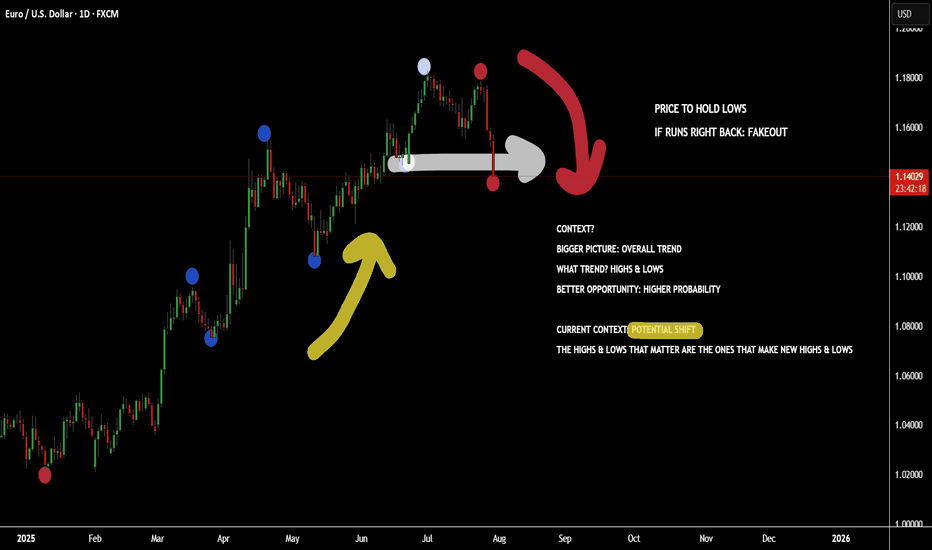

MARKET CONTEXT...#1 TOOL FOR PROFITABLE TRADING...EURUSD EXAMPLEHey hey TradingView family! Hope you are all doing amazing! I just wanted to come on and make a video speaking on market context, the #1 tool/idea that helped me go from struggling to profitable trader.

Understanding the bigger picture in trading, like TRULY understanding the higher timeframe perspective will work wonders in your analysis & trading whether you are a scalper or a position trader. It gives you the context for what market and the stage of market you are in whether in short term or longer term positions, which will IMMEDIATELY give you an edge.

Understanding=profitability in the markets. So does simplicity.

So watch this video as many times as you guys need, keep it simple, and watch this change your trading starting TODAY for the GOOD!

Cheers!

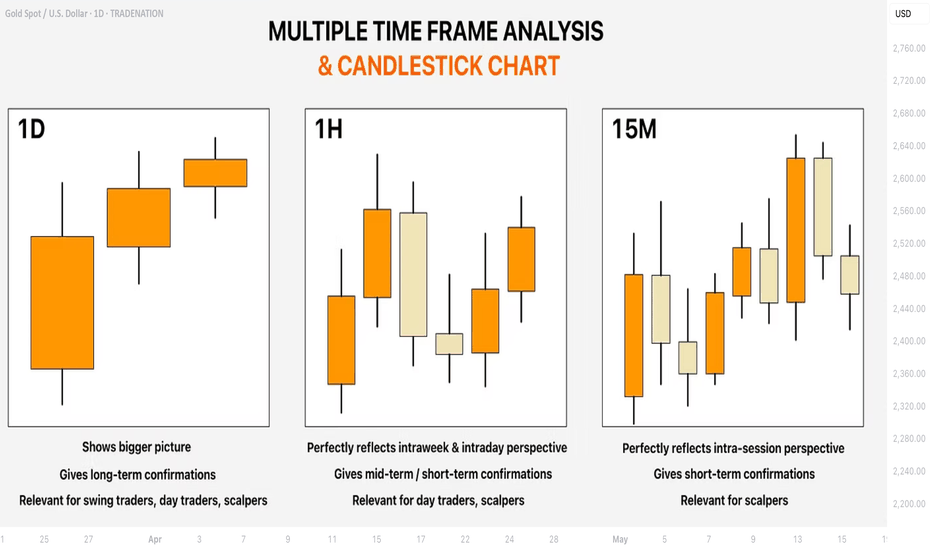

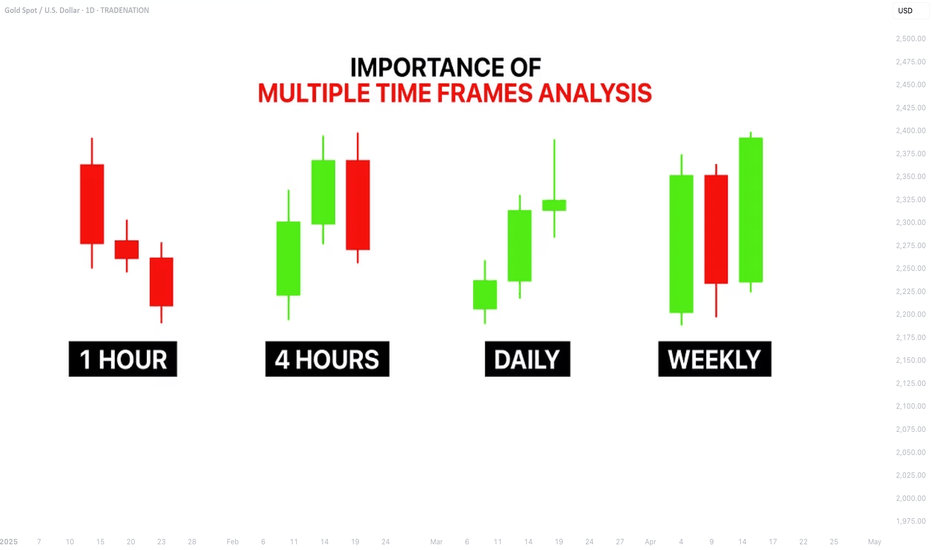

Multiple Time Frame Analysis

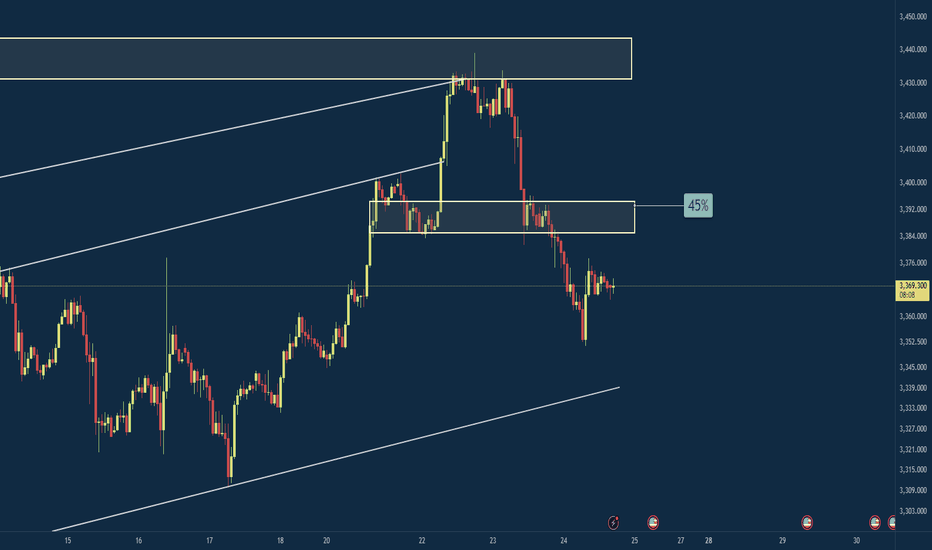

Welcome Back! Gold Trading Strategy & Key Zones to WatchIn this week’s welcome back video, I’m breaking down my updated approach to XAU/USD and how I plan to tackle the Gold markets in the coming days. After taking a short break, I’m back with fresh eyes and refined focus.

We’ll review current market structure, identify key liquidity zones, and outline the scenarios I’m watching for potential entries. Whether you’re day trading or swing trading gold, this breakdown will help you frame your week with clarity and confidence.

📌 Covered in this video:

My refreshed trading mindset after a break

Key support/resistance and liquidity zones

Market structure insights and setup conditions

What I’ll personally avoid this week

The “trap zones” that might catch retail traders off guard

🧠 Let’s focus on process over profits — welcome back, and let’s get to work.

Pending Orders Are Not Set in Stone – Context Still MattersIn a previous educational article, I explained why I almost never trade breakouts on Gold.

Too many fakeouts. Too many emotional traps.

Instead, I stick to what works:

• ✅ Buying dips

• ✅ Selling rallies

But even these entries — placed with pending orders — are not automatic.

Because in real trading, price is not just a number — it’s a narrative.

And if the story changes, so should the trade.

________________________________________

🎯 The Setup – Buy the Dip Around 3400

Let’s take a real example from yesterday.

In my analysis, I mentioned I would look to buy dips near 3400, a former resistance now acting as support.

Price dropped to 3405, just a few points above my pending buy at 3402.

We saw a clean initial bounce — confirming that short-term support was real.

But I missed the entry by 30 pips.

So far, so good.

But here’s the important part — what happened next changed everything.

________________________________________

🧠 The Rejection Shifted the Entire Story

The bounce from 3405 was immediately sold into at 3420, a newly formed short-term resistance (clearly visible on the 15-minute posted chart).

After that, price started falling again — heading back toward my pending order.

📌 At that point, I cancelled the order. Why?

Because the context had changed:

• Bulls had tried once — and failed at 3420

• Sellers were clearly active and waiting above

• A second drop into my level wouldn’t be a clean dip — it would be retest under pressure.

The market was no longer giving me a “buy the dip” setup.

It was showing me a failed recovery. That’s a very different trade.

________________________________________

💡 What If It Had Triggered?

Let’s imagine that price had hit 3402 first, triggering my order.

Then rebounded, failed at 3420, and started dropping again.

Even then, I wouldn’t hold blindly.

Once I saw the rejection at 3420, I would have understood:

The structure had shifted.

The bullish case is weakening.

Exit early — breakeven or small controlled loss.

________________________________________

🔁 Sequence > Level

This is the most important principle:

• ✅ First down, then up = healthy dip → shows buyers are still in control

• ❌ First up, then down = failed breakout → shows selling pressure is stronger

Two scenarios. Same price. Opposite meaning.

That’s why you should look for:

Not just where price goes — but how it gets there.

________________________________________

🔒 Pending Orders Are Conditional

Many traders treat pending orders like traps:

“Just let price come to my level, and I’m in.”, but you should refine a little

✅ Pending orders should be based on a conditional expectation

❌ Not a fixed belief that the zone must hold

If the market tells a different story, remove the order.

No ego. No drama. Just process.

________________________________________

📌 Final Thought

Trading isn’t just about catching a price.

It’s about understanding price behavior.

