Community ideas

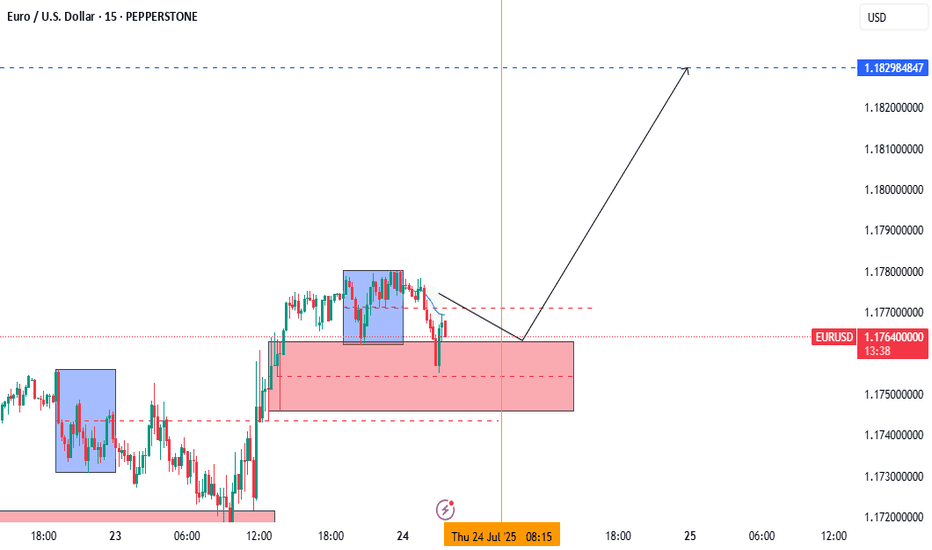

EURUSD LONG AND EDUCATIONAL BREAKDOWN ECB INTRESTRATE RELEASE The European Central Bank is expected to hold key rates for the first time in over a year on Thursday.

The Eurozone inflation rate has hit the ECB’s 2% target as the US-EU trade deal uncertainty lingers.

The EUR/USD pair could experience intense volatility following the ECB policy announcements.

The European Central Bank (ECB) is on track to leave its key interest rates unchanged after its July policy meeting, after having reduced rates at each of its last seven meetings. The decision will be announced on Thursday at 12:15 GMT.

The interest rate decision will be followed by ECB President Christine Lagarde’s press conference at 12:45 GMT.

