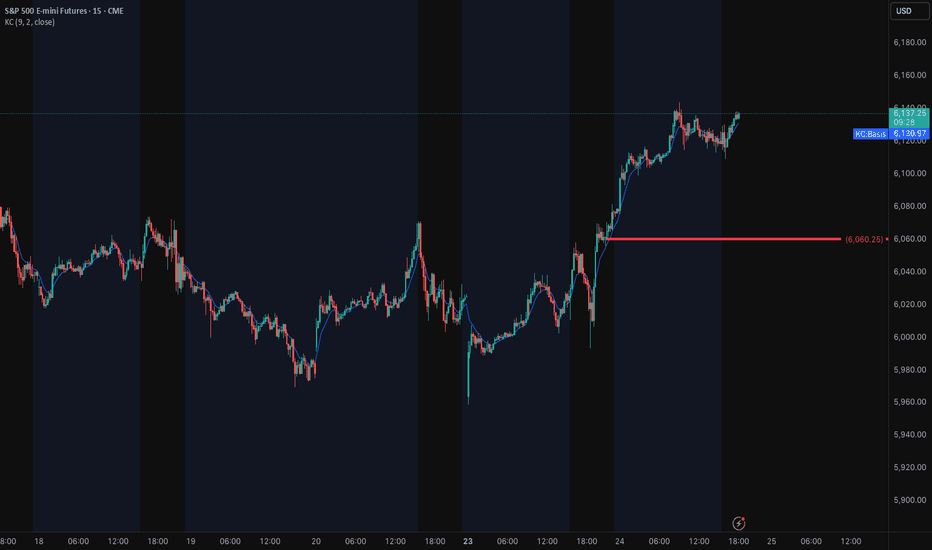

LONG ES after London Open*I like the long better for london open.

From 6000, weak liquidity built up above, Finished business below, macro SMAs buy bias...

HOWEVER there is also a good case for shorts as we are heading up into futures open, SMAs and there is LVN space below to squeeze into. So... I will be looking for finis

