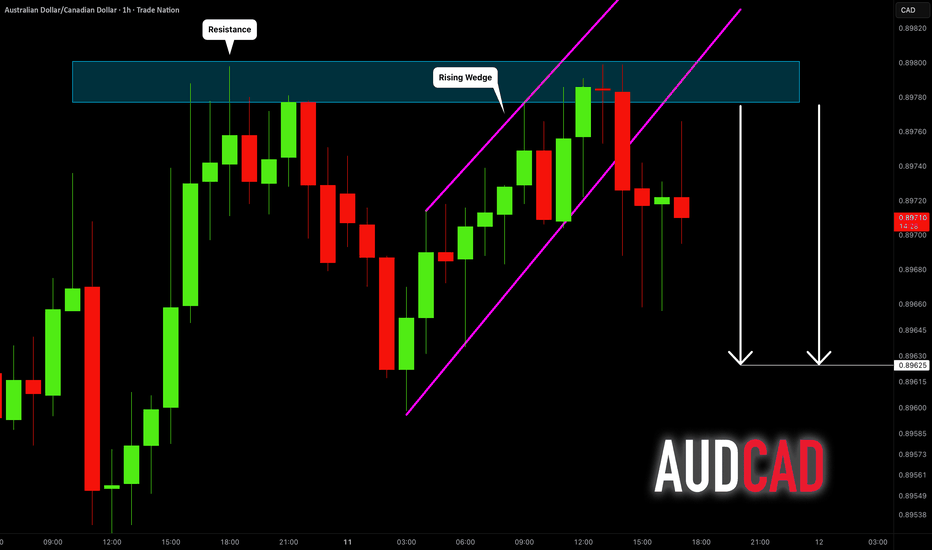

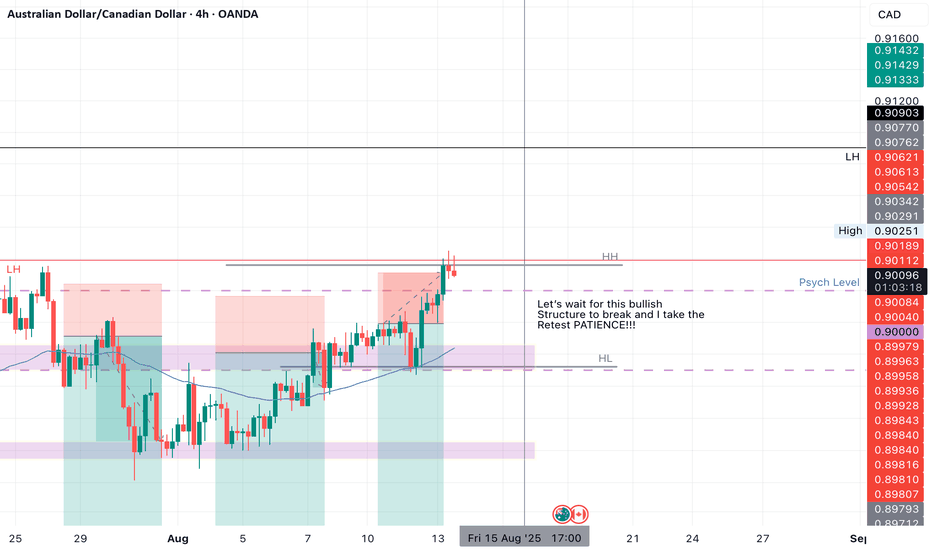

AUDCAD: Pullback From Resistance 🇦🇺🇨🇦

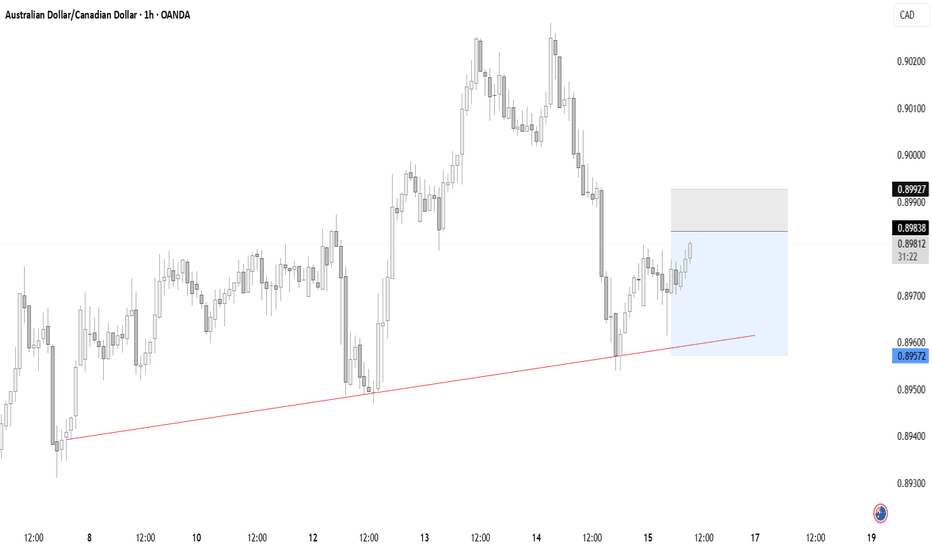

AUDCAD may retrace from the underlined blue resistance.

A breakout of a support line of a rising wedge pattern

after its test leaves a strong bearish clue.

We can expect a pullback to 0.8962 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer prog

About Australian Dollar/Canadian Dollar

The Australian Dollar vs. the Canadian Dollar. Both of these currencies are regarded as