Community ideas

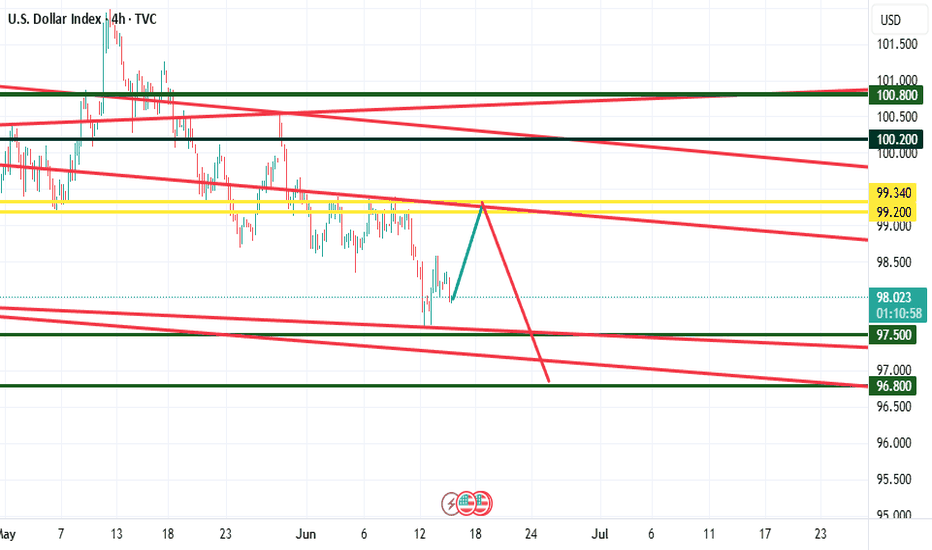

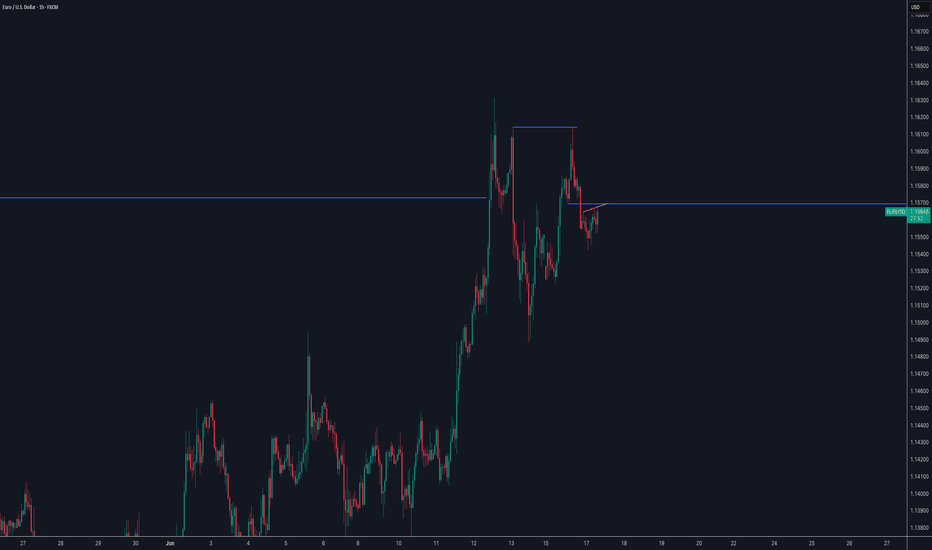

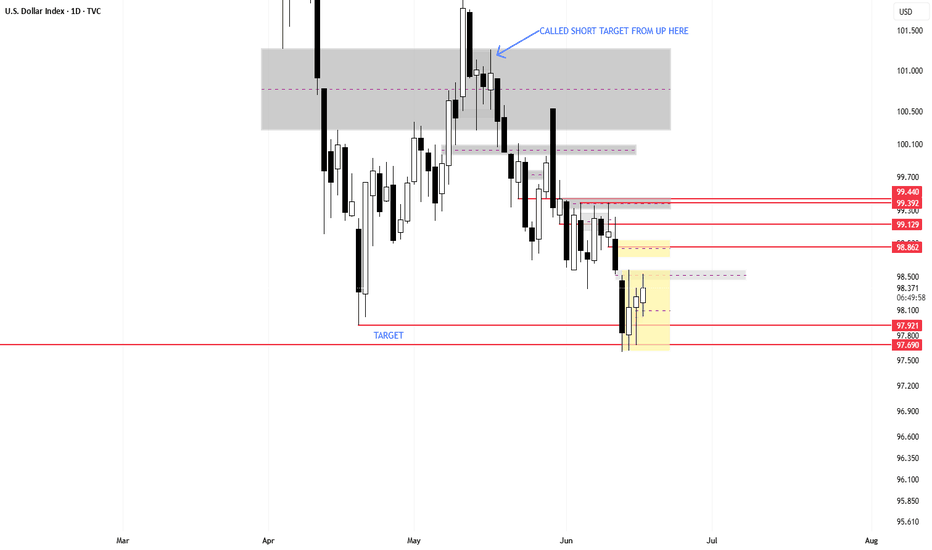

DXY OVERVIEW AND ANALYSIS - SELLOFF AT FOMC PRESS CONFERENCE 🟣DXY🟣 H4 CHART

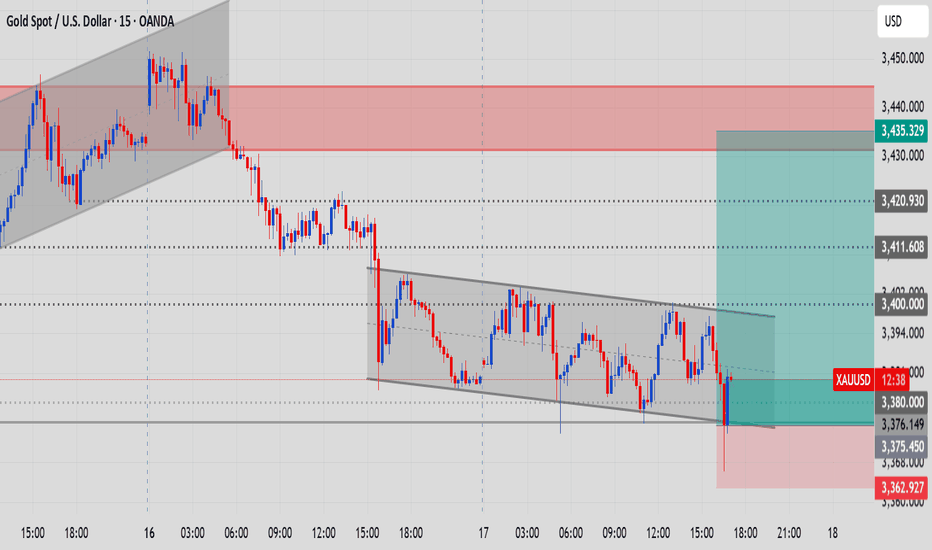

As we witness the unfolding of a conflict in the Middle East this week I expect the commodities of OIL and GOLD to raise more after a pullback that will offer buy entries.

