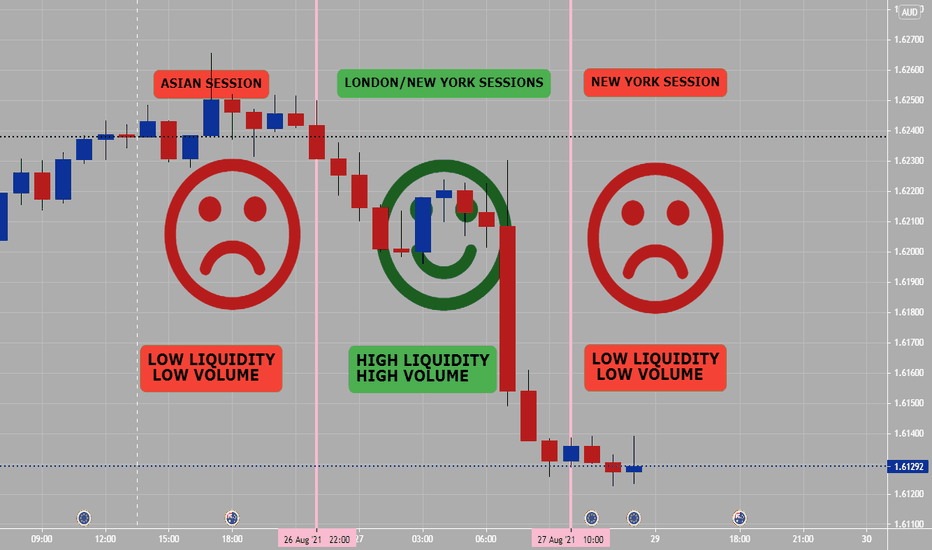

High or Low Liquidity & Volume (When Is It?)Liquidity and Volume (When Is high and low periods of both?)

Generally per day in Forex trading 24/5 market their is 12 hours of low liquidity and low volume, which is after London ends to Tokyo ends.

Then, the other 12 hrs of high liquidity and high volume, which is easier to scalp or day trade which is at end of Tokyo to end of London.

You would need to know when Tokyo ends to London ends in your time zone (yes that overlaps New York 1st 4 hours too). Best hours to trade.

For your health: keep Forex trading within a certain times of days, so you can live life and maintain balance and enjoy fresh air......

Trading Plan

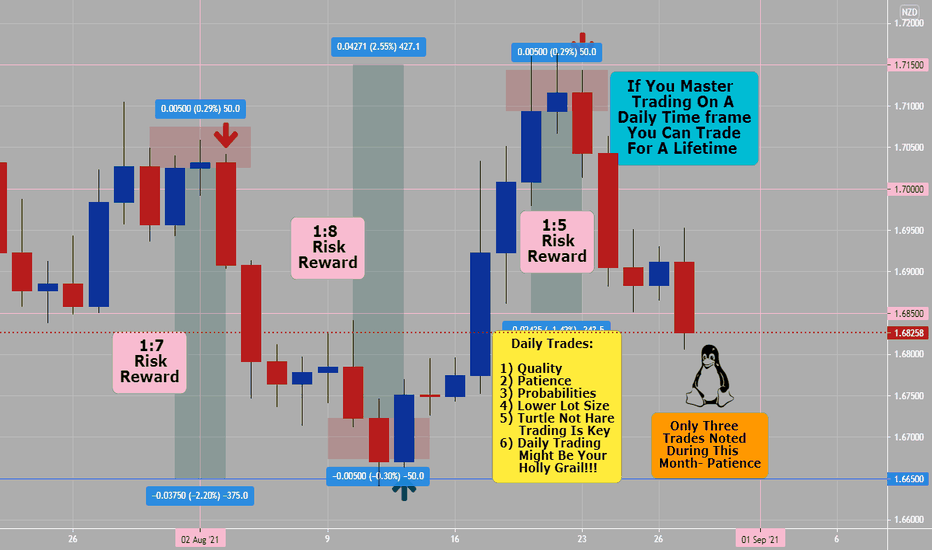

Trading Daily Charts (Might Save Your Trading)If You Master Forex Trading On Daily Charts, You Can Trade For A Lifetime. (Understand the language of candlesticks on daily charts)

1) Quality trades not Quantity of trades- Trade your best trade setups only at swing points on daily charts.

2) Patience- You make money waiting not trading. You do not need to trade 20-30 times on lower time frames per month, when 2-3 times will make same money with less emotions and stress. Also, you will have more time freedom to enjoy life and find balance. Forex trading is not everything you are.

3) Probabilities- Only trade your best set ups at swing points (ex: like support/resistance, fib ret 50% to 61.8% area, swing points, etc..

4) Lower Lot Size- Related to using high stop loss, but like chart example let trade run for one or two weeks. 1:5 to 1:8 Risk Reward on trades will be goal.

5) Turtle Not Rabbit Trading Is Key- Trading Forex is a turtle marathon not a rabbit sprint race. Slow down- have faith in your strategy and edge.

6) Daily Trading Might Be Your Holly Grail- Look for entering only on Engulfing, Harami or Pin-bar setups on daily charts (that is all you need).

If you are part of the majority of Forex traders whom trading is difficult, DO NOT trade lower time frames which are under 1 hour (to much noise).

Only trade daily time frames until the end of this year and master them. Then maybe, next year can go to lower time frames of 4 hours and 1 hours. You tube videos on Forex trading position sizing, risk management and Forex daily charts. Daily charts help develop a more effective and accurate market bias, higher risk and reward (look at example chart) with 50 pip stop risk vs. 5xs to 8xs reward- which is great. Slow ans stead wins the race (Hare vs Turtle).

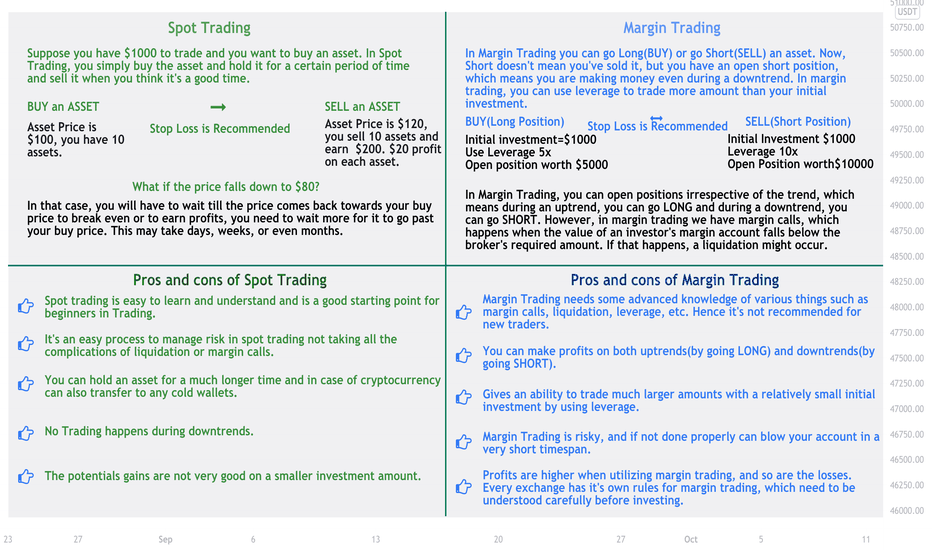

Spot Trading vs Margin Trading Pros and ConsSpot Trading is the most basic form of trading method and is the most suitable for beginners in trading. It's simply a BUY > HOLD > SELL mechanism.

