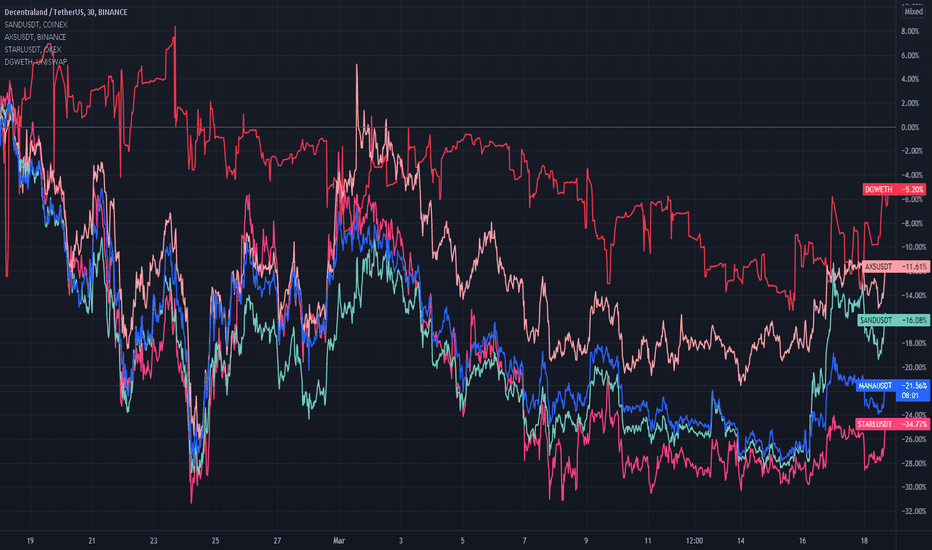

Why is Decentraland the Metaverse of Choice for Businesses?The metaverse market as a whole has been down for the last 3 months as we plod through this crypto "winter" - though it's worth noting that Decentraland is slowly closing the gap to Sandbox after its surge last year. But one trend in particular here sticks out -- the emergence of Decentral Games ($DG) coin, which is a project that focuses on casino-style gambling games that are playable directly on the metaverse.

In a way it's not surprising -- if you've been on Decentraland lately you might have noticed something: the majority of traffic on the platform right now is clustered near two types of locations -- play-to-earn games (Wunderland, etc.) and casinos run by organizations like Decentral Games. DG is a coin that went all-in on Decentraland's future -- it named itself after the platform it built itself on, even. We've heard many well-known companies jumping into the metaverse but Decentraland seems to be metaverse of choice above all others. Why?

After looking into the details of the more popular metaverse projects (Decentraland, The Sandbox, Cryptovoxels, Somnium Space...even platforms like Roblox or Meta) the one thing that makes MANA stand out is the fact that it's the most decentralized platform out of all of its competitors, and its governed by its own DAO in a transparent way.

governance.decentraland.org

While there may be many who might oppose DG on principle (taking an anti-gambling stance), DG coin is, too, run by a DAO as well.

decentral.games

We may not see the influx of money going into MANA until the next fiscal year, but the fact that the big companies (including JP Morgan who recently opened its "Onyx Lounge" in Decentraland recently) are going there is easily noticeable -- why? Companies that are planning on operating businesses inside the metaverse seek a platform that maintains its neutrality and largely stays out of its way. The other projects are all run by companies or teams with centralized control in the background - for businesses that have done its due-diligence, a truly decentralized platform is the only option that makes any sort of sense.

Following the lead of DG, a lot of companies are hoping to create commerce layers on top of Decentraland to drive more traffic to its worlds, long-term. In a way, these trends is a validation of the decentralized model, since it encourages other projects to follow the success of the DAO model as a whole. Projects that are currently centralized may find itself being left behind long-term, as the partnerships and resources required to make Web3 models work migrate towards better (neutral) waters as a whole.

Community ideas

Why VXX exploded and what it means for volatility (VIX)One of the big market events today is the explosion in price of AMEX:VXX which according to the issuer Barclays has nothing to do with Ukraine or market events. I think it is tangentially related in some way to the market conditions but what does this actually mean for the near future of volatility? I look at TVC:VIX as a measure of the "fear index" of the S&P500. The VIX can be very useful in timing market tops and bottoms as it represents maximums of emotion. The VIX is telling us something about the current lows of the market and how the recent correction might soon be over.