On my view the DXY index will pullback to the previous broken support now resistance in the 99.200 - 99.340 area and selloff to the weekly targets 97.500 and 96.800.

FOMC on Wednesday should catalyse this move and I expect the pullback to take place between the first days of the week

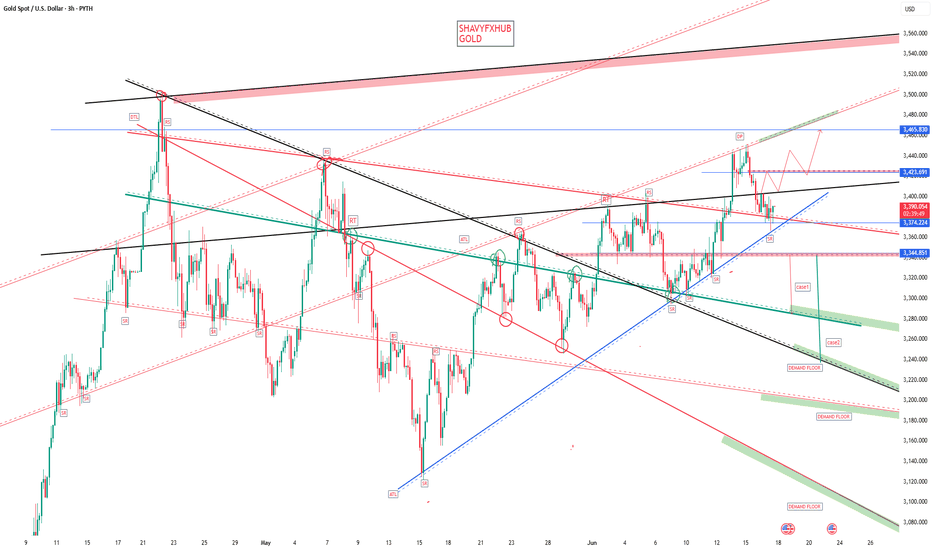

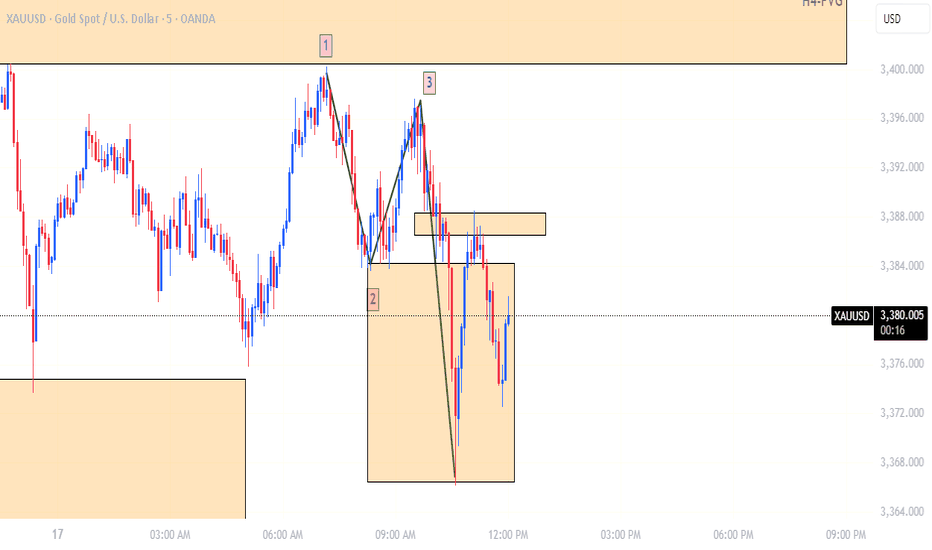

GOLD Gold (XAU/USD), DXY (U.S. Dollar Index), 10-Year Bond Yield, and Interest Rate Correlations

