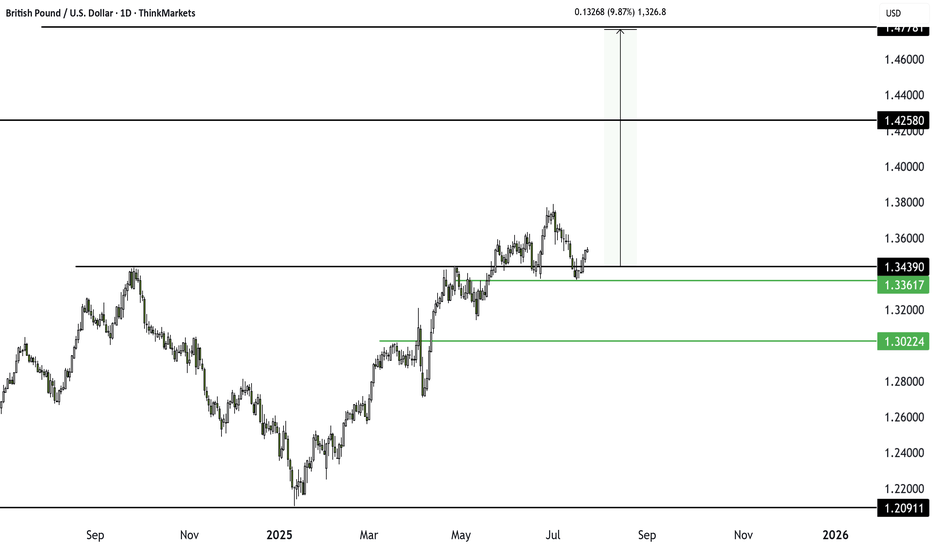

GBPUSD Traders Beware: A Major Drop Could Be ComingThe classic rule says what doesn’t go up must come down. After a failed breakout at 1.3439, GBPUSD is struggling. With longs sitting on big gains from January’s low, a drop toward 1.3361 or even lower looks likely. Watch this key level now.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Community ideas

