How to achieve quick profits through short-term trading?Many friends enjoy short-term trading, mostly due to the short holding time, quick results, and the thrill of the process. However, short-term trading is the most challenging among all trading methods and requires careful consideration.

Today, I will share my early experience of short-term trading with you. Specific methods and strategies will be provided in the later part of this article, which are closely related to practical applications and, I believe, will be helpful for you.

The article is quite lengthy. If you find it helpful, please give it a thumbs-up at the end of the article. Thank you.

Advantages and disadvantages of short-term trading

Short-term trading does not have a strict definition standard. When the market moves quickly, positions can be closed within a day, but if the market moves slowly, it may take two or three days to close the position, all of which belong to short-term trading.

On charts, I usually consider trades at the 5-minute, 15-minute, and even 1-hour level as short-term trades.

The advantages of short-term trading are:

(1) Short holding time and quick results. People are naturally curious about the unknown and want to know the results quickly. Short-term trading fits human nature, making it easier to control emotions.

(2) High trading frequency, providing a thrilling experience. Many traders are restless and want to trade multiple times a day, short-term trading meets this human need.

(3) The decay cycle of the short-term trading system is short, and the distribution of trading results is more evenly distributed, making it easier to execute. Sometimes, even with a losing streak of 5 times, the long-term trading strategy may take over a month to recover, while the short-term trading strategy may only take two or three days. Thus, short-term trading is less torturous to human psychology during a losing streak.

Disadvantages of short-term trading:

(1) High trading frequency requires more time and energy and is not suitable for part-time traders.

(2) Frequent trading generates high trading costs. Therefore, short-term traders need to pay attention to their commission fees. I have seen many futures traders who have had their accounts charged two or three times, or even ten times, the commission fees. How can they make a profit like this?

(3) Requires higher professionalism and attention to trading details. Short-term trading is more sensitive to changes in the market. Sometimes, when the market changes, you don't have much time to think and must act decisively. People with more procrastinating personalities are not suitable for short-term trading. Additionally, the margin of error for short-term trading is relatively low. Long-term trades do not require very precise entry points, and being off by 5 or 10 points does not have a significant impact on the overall trade. However, in short-term trading, being off by 5 or 10 points can be the difference between profit and loss.

Therefore, short-term trading is a delicate operation, and all trading details must be clear and easy to execute. Short-term traders also need to possess qualities such as attention to detail, boldness, calmness, and decisiveness.

So, how can you quickly profit from short-term trading? Next, I will share two strategies.

2.Plan One: Choosing Volatile Markets with Large Amplitude for Short-term Trading

As a short-term trader, we only need to capture a small segment of market volatility, and it doesn't have to be the overall trend, as long as the market volatility is fast and the amplitude is large.

The faster the market volatility and the larger the amplitude, the easier it is to make profits. For the same 100-point profit, it may take only one day to achieve it when the volatility is fast and the amplitude is large, while it may take several days to achieve it when the volatility is slow and the amplitude is small, resulting in a much lower trading efficiency and different challenges to our mentality.

Therefore, the amplitude of the product is the key to making profits in short-term trading. We need to selectively engage in short-term trading and not try to swallow all profits. There are two specific strategies to consider.

Strategy One: Directly select high amplitude products for short-term trading.

Different products have their own characteristics when operating in the market. Some products have fast volatility and large amplitude, while others have slow volatility and small amplitude. Before engaging in short-term trading, we must select the most suitable products.

For example, in the same breakout trading opportunity, products with high volatility and larger amplitude can achieve greater profits more quickly.

As traders, we all understand that the faster we can lock in profits, the more confident we feel. Therefore, selecting the right products makes short-term trading easier.

Moreover, if you choose a slow-moving product, your holding time will be longer, and your position may be occupied, which will reduce the utilization rate of your funds and affect the final profit. Short-term trading is about paying attention to details and maintaining a strong mindset, as even the smallest details can determine your success or failure. Therefore, do not be careless.

FXOPEN:XAUUSD FOREXCOM:EURUSD

Trading Plan

howto set stoploss correctly and do a goodjob of risk managementStop loss is a necessary means to control risk, and using a good stop loss point is the only way for investors to win.

There are two types of methods for setting the stop loss point: the first type is a regular stop loss, that is, when the reasons and conditions for buying or holding disappear due to changes in market conditions, the position must be closed or stopped immediately. The second category is auxiliary stop loss. In practice, the maximum loss method, retracement stop loss, sideways stop loss, expected R multiplier stop loss, key psychological price stop loss, tangent support level stop loss, moving average stop loss, cost moving average stop loss, Bollinger band stop loss, volatility stop loss, K-line combination stop loss, chip intensive area stop loss, CDP (contrarian operation) stop loss, etc.Investors should judge based on their own risk tolerance and choose a stop loss method that suits them.

The market has been fluctuating all the time, and there are opportunities at all times, but before we make a transaction, when we look at a certain position, we also need to refer to whether the stop loss position is well set, how much profit margin can be grasped, and whether it has played a role in using small capital to fight for high returns.

The size of the stop loss: It can be set according to the resistance support in the seeking stop loss point above. The size of the stop loss we are talking about here should be set more based on the profit margin. This is the high return of small capital. When our profit margin can only be seen at 5-8 points, the stop loss can be controlled at about 3 points; The stop loss point for medium- and long-term trading can be appropriately enlarged, and when the profit point is above 30 points, the stop loss can be set to more than 8-10 points.Of course, the size of the stop loss is more of a reference factor in resistance and support.

Spread in stop loss: We all know that the cost of trading is composed of spread and commission. When we place an order, we try to find the best entry point and calculate the spread. Then the same is true when setting the stop loss. The above talked about finding the stop loss point and the size of the stop loss, then in the gold investment market, it is often a decimal point that can change the profit or loss, so we need to calculate the spread when setting the stop loss.

Several principles for setting a stop loss point:

1. Once the stop loss point is set, it is not recommended to change frequently if it is not necessary. It should be implemented decisively. Stop loss is actually a prerequisite and guarantee for profit.

2. The stop loss point should be set before each lot is traded.

3. The stop loss point can be flexibly changed, but it must not be changed day and night.

4. Before setting the stop loss point, it must be based on the current overall trend

In order to facilitate everyone to continue to follow up on my analysis and sharing, you can like and follow me; in addition, I will share the daily real-time strategy in the channel. If you can't follow up in real time, you may make operational errors.You can use the following methods to enter my channel for free to follow the latest news and follow up on market trends in real time.

What is the golden stop-loss rule?

For trades such as stocks, futures, or forex, stop loss is a part of the trade, and it only works for investors if there is a stop loss in each transaction and it is adhered to. Today, I bring you a 3:1 gold stop loss rule, hoping to help with your investments.

Stop loss is a way to minimize losses in current market trades and is frequently mentioned. However, the essence of stop loss is not just setting a stop loss price. In particular, in markets such as forex and futures where long and short positions can be taken, too many stop losses will undoubtedly cause significant loss of capital. Market leaders use people's fear to cause repeated shocks, even unilateral rises or falls to trigger short-term traders' stop loss prices, and then quickly retract. The normal daily volatility of the stock market is also around 5%, so if your stop loss is set at 5%, won't it often be hit?

This requires attention to two issues: first, judging the trend of the market, whether it is a volatile market or a clear trend market; second, setting a reasonable stop loss position.