As of June 2025, the relationships between these assets reflect a mix of traditional dynamics and evolving market forces. Below is a breakdown of their correlations and current data:

1. Gold (XAU/USD) and DXY (U.S. Dollar Index)

Traditional Inverse Relationship: Gold is priced in USD, so a stronger dollar (higher DXY) typically makes gold more expensive for foreign buyers, reducing demand and lowering prices. Conversely, a weaker dollar supports gold prices.

Recent Anomaly (2023–2025): Geopolitical tensions (e.g., Iran-Israel conflict, U.S.-China trade disputes) and central bank gold purchases (notably by China and Russia) have driven simultaneous strength in gold and the dollar. For example:

Gold hit a record high of $3,500/oz in April 2025 despite DXY hovering near 98.43.

Central banks bought 1,037 tonnes of gold in 2024, offsetting typical dollar-driven headwinds.

The inverse correlation is reasserting as Fed rate-cut expectations grow, but geopolitical risks still support gold.

2. Gold and 10-Year Treasury Yield

Inverse Correlation Typically: Higher yields increase the opportunity cost of holding non-yielding gold.

Inflation Hedge Exception: When real interest rates (nominal yield - inflation) are negative or low, gold rises despite higher yields. For example:

10-year yield: 4.450% (June 2025)

U.S. inflation: 3.1% (May 2025) → real rate ~1.26%, reducing gold’s appeal but not eliminating it.

Current Driver: Market focus on Fed policy (potential cuts) and inflation persistence keeps gold supported even with elevated yields.

3. DXY and 10-Year Treasury Yield

Positive Correlation: Higher yields attract foreign capital into U.S. bonds, boosting dollar demand (DXY↑).

Divergence Risks: Geopolitical tensions can decouple this relationship (e.g., safe-haven dollar demand outweighs yield changes).

4. Interest Rates and Gold

Fed Policy Impact: Higher rates strengthen the dollar and dampen gold demand, while rate cuts weaken the dollar and boost gold.

2025 Outlook:

Fed funds rate: 4.25–4.50% (held steady in June 2025).

Geopolitical Risks: Safe-haven demand for gold and the dollar persists.

Real Interest Rates: Gold’s performance hinges on whether real rates stay subdued.

Central Bank Demand: Record gold purchases (1,200+ tonnes in 2024) provide structural support.

Conclusion

While traditional correlations between gold, DXY, and yields persist, structural shifts (central bank buying, geopolitical fragmentation) and evolving Fed policy are redefining these relationships. Gold remains bullish in the medium term.

WATCH MY GREEN BAR ZONE FOR BUY.

