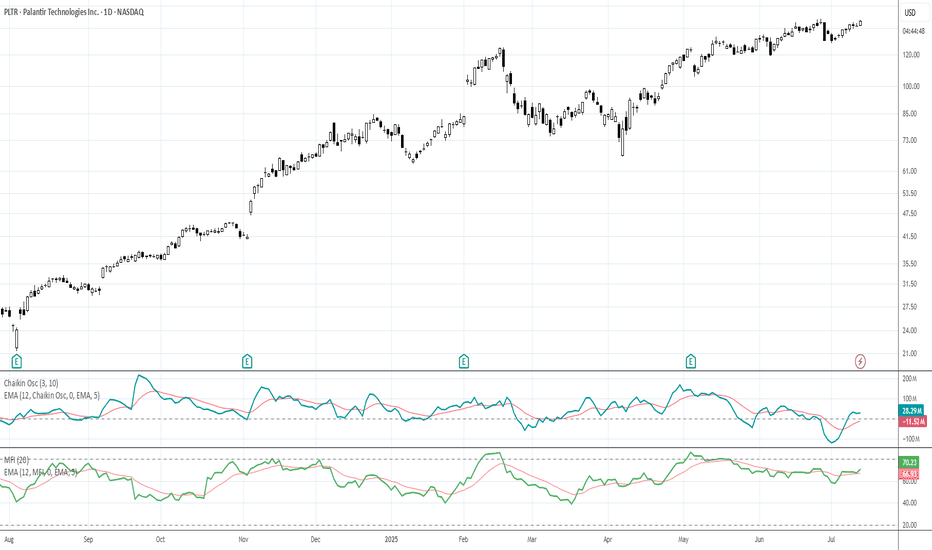

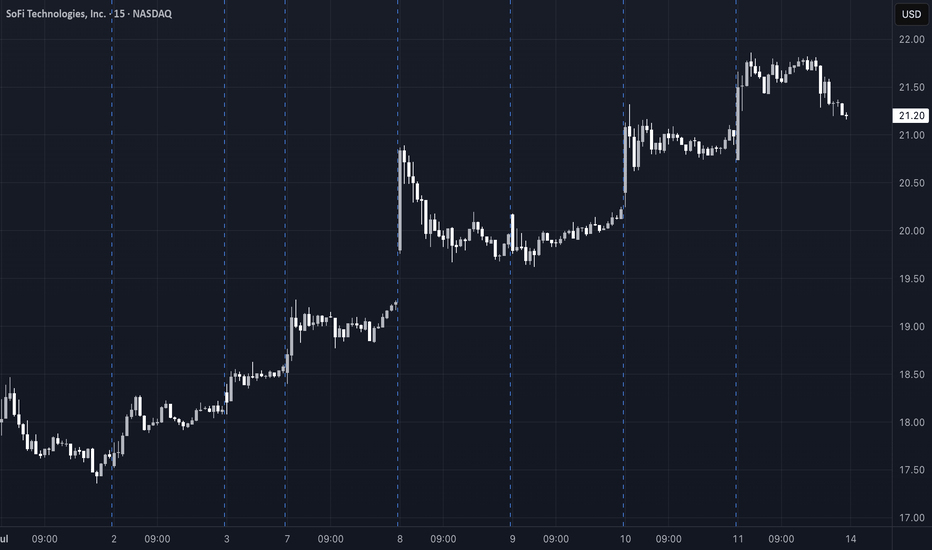

Earnings HFT gapsThe gaps that form during earnings season on or the next day after the CEO reports the revenues and income for that past quarter are always HFT driven. The concern over the past 2 previous quarters was the fact that the High Frequency Trading Firms were incorporating Artificial Intelligence into their Algos to make automated trading decisions on the millisecond scale. These small lot orders fill the ques milliseconds ahead of the market open in the US and any huge quantity of ORDERS (not lot size) causes the computers of the public exchanges and market to gap up or gap down, often a huge gap.

This can be problematic for those of you who use Pre Earnings Runs to enter a stock in anticipation of a positive to excellent earnings report for this upcoming quarter.

The HFT algos had several major flaws in the programming that did the opposite: The AI triggered sell orders rather than buy order causing the stock price to gap down hugely on good earnings news.

Be mindful that normal gaps due to a corporate event are far more reliable and consistent.

When you trade during earnings season, be aware that there is still added risk of an AI making a mistake and causing the stock to gap and run down on good news.

It is important to calculate the risk factors until it is evident by the end of this earnings season that the errors within the AI programming have been corrected and that the AI will gap appropriately to the actual facts rather than misinterpreted information.

Community ideas

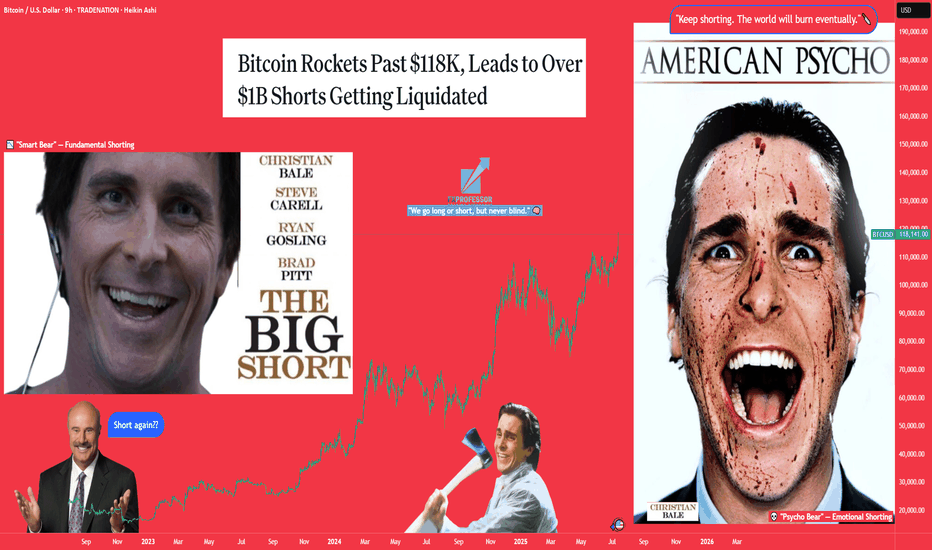

Deep Dive Part III – The Next BIG Whale Play UnfoldsDeep Dive Part III – The Next BIG Whale Play Unfolds

📍In Parts I & II of this Deep Dive, we broke down the psychology of whale behavior — from “Buy the Rumors, Sell the News” to the critical breakout zones that echoed historical patterns.

🐋 Back then, we spotted the whales' playbook early. The strategy was simple:

Buy the Rumors – Sell the News.

🧠 But now, the script has changed.

“The trap is where you’re most bored… 🌴📵

Their exit — on your liquidity — comes when you’re least ready. 💰🏄♂️💼”

Let’s break this moment down into what’s really unfolding.

We are officially entering the next stage of the cycle — not just in price, but in psychology.

This is no longer just about charts.

This is about human behavior on autopilot.

Here’s what I see happening right now — broken into three truths:

1️⃣ People Are On Holiday 🌞

From my community to the broader market, the energy is low.

People are either sunbathing on a beach or mentally checked out.

The focus is not there. The reflex to take action is dulled.

📉 The trap is where you’re most bored… 🌴📵

💰 Their exit — on your liquidity — comes when you’re least ready. 🏄♂️💼🚀

We’re seeing it unfold now:

1. Set the Bear Trap

2. Trigger the FOMO (will be down the road, yes)

3. Exit on Liquidity (the closing act of the play)

🕶️ But when everyone is away or asleep, that’s when the trap is laid.

It’s during these quiet, lazy days that the big moves get built.

2️⃣ This is a Disbelief Rally 🎢

The market trained everyone with a rhythm:

pump ➝ dump, pump ➝ dump, pump ➝ dump…

So what happens now?

People don’t trust the breakout. They’re frozen.

“We’ll dump again,” they say.

Except… what if this time, we don’t?

That disbelief becomes fuel.

It becomes hesitation — and hesitation becomes missed opportunity.

3️⃣ Bears Are Shorting Into Strength 🧨

This is key. While retail is confused, the bears are pressing in hard.

Their shorts are adding fuel to the pump they don’t see coming.

That’s why I posted recently:

“Shorting isn’t the problem. Being a psycho bear is.”

It’s not about being bullish or bearish —

It’s about timing , discipline , and narrative awareness .

Whales love this moment.

They lure in shorts, set the trap, then ignite the breakout straight into FOMO.

🧠 The Game:

Set the Trap → Trigger the FOMO → Exit on Liquidity 💥

This is what you’re seeing on the chart.

Not just price action — psychological choreography.

🕰️ In 2020–2021, we saw the exact same structure.

Part I warned about early accumulation and baiting behavior.

Part II showed how whales manipulated expectations with layered waves of doubt.

Now in Part III — the explosion few are ready for.

Zoom into the chart and it’s all there:

The curve, the trap, the trigger… and yes — the Final Boss.

🎯 The Final Boss: 6.51T

That’s the ultimate liquidity zone.

If this cycle plays out, we’re headed toward it.

“Sell the Rate Cuts” will be the new “Sell the News.”

It’s not the headlines that matter — it’s who’s left holding the bag.

🔚 Final Thought

The real exit — the one that traps most of retail — will come not when you’re euphoric,

but when you’re still saying:

“Surely we must dump now…”

So stay sharp.

Trade the chart — but don’t forget to read the behavior.

One Love,

The FXPROFESSOR 💙

Part1:

Part2:https://tradingview.sweetlogin.com/chart/idea/VgMBPsp3/

The Bear Trap:

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

Atomic Pump Exploded, You Missed It! Now What?Ever opened your charts after a few hours off and realized the market just exploded upwards without you?

That feeling of missing out, regret, and mental chaos is real.

But here’s the thing: if you missed the move, what should you do next?

This post is for you the ones who feel like the train left the station, but still want to win the next round.

Hello✌

Spend 3 minutes ⏰ reading this educational material.

