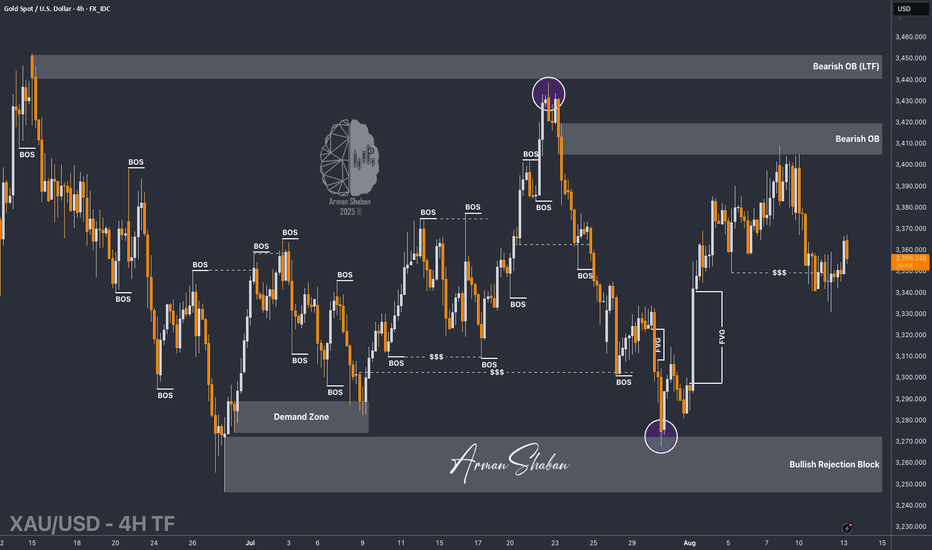

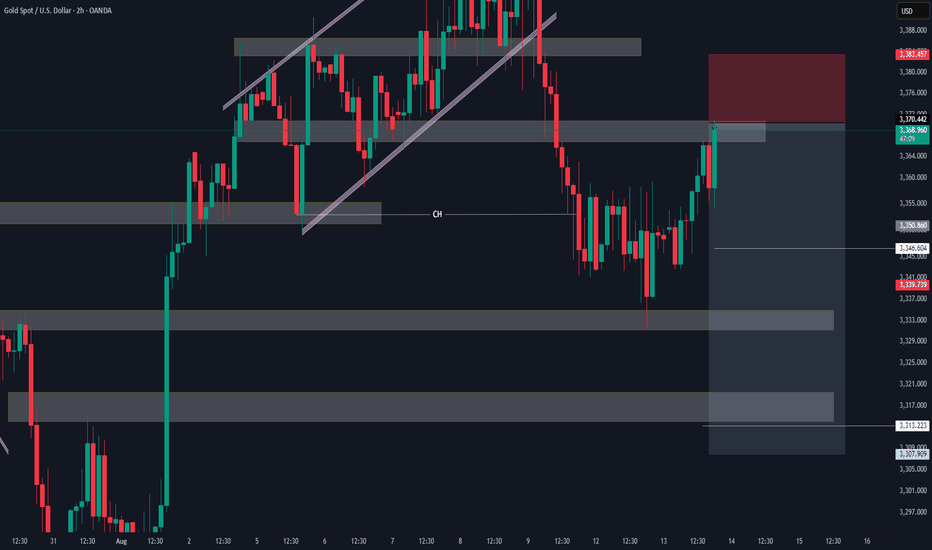

XAU/USD | Bull or Bear? Let's See! (READ THE CAPTION)By analyzing the #Gold chart on the 4-hour timeframe, we can see that after correcting down to the $3331 demand zone, price faced strong buying pressure and is now trading around $3357.

If gold manages to hold below $3367, we could expect a stronger drop, with downside targets at $3342, $3331, and

About Gold Spot / U.S. Dollar

Gold price is widely followed in financial markets around the world. Gold was the basis of economic capitalism for hundreds of years until the repeal of the Gold standard, which led to the expansion of a flat currency system in which paper money doesn't have an implied backing with any physical form of monetization. AU is the code for Gold on the Periodic table of elements, and the price above is Gold quoted in US Dollars, which is the common yardstick for measuring the value of Gold across the world.

