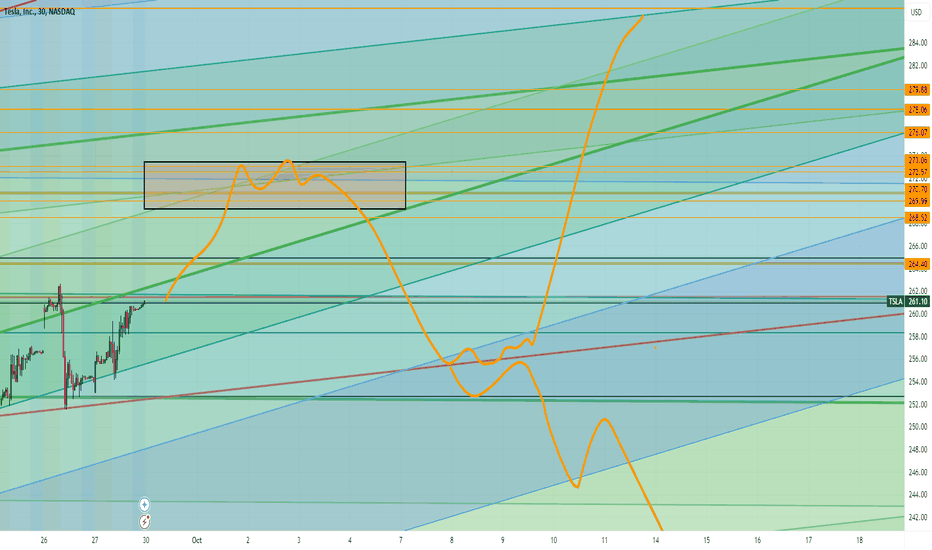

Tesla Full Analysis Weekly to 30 minute Must Watch Good afternoon everyone

In this video I give you in full detail a full analysis of Tesla where it is going and why and the tools I use to see everything in between.

If you have any questions or comments I am an open book and want to make the best videos I can for everyone.

MB Trader

Happy Hunting

Community ideas

Options Trading PrimerTradingView has recently introduced the Options Strategy Builder, a powerful tool designed to help you learn the mechanics of options trading and create efficient strategies. In this video, I explain the basics of options trading and demonstrate how to use the Strategy Builder. This video is helpful for those who are new to options but wish to explore this area.

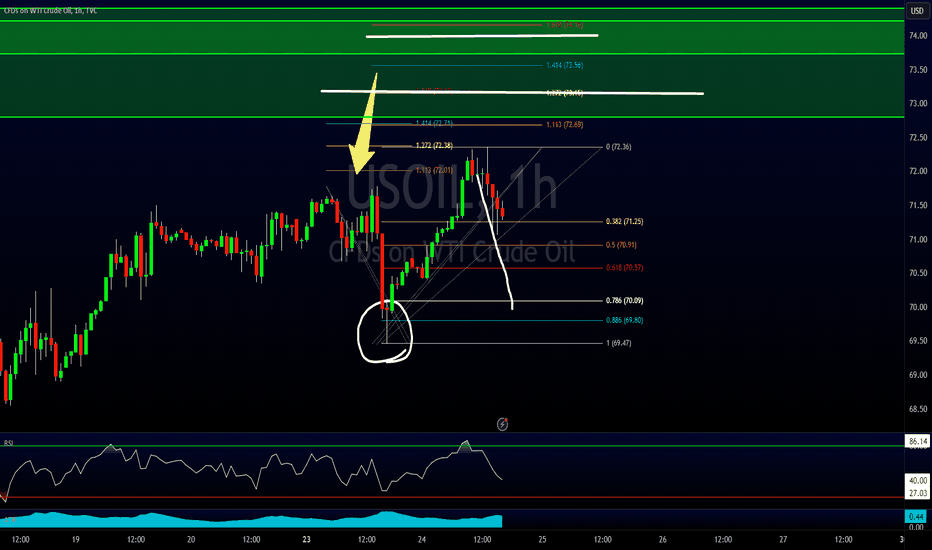

USOIL - Short Term Buys Using Structure & Fibonacci A complete walkthrough of a short-term buying opportunity on Oil using support and resistance to confirm our decision along with the use of our Fibonacci tools to help choose out profit targets.

If you have any questions or comments please leave them below.

