Learn 10 Habits of Successful Trader

Hey traders,

In this post, we will discuss 10 divine rules that every trader must obey:

1️⃣ - Accept that risk and losses are a necessary part of trading.

Even though most of the traders are looking for a holy grail, for a system that produces 100% win rate, in fact, losses are inevitable, they are part of the game.

No matter how good you are as a trader, occasionally, the market will outsmart you.

2️⃣ - Have a proven trading system.

Trade only with a trading strategy that you backtested, that proved its accuracy and efficiency.

3️⃣ - Concentrate on the risk, not the reward.

Cut losses, and control your risk. Remember about risk management and never neglect that.

4️⃣ - Never trade without stop loss.

Some traders say that they can easily control losses without stop loss. Don't listen to them. Always set a stop loss once you are in a trade.

5️⃣ - Have an attainable target.

Setting a stop loss remember to know where to close your trade in profit. Follow strict rules and do not let your greed take you under control.

6️⃣ - Take your emotions under control.

No matter whether you are losing, winning, or do not see any trading setups to trade, your emotions will always try to distract you.

Be cold-hearted.

7️⃣ - Always stick to your trading plan.

Never break your rules, follow your system, and do not deviate.

Your trading plan is your only map.

8️⃣ - Limit your losses, never limit your profits.

While your gains can be scalable, your risks and losses must be fixed.

9️⃣ - Treat your trading as a business.

Trading should be treated with the same discipline as a business.

Every business has a solid business plan which entails how the day-to-day running of the business is done, and this also guides the decision-making process.

🔟 - Always journal your trades.

Always keep a trading journal. Record your winners and losers, entry reasons, mistakes, failures etc. Revise and learn from your mistakes.

Of course, that list can be extended and more commandments and rules can be added. However, these 10 in my view are the most important. Print that list and let it guide you in your trading journey.

What would you add in that list?

Hey traders, let me know what subject do you want to dive in in the next post?

Trading Plan

The ONLY Way to Become a Successful Trader

Hey traders,

Like any discipline, consistently profitable trading requires many years of practice.

In this post, we will discuss the only proven way to become successful in trading.

🔰First, let's start with the axiom: there are no inborn traders, trading is a skill, a skill that can be learned. Though talent may help you in some manner it does not guarantee your success.

One more axiom that is logically derived from the first one is the fact that trading is a complex skill.

The one that can be split into dozens of subskills.

Making that statement we may assume that our success in trading directly depends on mastering each subskill, each domain that it consists of.

But how do we master these skills?🤔

The only way to do that is to practice. Practice means doing something regularly in order to be able to do it better.

With your first attempts, you are doomed to fail. Inevitable you will suffer and you will feel miserable because of your incompetence.

Trying and doing the same thing again and again, at some moment you will feel the progress and growth. Your perseverance will bear fruit.

Knock, and it shall be opened to you.

And as a consequence, with some attempt, you will feel that finally the skill is mastered, that one more stage in your journey is passed.

Polishing the entire set of subskills and learning to apply that as a single unit will make you a consistently profitable trader.

Just stipulate the domains properly, name them and be ready to work hard.

Hey traders, let me know what subject do you want to dive in in the next post?

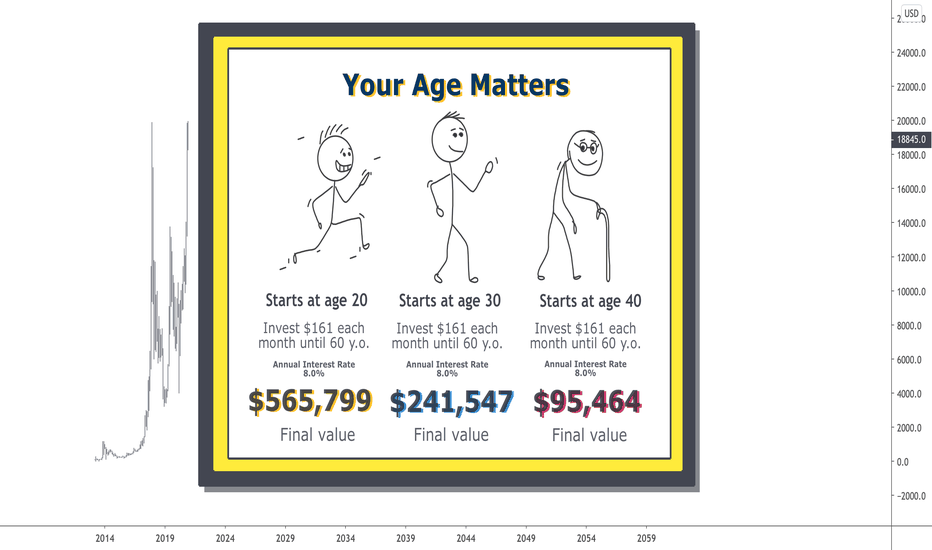

Simple Investing Strategy, Affordable for all!Hey! Everybody wants to get rich. But not many from us know what it takes. In this article let's discuss Investing income from annual percentage yield (APY) . Key point is the percentage of income can be different from your location, but lets make our calculations from 8.0% APY.

Why this strategy is Affordable for ALL? Well, for calculation I've used only $161 of monthly investing.

I understand for some person this is nothing, and for another it is a lot. But you can calculate your own affordable investing amount per month and use it. Consistency is the key!

Another point why its affordable, its because you don't need to have a lot of money at the beginning. You can start from minimal deposit allowed by service/fund/bank (APY provider) where you allocating your funds.

Please, note, this is simple and affordable investing strategy. But still THIS IS NOT 100% SAFE STRATEGY... There are several risks of losing your money after all. Mostly this risks depends on APY provider, so I recommend to change your APY provider over a time, and to secure your funds use multiple providers.

Let's see how we get this numbers and first of all it is important to keep consistency during all your investment journey. Remember, this way can make you millionaire and can create a fortune for your kids.

To understand how this works, let's see what is Compound Interest:

Compound interest is the concept of adding accumulated interest back to the principal sum, so that interest is earned on top of interest from that moment on. The act of declaring interest to be principal is called compounding. Financials institutions vary in terms of their compounding rate frequency - daily, monthly, yearly, etc.

Your savings account may vary on this, so you may wish to check with your bank or financial institution to find out which frequency they compound your interest at. I used monthly compounding to calculate final value.

With savings accounts, interest can be compounded at either the start or the end of the compounding period (month or year).

Compound interest formula

Compound interest, or 'interest on interest', is calculated with the compound interest formula. Multiply the principal amount by one plus the annual interest rate to the power of the number of compound periods to get a combined figure for principal and compound interest.

This formula is base of all interest calculations. To get easier process of calculation, I have used online Compound Interest Calculator.

Best numbers we can get if we start investing early, but it happens we see right information too late, and we ask ourselves "Is it good time to start?" — I can say for sure, YES! Always good idea to start investing in your savings account. Trading is trading, but investing is a little different. You can invest in markets, or in savings accounts.

Now let's see "worst case" — you starting your investing journey at 40 years old.

How much you can earn on savings account until 60?

I have calculated it with calculator, and used only $161 investments/savings per month with APY of 8%.

You can see after 20 years of savings this amount of money (pretty much affordable for many people out there) you will get about $95,464 Final Value. Very impressive. Imagine if you can save more from your income each month... For example if you can save $1000 monthly, you will get $592,947 Final value after 20 years on your Savings Account.

Middle scenario — investing for 30 years on your savings account. Until 60 you can earn solid $241,547 Final value, investing only $161 per month!

Now if you can invest about $500 per month from your income you will get amazing $750,147 Final value.

And of course best scenario — start investing on savings account early from 20y.o. This way you can get $565,799 Final value by 60 y.o.

And if its possible to save more, let's say $250 monthly, you can get $878,570.30 Final value by 60 y.o.

So in order to get rich, you don't need to invest a lot of money. Just make you investments consistent, and improve your financial education.

Hope this article can inspire you to create your savings account and plan your future.

Best regards,

Artem Crypto

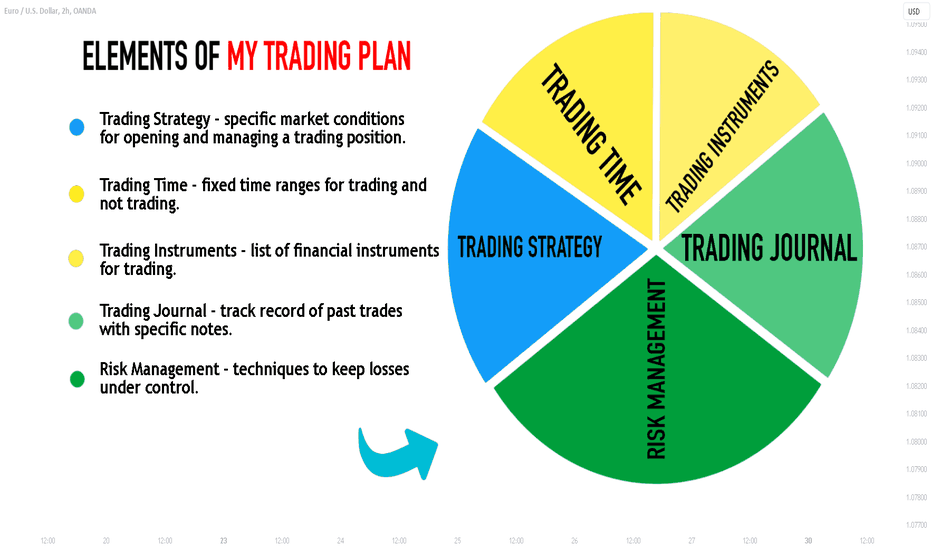

What is Inside a PROFESSIONAL TRADING Plan

Hey traders,

One month ago I wrote an article about the importance of a trading plan. Now it is time to discuss what should be inside your trading plan.

