HOW-TO: Integrate Probabilities into Mechanical Trading StrategyIf you want to skip all the explanations and start working with the OptiRange indicator right away , skip to the last paragraph.

What are the two main approaches in manual trading?

In the world of manual trading, there are two main approaches: mechanical and discretionary trading.

Mechanical or systematic trading is about sticking to a set of predefined rules, almost like following a recipe. Even though you're still executing the trades manually, the decisions are made based on a systematic approach that doesn’t waver. This method is designed to leverage a specific edge in the market, reducing emotional involvement and decision-making stress.

Discretionary trading is a trading approach that relies heavily on the trader's judgment and intuition. Unlike mechanical trading, which follows strict, predefined rules, discretionary trading involves making decisions based on a subjective evaluation of market conditions , price patterns, news events, and other factors. Traders using this method often seek to add confluence—multiple signals or pieces of evidence—to support their trade decisions.

However, this approach can sometimes mislead traders into believing they are identifying high-probability opportunities .

This can create a false sense of confidence , forcing you more likely to take trades that don't actually align with any proven edge. The result is often poor trading decisions, driven by overconfidence rather than objective analysis.

Why isn't mechanical trading talked about more often?

Many people aren't aware of mechanical trading because most trading mentors and courses focus on discretionary trading. This method is more intuitive and accessible, especially for beginners who are interested in learning how to read charts.

Discretionary trading is often seen as more engaging and gives traders a sense of control, which can be appealing.

If mechanical trading is so effective, why do most mentors teach discretionary trading?

Discretionary trading is easier to understand and start with It also appears to offer more flexibility and engagement. As a result, it's more commonly taught and discussed, which means many traders don't get exposed to the benefits of a systematic, rules-based approach like mechanical trading. This leads to a lack of awareness and understanding about the potential advantages of mechanical trading strategies.

Why aren't more mentors switching from discretionary trading to mechanical trading?

Many mentors stick with teaching discretionary trading because it allows them to cover up losses and highlight their winning trades more easily. They can always justify their trading decisions with various explanations, keeping their clients entertained and engaged. This approach creates a dependency, as clients often feel they need ongoing guidance to navigate the complexities of the market.

In contrast, if a mentor were to teach mechanical trading, students would learn a clear set of rules and strategies. Once these rules are understood, traders can become independent, reducing their reliance on the mentor . This independence can be less appealing to mentors who want to maintain a steady stream of clients. Thus, the lack of transparency and the ability to mystify trading strategies keep the focus on discretionary trading methods.

Why consistency is key in trading?

Consistency is essential in trading because it directly affects your results. When your approach varies, such as with discretionary analysis that changes with each setup, your outcomes become unpredictable. Sticking to a set of rules, however, gives you predictable and reliable results.

When you adhere to a fixed set of rules, your actions remain consistent. This consistency leads to results that are also reliable and predictable.

With mechanical trading rules, you're not relying on guesswork or intuition. You have a clear, predefined set of actions, knowing exactly what to do and when to do it.

What are the first steps I should be taking to become a systematic trader?

The first step towards becoming an independent systematic trader is accepting that consistently beating the market with discretionary trading is highly challenging. Despite what you might see on social media—traders getting funded and posting their success—these stories are often disconnected from the reality of intuition-based trading. Many traders spend thousands on challenges, and while some might get lucky and achieve initial funding, they often end up blowing their accounts after a few emotional sessions.

Instead, I want you to shift your focus to developing your own understanding of systematic trading. Know the fact that sticking to pre-defined rules and executing a mechanical trading strategy is key to long-term success. This approach requires you to take it seriously and act responsibly, adhering to a structured, rules-based system that removes emotion and improves your consistency.

The second step is to study the market on your own and identify setups that occur repeatedly across multiple timeframes. Develop clear, step-by-step rules for your strategy and understand the logic behind each rule. Once your rules are written out, create a flowchart to visualize and follow them daily, ensuring you stick to the strategy without introducing flexibility.

Afterward, spend several months backtesting your strategy to verify that the edge you plan to execute is genuinely profitable. This thorough testing will help confirm that your approach works under different market conditions and provides the consistency needed for systematic trading.

Luckily for you, I have done it all. it took me one year to test and validate the strategy by manually going through data collection and backtesting and one year to fully code the strategy into an indicator so I can trade it as systematic as possible.

I'm more than happy to share this with rule-driven individuals who are serious about excelling their trading business.

-----

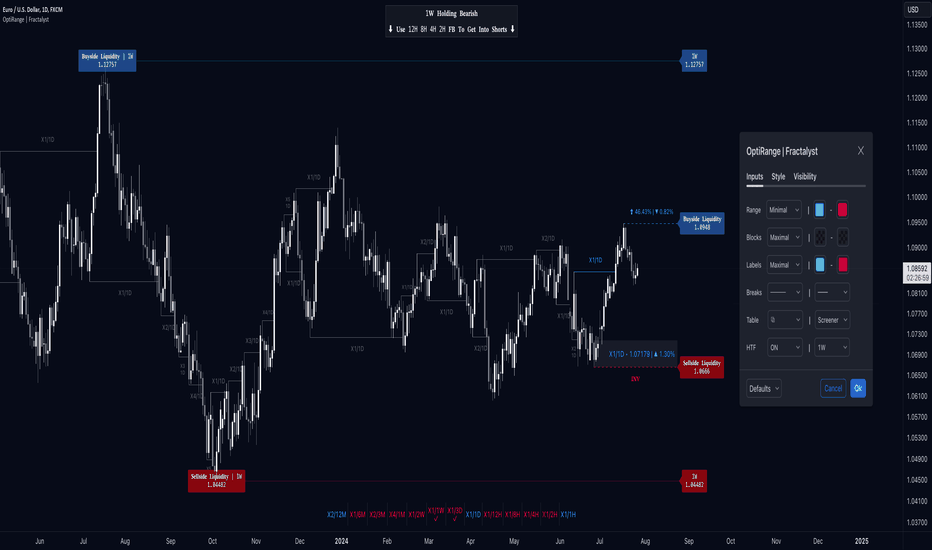

How does the OptiRange indicator work?

Market Structure: The Optirange indicator analyzes market structure across multiple timeframes, from a top-down perspective, including 12M, 6M, 3M, 1M, 2W, 1W, 3D, and 1D all the way down to hourly timeframes including 12H 8H 6H 4H 2H 1H.

Fractal Blocks: Once the market structure or current range is identified, the indicator automatically identifies the last push before the break and draws it as a box. These zones acts as a key area where the price often rejects from.

Mitigations: After identifying the Fractal Block, the indicator checks for price mitigation or rejection within this zone. If mitigation occurs, meaning the price has reacted or rejected from the Fractal Block, the indicator draws a checkmark from the deepest candle within the Fractal Block to the initial candle that has created the zone.

Bias Table: After identifying the three key elements—market structure, Fractal Blocks, and price mitigations—the indicator compiles this information into a multi-timeframe table. This table provides a comprehensive top-down perspective, showing what is happening from a structural standpoint across all timeframes. The Bias Table presents raw data, including identified Fractal Blocks and mitigations, to help traders understand the overall market trend. This data is crucial for the screener, which uses it to determine the current market bias based on a top-down analysis.

Screener: Once all higher timeframes (HTF) and lower timeframes (LTF) are calculated using the indicator, it follows the exact rules outlined in the flowchart to determine the market bias. This systematic approach not only helps identify the current market trend but also suggests the exact timeframes to use for finding entry, particularly on hourly timeframes.

According to the above trade plan, why do we only look for mitigations within Fractal Blocks of X1/X2?

In this context, "X" stands for a break in the market's structure, and the numbers (1 and 2) indicate the sequence of these breaks within the same trend direction, either up or down.

We focus on mitigations within Fractal Blocks during the X1/X2 stages because these points mark the early phase (X1) and the continuation (X2) of a trend. By doing so, we align our trades with the market's main direction and avoid getting stopped out in the middle of trends.

-----

To illustrate how the script analyzes market data and the thought process behind it, let's go through an example.

Example:

12M Timeframe: FX:EURUSD

6M Timeframe : FX:EURUSD

3M Timeframe : FX:EURUSD

1M Timeframe : FX:EURUSD

2W Timeframe : FX:EURUSD

1W Timeframe : FX:EURUSD

Hourly Entry: FX:EURUSD

Final HTF TP: FX:EURUSD

-----

Don’t worry about understanding every detail of how the script works.

It's only to show you how the indicator calculates multiple timeframe and how it guides you on when to sell/buy or stay away.

Last paragraph:

You can simply turn on the Screener in user-input so that the indicator instantly does a top-down analysis for you using the strategy flowchart and decides for you what hourly timeframes you should be using to get your entries.

-----

Now that you understand how the OptiRange indicator works, you can start using it to execute a mechanical edge from today.

If you have any questions or need further assistance, feel free to leave a comment!

Risk Management

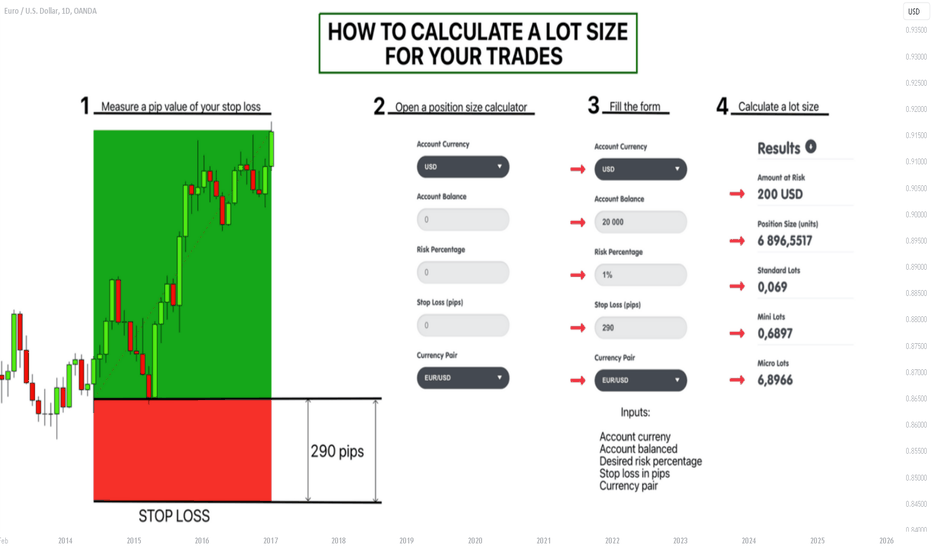

How to Apply a Position Size Calculator in Forex Trading

In this educational article, I will teach you how to apply a position size calculator in Forex and calculate a lot size for your trades depending on a desired risk .