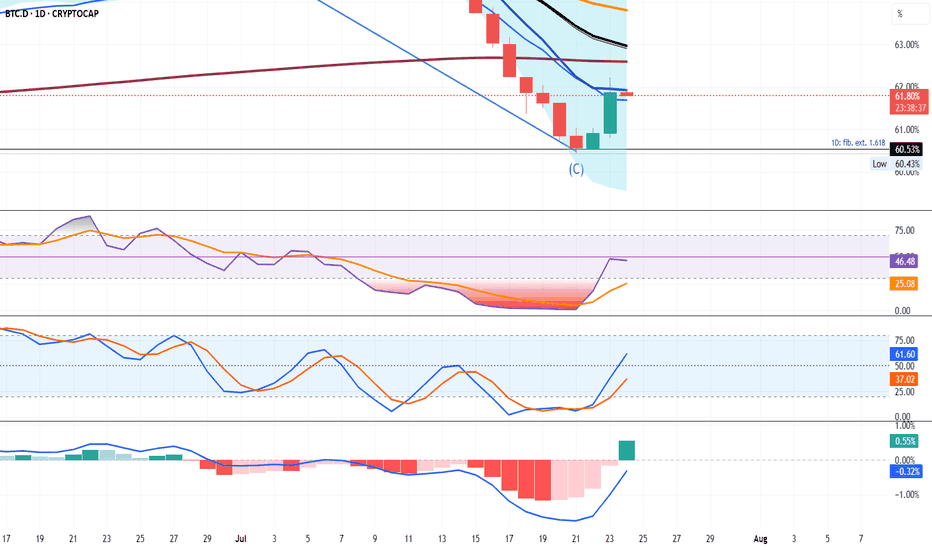

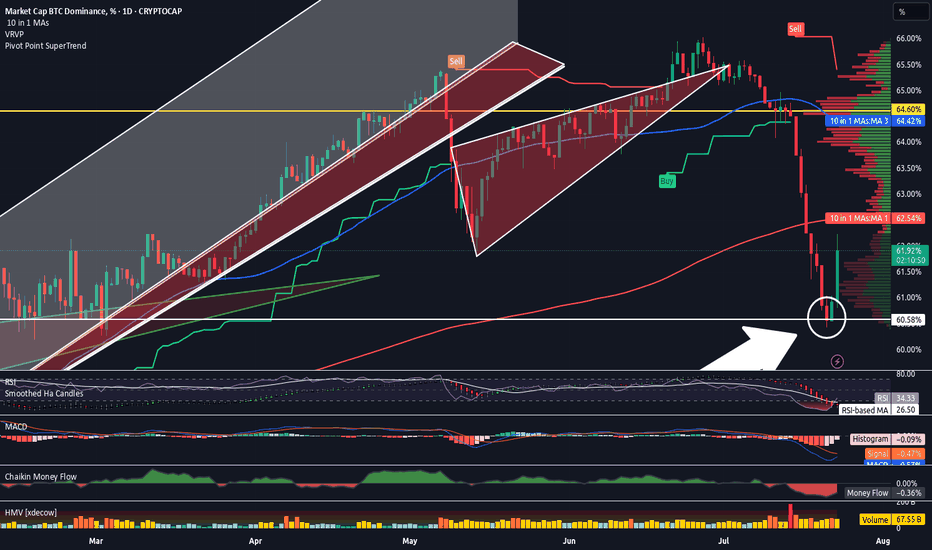

BITCOIN DOMINANCE PULLBACK FOR ALTSCOINS RELIEFJust as we discussed over the weekend, Bitcoin dominance has arrived at intended target in an A-B-C wave on the 1 hour and 4 hour timeframe with a shooting star at the 50EMA on 4 hour set. This candlestick pattern will surely give altcoins a relief tonight but we will analyze if this is done or there will another wave up to the 21EMA on the daily chart. That will be updated once dominance finishes the pullback. Stay tuned fellow traders!

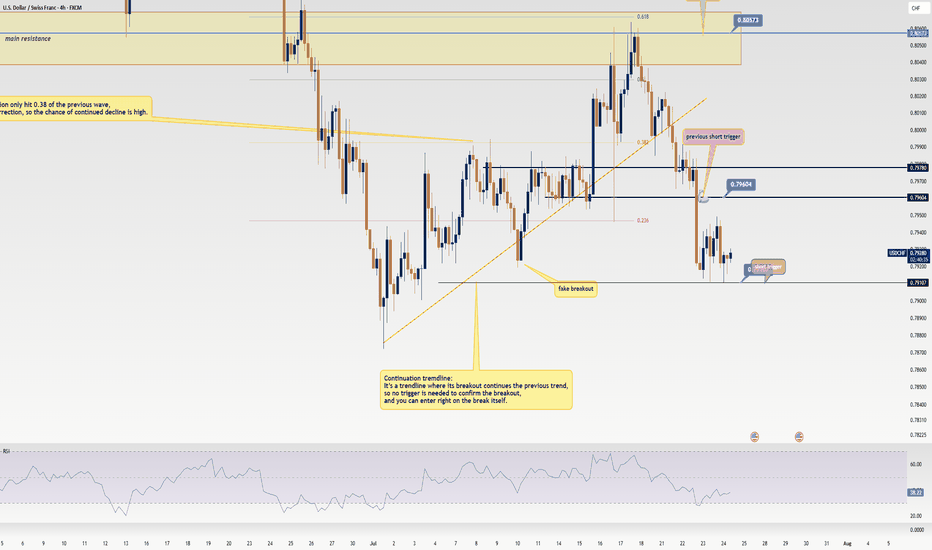

USD/CHF Update: Missed the Last Short? Grab the New Trigger!Yo traders and market lovers, it’s Skeptic from Skeptic Lab! Here’s a quick USD/CHF update: my last short trigger after the support break gave us a 50-pip drop . With a solid stop loss, you’re likely sitting on a 2:1 R/R; risk-takers might even be at 5:1. I’m breaking down a fresh trigger in this video—don’t miss it! Drop your thoughts or coin requests in the comments, give it a boost if it helped , and don’t miss my educational post coming tonight on Skeptic Lab’s TradingView page with lessons from my first 100 trades—it’s gonna be fire. Catch you tonight! 😎

