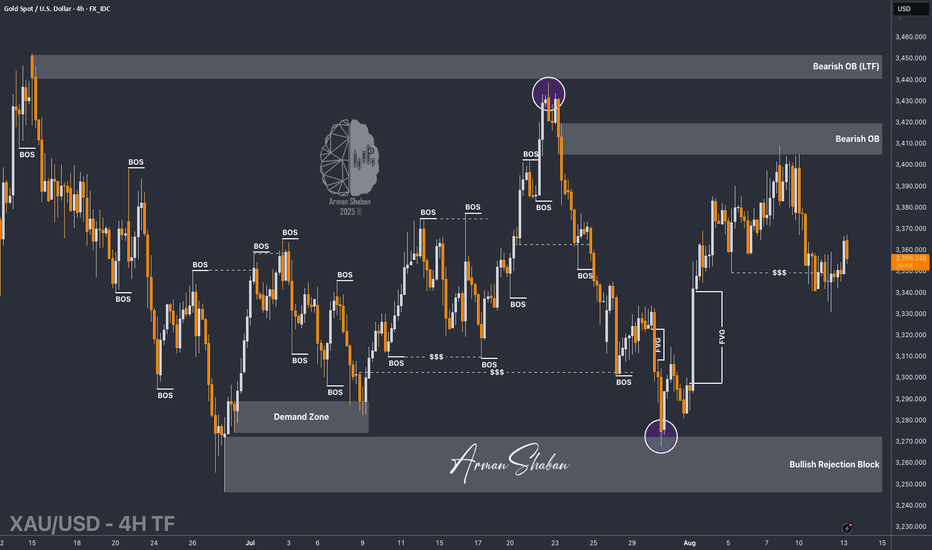

XAU/USD | Bull or Bear? Let's See! (READ THE CAPTION)By analyzing the #Gold chart on the 4-hour timeframe, we can see that after correcting down to the $3331 demand zone, price faced strong buying pressure and is now trading around $3357.

If gold manages to hold below $3367, we could expect a stronger drop, with downside targets at $3342, $3331, and $3323. This scenario will only fail if price holds above $3350, pushes past $3367, and closes above it — in that case, gold may rally back toward levels above $3390.

This analysis will be updated soon — don’t forget to show some support, friends!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

XAUUSD trade ideas

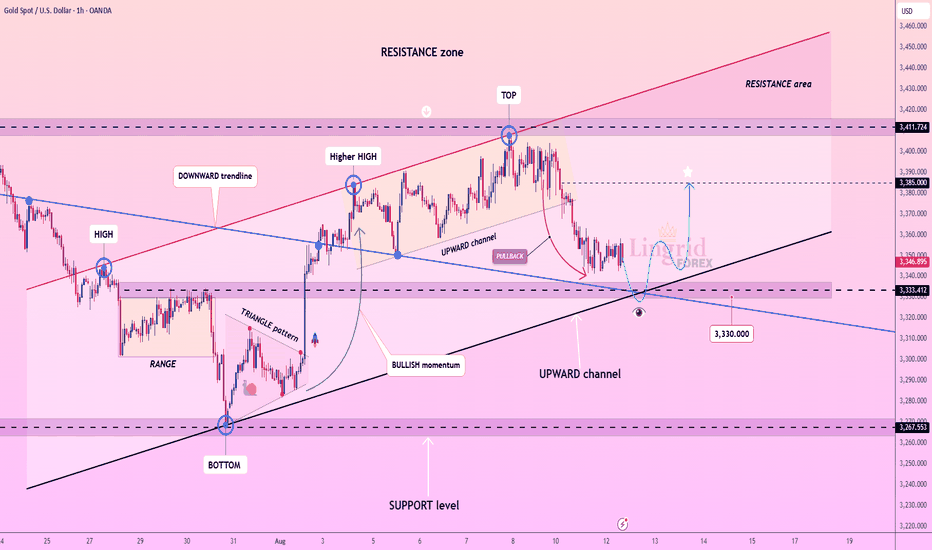

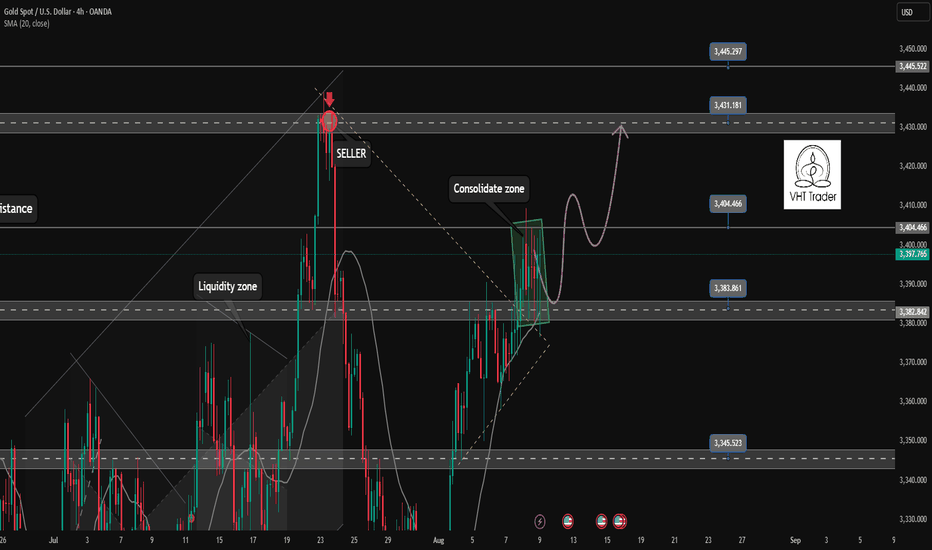

Lingrid | GOLD Anticipating a Trend Continuation Amid PullbackOANDA:XAUUSD is pulling back within the upward channel after topping near the 3,410 resistance zone. Price is currently holding above 3,330 support and aligning with the channel base, signaling potential for a bullish rebound. A push above 3,350 could open the way toward 3,385, while a drop under 3,315 risks deeper correction.

📉 Key Levels

Buy trigger: Break above 3,350

Buy zone: 3,328–3,350

Target: 3,385

Invalidation: Close below 3,320

💡 Risks

Failure to hold upward channel support

Strengthening USD pressuring gold

Sudden macroeconomic news impacting safe-haven demand

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

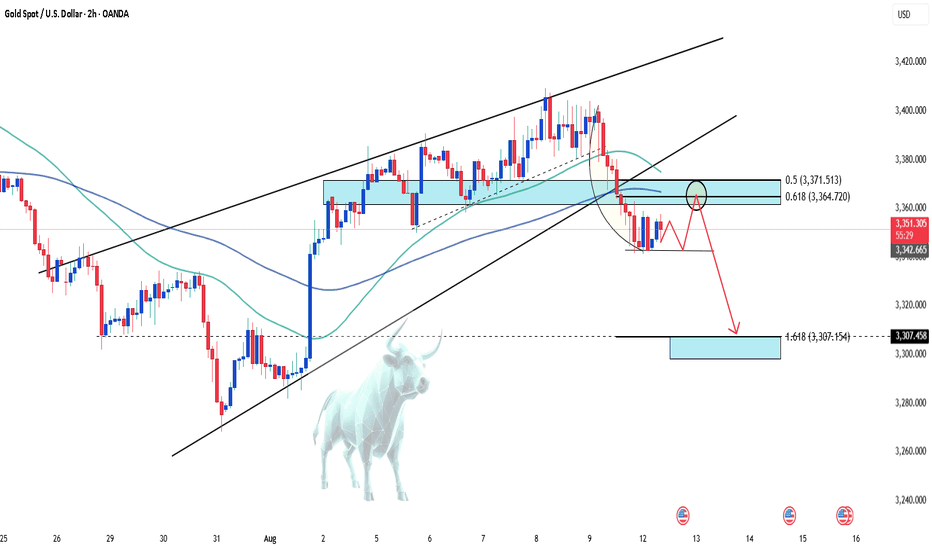

Lingrid | GOLD Key Support Zone In Range-Bound MarketOANDA:XAUUSD is approaching the confluence of the downward trendline and the 3,315 support, forming a potential bullish reversal setup. The structure suggests a base-building phase after the recent correction, aligning with the 61.8% golden zone of the prior swing. A decisive push above 3,340 would confirm momentum toward the 3,400 target. Sustaining this move would keep bulls in control, aiming for a retest of the broader resistance zone.

