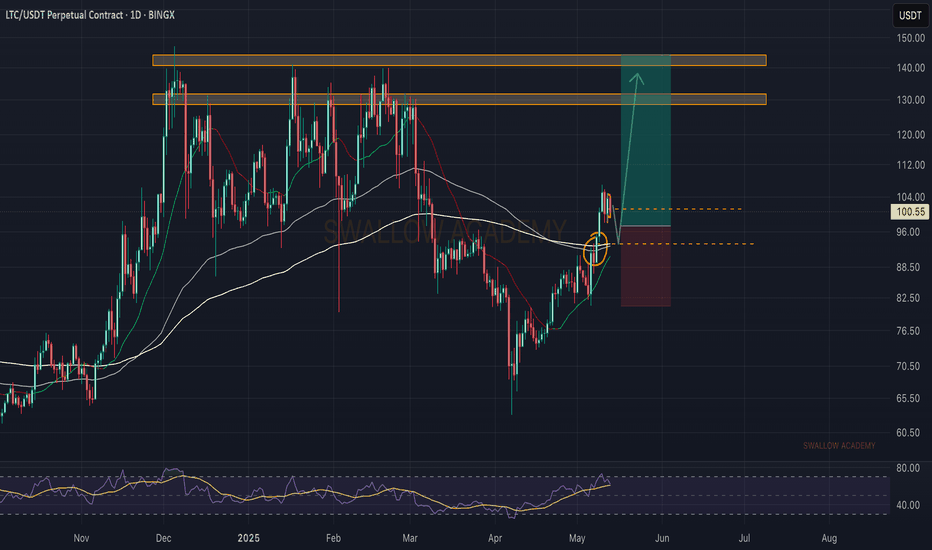

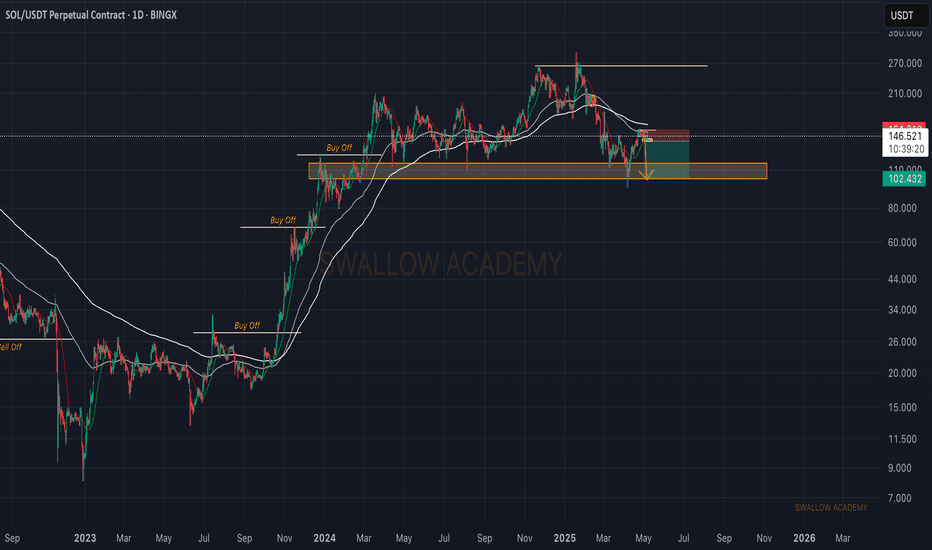

Litecoin (LTC): We Are Looking For Re-Test and 48% of PumpLitecoin has a good chance of retesting the recently broken EMAs area, where once we are going to see a smaller correction, we will be looking for the price to push and gain at least 40-48% of market price movement.

More in-depth info is in the video—enjoy!