Why do you need a position size calculator?

Even though, most of the newbie traders trade with the fixed lot , the truth is that fixed lot trading is considered to be very risky .

Depending on the trading instrument, time frame and a desired stop loss, the risks from one trade to another are constantly floating .

With the constant fluctuations of losses per trade, it is very complicated to control your risks and drawdowns.

A lot size calculation , however, allows you to risk the desired percentage of your capital per trade , limiting the maximum you can potentially lose.

A lot size is calculated with a position size calculator .

How to Measure Lot Size for Trades?

Let's measure a lot size for the following trade on EURUSD.

Step 1:

Measure a pip value of your stop loss.

It is the distance from your entry level to your stop loss level.

In the example on the picture, the stop loss is 35 pips.

Step 2:

Open a position size calculator

Step 3:

Fill the form.

Inputs: Account currency, account balance, desired risk %, stop loss in pips, currency pair.

Let's say that we are trading with USD account.

Its balance is $10000.

The risk for this trade is 1%.

Step 4:

Calculate a lot size.

The system will calculate a lot size for your trade.

0.28 standard lot in our example.

Taking a trade on EURUSD with $10000 deposit and 35 pips stop loss , you will need 0.28 lot size to risk 1% of your trading account.

Learn to apply a position size calculator. That is the must-use tool for a proper risk management.

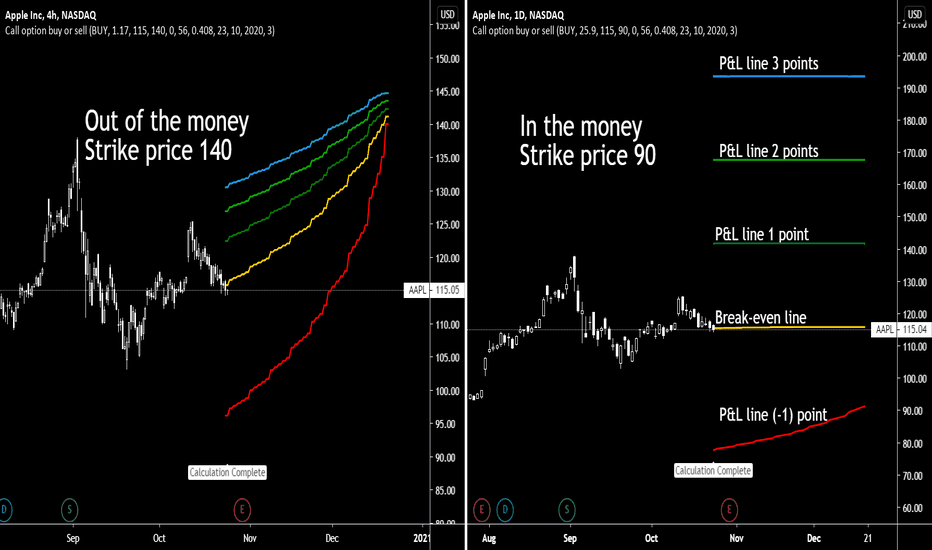

Buy call option – at the money / in the money / out of the moneyDefinitions

Buy call option – a stock option is the right to buy a stock (but not the obligation) at a certain price for a limited period of time. The price at which the stock may be bought is called the striking price.

Three terms describe the relationship between the stock price and the options striking price: At the money / In the money / Out of the money

For example; stock XYZ trade at $100

At the money – the strike price of the option is $100

In the money - the strike price of the option is $90

Out of the money – the strike price of the option is $110

The strike price is one of the 6 factors that determine the price of the option.

Those factors are:

1. The price of the stock

2. The strike price of the option

3. The time until the option expires

4. The volatility of the stock also called “implied volatility”

5. The risk-free interest rate (usually the 90-day treasury bills)

6. The dividend rate of the stock.

The last two have less influence on the option price.

The option pricing has two elements, “time premium” and “intrinsic value”.

In this post, I’m not going to elaborate on those two. (But they are important to understand).

The Delta

The delta of an option is the amount by which the call option will increase or decrease in price if the stock moves by 1 point. The values of the delta are between zero to one, if the call option is in the money the delta is closer to 1 if the call option is out of the money the delta is closer to 0.

For example; if the stock option has a delta value of 0.8, this means that if the stock increases or decreases in price by $1 per share, the option price will rise or fall by $0.8.

The option pricing is based on a partial differential equation because of that the behaver of the option pricing is not linear, as we can see from the charts.

In the right chart, we see In the money option with a delta of 0.92, meaning the option price is behaving very similar to the stock price, we see that the lines are nearly flat.

In the left chart, we see Out of the money option with a delta of 0.12, meaning the option price does not move like the stock price, for every $1 the stock will move the option price will move $0.12.

Also, note the difference between the profit lines, to make 3 points with In the money option the stock needs to move to above $190, but the Out of the money option needs only to move above $145.

This was the profit side, the losing side as you can see if the stock will remain at the same place the In the money options will break-even while the Out of the money options will expire worthless and will lose 1 point.

The options that were used (input):

Right chart: Option price -> $25.9, Stock price -> $115 , Strike price -> 90$ , Interest rate -> 0 , Days to expire -> 56 , Implied volatility -> 40.8%

Left chart: Option price -> $1.17, Stock price -> $115 , Strike price -> $140 , Interest rate -> 0 , Days to expire -> 56 , Implied volatility -> 40.8%

One option contract is the right to buy 100 shares so the cost for the options would be: $2590 and $117 respectively, not include commissions.

For clarification: If you hold it to expiration and it is not worthless, that means you need to buy 100 shares at the strike price, $9000 in the right chart, $14,000 in the left chart. (not include what you already paid)

Ultimate Trading Strategy: Reaction to Supply and Demand Levels!🔍 Identifying Potential Buy or Sell Zones: In this step, you need to identify the zones that are likely to react and wait for the price to potentially reach them. ⏳📊

🌟 With the reaction to the first area, a buy trade is activated. 🌟

📝 Confirmations:

📉 Reaction to the expected area – Watch for a price movement hitting our anticipated zone!

🛠️ Formation of a combined hammer pattern – Look out for this powerful reversal signal!

📈 Formation of a bullish engulfing pattern – A strong indicator of upward momentum!

🔍 Trading Tips:

💡 High-risk stop-loss location:

👉 Place it below the candlestick pattern. At least twice the spread to ensure you're covered! 📏🔒

💡 Lower-risk stop-loss location:

👉 Place it below the expected area. Again, at least twice the spread for extra safety! 📏🔒

💰 Take-profit strategy:

👉 Base it on risk management mathematics, such as risk-reward ratios of 2, 4, and 6.

👉 Alternatively, observe reactions to past market areas, especially near important market highs and lows. 📊📈

🎯 Entry point strategies:

👉 Enter at the close of the confirmation candle.

👉 Or, set a limit order around 50% of the confirmation candle for a bigger volume opportunity! 📉📈

🌟 Buying in Two Phases: A Smart and Exciting Strategy! 🌟

🔹 Phase One:

When you reach a profit of twice the risk, exit the trade. Why? Because the Asian high has been hunted and the candlestick formed has a long upper shadow. 🌄💹

💡 Analysis:

The price hasn’t reached other zones yet and has risen in reaction to the first expected zone. Therefore, we expect a pullback and continued upward movement. 💪📈 So, I’ll place a second buy trade. 🚀💵

🔍 Confirmations for the Second Buy Trade:

A double bottom has formed, marked with an X. ❌❌

A small hammer candlestick has swept the double bottom. 🔨

A long positive shadow candlestick has swept the bottom and reacted to a small order block on the left. 🌟

💡 Tips for the Second Buy Trade:

Enter at the close of the long-shadowed doji candlestick or place a stop limit order above the long-shadowed doji candlestick. 📉📈

The stop loss should be below this candlestick. 📏🔒

🔹 Phase Two:

Next, the price has reached an expected reaction zone from where we expected a price drop. 🌐💡

🔍 Confirmations for the Sell Trade:

Reaction to the expected zone. 🔍

An inverse hammer candlestick reacting to the zone. 🔨

💡 Tips for the Sell Trade:

The entry point should be in a candlestick with a negative signal indicating a price drop. This hammer candlestick can indicate a decline. 📉🔻

The target can be a reward of 2 or the last price bottom. 🎯💰

The stop loss should preferably be behind the expected zone. 📏🔒

🔥 Important Points!!:

Since the price hasn’t deeply penetrated the zones, there’s a chance it might go higher or even mitigate this zone twice, ultimately turning it into a pullback for a further price rise. 🚀📈

Continuing on, the price reached the upper zone area.

We expected a price drop from this zone, but it reached at 03:15,

which is outside our trading session. However, we could have traded on it.

🔍 Sell Confirmations:

The price has reached the expected zone.

An inverse hammer candlestick pattern.

💡 Interesting Fact:

If you had placed a limit order around the midpoint of the previous two zones,

you would have profited by now. So, for this zone, you can also place

a limit order around 50% of it.

Continuing further, other zones have formed below that could be useful

for new trades.

✨ Successful Sell Trade Achieved, Reaching a Reward of 4 Times the Risk.

📉 During the session continuation, the trend line was broken, triggering an upward price pullback.

🔹 Now, at the beginning of the session, we have a new zone, likely a selling order placement area. We're taking the risk on this zone. This time, we can place the trade around 50% of it. 🚀💼

🔥 Alright, what's your take now? 🔥

🌟 Is the price reacting to this level or not? 🌟

🚀📈 or 📉💥

Where are the upper zones located?

What do you think? 🤔💬

How to Use Stop Loss Orders in Trading?Stop loss order is the order that automatically closes your trade once it reaches a specified price target. Learn all about it here.