#gold

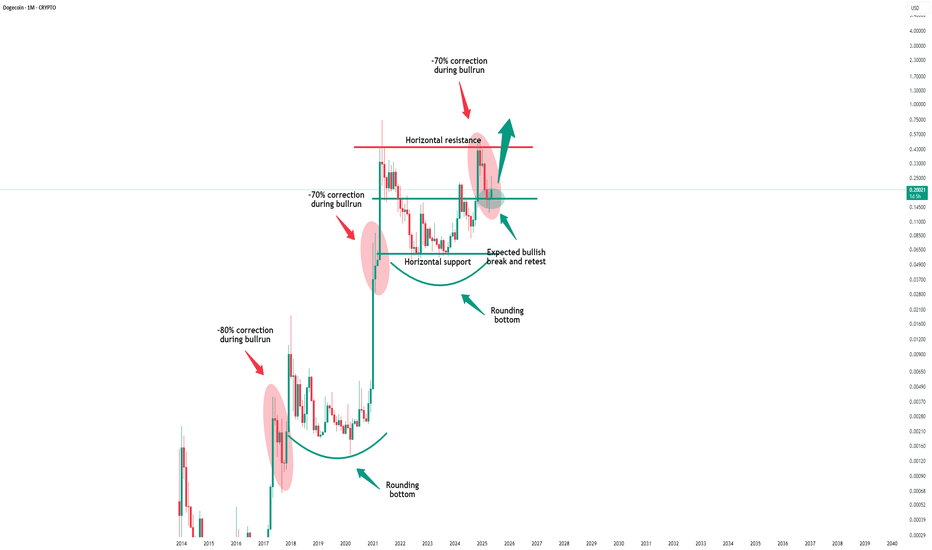

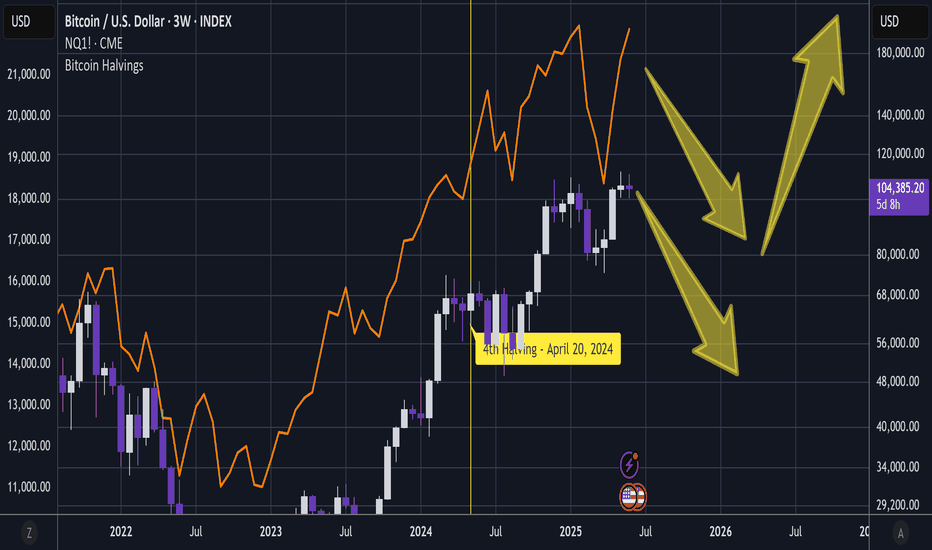

Dogecoin - Don't forget the dog now!Dogecoin - CRYPTO:DOGEUSD - still remains quite bullish:

(click chart above to see the in depth analysis👆🏻)

Basically during every major bullrun on Dogecoin, we always saw a correction of at least -60%. Therefore the recent drop of -70% was not a surprise at all but rather a natural all time high rejection. If Dogecoin manages to now create bullish confirmation, the bullrun will continue.

Levels to watch: $0.2. $0.5

Keep your long term vision!

Philip (BasicTrading)

Review and plan for 18th June 2025 Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

CRYPTO - 4 Year Cycle May Fail But AltSeason May Yet Arrive Late50 minutes depth TA covering many aspects of crypto + considerations of the dominant influence of stock indexes.

If you appreciate the effort given for FREE then do hit the BOOST - it encourages me to continue to operate on this website 👍

Not advice.