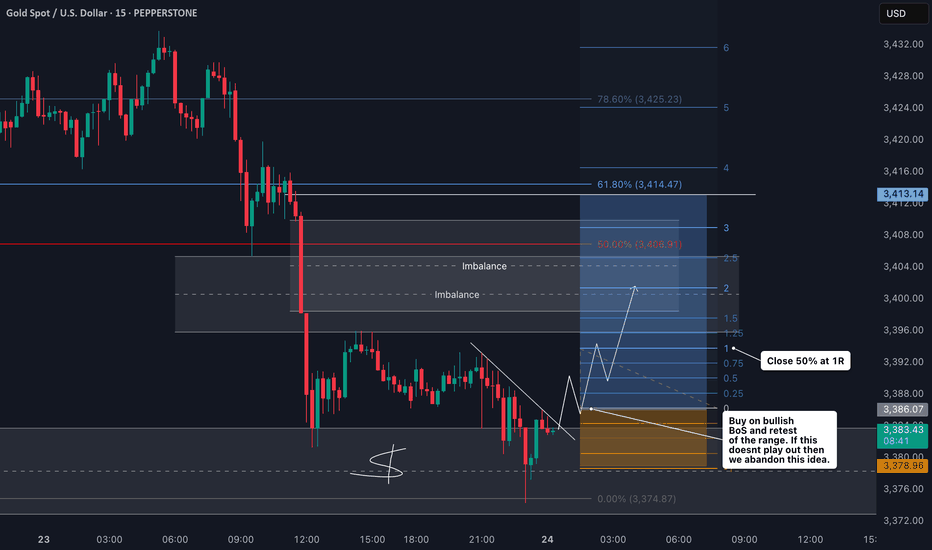

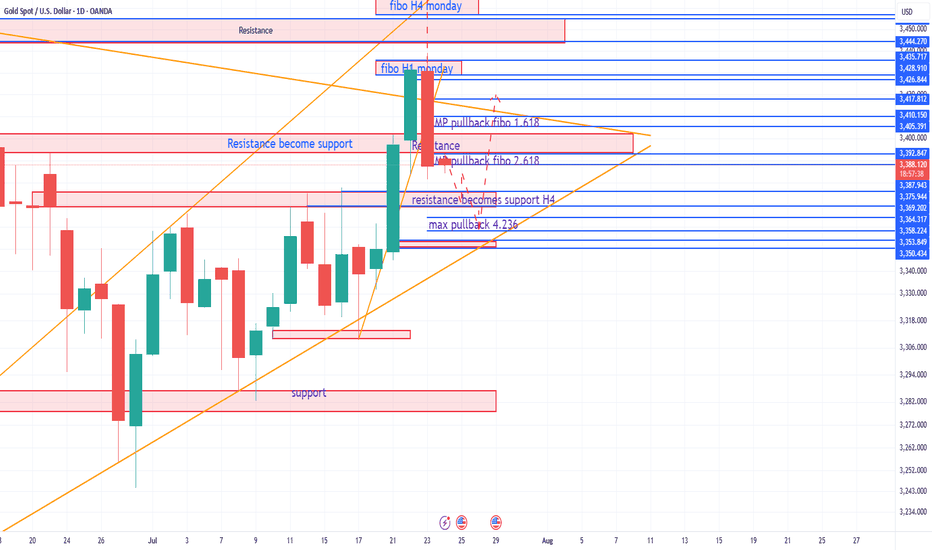

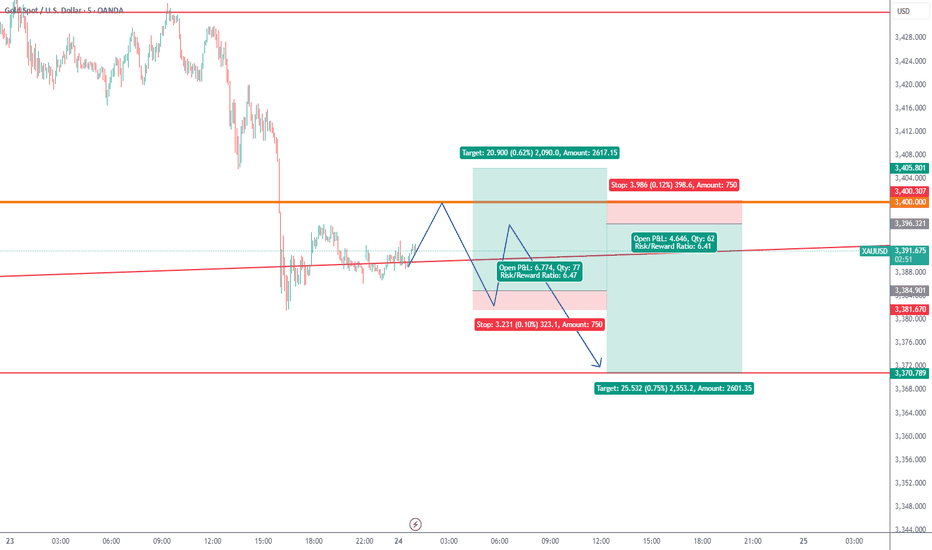

Deep Pullback on XAUUSD Gold: What I'm Watching Now🚨 Gold Update & Trade Plan 🚨

Taking a look at Gold (XAUUSD) right now — it's been trending strongly in an uptrend 📈, showing impressive momentum over the past sessions. However, we've recently seen a deep pullback 🔻 that has tapped into a key liquidity pool 💧.

From this level, I'm anticipating a bullish reaction 🔁, and I’m eyeing a potential scalping or intraday opportunity. In the video, we break down:

🔹 Market structure

🔹 Price action analysis

🔹 Trend context

🔹 A complete trade plan

🎯 Entry, stop-loss, and targets are all discussed based on technicals — with precision and discipline.

This is my personal trading plan based on how I read the markets — not financial advice. Trade safe and stay sharp! ⚔️💹