Akil

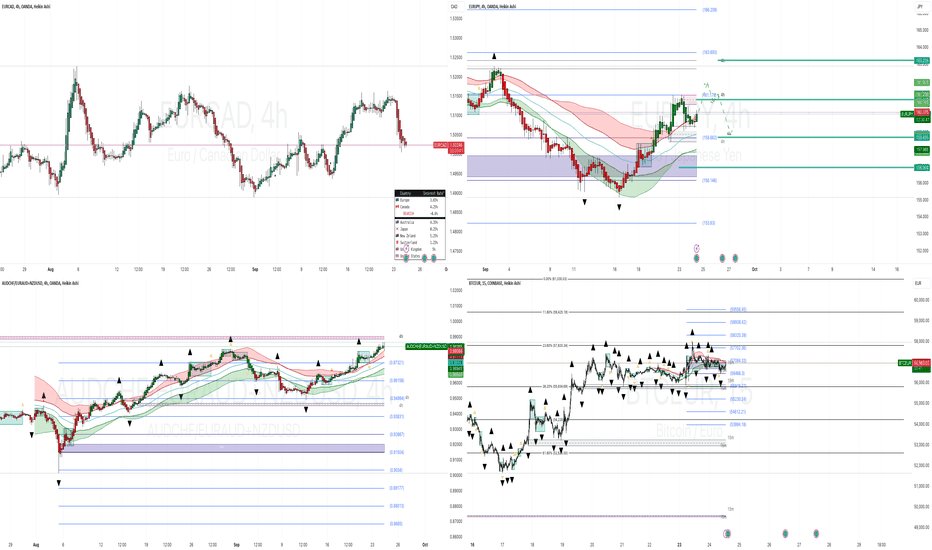

WHATS FLOWING!?: EURCAD | EURJPY | GBPCHF | BTCEUROANDA:EURCAD

OANDA:EURJPY

OANDA:GBPCHF

COINBASE:BTCEUR

Today's Episode of What's Flowing: EURCAD, EURJPY, GBPCHF, BTCEUR Trade Ideas

In today's episode, we will be looking at four key trading pairs and their current market movements, providing insights into potential trade setups and market sentiment.

1. EURCAD

Current Price: EURCAD traded at 1.50239, slightly decreasing by 0.04% since the last session. Over the past month, it has lost 0.19% but remains up 5.46% over the last 12 months.

Forecast: Projections suggest EURCAD could decline further, with expected levels at 1.48962 by the end of this quarter and 1.48690 in a year. With a declining trend, this suggests a potential short setup for traders looking to capitalize on continued weakness in the pair.

2. EURJPY

Current Price: EURJPY traded at 160.189, showing a gain of 0.34% in today's session. It’s up 0.70% over the past month and 1.57% over the last year.

Forecast: EURJPY is projected to climb to 161.743 by the end of the quarter and 162.624 within a year. Given its upward momentum, this pair presents a potential long trade opportunity for those looking to take advantage of its positive trajectory.

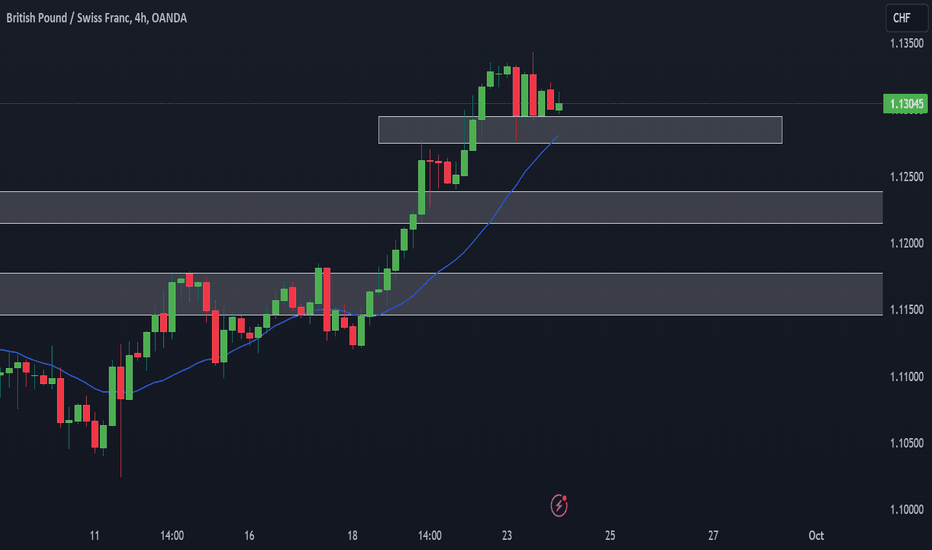

3. GBPCHF

Current Price: GBPCHF traded at 1.13158, increasing slightly by 0.05% today. The pair has gained 1.26% over the past four weeks and 1.62% over the past year.

Forecast: With forecasts indicating a potential drop to 1.11578 by the end of the quarter and 1.11645 within the year, this pair offers an attractive short opportunity for those looking to ride the predicted downside.

4. BTCEUR

Current Price: Bitcoin is trading at 57,015.7 EUR, rising 0.70% today. Over the past year, BTCEUR has seen a staggering rise of 129.62%, with strong momentum in recent months.

Forecast: BTC is expected to correct slightly to 51,739.8 EUR by the end of this quarter and could drop further to 48,987.6 EUR in one year. This indicates a potential profit-taking opportunity or a short-term pullback setup for those cautious about BTC’s extended rally.

I have a rule to follow the money rather than marry the marketThe cost to trade Bitcoin, the boring movement and other reasons have me moving away from trading Bitcoin from today.