First down, then up = strength.

First up, then down = weakness.

Let the market show its hand — then decide if you want to play.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Japanese Candlestick Cheat Sheet – Part OneSingle-Candle Formations That Speak

Before you dream of profits, learn the one language that never lies: price.

Indicators are just subtitles — price is the voice.

Japanese candlesticks are more than just red and green bars — they reflect emotion, pressure, and intention within the market.

This series will walk you through the real psychology behind candlestick patterns — starting here, with the most essential:

🕯️ Single-candle formations — the quiet signals that often appear before big moves happen.

If you can’t read a doji, you’re not ready to understand the market’s hesitation.

If you ignore a hammer, you’ll miss the moment sentiment shifts.

Let’s start simple. Let’s start strong.

This is Part One of a five-part series designed to build your candlestick fluency from the ground up.

1. DOJI

Bias: Neutral

What is the Doji pattern?

The Doji candlestick pattern forms when a candle’s open and close prices are nearly identical, resulting in a small or nonexistent body with wicks on both sides. This pattern reflects market equilibrium, where neither buyers nor sellers dominate. Dojis often appear at trend ends, signaling potential reversals or pauses.

As a fundamental tool in technical analysis, Dojis help traders gauge the psychological battle between buyers and sellers. Proper interpretation requires context and experience, especially for spotting trend shifts.

Meaning:

Indicates market indecision or balance. Found during trends and may signal a reversal or continuation based on context.

LONG-LEGGED DOJI

Bias: Neutral

What is the Long-Legged Doji pattern?

The Long-Legged Doji captures a moment of intense uncertainty and volatility in the market. Its long wicks represent significant movement on both sides, suggesting that neither buyers nor sellers have control. This back-and-forth reflects the psychology of market participants wrestling for control, which often foreshadows a shift in sentiment. When traders see a Long-Legged Doji, it highlights the need to monitor for potential changes in direction.

They can appear within trends, at potential reversal points, or at consolidation zones. When they form at the end of an uptrend or downtrend, they often signal that the current trend may be losing momentum.

Meaning:

The prominent wicks indicate volatility. Buyers and sellers pushed prices in opposite directions throughout the session, ultimately reaching an indecisive close.

SPINNING TOP

Bias: Neutral

What is the Spinning Top pattern?

A Spinning Top is a candlestick with a small body and long upper and lower wicks, indicating that the market has fluctuated significantly but ultimately closed near its opening price. This pattern often points to a moment of indecision, where both buyers and sellers are active but neither dominates. Spinning Tops are commonly found within both uptrends and downtrends and can suggest that a trend is losing momentum.

For traders, a Spinning Top provides a valuable insight into market psychology, as it hints that the prevailing sentiment may be weakening. While Spinning Tops alone aren’t always definitive, they can serve as a precursor to larger moves if the following candles confirm a shift in sentiment.

Meaning:

Shows indecision between buyers and sellers. Common in both up and downtrends; signals potential reversal or pause.

HAMMER

Bias: Bullish

What is the Hammer pattern?

A Hammer candlestick appears at the end of a downtrend, with a small body and a long lower wick. This shape reflects a moment when sellers pushed prices lower, but buyers managed to absorb the selling pressure and drive prices back up before the close. This pattern is particularly important for spotting potential reversals, as it indicates that buyers are beginning to reassert control.

Hammers reveal the underlying psychology of a market where buying confidence is emerging, even if sellers have dominated for a while. To successfully trade this pattern, it’s essential to confirm the reversal with subsequent candles.

Meaning:

Showing rejection of lower prices. Signals potential bullish reversal, especially if followed by strong buying candles.

INVERTED HAMMER

Bias: Bullish

What is the Inverted Hammer pattern?

The Inverted Hammer forms at the bottom of a downtrend, with a small body and long upper wick. This pattern shows that buyers attempted to push prices higher, but sellers ultimately brought them back down by the close. The Inverted Hammer is an early sign of buyer interest, hinting that a trend reversal may be underway if subsequent candles confirm the shift.

Interpreting the Inverted Hammer helps traders understand where sentiment may be shifting from bearish to bullish, often marking the beginning of a recovery. Recognizing these patterns takes practice and familiarity with market conditions.

Meaning:

Showing rejection of higher prices. Can signal bullish reversal if confirmed by subsequent buying pressure.

DRAGONFLY DOJI

Bias: Bullish

What is the Dragonfly Doji pattern?

The Dragonfly Doji has a long lower wick and no upper wick, forming in downtrends to signal potential bullish reversal. This pattern reveals that sellers were initially in control, pushing prices lower, but buyers stepped in to push prices back up to the opening level. The Dragonfly Doji’s unique shape signifies that strong buying support exists at the lower price level, hinting at an impending reversal.

Recognizing the psychology behind a Dragonfly Doji can enhance a trader’s ability to anticipate trend changes, especially in markets where support levels are being tested.

Meaning:

Found in downtrends; suggests possible bullish reversal if confirmed by a strong upward move.

BULLISH MARUBOZU

Bias: Bullish

What is the Bullish Marubozu pattern?

The Bullish Marubozu is a large, solid candle with no wicks, indicating that buyers were in complete control throughout the session. This pattern appears in uptrends, where it signals strong buying momentum and often foreshadows continued upward movement. The absence of wicks reveals that prices consistently moved higher, with little resistance from sellers.

For traders, the Bullish Marubozu offers a glimpse into market psychology, highlighting moments when buyer sentiment is particularly strong. Learning to identify these periods of intense momentum is crucial for trading success.

Meaning:

Showing complete buying control. Found in uptrends or at reversal points; indicates strong buying pressure and likely continuation of the trend.

SHOOTING STAR

Bias: Bearish

What is the Shooting Star pattern?

The Shooting Star appears at the top of an uptrend, characterized by a small body and a long upper wick, indicating a potential bearish reversal. Buyers initially drove prices higher, but sellers took over, bringing prices back down near the open. This shift suggests that buyers may be losing control, and a reversal could be imminent.

Interpreting the Shooting Star gives traders valuable insights into moments when optimism begins to fade, providing clues about a potential trend shift.

Meaning:

Indicating rejection of higher prices. Signals a potential bearish reversal if followed by selling pressure.

HANGING MAN

Bias: Bearish

W hat is the Hanging Man pattern?

The Hanging Man candle forms at the top of an uptrend, with a small body and long lower wick. This pattern suggests that sellers attempted to drive prices down, but buyers regained control. However, the presence of a long lower shadow hints that sellers may be gaining strength, potentially signaling a bearish reversal.

The Hanging Man pattern reflects market psychology where buyers might be overextended, making it a valuable tool for identifying potential tops in trends.

Meaning:

Signals potential bearish reversal if confirmed by selling candles afterward.

GRAVESTONE DOJI

Bias: Bearish

What is the Gravestone Doji pattern?

With a long upper wick and no lower wick, the Gravestone Doji reveals that buyers pushed prices up, but sellers eventually regained control. Found in uptrends, it suggests that a bearish reversal could be near, as the upper shadow indicates buyer exhaustion. The Gravestone Doji often appears at market tops, making it a valuable indicator for those looking to anticipate shifts.

Understanding the psychology behind this pattern helps traders make informed decisions, especially in markets prone to overbought conditions.

Meaning:

Showing rejection of higher prices. Found in uptrends; signals potential bearish reversal if followed by selling activity.

BEARISH MARUBOZU

Bias: Bearish

What is the Bearish Marubozu pattern?

The Bearish Marubozu is a large, solid bearish candle without wicks, showing that sellers held control throughout the session. Found in downtrends, it signals strong bearish sentiment and suggests that the trend is likely to continue. The lack of wicks reflects consistent downward momentum without significant buyer support.

This pattern speaks about market psychology, offering traders insights into moments of intense selling pressure. Recognizing the Bearish Marubozu can help you align with prevailing trends and avoid buying into weakening markets

Meaning:

Showing strong selling pressure. Found in downtrends; signals continuation of the bearish trend or an intensifying sell-off.

👉 Up next: Double-candle formations – where price meets reaction.

