Diamond Pattern Trading: How to Spot and TradeSome patterns scream for attention, while others sneak up on traders who aren’t looking closely. The diamond pattern is one of those sneaky ones — a formation that hints at a brewing reversal but requires a sharp eye to catch.

Let’s dive into this pattern, how it forms, and the best strategies for effectively trading diamond top and bottom patterns.

What Is a Diamond Pattern?

The diamond pattern is a reversal chart pattern that occurs after a strong trend, indicating a potential shift in market direction. It forms when price action expands and then contracts, creating a diamond-shaped contour. This pattern is rare compared to triangles or head-and-shoulders formations, but it often signals significant price moves when it appears.

There Are Two Types of Diamond Patterns:

Diamond Top Pattern – A 🐻 Reversal Pattern That Appears After an Uptrend.

Diamond Bottom Pattern – A 🐂 Reversal Pattern That Forms After a Downtrend.

These patterns can help traders identify potential turning points and prepare for a change in trend.

How Can You Identify a Diamond Pattern in Trading?

To spot a diamond pattern trading setup, look for the following characteristics:

Broadening Formation: The price action initially expands, creating higher highs and lower lows.

Narrowing Structure: After the expansion, the price contracts, creating lower highs and higher lows.

Symmetrical Shape: When trendlines are drawn connecting the highs and lows, they create a diamond shape.

Breakout Point: The pattern is confirmed when the price breaks out of the structure, either to the upside or downside.

While it might resemble a diamond quilt pattern or a diamond tile pattern on the chart, the key difference is its role as a market reversal signal.

Diamond Top Pattern: Bearish Reversal

A diamond top pattern forms at the peak of an uptrend and signals that bullish momentum is weakening. Traders often look for a downside breakout to confirm the reversal.

What Does a Diamond Top Pattern Typically Involve?

Identify the diamond formation after a strong uptrend.

Wait for a breakout below the lower trendline with increased volume.

Enter a short position once the breakout is confirmed.

Set a stop-loss above the recent high.

Target price: Measure the height of the pattern and project it downward.

This pattern suggests buyers are losing control, and a downtrend will likely follow.

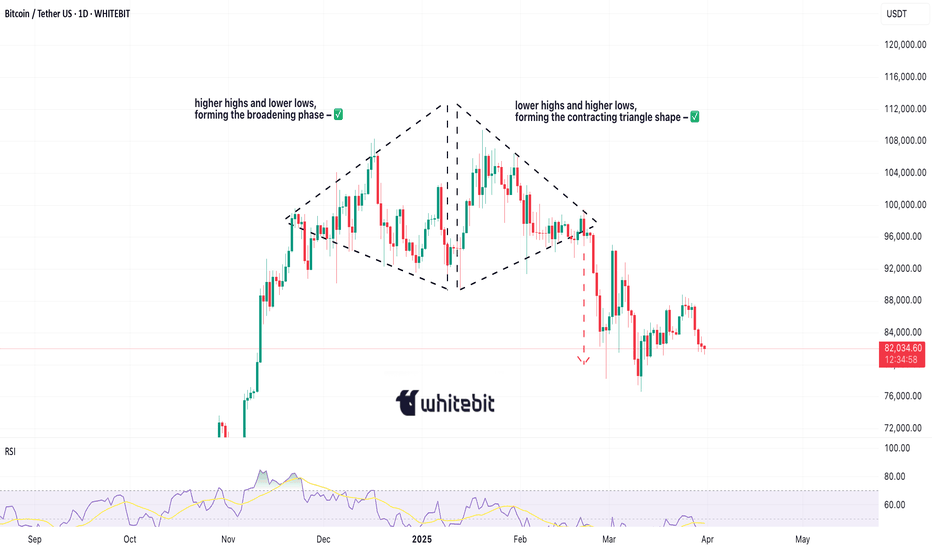

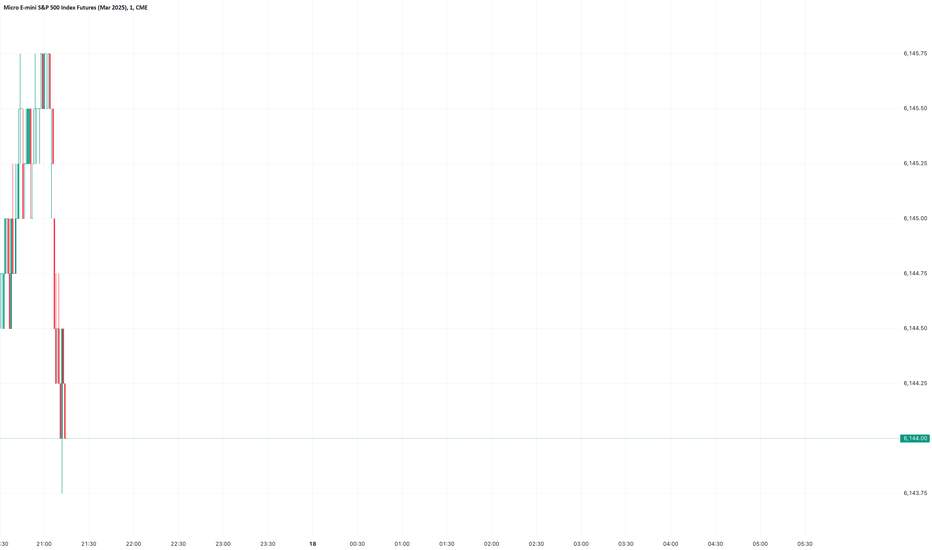

📊 Diamond Top in Action

Between late 2024 and early 2025, Bitcoin surged toward $105,000. Following this uptrend, price action began to shift: the candles first spread wider, then started to tighten — ultimately forming what resembled a diamond top on the daily chart.

The pattern formed over several weeks, showing the hallmark structure: broad on the left,

symmetrical tightening on the right, with support and resistance lines converging.

Shortly after the narrowing phase was completed, Bitcoin broke downward — a typical outcome of a diamond top pattern. The price declined sharply over several days, validating the pattern and suggesting a broader correction.

Analysts watching the pattern noted that while it wasn’t perfectly symmetrical (as real-world patterns rarely are), the structure was clear enough to support the reversal thesis. The breakout marked a momentum shift as bullish pressure faded and sellers gained temporary control.

Following the initial drop, Bitcoin stabilized and began consolidating. This sideways movement is common after strong breakouts — reflecting indecision and market recalibration.

Diamond Bottom Pattern: Bullish Reversal

A diamond bottom pattern appears at the end of a downtrend, indicating a potential shift to bullish momentum.

How a Diamond Bottom Pattern Is Typically Interpreted

Identify the diamond shape forming after a downtrend.

Wait for an upside breakout above the upper trendline with substantial volume.

Enter a long position once the breakout is confirmed.

Set a stop-loss below the recent low.

Target price: Measure the pattern’s height and project it upward.

This pattern signals that selling pressure decreases, and buyers may take control.

Why the Diamond Pattern Is Important for Traders

Reliable Reversal Signal. The diamond pattern trading setup strongly indicates trend reversals.

Clear Entry and Exit Points. Well-defined breakout levels make risk management easier.

Works in Different Markets. The diamond pattern remains effective when trading stocks, forex, or crypto.

Final Thoughts

The diamond pattern is a rare but powerful tool that can help traders confidently spot trend reversals. Whether you’re trading a diamond top pattern for bearish setups or a diamond bottom pattern for bullish breakouts, understanding this formation can give you an edge in the market.

So, traders, have you spotted a diamond pattern trading setup recently? Share your experiences and strategies in the comments!

This analysis is performed on historical data, does not relate to current market conditions, is for educational purposes only, and is not a trading recommendation.

Community ideas

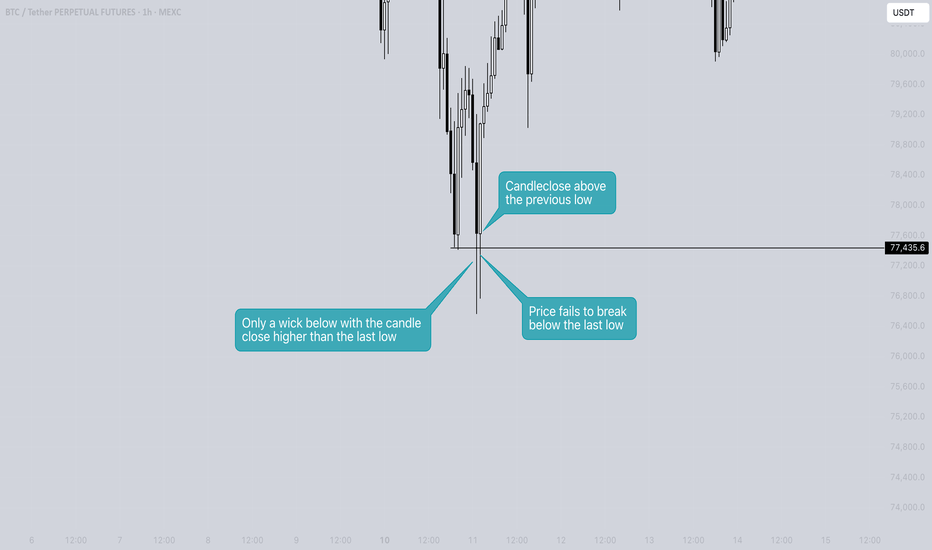

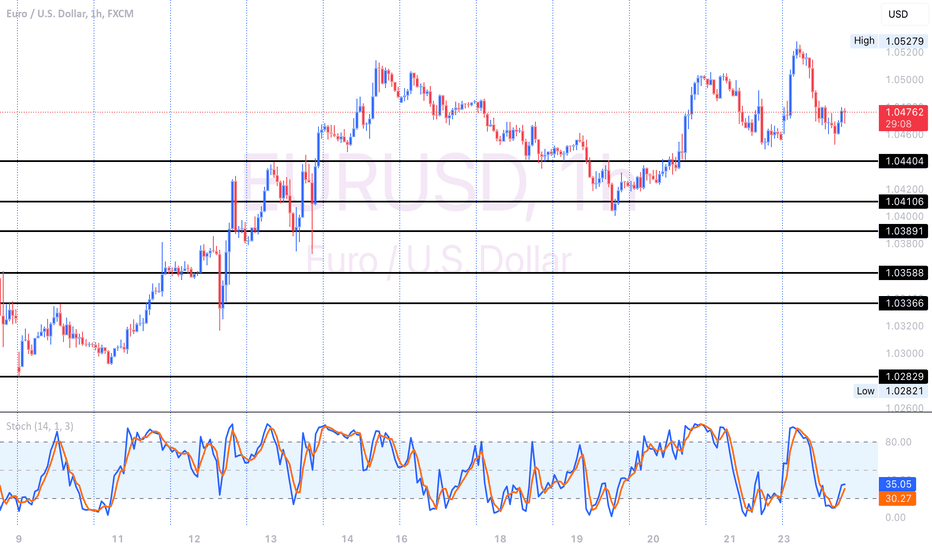

What is a Swing Failure Pattern? - Basic explanation!A Swing Failure Pattern (SFP) is a technical chart pattern often used in price action trading to identify potential reversals in the market. It is typically seen on candlestick or bar charts in the context of trend analysis.

