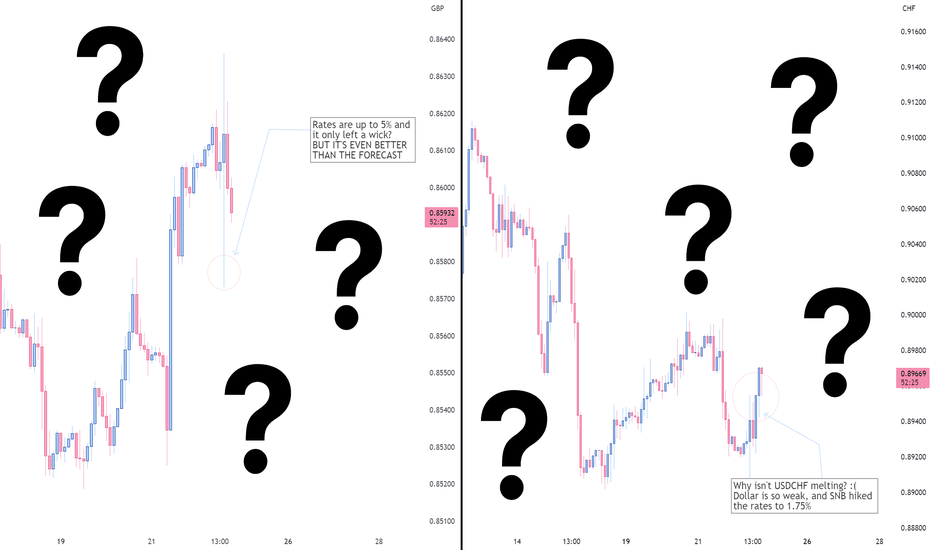

Decoding Forex Mysteries: USDCHF & EURGBP Reaction to Rate HikesWelcome to the intriguing world of Forex, where currencies act at their own rhythm, sometimes defying expectations and confounding even the most experienced traders. In this article, we are going to unravel the “mysteries” surrounding the reactions of USDCHF and EURGBP to recent interest rate hikes. We will dive into the realms of market anticipation, monetary policy statements, and the significance of staying ahead in this dynamic landscape.

1. The Resilience of USDCHF

As the Swiss National Bank (SNB) raises interest rates from 1.5% to 1.75%, market observers brace for the anticipated downward movement of the USDCHF. However, contrary to expectations, the currency pair displays remarkable resilience. Let's explore the underlying factors:

a) Priced-in Expectations: The forex market is renowned for its ability to assimilate information in advance. It is likely that market participants had already factored in the interest rate hike, blunting the immediate impact on USDCHF. Such anticipatory behavior highlights the importance of staying attuned to prevailing sentiment and analyzing market positioning.

b) Comparative Interest Rates: Understanding the relative interest rates of different currencies is paramount. If the rate hike in Switzerland was aligned with or lower than market expectations, and other major currencies offered more attractive rates, investors might have favored those currencies, mitigating the downward pressure on USDCHF.

c) Monetary Policy Statement Outlook: Monetary policy statements accompanying interest rate decisions provide crucial insights into central banks' future intentions (you can usually watch them live on YouTube 30 minutes after the data release or on Bloomberg type of channels). Since the SNB's statement revealed a cautious and neutral stance, it has tempered the impact of the rate hike on USDCHF. Market participants pay close attention to forward guidance, as it shapes expectations regarding future policy actions and influences currency movements.

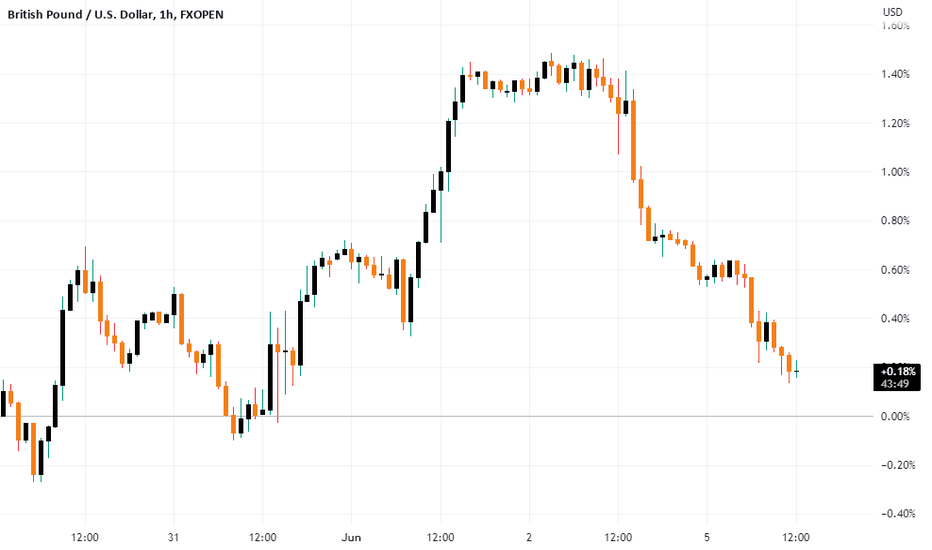

2. The Curious Behavior of EURGBP

Let us now turn our attention to EURGBP, which failed to sustain a short sentiment following the Bank of England's interest rate hike from 4.5% to 5.00% (versus the expected 4.75%) and left a nasty week. To understand this curious behavior, we delve into the following factors:

a) Market Expectations: The forex market is often driven by expectations and anticipatory positioning. If traders had already priced in the interest rate hike, the actual announcement might not have triggered a significant market reaction. Therefore, the lack of sustained short sentiment in EURGBP could be attributed to market participants adjusting their positions in advance. The GBP was up already by 4% within the last month against major currencies, so a big chunk of market was already longing EG for the expected short term recovery (guilty, but we also made a 2.9% profit closure on this).

b) Monetary Policy Outlook: Beyond interest rate changes, central banks' monetary policy outlooks play a vital role in shaping currency dynamics. The accompanying statement from the Bank of England, which shed light on their future plans, indicated a more gradual approach to tightening or expressed concerns about economic conditions. Such cues influence market sentiment and limit the downward pressure on EURGBP. In case of UK, this is already not a good look with their inflation rates :/

Now, you may ask: “Investroy, what do we do if fundamentals don’t exhibit the expected economical impact?” Don’t worry, we got you!

A Prerequisite for Success In the ever-evolving forex market, staying ahead of the curve is crucial. To navigate the intricacies and maximize opportunities, traders must adopt a proactive approach:

a) Monitor Central Bank Communications: Understanding central banks' intentions requires careful analysis of their policy statements, speeches, and press conferences. These sources provide valuable clues about future policy decisions and can guide trading strategies.

b) Assess Economic Indicators: Keep a keen eye on economic indicators that impact currency valuations, such as GDP, inflation, and employment data. These indicators provide a foundation for understanding a country's economic health and can influence currency movements.

c) Stay Informed of Geopolitical Developments: Geopolitical events, such as trade disputes or political instability, can significantly impact forex markets. Being aware of these developments and their potential consequences on currency movements is crucial for staying ahead.

d) Analyze Market Sentiment: Sentiment analysis, gauging the collective psychology of market participants, can offer valuable insights. Monitoring market sentiment through various indicators, such as positioning data and sentiment surveys, helps identify potential shifts and align trading strategies accordingly.

e) Embrace Technological Tools: Utilize advanced trading platforms and tools that provide real-time data, customizable charts, and algorithmic trading capabilities. These resources empower traders to analyze market trends, spot patterns, and execute trades swiftly.

Bonus) this one is a little subjective, but markets are very cyclic, if something is oversold, but everybody is expecting further bearish move, be sure there is a retracement coming before that happens 😊

Stay safe and enjoy your day!

Community ideas

Understanding Market Corrections:Definition & Key ConsiderationsInvesting in the stock market has the potential to generate substantial wealth over the long term, although it comes with inherent risks. One notable obstacle that investors frequently encounter involves safeguarding their capital during periods of declining stock prices. When the market undergoes a downturn, the inclination to panic and sell off investments to evade additional losses can be strong. However, this reactive approach often results in even greater financial setbacks and hinders the ability to capitalize on future market rebounds. In this comprehensive article, we will delve into the concept of a market correction and delve into various strategies that can assist investors in preserving their capital amidst market downturns, enabling them to emerge stronger when the market inevitably recovers.

Market Correction: A Comprehensive Explanation

In the realm of financial markets, a market correction is a notable event characterized by a substantial decline in the value of a financial instrument. This decline typically ranges between 10% to 20% and can encompass individual stocks of a specific company or even extend to encompass entire market indices comprising a vast array of companies. The duration of a correction can vary significantly, ranging from as short as a single day to as long as a year, with the average duration spanning approximately four months.

