About U.S. Dollar / Japanese Yen

Also known as trading the “gopher” the USDJPY pair is one of the most traded pairs in the world. The value of these currencies when compared to each other is affected by the interest rate differential between the Federal Reserve and the Bank of Japan.

Related currencies

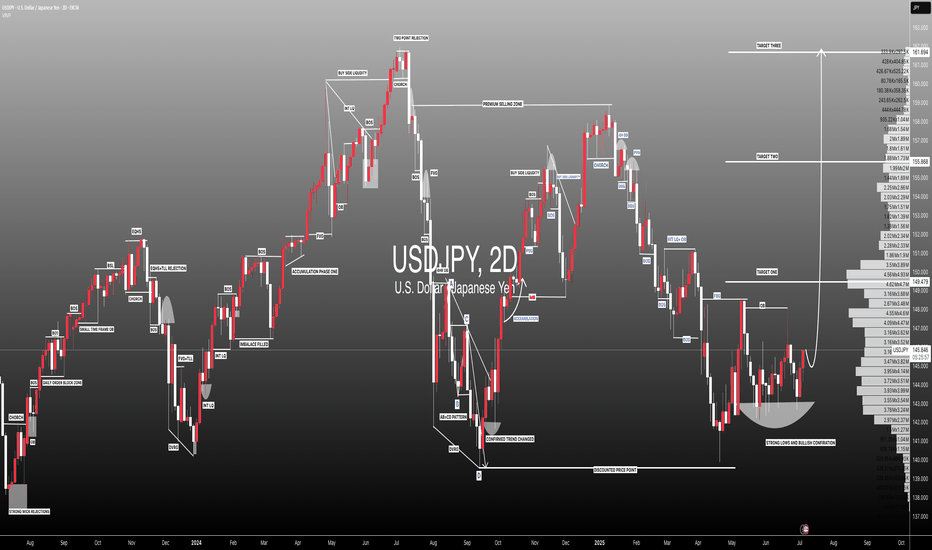

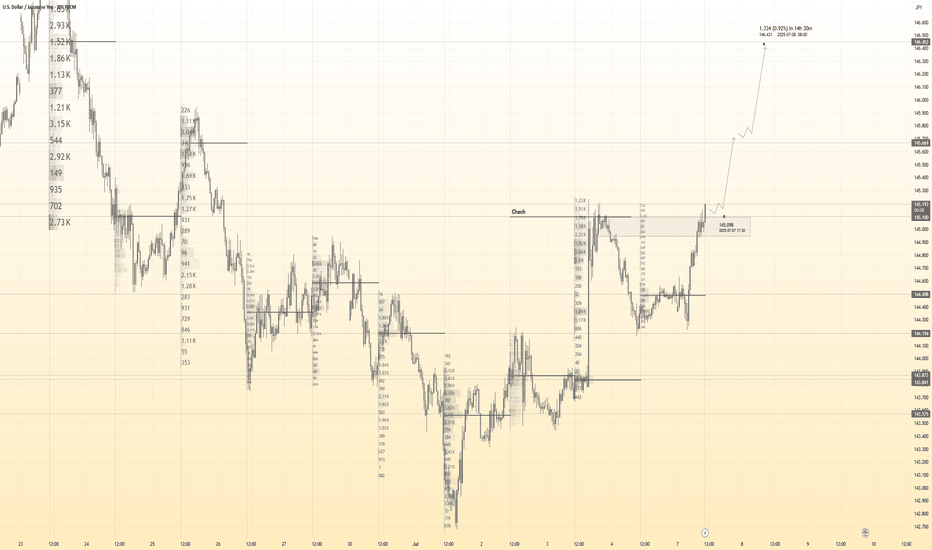

USDJPY Price Accumulated|Time For Bullish Distribution|Setupsfx|The price has accumulated nicely and is now distributing. We have three targets in mind, but set your own based on your analysis. Our approach is purely technical, but also includes a basic fundamental approach. This analysis concludes over 1500 pips and is a swing move. Please use this analysis as