Before we start let me note that a trading plan is a very personal thing and depending on your personality you may have some other elements. In this article, we discuss key elements that must be in every trading plan.

🔰Trading Strategy.

I want you to realize that a trading strategy is not a trading plan. A trading strategy is simply one of its main elements.

A trading strategy defines a set of rules and market conditions that one is looking for to open a trade and then manage that.

🔰Trading Time.

Relying on your trading strategy you should know exactly when you trade. The time range must be precise and fixed. If you think that today you can trade the opening of the London session, tomorrow the Asian one, and then the US opening, I have very bad news for you.

Your trading hours must be fixed and objective.

🔰Trading Instruments.

As with your trading time, you should have a fixed trading list.

A set of financial instruments that you monitor on a daily basis.

🔰Trading Journal.

You should learn to journal your trades. Just a single performance is not enough.

You should note the exact market conditions that made you open the trade and many other factors that you consider to be important.

Then learn from your mistakes and improve your trading strategy based on your journal.

🔰Risk Management.

Having the best trading strategy in the world one can fail simply because of neglecting the rules of risk management.

Define your risk per trade, maximum drawdown, and biggest losing streak you can take.

Optimize your trading to keep your losses under control.

Of course, that list can be extended. We can add, for example, trading psychology into that.

As I said, a trading plan is a very personal thing and while you mature in trading it will become more and more sophisticated.

The elements that we discussed in this article are crucial for your success in trading. In my view, their absence will lead you to a failure.

What do you want to learn in the next article?

Hey traders, let me know what subject do you want to dive in in the next post?

5 RULES DISCIPLINED TRADERS FOLLOW 👨🎓Hey guys! In this article you will learn about 5 RULES DISCIPLINED TRADERS FOLLOW, let's dive in it!

But before you do so, make sure you follow my page and turn TradingView notifications ON! Let's go!

1️⃣ Follow Financial Plan, Do Not Go All In

A trading plan is a written set of rules that specifies a trader's entry, exit, and money management criteria for every buy or sell entry.

Do not go all in! Want to lose most or all of your money real fast? Make outsized trading bets, like a roulette player betting it all on red or black.

In fact, big trading bets are a form of gambling.

So avoid gambling, stop going “all in” in single stock or coin.

Start planning your investments, invest in the long-term at least 10% of your income every month in markets and other assets. If you invest a certain amount every month, you are buying shares in good times as well as bad times.

In good times, the value of your shares increase. If you keep your cool and stick with the plan even when the market is down, you get more shares for your money. These additional shares boost investment returns when the market rebounds.

This is a big part of the reason why regular stock investors get a higher long-term return compared to safer investments despite the temporary ups and downs in the market.

A long-term investor has a minimum of a 20-year time horizon; this time frame enables them to avoid playing it safe and to instead take measured risks, which can ultimately pay off in the long run.

2️⃣ Treat Trading Like A Business

To be successful, you must approach trading as a full- or part-time business, not as a hobby or a job.

If it's approached as a hobby, there is no real commitment to learning. If it's a job, it can be frustrating because there is no regular paycheck.

Trading is a business and incurs expenses, losses, taxes, uncertainty, stress, and risk. As a trader, you are essentially a small business owner and you must research and strategize to maximize your business's potential.

Think in Long term – Don’t trade like you are going to retire tomorrow

Have a Clean Trading Office That inspire you

Have a trading Plan for Your Trading Business

Don’t Present Yourself all Over the Market – Have a Proper EDGE over the Market

Have a Strict Daily Trading Routine & Follow it Continuously

Always Protect Your Trading Capital

Have Solid Trading Journal

3️⃣ Don't Trade Everyday

You don't have to open trades every day

Beginners tend to think that professional traders open their trades every day. But this is not true. Professional traders wait for good trading opportunities and only then enter the market.

Some days there will be no good trading opportunities. Sometimes the volatility will be too low, and you simply will not be able to take more or less decent profits. Sometimes, on the contrary, the volatility will be too high, and you will not be able to open your trades safely. There can be many different reasons in the market when it is best to refrain from trading.

Experienced traders know when to sit back and just wait. At the same time, most novice traders constantly open new positions because they think they should trade. But in the end, they make bad trades and constantly suffer losses.

If you don't find valid good entry points, but still open new trades, you will lose much more money than if you had the patience and stayed out of the market.

4️⃣ Accept Losses, Losses = Learning

It is much more useful to accept the fact that losses are the norm rather than the exception. It is also vital to define your potential losses before you enter any trade. Define your possible loss, or risk, in comparison to your possible reward, or profit. It is also vital that you don't take losing personally.

5️⃣ Risk Only What You Can Afford to Lose

Let the profits flow and cut the losses. This idea is one of the most common among traders.

As George Soros said:

It doesn't matter if you're right or wrong. What matters is how much you earn when you are right and how much you lose when you are wrong.

The key to trading success is to grow your profitable trades.

Traders who are afraid of losing their money often stop paying attention to the market situation and become too attached to the current profit. They make their decisions about open positions based only on the fear that the price will not reach their profit.

We know that unfixed profits still belong to the market. But once you start cutting back on your winning trades, you also cut your risk to reward ratio.

Of course, sometimes the market will give you less profit than you bargained for. And that's okay. To trade successfully, you must free the market and stop restricting it.

But if you are trading with money that you fear losing, you will not have that luxury. Instead, you will be afraid of losing your accumulated profits and you will not be able to sit back and let the market do its job.

The beauty of using multiple risk-reward ratios is that you can ignore your winning ratio and still make good money. If you reduce this ratio, you are faced with the need to make a high percentage of profitable trades in order to make a profit. Basically, you yourself are reducing your chances of achieving success.

Stay tuned for further updates!

Always learn, never give up!

Best regards

Artem Shevelev

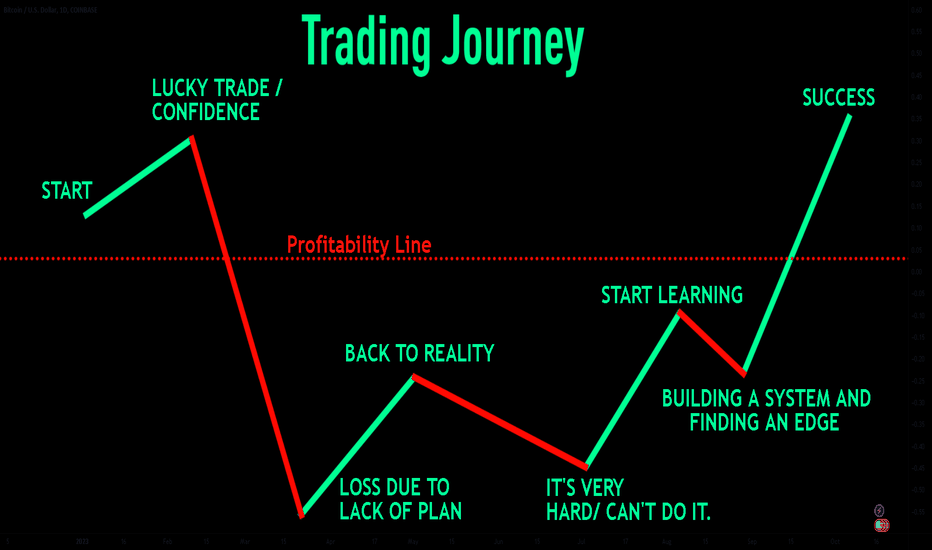

Navigating the Rocky Road: The Hard Trade Journey 🌄💼

The path to success in trading is not always a smooth one. For many, it's a hard-fought journey filled with challenges, setbacks, and invaluable lessons. In this comprehensive exploration, we delve into the trials and triumphs of traders who have faced adversity and emerged wiser and stronger. Learn from their experiences, find inspiration in their stories, and discover that the hard trade journey is a crucible where traders are forged.