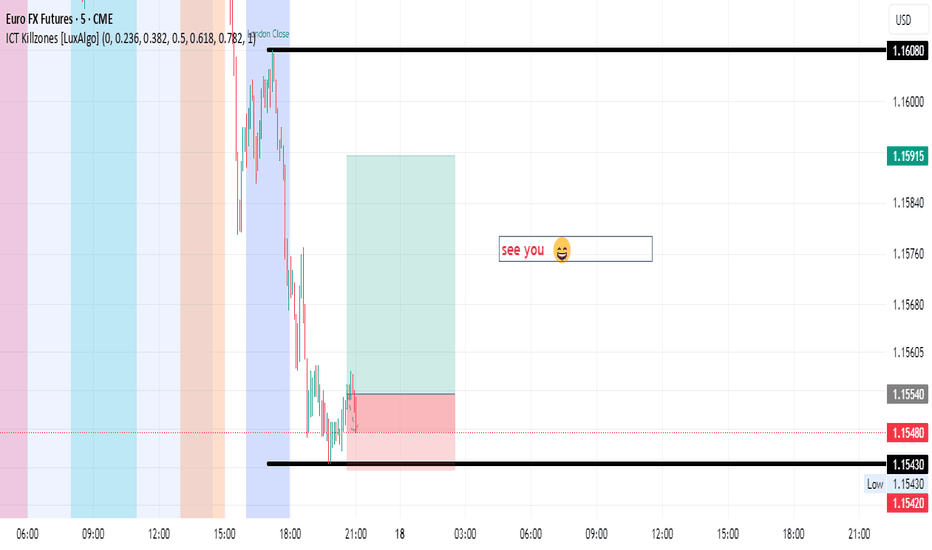

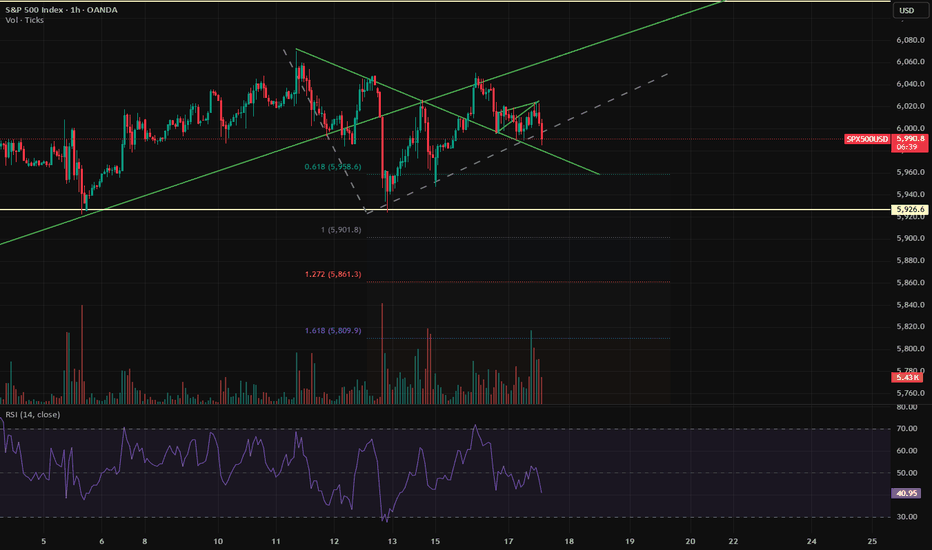

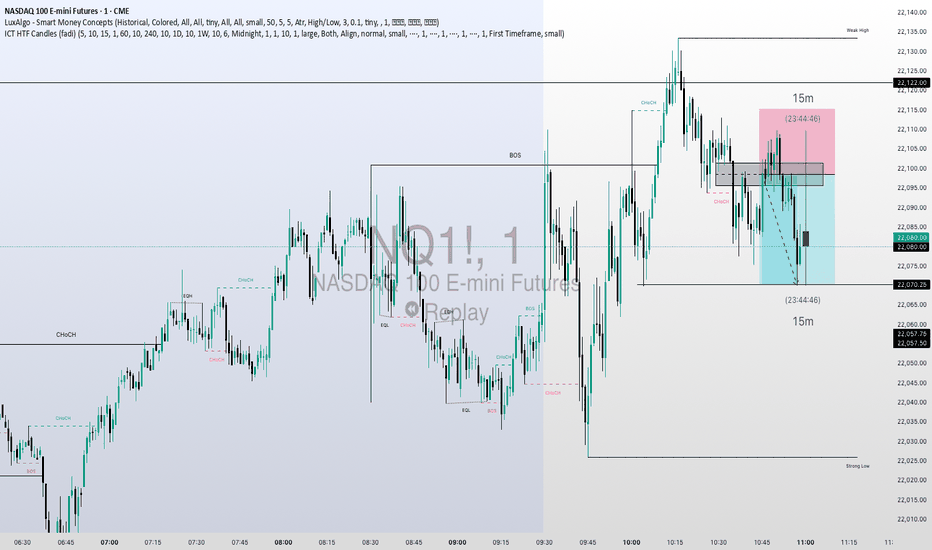

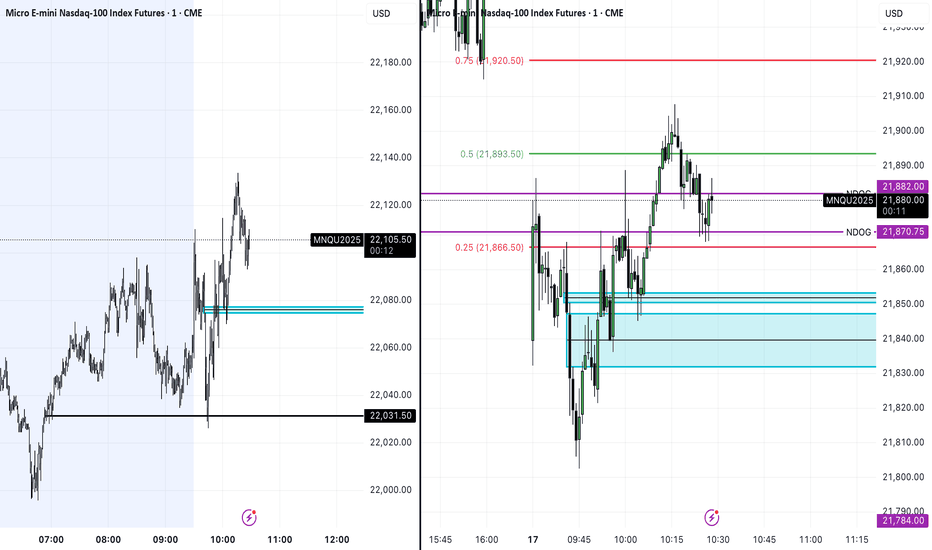

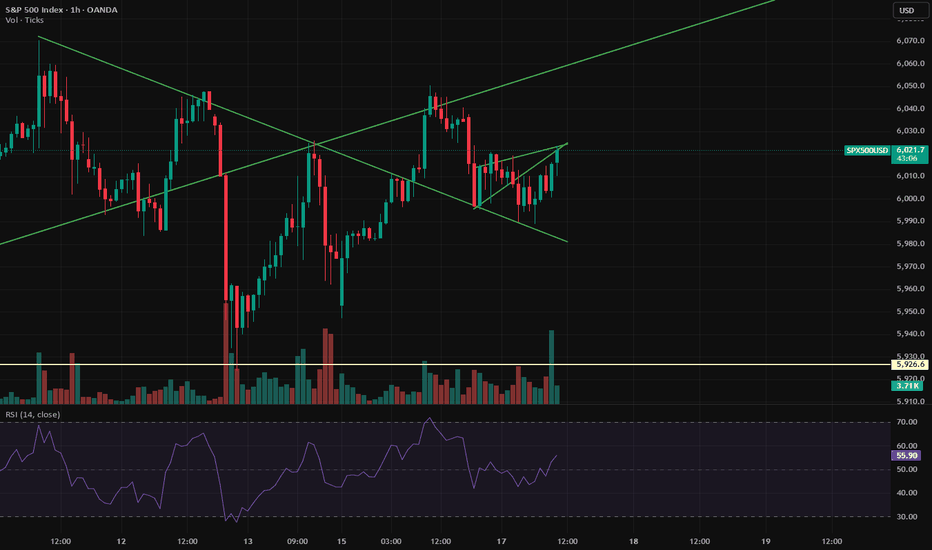

Trading Game of the day 17-MAY=2025Trading Plan of the day :-

1-bearish trend

2-(1-2-3)pattern

3-PDA :-30 m FVG

4-FVA:-which should give a chance for buyer to take its opportunity and then selling pressure increase in the bearish direction at the PDA

