Community ideas

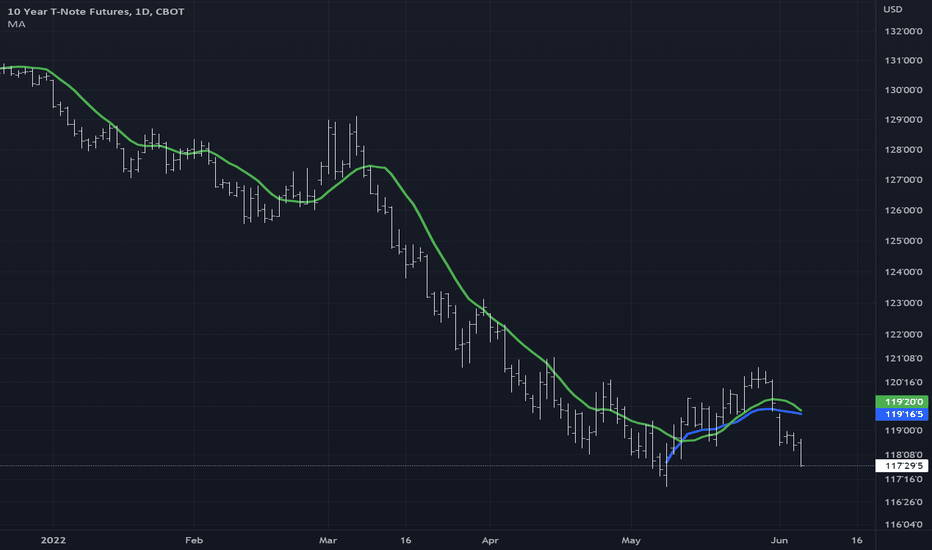

How I Use Treasury Futures To Better Execute The E-mini S&P 500Interest Rate Futures are the market leaders this year. Our technical indicators have less of an impact when the Bond & Treasury Markets are on the move and as Traders we have to be aware of when that is and how it impacts the price action in the E-mini S&P 500, E-mini Nasdaq 100 and Russell 2000 Futures. In this video I go over a simple, but effective way I use the 10 YR Futures ZN1! & the Micro 10 YR Treasury Futures 10Y1! to better execute the Indexes.

To learn more about the Futures Products discussed in the video please check out CME Group's Website. I also mention that I trade futures on TradingView using TradeStation so please go to TradingView's website or TradeStation's website to learn more.

Past Performance is not indicative of Future Results. This is for Educational purposes only. Derivatives Trading is not suitable for all Investors.

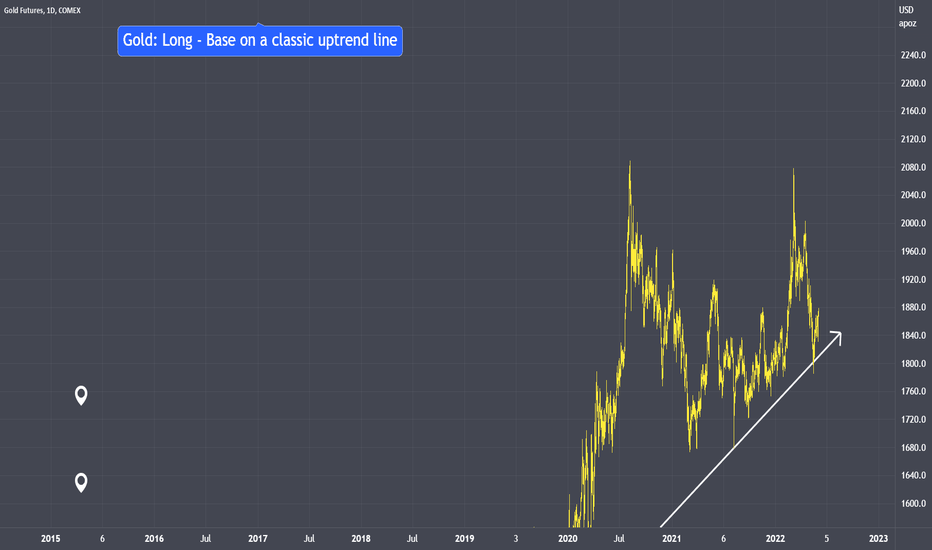

Gold: Long on a classic uptrend lineDiscussion:

1. 2 rules to draw an uptrend line

2. Primary uptrend line

3. Secondary uptrend line

4. Time for buy Gold?

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

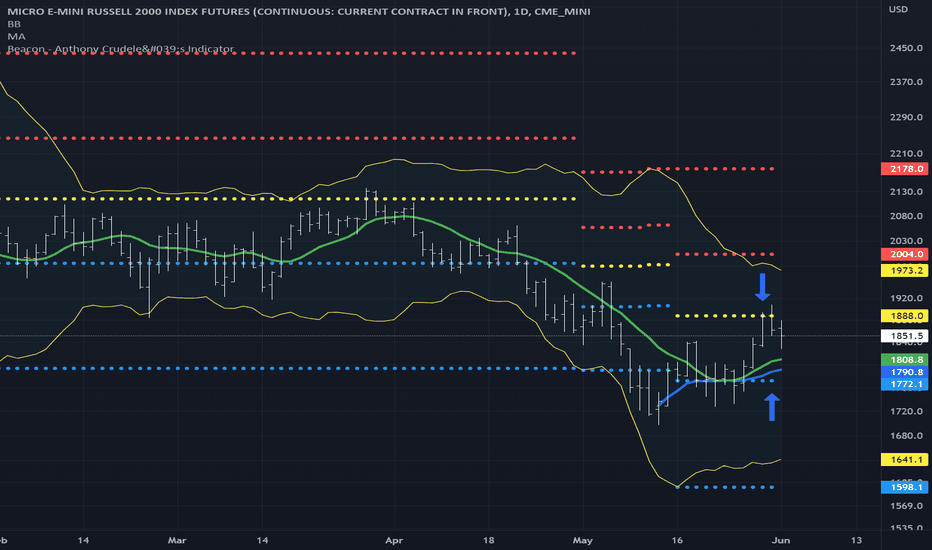

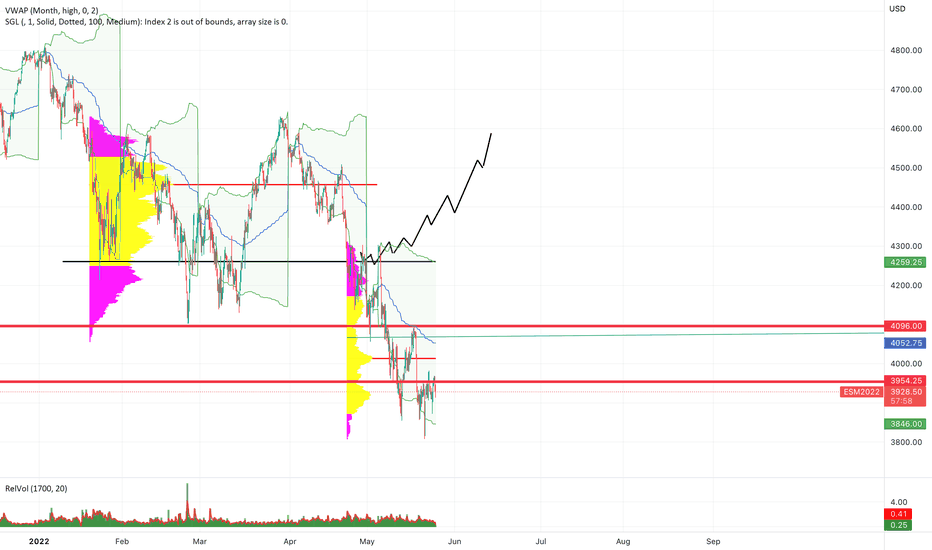

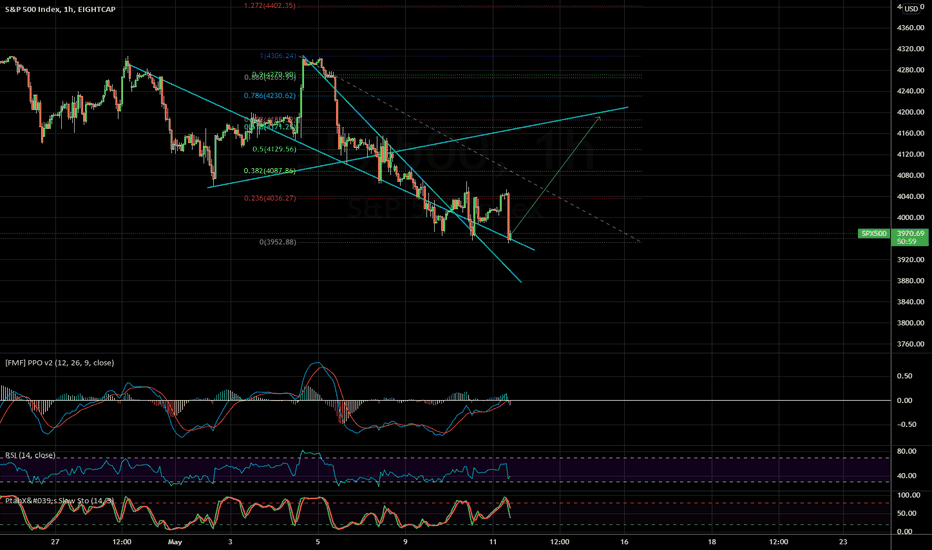

Key Technical Areas In The E-mini S&P, Nasdaq & Russell 2000We're in a phase of the markets where the E-mini S&P 500, E-mini Nasdaq 100 & E-mini Russell 2000 Futures are all moving together without divergences. This is a good look for Index traders because when the Indexes are working together we get cleaner moves. In this video I go over the key technical areas I am seeing in these Indexes and how I now have a line in the sand for the bulls to hold. In the video I use Bollinger Bands, Anchored VWAP, 10 day simple moving average and my Beacon Indicator (it's free and open source here on TradingView).

I mentioned in the video I am using Micro Futures to execute some of these trades. To learn more about these products go to CME Group's website. I am also executing my futures on TradeStation which you can connect to TradingView to trade spot, futures and crypto. To learn more you can go to TradeStation dot com/anthony.

Derivatives trading is not suitable for everyone. Past performance is not indicative of future results.

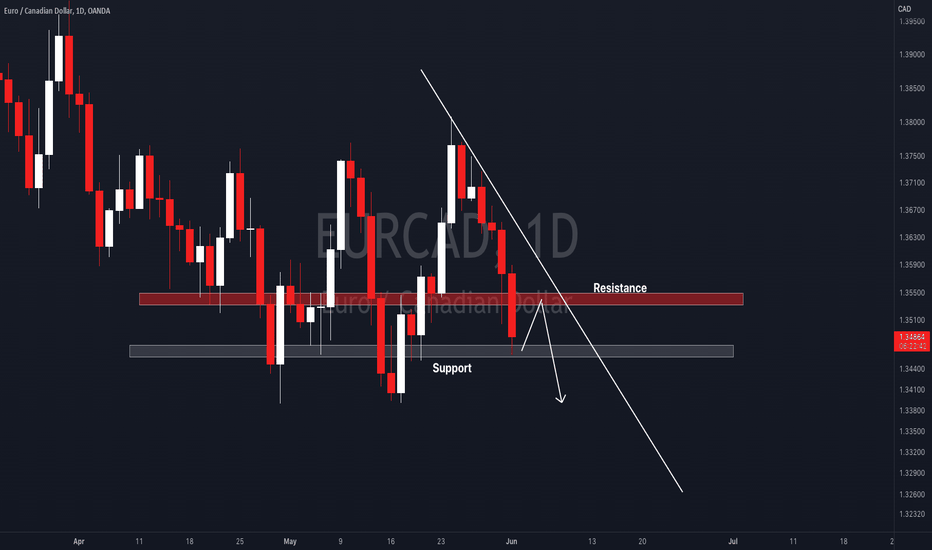

EURCAD Analyis Welcome back! Here's an analysis of this pair!

**ERUCAD - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

Brian & Kenya Horton, BK Forex Academy

Morning Ideas May 25, 2022Good morning traders,

Apologies for yesterday's morning ideas coming out without audio.

What I was expecting yesterday was more of a non-trendy day. The difficulty with this market is that it's difficult to look for a back and forth market setup when we whip around intraday. For example, yesterday at 1130 it looked like it was a trend down day, just to turn around and trend higher the rest of the day.

What we are left with today is a market continuing to build out volume in this lower distribution that I discuss in the video. I think you have to continue to give the edge to the sellers here, as the market continues to have trouble holding onto higher prices.

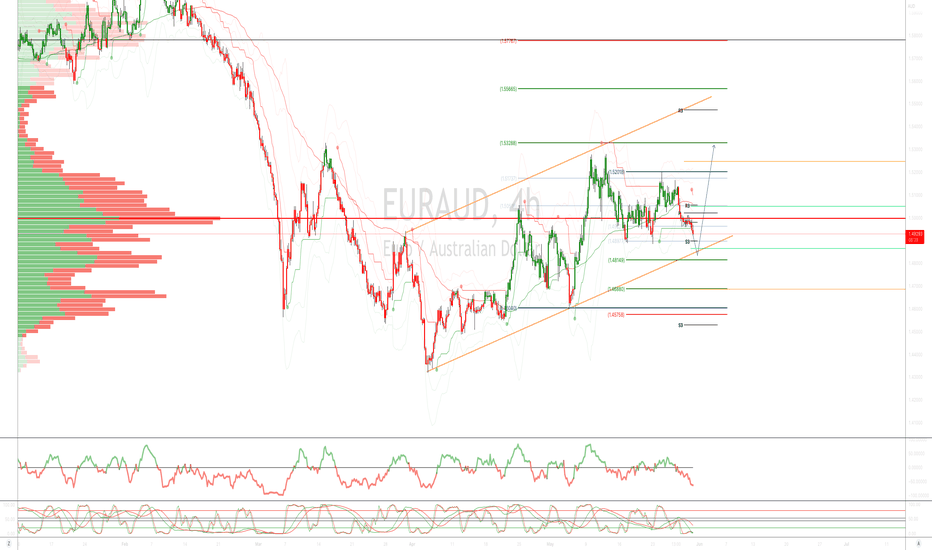

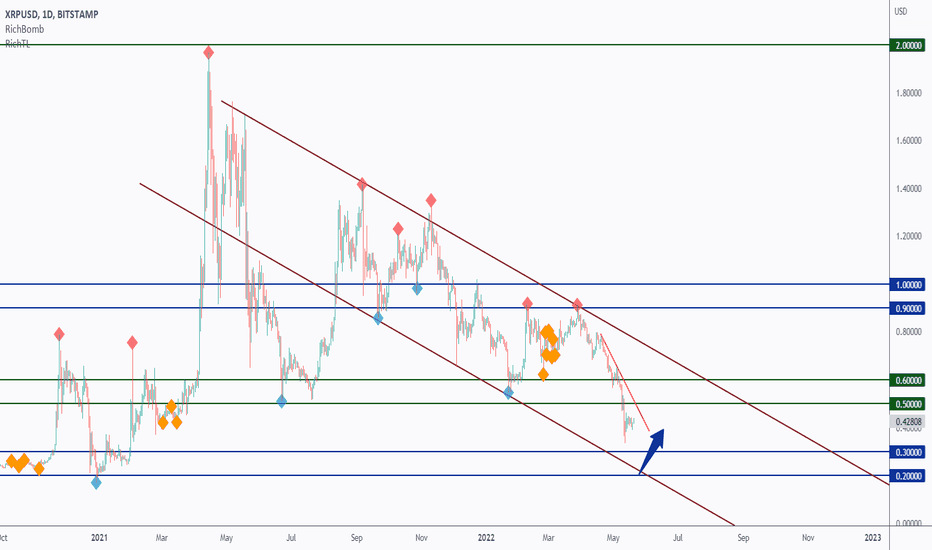

How To Analyze Any Chart From Scratch - Episode 2Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

Today we are going to go over a practical example on XRP, but you can apply the same logic / strategy on any instrument.

Feel free to ask questions or request any instrument for the next episode.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

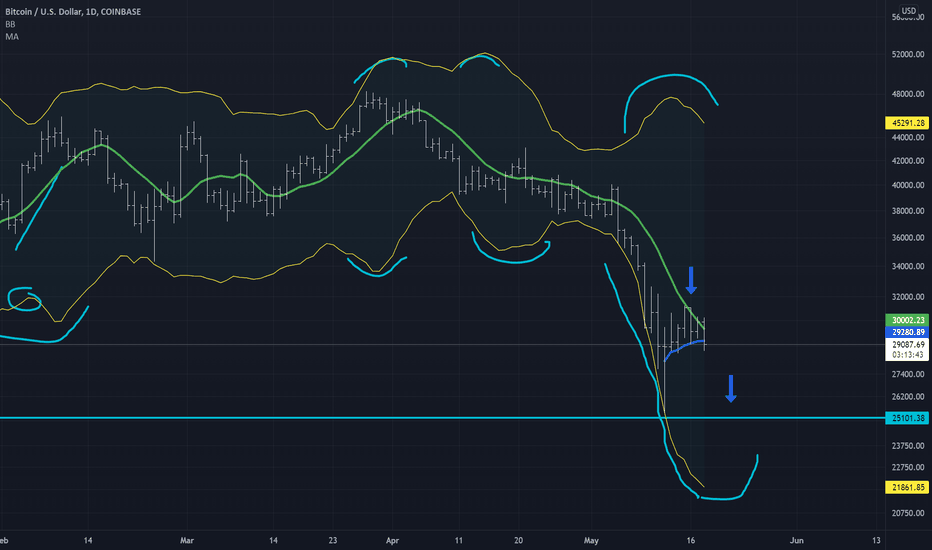

Why I'm Short Bitcoin MBT FuturesAfter that steep selloff we had in Bitcoin down to around 25k I anchored a VWAP to that day to see if we could hold above it to gauge the strength of the market coming off that low. I also kept up a simple 10 day moving average to gauge the trend of the market. The entire rally off the low we held below the 10 day moving average and as of today we failed to hold above the Anchored VWAP. Both of those are signals of weakness to me and adding to that my Bollinger Bands are also telling me that the market still favors the short side. This area for me is pretty good risk reward as I will stay with the shorts until a daily close above the 10 day moving average or a violation of the recent high off the lows around 31,000. As I recorded today we are right around 29,100 and I am slowly getting in to the short side looking for a possibility of the 25,000 low to be tested and possibly even lower prices following that. I mentioned in the video I am using Micro Bitcoin Futures to execute my shorts. I am also executing my trades on TradeStation which you can connect to TradingView to trade spot, futures and crypto.

Derivatives trading is not suitable for everyone. Past performance is not indicative of future results.

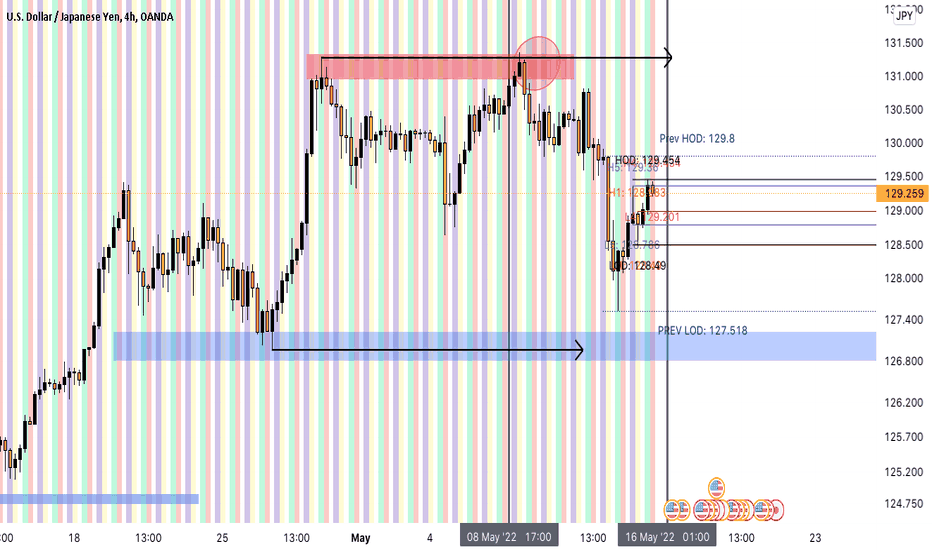

The BEST position of 2022? The answer may surprise you...What has been the best investment/position of 2022? The best trade was of course to be "short stocks" or "short crypto" but where could we have put capital to have achieved the best return. Believe it or not, despite all the FUD narratives about inflation and the US Dollar's weakness, one of the best performing assets of 2022 was in fact... US Dollars. That's right, "cash is a position" and relative to other world currencies the US Dollar has been RISING. Your cash buys more stock, more crypto, more foreign currency.

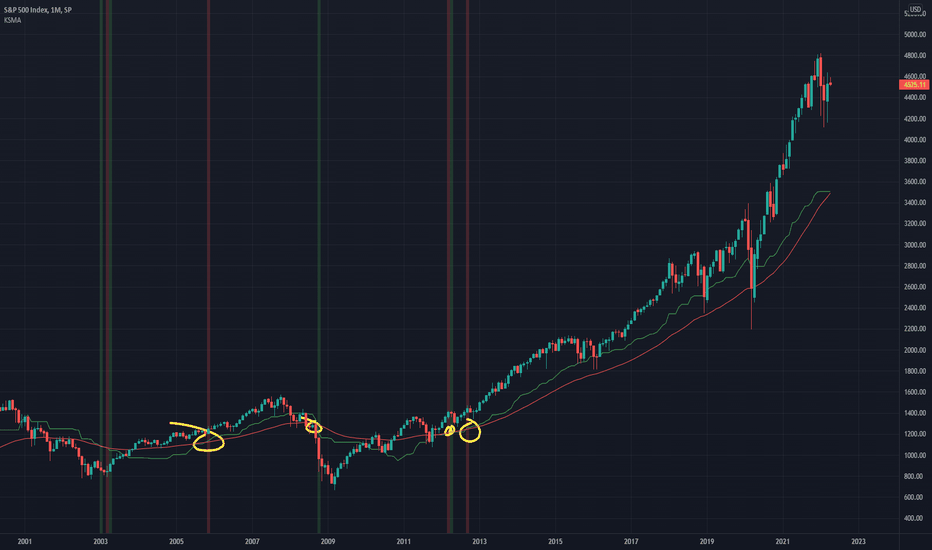

Why I'm Bullish The E-mini Nasdaq 100 FuturesIn this video I go over several reasons why yesterday's low signaled to me that it is a good low to now look for longs. I use a measuring tool for rotations, Bollinger Bands (20 Period 3 Standard Deviation), 10 day Moving Average, and the Year To Date Auto Anchored VWAP.

I connect my TradeStation account to Trading to Trade Futures.

Past performance is not indicative of future results. Derivatives trading is not suitable for all investors.

Decentraland (MANA) and the Metaverse Rental MarketThe metaverse (Decentraland especially) has a lot of hype behind it but the utility aspects of it is still underbuilt in its current form. Will it eventually get there? A look at a few things being worked on in the background during this bear market.

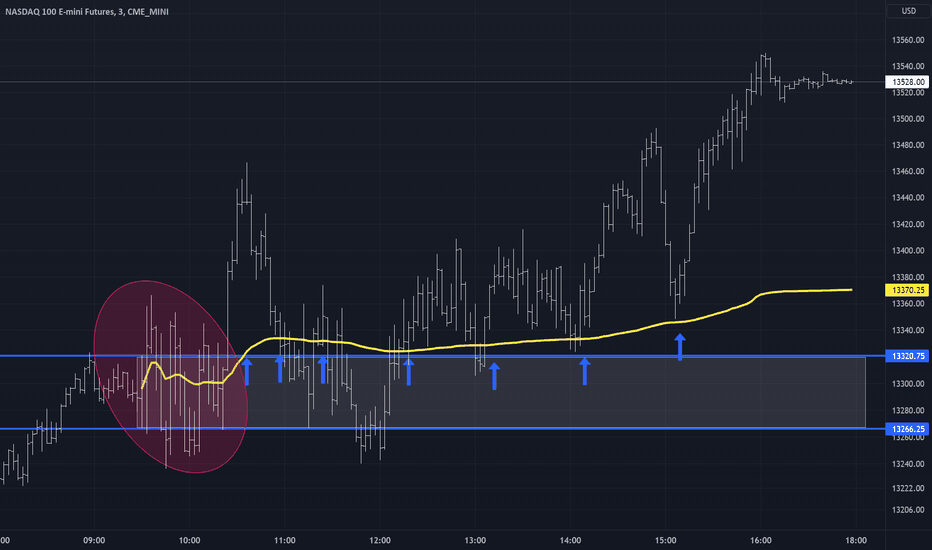

How I Day Trade The E-mini NasdaqSimplicity is King when it comes to day trading futures. One of the keys for me when I am day trading futures is to find one side of the market to trade on and stick with it throughout the day. I think too many people get caught up trading both sides of the market and get themselves over trading. In today's video I show you a simple strategy using a 3 minute opening range along with an Anchored VWAP to help you determine if the day is going to be choppy, or a trend day. This strategy is something I use to determine direction for the day and can easily be used as an addition to your strategy to give you confirmation of trend.

Past Performance is not indicative of future results. Derivates trading is not suitable for all investors. This is not investment advice.

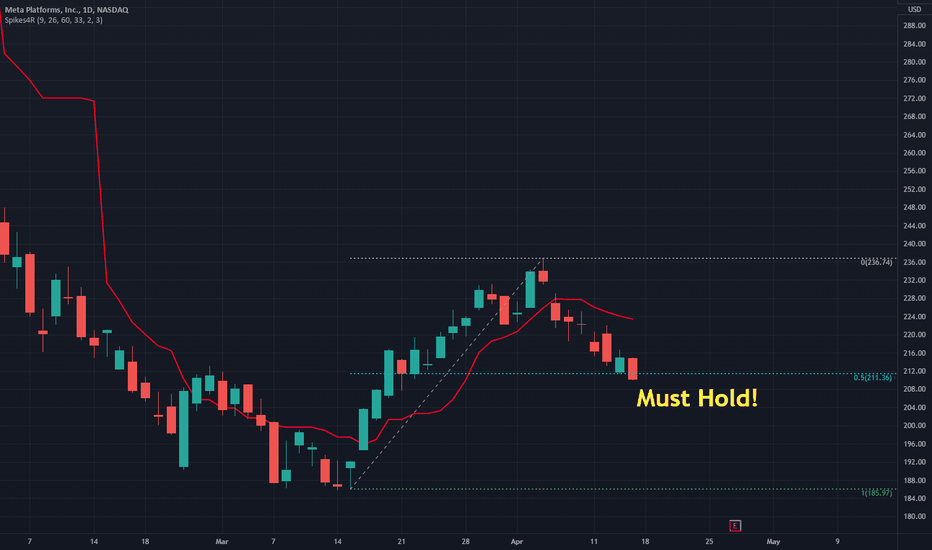

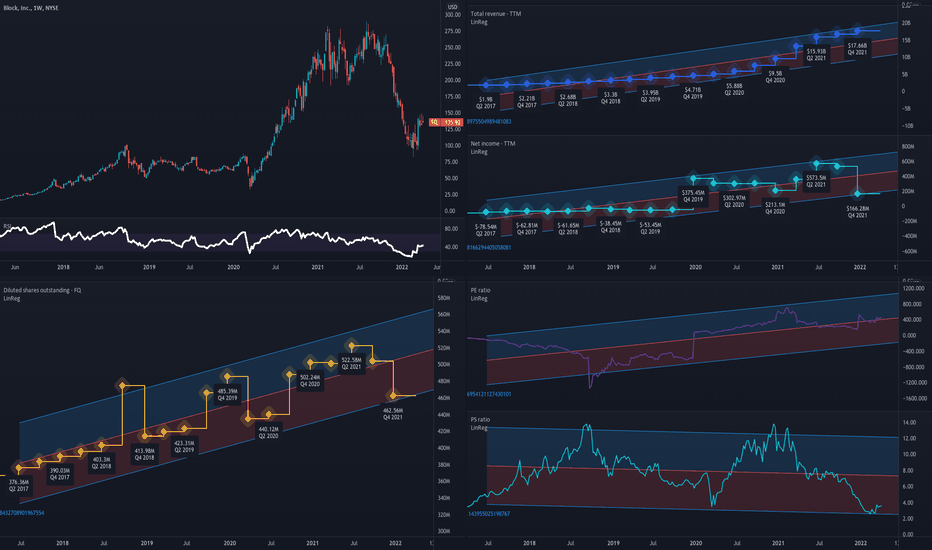

Strategy, Support, Resistance - 4/17/2022 - Crypto, StocksThis week we look at stocks, cryptocurrencies, commodities, and stocks making moves. The stock market looks to be inside a bear trend coming off the late March rally. I am looking for a spike up on VIX to mark the next stock market swing bottom. Cryptocurrencies have almost all given up their recent March rallies with Ethereum holding its ground for now. Oil is on its way back up to 112. Gold and silver are showing signs of trying to retest the recent failed breakout high but may just be marking a new consolidation. Tech stocks are giving up the resurgence and value stocks continue to be winners.

LET'S GET REAL: Stop Strategy Jumping!Hey Traders,

This one is going to be a little bit different, a little bit deeper and a little bit harder to listen to rather than usual technical analysis. I recommend you sit down and listen to this. Have a think whether it relates to you or whether you found yourself in this position, or even if you've gone through this position and share your experience on how you go through it. A lot of traders struggle with their strategy, jumping from aspects of trading and that's why so many educators out there make a lot of money off of them. It is time to stop.

In this video I outlay a challenge that I put to all the traders who may find themselves in this position to sit down and to thoroughly test their current or previous strategies and understand them on a deeper level. No more jumping around, no more looking outwards. Let's start looking inwards. Let's see the data that we have handed to us and what we can do to improve that data.

If you enjoyed this video, please leave a comment. Leave a like, if we do get enough likes and comments, I will make a Part 2 on how to go about this with a more depth avenue while using different resources.

As always, have a fantastic training week.

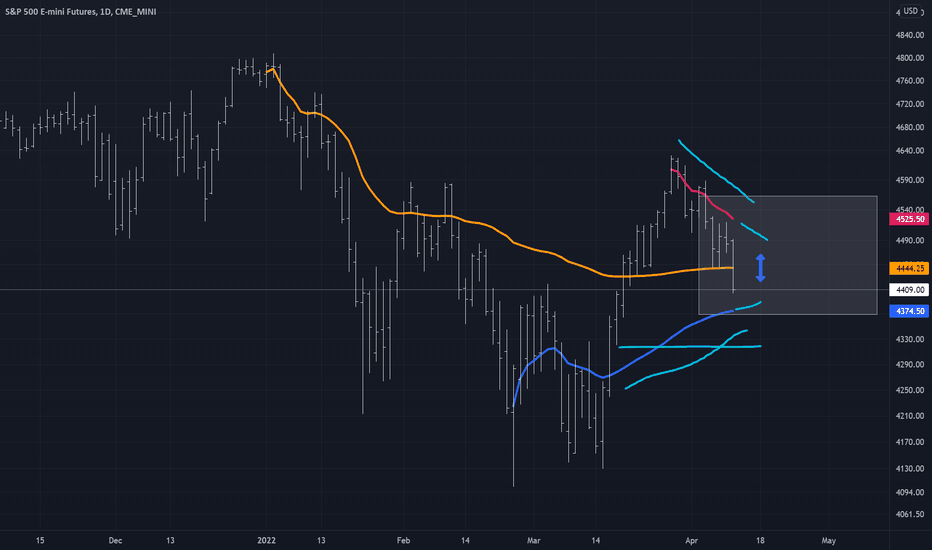

How I Trade A 2-Way Market In The E-mini S&P 500 FuturesI see a lot of talk on whether the S&P is in a bull or bear market and IMHO, neither the bulls or the bears have control right now. I think this is a 2-way tape frustrating a lot of bulls and bears. In this video I share my simple process for assessing how we are in a 2-way market, not a bull or bear market and how I am using Anchored VWAP's to keep me out of trading the middle and keep me trading the edges. As of right now I am looking at 4375 to get tested in the coming day(s) where I will look to establish a long position. If that holds I will look for a retest of 4444.50 and potentially a rally up to 4526. A daily close below 4375 I would be out of my longs and then I think that the bears have a chance to take control of the market.

Past performance is not indicative of future results. Derivatives trading is not suitable for all investors.

XAUUSD Overall Bullish

Good Afternoon traders we are looking for the massive pennant formation to continue to the upside.

Will be looking to add additional positions around g 1940-1942, looking for gold to move into the 60's and potentially the 80's depending on how we see it react once reaching 1960.

As always trade proper RR live to trade another day. Let's make some money guys.

Thank you for watching.

Making A Signal In Tradingview Pinescript In Under 20 MinutesHave you ever wanted to combine two technical analysis indicators into a single signal to find your own way of making profit? This video is a tutorial where I take two stock Tradingview Pinescript indicators and combine them into a signal that makes it easier for the user to spot with their eyes when an even occurs on a chart. By following along I hope the viewer can learn the basic process of repeating this for their own research!

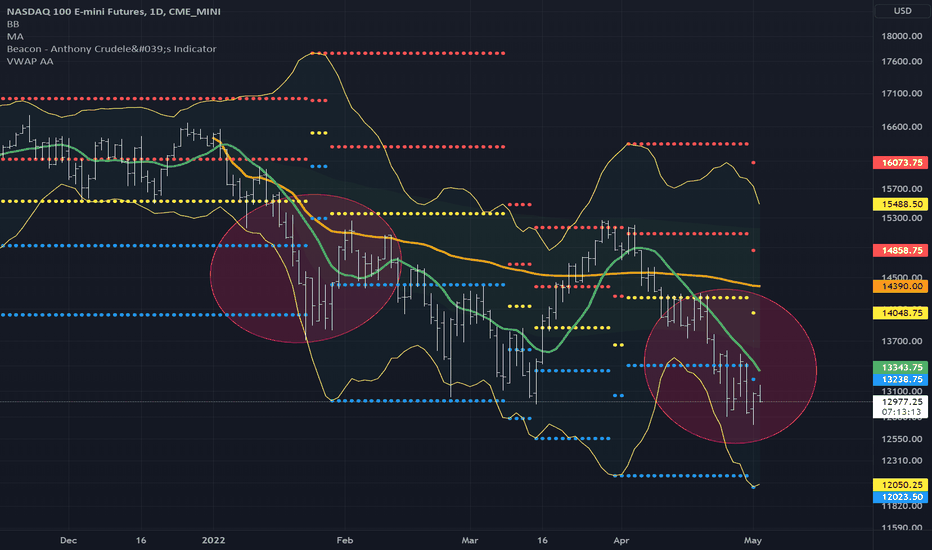

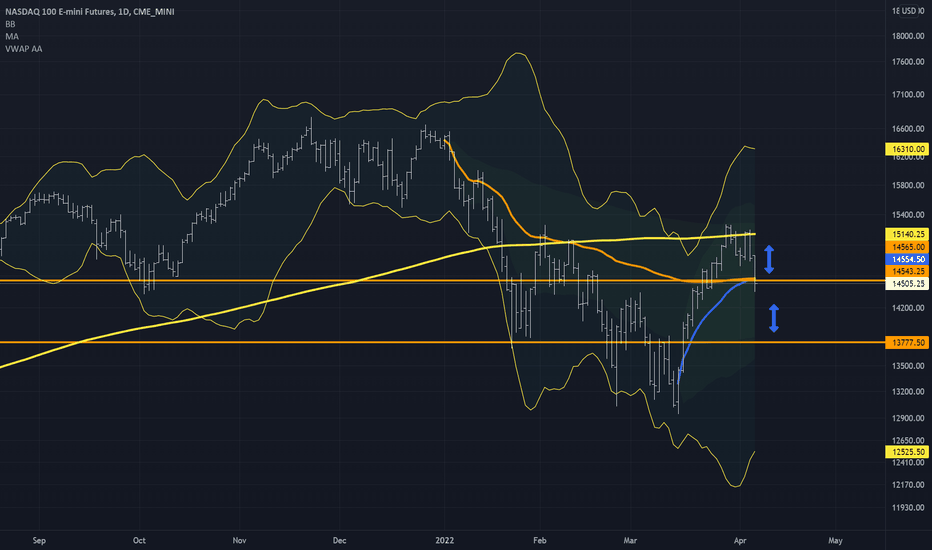

How I Use Anchored VWAP's To Trade Nasdaq FuturesRight now the Nasdaq is at a very important area on my charts. We just came off another failed attempt of regaining the 200 Day Moving Average and now we are back to the VWAP from the opening day of the year and the VWAP from the low of the year. Both VWAP's are trading right around 14,550. I think that VWAP's from the open of the year and the low of the year are one of the best tools to test the trend of a market. Since we just failed at the 200 day MA, but we are still a good distance from the lows of the year, these VWAP's are going to be my key pivots for the next move in Nasdaq. I also use my Indicator, Beacon (which is free and open source on TradingView) along with Bollinger Bands to show you in this quick video how I will be trading E-mini Nasdaq & Micro E-mini Nasdaq Futures and Options in the coming days.

Past performance is not indicative of future results. Derivates trading is not suitable for all investors.

How To Become A Profitable Trader: Part 1Hey guys! Today, I'm launching a video series about how to actually make money in the markets. This is the first video.

At this point, it's a cliche, but I'll say it anyway: The first step to making money is not losing money.

So many people lose money by committing unenforced errors. This video is simply about helping people see the obvious mistakes they are making, from the perspective of a professional trader who's been at this for 6+ years.

One note: when talking about leverage, obviously with FX you may want to use some leverage because the %ATR is so low. But keep it under 10x.

In the following videos, I will touch on:

- How to understand trading any market on any timeframe

- The basics of how to make a trade decision

- Simple strategies I know work, and have seen work over a long period of time

Hopefully you find this useful. LMK in a comment!

-AW

HOW TO: Find the money making stocks, cryptos and FX pairsToday I'm going to be looking to something a little bit different than our normal analytics!

We're going to dive into the tradingview screener! The Forex Screener specifically, but everything I do talk about does also apply to the crypto Screener and the stock Screener. What I want to explain is how I use it to find pairs, stocks and cryptos which are setting up the way I want them to, in order for me to day trade. I show how I use a range of different Bollinger bands to moving averages to overall technical aspects, like growth statistics or reaching all time highs.

The Forex Screener and the tradingview tools that they offer is top of the range stuff. I recommend trying to figure out how to use them and how to utilize them to benefit you in your trading.

Have a listen. Have a look yourself through the Tradingview screener and the different technical aspects in which you can change. I guarantee it'll streamline your process in finding the right pairs that you're going to choose when it comes down to day trading.

I hope you enjoyed it. If you did, please leave a comment and a like. As always, have a very successful week of trading guys. Thank you.