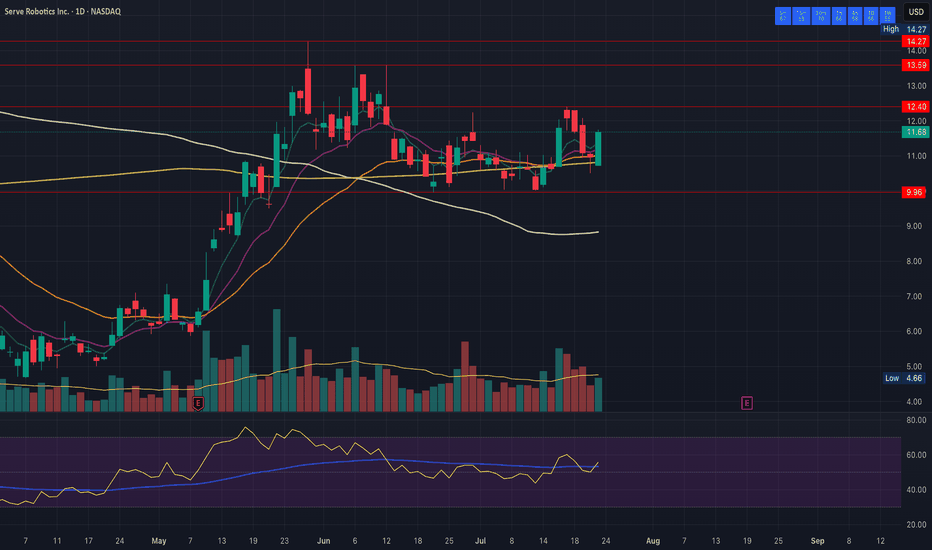

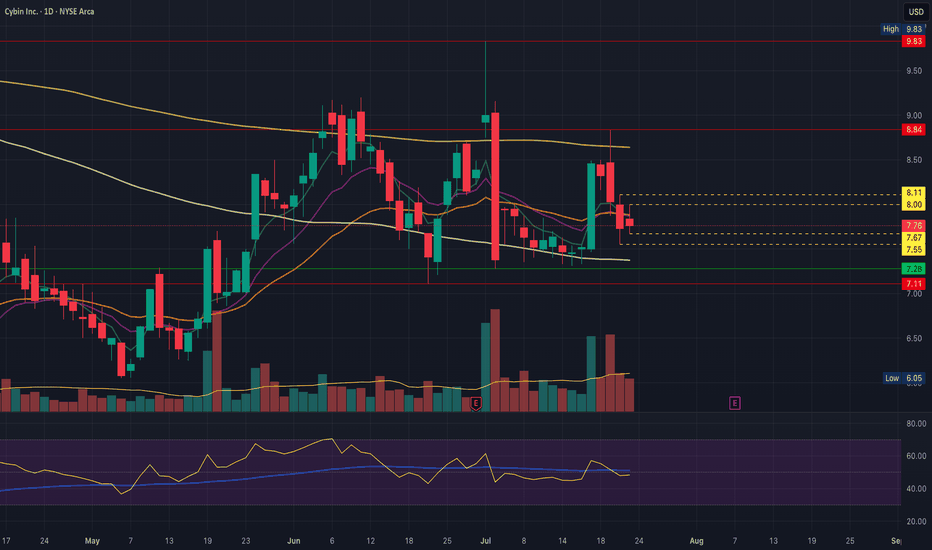

CYBN remains in daily equilibriumCYBN remains within a wide daily equilibrium, we have an inside bar today for early clues to get an early gauge on direction. Nothing changes for me as long as price remains between 7.11 and 8.84, and we can remain tightening within this range for another couple of weeks..

Support: 7.67, 7.55, 7.28, 7.11 key

Resistance: 8.00, 8.11, 8.847 key

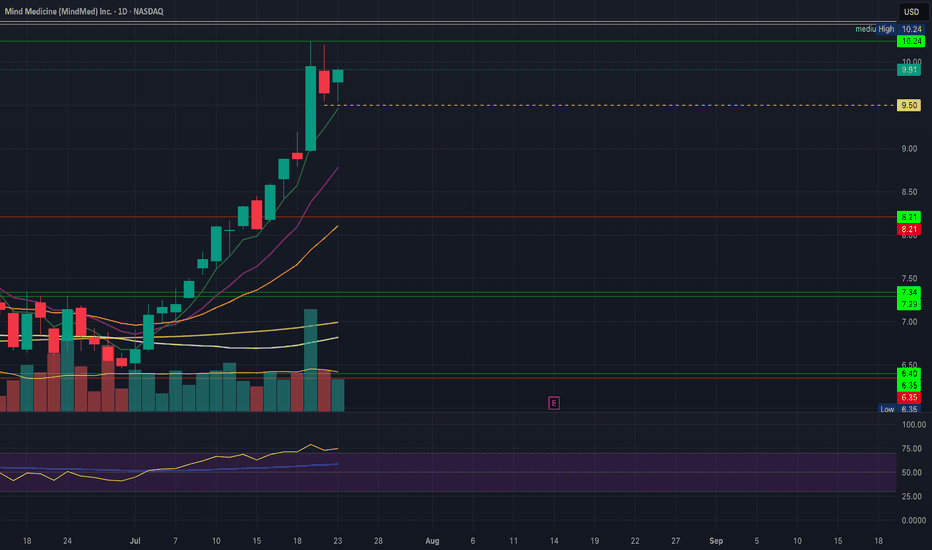

MNMD Daily bullflag below key resistance on monthly timeframe MNMD bulls are setting up a daily bullflag just below key monthly resistance at 10.44, the break of which would confirm the monthly trend change for the first time in the history of the chart. 10.24 key short term resistance to confirm the bull flag.