Related futures

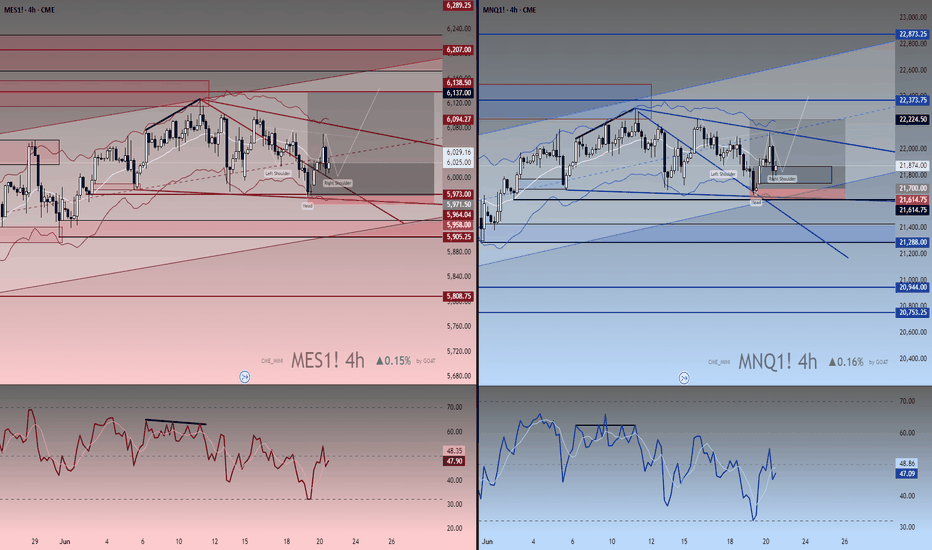

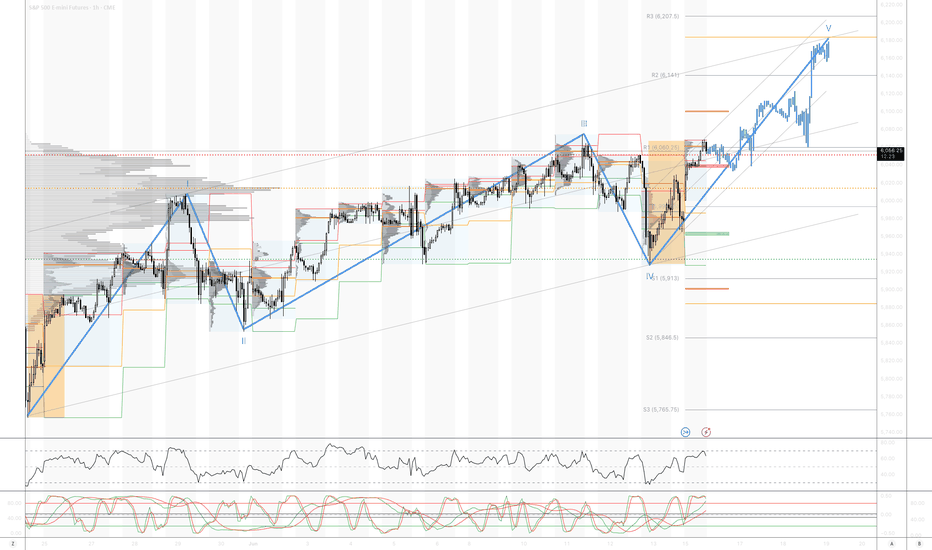

Watch These Reversals – MES & MNQ at Major 4H Turning Points!Chart Breakdown: MES1! & MNQ1! – 4H Timeframe Analysis by GOAT

This dual-pane chart presents a detailed technical analysis of the E-mini S&P 500 Futures (MES1!) and Micro Nasdaq Futures (MNQ1!) on the 4-hour timeframe, designed with a custom visual aesthetic and proprietary tools by GOAT.

🔺 Left Pa

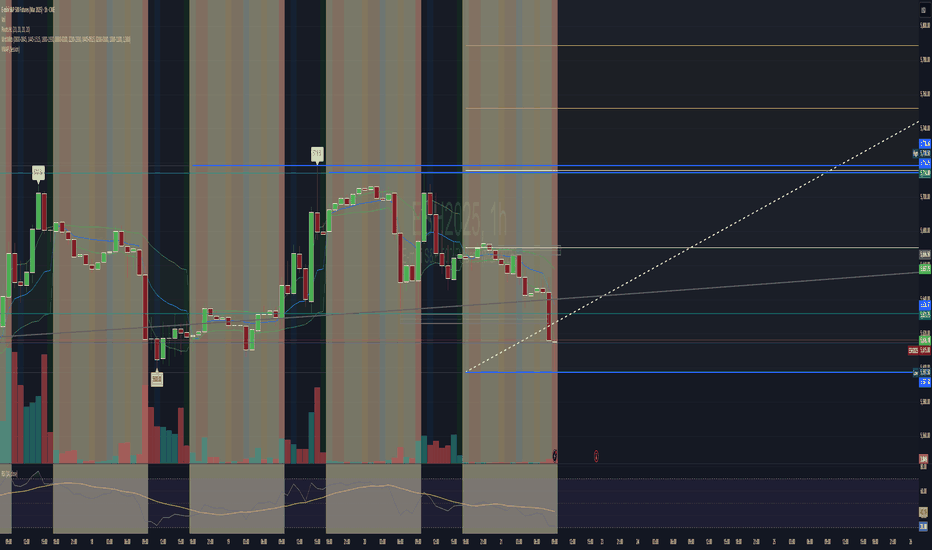

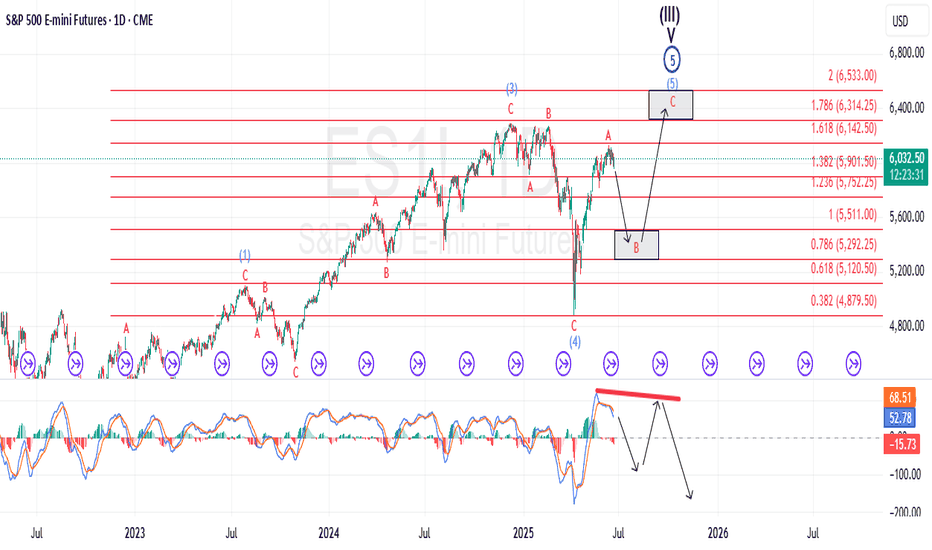

A Trend on Borrowed Time, A Micro ED within a Larger ED?Since mid-last month, the broader equity market has been grinding higher — but not with confidence.