On the Other Hand

Margin Trading is complicated and should only be done by experienced traders. There are various components to margin trading such as Maintenance margin, margin calls, leverage, and liquidation.

Pros and cons of Spot Trading

👉Spot trading is easy to learn and understand and is a good starting point for beginners in Trading.

👉It's an easy process to manage risk in spot trading not taking all the complications of liquidation or margin calls.

👉You can hold an asset for a much longer time and in the case of cryptocurrency can also transfer to any cold wallet.

👉No Trading happens during downtrends.

👉The potentials gains are not very good on a smaller investment amount.

Pros and cons of Margin Trading

👉Margin Trading needs some advanced knowledge of various things such as margin calls, liquidation, leverage, etc. Hence it's not recommended for new traders.

👉You can make profits on both uptrends(by going LONG) and downtrends(by going SHORT).

👉Gives an ability to trade much larger amounts with a relatively small initial investment by using leverage.

👉Margin Trading is risky, and if not done properly can blow your account in a very short time span.

👉Profits are higher when utilizing margin trading, and so are the losses. Every exchange has its own rules for margin trading, which need to be understood carefully before investing.

Thanks for reading and what kind of trading technique do you use and why? Share in the comments below.

For more similar educational ideas, scripts and trend analysis follow us.

Happy Trading.

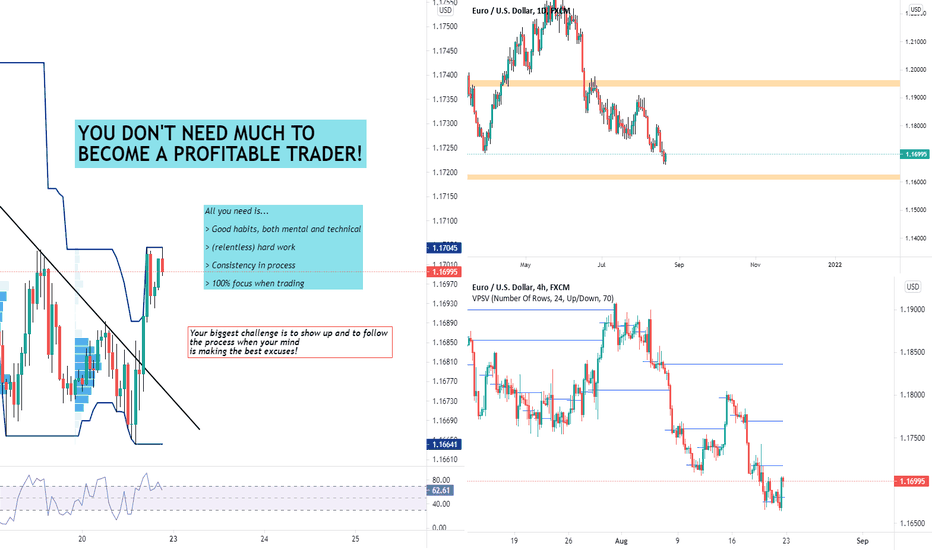

Daily Primer: Break your limits 💥In todays daily primer we talk about limitations and cause and effect. This short 5 minute video will give you the necessary guidance as to what you need to focus on to achieve the success you seek in the markets.

Success in trading, just like in any other business, is a

cause and effect relationship:

Poor or average causes = poor or average results

good causes = good results

excellent causes = excellent results

If you want to achieve success, do the work!

(metal: have patience, discipline, resilience)

(work ethic: prepare your charts, know the news, prepare your plan)

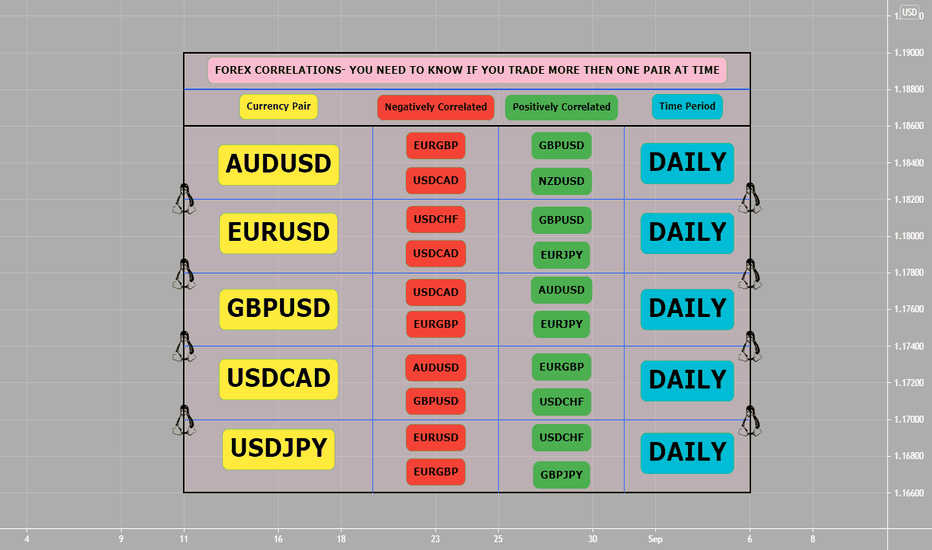

Forex Correlations ( Need To Know )Noted chart only has a few highly traded pairs and their either highly correlated negative or positive pairs on daily charts.

If you trade more then one pair at a time, you should know which pairs either mostly go same direction and or go opposite direction.

You might not want to do two trades that have a positive correlation or negative correlation for diversity and so you do not lose two trades at same time.

There are websites which have further information on Forex correlation- you should check out.