Market corrections can be triggered by a myriad of factors, each with its own unique catalyst. These factors can range from a company's disappointing financial performance and weak earnings report to more extensive global geopolitical conflicts. In some instances, corrections may occur seemingly without any discernible external cause.

It is worth noting that market corrections are not exclusive to stocks alone. They can manifest in various other financial instruments such as commodities like oil, platinum, and grain, as well as currencies, funds, specific industry sectors, or even the entire market as a whole. This exemplifies the widespread impact that a correction can have across diverse segments of the financial landscape.

To illustrate the significance of a market correction, let's consider an example from recent history. In the year 2018, the prices of over 500 companies experienced a decline of 10% or more. This widespread correction exemplifies how fluctuations in market conditions can influence a substantial number of companies simultaneously, affecting their valuation and investor sentiment.

In conclusion, a market correction denotes a notable decline in the value of financial instruments, with the range typically falling between 10% to 20%. The causes behind these corrections can be diverse and encompass factors ranging from company-specific issues to broader global conflicts. Moreover, corrections can impact various financial instruments and market segments, underscoring their potential for wide-reaching consequences within the financial landscape.

Example : AMZN stocks Daily chart showing a correction in 2018 - 2020

Market corrections are not uncommon events within the realm of financial markets. On average, a decline of 10-20% in the stock market transpires approximately once a year. These corrections, characterized by a significant decrease in stock prices, serve as reminders of the inherent volatility and fluctuations present in the market.

While corrections of 10-20% occur relatively frequently, more profound market declines exceeding 20% are less frequent, transpiring approximately once every six years. These substantial corrections are often referred to as market collapses, signifying a more severe and prolonged downturn.

One illustrative example of a market collapse occurred in response to the global pandemic outbreak in March 2020. The COVID-19 pandemic triggered a swift and severe decline in stock markets worldwide, leading to a precipitous drop of approximately 38% within a matter of days. This extreme correction exemplifies the impact of unforeseen events and external factors on market stability and investor sentiment.

It is important to recognize that market corrections and collapses are not solely confined to a particular asset class or geographic region. They can have a broad-ranging effect, transcending national boundaries and impacting various financial instruments, indices, and markets worldwide.

In summary, market corrections, defined by significant declines in stock prices, are regular occurrences, transpiring approximately once a year with a magnitude of 10-20%. Market collapses, on the other hand, encompass more profound declines exceeding 20% and typically transpire once every six years. These events serve as reminders of the dynamic nature of financial markets and their vulnerability to various factors, such as the recent pandemic-induced collapse in 2020, which had a profound impact on global markets.

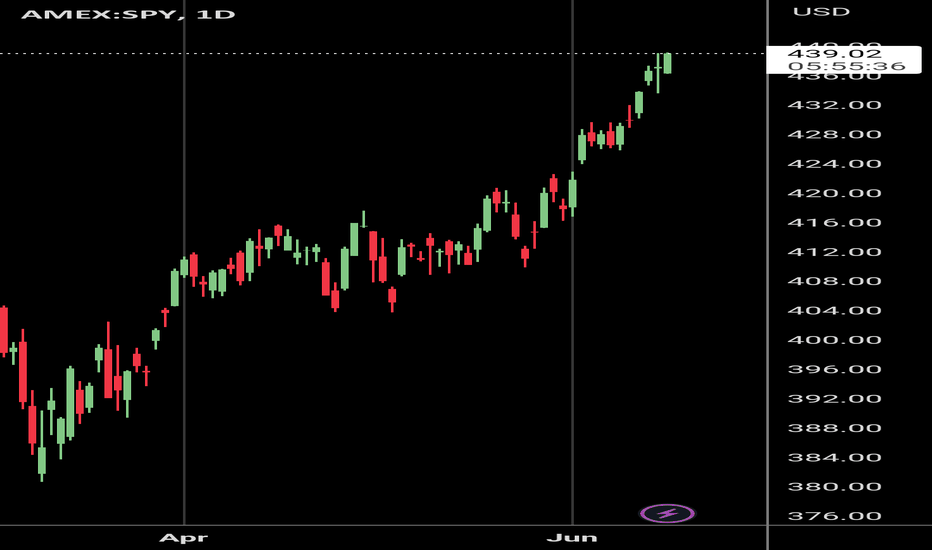

Example : SPX500 / US500 stocks Daily chart showing a correction in 2020

Investors who adopt a long-term investment strategy tend to navigate corrections with relative ease, primarily due to their extended investment horizon. By committing their funds for a substantial period, typically ranging from 5 to 10 years, these investors are less likely to be perturbed by temporary price declines. On the other hand, individuals who rely on leverage or engage in short-term trading bear the brunt of corrections, experiencing greater challenges and losses.

The impact of a correction can be readily observed by examining the chart depicting the historical performance of any given company. By selecting the annual or five-year chart display, one can identify specific time periods when the asset's value experienced temporary declines. Additionally, it is crucial to consider the decrease in stock price subsequent to the ex-dividend date, commonly referred to as the dividend gap. It is essential to note that the dividend gap phenomenon is distinct from a correction and should be treated as such.

What Causes A Correction?

A correction in the stock market can be triggered by a multitude of factors and events that impact stock prices. These events can range from speeches given by company executives, investor reports, pandemics, regulatory changes, economic sanctions, natural disasters like hurricanes and floods, man-made disasters, to high-level meetings of world leaders. Even the most stable companies can experience declines in their stock prices due to these events.

It is important to recognize that human behavior also plays a significant role in causing market corrections. The stock market is inherently driven by human participation and investor sentiment, which can sometimes lead to corrective actions. For instance, if a popular figure like Elon Musk garners significant attention and support, investors may pour money into his company beyond its actual earnings. Eventually, the overvaluation of such a "hyped" company may result in a decline in its stock price.

Furthermore, investors often attempt to follow trends in the market. When a particular stock shows an upward trajectory, more people tend to invest in it, thus increasing its demand and subsequently driving up its price. However, as the price reaches a certain peak, some investors choose to sell their holdings to realize profits. This selling pressure can initiate a correction, causing those who entered the market later to incur losses. Therefore, blindly chasing market trends without careful analysis may prove detrimental.

Additionally, corrections can exhibit seasonal patterns. For example, during the summer months, prior to holidays or extended weekends, investor participation in trading may decrease. This reduced trading activity leads to lower liquidity in stocks, creating an opportunity for speculators to exploit the situation. Such periods often witness sharp price fluctuations, potentially resulting in stock prices declining by 10-20%.

It is crucial to understand that corrections are a natural part of the market cycle, and it is neither productive nor feasible to fear them indefinitely. The market cannot sustain perpetual growth, and corrections serve as necessary adjustments. By acknowledging their inevitability, investors can adopt strategies that are mindful of market dynamics and position themselves accordingly.

How Long Do Corrections Last?

Between the years 1980 and 2018, the US markets experienced a total of 37 corrections, characterized by an average drawdown of 15.7%. These corrections typically lasted for approximately four months before the market began to recover. Consider the following scenario: an investor commits $15,000 in January, experiences a loss of $2,355 during the correction, and by May, witnesses their portfolio rebounding to $15,999, based on statistical data. However, it is important to note that outcomes may deviate from this pattern.

It is worth noting that the magnitude of a stock's decline directly impacts the duration of its recovery. As an illustration, during the financial crisis of 2008, US stocks tumbled by approximately 50%. The subsequent recovery of the stock market extended over a period of 17 months, primarily attributed to the active support provided by the US government and the Federal Reserve. This underscores the notion that severe market downturns necessitate more prolonged periods for recuperation, even with significant intervention from regulatory bodies.

Dow Jones Industrial Average index drop in 2008

The timing of a market correction is often challenging for financiers and experts to predict with certainty. In retrospect, it becomes clear when a correction started, but identifying the precise moment beforehand is a complex task. Taking the aforementioned example of the market collapse in October 2007, it was not officially acknowledged until June 2008. This highlights the inherent difficulty in pinpointing the onset of a correction in real-time.

Following a correction, the market's recovery period can vary significantly. In some instances, the market may swiftly regain stability and resume an upward trajectory. However, in other cases, it may take several years for the market to fully recover from a correction. The duration of the recovery depends on a multitude of factors, including the severity of the correction, underlying economic conditions, government interventions, and investor sentiment.

Hence, it is crucial to recognize that financiers and market participants can only definitively determine the start and extent of a correction in hindsight. The future behavior of the market after a correction remains uncertain, and it is possible for the market to swiftly recover or take a considerable amount of time to regain stability.

How To Predict A Correction

Predicting the precise timing, duration, and magnitude of a market correction is inherently unreliable and challenging. There is no foolproof method to accurately forecast when a correction will occur, when it will conclude, or the extent to which asset prices will change.