Table of Contents:

🔹What Is a Stop Loss Order?

🔹Why Stop Loss Orders Matter?

🔹Setting Stop Loss Levels

🔹Types of Stop Loss Orders

🔹Adjusting Your Stop Loss Orders

🔹Summary

In trading, reducing risks is oftentimes all that matters to achieving success. One of the essential tools to protect your investments from steep or unexpected losses is the stop loss order. Understanding how to use stop loss orders can unlock your path to profitability by allowing you to balance your risk and reward ratio. In other words, with the right stop loss setup, you can shoot for asymmetrical risk returns by keeping your drawdown small and letting your profits run.

Let’s dive into the exciting world of trading and see how stop loss orders can be your greatest ally in trading.

📍 What Is a Stop Loss Order?

A stop loss order is an essential risk management tool used by traders to limit potential losses on a trade. By using a stop loss order, you instruct your broker to automatically sell the asset you’re holding when it reaches a predetermined price level that is below your purchase price, or entry.

A stop loss order allows you to control your losses and protect your investments so you don’t have to sit glued to the screen all the time.

📍 Why Stop Loss Orders Matter

Stop loss orders play a big role in risk management. These easy-to-set trading tools help traders stick to predefined risk tolerance levels by limiting the amount of money they are willing to lose on any given trade.

Without a stop loss order in place, traders may give in to emotional decision-making during periods of market volatility, leading to potential losses. If you have a hard time cutting your losses If you have a hard time cutting your losses when —ok, we get it, you're a bigshot— IF positions go against you, setting a stop loss when you enter the market will do the hard work for you.

➡️ Risk Management: One of the primary reasons stop loss orders are essential is because they help traders manage risk effectively. This is crucial in volatile markets where prices can fluctuate rapidly, as it prevents significant losses that could otherwise occur if trades were left unattended.

➡️ Emotional Control: Trading can evoke strong emotions such as fear and greed, which can lead to irrational decision-making. Without a stop loss order in place, traders may be tempted to hold onto losing positions in the hope that the market will reverse in their favor.

➡️ Peace of Mind: Knowing that there is a safety net in place can provide traders with peace of mind. Stop loss orders allow you to do your thing in the market without obsessively watching charts and tickers. Set your stop loss orders and focus on other aspects of your market study like catching up on the latest market-moving news and analysis .

➡️ Preventing Catastrophic Losses: In extreme market conditions, prices can experience sudden and significant declines. Without stop loss orders, traders risk experiencing catastrophic losses that could wipe out a significant portion of their capital.

➡️ Enforcing Discipline: Successful trading requires discipline and adherence to a well-defined trading plan. Stop loss orders help enforce discipline by striving to ensure that traders stick to their predetermined risk management rules. If trading is about discipline and consistency, then stop loss orders are the stepping stone to success.

📍 Setting Stop Loss Levels

Choosing the appropriate stop loss level is a critical aspect of using stop loss orders effectively. Traders should consider various factors, including their risk tolerance, investment objectives, market conditions, and the volatility of the asset being traded.

A common approach is to set the stop loss below a significant support level or a recent low in an uptrend (if you have a long position) and above a significant resistance level or a recent high in a downtrend (if you have a short position).

Example: Suppose you purchase shares of a company called X (not Elon Musk’s privately held X Corp., which he created by rebranding Twitter) at $50 per share. You estimate that a 5% decline in the stock price would indicate a potential trend reversal. Therefore, you set your stop loss order at $47.50 per share to limit your potential loss to 5% of your investment.

📍 Types of Stop Loss Orders

There are several types of stop loss orders that traders can utilize, each with its own special characteristics. The most common types include:

➡️ Market Stop Loss: a type of stop loss order that triggers a market order to sell the instrument at the prevailing market price once the stop loss level is reached.

➡️ Stop Limit: with a stop limit order, you have to deal with two types of prices. The first one is the price that will trigger a sell and the limit price. But instead of converting your order into a sell based on current market prices, you set a limit price.

➡️ Trailing Stop Loss: A trailing stop loss order is dynamically adjusted based on the movement of the instrument’s price. It allows traders to lock in profits while giving the trade room to move in their favor.

Example: You purchase shares of a big tech company at $100 per share, and the stock price then rises to $120 per share. You set a trailing stop loss order with a 10% trail. If the stock price declines by 10% from its peak, the trailing stop loss order will trigger, selling the shares at prevailing market prices.

📍 Adjusting Stop Loss Orders

While setting stop loss orders is essential, monitoring and adjusting them as market conditions evolve is equally important. Traders should regularly reassess their stop loss levels to account for changes in volatility, price action, and overall market sentiment. Additionally, as profits accumulate, trailing stop loss orders should be adjusted to protect gains and minimize potential losses.

📍 Summary

In conclusion, stop loss orders are one of the most essential and effective tools for traders seeking to manage risk and preserve and grow capital in the challenging world of trading. By understanding how to use stop loss orders effectively, you can rein in emotional decision-making, protect your investments, and increase your chances of long-term success.

Whether you're a novice or an experienced trader, integrating stop loss orders into your trading strategy is a smart approach to navigate the twists and turns of the financial markets. Remember, trading involves inherent risks, but with proper risk management techniques like stop loss orders, you can tilt the odds of success in your favor.

❓Do you use stop loss orders when trading? Which type ? Let us know in the comments ⬇️

Diversification: What It Is, Why It Matters & How to Do ItDiversification is a market strategy that enables you to spread your money across a variety of assets and investments in pursuit of uncorrelated returns, hedging, and risk control.

Table of Contents

What is portfolio diversification?

Brief history of the modern portfolio theory

Why is diversification important?

An example of diversification at work

How to diversify your portfolio

Components of a diversified portfolio

Build wealth through diversification

Diversification vs concentration

Summary

📍 What is portfolio diversification?

Portfolio diversification is the strategy of spreading your money across diverse investments in order to mitigate risk, hedge and balance your exposure in pursuit of uncorrelated returns. While it may sound complex at first, portfolio diversification could be your greatest strength when you set out to trade and invest in the financial markets.

As a matter of fact, once you immerse yourself into the markets, you will be overwhelmed by the wide horizons waiting for you. That’s when you’ll need to know about diversification.

There are thousands of stocks available for trading, dozens of indices, and a sea of cryptocurrencies. Choosing your investments will invariably lead to relying on diversification in order to protect and grow your money.

Diversifying well will enable you to go into different sectors, markets and asset classes. Together, all of these will build up your diversified portfolio.

📍 Brief history of the modern portfolio theory

“ Diversification is both observed and sensible; a rule of behavior which does not imply the superiority of diversification must be rejected both as a hypothesis and as a maxim. ” These are the words of the father of the modern portfolio theory, Harry Markowitz.

His paper on diversification called “Portfolio Selection” was published in The Journal of Finance in 1952. The theory, which helped Mr. Markowitz win a Nobel prize in 1990, posits that a rational investor should aim to maximize their returns relative to risk.

The most significant feature from the modern portfolio theory was the discovery that you can reduce volatility without sacrificing returns. In other words, Mr. Markowitz argued that a well-diverse portfolio would still hold volatile assets. But relative to each other, their volatility would balance out because they all comprise one portfolio.

Therefore, the volatility of a single asset, Mr. Markowitz discovered, is not as significant as the contribution it makes to the volatility of the entire portfolio.

Let’s dive in and see how this works.

📍 Why is diversification important?

Diversification is important for any trader and investor because it builds out a mix of assets working together to yield returns. In practice, all assets contained in your portfolio will play a role in shaping the total performance of your portfolio.

However, these same assets out there in the market may or may not be correlated. The interrelationship of those assets within your portfolio is what will allow you to reduce your overall risk profile.

With this in mind, the total return of your investments will depend on the performance of all assets in your portfolio. Let’s give an example.

📍 An example of diversification at work

Say you want to own two different stocks, Apple (ticker: AAPL ) and Coca-Cola (ticker: KO ). In order to easily track your performance, you invest an equal amount of funds into each one—$500.

While you expect to reap handsome profits from both investments, Coca-Cola happens to deliver a disappointing earnings report and shares go down 5%. Your investment is now worth $475, provided no leverage is used.

Apple, on the other hand, posts a blowout report for the last quarter and its stock soars 10%. This move would propel your investment to a valuation of $550 thanks to $50 added as profits.

So, how does your portfolio look now? In total, your investment of $1000 is now $1,025, or a gain of 2.5% to your capital. You have taken a loss in Coca-Cola but your profit in Apple has compensated for it.

The more assets you add to your portfolio, the more complex the correlation would be between them. In practice, you could be diversifying to infinity. But beyond a certain point, diversification would be more likely to water down your portfolio instead of helping you get more returns.

📍 How to diversify your portfolio

The way to diversify your portfolio is to add a variety of different assets from different markets and see how they perform relative to one another. A single asset in your portfolio would mean that you rely on it entirely and how it performs will define your total investment result.

If you diversify, however, you will have a broader exposure to financial markets and ultimately enjoy more probabilities for winning trades, increased returns and decreased overall risks.

You can optimize your asset choices by going into different asset classes. Let’s check some of the most popular ones.

📍 Components of a diversified portfolio

Stocks

A great way to add diversification to your portfolio is to include world stocks , also called equities. You can look virtually anywhere—US stocks such as technology giants , the world’s biggest car manufacturers , and even Reddit’s favorite meme darlings .

Stock selection is among the most difficult and demanding tasks in trading and investing. But if you do it well, you will reap hefty profits.

Every stock sector is fashionable in different times. Your job as an investor (or day trader) is to analyze market sentiment and increase your probabilities of being in the right stock at the right time.

Currencies

The forex market , short for foreign exchange, is the market for currency pairs floating against each other. Trading currencies and having them sit in your portfolio is another way to add diversification to your market exposure.

Forex is the world’s biggest marketplace with more than $7.5 trillion in daily volume traded between participants.

Unlike stock markets that have specific trading hours, the forex market operates 24 hours a day, five days a week. Continuous trading allows for more opportunities for price fluctuations as events occurring in different time zones can impact currency values at any given moment.