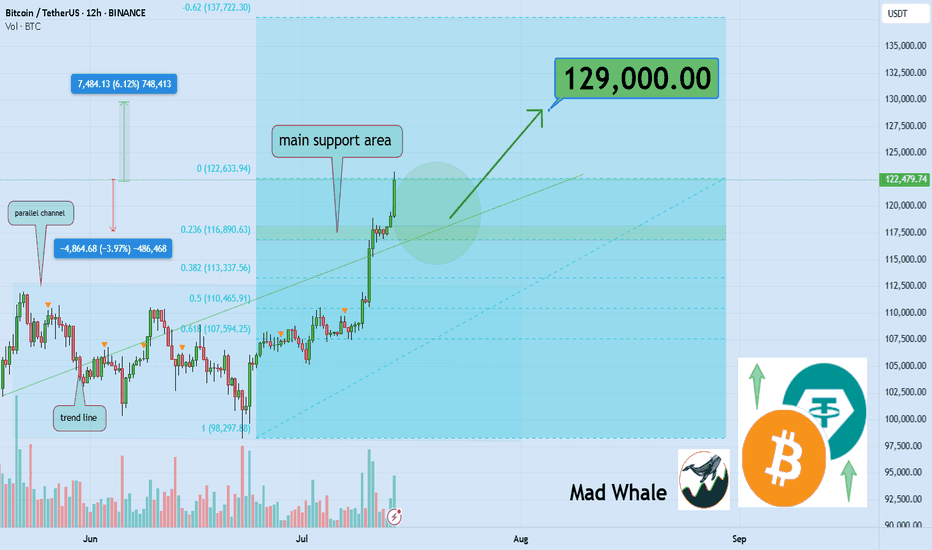

🎯 Analytical Insight on Bitcoin :

Volume remains the decisive factor driving BINANCE:BTCUSDT toward higher price levels 📈. Across various scenarios whether it’s market battles, FOMO spikes, institutional capital flows, or extended periods of consolidation volume confirms the strength behind the move. Discussions about Bitcoin as the new global currency continue to fuel interest and momentum. In the short term, I’m targeting $129,000 for Bitcoin, representing roughly a 6% upside from current prices 🚀.

Now , let's dive into the educational section,

🧠 Understanding the Trader Psychology After Missing a Market Nuclear Explosion

When the market suddenly pumps, the first thought for many traders is: “I missed it.” That’s where the mental storm begins. Your mind starts blaming you, your analysis, or even bad luck. But all of that is just an emotional response.

The real question is can you use this moment to build your self-awareness and grow as a trader?

🧨 Turning Mistakes into Opportunities Without Self-Blame

Missing a pump isn’t necessarily a mistake it’s just an outcome. Maybe you didn’t check the charts, maybe fear held you back. What matters is: what did you learn?

A real trader documents every misstep, studies it, and adjusts next time. Turn that missed opportunity into a "pivot moment".

Keep a trading journal. Write why you missed it. What signs were there that you ignored? What can you do differently next time?

📊 TradingView Tools to Hunt the Next Big Move 🚀

When the market explodes, jumping in without a plan is a recipe for disaster. Step one? Turn off your emotions. Step two? Open up TradingView.

In moments like these, a few key tools can help you figure out whether the pump is over — or just getting started. One of the most powerful tools is Volume Profile Visible Range (VPVR). It shows you where volume is stacking up.

Heavy pumps usually lead to corrections, but if VPVR shows strong volume still holding higher levels, the opportunity may not be gone yet.

Next is the Relative Strength Index (RSI). If RSI is already above 70, chances are you're showing up late. But here’s the twist if there’s a small dip, RSI cools down, and then starts rising again… that might be your real chance to enter.

💥 When the Market Blows Up Like a Nuclear Bomb, How Do You React?

When green candles start stacking and everyone’s flexing profits, you’re left behind staring at a chart that feels like it betrayed you.

This is exactly when people make emotional decisions. But urgent hype is the enemy of good analysis. Your first job here: stay calm and look at the trend like a surgeon.

🧩 Greed vs. Logic Entering at the Top or Waiting for a Pullback?

The question isn’t whether to enter now. The real question is: why are you entering?

Because you feel left out? Or because your system gives you a signal?

If your decision isn’t based on a clean setup, you’re not trading you’re gambling. Logic must win over emotion. Every. Single. Time.

🧱 Coping With the Psychological Wall of Missing Out

The pain of missing out is real. It’s like arriving at the station just to see the train’s dust.

But here’s the truth: this wasn’t the last train.

One of the best traits of a great trader is the belief in future opportunities. If you chase what’s already gone, you’ll keep losing.

Instead, focus on rebuilding your mindset.

🎯 Smart Goal Setting: Prepare for the Next Wave, Don’t Chase the Previous One

Don’t chase a pump that’s already peaked. Instead, watch for early signs of the next one.

Look at coins that haven’t moved yet but are building momentum.

Focus on price action, volume behavior, hidden news, and reliable chart patterns. Let logic lead the way not FOMO.

🔄 What’s the Best Move After Missing a Pump? Maybe… Do Nothing

Sometimes, doing nothing is the best strategy.

The market isn’t a one-time lottery ticket. It gives out chances regularly but your impatient mind makes you believe you’re running out of time.

If your next move feels rushed, pause. Train your discipline to only trade with a cool head.

💡 Pro Tips to Come Back Stronger in the Next Big Move

Instead of regret, build a killer watchlist.

Set smart price alerts.

Go back to your past data and find recurring setups.

Sharpen your skills, study tools that help, and prepare for different scenarios.

Being prepared = staying ahead.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

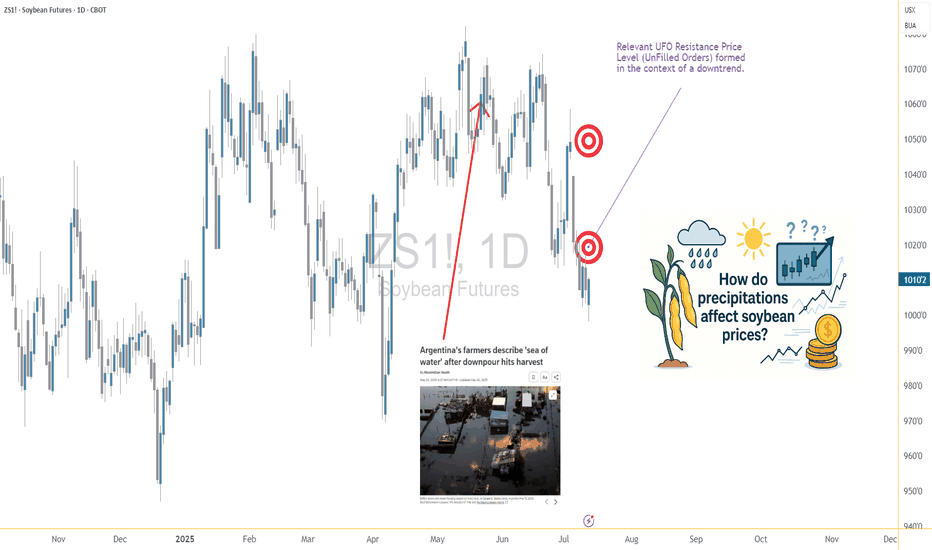

Soybeans and Rain: Moisture’s Market Impact on the Bean Trade1. Introduction: Moisture & Market Momentum

Soybeans, often referred to as “the oilseed king,” are a cornerstone of global agriculture. As a leading source of protein for both humans and animals, their price fluctuations affect industries ranging from food production to biofuels. One key variable traders often monitor? Rainfall. 🌧️

Moisture plays a critical role in soybean development, influencing yield and quality from the moment the seed is sown. It’s no surprise that many market participants assume a strong correlation between rainfall and price behavior. But is that assumption truly supported by data?

In this article, we analyze how varying precipitation levels impact weekly soybean futures returns. As you'll see, the results might not be as clear-cut as you’d expect—but they still offer meaningful insights.

2. Biological Realities: Soybeans’ Water Needs

Soybeans thrive under specific conditions. While they’re generally resilient, rainfall—or the lack thereof—can tip the balance between bumper harvests and disappointing yields.

During early vegetative stages, sufficient moisture ensures healthy root development. Later, during the pod-fill phase, rainfall becomes even more essential. Too little water at this point leads to incomplete pods or aborted seeds. On the flip side, too much rain can invite fungal diseases and delay harvests, especially in lower-lying regions.

In countries like Brazil and Argentina, soybean fields often face seasonal extremes, while the U.S. Midwest typically enjoys more consistent conditions—though droughts and floods have both hit the Corn Belt in recent years. These environmental realities create natural volatility in both yield and pricing expectations.

3. Methodology: How We Analyzed Weather vs. Futures

To explore the potential connection between rainfall and soybean futures prices, we collected weekly weather data for major soybean-growing cities across the globe. Each week’s precipitation was categorized using a normalized percentile system:

Low Rainfall: below the 25th percentile

Normal Rainfall: between the 25th and 75th percentiles

High Rainfall: above the 75th percentile

We then matched this data against weekly returns of standard soybean futures (ZS) and micro soybean futures (MZS), both traded on the CME Group.

This allowed us to compare average price behavior in different rainfall scenarios—and test whether there was any statistically significant difference between dry and wet weeks.

4. Statistical Findings: Is There a Signal in the Noise?

When examining the data, the initial visual impression from boxplots was underwhelming—return distributions across rainfall categories looked surprisingly similar. However, a deeper dive showed that the difference in mean returns between low and high precipitation weeks was statistically significant, with a p-value around 0.0013.

What does that mean for traders? While the signal may not be obvious to the naked eye, statistically, rainfall extremes do impact market behavior. However, the magnitude of impact remains modest—enough to be part of your strategy but not enough to drive decisions in isolation.

Soybean prices appear to be influenced by a mosaic of factors, with precipitation being just one tile in that complex picture.

5. Charting the Relationship: Visual Evidence

While statistical tests gave us the green light on significance, we know traders love to “see” the story too. Boxplots of weekly soybean futures returns segmented by rainfall categories offered a subtle narrative:

Low-precipitation weeks showed slightly higher average returns and tighter interquartile ranges.

High-precipitation weeks had broader return distributions and more frequent downside outliers.

Normal weeks exhibited relatively stable behavior, reinforcing the idea that the market reacts most during extremes.

This kind of visualization may not scream alpha at first glance, but it reinforces the idea that precipitation events—particularly dry spells—tend to nudge prices upward, possibly as market participants price in production risk.

6. Trading Implications: Positioning Around Weather

Here’s where things get practical. While weather alone won’t dictate every trading decision, it can be a key filter in a broader strategy. For soybean traders, rainfall data can help inform:

Bias assessment: Low-precipitation weeks may suggest bullish tendencies.

Risk control: Expect wider return distributions in high-precip weeks—adjust stops or contract sizing accordingly.

Event trading: Pair weather anomalies with technical signals like trendline breaks or volume surges for potential setups.

It’s also worth noting that weekly weather forecasts from reputable sources can serve as a forward-looking indicator, giving traders a head start before the market fully reacts.

7. Margin Efficiency with Micro Soybeans

For traders looking to scale into soybean exposure without the capital intensity of full contracts, the CME Group’s micro-sized futures offer a compelling alternative.

📌 Contract Specs for Soybean Futures (ZS):

Symbol: ZS

Contract size: 5,000 bushels

Tick size: 1/4 of one cent (0.0025) per bushel = $12.50

Initial margin: ~$2,100 (varies by broker and volatility)

📌 Micro Soybean Futures (MZS):

Symbol: MZS

Contract size: 500 bushels

Tick size: 0.0050 per bushel = $2.50

Initial margin: ~$210

These smaller contracts are perfect for strategy testing, risk scaling, or layering exposure around key macro events like WASDE reports or weather disruptions. For traders aiming to build weather-aligned positions, MZS is a powerful tool to balance conviction with capital efficiency.