The basic idea behind a Swing Failure Pattern is that the price temporarily breaks above or below a previous swing high or low, but fails to sustain that move and reverses direction quickly. This indicates a potential shift in market sentiment, and it can be a signal for a trend reversal or breakdown.

When is it a SFP?

- In needs to sweep the previous low

- It has to close the candlestick above the previous low. So only a wick down When the price closes the body of a candle below the last low, it will not be considered an SFP. In this case, it is highly likely that the trend will continue in that direction.

The SFP can occur across various timeframes, from lower to higher timeframes.

Example on the daily timeframe

Here, we see two SFPs: one to the upside and one to the downside.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

How to Actually Do Backtesting?Welcome back guys, I’m Skeptic!

Today, I’m gonna break down one of the most important and fundamental skills every trader needs: Backtesting .

Backtesting is the very first step on your trading journey and probably the most crucial one. It’s all about putting your theoretical knowledge and trading plan to the test by evaluating them against historical market data. The goal? To see whether your strategy actually works — with what win rate, R/R ratio , and more.

But here’s the problem: many traders do it wrong. They end up getting unreliable results, which leads to self-doubt when it comes to forward testing. The real issue is not your strategy but how you conduct your backtest.

Let’s dive into the complete process! 💪

🛠️ Tools You Need

To start backtesting, you’ll need some software that supports the replay feature, allowing you to move through historical data as if it were live.

The best platforms for this are TradingView and MetaTrader . Personally, I use TradingView because it’s super intuitive and has great backtesting capabilities.

Also, make sure to choose appropriate timeframes for backtesting that align with your strategy.

🕰️ Choosing Market Conditions:

You need to backtest your strategy in all types of market conditions:

Uptrend

Downtrend

Range-bound

High Volatility

🚀 Step-by-Step Backtesting

1.Choose the Timeframe:

Make sure your backtesting timeframe matches your strategy’s timeframe. For example, if your strategy works on the 4H chart, don’t backtest on the 1H chart.

2.Select Your Strategy:

Stick to your written trading plan without improvising.

3.Pick the Asset Pair:

Test on at least three different pairs or assets (e.g., EUR/USD, XAU/USD, GBP/NZD) to get diverse results.

4.Define Entry and Exit Rules:

Clearly specify your entry, stop loss, and target levels. Never change these rules mid-backtest, even if it seems illogical. In real trading, you won’t have the luxury of endless contemplation.

🎯 Running the Backtest

Use the Replay Tool to move through historical data.

Never peek at the future price movement. If you accidentally see it, restart from a different point.

Open a minimum of 30 positions for each market condition (e.g., uptrend, downtrend, range).

Record each trade in a spreadsheet (Excel, Google Sheets, etc.) with the following columns:

Date

Time

Entry strategy

Stop loss

Target

Result (profit/loss as R/R ratio)

Exit time

📊 Analyzing Your Results

After completing your backtest, it’s time to analyze the data. Key metrics to focus on include:

R/R Ratio

Win Rate (%)

Drawdown (%)

Losing Streaks

Position Frequency

🚩 Common Mistakes to Avoid

Inconsistent Strategy: Changing your rules during backtesting is a no-go. Stick to the plan.

Incomplete Testing: Don’t cut corners and always aim for a substantial number of trades.

Ignoring Market Conditions: Make sure your strategy is tested in all four market scenarios.

Lack of Patience: Just because the first few trades are losses doesn’t mean the strategy is a failure. Sometimes, a losing streak can be followed by a winning trade that covers it all.

💡 Conclusion

Backtesting is the beating heart of any trader’s skill set. It builds confidence and lays the foundation for a profitable strategy. If you found this tutorial helpful, give it a boost and share it with your fellow traders. Let’s grow together, not alone!

And as Freddie Mercury once said:

We are the champions, my friends! :)🏆

Happy trading, and see you in the next analysis! 💪🔥

Revenge Trading vs. Roaring Comeback: How to Tell the Difference“I’m going to get even with the market and I’m going to get even today!” We’ve all been there. You take a loss—maybe a small one, maybe an account-crushing one—and something inside you snaps.

Logic leaves the chat, and a new trader takes over: the vengeful, angry version of you who’s out to "get back" at the market.

Welcome to the world of revenge trading, where decisions are fueled by frustration, and the market does what it always does: punishes impatient and emotional traders.

But what if there’s a better way? What if instead of spiraling into self-destruction, you could channel that energy into a thoughtful and strategic comeback? That’s the difference between revenge trading and a true trader’s rebound. Grab your hot coffee and let’s talk about it.

💥 Revenge Trading: The Fastest Way to Financial Self-Sabotage

Revenge trading isn’t a trading strategy—it’s an emotional response masquerading as a quick-witted reaction. The thought process goes like this: "I just lost money. I need to make it back—fast."

So you double down, size up, stretch out the leverage ratio and ignore your usual risk management rules. Maybe you trade assets you don’t even understand because the price looks juicy. Maybe you jump into a leveraged position without a stop loss because, hey, you’re in it to win it. What could go wrong?

Everything. Everything can go wrong.

Revenge trading is the financial equivalent of trying to punch the ocean. The market doesn’t care that you’re mad. It doesn’t owe you a winning trade. And when you start making impulsive decisions, the only thing that may get hurt is your trading mindset.

📢 Signs You’re Revenge Trading

You’re taking trades you wouldn’t normally take.

You’re increasing position sizes irrationally.

You’re ditching risk management (stop losses, position sizing, logic, etc.).

You feel desperate to "make it back"—right now.

You’re ignoring your trading plan, assuming you had one to begin with.

Recognizing these signs is the first step to stopping the cycle. But avoiding revenge trading is only half of the battle—you need to know how to stage a real comeback.

🦁 Staging the Roaring Comeback

A roaring comeback isn’t about making back your losses in one dramatic trade. It’s about recalibrating, reassessing, and regaining control. Here’s how traders who actually recover from losses do it:

📌 Recognize the Signs Early

If your heart rate spikes and your fingers are itching to “fix” a bad trade immediately, stop. That’s not a setup. That’s an emotional reaction.

📌 Set Daily Loss Limits

If you hit your max loss for the day, you’re done. No exceptions. Your best decision at that point is to fight another day with a clear head.

📌 Step Away from the Screens

Revenge trading thrives on impulsivity, and the best way to kill that impulse is to take a break. Go outside. Breathe. The market isn’t going anywhere. Now touch that grass.

📌 Post-Loss Review: What Actually Happened?

Was the loss due to a bad strategy, poor execution, or just market randomness? Pull up your trading journal ( you do keep one, right ?) and break it down.

📌 Reaffirm Your Strategy (Tweak if Necessary)

If your loss came from a solid trade setup that just didn’t work, then there’s nothing to change. If it came from a mistake, figure out how to prevent that mistake from repeating.

📌 Reduce Risk for the Next Trades

After a loss, the worst thing you can do is over-leverage. Instead, cut your position size and take smaller, high-probability trades to rebuild confidence. Howard Marks, a firm believer in market psychology, always reminds investors that the biggest risk is emotional overreaction. Stay disciplined.

📌 Trust the Process

The best traders understand that one trade does not define them. They trust their system, stick to their edge, and take losses as part of the game. Trading is a long-term play, not a single battle to be won or lost.

💚 Turning Losses into Lessons

Losses are tuition fees for the market’s greatest lessons. Every great trader has taken hits—what separates them from the rest is how they respond. The thing is this can happen anywhere—from an ill-fated trade in the crypto market (it’s wild out there) to an account-battering reaction to anything that pops out of the earnings calendar .

How do you deal with a trading loss? And when’s the last time you had to stiffen that upper lip and make your comeback? Share your experience in the comments!

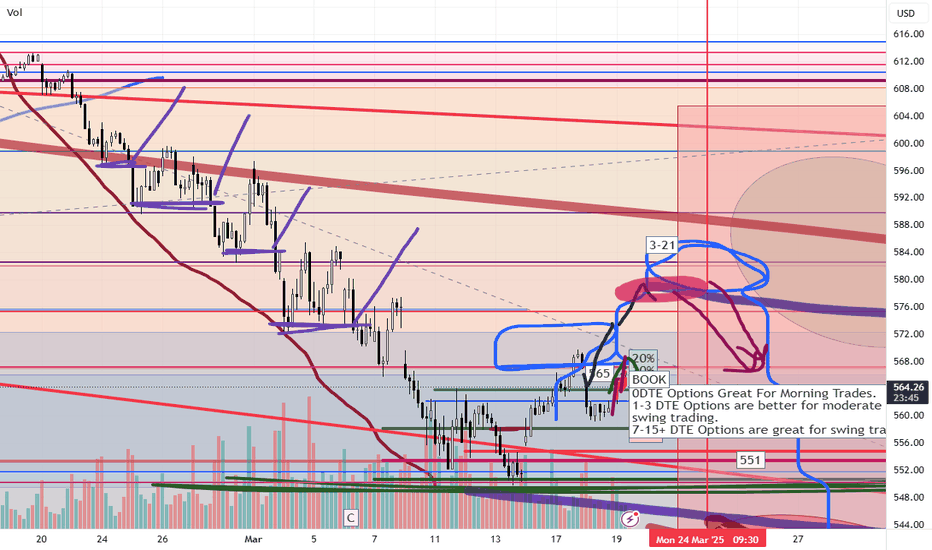

Trading Is Not Gambling : Become A Better Trade Part IOver the last few weeks/months, I've tried to help hundreds of traders learn the difference between trading and gambling.