5-At Lower timeframe :-CISD with FVG

6-ARGUMENT:-

There was an FVA with FVG and OB bullish :-That make the rejection candles against the trend

These rejection candle was not significant because not only it is against the trend but there is no CISD against the trend and there is no FVG against the trend

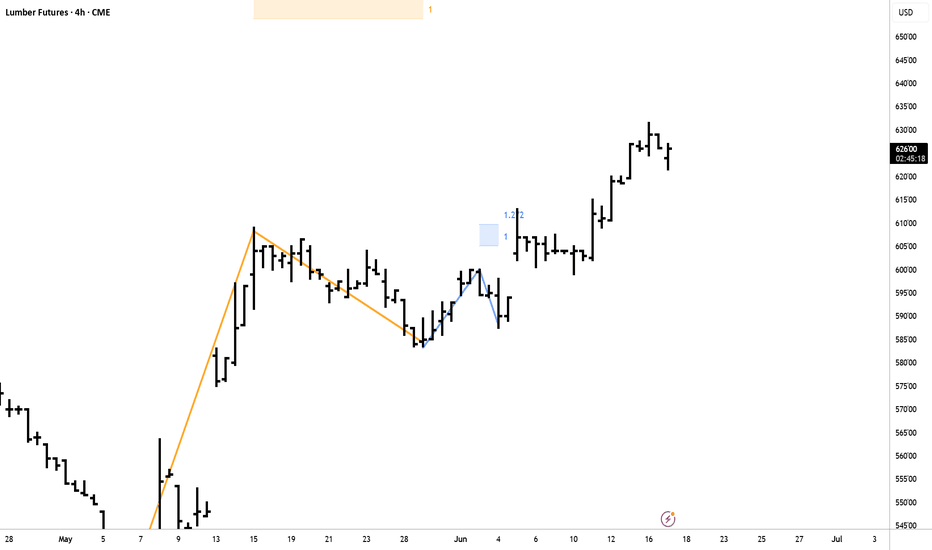

A review of multiple markets6.17. 25 an important change in oil to check out. we'll have to wait for some changes on gold to decide its direction.... it's not far below the high but it's not trading well... and I have some concern that the market could wash and rinse buyers and sellers.... so there needs to be more clarity for me to take a trade one way or the other.... it's no big deal but if you're not in a trade and it's not clear of its direction it's better not to take a trade until there's more clarity.

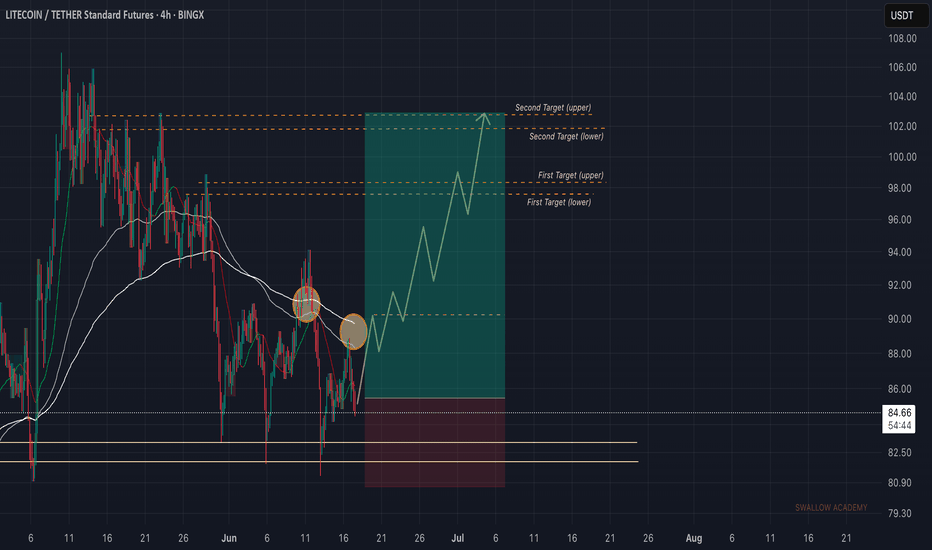

Litecoin (LTC): Looking Bad Now, But Has Good Potential Litecoin is in bad shape, where sellers are showing pressure, which could lead to bigger downward movement.

Despite that, we are still above the local neckline area, so we are still bullish, for now!

More in-depth info is in the video—enjoy!

Swallow Academy

TradingView Show: New Trade Ideas and The Leap TradeStationJoin us for a timely TradingView live stream with David Russell, Head of Global Market Strategy at TradeStation, as we break down the latest rebound in the markets and what it could mean for traders and investors. In this session, we’ll dive into:

- The upcoming Fed meeting and what policymakers might signal heading into the second half of the year

- Why the 10-year yield nearing 4.5% is important — and how to set alerts to stay ahead of key moves

- Summer trading strategies to navigate slower market conditions and spot emerging opportunities

- A closer look at Latin American equities, with names like Mercado Libre in focus

- The surprising strength in stocks that have doubled since the tariff-driven selloff

- How energy and oil markets are reacting to renewed geopolitical tensions in the Middle East

- And other trends that are shaping the broader investment landscape

Whether you're trading short-term setups or planning longer-term plays, this session will give you fresh insights and practical takeaways to help you stay prepared and informed through the summer months.

