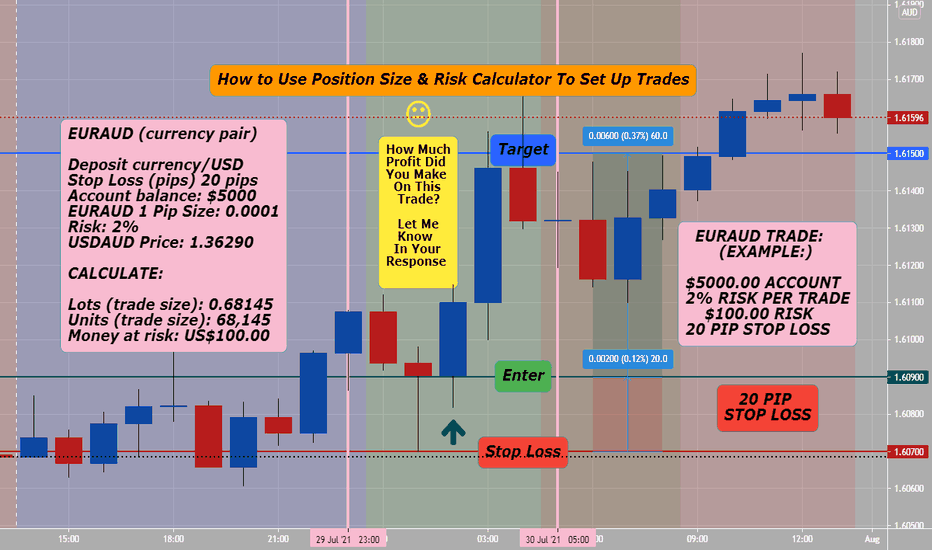

How To Use Position Size & Risk Calculator (On All Trades)Use Position Size and Risk Calculator to easily calculate recommended lot size, using live market quotes, account equity, risk percentage and stop loss.

What are Lots:

Standard 1.0 Lots: 100,000 Units Mini 0.10 Lots: 10,000 Units Micro 0.01 Lots: 1,000 Units Nano 0.001 Lots: 100 Units

In Forex a Lot defines the trade size, or number of currency units to be bought or sold in a trade. One Standard Lot is 100,000 units of base currency. Most brokers allow trading with fractional lot sizes down to .01 or even less. Fractional lot sizes are sometimes referred to as mini lots, micro lots and nano lots.

How To Use Position Size & Risk Calculator: (Select and/or impute your particular details of any pending trade)* THEY ARE FREE ON LINE!!!

Currency pair: Traders can select from Major Forex crosses, Minor pairs.

Stop loss (pips): Traders should input the maximum number of pips they are willing to risk, or lose, in a trade, to protect the account equity in case the market goes against their position.

Account balance: Pretty straight forward, traders just need to input their account equity.

Risk: The crucial field of this Position Size and Risk Calculator! In this field traders can select from a risk percentage or any amount of their account base currency ($2, $20, $40, etc). As a guideline, professional traders do not risk more than 2% of their account equity per trade. This technique will allow for traders to last longer with their trading careers, and eventually, also to recoup from previously losing trades.

Now Hit the "CALCULATE" button

The results: The Position Size and Risk Calculator uses a market price live feed with the current inter bank rate (in a 5-digit format) and it will display the selected currency pair price

Calculator displays the amount of units that that a lot represent; how many trade units and finally the portion of the account equity at risk, or the value of the position, in this case $100 USD.

Trading Plan

Is Trading Forex Gambling? DependsIs Forex Trading Gambling? Depends

Notice a common theme? “Risk” and “losing”. If there are two things a Forex trader knows, it’s that there’s always risk and you will lose money at some point. It’s simply the cost of doing business as a Forex trader.

What is the truth? The truth is that even the large banks and hedge funds gamble every time they sit down at their trading computer. But (and it’s a BIG but) there’s an inherent difference between how they gamble and how 99.9% of retail Forex traders gamble. It’s a little thing called “probabilities”.

Learn to Think in Probabilities

It all comes down to putting on trades where the probable win is higher than the probable loss. In other words, stacking the odds in your favor. Use price action and confluence. The more “Confluence Factors” you have in your favor on any one trade, the higher the probability is that the trade will make you money. Different types of probabilities: Price action pin bar on the daily chart. Price is rejecting a key level.The trend is up.The moving averages are providing dynamic support. No immediate resistance to the upside (there are several more probables, you might use for your edge, plan or in your strategy).

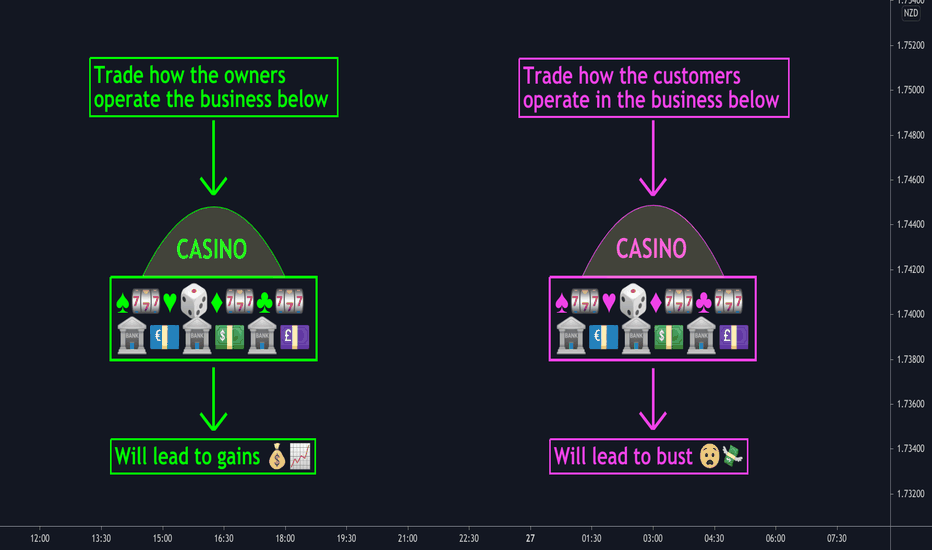

Let’s go back to the casino example for a second. We can learn something from casinos. The goal for any Forex trader should be to trade their account like a casino owner runs his/her business. Casino owners know they’re going to lose money on some customers, it’s the cost of doing business. But they also know that by the end of the year, they’ll turn a profit because the odds are stacked in their favor.

So start trading account like casino owner runs his/her business by using price action and confluence, and begin stacking the odds in your favor.

Trade like a casino! 🎰🎲💵Yep you heard me right you need trade like a casino 🎰

Key bit here is trade like the casino operates their business model.

Don't trade like the clients that frequent the casinos.

Why should you trade like a casino?

Profitable traders understand how casinos are successful.

Casinos are profitable and make money because they have an edge which they let play out.

They know probability is in their favour.

How many times have we all been at a roulette table thinking we have a 50% chance of winning betting on red or black.

We all seem to forget about that green zero on the table and here in lies the casinos edge.

With having an edge they let play out it's impossible for them not to make money.

The casino is comfortable with every outcome on the bets placed knowing the edge will play out.

Losses are seen as a cost of business, risk is controlled and emotions to are in check.

This is why the house always wins! 🎰🤑

If you as a trader apply the same logic's to your trading strategies the end results will be the same as the casino.

If you choose to trade like one of the clients in the casino with no fixed rules you essentially are gambling with you trading.

Subjectivity and emotions will come in to play.

Random winning and losing runs will occur which will impact trading psychology.

This way of trading will only end in one way and that's by giving everything to the house or in this case your broker!

Development of a strategies with proven mathematical edges ensures you will become the house 🏦💰

Once an edge is established trust your strategy and let that edge play out.

-----------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

Thank you.