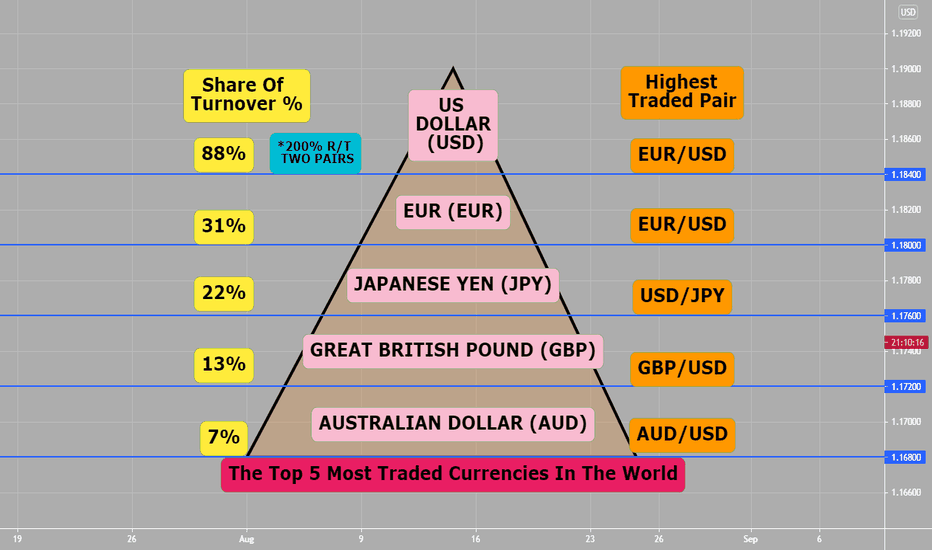

Top 5 Most Traded Forex Currencies & Sessions The Top 5 Most Traded Currencies in the World

1. US Dollar (USD)

The official currency of the United States of America, the US Dollar is also the world’s primary reserve currency.

Most traded currency pair: EUR/USD

Most active trading session: New York and London sessions

2. Euro (EUR)

The second widely traded currency is the Euro.

Most traded currency pair: EUR/USD

Most active trading session: London and New York sessions

3. Japanese Yen (JPY)

The Japanese Yen is the official currency of Japan.

Most traded currency pair: USD/JPY

Most active trading session: New York and Tokyo sessions

4. Great British Pound (GBP)

The official currency of the United Kingdom and its territories, the GBP is known colloquially as the Pound Sterling.

Most traded currency pair: GBP/USD

Most active trading session: London and New York sessions

5. Australian Dollar (AUD)

The Australian Dollar is the official currency of the Commonwealth of Australia.

Most traded currency pair: AUD/USD

Most active trading session: Sydney/Tokyo and New York sessions

The Different Types Of Trading StrategiesHello everyone, as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

In today’s video, we are going to be talking about The Different Types Of Trading Strategies, We are going to compare them to each other and look at their characteristics.

Characteristics include 1) Time Duration, Type of Chart, Trade Targets & Risks, Frequency of Trades, Entry and Exit Time.

There are 4 types of trading styles :

Most people fall in the first 3

1) Scalping

2) Day trading

3) Swing trading

4) Position trading (Refers to holding a certain position over a very long time frame like a number of years, I think this type of trade is more of an investment than trading but technically it's still trading so I had to mention it ).

So Let Us Start...

1) Scalping

Time Duration is between a few seconds and a number of minutes

The Analysis is done on 1,2 and 5 minutes charts

Small targets considering the very short trade duration

High frequency of trades because of the small risk on each trade

Scalpers need to know exactly when to enter and when to exit a trade because a small mistake can have a huge impact on the trade

2) Day trading

Time Duration from 15 min to a number of hours

The analysis is done on 30 min, 1 hour, and 4-hour charts

These trades have a larger target than Scalping

Day Traders have a lower trade frequency than scalpers and its usually between 2-10 trades per week

Day Traders doesn’t have to be so precise with entry and exits like in Scalping because being late for a trade on a daily basis won't have that much of an impact on the trade.

3) Swing trading

Time Duration typically last from a day to a couple of months

The Analysis is done daily, weekly & monthly charts

Because of the time frame, Targets usually are way larger than day trading or scalping

Low frequency in trades, Usually between 2-15 trades per month

Entry and exits here don’t have a big impact because the targets are so big

So now you ask yourself how do I know which type of trader am I?

And it comes down to 2 main factors :

Personality: You could be someone who likes to hold trades and profit big so swing trading is for you, Or you could be someone who doesn’t like to hold trades over a day period so scalping or day trading could be for you.

Lifestyle: So you may not have the time to always watch the market and how it's moving, so scalping and day trading are not for you, but for swing trading, u only have to check the market once a day so it's the better option for you.

Don’t feel like you need to decide what type of trader you are, you should try all of them and see for yourself what are you comfortable with after all there is no right answer.

I hope that I was able to help you understand The Different Types of Traders better and if you have any more questions don't hesitate to ask.

Hit that like if you found this helpful and check out my other video about the Moving Average, Stochastic oscillator, The Dow Jones Theory, How To Trade Breakouts, The RSI, The MACD, and The Bollinger Bands, links will be bellow

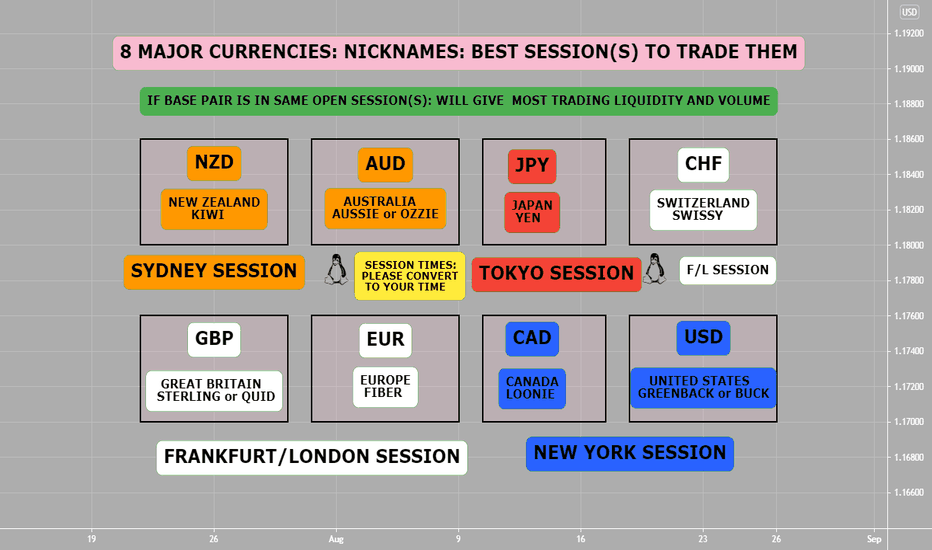

8 Major Currencies Nickname & Sessions Best Times to Trade 8 Major Currencies is when base currencies session is open. Why? It is time when highest liquidity & volume is trading.

Sydney:

AUD

NZD

Tokyo:

JPY

CHF

Frankfurt/London:

GBP

EUR

New York:

USD

CAD

PLEASE CONVERT SYDNEY-TOKYO-FRANKFURT/LONDON-NEW YORK sessions to your individual time zones: to get exact times of open and closes and overlapping sessions of TOKYO/LONDON and LONDON/NEW YORK sessions. Overlapping are highest liquidity and volume times of the Forex session.

8 Benefits Of Trading Forex8 Benefits Of Trading Forex-

-Low cost

Generally, retail brokers make their profits from the Bid/Ask Spread, which is apparently very transparent to users.

-No middle-people

It allows you to trade directly with the market accountable for the pricing of the currency pair.