Swallow Academy

Community ideas

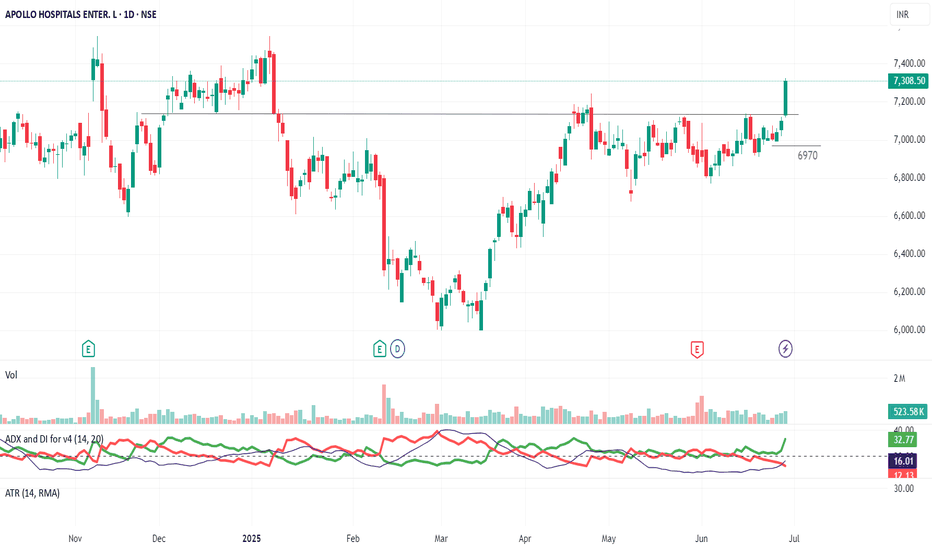

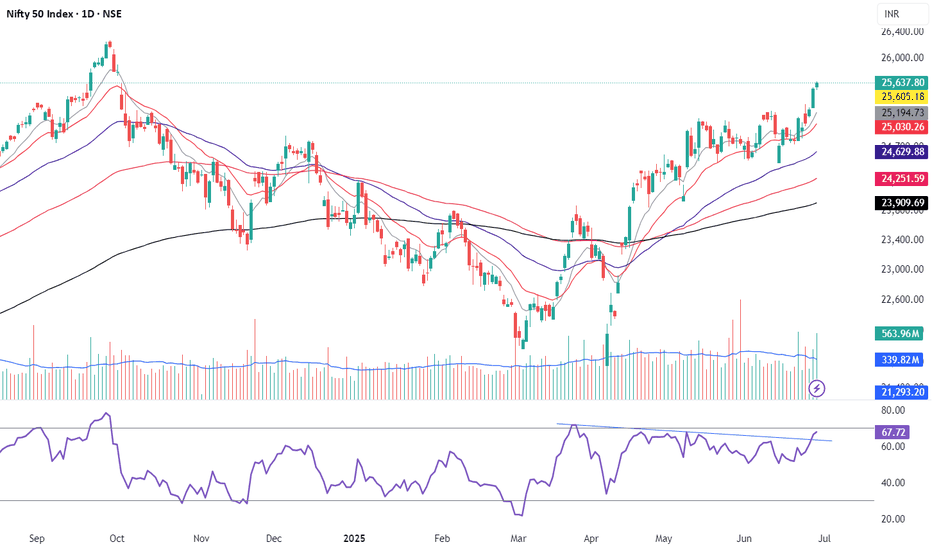

Review and plan for 30th June 2025Nifty future and banknifty future analysis and intraday plan.