Trading is where you take measured (risk-restricted) attempts to profit from market moves.

Gambling is where you let your emotions and GREED overtake your risk management decisions - going to BIG WINS on every trade.

I think of gambling in the stock market as a person who continually looks for the big 50% to 150%++ gains on options every day. Someone who will pass up the 20%, 30%, and 40% profits and "let it ride to HERO or ZERO" on most trades.

That's not trading. That's flat-out GAMBLING.

I'm going to start a new series of training videos to try to help you understand how trading operates and how you need to learn to protect capital while taking strategic opportunities for profits and growth.

This is not going to be some dumbed-down example of how to trade. I'm going to try to explain the DOs and DO N'Ts of trading vs. gambling.

If you want to be a gambler - then get used to being broke most of the time.

I'll work on this video's subsequent parts later today and this week.

I hope this helps. At least it is a starting point for what I want to teach all of you.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

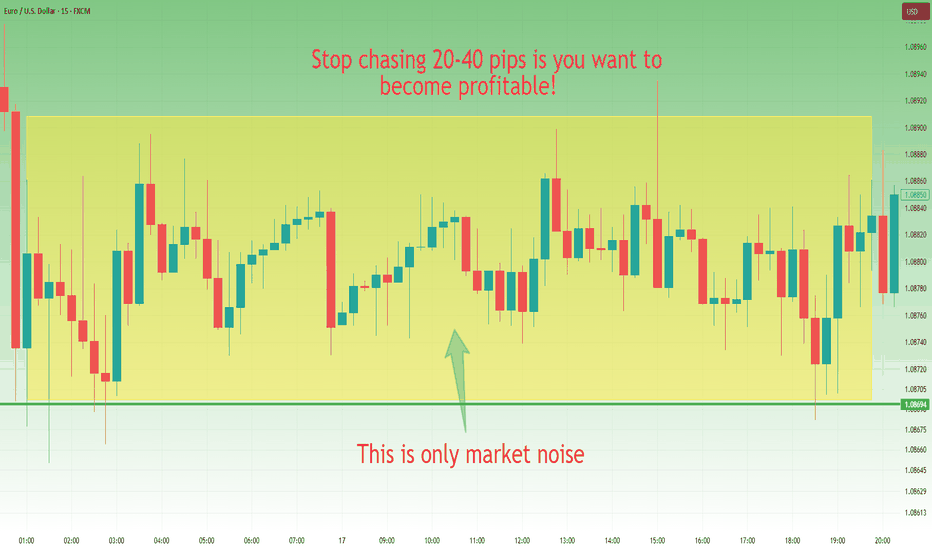

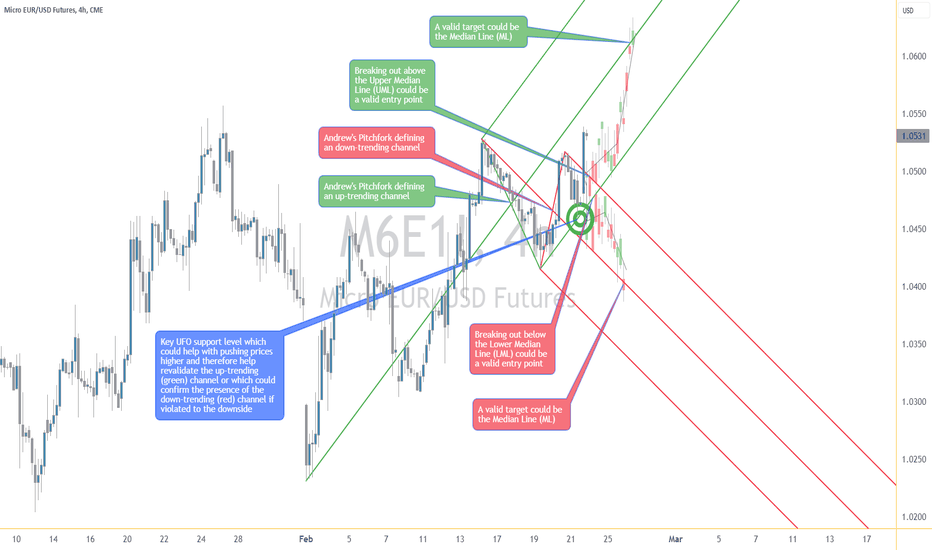

Stop chasing 20-30 pips if you want to become profitableOne of the biggest obstacles for traders who want to become consistently profitable is the mindset of chasing small 20-30 pip moves.

While it may seem appealing to enter and exit trades quickly for immediate profits, this strategy is often inefficient, risky, and unsustainable in the long run. Here’s why you should change your approach if you want to succeed in trading.

________________________________________

1. Trading Costs Eat Into Your Profits

When you target small moves, you need to open and close many trades. This means that spreads and commissions will eat up a significant portion of your profits. If you have a spread of 2-3 pips (depending on the pair) and you’re only aiming for 20-30 pips per trade, a consistent percentage of your potential gains is lost to execution costs.

________________________________________

2. High Risk Compared to Reward

A smart trader focuses on a favorable risk-reward ratio, such as 1:2, 1:3 or even 1:4. When you chase just 20-30 pips, your stop-loss has to be very tight, making you highly vulnerable to the normal volatility of the market. An unexpected news release or a liquidity spike can stop you out before the price even reaches your target.

________________________________________

3. You Miss Big Moves and Real Opportunities

Professional traders focus on larger trends and significant price movements of hundreds of pips. The market doesn’t move in a straight line; it goes through consolidations, pullbacks, and major trends. If you’re busy trading short-term 20-30 pip moves, you’ll likely miss the big trends that offer more sustainable profits and better risk management.

________________________________________

4. Increased Stress and Emotional Trading

Short-term trading requires constant monitoring and quick decision-making. This increases your level of stress and negative emotions like fear and greed, leading to costly mistakes. In the long run, this trading style is mentally exhausting and difficult to sustain.

________________________________________

How to Change Your Approach to Become Profitable

✅ Think in terms of larger trends – Focus on 200-300+ pip moves instead of small fluctuations.

✅ Aim for a strong risk-reward ratio – Look for setups with at least 1:2 risk-reward to maximize your profits.

✅ Use higher timeframes – Charts like 4H or daily provide clearer signals and reduce market noise.

✅ Be patient and wait for the best setups – Don’t enter trades just for the sake of activity; wait for high-probability opportunities.

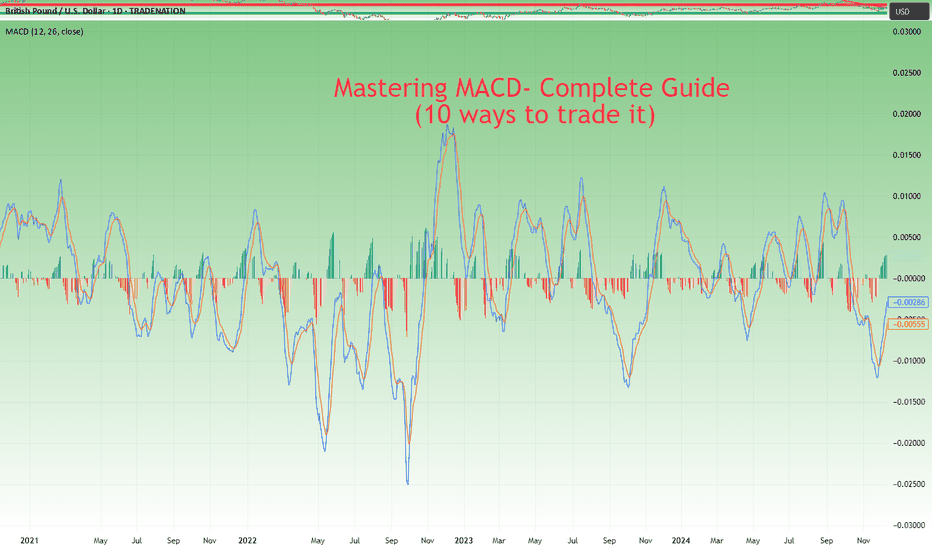

Mastering MACD- Complete Guide- 10 ways to trade itThe Moving Average Convergence Divergence (MACD) is a versatile indicator that can help traders navigate the markets with precision. From trend identification to momentum assessment, the MACD provides multiple actionable insights. In this educational post, we’ll explore the key ways to use MACD effectively, with an example illustration accompanying each strategy.

________________________________________

1. Signal Line Crossovers

The most common use of MACD is the signal line crossover, which identifies potential shifts in market momentum:

• Bullish Signal: When the MACD line (fast-moving) crosses above the signal line (slow-moving), it suggests upward momentum is increasing. This can be an entry signal for a long trade. Bullish crossovers often occur after a period of consolidation or a downtrend, signaling a reversal in market sentiment.

• Bearish Signal: When the MACD line crosses below the signal line, it signals downward momentum, often triggering a short-selling opportunity. Bearish crossovers can occur during retracements in an uptrend or at the start of a bearish reversal.

How to Use: Look for confirmation from price action or other indicators, such as a breakout above a resistance level for a bullish signal or a breakdown below support for a bearish signal. It's essential to avoid acting solely on a crossover; consider volume (stocks, crypto), candle stick formations and other market conditions.