Bonus: Discover our latest broker integration update with TradeStation—now supporting equity options trading directly on TradingView. This upgrade brings advanced tools like the strategy builder, options chain sheet, and volatility analysis to your fingertips, making it easier to trade through uncertain market conditions.

This session is sponsored by TradeStation, whose vision is to provide the ultimate online trading platform for self-directed traders and investors across equities, equity index options, futures, and futures options markets. Equities, equity options, and commodity futures services are offered by TradeStation Securities Inc., member NYSE, FINRA, CME, and SIPC.

Disclosures from TradeStation:

tradestation.com/insights/etf-disclosures/

tradestation.com/important-information/

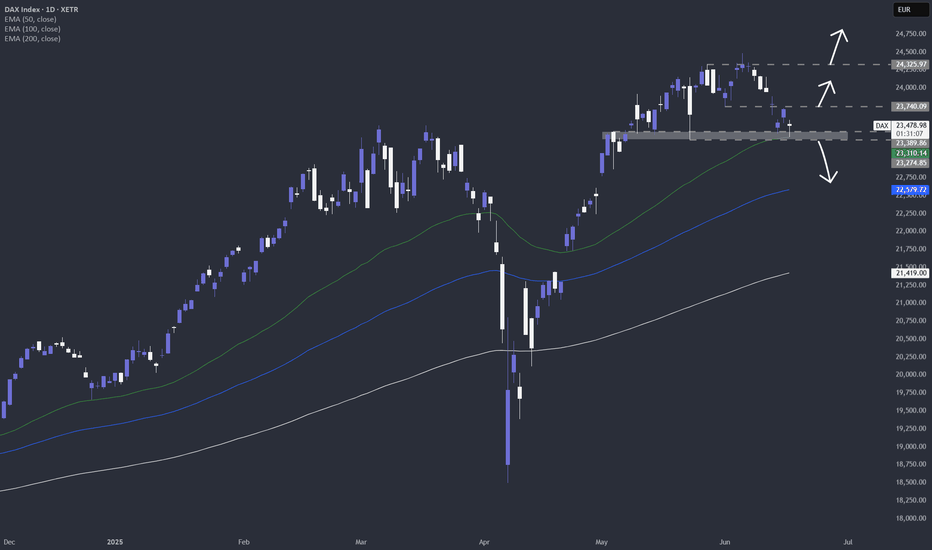

"Downside DAX" is what we will call it in July?Looking at the technical picture purely, we can see that weakness is starting to kick in. Will July be a negative month for DAX? Let's have a look.

XETR:DAX

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

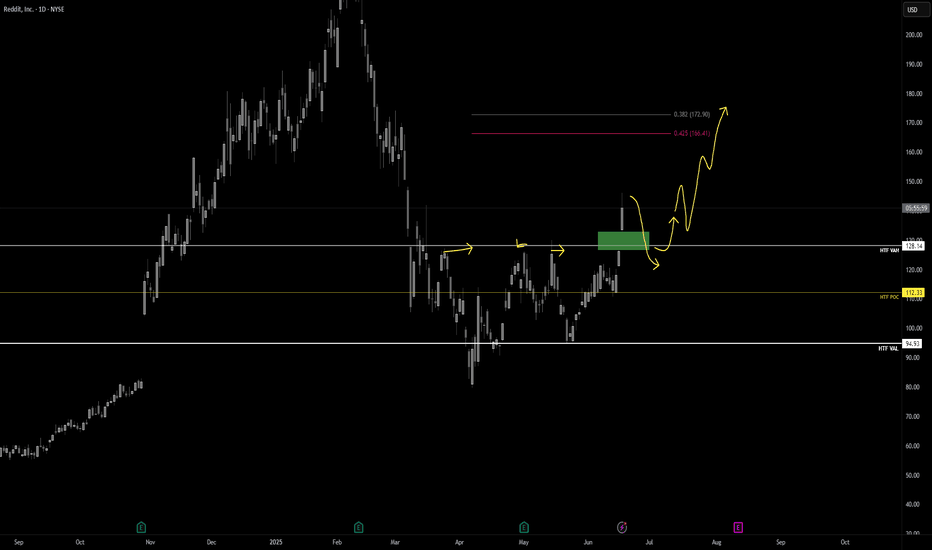

Reddit breaks out for bullish run I have been watching Reddit for a couple of weeks and identified that we had put in the .786 low from the correction since February and then formed a range that was well respected for the past 4 months .

In this video I highlight zones where i expect price to gravitate too and where a nice entry will be if you are looking to long reddit.

Tools used Fib suite , trend based fib , tr pocket , 0.786 + 0.382 and fixed range .