The Grit of Hardships

The Learning Curve

Emotional Battles

Triumphs in the Trenches

The Persistent Trader

The hard trade journey is not for the faint of heart, but it's within the crucible of challenges that traders are refined and their characters are tested. It's where learning happens, resilience is built, and triumphs become even more rewarding. The stories of those who have weathered the storm serve as an inspiration to all traders embarking on their own challenging but ultimately rewarding journeys. 🌄💼

Please, like this post and subscribe to our tradingview page!👍

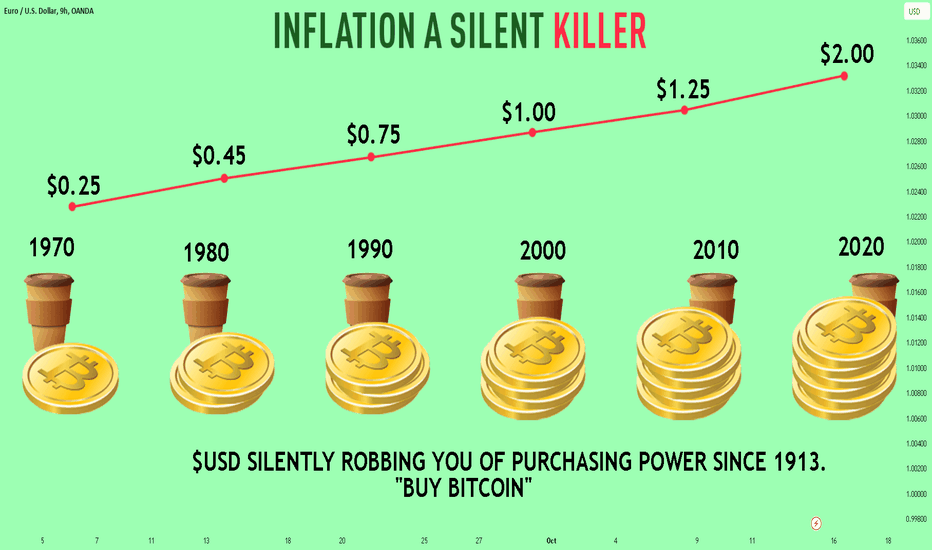

"Inflation: The Silent Wealth Eroder 🤐💸"

In the world of economics, there's a silent assassin at work, slowly but persistently eroding the value of your hard-earned money. Inflation, often overlooked but silently powerful, can be a wealth killer if left unattended. This in-depth exploration uncovers why inflation is a financial menace, examining its causes, consequences, and strategies to shield your wealth.

The Silent Thief

The Dollar Dilemma

Retirement Realities

Causes of Inflation

1. Demand-Pull Inflation 📈

When demand for goods and services surpasses their supply, prices go up. This can happen in booming economies when everyone wants a piece of the pie.

2. Cost-Push Inflation 📦🏭

Rising production costs, like increased wages or resource prices, can lead to higher prices for consumers. Businesses pass these costs on to buyers, contributing to inflation.

Consequences of Inaction

Stagnant Savings

Protecting Your Wealth

There are strategies to counter the silent thief:

1. Invest Wisely 📊💡

Consider investments that have the potential to outpace inflation, like stocks, real estate, or commodities.

2. Diversify Your Portfolio 🌐📈

Spreading your investments across various assets can reduce the impact of inflation on your overall portfolio.

Inflation may be silent, but its impact on your wealth is loud and clear. Understanding the causes, consequences, and protective measures can help you guard your financial future against this silent yet formidable adversary. Don't let your money silently slip away—act now to preserve your wealth. 💸🤐

Please, support my work with like and comment!

Love you, my dear followers!👩💻🌸

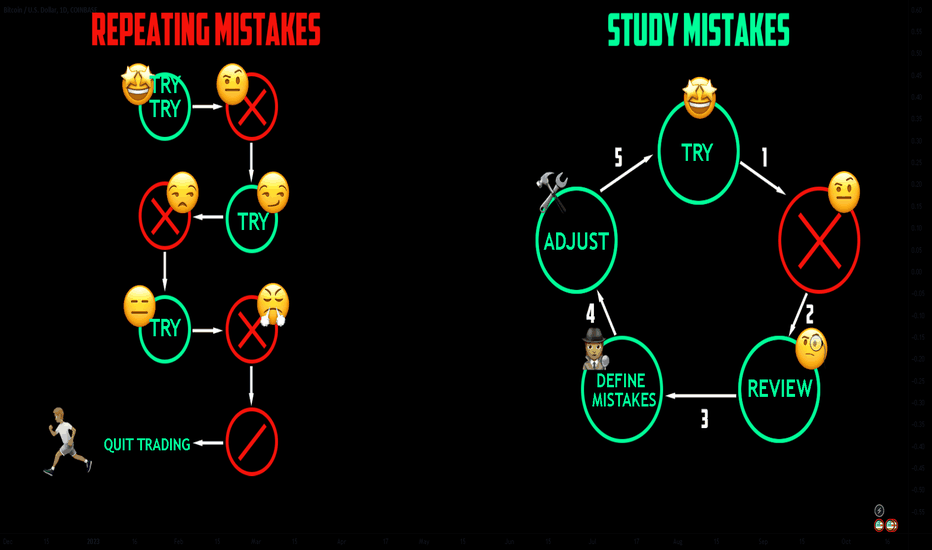

Learning from Mistakes: The Path to Trading Mastery 📈📚🛠

Mistakes are an inevitable part of a trader's journey. What sets successful traders apart is their ability to not only acknowledge these mistakes but also to study and learn from them. In this comprehensive guide, we'll explore the art of dissecting your trading mistakes, understanding their origins, and using them as stepping stones towards trading mastery. Join us on this enlightening journey, enriched with real-world examples and practical insights.

Mastering the Study of Trading Mistakes

Embracing Imperfection 🙌

To become a successful trader, one must first accept that mistakes are an integral part of the process. Mistakes provide invaluable lessons and opportunities for growth.

Overleveraging

Ignoring Stop Loss

The Art of Mistake Analysis

1. Identify the Mistake: The first step is recognizing what went wrong. Was it a poor entry, impulsive decision, or neglect of risk management?

2. Examine the Context: Understand the market conditions, news, or emotions that led to the mistake.

3. Quantify the Impact: Assess the financial and emotional impact of the mistake. How did it affect your trading account and mental state?

4. Learn and Adapt: Use the mistake as a source of knowledge. Develop strategies or rules to avoid making the same error in the future.

Mistakes in trading are not failures but stepping stones to success. By studying your errors with a critical and open mindset, you can extract invaluable lessons that propel you toward trading mastery. The path to becoming a consistently profitable trader is paved with self-reflection, adaptation, and the unwavering commitment to learn from your past missteps. Embrace your mistakes as opportunities for growth and make them a part of your journey to trading excellence. 📈📚🛠

Please, like this post and subscribe to our tradingview page!👍

Unmasking the FOMO Effect in Trading 📈💼

Fear of missing out, or FOMO, is a psychological phenomenon that has infiltrated the world of trading, leaving traders susceptible to impulsive decisions and emotional turbulence. In this comprehensive exploration, we delve into the FOMO effect, dissecting its origins, manifestations, and the impact it has on traders. Join us on this investigative journey into the minds of traders gripped by FOMO, enriched with real-world examples and practical insights.

Demystifying the FOMO Effect

Understanding FOMO 🧐

FOMO is an emotional response stemming from the fear of missing out on a potentially profitable opportunity. It often leads to impulsive actions and irrational decision-making.

The Hasty Investment

Example 2: The Bandwagon Trader

Detecting FOMO in Trading

Traders gripped by FOMO often exhibit certain behaviors:

1. Impulsive Trading: They impulsively enter positions without conducting proper analysis or risk assessment.

2. Overtrading: FOMO-driven traders may trade excessively, believing that more trades will increase their chances of hitting a winning opportunity.

3. Chasing the Market: They chase trends and enter positions after significant price movements, often buying at peaks.

4. Ignoring Risk Management: Risk management principles are sometimes disregarded as the excitement of potential gains overshadows the need to protect capital.

The FOMO effect is a pervasive psychological phenomenon that traders must be vigilant about. To navigate the markets successfully, traders must recognize the signs of FOMO and develop strategies to mitigate its impact. This involves maintaining discipline, conducting thorough research, and adhering to risk management principles. By doing so, traders can steer clear of impulsive decisions and chart a more rational and profitable trading path. 📈💼🔍

Do you like this post? Do you want more articles like that?

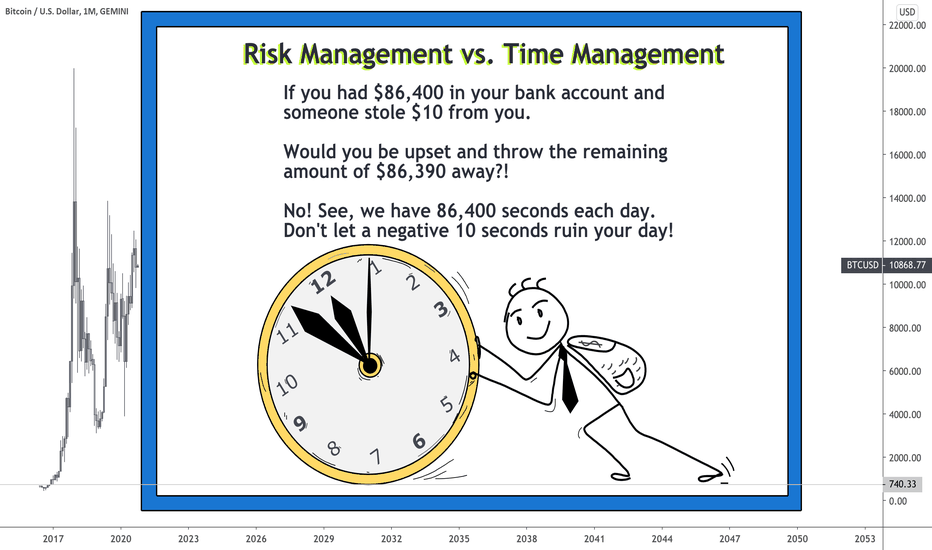

Risk Management vs. Time ManagementHey! Have you been spending day thinking about mistakes you made and things you didn't do?