Support: 9.50, 9.00, 8.79, 8.51, 8.43

Resistance: 10.24, 10.44, 10.47, 11.00, 11.22

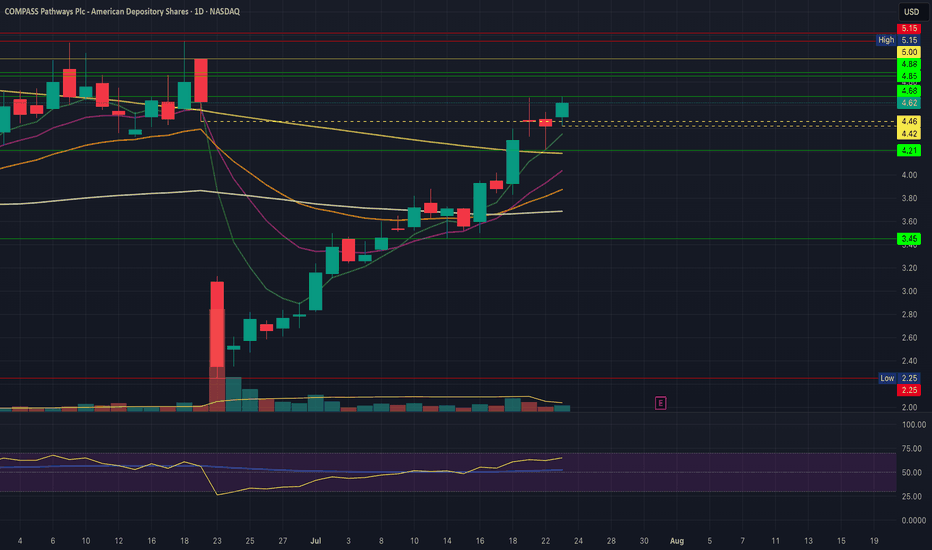

CMPS bulls trying to confirm the daily bullflagCMPS bulls attempting to confirm the daily bullflag and keep the very impressive bounce going, If we reject tomorrow anticipate a 4hr equilibrium and we'll look for a higher low above 4.21 and a tightening range for the next few days.

Support: 4.42, 4.21

Resistance: 4.68, 4.85, 4.88, 5.00

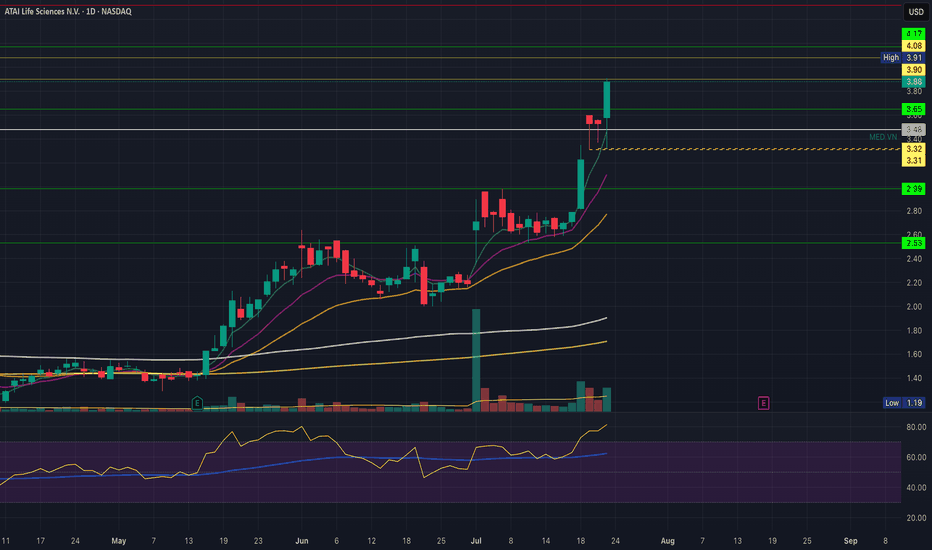

ATAI bulls confirm daily bullflagATAI bulls bought the dip for the third day in a row off of 3.31 support and V-shaped to a new high of day. As mentioned in previous videos we are now in a medium volume node so price can move through this area a bit more easily. Beware of short term extension, I wouldn't be a buyer up here but I see no reason to be a seller.

Support: 3.77, 3.75, 3.68, 3.31

Resistance: 3.90, 4.00, 4.08, 4.17, 4.52

Intro to what I call Algo TradingAlgorithmic training can mean different things to different people what I mean when I say the term algorithmic trading is just things that happen automatically.

Some guys have like these really complex formulas and based on like all this really advanced mathematics. If I'm being 100% honest i'm essentially looking at pictures on a chart and looking at the patterns.