Swing ideas.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

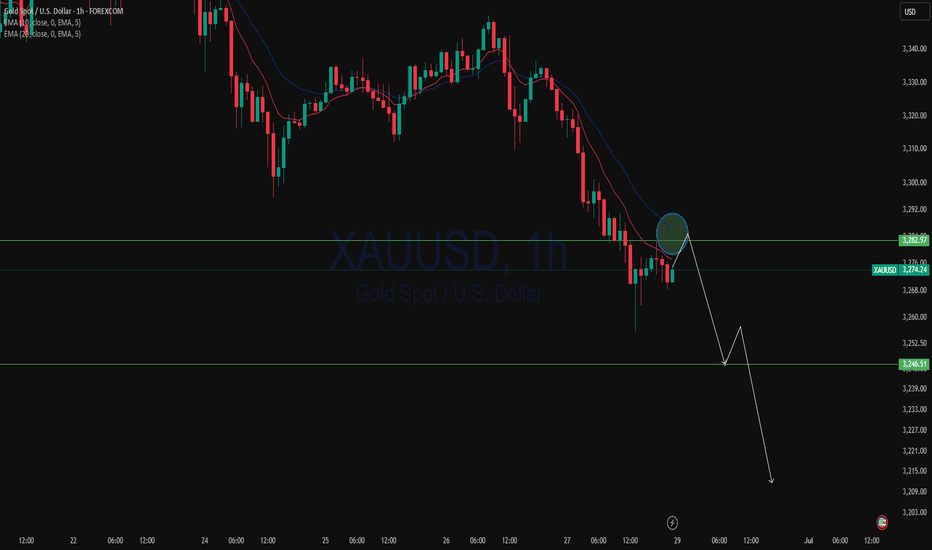

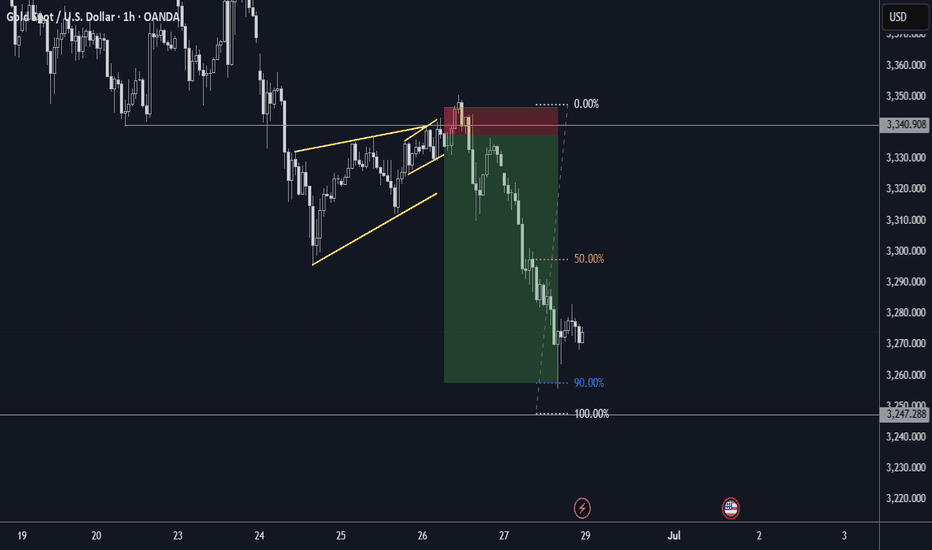

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

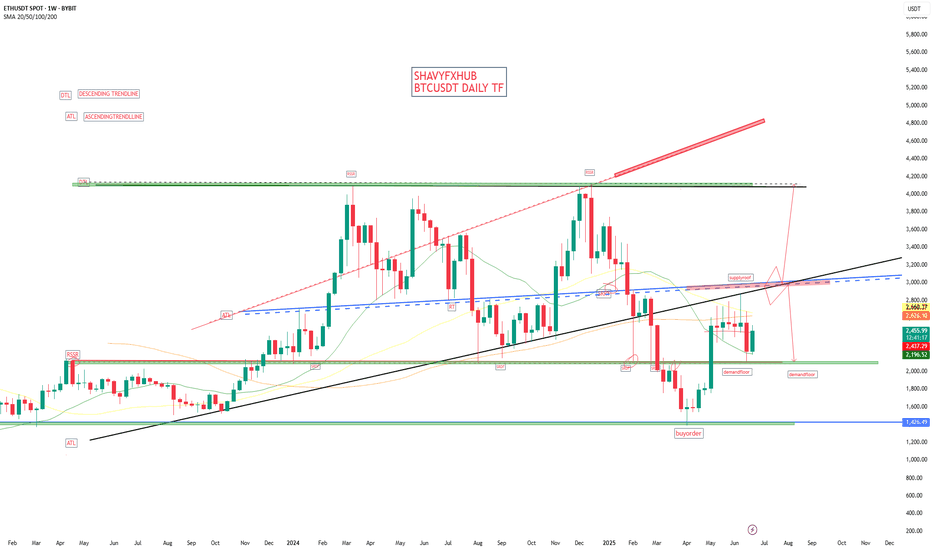

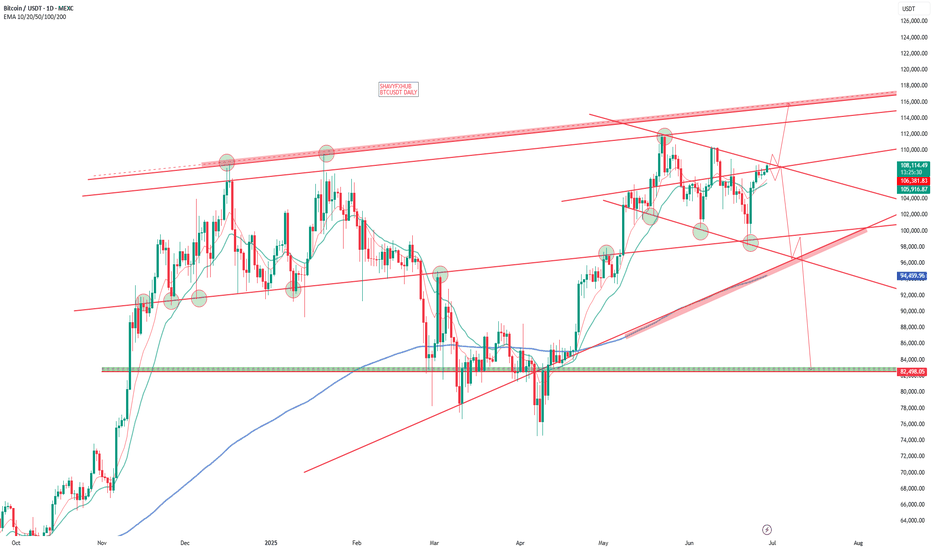

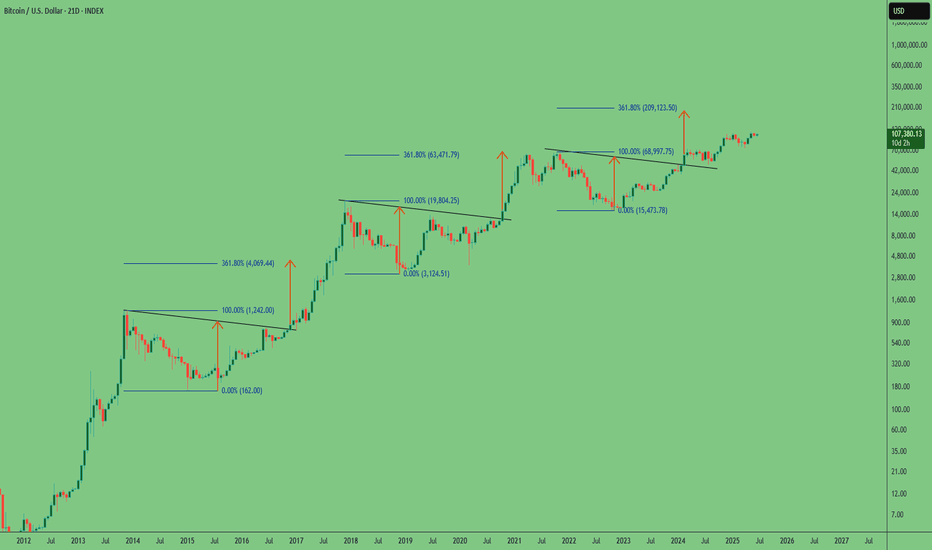

BITCOINBITCOIN wait on the close of daily candle for clear directional bias ,break and close 108k will expose 111-115 and more higher zones .break below by rejection on daily candle will call for sell and target will be around 100-94k zone .

trading is 100% probability, some people are gifted while some are not.