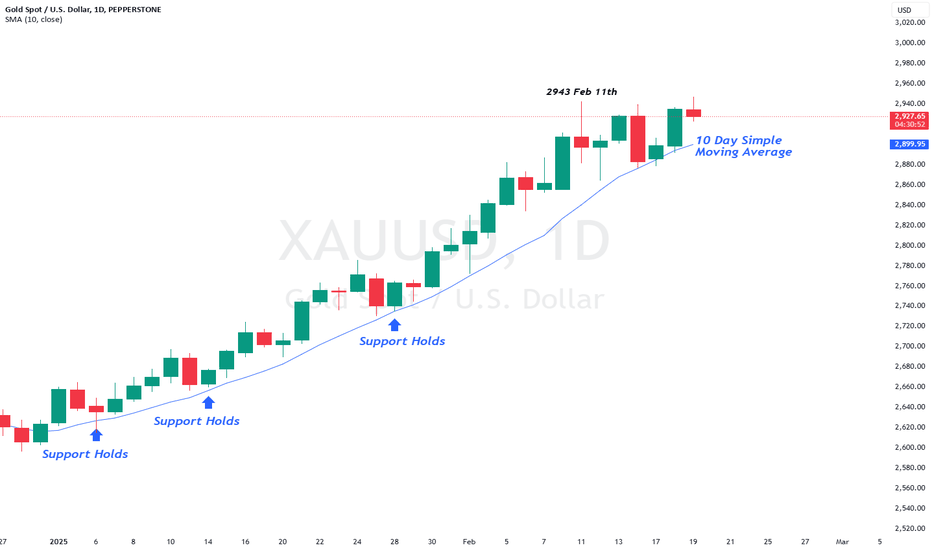

Example: A bullish crossover on the daily chart on TRADENATION:XAUUSD indicates a potential buying opportunity as the price begins to rise. Add a stop-loss below recent lows to manage risk and look for a 1:2 risk:r eward in the next resistance.

________________________________________

2. Zero Line Crossovers

The MACD’s zero line acts as a boundary between bullish and bearish momentum, making it a valuable trend confirmation tool:

• Above Zero: When the MACD line moves above the zero line, it confirms an uptrend, as the fast-moving average is above the slow-moving average. Sustained movement above zero often indicates a strong bullish trend.

• Below Zero: A MACD line below zero reflects a downtrend, indicating bearish market conditions. Persistent movement below zero confirms bearish momentum.

How to Use: Use the zero line crossover to validate trades based on other signals, such as candlestick patterns or trendline breaks. The crossover can act as a second layer of confirmation for existing trade setups.

Example: MACD on a crypto pair crosses above the zero line, confirming the start of a new bullish trend. Traders can combine this with volume analysis to ensure strong market participation.

________________________________________

3. Histogram Analysis

The histogram represents the distance between the MACD line and the signal line, offering insights into momentum:

• Expanding Histogram: Indicates strengthening momentum in the direction of the trend. Larger bars show increasing dominance of bulls or bears.

• Contracting Histogram: Suggests weakening momentum, signaling a possible reversal or consolidation. Smaller bars indicate a loss of trend strength.

How to Use: Monitor the histogram for early signs of momentum shifts before a crossover occurs. The histogram can act as a leading indicator, providing advanced warning of potential changes in price direction.

Example: A shrinking histogram in a forex pair signals that the bullish momentum is losing steam, warning traders of a possible retracement. This can be a cue to tighten stop-loss levels or take partial profits. Conversely, an expanding histogram during a breakout confirms the strength of the move.

________________________________________

4. Identifying Divergences

MACD divergences are powerful tools for spotting potential reversals:

• Bullish Divergence: Occurs when the price makes a lower low, but the MACD forms a higher low, signaling weakening bearish momentum. This often precedes a trend reversal to the upside.

• Bearish Divergence: Happens when the price makes a higher high, but the MACD forms a lower high, indicating diminishing bullish strength. This suggests a potential reversal to the downside.

How to Use: Combine divergence signals with support or resistance levels to enhance reliability. Divergences are most effective when spotted at major turning points in the market.

Example: On a TRADENATION:EURUSD chart, a bearish divergence signals an upcoming price reversal from an up trend to a down trend.

________________________________________

5. Trend Confirmation

MACD confirms trends by staying consistently above or below the zero line:

• Above Zero: Indicates a strong uptrend. Look for pullbacks to enter long trades. The longer the MACD remains above zero, the stronger the trend.

• Below Zero: Reflects a persistent downtrend. Use rallies as opportunities to short. A sustained period below zero reinforces bearish dominance.

How to Use: Use MACD’s trend confirmation alongside other trend-following tools like moving averages or Ichimoku clouds. Ensure that market conditions align with the broader trend.

Example: Combining MACD trend confirmation with moving averages helps traders stay on the right side of the trend in a stock market index. For example, buy when both MACD and a 50-day moving average indicate an uptrend. Exit trades when the MACD begins to cross below zero or shows a divergence.

________________________________________

6. Overbought and Oversold Conditions

Although MACD is not traditionally an overbought/oversold indicator, extreme deviations between the MACD line and the signal line can hint at stretched market conditions:

• Overbought: When the MACD line is significantly above the signal line, it may indicate a price correction is imminent. This often occurs after an extended rally.

• Oversold: When the MACD line is well below the signal line, it suggests a potential rebound. Such conditions are common following sharp sell-offs.

How to Use: Monitor extreme readings in conjunction with oscillators like RSI for added confidence. Look for reversals near key support or resistance levels.

Example: An extended bearish move with a large MACD-signal line gap warns traders of a potential price correction. This can signal an opportunity to exit. Pair this observation with a bullish candlestick pattern to confirm the move (in this example morning star)

________________________________________

7. Combining MACD with Other Indicators

MACD works best when paired with complementary indicators to provide a more comprehensive market analysis:

• RSI (Relative Strength Index): Use RSI to confirm momentum and overbought/oversold conditions.

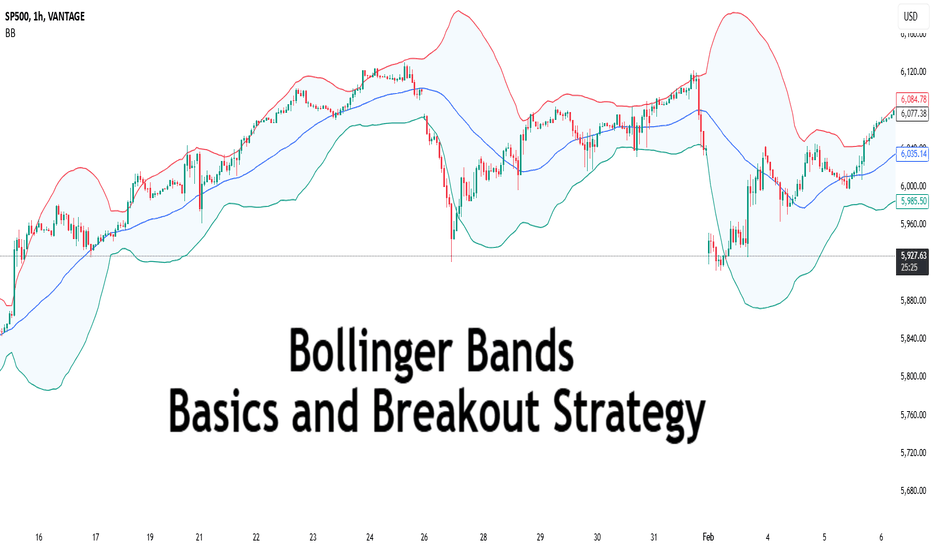

• Bollinger Bands: Validate price breakouts or consolidations with MACD signals.

• Support and Resistance: Use MACD signals around key levels for confluence.

How to Use: Wait for MACD signals to align with other indicator readings to improve accuracy. Cross-validation reduces false signals and increases confidence in trades.

Example: A bearish MACD crossover near a key resistance level reinforces a short-selling opportunity.

________________________________________

8. Multi-Timeframe Analysis

Using MACD across different timeframes strengthens trade signals and provides context:

• Higher Timeframe: Identify the broader trend to avoid trading against the market. For instance, if the daily chart shows a bullish MACD, focus on long trades in lower timeframes.

• Lower Timeframe: Pinpoint precise entries and exits within the higher timeframe’s trend. The MACD on lower timeframes can help fine-tune timing.

How to Use: Align MACD signals on both higher and lower timeframes to confirm trade setups. This alignment minimizes the risk of false signals.

________________________________________

9. Customizing MACD Settings

Traders can tailor MACD settings to suit different trading styles and timeframes:

• Shorter Periods: Provide more sensitive signals for scalping or day trading. Shorter settings react quickly to price changes but may generate more false signals.

• Longer Periods: Produce smoother signals for swing trading or position trading. Longer settings are less responsive but more reliable.

How to Use: Experiment with different settings on a demo account to find what works best for your strategy. Adjust settings based on the volatility and nature of the asset.

Example: A scalper uses a 5, 13, 6 MACD setting to capture quick momentum shifts in the market, while a swing trader sticks with the standard 12, 26, 9 for broader trends. Compare results across different markets to refine the approach.

________________________________________

10. Crossovers or Divergence at Key Levels

Combining MACD crossovers with price action levels enhances the reliability of trade signals:

• Horizontal Levels: Use MACD signals to confirm reversals or breakouts at support and resistance levels. Crossovers near these levels are often more reliable.

• Fibonacci Retracements: You can combine MACD with retracement levels to validate potential entries or exits. Confluence with retracements adds weight to the signal.

How to Use: Wait for MACD signals to align with key price levels for higher probability trades. Confirmation from candlestick patterns or volume (stock and crypto) adds further credibility.

Example: A bullish MACD divergence aligns with a strong support level, signaling a strong buy setup. Add confirmation with a candlestick reversal pattern, such as a piercing pattern in our case, to enhance precision.

________________________________________

Conclusion:

The MACD indicator’s flexibility makes it a must-have tool for traders of all styles. By mastering these strategies and integrating them in your trading, you can elevate your trading decisions.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

How to Draw Trendlines Like a Pro – Rulers Out, Rules In!Hi everyone!

If you don’t have any rules for drawing a trendline, then this is by far the most subjective technical analysis criterion of all. So, grab your ruler, and let’s dive in! ;)

Without clear guidelines, you can draw it however you want, shaping the narrative to fit your bias. This makes it the perfect tool to talk yourself into a trade or justify staying in a bad one—there’s always a new “support” coming…

If you don't have rules, you can always find some dots to connect, making it look "perfect" for you.

In this post, I'll discuss buying opportunities using trendlines, share key rules for drawing them correctly, and highlight common mistakes to avoid - all with a focus on mid- and long-term investment opportunities.