But the pictures on the chart themselves are based on really advanced mathematical formulas or they can be at least or a combination of multiple mathematical formulas that then that the result of our represented by a picture on a chart.

So I look at the pictures on the chart I analyzed them really carefully and if it looks good I use artificial intelligence to code the idea so it happens automatically based on the rules that I set.

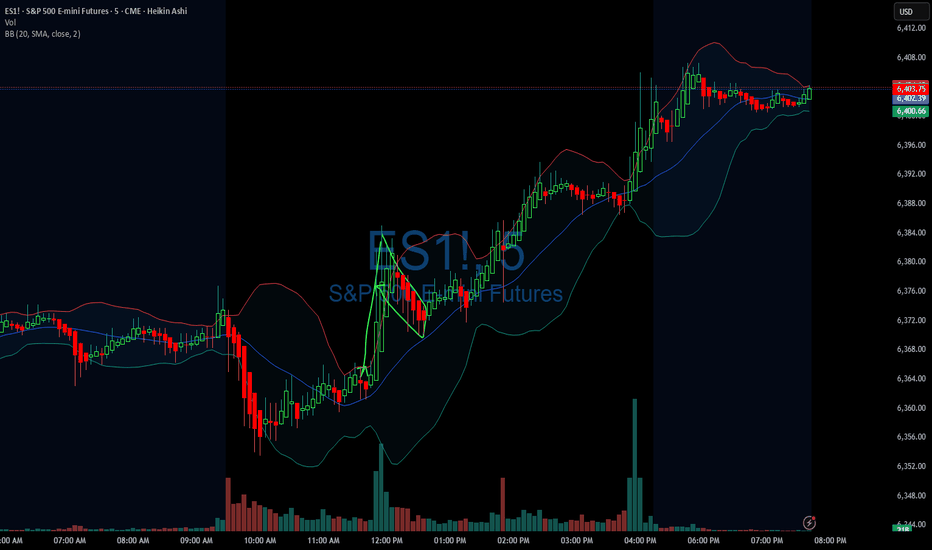

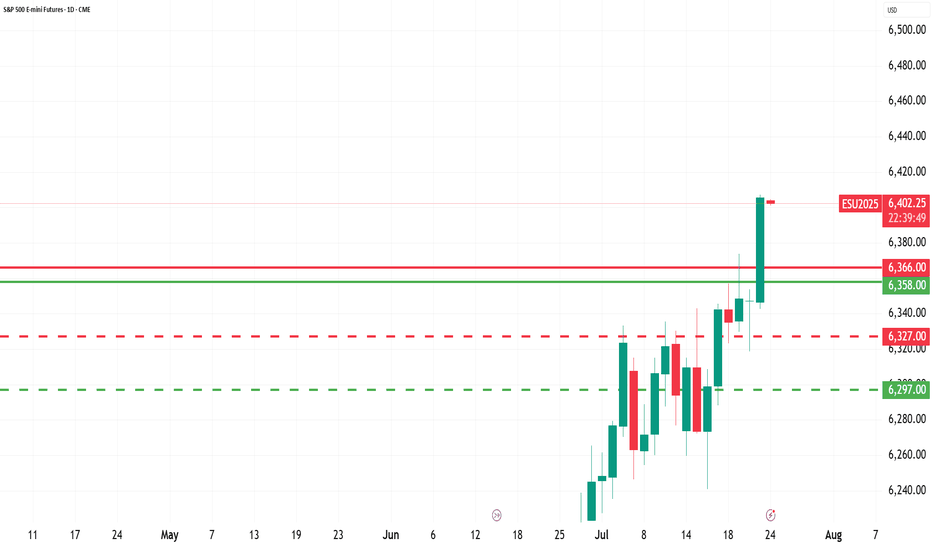

07/23/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: -1243

Sleep: 4 hours

Overall health: having issues with sleep the last 2 nights

VX Algo System Signals from (9:30am to 2pm)

9:23 AM Market Structure flipped bullish on VX Algo X3!

9:34 AM Market Structure flipped bearish on VX Algo X3!

11:47 AM Market Structure flipped bullish on VX Algo X3!