Investors are knowingly comparing an exchanges to a casino. A gambler, losing, does not get up from the gambling table in the hope of winning back. He believes that the likelihood of winning increases with every lost bet. This phenomenon, called player mistake, is common among investors.

The pioneers of the theory of behaviour finance Hersh Shifrin and Meyer Statman showed in 1985 that investors intuitively misjudge the likelihood of repeating random results - they hold unprofitable positions too long, hoping for a return in prices, and close profitable positions too quickly, fearing that the movement will end.

The assertion that the market cannot fall for many sessions in a row is untenable. Short-term changes in asset prices are mostly random, notes analyst and author of several books on behaviour finance, James Montier, in his article Global equity strategy, gamblers fallacy. Tails does not become more probable after a series of heads, the coin has no memory - in the same way, the chances of success do not increase after a series of failures.

The major problem in the trading when we trying to recoup from losses. Many people make this mistake over and over again.

The reason of this mistake is the unwillingness to accept and calculate affordable losses and come to terms with the result, the wrong internal setting that you must end every trade and every trading session with a profit. But not every trade will be profitable.

How can I avoid this mistake?

1. After loss trade, tell yourself: "Stop, I won't trade now, I will pause."

2. Analyze the failed trade and write it down. Thus, you will allow yourself to "cool down" and more intelligently approach the situation on the market. There will always be opportunities, don't be afraid to miss out on any movement and profits.

3. Calmly develop a new trading plan based on market changes. If according to the trading plan you need to enter, then enter and earn. Do not rush to enter the market immediately, because it is easy to enter, but it is difficult to exit, since it is no longer possible to change the initial price at which you entered.

4. Make sure you following your risk management and always trade with possibility to lose.

Stay safe and good luck!

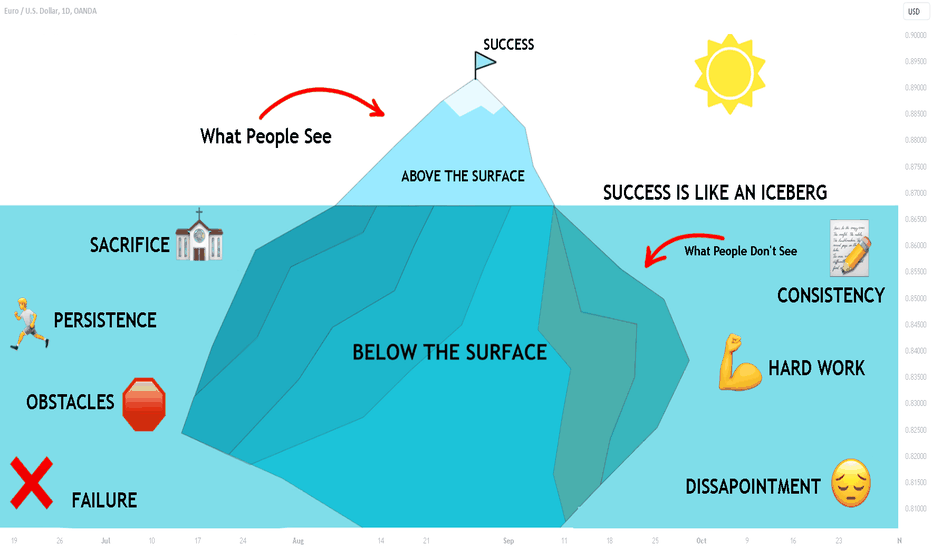

The REAL Story Behind SUCCESS in Trading

When people see a consistently profitable trader they do not consider all the costs a successful trader has paid overtime (below the surface) to get to what they see (above the surface).

So many things happen below the surface that nobody can see.

Here are some of the below the surface things that compose the top of the iceberg that everyone sees:

🔰Dedication – you need to be loyal to your dream of becoming a pro trader. Your belief must be that strong so no one could dissuade you. You need an iron discipline to make it happen.

🔰Hard work – you should work day after day not letting yourself give up. Charts must be in front of you as much as it is possible. Trading terminal must become your best friend.

🔰Good habits – follow your trading plan, do not break your rules of risk management, avoid FOMO, etc. This is the set of habits that will be your satellite in your trading journey. Do them consistently and they will become a natural part of your life.

🔰Disappointment – it does not matter how hard you try. Occasionally things will fall apart anyway: you will face losing streaks and a strategy will refuse to work. It will hurt. "Stand up straight with your shoulders back". Treat disappointments as temporary things.

🔰Sacrifice – to become a consistently profitable trader you should pay the price. Losses, time, nerves. Your prosperous future will have a tremendous cost.

🔰Failure – while you are learning how to trade you will inevitably blow a couple of trading accounts, you will spend time on strategies and techniques that do not work.

Occasionally you will fall. If so, stand up and keep going.

🔰Persistence – keep doing what you are doing no matter what. Do not let others persuade you that you can't make it. Even if things get tough, stay strong.

🔰Focus – always know what is your end goal, know where are you going, and what is your end destination.

🔰Flexibility – be prepared for sudden changes in the environment.

Keep your focus on the goals that you set learning to adjust to the changing circumstances.

🔰Consistency – you will not get the desired results immediately.

Be ready to do the same again and again, hundred times until the goal is achieved.

Overnight success does not exist. If you want to become a consistently profitable trade be prepared for years of struggling and pain. And do not be afraid, it is worth it.

Let me know, traders, what do you want to learn in the next educational post?

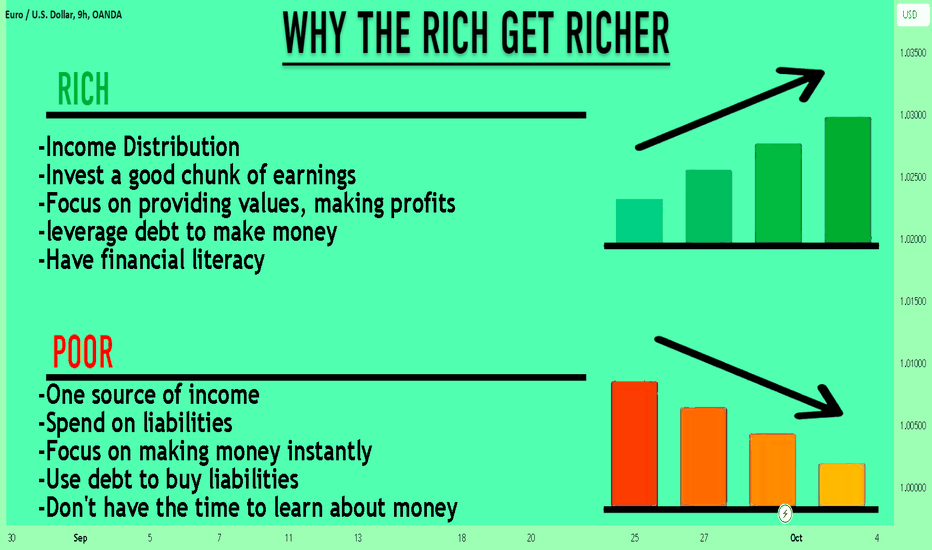

Why the Rich Get Richer and the Poor Get Poorer 📈💰📉

The widening gap between the wealthy and the impoverished is a growing concern in today's world. It's a complex issue with multiple factors at play, and it often leads to the rich getting richer while the poor become poorer. In this in-depth exploration, we'll dissect the key reasons behind this phenomenon, offering insights into the mechanisms that perpetuate inequality. With real-world examples, we'll shine a light on the socioeconomic forces driving this divide.

Understanding the Wealth Divide

The disparity in wealth accumulation isn't a new phenomenon but has intensified in recent years. Let's delve into the primary reasons behind this unsettling trend:

1. Income Inequality

Income inequality is a fundamental driver of wealth inequality. When the rich earn a disproportionately large share of a country's income, they have more capital available for investment and wealth generation.

2. Access to Education

Access to quality education plays a crucial role in wealth accumulation. Wealthier individuals often have greater access to education, including higher education, which can lead to better job opportunities and higher incomes.

3. Asset Ownership

Owning assets, such as stocks, real estate, and businesses, is a primary mechanism for wealth growth. The wealthy have more resources to invest in such assets, allowing their wealth to compound over time.

The cycle of the rich getting richer and the poor getting poorer is driven by a complex interplay of socioeconomic factors. Income inequality, access to education, and asset ownership are among the key elements perpetuating this divide. Addressing wealth inequality requires multifaceted solutions, including policies that promote income equality, improve educational access, and provide opportunities for asset accumulation among disadvantaged populations. By understanding the root causes of this issue, we can work toward a more equitable future where wealth is accessible to all. 📈💰📉

Please, support my work with like and comment!

