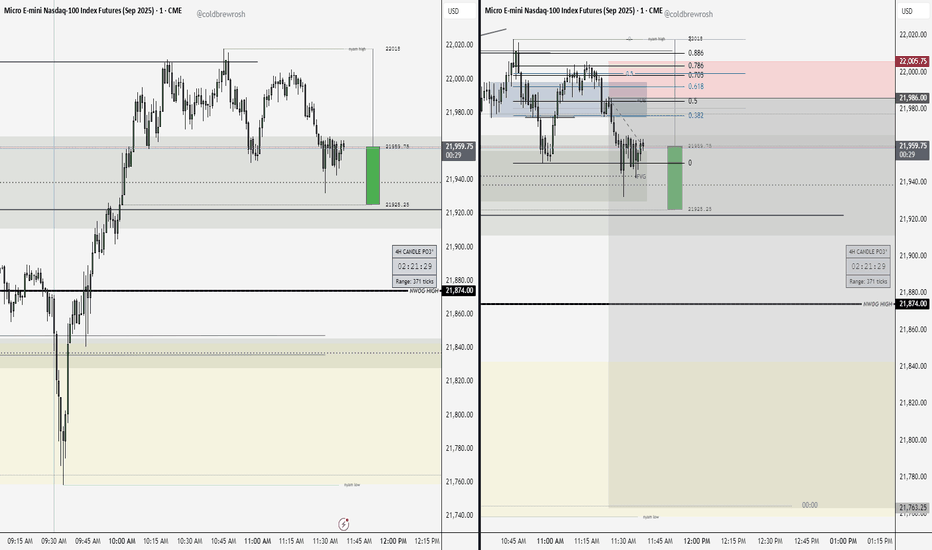

MNQU2025 SELL IDEAMy bias for MNQ this morning with this trade of 2 contracts running. Would like to see price trade lower to 9:30am lows.

What do you guys think will happen? Will post results of the trade below.

Thanks for watching! Give a like if you enjoyed the explanation and a comment on what you'd like me to share with you guys about my trading journey.

Community ideas

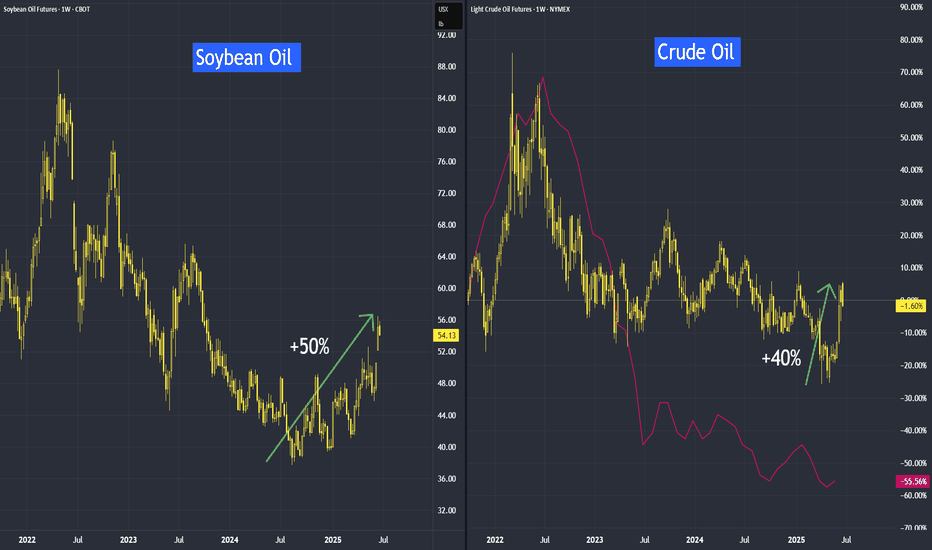

Why Soybean Oil Outperforms Crude Oil?From their recent lows, soybean oil has quietly crept up by 50%, while crude oil has risen by 40%. The reason goes beyond the recent renewal of tensions in the Middle East — it runs deeper than that.

Mirco SoybeanOil Futures

Ticker: MZL

Minimum fluctuation:

0.02 per pound = $1.20

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.sweetlogin.com

Trading the Micro: www.cmegroup.com

www.cmegroup.com

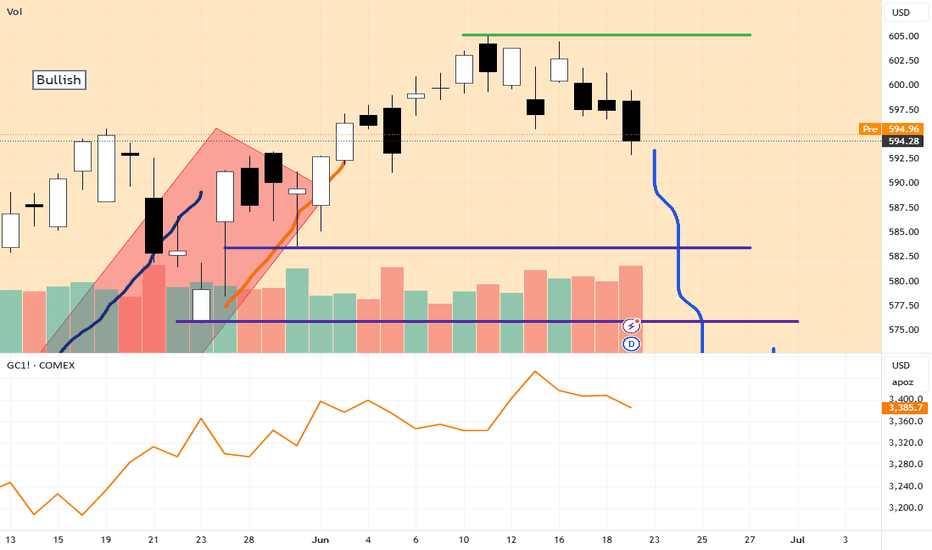

Futures Watchlist for week ending 6/27/2025Come join as i go through the future tickers that im watching this week and where i see them going. With war talks filling up on social media this will add to our volatility and we will look at key levels to capitalize off of it! Let me know your thoughts on these tickers. Also let me know if there is another symbol futures or stocks that you want me to breakdown for you!