-------------------------

The Basics: How to Draw a Trendline

The trendline is a highly effective tool for mid- and long-term investors to find an optimal buying zone for their chosen asset. I always take a full view of the chart, analyzing its entire history to find the longest trendline available. The longer the trendline, the stronger it is!

To draw a trendline, we simply connect two points and wait for the third touch to confirm it. Easy, right?

The strongest trendline comes from points that are easily recognizable—you should spot them in a split second.

Maximum view, if possible Monthly chart, connect the dots and wait for a third one.

For me, the third and fourth touches are the most reliable.

If you have to look deeply to find where to draw a trendline, then it's already a first sign that it’s not strong! The best ones appear instantly.

---------------------------

Two Myths About Trendlines

Myth #1: "You cannot draw a trendline without three touching points."

Don’t even remember from where I heard that kind of bs but as you see in the images above, yeah I can. If I have a correct lineup, the third touch is the strongest.

Myth #2: "The more touches, the stronger the trendline."

Yes, a trend appears stronger with more touches, but each additional touch increases the odds of a break or trend change. To buy from, let’s say, the sixth touch, there must be strong confluence factors, and fundamentals should support the investment.

“The trend is your friend, until the end when it bends.” — Ed Seykota

Sure, I’ve had great trades from the fifth or seventh touch, but as said, the area has to be strong, combining multiple criteria. Think of a trendline like 3-5 cm thick ice on a lake. You can’t break it with one hit, or the second, or the third. But after the fourth or fifth, it starts to crack, and by the sixth—boom!

From my psychological perspective, the more touches, the weaker the trendline becomes.

-----------------------

Rule #1: Wick to Wick or Body to Body

If there aren't any anomalies, the trendline should always be drawn from wick to wick (image below) or body to body.

Here was the trendline draw from wick to wick

I mostly use body-to-body when there is a lot of noise on the chart and many large wicks that don’t show the real price behavior—whether from a panic sell-off or other unexpected market moves.

Candlestick chart, the trendline drawn from body-to-body

Tip! Body-to-body means drawing trendlines from closing prices to remove unnecessary noise from the chart. To make the chart even clearer, I often use a line chart (it tracks closing prices), which filters out the noise and gives a cleaner view of the price action.

The same chart as above using line chart.

Mistake to avoid: If you start from the wick but the second point is from the body, it's wrong. This can lead to misleading breakout trades or confusing rejection trades.

If there are no significant large wicks, go from wicks.

If a chart offers a lot of huge panic-sell wicks, use bodies instead to get a cleaner setup.

Quite often, I use a hybrid version as well. We are investors, not traders. We need a price zone, not an exact price!

In these cases, I combine wicks and closing prices to find the optimal trendline, which stays somewhere between them.

Light-blue is the zone

-----------------------

Rule #2: Higher Highs Strengthen the Trendline

A trendline is more reliable if the price makes a new higher high (HH) after the previous rejection, and before it approaches a trendline.

The third and fourth touch came from higher high (HH) levels

This confirms that the recent trend is strong. If it all lines up, we can step in!

-----------------------

Rule #3: Even Timing Between Touches

A trendline rejection works best when the timing between touches is symmetrical. They don’t have to be perfectly equal but they also shouldn’t be wildly different - one touch being very small and another very large can weaken the trendline’s reliability.

A good combinations is when the price comes from higher high levels, the next touch has an equal or fairly similar distance between previous ones.

Yeah, there are quite a lot of touches, but you get the point; market symmetry plays an important role in making decisions.

Warning: If the next touch comes too soon, especially from a lower high (LH) levels, which signals that momentum may be fading, and the touch happens at an uneven distance, it weakens the trendline’s reliability. So, watch out for that.

Two alerts: uneven length between touches & comes from lower highs.

Next red alert: When there are huge uneven gaps between touches, as shown in the picture below.

The first and second touch compared to the second and third touch are out of balance, weakening the trendline's reliability.

------------------------

Trendline Summary: Key Criteria for Mid- to Long-Term Analysis

Open the maximum chart view – analyze all available data for the asset.

The higher the timeframe, the stronger the trendline.

A trendline needs two clean and clear points to be drawn.

The highest probability rejection happens at the third and fourth touch.

If there are large wicks or panic sell-offs, use closing prices (body-to-body).

Remove noise and wicks by using a line chart for a clearer view.

A trendline touch is strongest when the price approaches from a higher high (HH).

A trendline touch is strongest when the distance between touches is symmetrical.

A slight flex in the trendline is ideal; it should be between 20 to 35 degrees, not too steep in its climb. ;)

These are the main criteria for a trendline that I use when analyzing stocks or any asset from a mid-to long-term perspective.

----------------------

Trendlines Alone Are Not Enough

Now, here’s the interesting part. Even if a trendline looks perfect and meets all criteria, I still won’t rush to share an analysis. Why? Because a trendline alone isn’t enough.

A trendline is just one piece of the puzzle. We need multiple confluence factors in a single price zone to make the setup truly strong and reliable. Usually, I need at least 3-7 criteria to align before making a move or recommendation.

So, that's it! A brief overview and hopefully, you found this informative. Feel free to leave a comment with your thoughts!

Before you leave - Like & Boost if you find this useful! 🚀

Trade smart,

Vaido

Why DCA Does Not Work For Short-Term TradersIn this video I go through why DCA (Dollar Cost Averaging) does not work for short-term traders and is more suitable for investors. I go through the pitfalls than come through such techniques, as well as explain how trading should really be approached. Which at it's cost should be based on having a positive edge and using the power of compounding to grow your wealth.

I hope this video was insightful, and gives hope to those trying to make it as a trader. Believe me, it's possible.

- R2F Trading

5 Most Popular Momentum Indicators to Use in Trading in 20255 Most Popular Momentum Indicators to Use in Trading in 2025

Want to master the art of momentum trading? Look no further. In this FXOpen article, we’ll explore how to use momentum indicators, the signals they generate, and five most popular momentum indicators for trading in 2025.

What Is a Momentum Indicator?

Momentum in technical analysis refers to the rate at which an asset's price accelerates or decelerates, helping traders identify potential trend continuations or reversals.

A momentum indicator is a tool used in technical analysis to measure the speed and strength of an asset’s price movements. By analysing changes in price over a specific period, these indicators provide insights into the underlying force driving market trends.

Momentum indicators do not focus on the direction of the price movement itself, but rather the strength behind it. Traders use these tools to gauge whether the market is overbought, oversold, or losing momentum, which helps determine entry or exit points. A stock momentum indicator like the Relative Strength Index (RSI), for instance, may indicate that stocks are currently bought or sold too heavily and their price is due for a reversal.

The Significance of Momentum Technical Indicators

Momentum indicators do not focus on the direction of the price movement, but rather on the strength behind it. They’re able to quantify and represent hidden clues about the future market direction in an easily interpretable way. By learning to read momentum indicators, traders can develop effective trading strategies, identify potential opportunities, and manage risk more efficiently.

Momentum tools produce a range of signals that offer traders an edge over the markets. Let’s take a look at some of the most common momentum signals.

Overbought and Oversold Conditions

These signals indicate when an asset's price has moved too far in one direction without sufficient support from fundamental or technical factors and is likely to reverse. For example, RSI generates overbought signals when the reading rises above 70 and signals oversold conditions when the reading falls below 30.

Divergence

Divergence occurs when the price of an asset moves in the opposite direction of the indicator, suggesting an upcoming reversal. For instance, when the price is making higher highs, but RSI is making lower highs, this indicates a bearish divergence that increases the likelihood of a downward move.

Crossover

These signals are generated when the indicator's lines cross each other or a certain threshold. A common example is the MACD, where traders look for crossovers between the fast MACD line and the slower signal line to spot potential entry and exit points.

Top Five List of Momentum Indicators for Technical Analysis

Now that we understand the types of signals that momentum tools produce, let’s break down five of the most popular with a momentum indicators list.

1. Relative Strength Index (RSI)

The RSI is one of the most popular and well-documented momentum indicators. It measures the speed and change of price movements by comparing the average gain to the average loss over a specified period, usually 14.

RSI is an oscillator, moving between 0 and 100. Values above 70 reflect overbought conditions, while values below 30 indicate oversold conditions. When the RSI moves out of overbought or oversold territory, many traders interpret this as a reversal confirmation. Sustained movements above or below the midpoint (50) can also be used to confirm a bullish or bearish trend, respectively. Moreover, traders look for divergence between the RSI and price to identify weakening trends and possible reversals.

2. Average Directional Index (ADX)

The ADX is a momentum indicator used to determine a trend’s strength. Unlike most other tools, its reading doesn’t move according to the direction of price action, i.e. it doesn’t move up if bullish or down when bearish. Instead, it ranges from 0 to 100, with values above 25 indicating a strong trend and below 25 suggesting a weak or non-trending market.

ADX is commonly used in combination with other tools, as it simply confirms the trendiness of a market. For example, traders might use a leading indicator like RSI to anticipate bullishness and confirm the trend when ADX crosses over 25.

3. Commodity Channel Index (CCI)

The CCI is a versatile momentum indicator. It uses a constant in its calculation to ensure that 75% of values fall between +/- 100, with moves outside of the range generally indicating a trend breakout or continuation. It can also show extreme overbought or oversold conditions when its value exceeds +/- 200.

The CCI requires a more nuanced approach than other tools and is typically used to confirm a trader’s directional bias and to identify potential opportunities. For instance, a visually identifiable bullish trend can be confirmed by looking at the CCI. If its value is skewed toward 100+, traders can be confident in their observation. When the market cools off, CCI will fall below 100. Traders can then confirm a pullback entry with a move back into the +/- 100 range.

4. Moving Average Convergence Divergence (MACD)

The MACD is a highly regarded trend-following momentum indicator that shows the relationship between two moving averages of an asset's price. It’s used in technical analysis to identify the relationship between two moving averages of a security’s price. It helps traders understand the trend’s strength, direction, and duration, as well as possible reversal points.