Some economists and analysts attempt to predict market trends by employing various theories. For instance, Ralph Elliott formulated the Elliott Wave Theory, which posits that markets move in repetitive waves. By determining the current phase of the market—whether it is in an upward or downward wave—one could potentially profit. However, if such theories consistently yielded accurate predictions, financial losses during corrections would be virtually nonexistent.

It is crucial to acknowledge that market corrections are an inherent and inevitable part of market cycles. While attempting to predict corrections may be enticing, it is important to remember that they will inevitably occur, regardless of how long it has been since the previous one. Relying solely on the absence of a correction for an extended period as a basis for investment decisions warrants careful consideration and analysis rather than being treated as a definitive indicator.

Advantages And Disadvantages Of Market Correction

Advantages and disadvantages of market corrections can be summarized as follows:

Advantages of a market correction:

1) Buying opportunities: Market corrections often present favorable buying opportunities for investors. Lower stock prices allow investors to acquire shares at discounted prices, potentially leading to long-term gains when the market recovers.

2) Rebalancing opportunities: Corrections can prompt investors to rebalance their portfolios. Selling overvalued assets and reinvesting in undervalued ones can help optimize investment returns and maintain a diversified portfolio.

3) Expectation adjustment: Market corrections can serve as a reality check, helping investors reassess their expectations and risk tolerance. This can lead to more informed investment goals and strategies.

Disadvantages of a market correction:

1) Financial losses: Market corrections can result in substantial losses, particularly for investors who panic and sell their investments at lower prices. Reacting emotionally to market downturns may amplify the negative impact on portfolios.

2) Economic implications: Market corrections can have broader economic repercussions. They may lead to job losses, reduced consumer spending, and slower economic growth, potentially affecting industries and sectors beyond the financial markets.

3) Psychological impact: Market corrections can trigger fear, uncertainty, and anxiety among investors. These emotions may drive impulsive decision-making, such as selling investments hastily or hesitating to re-enter the market when conditions improve.

It is important for investors to carefully evaluate the potential advantages and disadvantages of market corrections and consider their own risk tolerance, investment goals, and long-term strategies when navigating such market events.

What Should You Do During A Correction?

Correction can make an investor richer or poorer or have no effect at all. The impact of a market correction on an investor's wealth depends on their actions and decisions during that period. It is impossible to predict with certainty the duration or direction of asset value changes during a correction.

However, there are general tips that can help investors navigate through a correction and potentially safeguard their finances:

1) Maintain a calm and rational mindset: During a correction, it is crucial to approach investment decisions with a cool head. Instead of making impulsive moves, take the time to understand the underlying causes of the correction and consider expert opinions and news.

2) Avoid excessive borrowing: It is advisable not to use borrowed money for investments, especially during a correction. This reduces the risk of incurring debts and potential losses. For beginners, it is often recommended to limit investments to the funds available in their brokerage accounts, particularly during a correction.

3) Assess company fundamentals: Evaluate the fundamental strength of a company by analyzing key metrics and ratios. Comparing a company's value with others in the same industry can provide insights. If a company is not overvalued, it may indicate that there is no fundamental reason for a correction, and its value may likely recover in due course.

4) View the correction as a buying opportunity: Prominent investors like Warren Buffett and Nathan Rothschild have emphasized that corrections present excellent opportunities for investment. If a stock's price has fallen, consider purchasing it based on the company's performance rather than solely focusing on the size of the discount. Maintaining some savings in cash allows for timely investments in undervalued assets.

5) Acknowledge the normalcy of corrections: It is important to recognize that corrections are a regular part of market cycles and serve as tests of an investor's composure. Following an investment strategy that includes provisions for investing during periods of 10-20% lower stock prices can help protect savings and optimize long-term returns.

By adhering to these general tips and maintaining a disciplined investment strategy, investors can better navigate market corrections and potentially preserve and enhance their financial well-being.

Conclusion

In summary, market corrections are an intrinsic aspect of the stock market's ebb and flow, and it is essential for investors to anticipate and navigate them effectively. During such periods, the inclination to succumb to panic and hastily sell investments can be strong. However, maintaining composure and adhering to prudent strategies that safeguard capital are crucial for weathering corrections and emerging stronger when the market inevitably rebounds. While corrections present challenges, they also offer advantageous opportunities, such as the ability to acquire stocks at discounted prices. Conversely, the potential for substantial losses exists, emphasizing the importance of a measured approach. A long-term investment strategy, rooted in sound analysis rather than reactionary emotions, serves as a vital compass for surviving corrections. By focusing on the broader picture and resisting the temptation of short-term market fluctuations, investors can position themselves for long-term success amidst the natural ebb and flow of the market.

How to Use the Accumulation/Distribution IndicatorLearning how to identify accumulation and distribution in an asset is an important skill to have for any trader. Luckily, there’s a handy tool we can use: the aptly-named Accumulation/Distribution indicator.

In this article, we’ll show you how this accumulation/distribution indicator works, where it’s best applied, and how you can combine it with other tools to boost your odds of success.

What Is the Accumulation/Distribution Indicator?

The accumulation/distribution indicator, also called the accumulation/distribution index, accumulation/distribution line, and abbreviated to A/D, is a cumulative indicator that uses price and volume data to measure the strength of an asset’s trend. It helps traders identify buying and selling pressure in the market and can show whether an asset is likely to continue trending or is due for a reversal. It was created by renowned trader Marc Chaikin, who also developed the famous Chaikin Money Flow indicator.

Accumulation vs Distribution

Accumulation occurs when buying pressure outweighs selling pressure, resulting in price appreciation. Conversely, distribution is where sellers have the upper hand over buyers, creating downward momentum. In practice, the plotted A/D line will move up when accumulation is present and down when distribution occurs.

Accumulation/Distribution Oscillator Formula and Components

The ADI seeks to quantify an asset's buying and selling pressure by considering its trading range and trading volume.

First, it calculates the Money Flow Multiplier (MFM) using the following formula:

MFM= ((Close−Low)−(High−Close)) / High−Low

This results in a reading between -1 and 1. When the price closes in the upper half of its high-low range, the MFM will be positive. If it closes in the lower half, then MFM will be negative. In other words, if buying pressure is strong, the MFM will rise, and vice versa.

Second, it generates the Money Flow Volume (MFV) with the following:

Money Flow Volume = MFM × Volume

For the first candle in a given chart, the MFV is the first A/D value. Since the indicator is cumulative, the MFV is added to the previous A/D value. In essence:

First Calculation = (ADI = MFV)

Subsequent Calculations = (ADI + MFV)

This then creates the A/D line. While it may seem unnecessary to know the formula, it can provide us with significant insight into how an accumulation/distribution rating is given. For example, a strong bullish trend may cause an asset to close high in its trading range, producing an MFM reading close to 1. If this is backed up by high volume, the A/D line will surge upward. However, if the volume is lacking, then the A/D may only increase slightly.

Thankfully, we don’t need to perform this calculation ourselves. With the free TickTrader platform we offer at FXOpen, you’ll find the accumulation/distribution indicator and dozens of other tools ready to help you navigate the markets.

How to Use the Accumulation Distribution Indicator

There are three popular ways to use the A/D indicator: identifying reversals, trend confirmation, and trading breakouts.

Identifying Reversals

One of the most effective uses of A/D is to spot potential reversals using divergences between the price and the A/D line.

A bullish divergence occurs when the price falls, making lower lows, while the A/D line trends upward, creating higher lows. Conversely, a bearish divergence can be seen when an asset makes new highs, but the A/D puts in lower highs.

It essentially shows us that while the price is moving in a specific direction, the underlying pressure supporting the move is waning. The example above demonstrates that fewer sellers are participating as the trend progresses lower; eventually, buyers take over and push the price much higher.

Trend Confirmation

A/D line can also be used to confirm the direction of a trend. In this context, traders monitor the alignment of the line with the price action.

In an uptrend, both the price and A/D should be rising. If the A/D moves in the same direction as the price, it confirms the strength of the uptrend and suggests that the buying pressure is likely to continue. As in the chart, traders could have used the A/D and price alignment to position themselves in the direction of the bull trend.

Similarly, during a downtrend, the price and the A/D should be falling. If the A/D is falling alongside the price, it indicates that the selling pressure is strong, and the downtrend is likely to persist.

Trading Breakouts

Lastly, A/D can help traders confirm breakouts beyond support/resistance levels. If there’s a critical level that a trader is watching to jump in on the breakout, a breakout beyond a similar level in the A/D indicator can signal the start of a new trend.

In the example, we see a strong resistance level, both in price and the accumulation distribution chart. As the move is confirmed by A/D, breaking out above both dashed lines, traders have confidence that the price is ready to move higher.

Integrating the Accumulation and Distribution Indicator with Other Tools

While the A/D indicator is a valuable tool on its own, it’s best to use it in combination with other indicators to help filter out false signals and improve the accuracy of your predictions. Let’s take a look at two indicators to integrate with A/D: moving averages and the Relative Strength Index (RSI).