📉 Key Levels

Buy trigger: Break and close above 3,340

Buy zone: 3,317–3,325

Target: 3,400

Invalidation: Below 3,300

💡 Risks

Failure to break 3,340 resistance could trigger another pullback.

Strong USD data may limit upside potential (PPI, Unemployment data).

Broader downtrend context still in play unless major resistance is breached.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

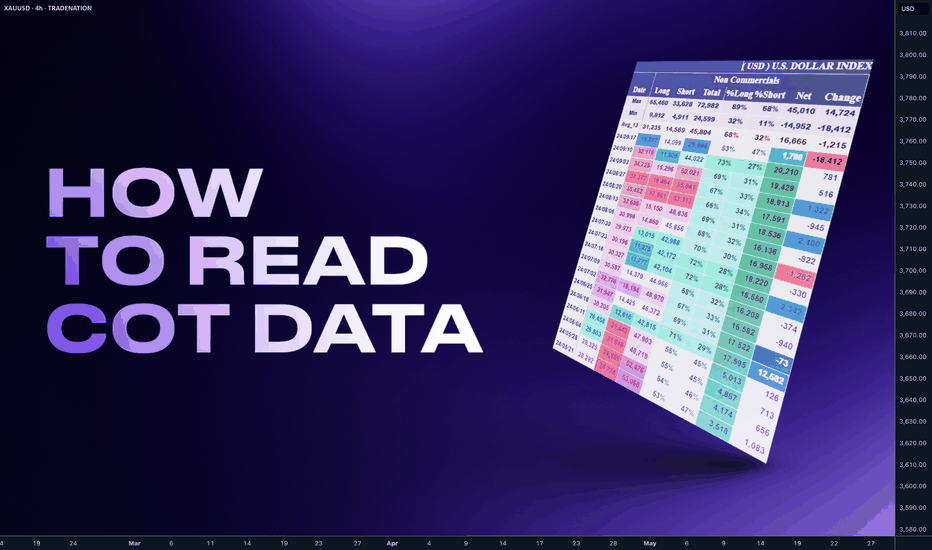

How to Read COT Data: Understanding Big Players’ Order FlowHey whats up traders, today Im going to reveal my COT approach. If you’re serious about finding higher timeframe bias based on what the big players are doing, then COT data is a tool you need to know. It offers unique insights into the positioning of institutional traders—and if read correctly, it can help you align with real market momentum rather than noise.

Before we break it down step-by- step. I want to mention that this is my personal approach. Larry Williams is doing it differently and I have seen some other approaches. This is what works for me, might you find it also usefull.

What Is COT Data?

The Commitment of Traders (COT) report is published every Friday by the CFTC (U.S. Commodity Futures Trading Commission). It shows the open positions of various market participants in the futures markets as of the previous Tuesday.

This data is based on the requirement that large traders must report their positions once they pass a certain threshold. In short, we’re peeking into the order flow of institutions—excluding high-frequency trading and market making noise.

Hope you already recognized small disadvantage to us as retail traders.

Big players report data on Tuesday and it's published on Friday. So we basically have it late and we dont know what has happen in last 3 days. But no worry I will show you my trick how to read between the lines.

COT helps us:

• Understand HTF (Higher Timeframe) bias

• Spot shifts in institutional positioning

• Identify trend continuations or potential reversals

• Avoid getting trapped in retail sentiment traps

It’s not a standalone entry tool, but rather a macro confirmation layer for swing or position trades. Huge advantage by following large players is that they are trading on fundamentals and you dont need to worry about that - you just follow them. But you must follow the right participants, because there is few.

Who Are the Market Participants?

The COT report breaks down traders into several categories. Each one has a different motive and behavior in the market:

1. Commercials

• Think of them as hedgers.

• These are producers, manufacturers, and institutions trying to lock in prices for raw materials or currencies.

• They are usually contrarian at extremes.

When they reach record net long or net short positions, reversals often follow.

2. Non-Commercials (Speculators)

• These are institutional funds, hedge funds, and large speculators.

• Their goal? Profit.

• Often, they follow trends and their positioning reflects the broader market sentiment of the big money.

3. Dealers

• Mostly big banks and institutions facilitating trades.

• They manage risk rather than speculate heavily, so they typically take the opposite side of speculative flows.

4. Leveraged Money

• Hedge funds using high leverage.

• Their positions often reflect short-term speculative behavior.

• Watching their net positioning and changes week-to-week can give clues on momentum exhaustion.

Now you might think which one to follow and Yes you can build your strategy on following any of them fore example

Larry Williams - been trading base on Commercials

Anton Kreil - suggest following Leveraged money

I tried both but for me works best - Non commercials ( Speculators)

Again here you cant say definitely which one is right or wrong. What works for you is right. Thats it.

There are multiple versions of the report, but here are the most commonly used, Im using - ✅ Traders in Financial Futures (TFF)

• Focused on financial markets like forex, bonds, and indexes.

Where to find COT data?

It's free and you can find it on the SEC website there is simple week to week format. As you can see below. Many traders are watching this.

I dont say this is wrong but you dont have complete data - missing big picture.

As you can see here these data below are clearly giving you a picture about an order flow and positioning changedsvn the positions which can confirm trend or help you spot potential reversal you need to watch bigger data sample. Institutions doesnt reverse market in a week, they need to of load positions and I it takes them some time. Which will explain later.

Im collecting the data to the collums. I want see longs, shorts of commercials and from that I calculate. Following

Longs % exposure

Shorts % exposure

Net positions

13 weeks average

Historical Highest positions

Historical Lowest Positions

Relationship between these numbers helps me justify whats going behind the price action, but also spot strong levels. I will show you how to put it together with the context of the charts and then I will show you few order flow patterns examples, it's not difficult but it requires a bit of practice.

Bullish Pattern - Longs growing / Shorts being closed

This is the strongest COT patter and clean sign of buying

This is classing pattern what we have just seen on the EURUSD

Notice how longs has been growing constantly and net positions confirms that.

In may been able to see rapid shorts closing, which and confirmed bullish trend and we can look just for the bullish setups.

Now lets look to the USDJPY chart it will be tricky because it's all red and looks tricky but focus to the numbers and price action, how longs are growing while shorts being closed. Very weak JPY.

Bearish consolidation Shorts being build

Massive shorts being added int he consolidation phase longs doenst move at all. Further big drop coming. This is now happening on the AUDUSD. Look at this tight price consolidation and let's read what is happening. just look at the COT its clean longs around 23K constantly while they are building massive shorts. Whats gonna happens next is clear.

Profit taking move

This ofter occurs when we can see sharp move above the highs but without real longs being added, rather they being closed. As on our example below on the gold. We can see massive profit taking on longs while price was moving up. But they were not been adding shorts. What doest it tell us. They do not want to trade full reversal - not building short position, but market is overheated and they taking profits to buy later for lower or price can go to the consolidation where they will be building short, but definitely its late for us to go long.

Here is another example on USDCHF

Notice longs positions in the moment where there was 46K long and then next week change -12K net. It's a huge change which has started Sell off. But look in to Shorts , there is no heavy shorting, price simply go down based on huge longs profit taking. This is why its important to look in to bigger picture because if you look only in to week to week data. You will still see bigger longs than shorts and it will give you bullish opinion. Hope it's clear. And by the way now we can see 2 weeks with more then +3.4K longs. Its getting bullish IMO.

Now lets look to the another example on the USDCAD

Now we will use one of my past analysis where based on the data I predicted further move. And here I want to mention one thing. Even though we can see COT being bearish. It doesnt mean that price cant go up in short term (can be be 2- 3 weeks) There for you still need to use price action and dont just blindly short, but short run above the highs, because this is where big players add shorts. Not on the lows.

P rice moving up shorts being added - Reversal coming

This is showing positions building for the sell. In this case you can see both growing longs and shorts remember. Big players are hedgers, they are taking longs to move price up so they build shorts. Once they got their positions they close longs and sell of starts.

Lets look to my TV analysis where I have seen shorts grown recently while GBP was moving up close the Monthly Order block , but notice the shorts colum how the shorts were growing recently and also longs dropped from 110K to 100K.

Clena signs of the reversal but again I waited for a pullback above the weekly highs. Click to open a chart bellow

This was a prediction from few week ago. Now let's look how the data looks right now. On the GBPUSD chart below we can see reveal in the data. Long significantly dropped by 50% and shorts increased by 50%. This is a clean reversal pattern in the COT. Look at net positions it clearly flipped to the bearish and big drop is coming.