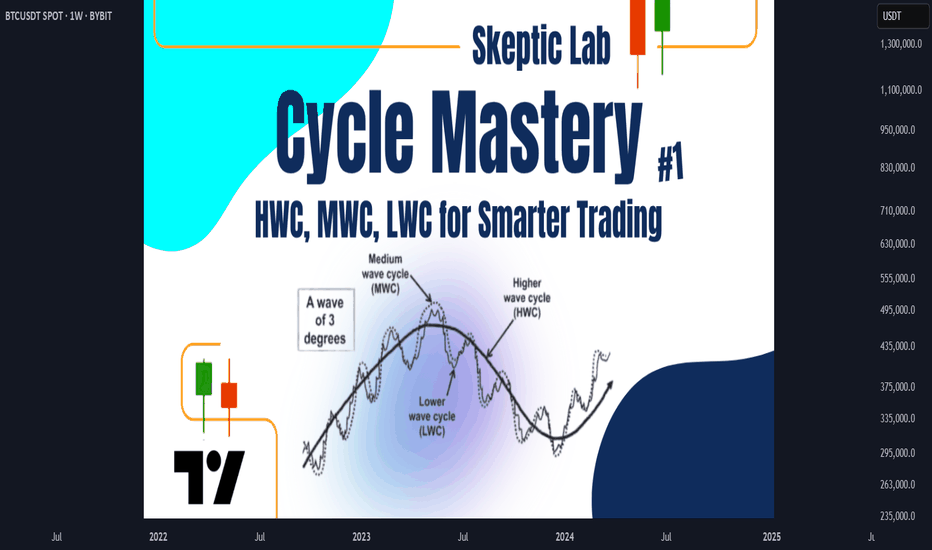

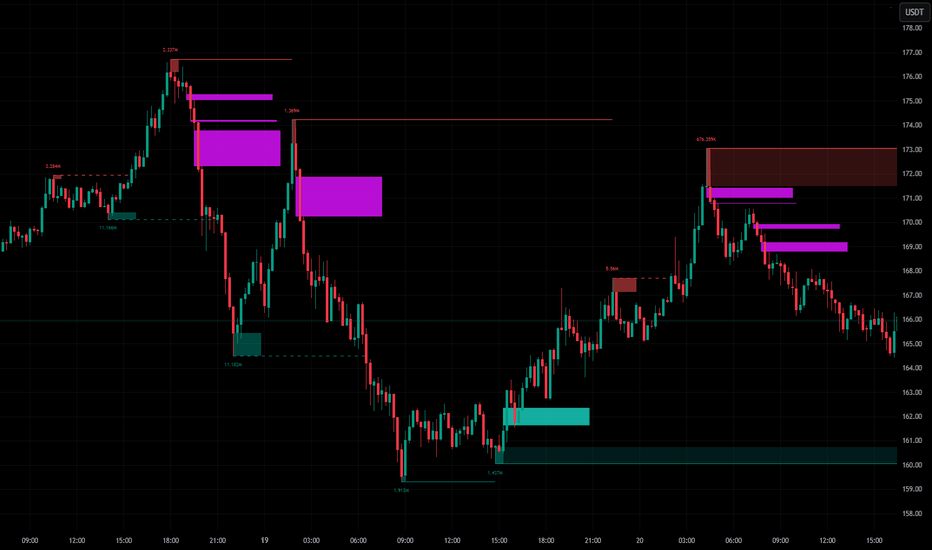

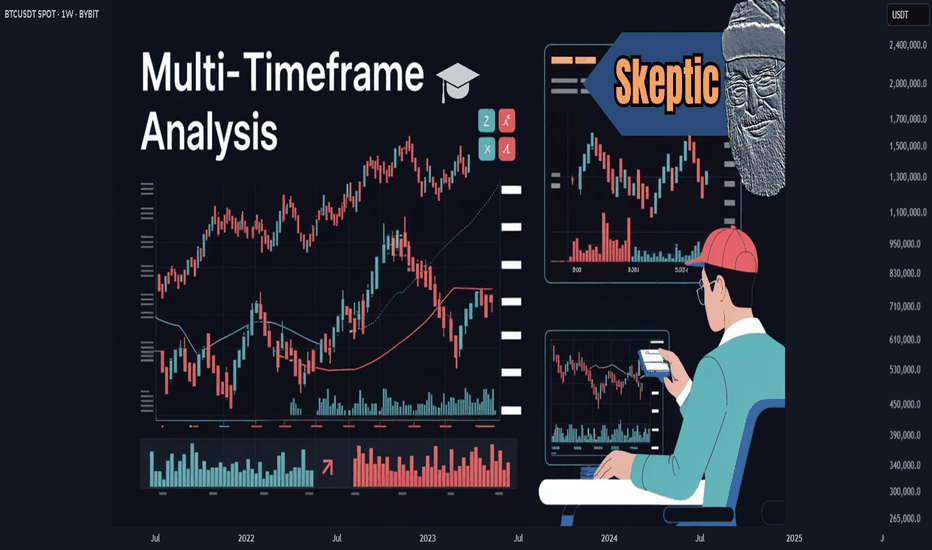

Skeptic| Cycle Mastery Part 1: HWC, MWC, LWC for Smarter TradingUnderstanding Higher Wave Cycle ( HWC ), Minor Wave Cycle ( MWC ), and Low Wave Cycle ( LWC ) is the key to making informed trading decisions, simplifying when to go long , short , or stay out . This Part 1 masterclass introduces these cycles, their relative nature, and how to align them with your strategy for precise entries and effective risk management . Let’s break it down. 📊

The Three Cycles: HWC, MWC, LWC

We trade across three market cycles:

HWC (Higher Wave Cycle) : The big-picture trend, like Bitcoin’s yearly uptrend.

MWC (Minor Wave Cycle): A medium-term trend, often an uptrend or corrective phase within the HWC.

LWC (Low Wave Cycle): The short-term daily trend, which can be range-bound, uptrend, or downtrend.

Knowing these cycles helps you decide when to e nter long, short, or avoid trading altogether, ensuring you align with the market’s rhythm.

Defining Your Cycles: It’s Relative

The main question before diving in: What timeframes are HWC, MWC, and LWC? The answer is relative—it depends on your strategy. Think of it like a temperature scale: 0°C isn’t “no heat” but a reference point (water’s freezing point). Similarly, your cycles are defined by the largest timeframe you analyze:

HWC: Your highest timeframe (e.g., Weekly for long-term traders).

MWC: The next level down (e.g., Daily).

LWC: Your shortest timeframe (e.g., 4-Hour or 1-Hour).

Ask yourself: What’s the largest timeframe I check? Set your HWC there, then scale down for MWC and LWC based on your trading style. This relativity ensures your cycles fit your unique approach.

While shorter cycles (LWC, MWC) form the HWC, the HWC’s power dominates, influencing smaller cycles. Let’s explore how to trade based on these relationships.

Trading Scenarios: When to Act

Scenario 1: HWC Uptrend, MWC Range

When the HWC is in an uptrend and the MWC is range-bound:

Action: Enter a long position on the first MWC wave when the LWC breaks the ceiling of the MWC range (e.g., a box breakout).

Why? The HWC’s bullish power supports the move, likely triggering an MWC uptrend. This makes the first wave a strong, low-risk entry.

Example: If the LWC (e.g., 4-hour) breaks the MWC range ceiling with a strong candle, you can confidently go long, backed by the HWC uptrend.

Scenario 2: HWC Downtrend, MWC Range

When the HWC is in a downtrend and the MWC is range-bound:

Action: Skip the first MWC wave. If the LWC breaks the MWC range ceiling, avoid going long—the bearish HWC could reject the move, resuming its downtrend.

Wait for the Second Wave: Let the MWC return to a range after the first wave. If the LWC breaks the range ceiling again, go long with confidence—the HWC’s influence is less likely to disrupt this second wave.

Risk Management Tips (if you trade the first wave against the HWC):

Reduce Risk: Lower your position size to minimize exposure.

Take Profits Early: Close the position or secure most profits (e.g., scale out) once you hit your R/R target, as volatility is high.

Wider Stop-Loss: Set a larger stop-loss to account for potential HWC-driven reversals, as stop-loss hunts are common in this scenario.

Adjusting Stop-Loss Size Based on Cycles

Aligned Cycles (HWC, MWC, LWC in Same Direction): When all three cycles align (e.g., all uptrend), set a tighter stop-loss relative to market conditions. Gradually scale out profits instead of closing the position, as the trend’s strength supports higher R/R (e.g., 5 or 10).

HWC Against MWC/LWC: If the HWC opposes the other cycles (e.g., HWC downtrend, MWC/LWC uptrend), use a wider stop-loss. The HWC’s power could reverse the LWC, lowering your win rate if stops are too tight. Expect volatility and plan accordingly.

Final Vibe Check

This Cycle Mastery Part 1 equips you to time MWC waves with precision, aligning HWC, MWC, and LWC for smarter entries. By mastering when to trade the first or second wave, you’ll avoid traps and maximize your edge. Part 2 will dive deeper with examples—stay tuned! At Skeptic Lab, we trade with no FOMO, no hype, just reason. Protect your capital—stick to 1%–2% risk per trade. Want Part 2 or another topic? Drop it in the comments! If this guide sharpened your game, hit that boost—it fuels my mission! 😊 Stay disciplined, fam! ✌️

💬 Let’s Talk!

How will you time your MWC waves? Share your thoughts in the comments, and let’s crush it together!

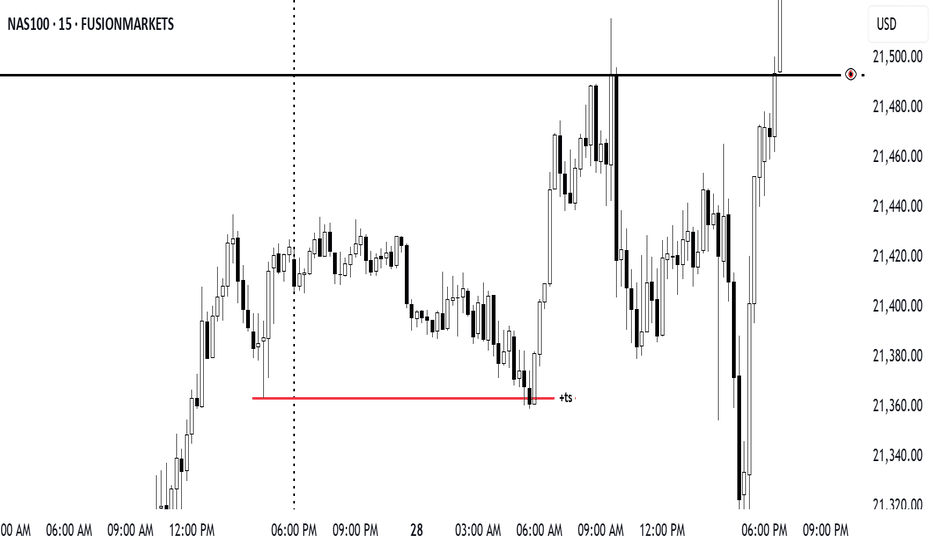

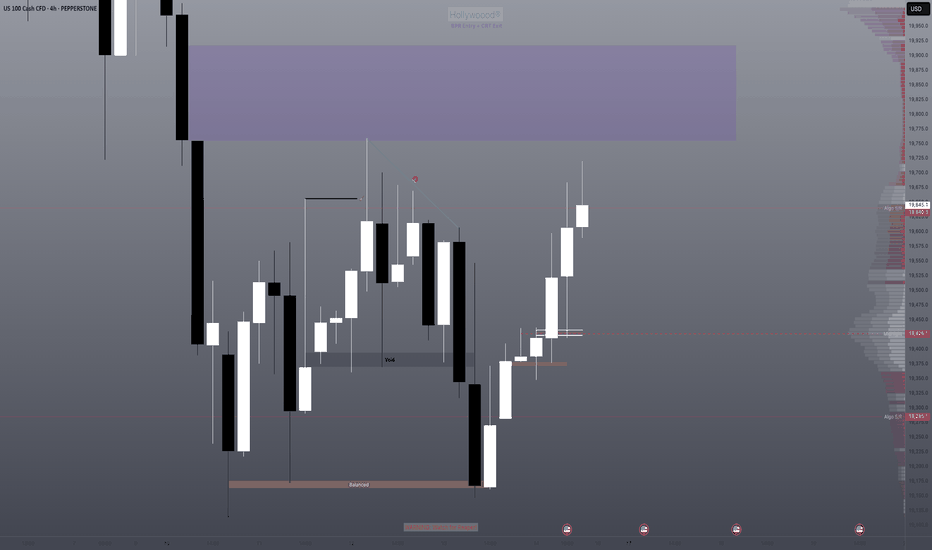

NASDAQ Bread and Butter & Turtle Soup Example XIIaight, so im gonna break down a trade i took on nasdaq today using a setup i picked out myself from the ict concepts. just my own flavor of it, ya know

before i knock out at night, i open up the charts real quick — just tryna see if there's any clean liquidity chillin’ nearby. if there aint, i shut it down and catch some solid sleep. but if there is... bingo baby

this basically means i might just wake up rich tomorrow, bro. on the daily, im seeing two strong green days back to back, and right above that boom some equal highs just sitting there, begging to get run. they are even cleaner on the 1h. bias locked in. im waking up tomorrow and hunting longs, simple as that.