Traders use crossovers between the MACD and signal lines as potential entry and exit signals. Additionally, when the MACD histogram crosses above or below the zero line, it can indicate bullish or bearish momentum in the market. Lastly, it’s also possible to spot divergences between price and the indicator’s peaks and troughs, similar to how divergences are identified with RSI.

5. Momentum (Mom)

The Momentum indicator is a simple yet potentially effective tool that measures the rate of change in an asset's price over a specific period. The value of the Momentum depends on the market it’s applied to. For example, using the Momentum indicator in stocks will result in a fluctuating value typically between +/- 20, depending on the stock’s price. For forex pairs, its range may look more like +/- 0.02.

The common feature across all markets, however, is the zero line. Generally speaking, positive Momentum values indicate upward price movement, while negative values suggest downward movement. It can also show overbought and oversold conditions, but its lack of defined boundaries means this can be tricky. However, Momentum is especially useful for identifying divergences.

Advantages of Momentum Indicators

Momentum indicators are valuable tools in technical analysis, helping traders assess the strength and speed of price movements. They offer several benefits that enhance trading strategies and decision-making:

- Identify Trends Early: Market momentum indicators can reveal the start of a new trend and the end of the old trend, allowing traders to enter trades at opportune moments.

- Objective Analysis: They provide quantifiable data, reducing reliance on subjective analysis and emotional decision-making.

- Spot Overbought and Oversold Conditions: Momentum tools help traders identify when an asset is overbought or oversold, signalling potential reversals and exit points.

- Confirm Trade Signals: Combining momentum indicators with other technical tools enhances the accuracy of trade signals, providing stronger confirmation for trading decisions.

- Adaptable Across Markets: They can be applied to various assets, including stocks, forex, and commodities, making them versatile tools for traders.

Things to Consider When Trading Momentum Indicators

While momentum indicators can be an effective addition to any trader’s arsenal, there are a few things to be aware of:

- Trade with the Trend: Trends often last longer than you may think, and constantly looking for trend reversals will only end in frustration. Look for bullish signals during an uptrend and bearish signals in a downtrend.

- Use Multiple Indicators: Relying on a single tool can lead to false signals. Many traders combine a lagging indicator, like MACD, with a leading indicator, like RSI. Combining two or three tools can help confirm signals and improve trade accuracy.

- Beware of False Signals: Momentum indicators can sometimes generate false signals, especially in sideways or choppy markets. Being patient and waiting for confirmation before entering a trade is vital.

- Don’t Rely Too Heavily on Indicators: While momentum indicators can be helpful, relying solely on them without considering price action, market structure, or fundamental aspects can lead to poor trading decisions. Use these indicators alongside other tools for a momentum indicator strategy.

Final Thoughts

Now that you have a comprehensive overview of momentum indicators and the signals they produce, it’s time to put your knowledge into practice. After experimenting with a few tools and settling on your favourites, you can open an FXOpen account. You’ll be able to trade over 600+ markets with low costs and ultra-fast execution speeds while partnering with one of the world’s fastest-growing forex brokers. Good luck!

FAQ

How to Use Momentum Indicators?

With momentum indicators, traders monitor the rate of price changes to assess whether it is gaining or losing strength. Traders look for overbought or oversold conditions, divergences, and crossovers to determine potential entry and exit points.

What Is the Best Period for a Momentum Indicator?

If we are talking about the Momentum indicator, the best period depends on your trading style. For short-term traders, 7 and 10 periods are common, while long-term traders may prefer 14 and 21 periods. Testing various periods based on asset volatility can improve results.

What Is the Best Momentum Indicator for Scalping?

There is no best momentum indicator for scalping but the Relative Strength Index (RSI) is often favoured by scalpers due to its ability to quickly identify overbought or oversold conditions. Its responsiveness helps scalpers make rapid decisions in fast-moving markets.

What Is the Difference Between Momentum and Trend Indicators?

Momentum trading indicators measure the speed of price changes, while trend indicators assess the direction and persistence of price movements. To put it simply, momentum focuses on strength, while trend indicators focus on the overall direction.

Is MACD a Momentum Indicator?

Yes, the Moving Average Convergence Divergence (MACD) is one of the most popular momentum indicators, especially in stock trading. It reveals changes in momentum and helps identify potential trend reversals.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

O kurwa! Curvature in Technical Analysis: What Does It Tell Us?Curvature in TA is trading approach where curved lines are used instead of traditional straight trendlines. Curved lines help to visualize how trends evolve and can provide insights into potential reversals or trend continuations.

One of the known methods that utilize curvature is the MIDAS (Market Interpretation/Data Analysis System). This system was developed by physicist Paul Levine in 1995 and uses curved support and resistance lines based on Volume-Weighted Average Price (VWAP). The curves adapt dynamically as price and volume change, helping to identify trend shifts and potential reversals.

💡 Why should we use Curvature?

Dynamic Support and Resistance: Curved lines adapt to price changes, unlike static horizontal lines.

Reversal Signals: They can signal potential trend shifts earlier than traditional methods.

Better Trend Visualization: They are particularly useful for parabolic or exponential price movements.

📊 Applying Curvature to HBAR (1H TF)

There are two curves on my chart. Both of them shows a curvature pattern forming on the 1-hour timeframe.

L: The curve on left side indicates a strong downward move, and the price appears to be following this curve closely.

R: On the other hand I have drawn curve on the right side, which is alligned as downward curve as well, but it has different angle.

This post is meant to test my theory on real life example.

🔑 Key Points:

Breaks away from the curvature could indicate a potential trend reversal or consolidation.

Combining this analysis with volume and momentum indicators can improve accuracy when predicting possible bounce or breakdown scenarios. Let's see how it works!

Trading Psychology or Technical Analysis—When Mind Meets MatterThere’s an age-old battle in trading that makes the bull vs. bear debate look like a game of pickleball (no offense, finance bros). It’s the clash between the traders who swear by their charts and the ones who insist it’s all about mindset.

The technicals versus the psychologicals. Fibonacci retracements versus fear and greed. RSI versus your racing heart.

TLDR? Both matter—a lot. But knowing when to trust your indicators, when to trust yourself, and when to blend both is the fine line that separates those who thrive from those who rage-quit.

⚔️ The Cold, Hard Numbers vs. the Soft, Messy Brain

Think of technical analysis as your sometimes inaccurate GPS in trading. It’s structured, predictable, and gives you clear entry and exit points—until it doesn’t. Because markets, much like a GPS in a tunnel, don’t always cooperate.

That’s where psychology creeps in. Your mind is the ultimate trading algorithm, but it’s often running outdated software. Fear of missing out? That’s just your brain throwing a tantrum. Revenge trading? A glitch in emotional processing. Overconfidence after three wins in a row? Well done, you genius.

Technical analysis gives you signals, but trading psychology determines how you act on them.

🤷♂️ When the Chart Says One Thing, and Your Brain Says Another

Picture this: You’ve mapped out the perfect setup. The moving averages align, volume confirms the breakout, and everything screams BUY .

But then your brain whispers, What if it reverses? What if this is a trap? What if I’m about to donate my account balance to the market gods?

You hesitate. The price moves without you. Now, frustration kicks in, and suddenly, you’re clicking BUY at the worst possible moment—just in time for a pullback.

Sometimes, the best trade is the one you don’t take. And sometimes, trusting the chart over your overthinking brain is the only way forward.

🔥 The Big Guys and Their Choices

Legendary investors have picked their sides in this debate. Howard Marks, the co-founder of Oaktree Capital, has long been a big believer in market psychology. He argues that understanding investor sentiment is more valuable than any chart pattern because markets are driven by cycles of greed and fear.

On the other hand, Paul Tudor Jones—one of the greatest traders of all time—leans on technicals, famously saying, “The whole trick in investing is: ‘How do I keep from losing everything?’ If you use the 200-day moving average rule, you get out. You play defense.”

Both approaches work. The question is: Are you the type who deciphers market mood swings, or do you trust that a well-placed moving average will tell you when to cut and run?

🌀 Overtrading: The Technical Trap and the Psychological Spiral

Overtrading usually starts with a good trade, a small win, and a rush of dopamine that convinces you you’ve cracked the code. So, you take another trade. Then another. And before you know it, you’re firing off entries like a caffeinated gamer, except your PnL is the one taking the damage.

Technical traders fall into this trap because they see too many setups. Every candlestick pattern, every little bounce, every “potential” breakout becomes a reason to trade.

Psychological traders, on the other hand, may overtrade out of boredom, frustration, or the need to “make back” losses.

The result? An emotional rollercoaster that ends with an account balance you don’t want to check the next morning.

The fix? Trade selectively. The best setups don’t come every five minutes, and forcing trades is like forcing a bad joke—it just doesn’t land.

💪 Fear, Greed, and the Art of Holding Your Ground

Every trader knows the feeling: You’re in profit, but instead of letting the trade play out, you close early because profit is profit, right?

Wrong.

Fear of losing profits is what keeps traders from maximizing their wins. And greed—the evil twin of fear—is what makes traders hold losing trades, hoping for a miracle. It’s the classic “let winners run, cut losers short” rule in reverse.

Technical traders know where their stops and targets are. The problem? They often ignore them when emotions take over. Psychological traders “feel” the market but get crushed when that gut feeling betrays them.

The best traders find the balance—using technicals to set logical targets and psychology to actually stick to the plan.

🤝 The Solution? A System That Checks Both Boxes

So, what’s the verdict? Do you put matter over mind or mind over matter?

The truth is, great traders do both. They develop strategies based on technicals but manage execution with discipline. They respect risk management rules not just because the chart says so, but because they know how destructive emotions can be.

Here’s what the best do differently:

✅ They journal trades —not just the setups but how they felt during the trade.

✅ They stick to a trading plan so they can trust their system over impulse.

✅ They set rules that help them to properly bounce back from losses .

✅ They know the value of knowledge and never stop learning. (We’ve got you covered here, too. Go check the Top Trading Books if you’re a trader and stop by the Top Books on Investing if you’re an investor).

💚 Final Thoughts: Mind and Market in Harmony

In the end, trading is never just one or the other. It’s not pure math, and it’s not pure mindset. It’s a dance between structure and instinct, strategy and psychology. The ones who get it right aren’t just great at reading charts—they’re great at reading themselves.