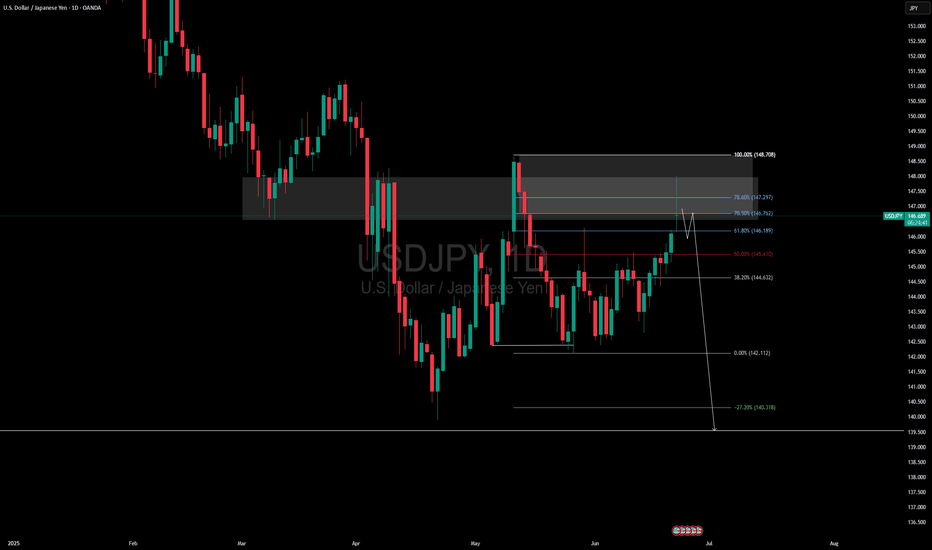

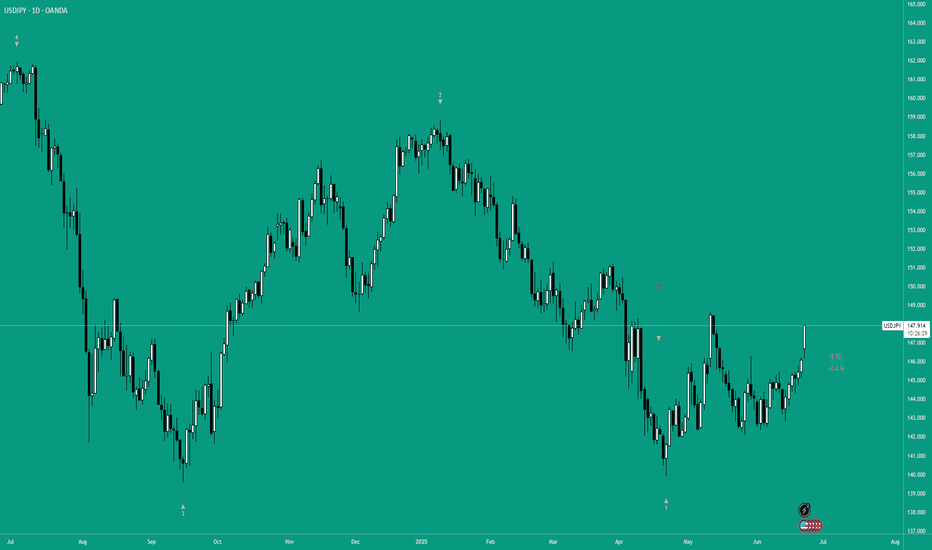

USDJPY MULTI TIME FRAME POV + XAUUSD , GU RECAP Hello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

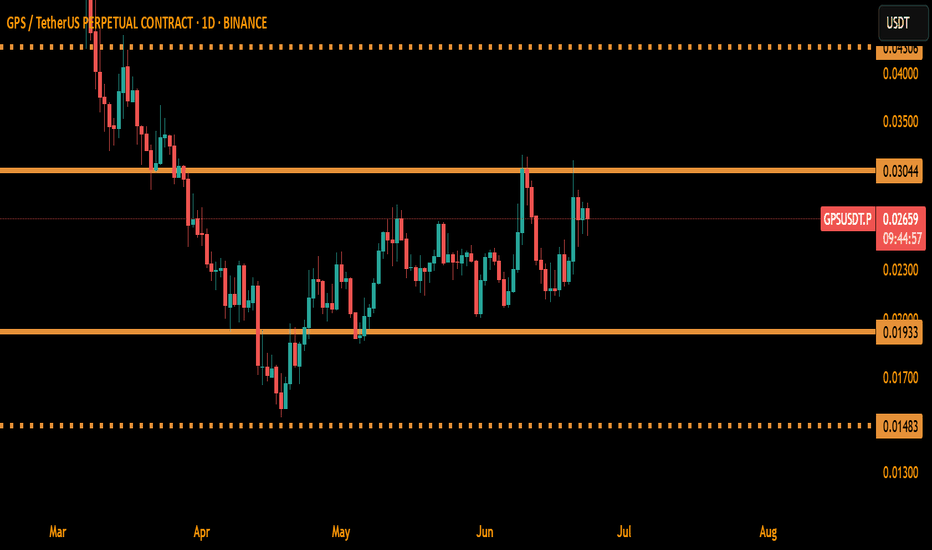

GPSUSDT CHART ANALYSİSWHAT IS CRYPTOCURRENCY?

Simply put, cryptocurrencies (also known as digital currencies,

cryptos, virtual assets, or digital assets) are digital forms of currencies.

They can be used to pay for goods and services just like conventional

currencies. Like how the traditional forms of currencies can be traded

against each other on the forex, cryptocurrencies can also be traded

against specific pairs on specialized platforms called cryptocurrency

exchanges.

The difference is that, unlike conventional currencies such as the U.S.

dollar, cryptocurrencies are often not controlled by a single entity.

