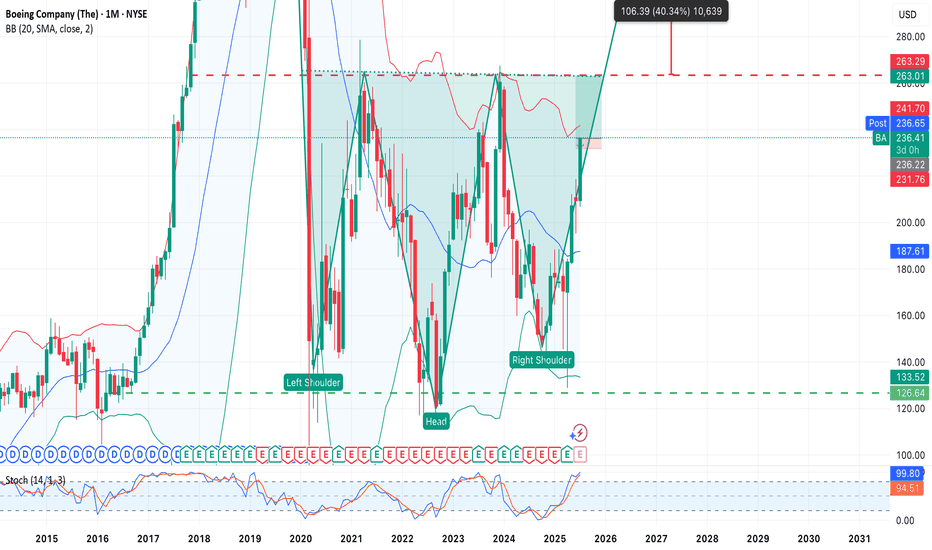

Boeing Headed back up to close gaps near 260 in the short term

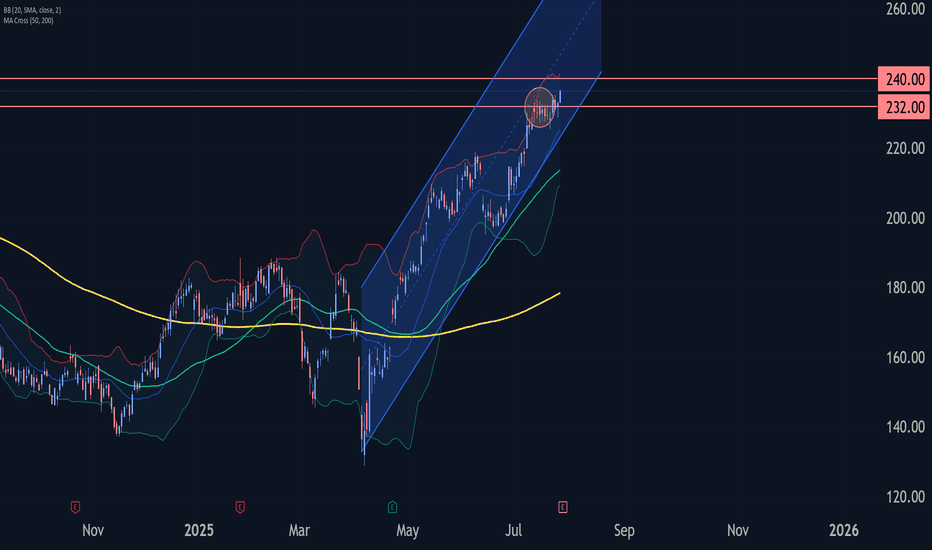

Zoomed in you can see its a channel trade

The next best long entry is above 235.00

On your daily chart, go back and look at the gap from Jan 2024 at 234.00 now if you stroll back to last month you'll see all of the price action that refl

Key facts today

A U.S. appeals court reinstated an $81 million award against Boeing in a trade secrets case with Zunum Aero, affirming the protectability of Zunum's trade secrets.

