Common trading mistakes to avoid as a trader ❌

For new market traders, review these common trading mistakes so you can avoid emotional blunders with your investments and take advantage of psychological edges.

The mechanics of trading are relatively simple. A click or two gets you into a trade, and a click or two gets you out. But the decision-making process behind those clicks is much more complex. And with complexity comes more opportunities to make mistakes that can affect your bottom line. Here are seven common mistakes that traders—both new and experienced—sometimes make.

1️⃣Mistake 1: Emotional trading/psychological trading

Trading can bring out the best and the worst in us. For a trader, nothing is more frustrating than opening a long position and seeing the market drop, bringing the value of your long position to levels well below the price you bought it. The same can be said about missing out on a move in a stock that's been on your radar for a while.

Anger, fear, and anxiety can lead traders to make quick and even irrational emotion-based decisions.

The reality is that markets are cyclical, moving through ups and downs. Trading decisions based on emotions may not always give the results you want. Instead, take a step back and think through the situation logically. Every situation is different, and instead of buying or selling in a panic, think about how you can best manage risk.

2️⃣Mistake 2: Pulling stop orders

When a position hits a stop order, it can often mean you're going to take a loss on it. Pulling—or canceling—a stop is often a subliminal attempt to avoid admitting you were wrong. After all, as long as the position is open, there's still a chance it could come back and be profitable.

The problem is every 50% loss starts with a 5% loss. It's not magic; it's just math. And it only takes one small loss that turns into a big one to make a big dent in a portfolio. Losing is no fun, but it's part of trading. Being disciplined about managing stop orders may help you come back and trade another day.

3️⃣Mistake 3: Trading without a plan

Trading plans should act as a blueprint during your time on the markets. They should contain a strategy, time commitments and the amount of capital that you are willing to invest.

After a bad day on the markets, traders could be tempted to scrap their plan. This is a mistake, because a trading plan should be the foundation for any new position. A bad trading day doesn’t mean that a plan is flawed, it simply means that the markets weren’t moving in the anticipated direction during that particular time period.

Every trader makes mistakes, and the examples covered in this article don’t need to be the end of your trading. However, they should be taken as opportunities to learn what works and what doesn’t work for you. The main points to remember are that you should make a trading plan based on your own analysis, and stick to it to prevent emotions from clouding your decision-making.

Hey traders, let me know what subject do you want to dive in in the next post?

Trading Plan

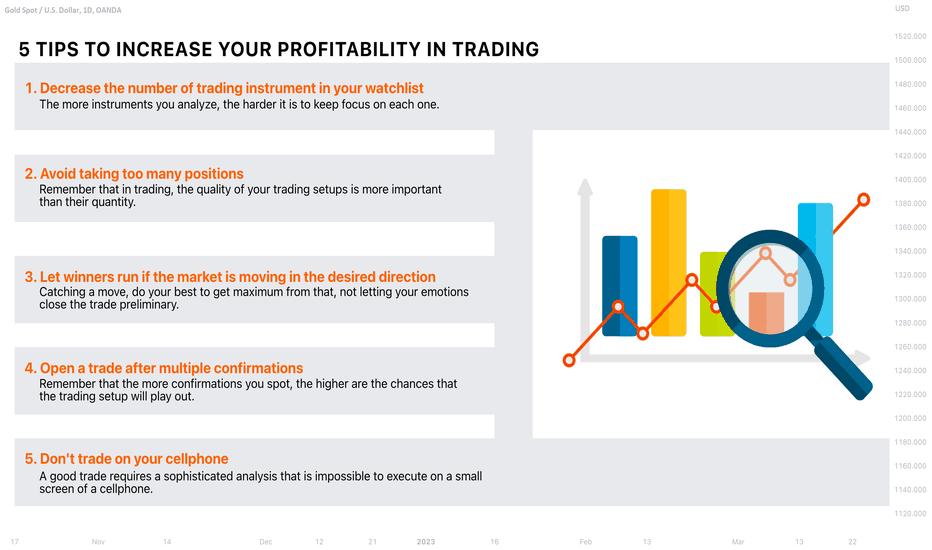

Top 5 Tips to Increase Your Profits in Trading 📈

In this educational article, I will share with you very useful tips how to improve your profitability in trading the financial markets.

1. Decrease the number of financial instruments in your watch list. ⬇️

Remember that each individual instrument in your watch list requires attention. The more of them you monitor on a daily basics, the harder it is to keep focus on them.

In order to not miss early confirmation signals and triggers, it is highly recommendable to reduce the size of your watch list and pay closer attention to the remaining instruments.

2. Avoid taking too many positions. ❌

For some reason, newbie traders are convinced that they should constantly trade and keep many trading positions.

Firstly, I want to remind you that the management of an active position is a quite tedious process that requires time and attention.

Therefore, more positions are opened, more time and effort is required.

Secondly, if the newbies can not spot a good setup, they assume that they are obliged to open some positions and they start forcing the setups.

Remember, that in trading, the quality of the trading setup beats the quantity. I advise taking less trades, but the better ones.

3. Let winners run if the market is going in the desired direction. 📈

Once you caught a good trade and the market is moving where you predicted, do not let your emotions close the trade preliminary.

Try to get maximum from your trade, closing that only after the desired level is reached.

4. Open a trade after multiple confirmations.✅

Analyzing a certain setup remember, that more confirmations you spot, higher is the accuracy of the trade that you take. In order to increase your win rate, it is recommendable to wait for at least 2 confirmations.

5. Don't trade on your cellphone. 📱

A good trade always requires a sophisticated analysis that is impossible to execute on the small screen of the cellphone.

A lot of elements and nuances simply will not be noticed. For that reason, trade only from a computer with a wide screen.

Relying on these tips, you will substantially increase your profits.

Take them into the consideration and good luck to you in your trading journey.

❤️Please, support my work with like, thank you!❤️

Unleashing the Power of Sentiment Indicators in TradingChapter 1: Introduction to Sentiment Indicators

In the world of trading and investment, understanding market sentiment is essential for making informed decisions. Market sentiment refers to the overall attitude, emotions, and opinions of market participants towards a particular financial instrument, sector, or the market as a whole. It is a key factor that influences price movements and can provide valuable insights for traders.

The role of emotions in trading is also crucial. Emotions such as fear, greed, optimism, and pessimism can significantly impact trading decisions and market behavior. Understanding and analyzing these emotions can help traders gauge market sentiment and identify potential trading opportunities.

Sentiment analysis is the approach used to measure and quantify market sentiment. It involves extracting subjective information from various sources such as social media, news articles, and options markets to determine the prevailing sentiment. The goal is to understand and interpret the collective emotions of market participants.

Sentiment indicators play a vital role in sentiment analysis. These indicators are tools and metrics that provide quantifiable measures of market sentiment. By incorporating sentiment indicators into their analysis, traders can gain a deeper understanding of market psychology and make more informed trading decisions.

In the following chapters, we will explore different types of sentiment indicators and their applications in trading. We will delve into social media sentiment analysis, news sentiment analysis, options market sentiment, and more. Through real-life case studies and examples, we will demonstrate how traders can effectively leverage sentiment indicators to enhance their trading strategies and navigate the markets with greater confidence.

So let's dive into the exciting world of sentiment indicators and discover how they can empower traders to make smarter trading decisions in various market conditions.

Chapter 2: Social Media Sentiment Analysis

Social media has become a powerful platform for expressing opinions and sharing information, making it an invaluable source for understanding market sentiment. Platforms such as Twitter, Facebook, and Reddit provide real-time insights into the thoughts and emotions of a wide range of market participants.

Traders can harness the power of social media by analyzing sentiment expressed in posts, comments, and discussions related to financial instruments or markets. This can be done through the use of sentiment analysis tools and platforms. These tools employ natural language processing and machine learning algorithms to analyze and quantify sentiment.

When analyzing social media sentiment, it is crucial to identify the influential platforms for each specific market. Different financial instruments and markets have unique social media platforms where participants share their views and opinions. For example, Twitter might be the primary platform for discussions related to cryptocurrencies, while LinkedIn could be more relevant for the stock market. By focusing on the platforms that hold more influence, traders can gain more accurate insights into market sentiment.

Real-time sentiment analysis of social media involves monitoring conversations, identifying relevant keywords, and applying sentiment analysis algorithms. This process enables traders to gauge the sentiment as positive, negative, or neutral. By tracking sentiment shifts in real-time, traders can make timely trading decisions and take advantage of emerging trends or sentiment-driven price movements.

To illustrate the effectiveness of social media sentiment analysis, let's explore some case studies. In one example, a trader monitors sentiment on Twitter for a particular cryptocurrency. By analyzing the sentiment expressed in tweets, the trader identifies a surge in positive sentiment accompanied by an increase in trading volume. This information serves as a signal to enter a long position, anticipating a price increase driven by bullish sentiment. The trader successfully profits from the sentiment-driven rally.

In another case, a trader uses sentiment analysis of social media discussions to identify a sudden increase in negative sentiment towards a stock. Recognizing this shift in sentiment, the trader decides to exit their position or tighten their stop-loss level to protect their profits, anticipating a potential price decline. This proactive risk management based on sentiment analysis helps the trader avoid potential losses.

By incorporating social media sentiment analysis into their trading strategies, traders can gain a deeper understanding of market sentiment and improve their decision-making process. However, it is important to remember that social media sentiment analysis should be used as one piece of the puzzle alongside other forms of analysis to build a comprehensive trading strategy.

Chapter 3: News Sentiment Analysis

News plays a significant role in shaping market sentiment. Positive news such as strong earnings reports, positive economic indicators, or favorable regulatory developments can create a bullish sentiment, leading to increased buying interest. Conversely, negative news such as poor economic data, geopolitical tensions, or negative corporate announcements can generate a bearish sentiment, resulting in selling pressure.

News sentiment analysis involves analyzing the sentiment expressed in news articles, press releases, and other sources of financial news. The goal is to extract the overall sentiment conveyed by the news and understand its potential impact on market sentiment and price movements.

There are various tools and techniques available for news sentiment analysis. These tools employ natural language processing and machine learning algorithms to analyze the sentiment of individual news pieces. They assign sentiment scores, such as positive, negative, or neutral, to quantify the sentiment expressed in the news.

Financial news headlines are particularly important as they often convey the key sentiment of an article. Traders can focus on analyzing sentiment in news headlines to quickly gauge the overall sentiment without delving into the complete article. This allows for efficient scanning of multiple news sources and provides traders with timely insights into market sentiment.