Love you, my dear followers!👩💻🌸

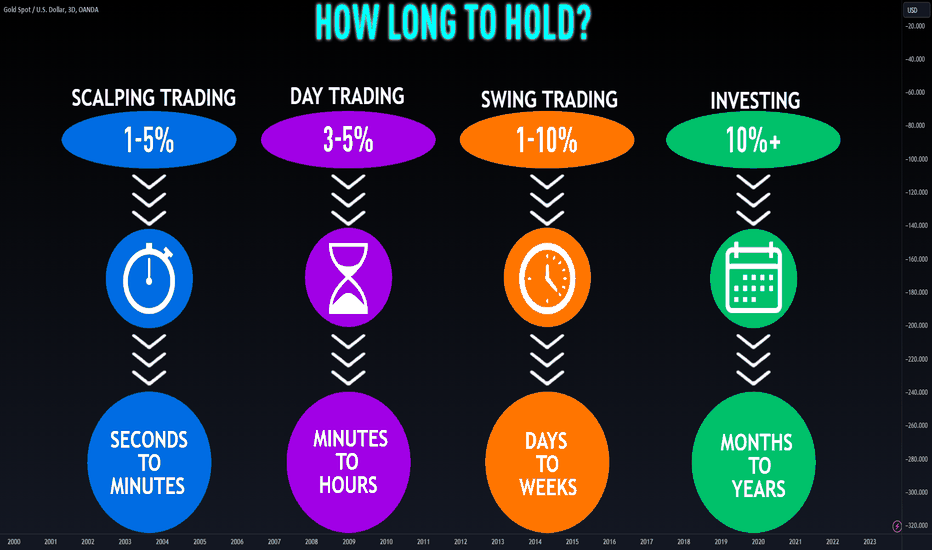

Timing Your Success: How Long to Hold in Forex Trading ⏳📈💼

In the dynamic world of forex trading, timing is everything. How long you hold a position can make or break your success. In this comprehensive guide, we'll explore the factors that influence the duration of your trades, backed by real-world examples, strategies, and insights to help you master the art of timing in forex trading. 🕒📈💰

Determining how long to hold a trade involves a delicate balance between your trading strategy, market conditions, and risk tolerance. Here are some key factors to consider:

1. Trading Style: Scalpers hold positions for minutes, day traders for hours, and swing traders for days or weeks. Your trading style dictates your holding period.

2. Market Volatility: Highly volatile markets may require shorter holding periods to manage risk, while stable markets can accommodate longer-term positions.

3. Trading Strategy: Different strategies, such as trend following or range trading, may necessitate varying holding times to align with their objectives.

Real-Life Timing Lessons 📊📉

1. Scalping for Quick Gains 🚀

2. Swing Trading for Larger Moves 🌟

3. Day Trading in Volatile Markets 🌪

Choosing how long to hold a forex trade is an art that combines strategy, analysis, and adaptability. By understanding the factors at play and learning from real-life examples, you can develop a personalized approach that aligns with your trading goals and risk tolerance. Timing truly is the key to unlocking success in the forex market. 🕒🚀💼

Let me know, traders, what do you want to learn in the next educational post?

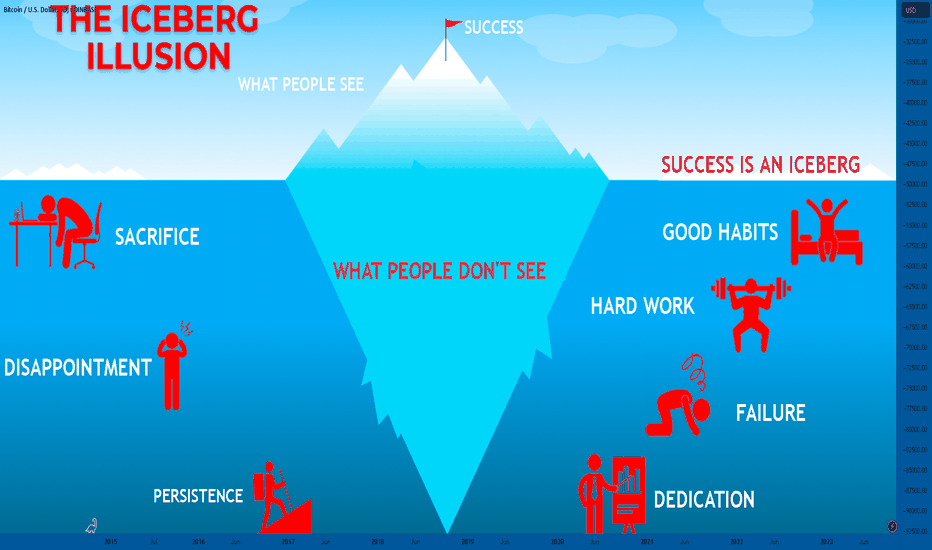

Unveiling the Iceberg Illusion of Success in Forex Trading🌊📈💡

Forex trading, like an iceberg, presents a deceptively simple surface while concealing complexity beneath. This enigmatic facet of the market is often referred to as the "Iceberg Illusion of Success." In this comprehensive exploration, we'll plunge beneath the visible market movements to uncover the hidden factors and dynamics that every forex trader should be aware of. Through real-world examples, you'll gain valuable insights into the forces that shape the forex landscape and influence trading outcomes.

Understanding the Iceberg Illusion of Success

The Iceberg Illusion of Success in forex trading refers to the idea that what novice traders typically see—price charts and technical indicators—is merely the visible tip of a much larger and intricate reality. Here's why grasping this concept is essential:

1. Hidden Market Forces

Beneath the surface of forex price charts lies a network of hidden market forces, including institutional trading, central bank interventions, and market sentiment. These powerful elements can significantly influence currency values but often remain unseen by retail traders.

2. Psychological Challenges

The Iceberg Illusion also extends to the psychological aspect of trading. Novice traders often perceive success as merely a matter of technical analysis. However, the emotional and psychological challenges that lie beneath the surface—such as discipline, risk management, and resilience—are equally critical to achieving long-term success.

3. Risk Management Depth

Risk management, a fundamental aspect of successful trading, often remains hidden beneath the surface of a trader's strategy. Effective risk management, including setting stop-loss orders and position sizing, is the foundation of capital preservation and long-term success.

Recognizing the Iceberg Illusion of Success is essential for traders navigating the complex world of forex trading. Success goes beyond the surface-level analysis and technical indicators. Hidden market forces, psychological resilience, and effective risk management all contribute to a trader's long-term journey. By diving beneath the surface and acknowledging the presence of this illusion, traders can better equip themselves to face the challenges of the forex market and achieve success over time. Remember, what you see in forex is just the tip of the iceberg. 🌊📈💡

What do you want to learn in the next post?

Exploring the Different Types of Orders in Trading 📊📈💹

Ordering success in the dynamic world of trading requires precision and strategy. Understanding the various types of orders at your disposal is akin to wielding different tools for different situations. In this comprehensive guide, we'll delve into the diverse universe of order types in trading, unraveling their purposes and when to employ them. Through real-world examples, you'll gain a profound understanding of how these orders can be the pillars of your trading success.

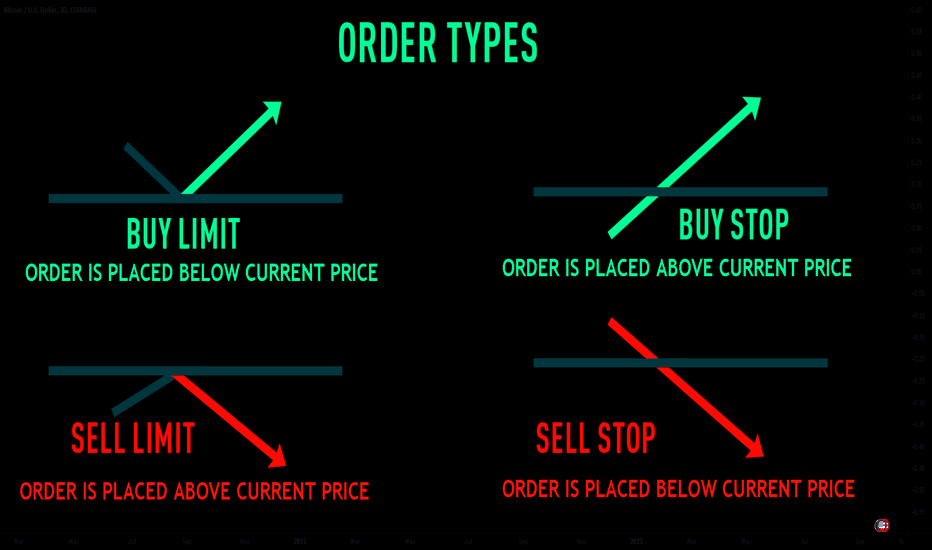

Types of Orders in Trading

Trading platforms offer a plethora of order types, each designed to serve a specific purpose. Here are four fundamental order types:

1. Market Order: The Need for Speed

A *market order* is executed at the current market price, guaranteeing immediacy but not a specific price. Traders use market orders when they want to enter or exit a position quickly.

2. Limit Order: Price Precision

A *limit order* specifies a particular price at which you're willing to buy or sell an asset. It ensures price precision but doesn't guarantee execution if the market doesn't reach your set price.

3. Stop Order: Managing Risk

A *stop order* becomes a market order when a specified price level (the "stop price") is reached. Traders use stop orders to limit potential losses or trigger entry into a trade when a particular price is breached.

4. Stop-Limit Order: Precision and Control

A *stop-limit order* combines elements of a stop order and a limit order. It involves two prices: the "stop price" and the "limit price." When the stop price is reached, the order becomes a limit order, specifying the minimum price at which you're willing to buy or sell.

