Adapting Your Strategies to Stay AheadThis is how I embrace market adaptability and recognize (and navigate) changing market conditions! As a trader, I've learned the art of adapting my strategies to stay ahead and here's how:

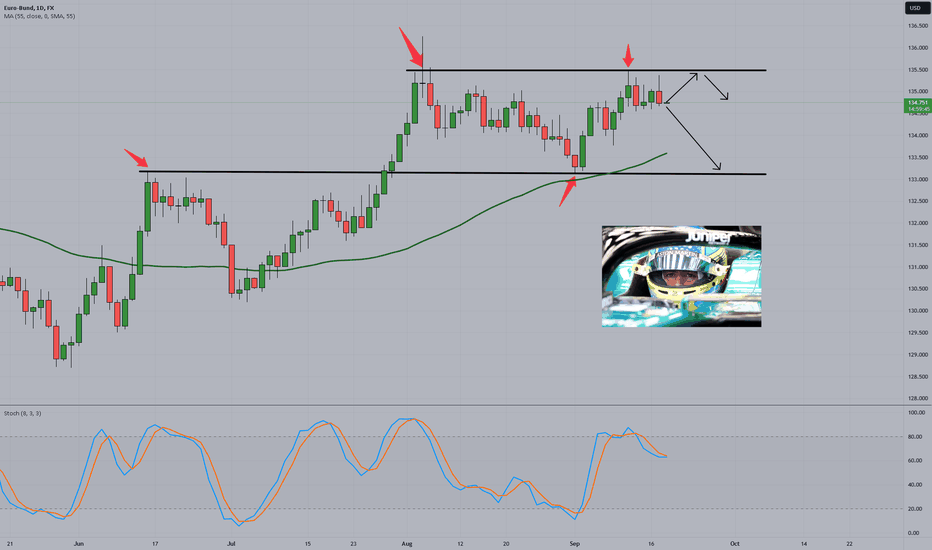

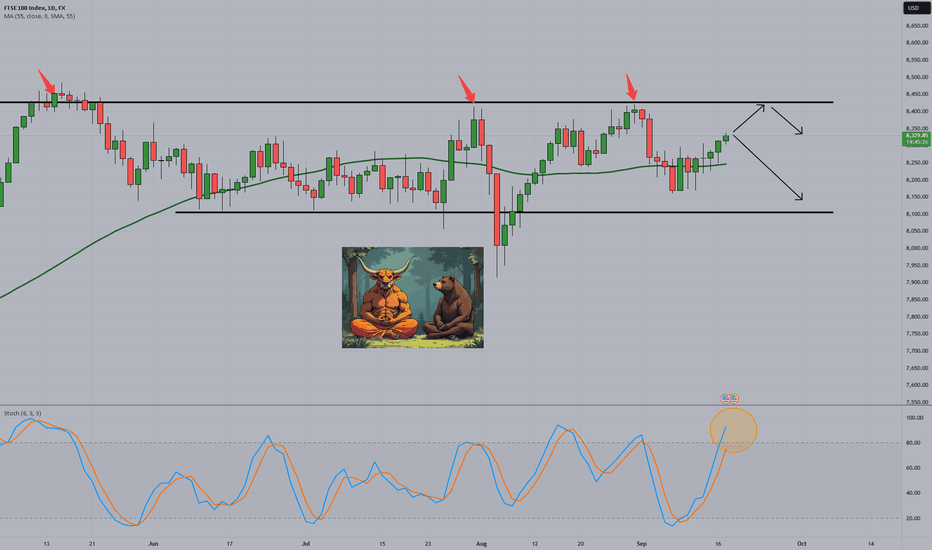

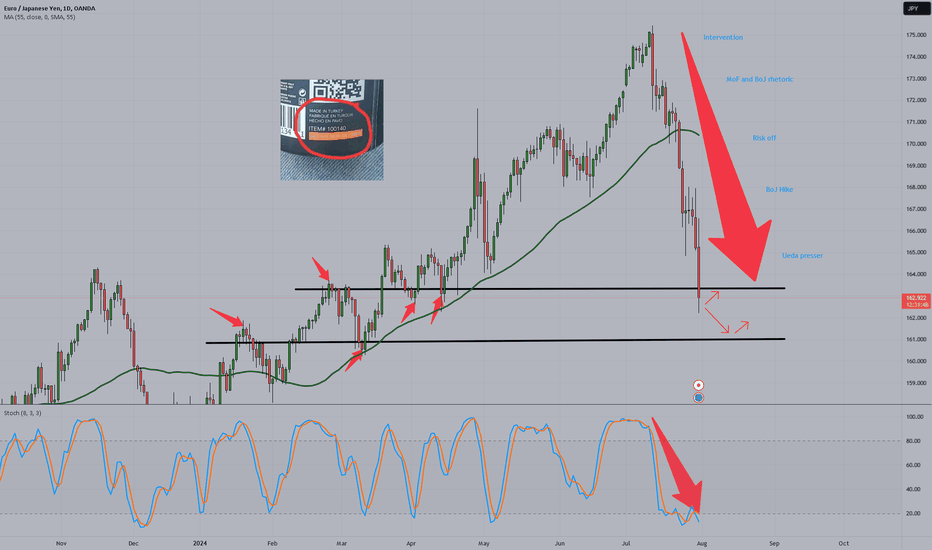

1️⃣ Market Awareness: I continuously monitor market trends, economic data, and global events to stay informed. Recognizing shifts in volatility, sentiment, and liquidity (if not trading FX) is key to adapting. I make sure to have a baseline short and mid term outlook, so I can spot deviations which could signal changes (particularly useful when it comes to monetary policy shifts).

2️⃣ Flexible Strategies: I avoid rigid approaches and embrace flexibility in my trading strategies. Being open to different approaches within my methodology helps me capitalize on diverse market environments. I have an arsenal full of trading weapons... and I am not afraid to use any of them.

3️⃣ Indicators & Patterns: I incorporate a wide range of technical indicators and chart patterns to gauge changing market dynamics and correlate what I see to fundamentals and sentiment. This allows me to spot emerging trends and reversals.

4️⃣ Review & Adapt: I regularly review my trading performance and identify periods of success and struggle. Adapting my strategies based on these insights enhances my edge.

5️⃣ Patience & Observation: During market shifts, I exercise patience and observe new patterns before making significant adjustments. Rushing to adapt can lead to hasty decisions. I follow the market and ride its waves so I like to see certain signs/clues before making decisions about changing a longer standing bias.

6️⃣ Risk Management: In times of uncertainty, I prioritize risk management to protect my capital. Adjusting position sizes and setting appropriate damage control or stop-loss levels is crucial.

7️⃣ Learn from Peers: Engaging with the trading community and learning from experienced traders enriches my understanding of market adaptations. Collaboration is valuable. You still have to separate the value from the mainstream influencer-regurgitated cliches, but hey, it's still free advice.

Embracing adaptability has been a game-changer in my trading journey. Recognizing changing markets and adjusting my strategies accordingly enhances my ability to thrive in any conditions.I always tell my students that we can all make money no matter what the environment is like as long as you can adapt to it. 🚀📊✨

Risk Management

Improve Trading Discipline and FocusMindfulness has emerged as a powerful tool for improving performance in high-pressure fields, and trading is no exception. In the world of trading, where discipline, focus, and emotional control are paramount, the application of mindfulness techniques can help traders stay grounded and make more objective decisions. The combination of mindfulness with trading discipline allows for greater self-awareness, improved concentration, and the ability to detach from market noise and emotional triggers.

1️⃣ The Foundation of Mindfulness: Awareness of the Present Moment: Mindfulness starts with developing an awareness of the present moment—an invaluable skill for traders who often face information overload. In trading, being fully present means focusing on the data and market conditions as they are right now, not letting past mistakes or future anxieties cloud judgment. For example, when analyzing market trends, the ability to focus solely on current price action without allowing external distractions can improve execution timing. I’ve found that setting aside 10-15 minutes each morning for mindfulness practice, such as focusing on breathing or meditating, helps prepare my mind for the trading day ahead. This small act can cultivate a state of calm that carries into my trading.

2️⃣ Enhancing Emotional Regulation to Overcome Impulse Decisions: One of the most valuable aspects of mindfulness for trading is its capacity to regulate emotions. Emotional decisions—whether driven by greed or fear—often lead to suboptimal outcomes. Mindfulness trains traders to observe their emotional states without reacting impulsively. This detachment from emotional highs and lows prevents “revenge trading” or the urge to chase losses, which I have personally witnessed derail several trading plans. For example, a trader might see a sudden market drop and feel compelled to exit a position prematurely. However, practicing mindfulness during such events enables the trader to observe the fear, recognize it, and stick to the original strategy.

3️⃣ Reducing Overtrading Through Increased Discipline: Mindfulness helps curb the tendency to overtrade. Overtrading often stems from the need to be constantly active in the market, which can result in poor trade setups and increased order clusters. Mindful traders learn to wait patiently for high-probability setups by cultivating awareness of their own trading behaviors. Personally, I’ve reduced my trading frequency by becoming more mindful of whether my trading actions are rooted in well-thought-out plans or simply in a need to “do something.” Waiting for the right moment rather than reacting to every market tick has yielded better risk-adjusted returns over time.

4️⃣ The Role of Focus: Strengthening Attention and Reducing Market Noise: Mindfulness practices also enhance focus, helping traders concentrate on key aspects of their strategy while blocking out irrelevant market noise. This is especially important in today’s markets, where social media and constant news updates can easily distract traders from their core strategy. I’ve found that short mindfulness exercises, such as concentrating solely on breathing for a few minutes between trades, help clear my mind and reset my focus. This mental reset makes it easier to refocus on technical analysis or strategy execution, avoiding the temptation to deviate based on irrelevant news.

5️⃣ Improving Decision-Making Under Stress: Trading is inherently stressful, especially during periods of volatility or uncertainty. Mindfulness equips traders with the tools to make clear, objective decisions even under pressure. By increasing awareness of physical and emotional stress responses, you can recognize when stress is clouding your judgment. I’ve learned to spot signs of physical tension, such as shallow breathing, that occur when I feel rushed to execute a trade. Recognizing these stress signals helps me pause, reassess, and make more rational decisions. This simple pause can make a significant difference in trade outcomes.

6️⃣ Creating a Consistent Trading Routine with Mindful Breaks: Integrating mindful moments into a daily trading routine builds consistency, which is vital for long-term success. Just as athletes incorporate rest days to maintain peak performance, traders can benefit from taking mindful breaks throughout the day. These breaks reduce mental fatigue and allow for clearer thinking. For example, after a morning trading session, stepping away for five minutes to practice a mindfulness exercise—such as focusing on sensations or a brief body scan—helps reset my mind. This habit has made a tangible difference in my ability to stay disciplined during afternoon trading sessions, maintaining my edge and remaining in the zone.

7️⃣ Detachment from Outcome: Embracing Losses Mindfully: Lastly, mindfulness helps traders detach from specific trade outcomes and accept losses with grace. Losses are inevitable in trading, but how traders handle them determines long-term success. Mindfulness encourages acceptance of both wins and losses without emotional attachment, focusing instead on the process. This mindset shift allows traders to learn from losing trades without falling into a downward emotional spiral. I’ve found that by reviewing my damage control assets in a calm, mindful state—rather than reacting with frustration—I can extract valuable lessons that improve future performance.

Mindfulness techniques offer traders a way to navigate the complexities of the financial markets with greater focus, emotional regulation, and discipline. By incorporating mindfulness into a trading routine, traders can maintain clarity even during volatile market conditions, leading to improved decision-making and long-term success.

e-Learning with the TradingMasteryHub - Growth is "simple"🚀 Welcome to the TradingMasteryHub Education Series! 📚

Looking to unlock consistent growth in your trading? Today, we’re diving into a powerful yet straightforward formula that many overlook. Growth isn’t magic; it’s a process that involves discipline, patience, and following a few key principles. Let’s explore seven strategies that can lead you to consistent success.

1. Get Rid of the Idea that You Can Calculate Profit

It’s time to rethink profit calculation. Many traders rely on risk/reward (R/R) ratios to estimate their potential profits, but the truth is, you can’t predict how far the market will go or how volatile it’ll be on the way. Setting a profit target can actually work against you. Your brain becomes fixated on that goal, which can cause you to make irrational decisions, like holding on too long when the market is telling you to exit. It’s more likely that you’ll lose out by not taking profits before reaching your target than by missing an extended move.

Instead of trying to calculate profit, focus on managing your trades as they unfold. No one knows where the market will go, but you can follow the price action and let it lead you to bigger gains than you initially expected.

2. Always Use a Stop Loss

The stop-loss order is your best friend in trading because it’s the only thing you can control. A stop loss does more than protect your capital—it measures your discipline and ability to stick to a plan. It helps you stay aligned with your risk tolerance (what I like to call your “bud meter”).

Set your stop loss at significant areas in the market. The best place to put it? Where you’d place the opposite trade. For example, if you’re buying, put the stop loss where a sell order would make sense in the current market context. This prevents you from being stopped out prematurely and ensures you stay on the right side of the momentum.

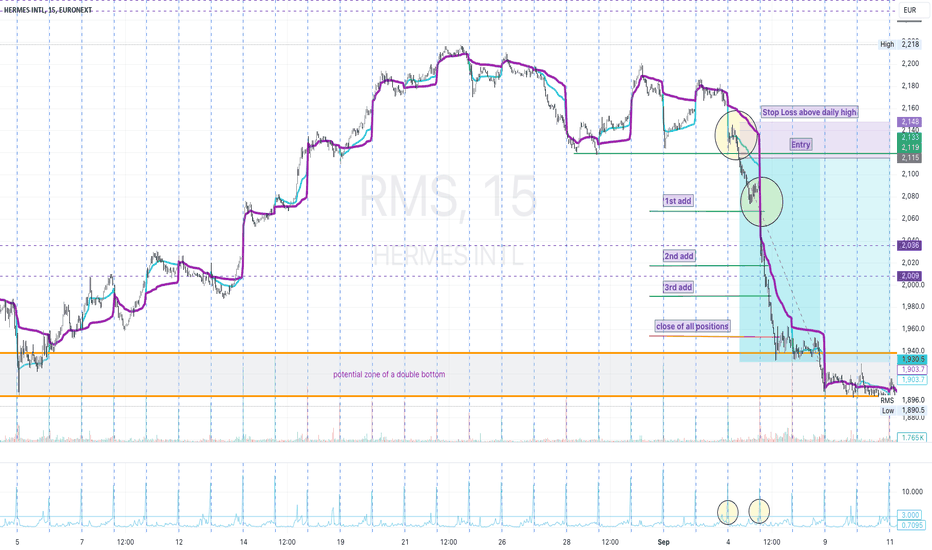

3. Add to Your Winners, Cut the Losers

Adding to winners is a game-changer. Most traders fade out of winning trades too quickly because they fear giving back profits. But by adding to positions that are moving in your favor, you’re compounding your success. Don’t worry about getting in at a higher price—if the market is showing strength, it’s a sign to follow.

Let’s look at how most traders handle a winning trade:

- They take small profits at 1:1 R/R ratio, move their stop loss, and try to let the rest run.

- But in doing so, they lock in limited gains and miss out on the bigger move.

Now, here’s what the top 10% of traders do:

- Instead of scaling out, they add to their winners at each significant level.

- By adding small positions as the market runs, they compound their gains, allowing the trade to grow much larger than initially estimated.

This approach not only maximizes your gains but also lowers your risk on each successive entry.

4. Only Trade in Trend Direction

Trading with the trend is like surfing—catching the wave takes you much farther than paddling against it. In bull markets, overhead resistance zones are often broken, just like support levels in bear markets. These trends are driven by large institutional players, like hedge funds and banks. Retail traders only make up a small fraction of the market, so swimming against these currents is a losing game.

About 20% of trading days in major indices are strong trending days where the market moves in one direction all day long. To take full advantage of these days, you need to add to your winning trades as the trend progresses.

5. Seek the "Brain Pain"—It’s a Sign of Growth

Your brain is wired to avoid pain at all costs, and this can be detrimental to your trading. Most traders scale out of winning positions too soon because their subconscious is trying to protect them from the fear of losing profits. On the flip side, they’ll add to losing positions, convincing themselves that they’re getting a “discount,” even when the market shows otherwise.

To become a winning trader, you need to train yourself to embrace discomfort. This means adding to your winning trades, using stop losses that you can stomach, and cutting losses as soon as your brain starts to rationalize bad decisions. Losing should never bother you—it’s part of the game. What matters is your overall growth and consistency, not avoiding pain in individual trades.

6. Don’t Do What 90% of Traders Do—Be the 10%

Want to be in the top 10%? It’s simple: avoid the mistakes of the 90%. Here’s how:

- Always set a stop loss.

- Add to your winners, don’t fade out.

- Cut losses before they snowball.

- Trade the market, not your account—don’t take revenge trades to “get even.” Focus on what the market is showing you, not what your account balance says.

The market doesn’t care about your profit target. It only cares about price movement, so align yourself with it.

7. Analyze Your Trades, Not Just Your Results

The best way to grow as a trader is through post-trade analysis. Screenshot your charts, mark your entries, stop losses, and exits, and review them daily. This helps you identify both technical and psychological weaknesses in your trading.

Think of it this way: if you had a business partner who consistently made poor decisions, you’d fire them eventually. Be your own business partner, and change your behavior if it’s not delivering results.

🔚 Conclusion and Recommendation

Growth in trading is a simple formula: get rid of fixed profit targets, control your risk with stop losses, add to winners, and cut your losers. Follow the trend, embrace discomfort, and don’t fall into the traps that 90% of traders do. Analyze your trades with an honest eye, and over time, you’ll see steady growth.

Success in trading isn’t about perfection—it’s about discipline, consistency, and continual learning.

---

🔥 Can’t Get Enough? Don’t Miss Out!

Subscribe, share, and engage with us in the comments. This is the start of a supportive trading community—built by traders, for traders! 🚀 Join us on the journey to market mastery, where we grow, learn, and succeed together. 💪

💡 What You'll Learn:

- Essential growth strategies in trading

- The psychological edge to outperform others

- Practical tools for trading success

- And much more!...

Best wishes,

TradingMasteryHub

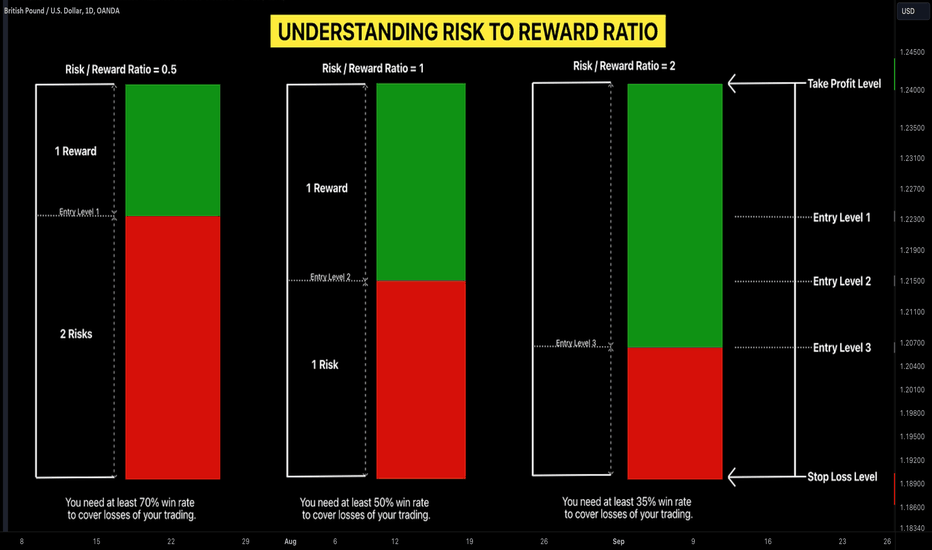

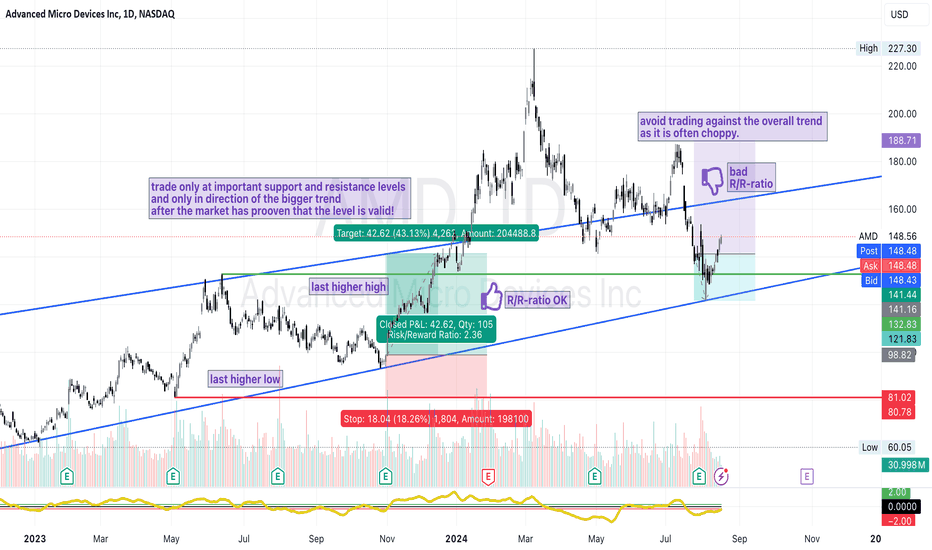

What is Reward to Risk Ratio | Forex Trading Basics

Planning your every Forex trade, you should know in advance the profit that you are aiming to make and the maximum amount of money you are willing to lose.

In this educational article, we will discuss risk reward ratio - the tool that is used to compare your potentials losses and profits in Forex trading.

What is Reward to Risk Ratio

Let's start with an example. Imagine you see a good buying opportunity on EURUSD. You quickly identify a safe entry point, your take profit level and stop loss.

From that trade you are aiming to make 100 pips with a maximum allowable loss of 50 pips.

To calculate a reward to risk ratio for this trade, you simply should divide a potential gain by a potential loss:

R/R ratio = 100 / 50 = 2

In that particular example, reward to risk ratio equals 2 meaning that potential gain outperform a potential loss by 2.

Let's take another example.

This time, you decide to short USDJPY.

From a desirable entry point, you can get 75 pips rerward with a potential loss of 150 pips.

R/R ratio = 75 / 150 = 0.5

Reward to risk ratio for this trade is 75 divided by 150 or 0.5.

Such a ratio means that potential loss outperform a potential gain by 2.

Positive and Negative Reward to Risk Ratio

Risk to reward ratio can be positive or negative.

If the ratio is bigger than 1 it is considered to be positive meaning that a potential gain outperforms a potential loss.

R/R ratio > 1

If the ratio is less than 1 , it is called negative so that potential loss is bigger than potential risk.

R/R ratio < 1

On the left chart above, the reward for the trade is bigger than a risk.

Such a trade has positive reward to risk ratio.

On the right chart, the risk is bigger than a reward.

This trade has negative reward to risk ratio.

Why?

Knowing the average risk to reward ratio for your trades, you can objectively calculate the required win rate for keeping a positive trading performance.

With R/R ratio = 0.5

2 winning trades recover 1 losing trade.

You need at least 70% win rate to cover losses of your trading.

With R/R ratio = 1

1 winning trade, recover 1 losing trade.

You require at least 50% win rate to compensate your losses.

With R/R ratio = 2

1 winning trade recovers 2 losing trades.

You will need at least 35% win rate to cover losses of your trading.

In the example above, the trading setups have 0.5 reward to risk ratio. In such a case, 2 winning trades will be needed to win the money back for 1 losing trade.

Forex trading involves extremely high risk. Risk to reward ratio is a number one risk management tool for limiting your risks. Calculating that and knowing your win rate, you can objectively decide whether a trade that you are planning to take is worth taking.

❤️Please, support my work with like, thank you!❤️

How I Made $2M in the Stock Market | Daily Trading PsychologyNicholas Darvas, a name that echoes through the annals of trading history, was not your typical Wall Street insider. A professional dancer by trade, Darvas' entrance into the stock market was as unconventional as his approach. His book, How I Made $2,000,000 in the Stock Market, offers insights that are as relevant today as they were in the mid-20th century. But the core of Darvas' success wasn’t rooted in complex algorithms or insider information—it was rooted in his mindset.

Darvas' journey is a testament to the idea that trading is 95% mental and only 5% technical. He didn't rely on flashy indicators or news headlines to guide his trades. Instead, he developed a disciplined, almost detached mindset. This stoic approach allowed him to navigate the unpredictable waves of the stock market with a level head, something that many traders today still struggle to achieve.

The essence of Darvas’ method was simplicity combined with self-control. He famously developed the "Darvas Box" theory, a straightforward yet effective technical analysis tool. However, it wasn’t the box that made him millions; it was his mental approach to the market. He treated trading as a business, with strict rules and a clear strategy. When the market moved against him, he didn’t react emotionally or second-guess his strategy. Instead, he adhered to his plan, trusting that his disciplined approach would yield results in the long run.

For traders looking to elevate their game, Darvas’ experience offers a critical lesson: master your mind, and the rest will follow. Emotions like fear and greed are the biggest enemies in trading. By maintaining a calm, almost indifferent attitude towards market fluctuations, traders can avoid the pitfalls that come with emotional decision-making. This mental fortitude allows for a focus on the bigger picture, rather than getting caught up in the noise of daily market movements.

In practical terms, this means developing a trading plan and sticking to it, regardless of short-term results. It means setting clear goals, knowing when to enter and exit trades, and—perhaps most importantly—accepting losses as part of the game. Darvas didn’t win on every trade, but his stoic mindset ensured that when he did lose, it didn’t derail his overall strategy.

In the end, the real takeaway from Darvas' story isn’t just about the money he made—it's about how he made it. By prioritizing mental discipline over technical complexity, traders can position themselves for long-term success. The markets will always be unpredictable, but with the right mindset, traders can navigate them with confidence and clarity.

T. L. Turner

Unlock the 10 Core Lessons Every Trader Needs for SuccessYou know that feeling when you stare at the charts, convinced you’re about to strike gold, only for the trade to go so wrong, you wonder if the market gods have a personal vendetta against you? Yeah, we’ve all been there.

But here’s the thing—it's not the market that's out to get you. It’s you.

Let’s cut to the chase: trading success isn’t just about mastering candlestick patterns or finding the perfect strategy. It’s about mastering yourself. So, I’m laying out the 10 core lessons that can stop you from sabotaging your trades—and maybe even save you from throwing your laptop out the window.

1. Emotional Self-Control (AKA Don’t Be Your Own Worst Enemy)

Ever taken a trade out of sheer frustration or FOMO? Spoiler alert: that’s your emotions talking, and they rarely have your back. Mastering emotional self-control is like giving yourself a built-in cheat code. Stay calm, stay cool, and you’ll stay profitable.

Quick task: Next time you feel emotions kicking in, take a 5-minute break before making any trade decisions. Walk away, breathe, then come back with a clear head.

2. Every Trade is a Lesson (Yes, Even the Ugly Ones)

Think that losing trade was a total waste of time? Wrong. Every trade, good or bad, is packed with insights. The market is your professor—start taking notes. You’ll find out where you’re tripping up, and trust me, you’ll trip less.

Quick task: Start a trade journal. Write down not just the outcome of each trade, but your emotions and reasoning at the time. Review it weekly to spot patterns.

3. Mindset is Everything (Cue the Zen Music)

You’ve probably heard it before, but it's worth repeating: mindset is everything. If you’re not thinking straight, your trades won’t be either. A positive mindset keeps you focused, even when the market is doing its best to mess with you.

Quick task: Before your next trading session, spend 5 minutes visualizing success. Remind yourself why you’re trading and what you’re working toward. This will keep your mindset sharp.

4. Have a Plan (Because Winging It Doesn’t Work Here)

If you’re going into trades without a solid game plan, you’re basically showing up to a knife fight with a spoon. Every trade should have a strategy, clear entry/exit points, and a reason behind it. Stop winging it—you’re better than that.

Quick task: Create a simple pre-trade checklist. Include things like entry/exit strategy, risk level, and reasons for entering the trade. Stick to it religiously.

5. Adapt or Get Left Behind (The Market Isn’t Waiting for You)

The market changes faster than your favorite Netflix series gets canceled. What worked yesterday may not work tomorrow. Be flexible, keep learning, and adapt. Otherwise, you’re going to be the guy stuck using strategies from 2010 in 2024.

Quick task: Spend 10 minutes a day researching a new trading strategy or tool. Even if you don’t use it right away, expanding your knowledge keeps you adaptable.

6. Patience Pays (And Impatience Costs You Big Time)

There’s no bigger account killer than impatience. Jumping in too early, exiting too late, chasing trades—it’s a recipe for disaster. Sometimes, the best move is to wait. Trust me, patience in trading is like waiting for that perfect slice of pizza—totally worth it.

Quick task: Set up alerts for your key setups instead of staring at the screen, waiting for something to happen. This forces you to only trade when your setup is there, not when you’re bored.

7. Risk Management is Non-Negotiable (No, Seriously)

If you don’t manage your risk, you’re playing with fire—and we all know how that ends. Set stop-losses, size your positions properly, and don’t gamble your entire account on a “gut feeling.” It’s not about how much you win, it’s about how little you lose.

Quick task: Review your last 10 trades and check how well you stuck to your risk management rules. If you didn't, figure out why and correct it for the next trade.

8. Never Stop Learning (The Market Has Zero Chill)

The market is constantly evolving, and if you think you’ve got it all figured out, the market is ready to humble you real quick. Stay curious, keep learning, and don’t let complacency be the reason you get left in the dust.

Quick task: Dedicate 30 minutes a week to learning something new—whether it’s a new strategy, a new tool, or just reading up on market trends. Never stop sharpening the saw.

9. Balance Emotions with Logic (It’s Like a Jedi Mind Trick)

This is where it gets tricky. You can’t trade on pure logic, but trading on pure emotion is just as dangerous. You need to find the sweet spot—where you can recognize your emotions, but let logic steer the ship. It’s like becoming a Jedi of your own trading.

Quick task: Before you enter your next trade, ask yourself one question: “Is this based on emotion or strategy?” If it’s emotion, step back until you’re thinking clearly.

10. Focus on the Process, Not Just the Profits (Money is a Byproduct)

Everyone wants to make money, but here’s the secret: focus on nailing your process. The profits will come as a result. If you’re constantly thinking about the money, you’re missing the point. Perfect your process, and let the money follow.

Quick task: Pick one area of your trading process to improve—whether it’s your analysis, your entry strategy, or your risk management—and focus solely on that for the next week. Master the process, the profits will follow.

Master these 10 lessons, and you’ll find yourself trading with more confidence, discipline, and success. Trading is as much a mental game as it is a technical one, and by focusing on these principles, you’re setting yourself up for long-term wins.

Now, which of these lessons do you need to focus on in your own trading journey? Let me know below :)

Emotional Intelligence in Trading: Developing Self-AwarenessIn trading, success is not just about having the right strategy or access to the best tools—it's also about mastering your emotions. Emotional intelligence (EI) plays a crucial role in trading performance, influencing decision-making, risk management, and overall resilience in the market. The ability to recognize, understand, and manage our emotions, as well as the emotions of others, can significantly enhance trading outcomes.

1️⃣ Understanding the Role of Emotions in Trading. Emotions like fear, greed, and overconfidence can lead to impulsive decisions, which often result in poor trading outcomes. Recognizing the influence of these emotions is the first step in managing them. For instance, fear can cause you to exit a position too early, missing out on potential gains, while greed can lead to holding onto a position for too long, resulting in losses. By developing emotional intelligence,you can better identify these emotional triggers and mitigate their impact on decision-making.

Example: During the 2008 financial crisis, many traders who allowed fear to dominate their decision-making process exited their positions at a loss, only to see the market recover later. Those with higher emotional intelligence were better equipped to manage their fear, allowing them to make more rational decisions.

2️⃣ The Importance of Self-Awareness in Trading. Self-awareness is the foundation of emotional intelligence. It involves being conscious of your emotions, strengths, weaknesses, and how these factors influence your trading decisions. By regularly reflecting on your emotional state and how it affects your trading, you can develop greater self-awareness, which can help in making more informed and objective decisions.

Practical Exercise: Keep a trading journal where you not only record your trades but also note your emotional state during each trade. Over time, patterns will emerge, allowing you to identify which emotions typically lead to poor decisions and which contribute to success.

3️⃣ Developing Emotional Regulation Skills. Once you are aware of your emotions, the next step is learning how to regulate them. Emotional regulation involves managing your emotional responses, especially in high-pressure situations, to ensure they don't negatively impact your trading. Techniques such as deep breathing, meditation, and cognitive reframing can help in maintaining composure during market volatility.

Historical Instance: In the 1990s, hedge fund manager Paul Tudor Jones famously used visualization techniques to regulate his emotions and maintain focus during market crashes, which contributed to his long-term success. I often recommend these techniques to my students.

4️⃣ The Role of Empathy in Trading. Empathy, the ability to understand and share the feelings of others, may seem less relevant to trading, but it plays a crucial role in market psychology. By understanding the emotional states of other market participants, you can better anticipate market movements. For example, recognizing widespread panic selling can provide opportunities to buy undervalued assets.

Case Study: During the COVID-19 pandemic, traders who empathized with the fear and uncertainty in the market were able to capitalize on the sharp declines by purchasing assets at a discount, leading to significant gains when the market rebounded.

5️⃣ Building Resilience Through Emotional Intelligence. Trading is inherently stressful, and setbacks are inevitable. Emotional intelligence helps traders build resilience, enabling them to recover quickly from losses and maintain a long-term perspective. Resilient traders are less likely to be discouraged by short-term failures and more likely to learn from their mistakes.

Practical Example: After experiencing a significant loss, instead of dwelling on it, a trader with high emotional intelligence might analyze what went wrong, adjust their strategy, and approach the next trade with renewed focus and confidence.

6️⃣ Integrating Emotional Intelligence with Technical Analysis. While technical analysis provides the data-driven foundation for trading decisions, emotional intelligence adds a layer of psychological insight. By combining these two approaches, you can avoid the common pitfall of over-reliance on charts and signals. For instance, a technically sound trade setup might be ignored if emotional cues suggest that market sentiment is unusually euphoric or fearful.

Strategy: Before executing a trade based on technical analysis, take a moment to assess your emotional state and the broader market sentiment. Ask yourself if your decision is influenced by overconfidence or fear, and adjust accordingly.

7️⃣ The Long-Term Benefits of Emotional Intelligence in Trading. Developing emotional intelligence is not a one-time effort but an ongoing process that yields long-term benefits. Traders who invest in their emotional growth tend to experience more consistent performance, lower stress levels, and greater overall satisfaction with their trading careers. They are better equipped to handle the psychological challenges of trading, such as uncertainty, volatility, and the pressure to perform.

Emotional intelligence is a critical yet often overlooked component of successful trading. By developing self-awareness, emotional regulation, empathy, and resilience, you can enhance your decision-making process and achieve more consistent results. The ability to manage one's emotions can make the difference between a good trader and a great one.

Are you ready to quit your job and join crypto full-time? You need to understand that most of the beautiful posts about the amazing life of a traders, airdrop hunters are complete nonsense and "fake it till you make it" life! Most people lose money in trading, and this applies not only to the crypto market! Therefore, on the channel we do not talk about stupid things like tothemoon, uponly, super-profitable meme tokens and other nonsense! Ask yourself the question, are you ready to quit your job and go into full-time trading or full-time work with cryptocurrency! These can be nodes, an accounts farm for airdrops, content creation, work in a crypto project, be the meme token degen, trading.

A few key questions that you need to honestly ask yourself

1. Do you have a extra cash for several months, if, for example, the first six months, you will not be able to make a profit from cryptocurrency?

2. How old are you and what are your expenses? After all, the responsibility for income when you have a family and children is much bigger than when you are 20 years old and you can live peacefully with responsibility only for yourself!

3. Do you have enough experience for regular trading, do you have an understanding of the market, if, for example, we will trade in a downward trend for 2-3 years and investments will not be able to generate income, but only trading! Do you have a deposit to work with!? Lets be real! Start with 100$ and trade every day with x50 lev its not a good idea and plan! One day all this succesefull signal channels and traders just drawdown their accounts, but they got a lot of money from Discords, memecoins alllocations! So be real with initial deposit!

4. How are things going with storing funds, diversification, risk management and money management! Do you have a strategy and a plan for what exactly you will do every day?

5. Do you have skills outside the market, what will you do if your plan does not work? Will you be able to quickly find a job to restore the deposit and try again

6. Are you mentally ready to work every day in this area now? After all, now you will have a lot of time, without a boss and a stable fixed payment at the end of the month! Do you know how to plan your day and work! Are you a disciplined and balanced person, because emotional decisions and trading on fear or greed can ruin your entire deposit!

7. Do you have a plan in case of a black swan in the world, a new pandemic, a financial collapse or abrupt regulation of cryptocurrency in your region!

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

Hidden Costs of Trading You Must Know

In this educational article, we will discuss the hidden costs of trading.

1 - Brokers' Commissions

Trading commission is the brokers' fee for opening a trading position.

Usually, it is calculated based on the size of the trade.

Though most of the traders believe that trading commissions are too low to even count them, the fact is that trading on consistent basis and opening a couple of trading positions weekly, the composite value of commissions may cut a substantial part of our profits.

2 - Education

Of course, most of the trading basics can be found on the Internet absolutely for free.

However, the more experienced you become, the harder it is to find the materials . So you typically should pay for the advanced training.

Moreover, there is no guarantee that the course/coaching that you purchase will improve your trading, quite often traders go through multiple courses/coaching programs before they become consistently profitable.

3 - Spreads

Spread is the difference between the sellers' and buyers' prices.

That difference must be compensated by a trader if one wished to open a trading position.

In highly liquid markets, the spreads are usually low and most of the traders ignore them.

However, being similar to commissions, spreads may cut the substantial part of the overall profits.

4 - Time

When you begin your trading journey, it is not possible to predict how much it will take to become a consistently profitable trader.

Moreover, there is no guarantee that you will become one.

One fact is true, you should spend a couple of years before you find a way to trade profitably, and as we know, the time is money. More time you sacrifice on trading, less time you have on something else.

5 - Swaps

Swap is the fee you pay for transferring a position overnight .

Swap is based on a difference between the interests rates of the currencies that are in a pair that you trade.

Occasionally, swaps can even be positive, and you can earn on holding such positions.

However, most of the time the swaps are negative and the longer you hold your trades, the more costly your trading becomes.

The brokers' commissions, spreads and swaps compose a substantial cost of our trading positions. Adding into the equation the expensive learning materials and time spent on practicing, trading becomes a very expensive game to play.

However, knowing in advance these hidden costs, the one can better prepare himself for a trading journey.

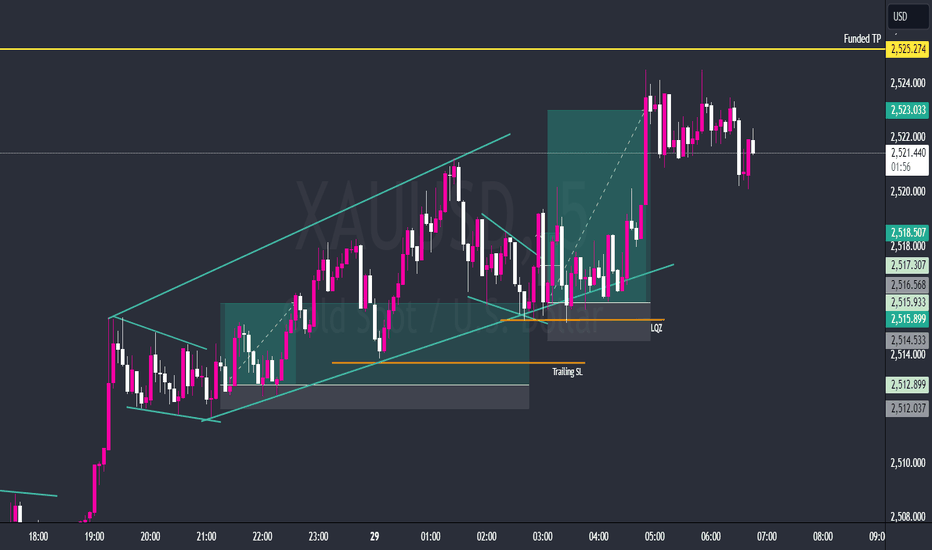

Strategic Gold Plays: Maverick-Rabbit Precision in Key PatternsBased on your archetype, a combination of the Bold Maverick and the Analytical Rabbit, you have a natural tendency to take calculated risks while also ensuring that those risks are backed by thorough analysis. This hybrid nature likely drives you to engage in trades that have high potential rewards, but only when they meet specific analytical criteria.

Chart Analysis and Coaching on Your Positions

Overview:

Context: This is a 15-minute chart of XAUUSD (Gold vs. USD).

Structure: The chart shows a clear bullish trend with higher highs and higher lows. There are multiple channel formations, liquidity zones (LQZ), and key levels identified (including a 4H Over Ride/LQZ level).

1. Position Analysis:

First Entry - Inside the Ascending Channel:

Entry Reasoning: You likely identified the ascending channel as a bullish continuation pattern and entered within it.

Archetype Reflection: As a Bold Maverick, you're comfortable entering before a full breakout, assuming the trend continuation. However, as an Analytical Rabbit, you probably also considered the channel support before entry.

Coaching: This entry aligns with your dual archetype. You took the position inside the channel, expecting price to continue its upward momentum. However, consider tightening your stop loss in case of a fake breakout to protect your position.

Second Entry - Near the LQZ:

Entry Reasoning: You likely saw price approaching the Liquidity Zone (LQZ), expecting a bounce or reaction at this level.

Archetype Reflection: Analytical Rabbits love analyzing levels like LQZ, while Bold Mavericks might anticipate a reaction before confirmation.

Coaching: Good job recognizing the importance of the LQZ. You probably set a trailing stop to capture profit while letting the trade run. Just be cautious with overconfidence—always have a plan if the price moves against you.

Third Entry - At the 4H Over Ride / LQZ level:

Entry Reasoning: This level is crucial as it represents a 4H Liquidity Zone (LQZ), a significant potential reversal point.

Archetype Reflection: This is a classic Bold Maverick move—anticipating a strong reaction at a higher timeframe LQZ. The Analytical Rabbit side of you likely analyzed the 4H timeframe and identified this as a high-probability zone.

Coaching: This is an aggressive yet well-informed entry. Ensure your stop loss is adjusted to below the LQZ to minimize risk in case the market turns against your position.

2. Trailing Stop Loss (SL) Usage:

Position: You’ve used trailing stop losses, which is a smart move, especially given the bold yet analytical approach.

Coaching: Trailing stops can help lock in profits as the price moves in your favor. Ensure that the trailing distance is neither too tight (to avoid premature exit) nor too wide (to protect against significant pullbacks). This aligns with the Analytical Rabbit’s cautious nature.

3. Key Levels and Patterns:

Ascending Channel: The price is respecting the channel boundaries, which validates your initial entries.

LQZ & 4H Override: Price has shown reactions at these levels, indicating they are well-chosen.

4. Risk Management:

Balance Between Risk and Reward: Your trading strategy seems to balance the Bold Maverick’s appetite for risk with the Analytical Rabbit’s focus on minimizing unnecessary exposure.

Coaching: Given your dual archetype, keep refining your entry and exit points. Use the rule of three (waiting for confirmation after three touches on key levels) to align with your analytical side.

Conclusion:

Your trading approach is a robust mix of intuition and analysis. You're combining bold entries with a solid understanding of market structure. Continue to refine your strategy, especially in the context of multi-timeframe analysis and liquidity zones, to maximize your trading effectiveness. Make sure to always have an exit strategy and avoid letting the Maverick side take over without sufficient backing from the Rabbit’s analysis.

Think Like a Pro: How to Be Your Own Trading PsychologistEver Felt Like Your Worst Enemy in Trading? Here’s How to Overcome it!

Have you ever been in that moment where you're staring at the screen, and every fiber of your being is screaming, "This trade is going south," but you still hold on?

It’s like watching a train wreck in slow motion—except you’re the conductor, and somehow, you’re glued to your seat.What if you could turn that inner chaos into clarity?

Imagine becoming your own trading psychologist, mastering the mental game to transform your trading experience. It’s possible, and it’s within your reach.

The Mirror Doesn’t LieThe biggest challenges in your trading aren’t just the volatile markets or the unpredictable news— they’re the emotions that cloud your judgment. Fear, greed, hesitation, overconfidence— these emotions can lead you to make mistakes that are both costly and frustrating.

But here’s the key: the problem isn’t the emotions themselves, but how you manage them. Recognizing this can help you see the market—and your trades—in a completely new light.

The Secret Sauce: Self-AwarenessThe first step toward mastering your trading psychology is learning to recognize your triggers.

What sets you off? Is it a losing streak? A sudden market spike? Maybe just a stressful day.

Identifying these triggers is crucial to controlling your trading behavior.Once you recognize your triggers, managing them becomes much easier.

It’s like seeing a storm on the horizon—you can’t stop it, but you can definitely prepare for it.

Setting hard rules for when to step away from the screen, and more importantly, when to stay focused, can make all the difference in your trading results.

Actionable Tips: Turn Insight into Action

So, how can you apply this in a practical way?

Here are a few strategies that can help you take control of your trading psychology:

Journal Everything : Start by journaling not just your trades, but your thoughts and emotions before, during, and after each trade.

You’ll begin to see patterns emerge, showing when you might be about to go off the rails.

Mindful Breaks: Set timers to remind yourself to step away from the screen for a minute or two. This gives you the space you need to reset, especially when things get intense.

The “Pause” Button: Before entering a trade, take a moment to pause and ask yourself, “Am I acting out of emotion, or is this a rational decision?”

This simple act can prevent countless bad trades.

Create a Pre-Trade Routine: Just like athletes have pre-game rituals, creating a routine to get into the right headspace before trading can be incredibly beneficial.

This might involve reviewing your journal, setting goals for the session, or doing a quick mental check-in.

Don’t Go It Alone: Trading doesn’t have to be a solo journey. Platforms like TradingView are excellent for connecting with other traders.

Whether you’re joining a chat, reading other traders’ ideas, or commenting on their posts, engaging with the community can provide valuable insights and feedback.

Sometimes, the best advice comes from others who’ve been in your shoes and can help you see things from a different perspective.

The Result? A Psychological EdgeBy mastering your trading psychology, you can stop sabotaging yourself.

Instead of reacting impulsively to the market, you can respond with clarity and purpose.

The challenges of trading will still be there—this is the market, after all—but with the right mindset, you can turn them into opportunities.

If trading psychology has been a struggle for you, know that you’re not alone, and there’s a way forward.

By looking inward, recognizing your patterns, and applying a few simple strategies, you can gain the psychological edge you need to succeed.

Trading isn’t just about reading the market; it’s about understanding yourself. And once you master that, the possibilities for your trading are endless.

Let me know what you think below:)

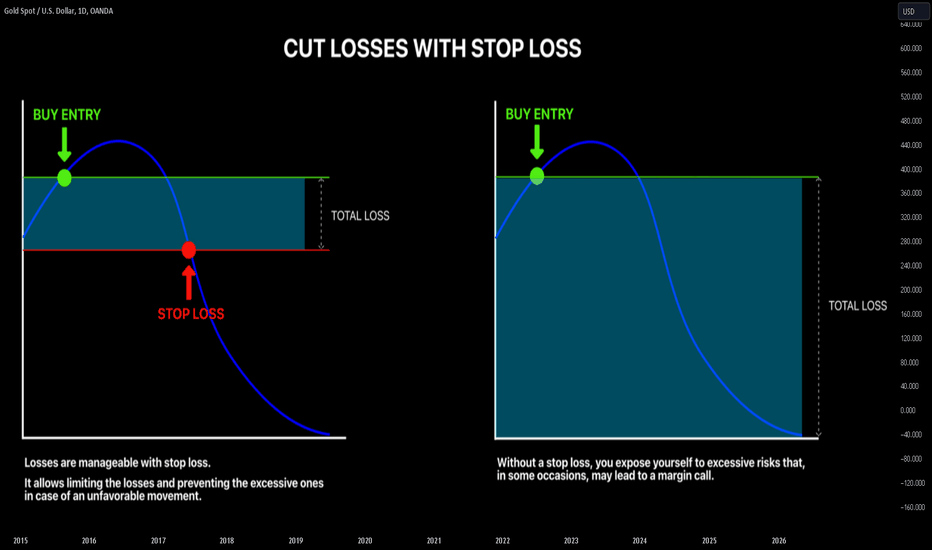

Never Trade Without Stop Loss!

Hey traders,

Talking to many struggling traders from different parts of the world, I realized that the majority constantly makes the same mistake : they do not set a stop loss .

Asking for the reason why they do that, the common answer is that

these traders consider the manual position closing to be safer, implying that if the market goes in the opposite direction, they will be able to much better track the exact moment to cut loss.

In this article, we will discuss why it is crucially important to set a stop loss and why it is the number one element of your trading position.

What is Stop Loss?

Let's discuss what is a stop loss . By a stop loss , we mean a certain price level where we close our trading position in loss. In comparison to a manual closing, the stop loss (preferably) should be set at the exact moment when the order is executed.

On the chart above, I have an active selling position on Gold.

My entry level is 2372, my stop loss is 2381.

It means that if the price goes up and reaches 2381 level, the position will automatically close in a loss.

Why Do You Need a Stop Loss?

Stop loss allows us limiting the risks in case of unfavorable movements .

On the chart above, I have illustrated 2 similar negative scenarios : 1 with a stop loss being placed and one without on USDJPY.

In the example on the left, stop loss helped to prevent the excessive risk , cutting the loss at the beginning of a bearish wave.

With the manual closing, however, traders usually hold the negative positions much longer , praying for a reversal.

Holding a losing trade, emotions intervene. Greed and fear usually spoil the reasoning, causing irrational decisions .

Following such a strategy, the total loss of the second scenario is 6 times bigger than the total loss with a placed stop loss order.

Always Set Stop Loss!

Stop loss defines the point where you become wrong in your predictions. Planning your trade, you should know in advance such a point and cut your loss once it is reached.

Never trade without a stop loss.

Risk Management: The Key to Trading SuccessCut the Cord: A Trader's Survival Guide

How to Cut Losses Wisely: A Trader's Guide

Mastering the Exit: A Trader's Handbook

As a trader, it's inevitable to encounter losing trades. However, the key to success lies in how you manage these losses. By implementing effective strategies, you can minimize their impact and stay on track towards your financial goals.

1. Manage Your Risk:

Never risk more than you can afford to lose. Diversify your portfolio, spread your investments across different assets, and avoid over-leveraging. By managing your risk, you can protect your capital and prevent a single losing trade from causing significant damage.

2. Set Stop-Loss Orders:

Your stop-loss order acts as a safety net, protecting your capital from excessive losses. Determine a specific price point at which you'll exit a trade if it moves against you. This helps prevent emotional trading decisions and ensures you stay disciplined.

3. Consider Trailing Stop-Loss Orders:

A trailing stop-loss is a dynamic order that adjusts automatically as the price moves in your favor. It allows you to lock in profits while still protecting against potential losses. This can be a valuable tool for managing your positions effectively.

4. Stick to Your Trading Plan:

A well-defined trading plan is your roadmap to success. It outlines your strategies, risk management rules, and exit points. Adhering to your plan, even during challenging times, helps avoid impulsive decisions that can lead to further losses.

5. Stay Informed:

Keep up-to-date with market news, economic indicators, and industry trends. Understanding the factors driving price movements can help you anticipate potential risks and make informed decisions.

6. Cut Your Losses Quickly:

Don't hold onto losing trades in the hope that they will recover. Cut your losses promptly to minimize the damage and preserve your capital for future opportunities.

7. Learn from Your Mistakes:

Every losing trade is an opportunity to learn and improve. Analyze your trades, identify the reasons for the losses, and adjust your strategies accordingly. By learning from your mistakes, you can become a more successful trader.

8. Take Breaks:

Emotional fatigue can lead to poor decision-making. When you're feeling overwhelmed or stressed, take a break from trading to allow yourself time to recharge and regain perspective.

9. Seek Guidance:

If you're struggling to manage losses or unsure about your trading strategies, consider seeking advice from a mentor or professional trader. They can provide valuable insights and help you develop effective risk management techniques.

10. Maintain a Positive Mindset:

Trading can be emotionally challenging, but it's important to maintain a positive mindset. Focus on your long-term goals, learn from your setbacks, and believe in your ability to succeed.

Remember, losing trades are a natural part of trading. By adopting these strategies, you can effectively manage your losses, protect your capital, and increase your chances of long-term success.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Determining Which Equity Index Futures to Trade: ES, NQ, YM, RTYWhen it comes to trading equity index futures, traders have a variety of options, each with its own unique characteristics. The four major players in this space—E-mini S&P 500 (ES), E-mini Nasdaq-100 (NQ), E-mini Dow Jones (YM), and E-mini Russell 2000 (RTY)—offer different advantages depending on your trading goals and risk tolerance. In this article, we’ll dive deep into the contract specifications of each index, explore their volatility using the Average True Range (ATR) on a daily timeframe, and discuss how these factors influence trading strategies.

1. Contract Specifications: Understanding the Basics

Each equity index future has specific contract specifications that are crucial for traders to understand. These details affect not only how the contracts are traded but also the potential risks and rewards involved.

E-mini S&P 500 (ES):

Contract Size: $50 times the S&P 500 Index.

Tick Size: 0.25 index points, equivalent to $12.50 per contract.

Trading Hours: Nearly 24 hours with key sessions during the U.S. trading hours.

Margin Requirements: Change through time given volatility conditions and perceived risk. Currently recommended as $13,800 per contract.

E-mini Nasdaq-100 (NQ):

Contract Size: $20 times the Nasdaq-100 Index.

Tick Size: 0.25 index points, worth $5 per contract.

Trading Hours: Similar to ES, with continuous trading almost 24 hours a day.

Margin Requirements: Higher due to its volatility and the tech-heavy nature of the index. Currently recommended as $21,000 per contract.

E-mini Dow Jones (YM):

Contract Size: $5 times the Dow Jones Industrial Average Index.

Tick Size: 1 index point, equating to $5 per contract.

Trading Hours: Nearly 24-hour trading, with peak activity during U.S. market hours.

Margin Requirements: Relatively lower, making it suitable for conservative traders. Currently recommended as $9,800 per contract.

E-mini Russell 2000 (RTY):

Contract Size: $50 times the Russell 2000 Index.

Tick Size: 0.1 index points, valued at $5 per contract.

Trading Hours: Continuous trading available, with key movements during U.S. hours.

Margin Requirements: Moderate, with significant price movements due to its focus on small-cap stocks. Currently recommended as $7,200 per contract.

Understanding these specifications helps traders align their trading strategies with the right market, considering factors such as account size, risk tolerance, and market exposure.

2. Applying ATR to Assess Volatility: A Key to Risk Management

Volatility is a critical factor in futures trading as it directly impacts the potential risk and reward of any trade. The Average True Range (ATR) is a popular technical indicator that measures market volatility by calculating the average range of price movements over a specified period.

In this analysis, we apply the ATR on a daily timeframe for each of the four indices—ES, NQ, YM, and RTY—to compare their volatility levels:

E-mini S&P 500 (ES): Typically exhibits moderate volatility, offering a balanced approach between risk and reward. Ideal for traders who prefer steady market movements.

E-mini Nasdaq-100 (NQ): Known for higher volatility, driven by the tech sector's dynamic nature. Offers larger price swings, which can lead to greater profit potential but also increased risk.

E-mini Dow Jones (YM): Generally shows lower volatility, reflecting the stability of the large-cap stocks in the Dow Jones Industrial Average. Suitable for traders seeking less risky and more predictable price movements.

E-mini Russell 2000 (RTY): Exhibits considerable volatility, as it focuses on small-cap stocks. This makes it attractive for traders looking to capitalize on significant price movements within shorter time frames.

By comparing the changing ATR values, traders can gain insights into which index futures offer the best fit for their trading style—whether they seek aggressive trading opportunities in high-volatility markets like NQ and RTY or more stable conditions in ES and YM.

3. Volatility and Trading Strategy: Matching Markets to Trader Preferences

The relationship between volatility and trading strategy cannot be overstated. High volatility markets like NQ and RTY can provide traders with larger potential profits, but they also require more robust risk management techniques. Conversely, markets like ES and YM may offer lower volatility and, therefore, smaller profit margins but with reduced risk.

Here’s how traders might consider using these indices based on their ATR readings:

Aggressive Traders: Those who thrive on high-risk, high-reward scenarios might prefer NQ or RTY due to their larger price fluctuations. These traders are typically well-versed in managing rapid market movements and can exploit the volatility to achieve significant gains.

Conservative Traders: If stability and consistent returns are more important, ES and YM are likely better suited. These indices provide a more predictable trading environment, allowing for smoother trade execution and potentially fewer surprises in market behavior.

Regardless of your trading style, the key takeaway is to align your strategy with the market conditions. Understanding how each index's volatility affects your potential risk and reward is essential for long-term success in futures trading.

4. Conclusion: Making Informed Trading Decisions

Choosing the right equity index futures to trade goes beyond personal preference. It requires a thorough understanding of contract specifications, an assessment of market volatility, and how these factors align with your trading objectives. Whether you opt for the balanced approach of ES, the tech-driven dynamics of NQ, the stability of YM, or the volatility of RTY, each market presents unique opportunities and challenges.

By leveraging tools like ATR and staying informed about the specific characteristics of each index, traders can make more strategic decisions and optimize their risk-to-reward ratio.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.sweetlogin.com This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

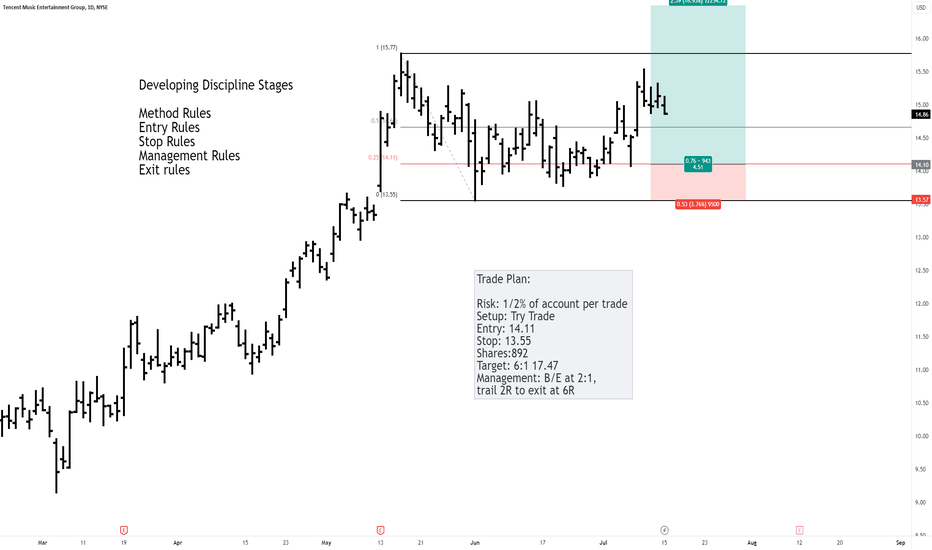

4. e-Learning with the TradingMasteryHub - Risk Management 1x1🚀 Welcome to the TradingMasteryHub Education Series! 📚

Are you looking to level up your trading game? Join us for the next 10 lessons as we dive deep into essential trading concepts that will help you grow your knowledge and sharpen your skills. Whether you're a beginner or looking to refine your strategy, these lessons are designed to guide you on your journey to better understand the markets.

📊 Manage Your Risk with These Three Simple Methods!

In trading, managing risk effectively is crucial to long-term success. Even the best strategies can fail if risk management is ignored. In this session, we'll explore three key methods that every trader should master to protect their capital and stay consistently profitable.

1. Position Sizing: Trade Smart, Trade Safe

Position sizing is the foundation of risk management. I always set a daily and weekly stop-loss limit to ensure that I can recover mentally and financially from any losses. My daily stop-loss is capped at 5-10% of my entire trading account, and I never risk more than 30% of that daily limit on a single trade.

Each trade's risk allocation depends on the quality of the opportunity:

- 5-star setups: Up to 30% of the daily stop-loss.

- 4-star setups: Up to 15% of the daily stop-loss.

- 3-star setups: Up to 5% of the daily stop-loss.

I only trade 4-star setups and above to avoid overtrading and the temptation to jump into random market opportunities. This disciplined approach ensures that I’m only putting my capital at risk when the odds are strongly in my favor.

2. Stop-Loss Orders: Protect Your Trades with Precision

When setting stop-losses, I place them at strategic points highlighted by the market, such as significant support or resistance levels. To avoid premature stop-outs due to market noise, I set my stop-loss beyond the spread and the market’s natural fluctuations. For example, if the FDAX is in an uptrend with the last higher low at 17,000 points and the spread is 15 points, I would set my stop-loss at 16,967 points (17,000 - 15 - 17).

This ensures that my risk/reward ratio (R/R-ratio) is correctly calculated. Before entering any trade, I carefully assess whether the potential upside justifies the risk. If the R/R-ratio isn’t favorable, even for a 5-star setup, I might avoid the trade to protect my capital.

3. Diversification: Tailor Your Strategy to Your Comfort Level

Diversification is another critical aspect of risk management. As a trader, you can choose to focus on a handful of ticker symbols or spread your risk across a broader range of assets. The first approach, trading a few instruments, is easier to manage and ideal for strategies like market profile trading in FX or indices.

Alternatively, you might opt for a more diversified portfolio, trading up to 50 different stocks at once. In this strategy, each trade only represents a small fraction of your total risk capital—such as your daily stop-loss. This minimizes the emotional strain of trading, as each individual trade carries a smaller risk. With a solid strategy, you can manage all trades effectively, spreading your approach across calls, puts, different markets, industries, and volatility levels. However, this approach is typically better suited for larger accounts, where spread costs won’t significantly impact your profits.

🔚 Conclusion and Recommendation

Risk management isn’t just about protecting your capital; it’s about maintaining the psychological stability needed to trade consistently. By mastering position sizing, setting precise stop-loss orders, and choosing the right diversification strategy, you can navigate the markets with confidence and discipline. Remember, successful trading isn’t just about finding the right opportunities—it’s about managing those opportunities wisely to ensure long-term profitability.

By focusing on high-quality trade setups, calculating your risks accurately, and diversifying appropriately, you’ll find that you can maintain your composure even during losing streaks. This approach not only protects your account but also keeps your mind clear and your emotions in check, paving the way for sustained success.

---

🔥 Can’t Get Enough? Don't Miss Out!

Subscribe, share, and engage with us in the comments. This is the start of a supportive trading community—built by traders, for traders! 🚀 Join us on the journey to market mastery, where we grow, learn, and succeed together. 💪

💡 What You'll Learn:

- The fundamentals of trading

- Key technical and sentiment indicators

- Risk management strategies

- And much more!...

Best wishes,

TradingMasteryHub

"Know Thyself: The Ancient Greek Secret to Mastering the Markets "Know Thyself.’ This ancient Greek wisdom has echoed through time, and over the years in the markets, I’ve realized it holds the key to trading success. But most traders learn this lesson the hard way, often after years of frustration, losses, and self-doubt.

To become a successful trader, you must truly know yourself. The saying "know thyself," inscribed at the Temple of Apollo at Delphi, might seem distant from the world of modern finance, but it’s more relevant than ever.

The market is a mirror, reflecting who you are inside, and it has an uncanny ability to expose your deepest fears, negative emotions, and limiting beliefs.

We all have traits that hinder our success—whether it’s fear, greed, impatience, or overconfidence. But rather than addressing these inner challenges, many traders look for external solutions, never realizing that self-awareness is the real key to success.

In my years as a trader, I've come to understand that the most successful traders aren’t just experts in analyzing charts—they are experts in understanding themselves. They know their strengths and weaknesses and have the courage to face them directly.

They recognize their emotional triggers and have developed the discipline to manage them effectively.

Trading isn’t just about predicting market movements; it’s about understanding how you react under pressure, how fear can distort your decisions, and how greed can lead to costly mistakes.

The journey to becoming a successful trader is as much about mastering yourself as it is about mastering the market.

To truly master the markets, you must first master yourself. The market is a relentless feedback loop, constantly reflecting your inner state back at you, whether you realize it or not.

When a trade is going against you, losing money, and you’re feeling the surge of anger and frustration, the market is holding up a mirror. It’s not just about the loss—it’s reflecting something deeper about your emotional state and mental approach.

What are you seeing in that reflection? Is it impatience, fear, or a lack of preparation?

When you find yourself revenge trading after a losing position, what's really happening? The market is showing you your vulnerability—perhaps an unchecked ego or a desperate need to validate yourself.

It’s telling you what needs fixing, but only if you’re willing to stop and listen.

Consider those moments when you double or triple up on positions, trying to force the market to move in your favor. What’s being reflected back at you then? Is it overconfidence? Maybe it’s fear dressed up as boldness.

The market is giving you feedback—are you hearing it?

And what about when you abandon your rules, chasing the allure of a quick profit or avoiding the pain of a potential loss?

The market is exposing a deeper truth: a lack of discipline, or perhaps a failure to trust in your own system. It’s showing you exactly what you need to work on.

Even in the good times, when you’re in a winning position but close out too early, the market reflects back your fear of losing what you’ve gained, your inability to let go, or your craving for certainty.

Each of these reactions is a lesson in self-awareness.

This is why trading often appears deceptively simple at first glance—yet is incredibly difficult to master. The principles seem straightforward: buy low, sell high, manage your risk.

But the reality is that the market is not just a puzzle of price movements; it's a test of your inner world. It’s this challenge, this confrontation with your own psychology, that makes trading so demanding and why it takes years to truly master.

Most people are not prepared for this journey of self-discovery, which is why so few actually make it.

You might notice that many traders online focus almost exclusively on trade ideas and strategies, rarely discussing the inner battles that make or break a trader. This is because self-mastery is the hardest part of trading, and it’s often the least glamorous.

Yet, every successful trader I’ve met or read about shares one common trait: a deep understanding of themselves. When you listen to them, you’ll hear them talk about overcoming their own internal struggles as much as they discuss their market strategies.

This resonates deeply with my own experience; my biggest challenges have always come from within. But each time I’ve faced and overcome these inner obstacles, my trading has consistently improved.

The truth is, the market reflects all our worst fears and attributes, as well as our strengths. The secret to success is learning to listen and understand what it’s telling you about yourself.

Many traders fail because they’re unwilling to face these reflections. Instead of looking in the mirror and realizing the truth lies within, they blame the strategy, the market, the broker—anyone but themselves.

But true courage in trading, just as in life, comes from facing your demons head-on . The saying "Know Thyself" is not just a call for introspection—it’s a challenge.

The darkest hour is just before dawn , and it’s in those moments of greatest struggle that we’re given the opportunity to grow.

By understanding yourself—your fears, your weaknesses, your triggers—you gain the strength to conquer the market.

So next time you’re in a tough spot, remember the ancient wisdom: "Know Thyself." The market isn’t just a battlefield—it’s a mirror.

Master what you see in that reflection, and you’ll master the markets. True success in trading and in life comes not from conquering the market, but from conquering yourself.

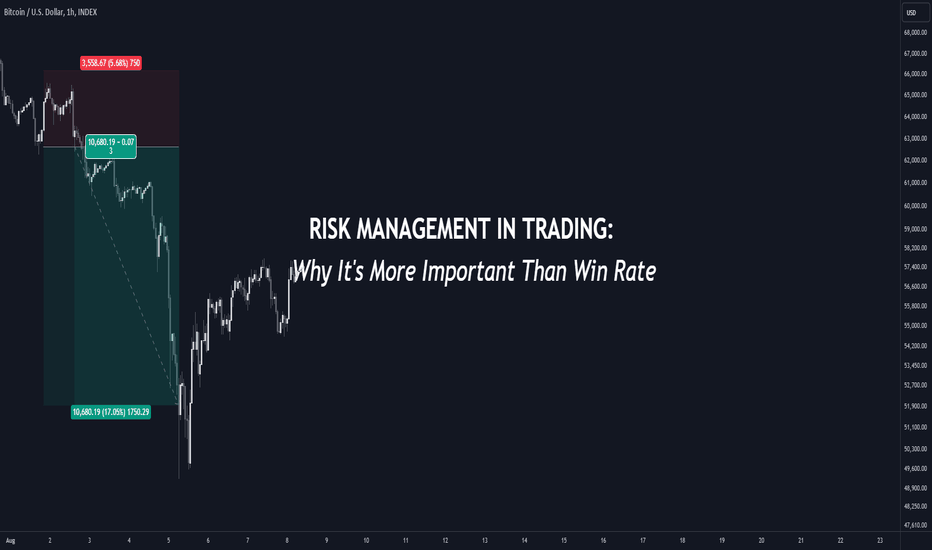

RISK MANAGEMENT IN TRADINGRISK MANAGEMENT IN TRADING:

Why It's More Important Than Win Rate

🔵 INTRODUCTION

In the world of trading, many newcomers fixate on finding the "perfect" strategy with the highest win rate. However, experienced traders know a secret: risk management is the real key to long-term profitability. In this post, we'll explore why managing your risk effectively is more crucial than your win rate, and how it can make the difference between success and failure in your trading career.

🔵 UNDERSTANDING RISK MANAGEMENT

Risk management in trading refers to the process of identifying, analyzing, and accepting or mitigating the uncertainties in investment decisions. It's about protecting your trading capital from excessive losses and ensuring you can survive to trade another day.

Key concepts in risk management include:

Position sizing: Determining how much of your capital to risk on each trade

Stop-loss orders: Predetermined points at which you'll exit a losing trade

Risk-reward ratio: The potential profit of a trade compared to its potential loss

Diversification: Spreading risk across different assets or strategies

Effective risk management is like wearing a seatbelt while driving. It won't prevent accidents, but it can significantly reduce the damage when they occur.

🔵 THE MYTH OF WIN RATE

Many novice traders believe that a high win rate is the holy grail of trading. After all, if you're winning most of your trades, you must be making money, right? Not necessarily.

Consider this example:

Over 100 trades:

Trader A: (90 x $100) - (10 x $1000) = $9000 - $10000 = -$1000 (Loss)

Trader B: (40 x $300) - (60 x $100) = $12000 - $6000 = $6000 (Profit)

This demonstrates that a high win rate doesn't guarantee profitability if your risk management is poor.

🔵 HOW RISK MANAGEMENT CONTRIBUTES TO PROFITABILITY

Effective risk management contributes to profitability in several ways:

1. Capital Preservation: By limiting losses on each trade, you ensure that you don't deplete your trading capital during inevitable losing streaks.

2. Maximizing Gains: Proper risk management allows you to size your positions appropriately, maximizing gains when your analysis is correct.

3. Emotional Stability: Knowing that your risk is controlled reduces stress and emotional decision-making, leading to better trading choices.

4. Consistency: A solid risk management strategy provides a structured approach to trading, leading to more consistent results over time.

🔵 RISK-REWARD RATIO

The risk-reward ratio is a fundamental concept in risk management. It compares the potential profit of a trade to its potential loss. For example, a risk-reward ratio of 1:3 means you're risking $1 to potentially make $3.

Here's why it's crucial:

A favorable risk-reward ratio allows you to be profitable even with a lower win rate.

It forces you to be selective with your trades, only taking those with the best potential outcomes.

Example:

(40 x 2) - (60 x 1) = 80 - 60 = 20 (units of profit)

🔵 RISK-REWARD AND WIN RATE CHEATSHEET

Understanding the relationship between risk-reward ratios and win rates is crucial for long-term profitability. Here's a quick reference guide to help you visualize how different combinations affect your overall results:

1:1 Risk-Reward Ratio

- Breakeven Win Rate: 50%

- To be profitable: Win rate must exceed 50%

1:2 Risk-Reward Ratio

- Breakeven Win Rate: 33.33%

- To be profitable: Win rate must exceed 33.33%

1:3 Risk-Reward Ratio

- Breakeven Win Rate: 25%

- To be profitable: Win rate must exceed 25%

1:4 Risk-Reward Ratio

- Breakeven Win Rate: 20%

- To be profitable: Win rate must exceed 20%

Key Takeaways:

Higher risk-reward ratios allow for profitability with lower win rates

Consistently achieving risk-reward ratios above 1:3 can lead to substantial profits even with win rates below 50%

Always consider both win rate and risk-reward ratio when evaluating a trading strategy

Remember: A high win rate with poor risk management can still result in overall losses

Use this cheatsheet as a quick reference when planning your trades and assessing your overall trading strategy. It reinforces the importance of maintaining favorable risk-reward ratios in your trading approach.

🔵 MATHEMATICAL DEMONSTRATION

Let's look at a more detailed example to show how risk management impacts profitability:

Scenario 1 (Poor Risk Management):

Win Rate: 60%

Risk per trade: 5% of capital

Reward per trade: 5% of capital

Starting Capital: $10,000

Number of trades: 100

Result after 100 trades:

60 winning trades: 60 x ($10,000 x 5%) = $30,000

40 losing trades: 40 x ($10,000 x 5%) = $20,000

Net Profit: $30,000 - $20,000 = $10,000

Ending Capital: $20,000

Scenario 2 (Good Risk Management):

Win Rate: 40%

Risk per trade: 1% of capital

Reward per trade: 3% of capital

Starting Capital: $10,000

Number of trades: 100

Result after 100 trades:

40 winning trades: 40 x ($10,000 x 3%) = $12,000

60 losing trades: 60 x ($10,000 x 1%) = $6,000

Net Profit: $12,000 - $6,000 = $6,000

Ending Capital: $16,000

Despite a lower win rate, Scenario 2 still results in significant profit with much lower risk to the trading account.

🔵 PRACTICAL TIPS FOR IMPLEMENTING RISK MANAGEMENT

1. Always use stop-loss orders: Determine your exit point before entering a trade and stick to it.

2. Follow the 1% rule: Never risk more than 1% of your trading capital on a single trade.

3. Calculate position sizes based on your stop-loss: Adjust your position size so that if your stop-loss is hit, you only lose the predetermined amount.

4. Maintain a favorable risk-reward ratio: Aim for a minimum of 1:2, preferably 1:3 or higher.

5. Diversify your trades: Don't put all your capital into one trade or one type of asset.

6. Keep a trading journal: Track your trades to identify patterns and areas for improvement in your risk management.

🔵 CONCLUSION

While a good win rate is certainly desirable, it's clear that effective risk management is the true foundation of trading success. By focusing on controlling your risk, you can achieve profitability even without an exceptionally high win rate.

Remember, the goal in trading isn't to be right all the time—it's to be profitable over time. Prioritize risk management in your trading strategy, and you'll be well on your way to long-term success in the markets.

Take action now: Review your current trading approach and assess how you can improve your risk management strategies. Your future trading self will thank you!

Market Anxiety Reflected in the "Fear Index"tradingview.sweetlogin.com

Market Anxiety Reflected in the "Fear Index": Understanding the Nikkei Volatility Index

The Nikkei Stock Average experienced significant volatility on August 7th in the Tokyo stock market. Although it initially plunged over 900 points at the opening, it quickly recovered.

One factor behind the sharp drop in Japanese stocks was the hawkish remarks made by Bank of Japan Governor Kazuo Ueda during the Monetary Policy Meeting. However, at a financial and economic symposium held in Hakodate, Hokkaido, Deputy Governor Uchida stated, "We will not raise interest rates under unstable financial market conditions." He also mentioned, "For the time being, we believe it is necessary to firmly continue monetary easing at the current level," easing market concerns about further rate hikes.

While the stock market is being swayed by the remarks of government and Bank of Japan officials, an analysis of the Nikkei Volatility Index, also known as the "fear index," revealed that it surpassed the warning level, reaching 45.63 on July 23rd. This indicates a highly unstable state in the stock market. Being able to anticipate rapid changes in volatility can make it easier to manage funds and trades, reducing the risk of being overwhelmed by market fluctuations.

The warning level is not only exceeded when the index surpasses 40 but also when it falls below 20, requiring market participants to exercise caution. When the index dips below 20, a situation akin to the "calm before the storm" can arise, making market movements difficult to predict. For instance, the usual correlation between the number of advancing and declining stocks and overall market movements may break down under these circumstances.

Although turbulent markets like this are rare, market participants must still be prepared for unforeseen events.