Incorporating news sentiment analysis into trading strategies can be done in several ways. Traders can use sentiment-triggered trade entries, where they initiate trades based on significant shifts in news sentiment. For example, a trader might enter a long position in response to overwhelmingly positive news sentiment regarding a particular stock, anticipating a price increase. Alternatively, news sentiment can serve as a confirming factor for technical analysis. If technical indicators suggest a bullish trend, positive news sentiment can provide additional confidence in the trade.

Let's examine a case study to further illustrate the application of news sentiment analysis. Suppose a trader is analyzing the sentiment surrounding a company's earnings announcement. Through news sentiment analysis, the trader identifies a strong positive sentiment across various financial news sources. This positive sentiment indicates high market expectations for the company's earnings results. Based on this analysis, the trader decides to enter a long position before the earnings release, anticipating a favorable outcome. When the company exceeds expectations and reports stellar earnings, the positive sentiment is reinforced, resulting in a significant price increase. The trader profits from the sentiment-driven rally by making a well-timed trade based on news sentiment analysis.

Chapter 4: Options Market Sentiment

Options trading provides valuable insights into market sentiment as it reflects investors' expectations and sentiment towards the underlying asset. By analyzing options market sentiment, traders can gain a deeper understanding of market sentiment and potential price movements.

One commonly used sentiment indicator in options trading is the put/call ratio. The put/call ratio compares the volume of put options, which give traders the right to sell an asset, to the volume of call options, which give traders the right to buy an asset. A high put/call ratio suggests bearish sentiment, indicating that more traders are betting on a price decline. Conversely, a low put/call ratio indicates bullish sentiment, with more traders anticipating a price increase.

Another important indicator is implied volatility. Implied volatility is derived from options prices and reflects the market's expectation of future price volatility. Higher implied volatility suggests increased market uncertainty and potentially heightened bearish sentiment, while lower implied volatility indicates lower expected volatility and potential bullish sentiment.

Traders can also analyze options-related metrics such as open interest, the skew index, and the volatility skew to gauge market sentiment. Open interest represents the total number of outstanding options contracts, providing insights into trader positioning and sentiment. The skew index measures the perceived risk of extreme price moves, while the volatility skew indicates the difference in implied volatility between options with different strike prices.

To illustrate the application of options market sentiment, let's consider a case study. Suppose a trader observes a high put/call ratio in a particular stock, indicating bearish sentiment. This signals a potential price decline. The trader combines this information with other technical indicators pointing towards a bearish trend and decides to enter a short position. As the market sentiment unfolds, the stock experiences a significant price drop, validating the initial bearish sentiment and resulting in a profitable trade for the trader.

Chapter 5: Fear and Greed Index

The Fear and Greed Index is a sentiment indicator that measures market sentiment on a scale of extreme fear to extreme greed. It combines various factors, such as stock price momentum, market volatility, junk bond demand, and safe-haven flows, to gauge overall market sentiment.

The components and calculation of the Fear and Greed Index can vary, but the index generally assigns a numerical value or category to represent the prevailing sentiment. Extreme fear levels suggest a highly pessimistic sentiment, often associated with market downturns or significant price declines. On the other hand, extreme greed levels indicate excessive optimism and potentially overbought conditions, signaling a potential market correction.

Traders can incorporate the Fear and Greed Index into their trading strategies in several ways. It can serve as a confirming factor for technical analysis, where extreme fear or greed levels align with other indicators pointing towards a potential trend reversal. Additionally, contrarian traders may use extreme sentiment levels as a signal to consider taking opposite positions, capitalizing on potential market reversals.

Let's explore a case study to demonstrate the practical application of the Fear and Greed Index. Suppose the Fear and Greed Index reaches an extreme greed level, indicating excessive optimism and potentially overbought conditions in the market. A trader who closely monitors the index recognizes this as a warning sign and starts analyzing other technical indicators. They observe overextended price levels, declining trading volume, and bearish divergence on oscillators. Taking all these factors into consideration, the trader decides to exit their long positions or initiate short positions, anticipating a potential market correction. As the market sentiment shifts from extreme greed to fear, the market experiences a significant decline, validating the trader's decision and resulting in profitable trades.

Chapter 6: Conclusion and Future Outlook

In conclusion, sentiment indicators provide valuable insights into market psychology and can significantly enhance trading decisions. By understanding market sentiment through sentiment analysis tools, traders can gain an edge in their strategies. Social media sentiment analysis allows traders to tap into the real-time opinions and emotions of market participants, while news sentiment analysis helps traders assess the impact of news events on market sentiment. Options market sentiment and sentiment indicators such as the Fear and Greed Index provide additional perspectives on investor expectations and sentiment towards the market.

As technology and data analysis techniques continue to advance, sentiment analysis is expected to evolve further. Integration of artificial intelligence and machine learning algorithms can enhance sentiment predictions and improve the accuracy of sentiment analysis tools. This will empower traders with even more robust insights into market sentiment.

To harness the power of sentiment indicators effectively, it is essential to integrate them with other forms of analysis, such as technical analysis and fundamental analysis. By combining multiple perspectives, traders can make well-informed trading decisions and increase their chances of success.

In the ever-changing landscape of financial markets, sentiment indicators will continue to play a crucial role in understanding market dynamics. By staying abreast of emerging trends and advancements in sentiment analysis, traders can adapt their strategies and stay ahead of the curve. Ultimately, by leveraging sentiment indicators, traders can enhance their trading success and capitalize on market opportunities.

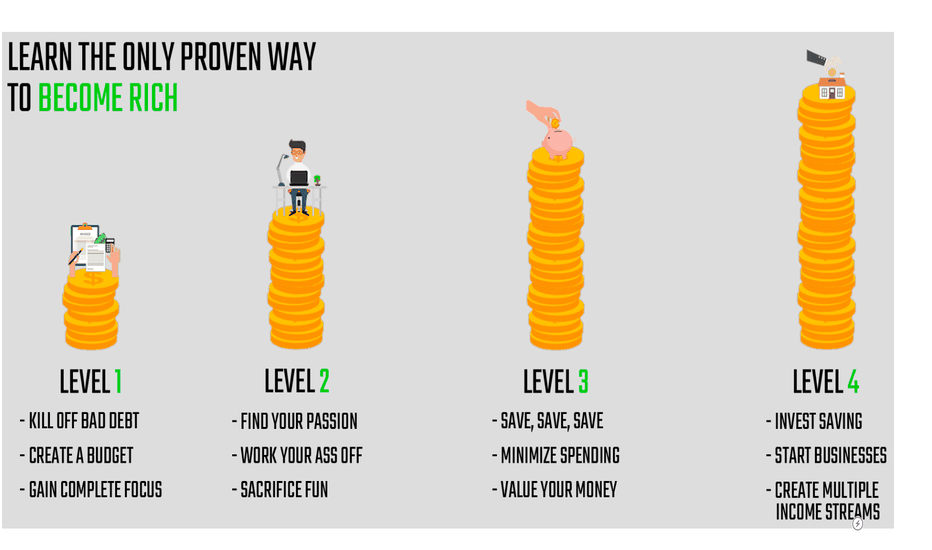

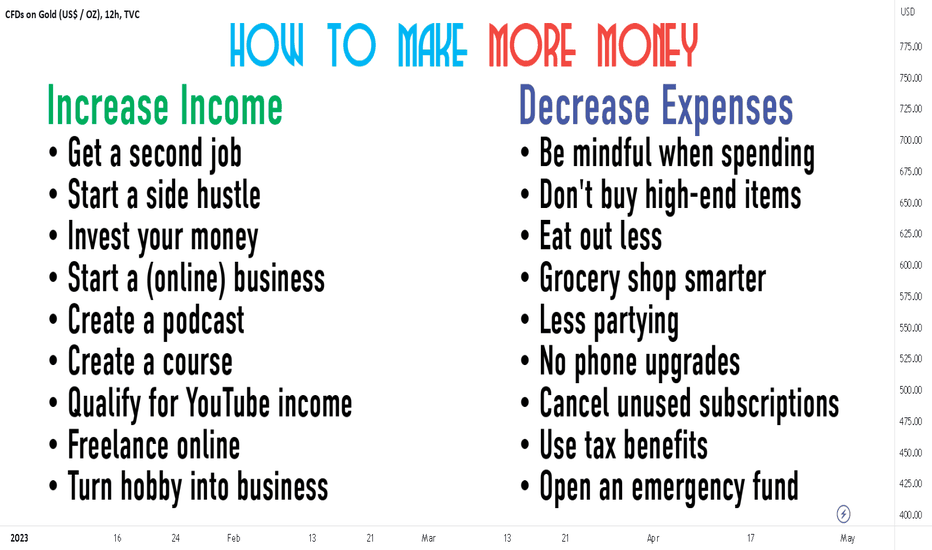

Learn The Only Proven Way to Become Rich

1. Money mindset is everything

You need to have a positive money mindset when it comes to creating wealth. Everyone carries a money story and it’s your job to understand what yours is and if it’s holding you back. Reframing your story to a millionaire’s mindset is essential for success because rich people think differently. How to get rich can’t be a passing phase in your life; it takes work and commitment.

2. Millionaires still budget

Hard to believe, but it’s true. Even millionaires follow a budget. The biggest secret on how to get rich and stay rich is spending less than you bring in. There will always be wants that exceed budget limits, even for millionaires, because there is not an unlimited supply of money.

3. Money management is key

Good money management is so important to get rich and stay rich. Money management is a behavior and habit. You need to be mindful of where you are investing and spending your money. There is a specific strategy to growing your wealth and maintaining it and you must follow it like you do a workout regime.

4. Invest your money for growth

Investing in assets that will appreciate over time and provide you with a return on your investment such as dividend or interest payments is smart. The goal is to build your asset portfolio and make it so strong that you can live off the passive income in your retirement.

5. Build your business around your personal financial goals

As a business owner you have more control over the money you make versus being an employee with a set salary. If you want more money in your pockets, you can increase your revenue and your profit margins to ensure you are taking home more money. The more profits you have in your business the more you can pay yourself a dividend or bonus, depending on the legal structure of your business.

6. Create multiple income streams

Smart business owners create more than one income streamas it protects them from fluctuations in the market. That means if one source of revenue dries up due to market conditions, other sources of income can protect you from a loss.