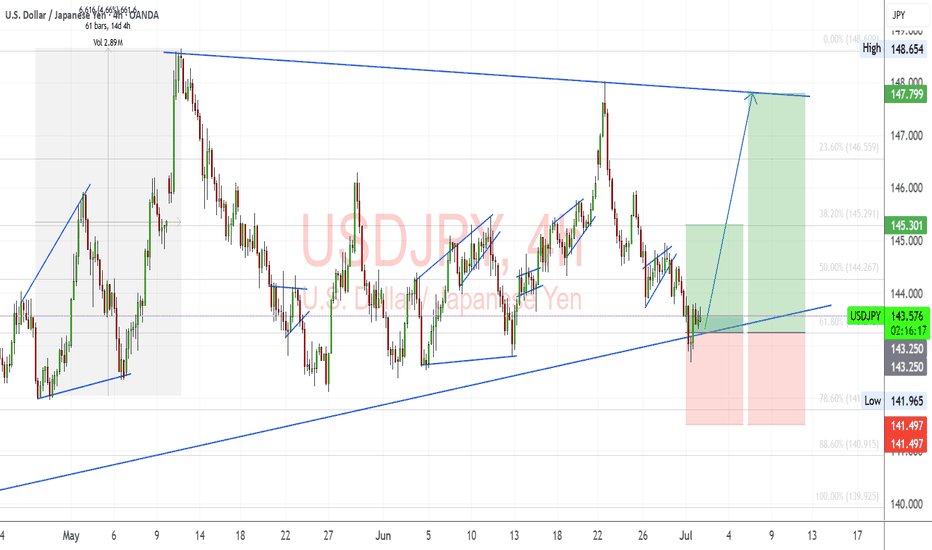

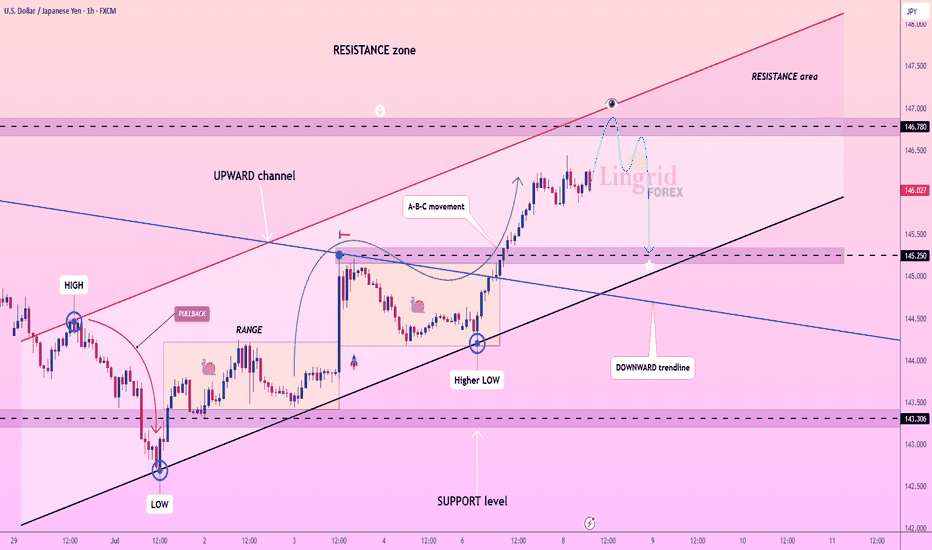

USDJPY – Key Support Bounce with Macro TailwindsUSDJPY is bouncing off a key trendline and 61.8% Fib zone (143.25–143.60) with confluence across multiple JPY crosses (EURJPY, AUDJPY, CADJPY). This area has historically triggered strong upside momentum, and the current setup aligns with both technical structure and macro drivers.