Few more tips

Remember they know we are watching this data and what we see is what they want us to see, so they are often trying to hide their positions as long as possible. Thats why intra-week reversal are happening on Wednesday after they report their positions.

They cannot hide the data forever, follow the data week by week to keep in track whats happening. It will increase your winning ratio.

Every 3 months there is a new futures contract. The must close the positions and reopen them in to the new contract, They are using it for reversals.

Also some if there is some US holidays on the day when report should be released to the public its delayed to the next week. And thats when they do biggest positions changes secretly.

COT data isn’t a magic crystal ball—but it’s a powerful tool if you know how to combine it with technical analysis. You need to use your mechanical system. It perfectly fits with my CLS strategy and It's suitable for swing traders.

Think outside the box. Even when you see bearish COT - dont be stupid to sell low. It's not NOD order flow for intraday scalping, you have time. But if you something is clearly bearish every run above weekly and daily highs is high probability Sell in the smart money trend.

Dont hesitate to ask any questions and follow. I share COT weekly updates.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

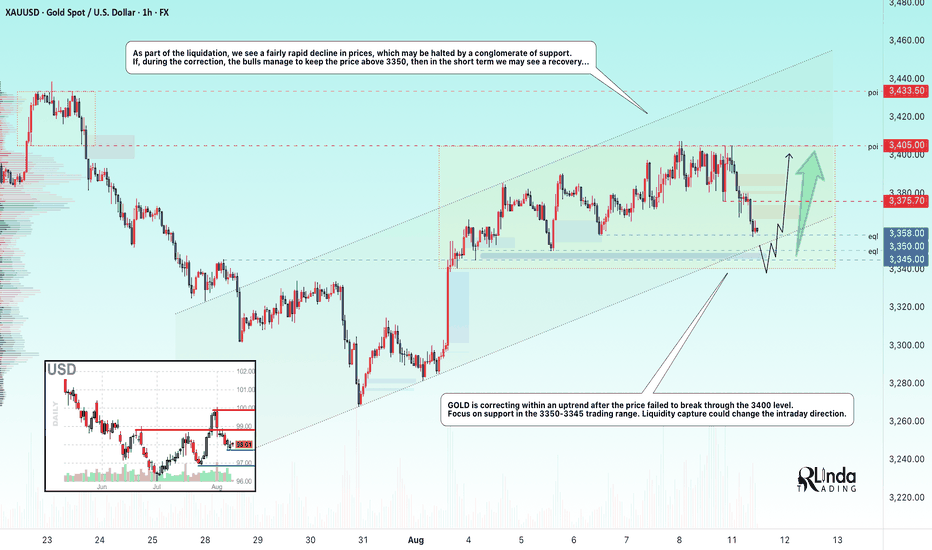

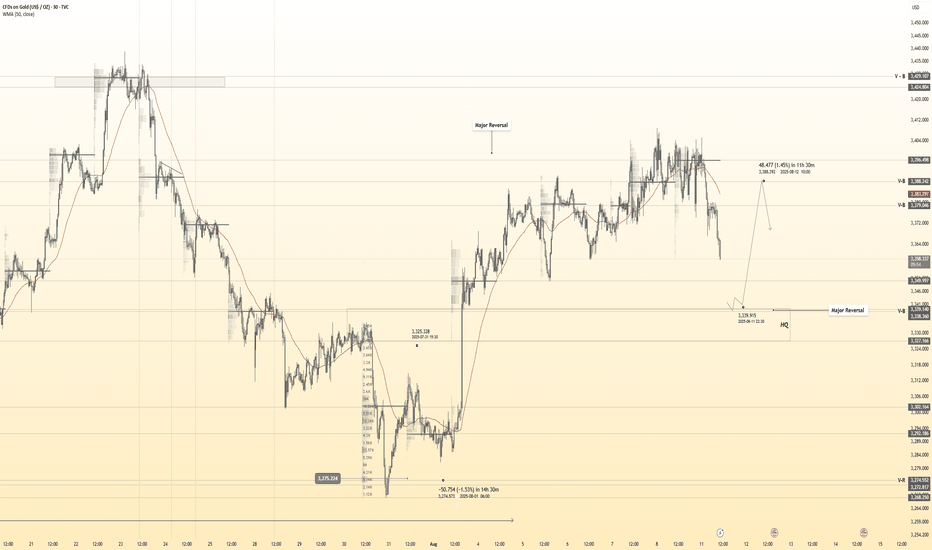

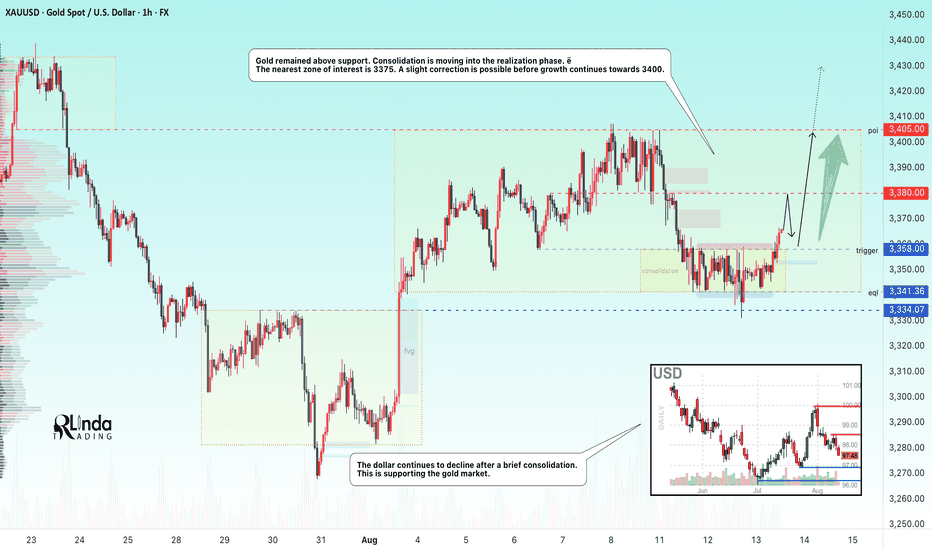

GOLD → Retest of support within an uptrendFX:XAUUSD is forming a liquidation phase as part of the previously mentioned bullish wedge pattern. Bulls were unable to break through the 3400 mark, and due to uncertainty, the price has entered a correction phase...

On Monday, gold fell to $3350, echoing the bearish sentiment in Asian trading, as $3400 remains an unattainable level. The pressure is intensified by weak data from China (PPI −3.6%), profit-taking and expectations for the US inflation report, as well as uncertainty in US-China trade negotiations and microchip policy. Optimism is being held back by expectations of Fed policy easing after negative statistics and forecasts of rate cuts, as well as possible meetings between US and Russian leaders. All this reduces demand for gold as a safe haven asset.

The focus is on the local trading range of 3400-3350. Before a possible rise, the market may test a strong support zone...

Resistance levels: 3376, 3405

Support levels: 3358, 3350, 3345

At the moment, we are seeing a retest of 3358 and a false breakdown, with a fairly weak reaction to the zone. In the short term, gold may test 3350-3345. A false breakdown and the bulls holding the price above this zone could bring the price back up...

Best regards, R. Linda!