7. CONCLUSION:

The bottom line is that knowing how to get rich is something that is learned. There are no guarantees that if you start a business that you will get rich because even the best business ideas fail due to poor execution. But if you educate yourself and get help in making your business a success, you will increase your chances of success.

Please, support my work with like and comment!

Love you, my dear followers!👩💻🌸

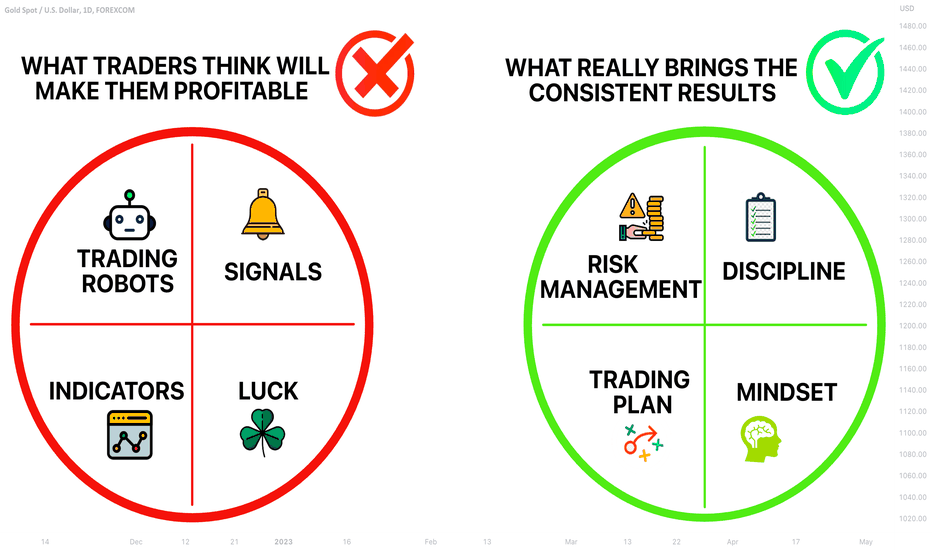

Learn What Will Really Make You Profitable in Trading

What brings the consistent profits in trading?

Talking to hundreds of struggling traders from different parts of the globe, I realized that there are the common misconceptions concerning that subject.

In this educational article, we will discuss what really will make you profitable in trading.

🔔The first thing that 99% of struggling traders are looking for is signals.

Why damn learn if you can simply follow the trades of a pro trader and make money?!

The truth is, however, is that in order to repeat the performance of a signal provider you have to open all your trading positions in the same exact moment he does. (And I would not even mention the fact that there will be a delay between the moment the provider opens the trade and the moment he sends you the signal)

Because the signal can be sent at a random moment, quite often it will take time for you to reach your trading terminal and open the position.

Just a 1-minute delay may dramatically change the risk to reward ration of the trade and, hence, the final result.

🤖The second thing that really attracts the struggling traders is trading robots (EA). The systems that trade automatically and aimed to generate consistent profits.

You simply start the program and wait for the money.

The main problem with EA is the fact that it requires constant monitoring. It can stop or freeze in a random moment and may require a reboot.

Moreover, due to changing market conditions, the EA should be regularly updated. Without the updates, at some moment it may blow your account.

Trading robot is the work: trading with the robots means their constant development, monitoring and improvement. And that work requires a high level of experience: both in coding and in trading.

📈The third thing that struggling traders are seeking is the "magic" indicator. The one that will accurately identify the safe points to buy and sell. You add the indicator on the chart, and you simply wait for the signal to open the trade.

The fact is that magic indicators do not exist. Indicator is the tool that can be applied as the extra confirmation. It should be applied strictly in a combination with something else, and its proper application requires a high level of expertise in trading.

🍀The fourth thing that newbie traders seek is luck. They open the trade, and then they pray the God, Powell, Fed or someone else to move the market in their favor.

And yes, occasionally, luck will be on your side. But relying on luck on a long-term basis, you are doomed to fail.

But what will make you profitable then?

What is the secret ingredient.

Remember, that secret ingredient does not exist.

In order to become a consistently profitable traders, you should rely on 4 crucial elements: trading plan, risk management, discipline and correct mindset.

🧠What is correct mindset in trading?

It simply means setting REALISTIC goals and having REALISTIC expectations from the market and from your trading.

📝A trading plan is the set of rules and conditions that you apply for the search of a trading setup and the management of the opened position.

Trading plan will be considered to be good if it is back tested on historical data and then tested on demo account for at least 3 consequent months.

✔️In order to follow the plan consistently, you need to be disciplined. You should be prepared for losing streaks, and you should be strong enough to not break once your trading account will be in a drawdown.

💰Risk management is one of the most important elements of your trading plan. It defines your risk per trade and your set of actions in case of losses. Even the best trading strategies may fail because of poor risk management.

Combining these 4 elements, you will become a consistently profitable trader. Remember, that there is no easy way, no shortcut. Trading is a hard work to be done.

❤️Please, support my work with like, thank you!❤️

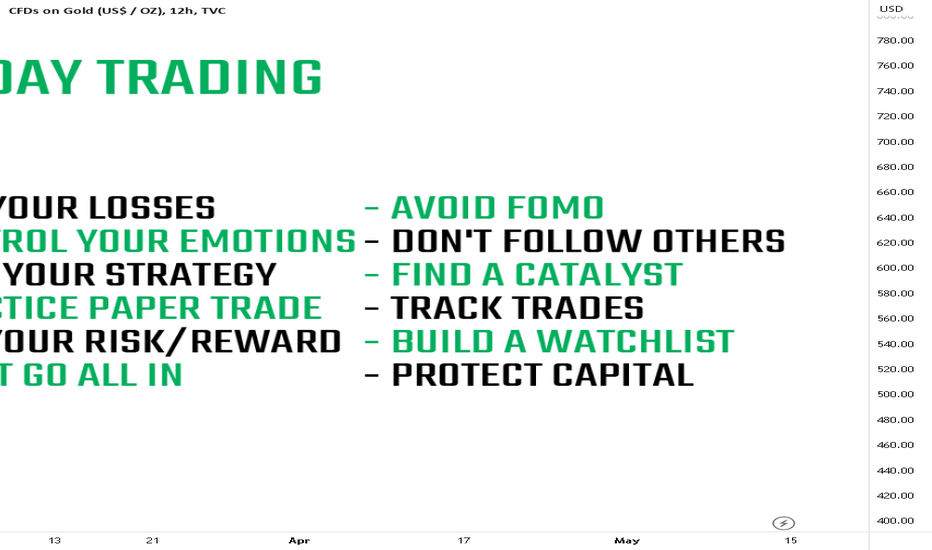

Day Trading Tips in 2023 📈

Day trading refers to a style of trading where the trader buys and sells a financial instrument within the same day, or even multiple times a day. With the right strategy and knowledge, you can take advantage of small price movements in the currency exchange market to earn a potential profit. However, it takes a lot of practice and dedication to become successful at day trading forex, so it's important for beginners to understand what they're getting into before starting out.

In this article, we'll discuss five insider tips to help beginners start their journey in day trading forex.

1. Set Aside Funds You Can Afford to Lose 💵

Before you start trading, it is important to understand how much capital you can realistically afford to risk. Almost all successful traders say that you should never trade more than you can afford to lose. So, it is advisable for beginners to start small and gradually increase their trading capital as they gain experience.

Typically, successful day traders commit no more than 1-2% of their account's balance per trade. Additionally, it is wise to earmark a surplus amount of funds that can be used solely for trading purposes, and ensure that you are prepared for any potential losses.

This way, even if your trades go in the wrong direction or don't turn out as well as you expected, you won't be risking your personal savings or other investments.

2. Be Realistic With Your Strategies 💫

Day traders should be realistic when formulating their strategies, as having too high expectations can only lead to disappointment. Namely, strategies do not need to succeed every time in order to be potentially profitable, and day traders often make potential profits on approximately 50-60% of their trades.

Furthermore, it is important to ensure the financial risk on each trade is limited to a specific percentage of the account and that entry and exit methods are clearly defined. By being realistic with their strategies, day traders can better manage risk while improving their chances of achieving long-term success.

3.Follow the Strategy 🎯

Once you have established a concise strategy that works for you, it is important to stick to it. Successful traders do not need to think on their feet or make decisions quickly, as they already have a specific trading strategy in place.

It is essential to follow the strategy closely rather than try to chase potential profits or abandon the strategy when things don't go as expected. Doing so can significantly increase the chances of you being successful in the long run.

4.Stop-Loss Orders 🛑

Risk can be mitigated through stop-loss orders, which exit the position at a specific exchange rate. Stop-loss orders are an essential forex risk management tool since they can help traders cap their risk per trade, preventing significant losses.

5.Journal Your Trades 📝

A printed record is a great learning tool. Print out a chart and list all the reasons for the trade, including the fundamentals that sway your decisions. Mark the chart with your entry and your exit points. Make any relevant comments on the chart, including emotional reasons for taking action.

The steps above will lead you to a structured approach to trading and should help you become a more refined trader. Trading is an art, and the only way to become increasingly proficient is through consistent and disciplined practice.

What do you want to learn in the next post?

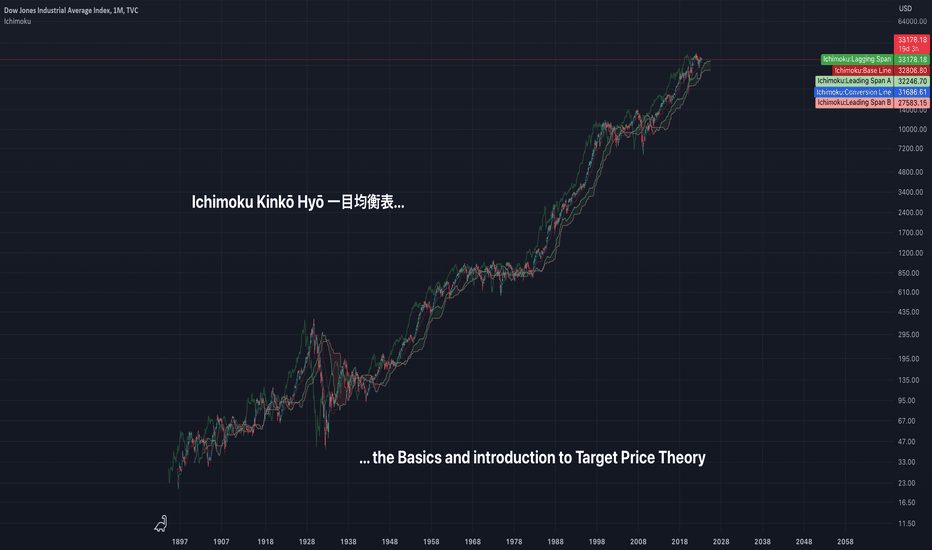

Ichimoku Target Price Theory V, N, E and NT CalculationsTHE BASICS:

Here is a close up of the Ichimoku Kinkō Hyō indicator:

Many people do not know that the Ichimoku Kinkō Hyō cloud system has its own Number, Wave, Target Price and Timespan Theories. After years of study, the numbers that Goichi Hosoda choose for his system are 9, 17, 26 as the basic numbers with 33, 42, 65, 76, 129 and 200~257. These numbers are used in the timespan as well as on the indicator itself.