-No fixed lot size

Lot sizes differ broker to broker - standard lot, mini lot, micro lot or even nano lots. This enables you to start trading from as low as $50.

-Low transaction costs

The retail transaction cost (bid/ask spread) is usually as low as 0.1% and for bigger dealers, this could be as low as 0.07%.

-No one can control the market

The foreign exchange market is large and has many participants, and no single participant (not even a central bank) can control the market price for a prolonged time period. Therefore, the chances of sudden extreme volatility is very rare.

-24-hour open market

The Forex market starts, from the Monday morning opening of the Sydney session to the afternoon close session of New York session.

- Use of Leverage and Margin

Forex brokers permit traders to use leverage and with low margin, which gives ability to trade with more money than what is available in your account.

-Very High Liquidity

Because the size of Forex market is huge, it is extremely liquid in nature. This allows you to buy or sell currency any time you want under normal market conditions. There is always someone who is willing to accept the other side of your trade.

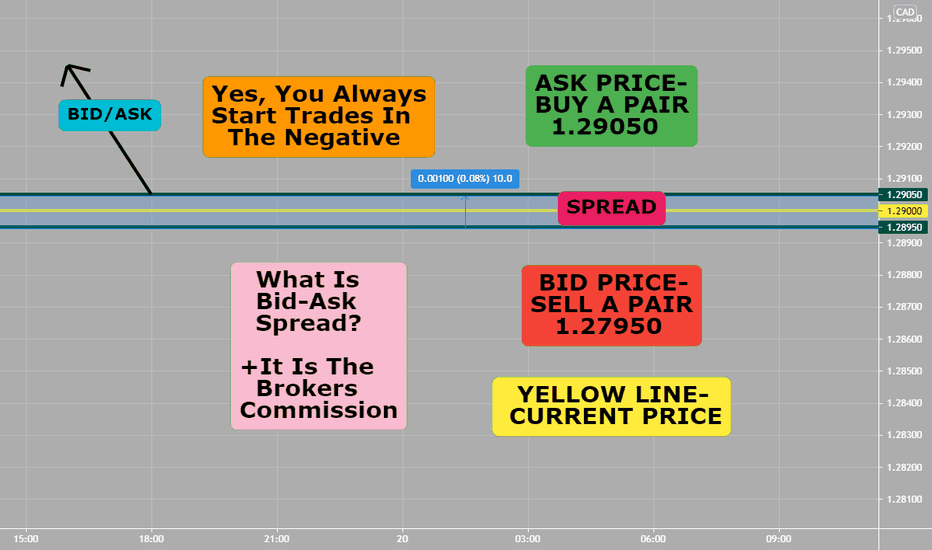

The Bid-Ask Spread (What Is It?)The spread is the difference between the bid price and the ask price.

The bid price is the rate at which you can sell a currency pair.

The ask price is the rate at which you can buy a currency pair.

Whenever you try to trade any currency pair, you will notice that there are two prices shown, left price is BID and right price is ASK.

The spread is brokerages commission on that trade, that is why all trades start off in negative until that spread is negated before turning profitable.

For Your Information:

The lower price is called the “Bid” and it is the price at your broker (through which you’re trading) is willing to pay for buying the base currency.

The higher price is called the ‘Ask’ price and it is the price at which the broker is willing to sell you the base currency against the counter currency.

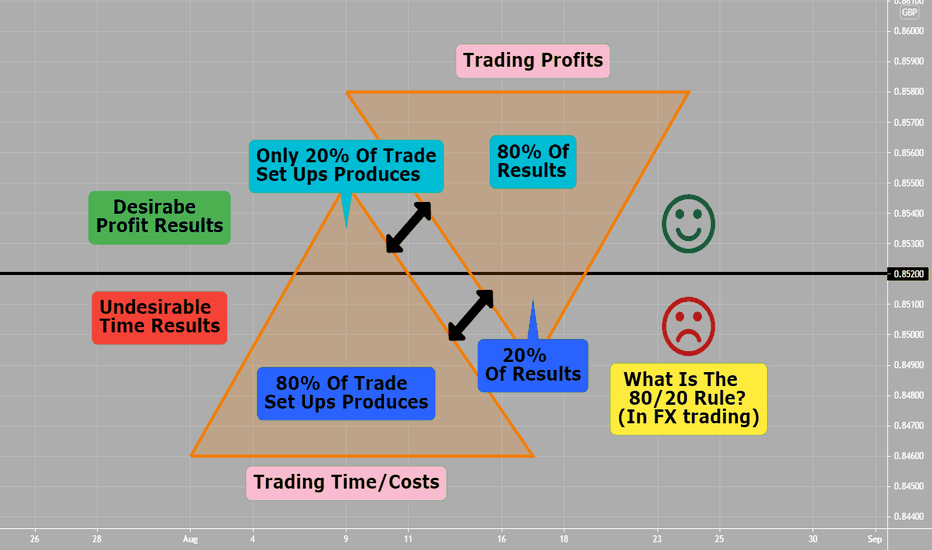

What Is The 80/20 Rule? (Forex trading)What is the 80/20 rule? this applies to play, work, trading, business and all parts of your life.

20% (of your trading) equals 80% (of your results).

An 80/20 mindset enables you to take control!

- More Time

- More Focus

- More Money

- More Freedom

- Less Stress

" Time Is A Gift"

"Time Is Money"

Questions To Ask Yourself?

1) Can you trade less and make more money trading?

2) Can you trade only high quality trades with the right pair, at right price, during right session & at right time?

3) Can you focus on only trading only one or few Forex pairs and know everything about them? news, price action etc...?

4) Can you trade with a simple and repeatable trading system and edge to profit in long run? Is trading strategy flexible?

5) Can you always use discipline when trading? using risk management: stop, entry and targets to protect your account?

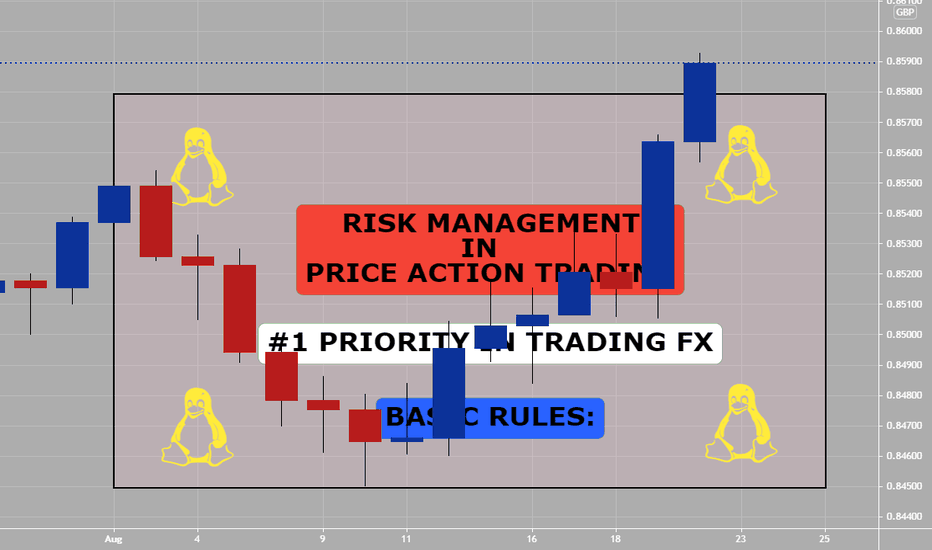

Risk Management (Your #1 Priority)Risk Management in Price Action Trading

Risk management in price action trading is much like risk management in any other style of trading; the same basic rules apply:

1. Know your maximum risk tolerance, i.e. the loss you are willing to take on each trade, before you place the trade. A common rule is that traders will not put more than 2% of their funds in the market at a time.