Cryptocurrencies

A relatively new (but booming) market, the cryptocurrency space is quickly gaining traction. As digital assets become increasingly more mainstream, newcomers enter the space and the Big Dogs on Wall Street join too , improving the odds of growth and adoption.

Adding crypto assets to your portfolio is a great way to diversify and shoot for long-term returns. There’s incentive in there for day traders as well. Crypto coins are notorious for their aggressive swings even on a daily basis. It’s not unusual for a crypto asset to skyrocket 20% or even double in size in a matter of hours.

But that inherent volatility holds sharpened risks, so make sure to always do your research before you decide to YOLO in any particular token.

Commodities

Commodities, the likes of gold ( XAU/USD ) and silver ( XAG/USD ) bring technicolor to any portfolio in need of diversification. Unlike traditional stocks, commodities provide a hedge against inflation as their values tend to rise with increasing prices.

Commodities exhibit low correlation with other asset classes, too, thereby enhancing portfolio diversification and reducing overall risk.

Incorporating commodities into a diversified portfolio can help mitigate risk, enhance returns, and preserve purchasing power in the face of inflationary pressures, geopolitical uncertainty and other macroeconomic risks.

ETFs

ETFs , short for exchange-traded funds, are investment vehicles which offer a convenient and cost-effective way to gain exposure to a number of assets all packaged in the same instrument. These funds pull a bunch of similar stocks, commodities and—more recently— crypto assets , into the same bundle and launch it out there in the public markets. Owning an ETF means owning everything inside it, or whatever it’s made of.

ETFs typically have lower expense ratios compared to mutual funds, making them affordable investment options.

Whether you seek broad market exposure, niche sectors, or thematic investing opportunities, ETFs are a convenient way to build a diversified portfolio tailored to your investment objectives and risk preferences.

Bonds

Bonds are fixed-income investments available through various issuers with the most common one being the US government. Bonds are a fairly complex financial product but at the same time are considered a no-brainer for investors pursuing the path of least risk.

Bonds have different rates of creditworthiness and maturity terms, allowing investors to pick what fits their style best. Bonds with longer maturity—10 to 30 years—generally offer a better yield than short-term bonds.

Government bonds offer stability and low risk because they’re backed by the government and the risk of bankruptcy is low.

Cash

Cash may seem like a strange allocation asset but it’s actually a relatively safe bet when it comes to managing your own money. Sitting in cash is among the best things you can do when stocks are falling and valuations are coming down to earth.

And vice versa—when you have cash on-hand, you can be ready to scoop up attractive shares when they’ve bottomed out and are ready to fire up again (if only it was that easy, right?).

Finally, cash on its own is a risk-free investment in a high interest-rate environment. If you shove it into a high-yield savings account, you can easily generate passive income (yield) and withdraw if you need cash quickly.

📍 Build wealth through diversification

In the current context of market events, elevated interest rates and looming uncertainty, you need to be careful in your market approach. To this end, many experts advise that the best strategy you could go with in order to build wealth is to have a well-diversified portfolio.

“ Diversifying well is the most important thing you need to do in order to invest well ,” says Ray Dalio , founder of the world’s biggest hedge fund Bridgewater Associates.

“ This is true because 1) in the markets, that which is unknown is much greater than that which can be known (relative to what is already discounted in the markets), and 2) diversification can improve your expected return-to-risk ratio by more than anything else you can do. ”

📍 Diversification vs concentration

The opposite of portfolio diversification is portfolio concentration. Think about diversification as “ don’t put your eggs in one basket. ” Concentration, on the flip side, is “ put all your eggs in one basket, and watch it carefully. ”

In practice, concentration is focusing your investment into a single financial asset. Or having a few large bets that would assume higher risk but higher, or quicker, return.

While diversification is a recommended investment strategy for all seasons, concentration comes with bigger risks and is not always the right approach. Still, at times when you have a high conviction on a trade and have thoroughly analyzed the market, you may decide to bet heavily, thus concentrating your investment.

However, you need to be careful with concentrated bets as they can turn against your portfolio and wreck it if you’re overexposed and underprepared. Diversification, however, promises to cushion your overall risk by a carefully balanced approach to various financial assets.

📍 Summary

A diversified portfolio is essentially your best bet for coordinated and sustainable returns over the long term. Choosing a mix of various types of investments, such as stocks, ETFs, currencies, and crypto assets, would spread your exposure and provide different avenues for growth potential. Not only that, but it would also protect you from outsized risks, sudden economic shocks, or unforeseen events.

While you decrease your risk tolerance, you raise your probability of having winning positions. Regardless of your style and approach to markets, diversifying well will increase your chances of being right. You can be a trader and bet on currencies and gold for the short term. Or you can be an investor and allocate funds to stocks and crypto assets for years ahead.

Potential sources of diversification are everywhere in the financial markets. Ultimately, diversifying gives you thousands of opportunities to balance your portfolio and position yourself for risk-adjusted returns.

🙋🏾♂️ FAQ

❔ What is portfolio diversification?

► Portfolio diversification is the strategy of spreading your money across diverse investments in order to mitigate risk, hedge and balance your exposure in pursuit of uncorrelated returns.

❔ Why is diversification important?

► Diversification is important for any trader and investor because it creates a mix of assets working together to yield high, uncorrelated returns.

❔ How to diversify your portfolio?

► The way to diversify your portfolio is to add a variety of different assets and see how they perform relative to one another. If you diversify, you will have a broader exposure to financial markets and ultimately enjoy more probabilities for winning trades, increased returns, and decreased overall risks.

Do you diversify? What is your strategy? Do you rebalance? Let us know in the comments.

Liked this article? Give it a boost 🚀 and don't forget to follow us if you want to be among the first to be informed.

What is the secret of success? 🌴 Being Wrong is OKAY!Here is the 5 TIPS TO DO with your mistakes:

1. Acknowledge Your Errors

So often, we say things like, “It’s unfortunate, but market goes opposite me” or "SEC lawsuit crashed prices, so I lose" But blaming other people or minimizing your responsibility isn’t helpful to anyone.

Before you can learn from your mistakes, you have to accept full responsibility for your role in the outcome. That can be uncomfortable sometimes, but until you can say, “I messed up,” you aren’t ready to change.

2. Ask Yourself Tough Questions

While you don’t want to dwell on your mistakes, reflecting on them can be productive. Ask yourself a few tough questions:

• What went wrong?

• What could I do better next time?

• What did I learn from this?

Write down your responses and you'll see the situation a little more clearly, sometimes from different side. Seeing your answers on paper can help you think more logically about an irrational or emotional experience.

3. Make A Plan (checklist)

Beating yourself up for your mistakes won’t help you down the road. It’s important to spend the bulk of your time thinking about how to do better in the future.

Make a plan that will help you avoid making a similar mistake. Be as detailed as possible but remain flexible since your plan may need to change.

Creating checklist of trading criterias (for entry, for stop loss, for target etc) can be very helpful. Make sure you have it in front of your eyes before open a trade or close it.

4. Make It Harder To Mess Up

Don’t depend on willpower alone to prevent you from taking an unhealthy choice or from giving into immediate gratification. Increase your chances of success by making it harder to mess up again.

To prevent yourself from having instant loss split your deposit to several accounts and make sure you using only small part of it for "intraday" or "scalping" trading. Additionally split your deposit for Savings account and Spot trading. And if you new to trading use only about 15% of your investment to learn, and don't touch other part untill you gain good experience.

5. Create A List Of Reasons Why You Don’t Want To Make The Mistake Again

Sometimes, it only takes one weak moment to indulge in something you shouldn’t. Creating a list of all the reasons why you should stay on track could help you stay self-disciplined, even during the toughest times.

Create a list of all the reasons why you shouldn’t enter the market, it could be your emotional state, willing to revenge on the market or might be a price action setup, fundamentals or something else.

It will help to resist the temptation to enter bad trade.

Self-discipline is like a muscle. Each time you delay gratification and make a healthy choice, you grow mentally stronger.

Cycle of Trading Psycology tips:

HOW TO BALANCE YOUR LIFE AND TRADING

5 TIPS FOR SMALL ACCOUNTS

Savings Account GAINS explained

Simple Investing Strategy, Affordable for all!

Best regards,

Artem Shevelev

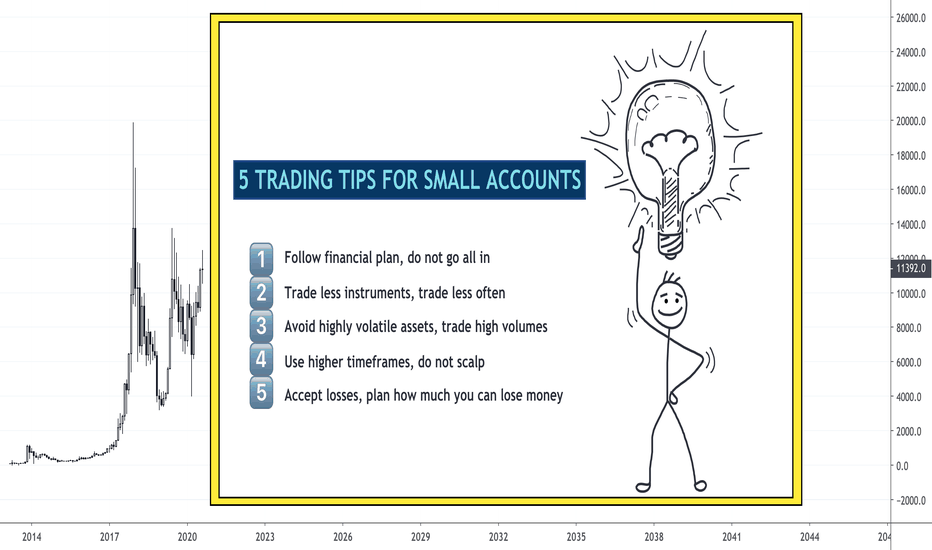

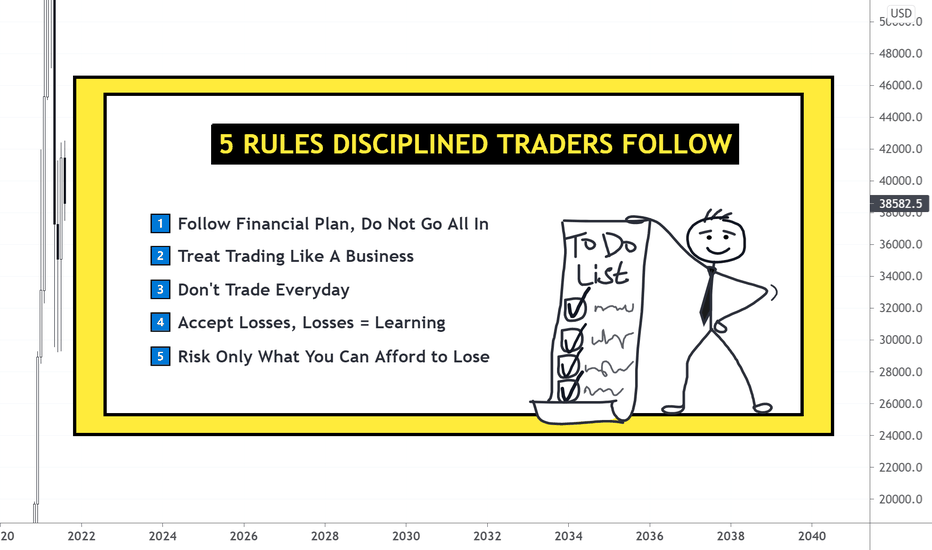

5 TIPS FOR SMALL ACCOUNTSHey! When we start trading we want to make a lot of money and became millionaires by the end of month. This awesome motivation could be cut off easily without following simple plan and strategy.