First of all, it's important to understand that the most notable characteristic of the trading market is volatility, and most of the time it's in a volatile trend, regardless of whether it's in a larger time frame or a shorter time frame. Therefore, the investment strategy for a volatile market should be the preferred strategy for short-term traders.

Secondly, identifying the range of volatility is crucial. Find the highest and lowest prices in recent price fluctuations. After a sharp rise or fall in the market, a corrective wave will form between these highest and lowest prices, sometimes lasting a long time. For example, commonly seen patterns such as triangle consolidation or box consolidation require a longer period of time before forming a new breakthrough. As for what prices to choose as the range, it depends on your trading period, whether it's daily, weekly, 60-minute, or even minute-by-minute. By using price analysis to determine the operational cycle, you will find a clear pattern of fluctuation range. The stop-loss price for such fluctuations should be set outside the highest or lowest points, and smaller stop-loss or trailing stop-loss should not be used.

When the price breaks through the highest point, it is necessary to observe its sustainability. In most cases, it will return to the range-bound area again. However, if the sustainability is strong, it continuously sets new highs, and trading volume continues to increase, a new trend can be determined, and the stop-loss can be changed to a trailing stop. Its price should be set at a price that falls more than one time period beyond the highest or lowest price, and there is no new high or low in three consecutive time periods. At this time, it can be judged that the trend has stopped and entered a range-bound market. For example, if the time period is a 5-minute candlestick chart, then the trailing stop should be set at a price formed by a relatively large 5-minute candlestick chart. But generally, it should not exceed two candlestick chart prices, because beyond this price, the profit left is often very small.

The 3:1 golden stop-loss rule in trading skills means that the profit of the take-profit point is three times the loss of the stop-loss point. For example, if you buy a stock and it falls by 7% or 8%, you should close your position in a timely manner. When your stock rises by 20% to 25%, you should consider selling some of it, and not be greedy and wait for it to rise further. Of course, the percentage values here can be changed according to the market situation, but the ratio should always be maintained at 3:1.

Some investors may have doubts, what if I set a stop loss at 8% and then the stock rises significantly, even by more than 50%, after I sell it? It seems like a big mistake to sell it, and many investors may no longer believe in the 3:1 rule. Actually, the reason why we set a stop loss at 8% is to prevent it from falling by 10%, 20%, 25%, 40% or even more. You can think of it as a small insurance premium to ensure that an 8% loss doesn't turn into a 60% loss. Isn't it easier to handle that way? For most investors, an 8% loss is manageable, but a 60% loss is a burden that many cannot afford.

In the market, human weaknesses will be reflected. When you hold a stock that falls, you will lose some capital, and you will fear that it will continue to fall, rather than hoping it will rebound to make up for previous losses. As a defensive measure, trading systems should still follow the 3:1 rule for stop losses. Finally, I wish everyone a happy investment journey.

How to resolve being trapped in gold position.

Given that no matter what market conditions may be, there will always be friends who find themselves trapped in a position, here are several methods for unlocking these positions:

Long-term unlocking: If an investor has a clear view of the big trend (such as a bullish market), and their position is trapped in a small trend (a dip in the market), they can first stop the loss and close out the position. Then, they can enter the market again at a lower price to earn the price difference and obtain the profit from the big trend while reducing the risk of being liquidated by the small trend.

Short-term unlocking: If the investor's judgment of the market is completely wrong, they should close out the position promptly to avoid suffering greater losses from the continuing one-sided trend. The longer a short-term investor holds a position in a one-sided market, the greater the loss.

Light position unlocking (also suitable for large fund investors): It means adding more long positions as the market falls, using idle funds to lower the average cost, and waiting for the price to rebound. The advantage is that as long as the operation is correct, unlocking is possible as soon as there is a rebound, regardless of how deeply the position is trapped.

Swing unlocking: This method is suitable for being trapped in various market stages, especially in volatile markets. It relies on the fluctuation of stock prices to unlock the position by using the price difference between high and low prices. The idea is to buy low and sell high, gradually reduce the cost, and minimize losses. The advantage is that the operation techniques are diverse and flexible, and can be adapted to different situations. If operated correctly, the unlocking speed is fast. The disadvantage is that it requires a high demand for personal time, energy, and skills, and frequent operations have a certain cost pressure. It requires professional guidance from those who have time, energy, and technical knowledge.

Tips for trading gold:

1.Entry point: The entry point is crucial. Although gold and crude oil trading involve two modes, long and short, there are actually four modes: low long, low short, high long, and high short. In a one-sided trend, all four modes are feasible. However, in a volatile market, it is essential to avoid low short and high long positions. These positions are akin to chasing rising and falling markets, which often leads to losses.

2.Stop loss: Before placing a trade, determine the stop loss price and ensure it is reasonable. Immediately input the stop loss price after placing the order. The purpose of stop loss is to limit losses. Only by limiting small losses can you preserve your capital. Sometimes you need to let go to gain something. Do not assume that if you lose this time, you cannot earn it back. Manage investment risks carefully.

3.Position sizing: How you allocate your funds affects your ability to tolerate risks. Oversized positions or full positions can lead to increased losses and psychological pressure. Often, you cannot analyze market trends carefully, which can result in mistakes.

4.Take profit: Many traders struggle to take profit, causing profitable trades to turn into losses. In a one-sided trend, the push stop-loss method can be used to increase profit margins. Taking profit requires personal consideration of exit points. Not every trade needs to yield thousands or millions of dollars. Sometimes, in a volatile market, a profit of a few hundred dollars can accumulate over time.

5.Mindset: This is the most critical point and one that every investor must master. When you enter the market, it is undeniable that everyone is here to make money. However, your mindset determines how far you will go on the investment journey. The goal is to prefer small gains over losses, not to think about making more or less profit.

Opportunities require us to seek them out ourselves. The moment you read this article, you have already been given an opportunity. Everyone in life experiences setbacks and failures, but the difference lies in our mindset when faced with adversity. Some people always regard setbacks as failures, which can undermine the courage to succeed. In investing, the key is to be on the right path and have the right direction. "A calm sea never made a skilled sailor," and there is no stable market environment. The purpose of investing is to make money! A clear mind is more important than a clever mind in this market. A good habit is more practical than a skilled technique. Perseverance is long-lasting, and authenticity is eternal. This is true of anything we do. I hope my article can bring you benefits and smooth sailing on your investment journey. May my investment experience benefit investors, and with you and me, an ordinary person plus an ordinary person, may we have an extraordinary investment experience and insights. Be meticulous in life and ordinary in your work. May your investment journey be smooth sailing.

If my article is helpful to you, please remember to like it. If you have other questions during your operations, you can follow my homepage↓↓↓ to conveniently get the information in the first time.

FXOPEN:XAUUSD TVC:GOLD COMEX:GC1!

judgment of technical indicators and application skills1. Simple judgment of support and resistance:

Support and resistance levels are the points in the chart that are subjected to continuous upward or downward pressure.The support level is usually the lowest point in all chart patterns (hourly, weekly, or annual), while the resistance level is the highest point (peak)in the chart.When these points show a downward trend, they are recognized as support and resistance.The best time to buy/sell is near the support/resistance level that is not easy to break.Once these levels are broken, they tend to become reverse obstacles.Therefore, in an uptrend market, the broken resistance level may become support for the upward trend; however, in a downtrend market, once the support level is broken, it will turn into resistance.