8. Wrapping It All Together

Rain matters. Not just in fields, but in futures prices too. While soybean markets may not overreact to every drizzle or downpour, extreme rainfall conditions—especially drought—can leave noticeable footprints on price action.

For traders, this means opportunity. By incorporating precipitation metrics into your workflow, you unlock a new layer of context. One that doesn’t replace technical or fundamental analysis, but enhances both.

And remember: this article is just one piece of a larger exploration into how weather affects the commodity markets. Make sure you also read prior installments.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.sweetlogin.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

watch the laws, not just the charts.stablecoins were once the rebels of finance—anchored to fiat yet untethered from traditional banking laws, but the tides are turning. Across major economies, lawmakers are drawing up legal frameworks that place stablecoins inside the banking sector rather than outside of it. This shift could be the most pivotal regulatory development since Bitcoin was born.

But what does this really mean for traders, investors, and markets?

In this @TradingView blog we’ll unpack the new laws on stablecoins entering the banking realm, and what their ripple effect might look like, using past regulatory shifts as a lens to foresee market behavior.

🧾 Section 1: What the New Stablecoin Laws Say

Many regions—especially the EU, UK, Japan, and the US—are moving toward a model where stablecoin issuers must register as banks or hold full banking licenses, or at minimum, comply with banking-like oversight.

Key pillars of these laws include:

Full reserve requirements (1:1 backing in liquid assets)

Audited transparency on reserves and redemptions

KYC/AML compliance for users and issuers

Supervision by central banks or financial regulators

In the US, the House Financial Services Committee recently advanced a bill that would make the Fed the ultimate overseer of dollar-backed stablecoins.

In the EU, MiCA (Markets in Crypto-Assets) requires issuers of e-money tokens to be regulated financial institutions.

Japan now allows banks and trust companies to issue stablecoins under strict regulations.

💥 Section 2: Why This Is a Big Deal

Bringing stablecoins into the banking system could change how liquidity flows, how DeFi operates, and how capital moves across borders.

Potential market impacts:

Increased trust = more institutional money entering stablecoins and crypto markets.

DeFi restrictions = protocols may face scrutiny if they allow unverified stablecoin usage.

Flight from algorithmic or offshore stables to regulated, bank-issued stablecoins (e.g., USDC, PYUSD).

On-chain surveillance increases, potentially limiting pseudonymous finance.

Think of it as crypto’s "Too Big To Ignore" moment—where stablecoins become infrastructure, not outlaws.

📉 Section 3: Past Laws That Shaped Crypto Markets

Let’s examine how previous regulations have affected crypto markets—offering clues about what to expect.

🧱 1. China’s Crypto Ban (2017–2021)

Kicked off a massive market crash in 2018.

Pushed mining and trading activity overseas, especially to the US and Southeast Asia.

Resulted in more global decentralization, ironically strengthening Bitcoin’s resilience.

🪙 2. SEC Lawsuits Against XRP & ICO Projects

Ripple’s XRP lawsuit caused delistings and volatility.

Set a precedent for how tokens are treated under securities law.

Resulted in more structured token launches (via SAFEs, Reg D, etc.).

🧮 3. MiCA Regulation in Europe (2023 Onward)

Provided regulatory clarity, prompting institutions to engage more with regulated entities.

Boosted legitimacy of Euro-backed stablecoins like EURS and Circle’s Euro Coin.

Sparked a race among exchanges to gain EU registration (e.g., Binance France, Coinbase Ireland).

Each of these regulatory waves caused temporary volatility, followed by long-term growth—as clarity invited capital.

📊 Section 4: The Possible Scenarios for the Market

Here’s how things might play out as stablecoin laws become mainstream:

Golden Path-Regulated stablecoins coexist with DeFi; innovation meets compliance - Bullish for crypto adoption and capital inflows.

Walled Garden-Only bank-issued stablecoins are allowed; DeFi stifled -Neutral or bearish short-term, bullish long-term.

Backlash-Overregulation pushes stables offshore or into non-compliant zones - Bearish, liquidity fragmentation returns.

🔍 Nerdy Conclusion:

Stablecoins are no longer just tools for traders—they’re becoming the backbone of digital finance. Their formal entrance into banking law marks a turning point that traders must understand.

While regulation has historically caused short-term fear, it often leads to long-term maturity in crypto markets. The stablecoin laws now in motion could unlock the next chapter of institutional adoption, cross-border finance, and perhaps, the integration of crypto into the real-world economy at scale.

💡 Nerdy Thought:

When a technology becomes systemically important, it stops being ignored—it gets integrated. Stablecoins have reached that level.

put together by : @currencynerd as Pako Phutietsile

#AN020: US Tariffs, Euro Weakness, USD Strength, Forex at Risk?

1. New US Tariff Threats Against the EU and Canada

Over the weekend, President Trump announced the sending of formal letters introducing new tariffs: 35% on Canadian goods and potential tariffs for the EU as well (15-20%).

Context: The return of protectionism fuels uncertainty.

Market Impact: Shift to safe-haven currencies — the US dollar gains ground, while EUR/USD and USD/CAD remain under pressure.

2. EUR/USD Below 1.1700

The EUR/USD pair closed the week below 1.1700, failing to recover.

3. GBP/USD Loses Ground

The GBP/USD pair fell below 1.3500, hitting a three-week low.

Factors: Disappointing UK GDP data + stronger USD.

Impact: Pressure on the pound, possible continuation of the downtrend to 1.3420 unless better data emerges.

4. USD/JPY near 147.50

The dollar reached new two-week highs against the yen, hitting 147.50.

Causes: Risk flight and reduced expectations for BoJ intervention.

Outlook: If global sentiment remains adverse, USD/JPY could head towards 148.00.

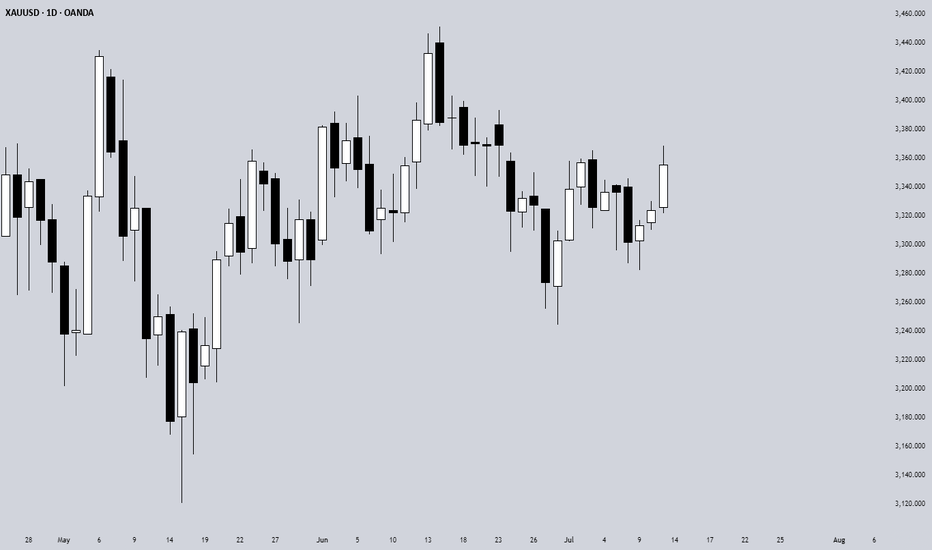

5. Gold and safe-haven assets recover

Trade uncertainty is supporting gold, which has risen to near $3,360/ounce.

Outlook: Volatility and preference for the USD and JPY are increasing; gold will act as a sentinel of fear in the markets.

🔍 Summary of Impacts on Forex Markets

EUR/USD Weaker: Push toward 1.1600 due to trade concerns and USD strength

GBP/USD Down: UK data pressured + risk aversion

USD/JPY Rising: USD refuge and possible break above 148

USD/CAD Volatile: Canadian tariffs penalize CAD, but oil prices and BoC reactions to monitor

Gold & XM Gold strengthens, signaling risk, USD support; JPY and USD benefit

Two Brains, One Trade: Why You Freeze Under PressureBy MJTrading:

In trading, your biggest opponent isn’t volatility.

It’s your own neural wiring.

Every trader operates with two main systems:

🧠 System 2 – Rational, deliberate, planning (Prefrontal Cortex)

🧠 System 1 – Emotional, instinctive, fast (Amygdala & Limbic Brain)

Before entry, System 2 is in control. You feel calm, logical.

But the moment money is at risk—especially in drawdown or after a missed TP—System 1 takes over.

💥 Stress hormones spike

💥 Focus narrows

💥 Long-term thinking disappears

💥 You freeze, or act impulsively

You knew what to do.

But you didn’t do it.

Because in that moment, your rational mind wasn’t driving anymore.

⚖️ Set & Forget vs. Floating Managers

Different trading personalities react differently under pressure:

🔹 Set & Forget Traders

Rely on automation or predefined exits to bypass emotional hijack.

They reduce cognitive load, but often feel regret when price goes “a little more.”

🔹 Floating Management Traders

Rely on intuition and live feeling. They stay with the chart, adjusting based on flow.

When calm and trained, they shine.

But under pressure, they’re more vulnerable to emotional loops:

– hesitation

– premature exits

– revenge tweaks

– system betrayal

🧘♂️ What can you do?

✔️ Pre-plan decisions

Make the hard calls before emotions kick in.

✔️ Mental rehearsal

Visualize trade management scenarios—yes, like athletes do.

✔️ Create fallback protocols

So if you freeze, your system still knows what to do.

🧠 For Those Who Want to Go Deeper:

“Thinking, Fast and Slow” by Daniel Kahneman

Understand System 1 & 2 thinking—and how cognitive bias shapes all decisions, not just trades.

“The Hour Between Dog and Wolf” by John Coates

A stunning look at how biology, hormones, and risk-taking collide in traders' brains.

🔓 Final Thought:

If your strategy works in theory, but breaks in real-time—

It’s time to work on your neural execution layer.

Because in trading, you don’t rise to your level of analysis—

you fall to your level of emotional wiring.