📊 Fundamentals S

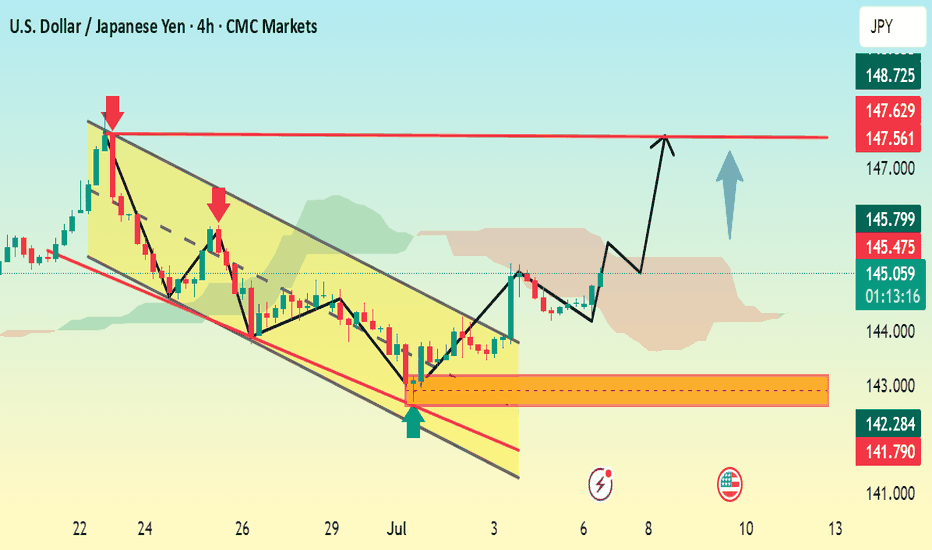

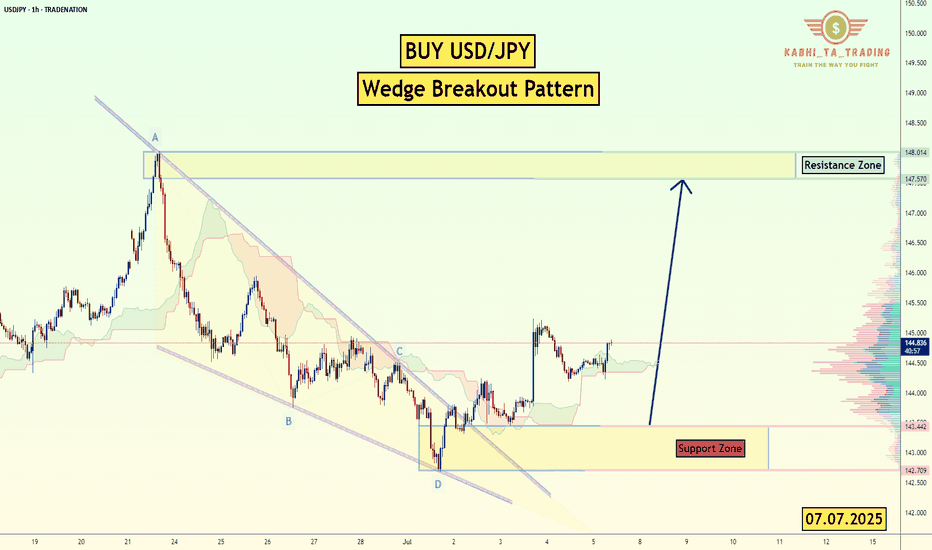

BULLISH H4 MOMENTUM ACTIVATED...?📊 Pattern & Structure:

The chart shows a downward channel (falling wedge) pattern that has recently been broken to the upside, indicating a bullish breakout.

The breakout is clean, with a sharp upward move, confirming the reversal from the bearish trend.