commodity currencies and are considered to be a relatively stable currency pair. The CAD fortunes are closely related to the U.S. because it is their largest trading partner and neighbor. The AUD is more effected by its alignment with Australia and emerging Asian markets.

Related currencies

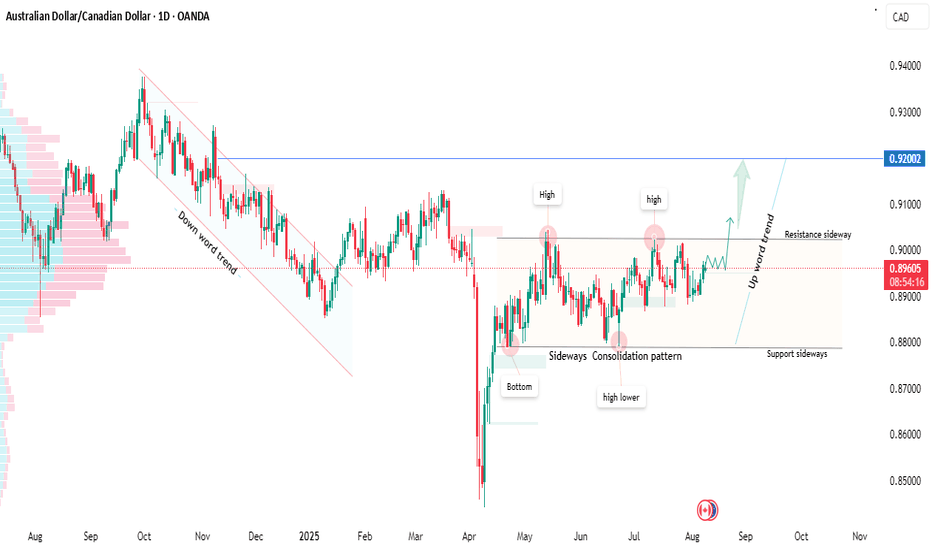

AUD/CAD–From Downtrend to Breakout Watch/Sideways ConsolidationAfter an extended downtrend, AUD/CAD transitioned into a sideways consolidation pattern, holding between clearly defined support and resistance levels.