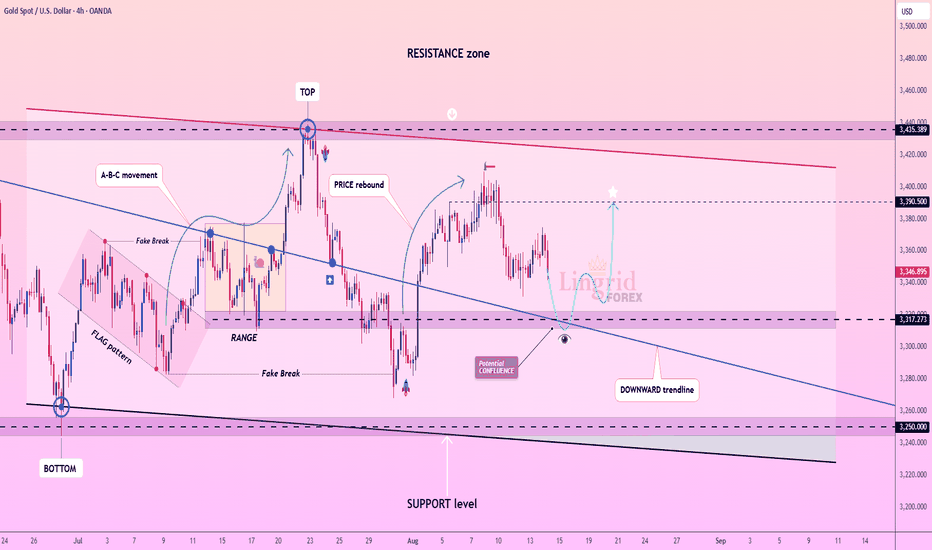

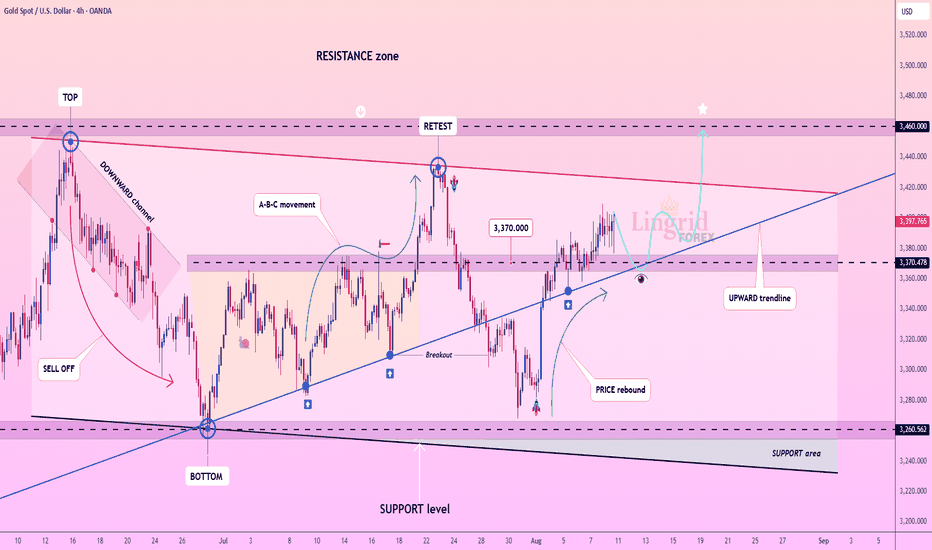

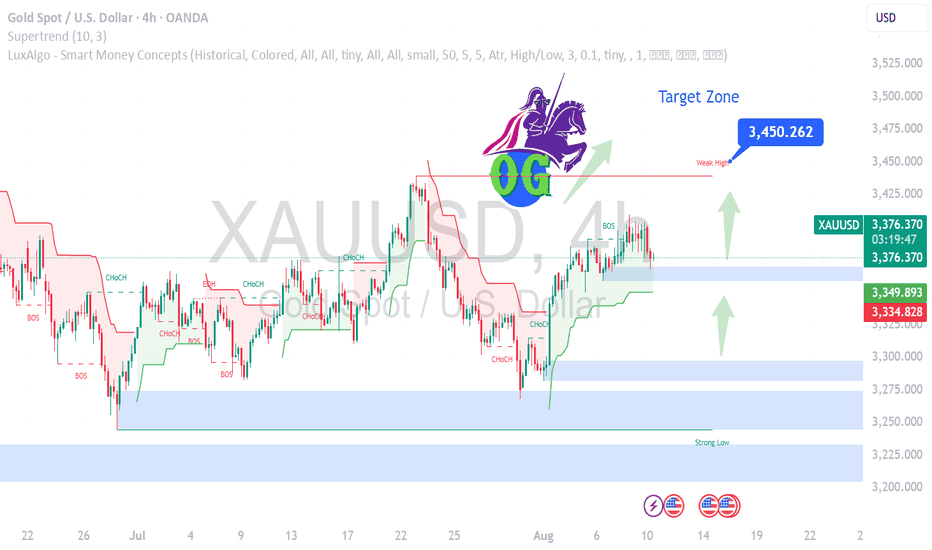

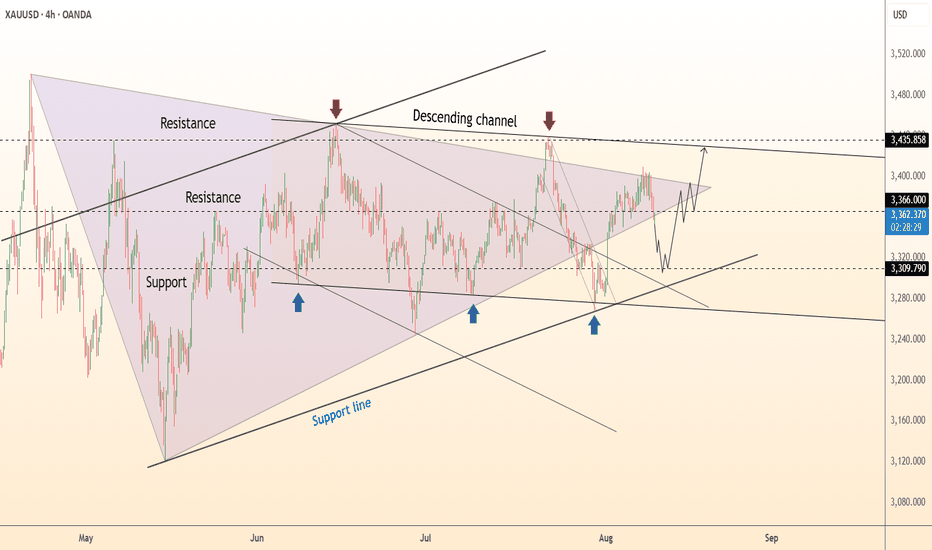

Lingrid | GOLD Weekly Price Outlook: Uptrend AccelerationOANDA:XAUUSD continues attracting significant buying interest as bulls successfully penetrated key resistance levels during the week. The market demonstrates resilience with bulls consistently stepping in during any price declines, suggesting an ongoing upward trajectory ahead.

The 4H timeframe shows gold trading within a defined channel, with price action completing an A-B-C corrective movement before breaking through the downward-sloping resistance trendline. The breach above the $3,370 level signals a potential shift in momentum, with the upward trendline now providing dynamic support. The resistance zone around $3,450-3,460 remains the next critical target.

The longer-term perspective highlights an ascending triangle pattern with multiple tests of the resistance band near $3,450. Gold price has risen approximately 40% from where they stood one year ago, reflecting extraordinary momentum. Each test of resistance has been met with renewed buying pressure, indicating strong underlying demand.

On the long-run price action suggest price could average $3,650 by Q4 2025, with potential for $4,000 by mid-2026. Central banks purchased over 400 metric tons in the first half of 2025, providing fundamental support beneath current technical developments.

The breakout above established resistance, combined with the ascending triangle formation and persistent institutional demand, suggests gold remains positioned for continued strength. We should monitor the $3,370 level as new support, with upside targets extending toward $3,500 and beyond.

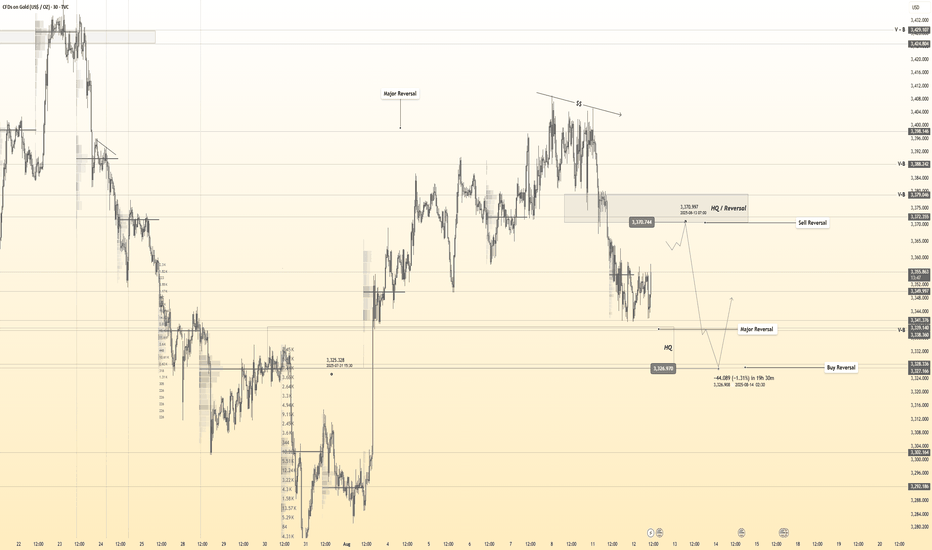

Gold 30Min Engaged ( Buy and sell Reversal Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Reversal - 3329

🩸Bearish Reversal - 3370

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

GOLD NEXT MOVE (expecting a bearish move)(13-08-2025)Go through the analysis carefully and do trade accordingly.

