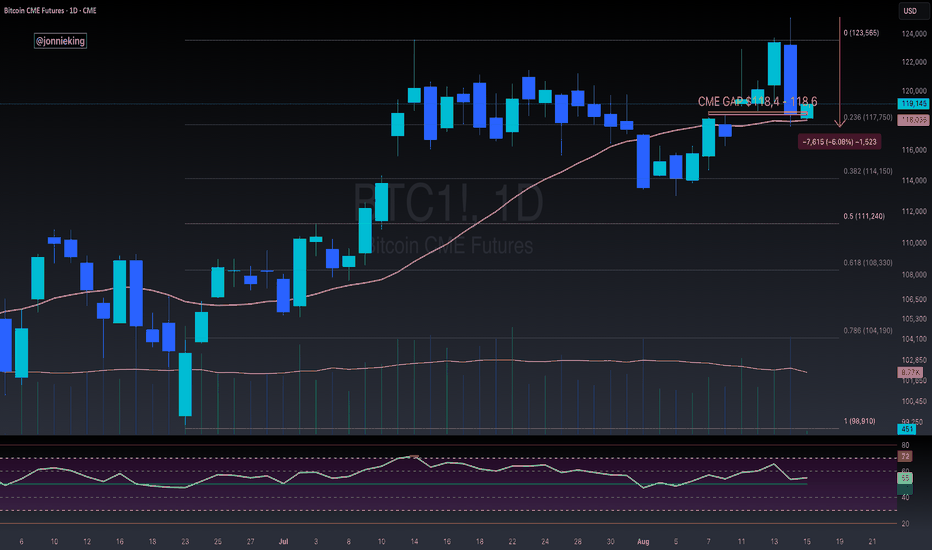

Bitcoin CME Closing Price: The Key to Next Week’s TrendIn this video I cover the CME closing price and go through a plan which includes a gap to the upside and a short squeeze before gravitating to the downside for lower targets .

I also give a bias for higher prices if the VAH is claimed .

This idea is modelled on the daily time frame and can play ou

Related futures

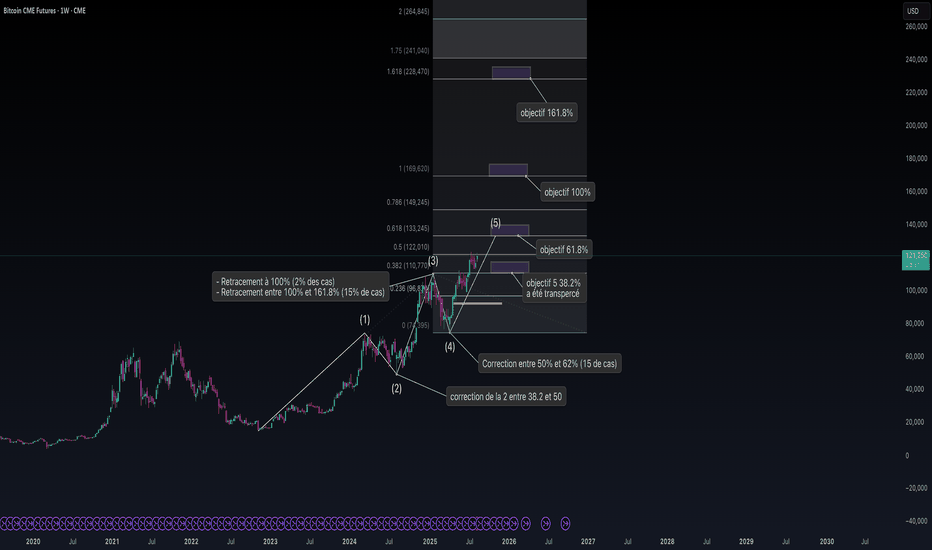

Bitcoin – wave 5 Targets (Elliott Wave + Fibonacci)

Bitcoin appears to be in the final wave 5 of the current bullish cycle. After breaking the 38.2% Fibonacci extension target, focus shifts to the next major levels:

