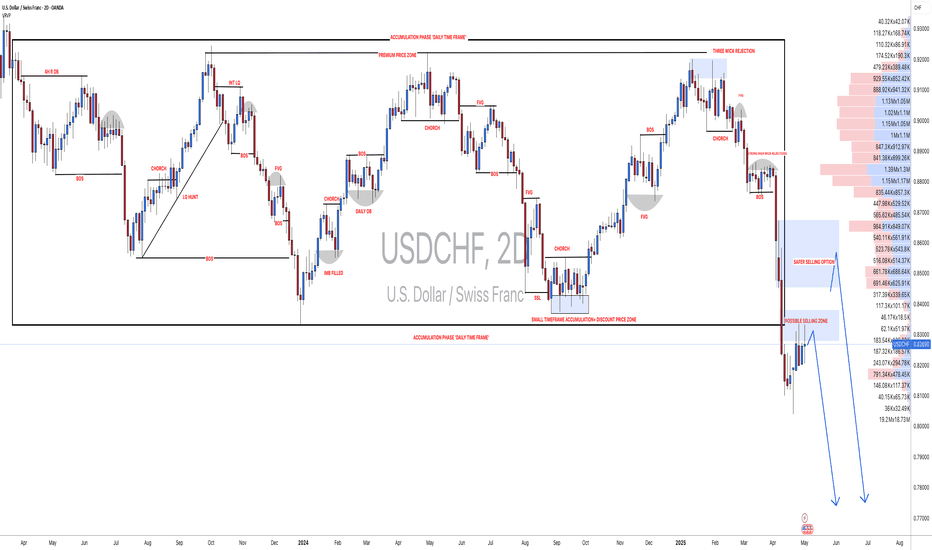

#USDCHF: Will USD Breakthrough The Strong Bearish Downtrend? The USDCHF currency pair has experienced significant volatility due to the ongoing trade dispute between the United States and China, which has led to a substantial decline in the DXY index. Consequently, CHF and JPY have emerged as the most stable currencies in the market.

Despite the USDCHF curre

About U.S. Dollar / Swiss Franc

The USDCHF, also known as the “swissie” is the fifth most traded currency in the Forex market. It is considered to be a safe haven pair due to its stability and neutral character of Switzerland and is a reserve currency used by markets worldwide.