Darren

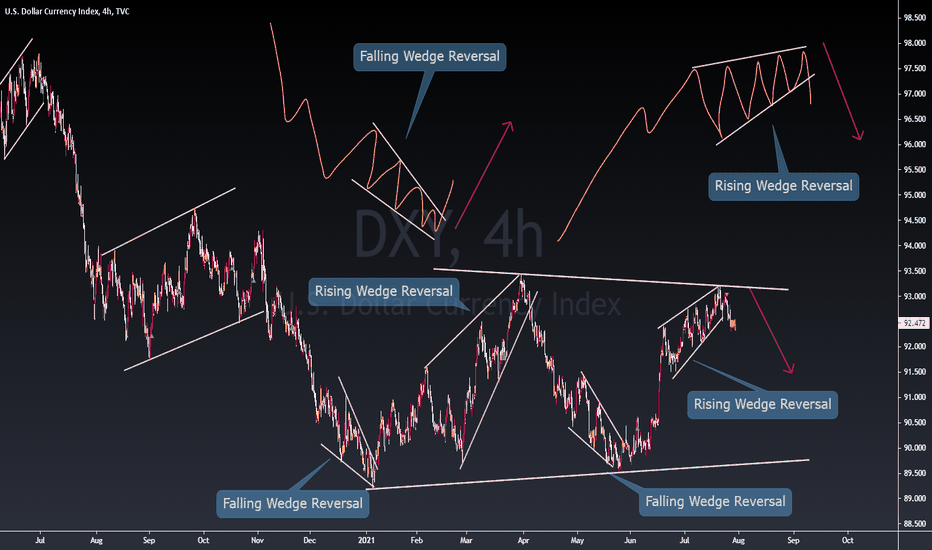

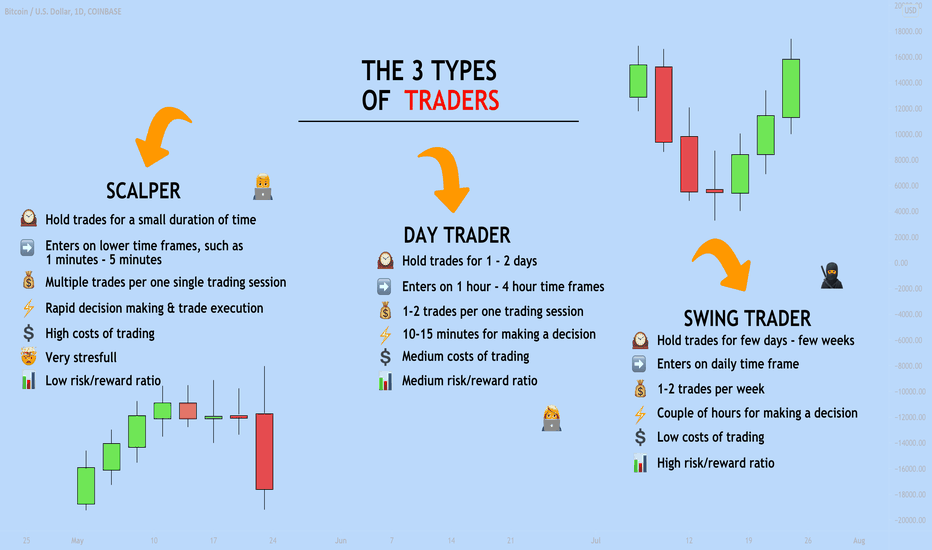

Closer look into Rising/Falling Wedge, Reversal Price Action

Closer look into Rising/Falling Wedge, Reversal Price Action structures/patterns

Hi traders:

Today I will go more in detail on rising/falling wedge correction in price action structures/patterns.

You might have already heard about these types of correctional structures, and many traders who utilize them.

Certainly there are many ways of traders identifying them and taking advantage of these kinds of price action, so it's ideal for you to understand them in your analysis.

We first need to understand that a rising/falling wedge is a REVERSAL price action. Meaning when the correction completes, there's a higher probability of the price to reverse.

You might have already seen multiple price action videos from me that go over all sorts of continuation and reversal price action (I will share links below),

and I always talk about when combining multiples of different price action structures/patterns will give you a better edge at entering positions that work out in your favor.

Same idea here, so let's take a look at how rising/falling wedges are, how to identify them, and how to effectively use them in your analysis.

Rising/falling wedge, just as the name suggests, is an ascending/descending type of correction where the price is getting squeezed into a “wedge”.

As the price gets narrower and narrower, there's a higher probability of the price to “reverse” from the wedge.

Now about entries, certainly many traders have their own method of entering, so I will share my point of view and the way how I like to enter them.

Any questions, comments or feedback welcome to let me know :)

Thank you

Risk Management: 3 different entries on how to enter the impulsive phrase of price action

Multi-time frame analysis

Identify a correction for the next impulse move in price action analysis

Continuation and Reversal Correction

Continuation Bull/Bear Flag

Parallel Channel (Horizontal, Ascending, Descending)

Reversal Ascending/Descending Channel

Reversal Double Top/Bottom

Reversal Head & Shoulder Pattern

Reversal “M” and “W” style pattern

Reversal Impulse Price Action

Continuation/Reversal Expanding Structure/Pattern

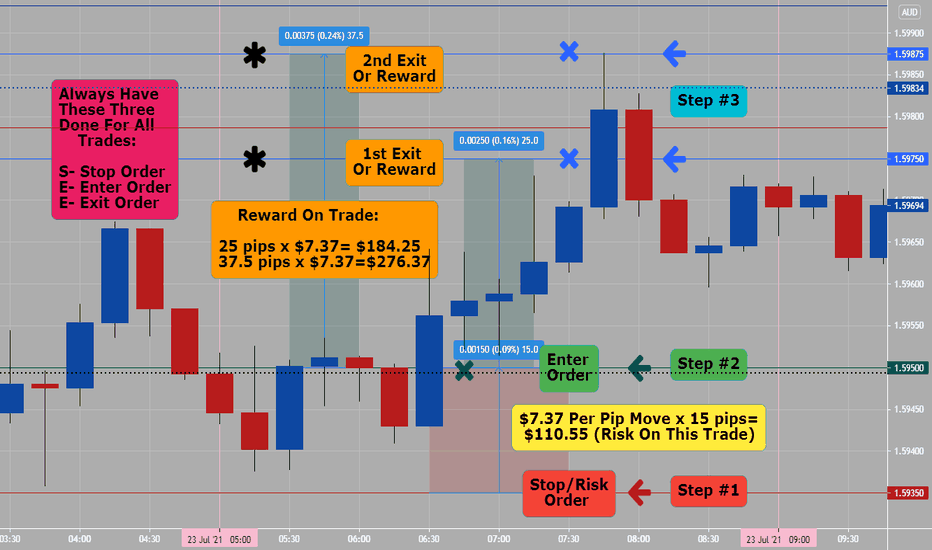

3 Steps Of A Trade (Step #3 Exit Order)Forex Exit Strategies: Tricks on Setting Limit Orders:

Forex exit strategies and exiting a trading position at the right time and price is arguably more important than your entry order. Because only when you exit, you lock in and confirm your profit. Choose the best currency pairs and the best times to trade.Today, let’s talk about getting out, WITH profit. By paying attention to a small trick when setting limit exit orders in your long-term trades.

There are many ways to calculate your Forex exit strategies. They highly depend on your trading time frame, your account’s margin and on the market sentiment in general.Identifying Limit orders or Profit Taking Levels is one of them. These are the areas you calculate to get out of your position and manage your Forex exit strategies when the market prices reach your target.

Limit Orders

Traders usually use market orders to exit trades with a big profit. If you use a limit order while you are going long, then your limit order will be higher than the market price.On the other hand, if you go short with a limit order, then your limit order will be below the market price. Imagine a limit order like a finish line. Your trades will be directly closed every time the market price crosses your limit orders.