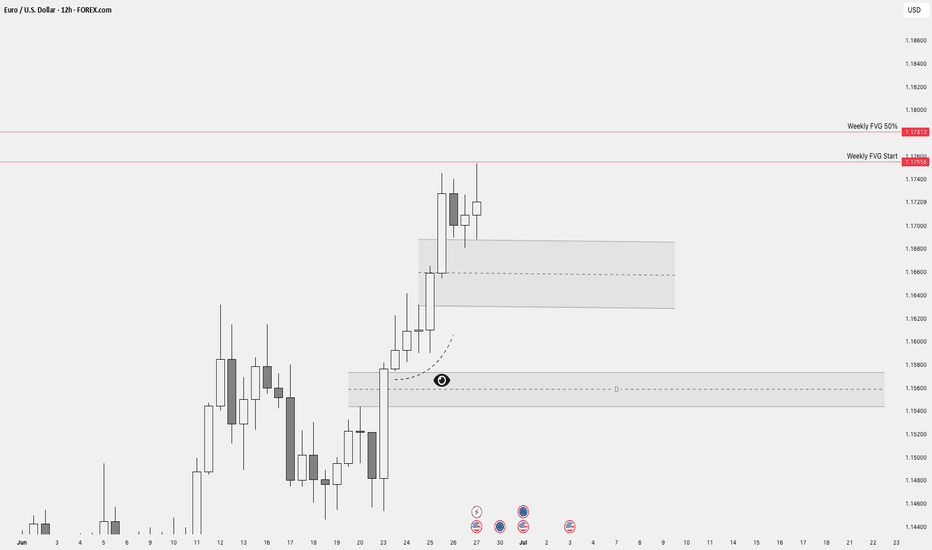

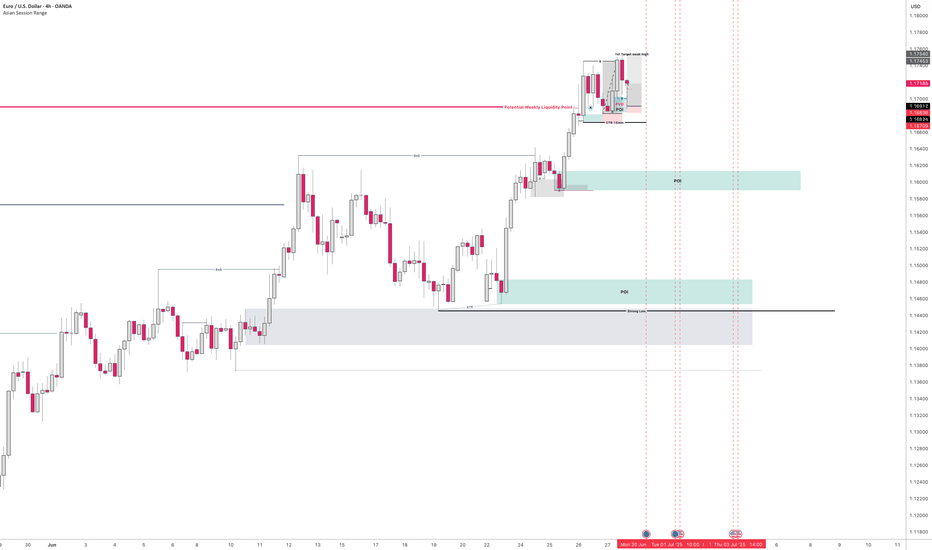

Last week of June EU outlookWeekly forecast for EU. We have seen a very bullish June so far. We approached a weekly POI before starting to consolidate.

We are now entering the last week of the month where the monthly candle's upper wick needs to be formed.

In this video I have identified a potential area where we could see the pullback take place.

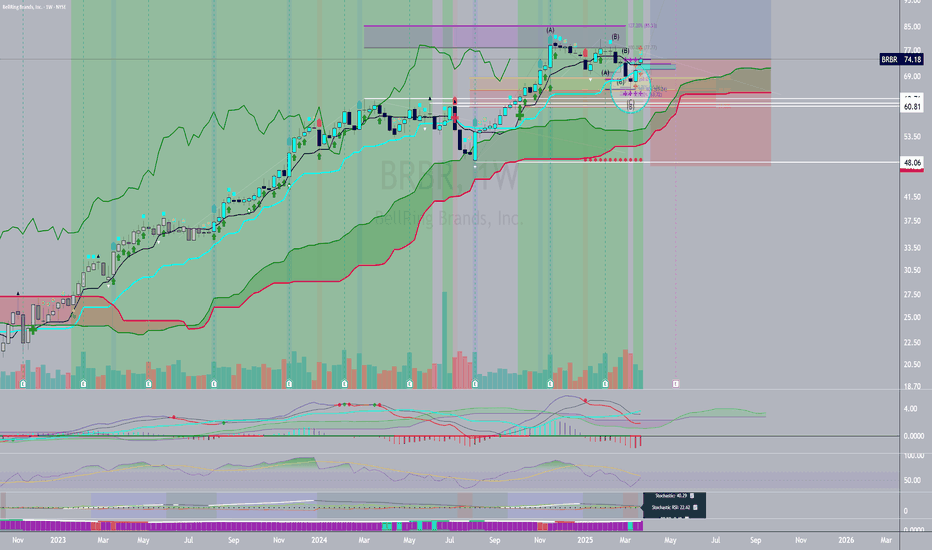

BRBR Power Bar and Protein Shakes Shakin' It UP!Fundamentals:

Meets my parameters for investing long-term.