61.8% extension ≈ $133,245

100% extension ≈ $169,620

161.8% extension ≈ $228,470

Historically, wave 5 often tops between 61.8%

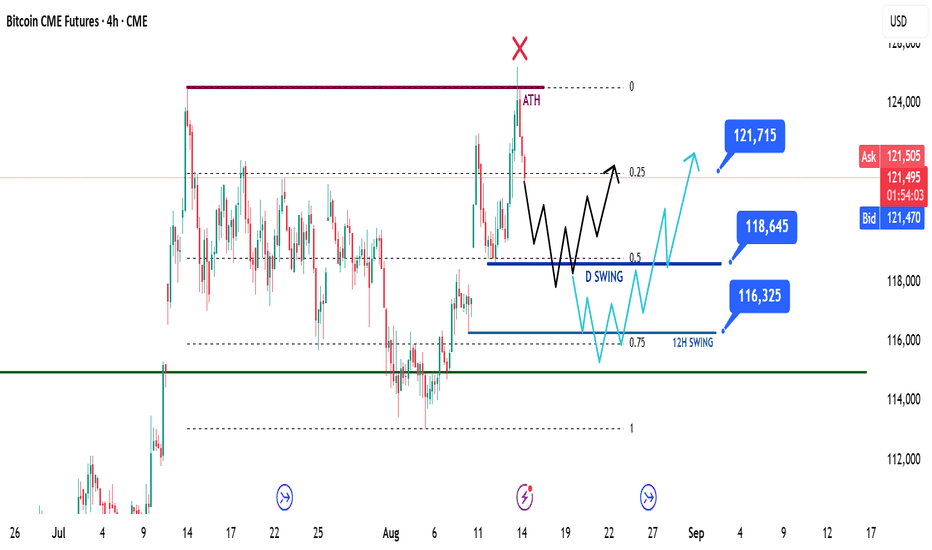

BTC Daily Recap & Game Plan – 15.08.2025BTC Daily Recap & Game Plan – 15.08.2025

📊 Market Sentiment

Overall sentiment remains bullish, supported by expectations of a 0.25% rate cut in the upcoming FOMC meeting. A weakening USD and increasing global risk appetite are creating favorable conditions for further upside in crypto assets.

📈

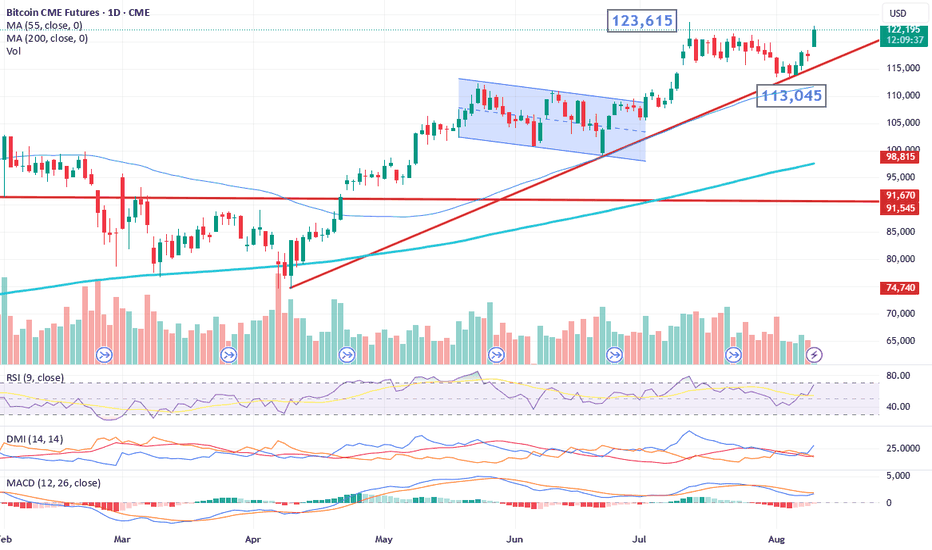

Bitcoin Technical Update It’s been nearly a month since our last look at CRYPTOCAP:BTC , and the uptrend from April is still firmly in place. 📈

🔹 Price recently bounced sharply from the trendline, supported by the 55-day MA (blue line).

🔹 Immediate upside focus: 123,615 (July high)