Understanding the various types of orders in trading is crucial for executing your strategies effectively. Whether you're aiming for speed, price precision, risk management, or a combination, there's an order type that suits your needs. By mastering these tools and deploying them judiciously, you can navigate the complex world of trading with confidence and strategy. Remember, the right order at the right time can be the key to your trading success. 📊📈💹

Please, like this post and subscribe to our tradingview page!👍

Exploring the 4 Key Types of Fibonacci Tools🌐📈💫

In the vast cosmos of forex trading, Fibonacci tools serve as celestial guides for traders seeking precision and insight. These mathematical wonders unlock hidden patterns, potential reversals, and projection zones in price charts. In this comprehensive exploration, we'll embark on a cosmic journey to discover the four essential types of Fibonacci tools that can illuminate your path to forex trading success. Through real-world examples, you'll gain a profound understanding of how these tools can be your North Star in the forex galaxy.

The Four Types of Fibonacci Tools

Fibonacci tools are a diverse constellation, each with a unique purpose. Here are the four primary types that shine brightest in the world of forex:

1. Fibonacci Retracement: The Price Bouncer

*Fibonacci retracement* is a key tool for identifying potential reversal levels during corrective price movements within an established trend. Traders often use the key retracement levels of 23.6%, 38.2%, 50%, 61.8%, and 78.6% to pinpoint areas where price may bounce.

2. Fibonacci Extensions: Mapping Future Horizons

*Fibonacci extensions* project potential price targets beyond the current trend. Key extension levels include 127.2%, 161.8%, 261.8%, and 423.6%. Traders use these levels to anticipate where price might head after a trend has formed.

3. Fibonacci Fans: Drawing Trendlines

*Fibonacci fans* are tools for identifying potential trendlines by connecting significant high and low points on a price chart. These diagonal lines assist traders in spotting areas of support and resistance.

4. Fibonacci Arcs: Curving Towards Clarity

*Fibonacci arcs* offer a different perspective, using curved lines to identify potential support and resistance levels. These arcs are drawn from significant turning points on the price chart.

The world of Fibonacci in forex is a constellation of tools that can guide traders through the cosmic expanse of price charts. By mastering the four key types of Fibonacci tools and incorporating them into your trading strategy, you can enhance your ability to identify potential reversals, projection zones, and trendlines. Whether you're a seasoned trader or just launching your trading voyage, these Fibonacci tools can be your guiding stars in the forex universe. 🌐📈💫

Do you like this post? Do you want more articles like that?

Inside the Trader's Mind: Unraveling the Psychology of Trading🧠

Trading in the financial markets isn't just about numbers and charts; it's equally about understanding the intricate landscape of the trader's mind. The psychology of trading plays a pivotal role in a trader's success or downfall. In this in-depth exploration, we'll delve into the fascinating world of trader psychology, shedding light on the emotions, biases, and mental strategies that impact decision-making. Through real-life examples, you'll gain insights into the complex psychology behind trading.

Understanding Trader Psychology

Trader psychology encompasses a wide array of emotions and behaviors that influence trading decisions. Here are a few key aspects:

1. Fear and Greed:

- Fear: Fear can lead to hesitation and missed opportunities. For example, a trader might fear entering a trade because of previous losses, even when conditions favor success.

- Greed: Greed can lead to overtrading or holding positions for too long, hoping for larger profits. This can result in significant losses.

2. Loss Aversion:

- Traders often experience a heightened sensitivity to losses compared to gains. This can lead to premature closing of winning positions and letting losing trades run, both of which can harm profitability.

3. Confirmation Bias:

- Confirmation bias causes traders to seek and give more weight to information that confirms their existing beliefs or positions, even if it's not objectively accurate.

Examples of Trader Psychology in Action

Example 1: Fear of Missing Out (FOMO)

Example 2: Revenge Trading

After a series of losses, a trader becomes emotionally charged and seeks revenge on the market. They take aggressive positions without proper analysis, leading to further losses and emotional turmoil.

Understanding the psychology of trading is as essential as mastering technical analysis or risk management. Emotions like fear and greed can cloud judgment and lead to impulsive decisions. By recognizing and managing these psychological factors, traders can enhance their decision-making process and increase their chances of success. Remember, the journey to becoming a successful trader involves not only studying the markets but also understanding the complex workings of your own mind. 🧠💹🚀

What do you want to learn in the next post?

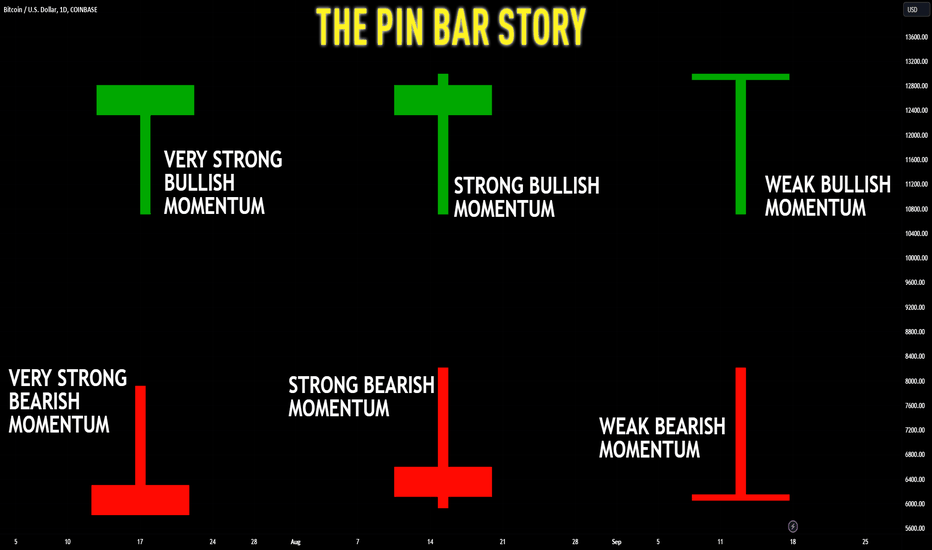

Mastering the Pin Bar Candlestick Pattern in Forex 🕵️♂️📈✨

In the world of forex and gold trading, chart patterns often hold the key to unlocking profit potential. Among these patterns, the pin bar stands out for its reliability and versatility. In this comprehensive guide, we'll delve into how to effectively apply the pin bar candlestick pattern to enhance your trading strategies. Through real-world examples, you'll gain the skills and knowledge to spot and leverage this powerful pattern in your trading endeavors.

Understanding the Pin Bar Candlestick Pattern

A pin bar, or "Pinocchio bar," is a single candlestick pattern that indicates potential price reversals or continuations. It consists of a small body with a long wick or "nose" that extends beyond the body. The direction of the nose (up or down) is a crucial signal:

- Bullish Pin Bar: The nose points downward and appears at the bottom of a downtrend, suggesting a potential bullish reversal.

Example 1: Bullish Pin Bar in Gold Trading

- Bearish Pin Bar: The nose points upward and forms at the top of an uptrend, indicating a possible bearish reversal.

Example 2: Bearish Pin Bar in Forex

Applying the Pin Bar in Your Trading Strategy

1. Confirmation: Don't rely solely on the pin bar; use it in conjunction with other technical analysis tools like support and resistance levels, trendlines, and indicators to confirm your trade.

2. Risk Management: Set stop-loss orders below the low (for bearish pin bars) or above the high (for bullish pin bars) of the pin bar to limit potential losses.

3. Entry and Exit: Determine your entry and exit points based on the pin bar's implications. For instance, you might enter a trade on the open of the next candle after a pin bar and exit when a predetermined profit target is reached.

The pin bar candlestick pattern is a valuable tool in forex and gold trading, offering insights into potential reversals or continuations. By understanding its structure and applying it in conjunction with other technical analysis tools, you can make more informed trading decisions. Remember, practice and careful analysis are key to successfully integrating the pin bar into your trading strategy. Now, armed with this knowledge, you're ready to uncover profit potential in the markets! 🕵️♂️📈✨

Dear followers, let me know, what topic interests you for new educational posts?

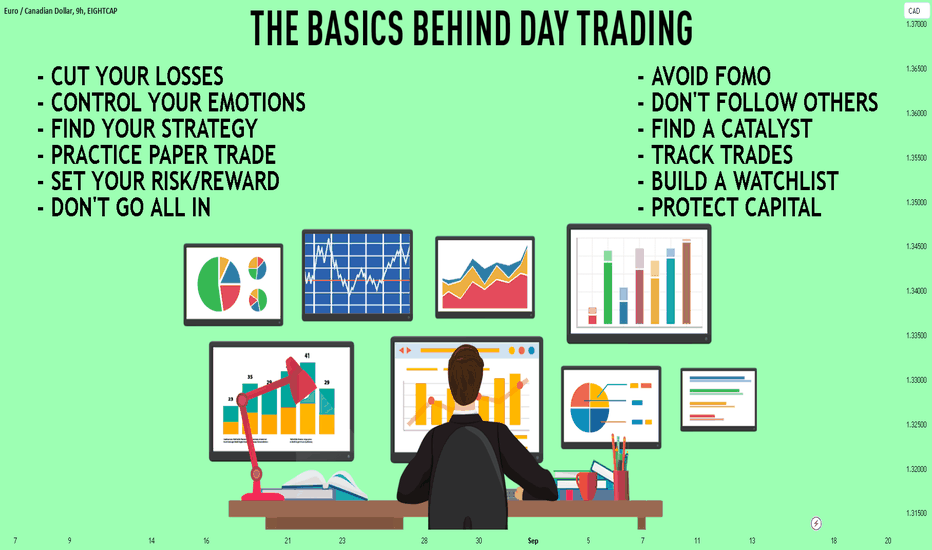

Simple Recommendations for Newbie Day Traders in Forex 🌟📈💼

Twitter Hashtags:

1. #

2. #

3. #

4. #

5. #

6. #

Embarking on the exhilarating journey of day trading in forex and gold can be both thrilling and challenging, especially for newcomers. In this comprehensive guide, we'll provide straightforward recommendations to help newbie day traders navigate these dynamic markets. Drawing from the wisdom of experienced traders, we'll offer valuable insights and real-world examples to set you on a course for success.