Technicals:

Daily:

ExDiv1

Triples

161 extension, equal legs and weekly key fib meeting at the same spot (confluence)

New Crown high formed on the daily

Weekly:

uHd+hammerw/ d3 volume @ key fib pullback

morning star

Met monthly average range

Kijun signal

extreme indicator

Target 140 (tentatively), but will hold forever if I possible

Tentative rethinking point to buy more investment if it falls is about 48.

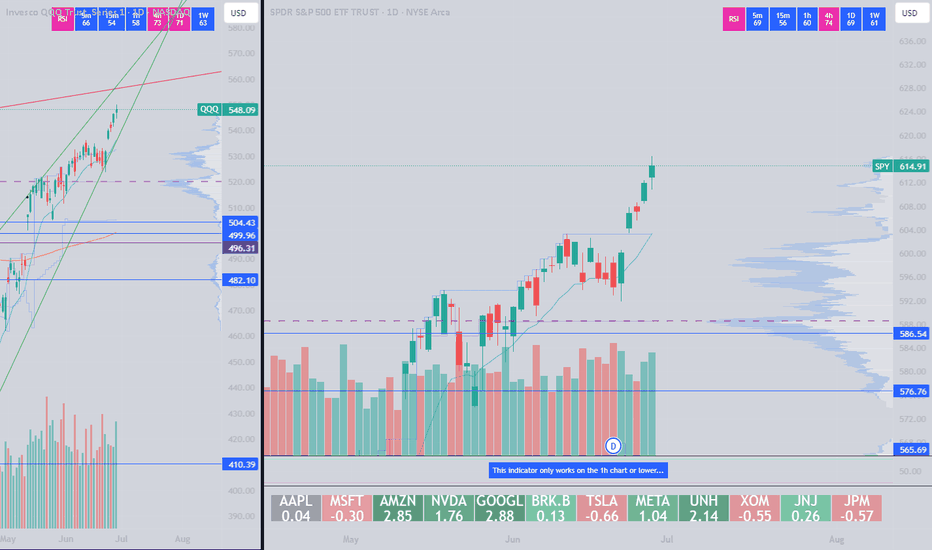

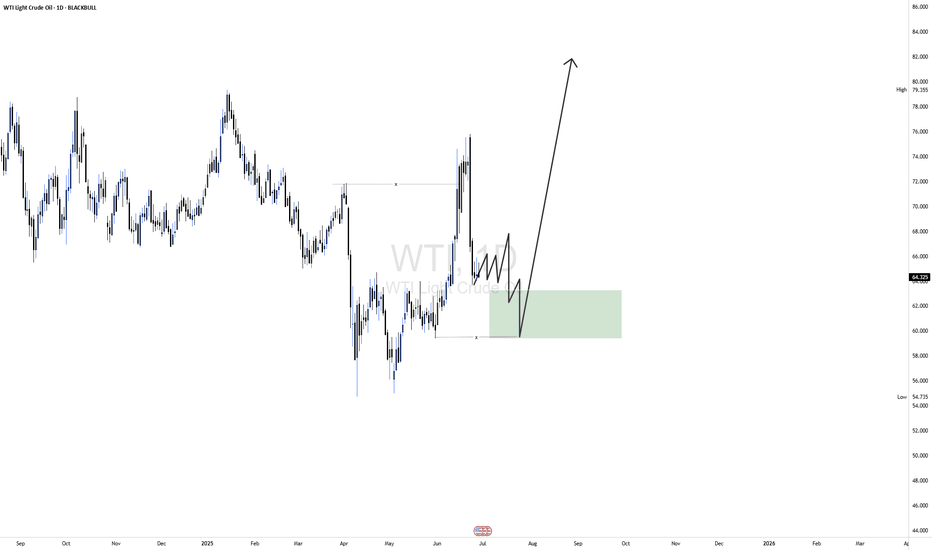

Weekly Market ReportIn this week’s video, I break down the key technical levels and market dynamics across four major instruments: S&P 500 (/ES), Gold (XAUUSD), Crude Oil (WTI), and Bitcoin (BTCUSD).