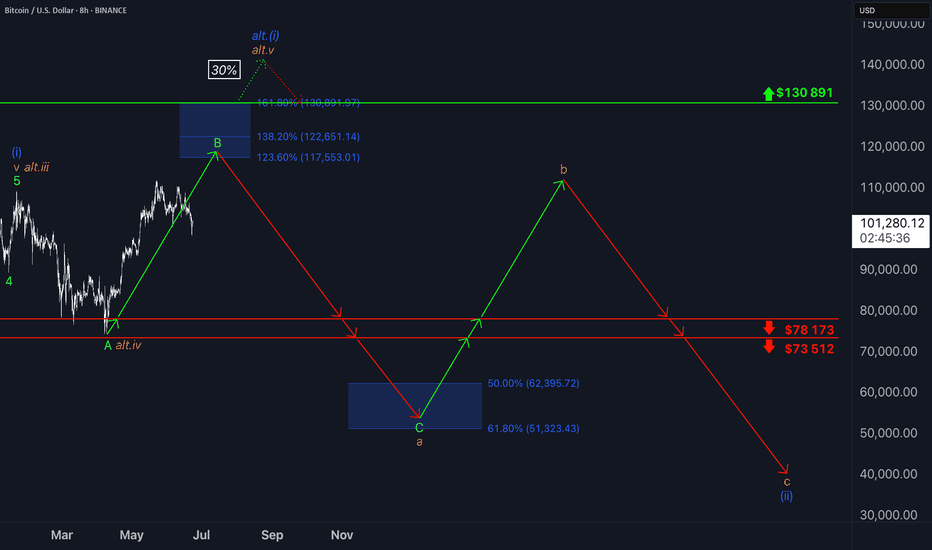

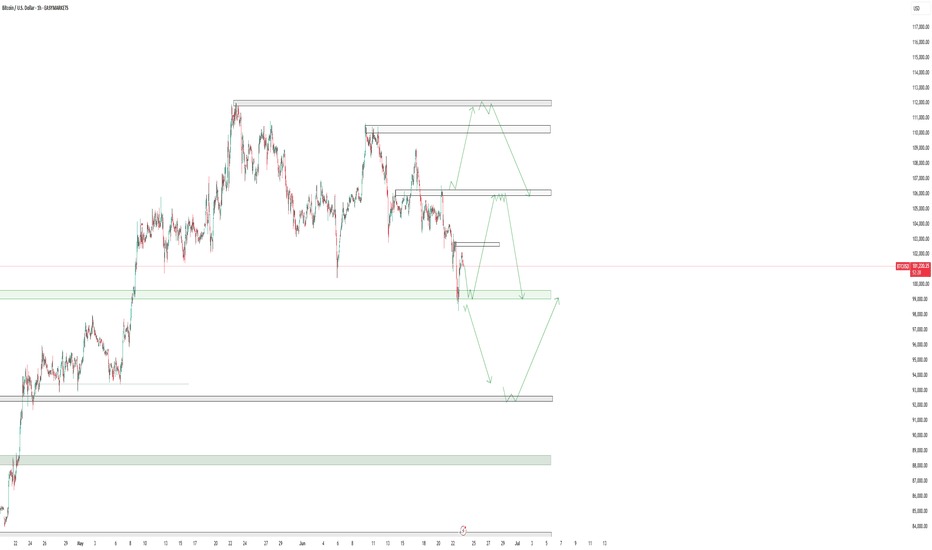

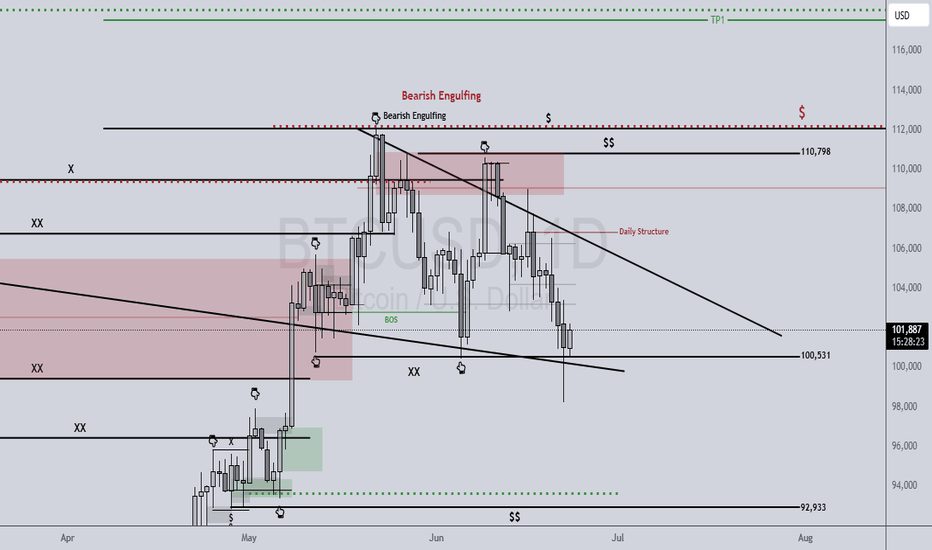

₿itcoin: PullbackBitcoin has experienced significant selling since Friday, briefly slipping below the $100,000 mark. We previously mentioned that a sharper pullback wouldn't surprise us. Whether prices will drop a bit further remains to be seen for the moment. Ultimately, we still expect Bitcoin to climb into the upper blue Target Zone (coordinates: $117,553 – $130,891) before a broader C-wave sell-off occurs, pushing the price down to the lower blue Target Zone (coordinates: $62,395 – $51,323). There, we anticipate the low of the larger orange wave a, which should mark the start of another corrective upward move. Afterward, we're preparing for the last downward leg of blue wave (ii). However, if Bitcoin directly surpasses the resistance at $130,891 – and thus our upper blue Target Zone – we'll locate it still in blue wave alt.(i) (30% probability).

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

SPY/QQQ Plan Your Trade For 6-23 : CRUSH PatternToday's CRUSH pattern suggests the markets will struggle to find any support for a rally. A CRUSH pattern is usually a large breakdown type of price bar that moves aggressively against the dominant trend.

Som, today I'm expecting some fairly large price action and I believe the markets may start a breakdown move this week as we continue to get more news related to the Israel/Iran/US conflict.

This week will be a "resettling" week in my opinion. Buyers will start to actively liquidate and reposition assets as we move deeper into this conflict. When buyers turn into sellers (to get out), the markets usually react very aggressively in trend.

Metals continue to hold up without making any big moves. I believe the increased FEAR level could play out as a moderate rally for metals over the next 15-30+ days.

BTCUSD broke down very hard (more than 6%) over the past 3-4+ days. This is a big move downward for Bitcoin and could suggest US technology stocks/sectors could also collapse on fear of a "rollover top" in the US stock market.

Smart traders will hedge and pull capital away from this potential top - just like I've been suggesting for the past 2-3+ weeks.