1. Learn the Basics: Knowledge is Power

Before you dive in, ensure you have a solid understanding of the forex and gold markets. Learn the terminology, grasp the fundamentals, and familiarize yourself with trading strategies.

2. Practice with a Demo Account: Safe Harbor for Learning

Newbie traders should begin with a demo account to hone their skills without risking real capital. Use this platform to test strategies, understand market dynamics, and develop your trading style.

3. Develop a Trading Plan: Chart Your Course

Create a well-defined trading plan that includes your risk tolerance, entry and exit strategies, and money management rules. Stick to your plan, and avoid making impulsive decisions.

As a newbie day trader venturing into the forex and gold markets, the journey may seem daunting, but with the right guidance, it can be highly rewarding. By learning the basics, practicing with a demo account, and crafting a well-defined trading plan, you can set a course for success. Remember, patience and discipline are your allies in the world of day trading. Now, hoist your sails and embark on this exciting voyage with confidence! 🌟📈💼

Please, support my work with like and comment!

Love you, my dear followers!👩💻🌸

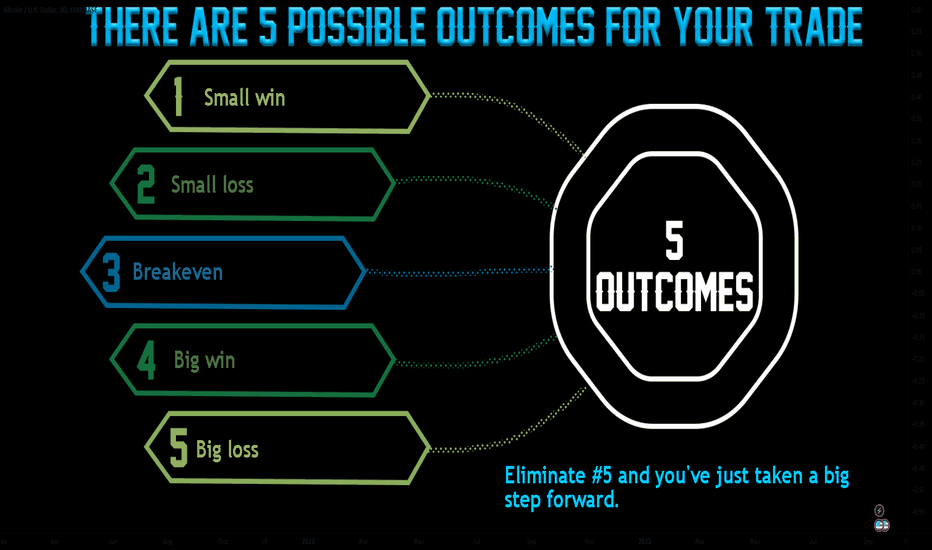

Navigating the Forex Waters: 5 Possible Trading Outcomes🌊💹🚀

In the world of forex trading, each journey is a unique voyage filled with uncertainties. Every trade you embark upon carries the potential for different outcomes. In this comprehensive article, we'll explore the five possible results of your forex trades. We'll provide real-world examples and equip you with the knowledge to navigate these outcomes effectively, ensuring a smoother ride on your trading journey.

1. Profitable Trade: Riding the Waves of Success

A profitable trade is the holy grail of forex trading. It's when your analysis and execution align perfectly, resulting in gains.

2. Breakeven Trade: Holding Steady in Turbulence

A breakeven trade occurs when you exit a trade without making a profit or incurring a loss. It's a crucial outcome for risk management.

3. Small Loss: Navigating Choppy Waters

Incurring a small loss is a common outcome in forex trading. It's when your analysis doesn't quite align with market movements, resulting in a manageable loss.

4. Moderate Loss: Weathering the Storm

A moderate loss occurs when market movements go against your position, resulting in a larger loss than expected.

5. Significant Loss: Adapting to a Sea Change

A significant loss is the result of adverse market movements that lead to substantial financial setbacks.

Understanding the various outcomes of your forex trades is essential for successful navigation in the forex market. By analyzing and adapting to these outcomes, you can refine your trading strategy, manage risk effectively, and enhance your chances of achieving profitable voyages in the forex waters. Remember, every trade is a learning experience that contributes to your growth as a trader. 🌊💹🚀

Please, like this post and subscribe to our tradingview page!👍

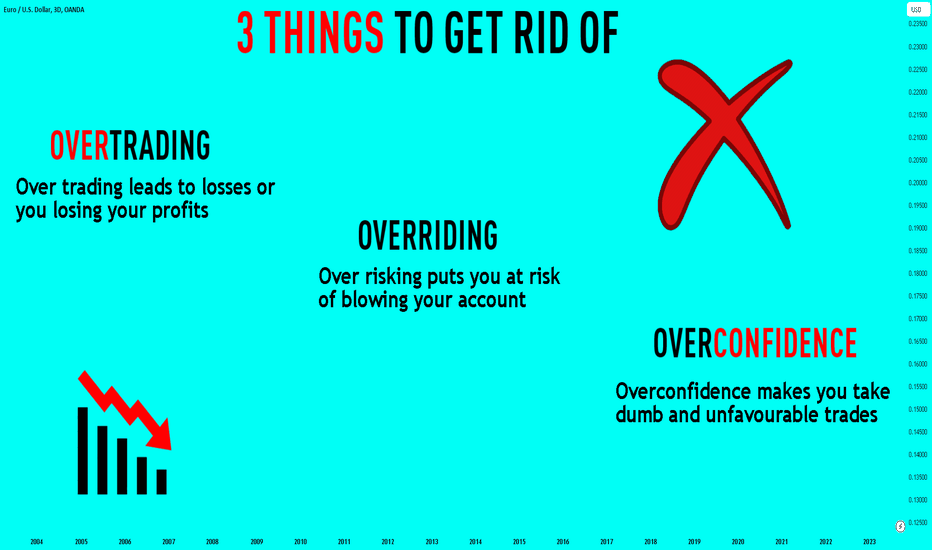

Sailing Smooth in Forex: 3 Hazards to Abandon" 🚢💹🔐

In the vast sea of forex trading, success often hinges on what you let go of rather than what you acquire. Overtrading, overrisking, and overconfidence are like treacherous waves that can capsize your trading ship. In this article, we'll explore these three perilous habits and explain why you must bid them farewell for a safer and more profitable voyage in the world of forex.

1. Overtrading: The Temptation to Sail Too Often

Overtrading occurs when traders execute an excessive number of trades, often beyond their risk tolerance or strategy capacity.

2. Overrisking: The Peril of Excessive Exposure

Overrisking involves allocating too much of your capital to a single trade, disregarding prudent risk management.

3. Overconfidence: The Siren's Call

Overconfidence can lead traders to believe they are infallible, causing them to neglect due diligence and risk management.

In the unpredictable waters of forex trading, success requires abandoning the hazardous habits of overtrading, overrisking, and overconfidence. By recognizing and addressing these tendencies, you can set a course for safer and more profitable trading. Remember, a disciplined and calculated approach is the lighthouse that guides you through the fog of trading uncertainties. 🚢💹🔐

Do you like this post? Do you want more articles like that?

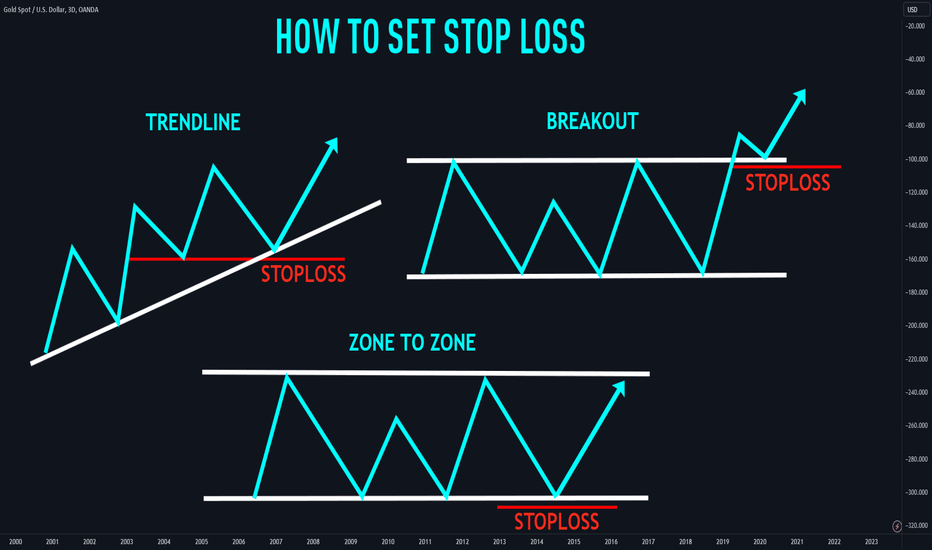

Mastering Risk: A Guide to Setting Stop Loss in Forex Trading 🛡

In the world of forex trading, where price fluctuations can be swift and unpredictable, mastering risk is paramount. One of the most crucial risk management tools at your disposal is the stop loss order. In this comprehensive guide, we will explore the ins and outs of setting stop losses in forex trading. We'll provide real-world examples and equip you with the knowledge needed to protect your capital and trade with confidence.