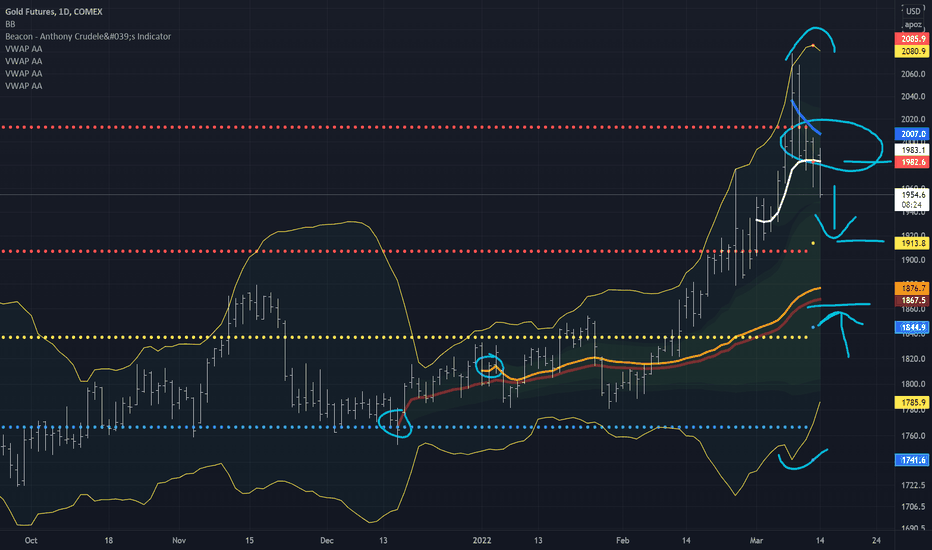

How I Use Auto Anchored VWAP To Trade GoldGold has been one of the most bullish markets on my charts this year until the past couple of sessions...I have now turned bearish Gold looking for a test of 1913 in the coming sessions. In this video I explain why I have now turned bearish Gold and more importantly I share my process for trading Gold Futures using the following indicators; TradingView's new Auto Anchored VWAP, Bollinger Bands and my Beacon Indicator. I also go over what levels will turn me bullish again in Gold and why I believe Gold Futures and Micro Gold Futures are the best products to use for trading the price action in Gold.

Past performance is no guarantee of future results. Derivatives trading is not suitable for all investors.

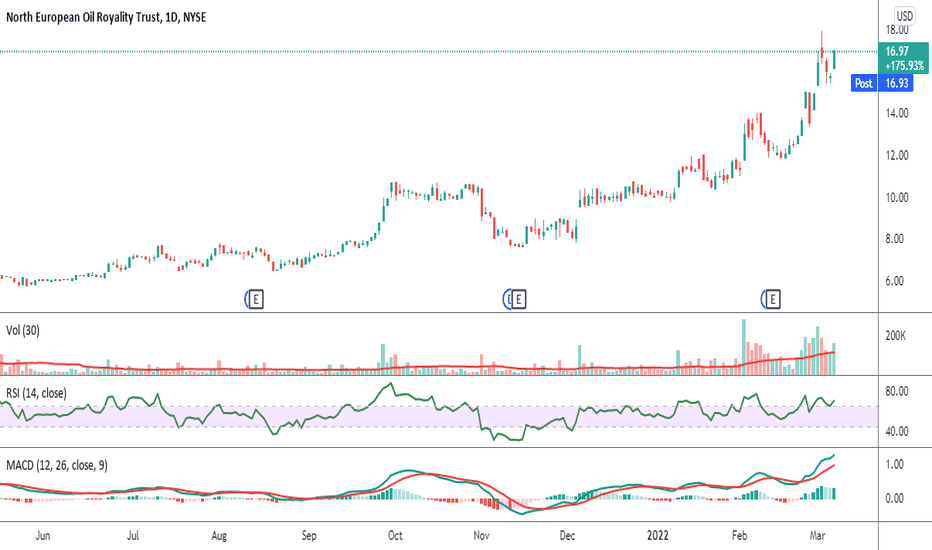

How To: Find Oil and Gas Stocks on the MoveThis video is more about how to use the TradingView Screener to find stocks in industries you might be interested in investing in, and this example is just looking at Gas and Oil where a lot of the action is at the moment with possible shortages not only in Europe, but potentially all around the world if things continue the way they are.