Oddly enough, if we do get a rollover/top this week because of the Iran conflict, it plays right into my Excess Phase Peak pattern and the predictions I've been making over the past 4+ months.

No, I don't foresee events like this Israel/US/Iran conflict. I can't see into the future.

What I can do, and continue to try to deliver, is the best analysis I can offer without becoming BIASED by indicators, comments, or other inputs.

I just read the chart and will tell you what I see as the most likely outcome.

Get some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Bitcoin Analysis 23-Jun-25Bitcoin price in the weekend retested around 98,500$, this drop was mainly supported by the fear in the markets due to the escalations in the Middle East, & the US taking part in the War.

In this short analysis video, we will be discussing the Areas of interest and possible price movement we could see.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

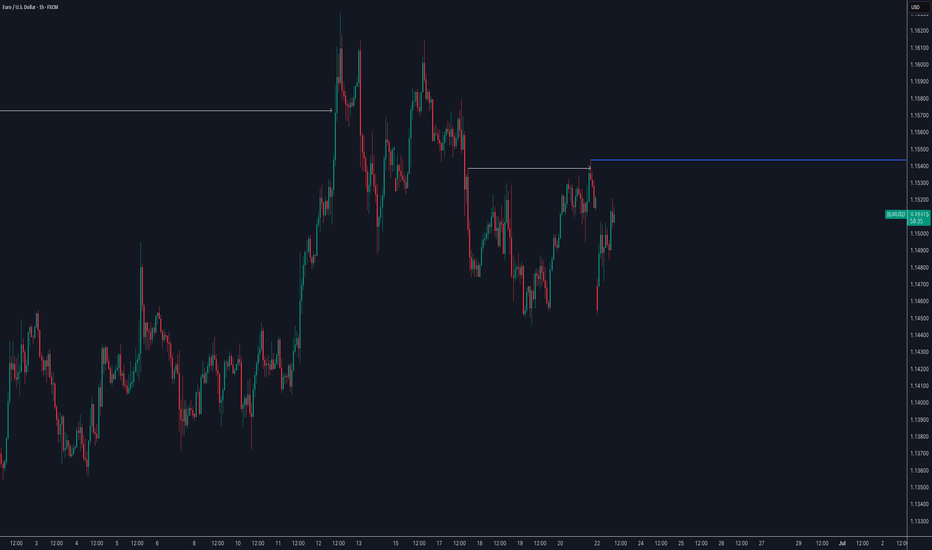

Quick Forex Market Overview | USDJPY, GBPUSD, CADJPY, EURUSD...In this video, I give an unstructured but insightful overview of the current market conditions across several major forex pairs. I walk through key price action and technical levels on USDJPY, GBPUSD, CADJPY, EURJPY, EURUSD, and EURAUD — sharing what I’m seeing in the moment and how the setups are developing.

Perfect if you're looking for a raw, real-time perspective without the fluff.