Viking Global Investors LP has reduced its share stake in Boeing by 12.3%, resulting in total holdings of 2.8 million shares as of June 30, 2025.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−14.02 EUR

−11.41 B EUR

64.25 B EUR

755.18 M

About Boeing Company (The)

Sector

Industry

CEO

Robert Kelly Ortberg

Website

Headquarters

Arlington

Founded

1916

FIGI

BBG00GQ6S092

The Boeing Co. is an aerospace company, which engages in the manufacture of commercial jetliners and defense, space, and security systems. It operates through the following segments: Commercial Airplanes (BCA), Defense, Space and Security (BDS), Global Services (BGS), and Boeing Capital (BCC). The Commercial Airplanes segment includes the development, production, and market of commercial jet aircraft and provides fleet support services, principally to the commercial airline industry worldwide. The Defense, Space and Security segment refers to the research, development, production and modification of manned and unmanned military aircraft and weapons systems for global strike, including fighter and combat rotorcraft aircraft and missile systems, global mobility, including tanker, rotorcraft and tilt-rotor aircraft, and airborne surveillance and reconnaissance, including command and control, battle management and airborne anti-submarine aircraft. The Global Services segment provides services to commercial and defense customers. The Boeing Capital segment seeks to ensure that Boeing customers have the financing they need to buy and take delivery of their Boeing product and manages overall financing exposure. The company was founded by William Edward Boeing on July 15, 1916 and is headquartered in Arlington, VA.

Related stocks

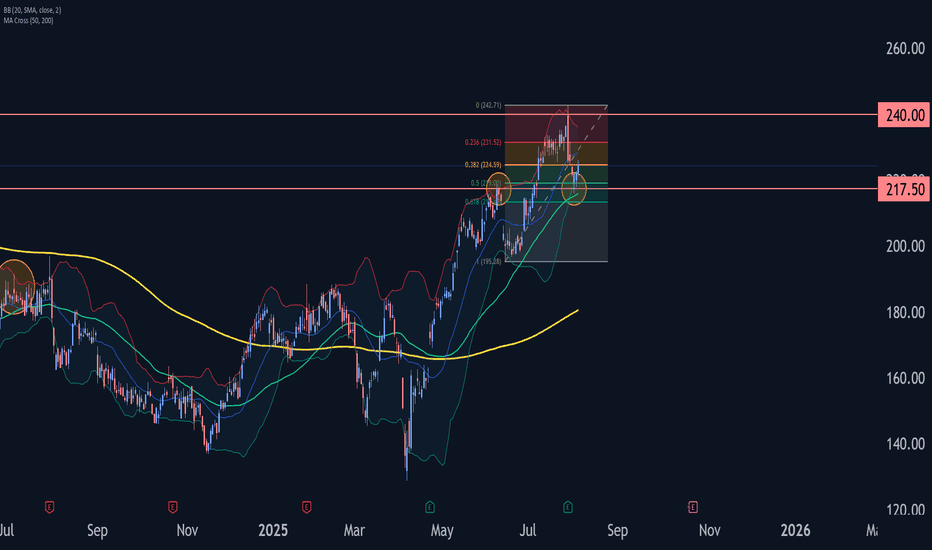

Boeing Wave Analysis – 5 August 2025- Boeing reversed from the support zone

- Likely to rise to resistance level 230.00

Boeing recently reversed up from the support zone between the pivotal support level of 217.50 (former top of wave 1 from June) and the lower daily Bollinger Band.

This support zone was further strengthened by the 5

BOEING for a Short Term Swing and LEAP tradeI'm liking Boeing here. Currently looks to be in the final move of a 5 year inverse head and shoulders / ascending triangle pattern, which I take as very bullish.

For a short term swing I'm targeting $250-$255 where I will take profit.

For long term leaps I'm targeting purple range ($300+).