Moving Averages

Moving averages are a popular tool used by many traders to determine the direction of a trend, especially when two moving averages cross over. As mentioned, the trajectory of the A/D line can show traders that a trend is supported by volume; similarly, a price sitting above or below a moving average can indicate a trend’s direction. Using the two together can provide an at-a-glance reading of a trend, which can be extremely useful for trend-following traders.

In this example, we’ve used the Exponential Moving Average (EMA) cross indicator in TickTrader, with two 20-period and 50-period EMAs. The fast EMA crosses above the slow EMA, showing that a potential bullish trend is forming. The price continues to stay well above the 50-period EMA as time progresses, demonstrating that there’s a strong bull trend.

We also have confirmation from the A/D line that the bullish momentum is backed up by supporting volume. Seeing this, traders can be confident that the trend will continue. When the EMAs cross over bearishly, as seen on the right-hand side, traders may start looking for the A/D line to confirm that a bearish trend has started and exit their position.

RSI

Similar to the A/D indicator, RSI can be used to both spot divergences and confirm trends. The divergences are the same as A/D; a lower low in a price with a higher low in the RSI indicates a potential bullish reversal, while a price making a higher high and a lower low in RSI is regarded as bearish. Meanwhile, an RSI reading above 50 is typically seen as bullish, while below is bearish.

Using the two indicators together can offer traders extra confluence that the market is headed in a particular direction. In the chart shown, we can see that the price is making a lower low. However, the Apple stock’s accumulation/distribution line shows a bullish divergence, as does the RSI.

Traders could have marked the most recent area of resistance (dashed line), and then waited for the price to break out above it before looking for an entry. This move was confirmed by the RSI moving above 50, showing that bullish momentum is truly entering the market and offering multiple factors of confluence.

What to Do Next

You now have a comprehensive understanding of the accumulation/distribution indicator, including its formulation, its three main uses, and how to combine it with other indicators for extra confirmation. Ready to put your newfound knowledge to the test? You can open an FXOpen account to apply what you’ve learned and hone your trading skills across a diverse range of markets, from forex and commodities to stocks and indices.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Trading Mindfully: Letting Go of Revenge for Financial Success

Sometimes the market can really wear us down mentally and emotionally. Imagine this scenario: you enter a trade feeling confident, having carefully considered and calculated everything. You're in a fantastic mood, already envisioning the profits. And then, unexpectedly, everything goes wrong.

In moments like these, even if you have a solid system and strategy in place, anger and resentment can take over. You might feel the need to seek revenge on the market for what you perceive as an injustice, and impulsively open positions with the intention of punishing it. However, the outcome of such revenge trading is almost always regrettable, resulting in significant financial losses.

Let's take a closer look at what revenge trading entails and why it is so dangerous.

Revenge trading occurs when we believe that the market has taken "too much" from us or treated us unfairly. Instead of stepping back and regaining composure, traders act contrary to every rule and guideline, driven by anger and a desire to prove themselves.

Fueled by a mixture of frustration and determination, traders tend to fall into one of two scenarios: they either open large positions that further amplify their losses, or they manage to recoup some of their losses if luck is on their side. However, the best course of action in such situations is actually to take a break and reflect on the situation at hand.

Attempting to take revenge on a market that is infinitely more powerful than any individual trader is inherently irrational. Moreover, this type of trading has several other negative consequences.

When you trade out of revenge, you are driven by emotion rather than logic and strategy. This approach is destined to fail and can result in even greater losses over time.

At this point, you lose touch with reality, forgetting everything you know and have learned about the market. Your well-thought-out strategies and trading algorithms that used to bring you profits are abandoned.

Effective money management and risk compliance become distant thoughts. You throw all your resources into the blazing fire of revenge.

As a result, you find yourself trading based on intuition, which is no longer a disciplined approach but akin to gambling.

How to Overcome the Urge for Market Revenge

There is a simple yet crucial mechanism that can help traders overcome the desire to seek revenge on the market. The most challenging part, however, is remembering to apply it in practice. Here are some steps to follow:

1: Take a Step Back: When the desire for revenge arises, it's important to slow down your emotions and actions. Step away from the computer and engage in activities that involve fine motor skills, such as solving puzzles or engaging in a hobby. It's detrimental to continuously look at the screen that displays recent losses, as it only amplifies your emotional state. By diverting your attention to non-trading activities, you allow the frontal cortex of your brain, responsible for rational decision-making, to activate. Going for a walk or connecting with a friend can also be effective ways to shift your focus and regain composure.

2: Analyze the Situation: To regain a conscious state and process your emotions, conduct a written analysis of the situation. It's beneficial to do this manually on a plain sheet of paper, utilizing your fine motor skills once again. Describe the entire incident in detail, including your thoughts, emotions, and actions. By gaining a comprehensive understanding of what threw you off balance emotionally, you'll be better equipped to recognize and control those triggers in the future.

3: Evaluate Your Trading Strategy: Every trader relies on a specific algorithm or trading system to make decisions. Take the time to thoroughly examine your trading system and ask yourself some important questions:

- Does your trading system genuinely work?

- If you had followed your system entirely (which you didn't do when seeking revenge), would it have helped minimize losses?

- Are the losses that angered you a result of system losses or a breach of the system's rules?

In addition to studying your trading system, it's crucial to assess your money management rules and ensure you are effectively managing risks. Proper risk management acts as insurance, protecting you from substantial losses. Regardless of market fluctuations, you can confidently close trades when necessary. Effective risk management is what distinguishes profitable traders from those who suffer losses.

Final Thoughts:

To overcome the desire for revenge, it is essential to understand what triggers it and address the underlying reasons. When we view the market as a reflection of our self-image and attribute personal meaning to our trades, it often leads to an emotional storm. In such a state, we may disregard trading systems and risk management principles, making foolish mistakes that can devastate our trading accounts. It's important to remember that the market provides only factual information for analysis, and behind the price quotes lies nothing more than information.

Ninja Talks EP 10: Snollygoster Definition;

"A rude and unscrupulous person".

Many-o-moons ago I used to believe trading was a team sport (I know, how naive of me) but that's because I joined some supply and demand community where we all traded the same strategy.

These days I'm more of a Snollygoster.

I can't help it.

When I see other traders, I see them as competition - even those I teach!

You see the thing is, it helps my trading when I understand that when I win, someone else loses.

Why?

Because it's true.

There's always "someone" on the other side of our trades wether we like to think about it or not.

We've been conditioned to think the market has a "mind of its own", but it really doesn't - it's just a sum of its participants, which for the most part are individuals.

Indivuals who are all looking to out smart and win against other traders.

It's not a game.

Bruce Lee on fighting;

"Fighting should be like a small play, but played seriously."

Same goes for trading.

Keep your emotions, mind, analysis etc light and playful, but always understand that this is serious.

When you look at the market as another human you'll understand how to "outsmart " it (for lack of a better word).

Imagine you're up against yourself, how would you analyze the charts?

Find YOUR stop losses and key levels - then see how you can take advantage.

This is 5D chess trading at its finest and the quickest most lucrative way to become a gigachad trader in 2023 and beyond.

Understand?

Follow for the next episode of Ninja Talks.

Nick

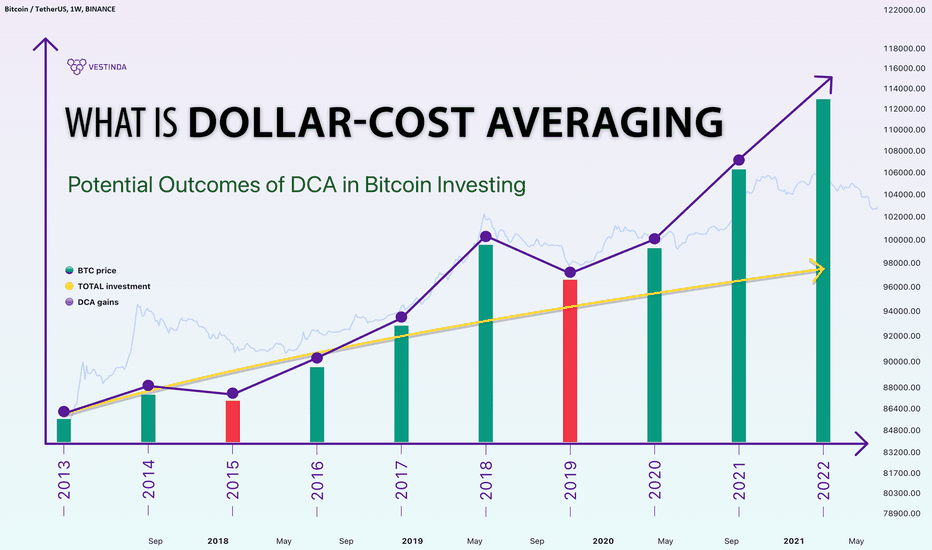

The Struggle of Consistency: Navigating DCA in Crypto InvestingHello dear @TradingView community! Today let’s focus on what is Dollar Cost Averaging ?