i mark up the daily open first thing. if im lookin for longs, i wanna see some turtle soup under the open. if im hunting shorts, i need that setup above the open. thats just how i roll.

if there is a swing low, trend liquidity, or some equal lows carryin over from yesterday, im locked in on those levels for turtle soup. if not, im just chillin, waitin for price to build some fresh liquidity during the day and then snatch it.

in this setup, i got some leftover liquidity from yesterday plus a clean 4h fvg sittin there like a neon sign.

next, i check the time. liquidity grabs usually hit during one of the killzones depends on the pair, but im watchin asia, london, or new york sessions.

then i scope out if there is any news droppin around that time, especially stuff that could move the pair. no point in getting blindsided.

and yeah, i always peep correlated pairs too sometimes they snitch before your chart even says a word.

when all the stars and planets line up just right, that is when I drop down to the 15m and wait for a clean csd to show up. but here is the thing i dont jump in the second i see it. i wanna see price actually leave the liquidity zone.

yeah, it might lower my rr a bit, but the win rate goes way up. It keeps me outta those fake-ass turtle soups that look good at first but just wanna wreck your stop.

once im in the trade, i usually try to close out half the position the same day take profits where the chance of price reversing is damn near zero. then i let the other half ride toward my target liquidity. just lettin it breathe, do its thing.

thats it, peace out

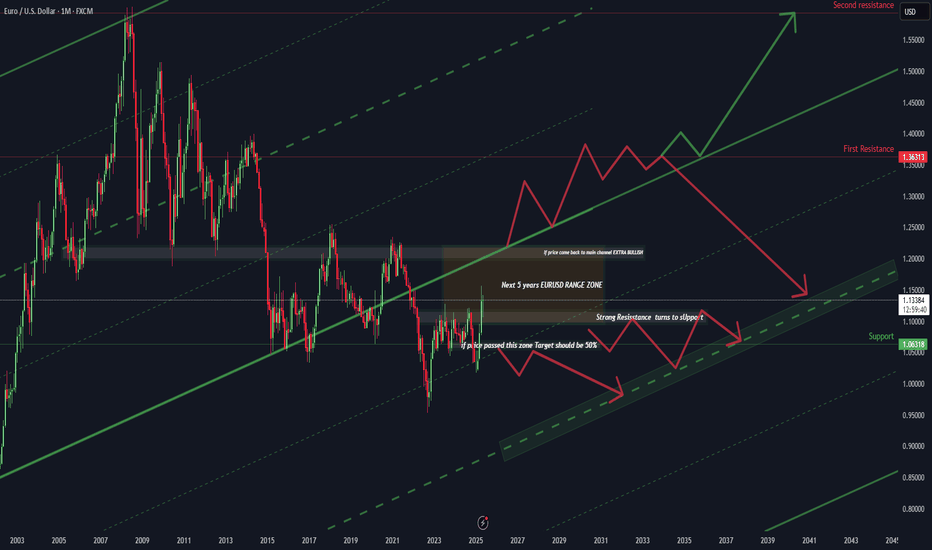

EUR/USD – The 20-Year Gameplan | How to Think Like a Macro TradWelcome to the most important EUR/USD chart you'll see this decade.

This isn't just technical analysis. This is a macro roadmap stretching from 2003 to 2045 — built for serious traders who think beyond the next candle.

@TradeWithMky #Miracle

📚 What This Chart Teaches You:

✅ Long-Term Channeling: How to map 40-year channels that actually hold.

✅ Key Reaction Zones: Learn where multi-year reversals are most likely.

✅ "Range of a Generation": Why EUR/USD could stay trapped for 5+ years.

✅ Two Futures – One Decision Point: Reclaiming the main channel = Ultra Bullish. Rejection = Controlled Descent.

🎯 Trade Plan Logic (Educational Focus)

📌 If price breaks above the range zone, target is a 50% Fibonacci expansion — with 1.36 and 1.55 as the macro resistances.

📌 If price rejects, the pair could drift within a multi-year compression channel targeting the 1.06–0.95 zone over the next decade.

📌 This model blends technical geometry, historical behavior, and trend integrity — skills every pro trader should master.

👁️ Why This Matters

This is not about predicting next week’s move.

This is about training your eyes to see structure where others see noise.

And if you can see the macro structure, you can outperform 99% of traders who zoom in too much, too soon.

⚡ Bonus Wisdom:

"Amateurs react. Professionals anticipate. Masters build maps."

– TradeWithMky

🔔 Follow me for more deep-dive macro education.

This is where Forex meets vision.

📌 TradeWithMky – where altcoins speak louder than Bitcoin... but Forex whispers the truth.

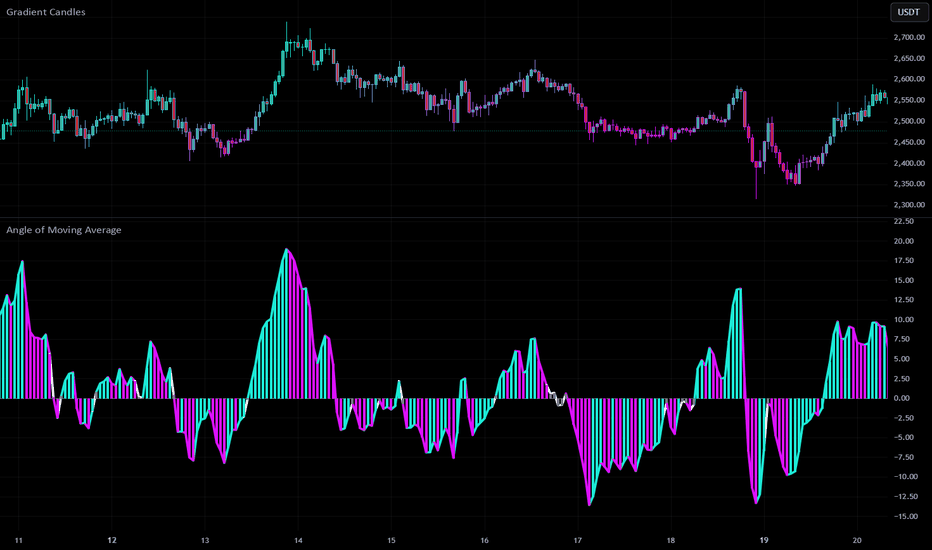

Trade the Angle, Not the Chop: Angle of MA ExplainedNot all moving averages are created equal. While most traders rely on the slope of a moving average to gauge trend direction, the Angle of Moving Average script by Mango2Juice takes it a step further—literally measuring the angle of the MA to help filter out sideways markets and highlight trending conditions.

Let’s explore how this tool works, how we use it at Xuantify, and how it can sharpen your trend-following strategy.

🔍 What Is the Angle of Moving Average?

This indicator calculates the angle of a moving average (default: EMA 20) to determine whether the market is trending or ranging. It introduces a No Trade Zone , visually marked in gray, to signal when the angle is too flat—suggesting the market is consolidating.

Key Features:

Measures the slope of the moving average

Highlights ranging zones with a gray color

Helps filter out low-momentum conditions

Customizable MA type and length

🧠 How We Use It at Xuantify

We use the Angle of Moving Average as a trend filter —not a signal generator.

1. Trend Confirmation

We only take trades in the direction of a steep enough angle. If the MA is flat or in the gray zone, we stay out.

2. Entry Timing

We combine this with structure tools (like BOS/CHOCH) to time entries after the angle confirms a trend is underway.

🎨 Visual Cues That Matter

The script uses color to show when the market is:

Trending : Clear slope, colored line

Ranging : Flat slope, gray line (No Trade Zone)

This makes it easy to:

Avoid choppy markets

Focus on momentum-driven setups

Stay aligned with the dominant trend

⚙️ Settings That Matter

You can customize:

MA Type : EMA, SMA, etc.

MA Length : Default is 20

Angle Sensitivity : Adjust to define what counts as “flat”

⚙️ Higher timeframe alignment

You can look at HTFs for better and stronger entry and exit points.

Below a 1H and 4H chart where the 4H clearly adds strong buying power for a good long entry point.

🔗 Best Combinations with This Indicator

We pair the Angle of MA with:

Structure Tools – BOS/CHOCH for trend context

MACD 4C – For momentum confirmation

Volume Profile – To validate breakout strength

Fair Value Gaps (FVGs) – For sniper entries

⚠️ What to Watch Out For

This is a filter , not a signal. It won’t tell you when to enter or exit—it tells you when not to trade . Use it with price action and structure for best results.

🚀 Final Thoughts

If you’re tired of getting chopped up in sideways markets, the Angle of Moving Average is a simple but powerful filter. It helps you stay out of low-probability trades and focus on trending opportunities.

Try it, tweak it, and see how it fits into your system.

Learn TOP 3 Elements of a Perfect SWING TRADE (GOLD, FOREX)

In the today's post, I will share with you a formula of ideal swing trading setup.

✔️Element 1 - Market Trend

When you are planning a swing trade, it is highly recommendable that the direction of your trade would match with the direction of the market trend.

If the market is trading in a bullish trend, you should look for buying the market while if the market is bearish, you should look for shorting.

Take a look at CHFJPY pair on a daily. Obviously, the market is trading in a bullish trend and your should look for swing BUYING opportunity.

✔️Element 2 - Key Level

You should look for a trading opportunity from a key structure.

IF the market is bullish, you should look for buying from a key horizontal or vertical SUPPORT, WHILE if the market is bearish, you should look for shorting from a key horizontal or vertical RESISTANCE.

CHFJPY is currently approaching a rising trend line - a key vertical support.

Please, note that if the price is NOT on a key structure, you should patiently wait for the test of the closest one.

✔️Element 3 - Confirmation

Once the market is on a key level, do not open a trading position blindly. Look for a confirmation - for the sign of strength of the buyers, if you want to buy or for the sign of strength of the sellers, if you are planning to short.

There are dozens of confirmation strategies, one of the most accurate is the price action confirmation.

Analyzing a 4H time frame on CHFJPY, we can spot a falling wedge pattern. While the price is stuck within that, the minor trend remains bearish. Bullish breakout of the resistance of the wedge will be the important sign of strength of the buyers and can be your strong bullish confirmation.

Following these 3 conditions, you will achieve high win rate in swing trading. Try these techniques yourself and good luck in your trading journey.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Exposing Price Inefficiencies: The Role of Fair Value Gaps (FVG)In the ever-evolving landscape of price action trading, one concept has gained significant traction among institutional and retail traders alike: Fair Value Gaps (FVGs) . At Xuantify, we believe that understanding market inefficiencies is key to anticipating high-probability setups—and FVGs offer just that.

🔍 What Is a Fair Value Gap?