I will be focussing on a morning market and an afternoon market

Right not it seems to be Forex in the morning and an Indice in the afternoon, namely the GPBJPY and Dow Jones

I hope this doesn't upset anyone. I have a rule to follow the money rather than marry the market

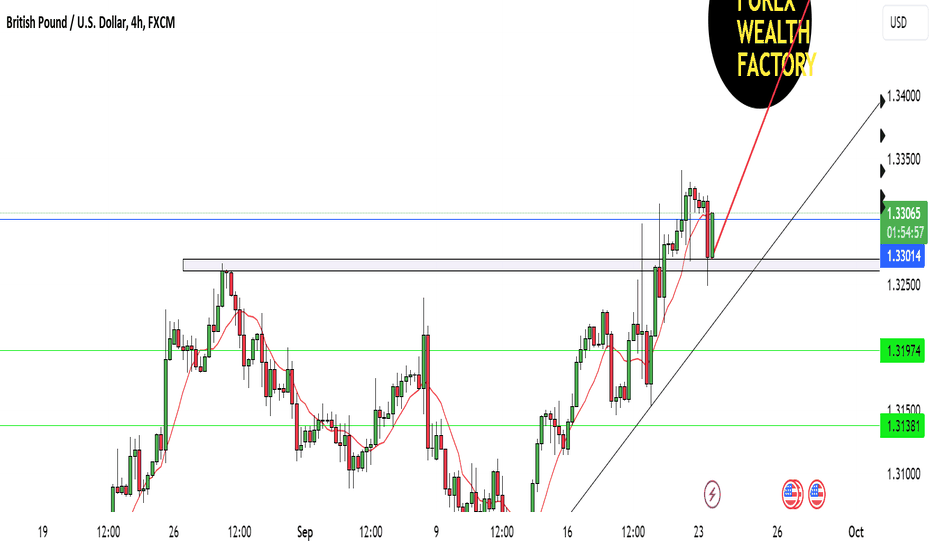

BUY GBPCHF - trade explained in detail Trader Tom, a technical analyst with over 15 years’ experience, explains his trade idea using price action and a top down approach. This is one of many trades so if you would like to see more then please follow us and hit the boost button.

We are proud to be an OFFICIAL Trading View partner so please support the channel by using the link below and unleash the power of trading view today!