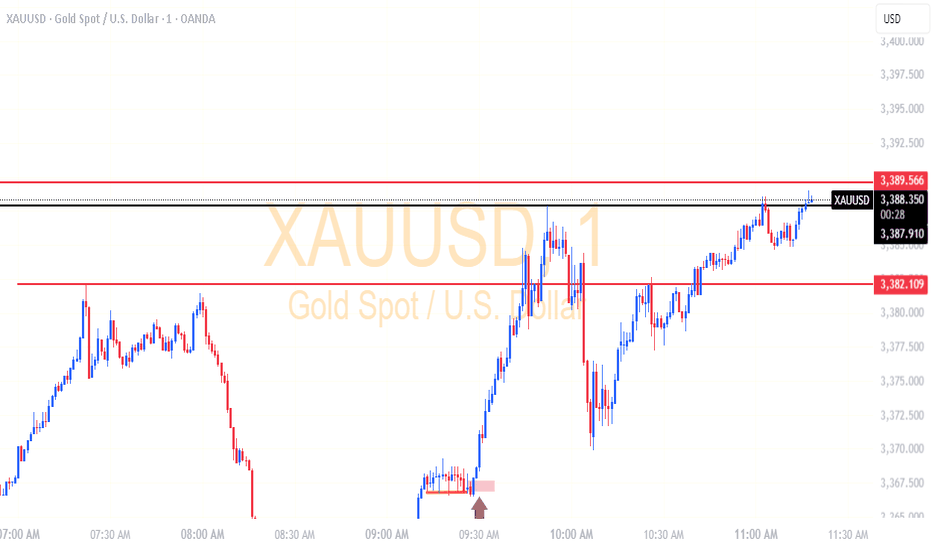

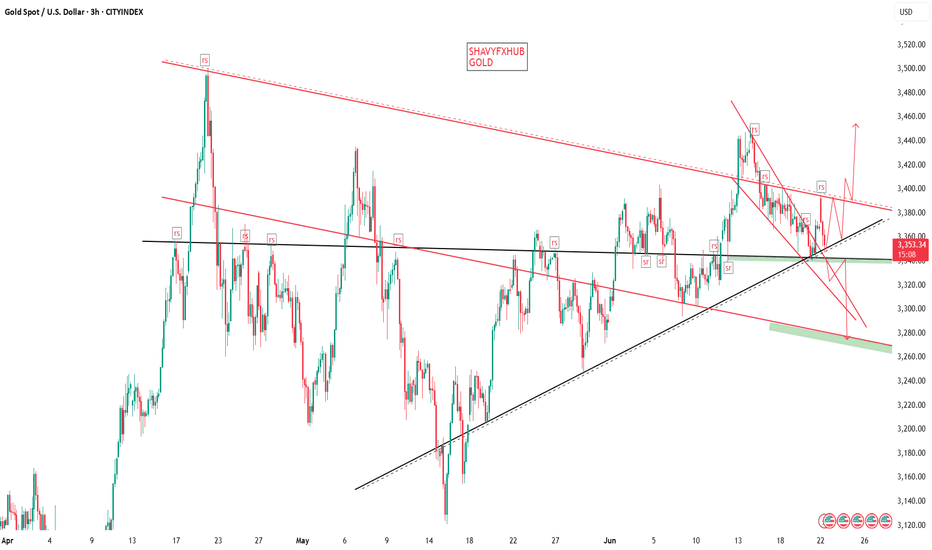

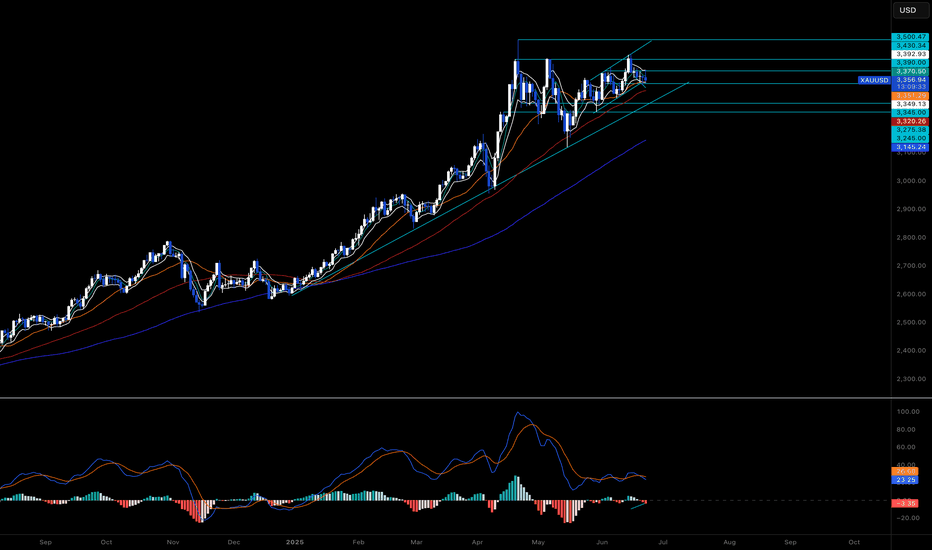

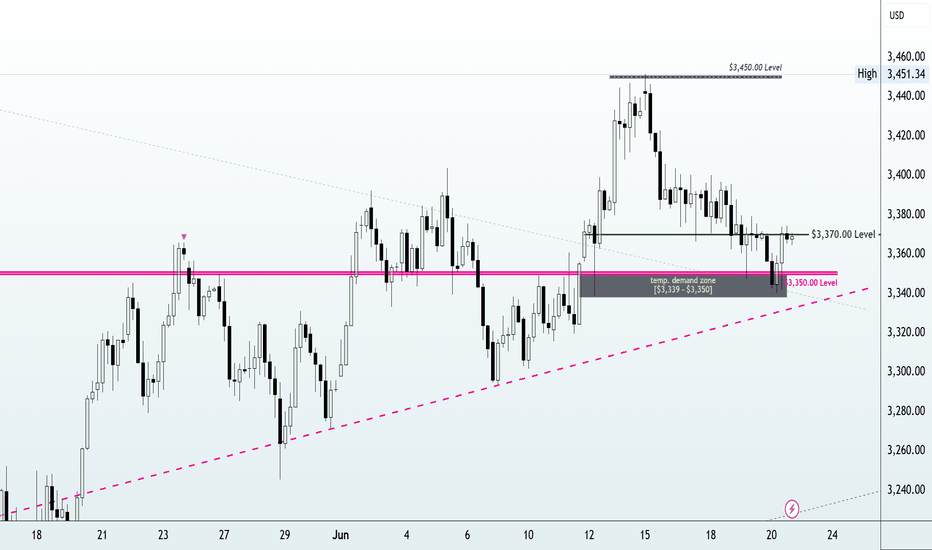

GOLDGOLD DEMAND FLOOR 3348-3350 could be the last defense in price for buy. after seeing 3358-3360 broken demand cross on 45 min ,sellers could be taking price beyond 3348-3350 if buyers don't demand coming.

geopolitical tension and 15min ascending trendline aligns with 3348 for buy entry.

if this layers fails wait at 3274-3285 zone .