🔹 Fibonacci checkpoints: approx. 127K & 1

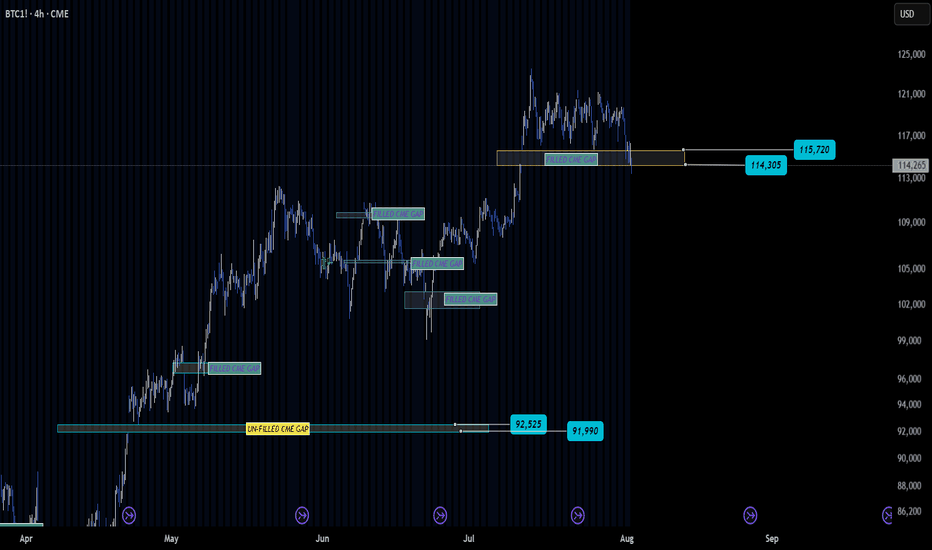

BTC Fills Key CME Gap — Eyes Now on What’s Next✅ The CME gap between 115700–114300 has officially been filled — a level many traders were watching closely.

What happens here could shape BTC’s next major move 🎯

Will we see consolidation, reversal, or continuation? Price action at this level deserves attention.

🕵️ Worth noting: one more unfilled

$BTC Bearish Engulfing Candle AlertGOOD NEWS:

-CME Gap was completely filled.

-PA is still above the 20DMA.

BAD NEWS:

-Very concerning Bearish Engulfing candle on the Daily Close.

-Volume confirms the change in trend.

MY TAKE: I wouldn't be surprised to see the market rally into a low liquidity weekend and dump hard on Monday.

BTC Daily Recap & Game Plan 14.08.2025BTC Daily Recap & Game Plan 14.08.2025

📊 Market Sentiment

Overall sentiment remains bullish, supported by expectations of a 0.25% rate cut in the upcoming FOMC meeting. A weakening USD and increasing global risk appetite are providing favorable conditions for further upside in crypto assets.

📈

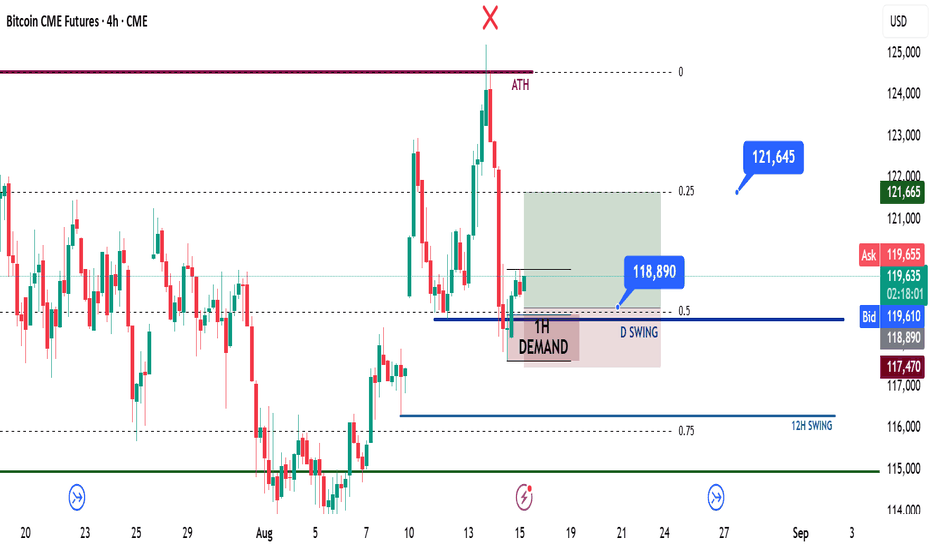

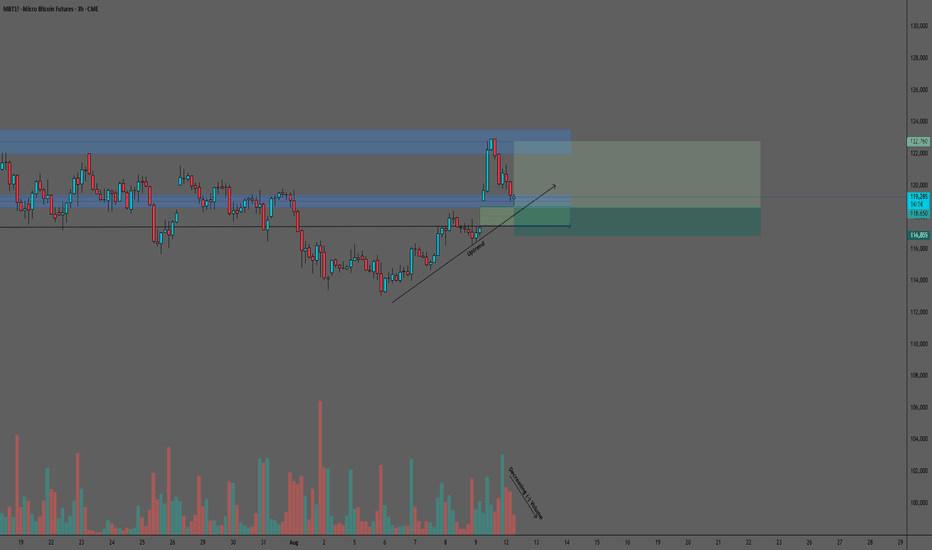

MBT (Micro Bitcoin Futures) Trade Setup – 3H TimeframeBullish Setup at Key Support Level with Declining Selling Pressure