tradingview.sweetlogin.com

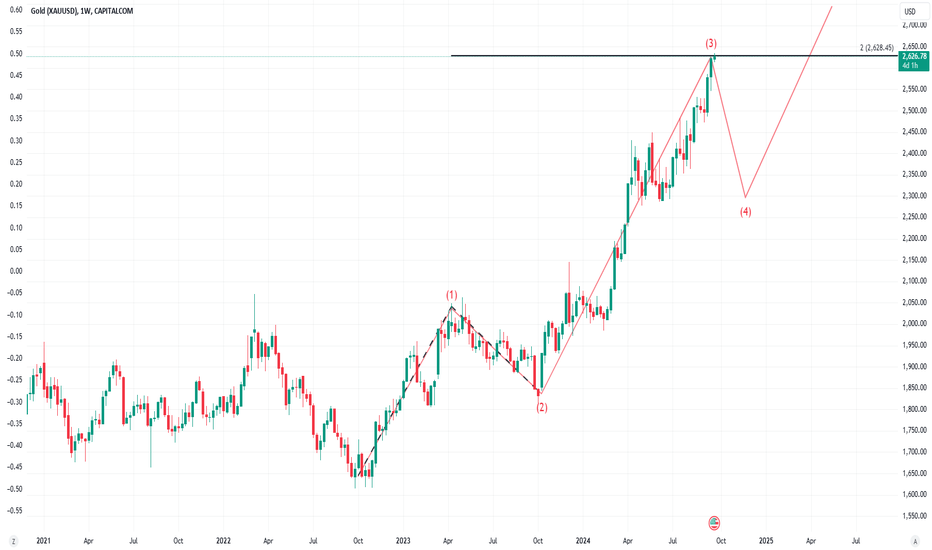

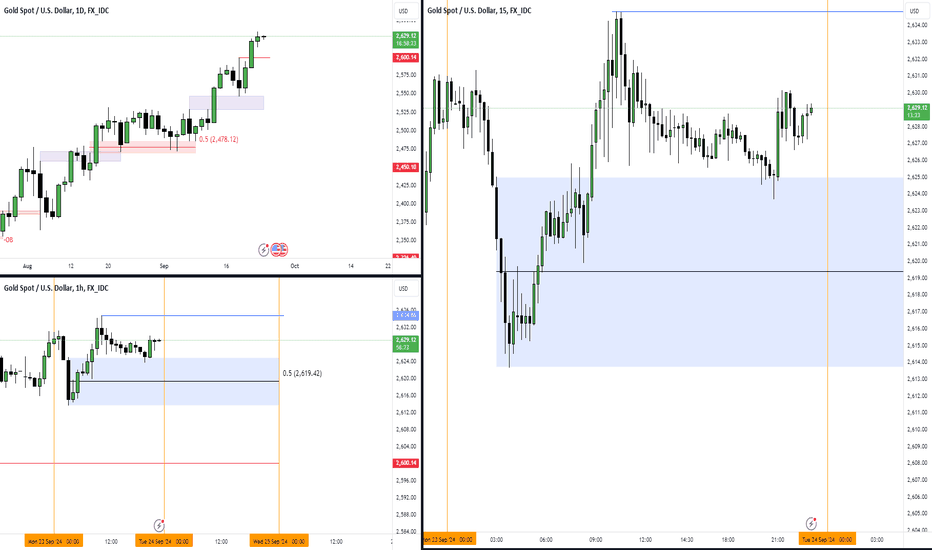

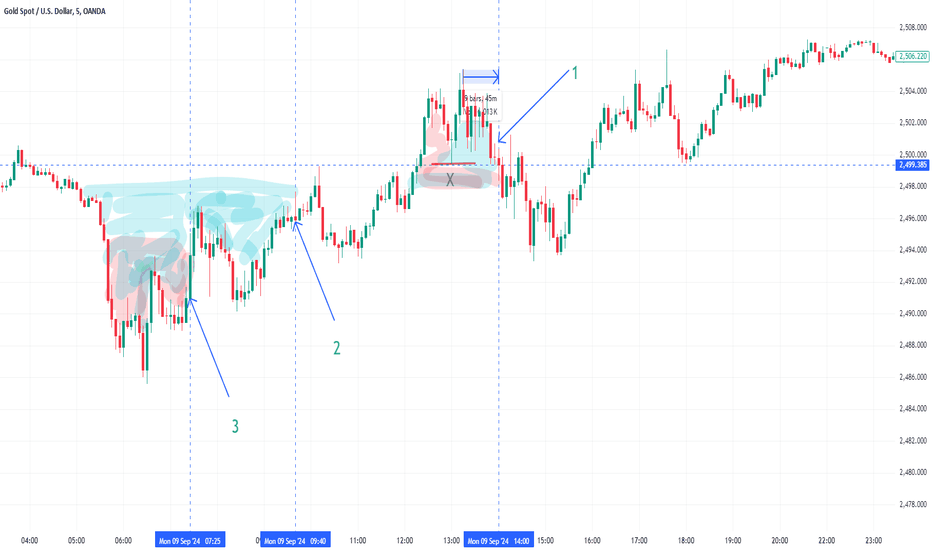

Gold - Capturing Short-Term Retracements Continuous bullish price action will eventually lead to minor retracements where scalpers can profit from.

Many say the trend is your friend but i like to go against that so i am looking @ $2,619 low hanging fruit for a healthy retracement. $2,600 would also be considered healthy in my eyes as market structure will still be in tact.

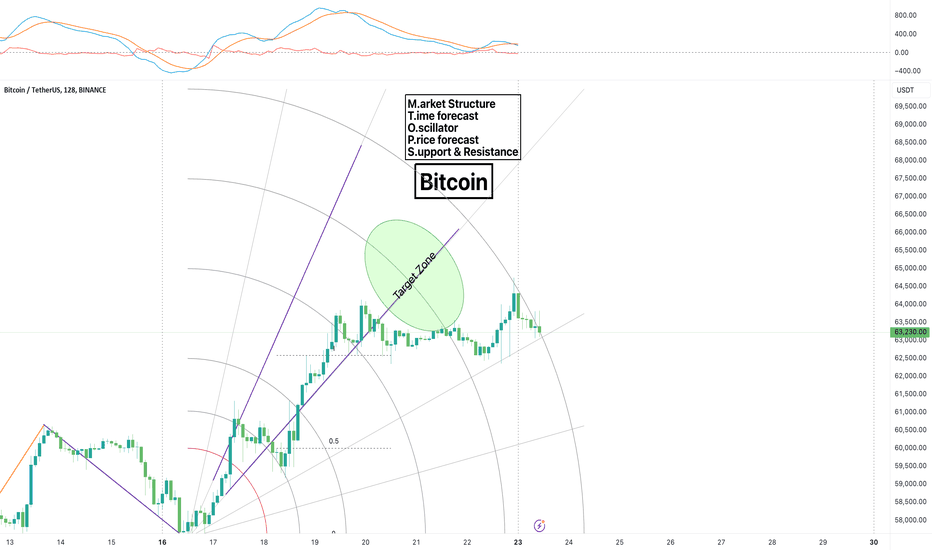

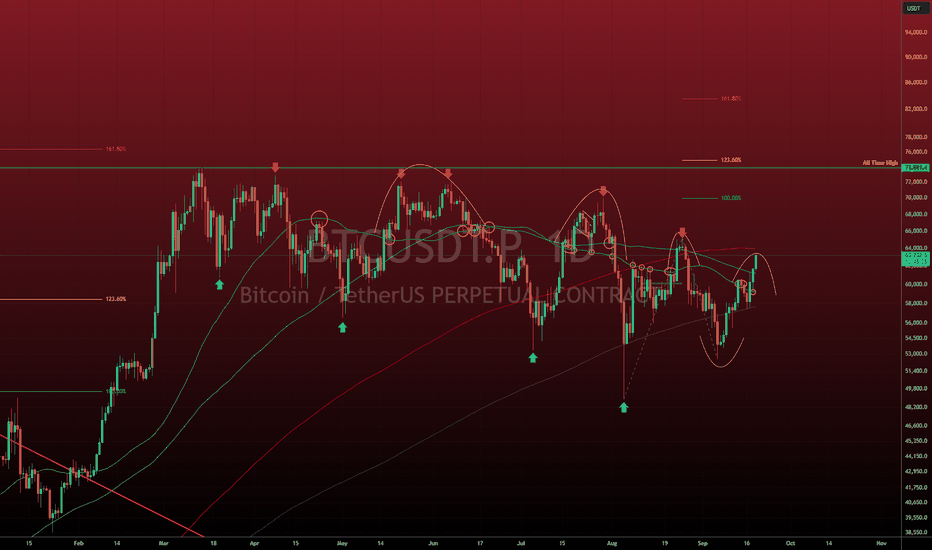

BTCUSD - BITCOIN seeing strength?Good day traders!

Alright. For BTCUSD I'm still seeing the same pattern, however things are starting to look a little more optimistic. The pattern that I've been discussing for weeks now is the series of lower highs and lower lows. Once we break this pattern, then we can start to talk about that move to ATH and ~$85k above ATH.