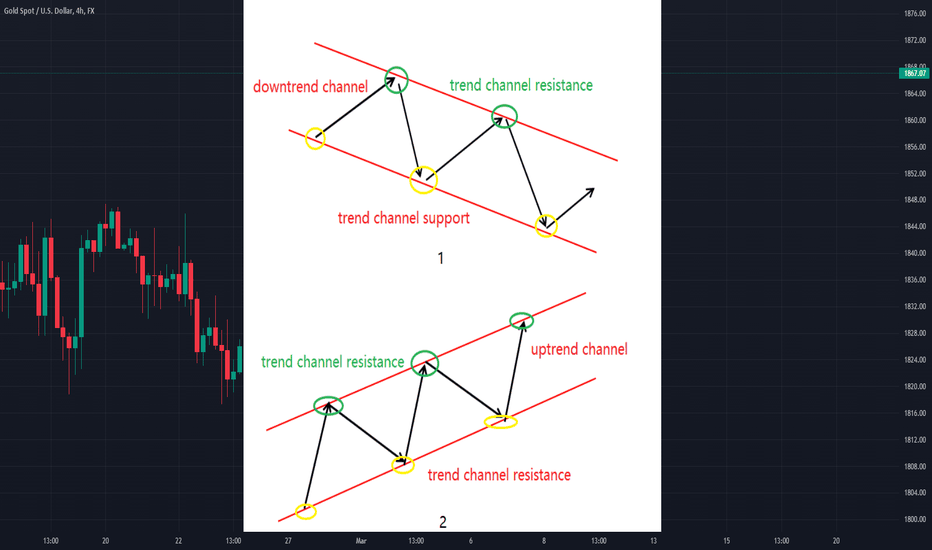

2. Understanding of lines and channels:

Trend lines are a simple and practical tool in identifying the direction of market trends.The upward straight line is formed by at least two consecutive low points connected.Naturally, the second point must be higher than the first point.The extension of a straight line helps determine the path along which the market will move.Upward trend is a specific method used to identify support lines/levels.On the contrary, the downward line is drawn by connecting two or more points.The variability of trading lines is to some extent related to the number of connection points.However, it is worth mentioning that each point does not have to be too close.A channel is defined as an upward trend line parallel to the corresponding downward trend line.Two lines can represent price upward, downward, or horizontal corridors.The common attribute of a channel that supports the connection point of a trend line should be between the two connection points of its reverse line.

3. Understanding and understanding of the average line:

If you believe in the creed of "trend is your friend" in technical analysis, then the moving average will benefit you a lot.The moving average shows the average price at a specific time in a specific period.They are called "moves" because they are measured at the same time and reflect the latest average.

One of the shortcomings of moving averages is that they lag behind the market, so they are not necessarily a sign of a trend shift.To solve this problem, using a shorter period moving average of 5 or 10 days will better reflect recent price movements than a 40 or 200-day moving average.Alternatively, the moving average can also be used by combining two average lines of different time spans.Regardless of the use of 5 and 10-day moving averages, or 40- and 200-day moving averages, buy signals are usually detected when the shorter-term average crosses the longer-term average upward.In contrast, a sell signal will be prompted when the shorter-term average crosses the longer-term average downwards.

In order to facilitate everyone to continue to follow up on my analysis and sharing, you can like and follow me; in addition, I will share the daily real-time strategy in the channel. If you can't follow up in real time, you may make operational errors.You can use the following methods to enter my channel for free to follow the latest news and follow up on market trends in real time.

Ways to achieve greater profits

It's not necessary to use heavy positions or hold onto trades in order to achieve greater profits. I want to emphasize the dangers of these two approaches again. Heavy positions - the most direct manifestation of this in the market is that even if you are in a relatively good position, once you are stopped out, the heavy position can lead to significant losses. Of course, it must be acknowledged that if you can correctly predict the direction, it can also bring significant returns.

However, when weighing the two approaches, preserving capital should always be the first principle. Holding onto trades is even riskier. Once you encounter a one-way market, if you keep adding to your position, the result will be huge losses or even blowing up your account. Therefore, both approaches are not advisable.

The correct approach is twofold. First, operate in markets with larger formations, using staged profit-taking and setting trailing stops to take advantage of greater market space with zero risk. By holding for the long term, you can maximize profits.

Second, as the market continues to move, add to your position appropriately in situations where you already have profits, and then set stop-loss orders to protect your capital. For example, if you sell at the upper bound and the market later falls below the lower bound, the entire formation will turn downward.

We understand that there is still a lot of room for the market to run, so if you have profits from your sell order at the upper bound and the formation begins to turn downward, you can use additional orders and stop-loss orders to hold onto the position with zero risk, thereby maximizing profits.

Follow me for more interesting ideas that will greatly help your trading.

Two methods to ensure no loss of principal

There are only two ways to avoid losing capital: one is to have a small stop-loss space (reflected in the entry position), and the other is not to bet too much at once. For example, buying one lot with $10,000 can earn $1,000, and buying ten lots with $100,000 can earn $10,000. Although the probability is the same, the more you do, the more you earn, and the less you do, the less you earn. However, controlling losses should be the top priority. As discussed earlier, if you buy too many lots this time and get stopped out, it will result in a big loss, which violates the principle of capital preservation.

Some traders become increasingly greedy after making profits and then add more positions. A typical behavior is adding positions. For example, if you bought 10 lots at first and then made a profit in the expected direction, the trader would blame himself for not buying more at the beginning. Then, he would begin to imagine that the market would continue to move in the expected direction and invest most of his capital in this product, let alone any correct practices such as taking profits in batches.

After you add more positions, it means that the cost has changed. Once the market reverses slightly, you will go from being profitable to losing money. At this point, you panic, lose your ability to think, and greed slowly turns into hope. You hope that this is only temporary, but the losses increase every moment. Perhaps you will have some luck a few times, but it won't be long before there is a risk of a big loss or liquidation.

It is important to understand that becoming rich cannot be achieved by just one market movement, so don't be obsessed with this one time. Greed makes people forget about risk, and don't always imagine that the market will move in the expected direction, ignoring the risk of the opposite trend. This is the key to keeping your capital out of danger.

Follow me, and I will share more interesting ideas that will greatly help your trading.

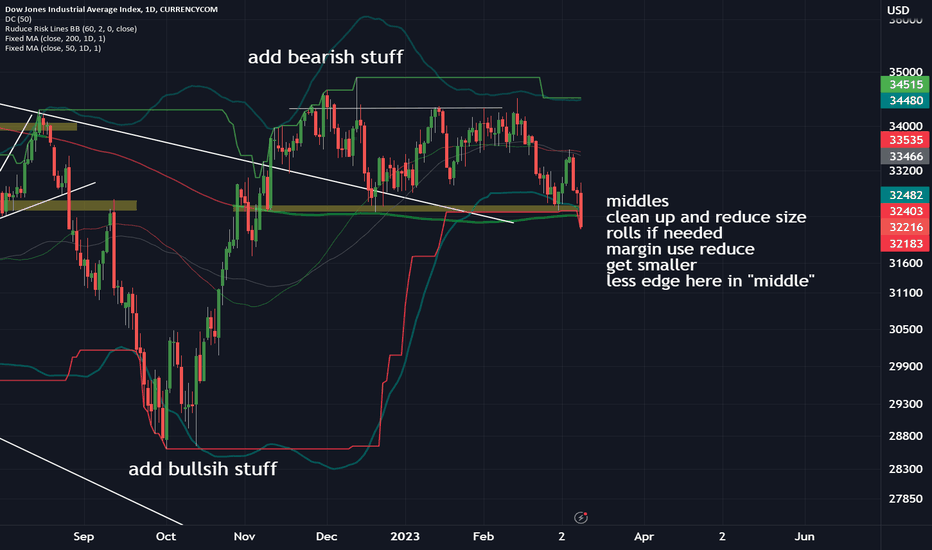

Know when you have trading edge, and know when to clean housebull trades when over sold,

bear trades when overbought,

and tidy up the house when in the middles.

when you know you dont have edge, trade small and clean up. wait for you setup scenario.

dont be in a rush to lose money

the market will always take your money, dont rush it. wait for you sweet spot for better reward to risk.

audio book link if you want: www.youtube.com

What is the ultimate level of stop-loss in trading?