The advance has been marked by choppy, overlapping price action that feels more hesitant than bullish. Yes, prices continue carving out higher highs and higher lows, but MACD momentum tells a differ

ES1!/SP500 Targeting Weekly Range Resistance***QUOTING SEP CONTRACT FOR JUNE CONTRACT OR CASH US500 EQUIVALENT LEVELS SUBTRACT ~52 POINTS***

***WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN***

WEEKLY BULL BEAR ZONE 6090/6100

WEEKLY RANGE RES 6150 SUP 5914

DAILY RANGE RES 6090 SUP 5972

DAILY VWAP BULLISH 6019

WEEKLY VWAP BULLISH 59

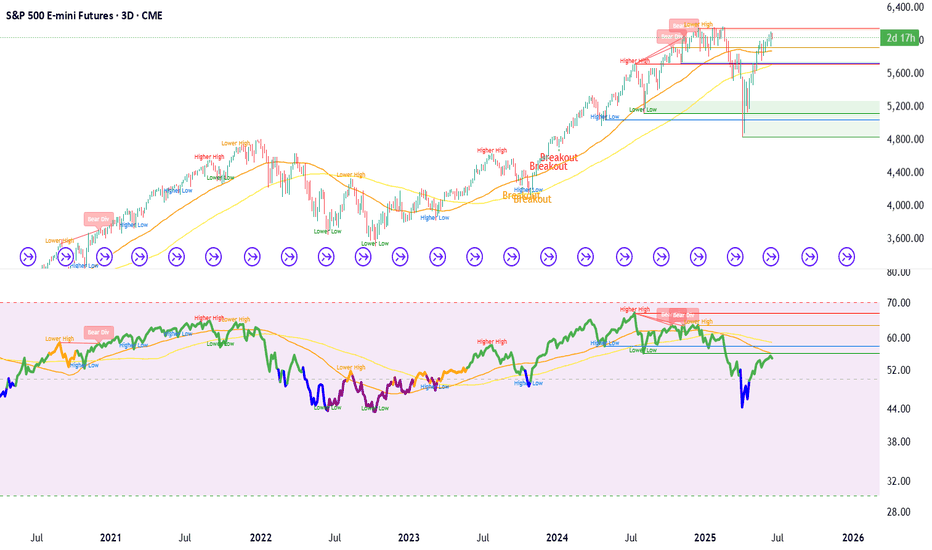

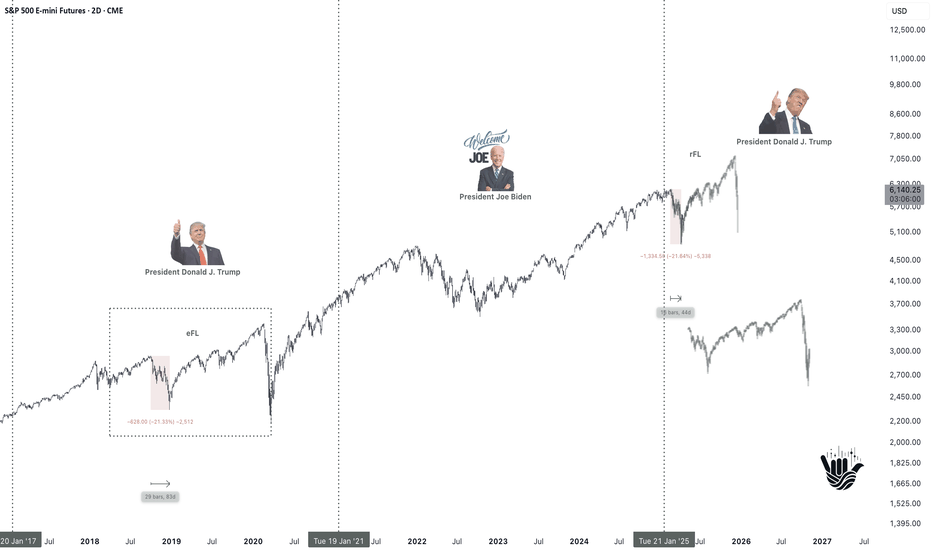

Déjà Vu: Echoes of 2018 in Today’s MarketI’ve spotted a striking resemblance between the current price action and the 2018 market structure. This emerging fractal might be a key to anticipating what comes next.