— MJTrading

#NeuroTrading #TraderTypes #TradingPsychology #SetAndForget #FloatingManagement #MindOverMarkets #EURUSD #MJTrading

Previous psychology Ideas:

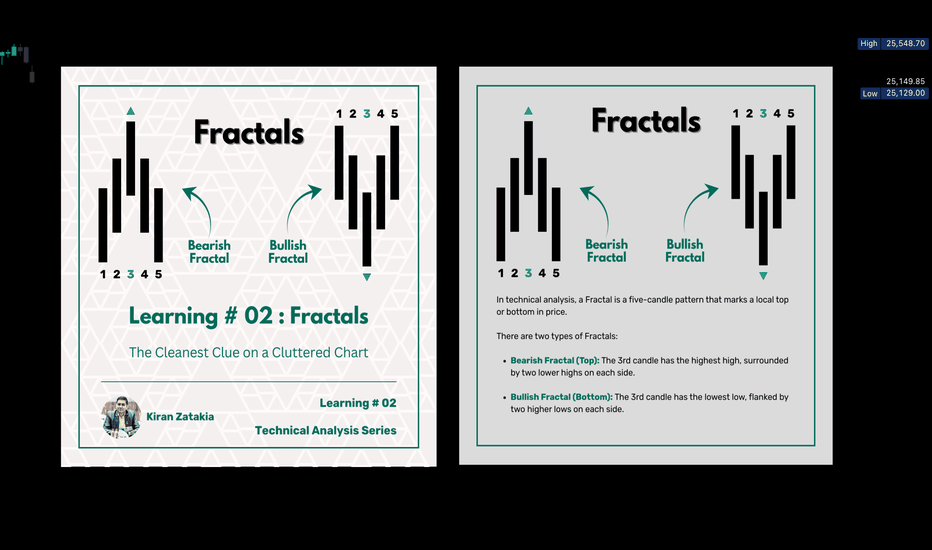

Learning#02 : Fractals⛰️ Learning#02 : Fractals

The Cleanest Clue on a Cluttered Chart

If you like clean charts and smart price behaviour, Fractals are one of those tools that give subtle but powerful signals. They’re not magic. They simply reflect what price is telling you—if you’re willing to listen.

Let’s unpack the concept and learn how to use Fractals like a pro.

🔍 What Is a Fractal in Trading?

In technical analysis, a Fractal is a five-candle pattern that marks a local top or bottom in price. It’s a pure price-action signal that doesn’t rely on lagging indicators.

There are two types of Fractals:

Bearish Fractal (Top): The 3rd candle has the highest high, surrounded by two lower highs on each side.

Bullish Fractal (Bottom): The 3rd candle has the lowest low, flanked by two higher lows on each side.

These formations are Price's way of saying: *"I tried to go further, but couldn't."

📊 What Do Fractals Indicate?

A shift in short-term control (bulls vs. bears)

Minor support or resistance zones

Useful markers for entries, exits, or trailing stop levels

They don't guarantee reversals but are excellent at highlighting where price momentum may pause, reverse, or build structure.

📈 How to Use Fractals – A Practical Guide

Let’s be clear: Fractals are not trade signals by themselves.

Instead, they work best when used in confluence with your strategy. Think of them as tools that:

Help confirm breakout levels

Refine pullback entries

Guide you in drawing cleaner trendlines, fib zones, and support/resistance levels

Assist in identifying swing highs and lows for Dow Theory-style trend analysis

🔗 Fractals + Strategy = Smart Trading

Whether you trade breakouts or mean reversion, Fractals help clarify:

Which highs or lows matter

Where to place stop losses with structure-based logic

How to trail SL as the trade progresses

They quietly organize your chart into readable, tradeable levels.

🚀 Practical Uses of Fractals

Fractals are the first tool I add to any chart—they instantly reveal structure and guide every step of my analysis.

1. Breakout Confirmation

Wait for a candle to close above a bullish fractal high or below a bearish fractal low.

Useful when the market is trending or forming structures like double bottoms/tops.

2. Pullback with Confirmation

Use the fractal zone as a short-term S/R level. If price returns and shows signs of rejection (like an inside bar, wick rejections, or low volume), consider entries based on confirmation.

Great in sideways or swing environments.

3. Trend Structure Validation

Fractals reveal clear pivot highs/lows, helping:

Confirm higher highs/higher lows

Mark structure for trendline drawing

Validate Fib levels or S/R zones

4. Trailing Stop Loss

Update your SL to trail behind the most recent opposite-side fractals.

In longs: SL below new bullish fractals

In shorts: SL above new bearish fractals

This lets you stay in the move while managing risk like a pro.

How it’s Look Like on Chart

snapshot

⚠️ Common Mistakes to Avoid

Trading every fractal blindly

Ignoring price context or trend

Relying on fractals in low-volume, choppy markets

📝 Final Thoughts

Fractals are like breadcrumbs left by price action. They quietly point to areas where the market faced resistance or found support. Alone, they’re not enough. But in the hands of a price-action trader, they’re incredibly useful.

Used alongside market structure, confirmation signals, and clean charting habits, Fractals become:

Trend identifiers

Entry enhancers

Stop loss trail markers

⭐ Bonus Tip

Next time you mark a level, Fibonacci or draw a trendline, check if a Fractal confirms it. You’ll be surprised how often it does.

Trade simple. Trade clean.

— Kiran Zatakia

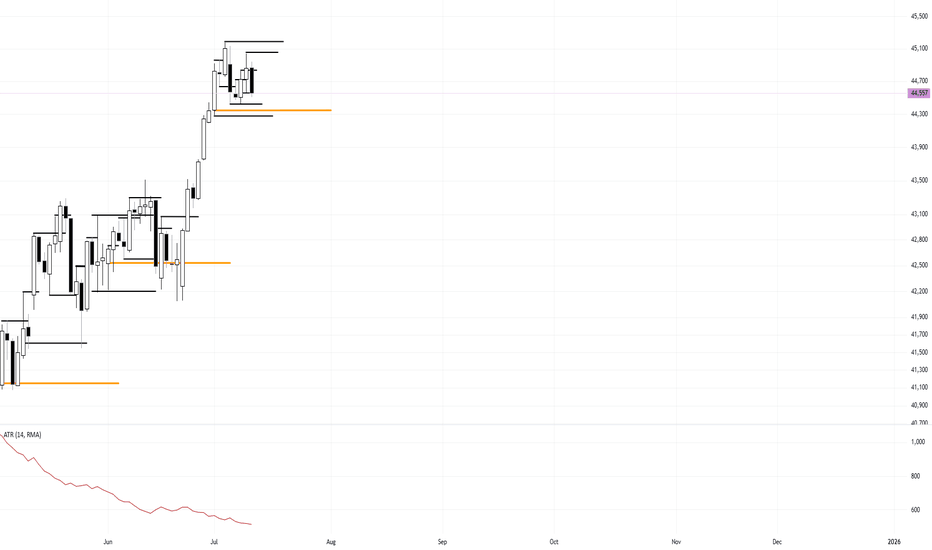

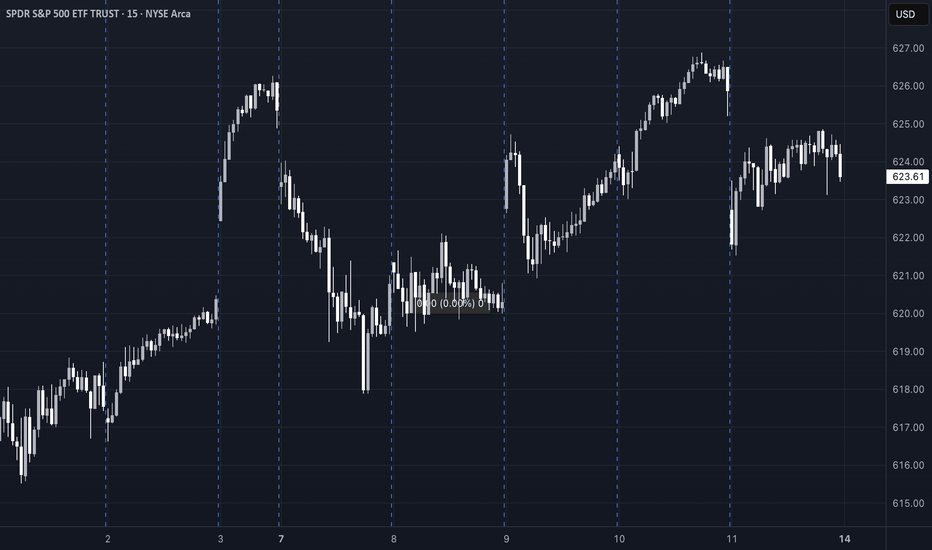

Full Breakdown of My Trading Strategy Dow Futures DaytradingI will be detailing my strategy to both help others and to help myself fine tune my strategy.

My strategy is one of market maker cycles. The end goal: to trade off of the Daily chart by drilling down to the 15 minutes for entries. Everything revolves around the Daily chart. The only indicator I use is ATR, other than that, pure price action. I use opening prices a lot in my trading.

Starting with the MONTHLY chart:

Every month has the following-

An opening price

A first trading day

A last trading day

These are things that ALL traders see and can't misinterpret.

I will use June as the basis for my examples.

I try to figure out what kind of monthly candle is likely to form. Bullish, Bearish or Doji. I use ATR to try to figure out the likely size also. For Dow Futures, a typical Monthly candle is around 3000 ticks +/-

Going to the Daily chart, I mark the beginning of the month and the end of the month.

The meat of the strategy, and the one quite frankly is the most difficult and the most discretionary, is reading price action on the Daily chart to determine what the next daily candle is likely to do and where it opens at. No strategy is 100% accurate and I do take losses from being wrong. With proper risk management ( I will detail my personal risk management later ) you can still make tons of money being 50% right.

Not everyday is meant to be traded and quite frankly, most days are pure trash. Over 55% of all Daily candles are small, resting Doji days. You are looking for the expansion daily candles.

Starting with the first trading of June:

1. May 29th, Large Doji day and and formed a mother bar

2. May 30th, another doji day and still inside the previous bar

3. June 2nd, opened up in middle of inside bar, Bias for day is Long. Buy near the bottom of the inside bar and a break of Yesterday's Low.

This is an actual trade I took. Once I saw the Doji candle on the 15 minute break below yesterday's low I entered in Long. I will go over stops and targets later. For now, I am explaining how I find my bias and locations.

The next day: start the process over again. Look at the Daily and the context of the bars. Look for swing points, Daily highs and lows. Key Daily bars as signals. I usually like to do this 5 minutes after Asia opens just to see where price opens at. I then mark the daily open with a cyan blue line. If I am Long bias then I want to buy under the open at key levels. I use SP as swing point, a daily high or low that has not been broken yet.

Tuesday, I would have a Long bias again. Because we opened still inside of the mother bar and I see highs not broken, I want to trade in that direction. What is a key level on this Tuesday? I see the monthly open right underneath. The big question I would ask myself on this Tuesday is where in that move can I get in on a pullback for the Long trade?

The market gives you an entry here.

I did not take that trade, I WILL show you the trade I did take on this day. After NY opened, I saw the spike into the monthly open and a doji right ON the open. I slammed Long. Especially, the three swing points to be used as the direction.

Now on to trade management. Stops, Targets. I have the same bracket for every trade, so the only variable is my entry. Once I enter, I set my ATM strategy.

I use the 15 minute ATR to determine my stop loss. This part is also up to the individual trader and is discretionary. I will show you MY strategy.