When I started trading I entered only with 100$ account and loose it all within a month. I didn’t payed attention to my personal financial plan and rules, which cost me a lot of losses during my first steps in trading.

Knowing this 5 tips will help you out if you just started trading and run small account.

So, 5 TIPS FOR SMALL ACCOUNTS

1. Follow financial plan, do not go all in. Yeah, to make financial plan you need to study it first, if you are without financial education. DO NOT GO ALL IN, this is not joke, stop it right now! Small is Big in trading, and watch your trades carefully.

2. Trade less instruments, trade less often. Focus. Once again, small is big. Learn one or two assets, learn their nature and regular chart behaviour. This will help you focus and start open profitable trades.

3. Avoid highly volatile assets, trade high volumes. Take one or two big volume assets and start trading on them only. Do not run into forgotten stocks or coins just because they low cost.

4. Use higher timeframes, do not scalp. Most of new traders lose money in first months just because they trying scalping, your emotions going crazy and risks increasing rapidly. Start taking one-two trades per week and see how it will go, this will release pressure and relax.

5. Accept losses, plan how much you can lose. The biggest problem of all traders is to think in percentages about losses, this way will only increase losses. Think about money and plan you affordable loss amount.

👍I appreciate your likes and comments below this post, lets discuss our problems in trading! 💬

100% TRADERS START WITH DREAM TO GET RICH QUICKHey guys! Do you agree with me?!

It's easy to become charmed by the prospect of making rapid money in the financial markets, yet trading makes almost no one rich – in fact, many individuals lose money*

If you like my graphics, please use Like button 💙💛

* 90% of traders losing money, only 10% get profits. Why?

Here is 3 reasons:

1) Most traders Enter A Trade Too Early

2) Most traders Exit Too Late

3) Most traders Don’t Follow a Risk Management

Here is list my tips to help you to get in profit:

DAY TRADING WHILE HOLDING A 9-5 JOBDAY TRADING WHILE HOLDING A 9-5 JOB

Embarking on the exciting journey of day trading while managing the demands of a full-time job is indeed a challenging yet achievable endeavor. Thanks to the rise of user-friendly mobile applications offered by trading platforms, individuals now have the power to execute trades seamlessly from various locations. This creates an opportunity for those with traditional 9-5 jobs to actively participate in the dynamic world of day trading.

Let's explore the practical aspects of day trading while maintaining a 9-5 job, discovering strategies and considerations that can enhance your ability to strike a harmonious balance between your professional life and the enticing financial markets.

Day Trading With A 9-5 Job:

Engaging in day trading while juggling a full-time job is not only feasible but also a thrilling adventure. The availability of robust mobile applications has made it possible to trade conveniently from different locations, allowing individuals with office hours to participate in the excitement of day trading.

Several factors contribute to the viability of day trading alongside a regular job. Firstly, the accessibility of markets on a 24/7 basis provides flexibility. The forex market operates continuously from Monday to Friday, enabling individuals with office hours to trade after work. Additionally, cryptocurrencies trade around the clock, and some platforms have introduced extended stock trading hours from Monday to Friday.

Strategies like swing trading and position trading offer alternatives for individuals unable to actively day trade. These approaches involve setting predetermined Stop Loss and Take Profit levels, allowing traders to initiate trades and await favorable outcomes over longer periods.

For stock traders, focusing on pre-market and extended-hours trading is a viable strategy. The pre-market session, beginning at 4 AM ET, extends until the regular session commences at 9 AM, and extended-hours trading continues beyond the regular session.

Why You Should Not Day Trade At Work:

While day trading with a full-time job is plausible, certain pitfalls make it less than ideal. Successful day trading demands substantial time, concentration, and dedication, aspects often hindered by professional commitments. The need for consistent market analysis, risk evaluation, and timely trade execution can be challenging to fulfill amidst the demands of a 9-5 job.

Engaging in day trading during working hours may also impact productivity and mental well-being. Maintaining a high level of workplace productivity and a positive demeanor is crucial for professionals, and day trading disruptions, especially in the face of losses, can adversely affect these aspects.

Mental fatigue, stress, and depression are significant concerns for day traders. The demanding nature of the activity, coupled with potential losses, can contribute to a negative impact on one's mental health. This, in turn, may lead to reduced workplace productivity and strained personal relationships.

Furthermore, the comprehensive research required for effective day trading, including technical and fundamental analysis, and sentimental and price action analysis, may be challenging to undertake alongside a demanding job. Professions such as healthcare, finance, and real estate may leave little room for the in-depth analysis needed for successful day trading.

Best Strategies For Day Trading With A 9-5 Job

Successfully managing day trading alongside a 9-5 job requires a strategic approach to ensure optimal results without compromising professional responsibilities. Here are some effective strategies for individuals seeking to seamlessly integrate day trading into their daily work routine:

After-Hours Trading:

Leverage the extended trading hours available in the evenings after the regular workday. Focus on markets like cryptocurrencies, which operate 24/7, or utilize platforms offering extended stock trading hours.

Swing Trading:

Embrace the swing trading strategy that allows traders to capture short to medium-term price movements. This approach requires less frequent monitoring, making it suitable for those with limited time during the workday.

Algorithmic Trading:

Explore algorithmic trading using automated systems or expert advisors. While demanding thorough testing, these systems can execute trades on your behalf, freeing you from constant market monitoring.

Pre-Market and Extended Hours Focus:

Concentrate on pre-market and extended-hours trading, especially if dealing with stocks. This allows you to engage in market activities before and after regular working hours.

Strategic Breaks:

Schedule breaks during the workday for brief market check-ins. Use this time to assess market conditions, manage existing trades, and stay informed about potential opportunities.

Set Clear Trading Goals:

Establish realistic trading goals that align with your work schedule. Define specific time frames for market analysis, trade execution, and review to maintain a disciplined and organized approach.

Utilize Limit Orders:

Reduce the need for constant monitoring by implementing limit orders. Set predetermined entry and exit points, allowing trades to execute automatically when market conditions align with your strategy.

By incorporating these strategies, individuals can strike a balance between day trading and a 9-5 job, optimizing opportunities while minimizing the impact on professional responsibilities.

In conclusion..

In the intricate dance between day trading and the demands of a 9-5 job, finding equilibrium is an art. Technological strides have offered a bridge, enabling individuals to traverse the realms of financial markets while anchored in full-time employment. Yet, the fragility of this balance necessitates a nuanced understanding of its implications. The potential trade-offs — be it in productivity, mental well-being, or the relentless demand for in-depth research — underscore the gravity of this endeavor. As we navigate the dual responsibilities of day trading and professional life, thoughtful consideration and strategic planning emerge as our guiding lights. In this dynamic landscape, success lies not just in seizing market opportunities but in orchestrating a harmonious symphony between financial aspirations and the structured cadence of a 9-5 routine.

I hope this article will give you some nice thoughts before opening your charts while you are working.

Happy trading!

How to Become a Professional Trader!The Triad of Successful Trading:

Strategies, Psychology, and Risk Management.

Introduction:

In the dynamic world of trading, achieving success is a multifaceted challenge that requires a comprehensive approach. While many enthusiasts focus primarily on trading strategies, it is crucial to recognize that a holistic approach, incorporating trading psychology and risk management, is indispensable for sustained success. This article delves into the three pillars of successful trading: trading strategies, psychology, and risk management.

Trading Strategies (25 Marks):

A robust trading strategy serves as the foundation of a trader's success. This section explores the importance of having a well-defined and tested trading strategy. Investors must understand that possessing the same strategy as others does not guarantee success; execution and adherence are key. Points will be awarded based on the clarity and effectiveness of the chosen strategy, as well as the ability to adapt to changing market conditions.

Trading Psychology (35 Marks):

Trading psychology plays a pivotal role in determining success or failure in the financial markets. This section emphasizes the significance of maintaining a disciplined and rational mindset. Factors such as emotional control, patience, and the ability to handle losses are crucial components of a trader's psychological makeup. The article will explore techniques to cultivate a resilient mindset, addressing the common pitfalls that novice traders often encounter.

Risk Management (40 Marks):

Arguably the most critical aspect of successful trading, risk management deserves the lion's share of consideration. This section delves into the methodologies and practices that traders should adopt to protect their capital. Key areas of discussion include position sizing, setting stop-loss orders, and diversification. The article will emphasize the importance of preserving capital and preventing catastrophic losses, assigning points based on the thoroughness and effectiveness of the risk management approach.

Conclusion:

In conclusion, the path to becoming a successful trader hinges on the harmonious integration of trading strategies, psychology, and risk management. While a strong trading strategy provides direction, a disciplined mindset ensures adherence to the plan, and prudent risk management safeguards against significant setbacks. Traders must recognize that neglecting any one of these pillars compromises the overall structure of their trading endeavors. By assigning marks to each component, this article underscores the balanced significance of these three elements and emphasizes their collective role in achieving success in the complex world of trading.

