US Crude Oil SPOT forum

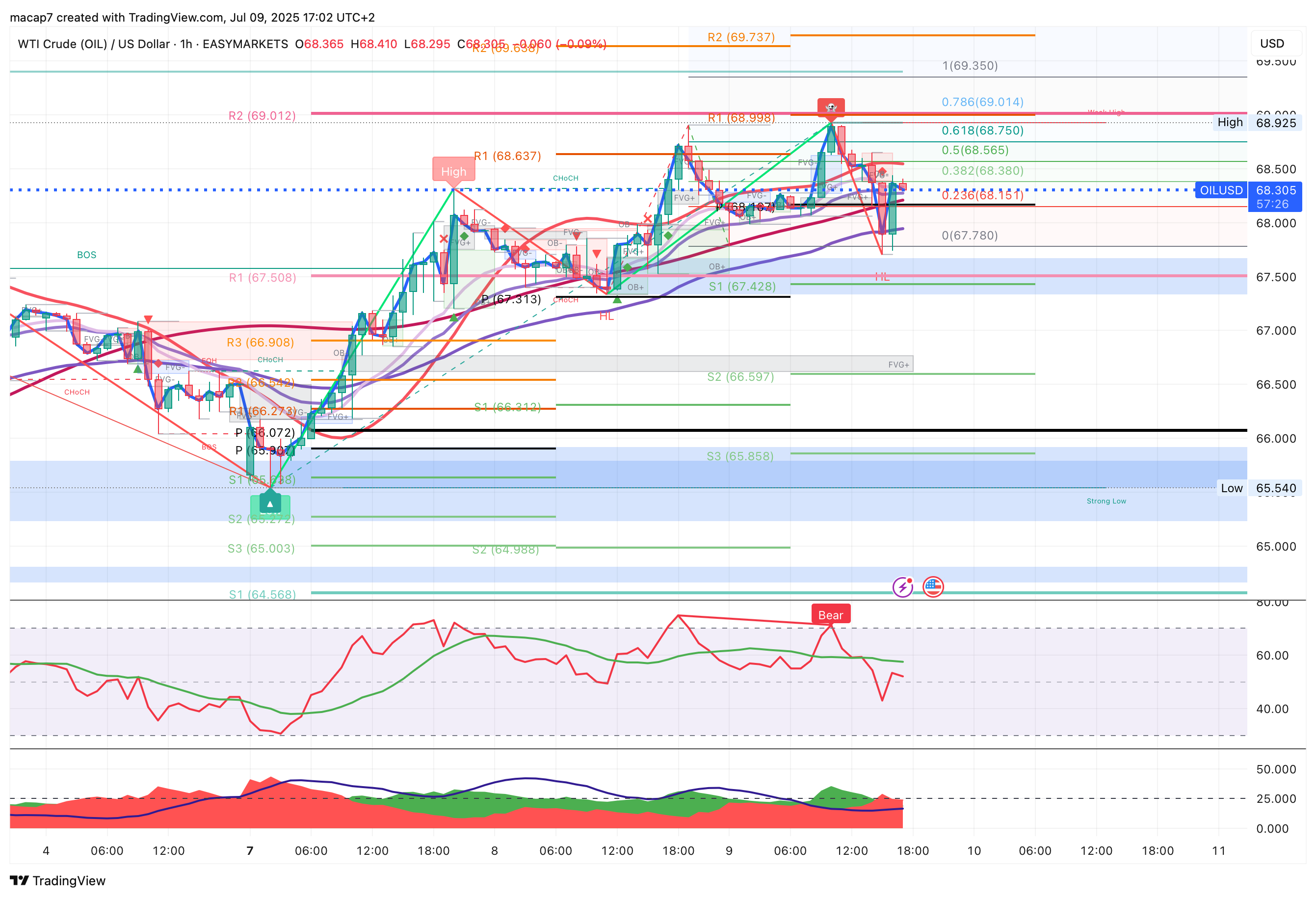

This rise is for a potential retest of the Bullish Trendline (in green dotted line), then back down again was my earlier post.

But if the Swing High of 68.90 is breached, the market bias is likely to flip from bearish to bullish and more moves to the upside.

🔹 Insights:

Crude Oil Inventories (Commercial + SPR) increased sharply week-over-week, indicating a build in storage despite ongoing drawdowns earlier in the year.

Gasoline and Distillates both declined, suggesting higher demand or lower refinery output, typical of summer driving season trends.

Distillate Fuel Oil and Residual Fuel Oil continue to show large year-on-year declines, pointing to tighter supplies or lower industrial demand.

SPR levels continue to trend lower year-over-year, reflecting the ongoing recovery from past emergency releases.

Propane/Propylene stocks are recovering strongly, up both weekly and annually.

Total petroleum stocks (excluding SPR) remain 3.0% below last year, highlighting broader market tightness.

📌 Conclusion:

The U.S. petroleum balance for the week ending July 4, 2025, reflects moderate weekly inventory builds in crude oil and some key products, but gasoline and distillates are still under pressure, likely due to strong seasonal consumption. On a yearly basis, commercial stocks are tighter, particularly in distillates, signaling potential price or supply impacts if demand stays firm.

I would wait for the market to factor in price as there was not an immediate drive down or up in the first 5 minutes.

EIA Crude Cushing Inventories Actual 0.464M (Forecast -, Previous -1.493M)

EIA Crude Oil Inventories Actual 7.07M (Forecast -1.6M, Previous 3.845M)

EIA Distillate Inventories Actual -0.825M (Forecast -1.5M, Previous -1.710M)

EIA Gasoline Inventories Actual -2.658M (Forecast -1M, Previous 4.188M)

financialjuice.com/images/9030202.png