U.S. Dollar / Japanese Yen forum

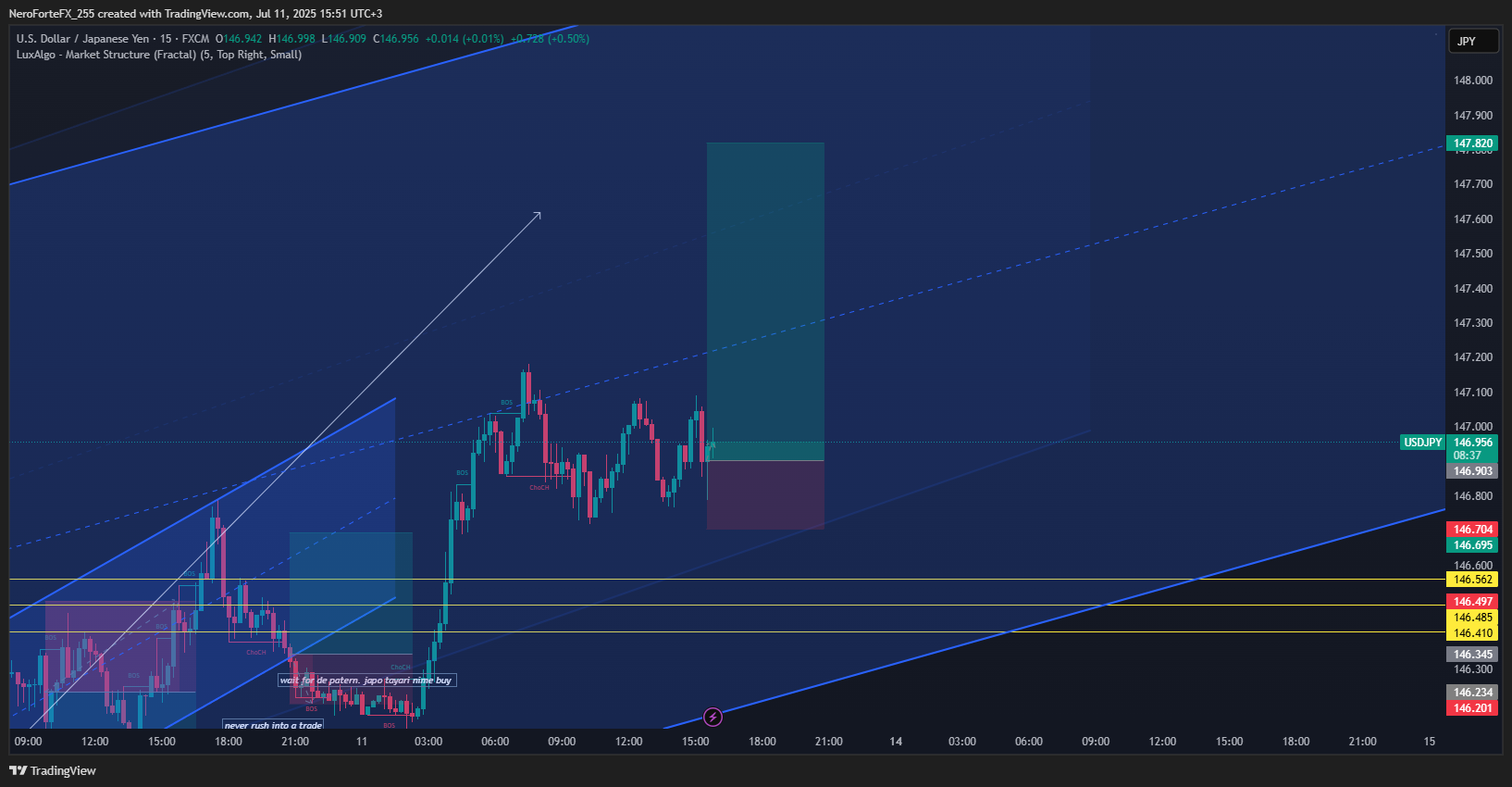

tp 147.550

tp 147.750

tp 147.970

tp 148.250

sl 146.850

Key drivers include Fed-BoJ policy divergence and strong U.S. yields.

You’re here to survive.

Trading is not a battle of strategy. It's a battle of survival.

2/2 Summary of Key Levels

Daily & 4-Hour Support and Resistance

Daily Support Levels: 145.500, 144.800, 144.200

Daily Resistance Levels: 147.500, 148.000, 148.500

4-Hour Support Levels: 146.200, 145.800, 145.300

4-Hour Resistance Levels: 147.000, 147.600, 148.000

Exponential Moving Average (EMA) Levels

Daily EMA Levels:

EMA 50: 146.500

EMA 100: 145.800

EMA 200: 144.300

EMA 400: 143.200

4-Hour EMA Levels:

EMA 50: 146.800

EMA 100: 146.200

EMA 200: 145.600

EMA 400: 144.500

Weekly and Daily Pivots

Weekly Pivots:

Pivot Point: 146.500

Resistance 1: 147.000

Support 1: 145.000

Daily Pivots:

Pivot Point: 146.750

Resistance 1: 147.250

Support 1: 146.250

Fibonacci Retracement Levels

23.6% Level: 146.034

38.2% Level: 145.500

50% Level: 145.357

61.8% Level: 144.214

78.6% Level: 143.500

Fundamental Analysis and Upcoming USD News

📈 As traders analyze the USDJPY market, it is essential to consider upcoming economic events that may influence the USD. This week, the following key U.S. economic indicators are scheduled for release:

Consumer Price Index (CPI): Expected to be released on July 12, 2025. A higher than expected CPI may bolster the USD, leading to potential upward pressure on USDJPY.

Retail Sales Data: Scheduled for July 15, 2025. Strong retail sales figures can indicate consumer confidence and spending, further supporting the USD.

Federal Reserve Meeting Minutes: Expected on July 18, 2025. Insights into future monetary policy could significantly impact market sentiment and the USDJPY exchange rate.

The outcomes of these events could create volatility in the USDJPY pair, making it crucial for traders to stay informed and adjust their strategies accordingly.

Conclusion

In summary, the USDJPY pair is currently trading at 146.896, situated between key support and resistance levels. The technical indicators analyzed—Fibonacci retracement levels, EMAs, RSI divergence, order blocks, and MACD—provide a comprehensive view of the market dynamics.