A Fair Value Gap is a price imbalance that occurs when the market moves too quickly in one direction, leaving behind a "gap" in liquidity. This typically happens during high volatility or news-driven events, where price skips over levels without sufficient buying or selling.

In technical terms, an FVG is identified when a candle’s low (in a bullish move) or high (in a bearish move) does not overlap with the previous or next candle. This creates a three-candle structure :

- Bullish FVG : Candle 1 (bearish), Candle 2 (strong bullish), Candle 3 (bullish or neutral)

- Bearish FVG : Candle 1 (bullish), Candle 2 (strong bearish), Candle 3 (bearish or neutral)

These gaps often act as magnets for price , as the market seeks to rebalance and fill the inefficiency.

🧠 Why Do FVGs Matter?

FVGs are not just visual anomalies—they represent institutional footprints . When large orders are executed, they often cause price to move rapidly, leaving behind unfilled orders. Smart money tends to revisit these zones to complete their positions.

Key Benefits of Trading FVGs:

- ✅ High-probability entries: Price often returns to fill the gap before continuing its trend.

- ✅ Clear invalidation levels: The edges of the gap provide natural stop-loss zones.

- ✅ Works across timeframes: From scalping on the 1-minute to swing trading on the daily.

🧩 Using the “Fair Value Gap ” Indicator

To simplify the process of identifying and trading FVGs, we recommend the Fair Value Gap indicator on TradingView. This tool automatically highlights bullish and bearish FVGs, tracks their mitigation, and even provides alerts when gaps are filled.

Key Features:

- Auto-detection of bullish and bearish FVGs

- Mitigation tracking: See which gaps are filled and which remain open

- Threshold filtering: Focus on significant gaps by adjusting the minimum size

- Dynamic mode: Monitor evolving FVGs in real time

- Alerts: Get notified when price fills a gap

💡 No Repainting, No Delays

One of the most reassuring aspects of this indicator is that it does not repaint . Once a fair value gap is printed, it stays on the chart—no disappearing zones, no misleading signals.

Even better, the indicator plots FVGs in real time . It uses a three-candle structure and confirms the gap immediately after the third candle closes . This means you’re seeing valid, actionable gaps as they form—not in hindsight.

This makes the LuxAlgo FVG tool a reliable companion for both live trading and backtesting , giving traders the confidence that what they see is what the market actually delivered.

How to Use It:

1. Add the indicator : Search for “Fair Value Gap ” in the TradingView Indicators tab.

2. Adjust settings :

- Use the “Threshold %” to filter out smaller, less relevant gaps.

- Enable “Mitigation Levels” to track filled gaps.

- Use “Auto Threshold” for adaptive filtering based on volatility.

3. Trade setups :

- Contrarian : Wait for price to fill a gap and look for reversal signals.

- Trend-following : Enter trades in the direction of the gap when it forms.

⚠️ FVGs Are Not Always Honored

While FVGs offer powerful insight into market inefficiencies, it's important to remember: they are not guaranteed reversal or continuation zones . Sometimes price will blow right through a gap without reacting—especially in trending or news-driven markets.

Why this happens:

The gap may have already been mitigated on a lower timeframe

Strong momentum or macroeconomic catalysts override technical zones

The FVG is too small or lacks confluence with other key levels

How to manage this:

Always combine FVGs with structure, liquidity, and volume

Use alerts and confirmations (e.g., candle patterns or BOS/CHOCH)

Avoid trading FVGs in isolation—context is everything

🧠 Best Indicator Combinations with FVG

To increase the accuracy of FVG-based setups, we recommend combining the LuxAlgo FVG indicator with the following tools:

1. Market Structure (LuxAlgo Smart Money Concepts)

Identify breaks of structure (BOS) or change of character (CHOCH) near FVGs. Use structure shifts to confirm whether the FVG is likely to hold or fail.

2. Volume Profile or Session Volume

Confirm FVGs with low-volume nodes or volume gaps . FVGs aligning with volume imbalances are more likely to be respected.

3. Order Blocks

Look for FVGs that overlap with bullish or bearish order blocks . This confluence often signals institutional accumulation or distribution.

4. Relative Strength Index (RSI) or Stochastic

Use momentum indicators to confirm exhaustion or continuation near FVGs. For example, a bullish FVG + oversold RSI = potential long setup.

5. Liquidity Zones (Equal Highs/Lows, Swing Points)

FVGs near liquidity pools are often targeted before reversal. Combine with sweep setups for sniper entries.

Here’s a new section you can add to your blog post, focusing on the power of **Multi-Timeframe (MTF) FVG Alignments**:

🧭 Multi-Timeframe FVG Alignments

One of the most powerful ways to increase the reliability of Fair Value Gaps is by using multi-timeframe confluence . When FVGs align across different timeframes—say, a 1H FVG inside a 4H FVG zone—it often signals a high-probability reaction area .

Why it works:

Higher timeframe FVGs represent broader institutional imbalances

Lower timeframe FVGs offer precise entries within those zones

Alignment confirms that multiple layers of market participants are active in the same area

How to use it:

Start with a higher timeframe (e.g., 4H or Daily) and mark key FVGs

Drop to a lower timeframe (e.g., 15M or 1H) and look for fresh FVGs forming inside the higher zone

Wait for structure shifts or liquidity sweeps within the lower timeframe FVG before entering

This technique is especially effective when combined with tools like LuxAlgo Smart Money Concepts and Volume Profile , helping you time entries with sniper-like precision while staying aligned with the broader market narrative.

📊 Backtest It Yourself

FVGs are best understood through chart time . Load up your favorite pair on TradingView, activate the LuxAlgo FVG indicator, and observe how price reacts. You’ll be surprised how often these zones act as support, resistance, or launchpads for major moves.

🚀 Final Thoughts

Fair Value Gaps are more than just a buzzword—they’re a window into how smart money operates. By incorporating FVGs and tools like the LuxAlgo indicator , you gain a deeper understanding of market dynamics and a sharper edge in execution.

At Xuantify, we’re committed to decoding institutional logic and bringing it to the retail trader. Stay tuned for more insights, and as always— trade smart, not hard .

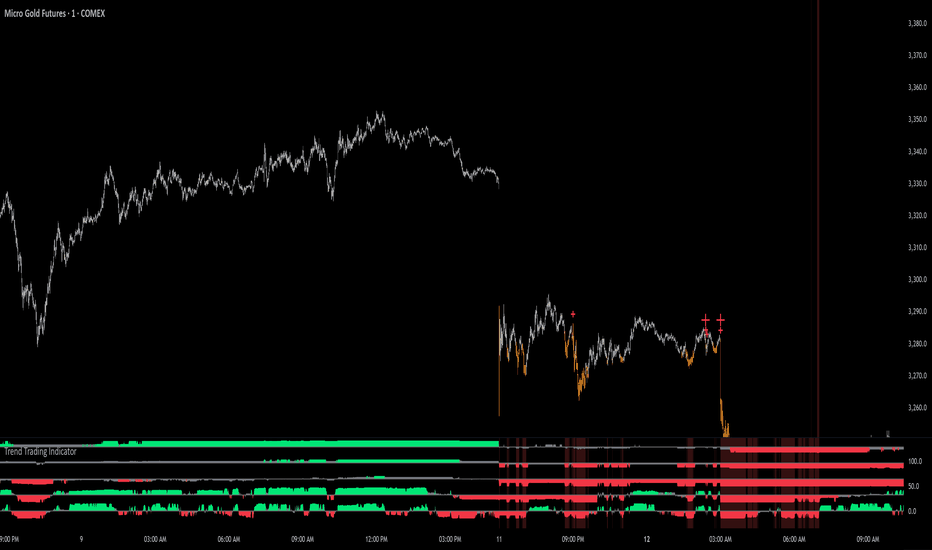

How To Setup & Use The Trend Trading IndicatorThis video gives an in depth explanation of each setting of the Trend Trading Indicator so you can understand how to set up the indicator properly and get your desired results.

We cover the following:

Master trend signals and settings

How to configure your master trend signal timeframes correctly

How to get rid of signals when the market is ranging

Each type of extra signal: strong all timeframe trends, pullbacks during strong trends, trend score signals and more

What timeframes and settings to use for intraday trading

Customizing the settings to get the results that fit your trading style

Make sure to test out your settings on various markets using historical data to ensure you have the indicator performing according to your specific parameters.

If you have any questions about using the indicator or the settings, feel free to reach out to us.

Happy Trading :)

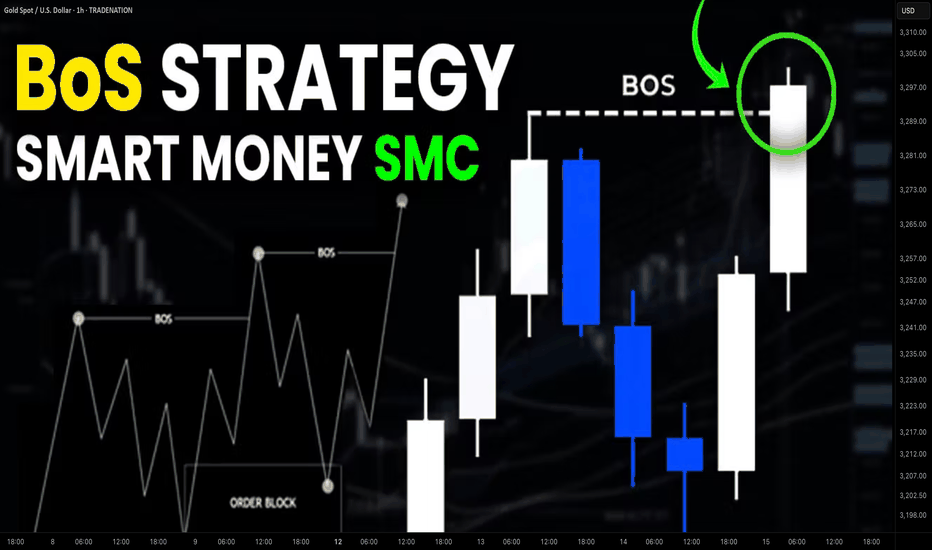

Simple Break of Structure BoS Trading Strategy Explained

One of the best and reliable strategies to trade break of structure BoS is to apply multiple time frame analysis.

In this article, I will teach you my break of structure gold forex trading strategy. You will get a complete step-by-step guide with examples.

Let's start with a quick theory and let me explain to you what is break of structure BoS in Smart Money Concept SMC trading.

In a bullish trend, break of structure BoS is an important event that signifies a continuation of an uptrend. It is based on a violation and a candle close above the level of the last higher high (HH).

After a breakout, the broken level becomes the first strong support for trend-following buying.

Check multiple examples of confirmed breaks of structure BoS on GBPNZD forex pair on a weekly time frame.