For trading in stocks, futures, or forex, stop loss is a part of the trade. It only works effectively for investors if it is included and adhered to in every transaction. As we all know, stock investment requires three basic skills: stock selection, stop loss techniques, and profit-taking strategies. However, many investors do not pay enough attention to stop loss and profit-taking techniques, and ultimately regret not setting stop loss and profit-taking points. Today, we will introduce the highest level of stop loss techniques.

First, the comprehensive stop loss method is the highest level of stop loss for stock investment. Therefore, when setting the stop loss point, the overall situation must be taken into account. There is no stop loss method that exists separately from the investor's overall operation. If the stock market develops beyond the investor's ability, it means that the stop loss measures must be implemented.

Second, the highest level of stop loss is in the heart of the investor. When selling stocks, investors should not only rely on their eyes but also observe and analyze with their hearts. Many stock investors only believe in what they see when selling stocks. As a result, they often miss the selling opportunity when they finally realize the situation.

Third, the stop loss method based on consolidation time. If an investor buys a stock with a heavy position, but the stock price does not rise much after buying, and it starts to move sideways after a period of time, it is important to note that if the consolidation time is too long, it means that the main force cannot use funds to boost the stock price.

Fourth, stop loss based on real-time trends. If the main force of a stock has been washing the stock for some time and still has not controlled the stock when it is time to do so, it means that the main force has no intention of raising the stock price, and the future outlook is pessimistic. At this time, investors should take timely stop loss measures, otherwise, they will end up suffering losses.

Fifth, stop loss based on trading volume. If an investor encounters a stock that is severely oversold, and many investors are trapped at a higher price, it is time to sell the stock. However, sometimes, observing the daily k-line chart, it is found that there has been a huge increase in trading volume in recent days. Note that this is a trap set by the main force to lure retail investors.

In summary, the above is the relevant knowledge about stop loss techniques that we introduce to stock investors, hoping to help our friends in the investment field.

FXOPEN:XAUUSD MCX:CRUDEOIL1! FX:EURUSD

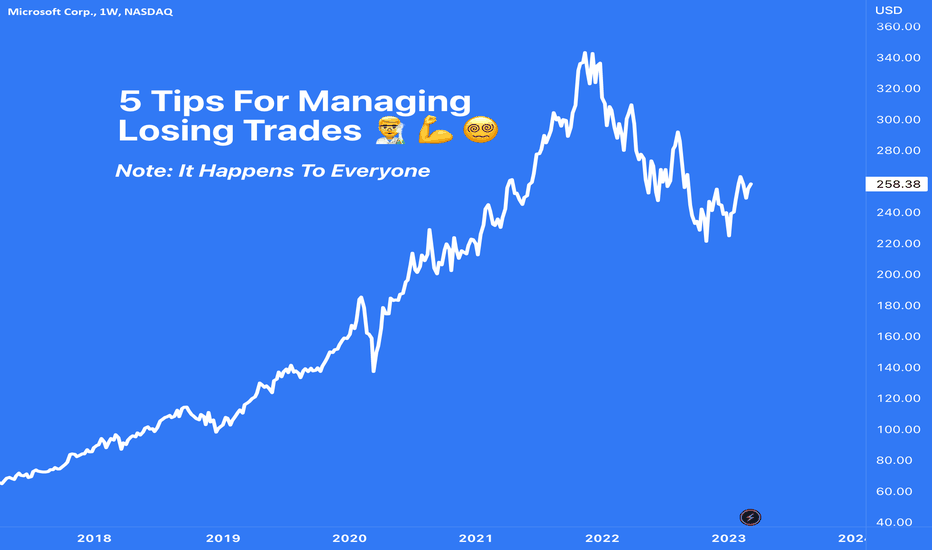

5 Tips For Managing Losing Trades (It Happens To Everyone)Losing trades happen. They are apart of the journey. There is simply no such thing as a trader or investor who wins all the time. All the famous investors or traders you know have LOST many times in their career. It is perfectly normal. Did you know the famed hedge fund manager Ray Dalio lost everything in his 30s? He went broke. He had to start over from scratch.

This post will address what losing trades really mean and how to deal with it.

Before we begin, let us state the obvious:

- Be careful of people who claim they don't lose.

- Avoid people who flaunt win rates or success rates that are simply not possible.

- Losing trades happen to everyone! You are not alone.

Now, let's talk about what bad trades mean and 5 tips for managing them:

Number 1: A losing trade is different from a bad trade

The most experienced traders are well aware of their risk before they ever place a trade. Each losing trade is a small component of a bigger process that relates to a system, plan or strategy that has been thoroughly tested and studied. A losing trade is a calculated event for experienced traders. They defined their risk, position size, stop loss, and profit target. 🎯

A bad trade is very different. A bad trade implies someone risked their hard earned money with no plan or process. A bad trade is reckless and indiscriminate trading. This often happens to new investors or traders who do not yet understand the time, studying, and research that goes into making a rock solid plan. Be sure to remember the difference between a calculated losing trade and a bad trade with no plan or process.

TradingView Tip: there are several ways to get started with a plan, system or process. Paper trading, backtesting and/or working with proficient traders who give valuable feedback are all ways to get started. Don't risk your money without first doing research.

Number 2: Every losing trade provides data to get better

As we've mentioned several times now, losing trades happen to everyone. But remember, losing trades are also filled with insightful information and data. You can learn a lot from analyzing losing trades. 🔍

At the end of each trading day, week or month, experienced traders will analyze their losing trades in detail. What patterns are appearing? What do they share in common? Why did they happen? With this information, a trader or investor can adjust their strategy based on what they've uncovered.

Number 3: Do not let losing trades impact your health

Your mental and physical health are just as important as your financial health. Do not let losing trades impact either of those.

If your system is breaking down or several losing trades are starting to impact your emotions, step away from the computer or phone. Turn everything off and walk away. The markets have been open for hundreds of years and are not going away. When you're ready to come back, they'll be there.

Get up, get some fresh air, and get back in the arena when you're ready.

Number 4: Share your experiences with others

Traders and investors across the globe want to learn from your stories and losing trades. These are invaluable experiences that we all share in common. Social networks allow you to chat, share, and meet people who are going through similar things. We can all learn from each other.

Sure, the temptation to share your winners or act like the best trader who ever existed is tempting 😜 - but it's clear we learn together and get better when we share lessons from the loses. This is where the deepest insights are found, and together, it's where we can grow as a community of traders all trying to outperform the market.

Share and ask for constructive feedback!