Take a zoomed-out view of the 15-minute chart with the 14 period ATR, mark the clusters of the peak ATR readings from NY sessions. In this case it is between 70-90. I tend to go towards the upper limit, this case 90. I then use 1.25-1.5 times of this reading based on my account and position sizing. In June AND in July, I am using 120 tick stops.

My targets are all strictly 2.5 risk to reward of what my stop is plus or minus a few ticks for commissions. Since I am using 120 tick stops, my targets are therefore, 300-310 ticks. Going back to my Tuesday trade, the trade management would be a set 2.5R all or nothing. Enter the trade and walk away. Go read a book or play PS5. Go to gym. It will either hit stop, target or close out at 4pm NY close.

2 Winning trades wipes away 5 losers. I have losers all the time with a 50% win rate. I can expect 8 losing trades in a row at any given time. Something I have experienced multiple times.

Now on to my money management strategy. The holy grail of this entire system. Quite frankly, how you enter and your strategy at the end of the day doesn't amount to much. How you manage your money is where professionalism is achieved.

Take your starting account balance, divide it in fours. I will use a 10,000 account as simple math.

10,000

2500 Level 1 14.5R

2500 Level 2 11.5R

2500 Level 3 9.5R

2500 Level 4 8.5R

I risk 1.75% per trade and each level will stay fixed until the next level is reached. In this example, Level 1 will be using $175 risk per trade and a 2.5 risk to reward, $440 reward. You will keep risking $175 per trade until you hit your $2500 profit goal to advance to Level 2. In this case this will take you 14.5R

Now you are on Level 2, you find your new account balance is now $12,500. Find 1.75% of this = $220. Keep using $220 risk until you hit another $2500 in profits. This will take you 11.5R.

Keep repeating these steps until you have hit all 4 profit levels and your account has doubled. Your new account balance is now $20,000. You will start this process over again. To double your account you will need a total of 44-45R. At a conservative approach of 5-7% monthly gain, you can expect to double your account in 8 months +/- depending on how good you can get.

The number one major key to ALL OF THIS IS

One trade per Daily candle. You lose on that day, move on and come again tomorrow

All profit targets need to be hit or close out at 4pm depending on price

Trading Style, Timeframe Compatibility & Reasonable RiskTrading Style & Timeframe Compatibility

When selecting a timeframe for your trading strategy, it's essential to understand how that timeframe interacts with your chosen approach. Not every timeframe works well with every style — and the reason is rooted in time itself.

Each strategy — scalping , day trading , intra-week trading , or swing trading — is defined by how long you intend to hold a position:

-Scalping involves entering and exiting within minutes.

-Day trading means you're flat by the end of the day.

-Intra-week trading covers trades held for several days, but typically wrapped within one or two weeks.

-Swing trading extends beyond that timeframe, sometimes lasting weeks to months.

So before anything else, your timeframe should reflect your intended holding period . If that alignment is off, the edge you're trying to build may be fundamentally flawed.

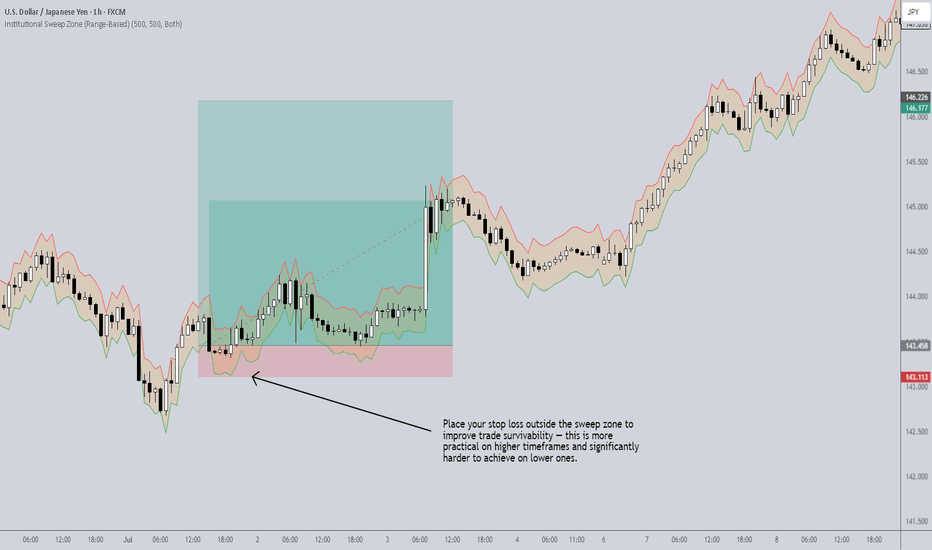

Timeframes and Institutional Risk

Here’s where it gets interesting: the lower the timeframe , the closer you are to current price action — and that proximity increases your exposure to short-term liquidity grabs by institutional players.

Institutions don’t just push price around randomly. They insert large capital into the market with calculated precision, typically aiming to sweep liquidity (aka stop hunts) before executing their real positions. But there's a limit: institutions can only inject so much money at a time before it becomes inefficient or risky for them.

This is where tools like the Institutional Sweep Zone indicator come into play. It estimates how far price can move given a range of institutional capital (e.g., $500M–$1B). It calculates the potential sweep distance based on the pair you're trading, and visually maps the zone where stops are most vulnerable.

For example:

A sweep zone that stretches 20 pips might represent the range where $1B could realistically push price.

If your stop is inside that range, you're at higher risk of getting swept.

If your stop is well outside of it (often found on higher timeframes), the risk decreases substantially — because it would require too much capital to reach your level.

So, higher timeframe strategy stop-losses tend to sit outside these high-risk zones naturally , making them less likely to be manipulated by institutional moves. That’s why:

-Lower timeframe = higher risk of being swept

-Higher timeframe = lower risk, higher survivability

-More Trades ≠ More Profit

One of the biggest traps new traders fall into is believing that more trades will generate more returns. In reality, more trades just amplify risk — especially when you’re relying on low timeframes that are constantly under pressure from liquidity sweeps and volatility.

Patience is a skill. Eager traders often gravitate to the 1-minute, 5-minute or 15-minute charts, thinking they’re catching more opportunities. In truth, they’re exposing themselves to more noise, more traps, and more stop-outs.

Final Thoughts

If you’re serious about aligning your strategy with institutional mechanics, be intentional about your timeframe. Think in terms of:

-Risk exposure to sweeps

-Capital required to invalidate your position

-Holding power relative to time classification

And remember: fewer, higher-quality trades on appropriate timeframes often outperform dozens of rushed trades on lower ones.

For more concepts like this — along with access to unique tools like the Institutional Sweep Zone — check out my TradingView page: The_Forex_Steward . If this post helped clarify your thinking, give it a boost to let others benefit too.

You Seek Profit, they seek you !who?Every time you think the market’s about to crash, it pumps.

And when you’re sure it’s time to enter, it dumps.

Maybe it’s time to ask a serious question: Who’s really hunting whom?

Hello✌

Spend 3 minutes ⏰ reading this educational material.

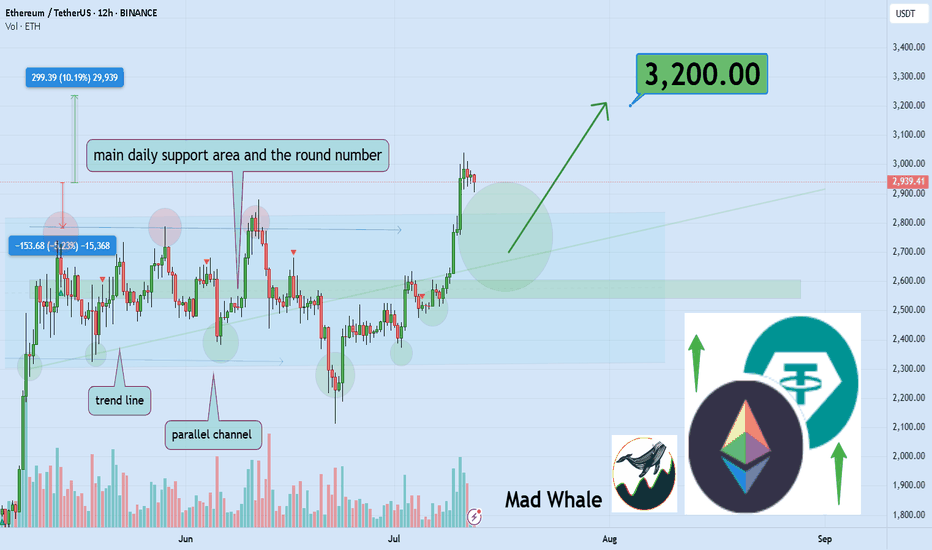

🎯 Analytical Insight on Ethereum:

As noted earlier, after several days of sideways action, BINANCE:ETHUSDT has confidently broken above its parallel channel. 🚀 This breakout sets the stage for a potential gain of at least 10%, targeting around 3200. There is also a chance for a retest of the channel’s upper boundary before continuing higher. 🔄

Now, let's dive into the educational section,

🎯 The Modern Market Hunters

Markets today aren’t simple anymore. Behind every candle lies a strategy, an algorithm designed for one thing:

Profiting from your fear and greed.

In crypto, liquidations have turned from a mere term to a deadly tactic. When you enter a position, exchanges know exactly where your stops are. Often, price moves are designed to trigger liquidations of traders like you.

🛠 TradingView’s Tools to Spot the Traps

In a market where hunters are always one step ahead, TradingView’s default tools can be your secret weapon. You just need to know where and what to check:

Volume Profile (Range & Fixed): Shows where real money volume has entered, not just pretty candles.

Liquidity Zones Indicators: Pinpoints exact areas where stops cluster the prime hunting grounds.

Order Block Detection Scripts: Marks zones where whales place heavy orders, always moving against retail trader sentiment.

Set these tools on 1H to 4H timeframes and focus on overlapping areas. This way, you can spot traps before they activate, not after.

🔬 How Are Traps Actually Set?

Markets first build a nice trend, making everyone FOMO in. Then, a sudden shadowy candle crashes the party.

This is called a liquidity sweep or stop hunt.

Signs are clear:

Sudden volume spikes

Positions quickly flipping to profit or loss

Long shadows on candles signaling stop grabs

This is exactly where Open Interest and Liquidity Maps come in handy. They reveal the hunting map before your eyes.

🧠 Your Mind Is The Biggest Liquidity Map

The biggest traps are built inside traders’ minds. When the market moves against you, you panic and set stops.

But that’s exactly the lesson market makers want you to learn: don’t react emotionally.

Instead, a pro trader uses others’ behaviors as cues before market moves.

While you focus on profit, whales focus on your biggest fear: stop loss.

🔄 Your Greed Is Their Data

Every stop you set is a data point for them. You chase profit, they chase your surrender.

Lots of long volume in one zone? Price gets dragged down.

Everyone’s short? Expect a fake pump.

Volume is a footprint, and they track emotional traders like a bloodhound.

🚧 Escape The Trap, Don’t Predict The Market

Pro trader’s formula:

Don’t try to predict track.