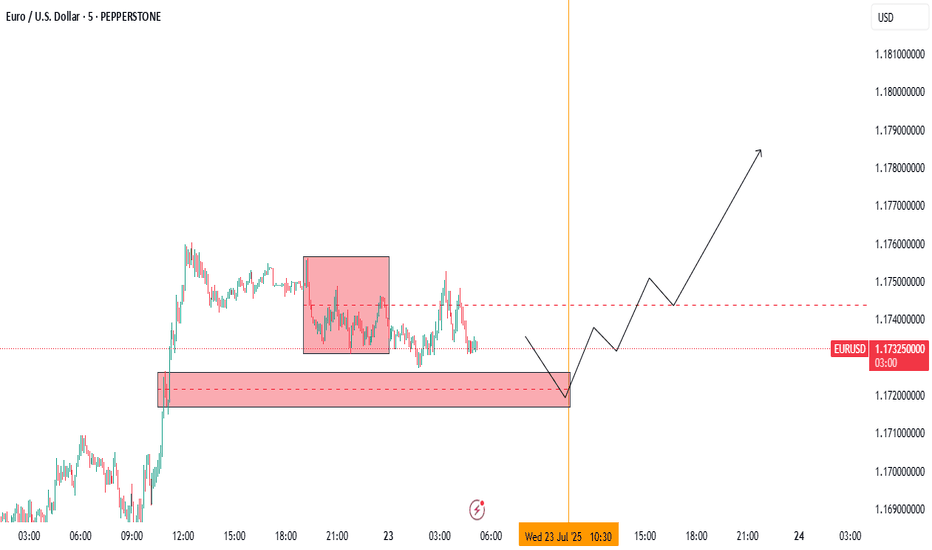

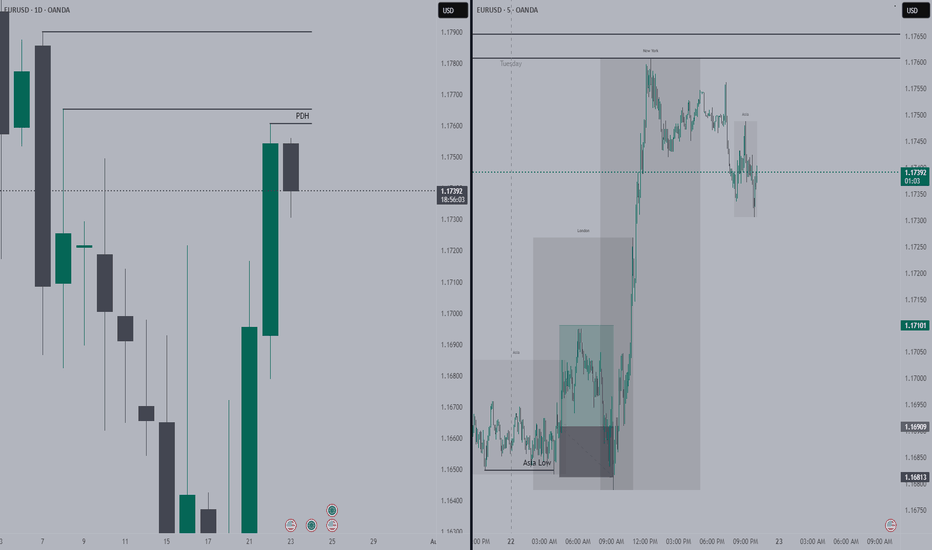

EURUSD LONG AND EDUCATIONAL EXPLANATION ON SNIPER TRADESEUR/USD climbs to two-week tops around 1.1760

EUR/USD now gathers extra steam and advances to new two-week peaks around 1.1760 on Tuesday. The increasing selling pressure continues to hurt the US Dollar amid steady trade concerns and rising effervescence surrounding the Trump-Powell spat.

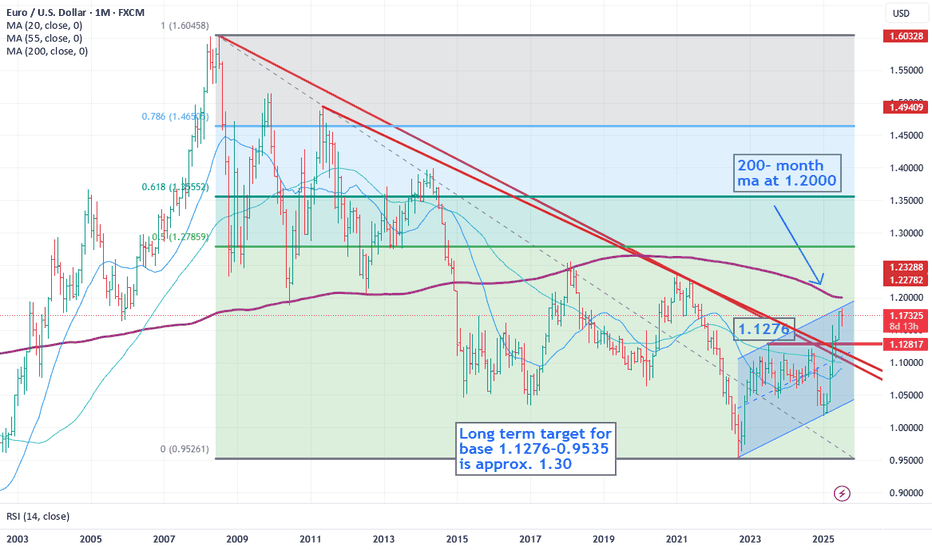

EUR/USD Update: Bullish Momentum Builds The euro just popped above $1.17 as optimism grows around a potential US-EU trade deal, following the recent US-Japan agreement. 📊

From a technical perspective:

• The euro found support at the April high of 1.1573, rebounding sharply — a strong sign that the bull trend is still intact. 🚀

• Next resistance levels to watch:

o 1.1830 – July’s high 📅

o 1.1850 – Top of a long-term channel from 2022 📈

o 1.2000 – The 200-month moving average, a major long-term target that often attracts price reaction 🔄

📌 Key takeaway: The path of least resistance remains to the upside, with momentum building toward 1.18+ in the near term.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

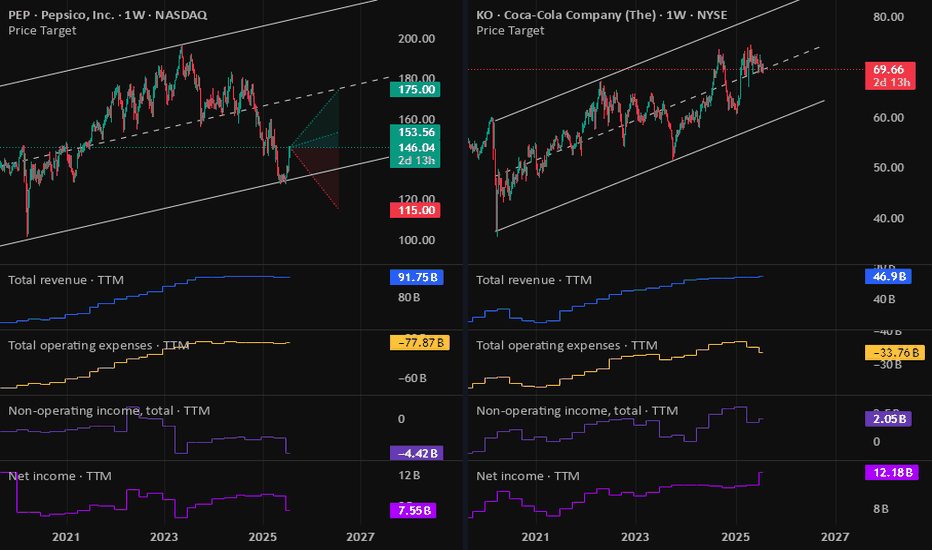

KO: Coca-Cola (CFD) Earnings 23-07-2025Yesterday we have the Coca-Cola earnings report came out and beat on both earning and revenue. But due to the technical position I do not see it a good entry on the stock CFD, still see PepsiCo stock CFD is a better option.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

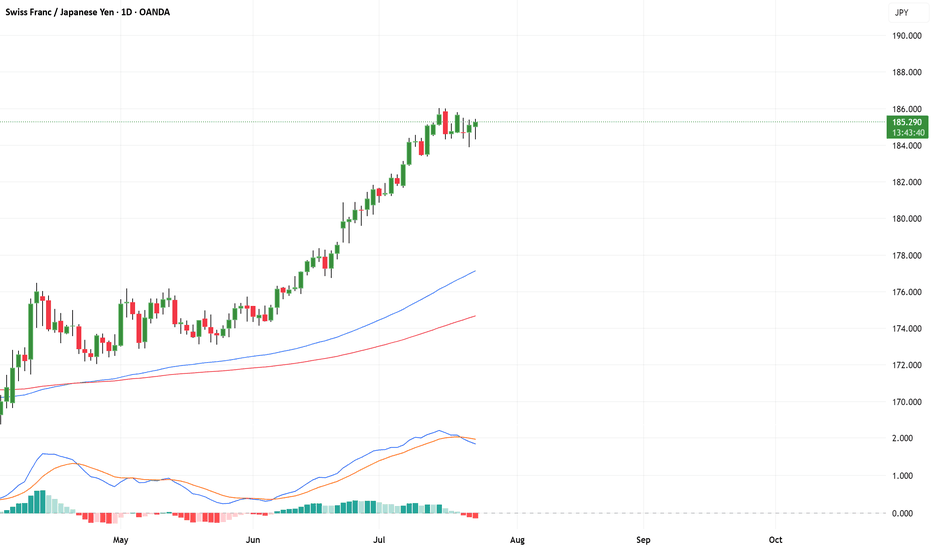

CHFJPY Looks Toppy… Is a 500 Pip Crash Coming?CHFJPY Has Exploded Past 180 — But Is the Top Already In?