Number 5: Keep Going

Markets are a game of learning, relearning, and progressing forward. New themes, trends, and stories appear and disappear daily. The journey is long and it never stops. When implementing your trading plan or investing plan, it's important to do it with the long-term in mind. One or two losing trades in a single day or week is a small fraction of what's to come many months and years down the road. 🌎

Keep going. Keep building. Keep refining your plan. Study the data.

We hope you enjoyed this post!

We hope you learned something new or informative!

Please leave any comments below and our team will read them.

- TradingView ❤️

How to achieve stable and sustained profits.

How to grasp the trend in this market? It is to follow the trend. When the trend comes, the invisible force is pushing you forward. To gain profit and income in the gold and foreign exchange markets, this is particularly important. What is the secret to making profits? The answer is simple and also the most overlooked and precious thing that is free, just like the air we breathe and the sunshine. What is the secret to making money? In fact, it is simple. Throw away all the news and fundamentals, return to rationality, and independently analyze and follow the trend.

Trading is a trial-and-error process! In the continuous occurrence of errors, the main problem faced is the shrinking of funds and psychological torment. A trader must reduce the probability of making mistakes because your profit comes from other people's losses. That is to say, when someone makes a mistake, there will be profits for others to earn in the market. However, you cannot calculate or predict how many people will make mistakes in the next step, how big the mistakes will be, nor can you guarantee that you will always be on the correct side. Therefore, in trading, the only thing you can do is to try to make the time of your mistakes as short as possible. The rest is to wait for others to make mistakes, let's work hard together!

In trading, we may have short-term profit goals, but long-term goals are based on short-term profits. Without short-term profits, long-term goals are meaningless. Therefore, we need to balance short-term and long-term goals to achieve stable and sustained profits.

Pay attention to me and make trading simpler.

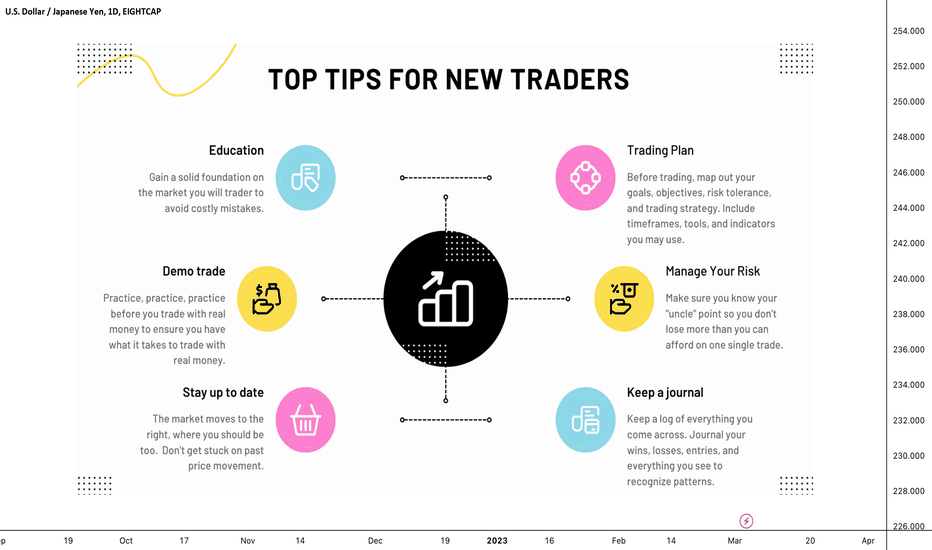

Top Tips For Beginner TradersTrading can be a lucrative and exciting venture, but it can also be overwhelming and risky for new traders. Whether you are interested in stocks, forex, or other markets, there are some important tips to keep in mind as you begin your journey as a trader. Let's outline some of the top tips for new traders.

Start with a solid education

The first step to becoming a successful trader is to gain a solid education on the markets you are interested in trading. This can involve reading books, taking courses, attending seminars, and researching online. By understanding the fundamentals of trading, you can avoid many common mistakes and develop a strong foundation for your trading career.

Develop a trading plan

Before making any trades, it is essential to develop a trading plan that outlines your strategy, risk management approach, and goals. Your plan should also include details such as the types of trades you will make, the timeframes you will trade on, and the tools and indicators you will use to analyze the markets.

Practice with a demo account

Many brokers offer demo accounts that allow you to practice trading without risking real money. This is a valuable way to test out your trading strategies and get a feel for the markets before committing to real trades. Practice trading on a demo account until you feel comfortable with your approach and have a solid understanding of the markets.

What I love about Trading view is that you can demo trade without a broker. You can save the headache of having to find a broker later in your trading journey when you're ready to trade live.

Manage your risk

One of the most important aspects of successful trading is managing your risk. This involves setting stop-loss orders to limit your losses and using proper position sizing to ensure that you do not risk more than you can afford to lose. Never trade with money that you cannot afford to lose, and always be mindful of the risks involved in each trade.

Think of each trade as it's own idea that gets a portion of your capital. That makes it easier to trade in size instead of betting everything in 1 or 2 trades.

Keep a trading journal

Keeping a trading journal is a great way to track your progress and identify areas for improvement. Record your trades, the reasons behind them, and the outcomes. Analyze your trades regularly to identify patterns, mistakes, and successes, and adjust your trading plan accordingly.

Your journal will differ from other trader's journal so be mindful you're keeping dated records of everything you do.

Be patient and disciplined

Successful trading requires patience and discipline. Avoid the temptation to make impulsive trades based on emotions or rumors, and stick to your trading plan. Remember that trading is a long-term endeavor, and focus on making consistent gains over time rather than trying to get rich quick.

If you add stress to your journey, the road to being a profitable trader will not be enjoyable. Being patient and disciplined can reserve your mental and physical capacity as a trader.

Stay informed

Finally, it is important to stay informed about the markets you are trading in. I'm big on not following every trader's advice or suggestions because then, you'll trade their journey. While their journey may be great yours could suffer if they decide to stop trading and you can't hold your own.

To get the best results, stay up to date with current price movement. If you are a fundamental trader, stay up to date on what economical data is moving the market. be sure you understand what you do for yourself and not based on what others have to say about the market.

In conclusion, trading can be a rewarding and profitable venture, but it requires dedication, discipline, and a solid education. By following these top tips for new traders, you can avoid many common mistakes and develop a strong foundation for your trading career. Remember to stay patient, manage your risk, and stay informed, and you will be on your way to success in the world of trading.

I'll be live-streaming here on Trading view tomorrow at 1:00 pm EST. to give more tips to help the beginner trader.

I hope to see you there and I hope you enjoyed these tips.

How to achieve profits by managing emotions?Market fluctuations are often a direct reflection of the emotions of market participants. Managing and controlling emotions is essential for successful trading. If you cannot control your emotions, you will suffer from impulsive emotional behavior and make bad decisions, which will harm your trading performance.

Negative emotions such as fear, hatred, anger, greed, jealousy, pessimism, and despair can lead to negative consequences for traders. Traders who have negative emotions may lack the ability to leave positions, refuse to accept reality, and blame others, resulting in selling positions only after a long period of price declines, missing the best buying points, and selling too early.

Negative traders may also regard failure as a negative, significant, and final result, attributing losses to their own shortcomings or negligence.

Everyone experiences various emotions, but people with high emotional intelligence can better manage their negative emotions and vent them appropriately. Emotional control skills can be developed through practice, but it is important to note that this process is a long-term and systematic one. Traders must be psychologically prepared for this.