Understanding Volume In TradingVolume is one of the most crucial yet often overlooked aspects of trading. It represents the total number of shares, contracts, or lots traded in a given period and provides insight into the strength of price movements. By analyzing volume effectively, traders can identify trends, confirm breakouts, and detect potential reversals before they happen.

Unlike price action alone, volume adds a critical layer of confirmation. A price move supported by high volume is more likely to be sustainable, while a move on low volume may indicate weakness or manipulation. Institutions, hedge funds, and large market players leave footprints through volume, and understanding these patterns can give traders an edge.

Volume Types 🎯

Volume

Buy/Sell Volume

Delta Volume

Cumulative Delta Volume

Relative Volume

Cumulative Relative Volume

Open Interest

Volume Profile

01. Volume 🔥

In trading, volume refers to the total quantity of assets traded during a specific time frame, whether they are stocks, futures contracts, options, or currencies. It measures the activity level of a security and provides insights into the strength or weakness of price movements.

Key aspects:

Market sentiment: High volume often indicates strong interest in a security and can signal the strength of a price move. Conversely, low volume may suggest a lack of interest and can indicate that price movements may not be sustainable.

Liquidity: High volume generally indicates better liquidity, meaning it is easier to enter and exit positions without significantly impacting the asset’s price. Low volume may lead to higher slippage and greater price volatility.

Volume spikes: Extremely high volume after a prolonged trend may signal the end of that trend (blow-off tops or panic selling bottoms).

Market types: Volume can vary by market type. In stock markets, it is usually reported in shares. In futures and options, it is reported in contracts, while in Forex, it is often measured by tick volume (the number of price changes).

Impact on market orders & liquidity

High Volume = Lower Slippage: Large orders can be executed more efficiently in high-volume environments.

Low Volume = Higher Volatility: Thin order books in low-volume markets can lead to erratic price swings and wider bid-ask spreads.

02. Buy/Sell Volume 💹

Buy volume and sell volume are key metrics that indicate the level of buying and selling activity in a market. They help traders assess the strength of price movements and market sentiment.

Buy Volume

Buy volume represents the number of shares, contracts, or lots traded at the ask price (or higher). It occurs when buyers are willing to pay the seller’s asking price, indicating buying pressure and potential bullish sentiment.

How buy volume is measured:

Transactions that execute at the ask price are counted as buy volume.

In some cases, aggressive market orders (where buyers take liquidity) are considered buy volume.

Buy volume is often compared to total volume to determine demand strength.

Sell Volume

Sell volume represents the number of shares, contracts, or lots traded at the bid price (or lower). It occurs when sellers accept the buyer’s bid price, indicating selling pressure and potential bearish sentiment.

How sell volume is measured:

Transactions executed at the bid price are counted as sell volume.

Market sell orders (where sellers take liquidity) contribute to sell volume.

Higher sell volume relative to buy volume suggests downward price pressure.

03. Delta Volume ✨

Delta Volume (often referred to as Volume Delta) is a key order flow metric that measures the difference between buy volume and sell volume over a given period.

Calculation

Delta Volume is defined as: Delta Volume = Buy Volume − Sell Volume

Where:

Buy Volume is the total volume transacted at the ask price (aggressive buying).

Sell Volume is the total volume transacted at the bid price (aggressive selling).

Interpretation

Positive Delta (Buy Volume > Sell Volume): Indicates more aggressive buying, suggesting bullish momentum.

Negative Delta (Sell Volume > Buy Volume): Indicates more aggressive selling, suggesting bearish momentum.

Near Zero Delta: Indicates a balance between buyers and sellers, often seen in range-bound markets.

04. Cumulative Delta Volume ⚡

Cumulative Delta Volume (CVD) is an advanced order flow metric that tracks the cumulative sum of Delta Volume over time.

Calculation

CVD t =CVD t − 1 + (Buy Volume − Sell Volume)

Where:

Buy Volume = Volume transacted at the ask price (aggressive buying).

Sell Volume = Volume transacted at the bid price (aggressive selling).

CVD*t = Current cumulative delta value.

CVD\*{t-1} = Previous cumulative delta value.

Interpretation

Rising CVD (Positive Delta Accumulation): Buyers are dominating, indicating bullish momentum.

Falling CVD (Negative Delta Accumulation): Sellers are in control, signaling bearish momentum.

Flat or Divergent CVD: A divergence between price and CVD can indicate potential reversals or absorption by large traders.

05. Relative Volume 📉

Relative Volume (RVOL) is a key trading metric that measures current trading volume compared to its historical average over a specified period. It helps traders assess whether a security is experiencing unusual trading activity and provides insights into liquidity, volatility, and potential price movements.

Calculation

Relative Volume is typically expressed as a ratio:

RVOL = Current Volume / Average Volume Over A Given Period

Where:

Current Volume = The total shares/contracts traded in the current period (e.g., 1-minute, 5-minute, daily).

Average Volume = The average volume over a past period (e.g., 10-day average, 50-day average).

A higher RVOL (>1) means the security is trading at above-average volume, while a lower RVOL (<1) indicates below-average activity.

Interpretation

RVOL > 2: Indicates significantly higher-than-normal volume, often linked to news events, earnings reports, or breakout trends.

RVOL around 1: Suggests normal trading activity with no unusual volume spikes.

RVOL < 1: Indicates low trading activity, which may lead to weak price movements and lower liquidity.

06. Cumulative Relative Volume 💥

Cumulative Relative Volume (CRVOL) is an advanced volume metric that tracks the total volume traded throughout a session relative to its historical average at the same time of day.

Calculation

Cumulative Relative Volume compares the ongoing total volume at a given point in time to the average cumulative volume at that same time over a historical period.

CRVOL = Cumulative Volume at Time X / Average Cumulative Volume at Time X over N periods

Where:

Cumulative Volume at Time X = The total volume traded from market open up to time X.

Average Cumulative Volume at Time X = The average total volume at that point in time over a selected historical period (e.g., 10 days).

N periods = The number of historical sessions used for comparison.

A CRVOL > 1 indicates higher-than-normal trading activity, while CRVOL < 1 suggests lower-than-average activity.

Interpretation

CRVOL > 1.5: Significantly higher trading activity than usual, often linked to news events, earnings reports, or institutional participation.

CRVOL ≈ 1: Normal trading volume, suggesting typical market conditions.

CRVOL < 0.8: Below-average trading volume, often indicating low liquidity and reduced volatility.

07. Open Interest 📊

Open Interest (OI) is a key metric in derivatives markets (futures and options) that represents the total number of outstanding contracts that have not been settled or closed. It is an important indicator of market activity, liquidity, and trader commitment.

How it works?

Open Interest increases or decreases based on the interaction between buyers and sellers:

OI Increases: When a new buyer and a new seller enter the market, creating a fresh contract.

OI Decreases: When an existing buyer and seller close their positions (either by offsetting trades or expiration).

OI Unchanged: If an existing contract is transferred between traders (one trader closes, another opens an equal position).

Interpretation

Rising OI + Rising Price: Suggests strong buying interest, indicating a bullish trend with conviction.

Rising OI + Falling Price: Indicates strong selling pressure, confirming a bearish trend.

Falling OI + Rising Price: Signals a short-covering rally or weakening trend, as traders close positions.

Falling OI + Falling Price: Suggests a lack of commitment to further declines, indicating potential trend exhaustion.

08. Volume Profile 🎢

Volume Profile is a powerful market analysis tool that plots trading volume at different price levels over a specific period. Unlike traditional volume indicators, which show volume per time interval, Volume Profile reveals where the most buying and selling activity occurred, helping traders identify key support and resistance levels, market structure, and potential price reactions.

Components

Volume Profile is displayed as a histogram on the vertical axis, showing the amount of volume traded at each price level. It is built using tick data or intraday price action and is often calculated for different timeframes (daily, weekly, monthly, or custom sessions).

Key components of Volume Profile include:

Point of Control (POC): The price level where the highest volume was traded, acting as a major support/resistance zone.

High Volume Nodes (HVN): Price areas with heavy trading activity, indicating consolidation zones where price is likely to stabilize.

Low Volume Nodes (LVN): Price areas with little trading activity, often leading to fast price movements as there is little resistance or support.

Value Area (VA): The price range where 70% of the total volume was traded, representing the "fair value" zone of the market.

Value Area High (VAH) & Value Area Low (VAL): The upper and lower boundaries of the Value Area, acting as dynamic support and resistance levels.

Types

Session Volume Profile: Analyzes volume for a single trading session (daily or intraday).

Composite Volume Profile: Covers a longer period (weeks, months, or custom-defined ranges).

Fixed Range Volume Profile: Analyzes volume for a specific price range or custom-selected area.

Developing Volume Profile: Updates dynamically throughout the trading session to show real-time changes in volume distribution.

Interpretation

POC as a Magnet: Price tends to revisit the POC due to high liquidity and market agreement at that level.

Breakouts from Value Area: If price breaks above VAH with strong volume, it signals a bullish trend; if it breaks below VAL, it signals a bearish trend.

Reaction at LVN: Price moves quickly through LVN areas but may reverse or stall when approaching HVN.

Rejections at VAH/VAL: If price rejects VAH, it may return to POC or VAL, and vice versa.

09. Indicators 📦

Volume indicators help traders gauge market strength by analyzing the number of shares or contracts traded.

Volume (Default) – Displays the total volume traded per candle, often color-coded based on price movement.

Volume Profile (Fixed Range, Session, Visible Range) – Shows volume distribution across price levels to identify support and resistance zones.

Volume Weighted Average Price (VWAP) – A dynamic support/resistance line that calculates the average price based on volume.

On-Balance Volume (OBV) – Measures cumulative volume flow to detect price trends and confirm breakouts.

Money Flow Index (MFI) – A volume-weighted RSI-like oscillator that identifies overbought and oversold conditions.

Volume Delta – Measures the difference between buying (ask) and selling (bid) volume.

Cumulative Delta Volume – Tracks the cumulative sum of volume delta over time to assess buying/selling pressure.

Relative Volume (RVOL) – Compares current volume to historical averages to highlight unusual trading activity.

Key Takeaways 📋

Volume is a crucial market indicator that reflects trading activity and liquidity, often preceding price movements.