Support zone: ~0.8800 – 0.8850

Resistance zone: ~0.9000 – 0.9050

Potential breakout target: 0.9200

Price is testing the upper boundary of the ra

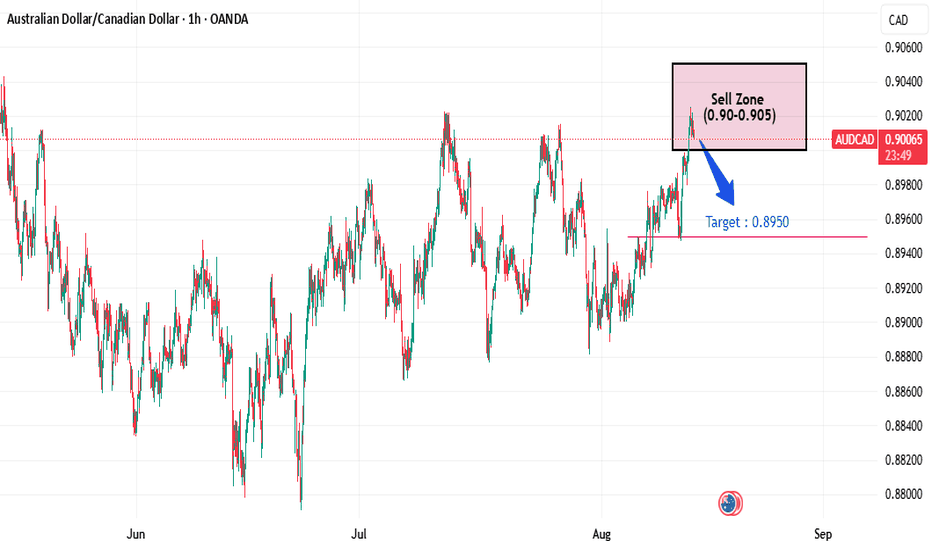

AUD/CAD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

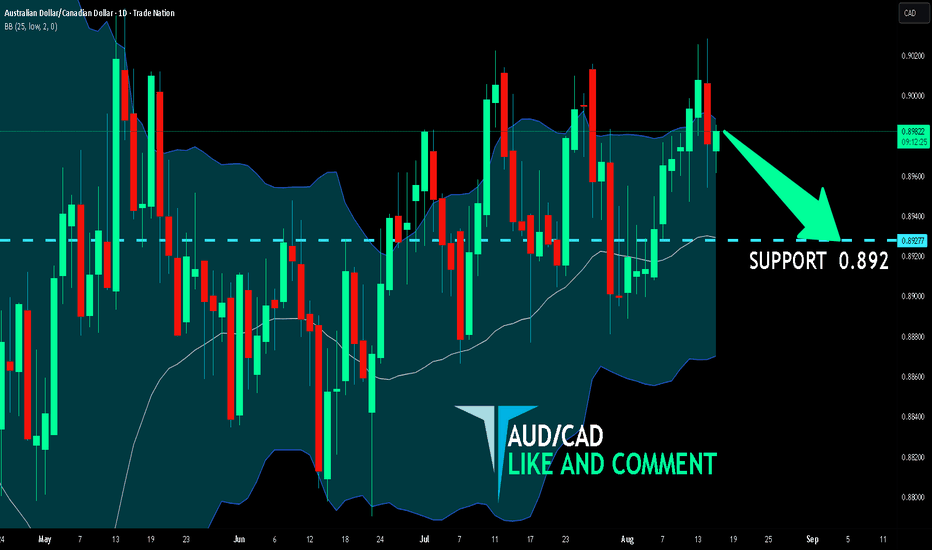

Bearish trend on AUD/CAD, defined by the red colour of the last week candle combined with the fact the pair is overbought based on the BB upper band proximity, makes me expect a bearish rebound from the resistance line above and a retest of the local target below at 0.892.