MBT has recently encountered resistance at the 122000-123500 zone, which previously marked its all-time high on July 14, 2025. The subsequent pullback to the 118650-119400 support area presents an intriguing bullish opportunity, pa

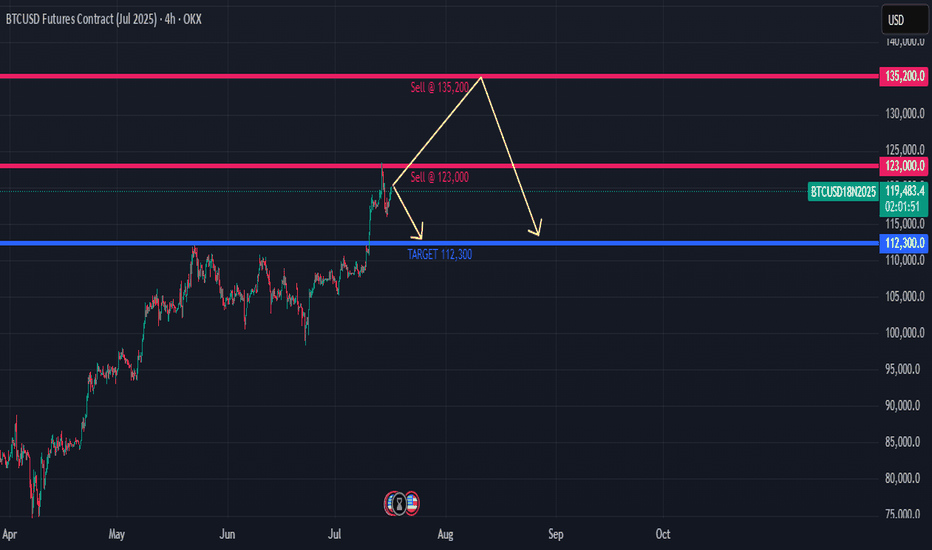

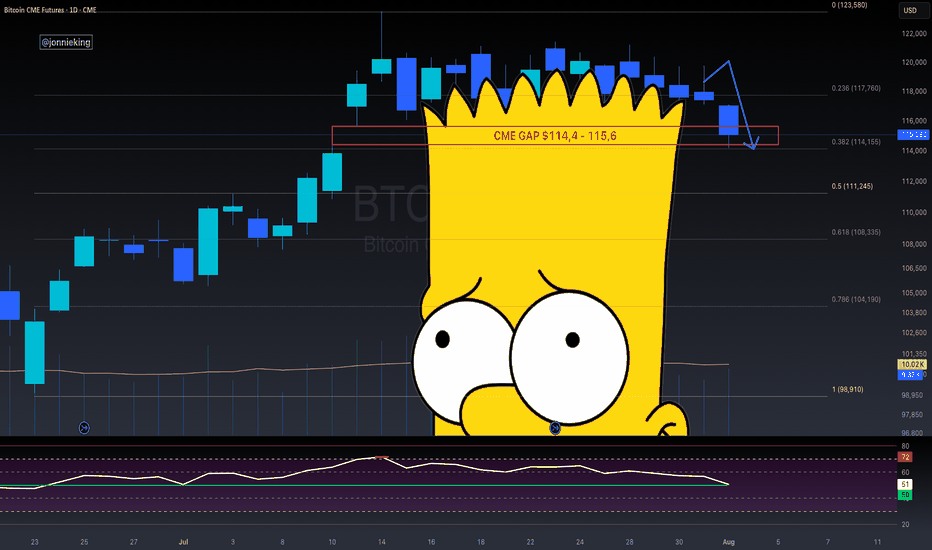

$BTC CME Gap + Bad Bart = Easiest Short EverCME Gap + Bad Bart is like taking candy from a baby 👨🏻🍼

Look at that textbook bounce off the .382 Fib 🤓

Pain ain’t over folks.

RSI still shows room on the downside 📉

Global Liquidity drain on the 4th.

Looking like the 50% Gann Level is next ~$111k

Get those bids in 😎

And never forget the Bul

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Bitcoin Futures (May 2019) is May 31, 2019.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Bitcoin Futures (May 2019) before May 31, 2019.