After blowing clean through the key 180 resistance level, CHFJPY has continued surging into July — a month historically known for thin liquidity as traders hit holiday mode. These low-volume environments often lead to exaggerated price moves, much like we see in late December.

From a structural standpoint, this pair looks seriously overextended and ripe for a sharp pullback — with potential downside targets around 180 and 178 over the coming weeks.

If I were a bull, I’d want to see a clear break and weekly/monthly close above 186 before considering further upside.

As it stands, I’m gradually building into a short position, eyeing that 180 handle as my first key level.

Let me know your thoughts in the comments — agree, disagree, or seeing something I’m not?

*This is my personal analysis shared for educational purposes only. Always do your own research — never blindly follow anyone’s trades.*

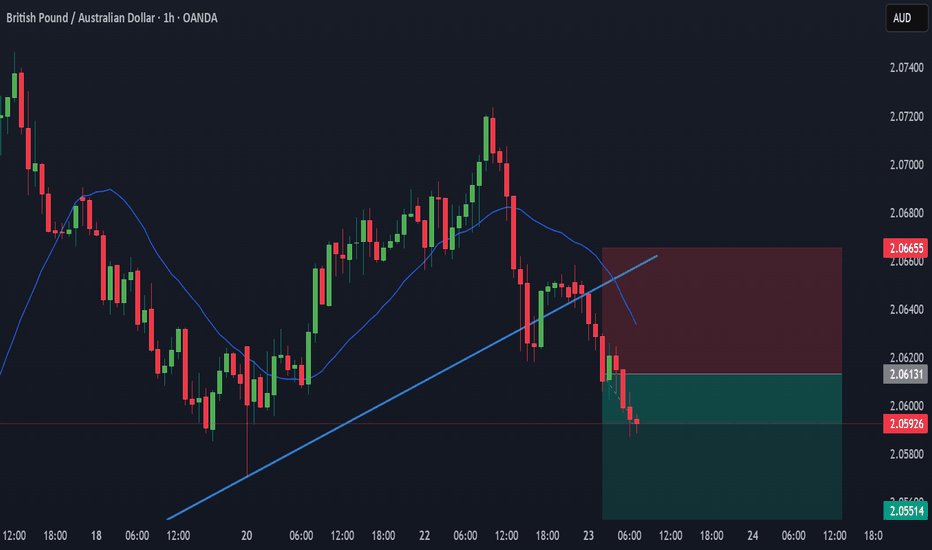

WOULD YOU TAKE THIS TRADE? GBPAUD SELLAll the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