2. Understand correlation between assets, and to what extent you would like to be diversified.

3. Know when you will exit before you enter.

4. Know your reward/risk ratio.

5. Identify what you expect to happen and why, and what price point negates that expectation. This is price point at which you should put stop. Of course, with risk management, techniques are important, but, ultimately, it is up to the trader to ensure they are psychologically prepared for all that is involved.

Even if a trader is using a fully automated system, he/she must still have confidence in the system, and must know when any losing streak experienced is just a temporary losing streak versus a more fundamental problem suggesting the system is no longer valid.

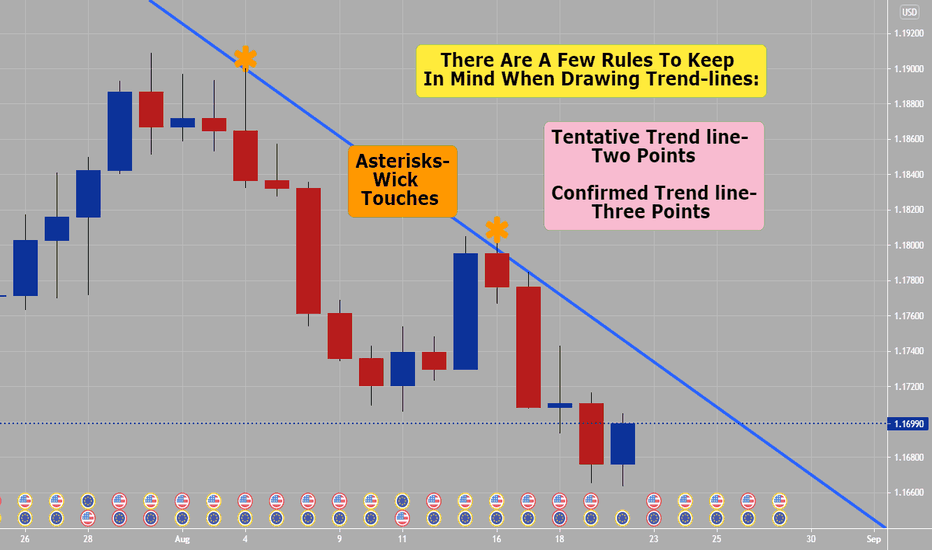

Trend lines (How To Draw & Use)There are a few basic rules to bear in mind when drawing trend lines:

1. Tentative trend line - A diagonal line market bounces off of twice. This trend line is indicative of a potential trend, but is not confirmed & actionable yet.

This is a tentative trend line; two points touch the line. It suggests the possibility of a trend in the making, though conventional analysis will not regarding the trend as established until there are three points on the line.

2. Confirmed trend line - The market has bounced off this trend line three times. Conventional analysis regards this as a sign that the trend line is real, and that the market will react around it.

It is easiest to trade from a trend when its highs or lows trend closely to a recognizable diagonal line, since this line may be used to predict future highs or lows. Opinions vary on whether trend lines should be drawn from the highs and lows of candles or from body of the candle, open & close prices; successful traders can be found employing either approach.

In an up trend, trend lines touched three times, this validates the trend line. Those who wish to trade with the trend may have looked for opportunities to buy based on validated trend. Price pulled back to the trend line that was previously confirmed. Traders can do a trend trade & may be a buying opportunity.

Support and Resistance

The price action trader pays particular attention to pivotal price levels, often “drawing” these lines horizontally as Support and Resistance levels. The theory behind employing these lines is that the market has a sort of memory: price behaves with respect to certain levels that have previously been significant

turning points in the historical narrative of the price’s action, and other market participants are likely

The Hard Truth About Trading 😅

Well, that is just a joke.

Or not a joke?

In every good joke, there's a sliver of truth...

So many people blew their trading accounts in a blink of an idea chasing the profits, so many people went bankrupt practicing leverage trading...

Do not be that guy in a picture.

Be a true trader!

Never forget about risk management and don't be greedy.

Never let your emotions control you.

Stay calm and humble while you trade.

Have a great weekend!

❤️Please, support these drawings with like! It really helps!

The Hard Truth About Trading 😅

Well, that is just a joke.

Or not a joke?

In every good joke, there's a sliver of truth...

So many people blew their trading accounts in a blink of an idea chasing the profits, so many people went bankrupt practicing leverage trading...

Do not be that guy in a picture.

Be a true trader!

Never forget about risk management and don't be greedy.

Never let your emotions control you.

Stay calm and humble while you trade.

Have a great weekend!

❤️Please, support these drawings with like! It really helps!

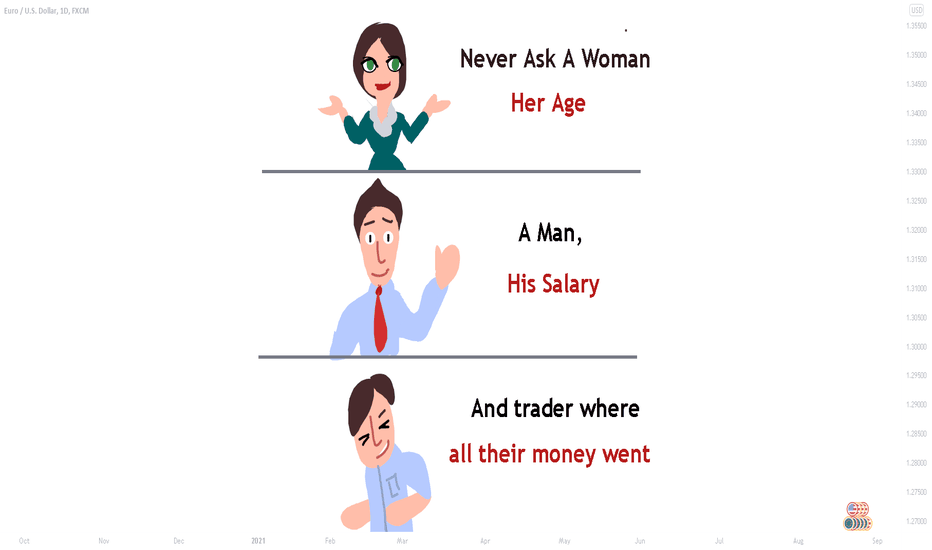

How To Trade With The Big Banks (Price Cycle Trade Setup)Elements To The Trade Set Up: Price Cycle Of Institutions.