Put bull exit orders below obvious psychological round numbers (ex: 1.50000, etc...) and above bearish psychological numbers, support and resistance areas. Most of time big banks on purpose do not go to these areas knowingly that a lot of traders are TRAPPED in these areas.

Trade 3 Steps (Step #2 Enter Order)Entry orders are a valuable tool in Forex trading. Traders can have a great trading plan, but if they can’t execute that plan effectively, all their hard work might as well be thrown out the window. This is where setting up Forex entry orders comes into play. Entry orders allow traders to set price that they would like to buy or sell a currency ahead of time. Only be executed if that specific price is hit. There are several benefits to trading Forex using entry orders.

WHAT IS AN ENTRY ORDER IN FOREX TRADING?

A Forex entry order is an order that is placed at a specified price level for a currency pair. Once this price is reached, the order is then executed/filled. If the price never reaches the desired price level, the order will not execute. The type of order can vary as well, which should be taken into consideration prior to placing the Forex order.

TOP 5 BENEFITS OF USING FOREX ENTRY ORDERS

1. Price Control- The first benefit of entry orders is the control they provide over price level. Traders can indicate their desired price level entry point at which the trade will execute. Having this ability to designate a level allows for ease of trading without having to constantly monitor the market.

2. Entry Orders Save Time-Forex entry orders are very useful for saving time. By setting one, traders do not need to be at a computer when a trend line is hit or when price breaks out of its price channel. Traders can very easily add an entry order to get in the trade if price behaves in the way he/she thinks it will. The order does the waiting and allows traders to focus on other things.

3. Better Money Management- Forex entry orders help to save money. To understand this better, consider how much time traders dedicate to trading each day.

4. Accountability-Forex entry orders (with stops and limits attached) also help keep traders accountable. This is because they eliminate the possibility of emotions getting in the way of reliable, profitable trades, and make sure traders are following the rules to the latter.

5. Support Trading on a Time Frame-Trading on a custom time frame can allow for more specified trades that could be in line with upcoming market news, political events or company results depending on what market is being traded. Traders can stipulate the expiry period for the entry order:

Trade 3 Steps (Step #1 Stop-Loss Order)“Always use stop-loss orders.” -W.D. Gann, legendary investor/trader

What is Stop Loss in Forex?

Stop loss in Forex is a great way to minimize the amount of money you lose through trading. It is an exit plan in the event of a losing trade. Essentially, stop loss is a limit you set to minimize your risk that automatically exits you out of a trade if your currency pair dips below a level that is losing you money. Stop loss is a valuable mechanism that Forex traders must use if they want to make a living from Forex Trading. It is especially essential for beginner and inexperienced Forex traders who aren’t able to always make the best trade choices. Stop loss, while important for beginners, is also used by experienced traders. There’s no downside to protecting your trades- unexpected fluctuations of currency prices happens all the time, and it’s wise to safeguard your investing when you can. Stop loss also allows you to make trades and walk away from the computer for a while, instead of having to watch the currencies change. It also worth mentioning that stop loss can work against you. * I let the trade breath with stop loss but still look for 1:5 or higher risk reward setups.

Let’s say your stop-loss is hit and you are automatically backed out of a trade, and after you’re exited from the trade the currency pair swings back other way exponentially? Not only did you just lose money on the trade, you missed out on a potentially big profit. This is why some Forex traders might have a disdain for stop loss since they view it as missing out on opportunities for major swings in a currency pair. While it depends on who you talk to, the majority of Forex traders will advise you to use stop loss, especially for beginners. It’s necessary to know about stop loss orders and how to calculate the proper limit to set it at.

Figure out your stop-loss strategy and keep to it- it will save you in the long run. Nailing down a proper stop loss strategy before you start trading is one of the best ways you can ensure yourself from the always-changing Forex market.Choosing best stop loss strategy depends on your experience, skill level, bankroll, etc. There are so many different factors that will impact what the best stop loss strategy will be for you. As with everything in Forex, it’s best to educate yourself on Forex trading strategies to eventually get to the point where you’re making a consistent income through online trading.

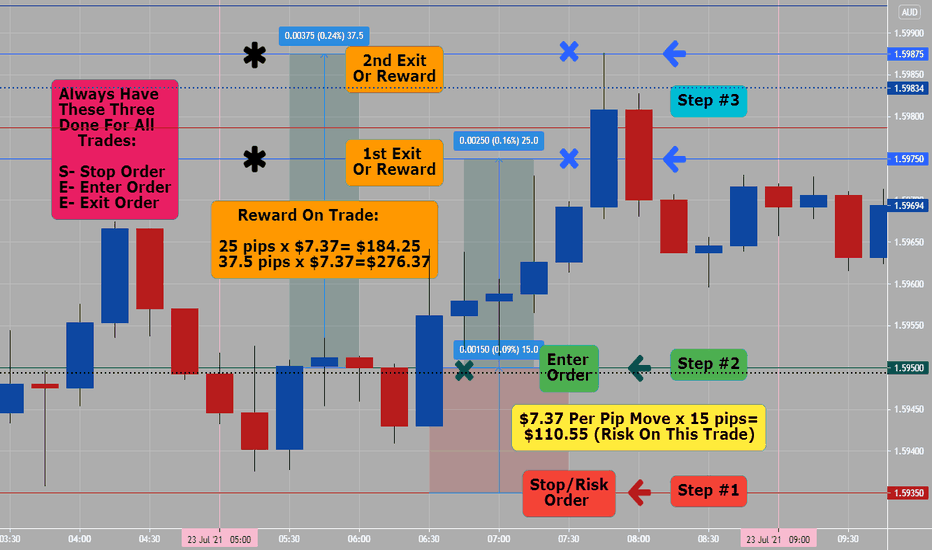

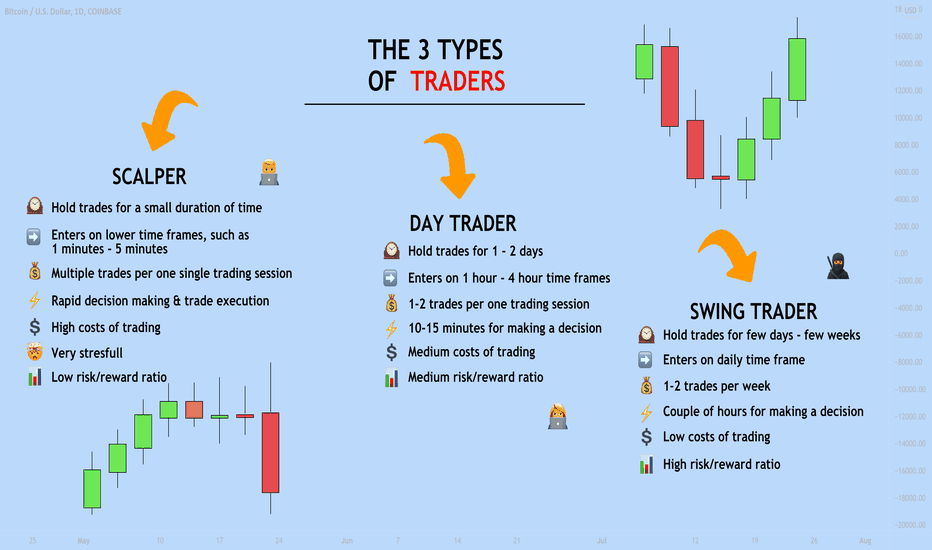

The 3 Types of Traders. Who Do You Belong To? 🤔

There are thousands of different ways to trade the market.

During the last 100 years, various trading strategies and techniques were invented.

One of the ways to categorize them is to split them by types of traders.

Such a category type will lean on 2 main elements:

trading frequency and time frame selection.

1️⃣ - Scalper

I guess 99% of newbie traders start from scalping.

Trying to catch quick market moves and become rich quick,

newbies are practicing different scalping strategies.

