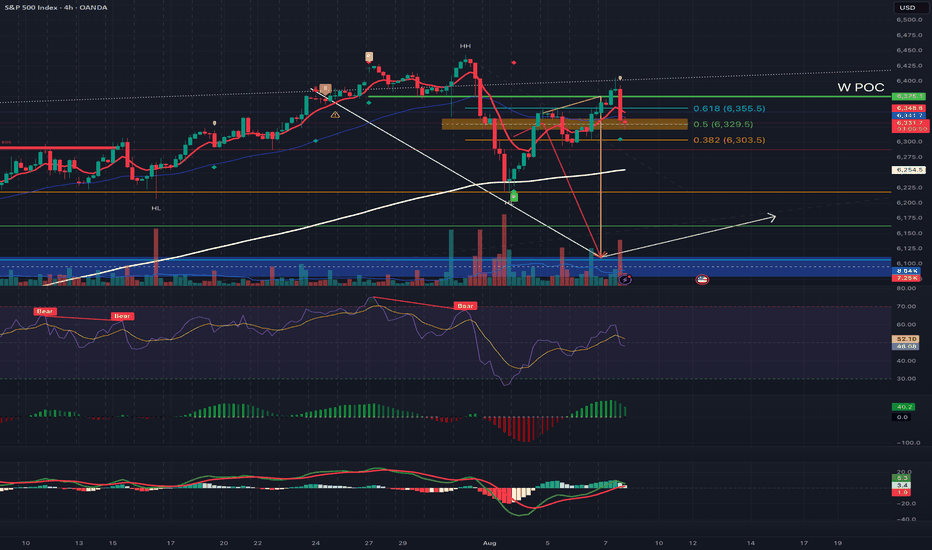

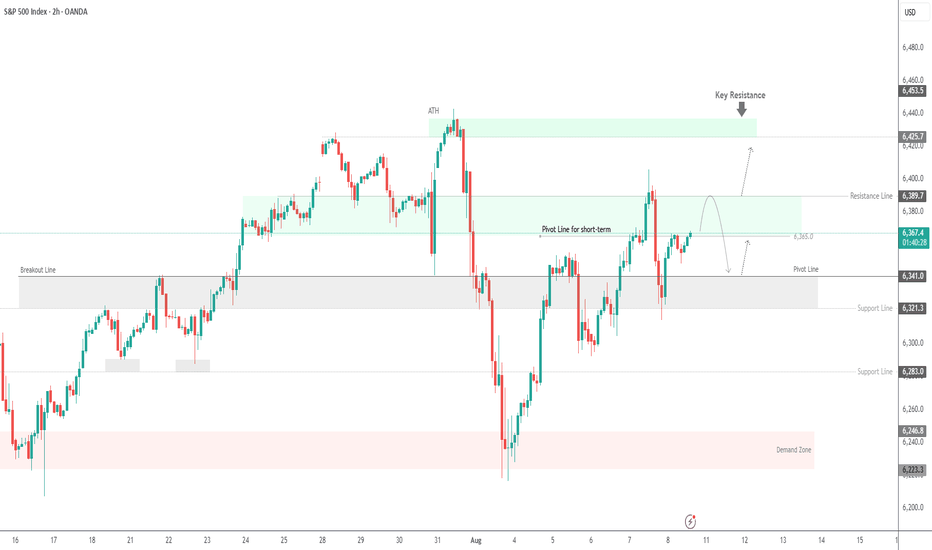

SPX500 at Key Pivot – Bearish Below 6365, Bullish AboveSPX500 – Market Overview

U.S. stock index futures rose on Friday after President Donald Trump’s temporary pick for a Federal Reserve governor boosted expectations for a more dovish central bank board.

Technical Outlook

Stability below 6365, we expect a move down toward 6341.

A 1H close below 6321 would likely extend the bearish trend toward 6301.

A 1H close above 6365 could trigger a push toward 6389.