9 is used for the Conversion Line (Tenkan Sen)

26 is used for the Base Line (Kijun Sen)

26 is also used for the Lagging Span (Chikou Span) and is used to shift the current price back 26 periods. The Lagging Span (Chikou Span) is an exceptional part of the system and allows you to see possible support and resistance levels without drawing any lines.

The Leading Span A (Senkou Span A) is calculated using the Conversion Line (Tenkan Sen) and Base Line (Kijun Sen) values and is then plotted 26 periods into the future and shows potential future support and resistance levels.

The Leading Span B (Senkou Span B) is calculated using double of 26 so 52 periods and is then and is then plotted 26 periods into the future. This also shows potential future support and resistance levels.

Note that:

The Area ABOVE the cloud is called the BULLISH ZONE.

The Area BELOW the cloud is called the BEARISH ZONE.

The Area IN BETWEEN the Leading Span A (Senkou Span A) and Leading Span B (Senkou Span B) levels is called the EQUILIBRIUM ZONE.

Note that the Conversion Line (Tenkan Sen) and Base Line (Kijun Sen) ARE NOT MOVING AVERAGES but are instead calculated high and low midpoints of the price. So the Conversion Line (Tenkan Sen) is high and low calculated midpoint for the last 9 Periods (short-term) and the Base Line (Kijun Sen) is high and low calculated midpoint for the last 26 Periods (mid-term).

THE ADVANCED:

Ichimoku Kinkō Hyō Target Price Theory with examples:

How accurate is Goichi Hosoda’s Target Price Theory? Using the history of the DJI/USD chart….. it turns out the calculation are very accurate.

Note that i have added in timespans from Hosoda’s numbers to see if there is a day of change on the Ichimoku numbers 9, 17, 26, 33, 42, 65, 76, 129 and 200~257. Note that you can be flexible with these numbers so if a day of change is 8 days instead of 9 or 77 days instead of 76 then that is fine with this system.

Ichimoku System has 4 Price Target Calculations called V, N, E and NT. A few of these we will see below. As you’ll see below, the calculations do change if they are POSITIVE or NEGATIVE.

If we look at the Positive N Calculation from the Monday 3rd August 1896 until Monday 6th sept 1897 we can see that it was spot on.

N Calculation positive

N = C + (B-A) = D

(B) $32.55 - (A) $20.77 = $11.79

(C) $27.79 + (B-A) $11.78 = (D) $39.57

The actual price it went to was $40.41

If we look at the above Negative V Calculation from the Monday 29th Sept 1929 until Monday 5th sept 1931 we can see that again, the calculation was spot on.

V Calculation Negative

V = B - (C-B) = D

(C) $302 - (B) $194 = $108

(B) $194 - (C-B) $108 = (D) $86

The actual price it went to was $85.76 and continued to $40.72

If we look at this Negative N Calculation from the Monday 9th November 1931 until Monday 30th May 1932 we can see that again, it was almost spot on.

N Calculation Negative

N = C - (A-B) = D

(A) $118.86 - (B) $69.85 = $48.75

(C) $89.87 - (C-B) $48.75 = (D) $41.12

Actual = $43.52 and continued to $40.72

If we look at the Positive V Calculation from Monday 4th July 1932 until Monday 17th July 1933 we can see that again, it was almost spot on.

V Calculation Positive

V = B + (B-C) = D

(B) $81.63 - (C) $48.81 = $32.82

(B) $81.63 + (C-B) $32.82 = (D) $114.45

Actual = $110.90

If we look at the Negative V Calculation from Monday 4th Nov 1940 until Monday 13th April 1942 we can see that again, it was almost spot on.

V Calculation Negative

V = B - (C-B) = D

(C) $131 - (B) $114 = $17

(B) $114 - (C-B) $17 = (D) $97

Actual = $92.60

If we look at the Positive NT Calculation from Monday 23rd March 2020 until Monday 10th May 2021 we can see that again, it was spot on.

NT Calculation Positive

NT = C + (C-A)

(C) $26,114 - (A) $18,217 = $7,897

(C) $26,114 + (C-A) $7,897 = $34,011

Actually price went up to $36,971 which was until Monday 3rd Jan 2022.

If we look at the Negative V Calculation from Monday 12th Dec 2022 until Monday 13th March 2023 we can see that again, it was close but off from about $600 but still would’ve made a profit.

V Calculation Negative

V = B - (C-B) = D

(C) $34,344 - (B) $32,582 = $1,762

(B) $32,582 - (C-B) $1,762 = (D) $30,820

Actual price went to = $31,428

I have done these examples on the 1 week chart but this system also work for lower timeframes. I could go through and add much more calculations but i think you get the point with just these few. I hope this post has been helpful and insightful.

For those interested, below are 2 links to my previous post about Ichimoku Kinkō Hyō that you may find helpful.

Ichimoku Wave Theory:

Ichimoku Crypto:

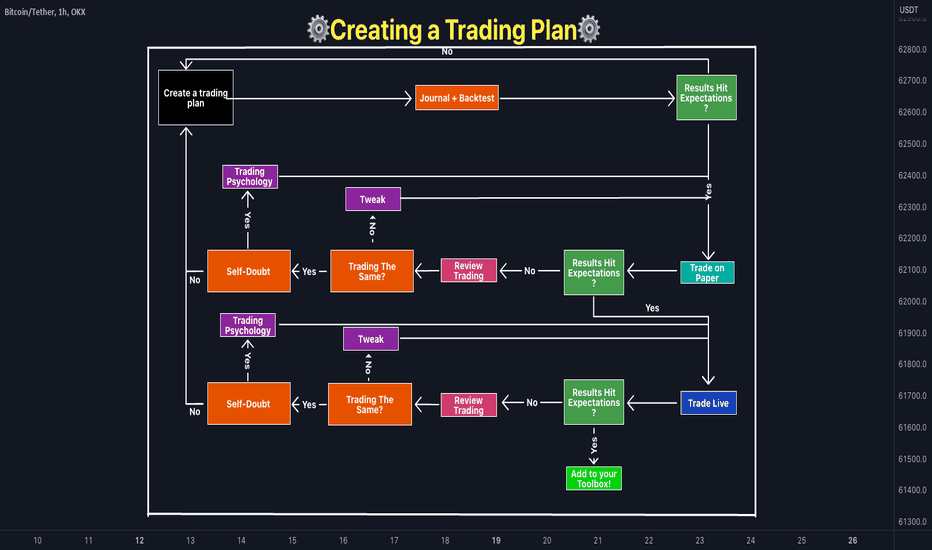

⚙️Creating a Trading Plan⚙️📍Creating a trading plan and trading journal are two important steps in developing a successful trading strategy. Backtesting is also a crucial component of any trading plan. Here are the steps you can follow to create a trading plan, trading journal, and backtest your strategy.

🔷Define Your Goals and Risk Tolerance

The first step in creating a trading plan is to define your trading goals. You should have a clear idea of what you want to achieve with your trading, such as making a certain amount of profit per month or year, and how much you are willing to risk on each trade. Your risk tolerance will also play a role in determining your trading strategy.

🔷Choose Your Trading Methodology

The next step is to choose your trading methodology. There are many different trading strategies, such as trend following, momentum trading, and mean reversion. You should choose a strategy that fits with your goals, risk tolerance, and trading style.

🔷Define Your Trading Rules

Once you have chosen your trading methodology, you need to define your trading rules. Your trading rules should cover when to enter a trade, when to exit a trade, and how much to risk on each trade. Your rules should be clear, objective, and based on your trading methodology.

🔷Create a Trading Journal

A trading journal is a record of all your trades. It is important to keep a trading journal so you can analyze your trading performance over time. Your trading journal should include the date and time of each trade, the entry and exit price, the size of the position, and the reason for entering the trade. You can use a spreadsheet or a specialized trading journal software to keep track of your trades.

🔷Backtest Your Strategy

Backtesting is the process of testing your trading strategy on historical data to see how it would have performed in the past. You can use specialized backtesting software or create your own backtesting tool using spreadsheet software. Backtesting allows you to refine your trading strategy and identify its strengths and weaknesses.

🔷Analyze Your Trading Journal

After you have started trading, you should analyze your trading journal regularly. Look for patterns in your trading performance and identify areas for improvement. You should also review your trading plan and adjust it as necessary.

📍Key Takeaways:

🔸 Defining your trading goals and risk tolerance is important before creating a trading plan.

🔸 Choose a trading methodology that fits your goals, risk tolerance, and trading style.

🔸 Define clear, objective trading rules based on your trading methodology.

🔸 Keep a trading journal to record all your trades.

🔸 Backtest your trading strategy to refine it and identify its strengths and weaknesses.

🔸 Analyze your trading journal regularly to identify areas for improvement and adjust your trading plan as necessary.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

Why Failure Is Key Of Success

Like anyone else on Earth, I’ve had successes (and failures) in years past, at both the personal and professional level. If you’re scoring at home, that’s called being a human being. I can probably make a case that failure is more important than success in many respects because you can’t really succeed unless you’ve truly inhaled your failures (own it!) and then exhaled them to improve your future approach.

There is no finality about failure, said Jawaharlal Nehru. Perhaps, that is why learning from failure is easier than learning from success, as success often appears to be the last step of the ladder. Possibilities of life, however, are endless and there are worlds beyond the stars-which is literally true. What appears as success in one moment may turn out to be a failure or even worse in the next moment.We often do not know what is failure and what is success ultimately.