When you realize the market isn’t moving naturally but hunting orders, your mindset shifts. You become a tracker, not a soothsayer.

📉 Every Candle Can Be A Killer If You’re Unaware

When a big opposing candle hits your position, ask:

Are we all thinking the same thing?

If yes, you’re likely the next target.

📌 Final Summary

If you only chase profit, you miss the fact the market is hunting you.

The only way out: know they play with your info, not just the charts.

Trading blindfolded is walking into the wolf’s den.

✅ What To Do Next?

Learn to analyze other traders’ moves, not just price action.

Use TradingView tools to see behind the candles.

You’re not here to be hunted you’re here to hunt. So this time, guess where everyone’s stop will be before entering!

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

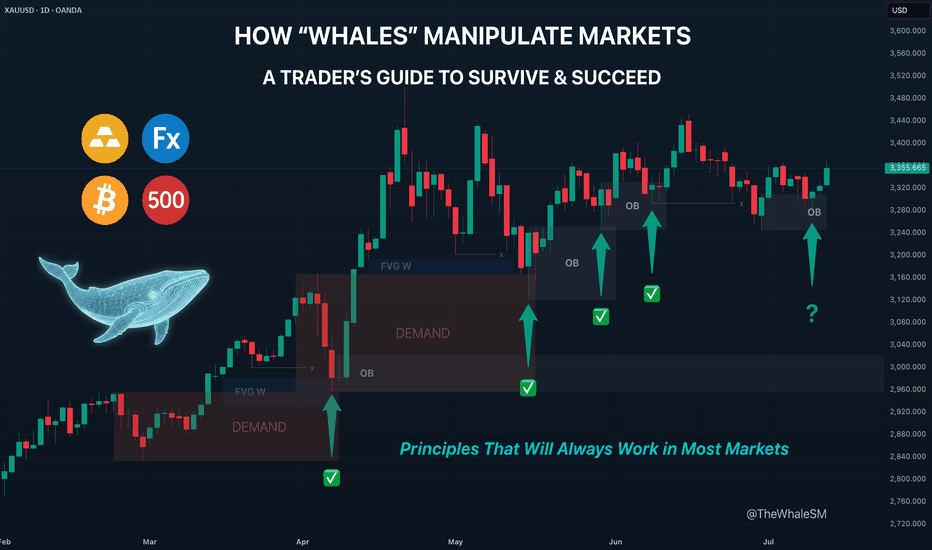

How "Whales" Manipulate Markets: A Trader's Guide to SucceedEvery chart tells a story of institutional footprints. For most, it's chaotic noise. But when you understand the market's true engine — the constant need of "Smart Money" to capture vast amounts of liquidity to fill their orders — that noise turns into a clear map.

This guide will teach you to read that map. We will break down the main types of manipulation and show you how to use them to identify high-probability zones for potential entries.

So, why exactly is liquidity the fuel for these "Smart Money" players, which for simplicity, we'll call "Whales"? It's because a Whale holds the largest volume of funds in a specific asset and, unlike retail traders like us, it cannot open its huge position at any given moment simply because there aren't enough buy or sell offers on the market.

To fill its orders, the Whale constantly carries out manipulations to capture additional liquidity. This isn't about deception or anything negative—it's how the market constantly forms its movements, how whales achieve their goals by moving from one liquidity pool to another, much like whales in the ocean hunt for plankton to get vital energy for long journeys from one feeding ground to another.

Why will these principles of price movement through manipulation, which worked decades ago, continue to work forever? Because human nature doesn't change over time. The crowd is always driven by greed and fear, making it easy to manipulate. Therefore, manipulation is often the motive for the birth of a future move and is a key element in market mechanics. If you understand these mechanics, you will be able to see the footprints of whales on any chart and not only minimize your chances of becoming their food but also join their next move to get your share of the profit in the boundless ocean of market opportunities.

Let's take a closer look at how whales carry out their manipulations and classify their types.

The Whale is constantly in hedged positions. To fill its large-sum orders without impacting the price, it uses the principles of Sell to Buy (STB) and Buy to Sell (BTS) .

The STB manipulation is used to accumulate long positions. To do this, the Whale opens an opposing short position, activating stop orders and liquidations of buyers, purchasing their positions at a favorable price. It also encourages other retail participants, especially breakout traders, to open short positions. Continuing to accumulate long positions, the Whale sharply moves the price up, liquidating short participants and absorbing their positions. After the price has moved up, the Whale is left with an open losing position from its short manipulation. To close it at breakeven or a small loss, the Whale needs to return the price back to the zone of its manipulation. This return is called mitigation .

In the opposite case, when the Whale needs to drive an asset's price down, it uses the BTS manipulation . To fill its short positions, the Whale opens a long position, activating stop-losses and forced liquidations of sellers, and encouraging retail breakout traders to also open long positions. Continuing to accumulate short positions, the Whale aggressively moves the price down, absorbing and liquidating the positions of impatient longs. After the downward impulse is complete, the Whale is left with an open losing long position. Just as in the first case, to close it at zero or a small loss, the Whale needs to return the price to the manipulation zone, after which another markdown of the asset occurs, and the cycle can be repeated as many times as necessary.

Thus, through manipulation, the Whale achieves two goals at once:

It gets the most favorable price.

It eliminates most of its competitors by liquidating their positions with an opposing move.

Most of the time, the price movement between manipulations is unpredictable. Entering during this movement, for example, in the middle or end of an impulse or within a range, increases the chances that you will become a victim of the next manipulation and liquidity for the Whale. However, if you wait for the price to arrive at the manipulation zone, also known as a Point of Interest (POI) , and ensure that the Whale acknowledges this area (i.e., it has stopped there and is beginning a reversal), the probability of choosing the correct direction for a trade will be on your side.

To help you recognize manipulation zones, let's look at their different types.

🔹 Order Block (OB) - A down candle (sometimes 2, rarely 3 candles) before an impulsive move up (in the case of a bullish OB), or an up candle (sometimes 2, rarely 3 candles) before an impulsive move down (in the case of a bearish OB). In most cases, this short, sharp move should sweep some form of significant liquidity. An additional confirmation of an Order Block is the immediate imbalance or Fair Value Gap (FVG) that follows it, because the Whale's intensive position accumulation and the associated impulse move don't allow enough time for all market participants' orders to be filled.

🔹 Demand/Supply Zones are similar in principle to Order Blocks but differ in that they have a more prolonged action, which can consist of many up or down candles, making these zones often significantly wider than OBs.

Demand Zone - The last downward move before an intensive rally.

Supply Zone - The last upward move before an intensive drop.

Often, an Order Block can be found inside a Demand/Supply zone.

🔹 Range - Also a manipulation zone and essentially an Order Block, but unlike an OB, this manipulation can last for a very long time when the Whale lacks sufficient liquidity from a quick manipulation and accumulates its large position by collecting internal and external liquidity through the range. Ranges, just like Order Blocks and Demand/Supply zones, are points of interest for the Whale to close its losing hedged positions and continue moving towards its goals.

Conditions for Applying and Validity of Manipulation Zones

An important condition for applying manipulation zones is that they can only be used once . That is, if the price has come to a zone and reacted to it, upon a second arrival, that zone is no longer valid. For convenience in marking used zones, I shorten them to the point of the first touch so as not to consider them anymore, but to understand which way the order flow is directed—a very important concept that, unlike structure, shows the true direction of the Whale's movement. Order flow is manifested by the price reacting to manipulation zones from below in an uptrend and from above in a downtrend.

It is also very important to understand that it makes sense to identify and use manipulation zones as one of a trade's entry conditions only from below for an uptrend and from above for a downtrend . Any counter-trend zones formed in the path of a trend are highly likely to be broken and serve as liquidity.

In ranges, manipulations formed after deviations can be used for entries from both sides.

Only manipulations that were formed at the beginning of an impulsive price move can be considered valid for entry. That is, they must be the manipulations that directly triggered the start of the move; in Smart Money terminology, they are often called the "origin" . Any manipulation in the middle or end of a move will most likely serve as liquidity on the way back to mitigate the origin zone.

How long does a manipulation zone remain relevant? It remains relevant until a new structural element (a higher high or a lower low) is formed , especially if the price has already come close to the manipulation zone, for example, into the FVG before the zone. This most likely means the Whale has already finished its business there and closed one of its losing hedged positions at a small loss. When the trend changes, such a zone will act as liquidity, not a POI. So, a manipulation zone will not always be mitigated; often, a reversal occurs from the FVG before it. However, entering from an FVG is much less reliable than from an Order Block, Demand/Supply zone, or Range. I personally skip such entries and wait for a new manipulation zone to form and be mitigated; they happen on the market constantly.

A good bonus that further strengthens the probability of a setup working out during the mitigation of manipulation zones is a liquidity sweep upon reaching them.

Consider the context and supplementary conditions. Although manipulation zones are the strongest areas for price reversals, they should always be used in conjunction with other supplementary conditions and tools, for example, with Fibonacci retracement levels or liquidity sweeps. "Context" implies any other conditions that can either confirm or contradict the likely direction of price movement. For example: in which phase of correction is the price? For a long, safe entries can only be considered from the discount zone (below the 50% Fib level); for shorts, only from the premium zone (above the 50% Fib level). Is there significant, un-swept liquidity nearby, such as previous daily, weekly, or monthly highs/lows, or an untouched Asian session high/low? What upcoming news could affect the asset and hit the stop before the setup plays out? At what time of day did the price mitigate the manipulation? Taking context into account is a crucial and integral part of analysis in the search for entry points.

Due to the fractal nature of market charts, manipulations can be seen on any timeframe. On weekly and daily timeframes, manipulation zones can be used for swing trading or investment purchases. 4-hour and 1-hour timeframes will show potential entries from manipulations for intraday trading or holding positions for several days. 5-minute and 1-minute timeframes will show manipulations in the form of order flow for final entry confirmation.

Whatever type of analysis you use for your trading, understanding the nature of market manipulations and practicing their recognition will allow you to be one step ahead of most market participants and open your trades with an understanding of which way institutional capital is most likely to move next.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this guide helpful, support it with a Boost! 🚀

Have a question or a "lightbulb moment" from this article? Share it in the comments! I read every single one. 💬

► Follow me on TradingView for more educational content like this and to not miss my next detailed trade idea .

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

What’s Your Catalyst?

Lately, many QS members have been DM’ing me asking:

“What do you think of this trade idea?”

“Should I go long here?”

“Do you think this setup looks good?”

And my go-to response is always the same:

“What’s your catalyst?”

Because without a catalyst, you’re not trading — you’re guessing.

---

🎮 Trading Is Not a Video Game

New traders often treat the market like it’s a video game.

As long as they “crack the code” of green arrows and red arrows on the chart, they believe they’ll make infinite money.

But that’s not trading.

That’s fantasy.

The harsh truth? Most of these traders haven’t paid their tuition yet.

Some are still in the honeymoon phase.