🔍 Key Levels Identified:

Support Zone:

USDJPY 30Min Engaged ( Bullish Entry Detected )➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish Break : 145.100

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of wh

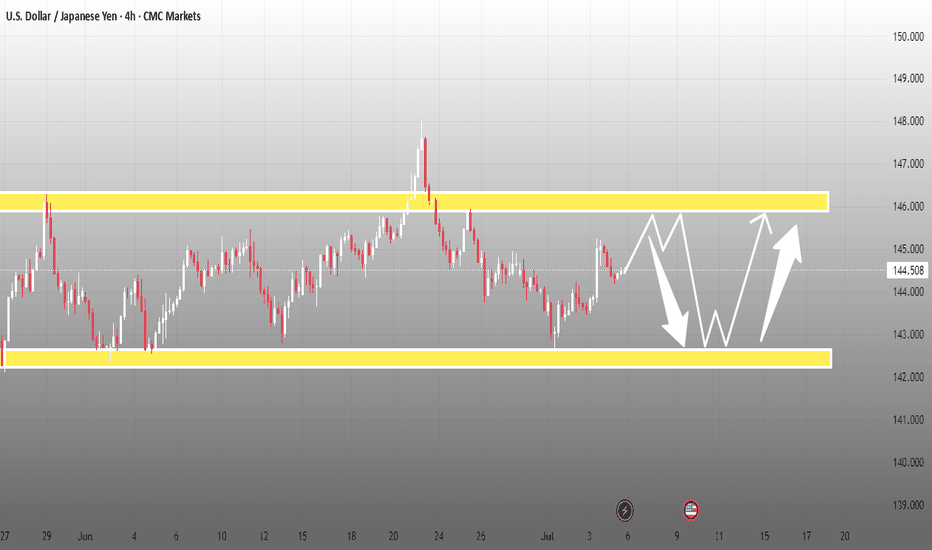

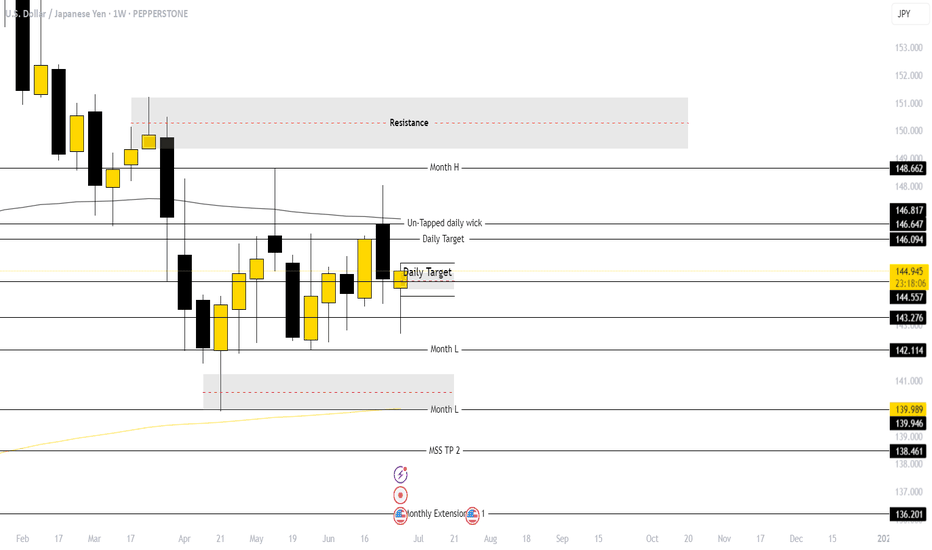

USD/JPY Range- weekly chart setupUSD/JPY abhi ek strong range-bound structure mein trade kar raha hai jisme clearly defined support aur resistance zones dikhai de rahe hain. Chart par price 144.50 ke aas paas consolidate kar raha hai, jahan se dono directions mein breakout ka potential bana hua hai.