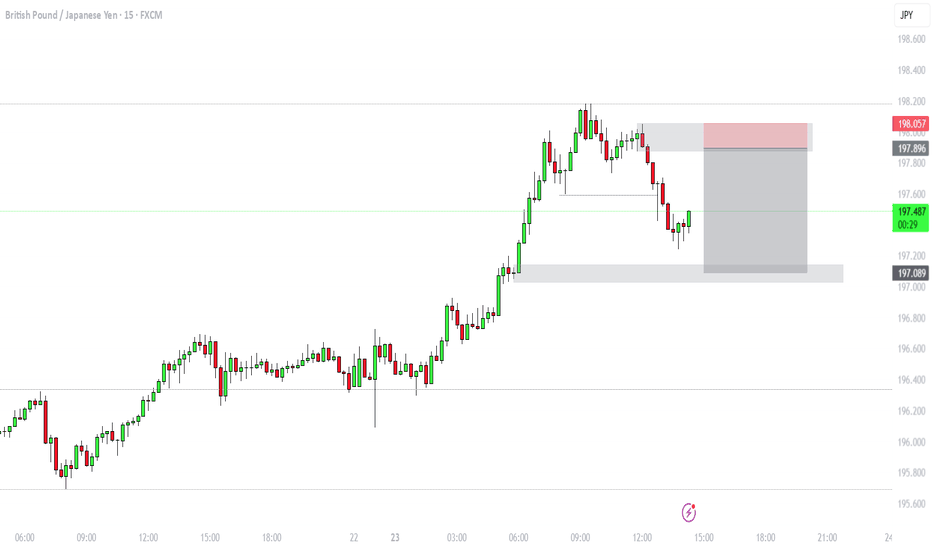

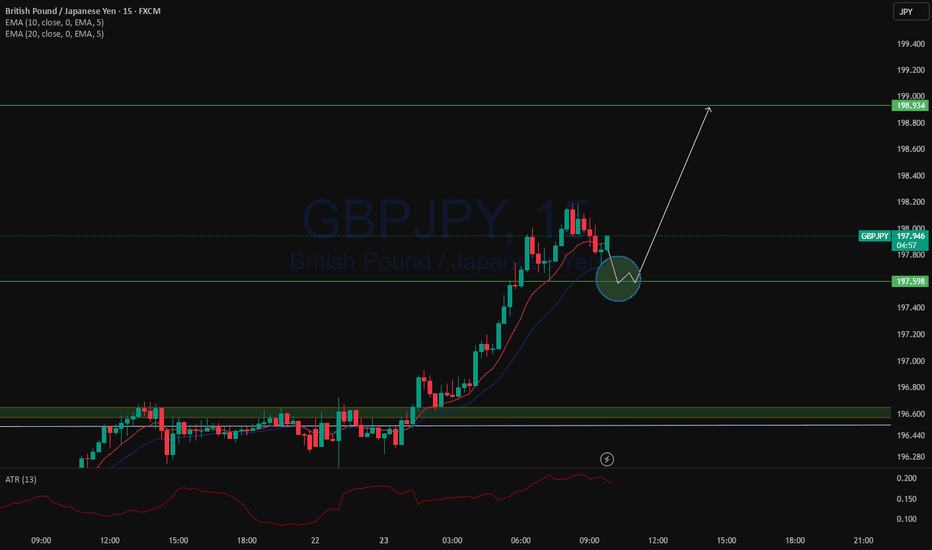

GBPJPY and USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

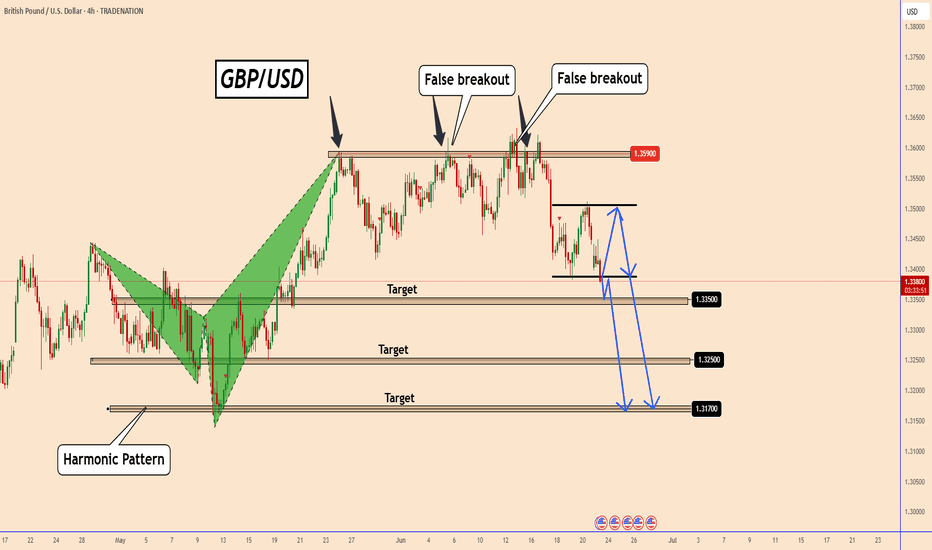

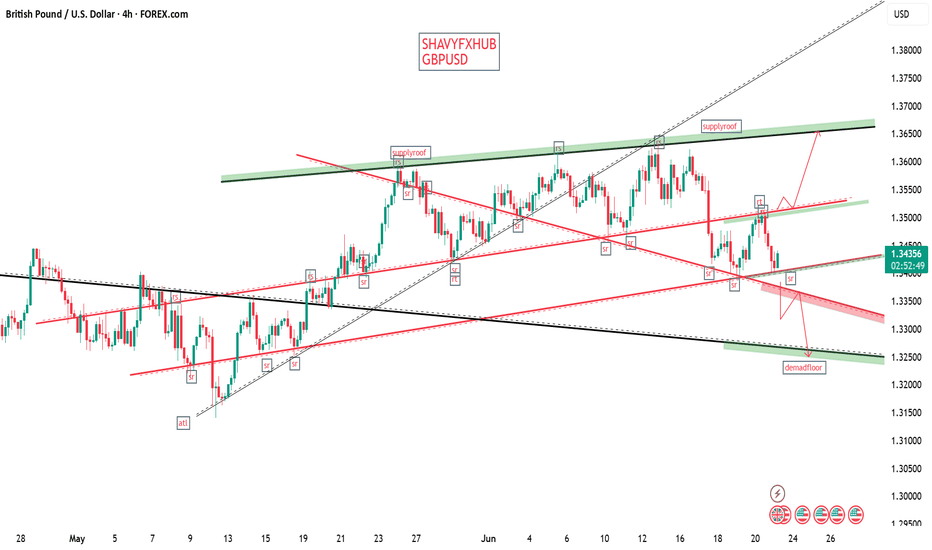

GBPUSD: The Bearish Setup Remains IntactGBPUSD: The Bearish Setup Remains Intact

From our previous analysis we can see that GBPUSD remains bearish despite not having broken down yet.

The war is not affecting the strength of the US dollar and may perhaps become stronger at a time when we expected the US dollar to show slight weakness given that the war could become more serious.

However, as I have explained before, this is not the first time that the US has been involved in a war.

You may watch the analysis for further details

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

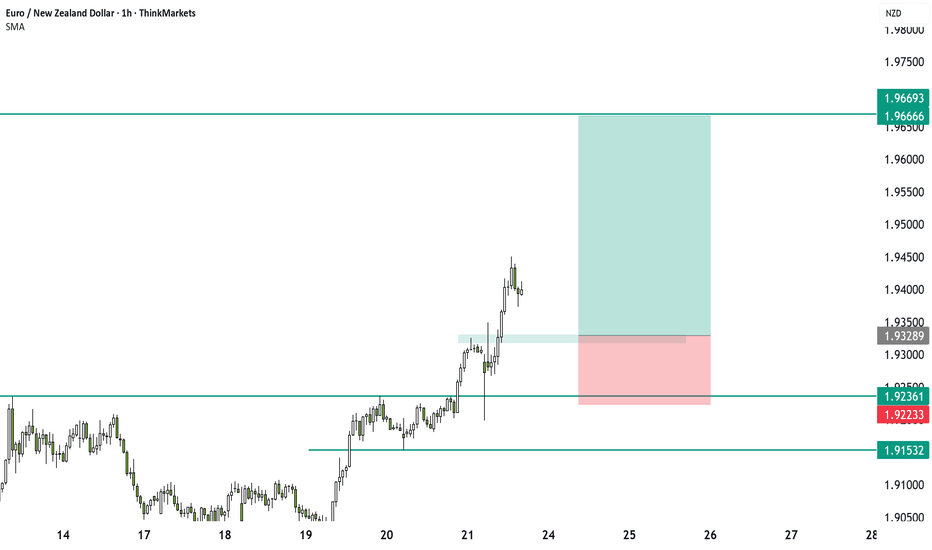

War shock moves EURNZD: breakout targets 196.69The US strike on Iran hit risk currencies hard. NZD, AUD, and JPY dropped, while EURNZD broke out of a rectangle pattern. We analyse the setup, target at 196.69, and possible entry zones. Would you trade this in wartime volatility?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

BTCUSD 6/23/2025Come Tap into the mind of SnipeGoat, as he gives you an amazing Full Top-Down Analysis & an update to his previous market call. Ohhhh & he comes with receipts...