I'm Shaw, a seasoned forex trader with 14+ years of success. Whether you're new or experienced,

I'm here to help you achieve long-term profitability.

Trending Hashtags:

#TradingSuccess

#TraderMindset

#RiskManagement

#TradingStrategies

#FinancialMarkets

#TradingPsychology

#InvestmentStrategy

#CapitalProtection

#MarketDiscipline

#ProfessionalTrader

Protecting Your Investments: The Art of Setting Stop Losses 📉💰

Protecting Your Investments: The Art of Setting Stop Losses 📉💰

✅Setting stop losses is a crucial aspect of risk management in the world of investing. Whether you are a seasoned trader or just starting out, understanding how to set stop losses can help protect your capital and minimize losses. In this article, we will delve into the intricacies of setting stop losses and provide practical examples to illustrate the process.

✅Understanding Stop Loss

A stop loss is an order placed with a broker to buy or sell a security once the price reaches a certain level. It is used to limit potential losses on a trade. When setting a stop loss, it's important to consider factors such as volatility, market conditions, and individual risk tolerance.

Gold broke the rising support so a short trade was opened at the retest, with the SL being above the local key structure

✅ How to Set Stop Losses

1. Determine your risk tolerance: Before setting a stop loss, it's essential to assess how much you are willing to risk on a trade. This will help you determine the appropriate level for your stop loss.

2. Consider technical analysis: Utilize technical indicators and chart patterns to identify key support and resistance levels. These can serve as potential areas to place your stop loss.

3. Implement a trailing stop: As the price of a security moves in a favorable direction, consider adjusting your stop loss to lock in profits while still protecting against potential reversals.

Gold was retesting the horizontal resistance level so a short trade was activated, with the SL above the resistance level

✅Examples:

1. Scenario 1: An investor purchases 100 shares of Company XYZ at $50 per share. They set a stop loss at $45 to limit potential losses if the stock price declines.

2. Scenario 2: A swing trader enters a long position on a currency pair at 1.2000. They place a trailing stop loss at 1.2050 to protect against adverse price movements.

Gold was retesting the strong horizontal support level from where we took a long trade and placed the SL below the lower bound of the support level

When setting stop losses, it's important to strike a balance between protecting your capital and allowing for potential market fluctuations. By mastering the art of setting stop losses, investors can better navigate the unpredictable nature of financial markets and safeguard their hard-earned investments. 📊✅

10 Rules for Successful Trading1. Study.

Learn how financial markets work. Years ago I took Khan Academy's free courses on the financial markets. It really helped reinforce what I already knew, taught me new stuff and solidified my confidence in understanding how the financial markets work. Here's the link: www.khanacademy.org

Learn the basics of Technical Analysis. For this part I read "Technical Analysis of the Financial Markets" by John Murphy. I read the whole book not once, but twice, and I constantly refer to it to refresh my memory. You can also get the supplemental workbook to do exercises and test your proficiency. Link: www.amazon.com

Learn the basics of Macroeconomics and Microeconomics. Khan Academy also provides excellent free courses in this subject area with quizzes and tests to confirm your proficiency. This part is important for understanding the big picture. Link: www.khanacademy.org

2. Develop a trading plan.

Write out your trading plan step-by-step and follow it every time. If you don't do this, you won't be consistently profitable in the long term. Never trade on a whim, even if you fear missing out on a big move. I would rather miss out on a big move up because I took the time to develop a plan than jump in without a plan and experience a big move down. Here's a good resource for how to develop a trading plan: www.ig.com

3. Find a trading mentor.

Find someone who is more experienced than you and learn from them. I was able to connect with a very experienced trader here on Trading View with whom I share watchlists and get trade ideas from. We chat regularly and confirm or critique each other's ideas. Having a trading mentor has been invaluable to my trading. It's important to find someone who is trustworthy and competent, and willing to critique your trading ideas. Often we as traders only see what we want to see in the chart and miss or ignore obvious clues that go against our theory. For example, what one person sees as a triple bottom (bullish) another person may see as a bear flag (bearish).

Another way to learn from other traders is to subscribe to traders who post high-quality content on Youtube. I subscribe to a few great trading Youtubers who give me all kinds of insights. My trading has definitely improved because of learning from other traders. With this said, don't go overboard. Find just a couple of good people to follow. You don't want to follow dozens and dozens of traders as you will suffer from information overload.

4. Manage risk.

Preserving your capital is necessary to stay in the game, so you need to manage risk. No matter how good your charting may be, some of your trades will go against you and will need to get out. That's why I always use stop losses and get out of a trade at a certain predetermined level. Stop losses always limit loss, but do not necessary limit profit. This in turn allows you to only be right half of the time (or in some cases even less) and still be profitable. The topic of stop losses actually warrants it own discussion. In the future, I will be writing a post on how to place your stop losses.

Other risk management strategies include: limiting the amount of margin you use, only risking a certain percentage of your portfolio on any given trade, and diversifying your portfolio. A key difference between trading and investing is that investing does not (typically) employ stop losses. Long-term investors typically manage risk by using diversification.

5. Be humble.

Check your ego at the door. It does not matter if you're right. The only thing that matters is your money. Never stay in a trade because you don't want to admit that you were wrong. I've seen plenty of charts that looked amazing and then a black swan event happens. Perhaps one of the best ways to think about it is to consider this paraphrased statement from the legendary trader Larry Williams: "Regardless of past performance, never forget that every new trade you make only has a 50% chance of success." I have seen some Trading View users who are completely consumed by pride and post their win rates and super high-profit percentages. I steer clear of these traders because they fail one major rule of good trading: staying humble. Past performance is not a guarantee of future performance.

6. Keep a journal.

This one is very important. Whenever I learn something new about trading, I write it down in a trading notebook. Whenever I make a mistake, I write down what went wrong and what I learned from the mistake. My trading notebook contains my strategies both for bear markets and bull markets, contains the steps for my daily routine, contains my screener criteria, and contains a listing of all the important things I've picked up over the years of trading.

7. Track your assets.

Employ some kind of a method for tracking your performance. Even though it's time-consuming, I use a spreadsheet.

8. Avoid speculation.

Never trade based on speculation or emotion. Never buy or sell an asset because of fear (whether fear of a market crash or fear of missing out on a huge rally). Never enter into a position simply because you like the company, and similarly do not avoid selling your position because you love the company too much. The most successful traders are rigorously unemotional and unattached. In my opinion, I define anything that does not involve an analysis of data as speculation.

I have also come to learn that by the time everyone is talking about something, it is usually at peak mania and will not go up further. For example, when your co-worker or close friend is talking about how much they made from Bitcoin, it's probably time to sell. Similarly, if you see everyone on social media posting photos of how much it costs to fill up their car with gas, it probably means we're at the peak of gas prices.

9. Learn how to use your charting platform.

One of the best things I ever did to master my charting was to spend a few weeks doing nothing but just learning all the features on Trading View. When I first signed up for Trading View I was overwhelmed by all the tools, indicators, strategies, and ideas on here. So I knew I had to take a timeout from trading and just learn the tools first. For several weeks rather than focus on trading, I focused on learning Trading View. I favorited indicators that work best for my strategy, I created layouts and explored every nook and cranny on the platform. Trading View is incredibly powerful because it provides access to so much data. Having access to data is power. By taking the time to learn how to use all of its tools, I was able master the financial markets to a degree that I can now make predictions just good as those high-paid Wall Street analysts. Your subscription will pay for itself through the profits you make.

10. "Look first. Then leap."

Always chart out your entry point, stop loss, and profit target before entering a trade. Ask yourself: How much risk am I willing to take for how much profit?

Here's a great resource from Investopedia that inspired this post: www.investopedia.com

This list of good trading rules is nowhere near comprehensive, so please leave a comment below to share your rules and tips for successful trading!

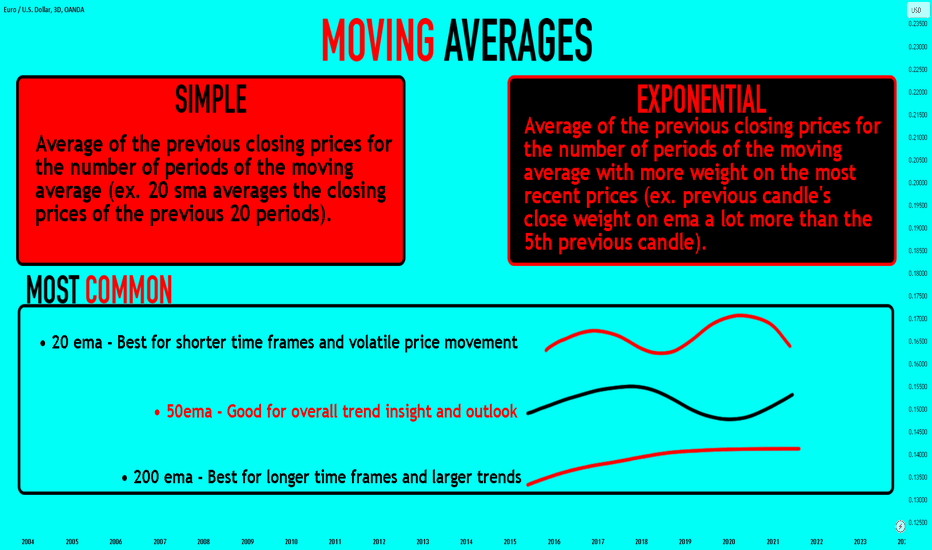

Navigating Moving Averages: Decoding Simple vs. Exponential 📊📈

Moving averages (MA) serve as foundational tools in technical analysis, offering insights into market trends and potential entry/exit points. This article delves into the comparison between two primary types: Simple Moving Averages (SMA) and Exponential Moving Averages (EMA), providing traders with a comprehensive understanding of their differences, applications, and advantages.

Differentiating Simple and Exponential Moving Averages

1. Simple Moving Averages (SMA):

- Calculate by averaging closing prices over a specified period, providing a smooth representation of price trends.