Determining the optimal moment to buy cryptocurrency is often a challenging task due to the high volatility of crypto assets. Prices can fluctuate unpredictably at any given time, leading traders to experience the fear of missing out (FOMO).

This fear is commonly felt when the price of a cryptocurrency, such as Bitcoin (BTC), suddenly surges or plunges. During price drops, individuals tend to panic and sell their holdings in a frantic attempt to avoid further losses. Conversely, when prices rise, panic ensues as people worry they don't possess enough coins to sell.

As evident, making decisions to buy or sell cryptocurrencies is no easy feat. However, if you seek long-term financial gains from cryptocurrencies without succumbing to the anxiety caused by every price spike, it would be wise to consider the Dollar Cost Averaging (DCA) strategy. Let's delve deeper into what DCA entails and how it functions in the realm of cryptocurrencies.

What is Dollar Cost Averaging?

Dollar cost averaging is an investment strategy where fixed amounts are regularly invested at consistent intervals, in contrast to a one-time lump sum investment. This approach involves executing transactions regardless of the asset's current price or market fluctuations. It is highly favored by investors and management funds seeking long-term profits from various assets like ETFs, commodities, cryptocurrencies, stocks, and more.

How does DCA work? To employ the DCA strategy, you first determine the amount of cryptocurrency you wish to invest. In conventional investing, one would typically invest the entire designated sum in a specific asset. However, with DCA, you invest fixed amounts of USD into Bitcoin or any other asset over a designated period. For instance, you may choose to purchase $100 worth of BTC every month for a 10 year period.

When utilizing DCA, the selection of the cryptocurrency becomes crucial. With around 22,904 cryptocurrencies available today, you must pick a coin you believe will appreciate in value and yield profitable returns. You can even choose an ETF which follows the trend (up or down) for any specific asset or basket of assets.

To comprehend how DCA operates, consider the following example:

Let's assume it is June of 2014, and Katie decides to allocate $10,000 in BTC. In June of 2014, the price of Bitcoin stood at approximately $560 per coin. Instead of investing the entire sum at once, Katie opts for dollar cost averaging throughout the 9 years.

From June 2014 to May 2022, Katie spent $100 each month on BTC, disregarding market price fluctuations. After 8 years, she spends almost $9,600 and her earnings reflect the following:

The green line in the chart represents Katie’s total investment amount, while the orange line depicts the fluctuation of portfolio size value over the 9-year period. When Katie initiated his investments, both the cost of BTC and his investments were approximately $100. However, as time progressed, the price of Bitcoin underwent changes.

By May of 2022, Katie's $9,600 investment had grown to $287,518 worth of BTC, showcasing a growth rate of 2,895%. With maximum gain of $631,540 at bitcoin ATH.

Online DCA tools are also available to estimate the earnings from purchasing bitcoins over several months. For example, platforms like dcaBTC enable users to customize their DCA strategy according to their preferences, specifying the amount to purchase, investment frequency, and duration.

To successfully implement dollar-cost averaging (DCA) in Bitcoin investing, several key steps need to be followed. These steps involve setting a budget, choosing a reputable cryptocurrency exchange, establishing recurring purchases or utilizing recurring purchases and automated investment platforms (such as Binance, Coinbase, Kraken, Crypto.com or even at Vestinda), and monitoring and adjusting the strategy as necessary.

Pros and Cons of Dollar Cost Averaging

Let's commence with the pros of dollar cost averaging. By making regular and consistent purchases over time, you mitigate the risk associated with poorly timed lump sum investments. Additionally, since you make regular purchases, you alleviate the fear of missing out and impulsive decision-making prompted by price fluctuations.

Cryptocurrency exchanges and platforms charge transaction fees for every trade. While one might assume that DCA would result in higher commission fees, it is essential to remember that this is a long-term strategy. The commission costs are negligible compared to the potential profits that can be realized over several years.

Moreover, DCA does not necessitate substantial investments. This strategy involves smaller and consistent purchases, eliminating the need to determine how best to deploy a large sum in one go. Furthermore, if prices suddenly drop at the time of purchase, you can acquire the cryptocurrency at a lower price.

However, it is important to note that if the cryptocurrency's price is bullish, you may end up buying at a higher price. This is particularly relevant when dealing with BTC or any chosen cryptocurrency. Many crypto enthusiasts and investors prefer to purchase a significant amount at once, fearing a subsequent price surge in the hours, days, weeks, or months to come.

As previously mentioned, with the DCA strategy, you purchase small amounts at regular intervals, regardless of market stability.

Should you utilize the DCA Strategy?

DCA facilitates maximizing profits with relatively low risk. Although this approach is not devoid of drawbacks, it offers numerous advantages that can be leveraged to your benefit.

Hence, is DCA worth your time and money? As always, we recommend thoroughly studying all available information before making any decisions. Save this article to your browser bookmarks for easy reference in the future.

Happy trading!

⚖️OPTIONS TRADING: What are the Greeks?The Greeks are a set of mathematical measures used in options trading to assess and quantify various factors that influence the price and behavior of options.

📌 VEGA :

Vega is a measure of how much an option's premium will change in response to a 1% change in implied volatility. Implied volatility represents the market's expectation of the underlying security's future movement. When implied volatility is high, options tend to be more expensive, and when it is low, options are cheaper. Vega is particularly influential for options with longer expiration dates, as volatility has a greater impact on their prices. As an option approaches expiration, Vega decreases, while it increases as the underlying security moves closer to the strike price. Essentially, Vega is highest when the option is at-the-money and decreases as it goes out-of-the-money or in-the-money.

📌GAMMA

Gamma, represents the rate of change between an option's Delta and the price of the underlying asset. Higher Gamma values indicate that even small price changes in the underlying stock or fund can cause significant changes in the option's Delta. At-the-money options have the highest Gamma because their Deltas are most sensitive to underlying price movements. For instance, if XYZ is priced at $100.00 and a XYZ $100.00 call option is considered at-the-money, any price movement in either direction will push the option into either in-the-money or out-of-the-money territory. This high sensitivity to stock movement is reflected in the option's Gamma, making Gamma higher for at-the-money options.

📌THETA

Theta represents the theoretical daily decay of an option's premium, assuming all other factors remain constant. As time passes, options gradually lose value, and this loss is known as time value decay. The decay of time value is more significant as the expiration date approaches, particularly for near-the-money options. Theta does not behave linearly; instead, it accelerates as expiration nears. A higher Theta indicates that the option's value will decay more rapidly over time. Short-dated options, especially those near-the-money, tend to have higher Theta because there is greater urgency for the underlying asset to move in a favorable direction before expiration. Theta is negative for long (purchased) positions and positive for short (sold) positions, regardless of whether the option is a call or a put.

📌RHO

Rho measures an option's sensitivity to changes in the risk-free interest rate and is expressed as the amount of money the option will gain or lose with a 1% change in interest rates. Changes in interest rates can affect an option's value because they impact the cost of carrying the position over time. This effect is more significant for longer-term options compared to near-term options. Higher stock prices and longer time until expiration generally lead to greater sensitivity to interest rate changes, resulting in higher absolute Rho values. Rho is positive for long calls (the right to buy) and increases with the stock price. It is negative for long puts (the right to sell) and approaches zero as the stock price increases. Rho is positive for short puts (the obligation to buy) and negative for short calls (the obligation to sell).

📌DELTA

Delta is a measure that estimates how much an option's value may change with a $1 increase or decrease in the price of the underlying security. Delta values range from -1 to +1, where 0 indicates minimal movement of the option premium relative to changes in the underlying stock price. Delta is positive for long stocks, long calls, and short puts, which are considered bullish strategies. Conversely, Delta is negative for short stocks, short calls, and long puts, which are bearish strategies. A Delta of +1 is assigned to long stock shares, while a Delta of -1 is assigned to short stock shares. An option's Delta can range from -1 to +1, and the closer it is to +1 or -1, the more sensitive the option premium is to changes in the underlying security.