tradingview.sweetlogin.com

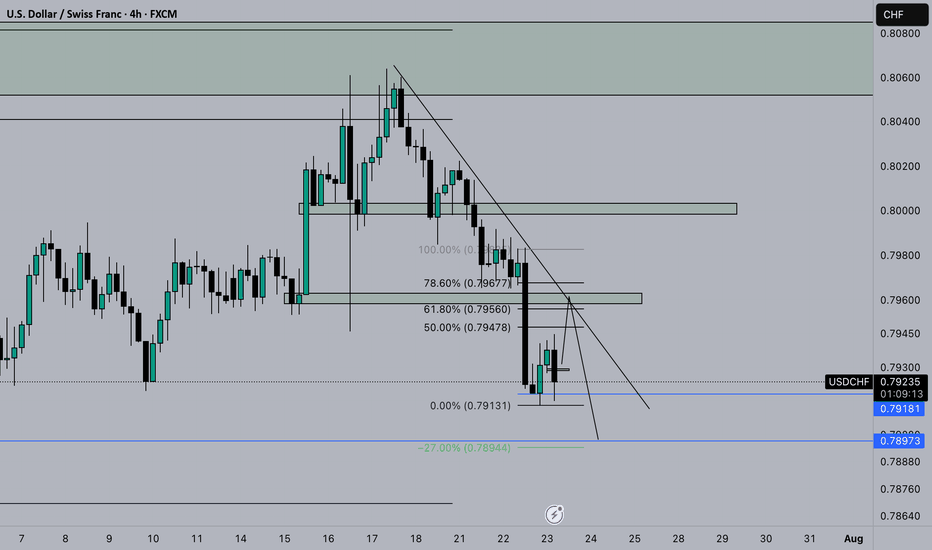

USDCHF FORECAST It has been quite so long now we are back again with a new energy and momentum, and probably I have changed the way that I look the market. With this USDCHF I'm actually waiting to see price coming into those potential zones and see if I get any potential to enter the market. Let's see how the market is going to develop. Remember patience is Key.

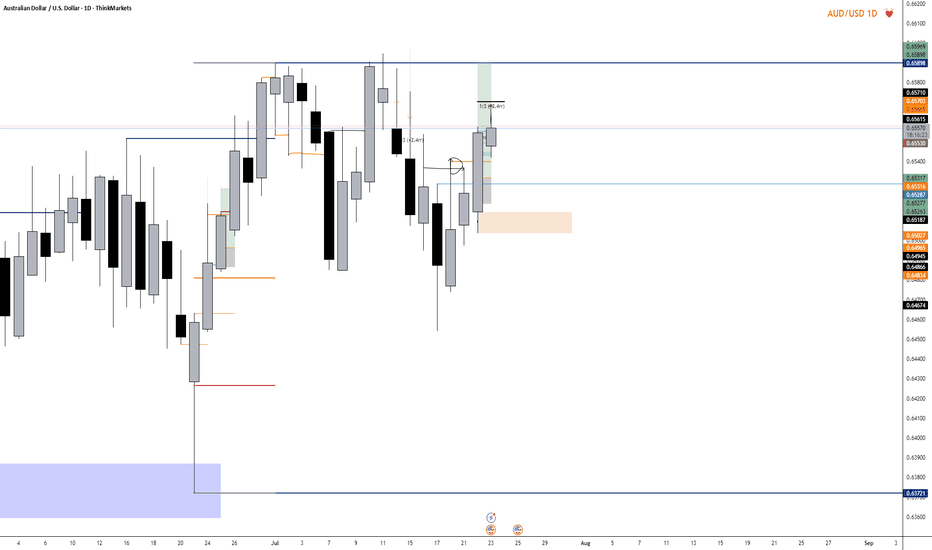

AUDUSD Long - A BreakdownAfter a thorough breakdown, I decided to enter longs on AUD/USD. I expect for price to reach highs of around .65898 Which is the daily structure high Currently in profit On a long position and We entered on the 5 minute using a one hour stop loss Hopefully this trade continues to play out, and we'll see you on the other side of profit.