2. Exponential Moving Averages (EMA):

- Prioritize recent prices, assigning more weight to the latest data points, leading to quicker responses to price changes.

Understanding the differences and applications of Simple and Exponential Moving Averages empowers traders with versatile tools for analyzing trends and making informed trading decisions in various market conditions. 📊📈

Do you like this post? Do you want more articles like that?

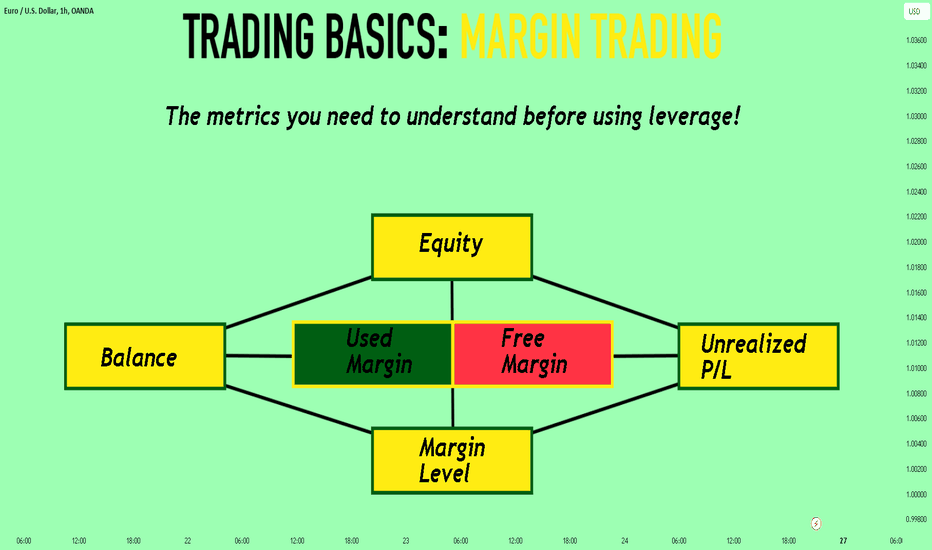

Unlocking Margin Trading: Your Guide to Trading Basics 📊🔓💡

Margin trading stands as a fundamental concept in the world of trading, offering opportunities to amplify potential gains but also carrying increased risk. This article is a comprehensive guide to understanding the basics of margin trading, exploring its mechanics, implications, and the vital role it plays in financial markets.

Understanding Margin Trading

Margin trading involves leveraging borrowed funds from a broker to increase trading position sizes, allowing traders to control larger positions than their initial capital.

Increased Buying Power:

Risks of Margin Calls:

Margin trading unlocks opportunities for increased exposure in the financial markets but demands a thorough understanding of risks and prudent risk management strategies. This article serves as a foundational guide to mastering this critical aspect of trading. 📊🔓💡

Please, support my work with like and comment!

Love you, my dear followers!👩💻🌸

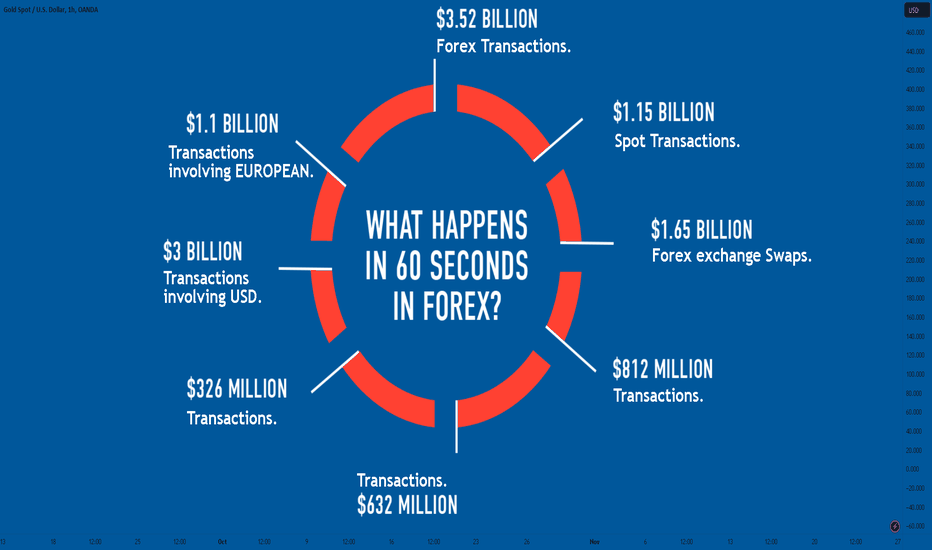

Deciphering the Forex Frenzy: A Closer Look at 60 Seconds ⏱💹✨

In the bustling realm of Forex, a single minute carries an abundance of activity, steering markets through rapid fluctuations and intricate maneuvers. Understanding the flurry of events that unfold within this brief window is pivotal for traders aiming to capitalize on these micro-movements. This article provides an insightful exploration into the dynamics of a mere 60 seconds in Forex, unraveling its significance and the potential impact on trading decisions.

60-Second Rush in Forex

Within this fleeting timeframe, several significant occurrences shape the landscape of currency pairs:

Price Surges and Retraces:

High-Frequency Trading Activity:

Navigating the 60-Second Window

Traders employ diverse strategies like scalping or utilizing minute-based technical indicators to swiftly identify opportunities for entering or exiting positions within this condensed timeframe.

In just 60 seconds, the Forex landscape undergoes a whirlwind of activities, presenting a microcosm of opportunities and challenges for traders seeking to navigate the swift and impactful movements within this brief yet dynamic timeframe. ⏱💹✨

What do you want to learn in the next post?

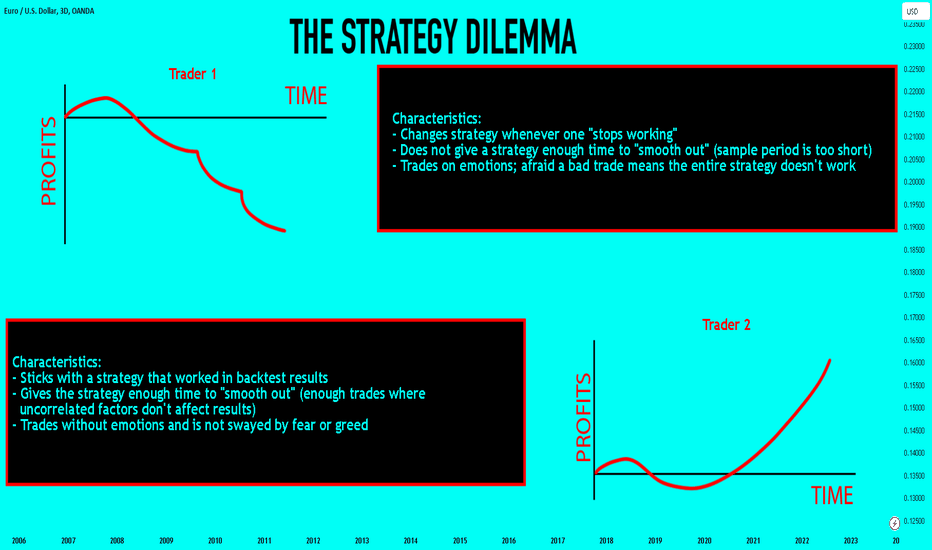

Changing Tactics vs. Staying the Course 🔄🚀

In the dynamic world of forex trading, the strategy dilemma often prompts traders to ponder whether to adapt and change tactics or remain steadfast with their initial approach. Let's explore the implications of altering strategies compared to the outcomes of sticking to one method in the pursuit of trading success. 📈💡

The Strategy Shift: First Trader Changes Strategy

One approach to the strategy dilemma is adopting a more flexible mindset, allowing for strategy shifts based on market conditions or performance feedback. Consider these insights:

1. Adapting to Market Changes 🌐

2. Responding to Performance Feedback 📊

After consecutive losses, a trader adjusts their strategy, incorporating tighter risk management techniques or altering entry and exit points.

3. Exploration and Learning Mindset 📚

Embracing the strategy dilemma as an opportunity to explore new methodologies and continuously improve trading skills.

The Steady Approach: Second Trader Stays the Course

Conversely, some traders opt to stick to their chosen strategy, believing in its long-term profitability and weathering challenges without altering their approach:

1. Consistency and Discipline 🎯

Despite short-term fluctuations or occasional losses, a trader remains committed to their strategy, believing in its efficacy over time.

2. Confidence in Strategy 🛡

A trader trusts their thorough research and extensive backtesting, maintaining confidence in their chosen approach despite short-term setbacks.

3. Patience and Long-Term Vision 🕰

Comparing Outcomes:

Each approach to the strategy dilemma carries its own set of advantages and challenges. While adapting strategies might offer flexibility and responsiveness to market changes, sticking to a consistent strategy can build discipline and confidence.

Navigating the Strategy Dilemma:

Finding the right balance between adapting and staying consistent can be pivotal for success in forex trading. Consider these steps:

1. Evaluate Performance Regularly 📈

2. Continuous Education and Improvement 📚

3. Balance Flexibility and Consistency 🔄

4. Adopt a Long-Term Perspective 🚀

The strategy dilemma in forex trading presents traders with a crucial decision: to adapt and change strategies or to stay the course. Both approaches have merits, and the key lies in finding a balance that aligns with individual trading styles and goals. Whether it's flexibility or consistency, the aim is to achieve sustained success in the dynamic world of forex trading. 🌟💹

Do you like this post? Do you want more articles like that?

Learn 10 Habits of Successful Trader

Hey traders,

In this post, we will discuss 10 divine rules that every trader must obey:

1️⃣ - Accept that risk and losses are a necessary part of trading.

Even though most of the traders are looking for a holy grail, for a system that produces 100% win rate, in fact, losses are inevitable, they are part of the game.

No matter how good you are as a trader, occasionally, the market will outsmart you.

2️⃣ - Have a proven trading system.

Trade only with a trading strategy that you backtested, that proved its accuracy and efficiency.

3️⃣ - Concentrate on the risk, not the reward.

Cut losses, and control your risk. Remember about risk management and never neglect that.

4️⃣ - Never trade without stop loss.

Some traders say that they can easily control losses without stop loss. Don't listen to them. Always set a stop loss once you are in a trade.