👤 @QuantVue

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

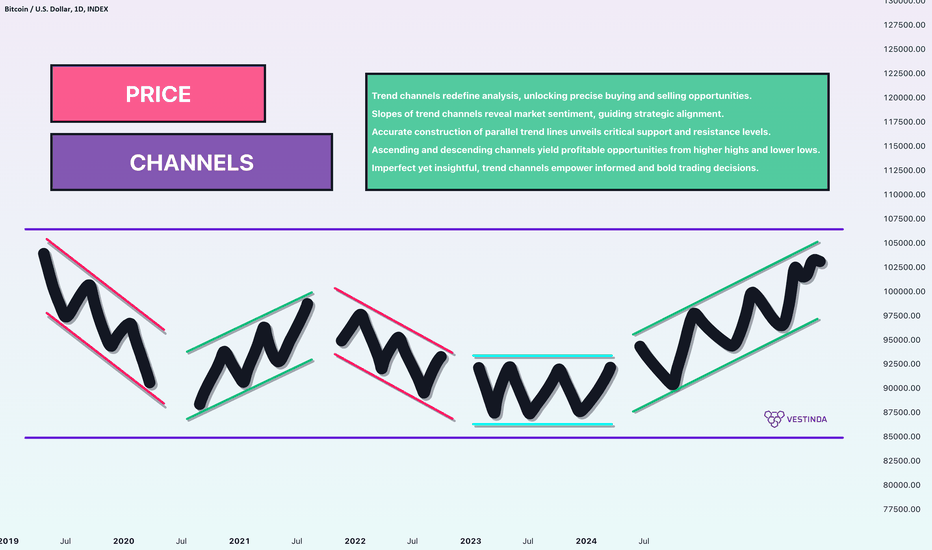

Price Channels — Quick and Easy Guide.Greetings, @TradingView community!

When it comes to analyzing market trends, there's a technique that takes trend theory to the next level: price channels.

This is @Vestinda, bringing you a helpful article on the topic of the price channels, also known as trend channels, offer an exciting way to identify optimal buying and selling opportunities in the market.

Price channels serve as a valuable tool in technical analysis, helping traders determine favorable entry and exit points. By drawing parallel lines that align with the angle of an uptrend or downtrend, we create a channel. The upper trend line acts as resistance, while the lower trend line represents support. These lines highlight potential areas where the market could experience reversals or continue its current trend.

Understanding the sentiment of a price channel is crucial. Channels with a positive slope (upward) are considered bullish, indicating an upward trend, while those with a negative slope (downward) are bearish, pointing to a downward trend. Recognizing the slope of a price channel allows traders to gauge the prevailing market conditions and make informed trading decisions.

Price channels can be categorized into three main types:

Ascending channels

Descending channels

Horizontal channels

Ascending channels display higher highs and higher lows, signaling a bullish sentiment. To create an ascending channel, draw a parallel line touching the most recent peak, aligning it with the angle of the uptrend line.

Conversely, descending channels exhibit lower highs and lower lows, suggesting a bearish sentiment. To create a descending channel, draw a parallel line touching the most recent valley, aligning it with the angle of the downtrend line

Horizontal channels , also known as ranging channels, indicate a consolidation phase with no clear trend direction.

These channels provide insights into potential buying zones when prices hit the lower trend line and selling zones when prices approach the upper trend line. Understanding these channel types empowers traders to adapt their strategies to different market scenarios.

Constructing a price channel requires parallelism between the trend lines. The lower trend line is typically considered a "buy zone," while the upper trend line serves as a "sell zone." It's crucial not to force price action into the drawn channels. When the channel boundaries slope at different angles, the pattern is no longer a price channel but a triangle pattern, requiring a distinct analytical approach.

Remember that price channels don't have to be flawlessly parallel. In reality, it's rare to find price action that perfectly aligns within two trend lines.

As traders, it's important not to solely rely on textbook price patterns but also consider broader market context and other essential cues from price action. Effective price channel analysis involves embracing imperfections and making informed decisions based on the available information.

In conclusion, price channels provide traders with a powerful technique to uncover profitable opportunities in the market. By drawing parallel trend lines and identifying support and resistance levels, traders can gain valuable insights into market sentiment and enhance their trading decisions.

However, it's essential to remember that perfection isn't the goal. Instead, focus on understanding market dynamics and adapting your strategy accordingly.

💜 So there you have it - a quick and easy guide to understanding price channels in trading! 💜

It's a numbers gameI see this more and more, especially in the crypto space. There are some wild stories out there from turning $8k to a billion through to a Pizza for 10,000 Bitcoin.

Here are some home truths. Although most of you won't want to hear this.

You see, as a professional trader - there is 1 key factor, almost a scale balancing between too much and just enough. Everyone pushes for more returns, we are only human after all. We have had stories of Wall Street Titans and Vegas big wins, but there is some simple logic to this.

You might have entered the market after Covid hit the world and wanted an extra income, might have seen a way to make millions from the money the government sent you? The issue is this is no different that rolling a dice in Vegas but without the fun! You possibly saw some influencer selling you the dream - they fail to tell you, they trade on demo accounts and make their income from affiliate links and social media watch time!

When you think of investors like Warren Buffet, you have to understand - he didn't watch an influencer video and say to himself "I want to be like that guy" - investing is often a long term thing and not a get rich quick scheme.

Here's a few examples to hit home.

This is boring, not worth it - so instead you seek higher returns, that opens up the possibility of falling into scams, listening to the wrong crowd and having dreams. To be honest, it's probably more enjoyable spending a day at the races.

With a smaller account, you can grow it a little, add to it on the next pay day and of course compound the investments.

As you move up the scale.

This is probably where most "semi serious" market goers start. It's often a flurry into the market cash in hand. The assumption often the same; you have done well to amass a lumpy investment, your clearly good at the field you have been in to earn your pot. Why wouldn't you be a good trader? After all, these kid influencers are making millions on their demo accounts.

Jump to the next level...

Your either a captain of industry, you have had your own business or you have a kind daddy.

How you got here is not important, staying here is.

When you trade with a medium sized account you start to think a little different. Instead of looking for 900x returns, you start thinking about investments that are a little less risky. This is the scales I mentioned earlier. You are now in the space of a good return might be good enough. Too high of a risk, means you are thinking of safe guarding your cash.

Here's where the Professionals play the game differently. Trying to make 1-5% is a lot more sustainable than trying to land a 900x return.

You have to remember 90% of traders lose 90% of their accounts in 90 days...

This can easily be attributed to things like;

Buying signals

Following influencers

Over trading

Trading too small a timeframe

Trying to find a silver bullet

As a professional - you can seek smaller returns, spend less time in front of the charts and let your money work for you, instead of you doing all the chasing!

As the amount of capital rises, so does your desire for risk. You might still have the appetite for returns but not at the cost of risk.

As a professional trader, you can afford the luxury of trading a bias and scaling into a trade - you will find fund managers who have what's known as secondary investment capital (in essence to add to winning positions).

So although this is not going to be what you want to hear, it's what you need to know.

There's always chasing the dream, but why not wake up and make it a reality?

Enjoy the weekend all!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

Trend Trading: What it is & How to do itWhat is trend trading?

Trend trading or trend following is a trading strategy that involves identifying the direction of a prevailing trend in the financial markets and then buying or selling assets following that trend.

Trend traders tend to use technical analysis tools, such as moving averages (MA), trend lines, and momentum indicators, to determine trends in the market. They will look for patterns in price movements and analyse charts to establish areas of support and resistance.

Once they identify a trend, trend traders usually enter a trade in the direction of that trend, and the goal is to ride the trend for as long as possible. As a trend trader, you may enter a long position when the price moves upward or a short position when the price is trending downward.

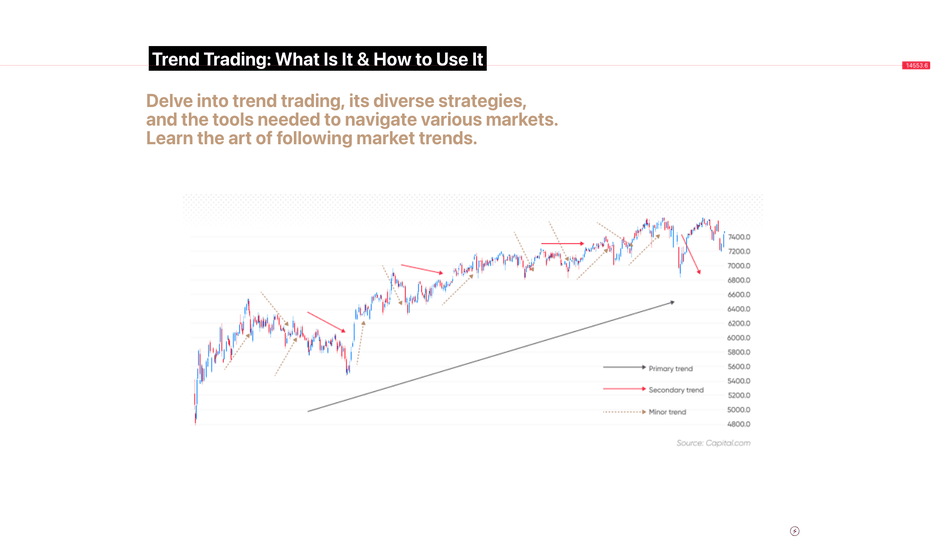

Different types of trends

Trend followers may want to be aware of several types of trends:

Secular trends: Secular trends are long-term trends that last for years or even decades. Structural changes in the economy or changes in demographic are some of the factors that influence these trends.