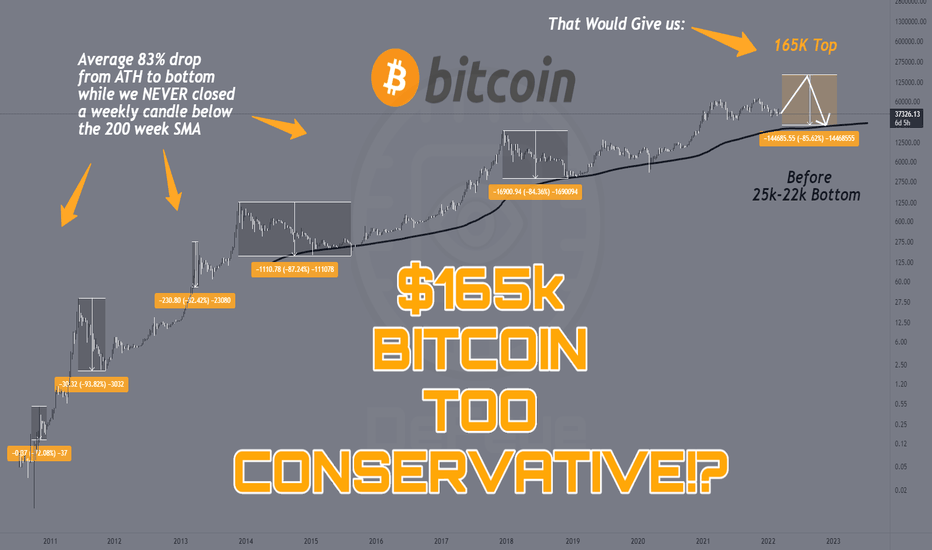

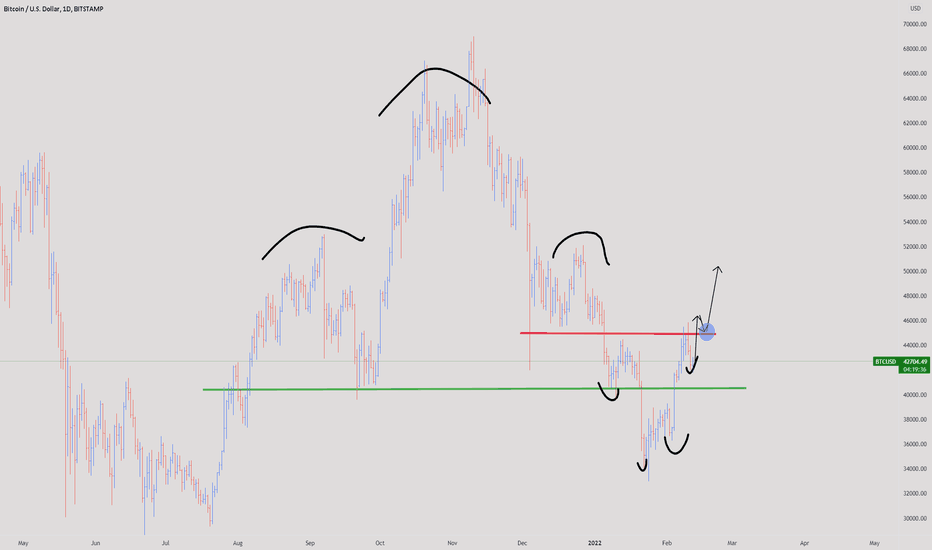

165k BITCOIN Prediction Too CONSERVATIVE?!Happy Monday Everyone! 😃

The title says it all, I'm going over my very controversial chart from yesterday where I predicted a 165k top for BTC .

I will post an updated more detailed version of the chart in the coming days.

Please make sure to check out my other posts too if you liked this one!

And finally a massive THANK YOU to all of you new followers and THANK YOU to @TradingView for publishing my post on to the front page of the website! 🙏🚀😃📈

I would like to add that this post is meant exclusively for educational purpose and that non of my posts are financial advise.

As always, A BIG THANK YOU for stopping by, I hope you liked my post! If you did, please take a second to drop a like or comment, every engagement puts a smile on my face, but also helps me to get my ideas out to many more of you guys! 😃🙏