Failure gives us the opportunity to bounce back, to learn from our mistakes, and helps us appreciate success.

Failure is therefore not the end, but only a stage in our journey. If it crosses our path and we know how to draw the necessary lessons from it, it even allows us to question ourselves when it's necessary and by doing so, it moves us forward.

Dear followers, let me know, what topic interests you for new educational posts?

Top 8 Rules of a Pro Trader

Hey traders,

Consistently profitable traders have a lot of things in common. Watching how they act and following their ideas & thoughts we can spot a lot of commonalities among them.

In this article, I have collected 8 trading habits that a trader should have to become successful.

1️⃣ - Continuous Learning 📚

The markets are infinitely deep in their nature.

Trading & constant monitoring of the market always unveil new, uncharted elements and things.

With 8 years of day trading, I can't help wondering how many new things I learn each and every day.

With continuous learning you evolve, you become better and it improves your trading performance & results.

2️⃣- Emotional Stability 🙏

The market is a wild beast who always wants to bite us.

And most of the time it manages to do that:

drawdowns, losing streaks...

Those who trade for at least 1 year know how unpredictable and unstable the market is.

A perfectly looking trading setup can easily turn into a big losing trade.

Of course, that is painful, of course with more and more losers, the anxiety will pursue us, the stress will overwhelm us.

Only by remaining stable and calm, you will manage to overcome the negative periods.

Learn to control your emotions, learn to take losses!

3️⃣ - Constant Practice 💪

Pro traders never stop, they always watch the charts, they always monitor the prices, and follow the market.

Trading requires constant TRADING.

Just spending one single week on a vacation without charts, you can not imagine how hard it is to return back.

The trading skills must be constantly maintained.

4️⃣ - Trade Journaling 📝

Pro trders always assess their past performance & results.

They track each and every trading position that they opened.

Both losing trades and winning trades require analysis and observations.

Only by studying the past results the trader can improve his trading performance and evolve. Only by identifying mistakes & peculiar commonalities, the trader learns to lose less than he makes.

5️⃣ - Anticipation of Different Outcomes 👁

Everything can happen in financial markets.

Pro trader always reasons in probabilities.

He knows that 100% chances do not exist.

Accepting the probabilities the trader (even while opening the trade) is always ready for completely different outcomes and accepts each and every move of the market.

6️⃣ - Flexibility & Adaptivity 🕺

The markets are always changing.

If you were trading before COVID crisis, I guess you feel how the reality among us shifted. With fundamental changes in our daily lives, the markets changed as well.

It is hard to say what exactly has altered though, however, we all can feel it.

In order to survive in a constantly changing environment, one should adapt . One should look for ways to be one step ahead.

To beat an evolving market, the traders should constantly polish their trading strategies, drop the things that don't work anymore, and adopt the new, reliable ones.

That is the only way to stay afloat.

7️⃣ - Selection of Right Markets 📈

The trader always knows what to trade and he always has a reason.

He admits that some financial instruments are appropriate for his trading style while some are completely not.

Pro trader does not wander around aimlessly from one market to another. He has a plan to follow and rules to rely on.

8️⃣ - Realistic Expectations ⭐️

Many newbie traders drop trading just because of wrong expectations.

The desire to get rich quick, to catch 20/1 risk to reward trades without substantial losses is playing a dirty trick with them.

The true trader is not greedy, in contrast, he is humble and the only thing that he wants is simply to win more than he loses and make that amount sufficient enough to have a good living.

Adapting these 8 habits, you will see dramatic improvements in your trading.

And even though most of them require a substantial effort and many years of practicing, trust me, it is worth it and it will help you in your daily life as well.

Would you add some other habits to this list?🤓

Let me know in a comment section.

Let me know, traders, what do you want to learn in the next educational post?

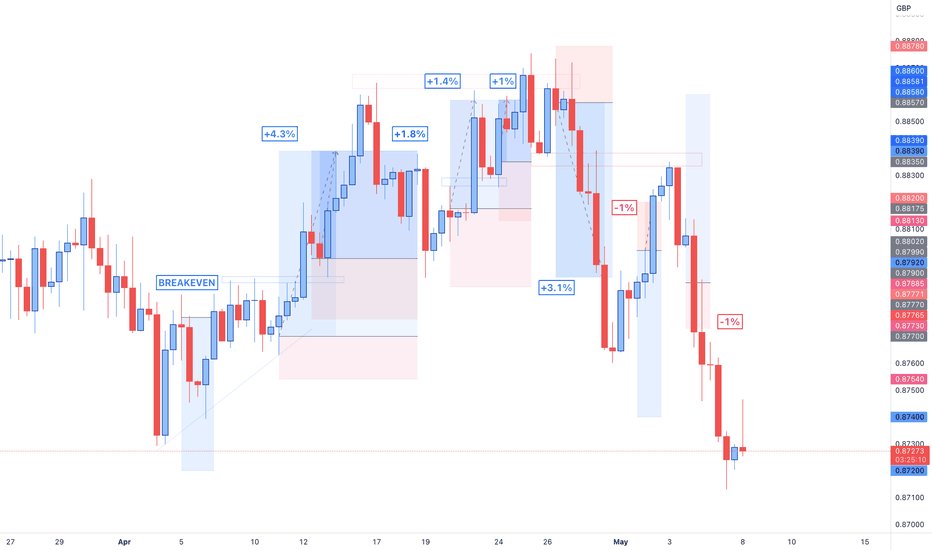

Unpopular trading advice: fall in LOVE with one pair ONLYIn a world where you can love anyone and anything your heart desires, fall in love with ONE currency pair ONLY.

The notion of "the more pairs I trade, the more money I will make" is false. If you wanna be a consistently profitable trader, it is more beneficial to focus on a small selection of securities and master them, and there is a concrete reason for that. Concentrating on one or two currency pairs instead of trading every single major, minor, and exotic pair will be more efficient, less confusing, and more profitable. When you study every single movement of any given pair, you get more experienced at trading it and you make more rational decisions and analyses.

Looking at the chart illustration, we might observe the trading log of all transactions we executed in April and May so far. With 8 trade entries and all of them being EUR/GBP, a total return of +9.6% has been generated constituting an approximate win rate percentage of 70%. Obviously, not every trade resulted in being profitable as we encountered 2 losses and a breakeven closure. Nevertheless, as we always indicate, trading is a game of big numbers and probabilities. Instead of trading 10 securities, we have only been focusing on one single currency pair recently.

One crucial thing that needs to be noted is the following: not always will the one specific currency pair of your choice provide you with clear swing opportunities as the example of EUR/GBP portrayed on the graph. Periods of long and dull consolidations, indecisions, and some other moments will take place and make a derivative unlikeable and less efficient to trade for a period of time.

Therefore, always have one or two other trades on the radar to eventually monitor and analyse along with the currency pair of your preference.

Love will save the world.

Investroy.

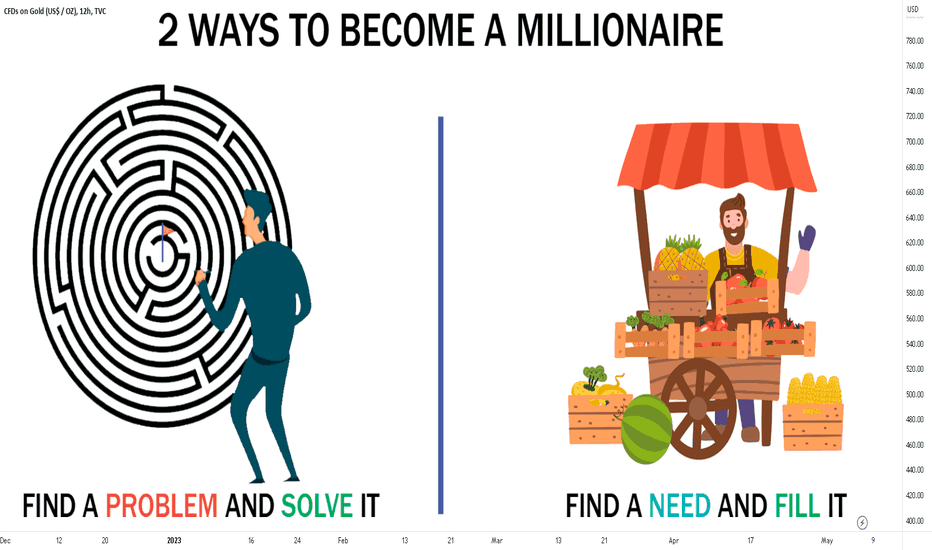

How To Become A Millionaire | 2 Proven Ways

Seeing people announce their net worth on social media may have you asking yourself, "How do I become a millionaire?" Yet "millionaire" can feel like a huge, unobtainable word. However, the good news is that becoming one is actually more realistic than you might think.

The fast-track method of becoming rich in your twenties is to start a high-growth, high-return business with a plan to exit within five years or so.

But, of course, there's absolutely no guarantee you'll even make a penny, and the risk can often outweigh your other options for building a long-term income.

It's important to have a well-researched idea and a solid business plan before you start, as well as a clear picture of how you'll support yourself when there's no money coming in.

Having said all this, there may never be a better time to start in business than as a graduate. Your responsibilities are minimal and even if it all goes wrong, you've got a wealth of experience to build on and take forward.

With your business, you should either identify a need and fill it or find a problem and solve it. Solving for customer needs and exceeding expectations along the way drives business growth.

A customer need is a motive that prompts a customer to buy a product or service. Ultimately, the need is the driver of the customer's purchase decision.

Learning to solve the problems of people, you can make a huge wealth on that. Just look around and look for the things to solve.

What do you want to learn in the next post?