We explore price structure, liquidity zones, and potential setups with a focus on probability-based trade planning and risk management. Whether you're a swing trader or intraday participant, this breakdown offers valuable insight into the week ahead.

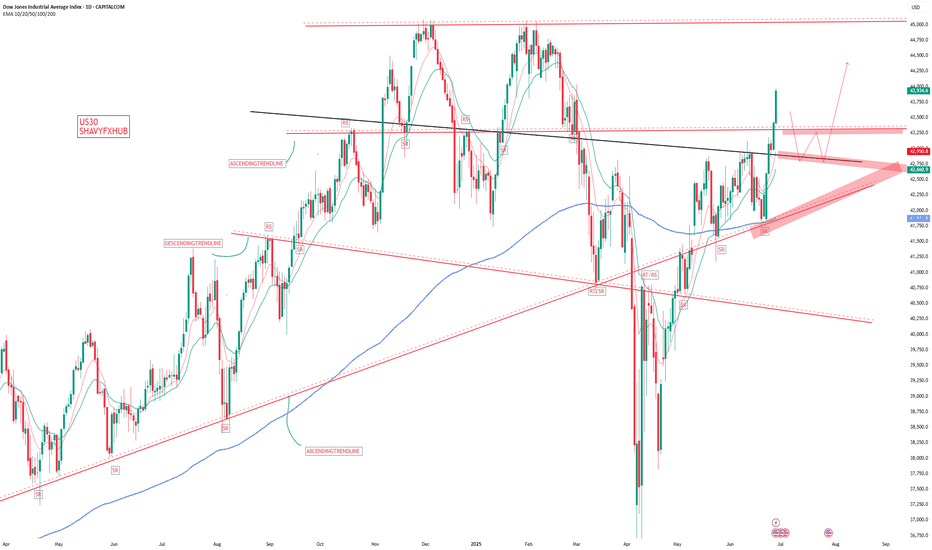

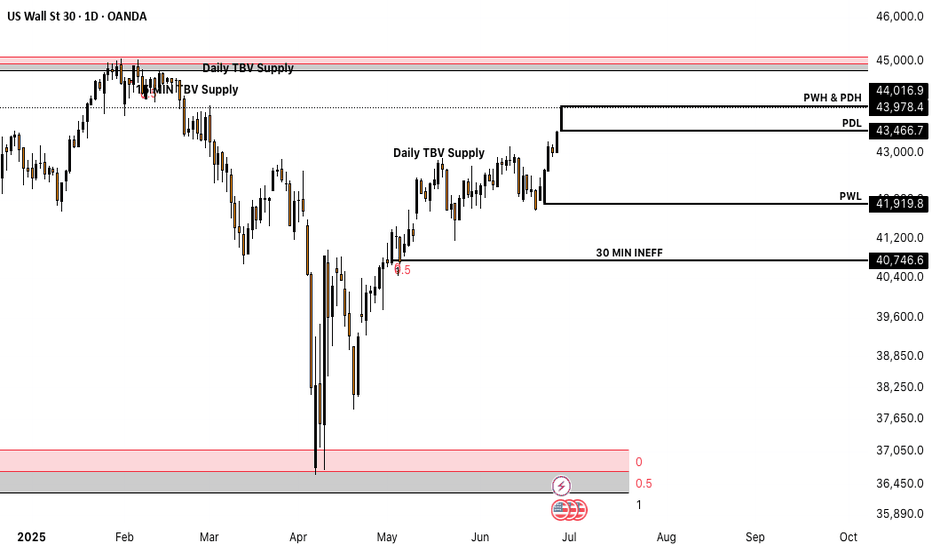

Market Re-Cap and Outlook for NEXT WEEKHere I am giving you a little insight as to what trades I am currently in, taken & looking to take for the week just gone and the week coming.

1 Winning trade on EU

1 Current open position on EU

EURGPB - Breakdown

AUDUSD - Breakdown

NZDUSD - Breakdown

Gold - Breakdown

If there are any pairs you would like me to share my feedback on give me a message and I will be happy to try and do so.

Thanks

Happy Hunting