_SnipeGoat_

_TheeCandleReadingGURU_

#PriceAction #MarketStructure #TechnicalAnalysis #Bearish #Bullish #Bitcoin #Crypto #BTCUSD #Forex #NakedChartReader #ZEROindicators #PreciseLevels #ProperTiming #PerfectDirection #ScalpingTrader #IntradayTrader #DayTrader #SwingTrader #PositionalTrader #HighLevelTrader #MambaMentality #GodMode #UltraInstinct #TheeBibleStrategy

Market Insights with Gary Thomson: 23 - 27 JuneMarket Insights with Gary Thomson: Canada Inflation, US Core Consumer Metrics, and Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode, we discuss:

— Inflation Rate in Canada

— US Durable Goods Orders

— US PCE Price Index, Personal Income & Personal Spending

— Corporate Earnings Statements

Don’t miss out—gain insights to stay ahead in your trading journey.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

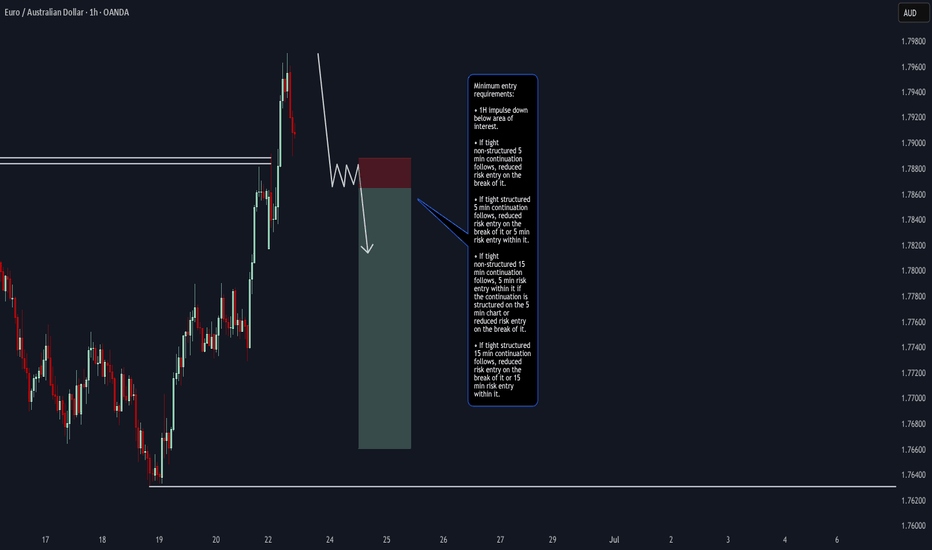

EUR/AUD ShortEUR/AUD Short

Minimum entry requirements:

- 1H impulse down below area of interest.

- If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

- If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

Geopolitics Shake Markets: DXY, XAUUSD, BTCUSD in FocusThis week’s market prep session comes at a critical moment. With the U.S. launching airstrikes on Iran’s nuclear facilities, geopolitical tensions are shaking global markets. In this in-depth session, we break down how these developments are impacting:

💵 DXY (US Dollar) – Safe-haven flows and what to expect from Powell’s upcoming testimony

🥇 Gold (XAU/USD) – Why analysts are calling for $3,900/oz amid global uncertainty

₿ Bitcoin (BTC/USD) – Volatile moves and whether BTC is holding up as a modern-day safe haven

We’ll also preview key events like U.S. PCE inflation data and global central bank meetings that could drive major moves. Whether you’re trading FX, commodities, or crypto—this is the market insight you don’t want to miss.

📅 Watch now to position yourself ahead of the curve this week.

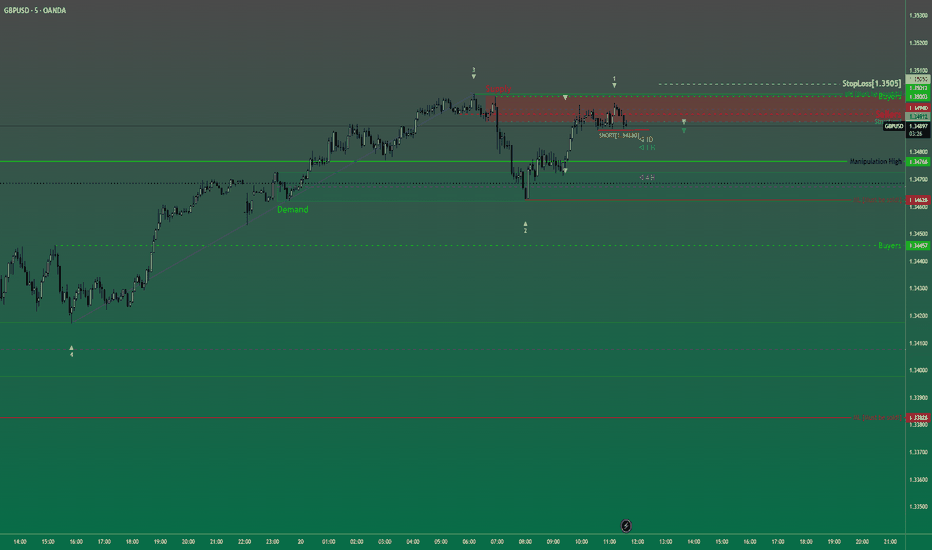

GBPUSD London Session | Live Forex Analysis & Trade ideasIn today’s London session, we conducted a detailed intraday analysis on the GBPUSD currency pair using wave structure analysis on the 5-minute (M5) timeframe.

Price action confirmed a break below bullish market structure that had previously formed the Asian session high, signalling a potential shift in market sentiment to the downside. This breakdown confirmed short-term bearish momentum shift.

Following the completion of the bearish wave, the price retraced to form a structural pullback (trend reset), providing a discounted price zone for new short positions and offering profit-taking opportunities for earlier sellers.