1) Expansion= Order block/Zone

Is when price moves quickly from a level of equilibrium in other words when price breaks out of consolidation. This will leave an order block or zone behind.

2) Retracement= PA Fills In Any Imbalance

Is when price pulls back inside the recently created price range or close to breakout of expansion area. Look for imbalance to be filled on retracement.

3) Reversal= Seek To Pick UP Liquidity

Is when price moves in the opposite direction from the current market direction was moving in. (from up trend to a downtrend).

4) Consolidation= Equilibrium In PA

Is a period of ranging or sideways price action, before expansion in price action area.

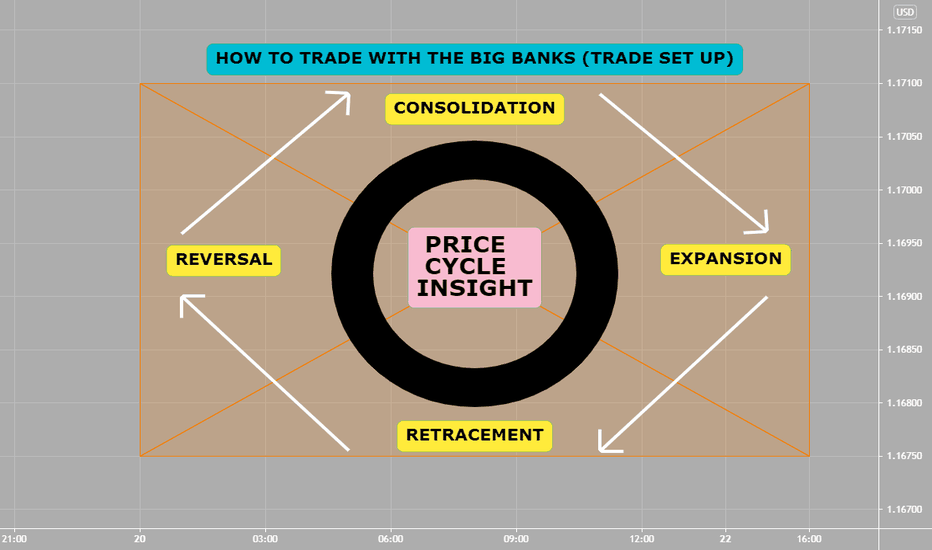

Trading Style? High Win Rate? High Risk Reward? Can't Have BothWin Rate, Risk/Reward, and Finding the Profitable Balance

You generally need to make a choice in your trading Forex: either have a high win rate % and low risk reward (hedge traders or scalp traders) or low win rate % and high risk reward. (day traders and swing traders).

Either can be successful, but it is a personal choice and different style of trading. Sometimes you can change depending on: pair, price, time & session that you are trading. End of Tokyo to end of London is high volume and liquidity daily time, so day trading might work and swing trading mid week. Hedging is mostly a high end money way of trading related to taking positions on both sides of a pair and scalping is going for many trades in same session, but make little pips per trade, but having high leverage per trade. These are great anytime of session, but do pretty good during low liquidity and volume times.

Win-rate is how many trades you win, usually given as a percentage. Such as 50%, 5 out of 10, or 50 out of 100. Means 50% of trades placed result in a profit.

Win rate is what many people focus on. They want to be right, often! Yet reward:risk (R:R) is just as important. R:R is how much a trader wins on winning trades versus how much they lose on a losing trade.

Most day traders focus on the win rate or win/loss ratio. The allure is to eventually reach that stage where nearly all their trades are winners. While this appears to make sense, having a high win rate doesn't mean you'll be a successful trader or even a profitable one. Your win rate is how many trades you win out of all your trades. For example, if you make five trades a day and win three, your daily win rate is three of five or 60%. If there are 20 trading days in the month, and you win 60 out of 100 trades, your monthly win rate is 60%.

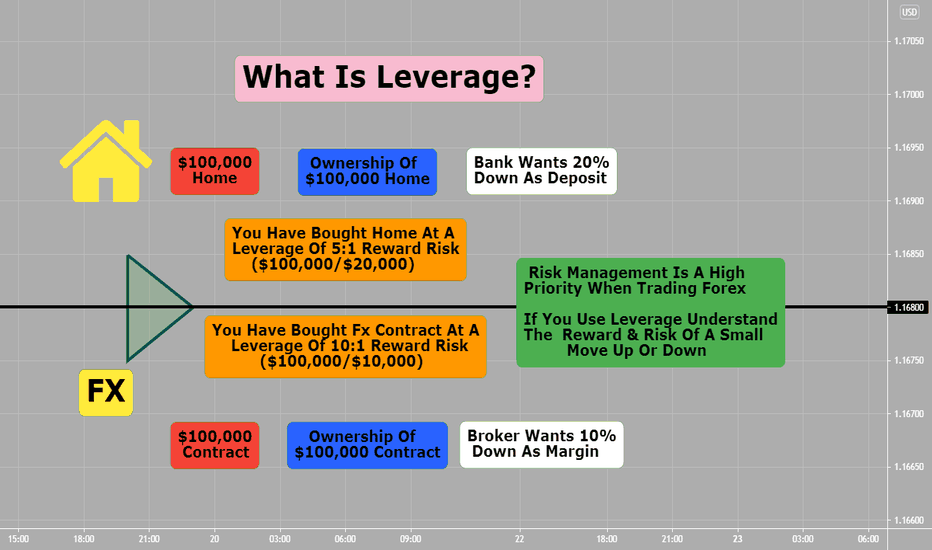

What Is Leverage?Leverage is the use of borrowed money (called capital) to invest in a currency, stock, or security. The concept of leverage is very common in Forex trading.

By borrowing money from a broker, investors can trade larger positions in a currency. As a result, leverage magnifies the returns from favorable movements in a currency's exchange rate. However, leverage is a double-edged sword, meaning it can also magnify losses. It's important that Forex traders learn how to manage leverage and employ risk management strategies to mitigate Forex losses.

KEY TAKEAWAYS:

Leverage, which is the use of borrowed money to invest, is very common in Forex trading.

By borrowing money from a broker, investors can trade larger positions in a currency.

However, leverage is a double-edged sword, meaning it can also magnify losses.

Many brokers require a percentage of a trade to be held in cash as collateral, and that requirement can be higher for certain currencies.

Leverage simply allows traders to control larger positions with a smaller amount of actual trading funds. In the case of 50:1 leverage (or 2% margin required), for example, $1 in a trading account can control a position worth $50. As a result, leveraged trading can be a "double-edged sword" in that both potential profits as well as potential losses are magnified according to the degree of leverage used.