What is funny about scalping is the fact that such a trading style is considered to be the easiest by the majority while remaining one of the hardest in the view of pros.

The main obstacle with scalping is a constant focus and rapid decision-making.

Scalpers usually open dozens of trading positions during the trading session, most of the time being in front of the screen constantly.

Paying huge commissions to the broker and dealing with complete chaos on lower time frames, the majority simply can't survive the pressure and drop, leaving the pie to true gurus.

2️⃣ - Day Trader

Day trading or intraday trading is the most appealing to me.

Staying relatively active, the market gives some time for the trader for reflection & thinking.

Opening and managing on average 1-2 trades per trading session, the intraday trader is granted a certain degree of freedom.

However, with declining volatility, quite ofter intraday traders get a relatively low risk/reward ratio for their trades,

3️⃣ - Swing Trader

Swing trading is the best choice for traders having a full-time job.

Primarily being focused on daily/weekly time frames, swing trading is not demanding for a daily routine and aims at catching mid-term/long-term market moves.

With an average holding period being around 2 weeks and opening 1-2 trading positions per week, swing trading is considered to be the least emotional and involves low risk.

The main problem with swing trading is patience.

Correctly identifying the market trend and opening a trading position,

the majority tends to close their positions preliminary not being patient enough to let the price reach their target.

Which trading type do you prefer?

Continuation & Reversal Correction in price action structures

In-depth look at Continuation & Reversal Correction in price action structures/patterns

Hi everyone:

Today I want to revisit the fundamental aspect of trading impulsive and corrective phases in Price Action Analysis.

As you all know I focus on multi-time frame analysis and forecasting/anticipating the next impulsive move in the market.

To me, the most important part of identifying the next impulsive phase of the market, is to understand how correction works.

An impulse phase usually happens after a correction has finished correcting, so the key is to identify and understand how a corrections structure will complete so we anticipate the next impulsive move.

You may have seen my videos on this topic, but today I will go more in detail on this, and explain the 2 types of correctional structure the market can create.

The market can only be in 2 phases, impulsive phrase or corrective phrase.

In addition, the corrective phrase can only be continuation, or reversal.

So to fully have an edge in the market, is to understand what the correctional structure the price is currently making,

whether a continuation/reversal, then forecast the possible price outlook, and go down to the lower time frames for possible entries.

Now, it's important to understand that different traders/strategies/styles will call these patterns/structures in varies names.

What they are called or identify isn't important, but the important aspect is to understand whether they are continuation, or they are reversal.

In addition, simply seeing price action structures/patterns by itself, is not a good enough entry criteria for me.

You want to combine multi- time frame analysis, top-down approach, and with multiples of these price actions all happening so it adds extra confluence for you to enter a particular trade.

Seeing a H and S pattern, on a 5 minute chart, without considering the overall HTF and other factors, will not be a consistent move in the long run.

Continuation Correctional Structure/Pattern

Bullish/Bearish Flag

Bullish/Bearish Pennant

Parallel Channel

Reversal Correctional Structure/Pattern

Ascending/Descending Channel

Rising/Falling Wedge

Double Top/Bottom

Head & Shoulder Pattern/Inverse H and S

“M” and “W” style pattern

Reversal Impulse Price Action

I will forward all the price action structures/patterns videos I have made in the past to help you understand each of the structures more.

Impulse VS Correction

Multi-time frame analysis

Identify a correction for the next impulse move in price action analysis

Continuation Bull/Bear Flag

Parallel Channel (Horizontal, Ascending, Descending)

Reversal Ascending/Descending Channel

Reversal Double Top/Bottom

Reversal Head & Shoulder Pattern

Reversal “M” and “W” style pattern

Reversal Impulse Price Action

Continuation/Reversal Expanding Structure/Pattern

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

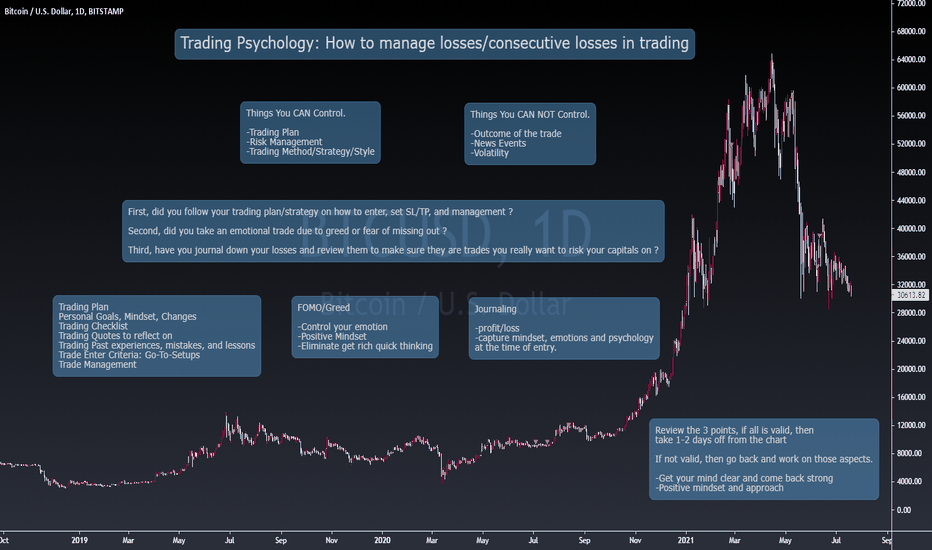

How to manage & deal with consecutive losses in trading ?

Trading Psychology: How to manage & deal with losses/consecutive losses in trading ?

Hi everyone:

Today I want to go over a very key trading psychology lesson on how to deal with losses, especially consecutive losses.

This is bound to happen to any traders, whether you are new or experienced. ITs something all professional traders will have to deal with on a regular basis.

Understand that, dealing with losses psychologically is the key factor in the success of a trader.

This is because losses are inevitable, and trading is a probability, which trades that you take will end up both in wins and losses.

However, traders usually can not accept losses, due to their ego, greed and other emotional factors.

Aside from having a good risk management, trading plan, and trading strategies, traders can still experience the psychological emotions of losing.

This is due to the fact that we are humans and we are an “emotional” animal. We don't want to be wrong, at all.

Taking a loss is like getting slapped in the face by the market, which we have egos to fight against.

What ends up after taking losses or consecutive losses, it puts traders at a disadvantage where their emotion is high, and likely to “revenage” trade to chase back losses, which end up in a deeper hole.

To deal with such psychological phenomena, take a step back and observe your situation:

First, did you follow your trading plan/strategy on how to enter, set SL/TP, and management ?

Second, did you take an emotional trade due to greed or fear of missing out ?

Third, have you journal down your losses and review them to make sure they are trades you really want to risk your capitals on ?

By now you will see why we need to review these. Trading is a probability, not right or wrong. It's a random variable that you are putting your $ at risk.

So if you understand the rules and plans that you follow and execute a trade accordingly,

then there should NOT be any negative emotions towards the outcome of the trades, whether they are winners or losers.

When I discuss the trades I entered every week in my trade recaps videos, I am always happy to enter a position, even if it goes to a loss.

This is because I have done enough backtesting, chart work, and plan to enter a position.

I understand strictly from a probability point of view, I could have a higher strike rate, and more often the trades will end up as a winner rather than a loser.

However, I also understand and acknowledge that some trades will end up in a loss, disregard mine technical analysis or other’s fundamental analysis. It is what trading is all about.

When I have consecutive losses, I will always review the 3 points I mentioned above and make sure they are all valid for me.

Then I simply will take 1 day off from the market, chart, phone, and just get your mind clear. Come back strong after 1-2 days of rest, and have a positive mindset.

What traders often do when they have consecutive losses is to right away re-enter back into the market and try to chase back their losses.

This has always been the downfall of losing and it creates anxiety in traders’ minds.