A confirmed break above 6389 would shift the bias to bullish, targeting 6425 and 6453.

Pivot Line: 6365

Resistance: 6389 – 6425 – 6453

Support: 6341 – 6321 – 6301

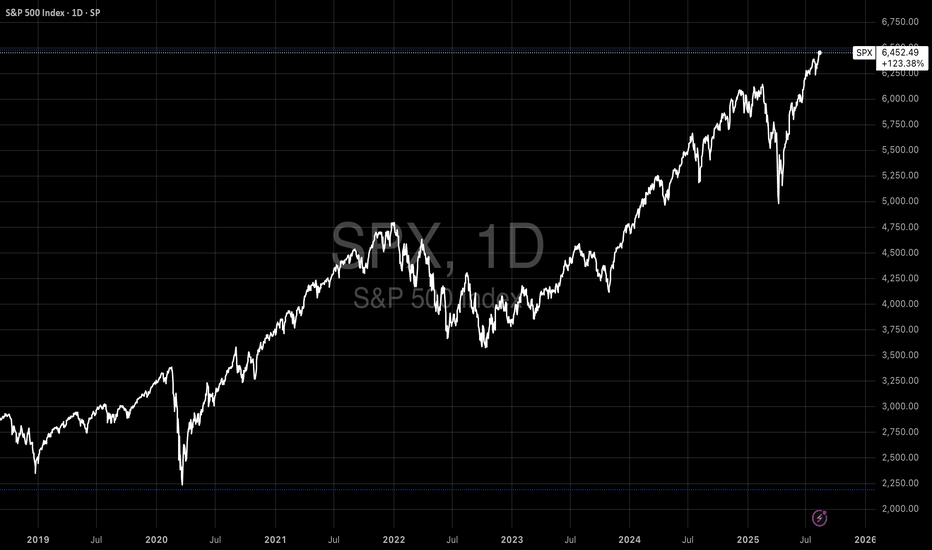

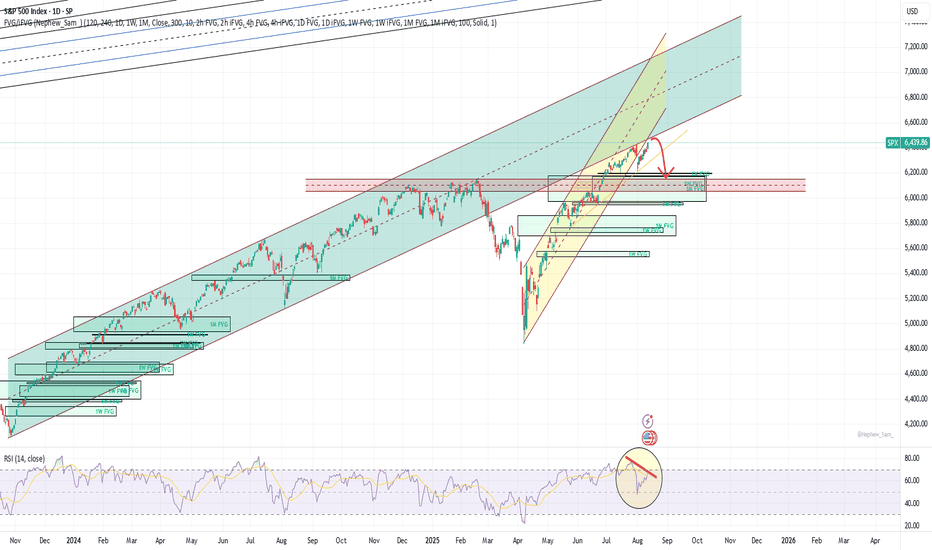

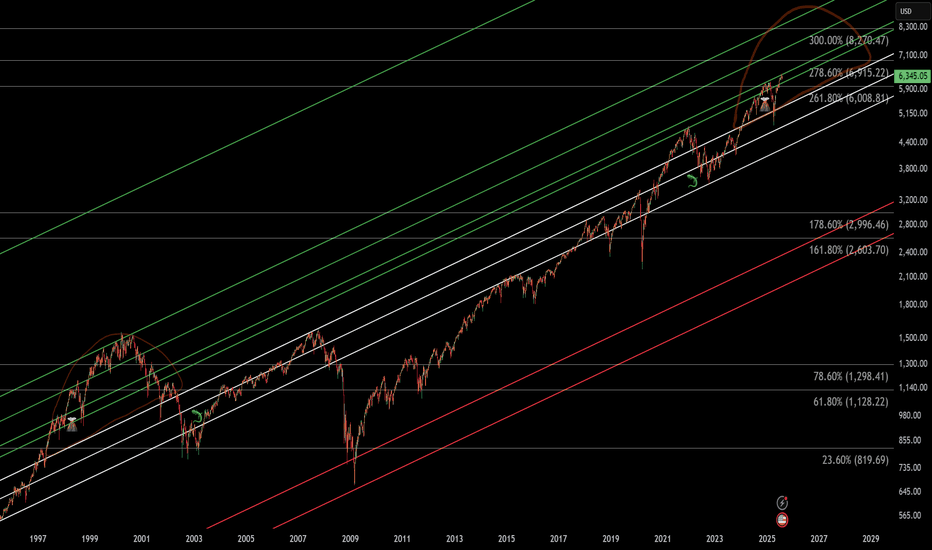

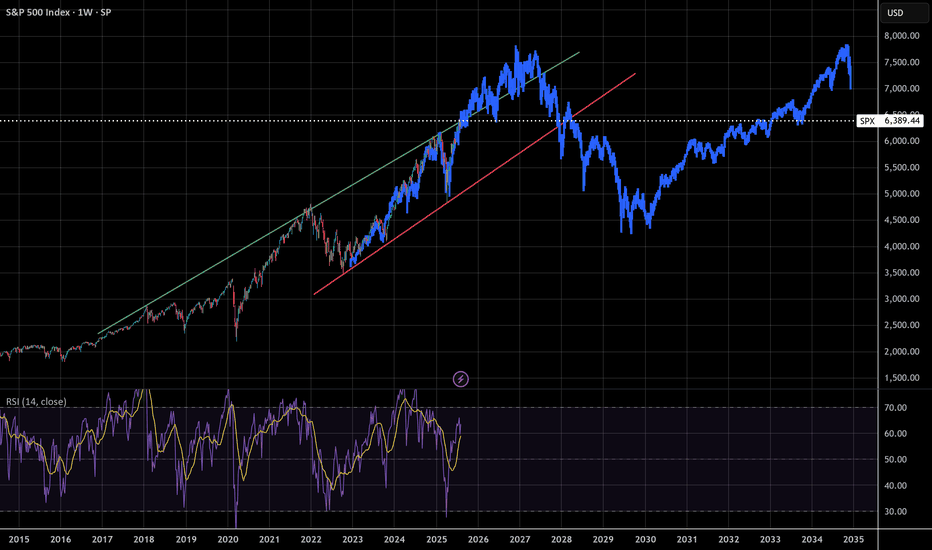

Dot Com Crash CorrelationThe following is a fractal of the lead up to the Dot Com crash, and the aftermath. It correlates extremely well with the current landscape. The TLDR is that if history repeats and we break the trendline, we'll form a blow off top in 2026 and crash spectacularly in 2027 (I'm guessing around May, a common dump month). If everyone is calling for the crash now, it means it's not over yet.