Anup 'BIAS for the day (13-08-2025)

Current price- 3370

"if Price stays below 3382, then next target is 3360, 3350 and 3320 and and above that 3400 ".

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (as geopolitical situation are worsening)

Best of luck

Never risk more than 1% of principal to follow any position.

Support us by liking and sharing the post.

Gold 30Min Engaged ( Bullish Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Reversal - 3340

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

Gold Shines Bright - Strong Buy Zone XAUUSD Buy Setup – Gold is maintaining strong bullish momentum after holding the 3375 support level. Market sentiment remains positive, with buyers stepping in and pushing price higher. As long as price sustains above 3375, the path of least resistance remains to the upside.

The next bullish targets are set at 3425 and 3450, where we expect potential profit-taking. A break and close above 3425 could accelerate momentum toward 3450. Traders should monitor intraday pullbacks for fresh buying opportunities, keeping stop-losses below the support zone to protect capital.

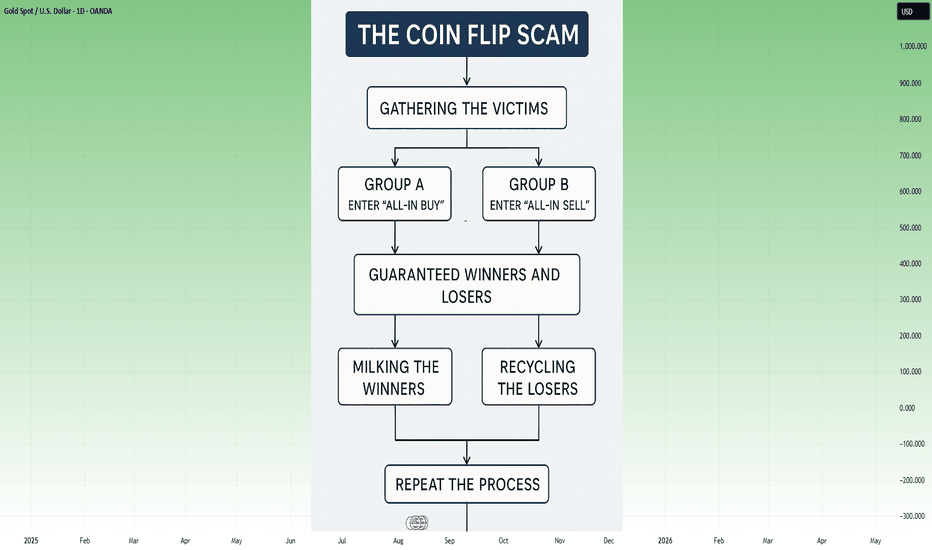

The 50/50 Account Management Scam- How it WorksFrom Cold Calling to Telegram

I’ve been in the markets for so long I feel like a dinosaur, and I’ve probably seen every scam out there.

The truth is, none of them are really new — they’re just adapted to the new social paradigm.

What was done in the 2000s through cold calling is now done through Telegram, Instagram, X, and other social platforms.

I didn’t really want to write this article, in case it gave someone ideas.

But since anyone who wants to be a scammer already knows how it works, maybe this article can warn those who still have no idea how the so-called account management scam operates — especially its most common form: the coin flip scam (50/50 scam, Opposite trades scam, Split-direction scam, Two-group margin call trick, as is also known)

Step-by-Step: How the Coin Flip Scam Works

1. Gathering the victims

The scammer starts by fishing for victims through Telegram channels/groups, Instagram profiles, Facebook groups, or even X posts.

They present fabulous profits, post ads with guaranteed return offers, and flood the feed with so-called “proofs” — screenshots of winning trades, client testimonials, and account statements. Most of these are either fabricated or selectively chosen to show only the winning side.

Once someone shows interest, the scammer’s first move is to earn their trust.

They’ll tell you the broker doesn’t matter, that you can choose it, and that they have no access to your money — which is, technically, true.

Then comes the closer:

“You don’t have to pay me upfront. I only get paid if I make you money, so it’s in my best interest not to lose. You see? We’re on the same side.”

This combination of flashy results and “risk-free” terms makes you feel safe enough to hand them trading access.

________________________________________

2. Splitting into two groups

The accounts are divided into two equal batches:

• Group A → All-in BUY

• Group B → All-in SELL

With high leverage (e.g., 1:200), a 50-pip move means either doubling the account or wiping it out completely.

Note: I won’t go too deep into the details here, because the exact margin call level depends on the broker. But trust me, it’s easy for a scammer to plan the money split based on the different brokers’ rules. What we’re talking about here is just the general principle.

________________________________________

3. Guaranteed winners and losers

The market moves.

One group hits margin call and loses, while the other doubles or triples its capital (depending on broker's leverage, even more on 1:500).

The scammer now has perfect marketing material: “Look how I doubled my client’s account!”

________________________________________

4. Milking the winners

Clients who made a profit are celebrated and told something like:

“I only worked with low capital this time just to show you I can do it. I have big clients and serious strategies — now that you’ve seen the proof, deposit more so we can make real money.”

The scammer frames the initial gain as a “demo run” to gain the client’s confidence, pushing them to commit much larger sums next.

________________________________________

5. Recycling the losers

The wiped-out clients are told:

“It was an unusual market move. Deposit another $1,000 and we’ll recover it tomorrow.”

Some quit, but others fall for it again.

________________________________________

6. Repeat the process

The cycle continues. There’s always a “happy” group and real account statements to attract fresh victims, while the losers are quietly discarded or convinced to reinvest.

________________________________________

Why the scam works

• The proof are authentic – Screenshots and MT4/MT5 statements for the winners are real.

• Survivorship bias – Prospects only see the successes, never the failures.

• Hope psychology – Losers believe “next time” will be different (and it can be if they end up in the "winner group" next time

________________________________________

Final word

If someone promises to double your account quickly and safely — walk away.

Real trading is about risk management and long-term consistency, not betting your capital on a 50/50 gamble.

Don’t be the next screenshot in a scammer’s sales pitch. 🚀

P.S.

Stop believing they “made you money on purpose” at the beginning and then “lost it on purpose” after you deposited more.

If they truly had the skill to do that, they wouldn’t need to be scammers in the first place.

The reality is simple — once you put in more money, you just happened to land on the losing side of their scam.

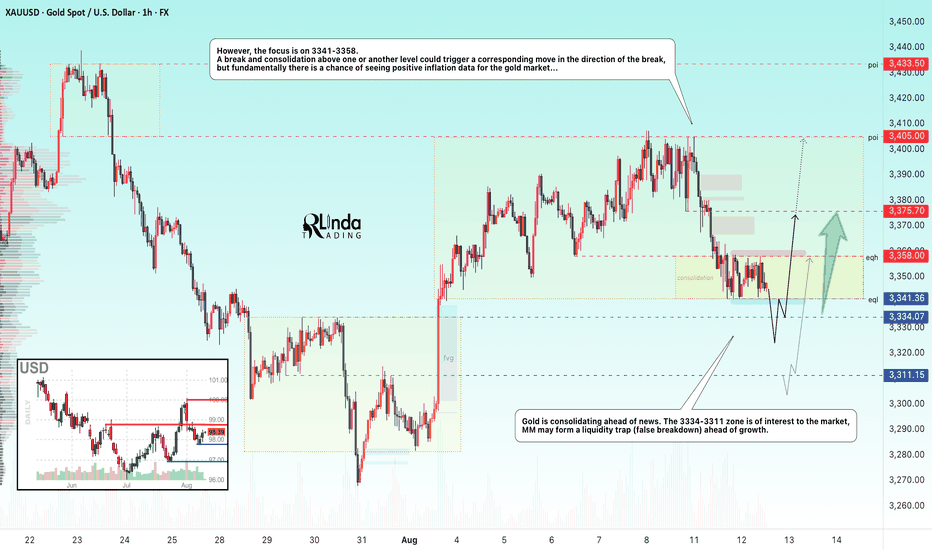

GOLD → Consolidation ahead of CPI data...FX:XAUUSD is consolidating ahead of news. Inflation is on the horizon, and further developments for the dollar and gold will depend on the data. Globally, gold is in a bullish trend, but locally we are seeing a correction...