We NEED to break FWB:65K and ideally with above average volume (which I did not discuss in the video). We need a breakout with volume to get some gas in the tank so to speak.

If we can do that, it simply increases confidence in the bullish scenario. There's never any certainty in the markets, but from a pattern perspective, we have to break the pattern in order to gain confidence in the next move. Break the pattern to the upside, I believe we'll see new highs. We have yet to break the pattern to the downside, but that is not off the table. I'm simply saying things are looking better from a bullish perspective at this time .

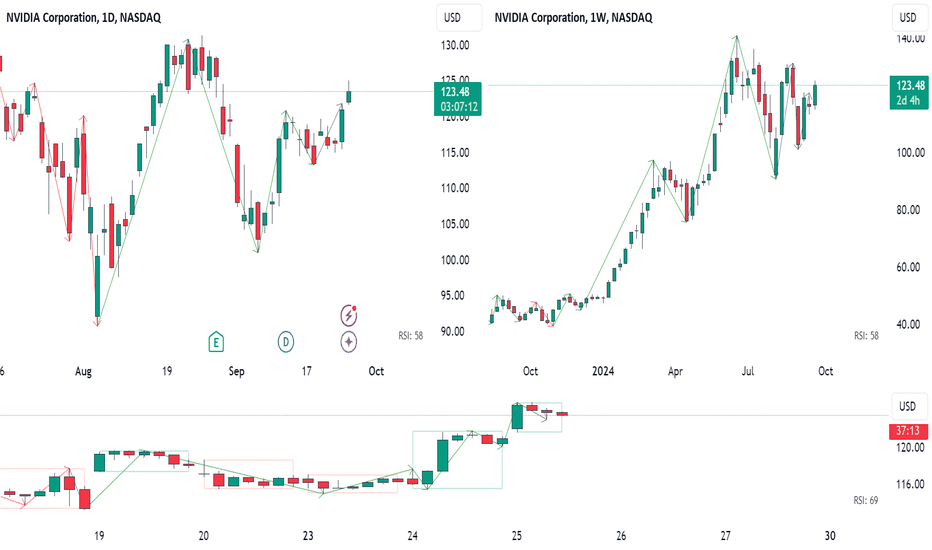

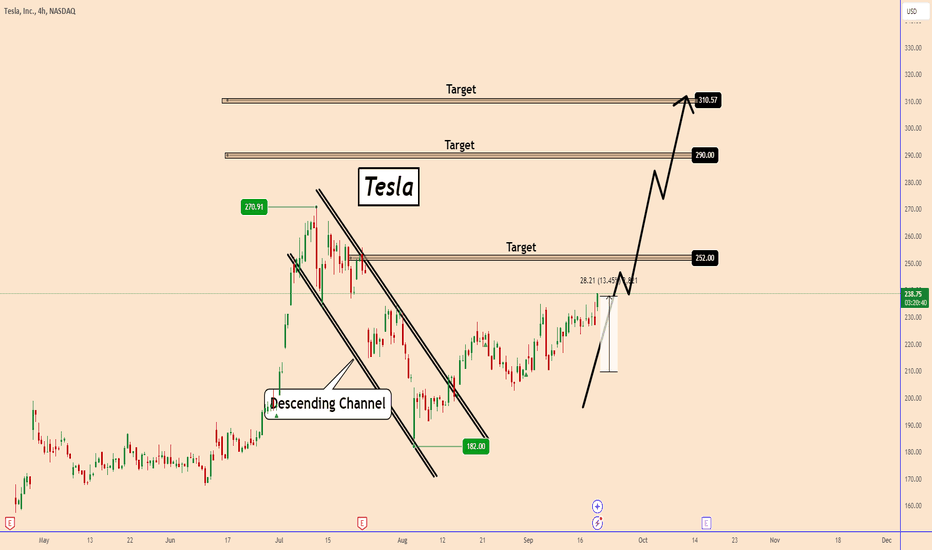

TESLA Looks Unstoppable This time +13% Already in ProfitsTESLA Looks Unstoppable This time +13% Already in Profits

Since when I posted the previous analysis on September 2nd the price increased by nearly +13% and is making higher highs.

Today it looks even better after the FED supported the economy by decreasing the rates by 50bps.

You can watch the video for further details.

Thank you and Good Luck!

Previous analysis:

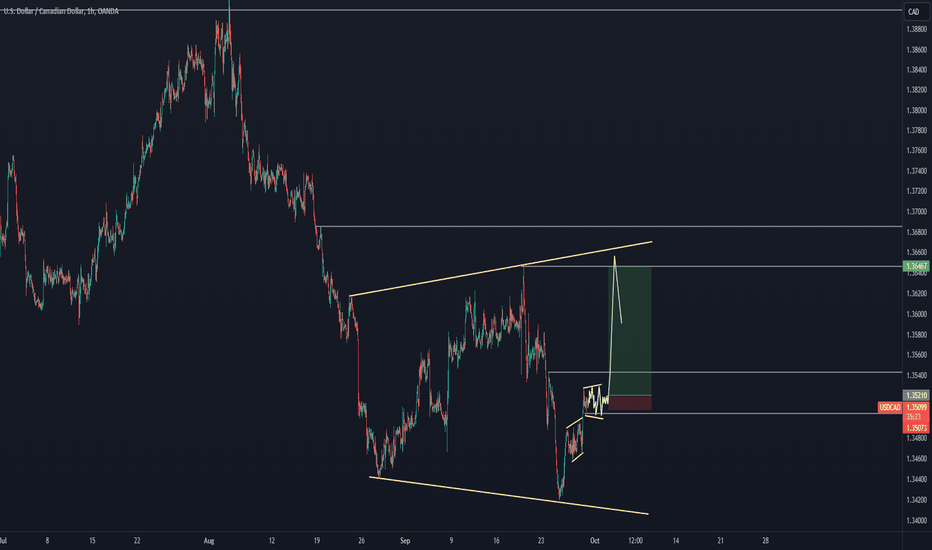

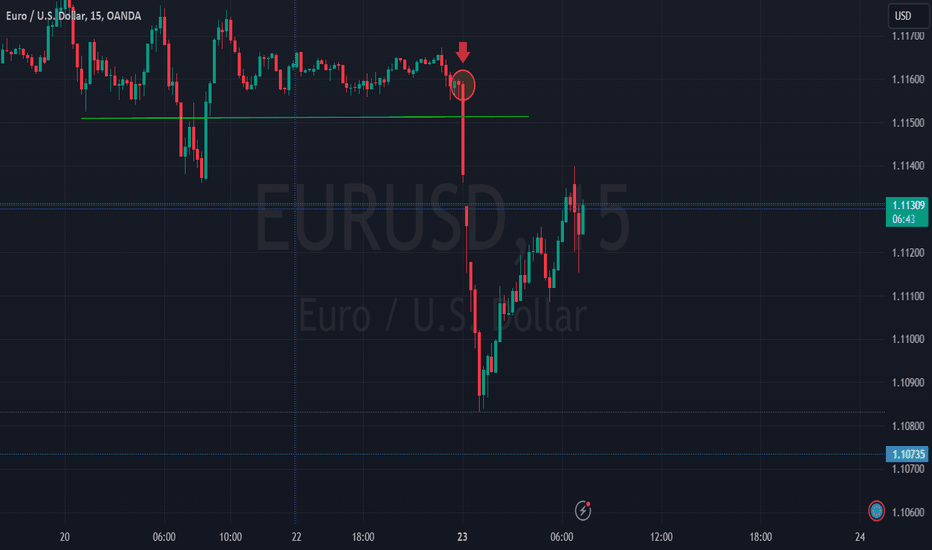

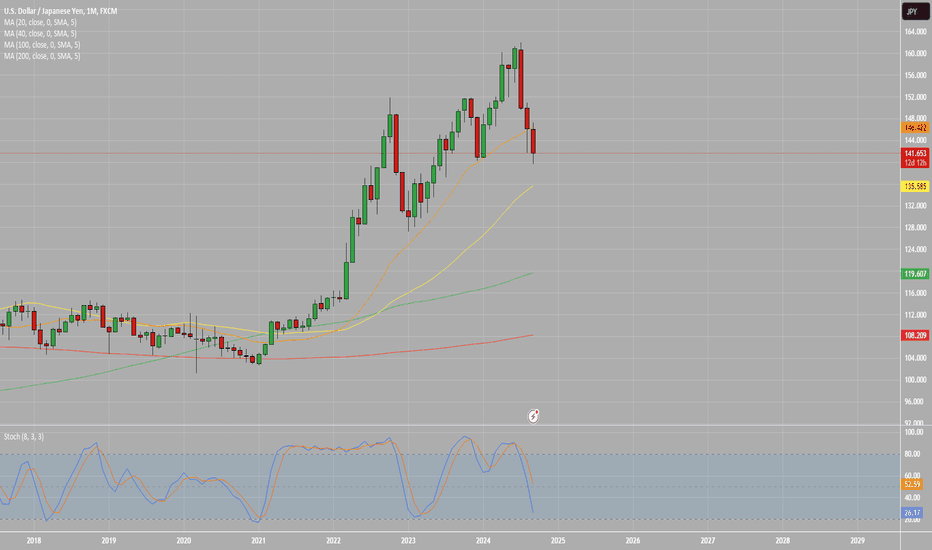

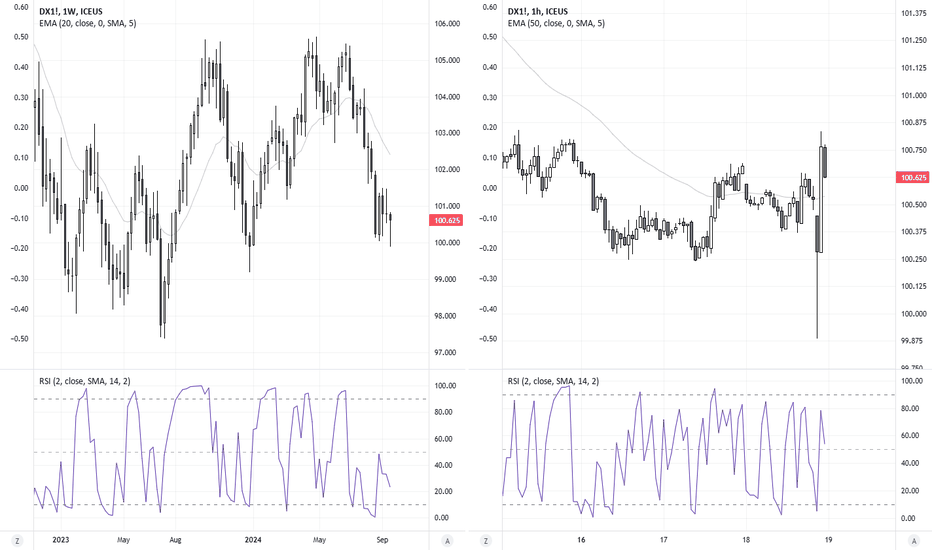

Why the US dollar bear should tread with careThe USD saw a sharp reversal higher despite a 50bp cut, simply because the markets were positioned for a more dovish dot plot. I have argued in prior analysis the USD exposure is a bit stretched over the near-term, so perhaps shorting the USD is getting a bit stale. We also have several key markets at inflection points after a risk event. Matt Simpson takes a technical look.

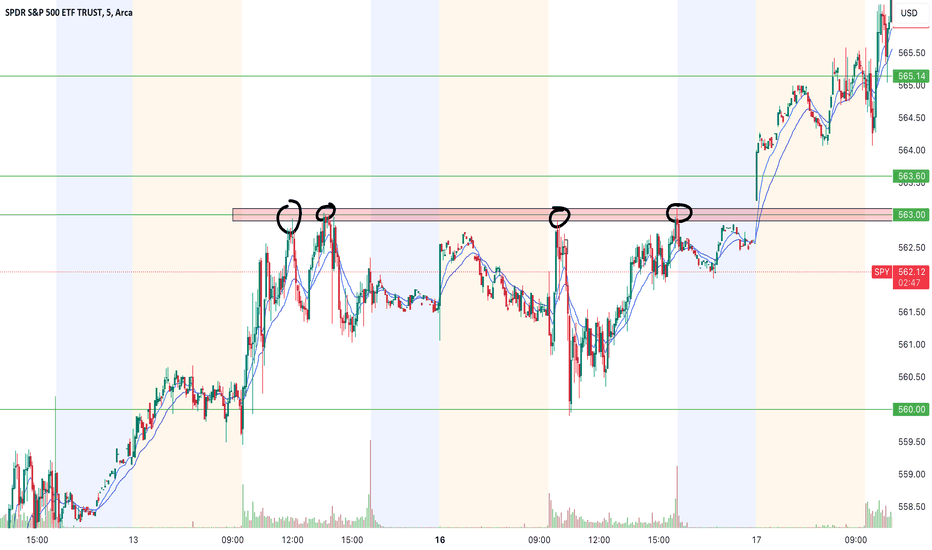

A+ Trade Set ups All From Respecting Simple Levels! We identify high-quality trade opportunities by focusing on key support and resistance levels. By respecting these fundamental price points, traders can enhance their decision-making process. Support levels act as a floor where buying interest tends to emerge, while resistance levels serve as a ceiling where selling pressure usually mounts. Recognizing and adhering to these simple levels helps traders pinpoint entry and exit points more effectively, increasing the probability of successful trades and improving overall trading performance.