Such a negative experience is going to stay in the traders’ mind longer and deeper, compared to consecutive winners.

So wise we understand that is the case how our brain is "programmed” into thinking, then it's up to us to do the opposite, and fight the urge to “revenge” our losses.

At the end of the day, no one is trading your trading account, except yourself.

Taking ownership of your account, learning to control our emotions, understanding the probability side of trading, and learning to let go, drop our ego will help us in the long run in this industry.

I hope these pointers can help some traders who are still struggling with this concept.

It's impossible not to take losses, but professional traders deal with it on a regular basis and still remain consistent in the long run.

Thank you

I will forward some Trading Psychology educational videos below on some of the topics explained today.

Trading Psychology: Revenge Trading

Trading Psychology: Fear Of Missing Out

Trading Psychology: Over Leveraged Trading

Trading Psychology: Is there Stop Loss Hunting in Trading ? How to deal with it ?

TradingView: Look first / Then leap.Every once in a while you have to commit to something that pushes the boundaries of your comfort zone — that gets your heart beating, the breath shaky and palms sweaty. For us, that’s this moment right now, where we share with you the efforts of a project that’s been a long time in the making. It’s with great pleasure that we present to you the new look and feel for TradingView!

Our mission has forever been: Always an informed decision. That it doesn’t matter who you are, where you’re from or what your risk appetite is, everyone is entitled to the right tools and the right information to make the best trading and investment decisions possible.

Now, to articulate that ambition more evocatively, you’ll see us using the concept Look first / Then leap . We think this sums up what TradingView is all about — there’s no point jumping blindly into trades (that’s why you use charts) but at the same time you don’t just do 100% of your analysis just for fun — there’s got to be some commitment required.

First you prepare, then you go for it: Look first / Then leap.

We will be sharing updates all week about our new look and feel. You'll also have a chance to meet our sponsored sports stars including the legendary free soloist featured in this video Alex Honnold , renowned free-skier Caite Zeliff and adventurer Leo Houlding .

Thank you for being a member, sharing feedback, and working your hardest to become the best trader or investor. This is a monumental day in our history together.

The 3 Types of Traders. Who Do You Belong To? 🤔

There are thousands of different ways to trade the market.

During the last 100 years, various trading strategies and techniques were invented.

One of the ways to categorize them is to split them by types of traders.

Such a category type will lean on 2 main elements:

trading frequency and time frame selection.

1️⃣ - Scalper

I guess 99% of newbie traders start from scalping.

Trying to catch quick market moves and become rich quick,

newbies are practicing different scalping strategies.

What is funny about scalping is the fact that such a trading style is considered to be the easiest by the majority while remaining one of the hardest in the view of pros.

The main obstacle with scalping is a constant focus and rapid decision-making.

Scalpers usually open dozens of trading positions during the trading session, most of the time being in front of the screen constantly.

Paying huge commissions to the broker and dealing with complete chaos on lower time frames, the majority simply can't survive the pressure and drop, leaving the pie to true gurus.

2️⃣ - Day Trader

Day trading or intraday trading is the most appealing to me.

Staying relatively active, the market gives some time for the trader for reflection & thinking.

Opening and managing on average 1-2 trades per trading session, the intraday trader is granted a certain degree of freedom.

However, with declining volatility, quite ofter intraday traders get a relatively low risk/reward ratio for their trades,

3️⃣ - Swing Trader

Swing trading is the best choice for traders having a full-time job.

Primarily being focused on daily/weekly time frames, swing trading is not demanding for a daily routine and aims at catching mid-term/long-term market moves.

With an average holding period being around 2 weeks and opening 1-2 trading positions per week, swing trading is considered to be the least emotional and involves low risk.

The main problem with swing trading is patience.

Correctly identifying the market trend and opening a trading position,

the majority tends to close their positions preliminary not being patient enough to let the price reach their target.

Which trading type do you prefer?

❤️Please, support this idea with a like and comment!❤️

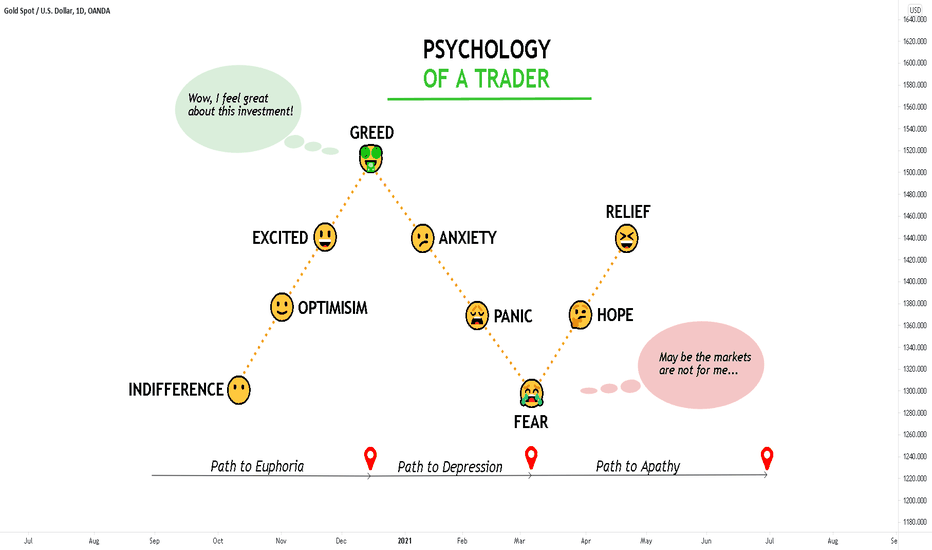

PSYCHOLOGY OF A TRADER | MASTER EMOTIONS & MASTER THE MARKET

The market is driven by people.

The crowds are always behind strong market rallies.

What the majority fails to recognize is the fact, that being chaotics in its nature, the markets are always trading in predictable patterns.

Believe it or now, but the market participants are driven by the same emotional impulses. It does not really depend on how wealthy is the person.

With the core motive being to make a ton of money with a little risk possible, we can derive a universal archetype.

Every asset, every financial instrument has an element of a "potential value". Being 100% subjective, an attempt to calculate the future value drives the market.

Depending on the current expectation of the crowd and its emotions it is necessary for a professional trader to learn to play with its behavior.

With many years of constant observations, the cyclic psychological curve was derived to explain the relationships between our emotions and market cycles.

On the chart, I have drawn 9 main stages of trader's psychology:

😶INDIFFERENCE - No opportunities are spotted, searching for the right pick.

🙂OPTIMISM – Positive outlook leading us to buy a certain asset

😃EXCITEMENT – Being initially right in our pick, we feel excited as bulls push the market to the new highs

The moment of happiness and feeling of being "a true investor"

🤑GREED – Being thrilled we start to ignore warning signs and add more and more cash to the market believing that the market will never stop.

😕ANXIETY – The market starts taking our gains back. Being biased and nihilistic we keep holding the position, thinking that it is just a pullback.

😩PANIC – Tremor. We are frozen. Emotions are draining our power. We are clueless and helpless. We totally lose the sense of control.

😭DEPRESSION – Position is closed. Money is lost. Considering trading & investment industry to be a scam.

🤔HOPE – The dawn. The market returns back to its normal state. Aspiration & desire to start again.

😆RELIEF – Again we start to believe in our strength. We return and the cycle repeats.

Do you recognize yourself in these stages?

Please, support our work with like and comment. It really helps.