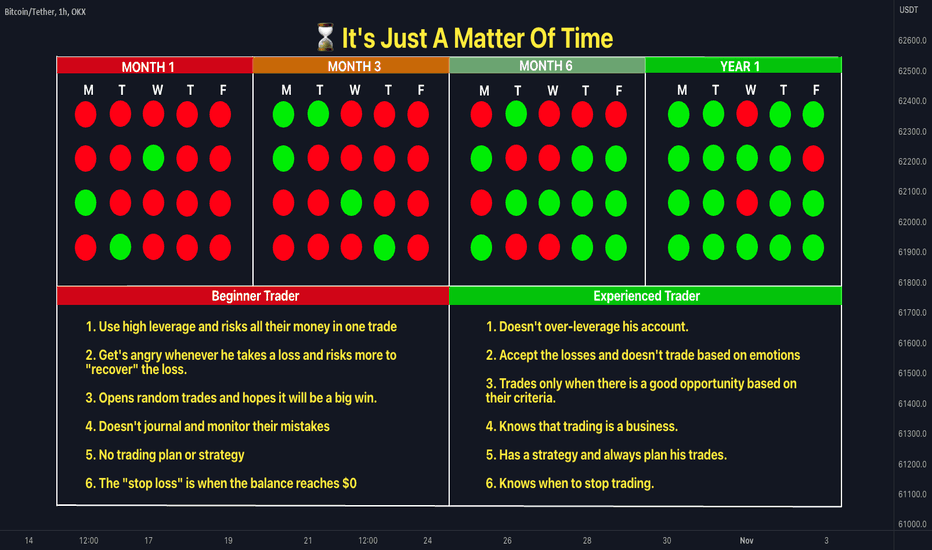

⌛ It's Just A Matter Of Time📍Journey Of a Successful Trader

No one started as a good trader. Every profitable trader was once a newbie. The journey of a successful trader is filled with challenges, hard work, and perseverance. It begins with a strong desire to learn and a commitment to become an expert in the markets they are trading.

📍The Right Path To Reach The Top

🔹Learn the basics of Trading

🔹Pick a Strategy that you fully understand

🔹Trading plan customized to your lifestyle

🔹Back Testing your strategy and plan

🔹Review your Trades, calculate your expectancy

🔹Demo Trading to build basic knowledge

🔹Live Trading, Manage your risk and emotions

🔹Professional Trader

📍Summary

The first step in the journey is to acquire the necessary knowledge and skills. This includes learning about the financial markets, technical analysis, risk management, and trading psychology. Successful traders also develop a trading strategy that fits their personality and trading style.

Once they have acquired the necessary knowledge and skills, successful traders spend countless hours studying the markets, analyzing charts, and monitoring news events that may impact their trades.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

📈 The Trailing Stop Loss📍 What Is a Trailing Stop?

A trailing stop is a modification of a typical stop order that can be set at a defined percentage or dollar amount away from a security's current market price. For a long position, an investor places a trailing stop loss below the current market price. For a short position, an investor places the trailing stop above the current market price.

A trailing stop is designed to protect gains by enabling a trade to remain open and continue to profit as long as the price is moving in the investor’s favor. The order closes the trade if the price changes direction by a specified percentage or dollar amount.

📍Important Takeaways

🔹 A trailing stop is an order type designed to lock in profits or limit losses as a trade moves favorably.

🔹 Trailing stops only move if the price moves favorably. Once it moves to lock in a profit or reduce a loss, it does not move back in the other direction.

🔹 A trailing stop is a stop order and has the additional option of being a limit order or a market order.

🔹 One of the most important considerations for a trailing stop order is whether it will be a percentage or fixed-dollar amount and by how much it will trail the price.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

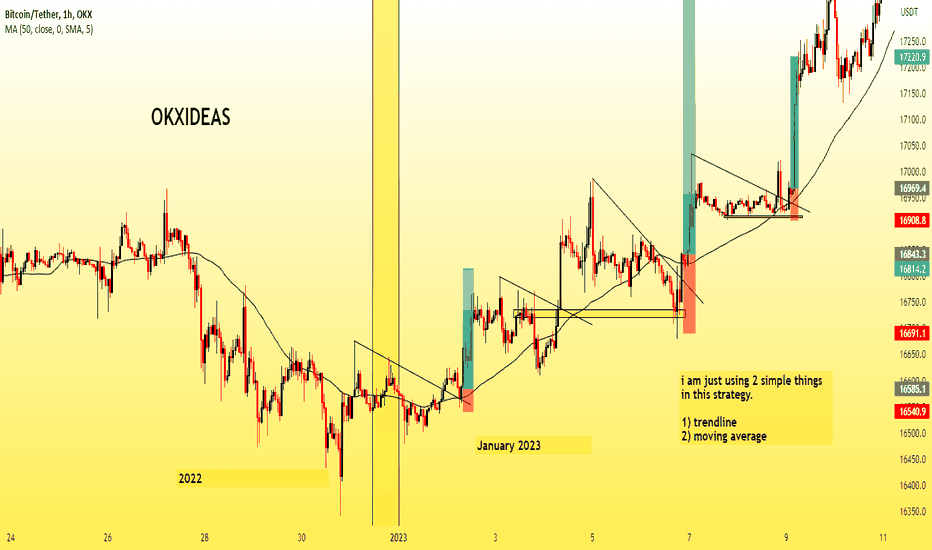

The Breakout Trading Strategy of Trendlines | OKXIDEAS

Hello traders,

In this post i am just showing you a very simple and easy trading strategy especially for beginners, in this strategy i am just using two basic things trendlines and 50 simple moving average which is you can also see in the charts above.

What you will be doing in this strategy just simply go to the 1hr timeframe see the clear trend draw the trendline wait for the breakout when breakout happen now wait for price to retest or just place a buy limit or sell limit order.

I hope you like the strategy this is the trendlines breakout trading strategy.

The one good thing about this strategy is the risk to reward ratio because in this strategy you will have potential to have around 1/3 risk to reward ratio so this means if you placed 10 trades and you lose 7 trades out of 10 and you just won 3 trades out of 10, you will be still profitable so meanwhile you just need to have a 30% wining ratio to be profitable in a long run.

I just advise you that try the strategy open the chart and back-test your chart and trade it on demo live market condition at least for one month and see the results ask the question to yourself can you be profitable? if the answer is yes so probably you know that what to do next but if the answer is no then look it your one month data that you have, make sure to journal your one month data record and try to analyze what mistakes you do what wining ratio you have can you have a little deference to between 30% see your taken trades you will be seeing some bad trades and you don't wanted to trade next time avoid those trades in the next month and just repeat the process be patient one day you will be consistently profitable but if not then don't lose the hope and just try again again and again learn from your mistakes come back and don't do that mistakes again, remember every strategy is good if you practice and managed it.

Just find the strategy that you suit and start the process.

I hope you liked the post, i wish you good luck and good trading.

Practical Insights into the Risk ManagementHey there, amazing @TradingView community! It's @Vestinda, and we're on a mission to deliver content that truly makes a difference.

👉 To become a successful crypto trader, it's essential to have a solid understanding of trade and risk management concepts, such as stop losses, position sizing, and scaling. In this article, we'll explore these key concepts in-depth to help you minimize your risks and maximize your gains in the cryptocurrency market.

Four Risk Management Concepts Every Crypto Trader Should Understand

To effectively manage the risk associated with trading, it is essential to first develop a comprehensive trade management and risk management strategy. Before committing your capital to any position, it's critical to have a clear plan in place to minimize potential losses and optimize your overall trading performance.

Successful market speculation requires effective risk management to preserve capital, which is the primary objective. By minimizing losses and maximizing gains through a comprehensive trade and risk management strategy, traders can achieve long-term success in the market.

One of the key strategies employed by the most successful traders is to minimize their losses while allowing their profitable trades to run. This approach is essential for avoiding disastrous scenarios, such as allowing profitable trades to turn into losers or allowing a single bad trade to wipe out an entire account. By focusing on risk management and trade management, traders can increase their chances of success and protect their capital over the long term.

It's true that implementing the "cut losses quickly and let profitable trades ride" strategy can be challenging, especially for discretionary traders who need to constantly evaluate changes in fundamentals and market sentiment against price movements. However, there are trade and risk management ("TRM") tools and methods available that can help simplify this process.

While these tools and methods may seem complex at first, they are quite accessible and easy to learn. With the right TRM strategies in place, traders can effectively manage risk and optimize their performance in any market condition.

Before diving into trading, it's crucial to understand four key concepts in trade and risk management:

Stop losses: Stop losses are predetermined exit points designed to limit potential losses on a trade. By setting a stop loss, traders can automatically close a position if the market moves against them beyond a certain point, minimizing their losses.

Traders may use price action signals, technical indicator signals, fundamental analysis, or a combination of all three to determine the appropriate level for a stop-loss order. This helps to limit potential losses on trade and is a crucial component of effective risk management.

Position sizing: Position sizing refers to the amount of capital allocated to a specific trade. By properly sizing positions based on risk tolerance and market conditions, traders can optimize their overall risk management strategy and minimize the impact of potential losses.

Position sizing refers to the process of determining the quantity of cryptocurrency to long or short based on the maximum amount of value a trader is willing to lose if the trade fails, also known as "max risk." For novice traders, it is recommended that the maximum risk should not exceed 1-2% of their portfolio for short-term transactions and 5% for longer-term positions.

For example, if a trader has a cryptocurrency account with $ 1,000 and wishes to purchase a token with a market price of $ 10.0 per token, they would need to determine the appropriate position size to maintain their desired level of risk. If their analysis indicates that they should place a stop loss at $ 5.0 per token to limit their maximum risk to 2% of their account, or $ 20.0, then the appropriate position size would be 4 units (40$ position size). This way, if the token's value drops by $ 5.0, the resulting loss of $ 20.0 would equal 2% of the trader's account.

Scaling: Scaling involves adjusting position sizes based on the performance of a trade or the overall market conditions. By scaling into or out of positions based on market conditions, traders can adjust their risk exposure and optimize their potential for gains while minimizing potential losses.

Scaling refers to the practice of dividing entries and exits into two or more orders around a trader's intended entry/exit area to reduce the likelihood of setting an entry too low or too high. This is particularly important because it is nearly impossible to predict the exact price or time at which the market's direction or volatility levels will change.

For example, if a trader intends to buy a token for $ 10.0 but their analysis indicates that it may drop as low as $ 8.0 before sentiment entirely flips bullish, they should consider dividing their entry/exit orders into multiple price levels. This way, they can enter the trade with a partial position if the token's price does not drop below $10.0, but if it drops to $ 8.0, they can scale into a lower average price of $ 8.75.

By using scaling and position sizing in conjunction with a maximum stop loss level, traders can effectively manage their risk and reduce the likelihood of incurring significant losses. While these concepts are relatively simple, understanding and applying them correctly can help traders avoid significant risks in the cryptocurrency market.

Leverage: Trading with leverage involves taking positions that exceed the account's total capital, which can be done through crypto exchanges (CEXs) offering margin trading or some DeFi protocols providing advanced borrowing mechanisms.