📉 Resistance Zone: 145.80 – 146

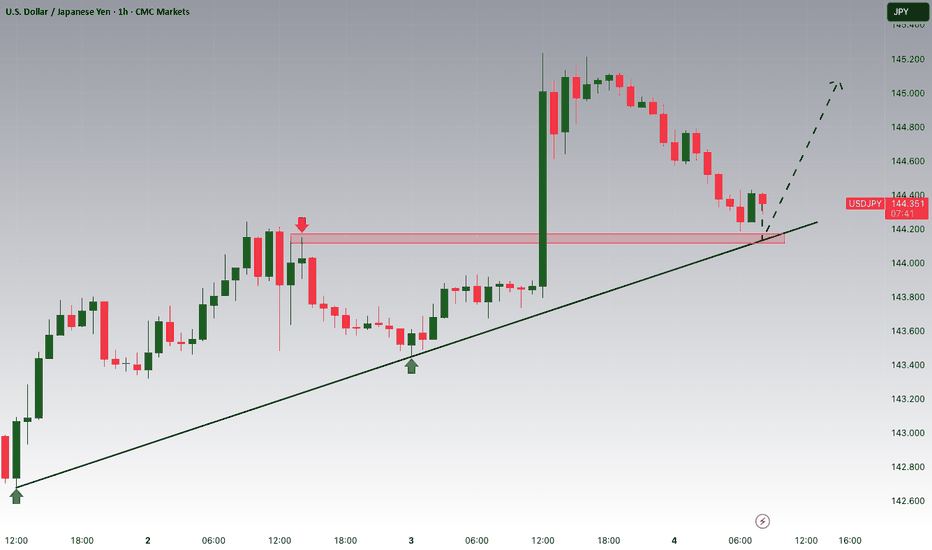

USD/JPY - H1- Wedge Breakout (07.07.2025)The USD/JPY pair on the H1 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Wedge Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A

Lingrid | USDJPY Pullback From the Key Resistance ZoneThe price perfectly fulfilled my previous idea . FX:USDJPY is moving inside an upward channel after reclaiming support near 145.25 and breaking out from its previous range. The pair printed a higher low and is now approaching resistance around 146.78, testing the upper boundary of the ascending

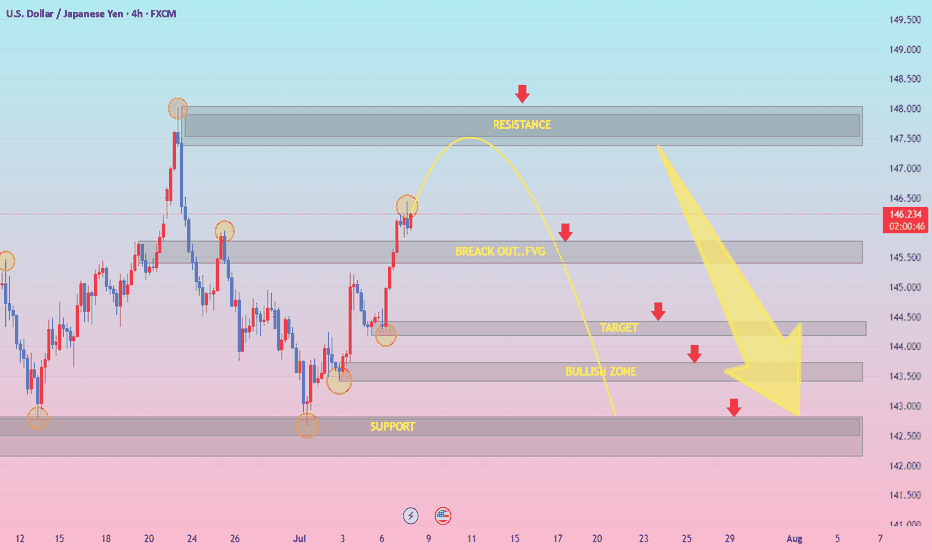

USDJPY h4 strongly downBearish Expectation Disruption / Bullish Counterpoint

Resistance (147.5) Rejection and drop Breakout and continuation toward 148.5+

Breakout FVG Fakeout and reversal True breakout — bullish trend continues

Bullish Zone (~144) Clean break below Accumulation zone, strong buying interest may emerge

Tar

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The value of the USDJPY pair is quoted as 1 USD per x JPY. For example, if the pair is trading at 1.50, it means it takes 1.5 JPY to buy 1 USD.

USDJPY is a major currency pair, i.e. a popular currency paired with USD.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade USDJPY right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.