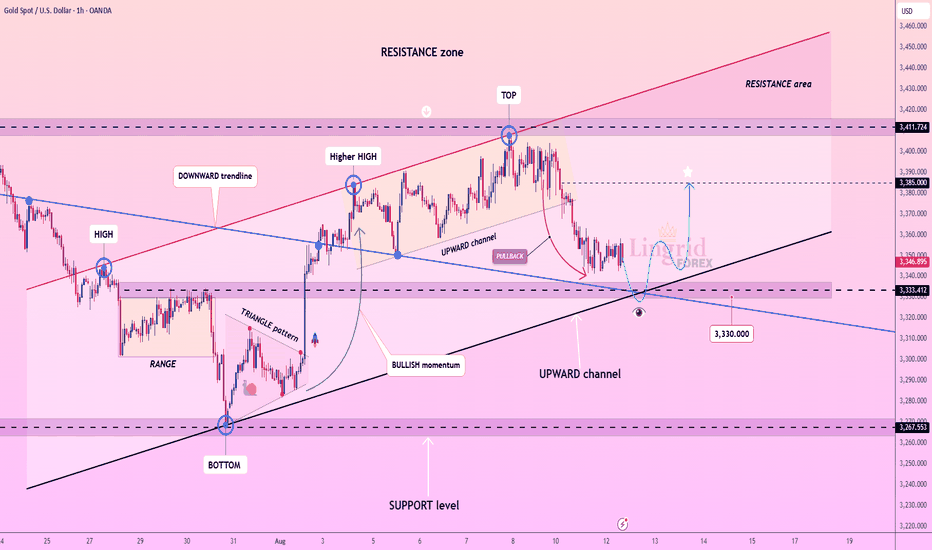

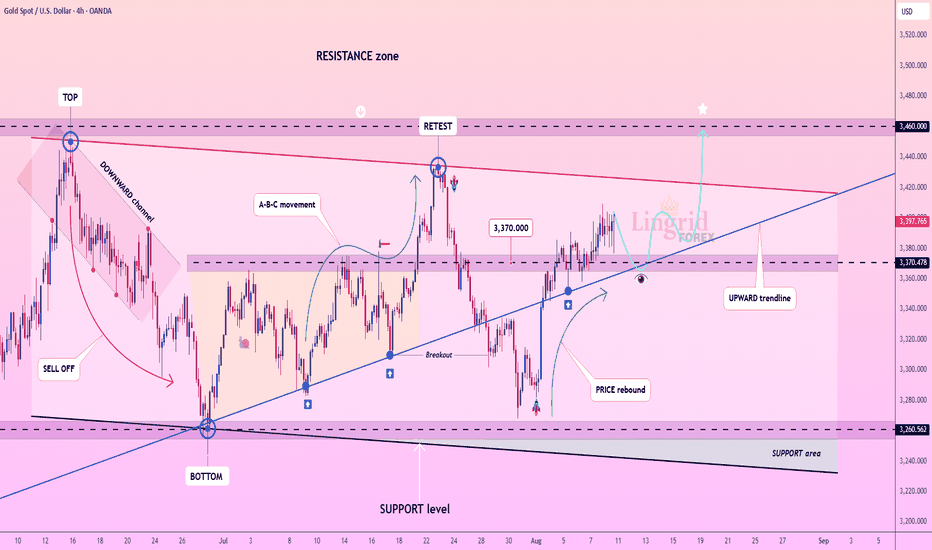

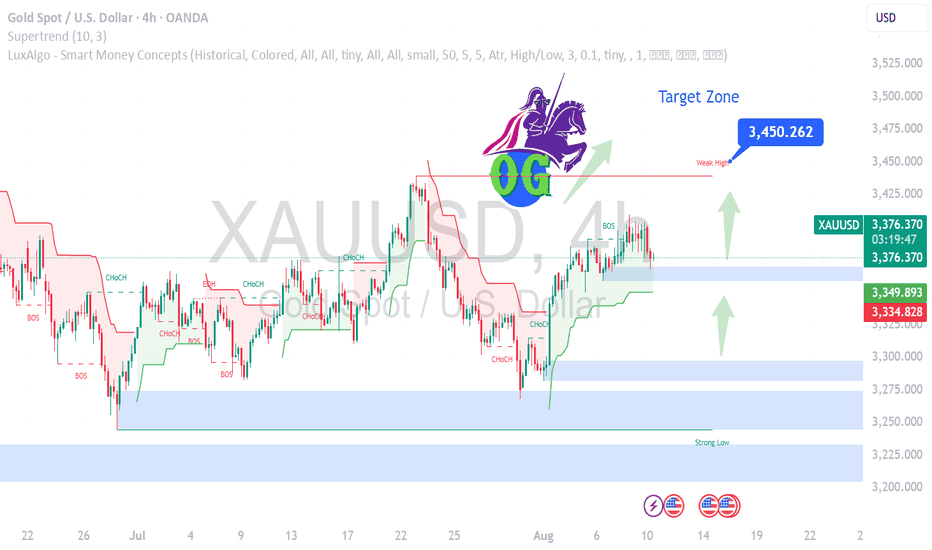

Lingrid | GOLD Anticipating a Trend Continuation Amid PullbackOANDA:XAUUSD is pulling back within the upward channel after topping near the 3,410 resistance zone. Price is currently holding above 3,330 support and aligning with the channel base, signaling potential for a bullish rebound. A push above 3,350 could open the way toward 3,385, while a drop under 3