For instance, assume you have $ 100 in your account, and you want to purchase 1 unit of XYZ token worth $ 100, creating an open position valued at $ 100. Margin trading offered by a CEX may only require a 10% margin, meaning you only need to invest $ 10 instead of the entire $ 100. You can then utilize the remaining $ 90 to open additional positions, which can be tempting for many traders.

With a 10% margin requirement and a $ 100 account, you can open a position size of 10 XYZ tokens, having a notional value of $ 1000 ($ 100 x 10 units), with the CEX holding the $ 100 in your account as a margin for the trades.

This would make you leveraged 10x, which is considered an extremely high amount of leverage. If the token increases in value by 10% in a short period, the position value would grow from $ 1000 to $ 1100, which means you could double your account value from $ 100 to $ 200 (i.e., $ 100 profit + $ 100 margin). Alternatively, if the token rises by 20% to $ 1200, you would triple your account to $ 300 in value.

Although the potential for high profits may sound exciting, it is crucial to remember the risks associated with trading with leverage, and it is advisable to exercise caution and not get carried away by the prospect of quick and easy gains.

Many traders are lured by the potential profits of leveraged trading, but it's important to remember that leverage can be just as dangerous as it is rewarding. If a trader opens a position with 10x leverage and the position loses just 5%, that would be a loss of $ 50, which is 50% of their $ 100 account.

Additionally, if the position were to lose 10%, resulting in a $ 100 loss, the trader would receive a margin call and would need to deposit more money to keep their trades open.

If they are unable to do so, the CEX will close all positions, also known as being "liquidated". The CEX will use the margin that the trader had provided to cover the $ 100 loss, which means that the trader's account balance would be reduced to $ 0. It's essential to be aware of the risks of leveraged trading, as you could potentially lose everything you've invested.

It's important to remember that leverage in crypto trading is a double-edged sword that can either grow your account or quickly deplete it. While it's possible to make significant profits with leverage, it's equally possible to suffer substantial losses.

As a new trader, it's important to acknowledge that trading with leverage requires expertise and a sound risk management strategy, which can be challenging to implement successfully.

Therefore, it's wise to approach leverage with caution and focus on developing your skills and knowledge before considering this tool.

Here are some recommendations that can help you navigate the exciting but risky world of crypto trading:

First, it's important to be conservative with your risk-taking and to only invest in your very best trade ideas. Limiting your total exposure to the crypto sector to a small percentage of your total liquid capital, starting at 1%, is a good way to minimize your risk.

You should also limit your exposure to a specific crypto asset to a small percentage of your total crypto portfolio, with a 1% to 2% max risk on short-term trades and a max of 5% risk on longer-term positions. Using a stop loss with every position is also crucial to limit potential losses.

Remember, perfect timing is near impossible, so consider scaling into trading positions or "dollar cost averaging" into longer-term investments. Take profits along the way if a trade goes your way. And most importantly, avoid using leverage, which can be a double-edged sword and lead to substantial losses.

Lastly, only invest your capital in your very best ideas, which should be low-risk/high-reward setups on high-probability ideas. Don't force trades when there are no compelling opportunities, and remember that "no position" is a perfectly fine position when you don't see any good opportunities.

Calling all traders! Are you ready to take your skills to the next level?

Join our community of like-minded traders and stay up to date with the latest market trends and insights. Hit that follow button and show your support by giving this article a big thumbs up.

Together, we'll navigate the markets with ease and achieve financial success. Don't miss out on this opportunity to grow and learn with us. Let's do this!

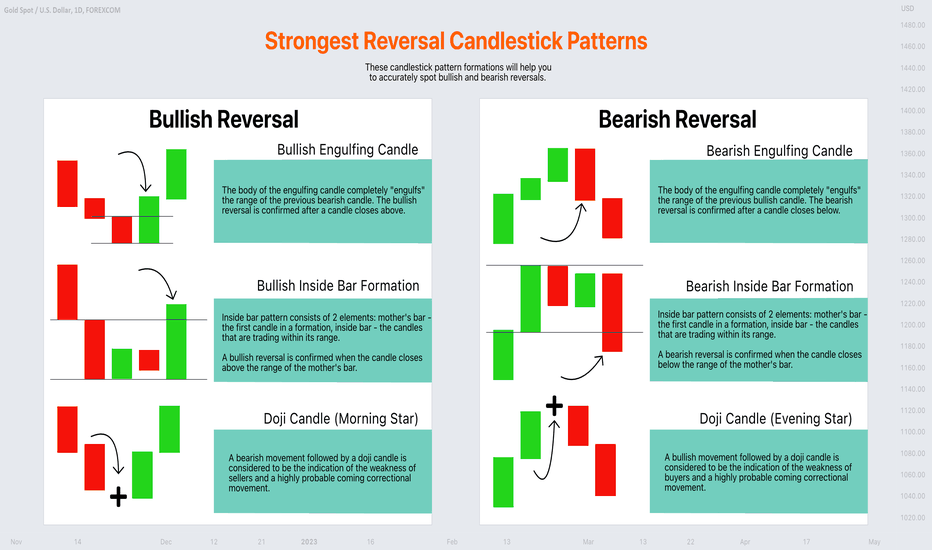

Learn the Strongest Reversal Candlestick Patterns

Hey traders,

In this educational article, we will discuss powerful reversal candlestick patterns that every trader must know.

Bullish Engulfing Candle

Bullish engulfing candle is one of my favorite ones.

It usually indicates the initiation of a bullish movement after a strong bearish wave.

The main element of this pattern is a relatively big body. Being bigger than the entire range of the previous (bearish) candle, it should completely "engulf" that.

Such a formation indicates the strength of the buyers and their willingness to push the price higher.

Bearish Engulfing Candle

The main element of this pattern is a relatively big body that is bigger than the entire range of the previous (bullish) candle.

Such a formation indicates the strength of the sellers and their willingness to push the price lower.

________________________

Bullish Inside Bar

Inside bar formation is a classic indecision pattern.

It usually forms after a strong bullish/bearish impulse and signifies a consolidation.

The pattern consists of 2 main elements:

mother's bar - a relatively strong bullish or bearish candle,

inside bars - the following candles that a trading within the range of the mother's bar.

The breakout of the range of the mother's bar may quite accurately confirm the reversal.

A bullish breakout of its range and a candle close above that usually initiates a strong bullish movement.

Bearish Inside Bar

A bearish breakout of the range of the mother's bar and a candle close below that usually initiates a strong bearish movement.

________________________

Doji Candle (Morning Star)

By a Doji we mean a candle that has the same opening and closing price.

Being formed after a strong bearish move, such a Doji will be called a Morning Star. It signifies the oversold condition of the market and the local weakness of sellers.

Such a formation may quite accurately indicate a coming bullish movement.

Doji Candle (Evening Star)

Being formed after a strong bullish move, such a Doji will be called an Evening Star. It signifies the overbought condition of the market and the local weakness of buyers.

Such a formation may quite accurately indicate a coming bearish movement.

I apply these formations for making predictions on financial markets every day. They perfectly work on Forex, Futures, Crypto markets and show their efficiency on various time frames.

❤️Please, support my work with like, thank you!❤️

EURUSD: Part 1 funny story!I. Not proficient unconsciously.

When you enter the market and start trading, you may think that it's a great way to make money because you hear a lot about it and know of people who have made a lot of money from Forex. However, it's important to note that this is just the first stage and, like when you first learn to drive, it may seem easy at first but can be challenging as you continue to learn. Prices in the market can fluctuate wildly, adding to the complexity of Forex trading.

When you're new to trading, it can be overwhelming and confusing. You may find yourself unsure of what to do when you see the prices fluctuate in the market. Without proper knowledge, you may take risks that could potentially harm your trades. You may even fall into a cycle of increasing your trading volume when you feel confident, only to end up losing capital in the long run. This is a common stage for beginners that typically lasts a few months to a year before moving on to the next phase.

Continue ...

I will release the next part tomorrow, stay tuned.

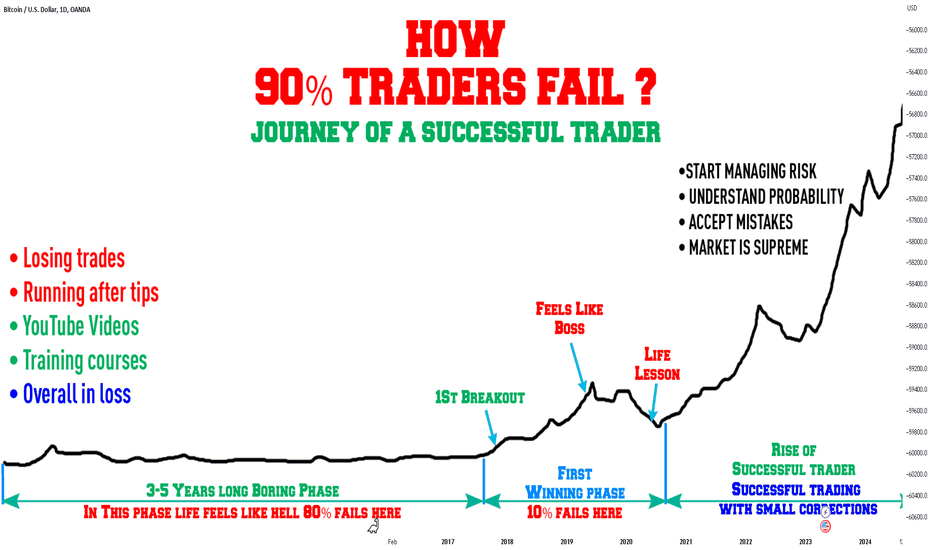

Why 90% Of Traders Lose Money?

Trading is a tough business and most people who start in the business lose money.

And these numbers aren't small at all, really. In fact, they might even be scary to look at. Therefore, in this article, we will look at some of the most popular reasons why more than 90% of new traders will lose their money in trading.

____

The most common reason why many traders lose money is simply that they want to become professional traders without learning more about it first. They trade without even learning the differences between assets and how trading works. Other people start trading after seeing the hyped stories of millionaire traders on television.

____

Some traders just follow the recommendations of others and do not conduct technical analyses of their own.

Traders should review the prices, analyze the volume, check the prior trends and analyze other technical indicators before placing their intraday orders.