In a downtrend, Break of Structure BoS means a bearish trend continuation . Break of Structure is considered to be confirmed when a candle closes below the level of the last lower low (LL).

The broken key level becomes the closest strong support for buying.

That's the example of a healthy downtrend on USDJPY forex pair on a daily. Each break of structure BoS pushed the prices lower, providing a strong signal to sell.

What newbie traders do incorrectly, they trade break of structure without a confirmation strategy, and it leads to substantial losses.

Though GBPCHF is trading in a bullish trend and though each BoS provided a trend-following signal. The price retraced significantly lower below the broken structure before the growth resumed.

When the price retests a broken structure after BoS in a bullish trend, start lower time frame analysis.

If you identified a break of structure on a daily, analyze 4h/1h time frames.

If on a 4H, then 30/15 minutes.

After the price sets a new higher high with BoS in uptrend, it usually starts trading in a minor bearish trend on lower time frames.

With our strategy, your signal to buy will be a retest of a broken structure and a consequent bullish Change of Character CHoCH . That will provide an accurate bullish signal.

In a bearish trend, analyze the lower time frames after a retest of a broken structure. Your signal to sell will be a bearish Change of Character CHoCH.

Look at a price action on EURCHF on a daily.

We see a strong bullish trend and a confirmed Break of Structure BoS.

According to the rules of our trading strategy, we start analyzing 4h/1h time frames after a retest of a broken level of the last Higher High.

Our signal to buy is an intraday bullish CHoCH. We open a long trade after that with the stop loss below the intraday lows and take profit being a current high.

That's how simple this strategy is.

Multiple time frame analysis provides the extra level of security.

Strong lower time frame confirmation substantially increases the win ratio of a trading setup.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Your ULTIMATE Guide For Time Frames in Gold, Forex Trading

If you just started trading, you are probably wondering what time frames to trade. In the today's post, I will reveal the difference between mainstream time frames like daily, 4h, 1h, 15m.

Firstly, you should know that the selection of a time frame primarily depends on your goals in trading. If you are interested in swing trading strategies, of course, you should concentrate on higher time frames analysis while for scalping the main focus should be on lower time frames.

Daily time frame shows a bigger picture.

It can be applied for the analysis of a price action for the last weeks, months, and even years.

It reveals the historical key levels that can be relevant for swing traders, day traders and scalpers.

The patterns that are formed on a daily time frame may predict long-term movements.

In the picture above, you can see how the daily time frame can show the price action for the last years, months and weeks.

In contrast, hourly time frame reflects intra week & intraday perspectives.

The patterns and key levels that are spotted there, will be important for day traders and scalpers.

The setups that are spotted on an hourly time frame, will be useful for predicting the intraday moves and occasionally the moves within a trading week.

Take a look at the 2 charts above, the hourly time frame perfectly shows the market moves within a week and within a single day.

4H time frame is somewhere in between. For both swing trader and day trader, it may provide some useful confirmations.

4H t.f shows intra week and week to week perspectives.

Above, you can see how nicely 4H time frame shows the price action on EURUSD within a week and for the last several weeks.

15 minutes time frame is a scalping time frame.

The setups and levels that are spotted there can be used to predict the market moves within hours or within a trading session.

Check the charts above: 15 minutes time frame shows both the price action within a London session and the price action for the last couple of hours.

It is also critical to mention, that lower is the time frame, lower is the accuracy of the patterns and lower is the strength of key levels that are identified there. It makes higher time frame analysis more simple and reliable.

The thing is that higher is the time frame, more important it is for the market participants.

While lower time frames can help to predict short term moves, higher time frames are aimed for predicting long-term trends.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

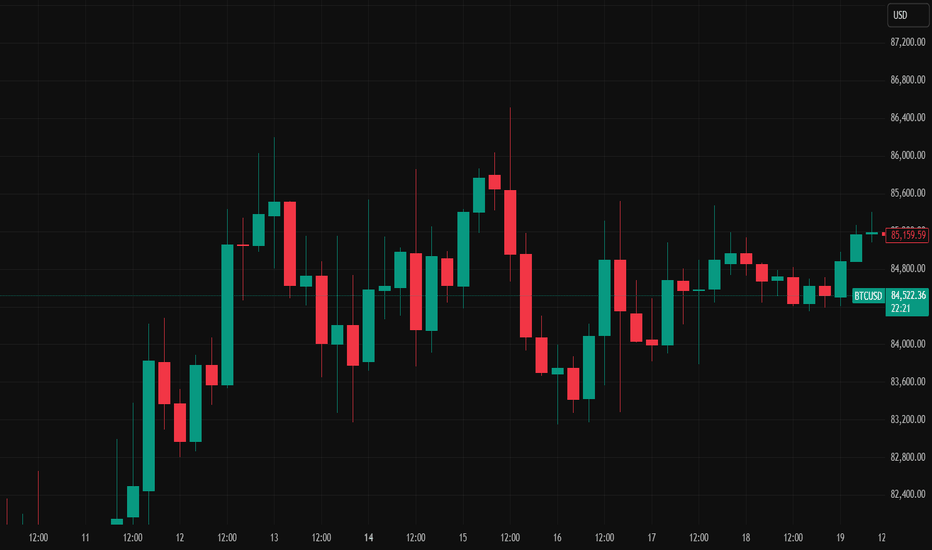

Unlock Trading Success with Multi-Timeframe MasteryIn trading, particularly in the Forex market, a well-defined strategy is crucial for consistent profitability. One of the most effective techniques used by successful traders is multi-timeframe (MTF) analysis. By examining price action across different timeframes (e.g., daily, 4-hour, 1-hour), traders gain a clearer understanding of market structure, trend direction, and optimal entry/exit points. This article explores how MTF analysis works, its benefits, and practical steps to implement it in your trading.

🔍1. Analyzing a Pair Across Multiple Timeframes for Clearer Trend Direction

The foundation of MTF analysis lies in identifying the major and minor trends. By analyzing at least two timeframes, traders can align their strategies with the broader market direction while fine-tuning entries on shorter timeframes.

⚡The High Wave Cycle (HWC) Approach

To begin, determine your High Wave Cycle (HWC), which depends on your trading strategy and timeframe. For instance:

If you trade on the daily timeframe, your HWC might be the monthly chart.

If you trade on the 1-hour timeframe, your HWC could be the weekly chart.

The HWC helps you identify the major trend. For example, on the daily chart, you might analyze the trend using Dow Theory, pinpoint key support and resistance levels, and identify trendlines or patterns. This gives you a clear picture of the market’s broader direction.

Once the HWC is defined, give it significant weight when analyzing lower timeframes for trade setups. For instance, if the daily chart (HWC) shows a downtrend, you’d prioritize bearish setups on the 1-hour chart, even if a minor uptrend appears.

Example: SOLUSDT Trade Setup

Consider a scenario where the 1-hour chart shows a strong uptrend. The price breaks a key resistance level and a descending trendline, suggesting a potential long position.

However, checking the daily chart..

(HWC) reveals a clear downtrend. According to Dow Theory, a major trend reversal requires a confirmed break above the previous high (e.g., $150). Since this hasn’t occurred, the market remains bearish.

In this case, MTF analysis guides your strategy:

Reduce position size to lower risk, as you’re trading against the major trend.

Take profits early, as the price could reverse at any moment.

Avoid overtrading by limiting the number of positions until the trend change is confirmed.

This approach ensures your trades are aligned with the bigger picture, minimizing losses from false signals.

🎯2. Spotting Entries and Exits by Confirming Trends Across Timeframes

MTF analysis not only enhances risk management but also improves the precision of your entries and exits. By confirming signals across timeframes, you can filter out noise and focus on high-probability trades.

Example: Bitcoin (May 15, 2021)

Let’s rewind to May 15, 2021, during Bitcoin’s post-bull run correction. On the daily chart (HWC), the price formed lower highs and lows, breaking a key support level, signaling a bearish trend and a potential exit for long positions. This indicates that spot traders should sell, and swing traders on lower timeframes should focus exclusively on short positions.

On the 1-hour chart, you might spot a minor pullback, tempting a long trade. However, MTF analysis reminds you to align with the daily downtrend, so you’d only consider short setups. This disciplined approach prevents you from trading against the major trend, improving your win rate.

📊The Medium Wave Cycle (MWC) for Added Clarity

Between the HWC and lower timeframes lies the Medium Wave Cycle (MWC), which provides an intermediate perspective. For example, if your HWC is the daily chart, the MWC might be the 4-hour chart. The MWC helps confirm the major trend’s strength or detect early signs of reversals before zooming into lower timeframes for entries. By checking the MWC, you can filter out noise and ensure your trades align with both the major and intermediate trends.

💡Conclusion

Multi-timeframe analysis is a game-changer for traders seeking consistency and precision. By combining the major trend from your HWC, the intermediate perspective from your MWC, and minor trends on lower timeframes, you can make informed decisions, manage risk effectively, and time your trades with confidence.

Start by defining your HWC and MWC, analyzing the major trend, and aligning your entries and exits with multiple timeframes. Pick a pair, test this strategy on a demo account, and share your results in the comments below! With practice, MTF analysis will give you a tactical edge in navigating the markets.

🤍 btw im Skeptic :) & If you found this article helpful, don’t forget to like, share, and follow for more insights and trading strategies! <3

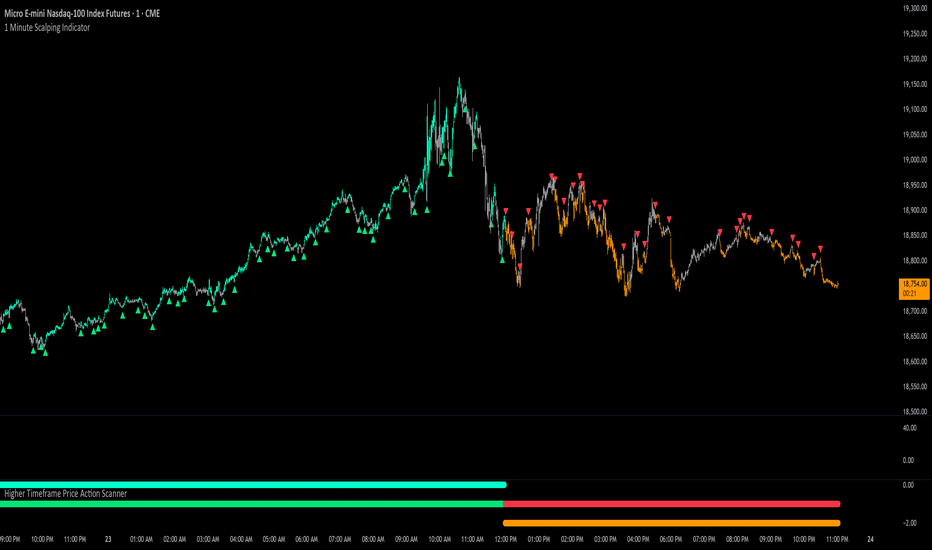

How To Filter Signals On The 1 Minute Scalping IndicatorThis tutorial shows you how to use external indicators to filter out signals on the 1 Minute Scalping Indicator so that you only get signals that are in the direction of the trend.