🧩 Similarities between the 2018–2020 and 2025 corrections AMEX:SPY CME_MINI:MES1! OANDA:SPX500USD CME_MINI:ES1! TV

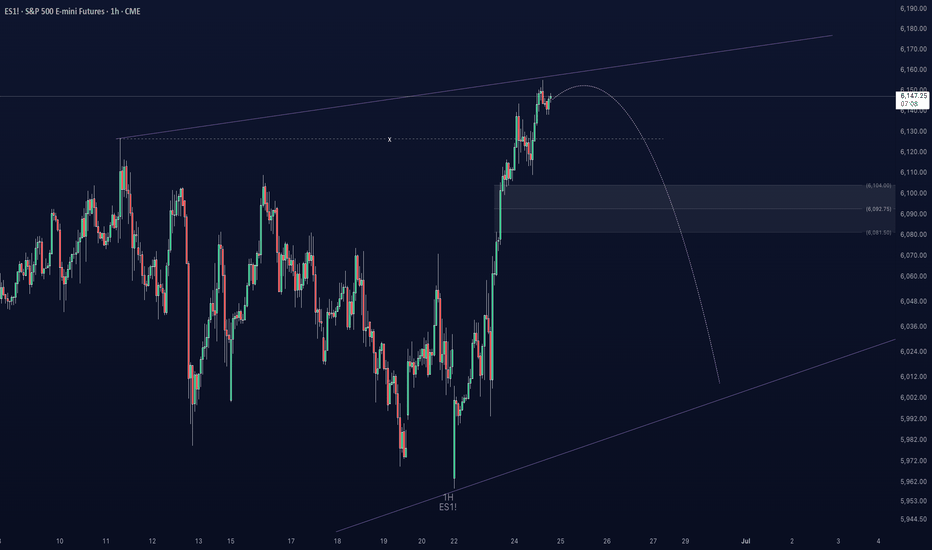

SPX Rug📊 Chart Analysis: ES1! (S&P 500 E-mini Futures, 1H) – Impending Breakdown via iFVG and Rising Wedge Top

This chart represents a technical analysis setup for ES1! (S&P 500 E-mini Futures) on the 1-hour timeframe. Here’s a contextual breakdown pointing toward a potential “rug pull” scenario by the en

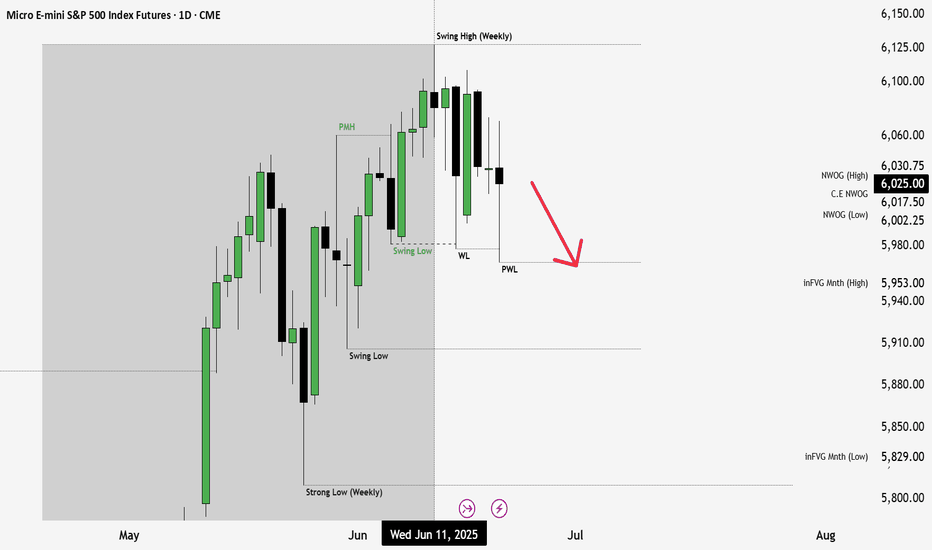

We may see lower prices for S&P FuturesHi Trading Community,

Over the past few weeks, I've been emphasizing the bullish nature of the market. However, in today’s video, I’m urging caution on long positions. Given current geopolitical trends and the recent candlestick formations, there’s a possibility we could see lower prices on the ES.

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for E-mini S&P 500 Futures (Dec 2014) is Dec 19, 2014.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell E-mini S&P 500 Futures (Dec 2014) before Dec 19, 2014.