Example: USD/CAD at 50:1 or 2% leverage ( in this example, if you place a 100,000 USD/CAD trade with 50:1 leverage, your margin requirement will be $2000. Trade Size: 100,000 Margin: $2,000 Trade Size: 10,000 Margin $200 and Trade Size 1,000 Trade Size $20. *Required Margin. Required margin is the minimum account balance needed to hold a position.

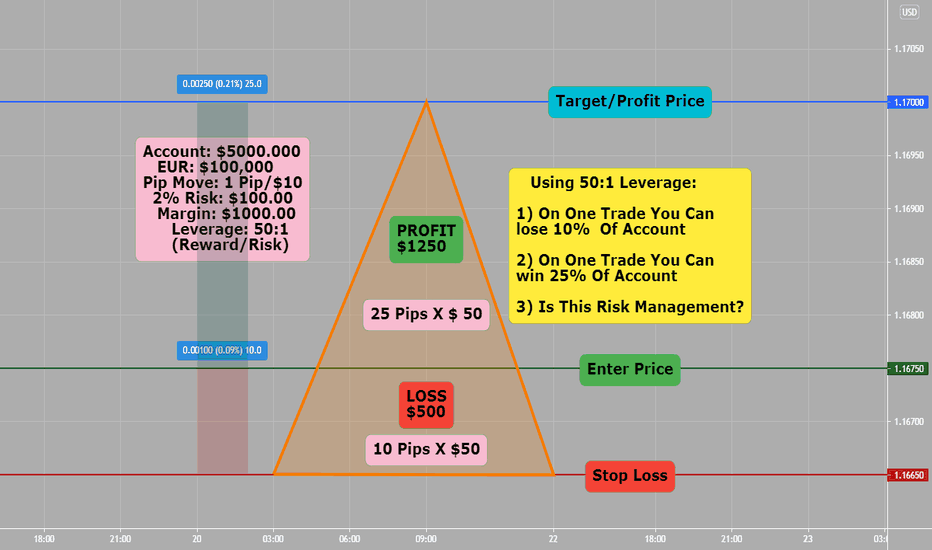

Leverage 50:1 (maximum Reward Risk)Should you use 50:1 leverage or maximum Reward Risk on any one trade? Is that using proper risk management?

Per chart example:

1) You could either lose on chart one trade 10% of your account or

2) You could win on chart one trade 25% of your account

Using Leverage is a double edged sword, which can be used or abused in the context of risk management, lot size, margin and leverage.

Bad risk management is number #1 reason why traders blow accounts.

Use 2% of account on one single trade, adjust lot size accordingly, stop losses and targets- this is a marathon not a sprint.

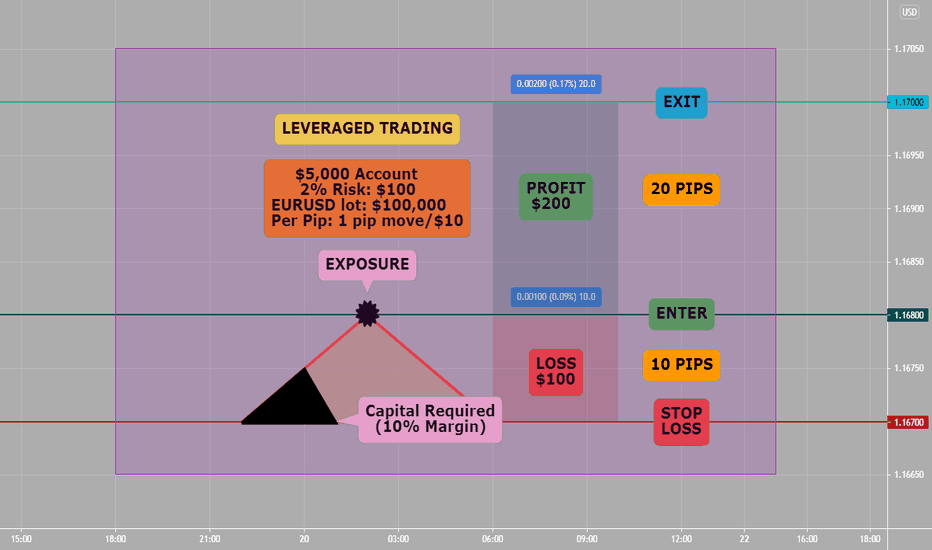

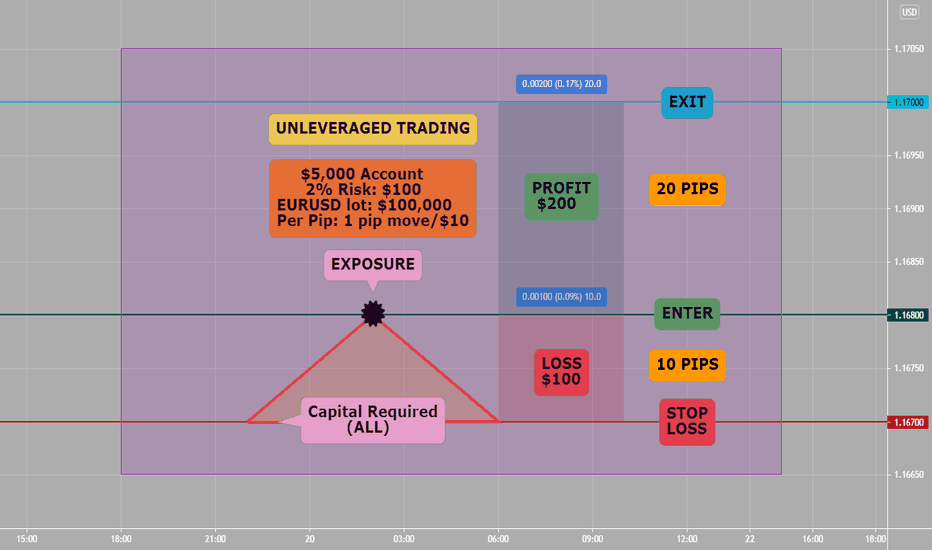

Leverage Trading (Example)What is leverage in Forex?

Leverage is a facility that enables you to get a much larger exposure to the market you’re trading than the amount you deposited to open the trade. Leveraged products, such as Forex trading, magnify your potential profit - but also increase your potential loss.

Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. Essentially, you’re putting down a fraction of the full value of your trade – and your provider is loaning you the rest.

Leverage and risk management

Leveraged trading can be risky as losses may exceed your initial outlay, but there are risk-management tools that you can use to reduce your potential loss. Using stop-losses is a popular way to reduce the risk of leverage. Attaching a stop-loss to your position can restrict your losses if a price moves against you. However, markets move quickly and certain conditions may result in your stop not being triggered at the price you’ve set.