High volume confirms trends and breakouts, while low volume can signal weak or false moves.

Volume Profile identifies key support and resistance zones, with High Volume Nodes (HVNs) acting as strong barriers and Low Volume Nodes (LVNs) allowing fast price movement.

Relative Volume (RVOL) highlights unusual market activity, while Delta Volume and Cumulative Delta reveal buying and selling pressure.

VWAP serves as a dynamic support/resistance tool commonly used by institutional traders.

How to Spot a Reversal Before It Happens (Before Your SL Hits)You know the feeling. You’re confidently riding a winning trend, high on the euphoria of green candles, when—BAM—the market flips faster than a politician in an election year. Your once-perfect trade is now a humiliating red mess, and your stop loss is the only thing standing between you and financial pain.

But what if you could see that reversal coming before it smacks you in the face? What if, instead of watching your profits evaporate, you could exit like a pro—or better yet, flip your position and ride the reversal in the other direction?

Reversals don’t happen out of thin air. The signs are always there—you just have to know where to look. In this idea, we break down how to spot reversals before they happen.

😉 Price Action: The Market’s Way of Dropping Hints

Markets don’t just change direction because they feel like it. Reversals happen when sentiment shifts—when buyers and sellers agree, sometimes all at once, that the current trend has run its course.

The first clue? Price action itself.

Look for hesitation. A strong uptrend should be making higher highs and higher lows. A downtrend should be carving out lower lows and lower highs. But what happens when that rhythm starts breaking?

A higher high forms, but the next low dips below the previous one? Warning sign.

Price approaches a key resistance level, but momentum stalls, and candles start looking indecisive? Caution flag.

A massive engulfing candle wipes out the last three sessions? Somebody just hit the eject button.

Before markets reverse, they throw up some red flags first—and depending on your time frame, these red flags can give you a heads up so you can prepare for what’s coming.

🔑 Divergence: When Your Indicators Are Screaming "Lies!"

Indicators might be lagging, but they’re not useless—especially when they start disagreeing with price.

This is where divergence comes in. If the price is making new highs, but your favorite momentum indicator (RSI, MACD, Stochastic—you name it) isn’t? That’s a major warning sign.

Bearish Divergence: Price makes a higher high, but RSI or MACD makes a lower high. Translation? The momentum behind the move is fizzling out.

Bullish Divergence: Price makes a lower low, but RSI or MACD makes a higher low. Translation? Sellers are losing their grip, and a bounce might be coming.

Divergences don’t mean immediate reversals, but they do suggest that something’s off. And when the market starts whispering, it’s best to listen before it starts shouting.

📍 Volume: Who’s Actually Driving the Move?

A trend without volume is like a car running on fumes—it’s only a matter of time before it stalls.

One of the clearest signs of a potential reversal is a divergence between price and volume.

If price is pushing higher, but volume is drying up? Buyers are getting exhausted.

If price is tanking, but selling volume isn’t increasing? The bears might be running out of steam.

If a major support or resistance level gets tested with huge volume and a violent rejection? That’s not a coincidence—it’s a battle, and one side is losing.

Reversals tend to be violent because traders are caught off guard. Watching the volume can help you avoid being one of them.

📊 Key Levels: Where the Market Loves to Reverse

Price doesn’t move in a vacuum. There are levels where reversals love to happen.

Support and Resistance: The most obvious, yet most ignored. When price approaches a level that’s been historically respected, pay attention.

Fibonacci Retracements: Markets are weirdly obsessed with 38.2%, 50%, and 61.8% retracement levels. If a trend starts stalling near these zones, don’t ignore it.

Psychological Numbers: Round numbers (like 1.2000 in Forex , $500 in stocks , or $120,000 in Bitcoin BITSTAMP:BTCUSD act like magnets. The more traders fixate on them, the more likely they become reversal points.

Smart money isn’t chasing prices randomly. They’re watching these levels—and if you’re not, you might consider doing it.

🚨 Candlestick Warnings: When the Market Paints a Picture

Candlesticks aren’t just pretty chart elements that give you a sense of thrill—they tell stories. Some of them hint at “reversal.”

Doji: The ultimate indecision candle. If one pops up after a strong trend, the market is questioning itself.

Engulfing Candles: A single candle that completely erases the previous one? That’s power shifting sides.

Pin Bars (Hammer/Inverted Hammer, Shooting Star): Long wicks show rejection. When they appear at key levels, reversals often follow.

Candlestick patterns alone aren’t enough, but when they show up alongside other reversal signals, they’re hard to ignore.

📰 The News Factor: When Fundamentals Crash the Party

Technical traders like to pretend breaking news doesn’t matter—until it does.

Earnings reports , economic data , interest rate decisions ECONOMICS:USINTR —these events can turn a strong trend into a dumpster fire instantly.

A stock making all-time highs right before earnings? Tread carefully.

A currency pair trending up before an inflation report? One bad number, and it’s lights out.

A crypto rally before a major regulation announcement? That could end badly.

Reversals don’t always come from charts alone. Sometimes, they come from the real world. And the market rarely gives second chances.

✨ The Reversal Cheat Sheet: When Everything Aligns

A single signal doesn’t guarantee a reversal. But when multiple factors line up? That’s when you need to take action.

If you see:

✅ Divergence on indicators

✅ Volume drying up or spiking at a key level

✅ A major support/resistance level getting tested

✅ Reversal candlestick patterns forming

✅ News lurking in the background

Then congratulations—you’ve likely spotted a reversal before your stop loss takes the hit.

✍ Conclusion: Stay Ahead, Not Behind

Catching reversals before they happen isn’t magic—it’s just about knowing where to look. Price action, volume, key levels, indicators, and even the news all leave clues. The problem? Most traders only see them after their account takes the hit.

Don’t be most traders. Pay attention, recognize the signs, and act before the market flips the script on you.

Because the best time to spot a reversal? Before it happens.

Do you use any of these strategies to spot reversals in your trading? What’s the last time you did it and what were you trading—forex, crypto, stocks or something else? Let us know in the comments!

How to pick a benchmark for you portfolio and beat the market What is a benchmark?

A benchmark is an index or a basket of assets used to evaluate the performance of an investment portfolio In the context of portfolio analysis the benchmark serves as a point of comparison to determine whether a fund a strategy or an investment is performing better worse or in line with the reference market.

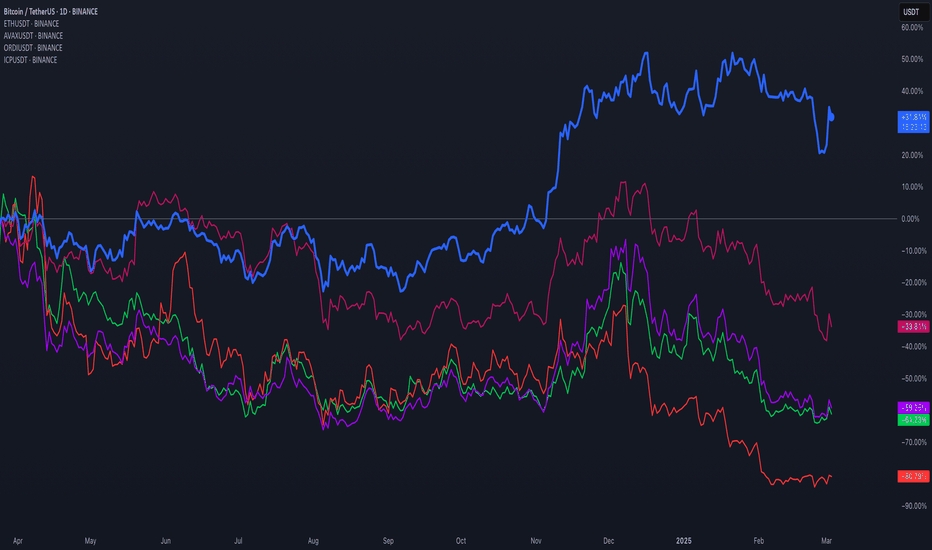

In the current chart, Bitcoin ( BINANCE:BTCUSDT ) is displayed with a solid and larger blue line in relation to other cryptocurrencies for the current period.

Benchmarks are essential tools for institutional and private investors as they allow measuring the effectiveness of asset allocation choices and risk management Additionally they help determine the added value of an active manager compared to a passive market replication strategy.

Benchmark analysis example: NASDAQ:TSLA - NASDAQ:NDX

Benchmark analysis example: NASDAQ:TSLA - NASDAQ:AAPL - NASDAQ:NDX

What is the purpose of a benchmark

The use of a benchmark in portfolio analysis has several objectives

1) Performance Evaluation: Provides a parameter to compare the portfolio's return against the market or other funds

2) Risk Analysis: Allows comparing the volatility of the portfolio against that of the benchmark offering a measure of risk management

3) Performance Attribution: Helps distinguish between returns derived from asset selection and those linked to market factors

4) Expectation Management: Supports investors and managers in assessing whether a portfolio is meeting expected return objectives

5) Strategy Control: If a portfolio deviates excessively from the benchmark it may signal the need to review the investment strategy

How to select an appropriate benchmark?

The choice of the correct benchmark depends on several factors:

1) Consistency with Portfolio Objective: The benchmark should reflect the market or sector in which the portfolio operates

2) Representativeness of Portfolio Assets: The benchmark should have a composition similar to that of the portfolio to ensure a fair comparison

3) Transparency and Data Availability: It must be easily accessible and calculated with clear and public methodologies

4) Stability Over Time: A good benchmark should not be subject to frequent modifications to ensure reliable historical comparison

5) Compatible Risk and Return: The benchmark should have a risk and return profile similar to that of the portfolio

Most used benchmarks

There are different benchmarks based on asset type and reference market Here are some of the most common.

Equity

FRED:SP500 Representative index of the 500 largest US companies.

NYSE:MSCI World Includes companies from various developed countries ideal for global strategies

FTSE:FTSEMIB Benchmark for the Italian stock market

NASDAQ:NDX Represents the largest technology and growth companies

Bonds

Barclays Global Aggregate Bond Index Broad benchmark for the global bond market

JP Morgan Emerging Market Bond Index EMBI Benchmark for emerging market debt