5️⃣ - Have an attainable target.

Setting a stop loss remember to know where to close your trade in profit. Follow strict rules and do not let your greed take you under control.

6️⃣ - Take your emotions under control.

No matter whether you are losing, winning, or do not see any trading setups to trade, your emotions will always try to distract you.

Be cold-hearted.

7️⃣ - Always stick to your trading plan.

Never break your rules, follow your system, and do not deviate.

Your trading plan is your only map.

8️⃣ - Limit your losses, never limit your profits.

While your gains can be scalable, your risks and losses must be fixed.

9️⃣ - Treat your trading as a business.

Trading should be treated with the same discipline as a business.

Every business has a solid business plan which entails how the day-to-day running of the business is done, and this also guides the decision-making process.

🔟 - Always journal your trades.

Always keep a trading journal. Record your winners and losers, entry reasons, mistakes, failures etc. Revise and learn from your mistakes.

Of course, that list can be extended and more commandments and rules can be added. However, these 10 in my view are the most important. Print that list and let it guide you in your trading journey.

What would you add in that list?

Hey traders, let me know what subject do you want to dive in in the next post?

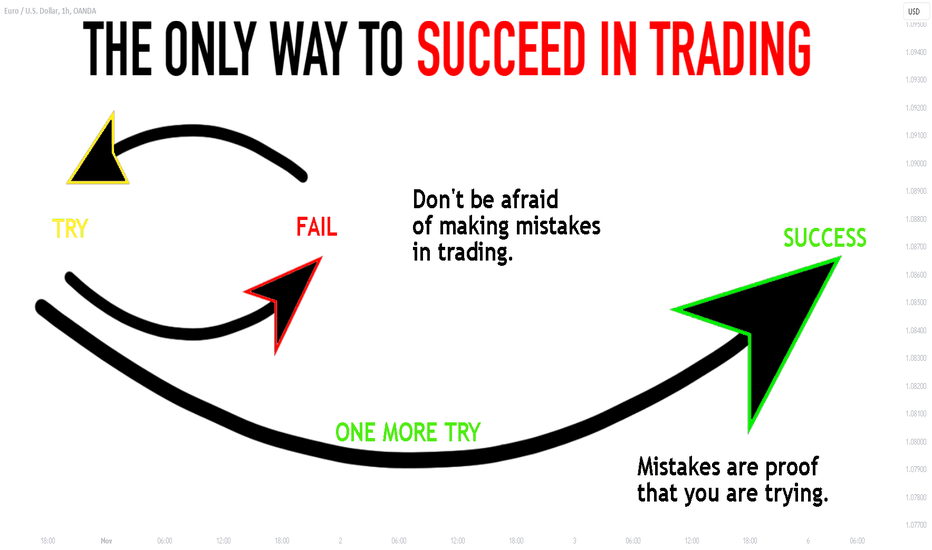

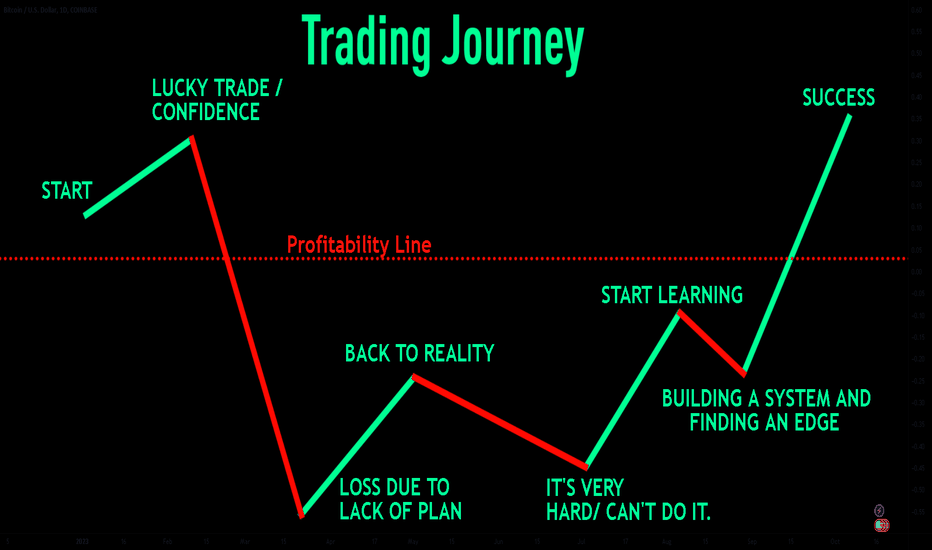

The ONLY Way to Become a Successful Trader

Hey traders,

Like any discipline, consistently profitable trading requires many years of practice.

In this post, we will discuss the only proven way to become successful in trading.

🔰First, let's start with the axiom: there are no inborn traders, trading is a skill, a skill that can be learned. Though talent may help you in some manner it does not guarantee your success.

One more axiom that is logically derived from the first one is the fact that trading is a complex skill.

The one that can be split into dozens of subskills.

Making that statement we may assume that our success in trading directly depends on mastering each subskill, each domain that it consists of.

But how do we master these skills?🤔

The only way to do that is to practice. Practice means doing something regularly in order to be able to do it better.

With your first attempts, you are doomed to fail. Inevitable you will suffer and you will feel miserable because of your incompetence.

Trying and doing the same thing again and again, at some moment you will feel the progress and growth. Your perseverance will bear fruit.

Knock, and it shall be opened to you.

And as a consequence, with some attempt, you will feel that finally the skill is mastered, that one more stage in your journey is passed.

Polishing the entire set of subskills and learning to apply that as a single unit will make you a consistently profitable trader.

Just stipulate the domains properly, name them and be ready to work hard.

Hey traders, let me know what subject do you want to dive in in the next post?

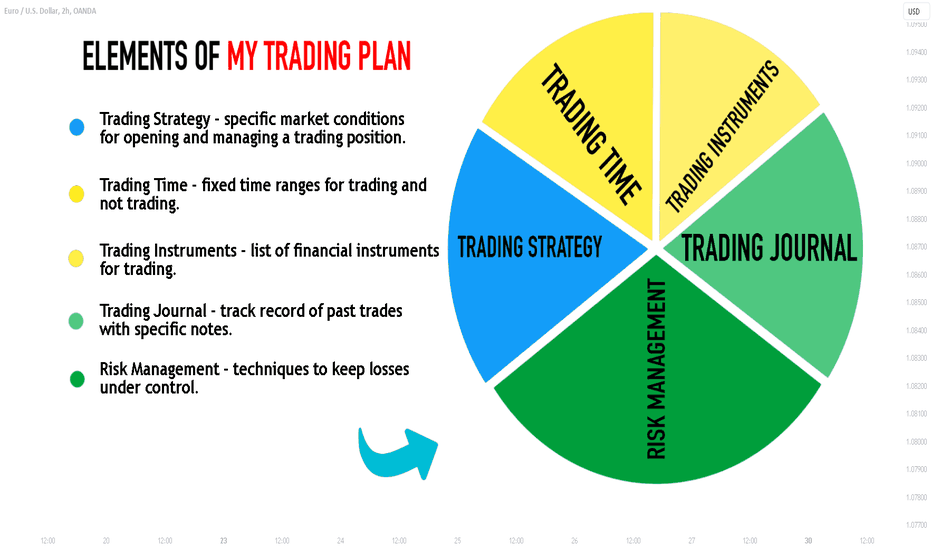

What is Inside a PROFESSIONAL TRADING Plan

Hey traders,

One month ago I wrote an article about the importance of a trading plan. Now it is time to discuss what should be inside your trading plan.

Before we start let me note that a trading plan is a very personal thing and depending on your personality you may have some other elements. In this article, we discuss key elements that must be in every trading plan.

🔰Trading Strategy.

I want you to realize that a trading strategy is not a trading plan. A trading strategy is simply one of its main elements.

A trading strategy defines a set of rules and market conditions that one is looking for to open a trade and then manage that.

🔰Trading Time.

Relying on your trading strategy you should know exactly when you trade. The time range must be precise and fixed. If you think that today you can trade the opening of the London session, tomorrow the Asian one, and then the US opening, I have very bad news for you.

Your trading hours must be fixed and objective.

🔰Trading Instruments.

As with your trading time, you should have a fixed trading list.

A set of financial instruments that you monitor on a daily basis.

🔰Trading Journal.

You should learn to journal your trades. Just a single performance is not enough.

You should note the exact market conditions that made you open the trade and many other factors that you consider to be important.

Then learn from your mistakes and improve your trading strategy based on your journal.

🔰Risk Management.

Having the best trading strategy in the world one can fail simply because of neglecting the rules of risk management.

Define your risk per trade, maximum drawdown, and biggest losing streak you can take.

Optimize your trading to keep your losses under control.

Of course, that list can be extended. We can add, for example, trading psychology into that.

As I said, a trading plan is a very personal thing and while you mature in trading it will become more and more sophisticated.

The elements that we discussed in this article are crucial for your success in trading. In my view, their absence will lead you to a failure.

What do you want to learn in the next article?

Hey traders, let me know what subject do you want to dive in in the next post?

Discover The Main Difference Between Scalping, Day, Swing TRADES

How long to hold your trading position?

Everything depends on your trading style.

In this post we will discuss the preferable holding period for your trading positions.

First,

Let's define 4 main trading styles:

Scalper, intraday trader, swing trader and investor.

One of the core differences between these styles is the time horizon of their predictions of a market behavior.

1️⃣ Scalper attempts to predict minor price fluctuations. His goal is not to pursue the waves, rather a minor moves up and down.

For that reason, pro scalpers tend to hold their position minutes, sometimes even seconds.

Expanding the time horizon, they are risking to be stopped out from their positions.

Above, you can see the examples of short-term scalping trades,

that were taken on a 15m time frame on Gold.

2️⃣ Intraday traders operate on intraday time frames.

They are trying to predict the price movements within a day or even a trading session.

The average holding period of a pro intraday trader is ranging from minutes to hours.

Above, EURUSD on an hourly time frame.

The trades were opened and closed within one single trading day.

3️⃣ Swing traders are aiming to catch swing moves - the waves.