Gold is rebounding slightly from $3,341 ahead of US CPI data for July and against the backdrop of the extension of the US-China trade truce until November. Investors are assessing the prospects for a Fed rate cut, expecting inflation to remain within 2.8% (core inflation is 3%). Weaker-than-expected data could cause the dollar to fall and support gold, while stronger data could resume the downward trend.

Technically, on D1-H4, gold is consolidating in a symmetrical triangle pattern and the price is in the support zone. There is a possibility that Trump may not make a mistake with inflation data, as he did with employment data...

Support levels: 3341, 3334, 3311

Resistance levels: 3358, 3375, 3405

The 3335-3310 zone attracts MM with an open FVG, which the market may partially close, forming a liquidity trap before continuing growth. However, it is also worth watching the boundaries of the current local consolidation, as a breakout of one or the other boundary could trigger a strong impulse.

Best regards, R. Linda!

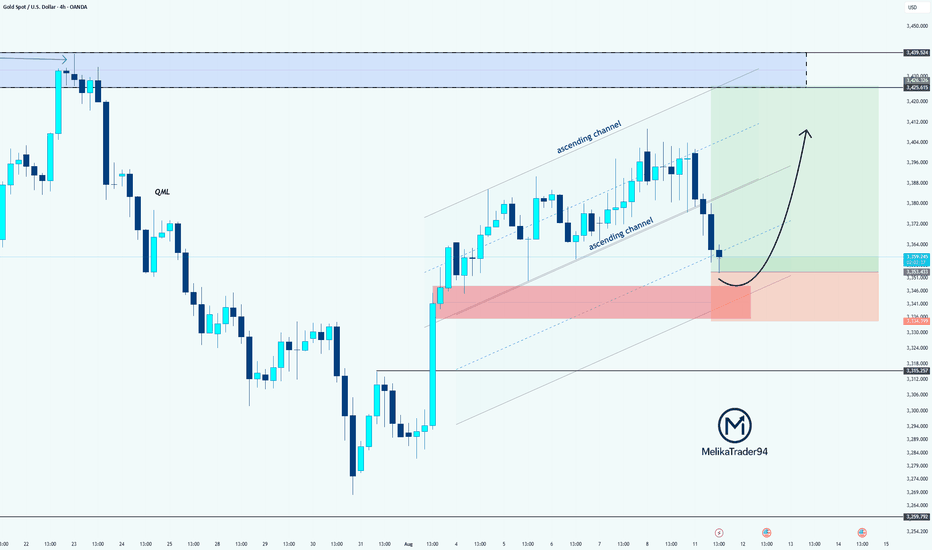

xauusd (GOLD): a signal Hi guys!

Key Technical Points:

Ascending Channel:

Price action has been moving within a well-defined ascending channel.

Currently, the price has pulled back and is approaching the lower boundary of this channel.

This lower boundary often acts as a support area where buyers might step in.

Support Zone (Red Box):

The red highlighted area, around $ 3,340-$ 3,350 USD, is a key support zone.

This zone aligns w ith the lower boundary of the channel , adding more weight to the support.

Price is currently testing this area, which could act as a springboard for the next upward move.

Resistance Zone (Blue Box):

The upper resistance zone between roughly 3,425 and 3,440 USD is a major target for bulls.

This is a previous high area where sellers might re-enter the market.

-------------------------------------------------------

Trade Idea:

Long Position:

Entry could be considered near the lower boundary of the channel and the red support zone (around 3,340-3,350 USD).

Stop loss placement: Just below the red support zone to limit downside risk.

Target: The upper resistance zone at around 3,425-3,440 USD.

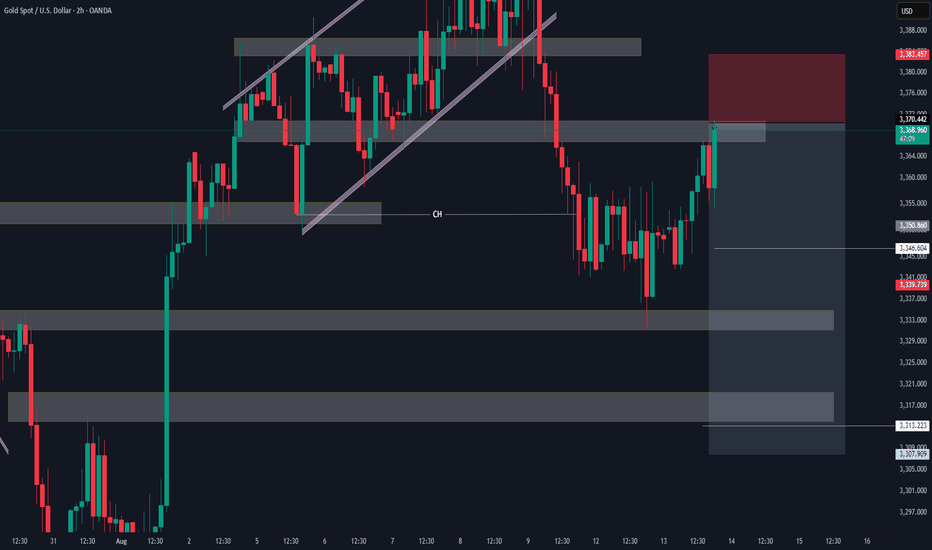

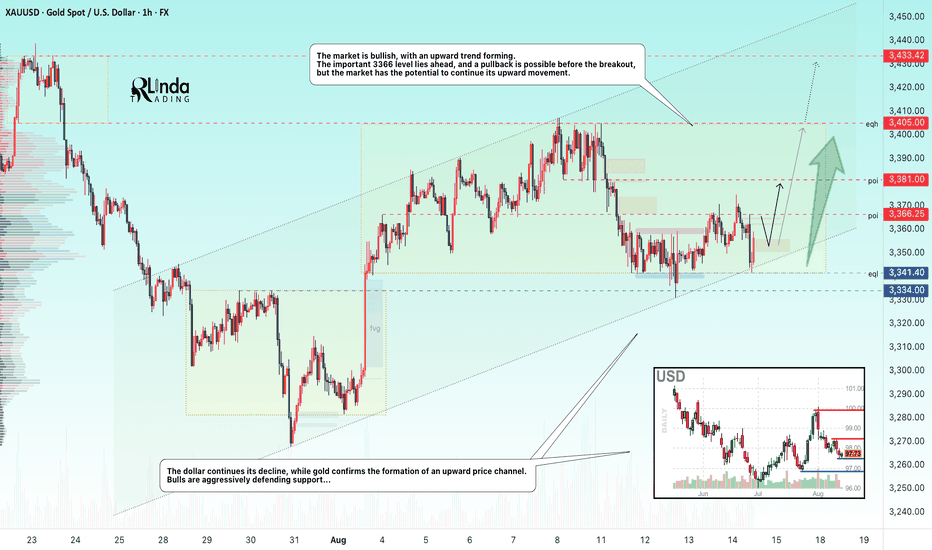

GOLD → Consolidation ahead of potential growth. PPI ahead...FX:XAUUSD is still consolidating, with the range expanding. The price has confirmed the formation of an upward price channel, which bulls are defending quite aggressively...

Gold remains in positive territory for the third day in a row and is consolidating above $3,350 in Asian trading, awaiting PPI data and jobless claims in the US. Moderate CPI and weak labor market statistics have reinforced expectations of a Fed rate cut in September, with some experts forecasting -50 bps. The dollar remains at a two-week low amid dovish comments and rumors of a possible change in the Fed chair, which supports demand for gold. Weak PPI data could accelerate the rise in metal prices, although market attention is gradually shifting to the meeting between Trump and Putin on Ukraine.

Technically, the focus is on the 3366-3340 range. A small correction may form from resistance before breaking the 3366 level and continuing to rise within the trend...

Resistance levels: 3366, 3381, 3400

Support levels: 3341, 3334

Before rising, the market may test the trend support or form a false breakdown. But there is a possibility that the price will immediately start storming 3366 for further growth. But, again, further developments depend on economic data, which will most likely be controlled by Trump after the NFP mistake...

