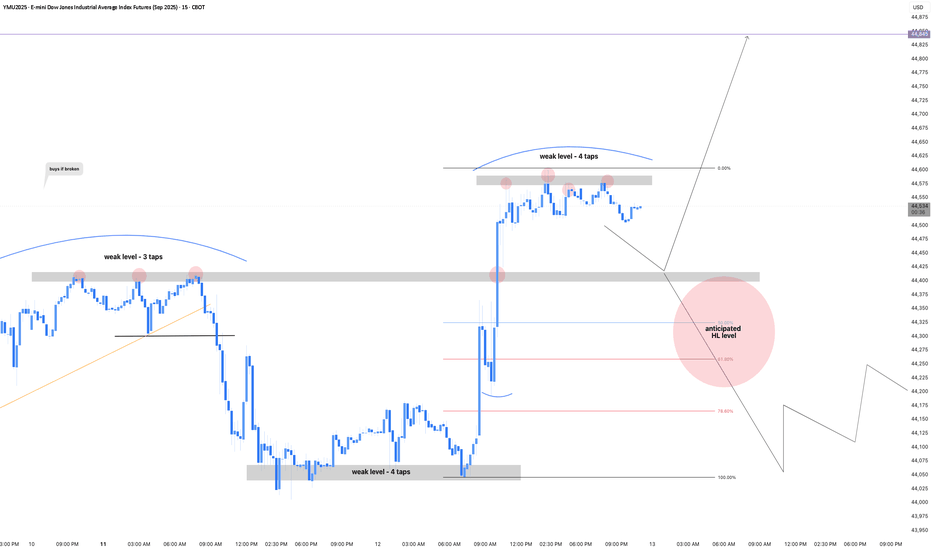

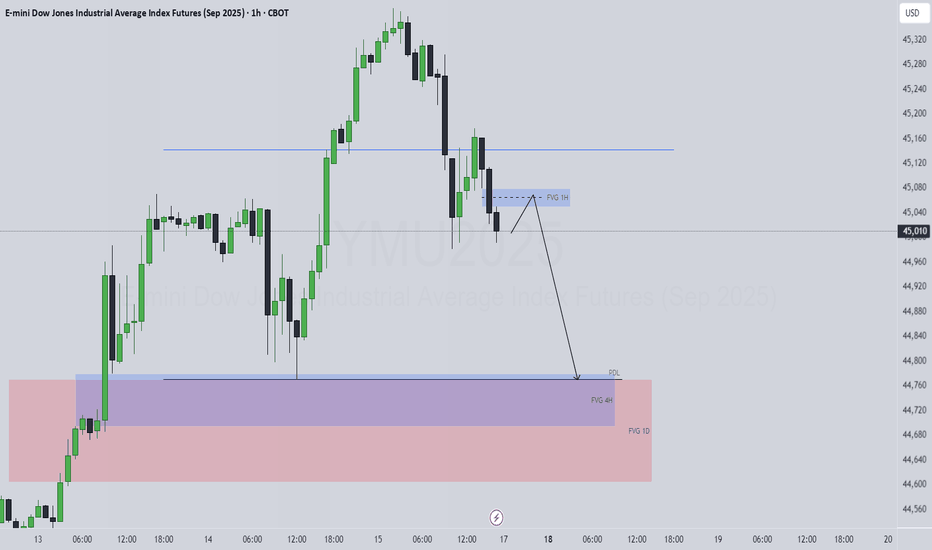

Setup Saturday Backtesting Templates Today I will be going over a setup that I am finding and am liking. It is a mean reversion; Low of the Day Buy Setup to take out the High of Day.

I want to trade like Mcdonald's with each setup being a cookie cutter formula. It is either there, or it isn't. I don't want to guess direction or trade