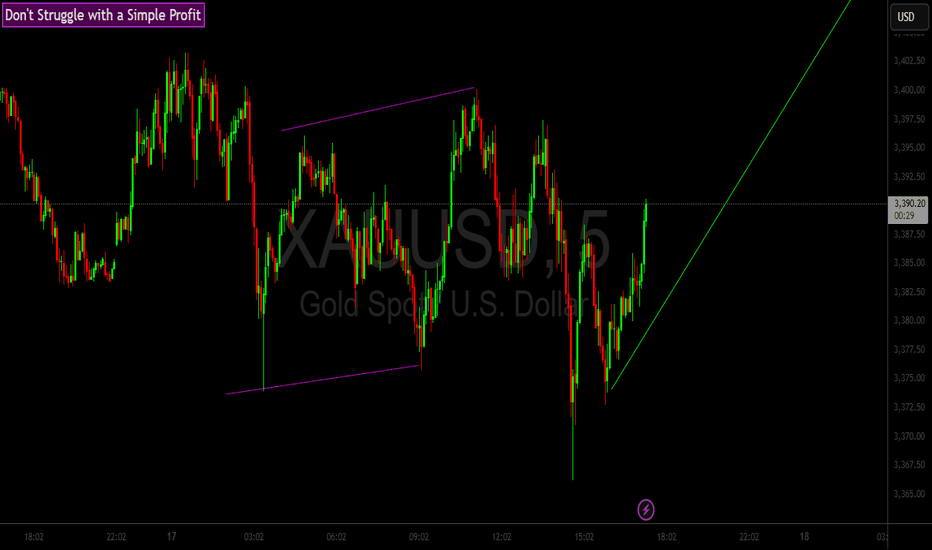

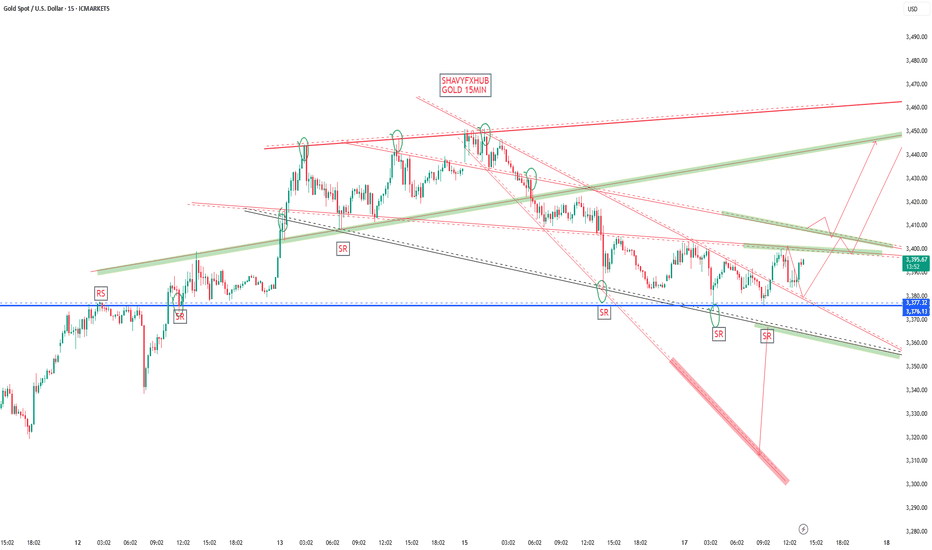

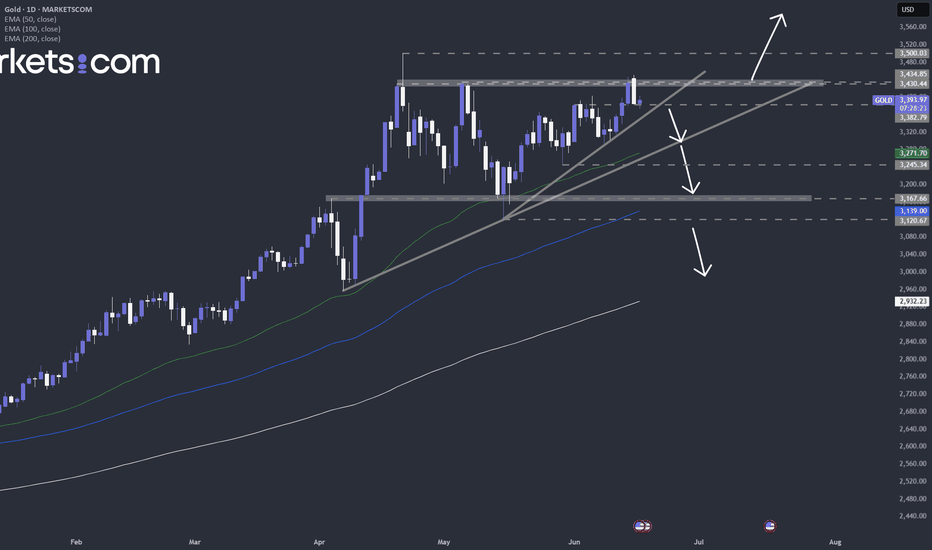

Is gold (XAUUSD) building up for a possible push higher?With the economic data sets, which we are getting and will be getting this week, all eyes on gold, and its possible move to the all-time high. Apart from this, the geopolitical tensions are also something that is fueling gold demand. But what are the technical saying? Let's take a look.

TVC:GOLD

FX_IDC:XAUUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.