AMEX:SPY

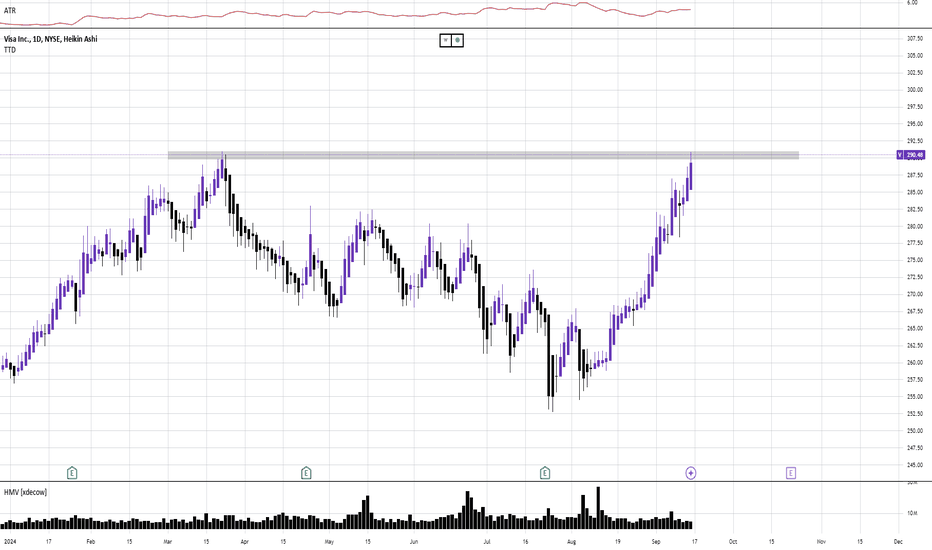

Looking for a potential breakout of all time highs on VISA!🔉Sound on!🔉

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

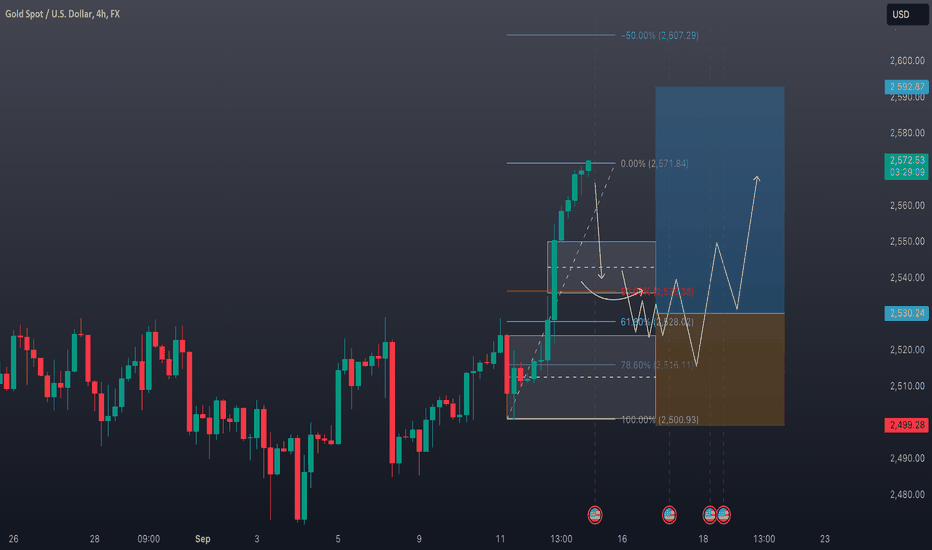

Gold Trading Strategy: A Professional Approach to XAUUSD 👀 👉 This comprehensive video presents a sophisticated trading plan for the XAUUSD (Gold/US Dollar) market, designed to maximize profitability through a structured approach. We delve into crucial aspects of technical analysis and leverage TradingView's advanced tools to gain a competitive edge in the markets.

Key topics covered include:

1. Trend identification and analysis

2. Entry and exit criteria

3. Market overextension assessment

4. Discount entry strategies aligned with institutional positioning

5. Higher timeframe trend analysis combined with 4-hour chart entry points

6. Price action and market structure interpretation

Our methodology emphasizes the importance of avoiding premium entries in bullish markets and instead focuses on identifying optimal discount entry opportunities. By aligning our strategy with institutional movements, we aim to enhance the probability of successful trades.

The video provides a detailed exploration of various technical analysis components, including:

- Trend analysis techniques

- Market structure interpretation

- Price action patterns

- Overextension indicators

- Traded Volume indicators

- Multi-timeframe analysis (higher timeframe trend combined with 4-hour chart entries)

This comprehensive approach to XAUUSD trading is designed to equip traders with the tools and knowledge necessary to navigate the gold market effectively and potentially increase their trading success.

Disclaimer: Trading in financial markets carries a high level of risk and may not be suitable for all investors. The information provided in this video is for educational purposes only and should not be construed as financial advice. Past performance is not indicative of future results. Always conduct your own research and consider your financial situation before making any investment decisions. Trade responsibly and use proper risk management techniques. 📉✅

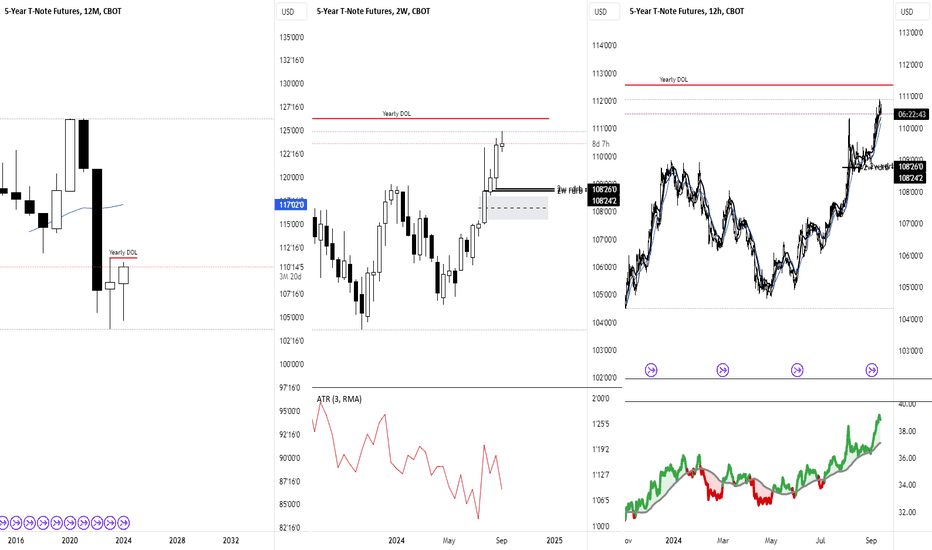

How I Use Multi Timeframe Analysis to Capture LARGE Price SwingsDISCLAIMER: This is not trade advice. Trading involves real risk. Do your own due diligence.

TUTORIAL:

Today, I demonstrate the thought process and mechanical steps I take when trading my Multi-Timeframe strategy. We take a look at US Treasuries, which have offers a classic lesson in how to apply this approach.

As you will see, throughout the year, this approach took some losses prior to getting involved in the "real" move which we anticipated. No strategy is perfect, and I do not purport this to be perfect. It is a rules based and effective way to read price. This strategy is great for people who don't have a lot of time to spend at the charts. I would classify this more as an "investing" strategy when utilizing the 12M-2W-12H timeframe.

If you have questions about anything in this video, feel free to shoot me a message.

I hope you have all had a great week so far.

Good Luck & Good Trading.