Related futures

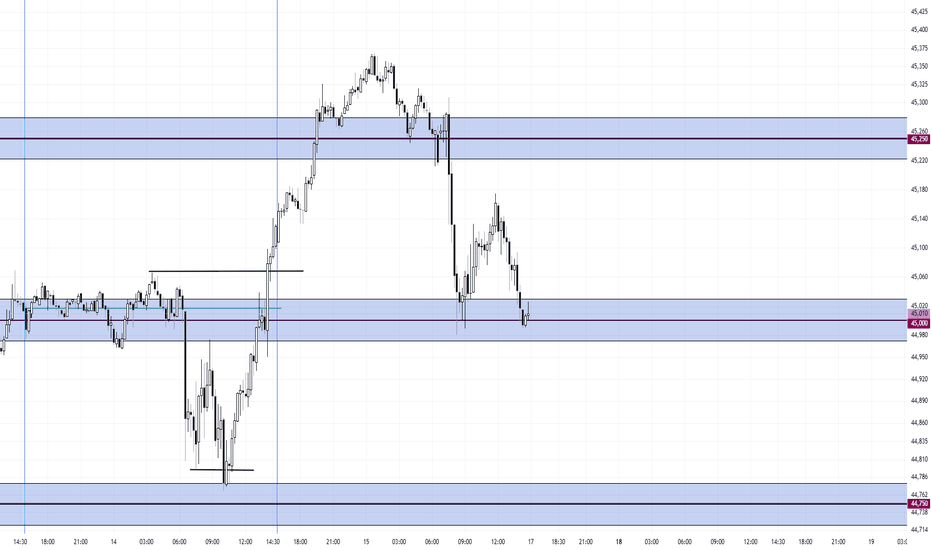

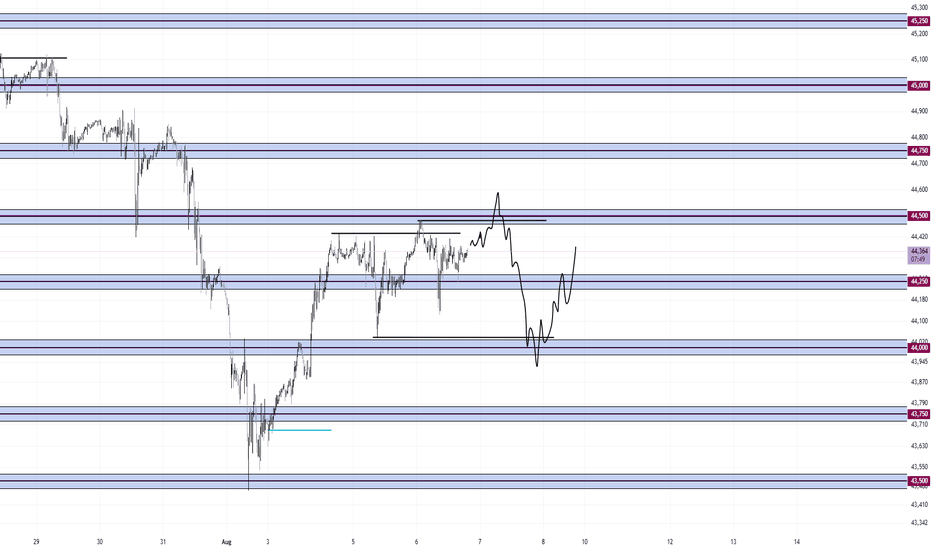

Mean Reversion Around 250. Buy at 00's and Sell 500I can see price mean reversion around 250. Therefore, buy the lows and sell the highs.

500 as resistance and 00's as support.

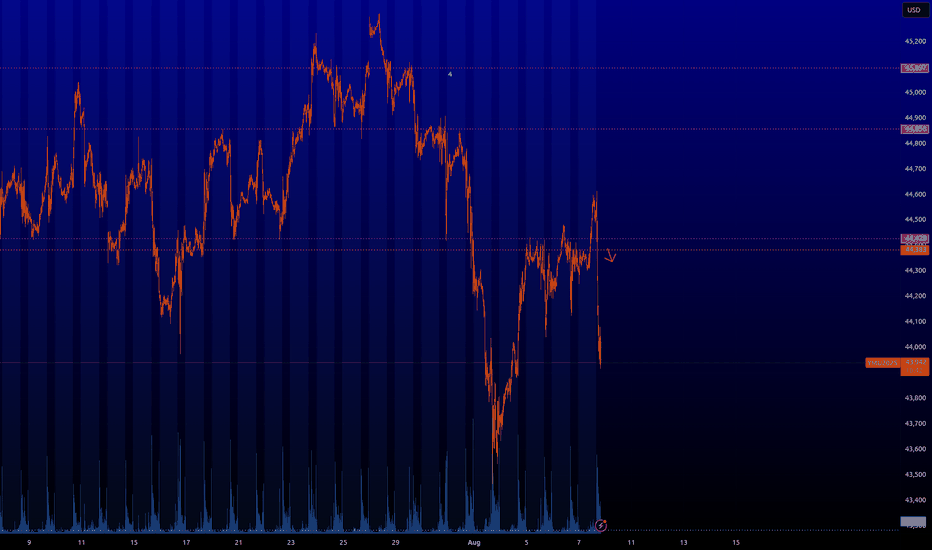

So far, the peak formation is at the low of August, therefore, the trend is bullish.

I am expecting a run of the high then a dump to 44,000 before the continuation of th