Discl

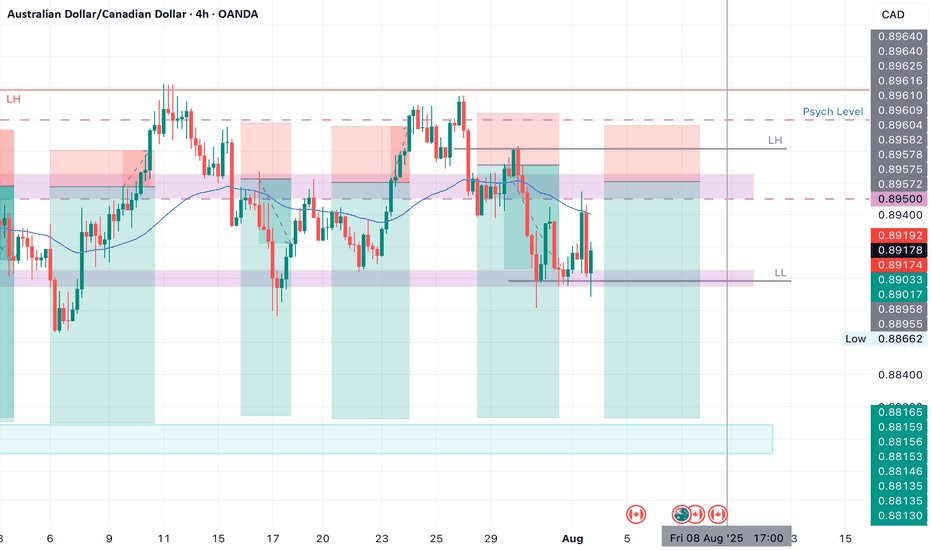

AUDCAD SHORT Market structure bearish on HTFs 3

Entry at both Daily and Weekly AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Previous Structure point Daily

Around Psych Level 0.89500

H4 Candlestick rejection

Rejection from Previous structure

Levels 4.18

Entry 120%

REMEMBER

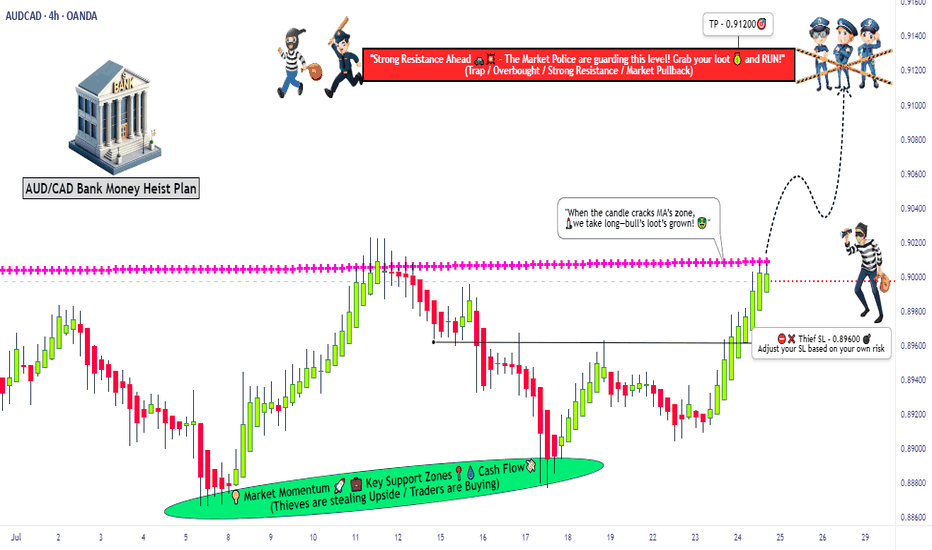

AUDCAD Forex Heist Plan: Entry, SL & TP by Thief Trader Style🏴☠️🔥 AUD/CAD Bank Heist Plan – Thief Trader's Long Con in Motion! 🔥🏴☠️

Breakout Bulls vs Bearish Guards – Who Wins the Forex Vault This Time?

🌍 Hello Money Makers, Market Bandits, and Strategic Robbers! 💰🚀💣

It’s Thief Trader back again, dropping heat with another high-stakes Forex bank job – this