Step By Step Process:

1. Pick an external indicator that provides an output value of 1 for bullish, -1 for bearish or 0 for neutral and add it to your chart. We have multiple indicators that can do this, but you can also customize your own indicators to provide this value and use that to filter out signals.

2. Set your desired trend parameters on your external indicator and make sure that indicator is on the same chart as the 1 Minute Scalping Indicator.

3. Go to the indicator settings for the 1 Minute Scalping Indicator and turn on one of the 3 available External Indicator Filters. Then from the dropdown menu, select the external indicator you want to use and make sure to choose the output value that gives the 1, -1 or 0 output for trends. Our indicators will have an output titled "Trend Direction To Send To External Indicators" to make that value easy to find in the dropdown menus.

That's it! Let the 1 Minute Scalping Indicator reload with the external indicator trend values and it will only show buy signals during bullish trends, only show sell signals during bearish trends or no signals during neutral markets. Make sure to back test your setup until you find the best external indicators and settings to use that work best for your trading style and then apply that setup to any chart you would like.

Here is the code you can use to add a trend value to your own custom indicators and send it to the 1 Minute Scalping Indicator:

trendDirection = 0

if close > ema1

trendDirection := 1

else if close < ema1

trendDirection := -1

else

trendDirection := 0

plot(trendDirection, title="Trend Direction To Send To External Indicators", color=#00000000, display=display.data_window)

Change the (close > ema1) and (close < ema1) to use your own variables from within your script.

“Does size matter?” when it comes to backtesting?It’s the kind of question that gets a few smirks, sure. But when it comes to backtesting trading strategies, it’s not a joke, it’s the difference between confidence and false hope.

Let’s get real for a minute: the size of your candles absolutely matters.

What you don’t see can hurt you

Most people start testing on bigger timeframes. It’s faster, easier on the eyes, and the results look clean. But clean doesn’t mean correct.

Larger candles blur the details. That one nice-looking 4-hour candle? Inside, price could’ve spiked, reversed, chopped around, or triggered your stop before closing where it did. You’d never know. And that’s the problem.

You might think your entry worked beautifully… but only because the data smoothed out everything that actually happened.

A backtest should feel like a real trade

Trading isn't just about the final price. It’s about what price does to get there. That messy movement inside the candle? That’s where most trades are made or broken.

If your strategy is even remotely reactive, waiting for structure, confirmation, retests, or anything time-sensitive, you need to see what price did between the open and close.

And the only way to see that? Use smaller candles.

Smaller data, clearer picture

1-minute candles might look overwhelming at first, but they give you something the higher timeframes just can’t: behavior.

Not just outcomes. Not just win/loss stats. But the actual shape of the move, the hesitation, the fakeouts, the precise moment when the trade made sense—or didn’t.

And once you start testing with that level of detail, your strategy either earns your trust… or shows its cracks.

So how small should you go?

There’s no one-size-fits-all here. But as a general rule: if your idea relies on precision, go small. Test it on 1-minute or 5-minute charts, even if you plan to execute on higher timeframes. You’ll quickly see if the entry makes sense, or if you’ve been relying on candle-close hindsight.

Yes, it takes longer. Yes, you’ll stare at noisy charts for hours. But your strategy will thank you.

Watch out for “too good to be true”

One last thing, if your backtest results look flawless on 1h or 4h candles, pause. That’s often a sign that you’re testing a story, not a strategy.

Zoom in. See what actually happens. You might be surprised at how different the same trade looks when you’re not glossing over the details.

TL;DR:

In backtesting, size absolutely matters. Smaller candles reveal real behavior. Bigger ones hide the truth. So if you care about how your strategy actually performs not just how it looks.

go smaller. Your backtesting will get sharper, and your confidence? Way more earned.

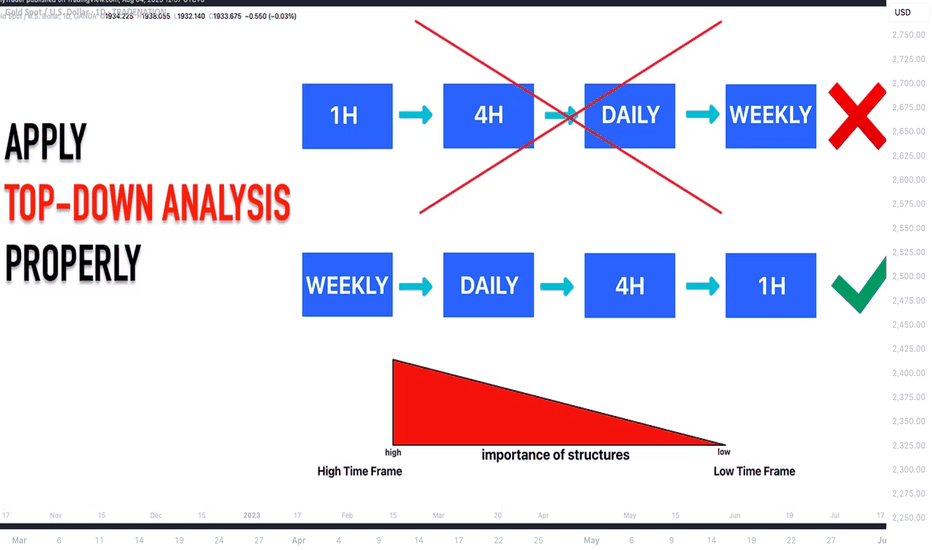

DON'T Make This MISTAKE in MULTIPLE TIME FRAME Analysis

Most of the traders apply multiple time frame analysis incorrectly . In the today's article, we will discuss how to properly use it and how to build the correct thinking process with that trading approach.

The problem is that many traders start their analysis with lower time frames first . They build the opinion and the directional bias analyzing hourly or even lower time frames and look for bullish / bearish signals there.

Once some solid setup is spotted, they start looking for confirmations , analyzing higher time frames. They are trying to find the clues that support their observations.

However, the pro traders do the opposite .

The fact is that higher is the time frame, more significant it is for the analysis. The key structures and the patterns that are spotted on an hourly time frame most of the time will be completely irrelevant on a daily time frame.

In the picture above, I underlined the key levels on USDJPY on an hourly time frame on the left.

On the right, I opened a daily time frame. You can see that on a higher time frame, the structures went completely lost.

BUT the structures that are identified on a daily, will be extremely important on any lower time frame.

In the example above, I have underlined key levels on a daily.

On an hourly time frame, we simply see in detail how important are these structures and how the market reacts to them.

The correct way to apply the top-down approach is to start with the higher time frame first: daily or weekly. Identify the market trend there, spot the important key levels. Make prediction on these time frames and let the analysis on lower time frames be your confirmation.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn 3 Best Time Frames for Day Trading Forex & Gold

If you want to day trade Forex & Gold, but you don't know what time frames you should use for chart analysis and trade execution, don't worry.

In this article, I prepared for you the list of best time frames for intraday trading and proven combinations for multiple time frame analysis.

For day trading forex with multiple time frame analysis, I recommend using these 3 time frames: daily, 1 hour, 30 minutes.

Daily Time Frame Analysis

The main time frame for day trading Forex is the daily.

It will be applied for the identification of significant support and resistance levels and the market trend.

You should find at least 2 supports that are below current prices and 2 resistances above.

In a bullish trend, supports will be applied for trend-following trading, the resistances - for trading against the trend.

That's the example of a proper daily time frame analysis on GBPCHF for day trading.

The pair is in an uptrend and 4 significant historic structures are underlined.

In a downtrend, a short from resistance will be a daytrade with the trend while a long from support will be against.

Look at GBPAUD. The market is bearish, and a structure analysis is executed.

Identified supports and resistances will provide the zones to trade from. You should let the price reach one of these areas and start analyzing lower time frames then.

Remember that counter trend trading setups always have lower accuracy and a profit potential. Your ability to properly recognize the market direction and the point that you are planning to open a position from will help you to correctly assess the winning chances and risks.

1H/30M Time Frames Analysis

These 2 time frames will be used for confirmations and entries.

What exactly should you look for?

It strictly depends on the rules of your strategy and trading style.

After a test of a resistance, one should wait for a clear sign of strength of the sellers : it can be based on technical indicators, candlestick, chart pattern, or something else.

For my day trading strategy, I prefer a price action based confirmation.

I wait for a formation of a bearish price action pattern on a resistance.

Look at GBPJPY on a daily. Being in an uptrend, the price is approaching a key resistance. From that, one can look for a day trade .

In that case, a price action signal is a double top pattern on 1H t.f and a violation of its neckline. That provides a nice confirmation to open a counter trend short trade.

Look at this retracement that followed then.

In this situation, there was no need to open 30 minutes chart because a signal was spotted on 1H.

I will show you when one should apply this t.f in another setup.

Once the price is on a key daily support, start looking for a bullish signal.

For me, it will be a bullish price action pattern.

USDCAD is in a strong bullish trend. The price tests a key support.

It can be a nice area for a day trade.

Opening an hourly chart, we can see no bullish pattern.

If so, open even lower time frame, quite often it will reveal hidden confirmations.

A bullish formation appeared on 30 minutes chart - a cup & handle.

Violation of its neckline is a strong day trading long signal.

Look how rapidly the price started to grow then.

In order to profitably day trade Forex, a single time frame analysis is not enough . Incorporation of 3 time frames: one daily and two intraday will help you to identify trading opportunities from safe places with the maximum reward potential.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

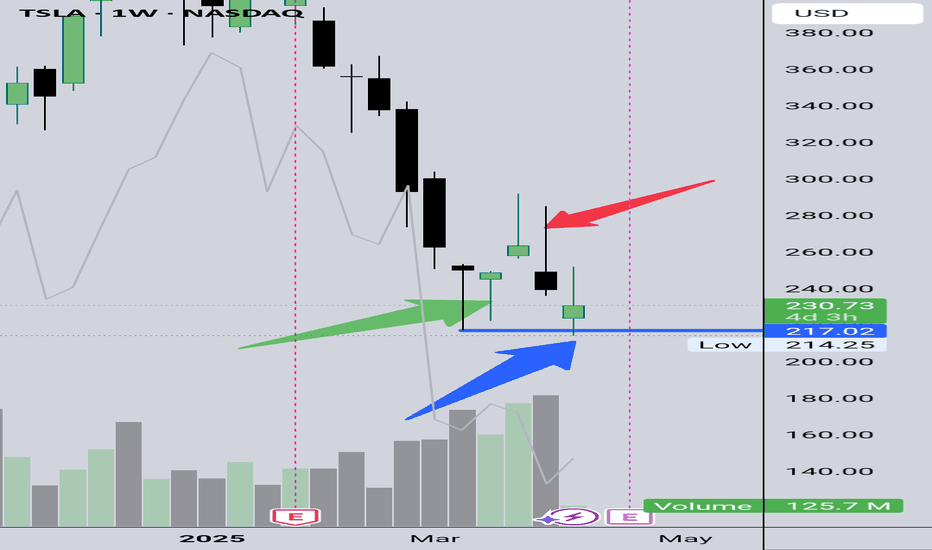

TESLA Always Pay YOURSELF! Tsla Stock were you PAID? GOLD Lesson

⭐️I want to go into depth regarding the this topic but it is a long one with PROS & CONS for doing and not doing it.