Therefore, no matter what happens, you must control your impulsive emotions. Take a deep breath for 10 seconds, then choose the best course of action. This often leads to more rational and correct decisions.

Do not make decisions when impulsive, and do not make promises when excited. By managing your emotions, you gain control over your life.

There are various emotions in life, and you must learn to manage and control them. Do not be a slave to your emotions. Manage your negative emotions and cleverly transfer them . Similarly, controlling emotions in life determines emotional control in trading.

The three stages of emotional failure leading to trading losses are: 1) being careless before unexpected events occur; 2) being panicked after unexpected events occur; 3) being eager to make up losses after suffering losses. The solutions are as follows:

Always respect the market and trade with caution. Approach the market with a trembling, cautious attitude.

Once you suffer losses, do not panic. Stop trading temporarily, find the cause, identify the problems, and improve your system.

Impatience is the biggest reason for traders' losses. Heavy positions are impatience, opening and closing positions without signals is impatience, frequent trading is impatience, adding positions is impatience, which is essentially greed, wanting to make money quickly. Be patient, make calm decisions, and the market will reward you.

Algorithmic Trading: Trading StrategiesTypes of Trading Strategies

When it comes to algorithmic trading, there are various types of trading strategies that traders use to identify trading opportunities and execute trades. In this chapter, we'll provide an overview of the most popular trading strategies used by algorithmic traders.

Momentum Trading

Momentum trading is a strategy where traders buy securities that are trending upwards and sell securities that are trending downwards. The idea behind this strategy is that trends tend to persist, so a security that is currently increasing in price is likely to continue to do so. Momentum traders typically use technical indicators such as moving averages, relative strength index (RSI), and stochastics to identify securities that are exhibiting strong momentum.

Mean Reversion Trading

Mean reversion trading is a strategy where traders buy securities that are currently trading below their mean or average price and sell securities that are trading above their mean or average price. The idea behind this strategy is that prices tend to revert to their mean over time. Mean reversion traders typically use technical indicators such as Bollinger Bands, RSI, and moving averages to identify securities that are trading outside of their normal range.

Trend Following

Trend following is a strategy where traders buy securities that are trending upwards and sell securities that are trending downwards. The idea behind this strategy is that trends tend to persist, so a security that is currently increasing in price is likely to continue to do so. Trend following traders typically use technical indicators such as moving averages, RSI, and stochastics to identify securities that are exhibiting strong trends.

Fundamental Analysis

Fundamental analysis is a strategy where traders use financial and economic data to analyze the underlying value of a security. The idea behind this strategy is that the market is sometimes inefficient and misprices securities, and by analyzing the underlying fundamentals, traders can identify opportunities to buy undervalued securities and sell overvalued securities.

Technical Analysis

Technical analysis is a strategy where traders use charts and technical indicators to identify trading opportunities. The idea behind this strategy is that historical price and volume data can be used to predict future price movements. Technical analysts typically use charts, moving averages, RSI, and other technical indicators to identify patterns and trends that can be used to make trading decisions.

Backtesting and Performance Evaluation

Once traders have identified a trading strategy, they must test it using historical data to determine whether it is profitable. This process is known as backtesting. Traders typically use software platforms such as Python, MATLAB, or R to backtest their strategies. Backtesting involves simulating trades using historical data and evaluating the performance of the strategy over time.

After backtesting, traders must evaluate the performance of their strategy to determine whether it is profitable. Traders typically use metrics such as the Sharpe ratio, the Sortino ratio, and the maximum drawdown to evaluate the performance of their strategy.

Conclusion

In this chapter, we provided an overview of the most popular trading strategies used by algorithmic traders. These strategies include momentum trading, mean reversion trading, trend following, fundamental analysis, and technical analysis. We also discussed the importance of backtesting and performance evaluation in determining the profitability of a trading strategy. It is important for traders to carefully consider their trading strategy and evaluate its performance before committing capital to it.

Human weaknesses that need to be overcome in the trading process

Fear of missing out

Before entering the market, you may have a bullish or bearish view and enter accordingly. Once you have a position, you are constantly concerned with the fluctuations of your account funds, tormented by various temptations, fears, greed, persistence, hope, and emotions influenced by these changes, and ignoring the market itself. This greatly interferes with normal thinking and judgment.

Whether it's a long or short position, whether it's a profit or loss, as long as small gains and losses are within an acceptable range, one should beware of large losses. Traders should focus on the correctness of the process and be content with the results as they come. If you think about the results in advance, it will disturb the entire trading process and result in losses every time.

The human mind always jumps ahead to imagine unrealistic outcomes and ignores what is actually happening in the present. This is a big mistake in our lives. These are the causes of fear or greed, which can lead to traders regretting after placing an order or closing a position, causing hesitation and indecision.

The reason for this is that there is no effective trading system, causing traders to lack confidence in any aspect of the trading process.

Confronting the market

Traders must first understand that the market does not shift according to human will. The education we have received since childhood is based on competition, such as overcoming various obstacles and fighting difficulties. This consciousness has deeply rooted itself in the hearts of traders.

In fact, when traders enter the market, they still carry this mentality. Often, some elites from various industries come to the market and suffer failures, and even more thoroughly than ordinary people.

This is because successful people in other industries have a strong sense of self and do not believe they will fail. They are also unwilling to accept their own failures. Their success makes their personalities become very tough, so when the market turns against them, they do not know how to yield and compromise, but adopt a confrontational attitude until they are destroyed.

People in life tend to defend their views to some extent, unwilling to admit their judgment errors. Therefore, regardless of whether a person is right or wrong, they will stick to their attitude to the end. What they defend is not the truth, but their self.

This inherent nature of struggle and the attitude of not wanting to yield or give up self is the biggest obstacle in trading. Holding positions, not setting stop losses, and not admitting mistakes can eventually result in large losses or even liquidation.

The pursuit of perfection

The pursuit of perfection is a very greedy and extreme mentality. Because of this pursuit, it does not allow any flaws, cannot bear even very small losses, and it is difficult to execute a stop loss when necessary, and wants more profit when it is time to close a profitable position. Because of this pursuit, a person tries to capture every movement and does not want to miss any market situation.

Everyone has their own limitations and areas in which they are not good at. The pursuit of perfection can easily lead to frequent and impulsive trading.

To be continued...

When Your Trading Journey Begins...

Hey traders,

In this article, we will discuss your first steps in trading.

Being interested in financial markets and being attracted by an idea to become a full time trader, you decide to learn how to trade.

The first obstacle that you will most likely face with is a tremendous range of topics and strategies to study:

key levels, price action, technical indicators, fundamental analysis...

The problem is that there is no one single way to learn how to trade.

Each educational article, each guru on YouTube dictates their own specific path.

You will most likely feel lost, not being able to grasp what even to start with.

You will chaotically jump from one topic to another, not being able to understand which concepts do actually work.

The situation will even worsen once you decide to try to trade on real money. I do not know any trade who would not blow his first trading deposit.

Not only you will be paralyzed by the complexity of the subject, but you will also lose money simultaneously.

There will be a lot of times when you will think about leaving this game. Many times, you will consider the entire trading industry to be a scam.

That is the moment where most of the traders quit.

I am telling you all that simply because I want to show you that we all have the same path. We go through the same obstacles and we think the same way.

The only difference between a true winner and a loser, however, is that winners never give up. Winners keep working hard and stay patient. And at the end of the day, magic things happen to them.