Happy Trading ✌♥📈

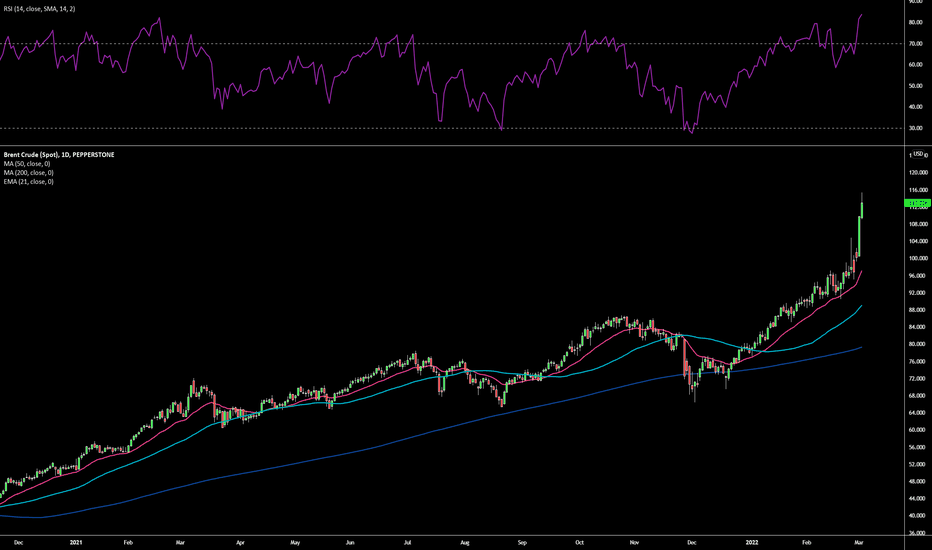

Oil rising be ready to sellAs war drums are beating and WW3 may be on the verge of becoming a new reality, oil is ripping the faces off of people shorting it. It's also ripping your wallet apart. I expect a sell-off at some point if it continues at this rate but probably not before making new all-time highs above $150/ barrel. I expected XLE to get to $135 over the next 4-5 years but now it climbing very quickly ut I believe that is short-term. I may be taking some profits around the $100 mark as I expect government control to come in. I am not sure what that will look like yet but if it is a subsidized market whether cash in people's pockets or giving money to oil companies to keep the price low, that's inflation so I expect those stock prices to continue to rise. In the short term, you can hear the negative talk that may trash these stock prices which is exactly why I want to be taking profits at technical places and be ready to buy on these bottoms.

XLE oil WTI

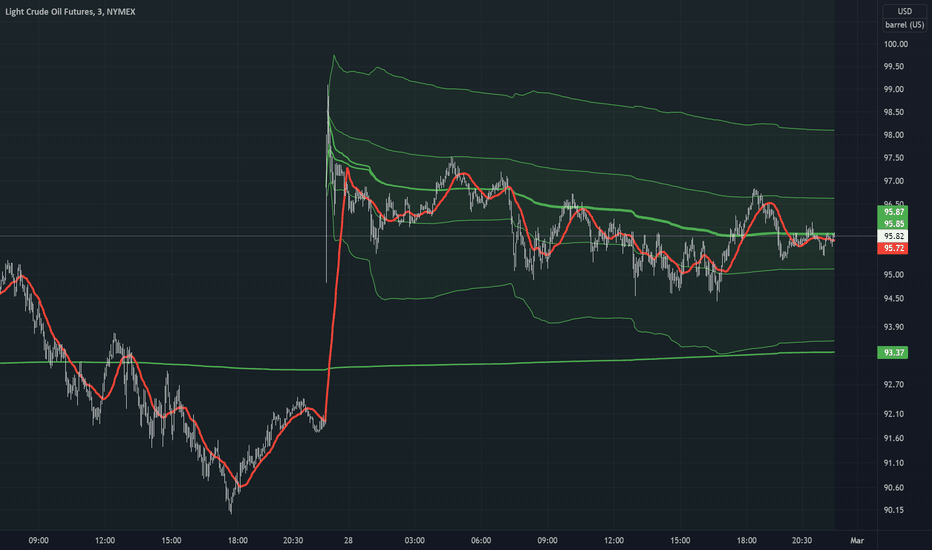

VWAP Strategy To Trade Crude Oil When Technicals coincide with Fundamentals you get the biggest moves. We continue to see bullish fundamentals and bullish technicals on Crude Oil so in this video I share my favorite way to trade Crude Oil. I start with a daily chart and use the 20 day moving average and Anchored VWAP. The 20 day ma helps me identify how strong the trend is. In 2022 Crude Oil has tested the 20 day multiple times, but has been unable to close below it. From there I take an anchored VWAP and take it to the recent low when Crude last tested the 20 day ma. From there I use a 3 standard deviation on the VWAP to show me where potential resistance will be on rallies. I only look for longs in this environment, no shorts at resistance. I go down to my 3 minute chart to help me with executing intraday and use two Anchored VWAP's. I anchor one VWAP from the open of new day and use a 1 standard deviation. I anchor another VWAP from the open and use a 3 standard deviation. The 1 std deviation helps me with an area to scale out of the trade. I only take longs when the 3 minute bar closes above the VWAP and I use the 1 standard deviation as my target to take off 50% or more of the position. As long as Crude Oil stays above the intraday VWAP I remain long and look to trail for a potential test of the 3 standard deviation VWAP.

Past performance is no guarantee of future results. Derivatives trading is not suitable for all investors.

Beware False Breakouts! How To Spot Them...Investors should use basic Technical Analysis for powerful decision making. I see it as a challenge to demonstrate how useful knowledge of one simple pattern can be to identify price reversals. Recognizing this pattern and acting on it will save much money and headache!

Both traders and investors need to be on guard for false breakout reversals. Seeing this pattern in action can provide an excellent profit target, entry point, or prevent major drawdown!

In this video I look at examples in the Silver ETF AMEX:SLV , Spotify stock NYSE:SPOT , and Forex Euro/Dollar pair FX:EURUSD for false breakouts and what follows.

I am excited to make this video for my viewers and for Best of Us Investing!