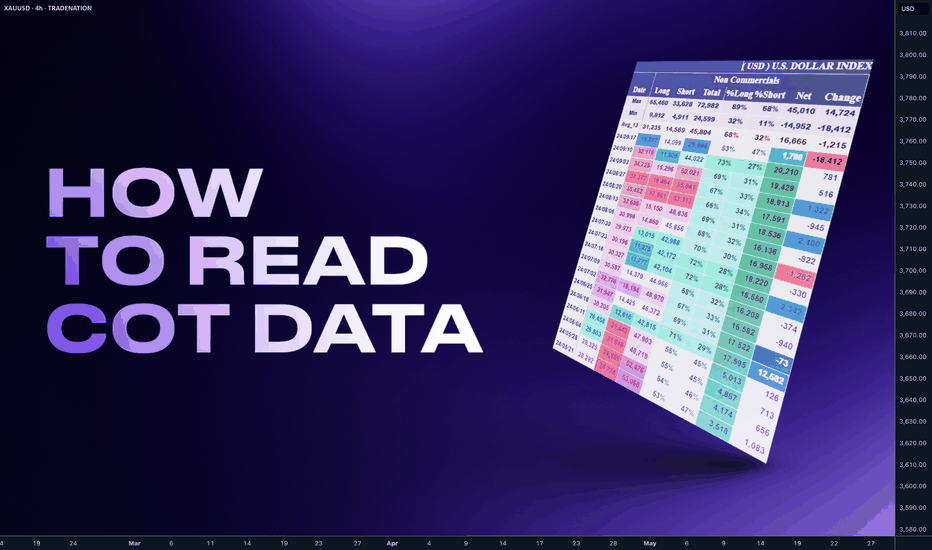

How to Read COT Data: Understanding Big Players’ Order FlowHey whats up traders, today Im going to reveal my COT approach. If you’re serious about finding higher timeframe bias based on what the big players are doing, then COT data is a tool you need to know. It offers unique insights into the positioning of institutional traders—and if read correctly, it c