The Importance of Setting Stop Loss Orders

A stop loss order is a predetermined price level at which a trade is automatically closed to limit potential losses. Here's why setting stop losses is vital in forex trading:

1. Risk Management: Forex trading carries inherent risks. Stop losses allow you to define your maximum acceptable loss and protect your capital.

2. Emotion Control : Trading can evoke strong emotions. Stop loss orders remove the need for impulsive decisions during adverse price movements, promoting discipline and reducing emotional stress.

3. Preserving Capital: Successful trading is about longevity. By limiting losses, stop loss orders help you maintain your capital, ensuring you have the resources to seize future opportunities.

Setting Stop Loss: Strategies and Examples

Example 1: EUR/USD Long Position:

Example 2: GBP/JPY Short Position:

Setting stop loss orders is a fundamental aspect of responsible and successful forex trading. By mastering the art of setting stop losses, you can effectively manage risk, maintain discipline, and ensure that your trading journey is characterized by longevity and success. Remember, it's not about avoiding losses entirely, but about controlling them to protect your capital and thrive in the forex market. 🛡📉📊

Let me know, traders, what do you want to learn in the next educational post?

Consistency - How To Master TradingTrading has always been an alluring career. The promise of financial freedom and the ability to escape the chains of a 9-5 job have led many individuals to explore the world of trading.

This is the same for me. I've first came across trading when I was serving in the army when I was 18. Trading is a whole new world to me. Candlesticks, expert advisors, and indicators all promised a world of luxury and freedom.

However, the path to becoming a successful trader is not an easy one. It requires discipline, knowledge, and the ability to control one's emotions.

My journey was constantly on and off, looking at small successes, then followed by big failures. It was around 5 years ago when I started to be serious in my trading career. It's definitely not a short one, but it's not long either.

In this article, I will delve into the key factors that can help you become a successful trader. From developing a systematic trading system to mastering risk management and overcoming emotional hurdles, we will cover it all. So, let's embark on this journey and unlock the secrets to becoming a profitable trader.

One of the key components of becoming a successful trader is the development of a systematic trading system. Without a well-thought-out plan, trading becomes a chaotic and unpredictable process. As the famous quote goes,

Knowledge is power, but without action, it is useless.

It is not enough to possess knowledge about various trading concepts and indicators. You must have a fixed strategy that you consistently trade with.

You fall into the trap of having a scattered approach to trading. You lack a well-defined trading plan and jump from one strategy to another, hoping to find the holy grail of trading. This lack of consistency and focus leads to poor results and frustration.

It took me years to be profitable. I tried many expert advisors, signals, indicator, PAMM and account management. It took me years of losses. Is it worth it? Probably. I could have accelerated my journey with a good and solid mentor. It took me years to condense my experiences into the trading system below.

Start by marking up your charts and identifying areas of liquidity, points of interest, and demand and supply zones. Conduct a thorough multi-timeframe analysis to identify higher probability trade opportunities. Set alerts at your points of interest to ensure you don't miss any trading opportunities.

Once a trade setup is triggered, write down your analysis on the chart. Clearly articulate what you expect to happen when the price hits your point of interest. This will help you stay focused on your trade plan and avoid impulsive decision-making.

When the alert goes off, evaluate your analysis to ensure it still holds true. If it does, mark out your stop loss and profit target levels based on your risk management principles. Confirm that the risk-to-reward ratio is suitable before entering the trade. If necessary, wait for additional confirmation on a lower timeframe before executing the trade.

Once in the trade, you have the option to either actively manage your position or let it run its course. This decision should be based on your backtesting results and personal preferences. Regardless of your approach, it is crucial to journal your trades. Record your entry, take-profit, and stop-loss levels, as well as any emotions or thoughts you experienced during the trade. This data will be invaluable for analyzing your performance and identifying areas for improvement.

Emotions can be both a greatest ally and a worst enemy. It is crucial to develop emotional discipline and learn how to control your feelings when making trading decisions. Emotions such as fear, greed, and impatience can cloud your judgment and lead to impulsive and irrational trading actions.

One common emotional pitfall is revenge trading. After experiencing a loss, you often feel the need to immediately recoup their losses by taking impulsive trades. This behavior is driven by anger and a desire to prove oneself right. However, revenge trading rarely ends well and typically leads to further losses.

I wasn't good at controlling my emotions in the past. I tend to get angry and sad whenever I had a losing trade. This is made worse when I was having a losing streak. I would deviate from my trading plan and enter into a position when it does not fit my trading plan. You guessed it, I went deeper into drawdown and this vicious cycle continues.

To overcome emotional hurdles, it is essential to stick to your trading plan and follow your predetermined rules. Trust the process and have faith in your strategy. Avoid making impulsive decisions based on short-term market movements or emotional reactions.

One effective way to maintain emotional discipline is through the use of a trading journal. By documenting your trades and recording your emotions and thoughts, you can gain valuable insights into your trading psychology. Reviewing your journal regularly will help you identify patterns and emotional triggers, allowing you to develop strategies to manage your emotions effectively.

Successful trading is not just about making profitable trades. It is also about managing risk. Risk management is the key to preserving capital and ensuring long-term profitability. Without proper risk management, even the most profitable trading strategy can lead to financial ruin.

A crucial aspect of risk management is determining an appropriate position size for each trade. This involves calculating the amount you are willing to risk on each trade based on your account size and risk tolerance. I recommend risking no more than 1% of your trading account on any single trade. This conservative approach helps protect your capital and prevents catastrophic losses.

I once had a losing streak of 7 trades. On the 8th trade, everything was telling me that I should go long on EURUSD. It was a A+ setup. Everything followed my plan. I increased my risk from 1% to 10%. Guess what? I lost this trade.

Anything can happen in the market.

Even with a 80% win rate trading system, it may seem impossible to have 10 losing trades in a row. Statistically speaking, it IS possible.

Another important risk management technique is the use of stop-loss orders. A stop-loss order is a predetermined price level at which you will exit a trade to limit your losses. By setting a stop loss, you define your maximum acceptable loss on a trade. This helps protect your trading account from significant drawdowns and allows you to maintain emotional discipline during adverse market conditions.

Trailing stop-loss orders can also be used to protect profits as a trade moves in your favor. This allows you to lock in profits while still allowing the trade to potentially run in your favor.

Becoming a successful trader requires practice and screen time. The more time you spend observing the markets, analyzing charts, and executing trades, the better you will become at identifying patterns and making informed trading decisions.

Practice is especially crucial to you if you are still developing your skills and gaining experience. Consider starting with a demo account to familiarize yourself with the trading platform and practice your strategy without risking real money. This allows you to refine your trading approach and gain confidence before transitioning to a live trading account.

As you gain experience and confidence, gradually increase the size of your trades while maintaining proper risk management principles. This gradual progression will help you build consistency and avoid the pitfalls of overtrading or taking excessive risks.

For many of you, finding an accountability partner is your path to success. An accountability partner is someone who holds you responsible for your trading actions and helps you stay on track with your goals. They can provide support, guidance, and feedback on your trading performance. Regular check-ins and discussions with your accountability partner can help you stay disciplined and focused on your trading plan.

Accountability partners can offer valuable support, tips and motivation. Conduct thorough research and due diligence to ensure that you are partnering with reputable individuals who have a proven track record. Records should also be verified by third parties such as Myfxbook and not excel, where they can write anything they want.

If you've been following me for the past few months or years, you would have known about my journey from being an unprofitable trader to a profitable one. I believe I'm successful right now, and is well on track to quitting my 9-5 job. I have a prop firm funded account journey here, where I document my journey to get a public 10k account for growing my YouTube channel. I also have a verified public track record.

Right now, I'm currently $230,000 funded, with 2x $200,000 challenges in Phase 2, and 1x $200,000 in phase 1. If I manage to pass these challenges, my AUM will jump up to $830,000.

Becoming a successful trader is a journey that requires discipline, knowledge, and emotional discipline. By developing a systematic trading system, managing risk effectively, and maintaining emotional discipline, you can increase your chances of achieving profitability in the financial markets.

Remember to focus on the process rather than the outcome. Trading is not a get-rich-quick scheme, but rather a long-term endeavor that requires continuous learning and adaptation. Be patient, stay committed to your trading plan, and continuously work on improving your skills.

With the right mindset, dedication, and a commitment to continuous learning, you can unlock the potential of trading and work towards achieving your financial goals. So, embark on this journey with confidence and embrace the challenges that lie ahead.

Happy trading!

Let me know if this post resonates with you. If it does, how does it relates to you!