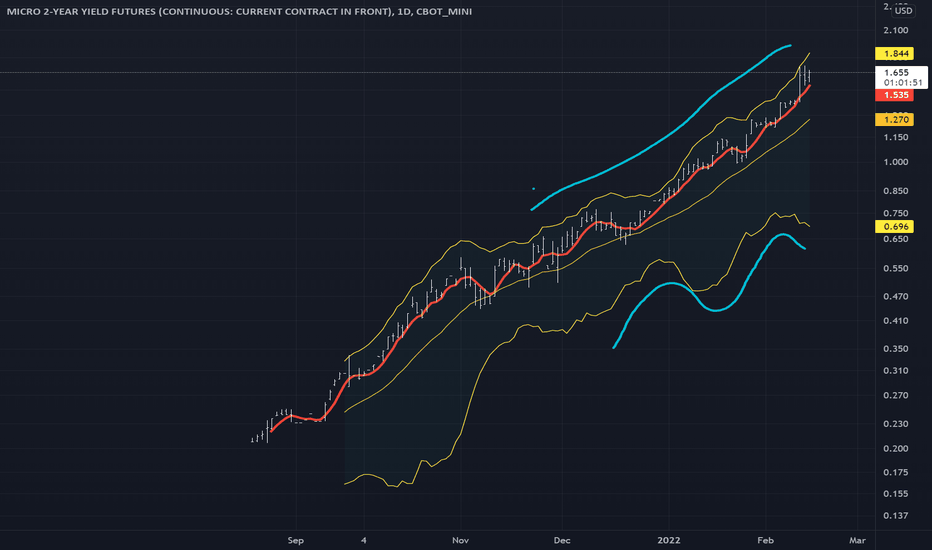

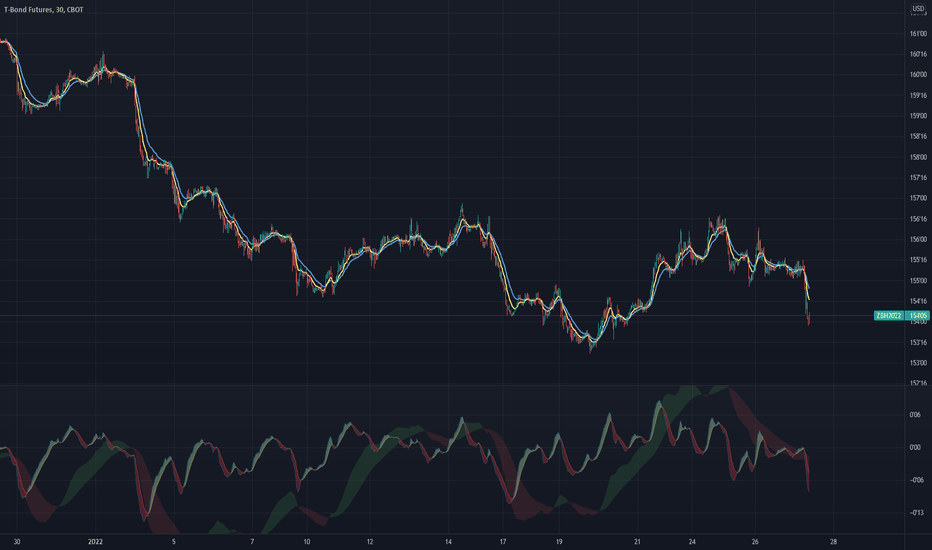

Why You Should Learn To Trade Interest RatesIf you're trading this market right now you have to keep your eye on Interest Rates. Why? Interest Rates have the largest web in the market. They impact every market we trade (even crypto :) What rates are doing not only impact the markets we trade, they impact us in everyday life. In this video I go over the best way to trade interest rates and even if you're not interested in trading interest rates, I go over the best markets to keep up on your quotes to see what rates are doing.

Past performance is no guarantee of future results. Derivatives trading is not suitable for all investors.

Bitcoin Analysis 12.02.2022Hello Traders,

welcome to this free and educational analysis.

I am going to explain where I think this asset is going to go over the next few days and weeks and where I would look for trading opportunities.

If you have any questions or suggestions which asset I should analyse tomorrow, please leave a comment below.

I will personally reply to every single comment!

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button and maybe consider following my channel.

Thank you for watching and I will see you tomorrow!

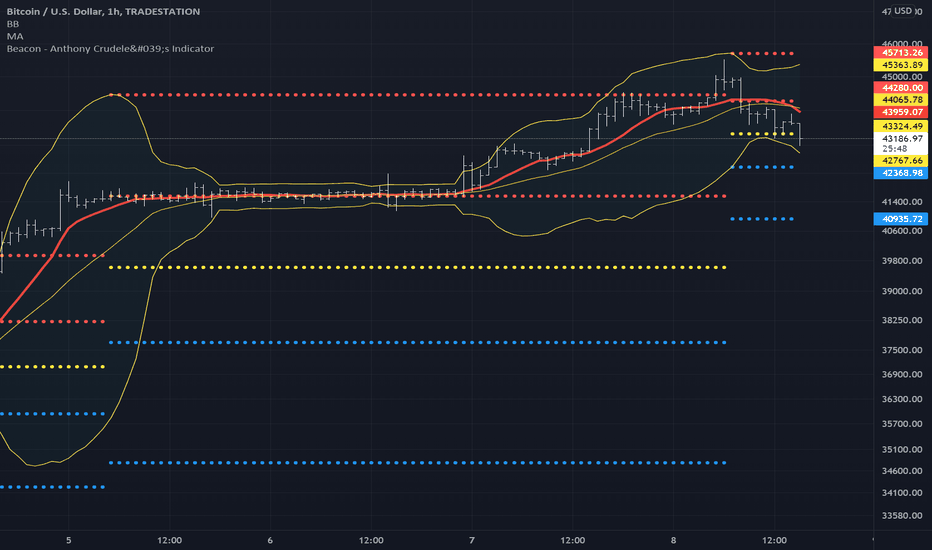

How To Use Bitcoin Futures To Hedge Your CryptoYou are either a trader or a HODL'er. Since I am a trader I don't like to sit in massive swings in my spot Bitcoin positions, I like to use Micro Bitcoin Futures to hedge my spot position to minimize the risk and also maximize my long position in spot. In this video I explain how I am currently hedging my long Spot Bitcoin position using Micro Bitcoin Futures, Symbol MBT.

Past performance is no guarantee of future results. Derivatives trading is not suitable for all investors.

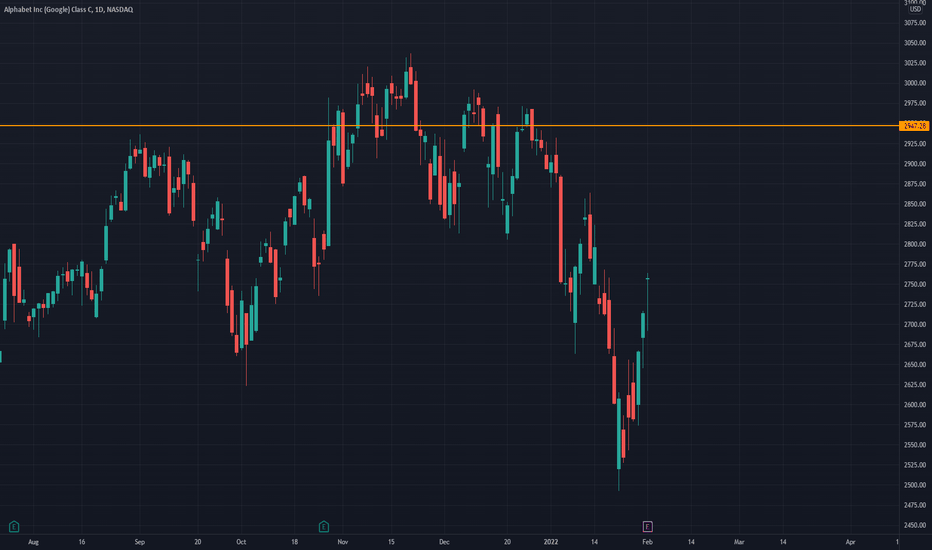

GOOGLE Stock Split - Big opportunity!Today on earnings NASDAQ:GOOG announced an upcoming 20 to 1 stock split. This is a major news event with a history we can look back on. There are three instances from the last two years (TSLA, AAPL, NVDA) where tech stocks announced splits and then proceeded to FOMO rally. Trade with proper risk controls but look for opportunity NOW in Google!

I talked about this trade last year with Nvidia when that stock did a split. It is the same trade. Check link below:

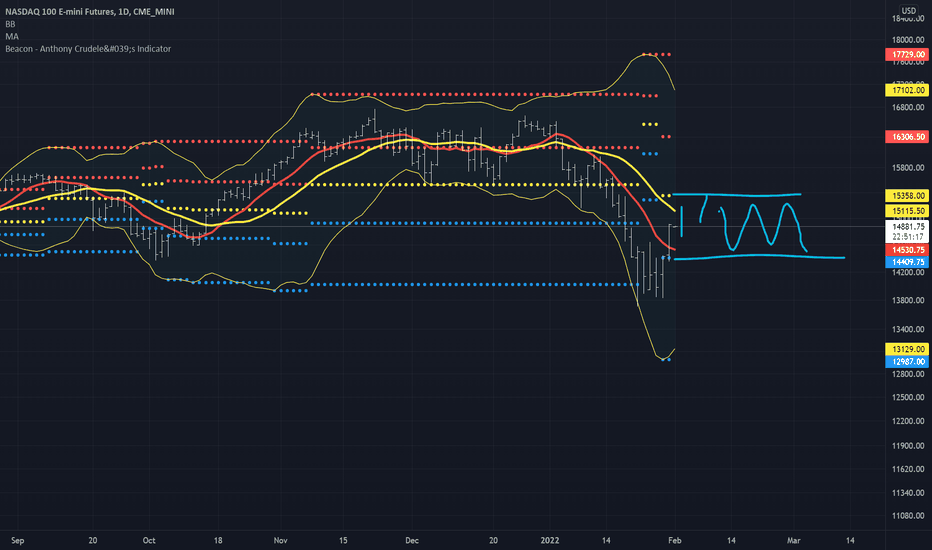

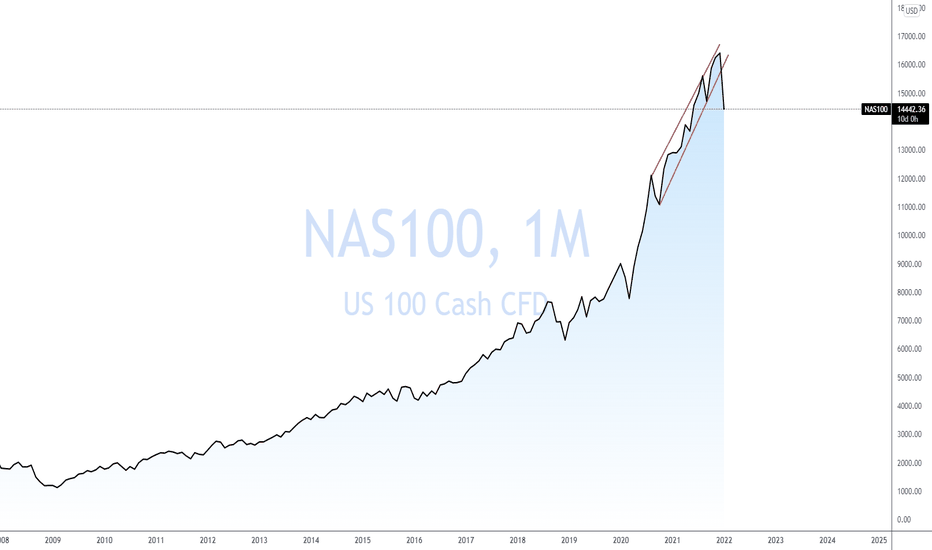

E-mini Nasdaq 100 Futures-15,350 TargetThe trend is back in favor of the bulls! Some people use trend lines to determine trends, but I use Bollinger Bands to determine bullish, bearish or neutral conditions and in today's video I explain how I use Bollinger Bands to determine that the E-mini Nasdaq 100 Futures are now back to being bullish and how my strategy triggered a long setup with a target of 15,350 in the coming week(s). I also use a 10 day simple moving average and my indicator (Free here on TradingView) Beacon to help guide my trade and help me manage risk.

This is not financial advice. This is for educational purposes. Do your own homework. This is how I think and I am teaching you how I think, not telling you what to think. Past performance is not indicative of future results. Derivatives not suitable for all investors.

Weekly Watchlist 1/31 - 2/4 Here is a couple of things we are looking to trade this week.

NASDAQ:MRVL

Nice Hammer Candle off the 200sma

Taking a move over $67 with targets of $68, $69, $70

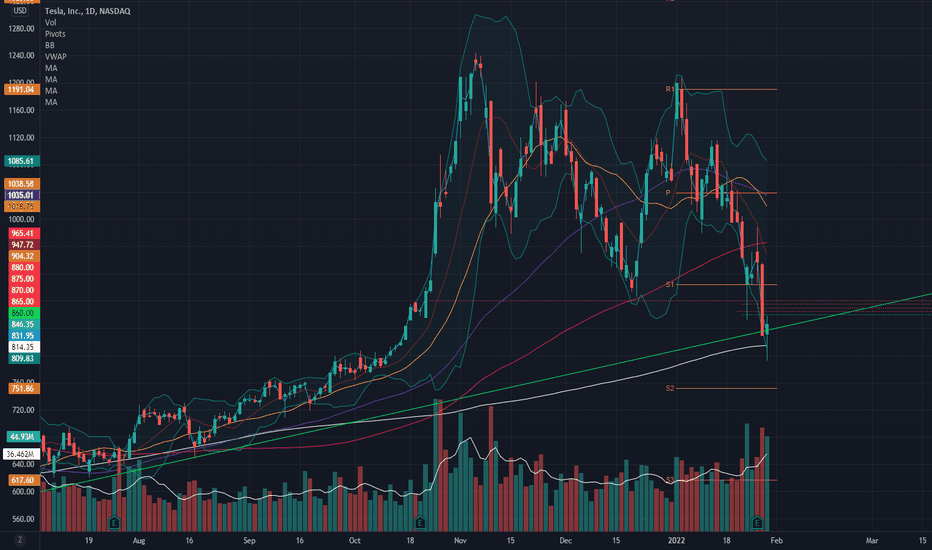

NASDAQ:TSLA

Another hammer candle off trend and the 200sma

Taking a move over $860 with targets of $865, $870, $875, $880

Bulls spooked into close...key levels for the coming sessionsMorning Jumpstart Macro view / US Market Recap 27-01-22

US markets took a hit into the close after the Fed Reserve signalled rate rises and an end to free money. Gold fell as the USD rallied while oil continued higher thanks to supply concerns.

For a deeper look at the price action, key levels and what I see playing out...watch the video and feel free to leave any comments.

Hope you enjoy and have a good trading day!!

Weekly Update Jan 21, 2022 Don't Try To Pick Bottoms.I will say it again. Caution in all asset classes remains. How much risk are you taking on for how much reward you are expecting to acquire?

Keep asking yourself that question. Better to be out of the market wishing you were in rather than being in the market wishing you were out.

Facebook/Meta Platforms Analysis 17.01.2022Hello Traders,

welcome to this free and educational analysis.

I am going to explain where I think this asset is going to go over the next few days and weeks and where I would look for trading opportunities.

If you have any questions or suggestions which asset I should analyse tomorrow, please leave a comment below.

I will personally reply to every single comment!

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button and maybe consider following my channel.

Thank you for watching and I will see you tomorrow!

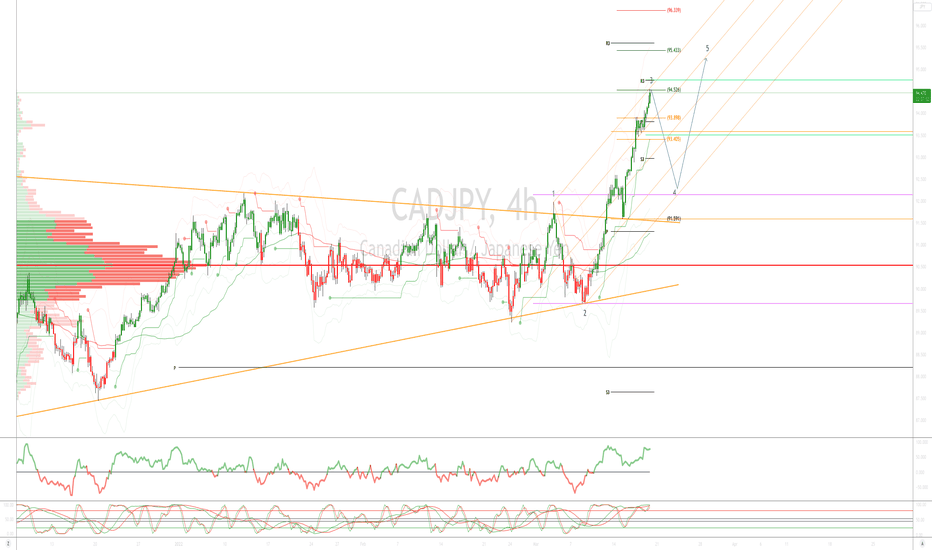

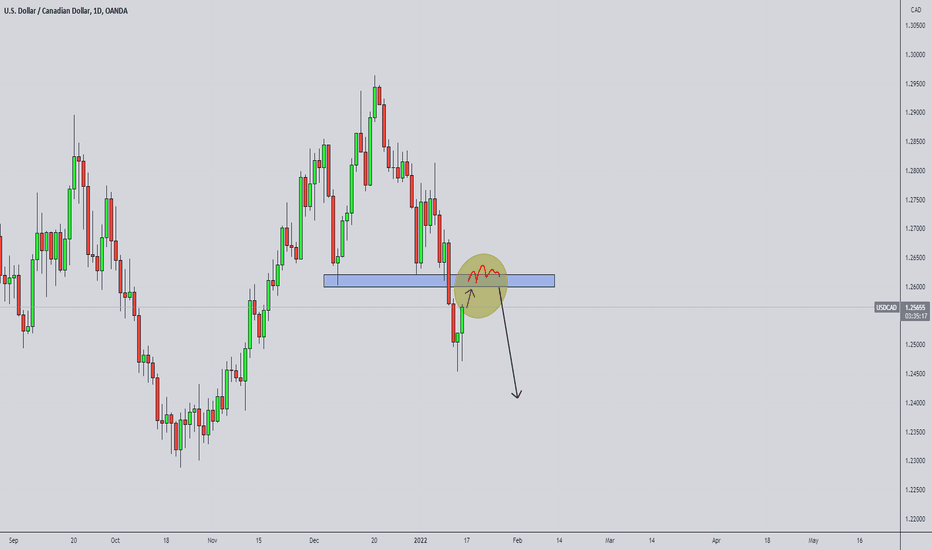

USD/CAD Swing Trading Analysis: ready for another impulse? Hello Traders, here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.