Primary trends: Primary trends are shorter-term trends that last for months or a few years. Changes in the business cycle or political or economic events usually cause them.

Secondary trends: Secondary trends are shorter-term trends that last for weeks or a few months. Changes in investor sentiment or technical factors typically cause them.

Intermediate trends: Intermediate trends are shorter-term trends that last for days or a few weeks. Changes in the supply and demand for a particular asset or changes in the level of volatility in the market usually cause them.

Minor trends: Minor trends are very short-term trends that last only a few days and are the bread and butter of day traders and swing traders. News events or changes in the level of trading activity in the market usually cause them.

How to use a trend-trading strategy

Traders may use a combination of trend-trading strategies, depending on their style and risk tolerance.

Moving averages

This strategy uses the moving average (MA) indicator, which measures an asset’s average price over a specified period.

A trader may look for a “golden cross” signal; this occurs when a short-term moving average (e.g. 50 days) crosses above a long-term moving average (e.g. 200 days). This signal could indicate that a bullish trend is shifting upwards.

Trend lines

Trend lines connect the highs and lows of an asset’s price movements. They are straight lines that connect two or more price points on a chart, representing the direction and slope of a trend.

Trend lines can pinpoint the direction of a trend. Traders can also use them with other technical indicators and candlestick patterns to spot potential trading scenarios. For example, a trader may look for a bullish chart pattern, such as a double bottom, to form near an uptrend line, which may indicate a bullish momentum.

Trend momentum

Momentum indicators measure the strength of a trend. They can help traders identify potential entry and exit points.

The indicators used are:

Relative Strength Index (RSI): This measures the speed and change of price movements. It oscillates between 0 and 100 and is typically used to identify overbought and oversold conditions. A reading above 70 indicates an overbought condition, while a reading below 30 indicates an oversold condition.

Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that consists of two lines: the MACD line and the signal line. When the

MACD line crosses above the signal line, it indicates a bullish trend. In contrast, a cross below the signal line shows a bearish trend.

Stochastic Oscillator: The indicator compares an asset’s closing price to its trading range over a specified period. It oscillates between 0 and 100 and is typically used similarly to RSI - to identify overbought and oversold conditions.

Trend-trading example

The chart above highlights activity over a few weeks and shows the 9-day moving average and 21-day moving average, trendlines and the RSI indicator below.

When the RSI falls below 30, indicating that the asset is oversold and a trend reversal is likely, we see a cross of the 9 and 21-day moving averages, which also signals a potential bullish trend reversal. A trend trader may have decided to buy the asset since two indicators confirm the reversal and follow the trend until RSI shoots above 70, suggesting that the asset is overbought.

Why choose trend trading?

Suitable for various markets: Trend trading can be applied to multiple financial markets, including stocks, currencies, commodities, and indices, making it a versatile strategy.

Capitalise on market momentum: The basic idea behind trend trading is to identify the market’s direction and then take positions that align with the direction of the trend.

Adaptable for various time frames: Trend trading can be used for multiple timeframes. Therefore, it may suit many strategies, from day trading to swing trading.

Risks of trend trading

False signals: One of the downsides of trend trading is that it can generate false signals, leading to losses. Trends can be short-lived, and price movements can be volatile, making it challenging to accurately identify the trend’s direction.

Lagging indicators: Trend trading often uses lagging indicators, such as moving averages, which may not accurately represent the current market situation. When a trend is identified, it may have already been in place for some time, and the price may have moved significantly.

Risk of trend reversals: Trends can reverse at any time, and traders who have taken long or short positions based on the trend may suffer significant losses if the trend reverses.

How to start trend trading

The key steps involved in trend trading include:

Identifying trends: The first step in trend trading is to find out the direction of the trend. This can be done by analysing price charts and looking for higher highs and higher lows in an uptrend or lower lows and lower highs in a downtrend. Traders can also use technical indicators such as moving averages and trend lines to highlight trends.

Selecting entry and exit points: Once a trader identifies the direction of the trend, the next step is to choose entry and exit points. Entry points can be determined using technical indicators such as momentum oscillators and chart patterns.

Managing risk: Risk management is essential to trend trading. Traders can use appropriate position sizing and risk management techniques. For example, stop-loss orders can be used to limit potential losses. Traders should note that ordinary stop-losses do not protect from slippage, while guaranteed stop losses do; however, they usually incur a fee.

Backtesting and demo trading

Backtesting involves testing a trading strategy on historical data to see how it would have performed in the past. This allows traders to evaluate the strategy’s effectiveness and make necessary adjustments before risking real money in the markets.

Backtesting helps traders identify the strengths and weaknesses of their strategy and refine their entry and exit points, risk management, and position sizing.

Demo trading, on the other hand, involves using a simulated trading account to practise executing trades based on a trading strategy. This allows traders to gain real-world experience without risking real money. In addition, demo trading helps traders to develop confidence in their approach, practise managing risk, and to become familiar with the trading platform they plan to use.

Summary

In summary, trend trading is a widely employed and adaptable trading strategy focusing on capitalising on market momentum by identifying and pursuing prevailing trends.

Traders can ascertain trends and evaluate their potential potency using technical analysis tools, such as moving averages, trend lines, and momentum indicators. Furthermore, by recognising the distinct types of trends – secular, primary, secondary, intermediate, and minor – traders can adapt their strategies for varying market conditions and timeframes.

Trend-following strategies may use moving averages, trend lines, and momentum indicators to establish entry and exit points while assessing a trend’s strength. The versatility of trend trading allows its application across diverse financial markets, including stocks, currencies, commodities, and indices.

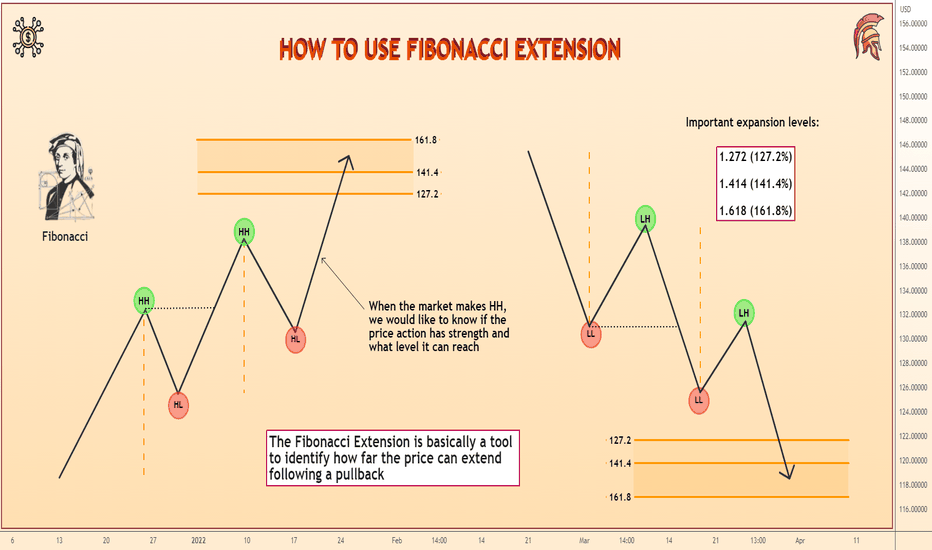

HOW TO USE FIBONACCI EXTENSIONFibonacci is a technical tool, essentially an automatic tool for building support and resistance levels. They need to be supplemented by:

Standard support and resistance lines

Trend lines

Japanese candlesticks

and additional indicators

Then they will be a good assistant in your trading. This is how a trading strategy is created, based on the combined instruments and the study of their features in different market conditions.

The three most important Fibonacci retracement levels are:

0.382 (38.2%)

0.5 (50.0%)

0.618 (61.8%)

All other levels, say 0.236 or 0.764 are secondary.

And these are important expansion levels:

1.272 (127.2%)

1.414 (141.4%)

1.618 (161.8%)

It's not difficult to use Fibonacci. Swings (upper and lower), as the maximum and minimum price values, are taken. From them, a fibo is drawn, and its lines are used as hints for support and resistance levels. It is up to you to decide whether to use Fibonacci in your trading. As we know from self-fulfilling prophecy, the more traders use a certain tool, the more important it become to the markets. Also, Fibonacci is a very popular tool, which often pops up on the charts of professional currency traders as well. So, it's a prophecy that comes true quite often.

Now let's expand our Fibonacci tool by examining the uptrend. We see that the 1.272 and 1.414 levels work as resistance, and after a couple of unsuccessful breakout attempts, as we can see many pinbars, the price might just go down and make another pullback.

Now let's do the same thing with the downtrend. Let's pull the fibo extension tool.

And here's what's happened:

Price ran into support, then broke through it. It was the level that was held up before the price went down. Price action made a new low. Fibo extension level 1.414 lines up with psychological level 1.59000. From these examples we can see that Fibonacci extension level is logical and often (though not always) form temporary support and resistance levels.