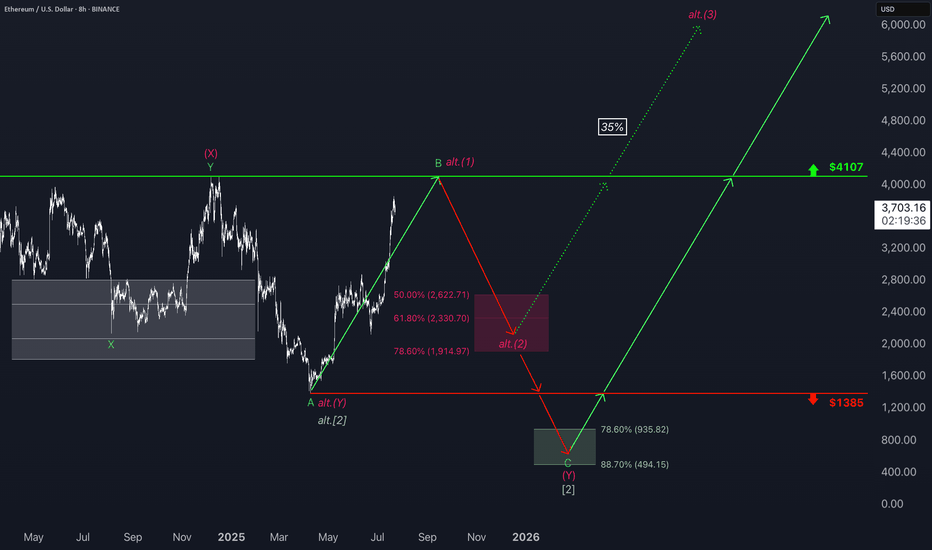

ETH: Eyes Resistance, But Correction Still LoomsEthereum has also seen a modest pullback since yesterday morning, but here too, it’s too soon to confirm a high for turquoise wave B. Accordingly, we anticipate further gains in this corrective rally—potentially up to resistance at $4,107—before the subsequent turquoise wave C takes over and drives the price down into the green long Target Zone ($935.82–$494.15). Within this range, we primarily expect the low of the wave- correction, which has now lasted more than four years, setting the stage for a long-term trend reversal to the upside. According to to our alternative scneario, magenta wave alt.(1) would complete with the next high. The following pullback, attributed to wave alt.(2), would then only extend into the slightly adjusted magenta Target Zone ($2,622–$1,914) before a move to new all-time highs (probability: 35%).