It's time to face the music. AI isn't profitable, it's an excuse to fire workers with high salaries. When there is no one left to fire and productivity/quality drops the answer will be clear: A program that is wrong 20% of the time is completely useless. The errors are a feature, not a bug, the AI can not work without hallucinating and hallucinating causes errors. Look it up if you don't believe me

Fundamentals:

-Rate cuts will keep this alive long enough to form a blow off top

-Extreme uncertainty from tariffs to manufacturing can account for that mid term drop

-AI Companies holding up the market make 0 net profit and have no realistic plans to make ROI

-The vast majority of AI companies have not made ROI

-Generative AI costs more to run than it makes. By their own very flawed estimate, OpenAI will take over 10 years to break even. In related news, snapchat just made ROI and they were founded in 2011, their stock is down 90%.

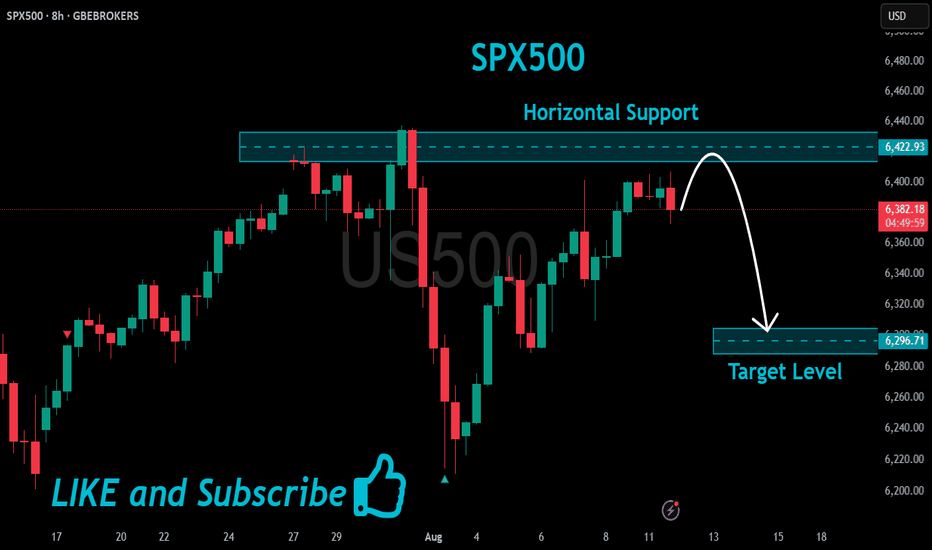

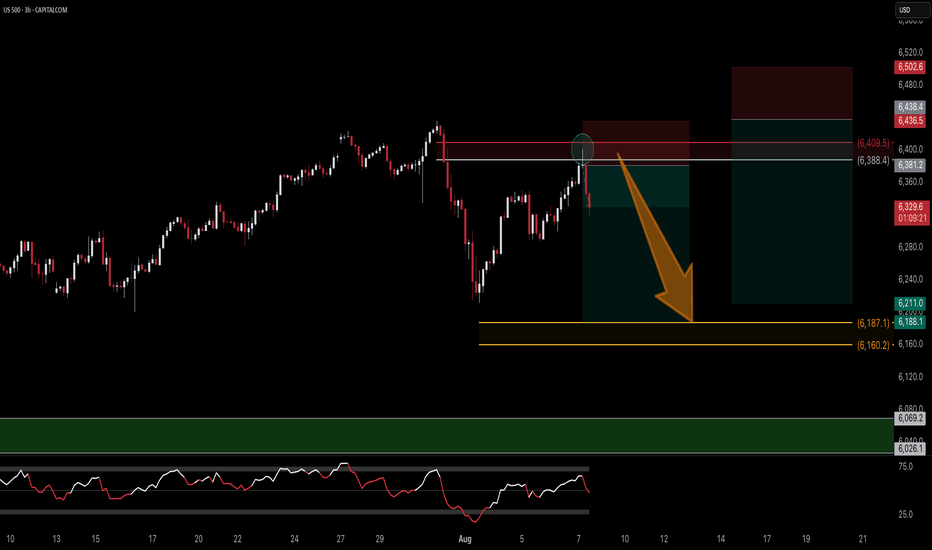

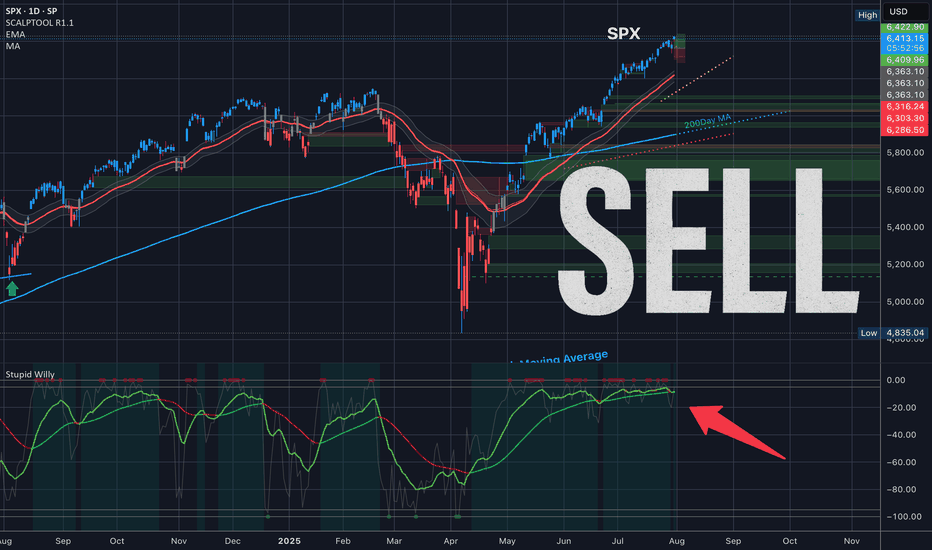

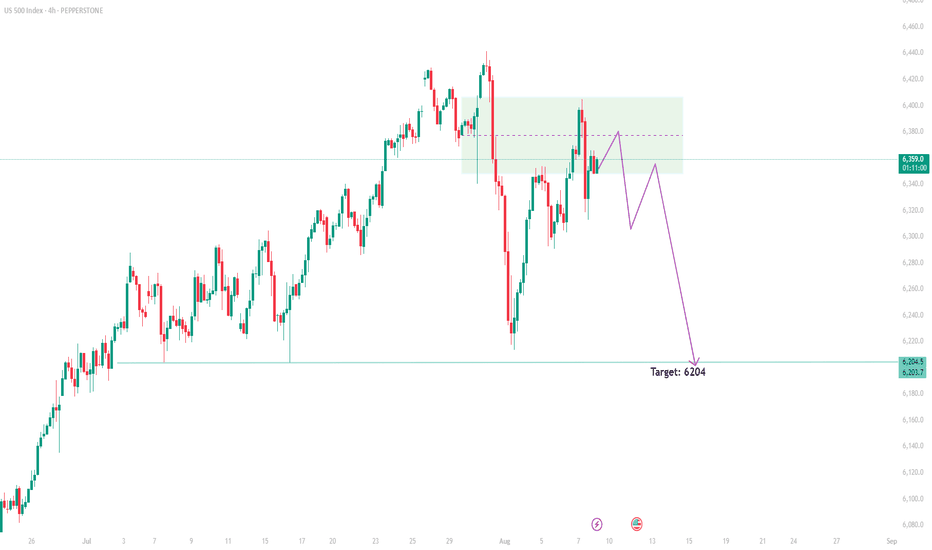

US500 Short Setup: Bearish Momentum Toward 6205Currently holding a short position on the US500 from the 6358 level, based on Smart Money Concepts. Price has tapped into a premium zone within a higher time frame supply area, showing clear signs of distribution. Liquidity has been swept above recent highs, and a shift in market structure confirms bearish intent. I’m targeting the 6205 level, expecting a rapid downside move in the very short term as smart money drives price toward discounted levels.