Related currencies

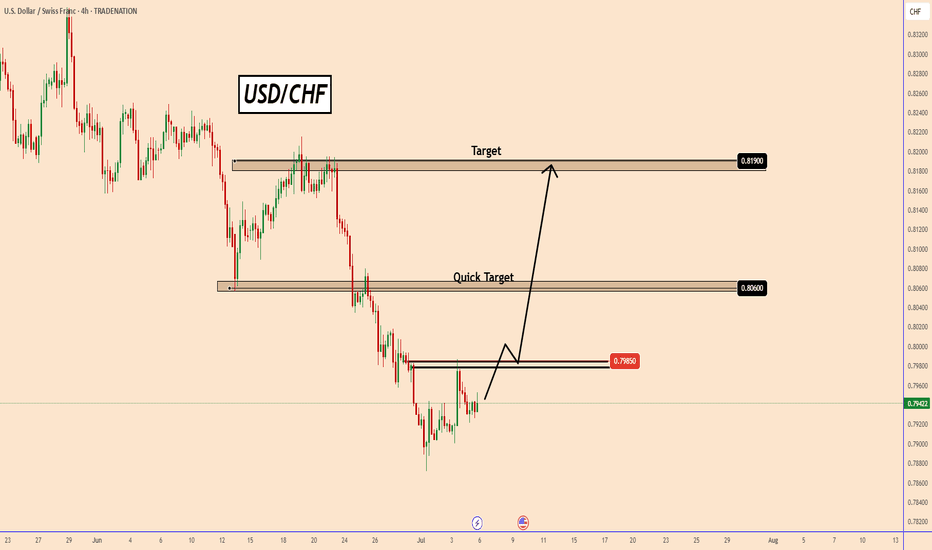

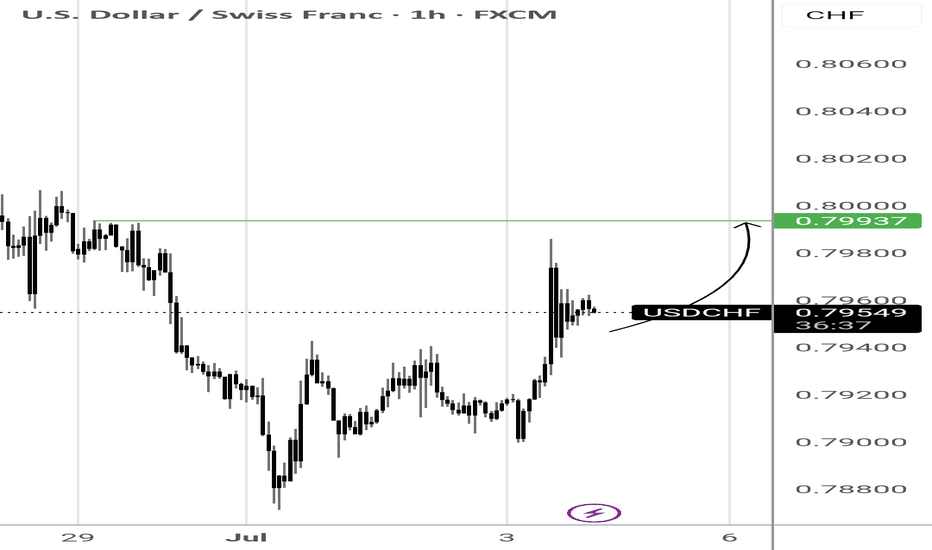

USDCHF: A Bullish Reversal Hinges on 0.7985USDCHF: A Bullish Reversal Hinges on 0.7985

USDCHF is currently testing a critical support zone near 0.7880—a level not seen since 2011.

The fact that price has returned to this area after more than a decade underscores the significance of this moment.

The pair remains under pressure for two ke

How to mark your charts Lightning fast!One of the things I didn't like was marking my charts. I would take so much time marking my charts and adding the prices on the side. My mentor showed me the fastest way. Just use the FIB tool and use "0" and "1". Now you can focus on other important things. I want to thank my mentor for showing me

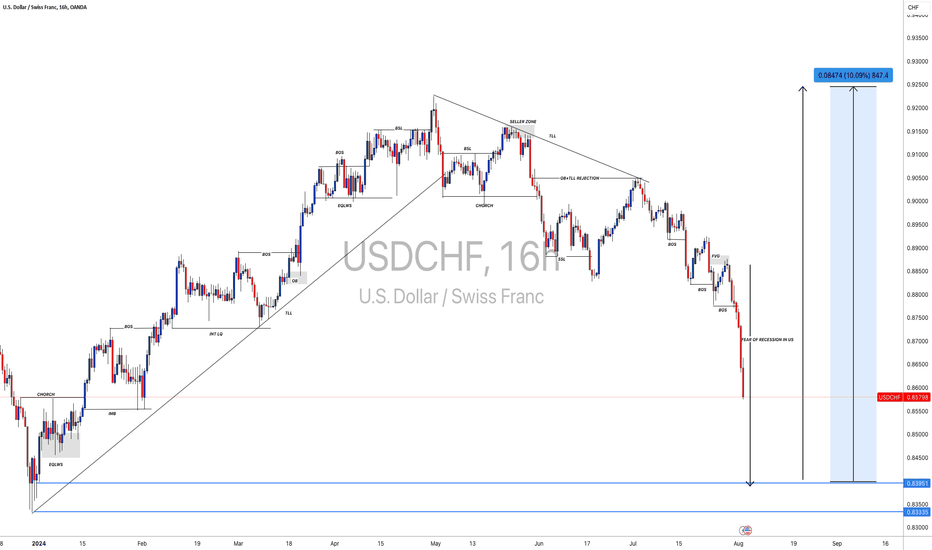

#USDCHF: 878+ PIPS Swing Buy In Making! Good Luck! Dear Traders,

OANDA:USDCHF

Price has been dropping since we had a change of character, there are many factors that are helping in USDCHF to drop. The mainly the first reason is CHF dominance in the market, CHF has been bullish ever since Gold continued the bullish trend, CHF, AUD and GOLD all

USDCHF: DXY Likely to remain bearish in long term! The USDCHF pair is likely to remain bearish in the coming days as DXY doesn’t show any bullish momentum. However, we expect DXY to be bullish in the short term, which will help the price reach our designated selling zone. Once the price reaches this zone and shows a reversal sign in a smaller timefr