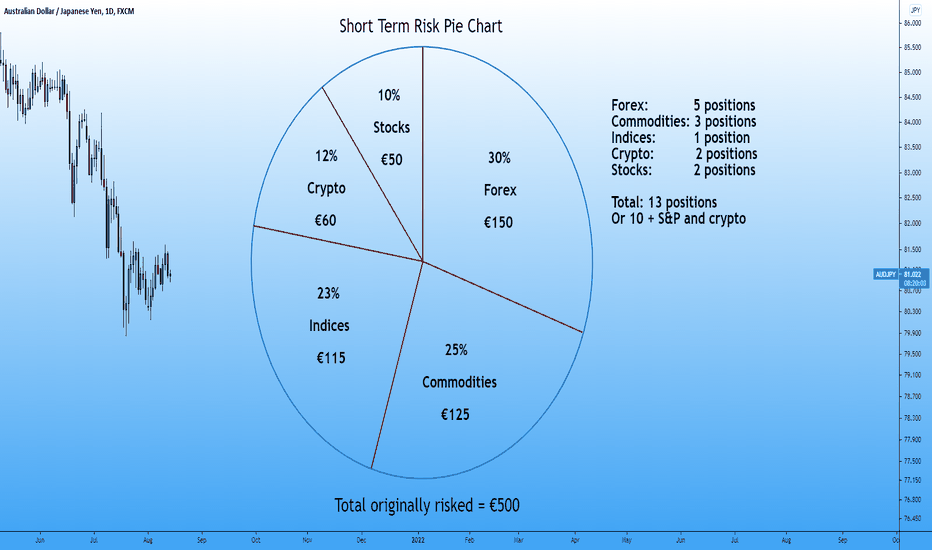

MrRenev portfolio exposedHere is my current short term portfolio. This might give the reader an idea of how a moderately diversified short term portfolio might look. I use various tools (including turbos, options...) so it's hard to say how much I have in, but I know how much of original risk I got. Which is today €500. I added my little XRP bag from earlier this year to my crypto holdings to get to exactly 500.

It makes more sense to build a PF looking at risk rather than the size that doesn't mean anything by itself. Of course I have some winners and I have trailed my stop so this is why I precise "original" risk, that's the risk when I opened the position.

The whole thing is maybe €40,000 with €25,000-€30,000 in Forex which would make it around 70% but it is less volatile, in "risk" terms it's actually 30%. Entry stops are tight (for example 0.50% with FX, 2% with S&P, 1% with commodities depends). I am sure I have 25 to 30K in FX, it's the rest that is hard to evaluate.

Here is the detail:

30% - Forex: 2 longs on the Yen, 2 shorts on AUD, and short USDZAR.

25% - Commodities: Gold, Platinum, Natural Gas. All long.

23% - Indices: All in the S&P500 long, pyramided in since April.

12% - Crypto: Mostly Bitcoin. And a bit of XRP (it's less than 6 month old).

10% - Stocks: Pfizer & Moderna.

I also have a few stocks & cryptos that I hold long term and have not listed here. And cash in the bank. And physical goods in my house. I even have stamps and a few old coins. I don't check on it every day, or week, or month, or year, but I really don't care about the long term stuff, I am focussed on the long term. Looks like I have found a perfect trick to not worry.

I am not "ultra" diversified, but some billionaires have hinted that diversification may be for idiots. If you saw Ray Dalio present his "holy grail" you know that (roughly) you get a huge improvement in risk adjusted returns going from 1 to 5 (good) positions, a little more improvement going from 5 to 10, and it basically flatlines past 10 positions no matter how much you add. This is universally true, I'm sure it can be proven by a mathematician and the limit of growth will be Euler's number 2.718 (like maybe the stdev can only be improved 2.718X?), no matter how many uncorrelated positions are added. The reasons for having dozens of positions is either you're such a whale you have to, or you're trying to attract clients and plenty of positions makes you look pro and justifies the cost and also makes it look too complicated to do for a novice.

My positions shown here are all short term, with:

FX and Commodities and Stocks (65%) all under 2 months

S&P500 and Crypto (35%) all under 6 months

I have been long US indices since September or October of 2020 but it was tech100 and I closed it all since then.

33% of my holdings are correlated to the US stock market but I am in the green on the S&P and have guaranteed stops, I have pyramided into my winner over time, so there is actually no major risks there. I am not a professional risk manager and I don't give advice but I don't think I have crazy risks.

No single instrument (a currency, an indice) ever has a leverage over 5 (when adding all pairs or all correlated indices). The max leverage I have been using on a position ever as far as I can recall is 2 (0.25% stop loss with a leverage of 2 = risk of 0.50% on the single position). Anyone who understands elementary school level maths should be able to understand the problem with too much volatility:

A 3% drawdown takes a 3.09% profit to get back to breakeven. This is 3% more (3.09% is 3% more than 3%).

A 10% drawdown takes an 11.11% profit to get back to breakeven. This is 11.11% more.

A 30% drawdown takes a 42.9% profit to get back to breakeven. This is 42.9% more.

A 70% drawdown takes a 233.33% profit to get back to breakeven. Good luck.

Simply since this is short term there will be much more volatility, so careful with leverage! (Indeed, if a long term portfolio had say 15% deviation happen every 100 years, the short term one could have this every 100 months or even 100 weeks).

And then there are the black swan events... They don't happen but when they do it stings. And in one's career they WILL happen.

Bill Hwang got destroyed by having 5 leverage on all his money, concentrated in a few stocks. The "Swiss Franc Tsunami" was a 15% drop. You'd have to be a complete mongrel to get wiped out, that would require over 6 leverage on a single currency. Legend james Cordier had next to 100 leverage divided between only half a dozen commodities, he was riding at least a 10X on NatGas alone. Even if you had 10 leverage on stocks but distributed in 10 a 20% gap down wouldn't wipe you out it's very unlikely they ALL gap down. Don't go 10X in stocks even if diversified, that was just for the example, in the EU it's not even possible anyway max is 5.

I even posted ideas for some of those positions

With Bitcoin I think I post everything. Not sure.

Almost 1 year ago, "buy area visited", hah I actually bought the very bottom. As I said this is nearly 1 year old but I moved to the S&P500 back in April to catch a new swing. 2 different trades within a long term bull bias. Buying pullbacks with tight stops you get stopped often but you also buy the very bottom often. I probably mentioned my transition to the S&P500 somewhere but without details and I don't write every single time I add or take profit or reduce my position.

Might add a bit to crypto if it keeps going. Hopefully I get to short GME soon, should reduce my overall stock risk, maybe. It can always shoot up while the rest crashes down, I don't think this is likely it's a 1/100 thing, it does happen, and you want to make sure you'll survive it, but it doesn't happen that often so it's worth taking the risk.

Typicall I might have something like this:

10 positions

2 wins I'm trailing (> 5R)

3 little wins trying (2.5-4.5R)

5 positions around my entry (between -1R and 2.5R)

I rarely see red in my accounts, losers go quite fast. So mostly I look at positions in the green. It has the benefit of feeling good. Losers hold losers, that simple.

Individual positions are very volatile, I might see a currency pair have a drastic move against me and crush my soul, but then I log in my accounts and I see my overall profits have not moved much, while the 1 pair was crashing 3 other ones sligthly went up. So it makes it more of a slow and steady growth rather than some hysterical bipolar game.