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

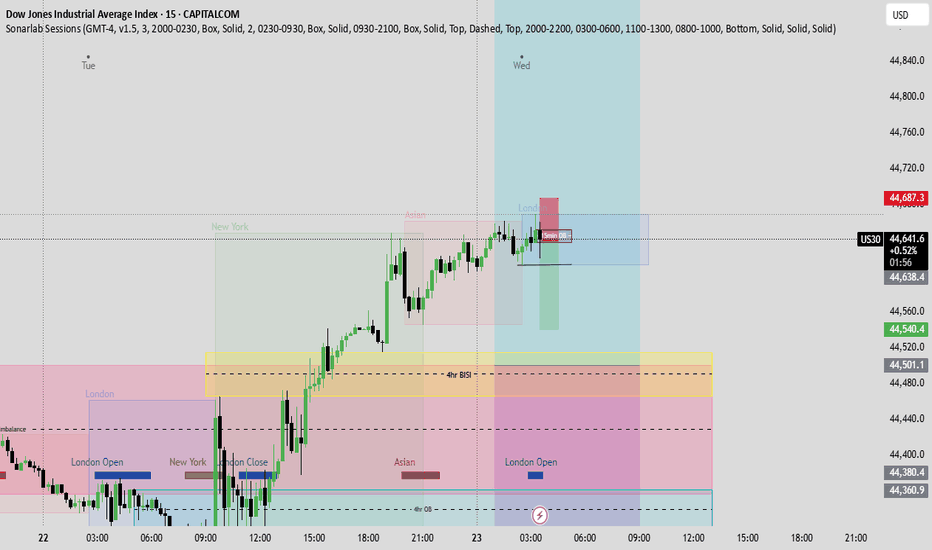

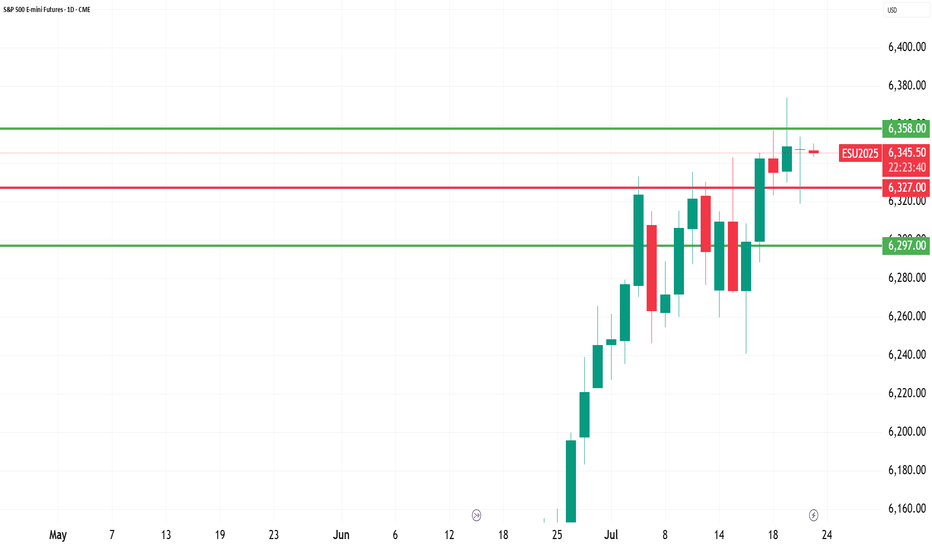

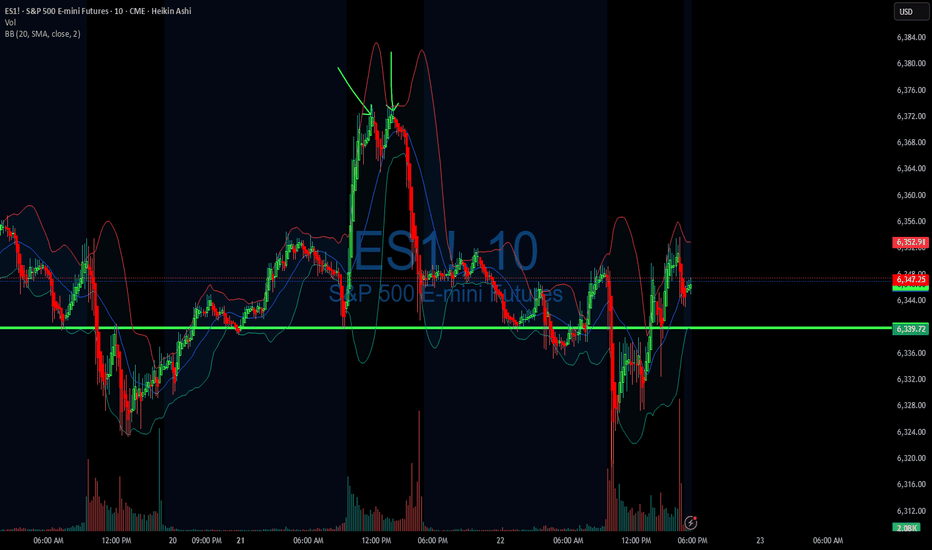

07/22/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +

Sleep: 6 hours

Overall health: Good

** VX Algo System Signals from (9:30am to 2pm) **

— 9:40 AM Market Structure flipped bearish on VX Algo X3!

— 10:20 AM VXAlgo ES X1 Buy signal

— 11:30 AM VXAlgo NQ X1DD Sell Signal

— 2:00 PM Market Structure flipped bullish on VX Algo X3!