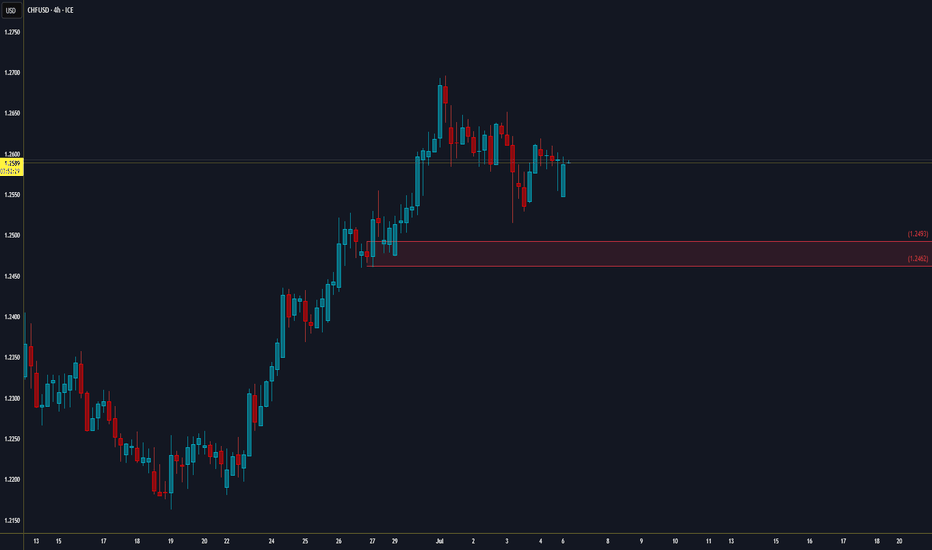

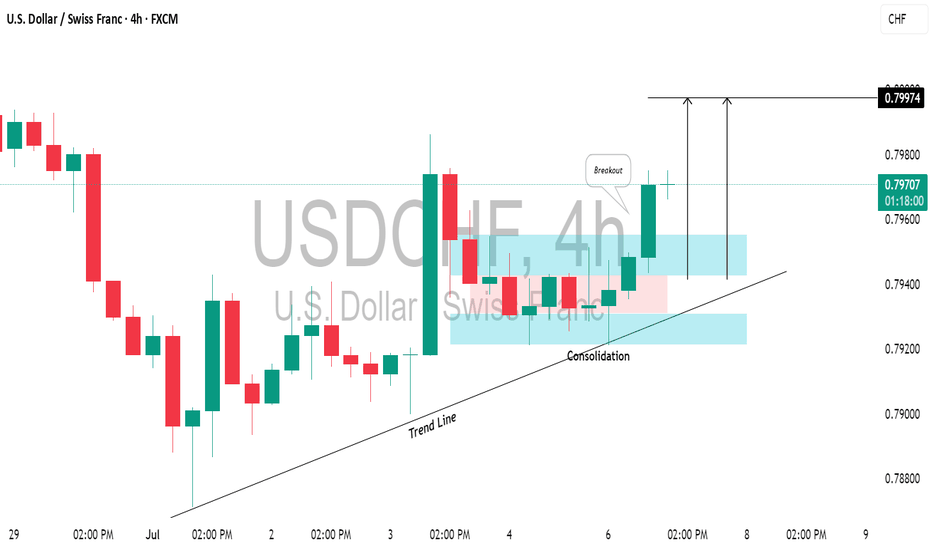

USDCHF: Bullish Outlook ExplainedLast week, the 📈USDCHF price reached a significant ascending trend line on the 4-hour chart.

Despite the market consolidating within a horizontal range for a while, the contact with the trend line propelled the pair upward.

The market subsequently broke and closed above the range's resistance.

I

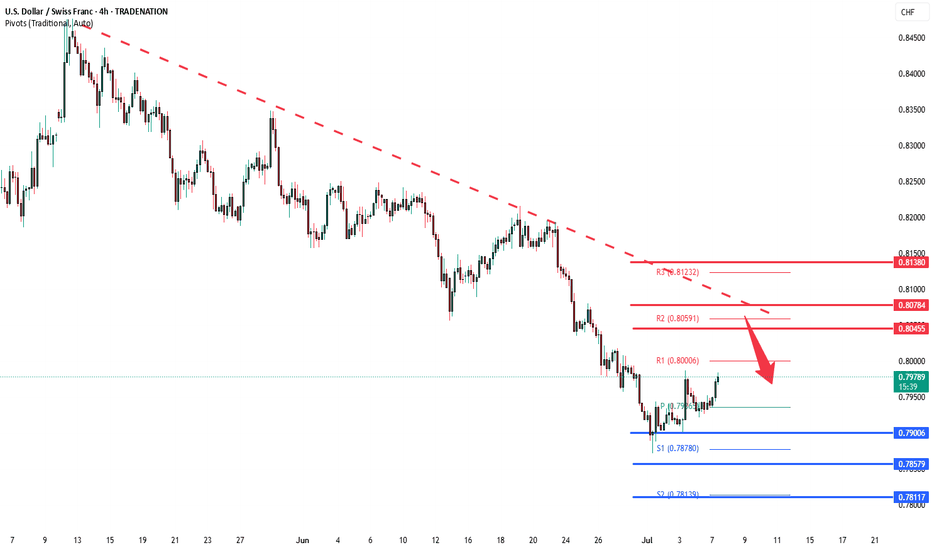

USDCHF Will Collapse! SELL!