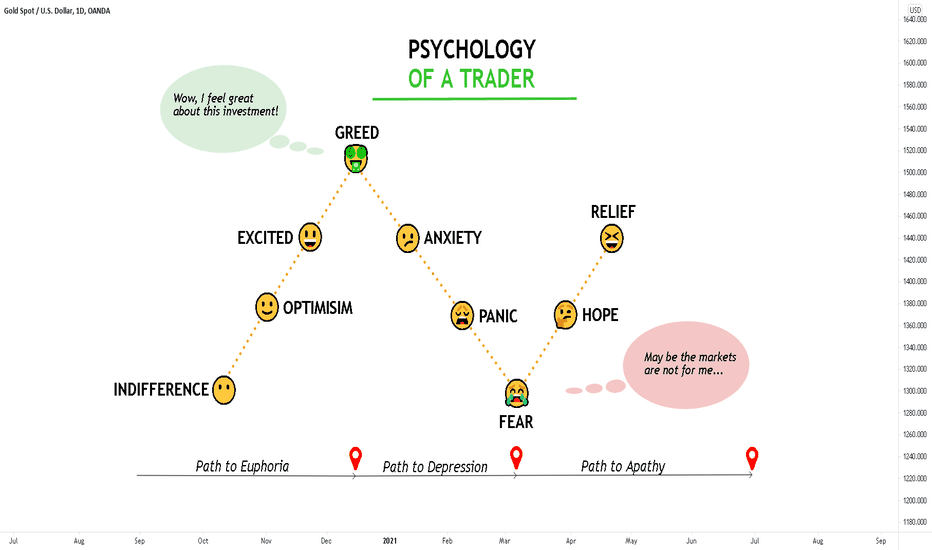

PSYCHOLOGY OF A TRADER | MASTER EMOTIONS & MASTER THE MARKET

The market is driven by people.

The crowds are always behind strong market rallies.

What the majority fails to recognize is the fact, that being chaotics in its nature, the markets are always trading in predictable patterns .

Believe it or now, but the market participants are driven by the same emotional impulses . It does not really depend on how wealthy is the person.

With the core motive being to make a ton of money with a little risk possible, we can derive a universal archetype .

Every asset, every financial instrument has an element of a "potential value" . Being 100% subjective, an attempt to calculate the future value drives the market.

Depending on the current expectation of the crowd and its emotions it is necessary for a professional trader to learn to play with its behavior.

With many years of constant observations, the cyclic psychological curve was derived to explain the relationships between our emotions and market cycles.

On the chart, I have drawn 9 main stages of trader's psychology:

😶 INDIFFERENCE - No opportunities are spotted, searching for the right pick.

🙂 OPTIMISM – Positive outlook leading us to buy a certain asset

😃 EXCITEMENT – Being initially right in our pick, we feel excited as bulls push the market to the new highs

The moment of happiness and feeling of being "a true investor"

🤑 GREED – Being thrilled we start to ignore warning signs and add more and more cash to the market believing that the market will never stop.

😕 ANXIETY – The market starts taking our gains back. Being biased and nihilistic we keep holding the position, thinking that it is just a pullback.

😩 PANIC – Tremor. We are frozen. Emotions are draining our power. We are clueless and helpless. We totally lose the sense of control.

😭 DEPRESSION – Position is closed. Money is lost. Considering trading & investment industry to be a scam.

🤔 HOPE – The dawn. The market returns back to its normal state. Aspiration & desire to start again.

😆 RELIEF – Again we start to believe in our strength. We return and the cycle repeats.

Do you recognize yourself in these stages?

Please, support our work with like and comment. It really helps.

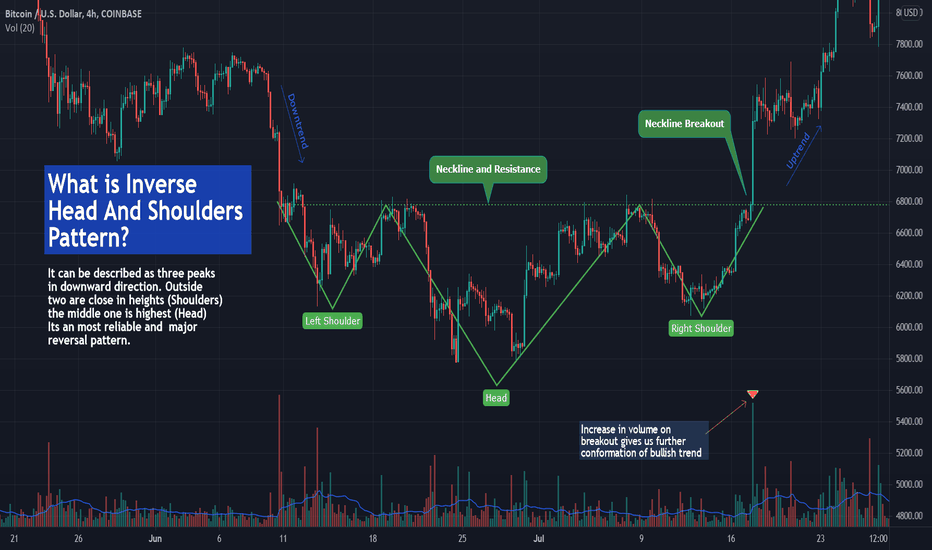

What is Inverse Head and Shoulders Pattern?Inverse Head and shoulders Pattern is the mirror image of head and shoulders pattern.

Read about Head and Shoulder Pattern here:

Inverse H&S Pattern is bullish reversal pattern. Signals the traders to enter into long position above the neckline.

Volume play a major role in both H&S and Inverse H&S Patterns. Usually the spike in volume on breakout is considered as a great signal for bullish entry.

Again a suitable target can be obtained by measuring the distance between head and neckline of the pattern and using same distance to project the target .

After the neckline breakout there is also a probability that prices can be retrace again to neckline due to lack of demand . Prices can only rise if again there is more demand which will lead to bullish uptrend.

Also if the neckline slopes slightly upward that is the sign of greater market strength thus gives further conformation to go bullish on Inverse H&S Patter .

Let us know what do you think about Inverse H&S Pattern? Please comment your views/doubts!

As always nothing works every time in

markets. Please do your research before taking any position. This is only for Educational Purpose.

We are covering all Major Reversal and continuation patterns in this series.

Follow to get updated with all the informative and educational trading ideas.

Next Pattern we will cover: Round Bottom Pattern

PS: We are publishing this again for global audience.

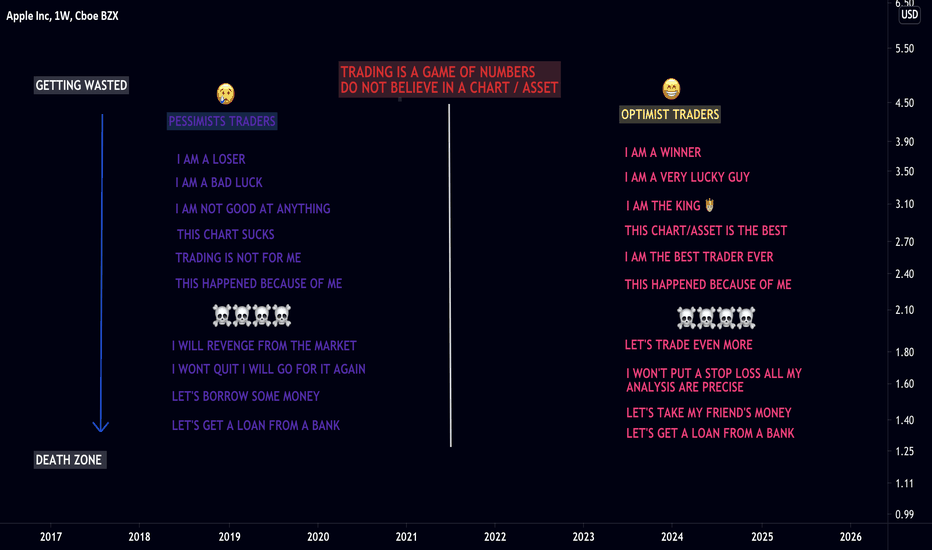

TOXIC TRADERS ☠️📌 Both optimism and pessimism is the worst thing to happen to a trader.