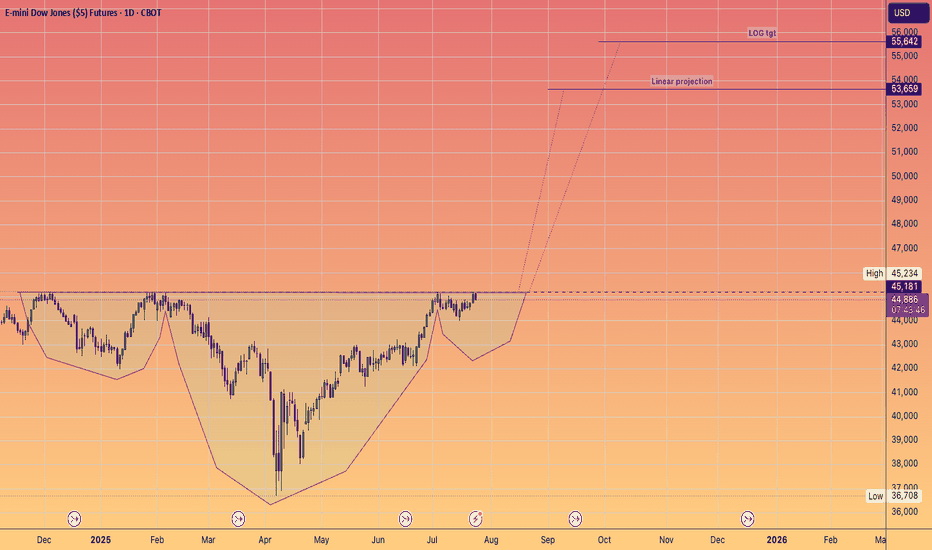

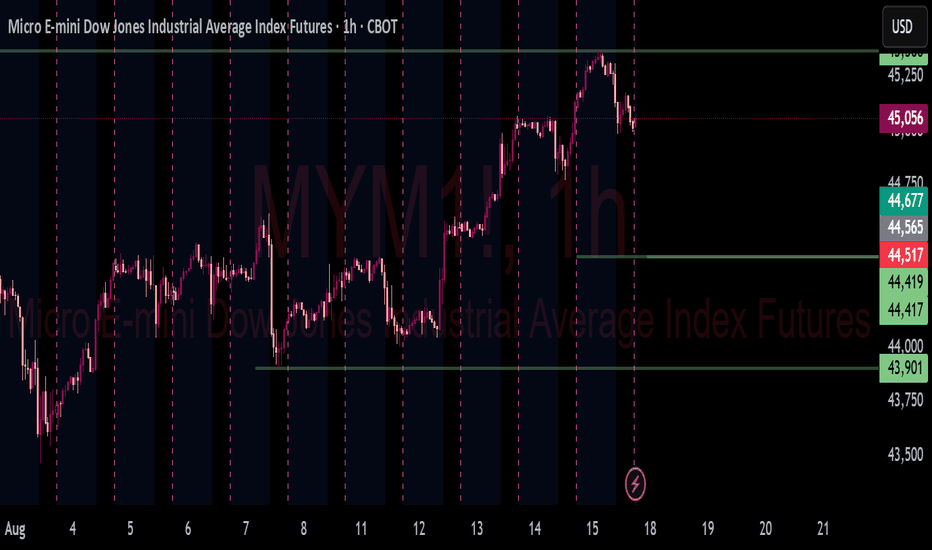

Dow Futures (YM) Nearing Final Push Before Significant RetreatThe Dow Futures (YM) cycle, initiated from the April 2025 low, has reached a mature phase and could conclude soon. We anticipate one final push higher to complete the impulsive cycle from that low. As shown on the one-hour chart, wave (3) of this impulse peaked at 45,312. The subsequent wave (4) pul

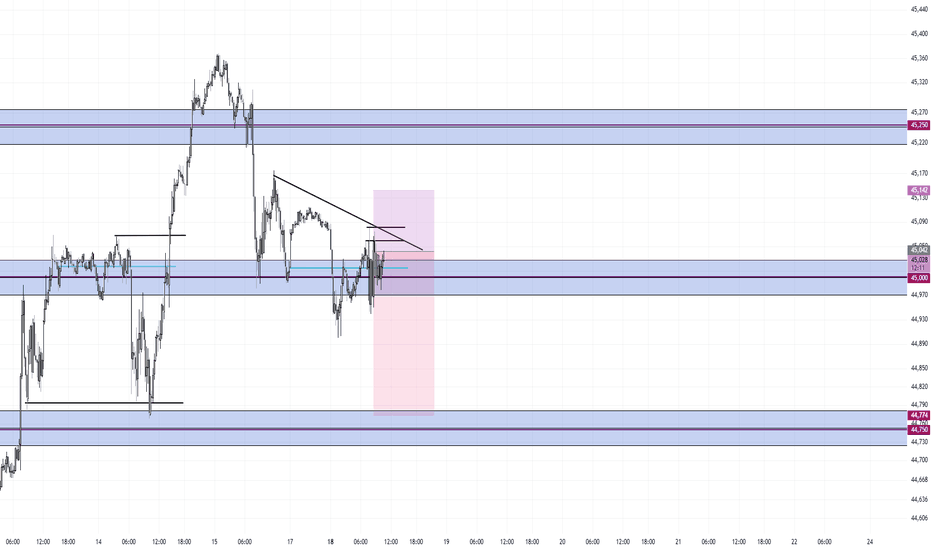

Mean Reversion Around 00's Short Down to 750I am short at 45,042 after the close of a fat green bar. My bias is down and so I sell into bull bars.

Price is currently mean reverting around 45,000 with the peak formation high above 250. I am looking for price to go down to the next level at 750.

I am using a 100 tick stop and a 265 tick tar

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for E-mini Dow Jones Industrial Average Index Futures (Mar 2018) is Mar 16, 2018.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell E-mini Dow Jones Industrial Average Index Futures (Mar 2018) before Mar 16, 2018.