Our trading plan for this session is to sell GBPUSD at 1.3488, anticipating a move below the midline (ML) support at 1.3462. The technical target for this trade, based on our London-New York session projection, is set at 1.3417.

The stop-loss for this setup is placed above MH of the bearish structure at 1.3505, maintaining proper risk management.

This trade idea aligns with our trend-following strategy and is supported by real-time price action analysis.

📉 Short Bias Confirmed

🎯 Entry: 1.3488

🛑 Stop Loss: 1.3505

✅ Take Profit: 1.3417

Trade safe, manage your risk, and stay blessed.

GOLD Price Forecast: Is the Pullback Over? | Weekly OutlookWill XAUUSD resume its bullish trend, or is more downside ahead?

In this video, I break down last week’s gold price movement and the current market reaction to rising geopolitical tensions between Iran and Israel, now with the U.S. joining the conflict. We also assess the impact of the Fed’s recent rate hold, weak retail sales, and upcoming high-impact U.S. economic events like PMI, GDP, and Core PCE.

💡 Here’s what you’ll learn:

✅What caused gold’s pullback last week

✅Why institutional traders shake out retail buyers

✅Key fundamentals driving gold right now

✅How to position yourself smartly for the upcoming trading week

🔔 Don’t forget to like the video in support of this work.

Disclaimer:

Based on experience and what I see on the charts, this is my take. It’s not financial advice—always do your research and consult a licensed advisor before trading.

#goldanalysis, #xauusd, #goldforecast, #goldpriceprediction, #forexanalysis, #fundamentalanalysis, #forextrading, #tradinggold, #goldnews, #federalreserve, #marketpsychology, #tradingstrategy, #geopoliticalrisk, #usdata, #iranisraeltensions, #goldbullish, #goldbearish, #forexmentor, #xauusdforecast, #tradingview

GBPUSD DID YOU KNOW THAT YOUR COUNTRY CENTRAL BANKS HAVE ANOTHER

CENTRAL BANK AND IS CALLED BIS(BANK OF INTERNATIONAL SETTLEMENTS )???

The Bank for International Settlements (BIS) was established in 1930 at the Hague Conference, making it the world's oldest international financial institution. Its initial purpose was to facilitate the settlement of World War I reparations and to promote cooperation among central banks.

The BIS trading market refers to the role of the Bank for International Settlements (BIS) as a key intermediary and facilitator in global financial markets, particularly in foreign exchange (FX) and central bank transactions

BIS is a secretive institution with sovereign immunity that can move trillions without oversight. aka central bank of central banks in Basel Swissland with over 63 members in the world which are centrals banks of countries that make up 95% of world GDP.

Key Points about BIS and Its Trading Market Role:

Central Bank’s Central Bank: BIS acts as a bank for central banks and international organizations, providing banking services such as accounts, gold and currency transactions, asset management, and short-term collateralized loans.

Market Intermediary: BIS frequently conducts large-scale transactions on behalf of central banks in the foreign exchange and gold markets. These trades are often substantial, reflecting central banks’ reserve management or monetary policy operations.

Avoiding Market Misinterpretation: When BIS buys or sells currencies or assets, it is usually acting for a central bank, not itself, helping avoid markets mistaking these large trades for speculative or official government interventions.

Forum for Cooperation: BIS provides a platform for central banks to exchange information, coordinate policies, and cooperate on monetary and financial stability, which indirectly influences market dynamics.

Research and Statistics: BIS publishes data and analysis on global banking, FX, derivatives markets, and financial stability, supporting informed decision-making in the trading community.

Summary

The BIS trading market is not a public exchange but a specialized, high-level market where BIS facilitates and conducts financial transactions for central banks, particularly in foreign exchange and gold. Its activities help central banks manage reserves and implement monetary policy while fostering international financial cooperation.

if you know you know because BOE (BANK OF ENGLAND ) and FED (FEDERAL RESERVE ) are members .

GBPUSD 10 YEAR BOND YIELD ,INTEREST RATE ,INTEREST RATE DIFFERENTIAL AND CARRY TRADE ADVANTAGE .

1. Current Rates and Yields

Metric United Kingdom (GBP) United States (USD) Differential (UK - US)

10-Year Bond Yield 4.54% 4.38% +0.16% (16 bps)

Policy Interest Rate 4.25% 4.25%–4.50% -0.25% to -0.01%

UK Context: The Bank of England (BoE) held rates at 4.25% amid sticky inflation (3.4% YoY in May ) but signaled potential cuts in August.

US Context: The Federal Reserve held rates at 4.25%–4.50%, prioritizing inflation control despite slowing growth .

2. Interest Rate Differential and Carry Trade Advantage

Yield Spread: The UK 10-year gilt yields 0.16% more than the US 10-year Treasury, creating a modest yield pickup for GBP-denominated bonds .

Policy Rate Spread: The USD offers a 0.25% higher short-term rate (using the Fed’s 4.50% upper bound vs. BoE’s 4.25%) .

Carry Trade Mechanics:

GBP-USD Strategy: Borrow USD at 4.50% and invest in GBP assets at 4.54% (10-year gilt) for a net carry of +0.04%.

USD-GBP Strategy: Borrow GBP at 4.25% and invest in USD assets at 4.38% (10-year Treasury) for a net carry of +0.13%.

Key Risks:

Currency Volatility: GBP/USD at 1.34–1.35 could erase gains if the dollar strengthens.

Policy Shifts: BoE rate cuts (expected August 2025) may narrow the yield spread , while Fed cuts could reduce USD rate advantages .

3. Market Outlook

UK Focus: Inflation persistence may delay BoE cuts, supporting GBP yields near-term .

US Focus: Fed’s "higher for longer" stance and tariff-related inflation risks could sustain USD yield appeal .

Carry Viability: The USD-GBP strategy offers a slight edge (0.13% carry) but requires hedging against GBP appreciation risks.

Summary

Yield Advantage: UK 10-year gilts yield 0.16% more than US Treasuries, but USD short-term rates are 0.25% higher.

Optimal Carry: Borrowing GBP to invest in USD assets (0.13% carry) is marginally favorable, though policy uncertainty warrants caution.

Critical Factors: Monitor BoE/Fed rate decisions and GBP/USD trends for carry trade adjustments.