12:17 PM NQ X1 Sell Signal (triple sell)

What’s are some news or takeaway from today? and What major news or event impacted the market today?

After going on a long green streak, I got a bit greedy and wanted to make a big profit and went a bit risky dicky at the end of the session, having been able to read everything pretty well, I was pretty sure $6400 was going to be a pretty tight resistance between reading the gammabot data and options data, it showed that we would stall at $6400 on ES so i decided to put a few big ES short positions there with a tight stoploss at 6405 thinking, it surely can't go wrong with only a few minutes left in the session.

and surely it did, it went completely wrong and i went from being positive for the day to negative and throwing my profits away.

News

*STOCKS SURGE AFTER US-JAPAN TRADE DEAL AS S&P 500 AND NASDAQ CLINCH FRESH RECORDS

What are the critical support levels to watch?

--> Above 6339= Bullish, Under 6320= Bearish

Video Recaps -->https://tradingview.sweetlogin.com/u/WallSt007/#published-charts

Altcoin Season Has Started. And A Quick Look At The Stock MarketHey Traders,

Time for me to catch you up on the latest price action in both the stock market and crypto as well as touch upon a few changes on my platform and subscription services and what I plan for the future.

Timestamps:

00:00 | Housekeeping - site changes, etc

04:35 | BTC Dominance

06:45 | DXY Dollar Chart

10:00 | SPY

14:25 | BTC Bitcoin Chart

15:45 | Bitcoin Liquidity Heatmap

17:30 | Solana

19:05 | Ethereum

20:20 | Crypto & Stock Trackers

24:25 | My Indicator

26:10 | Where I Went Wrong & How I Plan To Course Correct

✌️ Stew

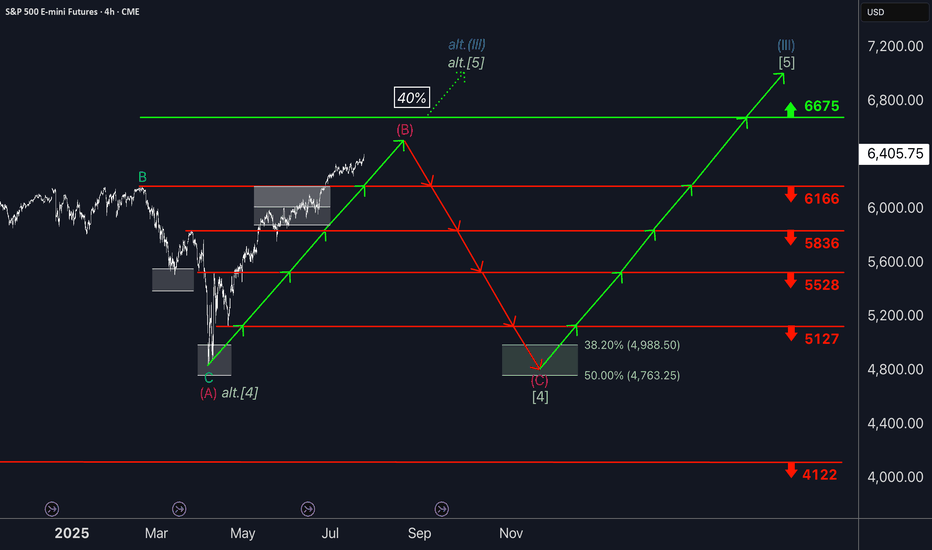

S&P500: Rally ContinuesYesterday, the S&P 500 managed to notch modest gains once again. In line with our primary scenario, the ongoing magenta wave (B) is likely to continue climbing toward resistance at 6,675 points. Once this corrective upswing reaches its peak—still below that level—we anticipate a pullback as part of wave (C), which should drive the index below support at 5,127 points. Beneath this threshold, our green long Target Zone spans from 4,988 to 4,763 points. We expect the low of wave (C) and the conclusion of the broader green wave to occur within this range. From there, a sustained rally is expected to unfold in wave , which should lift the index above resistance at 6,675 points and complete the cyclical blue wave (III). As a result, this price range can be considered for long entries. The alternative scenario, which calls for a direct breakout above the 6,675-point level without a prior pullback, remains in play with a 40% probability.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).