Rushing just to place buy or sell orders is one of the biggest mistakes intraday traders make.

One should conduct proper technical analysis and then start trading.

____

The phrase- “Trend is your best friend” always works in the market. Not following the trend is another biggest mistake that day traders make.

Unless a trader has many years of experience and understanding of the market, traders should try to avoid going against the trend.

If the market is in a strong uptrend, then one should try to trade in the up direction only unless there is any strong resistance or chart pattern breakout.

____

Some traders follow rumors and recommendations which are spread by the media houses and brokers.

This is another big mistake that intraday traders make. One should not blindly follow the intraday trading tips and rumors without their own analysis.

Going by these recommendations without conducting your own analysis can cause huge losses.

As we have discussed above traders should conduct proper research before following any recommendations or intraday tips. As we all know that the intraday trading is a mixed bag of losses and gains. Not every trade goes right or is profitable. Thus traders should put a stop loss of their trades when doing intraday trading to protect their capital from losses.

Please, like this post and subscribe to our tradingview page!👍

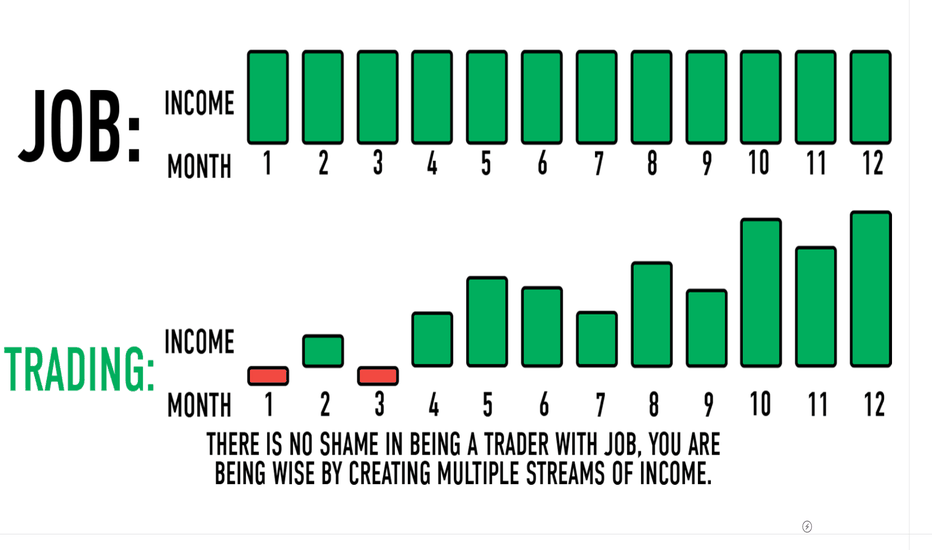

TRADING OR A JOB? DEEP DIVE❗️

Are you torn between choosing a job and getting into trading? Both have their advantages and pitfalls, but by combining the two, you can reap the rewards of both worlds.

🚷Firstly, let's consider a traditional job. A job offers security, stability, and a predictable income. You work for a set number of hours, and you receive a paycheck. You have employer benefits such as healthcare, 401k matching, and paid time off.

On the downside, you are limited to your salary, which may not always reflect your hard work and dedication. You may feel stuck in your role as there are usually limited opportunities for career advancement. And if you lose your job, you lose that source of income.

💹Now let's consider trading. Trading offers the potential for uncapped income, flexibility, and the autonomy to make your decisions. You can trade anywhere with an internet connection, and there are many different markets to choose from, such as forex, stocks, and commodities. You have complete control over your financial destiny.

However, trading is not for everyone. It requires a lot of time, effort, and discipline to become successful. There are risks involved, and you can lose money if you do not know what you are doing. It can also be a lonely profession as you may be working alone most of the time.

💡Now, what if we combine the two? This is where the concept of "side hustles" comes into play. You can keep your job for the stability and security, but you can also trade on the side to increase your income and diversify your portfolio.

By trading on the side, you can use the abundance of time outside of your job to learn, practice, and implement trading strategies. Gradually, you may earn enough money from trading to eventually quit your job and become a full-time trader.

However, the combination of the two must be approached with caution. Trading can be time-consuming, and you do not want to sacrifice the quality of your work at your job. It is also essential to practice risk management and not invest money that you cannot afford to lose.

⚖️In conclusion, both a job and trading have their advantages and disadvantages. Combining the two is an excellent way to increase your income, diversify your portfolio, and potentially become a full-time trader. But proceeding with caution, discipline, and good money management is key to success. Remember, the goal is to build a better future for yourself, and with the right balance between a job and trading, you can achieve it.

Thanks for reading bro, you are the best☺️

Like, comment and subscribe to boost your trading!

Dear followers, let me know, what topic interests you for new educational posts?

The Story of a Failed Trader | OKXIDEASOnce upon a time there was a man who was a very poor and he belong to a middle class family but he had the ability to dream it. He was 20 years old and he also think that he spend all of had 20 years doing nothing, he was a dreamer. He wanted to become a rich man, he finding ways to become a rich man, he tried almost every thing but failed. One day he watched a video about trading on YouTube and he decided to become a trader, become a rich with trading and fulfill all of had dreams. He started to learn trading, he watched all of educational videos about trading on YouTube and spend had 15 hours every day just watching videos, now he knows about the basic trading he shifted to the analysis part of trading, he started to practice and learn the technical analysis. He find the method that he can trade with, he combined some technical indicator signals and created strategy for himself. Now he had very passionate about trading, wanted to open a real account and start trading with real account. He had some saving money around 500 dollar he deposited that money in the real account and start trading with that money. He started dreaming from the first day of trading and created some trading rules for himself like he had to take 10% risk per trade and don't take that trade which is below 1/1 risk to reward ratio. On the first day he had taken almost 3 trades and win all of them, now he was more excited for trading he had made $192 profit means something around 38% profit on 500 dollar account. He wanted to trade more but he was a little bit smarter one, he think that i am in profit and my wining ratio is 100% so why i just damage my wining ratio and why i just risk my today profit so he had decided to come back tomorrow. On the second day he had $692 total balance in the account, he had to play a little bit more smarter than a previous day and he decided to take 10% risk per trade of the current total balance $692 in the account rather than the starting balance which is $500. On the second day he take almost 4 trades and he won 2 trades out of 4 trades, now the account condition had almost break-even no loss & no profit, he decided to try again and trade more, he finding the reason to trade more and then he calculate today and yesterday total taken trades which is 7 trades, he think that i won 5 trades out of 7 trades so my wining ratio is almost around 70% which is good and i can trade more because my wining ratio is still above 50% so i am still in positive side. He trade almost 3 trades again and he lose all of them, now he had very sad and almost broken, he decided to step back and come back later. He sturdy himself and come back on the third day, now he had facing a little bit draw-down on the third day the total account balance is around 484 dollar, he started looking for the trades opportunity and at the end of the day he took almost 5 trades with the 10% risk per trade but the third day results had also again bad and he lose 4 trades out of 5 and just win 1 trade, he had very shameful from himself, he closed the laptop goes to outdoor and talk to himself. He analysis the current situation of the account, it that point the total account balance is around 276 dollar he almost around 45% in draw-down and the wining ratio had below 50% so now he entered to the negative side. On the fourth day morning he traded 2 trades and he lose both of them now he almost lose the hope and the account condition had around 72% in draw-down and he left only 138 dollar in the account. At the time he give up and he just decided to depend on just one trade, he just waiting for the best opportunity of the day and finally he got the trade but at the end he lose that trade again and he almost blow out had account.

After that all he had stressful and sad from almost one week, he decided to leave the trading and move on to the next thing and he looking to find other things that suitable for him because he think that trading is not suitable for him. One month later he just scrolling on the internet and he see the FAQ that 90% of traders lose and only 10% had succeed, now he had a little bit shock and he think that its pretty normal every trader in the 90% had facing that stage which stage that i faced.

He decided to come back to trading and start from the zero, he started to modify had strategy and created new rules for had strategy like he set this time risk to reward ratio for had trades is minimum 1/2 and he decided to risk only 2% of the total account also he decided to take only 2 trades per day, this time he opened the demo account rather than the real account and start trading with demo account, he decided to journal had journey and after one month of consistency he hadn't break any rules and when he see the results after month he had profitable, now he feel like stronger and he continue the journey with that same demo account after three months he had similar results and still profitable. In that time he think that i don't have much money and in trading it's required a lot of money to earn a lot of profits, he started to search for that how he had to prove himself to big investors and raise money for himself to trade. One day he searching and he knows about prop firms trading now he had interested in that and wanted to know more about prop firms, he think that this is the big opportunity for himself to become succeed quickly, now he decided to trade with prop firms and buy the challenge from the prop firms, he adjusted had strategy rules and trading plan according to the prop firms requirement, now but the only problem is that he don't have money to actually buy the prop firms challenge. By the way he was dropout from the school after completing had secondary education and so he just setting at the home, he don't have much money to buy the challenge, the pocket money of him had just depend on him father and he hadn't want to say to father to give me extra money because of him father was very poor and he work as a taxi driver, so then he had decided to get the any kind of job for himself and try to earn some money in the form of salary and buy the challenge with that money, he worked hard and after one month he got the salary and then he just swift to the prop firm website and buy the $50000 account challenge for himself, now he started trading with challenge account phase one, on the phase one he decided to risk only 1% per trade, take only 2 trades a day and the every trade risk to reward ratio had to minimum 1/2 after one month of consistency he gained +8% profit, he was in profit but he hadn't achieved the prop firm required profit target which is +10% in that case prop firm gives traders free retake so then he take the challenge again with the new account and new month from zero and he think that my wining ratio for the previous month is almost around 40% with minimum 1/2 risk to reward ratio and my daily limit is 2 trades so i need to increase my daily limit from 2 to 3 because if i traded with the same rule 2 trades a day then i hadn't pass with 40% wining ratio. He calculate some numbers like he think, if i take 3 trades per day so then at the end of the month my all trades had to be 60 trades per month and if i maintain my 40% wining ratio then i can easily pass the challenge with that mindset he started the challenge and strictly follow the rules after month he hadn't maintain the 40% wining ratio and he end up with some loss and failed the challenge, this time he almost faced big depression after some days left he realized had mistake and he think i made mistake that i increase my daily trades limit because of this my wining accuracy goes down, i just forced myself to take 3 trades per day and get trapped into the normal trades.