Boein

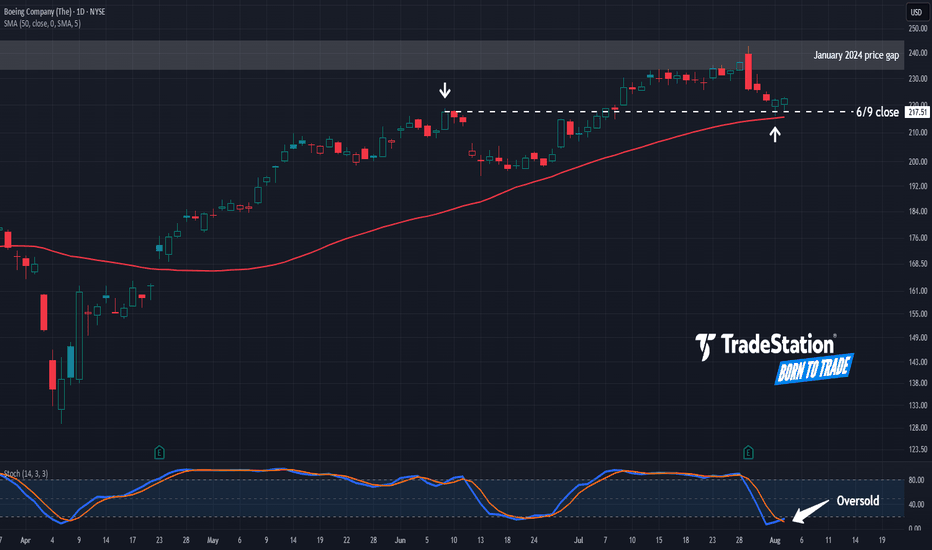

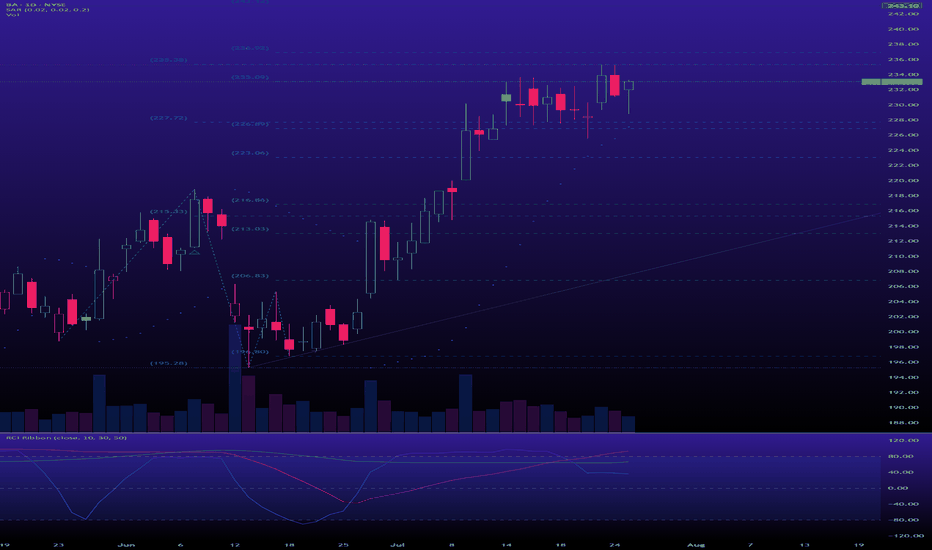

Boeing Has Pulled BackBoeing hit a 19-month high last week, and now it’s pulled back.

The first pattern on today’s chart is a price gap from January 2024. BA briefly entered that resistance area after earnings and revenue beat estimates on July 29.