Best regards, R. Linda!

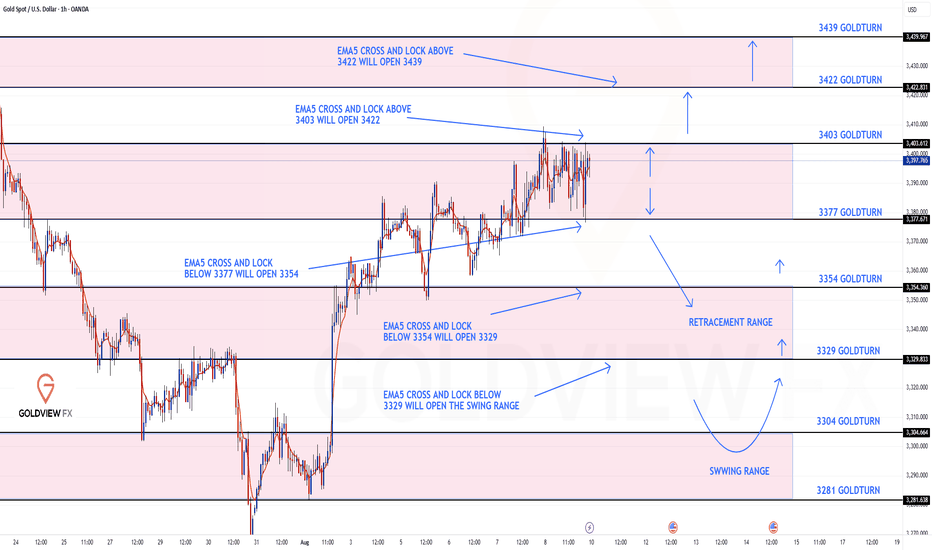

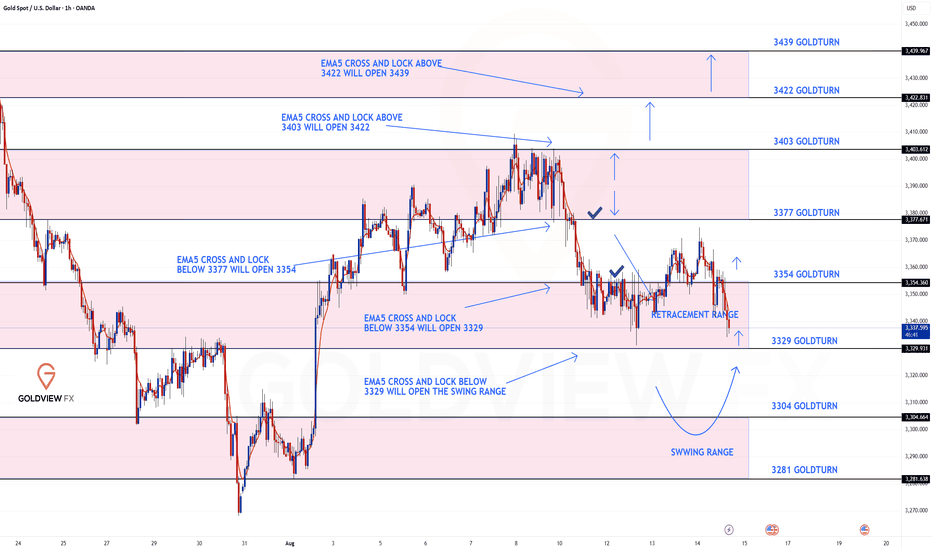

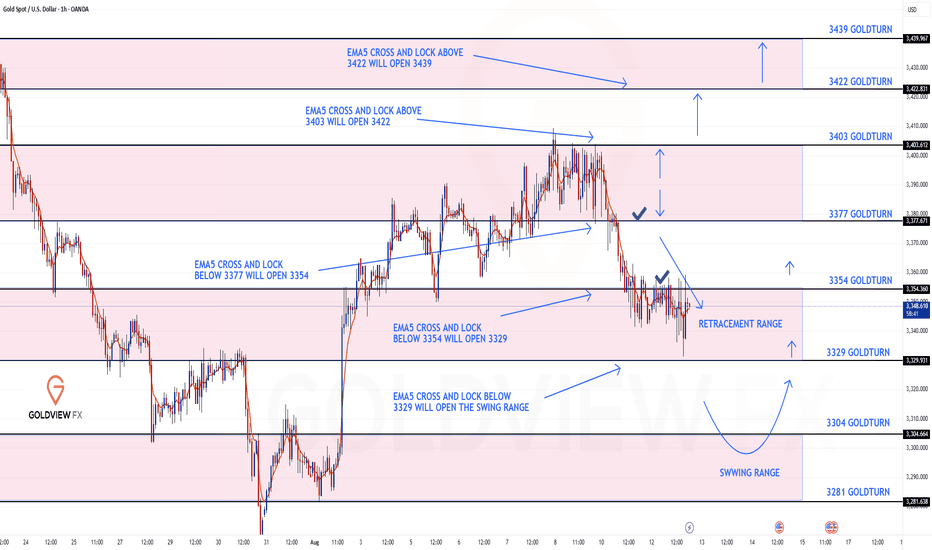

GOLD 1H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3403 and a gap below at 3377. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3403

EMA5 CROSS AND LOCK ABOVE 3403 WILL OPEN THE FOLLOWING BULLISH TARGETS

3422

EMA5 CROSS AND LOCK ABOVE 3422 WILL OPEN THE FOLLOWING BULLISH TARGET

3439

BEARISH TARGETS

3377

EMA5 CROSS AND LOCK BELOW 3377 WILL OPEN THE FOLLOWING BEARISH TARGET

3354

EMA5 CROSS AND LOCK BELOW 3354 WILL OPEN THE FOLLOWING BEARISH TARGET

3329

EMA5 CROSS AND LOCK BELOW 3329 WILL OPEN THE SWING RANGE

3304

3281

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

DeGRAM | GOLD rebound from the support line📊 Technical Analysis

● XAUUSD is consolidating within a narrowing wedge, holding above the 3,309–3,320 support zone while repeatedly testing the upper boundary.

● A breakout above 3,366 would confirm bullish momentum toward 3,435, with dips likely finding buyers at mid-channel support.

💡 Fundamental Analysis

● Softer US PPI data and declining Treasury yields have renewed interest in non-yielding assets like gold.

● Rising central bank gold purchases in July strengthen medium-term demand prospects.

✨ Summary

Buy above 3,366; target 3,435. Setup remains valid while holding above 3,309.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

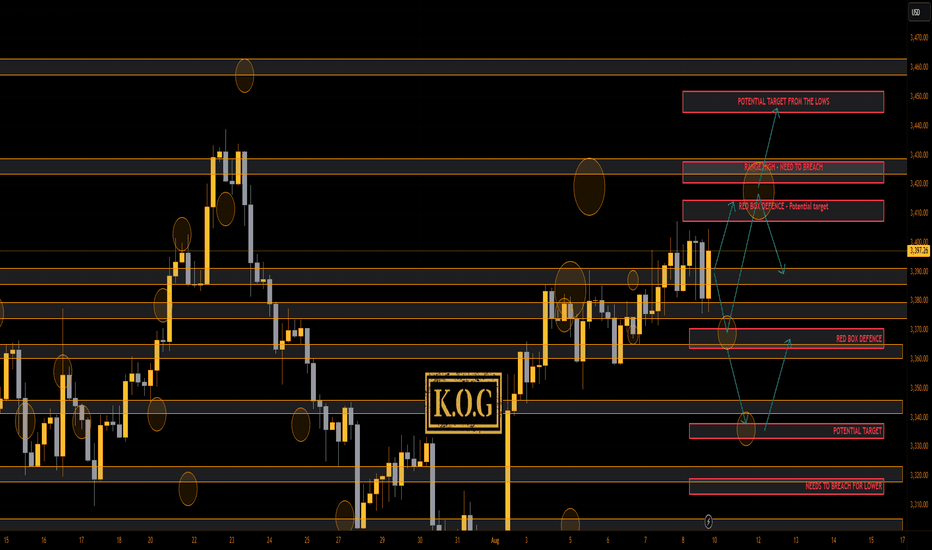

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we shared the NFP chart and the KOG Report chart for the wider community. We said we would be looking for price to support below at the red box and then push upside into the higher levels and the red box targets. We also suggested the shorting region and the target level for that trade which as you can see worked well playing level to level, point to point. We also completed all of our target levels without the breach and even though it was choppy, we completed numerous Excalibur targets in Camelot.