**What’s are some news or takeaway from today? and What major news or event impacted the market today? **

Very clean trading day for me, signals worked out really well and everything played out accordingly

**News**

S&P 500 CLOSES AT A NEW ALL-TIME HIGH ABOVE 6,000

**What are the critical support levels to watch?**

--> Above 6339= Bullish, Under 6320= Bearish

Video Recaps -->https://tradingview.sweetlogin.com/u/WallSt007/#published-charts

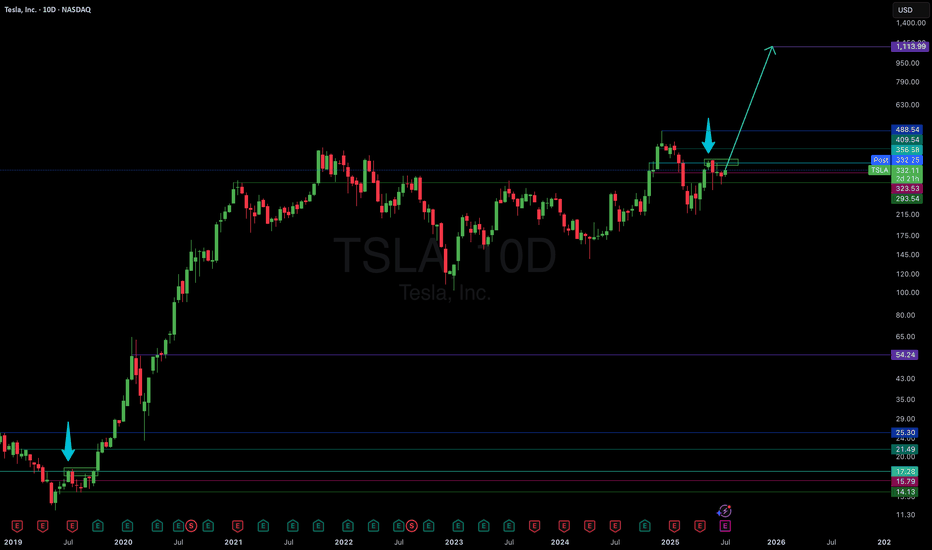

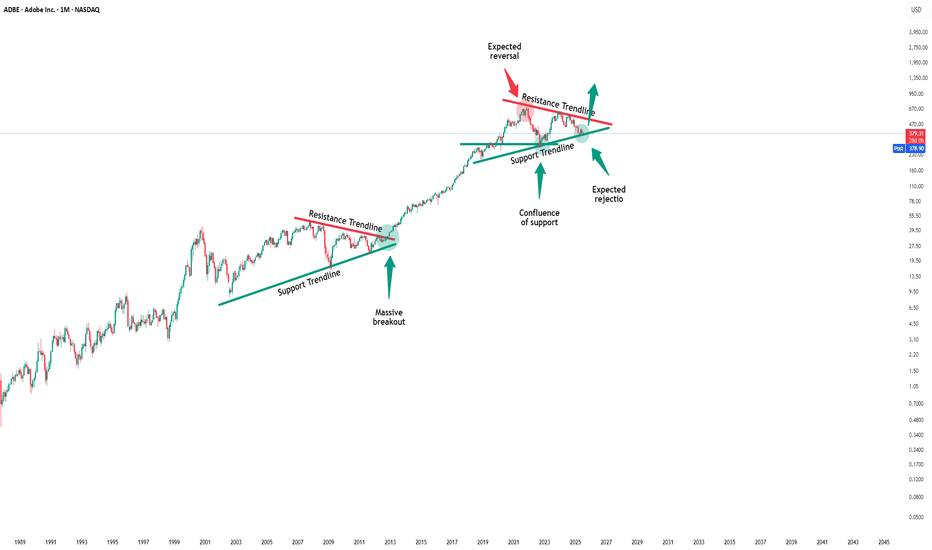

Adobe - A gigantic triangle breakout! 🔋Adobe ( NASDAQ:ADBE ) will break the triangle:

🔎Analysis summary:

Yes, for the past five years Adobe has been overall consolidating. But this consolidation was governed by a strong symmetrical triangle pattern. Thus following the underlying uptrend, there is already a higher chance that we will see a bullish breakout, followed by a strong rally.

📝Levels to watch:

$400, $700

🙏🏻#LONGTERMVISION

Philip - Swing Trader