My dear followers,

This is my opinion on the USDCHF next move:

The asset is approaching an important pivot point 0.7969

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal

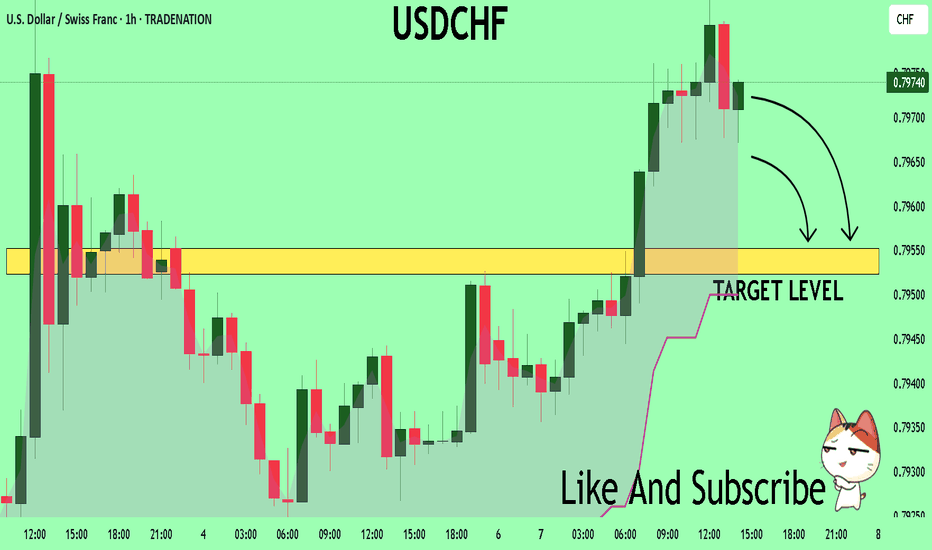

USDCHF downtrend continuation below 0.8050 The USDCHF pair remains under bearish pressure, consistent with the prevailing downtrend. Recent price action has transitioned into a sideways consolidation, suggesting a pause in bearish momentum but not a reversal.

The key technical level to monitor is 0.8050, which marks a prior intraday consoli

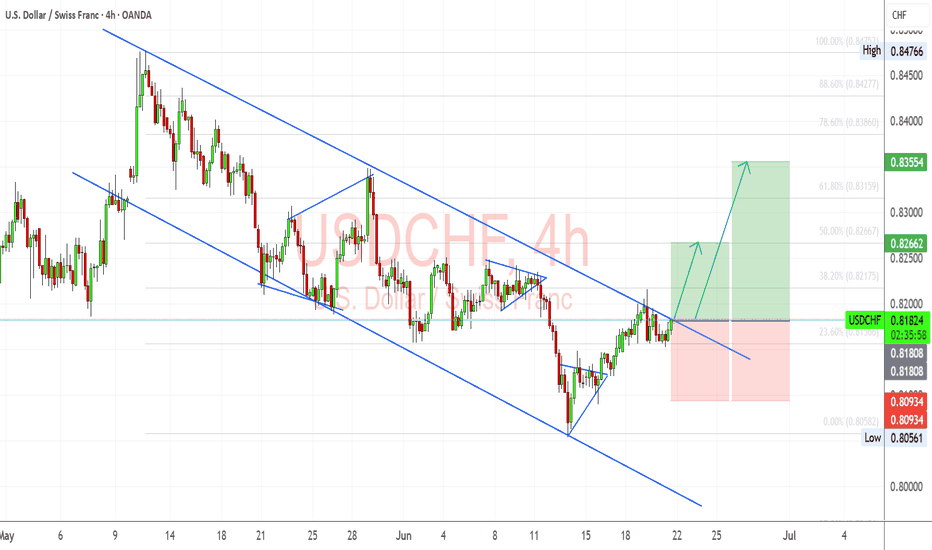

USDCHF Analysis – "Dollar Trying to Break Free from Downtrend"USDCHF is breaking out from a multi-week descending channel.

Structure shows a potential trend reversal from the June 12th low.

First bullish leg may target the 23.6% Fib level at 0.8266, followed by an extended move toward 0.8355.

Key resistance: 0.8266 and 0.8355 (Fib levels)

Stop loss: around

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The value of the USDCHF pair is quoted as 1 USD per x CHF. For example, if the pair is trading at 1.50, it means it takes 1.5 CHF to buy 1 USD.

USDCHF is a major currency pair, i.e. a popular currency paired with USD.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade USDCHF right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.