⚠️ Please do not believe in a chart or have a faith for that...

📍 Being realistic and trade based on reasonable facts is the best way of trading. Always make decision based on facts and DO NOT TRUST YOUR HEART NOT EVEN ONCE.

⚠️ Set your risk by considering your character; are you willing enough to take risks as dangerous as completely losing all your money?

⚠️ As I wanna mention it again: NEVER BELIEVE IN CHART. Just see it as a potential oppurtunity.

📍 Trading is a game of numbers, mathemtics, algorithms, cycles, supply and demand, economics, etc. One of the most strict majors in the human history.

⚠️ Do not include your emotions and or you belief or faith in this game.

This is not a financial advice, I just am willing to share my own experiece with you guys

With y'all a very happy and profitable lifestyle

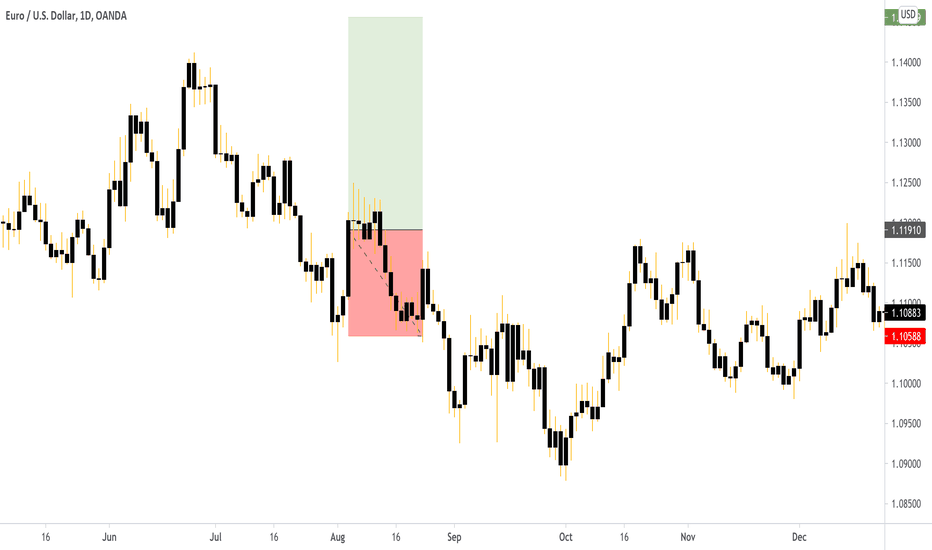

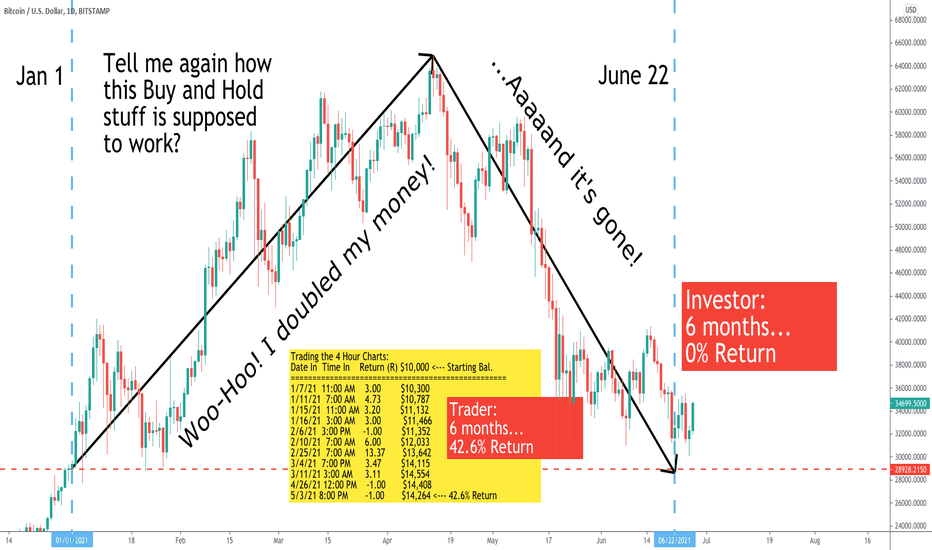

The Death of Buy-and-Hold reduxAs a follow-up to my previous article, “The Death of Buy-and-Hold” , Bitcoin in these last four months has demonstrated quite vividly to us the error of that outdated methodology, that Buy-and-Hold is truly dead and technical trading is superior to what is called “investing” today.

In the two month period from February, 2021 through April, Bitcoin enjoyed a meteoric rise, gaining 100% in value during that 60 day period. However, as they say, “The bigger they are, the harder they fall…“ And fall it did… Bitcoin gave back every penny in the following two months crashing back to its February levels.

The most profitable, reliable, and consistent trading systems available to the average investor, as I demonstrated in previous articles , are those systems based on "supply and demand" methodologies. We can’t fight the hedge funds. We can’t fight China. We can’t fight the “whales” of the crypto market.

… But we can follow their footprints as traders .

I backtested Bitcoin based on my own proprietary supply and demand methodology, but I would assume that any supply and demand system would achieve similar results because we are all chasing the same protagonist (or antagonist, depending on how you look at them).

The results: From January 1, 2021 through June 22, buying and and holding Bitcoin would’ve net a zero return for the investor! Following a supply and demand methodology, however, the casual trader who might work on the 4 hour charts, checking in on their account once or twice per day, I identified 11 trading opportunities which resulted in a net profit of 42 percent .

Why would the investor make zero and the trader make 42%? Buy-and-hold only works in one direction… When the product gains value. Supply and demand trading lets you profit rain or shine, by the day or by the hour, in good times and bad.

I bring this up, not ultimately as an "I told you so" but as an encouragement: Yes, indeed, it is possible to pull a reliable, steady income from the markets, from the cryptos , from the indexes , from the commodities , rain or shine, week after week, once you learn to "see the money flow" and follow the trail as a trader .

One does not have to have their livelihoods be subject to the whims of the economy, of policies imposed by public officials, of Tweets from CEOs, from natural disasters, from supply chain disruptions, the whims of totalitarian nations, nor an employer, employees, or customers.

Most importantly, Supply and Demand trading protects us from the large financial institutions who regularly engage in Market Manipulation , whose tactics include fear and greed news cycles, whose analysts and "experts" foment 'sentiment' among their viewing audience, whose priority is to broadcast information that will financially benefit themselves, and not their viewers.

Trade well!