After years of practicing and suffering, one day you will certainly realize how the things work. One day you will become a full time trade. Just don't give up, always remember, “The nearer the dawn the darker the night.”

❤️Please, support my work with like, thank you!❤️

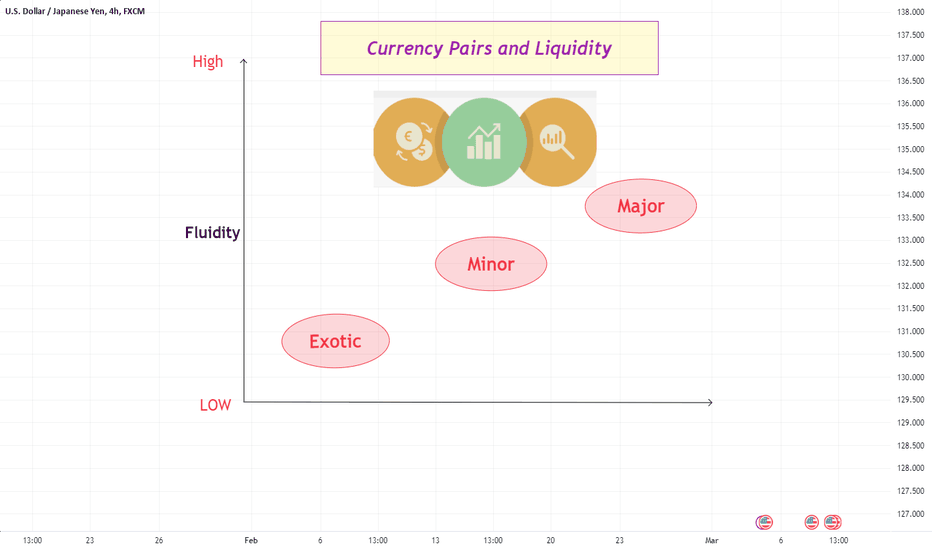

How important is liquidity in the forex

In the foreign exchange market, understanding liquidity and volatility is crucial for investors, as liquidity refers to the level of trading activity and volatility is highly influenced by liquidity. If liquidity is too poor, it can lead to significant price fluctuations, making it difficult for investors to manage risks.

What is liquidity, and why is it important?

Liquidity can be used to observe the level of activity in the foreign exchange market, specifically how many buy and sell orders are actively traded.

The foreign exchange market is a 24-hour trading market, with a daily trading volume of nearly $6 trillion, making it one of the most liquid markets in the world.

However, it is worth noting that not all currency pairs have excellent liquidity in the foreign exchange market. In fact, currency pairs often have varying degrees of liquidity depending on whether they are major, minor, or exotic currency pairs. Liquidity decreases in the order of major currency pairs -> minor currency pairs -> exotic currency pairs.

What are the major currency pairs with the "best" liquidity?

EURUSD

The euro against the US dollar is the most actively traded currency pair in the foreign exchange market due to the eurozone and the US being the two largest economies globally.

Due to the enormous trading volume of the EURUSD currency pair, it also has high liquidity, making its volatility usually lower than other currency pairs. However, even the most liquid instruments can experience significant price swings under certain conditions, such as the outbreak of the Covid-19 pandemic in March 2020, when the Fed implemented zero interest rates and unlimited QE, causing the EURUSD to surge instantaneously, one of the high volatility scenarios.

USDJPY

The US dollar against the Japanese yen is the second most traded currency pair in the foreign exchange market, second only to the EURUSD.

The USDJPY currency pair also has high liquidity because during periods of economic uncertainty or financial market turmoil globally, the Japanese yen is widely regarded as a "safe-haven currency." Thus, market funds are easy to flow into buying the Japanese yen, often resulting in a significant increase in trading volume of the USDJPY currency pair.

GBPUSD

The British pound against the US dollar currency pair is also known as "Cable" because GBPUSD was the first currency pair to be traded via transatlantic communication cables.

The UK and the US are two major Western economies with close trade relations, making the trading volume of GBPUSD also massive.

What are the "lowest" liquidity exotic currency pairs?

Exotic currency pairs usually have the lowest liquidity, such as the Polish zloty against the Japanese yen.

As the economic trade volume between Poland and Japan itself is not high, the delivery demand or hedging risk demand of the two currencies is relatively small. Therefore, exotic currency pairs usually have low liquidity.

Does the liquidity of the forex market vary during different trading sessions throughout the day?

In daily forex trading, there are periods of low activity, such as during the Asian session when prices tend to consolidate. However, during the London and US sessions, prices are more likely to experience significant fluctuations.

Among the trading sessions throughout the day, the US morning session has the best liquidity, as it overlaps with trading hours in Europe and London. The forex trading volume during the European and London trading sessions accounts for over 50% of the daily global trading volume, with the overlapping period with the US morning session accounting for approximately 20% of the total daily trading volume.

The volatility of forex is directly influenced by liquidity.

Liquidity has a significant direct impact on market price volatility in all financial markets, including the forex market. High liquidity markets have higher trading volumes and therefore lower volatility, resulting in more stable commodity prices. In contrast, low liquidity markets have lower trading volumes, higher volatility, and commodity prices are more likely to experience significant fluctuations.

As a professional with in-depth knowledge of futures products such as cryptocurrencies, forex, stocks, gold, and crude oil, I regularly update my trading strategies. Thank you for your support and likes, and please feel free to leave me a message if you have any questions. I will provide you with the most reliable advice and hope to be of help to you.

How to survive in the market for the long-term?

In the market, regret is a frequent word. Many people face the complex investment market and often feel fear, hesitation, and regret, whether it's before buying, after buying, after selling, or just watching without buying. How to avoid this phenomenon? The fear, hesitation, and regret are largely due to not knowing how to manage positions and follow the crowd. Often pursuing high probability profits results in the opposite.

Risk management is an unavoidable issue when it comes to this. Whether you are a financial master or an individual investor, the importance of risk management is paramount. To relax and operate in the market, you need to face your current situation, make correct judgments on the profit and loss ratio, determine your operating frequency and position management, and give yourself correct psychological guidance.

Everyone's personality is different, and their risk tolerance and trading styles are also different. There is no strategy that is 100% accurate, but if you want to survive in the market for a long time, you need to control risk. Don't be afraid of losses. Losses are inevitable, but the key is how much loss you can tolerate. This is the core of risk management. For small losses, we need to prepare ourselves psychologically. This is a link in risk management. Don't rely on luck. The losses brought about by a lucky mentality are incalculable.

About 70% of the time in market fluctuations is in oscillation, and only about 30% of the time is in a unilateral surge or decline. Therefore, accumulating small victories is the magic weapon for long-term success. Always wanting to go all-in and make a big move at once may result in missed profits due to not exiting in time. No matter what state you are in now, I hope I can bring you a little bit of help!

The Simpliest Math Behind Every Succesful TraderWhat exactly is risk management?

The ability to control your losses so that you do not lose all of your equity is referred to as risk management. This is a system that may be applied to everything that involves probabilities: trading, poker, blackjack, sports betting, and so on.

Many inexperienced traders underestimate the significance of risk management or don't understand the basics when it comes to risk management.

Would you risk $5,000 on every trade if you had a $10,000 trading account? Probably not. Because it only takes two consecutive losses in order to lose everything.