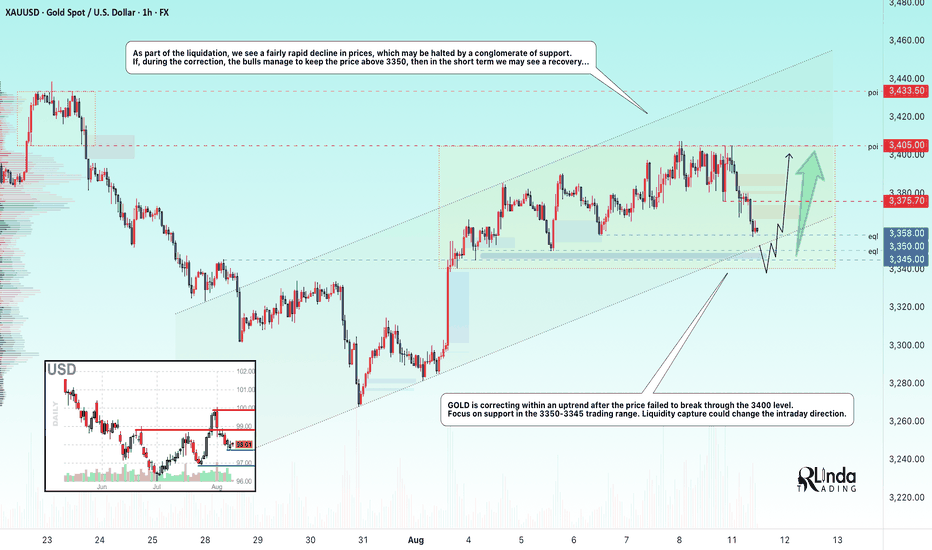

GOLD → Retest of support within an uptrendFX:XAUUSD is forming a liquidation phase as part of the previously mentioned bullish wedge pattern. Bulls were unable to break through the 3400 mark, and due to uncertainty, the price has entered a correction phase...

On Monday, gold fell to $3350, echoing the bearish sentiment in Asian tradin

Lingrid | GOLD Weekly Price Outlook: Uptrend AccelerationOANDA:XAUUSD continues attracting significant buying interest as bulls successfully penetrated key resistance levels during the week. The market demonstrates resilience with bulls consistently stepping in during any price declines, suggesting an ongoing upward trajectory ahead.