But the market always gets paid — in blood, time, or money.

---

💀 Real Trading Is Financial Warfare

Trading is not a game.

It’s war.

Behind every price tick, every candle, every fill — is another trader fighting for their financial life.

It’s a sword-to-sword battle. Just because you see it on your phone doesn’t mean it’s not real.

Real trading is life and death for hedge funds, prop firms, and even retail traders trying to survive.

Yet so many jump in, chasing arrows and patterns like they’re spinning a slot machine.

---

🎲 Why You’re Losing with “Green Arrow, Red Arrow”

No offense to TA — it has value. But let’s be honest:

If you’re blindly betting off green and red signals without context, you’re gambling.

You’re just hoping that one of those arrows lines up with a rare, random outlier move — so your one win is big enough to cover all your prior losses.

That’s not strategy.

That’s survival through luck.

---

🔍 What Real Traders Do Differently

To stand out, you need more than pretty charts.

You need information. Insight. Intent.

You need to answer questions like:

Why is this price movement happening?

How far can it go?

What’s driving this move — and what’s the broader context?

You won’t find those answers in price and volume alone.

---

💡 The 4D Framework of Modern Trading

To get an edge, you need to think in 4 dimensions — beyond what most retail traders see:

Market Data – price, volume, trends

Fundamentals – earnings, balance sheets, growth

Macro Forces – rates, inflation, policy, geopolitics

Catalysts – news, events, industry changes

Options Data – implied vol, skew, positioning

This 4D perspective is how modern trading works — and it’s exactly what AI is built to do better than any one trader.

You’re not going to out-research Goldman Sachs.

You’re not going to manually read every 10-K, earnings call, tweet, and Fed update.

But AI can.

---

🤖 AI Isn’t Perfect — But It’s Better Than Gambling

Is AI trading the ultimate answer?

No.

But it’s the closest thing we have to a scalable edge — because it combines massive information processing with human-level reasoning.

The choice is yours:

Stick with “green arrow, red arrow” and hope for Vegas-style luck

Or embrace AI tools that give you a fighting chance through context and analysis

I’ve made my choice.

And every day, my tools — and my edge — get better.

---

🧠 So Next Time You Trade, Ask Yourself

What’s your catalyst?

If you don’t have one, you don’t have a trade.

You have a lottery ticket.

How Much Risk Are You Really Taking?

I get two common horror stories from new QS members:

“I followed a few QS signals, nailed some wins… then bled it all back.”

“My first couple signals lost, and my account was toast.”

My first question to both groups is always the same:

“How much risk did you assign to that trade?”

❌ Why Most Traders Dodge This Question

Risk management isn’t sexy.

Green arrows and slam‑dunk gains are fun to talk about. Stop‑losses and position sizing? Not so much.

Gambling feels easier than math.

Going “all‑in” gives you the casino rush. Calculating max drawdown does not.

Accountability hurts.

If the trade blows up, there’s no one to blame except the person who sized it.

⚔️ Trading = War (No, It’s Not “Fun”)

Like I said in “What’s Your Catalyst?” — trading is financial warfare.

Show up without armor (risk rules) and you’re the first casualty.

In basketball you need defense before dunks.

In war you need body armor before bullets.

In trading you need risk management before any strategy.

📏 My Simple Rule

Only risk what you’re prepared to watch burn—completely.

If the idea of that money turning to ash makes you queasy, you’re oversized. Period.

🧠 Questions to Ask Before Every Trade

Position size: How many dollars exactly can I lose and still fight tomorrow?

Probability: Is this setup strong enough to justify that risk?

Stop‑loss: Where is my hard exit? No “I’ll see how it feels.”

Reward‑to‑risk: Is the upside worth at least 2–3× the downside?

Confidence check: If I’m not 100 % cool watching this cash burn, why am I risking it?

🚀 Pair Your Edge with Protection

AI and QS signals give you edge — a slightly better chance in a brutal game.

But edge without risk control is like a sniper without body armor: lethal until one bullet hits.

Next time you celebrate a hot streak or curse a quick wipe‑out, pause and ask:

“How much risk did I really assign to this trade, and was it worth it?”

If you can answer honestly and still sleep at night, proceed.

If not, size down, armor up, and protect your capital first.

Strong defense wins championships — and trading accounts. 🛡️💰

The Myth of Win RateOne of the most common questions I get from QS members:

“What’s the win rate of the signal?”

Sounds like a smart question. But it's often coming from the wrong mindset — the same mindset as a student cramming for a test, hoping for one perfect answer key that’ll give them a 90% score and an easy win.

Let me break this down for you:

🧮 The Only Two Numbers That Matter in Trading

There are only two math truths that actually grow your account:

Win Rate – how often you’re right

Win/Loss Ratio – how much you make when right vs. how much you lose when wrong

Everyone obsesses over #1.

Almost no one truly understands or applies #2 — and that’s the real killer.

---

🤔 So What’s the Ideal Setup?

In a perfect world, you’d have:

A high win rate (80–90%)

AND a high win/loss ratio (make $3, lose $1)

But guess what?

This isn’t a perfect world — this is a war.

See my earlier post: "What’s your catalyst?"

---

⚔️ Trading Is Like War (or Sports)

In war, victory is rare and costly.

In sports, scoring takes hard work, timing, and discipline.

In trading:

You win big when the odds are stacked in your favor

You cut losses quickly when you’re on the wrong side

That's the gold standard — but few do it.

Even worse, many do the exact opposite:

Take quick profits to “lock in a win”

Let losers run hoping for a miracle

Then they wonder why their account bleeds over time.

---

🎰 Vegas Was Built on 51% Win Rate

Casinos don’t need to win every game. They just need:

Slightly better than 50% edge

Strict control over risk and payout

That 1–2% edge? It built every billion-dollar casino on the Strip.

Now think again:

Why are you chasing a 90% win rate when even 55% + smart risk control can make you rich?

---

🧠 Profitability > Win Rate

You don’t need to win all the time.

You need to win big enough and lose small enough.

Your goal should be:

3 steps forward, 1 step back.

That’s the realistic rhythm of trading success.

---

✅ So Next Time You Ask About a Signal...

Don’t just ask:

“What’s the win rate?”

Instead ask:

“What’s the reward if I’m right?”

“What’s the damage if I’m wrong?”

“How do I size this trade so my wins outgrow my losses over time?”

This is how real traders think.

Not about perfection — but about probability, edge, and sustainability.

---

💬 TL;DR

Win rate is just one piece.

Your win/loss ratio and risk management matter more.

Profitability > accuracy.

The market doesn’t reward perfection. It rewards preparation, defense, and discipline.

Keep playing smart, not perfect.

And remember — it’s a long game. 🧠📈

How I Manage Risk (When Buying Options) If you’ve read my previous post — “How Much Risk Are You Really Taking?” — you already know my view on risk:

Treat every trade like watching your cash burn in front of you.

Ask yourself:

💭 “Would I be OK watching this much money disappear right now?”

If your answer is yes, take the trade and move on.

If it’s no, don’t do it — resize it.

🚫 What Not to Do:

Many traders fall into the trap of:

“I’ll think about it later”

“I’ll set a mental stop and cut if it hits my level…”

That approach has two fatal flaws:

#### ❗ 1. Execution failure

You might not react fast enough when the market hits your level — or worse, you’ll forget to act at all.

#### ❗ 2. Emotional resistance

Even if your stop level is hit, will you actually cut?

Probably not.

Human nature avoids pain and chases pleasure.

Cutting a loss — even a planned one — is painful. That’s why mental stops often fail.

Mental stops:

Add more burden to monitor

Add more emotion to your decision-making

That’s why I keep it simple.

---

✅ My Risk Rule for Buying Options:

Every dollar of premium I spend is 100% acceptable to lose.

This way:

I don’t need a mental stop.

I don’t need to watch it every second.

I sleep well, regardless of outcome.

---

📊 How Much Do I Risk?

It depends on account size and account type:

#### 📌 Main Account:

Risk 1–2% per trade

Never more than 5% on a single trade

Rarely hold more than 3 trades at once

Targeting 6–10% total exposure, only if trades are uncorrelated

⚠️ SPY & QQQ are NOT uncorrelated — don’t fool yourself.

#### 📌 Small Account:

Can risk 5–10% per trade, but only on A+ setups(See: “What’s Your Catalyst?” for what qualifies as A+ in my book)

The goal of a small account is different: it’s about growth — but still must be strategic.

---

💰 “But How Can I Make Big Money Risking So Little?”

This is the common pushback I get:

“Shouldn’t we take big risks to get big rewards?”

Sure — high risk = high reward.

But high risk also = high chance of blowing up.

Even if you hit a few big winners, you’ve compromised your long-term survival.

That’s not trading. That’s gambling.

---

🧠 What I Actually Look For:

Low Risk / High Reward.

Yes, they’re rare.

Yes, they’re like lotto tickets.

But you don’t need to win often if you only risk a little and win big when it counts.

What’s not rare is:

Traders risking big on uncertain setups

Going all in on gut feelings

Wiping out in one or two bad trades

That’s not strategy — that’s self-destruction.

---

🧾 The 2 Core Rules of Risk:

Protect capital at all costs

Only take trades where potential reward outsizes the risk

Don’t flip the logic.

Too many traders hear “high risk = high reward” and assume high risk is required.

It’s not.

That mindset is built for Vegas, not for Wall Street.

---

🧠 If You Want to Be a Trader — Not a Gambler:

You must believe in:

Small risk, big reward

Patience

Discipline

Letting time and luck compound your edge

No other way.

🎯 If you truly get this… congrats.

You’ve crossed the line from gambling to trading.

How to Do Your “Trading Homework” (The Smart Way)

If you’ve been following this channel, you’ve heard me say it many times:

Trading is war — and you should never enter a battle unprepared.

But here’s the real question:

How exactly do you prepare?

The answer lies in a powerful strategy I use called:

💡 Thematic Investing

Read more here →

Instead of chasing news or signals in isolation, thematic investing means:

You first understand where the world is heading

Then you position yourself ahead of that move

It’s not about reacting. It’s about anticipating.

---

❌ What Most Traders Do Wrong

Most beginners:

Follow one tweet

See one red or green arrow

Watch one chart pattern

Then they jump in blindly.

That’s not trading — that’s guessing.

News headlines and chart moves reflect what already happened.

But your edge comes from understanding what’s likely to happen next.

---

✅ What I Do Instead (with QS AI)

Back in the day, doing thematic analysis manually could take hours of reading across dozens of news sites, earnings calls, and macro reports.

But now?

QS AI does the heavy lifting for you — in seconds.

Here’s how I do my “trading homework” every week using QS signals:

---

🧠 Step 1: Start with the News Theme

Go to 📰news-signal — let the AI scan hundreds of headlines and summarize the key themes shaping the week.

Ask yourself:

What’s the main event or policy shift?

Which sectors are directly impacted?

Who are the winners and losers?