🧠 Now, let's imagine a thought experiment, in wich 🤩Alex and 🤨Peter are both traders with $10,000 in their accounts. Alex is a high-risk trader who puts $2500 risk on every trade. Peter is a cautious trader who puts $100 risk on every trade. Both apply a trading strategy that has a 50% success rate with an average risk-to-reward ratio of 1:2.

For good example, let's imagine the next 8 trades had the following results:

4 losing trades in a row

4 winning trades in a row

Here is the result for Alex: -$2,500, -$2,500, -$2,500, -$2,500 = -$10,000 Loss of the total account 😭😭😭😭

Here is the result for Peter: -$100, -$100, -$100, -$100, +$200, +$200, +$200, +$200 = +$800 Profits. 🏆 🏆 🏆 🏆

Can you tell the difference? See how risk management show the difference between being a profitable or losing trader. Peter managed to recover losing trades, and get into good profits after 8 trades. Alex didn't survive 4 trades...

🚨 You might have the finest trading strategy in the world, but if you don't manage how much you lose, you'll lose it all. It's only a matter of probability and time.

However, following this basic example will assist you to make your trading more profitable. Simply give it a shot.

Kind regards

Artem Crypto

Follow, Like and Share are appreciated!

Take a look at my other Educational ideas below:

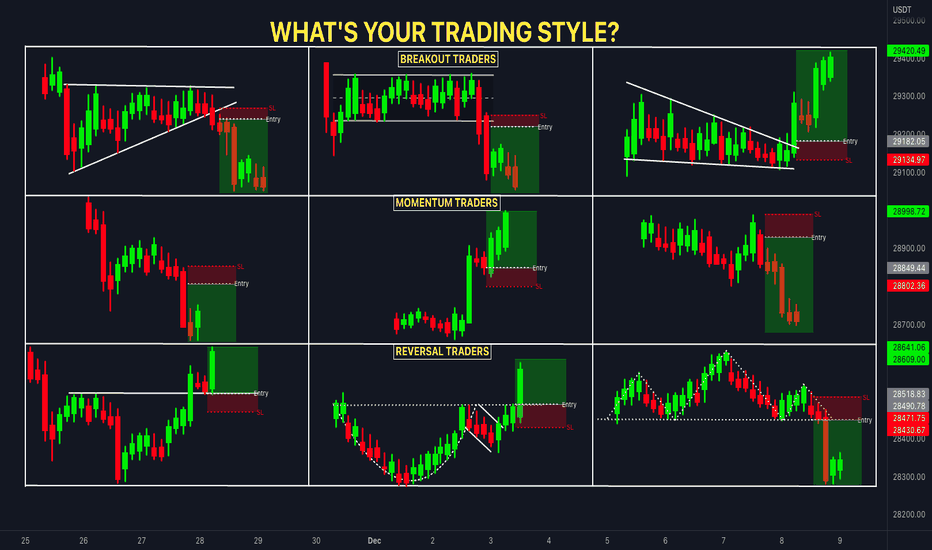

❓What's Your Trading Style❓Which of these methods is your favorite trading method? Comment below 👇

🔹 Breakout trading

Breakout trading involves identifying key levels of support and resistance and entering a trade when the price breaks through one of these levels. Traders using this strategy look for price patterns that suggest a breakout is likely to occur. For example, a trader might look for a currency pair that has been trading in a narrow range for an extended period and then enter a trade when the price breaks out of that range.

Example: A trader might identify a resistance level on the EUR/USD currency pair at 1.2000. If the price breaks through that level, the trader might enter a long position, anticipating that the price will continue to rise.

🔹 Momentum trading

Momentum trading involves entering a trade based on the strength of a trend. Traders using this strategy look for currency pairs that are trending strongly in one direction and then enter a trade in the same direction as the trend. This strategy is based on the assumption that the trend will continue.

Example: A trader might notice that the USD/JPY currency pair has been trending higher for several weeks. The trader might then enter a long position, anticipating that the trend will continue.

🔹 Reversal trading

Reversal trading involves entering a trade when a trend is about to reverse. Traders using this strategy look for signs that a trend is losing momentum or that a reversal is imminent. This strategy is based on the assumption that the trend will change direction.

Example: A trader might notice that the GBP/USD currency pair has been trending higher for several weeks but is now showing signs of weakness. The trader might then enter a short position, anticipating that the trend will reverse.

In summary, breakout trading involves entering a trade when the price breaks through a key level of support or resistance, momentum trading involves entering a trade based on the strength of a trend, and reversal trading involves entering a trade when a trend is about to reverse. Each strategy has its strengths and weaknesses, and traders should choose the strategy that best suits their trading style and risk tolerance.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

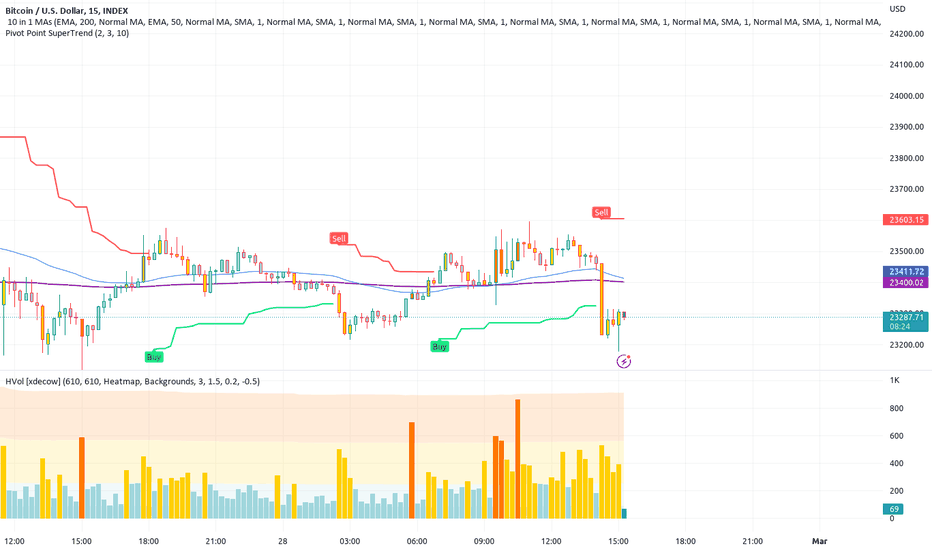

This Pivot Point Supertrend Strategy has up to 90% Success!Traders,

I'll review the Pivot Point Supertrend Trading Strategy in this video. This strategy has up to a 90% success rate with an avg. of 80-100% profits weekly. I think it's well worth our time to review and potentially implement or even automate going forward. Enjoy.

Stew

Doing this will make wealth love you more!

Avoid these four bad trading habits, and wealth will love you more!

In trading markets, whether it's cryptocurrency, forex, futures, or other markets with candlestick charts, it's not advisable to cut losses or take profits at the slightest gain or loss. You should not become greedy when you make large profits and not wait until you suffer a large loss to exit.

After opening a position, forget about your entry price, whether you're in a profitable or losing state, so you can hold more objectively, rather than wanting to exit when you've made a little profit or suffered a little loss.

It doesn't matter whether prices will rise or fall next, or whether you're in a profitable or losing state now. Your stop-loss point has already been set, and the same goes for your take-profit point. You don't need to worry about anything else. Don't make your entry price the center point of the balance, tilting left and right constantly.

The only criterion you should follow is the market situation.

FXOPEN:XAUUSD FX:EURUSD NASDAQ:IXIC TVC:USOIL COMEX:GC1!