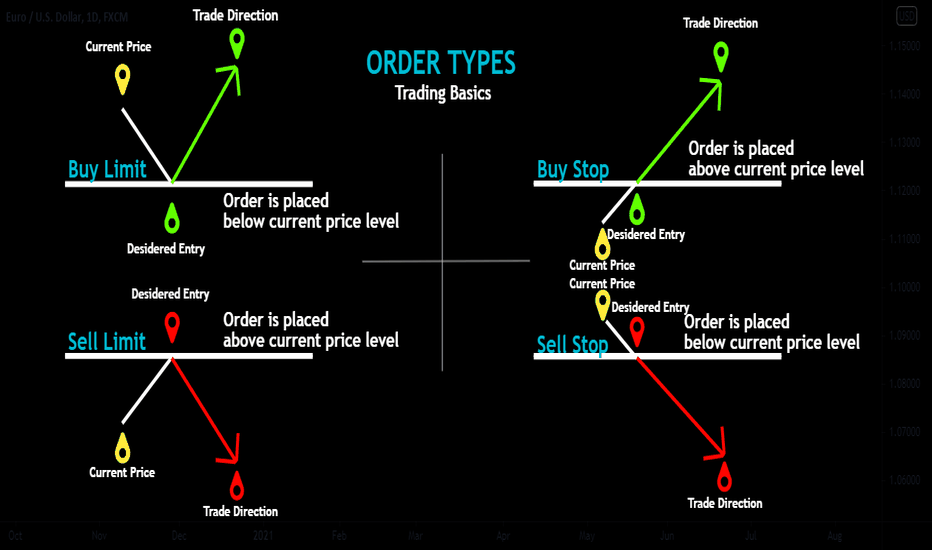

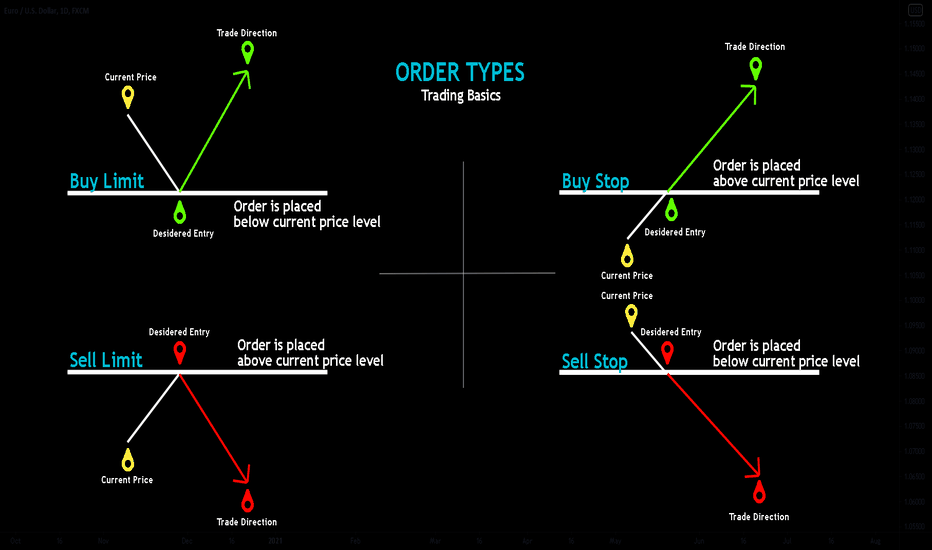

👶 Trading For Beginners | ORDER TYPES 👦👧

There are multiple ways of opening a trade in a trading terminal.

Here is the list of universal order types that you MUST know:

1. Market Order

A market order is a trade order to buy or sell a desired financial instrument on a current market price.

In such an order type, the price is determined by the market.

Constant price fluctuations and spreads make market order quite risky way of opening a trading position.

2. Limit Order

A limit order is a trade order to buy or sell a desired financial instrument at a specific price level. It allows the trader to enter the market on a strict price level ignoring the price fluctuations and spreads.

A limit order can be referred to as a buy limit order or a sell limit order.

3. Buy/Sell Stop Order

Buy stop order is used to buy at a price above the market price, and it is triggered when the market price touches or goes through the Buy Stop leve.

Sell stop order is used to sell when a specified price is reached.

The selection of order types is based on a trader's trading style.

Let me know in a comment section which order types do you apply in your trading!

Please, like this post and subscribe to our tradingview page!

👶 Trading For Beginners | ORDER TYPES 👦👧

There are multiple ways of opening a trade in a trading terminal.

Here is the list of universal order types that you MUST know:

1. Market Order

A market order is a trade order to buy or sell a desired financial instrument on a current market price.

In such an order type, the price is determined by the market.

Constant price fluctuations and spreads make market order quite risky way of opening a trading position.

2. Limit Order

A limit order is a trade order to buy or sell a desired financial instrument at a specific price level. It allows the trader to enter the market on a strict price level ignoring the price fluctuations and spreads.

A limit order can be referred to as a buy limit order or a sell limit order.

3. Buy/Sell Stop Order

Buy stop order is used to buy at a price above the market price, and it is triggered when the market price touches or goes through the Buy Stop leve.

Sell stop order is used to sell when a specified price is reached.

The selection of order types is based on a trader's trading style.

Let me know in a comment section which order types do you apply in your trading!

Please, like this post and subscribe to our tradingview page!

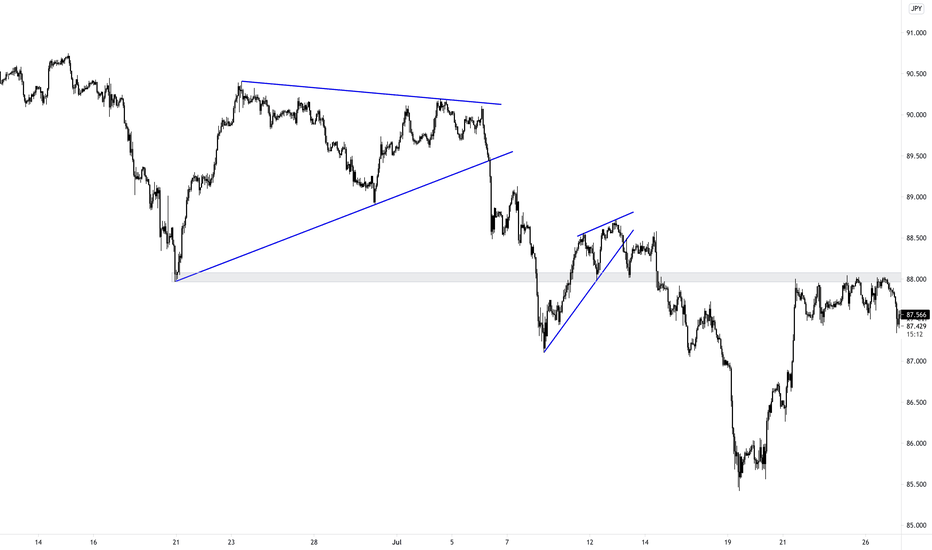

How To Set Up A Trade On Hour ChartIf you have a $5,000 account (USD currency)- want to trade Aud/Jpy currency with a 2% risk, what do you do? You need to know trade size on all pairs and pip value, so you can set stop loss, entry order and take profit/exit order- per your trading strategy and risk management tolerance.

1) go to Forex pip calculator online

2) Aud/Jpy current value of a pip Value of standard lot (units 100,000) is $900.45< yes, that is right!! What they are saying is every pip the AJ pair moves on a standard size is a $900 USD move (Crazy) Can you trade this lot size? NO. How about Micro Lot (units 1,000)? yes, pip value is $9.00.

3) On one hour AJ pair example chart, there are three noted trades: two bullish (1st and 3rd) and one bearish (2nd).

4) If you catch all three trades with by placing a 1: 4 Risk/Reward setup on them. What does that mean? (stop loss is around $100 per trade, related to 2% of account if you have $5,000 USD)- As your account gets higher, lets say $100,000 USD or more, even 1% would work- but to each their own)

5) Your stop loss is over entry of any bearish trades or under entry of any bullish trades by 10 pips or ($90.00 of risk) to make 40 pips or ($360.00)- possible on all three noted trades on chart. If you would have hit all three trades just right, you would have been in the money after two days around $1,000 USD with only risking 2% of your account. This is how the turtle beat the hare in Forex trading race- slowly but surely. If you trade micro lot of 500 units, you could have a larger 20 pip stop stop (around $100) and 40 pip targets would with a pip value of $4.50 instead (trade conservatively until confidence grows)

Put yourself in best position for success in Forex trading: Before any new trades know where to put stop, entry and profit orders. After your trade is active just let it play out, because the market is out of your hands at that point. Note keep in mind: right pair, right price, right session & right time.

The Lack of Knowledge in Forex - How to succeed in this businessThere is a big lack of knowledge in this forex industry. Retail Trader always forget that we are in the Champion League here and that we need to have a lot of knowledge in order to succeed.

Key Elements are

- Trading Plan

- Strategy

- Money and Risk Management

Predicting the right direction of the forex pairs is not to 100% possible and not even necessary. The key is to understand how to react to the new changes within the market. It is like in life.

Hopefully I could help you with this video.

Tell me your feedback

What do you think?