---

🔎 Step 2: Zoom Into Sectors or Stocks

Once you spot a theme, use other QS signals to dig deeper:

⏰0dte for fast-moving trades (same-day catalysts)

📅weekly-options for 1–5 day plays

💸earning-signal for earnings-related positioning

🔄swing-signal for broader trend/position trades

---

📈 Real Examples of Thematic Trades

Let me walk you through a few past trades — all built off this exact process:

✅ BBB Defense Play

Theme: Bill passed removing EV credits, boosting defense

Strategy: Long PLTR / Short EV sector using 📅weekly-options

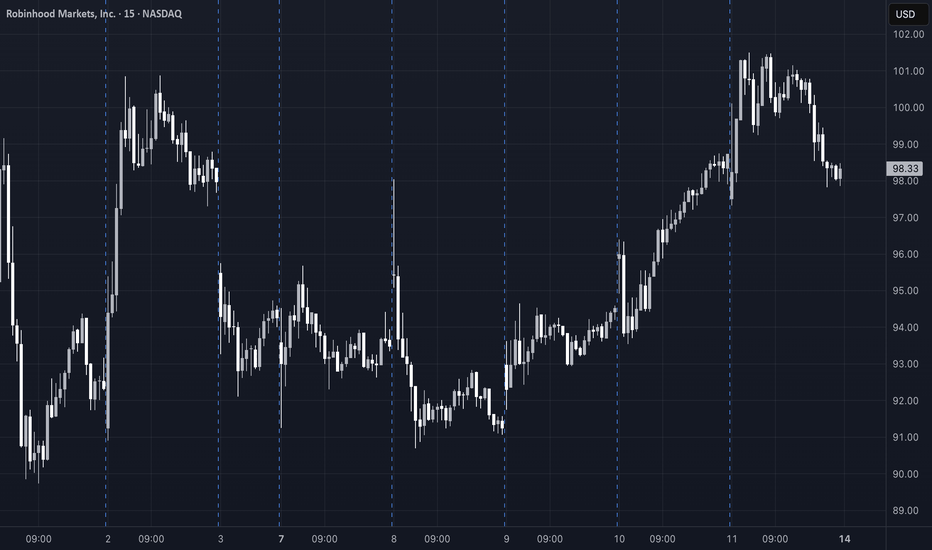

✅ Robinhood Crypto Tokenization

Theme: Robinhood’s crypto product event

Strategy: Crypto stocks pump → took profits early

✅ Tesla Robotaxi Week

Theme: TSLA reveals AI & robotaxi push

Strategy: Long TSLA / Short UBER

✅ Earnings Play: MSFT vs AAPL

Theme: MSFT cloud beat, AAPL revenue drop

Strategy: Long MSFT / Short AAPL using 💸earning-signal

All these trades started with thematic awareness → followed by precise signal-based execution.

---

⚙️ Your Homework Checklist (The QS Way)

Before every week or trade, ask:

📰 What is the major theme driving markets this week?

🧠 What sectors or companies are most impacted by this theme?

🔀 Can I find a relative strength/weakness pair to trade?

⏳ What’s the best time frame? (0DTE, weekly, swing?)

📊 What do QS signals say about timing, momentum, and volatility?

---

🤖 Why QS AI Gives You the Edge

Doing this manually would take you 5–10 hours a week.

But with QS AI:

You scan the entire news cycle in 10 seconds

Get real-time themes and reactions

Pair it with high-quality trade setups

Prepare your game plan before the market opens

This is how we prepare smarter, not harder.

No more chasing arrows.

No more gambling.

Just clean, thematic, risk-aware, high-conviction trades.

---

🏁 Final Thought

There are no guarantees in trading.

But there is a smarter way to prepare.

Thematic investing + QS AI gives you the best shape to step into the market and fight with confidence.

Follow where the world is going — one theme at a time.

That’s how we trade with QS. That’s how we print. 🧠💥💰

Select Your Trading Time

There’s an old saying:

“Plan your trade, and trade your plan.”

But I want to add something even more important:

“Pick your time to trade.”

---

💰 The Market Is Not Your ATM

Everyone enters trading with one goal: make money.

Some even think of the market as an ATM — pull the handle, cash comes out.

But the truth is:

❌ The market doesn’t care about your goals

❌ It won’t move just because you need to make money today

This is a brutal game. And you don’t control the clock.

---

⚠️ When You Force a Trade...

Too many traders say:

“I have to make money today.”

“I need to hit $X this week.”

“I just took a loss, I must come back now.”

That kind of thinking leads to:

Bad entries

Overtrading

Emotional decisions

Big losses

❗ Trading success doesn’t come from forcing outcomes — it comes from waiting for the right moments.

---

🧠 What Happens on Low-Volatility Days

Let’s take today as an example.

SPY moved in a 2-point range all day.

No momentum, no trend, just chop.

Some traders:

Ran one QS signal after another

Forced trades just to feel busy

Got chopped up by fast reversals

Then blamed the signals

But here’s the truth:

AI or not , you can’t expect any long-volatility trade to work when the market is dead still.

The only winners on days like today? Market makers and options sellers.

---

❓ Why Trade at All on a Day Like This?

If the market isn’t offering opportunity,

Why force it? Why chase trades? Why burn your energy?

The smarter move is:

Sit out

Observe

Wait for better setups

Preserve your mental and financial capital

---

🔄 Recovery? Yes — But on Your Terms

Some traders lose money and say:

“I need to make it back today.”

That’s emotional revenge trading.

What if the market doesn’t give you a clean opportunity today?

Are you still going to go all-in, out of frustration?

❌ That’s not a strategy. That’s gambling.

---

📍 QS Signals Are a Map — Not a Magic Button

QS AI signals help you find opportunities — but even the best map won’t help if:

You're in the wrong city (bad market environment)

You’re rushing without checking road conditions (volatility, news, timing)

Even with QS, you don’t have to trade every day, every hour.

---

✅ What You Should Do

Be patient

Respect market conditions

Take a break on slow or tricky days

Come back when the odds are in your favor

---

🧘♂️ Final Words

You don’t have to win every day.

You don’t have to trade every day.

You don’t even have to be active to be successful.

🎯 Trade less. Trade smarter. Select your time wisely.

That’s how real traders survive and thrive in this game.

How We’ll Trade Earnings This Season Earnings season is almost here — and if you're with QS, you’re already holding the most powerful edge in the market.

Let me walk you through how QS trades earnings, why we built 💸earning-signal, and how you can use it most effectively this quarter.

---

📜 A Little History: The Birth of 💸earning-signal

When QS launched in early April, we started with just two short-term signals:

⏰0dte

📅weekly-options

Both focused on short-term options trades.

Then came TSLA earnings in late April. That’s when we launched our very first 💸earning-signal — and nailed the prediction.

Since then?

We’ve had one of the best earnings win streaks on the internet. Period.

📌 Don’t take my word for it — check:

#✅signal-recap for the track record

#🤑profits and #🤩member-testimonials for real wins from members

---

🤖 Why We Built a Separate Earnings Signal

Earnings are not regular trading days. The dynamics are completely different.

On normal days, a stock might move <1%

On earnings? 10–20% swings are common

This is what we call a “pivot event” — and it requires a different engine to predict.

That’s why we separated:

📅 #weekly-options → normal day-to-day setups

💸 #earning-signal → high-volatility earnings plays

---

🧠 How a Human Would Trade Earnings...

If you wanted to manually trade an earnings report, you’d need to analyze:

Past earnings reactions

Analyst expectations

Earnings call language

Financial statement surprises

Options IV & skew

Post-earnings stock behavior

This would take hours (or days) — and most retail traders don’t have time.

---

⚙️ How QS AI Does It Instead

We built 💸earning-signal to do all that work for you — and more.

✅ It pulls in all the data above

✅ Runs it through 5 top LLM models (each acts as an independent analyst)

✅ Aggregates their insights + calculates probability-weighted direction & strategy

✅ Uses fine-tuning to learn from its past prediction success/failures

This means: faster decisions, deeper insights, and better accuracy — every week.

We don’t just run predictions. We let the AI learn from past mistakes and self-improve each quarter.

---

💥 Results Speak for Themselves

Last season, we nailed:

TSLA

MSFT (10x–20x winners!)

NVDA

AAPL

And many more...

All based on this unique AI-driven earnings analysis stack.

This season?

We’re going harder, faster, and even smarter. 📈

🎯 The goal is clear:

Make 💸earning-signal the #1 earnings prediction system in the world.

---

🧩 Final Notes

Earnings are 10x harder to trade than regular days

But with QS, you’re equipped with 500x the speed and insight of an average trader

Upgrade if you haven’t yet: #💰upgrade-instructions

Earnings season kicks off next week

Let’s get it.

Let’s win big.

Let’s make season 2 of 💸earning-signal our most legendary yet. 🚀💸

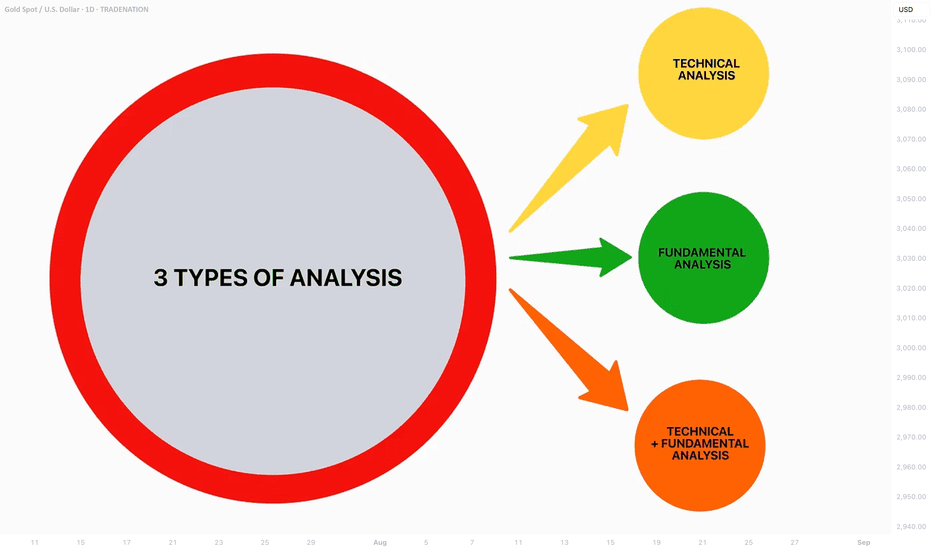

Learn the 3 TYPES of MARKET ANALYSIS in Gold Forex Trading

In the today's post, we will discuss 3 types of analysis of a financial market.

🛠1 - Technical Analysis

Technical analysis focuses on p rice action, key levels, technical indicators and technical tools for the assessment of a market sentiment.

Pure technician thoroughly believes that the price chart reflects all the news, all the actions of big and small players. With a proper application of technical strategies, technical analysts make predictions and identify trading opportunities.