A decent week not only on Gold but also the other pairs we trade an analyse.

So, what can we expect in the week ahead?

I have indications of higher pricing, however, how low can the take it before they then attempt higher? For that reason, let’s stick with the 4H as this the most effective for our strategy and analysis and lets look at the key levels!

We have the level above 3408-11 which is a reasonable target for this move, but there is red box defence there which will need to be attempted and broken to go higher. If we resist at that level with extension level 3430-5, there is a chance we can correct the move all the way back down into the 3350-40 levels before we again get an opportunity to capture that long trade!

We have no news tomorrow so again, more of a chop and ranging price action is on the cards, with the support level being 3375-70 for the Asian session and resistance being the 3408-11 level. My Red box indi’s are stretched, my daily liquidity indicator is stretched, so I would say please play caution on the markets as they are extremely fragile at the moment.

KOG’s Bias for the week:

Bullish above 3365 with targets above 3408, 3410, 3415 and above that 3420

Bearish below 3365 with targets below 3359, 3355, 3350 and below that 3345

RED BOX TARGETS: (You can see how effective these are so please make use of these together with the analysis and bias we share. It all goes together, without PRICE ACTION knowledge you only have hope)

Break above 3406 for 3407, 3410, 3420, 3429, 3430 and 3435 in extension of the move

Break below 3395 for 3393, 3385, 3380 and 3370 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

GOLD → From consolidation to distribution. Target 3400FX:XAUUSD is entering a distribution phase after the end of consolidation. The market is strong, bulls managed to keep prices from falling and formed an intermediate bottom in the 3340 zone.

The price increase was supported by expectations of a soft Fed policy after moderate July CPI data (2.7% y/y, 0.2% m/m, core 0.3%), which led to a decline in bond yields and a weakening of the dollar. However, demand for safe assets is declining amid optimism in global markets, fueled by the US-China trade truce, a possible meeting between Trump and Putin, and bets on a Fed rate cut in September. In the long term, gold could be supported by purchases by the Chinese central bank and a recovery in jewelry demand in India.

Technically, the focus is on the zone of interest ahead at 3370-3373, with a possible rebound before growth, as well as on the support zone at 3359. I do not rule out that the market may test the liquidity zone...

Resistance levels: 3370, 3380, 3400

Support levels: 3358, 3341, 3334

There is considerable potential within the consolidation, and the rally may be directed towards the resistance range of 3400. However, pullbacks are possible before growth, which could give us a good entry point.

Best regards, R. Linda!

XAUUSD - Drowning in RedHello everyone, what do you think about OANDA:XAUUSD ?

The other day, we discussed the movement of gold within the wedge pattern and the potential for it to test the 3350 USD support before bouncing back. That target was met, however, the sharp and sudden decline caused gold to lose its momentum momentarily.

Yesterday, gold dropped straight from 3398 USD to 3342 USD, a loss of more than 55 USD in less than a single session. The drop on Monday pushed the price of gold below a critical level. Moreover, the oscillators on the chart above are showing a bearish trend, supporting the scenario of further price decline.

The current support level is at 3350 USD, and price movement is following the Dow Theory. However, a convincing break below this level would act as a new trigger for bearish traders, potentially accelerating the decline towards the intermediate support at 3,315 USD, and then heading towards the round figure of 3,300 USD.

Do you think XAUUSD can bounce back from the 3350 USD support level? Feel free to share your thoughts!

GOLD ROUTE MAP UPDATEHey Everyone,

We are still seeing price action within the retracement range. The full gap below at 3329 remains open from the previous cross-and-lock, and we now have another cross-and-lock confirming this.

We expect a bounce at this level unless we see a further cross-and-lock below 3329, which would open the swing range. Until then, we also expect this level to provide a reaction.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3403

EMA5 CROSS AND LOCK ABOVE 3403 WILL OPEN THE FOLLOWING BULLISH TARGETS

3422

EMA5 CROSS AND LOCK ABOVE 3422 WILL OPEN THE FOLLOWING BULLISH TARGET

3439

BEARISH TARGETS

3377 - DONE

EMA5 CROSS AND LOCK BELOW 3377 WILL OPEN THE FOLLOWING BEARISH TARGET

3354 - DONE

EMA5 CROSS AND LOCK BELOW 3354 WILL OPEN THE FOLLOWING BEARISH TARGET

3329

EMA5 CROSS AND LOCK BELOW 3329 WILL OPEN THE SWING RANGE

3304

3281

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Waiting for new confirmation after 6th day of accumulation✏️Last weekend with a trading day in the accumulation range. Early this week waiting for new momentum to break the accumulation range from 3385 and 3405 to trade on the winning side. When breaking the lower range, a corrective wave will be formed and then create increasing waves to ATH. If breaking the upper range of the accumulation model, buying force can completely push the gold price to approach ATH around 3445 soon.

📉 Key Levels

Support: 3383-3345

Resistance: 3404-3431-3445

BUY Trigger: Price rejection of the candle around support 3383

BUY Trigger: Break resistance 3405

Target 3445

SELL trigger Break and trading bellow 3383

Target 3345

Leave your comments on the idea. I am happy to read your views.

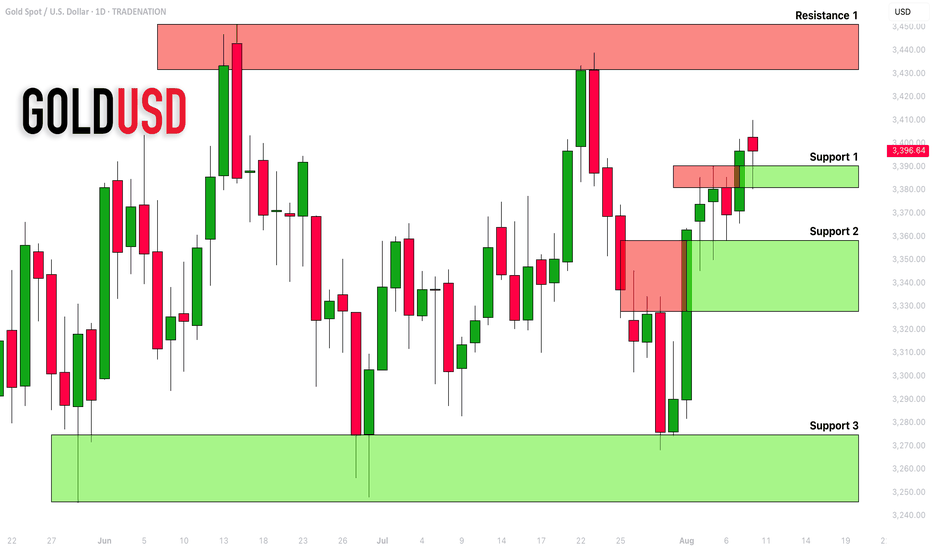

GOLD (XAUUSD): Support & Resistance Analysis For Next Week

Here is my latest support & resistance analysis for Gold

Support 1: 3380 - 3390 area

Support 2: 3327 - 3358 area

Support 3: 3246 - 3275 area

Resistance 1: 3431 - 3450 area

With a high probability, the market will continue rising to Resistance 1.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD ROUTE MAP UPDATEHey everyone,

Following up on yesterday’s update for our 1H chart route map:

The key retracement range continued to provide support, and we saw the reactionary bounce we expected.

Right now, we’re range-bound between 3329 and 3354.

As long as 3329 holds, we can expect continued bounces, tracking the movement upward.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3403

EMA5 CROSS AND LOCK ABOVE 3403 WILL OPEN THE FOLLOWING BULLISH TARGETS

3422

EMA5 CROSS AND LOCK ABOVE 3422 WILL OPEN THE FOLLOWING BULLISH TARGET

3439

BEARISH TARGETS

3377 - DONE

EMA5 CROSS AND LOCK BELOW 3377 WILL OPEN THE FOLLOWING BEARISH TARGET

3354 - DONE

EMA5 CROSS AND LOCK BELOW 3354 WILL OPEN THE FOLLOWING BEARISH TARGET

3329

EMA5 CROSS AND LOCK BELOW 3329 WILL OPEN THE SWING RANGE

3304

3281

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX