Unveiling the Secret to Wealth: Why Patient Traders Are Rich

In the fast-paced world of finance, patience may not always seem like a virtue. However, when it comes to trading, those who exhibit patience tend to emerge as the biggest winners. In this article, we will uncover the reasons why patient traders are often richer than their impulsive counterparts. So, let's delve deeper into the mindset, strategies, and benefits that set patient traders apart.

1. Proven Strategies:

Patient traders follow well-researched and proven strategies that enable them to minimize risks and maximize returns. They meticulously analyze market trends, study financial indicators, and make informed decisions based on thorough analysis.

2. Delayed Gratification:

Patient traders understand the concept of delayed gratification. Rather than constantly seeking instant gratification through frequent trades, they carefully select quality investment opportunities with an extended time horizon.

3. Embracing Volatility:

Patient traders are not intimidated by market volatility. They understand that short-term price fluctuations are inevitable and often present lucrative opportunities for long-term gains.

4. Long-Term Thinking:

Impatient traders often focus on short-term gains, while patient traders adopt a long-term perspective. By investing in fundamentally solid companies or assets with long-term growth potential, patient traders build wealth steadily over time.

5. Risk Management:

Patience allows traders to implement effective risk management strategies. Instead of making impulsive decisions driven by fear or greed, patient traders take calculated risks and set clear exit points.

6. Compound Interest Magic:

Patient traders harness the power of compound interest to their advantage. By allowing their investments to grow steadily over time, they benefit from the compounding effect, where returns are reinvested and generate additional returns.

7. Psychological Benefits:

Patience in trading brings about psychological benefits, enabling traders to maintain a disciplined approach. Patient traders do not succumb to impulsive decisions in response to short-term market fluctuations, which can lead to costly mistakes.

8. Financial Freedom:

Ultimately, patient traders attain financial freedom. They have the luxury to wait for their investments to mature, take advantage of long-term trends, and build substantial wealth.

The journey to becoming a wealthier trader lies in embracing patience. By adopting proven strategies, cultivating delayed gratification, and maintaining a long-term perspective, patient traders consistently outperform their impulsive counterparts. The compounding effect, risk management, and psychological advantages ultimately pave the path to financial freedom. So, if you aspire to be richer as a trader, remember: slow and steady wins the race!

Please, like this post and subscribe to our tradingview page!👍

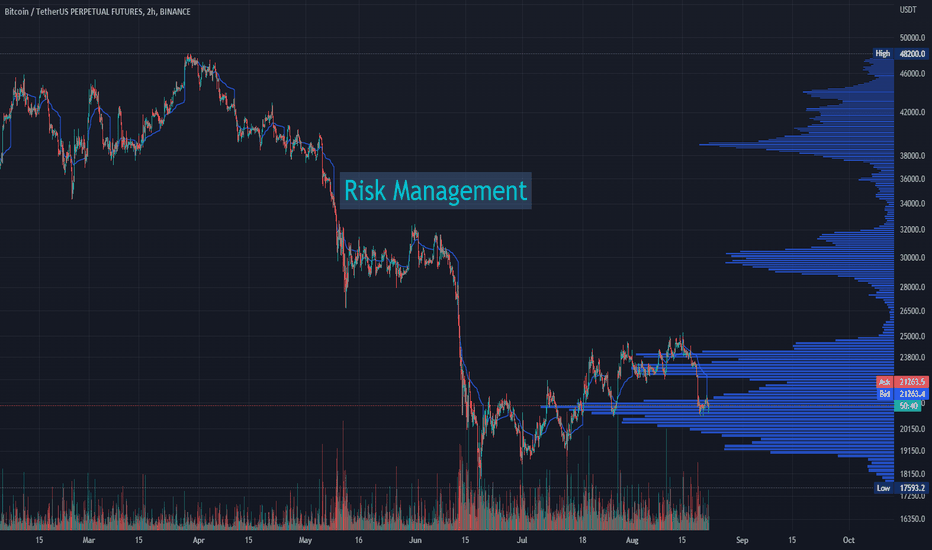

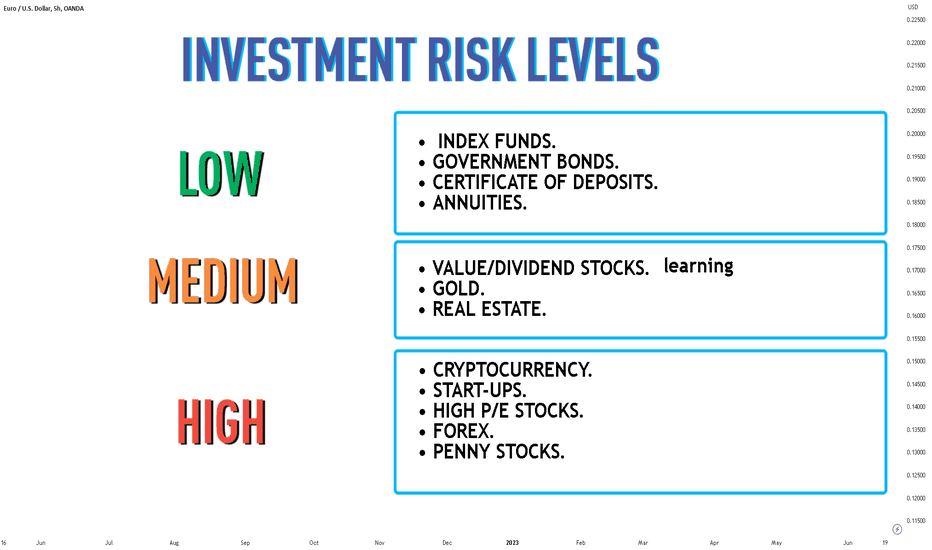

Risk Management

🐼Mastering the Art of Forex Trading Strategies🐼

Key words:

,,,,, , ,,

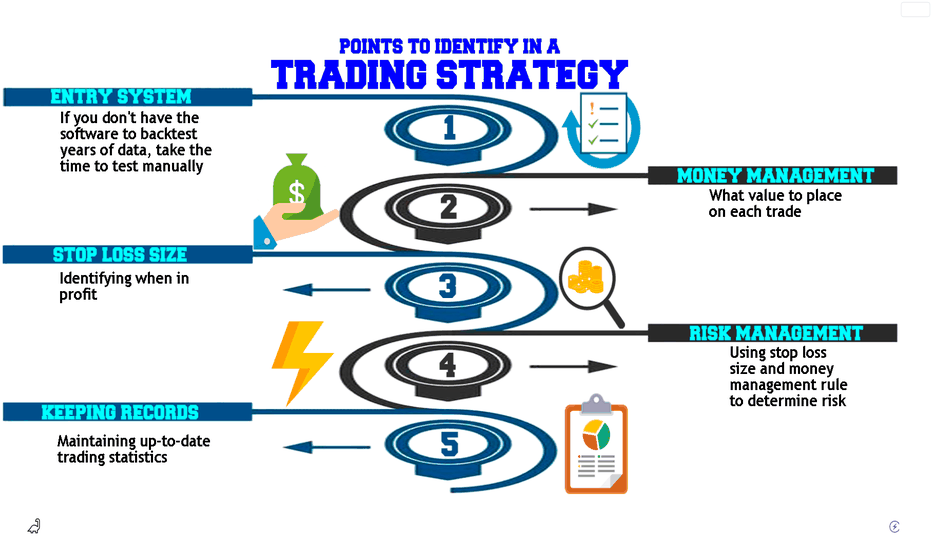

🐼The world of forex trading is as fascinating as it is dynamic. To thrive in this fast-paced market, developing a robust trading strategy is paramount. In this article, we will explore the key points that can help you identify and refine your trading strategy, bringing you closer to success.

🐼Identifying Market Trends:

Understanding market trends is crucial in making informed trading decisions. By analyzing moving averages, trend lines, and price patterns, you can identify the prevailing market direction and potential opportunities.

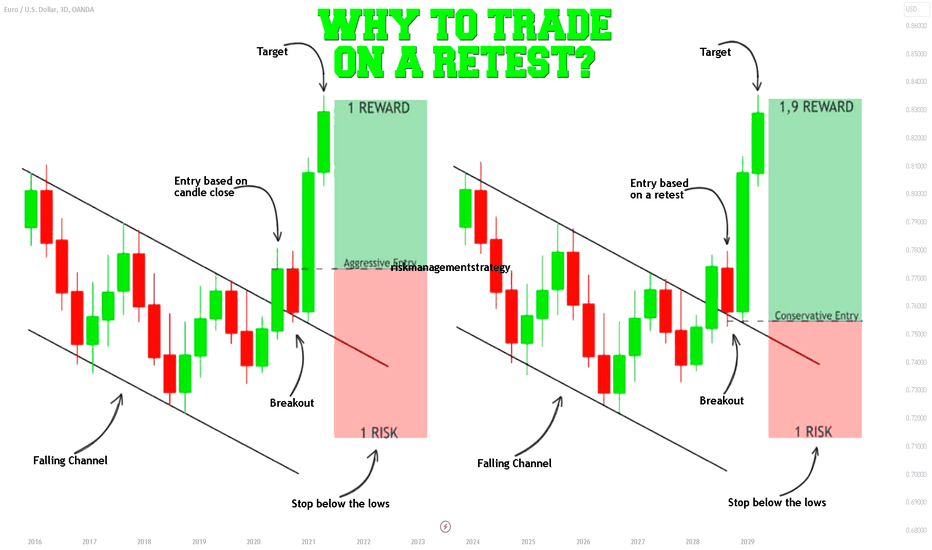

🐼Implementing Effective Risk Management Strategies:

Mitigating risks is a vital aspect of any trading strategy. Set appropriate stop-loss orders, determine suitable position sizes, and manage leverage wisely to protect your capital and minimize exposure to potential losses.

🐼Incorporating Technical Analysis Tools:

Technical analysis tools provide valuable insights into market behavior. Use oscillators like the Relative Strength Index (RSI) to identify overbought or oversold conditions, Fibonacci retracement levels to pinpoint support and resistance levels, and Bollinger Bands to gauge market volatility.

🐼Staying Informed about Market News and Economic Calendar Events:

Keeping up with the latest news and economic events can provide valuable context for your trading strategy. Monitor economic indicators such as GDP releases, central bank meetings, and geopolitical events to understand potential impacts on currency movements.

🐼Conclusion:

Crafting a successful forex trading strategy requires a comprehensive approach that covers market trend identification, risk management, technical analysis, and staying informed about market news. By incorporating these key points into your strategy, you can enhance your trading skills and increase your chances of long-term success in the forex market. Remember, forex trading is a continuous learning journey, so adapt and evolve your strategy as the market evolves.

Please cheer me up with a like and a nice comment😸❤️

Please, support my work with like and comment!

Love you, my dear followers!👩💻🌸

[Education] Itchy Hands Ruin Your CareerI was impatient.

I've always wanted my live trades to play out as fast. As fast as I click the "forward" button in TradingView replay function.

When I'm not in a trade, I'm bored. I want to be in a trade.

It doesn't matter if the trade does not fit my plan. I will find excuses to justify my actions because anything can happen in the market, right?

I want to feel the joy and excitement every time I'm in a trade. But every time I don't trade my plan, I see my account balance getting lower and lower.

This is when I realized I was gambling, not trading. Trading should be simple, boring and mundane. You should not feel anything from it. It's like working your day job. Do you feel happy analyzing spreadsheet?

My mentor suggested that I trade on the seconds timeframe. It's the closest to the speed of backtesting.

I agreed. I switched over to trade using the 15 seconds chart.

When I was scalping, things are moving fast. Analysis and trade management needed to be quick and there is no time for me to stop, gather my thoughts and act.

I took on many unnecessary losses because I wanted to be in all the moves.

At the end, my $1,000 account ended in a $600 drawdown in 1 month.

This is unsustainable.

Not Following Your Plan

Your biggest problem is not following your trading plan. You have a profitable trading system that you have backtested a lot. But why do you not trade according to it?

Discipline.

There is no one to keep you accountable for the trades that you take. If you're working in a day job, you will be discipline to arrive at work on time. You must meet your KPI, and to complete your job according to all the rules.

In trading, you're your own boss. No one will be telling you not to take the trade if it doesn't fit your trading plan. No one will be telling you to risk only 1% and not 10% on a single trade. No one will be here to punish you for all the mistakes that you've made. Success and failure belong to you only, no one else.

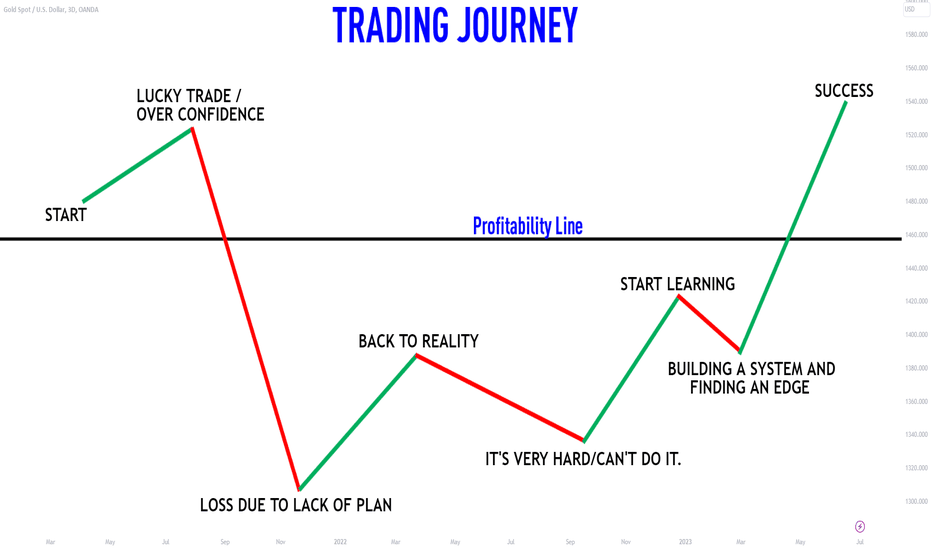

Without the discipline to follow your trading rules, you will be running around a circle. You will find some small successes, only to fall back into the same spot as you did a few months later. You will be a breakeven trader, unable to achieve profitability. Even worse, you will be in a drawdown, and will be unable to pull yourself back to profit.

If you want to improve your trading to achieve financial freedom, I have good news for you. I have a bespoke mentorship and is currently accepting students. Do note that slots are highly limited and not everyone who is interested can join. Check it out here.

Feeling The Pressure To Trade

There can only be two reasons why you feel the pressure to trade.

First, you're attempting a funded challenge and you're reaching the end of the time limit. Nowadays, there are many prop firms out there without any time limitations. This is better for your psychology and it's easier for you to pass since you do not need to force any trades. You are able to trade at your own pace, taking trades that fit your trading plan.

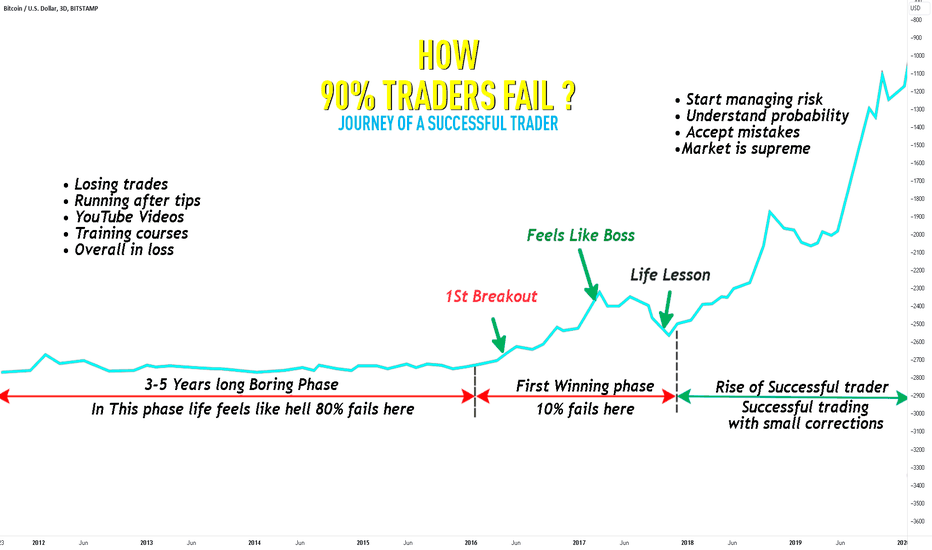

Second, you're relying on trading as the only source of income to put food on your table. Trading is the worst hustle you can rely on to put food on your table, especially if you're a beginner. Trading is already difficult and stressful to begin with. You are dealing with the fact that 95% of the traders fail. You're dealing with human's fundamental nature of greed and fear. It took me 5 years to achieve consistent profitability. What are the odds that you're a genius? What are the odds that you will be profitable when you're starting out? There is no guaranteed income in trading. Trading is a great side hustle at the start. You need consistent cash flow from your day job to put food on your table. You will most likely lose money during your first few years of trading.

Get your personal finance in order first. Make trading your main source of income later.

How To Curb Your Itch

You can create another small account. This account is to satisfy your urge to be in a trade. This way, you do not hurt your main trading account.

You are able to look at how you are performing when you’re not following your trading plan.

Compare this result to the results where you followed your trading plan. You will be able to see which is performing better.

If you get better results for not following your trading plan, tweak your actual trading plan. Backtest them and see whether there is an improvement by implementing these changes.

If yes, good! You’ve found improvement to your profitability. If not, you should realize that you must stick to your trading plan.

But Keeley, trading on a small account isn't satisfying enough.

Yes I know. But don’t forget, you’re deviating from your trading plan. You do not know whether this way of trading is profitable or not.

You can be lucky for the first 5 trades and think that you’re doing fine. This is when everything will go wrong. You will take the next trade on your main account. You will take the first loss. It’s ok, this is just 1 loss out of the 6 trades you took.

If you’re unlucky enough, you can lose 10 more trades this way and put a dent in your trading account. This could actually be a losing strategy. By continuing to trade like this, you will lose your trading edge over the long run.

Do you want to lose a small $100 account or your main $10,000 account? The answer is clear for me.

Accepting Change

Fear and greed are the enemy of traders. They are innate in us and it’s hard to overcome them.

Do you know that 95% of the traders are unprofitable? Do you know why people love to stay in their comfort zone, unwilling to try something new? Fear.

Change is the only constant in life. Why change something that is working ? Why change your lifestyle for the better when you’re not suffering? You’re not doing bad, but you’re not doing well either.

Everyone must choose one of two pain. The pain of discipline, or the pain of regret.

Whenever we try something new, we experience anxiety. We are afraid of the unknown. Master your emotions - Thibaut Meurisse

The most dangerous addiction in the world is comfort. People who’s living your dream life is not that smarter than you. They are simply better at overcoming the fear to take that very first step. It feels good to be trapped within your comfort zone. You have certainty. Negative emotions will find it hard to penetrate your bubble.

Think about it. You are in your 20s or 30s right now. When do you plan on retiring? 60? 70? That’s still a long way to go. Can you imagine yourself working for another 30 to 40 years? That’s 8 hours a working day on average. There’s an average of 260 work days in a year. Assuming you took all your 30 vacation leave and 14 sick days off. You’re still working 1,728 hours a year. What if you work for another 30 years? That’s 51,840 hours, or 2,160 days or 6 years of your life. And you don’t even work only 8 hours a day.

Slogging your life in a 9 - 5 on the weekdays, only to go home and watch Netflix and play video games. The cycle repeats. Look back into the past 2 years, what have you achieved? Do you want to continue living your life like this for 30 more years? Waiting for your paycheck at the end of the month, save and invest here so that you have enough money for a 5 days vacation to escape your mundane life. Then you’re back at it again with your savings wiped out.

Life always begins with one step outside of your comfort zone. - Shannon L. Alder

To create an extraordinary life, take full responsibility for your actions and decisions. Stop blaming external factors, and focus on the things you can control. If you can’t control what others think about you, then don’t. What are the things that you can control? How you treat yourself, your body and your mind. How you react to people and situations. How you think. What you do with your time. The people you choose to surround yourself with. How you treat others. Where you give your time, energy and attention. The contents that you consume.

When you’re trying to do the extraordinary, the ordinary will try to stop you from doing. People don’t like to see you succeed. They heard that entrepreneurship is hard and risky. You could lose a lot of money. They think that they have the best interest in you. They like to stay in the comfort zone and you should stay there with them. They tell you to be realistic. You are not someone incredible of great success.

Anything can happen. Ultimately it’s up to you to take the first step. There will be a lot of what-ifs and negative scenarios playing out in your head when you’re venturing into the unknown. The unknown is scary. But what if it turns out better than expected? What if everything should go well, actually went well? That’s something you can only find out if you take the first step.

Framework

Many of you focused a lot on the entry and the exit of your trades.

You have screenshots of your before and after of all the $Tesla Motors(TSLA)$, CSEMA:S&P 500(.SPX)$ and $Apple(AAPL)$ trades.

How about the process during the trade? Trade management is crucial in your trading career and is often neglected. You're interested in how many RR the trade can give you. You're interested in sniping the best entries with minimal drawdown. You're interested in trading using the smallest stop loss for the largest gains.

Understanding trade management can save you from losses. Trade management is also dependent on your personality. Do you like to manage your trade? Or do you prefer to set your limit order and continue with your life, forgetting about them?

You have to find a trade management system that fits your personality.

You can incorporate many trading tools into your stop loss placement. You can incorporate tools such as moving average, structural highs and lows, opposing order blocks, ATR, Fibonacci extension, using time elements, and even volume.

Set And Forget

I use this for myself. As I’m trading on the 15m timeframe, I know that my trade can take a few hours or even days to play out. Since I don’t have any power to control the market, I don’t manage my position. I manage my position when there are news or when my trade is aligned with the higher timeframe order flow. By using this method, you accept all the possibilities that this trade will be a loser. You know the win rate of your trading system through your backtesting. This way, you trade according to how you backtest. This method gives you a lot of free time for you to do what you love. This gives you time freedom which every traders should strive to achieve.

Trailing Stop Loss

When price moves in your favor, the stop loss will follow behind the current market price. This ensures that you capture all the profits. When a retracement comes, price will take you out in profit. I seldom use this method unless there is a red folder news. I will shift my stop loss to at least breakeven, and trail my stop loss to structure highs or lows. I have a few accounts with different prop firms. I can set my stop losses to different structure highs or lows to spread my risk. If one trade gets taken out, other trades could still be in. When red folder news is happening, the price can move fast in one direction. Often times, price will retrace back in my favor. This is to secure my profits, in case the price moved against me and hit my original stop loss position.

Taking Partial Profits

I use this whenever there is a red folder news approaching. 2 minutes before the release, I will close half of my position and shift my stop loss if my position is in a profit. I will close 75% of my position if my position is in a drawdown. There is great volatility during red folder news. If I do not close any position, I’m risking more than I want. This is due to the risk of slippage during news. I talked a lot about it here. You can consider taking partial profits when the price hits structural highs or lows. You can also use a Fibonacci extension to determine when you should be taking partials. This is up to you and your trading plan.

Results

If you've been following me on my journey, you would have seen my growth to be a consistent profitable trader.

Imagine receiving all these profit splits every other week. It gives a boost to my confidence. It also reinforce the fact that following my trading plan is the way to profitability.

I have a funded account journey where I trade a $10,000 account, showing the ups and downs of how real trading is like on my YouTube channel. I post weekly updates on my progress and show you the reality of trading.

I walk the talk, being transparent with my progress with the public. I know exactly what you're struggling with and I know exactly how to fix your issues. I’m sure you will benefit a lot from my free contents.

Stay consistent. Stay safe. Success is just around the corner.

If you enjoy such content, feel free to click the like button and subscribe for more.

Let me know what are your thoughts and learning points in the comments below so others can learn from you too!

Please let me know what kind of topic you would like to read next :)

Happy weekend!

❌Trading Mystery: Why 95% Of You Will Fail❓

🟥The world of forex trading holds immense allure - the promise of financial freedom and the opportunity to make money from the comfort of your own home. However, it is no secret that the path to success in forex trading is treacherous, with estimates suggesting that a staggering 95% of traders fail to achieve their desired outcomes. So, what exactly goes wrong for these aspiring traders? Let us unlock the creative narrative behind this apparent mystery and delve into the reasons that prevent them from cracking the code.

♦️Lack of Proper Education:

Just as successful carpentry requires the right tools, so does forex trading. Many traders dive into the financial ocean without a true understanding of its currents, waves, and hidden dangers. They overlook the importance of acquiring comprehensive knowledge about markets, technical indicators, risk management, and strategies. Without a firm grasp of these essentials, traders unwittingly chart a course for disaster.

♦️Emotional Tempests:

Imagine being a captain of a ship, navigating treacherous waters while being plagued by anxiety and fear. Forex trading is not for the faint of heart. As the markets fluctuate, traders battle their own emotions, succumbing to impulses that lead to impulsive trading decisions. Greed, fear, and overconfidence can cloud judgment, causing traders to buy or sell impulsively rather than relying on calculated analysis. Emotion-driven trading inevitably leaves traders shipwrecked amidst the unforgiving tides of the forex market.

♦️Unforeseen Volatility:

The forex market is a living organism that reacts to an array of factors, from economic data to geopolitical events. These dynamics can send currency values into a frenzy, defying logic and leaving traders bewildered. Sudden fluctuations, unpredictable trends, or unexpected policy decisions can capsize even the most astute trading strategies. By underestimating volatility, traders find themselves drowning rather than riding the waves.

♦️Inadequate Risk Management:

Imagine moving forward without a life jacket while navigating choppy waters. This risky endeavor can lead to dire consequences, just like trading without proper risk management. Successful traders understand the importance of setting stop-loss orders, managing trade sizes, and allocating a portion of their capital to each trade. Those who disregard risk management find themselves sinking beneath the weight of their poor decisions.

♦️Overreliance on Automation:

In recent years, the rise of automated trading systems has piqued the interest of aspiring traders. While these algorithms can streamline processes and enhance efficiency, they are not a guarantee of success. Blindly relying on automation without understanding how it works or constantly monitoring its performance may result in unexpected losses. It is essential to strike a balance between human insight and technological support.

🟥The realm of forex trading is a captivating one, tantalizing traders with elusive riches. However, becoming part of the 5% who succeed requires diligence, perseverance, and a deep understanding of the whimsical nature of the market. One must embark on this journey by arming themselves with knowledge, taming their emotions, embracing volatility, implementing effective risk management, and balancing human intuition with automation. Only then can traders hope to navigate the tempestuous seas and emerge victorious in their pursuit of forex trading success.

😸Thank you for reading buddy, hope you learned something new today😸

Do you like this post? Do you want more articles like that?

[Education] How I Lost Everything To TradingI wasn't always profitable. I lost a lot of money when I first started trading forex. I don't remember how I got started learning forex. But I know I started when I was serving in the army. I borrowed books from the library, watched many YouTube videos on trading. I was very knowledgeable on technical analysis. I know the concepts so well I could vomit them out to you. I didn't follow up on trading that much after my service ended.

I came back to trading when I was working as an auditor. The fact that I had to work long hours with little pay brings me to look for an alternative source of income. I found out that we can make money through percentage allocation money management (PAMM). You invest your money into a trader, and whatever profit they earn, you will give them a % cut, and you keep the rest.

I found this trader with a solid trade record. He has 3 years record with an average of 20% profit a month. He is trading with a $500,000 account. I thought that this trader was good. I calculated how fast my money will grow by putting money with him every month. I put in $1,000 for a start. A few months passed and it showed good results. I see the balance in my account increased too. That was when I decided to put all my savings in. I put $10,000 in, which was everything that I had.

I was working overseas that day. I checked my account after work. I saw that my account balance was $0.98. I thought it was some bug. I refreshed the page a few times. I saw that the account manager has risked everything in 1 trade. I was shocked. I felt numb. What was going on?

Red Flags

I did some research online, found out that the broker actually fakes the trades of “top trader” over a span of 2 years. When more suckers like me put my money in these PAMM, they will burst the account with 1 stupid trade. I believe this stupid trade was not even executed, but a front for them to scam all our money.

I realized that there were many red flags to begin with. None of the top traders offered any 3rd party verification through Myfxbook, MQL5, or even Fxblue. They don’t even give their investor passwords which are read-only to investors.

It was a painful lesson. But it led me to the journey of trading by myself. From then on, I put in a lot of hours studying and backtesting technical analysis.

Even right now, I’m not comfortable with putting my money with PAMM for diversification. I will need to know the trader, understand his trading style and the potential risk to reward of the trader.

The Problem Is You

Letting mathematics formulas do the compounding for your money is a bad expectation. You think trading is easy. You can trade from your room, or even overseas using your phone. Many people are posting screenshots of their profits consistently on the social media. You think that trading is the way to achieve financial freedom. This is a legit business and many people has done it. you can do it too. You start to play around with leverage, only to get your account wiped out after 4 trades.

You deposit $100 more. you are on a winning streak. You have 4 wins in a row. you look at your account balance increased from $100 to $1,000. You’re unstoppable. You continued overleveraging your account. I mean, what can stop you now right? You’re basically a god of trading with 4 win streak. next thing you know, you wiped out your $1,000 balance.

You repeat this cycle till you’re sick and tired. you proceed to find the next holy grail.

Breaking The Loop

Insanity Is Doing the Same Thing Over and Over Again and Expecting Different Results - Albert Einstein

You need to break this cycle. you are only repeating what you’re losing.

Relying on other sources for trading will not get you far. Yes, you might found a profitable signal provider. What if he don’t want to provide his service anymore? You will be back at where you begin, looking for another signal provider again. You will need a lot of time and waste money to make sure that the signal provider is legit. what if your profitable signal provider is experiencing a losing streak? will you continue to follow the signals? or will you start having doubt? will you take responsibility for all these losing trades? or will you blame your signal provider?

To be consistently profitable in the long run, you have to trade by yourself. Everyone’s view on the market is different. You can be looking at a long on EURUSD, but I could have a bearish bias.

Knowing how to trade by yourself is the key to success. You don’t need to rely on signal providers. You don't need to constantly monitoring your phone to check if there are any signals.

You know the risk and reward and your expected win rate by trading yourself. It is you who put in the hard work of backtesting. You will be putting your own trades. You determine the amount of risk you will take. You take trades based on your lifestyle and personality.

Do The Uncomfortable Stuff

Trading involves a lot of uncertainty. This is a hustle that you can earn money without knowing what can happen next. Even though I'm a profitable trader, I do not know what will happen next. I can only guarantee that either I will lose the next trade with -1%, or a profit. I focus on what I can control, not what I expect for things to happen.

When you trade according to your own plan, you understand the risk you are taking. It is scary to take your own trades at first. You don't know if your analysis is correct. You don't know if you will be successful. You don't know if you will be profitable. This is what every trader will experience. On my first trade, I was having adrenaline rush when price came back to tap my entry. I was looking at the chart for the whole day, even though I'm trading on the 15 minutes timeframe.

I know and understand that I cannot control the price. But psychologically, I'm not strong enough to let my trade play out. This trade ended up with a loss.

You have to start somewhere to learn how to trade by yourself. Without this, you will forever be trapped within the cycle of unprofitability.

If you keep telling yourself that trading alone is hard and you are unable to be profitable, you are right. You are constantly letting your subconscious mind get used to this message. Your subconscious never rests. Even when you’re asleep, your subconscious is still running in the background. It will keep telling your body what needs to be done to keep you functioning.

Being Trapped In The Loop

I was the same as you. I skipped from strategy to strategy, trying to find the holy grail. I tried many things. from EA to signals to mentorship.

I earned some, but I lost more. I lose before I even start. Buying EAs cost money. Subscribing to signals cost money. Signing up for mentorships cost money.

I tried EAs that uses grid and martingale. I bought indicators that repaint themselves after price actions have happened. I’ve tried EAs made by creators who adjust it to best fit past data, but are actually not profitable in the live market. I’ve tried signals that gives a 20 pips TP 1, but 100 pips stop loss. They make big celebrations with fire emojis when TP 1 hits. When TP 2 of 40 pips hits, they do the same thing. Weekly result summary are also posted which includes both TP 1 of 20 pips and TP 2 of 40 pips. They remove losing signals too. This looks like it’s a profitable signals, but the risk to reward ratio for their signals are shit with low win rate.

Some of the mentorships are cash grab. You pay them to give you video recordings and information. You can find them for free on Babypips.

It’s debatable that all mentorships are a scam. Some of the mentorships I joined actually provided great values. I’m able to look into how profitable traders are trading. I can get insights on their thought process behind their trades. There is a platform for me to do my analysis. Mentors will comment on my analysis, telling me what I could do to improve, or even add their insights. Some also provide 1-1 calls which is what all mentorships should offer. Sometimes, it’s faster and easier to explain through a call rather than on text. Furthermore, they record the 1-1 sessions and I can watch them in the future. These 1-1 sessions can be Q&As, or even backtesting session. This is where I will do the backtest and the mentor will comment on my thought processes.

I would consider myself to be lucky to have only lost $10,000. If I had more money, I’d lose way more for sure. After losing that $10,000, it led me on a journey to be a profitable trader now. I have no regrets on this journey.

Mentorship

Most people are unwilling to spend money for courses, knowing well that there are thousands of FREE online resources out there. But the problem lies in how do you sieve out all the unnecessary and useless information from such a huge amount of resources? Mentorships are made to solve these problems. They are built to solve and educate you on a specific skill and knowledge that you want to learn. They are built by people who have experienced the same problem as you did.

This is the same as spending money on university courses. Most of you are willing to pay thousands of dollars and 3 - 5 years of your lives to get a 4 - 5 figured day job, yet you don’t bear to spend that few hundred of dollars to get the specific skillset that you need as an investment.

My last mentorship costs me $2,000. I can tell you that it's the best investment I've ever made. Through the mentorship, it gives me different perspective from an active community. We look at the same chart every single day and anyone is free to critic our work. The 1-1 calls are also important to me. They gave me a good foundation, and I learnt a lot of advanced skills like psychology and risk management.

I got to a point where making $916.05 is as easy as placing 1 trade, and getting 2% return on a 0.5% risk. Yes this profit comes from only 1 trade on my $50,000 account.

I've covered the cost of mentorship through my funded account payouts. This return on investment will continue to accumulate. Sooner or later, I will be earning back whatever I've lost, and to quit my 9-5 job to trade full time.

Stay consistent. Stay safe. Success is just around the corner.

If you enjoy such content, feel free to click the like button and subscribe for more.

Let me know what are your thoughts and learning points in the comments below so others can learn from you too!

Please let me know what kind of topic you would like to read next :)

Breaking the Cycle: The Perils of Repeating Trading Mistakes

Trading in financial markets can be a challenging endeavor. It requires a combination of skill, knowledge, and adaptability to navigate the complexities of the market. Unfortunately, many traders fall into a common trap - they repeat their mistakes, often leading to failure. This article will explore why repeating mistakes in trading can be detrimental and explain how studying these errors can pave the way for long-term success in the markets.

1. The Importance of Recognizing Mistakes:

One of the primary reasons traders repeat mistakes is the failure to recognize them in the first place.

2. The Consequences of Repeating Trading Mistakes:

Continually making the same mistakes in trading can have severe consequences.

By understanding the negative impact of repeated mistakes, traders can be motivated to break the cycle.

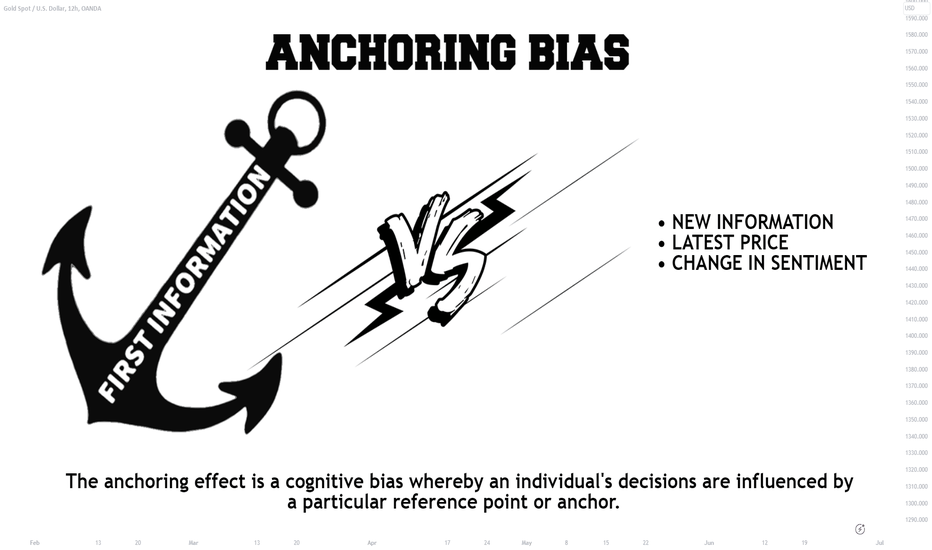

3. Psychological Factors:

Psychological biases and emotions significantly contribute to repeating trading mistakes.

Studying trading mistakes with a reflective mindset is crucial for professional growth. Techniques such as journaling, performance reviews, and seeking feedback can help traders gain valuable insights.

5. Identifying Patterns and Developing Strategies:

Mistakes often reveal patterns that can be detected and analyzed.

6. Continuous Learning and Adaptation:

The key to trading success lies in continuous learning and adaptation. The pursuit of knowledge is essential to avoid repeating trading mistakes.

7. Implementing Risk Management Measures:

Developing sound risk management practices helps prevent repeat mistakes and protect against potential losses.

Conclusion:

Repeated mistakes in trading are detrimental to success, both financially and psychologically. However, by acknowledging and studying these errors, traders can learn valuable lessons and refine their strategies. Through continuous learning, self-reflection, and effective risk management, traders can break the cycle of repeating mistakes, leading to improved performance and long-term success in the trading world.

Hey traders, let me know what subject do you want to dive in in the next post?

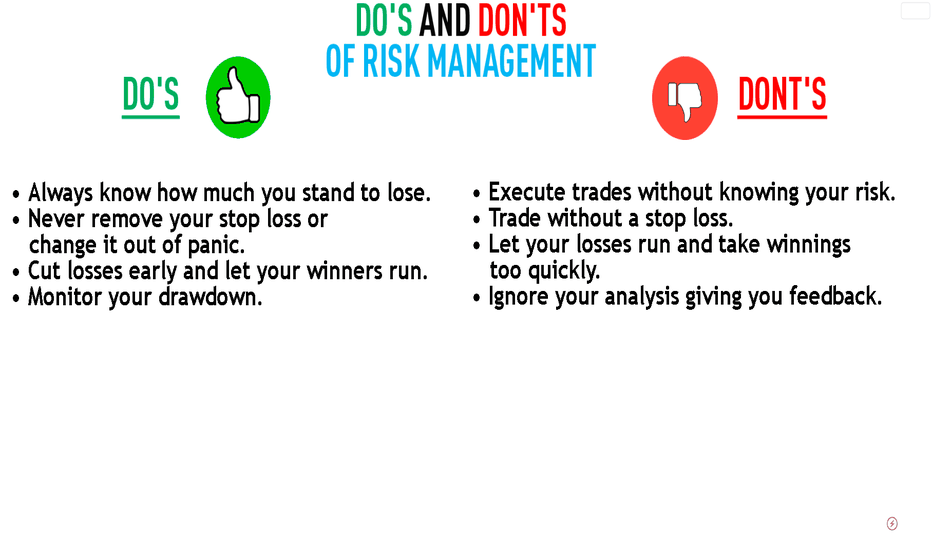

I want to share with you some points about Risk ManagementThis topic is so important, that´s why I wanted to share it with you and hope I can reach as much people as possible. Hope it will help some :)

I saw in the last years many who crashed their accounts very hard, they lost a lot of money and for some it was very dreadful!

It is hard to watch this people how they burn money and bring even his own family in financial danger. That´s why risk management in trading is so heavily important, to keep yourself and your life in balance.

May be some will find very helpful, or some will remember this rules again :)

I will keep it a bit shorter here as in my book, but the main points are still mentioned!

I can´t say it often enough, always keep your rules during trading. Trading is not the way to get rich quick, it is a serious and hard business! It take a lot of time to learn, it requires a lot of patience and it will happen a lot of failures.

This failures are even more important than your success! Success will not open up how it will not work, failures will.

But let´s talk about risk management!

For each investment you have to consider you take for each trade the risk to lose money, that´s why it is mandatory to handle each investment with a good risk/reward distribution.

You have to keep in mind, the determined risk/reward is only theoretically and can result complete different. But with knowledge you can dedicate a good entry for your trades to keep your risk as low as possible.

Determine important support and resistance levels and think about all situations what could happen and what will you do, if you are going into the red or into the green? Which levels are the best entries and exits?

This all will help you to determine your riks/reward ratio.

What is the Risk/Reward Ratio?

Successful day traders are generally aware of both, the potential risk and potential reward before entering a trade.

The goal of a day trader is to place trades where the potential reward outweighs the potential risk.

These trades would be considered to have a good risk/reward ratio.

A risk/reward ratio is simply the amount of money you plan to risk, compared to the amount of money you believe you can gain.

For example, if you think a potential trade may result in either a $400 profit or $100 loss, the trade would have a risk/reward ratio of 1:4, making it a favorable setup. Contrarily, if you risk $100 to make $100, the trade has a risk/reward ratio of 1:1, giving you the same type of unfavorable odds that you can find in a casino.

Which ratio should you desire?

Like described above, finding trades with high risk/reward ratios (1:2 or higher), will help you maintain higher average profits and lower average losses, making your trading strategy more sustainable.

The common suggestion between traders is a distribution of minimum 1:2 ratio. In reality there are often even better ratios available, if you do your technical chart analysis or financial stock analysis.

But what should you do if you have to cut losses?

We have to place our stop loss right below our support or other important levels we determined before.

The purpose is to cut losses before they grow too large. Stopping out of a losing trade can be one of the hardest things for traders to do consistently. However, failing to take stops can result in margin calls, unnecessarily large losses, and ultimately account blowouts.

How big should I enter a position?

To lower your risk I recommend to think about your size to enter a position.

Overall you shouldn´t risk money you need, only deposit money in your broker you can afford.

Entering small can be the smartest way to safe your account. I suggest that because of four reasons:

1. You don´t risk to much of your funds and your stop loss should be tight anyway.

2. You can average down if the price is going in the other direction, but consider this option only if you are sure what you are doing.

3. You can buy the dips/pullbacks if the trend is strong and still heading in your desired direction.

4. Your emotional control is stronger if the price movement is heading in the wrong direction.

This brings us to the next topic.

Should you use leverage?

Yes I know, big leverage will give you big gains...but as a beginner you will not have the experience to know which trade has a very big potential or not.

Even experienced traders use only a small amount to enter a position and not the whole fund.

If you use leverage the losses can be much higher and the problem with that is, if you lose money, your leverage will also decrease significantly and the losses are harder to recover after each loss.

So what is the answer of the question, should you use leverage?

For beginners we can easily answer: Take your hands of a big leverage!

You can so hardly blow up yourself with that tool, it is ridiculous. Your way back into the profit zone will probably take years.

But you have to save yourself and after a period of time, a period of taking profits and cutting losses you will gain knowledge until you feel much more comfortable on the market and you understand how trading really works, then you can consider to use leverage.

Conclusion:

As I said, I want to share only some big points about this topic, simple and understandable, because I think many new investors don´t understand how important that topic is!

Safe yourself and have fun in trading and learning!

Sincerely,

TradeandGrow

Trade safe!

Unveiling the Advantages of Trading a Single Currency Pair

Introduction:

In the world of foreign exchange (forex) trading, traders have an array of currency pairs to choose from. Among the various strategies employed by forex traders, a popular approach is to focus on trading a single currency pair. While some may argue that diversification across multiple currencies is more beneficial, trading one currency pair comes with its own set of advantages. In this article, we will explore these benefits and shed light on why concentrating on a single currency pair can maximize your trading potential.

1. Increased Specialization:

By focusing on a single currency pair, traders gain the boon of deep specialization. They can dedicate their time, energy, and resources to thoroughly studying and understanding the dynamics, trends, and drivers specific to that particular currency pair. In-depth knowledge allows traders to make more informed decisions, leading to higher chances of profitability.

2. Clarity in Market Analysis:

Trading a single currency pair enables traders to develop a comprehensive understanding of the factors driving that particular pair's movement. They can delve into technical analysis, monitor news releases, and study relevant economic indicators with greater precision and efficiency. This clarity in market analysis helps traders identify patterns and make accurate predictions, consequently enhancing their trading strategies.

3. Enhanced Risk Management:

Concentrating on one currency pair enables traders to manage risk more effectively. They can closely track and analyze historical data, volatility patterns, and overall market behavior.

4. Time Management Advantage:

Trading a single currency pair allows traders to manage their time more efficiently. Instead of spreading their attention across multiple pairs, which require continuous monitoring and analysis, traders can focus on one pair and streamline their research efforts. This time management advantage permits traders to conduct thorough analyses, develop effective trading strategies, and implement risk management techniques without being overwhelmed by the sheer volume of currency pairs.

5. Optimized Trade Execution:

Trading a single currency pair empowers traders to execute trades with greater precision and speed. Being highly specialized in a particular pair enables traders to spot opportunities promptly and take advantage of favorable trade setups.

Conclusion:

While diversification has its merits, trading a single currency pair offers unique advantages that can significantly impact a trader's success. Increased specialization, clarity in market analysis, enhanced risk management, time management advantage, optimized trade execution, and the potential for becoming an expert are some of the key benefits that traders can enjoy by focusing on one currency pair. As with any trading strategy, it is essential to conduct thorough research and practice disciplined risk management to realize the full potential of your trading endeavors

Please, like this post and subscribe to our tradingview page!👍

❌ The Significance of Stop Loss:Essential for Successful TradingThe Significance of Stop Loss: Essential for Successful Trading and Consistent Profits

The majority of seasoned forex traders unanimously emphasize the significance of implementing stop losses in all trading strategies. Unfortunately, beginners and newcomers tend to overlook this essential rule initially, but eventually, they either grasp its importance or cease trading due to consistent losses. Let's delve into the reasons why a stop loss is crucial for achieving successful trading and consistent profits.

Understanding Stop Loss In Trading

The Stop Loss is a specialized order that serves as a safeguard against trading losses by automatically closing positions when a specific price level is reached. Seasoned traders widely regard the Stop Loss as a pivotal element for successful and profitable trading. This viewpoint is difficult to dispute, especially considering the unfortunate outcomes that often befall beginners who underestimate its importance. Interestingly, even experienced traders, who have achieved remarkable heights in their trading careers, continue to utilize Stop Losses as a testament to their effectiveness.

From a technical perspective, a Stop Loss order can be likened to a typical pending order, triggered when the price reaches a predetermined value. However, the crucial distinction lies in the fact that a Stop Loss order closes an existing position rather than opening a new trade, as is the case with a pending order. Undoubtedly, the key advantage of this tool is its automated order closure, eliminating the need for constant monitoring of open positions. Stop orders frequently prove invaluable in mitigating substantial losses when the market behaves unexpectedly.

Why Use Stop Loss In Trading

A widely recognized trading advice emphasizes the importance of cutting losses in order to allow profits to grow. Many traders have personally experienced the significance of timely closing unprofitable positions. In today's trading landscape, the Stop Loss has become a standard approach for mitigating losses. It is actively incorporated into numerous trading strategies. However, there are some traders who completely dismiss the relevance of this tool and choose not to use it at all. They justify their stance by pointing out instances where prices initially triggered Stop Losses, closed a losing trade, and then abruptly reversed and moved in the desired direction.

While it's understandable to consider such viewpoints and frustrations, this argument revolves more around the skill of utilizing the tool, the proximity of Stop Loss levels to price or other critical boundaries, as well as random events that don't reflect systematic negative performance. Given the market's volatility, accurately predicting future outcomes and safeguarding one's position without incurring capital losses is exceedingly challenging. Therefore, it is prudent to err on the side of caution and employ Stop Losses as a form of insurance.

Benefits Of Using Stop Loss

Unfortunately, many novice traders tend to join the minority and avoid using Stop Losses. This hesitation often stems from the fear of experiencing premature losses. However, any doubts about the usefulness of Stop Losses can be dispelled by considering the following advantages:

1) Limiting losses per trade: The primary advantage lies in the ability to set a predetermined value for the potential loss, thus defining the risk for a specific position. This creates a foundation for effective money management strategies, adding flexibility to trading and safeguarding accounts against excessive drawdowns.

2) Protection against unforeseen events: Traders who actively employ Stop Losses can attest to how this tool has saved their accounts from catastrophic losses during sudden and significant market fluctuations. While opening a trade in the right direction is important, it is equally crucial to protect oneself from unforeseen market situations to prevent substantial losses. Instances where the market swiftly dropped by 50-100 points in a matter of seconds are not uncommon.

3) Stop Losses serve as profit protectors: By being able to limit losses, Stop Losses automatically become mechanisms for securing profits. It is crucial to differentiate this from another commonly used tool in forex and stock markets, known as Take Profit.

4) Psychological factor: The psychological aspect also plays a significant role. Many traders have experienced deep drawdowns where thoughts of financial doom dominate their minds. At such moments, there is often a willingness to spend countless hours in front of the monitor, hoping for the position to return to profitability, even if it's just a few dollars. However, self-confidence alone cannot solve the problem, and the situation continues to deteriorate.

As losses accumulate, regret sets in for not closing the order earlier when the losses were smaller. Profitability becomes secondary, and the focus shifts to minimizing losses as much as possible. Instead of closing the unsuccessful position, traders often find themselves waiting for a rebound, exacerbating their losses. To avoid such losses, nervous tension, and emotional exhaustion, all that was needed was the implementation of a Stop Loss.

This scenario perfectly illustrates the importance of always using a stop loss.

Consider the GBP/USD currency pair, where we plan to enter a trade based on a rebound from the support area marked by the blue rectangle. We decide to take a long position, with an expected profit of $100. However, to manage our risk effectively, we set a stop loss that allows for a maximum loss of $100.

Now, let's see what unfolded. The price unexpectedly dropped below our support area, surpassing our predetermined stop loss level. If we had not set the stop loss, the losses could have potentially escalated to a staggering minimum of $700.

Can You Trade Without Stop Loss ?

To fully grasp the importance of using stop orders and make an informed decision on whether to incorporate them into your trading strategy, it's crucial to understand how neglecting stops can lead to drawdowns:

1) Lost connection: Imagine a scenario where your internet connection suddenly drops, and at that very moment, the market experiences the activity you were anticipating. When the connection is restored, you might find your trade in a significant drawdown, potentially resulting in substantial losses.

2) Unfavorable market development: Sometimes, the market situation evolves in a way that works against the trader's position. In such cases, a properly placed stop loss would automatically close the trade, mitigating the risk of further losses.

3) Ignorance regarding stop loss closing: Some traders refrain from setting a stop loss due to a lack of understanding about when it should be triggered. Consequently, they end up closing the position out of desperation, often incurring losses of 20-40%. This approach leads to a focus on profit fixation, wherein the trader attempts to close other trades that have even minimal profits in order to compensate for losses on losing trades. Ultimately, this only adds more strain and results in new losses.

4) Constant monitoring requirement: Traders without a set stop loss are compelled to remain near their computers at all times to monitor market conditions. This not only leads to inefficient allocation of resources but also creates unnecessary stress and strain.

Why Are We Afraid To Accept Losses?

Many traders perceive losses as personal insults or signs of incompetence. This approach not only leads to significant stress but also impacts the maintenance of a trading journal. Subconsciously, we tend to equate a trader's journal with a school diary. Just like receiving a "D" grade at school made us hesitant to show the diary to the teacher, we adopt a similar mindset in trading. Conversely, we eagerly anticipate the teacher rewarding us with an "A" grade. However, in trading, there is no teacher to scold us for a "D" grade. Yet, the behavioral pattern remains ingrained, and our subconscious continues to deceive us. We convince ourselves that if there is no "F" grade in the journal, it's as if it doesn't exist, and there won't be any consequences for it.

The stop loss is a vital tool that gives traders an edge in the market by allowing them to manage risk effectively.

It is essential to approach a losing position with complete acceptance. Whatever has transpired is in the past and cannot be changed. Your focus should be on recording the trade in your trading diary, allowing for future analysis and drawing valuable insights. Remember, prioritizing capital preservation is far more crucial than denying the evident or attempting to prove oneself to the market.

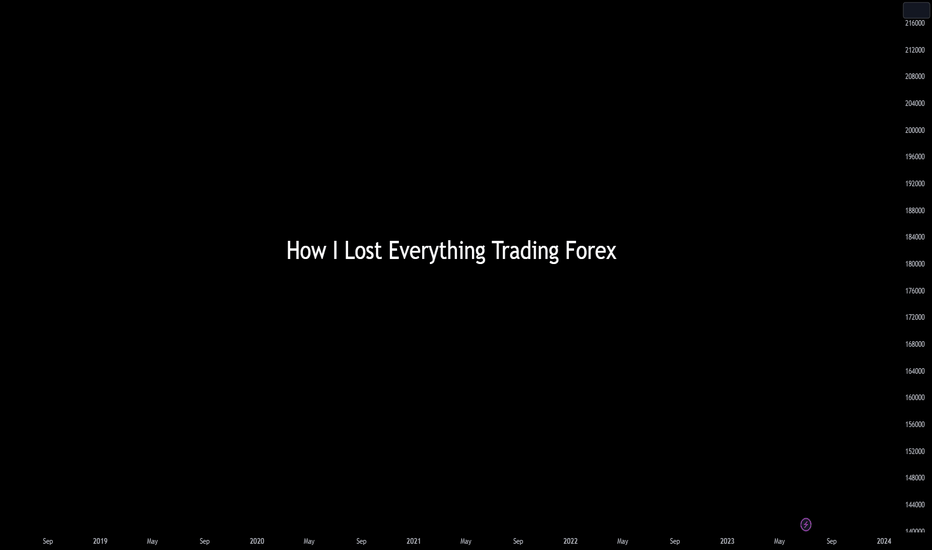

How I Lost Everything Trading ForexI wasn't always profitable. I lost a lot of money when I first started trading forex. I don't remember how I got started learning forex. But I know I started when I was serving in the army. I borrowed books from the library, watched many YouTube videos on trading. I was very knowledgeable on technical analysis. I know the concepts so well I could vomit them out to you. I didn't follow up on trading that much after my service ended.

I came back to trading when I was working as an auditor. The fact that I had to work long hours with little pay brings me to look for an alternative source of income. I found out that we can make money through percentage allocation money management (PAMM). You invest your money into a trader, and whatever profit they earn, you will give them a % cut, and you keep the rest.

I found this trader with a solid trade record. He has 3 years record with an average of 20% profit a month. He is trading with a $500,000 account. I thought that this trader was good. I calculated how fast my money will grow by putting money with him every month. I put in $1,000 for a start. A few months passed and it showed good results. I see the balance in my account increased too. That was when I decided to put all my savings in. I put $10,000 in, which was everything that I had.

I was working overseas that day. I checked my account after work. I saw that my account balance was $0.98. I thought it was some bug. I refreshed the page a few times. I saw that the account manager has risked everything in 1 trade. I was shocked. I felt numb. What was going on?

Red Flags

I did some research online, found out that the broker actually fakes the trades of “top trader” over a span of 2 years. When more suckers like me put my money in these PAMM, they will burst the account with 1 stupid trade. I believe this stupid trade was not even executed, but a front for them to scam all our money.

I realized that there were many red flags to begin with. None of the top traders offered any 3rd party verification through Myfxbook, MQL5, or even Fxblue. They don’t even give their investor passwords which are read-only to investors.

It was a painful lesson. But it led me to the journey of trading by myself. From then on, I put in a lot of hours studying and backtesting technical analysis.

Even right now, I’m not comfortable with putting my money with PAMM for diversification. I will need to know the trader, understand his trading style and the potential risk to reward of the trader.

The Problem Is You

Letting mathematics formulas do the compounding for your money is a bad expectation. You think trading is easy. You can trade from your room, or even overseas using your phone. Many people are posting screenshots of their profits consistently on the social media. You think that trading is the way to achieve financial freedom. This is a legit business and many people has done it. you can do it too. You start to play around with leverage, only to get your account wiped out after 4 trades.

You deposit $100 more. you are on a winning streak. You have 4 wins in a row. you look at your account balance increased from $100 to $1,000. You’re unstoppable. You continued overleveraging your account. I mean, what can stop you now right? You’re basically a god of trading with 4 win streak. next thing you know, you wiped out your $1,000 balance.

You repeat this cycle till you’re sick and tired. you proceed to find the next holy grail.

Breaking The Loop

Insanity Is Doing the Same Thing Over and Over Again and Expecting Different Results - Albert Einstein

You need to break this cycle. you are only repeating what you’re losing.

Relying on other sources for trading will not get you far. Yes, you might found a profitable signal provider. What if he don’t want to provide his service anymore? You will be back at where you begin, looking for another signal provider again. You will need a lot of time and waste money to make sure that the signal provider is legit. what if your profitable signal provider is experiencing a losing streak? will you continue to follow the signals? or will you start having doubt? will you take responsibility for all these losing trades? or will you blame your signal provider?

To be consistently profitable in the long run, you have to trade by yourself. Everyone’s view on the market is different. You can be looking at a long on EURUSD, but I could have a bearish bias.

Knowing how to trade by yourself is the key to success. You don’t need to rely on signal providers. You don't need to constantly monitoring your phone to check if there are any signals.

You know the risk and reward and your expected win rate by trading yourself. It is you who put in the hard work of backtesting. You will be putting your own trades. You determine the amount of risk you will take. You take trades based on your lifestyle and personality.

Do The Uncomfortable Stuff

Trading involves a lot of uncertainty. This is a hustle that you can earn money without knowing what can happen next. Even though I'm a profitable trader, I do not know what will happen next. I can only guarantee that either I will lose the next trade with -1%, or a profit. I focus on what I can control, not what I expect for things to happen.

When you trade according to your own plan, you understand the risk you are taking. It is scary to take your own trades at first. You don't know if your analysis is correct. You don't know if you will be successful. You don't know if you will be profitable. This is what every trader will experience. On my first trade, I was having adrenaline rush when price came back to tap my entry. I was looking at the chart for the whole day, even though I'm trading on the 15 minutes timeframe.

I know and understand that I cannot control the price. But psychologically, I'm not strong enough to let my trade play out. This trade ended up with a loss.

You have to start somewhere to learn how to trade by yourself. Without this, you will forever be trapped within the cycle of unprofitability.

If you keep telling yourself that trading alone is hard and you are unable to be profitable, you are right. You are constantly letting your subconscious mind get used to this message. Your subconscious never rests. Even when you’re asleep, your subconscious is still running in the background. It will keep telling your body what needs to be done to keep you functioning.

Being Trapped In The Loop

I was the same as you. I skipped from strategy to strategy, trying to find the holy grail. I tried many things. from EA to signals to mentorship.

I earned some, but I lost more. I lose before I even start. Buying EAs cost money. Subscribing to signals cost money. Signing up for mentorships cost money.

I tried EAs that uses grid and martingale. I bought indicators that repaint themselves after price actions have happened. I’ve tried EAs made by creators who adjust it to best fit past data, but are actually not profitable in the live market. I’ve tried signals that gives a 20 pips TP 1, but 100 pips stop loss. They make big celebrations with fire emojis when TP 1 hits. When TP 2 of 40 pips hits, they do the same thing. Weekly result summary are also posted which includes both TP 1 of 20 pips and TP 2 of 40 pips. They remove losing signals too. This looks like it’s a profitable signals, but the risk to reward ratio for their signals are shit with low win rate.

Some of the mentorships are cash grab. You pay them to give you video recordings and information. You can find them for free on Babypips.

It’s debatable that all mentorships are a scam. Some of the mentorships I joined actually provided great values. I’m able to look into how profitable traders are trading. I can get insights on their thought process behind their trades. There is a platform for me to do my analysis. Mentors will comment on my analysis, telling me what I could do to improve, or even add their insights. Some also provide 1-1 calls which is what all mentorships should offer. Sometimes, it’s faster and easier to explain through a call rather than on text. Furthermore, they record the 1-1 sessions and I can watch them in the future. These 1-1 sessions can be Q&As, or even backtesting session. This is where I will do the backtest and the mentor will comment on my thought processes.

I would consider myself to be lucky to have only lost $10,000. If I had more money, I’d lose way more for sure. After losing that $10,000, it led me on a journey to be a profitable trader now. I have no regrets on this journey.

Mentorship

Most people are unwilling to spend money for courses, knowing well that there are thousands of FREE online resources out there. But the problem lies in how do you sieve out all the unnecessary and useless information from such a huge amount of resources? Mentorships are made to solve these problems. They are built to solve and educate you on a specific skill and knowledge that you want to learn. They are built by people who have experienced the same problem as you did.

This is the same as spending money on university courses. Most of you are willing to pay thousands of dollars and 3 - 5 years of your lives to get a 4 - 5 figured day job, yet you don’t bear to spend that few hundred of dollars to get the specific skillset that you need as an investment.

My last mentorship costs me $2,000. I can tell you that it's the best investment I've ever made. Through the mentorship, it gives me different perspective from an active community. We look at the same chart every single day and anyone is free to critic our work. The 1-1 calls are also important to me. They gave me a good foundation, and I learnt a lot of advanced skills like psychology and risk management.

I got to a point where making $916.05 is as easy as placing 1 trade, and getting 2% return on a 0.5% risk. Yes this profit comes from only 1 trade on my $50,000 account.

I've covered the cost of mentorship through my funded account payouts. This return on investment will continue to accumulate. Sooner or later, I will be earning back whatever I've lost, and to quit my 9-5 job to trade full time.

Stay consistent. Stay safe. Success is just around the corner.

If you enjoy such content, feel free to click the like button and subscribe for more.

Let me know what are your thoughts and learning points in the comments below so others can learn from you too!

Please let me know what kind of topic you would like to read next :)

Happy weekend!

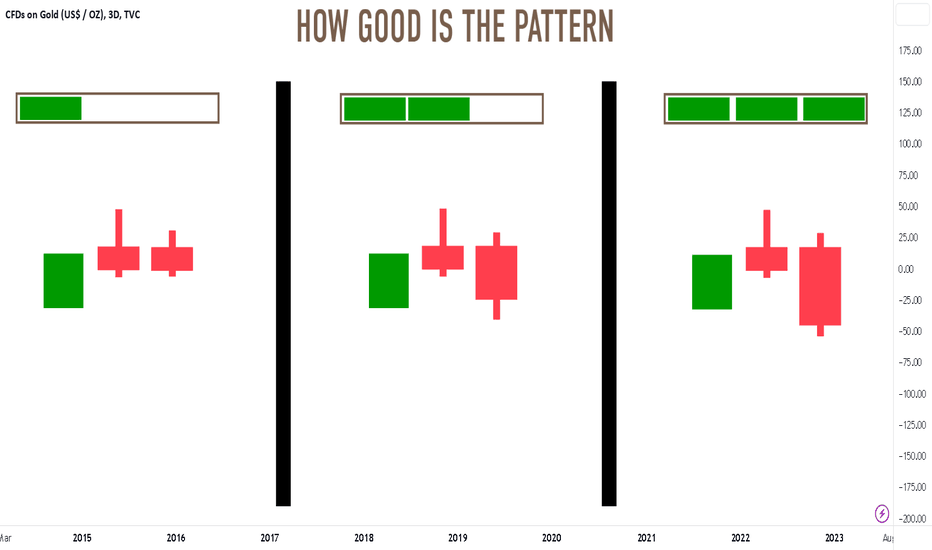

Mastering Engulfing Candle Trading

📚Engulfing candles are an essential feature of technical analysis in forex trading. An engulfing pattern happens when a larger candle engulfs the entire body of the previous candle, signaling a potential reversal of the current trend. Engulfing candles, which can be either bullish or bearish, are trusted by many traders for their reliability in predicting future price movements. However, to become an expert in engulfing candle trading, one needs to learn how to identify the best ones and leverage their body size effectively. In this article, we will look at the crucial steps to master this trading strategy.

🔎Identifying the Best Engulfing Candles

One of the key aspects of trading using engulfing candles is knowing how to spot the strongest signals. The best engulfing candles should be resistant to the noise and inconsistent movements that can often occur in the forex market. The first step towards identifying the best engulfing candles is to focus on the size of the preceding candles. Candles with small bodies and long wicks produce too much noise and can lead to false signals. Instead, seek engulfing candles that develop after a significant price move, ideally with a larger body and shorter wick. Higher timeframe charts - like the 4-hour and daily - offer better accuracy in identifying reliable engulfing patterns.

💪Leveraging Body Size for More Efficient Trading

The size of an engulfing candle’s body plays a crucial role in determining the strength of a trend. A larger body indicates more significant price movement and more active participation from traders. The size of the engulfing candle can also help ascertain the potential strength of the new trend. Bigger body sizes usually signal a stronger trend, whereas smaller bodies usually represent a more moderate price move. Traders can leverage body size to adjust their trading strategy – for instance, employing wider stop losses for more significant movements or using tighter take profit targets for moderate trends.

I have collected couple of good engulfing candles that we were trading with our team.

Take a closer look at their body sizes and the previous candles.

Such candles alone can provide fantastics trading opportunities.

🔔Conclusion

Engulfing candles are an essential tool in forex trading, and their size can significantly help traders identify the best entry signals. Traders who master engulfing candle trading can develop a more accurate technical analysis strategy that yields high returns. By continually analyzing candlestick patterns and using other technical analysis tools, traders can build robust investment strategies that enable them to become profitable forex traders.

What do you want to learn in the next post?

[Education] Falling In Love With The Wrong One Is CostlyTrade what you see, not what you feel.

Human are emotional creatures.

Believe it or not, I had attitude problems in the past. I get angry easily and this is a bad trait to be a trader.

In the beginning when I was still a noob, I would fund a live account without learning how to trade properly. I buy and sell base off moving average, RSI, MACD, and signals.

You guessed it, I burst plenty of accounts. Even if I win some trades, I would lose many more next. Whenever I lose a trade, I will feel angry. When I feel angry, can you guess what I do next? I revenge trade.

I don't believe that gold will not go higher. Let me take another long position.

Wait what the.. my trade got taken out again?

I think this is a stop hunt. Last try. This time the price will sure go higher.

"Opens another long position with larger lot size".

And you guessed it. I wiped out my account trying to catch a falling knife.

Ditch Your Emotions

Keep your feelings and emotions and aside when trading. The market doesn't care if you're happy or sad today. It will do what it wants to do. You can't control how the price move. Neither do I. Unless you have in control billions of dollars. If you do, why are you even reading this?

The problem is not with the market nor your trading strategy. The problem lies in YOU. You are the common factor here. All strategies can be profitable with the right execution, trade and risk management. But why can someone else be profitable but not you? It seems like everything is profitable until you put your own money in isn't it?

When you allow your emotions to take over, you won't be rationale. You will take actions based off your emotions.

If you feel doubt, you will look for confirmation not to take a trade.

If you feel angry, you will take revenge trades.

If you feel happy, you will feel like you won't lose your next trade and get complacent.

If you feel overconfident, you will risk more on your next trade.

If you feel fear, you will close your trade early for small profits.

If you feel tired, why the heck are you still on the chart?

Feelings are subjective and the market has no interest in it.

The Downward Spiral

Trading based off feeling is like gambling. Gambling belongs in a casino, not the financial market.

Let's say, you feel like the market is heading towards a recession. Would you blindly short the market if the price did not give you any confirmation?

This is the problem with you. You let emotions take over your decision making skills. This is why you cannot achieve profitability.

You might be in a trade, price goes against you and you’re in drawdown. You fear that the price will take you out. You cut your trade. Price reverse and hit your profit target.

You could have won the trade by following your plan, but you let your emotions take control of your decision.

When this happens too many times, your profitability decrease significantly. This makes a profitable strategy becomes unprofitable because your trade management sucks.

Not only will you lose money trading like this, but also precious time. How long did it take you to backtest that trading system? 1 day? 1 week?

How many times are you going to repeat this and waste even more time? Even if I give you the holy grail trading strategy, you will still not achieve profitability. It's not the system. It's you.

You will NOT achieve success in trading if you cannot master your emotions. Say goodbye to your financial freedom and a life of enjoyment. The only thing you can enjoy is the occasional small wins that you cut before the trade becomes a runner. You will still be unprofitable.

Follow Your Plan

If I have to summarize how I became profitable, it will be to follow your plan.

Trade what you see because only you know your own analysis. You've backtest enough to see how your edge will play out over a large number of trades. Do not let other people’s analysis interfere with your trades. They could be looking at the 1 minute timeframe, but you're trading on the 15 minute timeframe.

Price is fractal. If price is bullish on the 1 minute, it can be bearish on the 15 minute. Why do you want a second opinion on your trade?

When price shows you what it’s doing, react to it. Do not anticipate what the price will do and assume that price will do exactly that.

But Keeley, it’s so boring to wait for price to come back to my entry. I might miss the trade. I will take a short here because I’m expecting price to go lower and tap into my long order. People want to be in the action.

How many times do you expect price to make a bearish retracement and tap you into your long position? How many times did you actually open a short position and expect your long to get tapped in?

If price did not give you any confirmation, don't take the trade. The market will do what it wants to do. You can't expect the market to do exactly what you anticipate it to do.

Experience

When I was scalping on the seconds chart, I was loving every moment of it. I was constantly in a trade, catching all the movements. If I lose, it’s fine. I would always think that I have more opportunities coming soon. I would expect price to do what’s playing out in my mind.

This was not sustainable as I was taking too many trades within a short period of time. Even on a tight spread account, spread on lower timeframe accounts for a chunk of my risk management. Your trading psychology should be strong when scalping on the lower timeframe. Scalping a few pips per trade is doable but it's stressful.

I thought my trading psychology was good, until I experienced a losing streak. The more losses I experienced during the day, my psychology got affected more. This goes the same for losses in the same trading session. I’d do stupid things like risking more than normal, taking trades that I don’t usually take. I also take trades without confirmation. I used my feelings to trade as I expected price to play out what I wanted. Eventually, the win’s going to come right? This happened for a few weeks and I burst quite a few challenges. I lose quite a lot of motivation and called quits.

I’m quite a lazy person. I do not like to sit in front of my laptop stalking TSXV:SPDR S&P 500 ETF Trust(SPY)$ , $Tesla Motors(TSLA)$ or $Apple(AAPL)$ and trade for a few hours straight. I took a few weeks off from charts and reflected. I look deep into myself for answers.

I got the answers. I will try to be sufficient just by trading the higher timeframe. This way, I do not need to sit in front of my laptop for a few hours. I have the freedom to do what I like without sticking to my charts. This sits well with me too as this trading style fits my lifestyle. This way, I can avoid overtrading. I can easily see what I trade because each candle took 15 minutes to be completed. This kept my trading psychology at tip top condition.

Framework

PBJ Framework

No this is not peanut butter and jelly. Let's breakdown the following:

Plan: Know what to look out for. Know what to do before, during and after trading. Before entering a trade, know how much you’re risking. Know your entry signal, confirmation, and stop loss placement. Do you take partial profits? If yes, where will you take the profits? How much position will you take at each partial profit targets? If the price did not meet any of the condition, DO NOT take a trade.

Be in the moment: During the trade, know how you’re going to manage your trade. Do you shift your stop loss to breakeven? Do you take partial profits? Do you scale into your trade? Check your emotions. Are you feeling anxious? Angry? Confident? Tired? Excited? Your emotions have no say when you're trading.

Journal: After closing the trade, journal your trade. Write down how you feel before, during and after the trade. Write down how did you manage the trade. Give it a score from 1 - 5. This will help you in the future when you’re reviewing your trades.

When you have 100 trades recorded, you can finally do your analysis. Look at the times when you trade based on feeling. How do they play out? Are those trades profitable? Look for the common factor on all your winners and losers. The more information you record on your journal, the more analysis you can perform.

Achieving Profitability

Using the PBJ Framework, I see great improvement in my trading skills. I started to be more present and conscious of what I'm feeling.

I recorded almost everything. From my pre-trading ritual to post-trading ritual, I have all the data I need. I know how my emotions change throughout the trading session.

I know how often my edge will play out.

I know which days are profitable.

I know which trading sessions are profitable.

I know which months are profitable.

I know which are my most profitable pairs.

I find peace with losing. Why? I have all the data. I have evidence that my edge will be profitable if I take all the trades that appears in front of me.

I avoided trading on days and session where I have the least profitability. Not only did this increased my win ratio, but profitability too.

I was once unprofitable. Since then, I found consistency and manage to get funded with FTMO and The Funded Trader.

My first payout was small. It's only USD$200 on a $10,000 account. Even so, this is one big step ahead in my milestone. I was targeting one payout for 2023 and I've achieved this target in May. I got my second payout in June. My goal was to get $50,000 funding by end of this year, but I've already achieved it in May. I've now stretched my goal to $200,000 funded by end of this year.

The Ordinary Life

Life always begins with one step outside of your comfort zone. - Shannon L. Alder

To create an extraordinary life, take full responsibility for your actions and decisions. Stop blaming external factors, and focus on the things you can control. Take full responsibility of your trades, your mindset, and your emotions. If you can’t control what others think about you, then don’t. What are the things that you can control? How you treat yourself, your body and your mind. How you react to people and situations. How you think. What you do with your time. The people you choose to surround yourself with. How you treat others. Where you give your time, energy and attention. The contents that you consume.

When you’re trying to do the extraordinary, the ordinary will try to stop you from doing. People don’t like to see you succeed. They heard that entrepreneurship is hard and risky. You could lose a lot of money. They think that they have the best interest in you. They like to stay in the comfort zone and you should stay there with them. They tell you to be realistic. You are not someone incredible of great success.

Anything can happen, especially in the market. You can win with a wrong setup, and lose with the right setup. It’s up to you to take the first step. There will be a lot of what-ifs and negative scenarios in your head when you’re venturing into the unknown. The unknown is scary. But what if it turns out better than expected? What if everything should go well, actually went well? That’s something you can only find out if you take the first step.

Guidance

Trading is the easy part for many people. All trading strategies are profitable if you backtest them enough.

The hard part of trading is actually coming up with an exact trading plan and risk management system. Many of you drown when it comes to a trading plan. Not know where to start when creating one is also a very big issue.

You need to train and strengthen your psychology and discipline yourself. But you need a coach to guide you to the correct path.

This is why even world class athletes like Usain Bolt has a coach. A coach gives guidance and a holistic review on your

You can choose to grow alone. But having a coach an an accountability partner will help you achieve your goals faster. Imagine spending a year learning psychology and risk management, only to find out you were on the wrong track. If you had a coach and mentor, you would have saved yourself one year of trial and error. You could be profiting from the market so much earlier.

Remember, trading is not an easy hustle. It take years of hard work, losses and, breakeven before you can achieve consistent profitability.

Stay consistent. Stay safe. Success is just around the corner.

If you enjoy such content, feel free to click the like button and subscribe for more.