The 4H timeframe sh

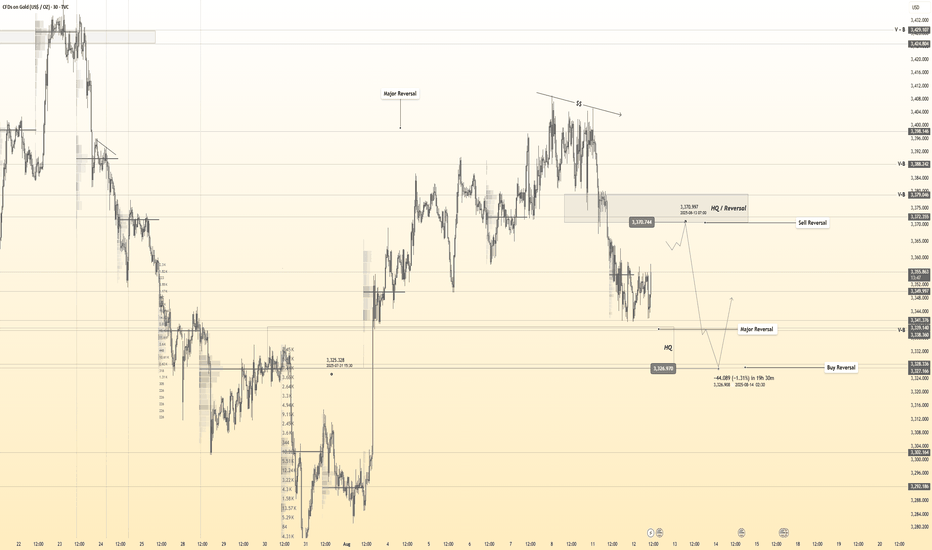

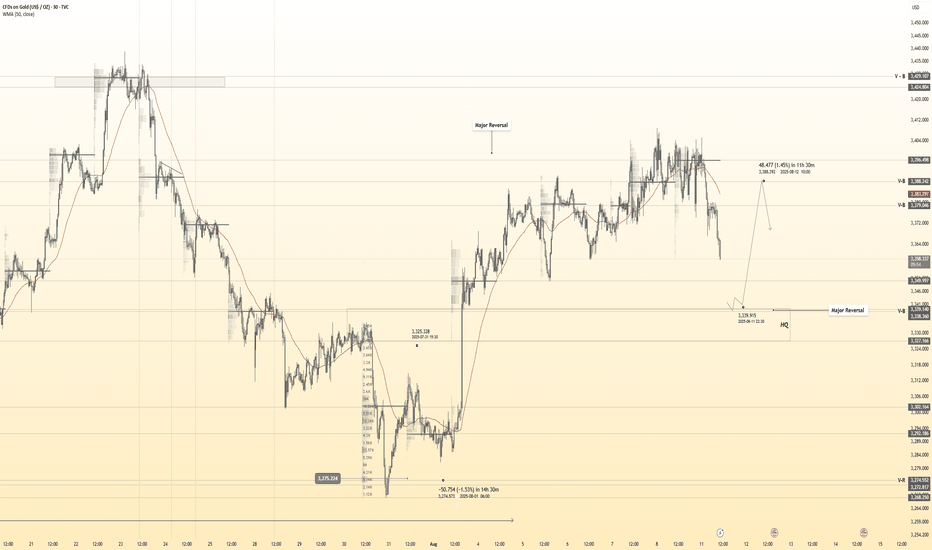

Gold 30Min Engaged ( Buy and sell Reversal Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Reversal - 3329

🩸Bearish Reversal - 3370

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved si

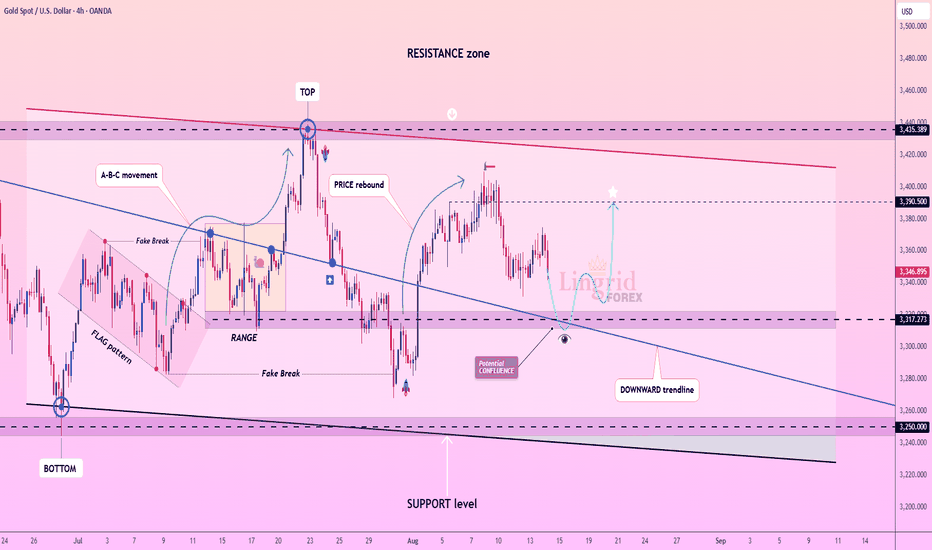

Lingrid | GOLD Key Support Zone In Range-Bound MarketOANDA:XAUUSD is approaching the confluence of the downward trendline and the 3,315 support, forming a potential bullish reversal setup. The structure suggests a base-building phase after the recent correction, aligning with the 61.8% golden zone of the prior swing. A decisive push above 3,340 would

GOLD NEXT MOVE (expecting a bearish move)(13-08-2025)Go through the analysis carefully and do trade accordingly.

Anup 'BIAS for the day (13-08-2025)

Current price- 3370

"if Price stays below 3382, then next target is 3360, 3350 and 3320 and and above that 3400 ".

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (

Gold 30Min Engaged ( Bullish Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Reversal - 3340

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising bene

Gold Shines Bright - Strong Buy Zone XAUUSD Buy Setup – Gold is maintaining strong bullish momentum after holding the 3375 support level. Market sentiment remains positive, with buyers stepping in and pushing price higher. As long as price sustains above 3375, the path of least resistance remains to the upside.

The next bullish target

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.