Every trader must choose what's best for them but you will SEE when I finally get to the write up that MANY OF THE PROS are NOT FINANCIAL but PSYCHOLOGICAL❗️

Another of 🟢SeekingPips🟢 KEY RULES!

⚠️ Always Pay YOURSELF.⚠️

I know some of you chose to HOLD ONTO EVERYTHING and place your STOP at the base of the WEEKLY CANDLE we entered on or the week priors base.

If you did that and it was in your plan GREAT but... if it was NOT that is a TRADING MISTAKE and You need to UPDATE YOUR JOURNAL NOW.

You need to note EVERYTHING. What you wanted to see before your exit, explain why not taking anything was justified to you, were there EARLY exit signals that you did not act on. EVERYTHING.

🟢SeekingPips🟢 ALWAYS SAYS THE BEST TRADING BOOK YOU WILL EVER READ WILL BE YOUR COMPLETE & HONEST TRADING JOURNAL ⚠️

📉When you read it in black amd white you will have YOUR OWN RECORD of your BEST trades and TRADING TRIUMPHS and your WORST TRADES and TRADING ERRORS.📈

✅️ KEEPING an UPTO DATE JOURNAL is STEP ONE.

STUDYING IT IS JUST AS IMPORTANT👍

⭐️🌟⭐️🌟⭐️A sneak peek of the LESSON after will be HOW & WHEN TO ENTER WHEN THE OPEN BAR IS GOING THE OPPOSITE WAY OF YOUR IDEA.👌

🚥Looking at the TESLA CHART ABOVE you will see that we were interested in being a BUYER when the weekly bar was BEARISH (GREEN ARROW) and we started to consider TAKE PROFITS and EXITS when the (RED ARROW) Weekly bar was still BULLISH.🚥

PL Dot Shapes (Detailed Summary)This idea shall focus on the behavior and structure of PL Dot Shapes, which are crucial in identifying market trends, congestion phases, and potential reversals. Let's deep dive on how to interpret PL Dot formations and recognize patterns that signal market movements.

1. Understanding PL Dot Behavior

- Trend:

PL Dots form a straight line, indicating a clear market direction. A trend stops when the market enters congestion.

- Congestion:

PL Dots move horizontally or “snake” sideways, signaling indecision or balance between buyers and sellers.

- Higher Time Period (HTP) Influence:

PL Dots from the HTP influence those in the Lower Time Period (LTP). Inconsistencies between them may indicate no clear pattern.

- Dot Distance:

Refers to the vertical price difference between consecutive PL Dots.

- Increasing Dot Distance: Indicates trend continuation or strength.

- Decreasing Dot Distance: Suggests trend exhaustion or potential reversal.

2. Key PL Dot Patterns

✅ Yes Pattern (Energy Termination Pattern)

Indicates the end of a trend and potential reversal. This pattern is characterized by signs of exhaustion:

1. PL Dot Pullback: PL Dot moves off the main trend channel, and the angle starts sloping down.

2. Decreasing Dot Distance: Dots get closer together, signaling waning momentum.

3. Exhaustion Signs: The dot pulls within range, with closes moving towards the PL Dot, causing congestion entrance.

4. Block Occurrence: Price likely returns to the area of 2-3 dots back.

5. Crest Formation: A PL Dot crest forms, indicating a potential market top.

6. Directional Shift: Dot directions begin turning downward.

7. Challenges: Be alert to price challenging PL Dot crests and valleys.

---

❌ No Pattern (Non-Termination Pattern)

Indicates that the trend is likely to continue without exhaustion:

1. Similar early behavior to the Yes Pattern but lacks signs of exhaustion.

2. No Significant Pullback: PL Dot may pull within range, but no congestion entrance signs appear (bullish).

3. Price Holds: Prices do not return to the 2-3 dots back area.

4. Weak Crests: No strong crest formation, or it's shallow.

5. Stable Direction: Dot direction struggles to turn down.

6. No Challenges: No challenges to PL Dot crests or valleys, confirming trend strength.

---

3. Trend Pattern (Trend Continuation Pattern)

Describes the start or continuation of a trend, especially in the LTP:

1. Dot Opening: PL Dot opens up, with increasing distance between dots, signaling strong momentum.

2. No Exhaustion: Continuation without signs of exhaustion.

3. Energy Refresh: If price reaches the area of 2-3 dots back, expect high energy on any PL Dot refresh.

4. Dots Out of Range: PL Dots move outside the prior bar’s range, confirming a strong trend.

5. Strong Challenges: Challenges to crests only add momentum to the trend.

6. Stable Direction: Dot direction maintains strength with minimal reversals.

---

4. PL Dot Shapes in Congestion

When the market is in congestion, expect the following:

1. Sideways Dots: PL Dots snake sideways, indicating market indecision.

2. Support/Resistance Holding: The 6-1 lines hold both sides of the congestion area.

3. Congestion Exit Signs: Look for signs indicating the market is ready to break out of congestion.

---

Key Takeaways:

- Trend Continuation: Increasing dot distance and out-of-range dots suggest a strong trend.

- Trend Exhaustion (Yes Pattern): Decreasing dot distance, dot pullbacks, and crest formation signal potential reversals.

- No Pattern: Indicates no exhaustion, suggesting the trend will continue.

- Congestion Behavior: PL Dots snake sideways with key support/resistance levels holding firm.

Understanding these patterns helps traders anticipate market behavior, identify trend reversals early, and manage trades effectively.

THE IMPORTANCE of Multiple Time Frame Analysis in Forex Gold

In my daily posts, I quite frequently use multiple time frame analysis.

If you want to enhance your predictions and make more accurate decisions, this is the technique you need to master.

In the today's post, we will discuss the crucial importance of multiple time frames analysis in trading the financial markets and forex gold in particular.

1️⃣ Trading on a single time frame, you may miss the important key levels that can be recognized on other time frames.

Take a look at the chart above. Analyzing a daily time frame, we can spot a confirmed bullish breakout of a key daily resistance.

That looks like a perfect buying opportunity.

However, a weekly time frame analysis changes the entire picture, just a little bit above the daily resistance, there is a solid weekly resistance.

From such a perspective, buying GBPUSD looks very risky.

2️⃣ The market trend on higher and lower time frames can be absolutely different.

In the example above, Gold is trading in a bullish trend on a 4h time frame.

It may appear for a newbie trader that buyers are dominating on the market. While a daily time frame analysis shows a completely different picture: the trend on a daily is bearish, and a bullish movement on a 4H is simply a local correctional move.

3️⃣ It may appear that the market has a big growth potential on one time frame while being heavily over-extended on other time frames.

Take a look at GBPJPY: on a weekly time frame, the market is trading in a strong bullish trend.

Checking a daily time frame, however, we can see that the bullish momentum is weakening: the double top pattern is formed and the market is consolidating.

The sentiment is even changing to a bearish once we analyze a 4H time frame. We can spot a rising wedge pattern there and its support breakout - very bearish signal.

4️⃣ Higher time frame analysis may help you to set a safe stop loss.

In the picture above, you can see that stop loss placement above a key daily resistance could help you to avoid stop hunting shorting the Dollar Index.

Analyzing the market solely on 1H time frame, stop loss would have been placed lower and the position would have closed in a loss.

Always check multiple time frame when you analyze the market.

It is highly recommendable to apply the combination of at least 2 time frames to make your trading safer and more accurate.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

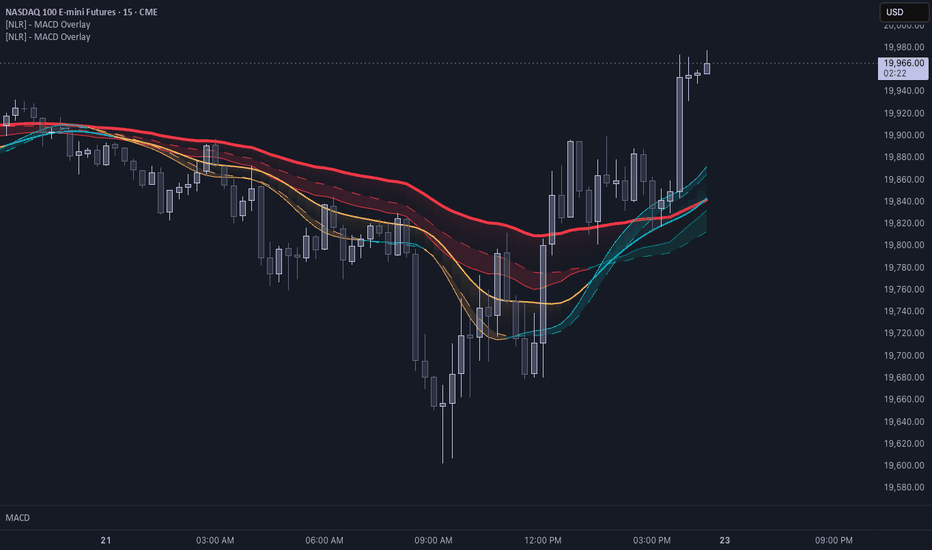

Enhance Your Trading with Dual MACD OverlaysBy using two MACD overlays—one based on the current timeframe and another on a higher timeframe—you gain a more comprehensive view of market momentum. This approach helps identify short-term opportunities while aligning trades with the broader trend, reducing false signals. As seen in my chart, combining multiple MACD perspectives can improve decision-making and trade timing.

Try it out and refine your strategy with better trend confirmation!

[How to] Properly analyzing relative equal levels with orderflow🔑 This is a basic principle and idea overview of why price will behave a certain way around levels where double lows or highs are. Also reviewing what is called Low Resistance Liquidity. This happens when multiple levels are stacked going lower or higher without a stop hunt.

Share this with your trading partner 💪🏽