Second is the June 9 close of $217.51. Sellers drove the aerospace gian

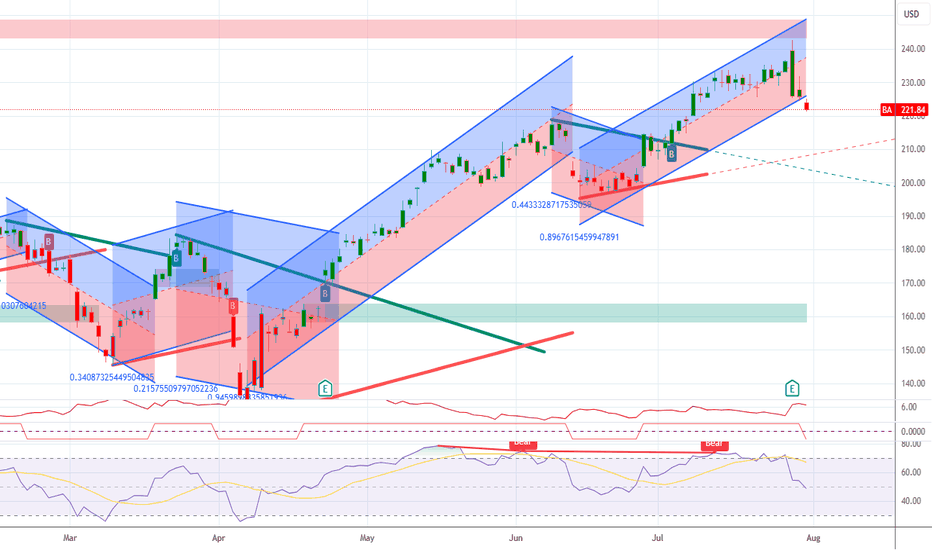

Boeing Company (BA) Long Setup Boeing Company (BA) Long Setup

Probable **Wave (5)** upside impulse from the recent \$225.26 low.

* Wave (4) looks complete — bullish structure shift starting from LL.

* Price is now breaking minor resistance, building momentum for continuation.

* **Demand Zone:** \$224.00–\$226.00 — proven boun

Boeing Wave Analysis – 28 July 2025- Boeing broke the resistance level 232.50

- Likely to rise to resistance level 240.00

Boeing recently broke the resistance level 232.50 (which stopped the previous minor impulse wave 3 in the middle of July, as can be seen below).

The breakout of the resistance level 232.50 continues the active s

An adventure? Yes. But technically — beautiful. Boeing.Adventure Idea: The Return of Boeing NYSE:BA

An inverted “Head and Shoulders” pattern is forming on the BA (Boeing) chart — one of the most reliable bullish formations in technical analysis. The price is confidently approaching the neckline around $235–241, and a breakout above this level could

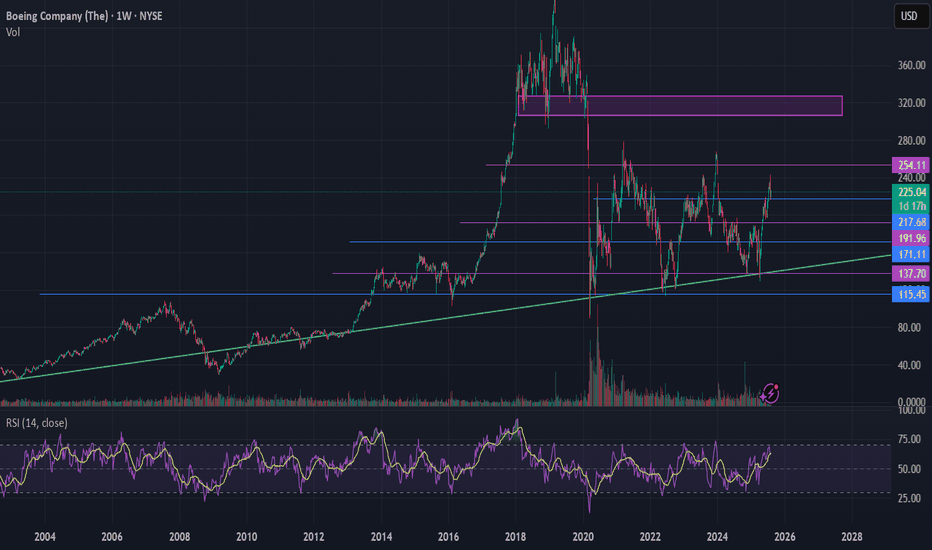

Boeing to $300 - Falling wedge** The year ahead **

On the above 6 day chart price action has corrected over 50% since December 2023. A number of reasons now favour a long position, they include:

1. Price action and RSI resistance breakouts.

2. Support on past resistance.

3. Double bottom on price action (yellow arrows)

4. Fall

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US97023BS3

BOEING CO. 16/46Yield to maturity

7.36%

Maturity date

Jun 15, 2046

US97023BV6

BOEING CO. 17/47Yield to maturity

7.35%

Maturity date

Mar 1, 2047

BCOC

BOEING CO. 15/45Yield to maturity

7.18%

Maturity date

Mar 1, 2045

BA4602171

Boeing Company 3.625% 01-MAR-2048Yield to maturity

7.00%

Maturity date

Mar 1, 2048

BA4798350

Boeing Company 3.825% 01-MAR-2059Yield to maturity

6.93%

Maturity date

Mar 1, 2059

BA4762315

Boeing Company 3.85% 01-NOV-2048Yield to maturity

6.88%

Maturity date

Nov 1, 2048

BA4829131

Boeing Company 3.9% 01-MAY-2049Yield to maturity

6.87%

Maturity date

May 1, 2049

BA4866210

Boeing Company 3.95% 01-AUG-2059Yield to maturity

6.87%

Maturity date

Aug 1, 2059

BA5803372

Boeing Company 7.008% 01-MAY-2064Yield to maturity

6.86%

Maturity date

May 1, 2064

BA4866209

Boeing Company 3.75% 01-FEB-2050Yield to maturity

6.85%

Maturity date

Feb 1, 2050

US97023BK0

BOEING CO. 2035Yield to maturity

6.37%

Maturity date

Mar 1, 2035

See all BA bonds

Curated watchlists where BA is featured.

Frequently Asked Questions

The current price of BA is 200.10 EUR — it has increased by 0.41% in the past 24 hours. Watch BOEING CO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange BOEING CO stocks are traded under the ticker BA.

BA stock has risen by 2.62% compared to the previous week, the month change is a 1.33% rise, over the last year BOEING CO has showed a 29.94% increase.

We've gathered analysts' opinions on BOEING CO future price: according to them, BA price has a max estimate of 251.40 EUR and a min estimate of 190.08 EUR. Watch BA chart and read a more detailed BOEING CO stock forecast: see what analysts think of BOEING CO and suggest that you do with its stocks.

BA stock is 0.49% volatile and has beta coefficient of 1.28. Track BOEING CO stock price on the chart and check out the list of the most volatile stocks — is BOEING CO there?

Today BOEING CO has the market capitalization of 151.37 B, it has increased by 1.73% over the last week.

Yes, you can track BOEING CO financials in yearly and quarterly reports right on TradingView.

BOEING CO is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

BA earnings for the last quarter are −1.05 EUR per share, whereas the estimation was −1.18 EUR resulting in a 11.11% surprise. The estimated earnings for the next quarter are −0.34 EUR per share. See more details about BOEING CO earnings.

BOEING CO revenue for the last quarter amounts to 19.31 B EUR, despite the estimated figure of 18.81 B EUR. In the next quarter, revenue is expected to reach 18.46 B EUR.

BA net income for the last quarter is −518.68 M EUR, while the quarter before that showed −34.20 M EUR of net income which accounts for −1.42 K% change. Track more BOEING CO financial stats to get the full picture.

As of Aug 15, 2025, the company has 172 K employees. See our rating of the largest employees — is BOEING CO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BOEING CO EBITDA is −6.33 B EUR, and current EBITDA margin is −13.46%. See more stats in BOEING CO financial statements.

Like other stocks, BA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BOEING CO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BOEING CO technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BOEING CO stock shows the buy signal. See more of BOEING CO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.