Remember, there is no guaranteed way to tell when a Fibonacci level will work as resistance or support. However, by applying all of the technical analysis techniques you've learned so far, you'll significantly increase your ability to identify these situations.

Therefore, you should consider Fibonacci expansion and retracement levels as an auxiliary tool that may be useful in some cases. But don't expect the price to bounce off right away. Fibonacci levels are your area of interest. If any candlestick combinations are formed near these levels, if oscillators or other instruments show anything curious, it is time to be alert.

22 trading rulesThe market rewards discipline and requires you to fulfill your specific role. For instance, as a tattoo artist, your responsibility is to provide quality tattoo, while as a trader, your task is to exercise discipline in decision-making. If you remain disciplined, any reasonable strategy can yield profits in the long term. However, even the most flawless strategy will fail to generate income if you lack self-control.

Here are some guidelines to follow:

1.Maintain discipline consistently. Trading demands unwavering discipline at all times. Save extreme emotions, excitement, and other non-work-related feelings for your personal hours. While working, stay focused and determined, adhering to your plan and experience.

2.Always reduce the risk of failed trades. If you experience a series of unprofitable transactions, decrease the volume or percentage of risk from your deposit, rather than increasing it. Some individuals mistakenly believe that if they have had three consecutive losses, the fourth trade is bound to be profitable and will make up for the previous losses. However, the chances of profit or loss in the fourth trade remain the same. Relying on luck is unnecessary.

3.Avoid turning profitable trades into losing ones. Close positions promptly when you recognize the risk of holding them further. If there are signs of market weakness and continuing to hold the position jeopardizes your profit, either take your existing profit or exit with a small loss. In most cases, you will have the opportunity to find another entry point that is equally good or even better.

4.Ensure that your highest loss does not exceed your highest profit. Keep a record of your trades to determine the mathematical ratio of profit to loss and the ratio of profitable to losing trades. If your losses surpass your profits, you need to optimize your system; otherwise, it may become unprofitable in the long run.

5.Develop a trading system and stick to it. Avoid constantly switching from one system to another. If you decide to become a trader, select a specific approach and commit to it. Over time, you will gain a deep understanding of the system and develop your own market perspective.

6.Be true to yourself; don't try to imitate others. If you find that scalping is not suitable for you, consider intraday or swing trading instead. Just because someone excels at intraday trading while you excel at swing trading doesn't mean you should abandon your preferred style. Each individual has their own trading style, and there is a style that matches every personality. Some traders earn substantial profits by only opening ten trades per year, while others achieve the same level of success by opening ten trades per day. Moreover, someone may be comfortable opening a trade with a large lot size, while you prefer a maximum of one lot. This doesn't imply that you are a poor trader; it simply indicates that everyone has their own comfort zone. Discomfort in trading can only be detrimental. Stay true to yourself and find your own style.

7.Remember that there will always be another day to trade, so don't risk too much. Some beginners risk 20-50% or even more of their deposit, only to find themselves with nothing when a profitable entry point arises. Such risks often shatter one's psychology, and it can be difficult to recover. However, if you make a few mistakes with standard and small risks, you will always have the next day to learn from and correct your errors.

8.Earn the privilege to trade in high volumes. Even if you have tens or hundreds of thousands of dollars in your account, it doesn't mean you should immediately start trading, for example, 10 lots. Begin by trading with the minimum volume allocated for your deposit. Only when you close ten consecutive sessions in profit should you consider increasing the volume.

9.The first conscious loss you encounter is the most valuable. It is during this moment that you understand the significance of stop-loss orders as part of your system. A stop-loss serves as a mechanism to exit a position when the trade is no longer favorable. By recognizing this and reacting appropriately, you are able to protect your account from significant losses. Understand that a stop-loss order is a benefit. See point 15.

10.Avoid relying on hope or prayer. If you catch yourself hoping for a positive outcome in a trade, it likely means that the trade is no longer profitable. Avoid concealing this fact from yourself as a trader. This psychological inclination to hope shields us from emotional distress and difficult decisions. However, as a trader, you must objectively assess the situation. If you realize that you are starting to rely on hope, reevaluate the facts and conduct a thorough analysis of your trade. It may no longer be as favorable as you initially thought.

11.Don't overly concern yourself with news. While trading the news is a separate strategy that may work for some traders, most try to avoid it. If the news is already known in advance, the market will react to it beforehand. However, if the information becomes clear only during the news release, it becomes challenging to trade based on such inputs. News that is widely broadcasted on TV or the internet tends to be outdated information when it comes to the market.

12.Choose a trading style that suits your circumstances. If you have a small account and can only afford short stop-loss levels, you may need to start with scalping or intraday trading. If you possess patience and adequate capital, swing trading could be an option. Long-term trading generally requires significant capital.

13.Embrace your losses. It doesn't mean you have to enjoy losing money. However, during your trading journey, you will inevitably experience losses. If you have a negative mindset towards losses, it will hinder your overall performance. Recognize that by exiting trades promptly and accepting short-term losses, you safeguard your account from larger losses in the long run. Learn to appreciate the importance of managing losses effectively.

14.Avoid setting excessively large stop-loss levels. Doing so will erode your profits from small trades. Consequently, instead of achieving a small profit, you may end up at breakeven or a slight loss, even if your trade initially showed promise.

15.Take consistent actions each day or week. Set a goal to capture a certain number of pips or points daily if you are a scalper or weekly if you trade intraday (the specific numbers provided here are for illustrative purposes and should not be taken as objectively evaluated results). By accumulating small gains over time, you can earn a significant amount by the end of the year.

16.Don't rely on a single trade for salvation. Some traders mistakenly believe that a single trade has the potential to generate substantial profits, recover previous losses, or significantly impact their overall performance. However, trading revolves around a series of transactions. No single trade can dictate your success. Instead, your behavior across ten or twenty trades holds tremendous importance in surviving and thriving in the market.

17.Consistency breeds confidence and control. Starting each morning with the knowledge that following your rules will result in profitable trades instills a sense of assurance. Similar to other traders, begin your day by reviewing the charts you trade and gathering the necessary information—perform top-down analysis, assess points of interest, liquidity, order flow, and more. Maintain this ritual consistently, as repeated actions are essential for earning profits in trading.

18.Master the art of position management. If you find yourself in a trade that is progressing favorably, consider partially closing your position to protect your profits in case the price suddenly reverses. Being flexible in managing your positions can lead to increased profitability and emotional balance in the market.

19.Execute the same trades repeatedly. Focus on specific trade setups that have proven successful for you. Avoid trying to trade multiple patterns simultaneously. Instead, identify two or three formations that work well for you and trade them consistently. Become an expert in those setups and execute them confidently and precisely. Avoid spreading yourself too thin.

20.Avoid excessive doubt and overanalysis. During the execution of a trade, trust your analysis and decision-making process. Doubts and unnecessary analysis during a trade can lead to detrimental outcomes. Overthinking can consume you and make it challenging to differentiate between the right and wrong decisions. Leave fluctuations and excessive analysis to the market. Conduct trade analysis before or after trades, not during them.

21.In the eyes of the market, all trades are equal. At the start of each trading day, everyone is on an equal footing. You haven't made any profits or losses yet. Your earnings depend solely on your actions. If you adhere to discipline and follow your predetermined rules, you will generate profits.

22.The market is an impartial judge of your trades. The market doesn't play favorites; it remains indifferent to your presence. Respect the market's authority and refrain from attempting to defy it. Engaging in a battle against the market is akin to fighting your reflection in a mirror. Instead, focus on understanding and following the market's rules.

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

Informational: SPARKS, meticulously crafted watchlistTradingView provides a wide array of features, and it can sometimes feel overwhelming to grasp them all. However, one particularly valuable but often overlooked feature on the platform is SPARKS. These specialized watchlists, curated by TradingView, offer an effortless way to monitor and follow specific industries within the market.

It is important to note that while SPARKS can serve as a useful starting point for research, they should not be regarded as comprehensive representations of an entire industry. They provide valuable insights, but additional analysis is recommended for a complete understanding.

Now, let's delve into the process of accessing and utilizing SPARKS effectively.

1: Load the TradingView website and look towards the top you will see "Market" Hover your cursor over the markets tab and then hover over "SPARKS" You will now see a list of preliminary categories

Lets select "Work" for testing purposes

2: You are now presented with a list of additional categories showing anything having to do with work and employment. You can also see the performance of each portfolio listed below the portfolio

Currently A.I is a major topic of discussion. Lets go ahead and look at the A.I portfolio named : " A.I Stocks: RISE of the machines"

3: You are now presented with a overview of the portfolio and a option to save the watchlist which will add it to your watchlist tab to the right. :

If you continue down you will now see information regarding the performance of the portfolio and as you can see for this portfolio year to date performance is up by 30%