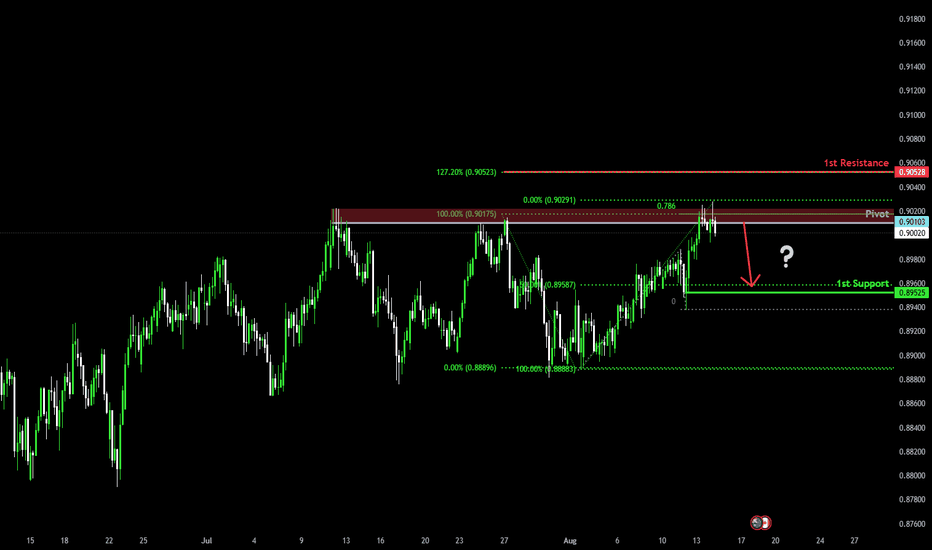

Bearish reversal?AUD/CAD is reacting off the pivot which has been identified as a multi swing high resistance that lines up with the 78.6% Fibonacci projection and could drop to the 1st support, which acts as a pullback support that aligns with the 50% Fibonacci retracement.

Pivot: 0.90103

1st Support: 0.89525

1s

AUDCAD SHHORTS Documentation Market structure 3

At AOI DW

Touching EMA W

Candlestick rejection DW

Previous Structure point DW

Round Psych Level 0.90000

Touching EMA Y

H4 Candlestick rejection Y

Rejection from Previous structure Y

Levels 4.75

Entry 125%

Trade executed but was not posted on TV, Documenting for future me

R

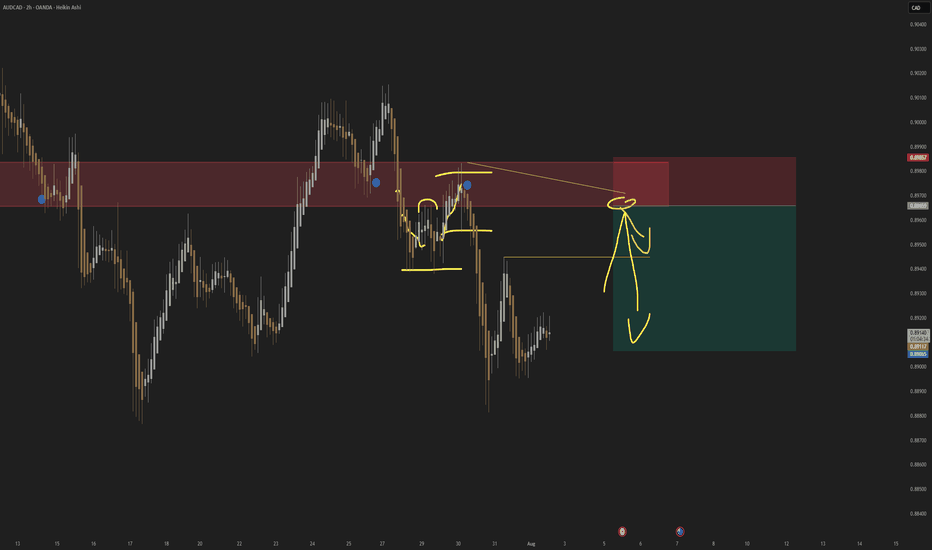

AUDCAD; Heikin Ashi Trade IdeaIn this video, I’ll be sharing my analysis of AUDCAD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedb

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of AUDCAD is 0.89934 CAD — it has increased by 0.18% in the past 24 hours. See more of AUDCAD rate dynamics on the detailed chart.

The value of the AUDCAD pair is quoted as 1 AUD per x CAD. For example, if the pair is trading at 1.50, it means it takes 1.5 CAD to buy 1 AUD.

The term volatility describes the risk related to the changes in an asset's value. AUDCAD has the volatility rating of 0.48%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The AUDCAD showed a 0.44% rise over the past week, the month change is a 0.58% rise, and over the last year it has decreased by −0.56%. Track live rate changes on the AUDCAD chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

AUDCAD is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade AUDCAD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with AUDCAD technical analysis. The technical rating for the pair is strong buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the AUDCAD shows the buy signal, and 1 month rating is neutral. See more of AUDCAD technicals for a more comprehensive analysis.